QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on January 10, 2007

Registration No. 333-136110

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT No. 3

TO FORM S-11

ON FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GTJ REIT, INC.

(Exact Name of Registrant as Specified in its Governing Instruments)

444 Merrick Road

Lynbrook, NY 11563

(516) 881-3535

(Address, Including Zip Code, and Telephone Number,

including Area Code, of Registrant's Principal Executive Offices)

Jerome Cooper

President

c/o GTJ Co., Inc.

444 Merrick Road

Lynbrook, NY 11563

(516) 881-3535

(Name, Address, Including Zip Code, and Telephone Number,

Including Area Code, of Agent for Service)

Copies to:

Stuart M. Sieger, Esq.

Ruskin Moscou Faltischek, P.C.

1425 Reckson Plaza

East Tower, 15th Floor

Uniondale, New York 11556

(516) 663-6546

(516) 663-6746 (Telecopy) | | Adam P. Silvers, Esq.

Ruskin Moscou Faltischek, P.C.

1425 Reckson Plaza

East Tower, 15th Floor

Uniondale, New York 11556

(516) 663-6519

(516) 663-6719 (Telecopy) |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effectiveness of this registration statement and the satisfaction or waiver of all other conditions under the merger agreement described herein.

If the securities being registered on this form are to be offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

|

Title of Securities Being

Registered

| | Proposed Maximum

Amount to be

Registered(1)

| | Proposed Maximum

Offering

Price per Share

| | Aggregate Offering

Price(2)

| | Amount of

Registration

Fee(3)

|

|---|

|

| Common Stock, $.001 par value per share | | 15,564,454 shares | | $11.14 | | $173,388,018 | | $18,553 |

|

- (1)

- Includes 10,000,000 shares offered in connection with a business combination and 3,769,122 shares to be offered as part of a distribution of earnings and profits to stockholders following the Reorganization

- (2)

- Estimated solely for the purpose of determining the registration fee in accordance with Rule 457(o) of the Securities Act of 1933.

- (3)

- Previously paid

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Subject to completion, dated January 10, 2007

The information in this proxy statement/prospectus is not complete and may be changed. GTJ REIT, Inc. may not sell these securities until the registration statement filed with the Securities and Exchange Commission, of which this document is a part, is declared effective. This proxy statement/prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer, solicitation or sale is not permitted or would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Any representation to the contrary is a criminal offense.

Green Bus Lines, Inc.

Triboro Coach Corporation

Jamaica Central Railways, Inc.

444 Merrick Road

Lynbrook, NY 11563

January , 2007

Dear Shareholder:

You are cordially invited to attend a special joint meeting of the shareholders of Green Bus Lines, Inc., a New York corporation ("Green"), Triboro Coach Corp., a New York corporation ("Triboro") and Jamaica Central Railways, Inc., a New York corporation ("Jamaica") (Green, Triboro and Jamaica, being sometimes referred to as a "Bus Company" and collectively as the "Bus Companies"), to be held on , 2007, at a.m., Eastern Time (the "special meeting"). The special meeting will be held at .

As described in the enclosed proxy statement/prospectus, at the special meeting, you will be asked to consider and vote upon a proposal to approve and adopt an Agreement and Plan of Merger ("merger agreement") that the Bus Companies have entered into as of July 24, 2006 with GTJ REIT, Inc. ("GTJ REIT") and its wholly owned subsidiaries, Triboro Acquisition, Inc., Green Acquisition, Inc. and Jamaica Acquisition, Inc., New York corporations, and to approve the mergers contemplated by the merger agreement.

If holders of record of two-thirds of the common stock, including voting trust certificates, of each of the Bus Companies, as of the record date, , 2007, voting separately, vote to adopt and approve the merger agreement and to approve the mergers, and the other conditions in the merger agreement are satisfied or waived, Green Bus Lines, Inc. would be merged with and into Green Acquisition, Inc., with the latter as the surviving corporation, Triboro Coach Corp. would be merged with and into Triboro Acquisition, Inc., with the latter as the surviving corporation, Jamaica Central Railways, Inc. would be merged with and into Jamaica Acquisition, Inc., with the latter as the surviving corporation, and the Bus Companies would become wholly owned subsidiaries of GTJ REIT.

As described in this proxy statement/prospectus, upon the approval of the mergers and the satisfaction of the other conditions in the merger agreement and a closing:

- (a)

- Each share of Green common stock will be converted into 1,117.429975 shares of GTJ REIT common stock;

- (b)

- Each share of Triboro common stock will be converted into 2,997.964137 shares of GTJ REIT common stock; and

- (c)

- Each share of Jamaica common stock will be converted into 195.001987 shares of GTJ REIT common stock.

The Bus Companies' Board of Directors investigated, considered and evaluated the terms and conditions of the merger agreement. Based on its review, the Bus Companies' Board of Directors has unanimously determined that the mergers are fair to, and in the best interests of the shareholders of the Bus Companies and recommends that you vote FOR approving the merger agreement and approving the mergers.

Your vote is very important, regardless of the number of shares you own of record or as a voting trust beneficiary. No Bus Company can complete its merger unless the merger agreement is adopted and approved and the mergers are approved, respectively by the affirmative vote of the holders of at least two-thirds (2/3) of the outstanding common stock of each Bus Company entitled to vote at the special meeting. Whether or not you plan to attend the special meeting in connection with the proposed mergers, please promptly complete, sign and return the enclosed proxy card in the envelope provided. Your proxy card may also include instructions about how to vote by telephone or by using the Internet. Your shares then will be represented at the special meeting. If you attend the special meeting, you may, by following the procedures discussed in the accompanying documents, withdraw your proxy and vote in person.

The accompanying Notice of Special Meeting, the proxy statement/prospectus and the proxy card explain the proposed mergers and provide specific information concerning the special meeting. Please read these materials carefully. IN PARTICULAR, PLEASE SEE "RISK FACTORS" BEGINNING ON PAGE 15 OF THIS PROXY STATEMENT/PROSPECTUS.

On behalf of the Board of Directors of the Bus Companies, I would like to express our appreciation for your continued interest in the affairs of the Bus Companies. We look forward to seeing you at the special meeting.

| | | Sincerely, |

|

|

Jerome Cooper

Chairman of the Board of Directors and President |

Lynbrook, New York

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the merger described in this proxy statement/prospectus, passed upon the fairness or merits of this transaction, or passed upon the accuracy or adequacy of the disclosure in this document. Any representation to the contrary is a criminal offense.

This proxy statement/prospectus is dated , 2007, and is first being mailed to the shareholders of the

Bus Companies beginning on or about , 2007.

GREEN BUS LINES, INC.

TRIBORO COACH CORPORATION

JAMAICA CENTRAL RAILWAYS, INC.

444 Merrick Road

Lynbrook, NY 11563

(516) 881-3535

NOTICE OF SPECIAL JOINT MEETING OF SHAREHOLDERS

To Be Held on , 2007

Commencing at a.m., Eastern Time

, 2007

Dear Shareholder:

You are cordially invited to attend a special joint meeting of shareholders of Green Bus Lines, Inc., a New York corporation ("Green"), Triboro Coach Corporation ("Triboro") and Jamaica Central Railways, Inc. ("Jamaica") (sometimes referred to as a "Bus Company" or collectively as the "Bus Companies") (the "special meeting") commencing at a.m. Eastern Time on , 2007 at .

We are holding this special meeting so that, and you will be asked:

- (a)

- as a Green shareholder, to vote on the merger of Green with and into Green Acquisition, Inc., a wholly owned subsidiary of GTJ REIT, with the latter as the surviving corporation;

- (b)

- as a Triboro shareholder, to vote on the merger of Triboro with and into Triboro Acquisition, Inc., a wholly owned subsidiary of GTJ REIT, with the latter as the surviving corporation;

- (c)

- as a Jamaica shareholder, to vote on the merger of Jamaica with and into Jamaica Acquisition, Inc., a wholly owned subsidiary of GTJ REIT, with the latter as the surviving corporation; and

- (d)

- to grant discretionary authority to vote upon any matters not known by our Board of Directors a reasonable period of time before the Bus Companies mailed this proxy statement/prospectus as may properly come before the special meeting, including authority to vote in favor of any postponements or adjournments of the special meeting, if necessary, to solicit additional proxies.

The mergers, and a related reorganization of the Bus Companies, are more fully described in the accompanying proxy statement/prospectus, which you should read carefully in its entirety before voting.

Shareholders of record or beneficiaries of voting trusts of each Bus Company as of the close of business on , , 2007 (referred to as the "record date") are entitled to notice of and to vote at the special meeting and any adjournment or postponement of the special meeting. A list of shareholders eligible to vote at the special meeting will be available for review during the Bus Companies' regular business hours at its headquarters, located at 444 Merrick Road, Lynbrook, New York, for ten days prior to the special meeting. At least two-thirds (2/3) of the common stock outstanding on the record date of each Bus Company must be voted, voting separately to approve the mergers in order for the mergers to be completed. Therefore, your vote is very important. Your failure to vote your shares will have the same effect as voting against the mergers.

It is important for your shares to be represented at the special meeting. We hope that you will promptly mark, sign, date and return the enclosed proxy even if you plan to attend the special meeting. Your proxy card may also include instructions about how to vote by telephone or by using the Internet. If you attend the special meeting, you may vote in person even if you have already returned a proxy card. You should not send any certificates representing Bus Company common stock or voting trust certificates with your proxy.

We look forward to seeing you at the meeting.

Lynbrook, New York

ADDITIONAL INFORMATION

You may obtain copies of information relating to the Bus Companies, without charge, by contacting the Bus Companies at:

Green Bus Lines, Inc.

Triboro Coach Corporation

Jamaica Central Railways, Inc.

Suite 370

444 Merrick Road

Lynbrook, NY 11563

Telephone: (516) 881-3535

We are not incorporating the contents of the websites of the SEC, the Bus Companies or any other person into this document. We are only providing the information about how you can obtain certain documents that are specifically incorporated by reference into this proxy statement/prospectus at these websites for your convenience.

In order for you to receive timely delivery of the documents in advance of the special meeting, the Bus Companies should receive your request no later than , 2007.

TABLE OF CONTENTS

| | Page

|

|---|

| QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING AND THE REORGANIZATION | | 1 |

| SUMMARY | | 5 |

| RISK FACTORS | | 15 |

| THE REORGANIZATION | | 27 |

| DESCRIPTION OF FAIRNESS OPINION | | 34 |

| BUSINESS OF THE BUS COMPANIES | | 52 |

| OUR REAL PROPERTY MANAGEMENT POLICIES | | 70 |

| SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA | | 77 |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | 82 |

| MANAGEMENT OF OUR COMPANY | | 120 |

| OUR PRINCIPAL STOCKHOLDERS | | 126 |

| POTENTIAL CONFLICTS OF INTEREST | | 127 |

| RELATED PARTY TRANSACTIONS | | 128 |

| FEDERAL INCOME TAX CONSEQUENCES OF THE REORGANIZATION AND OUR PROPOSED STATUS AS A REIT | | 130 |

| DESCRIPTION OF OUR CAPITAL STOCK | | 144 |

| SHARE REPURCHASES | | 149 |

| CERTAIN PROVISIONS OF MARYLAND CORPORATE LAW AND OUR CHARTER AND BYLAWS | | 150 |

| SHARES AVAILABLE FOR FUTURE SALE | | 159 |

| THE MERGER | | 159 |

| RIGHTS OF DISSENTING SHAREHOLDERS | | 166 |

| LEGAL PROCEEDINGS | | 169 |

| REPORTS TO STOCKHOLDERS | | 169 |

| LEGAL MATTERS | | 169 |

| EXPERTS | | 169 |

| ADDITIONAL INFORMATION | | 170 |

| FINANCIAL STATEMENTS | | F-1 |

ATTACHMENTS |

|

|

| | A—MERGER AGREEMENT AND PLAN OF MERGER | | A-1 |

| | B—SECTIONS 623 AND 910 OF THE NEW YORK BUSINESS CORPORATION

LAW | | B-1 |

| | C—OPINION OF RYAN BECK & CO. | | C-1 |

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING AND THE REORGANIZATION

The following are some questions that you, as a shareholder of one or more of the Bus Companies, may have regarding the mergers and the Reorganization being considered at the special meeting of the Bus Companies' shareholders and brief answers to those questions. The Bus Companies urge you to read carefully the remainder of this proxy statement/prospectus because the information in this section may not provide all the information that might be important to you with respect to the merger and the Reorganization being considered at the special meeting. Additional important information is also contained in the attachments to, and the documents incorporated by reference in, this proxy statement/prospectus.

- Q:

- Why am I, as a Bus Company shareholder, receiving this proxy statement/prospectus?

- A:

- The Bus Companies have determined to effect a reorganization (the "Reorganization") whereby each of the Bus Companies will become a wholly-owned subsidiary of GTJ REIT, Inc., a Maryland corporation ("GTJ REIT"). The Reorganization would be effected by a merger of each of the Bus Companies with a wholly-owned subsidiary of GTJ REIT, which are the mergers referred to in this proxy statement/prospectus on which you are being requested to vote. Please see "The Merger" beginning on page 159 of this proxy statement/prospectus. A copy of the merger agreement is attached to this proxy statement/prospectus as Attachment A. In order to complete the mergers, the shareholders of each Bus Company must approve the merger agreement and approve the mergers. The Bus Companies are holding a special joint meeting of their shareholders to obtain these approvals. This proxy statement/prospectus contains important information about the mergers, the merger agreement, the special meeting and the Reorganization, which you should read carefully. The enclosed voting materials allow you to vote your shares without attending the special meeting. Your vote is very important. We encourage you to vote as soon as possible.

- Q:

- Why is the Reorganization being proposed?

- A:

- As a result of the sales of the Bus Companies' bus assets to New York City and the execution of leases with New York City and others, the Bus Companies now receive a substantial amount of income and cash flow. Because the Bus Companies were organized more than half-century ago, their real property is still owned by "C" corporations. For tax purposes, these are corporations which are taxed on their income and do not "pass through" their tax liabilities to the shareholders, as would occur in, for example, a limited partnership or a limited liability company. Accordingly, the substantial income being generated under the leases described above is being taxed at the corporate level at a tax rate of approximately 45% and then, if distributed to the shareholder as dividends, would be taxed again at, for example, rates ranging from approximately 15% to 25% which would result, if such income were fully distributed, in a combined tax rate on the income ranging from approximately 53% to 59%. Accordingly, the Bus Companies' Board of Directors determined that the only tax efficient solution to the above situation is the creation of a real estate investment trust, or "REIT". All of the real property of the Bus Companies can be acquired by a REIT in a tax free reorganization. Furthermore, the income earned by the REIT's real properties will not be taxed to the REIT provided there is compliance with the REIT rules. Among other requirements, the REIT rules provide, with certain exceptions, that at least 90% of REIT net income for each year must be distributed to REIT shareholders. Income from the Bus Companies' outdoor maintenance, paratransit and other activities will continue to be subject to corporate taxation.

- Q:

- What will happen in the mergers?

- A:

- Pursuant to the merger agreement, Green would be merged with and into Green Acquisition, Inc., a wholly owned subsidiary of GTJ REIT and the surviving corporation, Triboro would be merged with and into Triboro Acquisition, Inc., a wholly owned subsidiary of GTJ REIT and the surviving

1

corporation, and Jamaica would be merged with and into Jamaica Acquisition, Inc., a wholly owned subsidiary of GTJ REIT and the surviving corporation.

- Q:

- What are Bus Company shareholders voting on?

- A:

- Bus Company shareholders are voting on a proposal to approve and adopt the merger agreement and approve the mergers. Bus Company shareholders are also voting on a proposal to approve any adjournment of the special meeting.

- Q:

- What vote of Bus Company shareholders is required to approve and adopt the merger agreement and to approve the mergers?

- A:

- Approval of the proposal to adopt the merger agreement and to approve the mergers requires the affirmative vote of the holders of at least two-thirds (2/3) of the outstanding common stock of each Bus Company entitled to vote at the special meeting, voting separately.

- Q:

- When do GTJ REIT and the Bus Companies expect the mergers to be completed?

- A:

- GTJ REIT and the Bus Companies are working to complete the mergers as quickly as practicable and currently expect that the mergers could be completed promptly after the special meeting. However, we cannot predict the exact timing of the completion of the mergers because they are subject to other conditions.

- Q:

- When and where will the special meeting be held?

- A:

- The special meeting will take place at , on , 2007 at a.m. Eastern Time at .

- Q:

- Who can attend and vote at the special meeting?

- A:

- All holders of record of the common stock, that is, persons holding Common Stock in their name, or beneficiaries of voting trusts, that is, persons holding voting trust certificates in their names, of one or more Bus Companies at the close of business on , 2006, the record date, are entitled to notice of and to vote at the special meeting. As of the record date, there were 3,766.50 shares of Green common stock, 1,277.10 shares of Triboro common stock and 10,064.00 shares of Jamaica common stock outstanding and entitled to vote at the special meeting.

- Q:

- How do the Bus Companies' Boards of Directors recommend that Bus Company shareholders vote?

- A:

- The Bus Companies' Boards of Directors unanimously recommends that the Bus Company shareholders vote "FOR" the proposal to approve and adopt the merger agreement and to approve the mergers and any adjournment of the special meeting. The Bus Companies and their Boards of Directors have determined that the merger agreement and the transactions contemplated by the merger agreement, including the mergers, are fair to and in the best interests of Bus Companies and their shareholders. Accordingly, the Bus Companies' Boards of Directors has approved the merger agreement and the transactions contemplated by the merger agreement, including the mergers.

- Q:

- Are there any shareholders who have already agreed to vote in favor of the mergers?

- A:

- No. Although management of the Bus Companies are in favor of the mergers and the Reorganization, there are no voting agreements with any person.

2

- Q:

- Am I entitled to appraisal or dissenters' rights?

- A:

- Yes. Under New York law, Bus Company shareholders are entitled to appraisal rights. See "Rights of Dissenting Shareholders" beginning on page 166 of this proxy statement/prospectus.

- Q:

- What should I do now in order to vote on the proposals being considered at the special meeting?

- A:

- Shareholders of record of one or more of the Bus Companies or shareholders holding voting trust certificates as of the record date of the special meeting may vote by proxy by completing, signing, dating and returning the enclosed proxy card in the accompanying pre-addressed postage paid envelope or by submitting a proxy over the Internet or by telephone by following the instructions on the enclosed proxy card. Additionally, you may also vote in person by attending the special meeting. If you plan to attend the special meeting and wish to vote in person, you will be given a ballot at the special meeting. Whether or not Bus Company shareholders, including holders of voting trust certificates plan to attend the special meeting, they should give their proxy as described in this proxy statement/prospectus.

| | | To vote by telephone, call 1-866-853-9739

To vote via the Internet, go to www.proxyvotenow.com/bus and enter the control

number(s) on your proxy card. | | |

- Q:

- Should I send in my Bus Company share or voting trust certificates now?

- A:

- No. You should not send in your Bus Company stock or voting trust certificates until you receive a separate transmittal letter. Following the mergers, a transmittal letter will be sent to Bus Company shareholders informing them of where to deliver their Bus Company stock or voting trust certificates in order to receive shares of GTJ REIT common stock. You should not send in your Bus Company stock or voting trust certificates prior to receiving this letter of transmittal.

- Q:

- What will happen if I abstain from voting or fail to vote?

- A:

- An abstention occurs when a shareholder attends a meeting, either in person or by proxy, but abstains from voting. If you abstain, it will have the same effect as voting NO on the proposal to approve and adopt the merger agreement and to approve the mergers. The approval of the holders of at least two-thirds (2/3) of the outstanding common stock of each of the Bus Companies is required to approve the merger agreement and mergers, and it is important that shareholders vote on the mergers.

- Q:

- Can I change my vote after I have delivered my proxy?

- A:

- Yes. You can change your vote at any time before your proxy is voted at the special meeting by:

- •

- delivering a signed written notice of revocation to the Secretary of the Bus Company at:

Green Bus Lines, Inc.

Triboro Coach Corporation

Jamaica Central Railways, Inc.

444 Merrick Road

Lynbrook, NY

(516) 881-3535

- •

- signing and delivering a new, valid proxy card bearing a later date; and delivered to the attention of the Bus Companies' Secretary;

- •

- submitting another proxy by telephone or on the Internet; or

- •

- attending the special meeting and voting in person, although your attendance alone will not revoke your proxy.

3

- Q:

- What should I do if I receive more than one set of voting materials for the special meeting?

- A:

- You may receive more than one set of voting materials for the special meeting, including multiple copies of this proxy statement/prospectus and multiple proxy cards or voting instruction cards. Please complete, sign, date and return EACH proxy card and voting instruction card that you receive. Please note that if you sign a proxy but do not complete the portion as to an item, your vote will be treated as FOR such item.

- Q:

- Who can help answer my questions?

- A:

- If you have any questions about the merger or how to submit your proxy, or if you need additional copies of this proxy statement/prospectus, the enclosed proxy card, voting instructions or the election form, you should contact:

Innisfree M&A, Inc.

501 Madison Avenue

New York, NY 10072

Call Collect (212) 750-5833

Call Toll-Free (877) 800-5187

E-mail: info@innisfreema.com

4

SUMMARY

The following is a summary that highlights certain material information contained in this proxy statement/prospectus. This summary may not contain all of the information that may be important to you. For a more complete description of the merger agreement and the transactions contemplated by the merger agreement, including the merger, we encourage you to read carefully this entire proxy statement/prospectus, including the attached annexes.

Introduction

The mergers are part of a proposed reorganization (the "Reorganization") of Green, Triboro and Jamaica, three affiliated New York corporations with long historical roots in the operation of private bus routes in New York City, as subsidiaries of GTJ REIT. The bus businesses of the Bus Companies were acquired by New York City in late 2005 and early 2006, leaving the Bus Companies with a portfolio of real property and a group of outdoor maintenance businesses and a paratransit business.

Participants in the mergers and the Reorganization

In addition to Green, Triboro and Jamaica, the participants in the mergers are the following wholly owned subsidiaries of GTJ REIT (sometimes referred to in this proxy statement/prospectus as the "Company" "we", "us", or "our", except to the extent it is used in a discussion of federal tax matters, in which case such term refers only to GTJ REIT unless the context indicates otherwise), namely, Green Acquisition, Inc., Triboro Acquisition, Inc. and Jamaica Acquisition, Inc.

Goal of the Mergers

The goal of the Mergers is to make the Bus Companies wholly-owned subsidiaries of GTJ REIT, which then proposes to take actions necessary to become a REIT.

Merger Consideration

Upon consummation of the mergers, the Bus Companies will become wholly-owned subsidiaries of GTJ REIT and their presently outstanding common stock will be converted as follows:

- (a)

- Each share of Green common stock will be converted into 1,117.429975 shares of GTJ REIT common stock;

- (b)

- Each share of Triboro common stock will be converted into 2,997.964137 shares of GTJ REIT common stock; and

- (c)

- Each share of Jamaica common stock will be converted into 195.001987 shares of GTJ REIT common stock.

Common management of the Bus Companies

The businesses of the Bus Companies have been managed under the direction of a common Board of Directors. The Board of Directors meets approximately once a month to discuss matters relating to the Bus Companies. All corporate actions by the Board of Directors with respect to the Bus Companies are decided by the directors, including the election of officers for each of the Bus Companies. The common Boards of Directors is maintained in place under voting trust agreements in which approximately 88% of the Green common stock, 89% of the Triboro common stock and 91% of the Jamaica common stock is voted by a single voting trustee, Jerome Cooper, who is also the Chief Executive Officer of the Bus Companies and of the Company. Mr. Cooper will not vote any of the common stock of which he is the voting trustee, at the special meeting and voting shall instead be done by the holders of voting trust certificates.

5

Present operations

The Bus Companies, including their subsidiaries, own a total of six rentable real properties, four of which are leased to New York City and one of which is leased to a commercial tenant (all five on a triple net basis), and one of which is used by our operations and the remainder of which is leased to a commercial tenant but not on a triple net basis. The annual gross rental income of all of the real properties from third party tenants is approximately $9,500,000. There is an additional real property of negligible size which is not rentable. In addition, the Bus Companies and their subsidiaries collectively operate a group of outdoor maintenance businesses, and a paratransit business, with aggregate sales of approximately $27,000,000 and an operating loss of approximately $500,000, exclusive of their present real estate operations, in 2005.

Reasons for the proposed mergers and Reorganization

As a result of the sales of the Bus Companies' bus assets to New York City and the execution of the leases described above with New York City and others, the Bus Companies now receive a substantial amount of income and cash flow. Because the Bus Companies were organized more than a half-century ago, their real property is still owned by "C" corporations. For tax purposes, these are corporations which are taxed on their income and do not "pass through" their tax liabilities to the shareholders, as would occur in, for example, a limited partnership or a limited liability company. Accordingly, the substantial income being generated under the leases described above is being taxed at the corporate level at a tax rate of approximately 45% and then, if distributed to the shareholders as dividends, would be taxed again at, for example, rates ranging from approximately 15% to 25%, which would result, if such income were fully distributed, in a combined tax rate on the income rates ranging from approximately 53% to 59%.

One solution to this situation is the transfer of all of the real properties to entities which could "pass through" the tax liability. Such transfers would be treated as a sale of the real properties and would generate very substantial tax liabilities. Another solution, sale of the properties to third parties, would entail similar very substantial tax liabilities.

The Board of Directors determined that the only tax efficient solution to the above situation is the creation of a REIT. Because of special tax rules applicable to REITs, all of the real property of the Bus Companies can be acquired by a REIT in tax free reorganizations. Furthermore, the income earned by the REIT's real properties will not be taxed to the REIT provided there is compliance with the REIT rules. Among other requirements, the REIT rules provide, with certain exceptions, that at least 90% of net income for each year must be distributed to REIT shareholders. Income from the Bus Companies' outdoor maintenance, paratransit and other activities will continue to be subject to corporate taxation.

Ryan Beck Fairness Opinion

The Bus Companies' Board of Directors engaged Ryan Beck & Co. to advise as to the relative valuations of each of the Bus Companies as part of the mergers. Ryan Beck & Co. reviewed information concerning the Bus Companies including third party valuations of their real properties and outdoor businesses. Ryan Beck & Co. derived the relative valuations of the Bus Companies from that information and so advised the Bus Companies' Board of Directors. A description of the opinion of Ryan Beck & Co. is included in "Description of Fairness Opinion", beginning on page 34, of this proxy statement/prospectus, and a copy of the opinion of Ryan Beck & Co. is included as Attachment C to this proxy statement/prospectus.

Based on the valuations of the real properties and outdoor maintenance businesses, and the paratransit business, and considering the ownership of the same in whole or part by each of the Bus Companies, we have been advised by Ryan Beck & Co. that the relative valuation of each the Bus Companies (as part of GTJ REIT) is Green—42.088%, Triboro—38.287% and Jamaica—19.625%. Accordingly, under the Reorganization, 10,000,000 shares of our common stock will be distributed as

6

follows: 4,208,800 shares to the shareholders of Green, 3,828,700 shares to the shareholders of Triboro and 1,962,500 shares to the shareholders of Jamaica, in such case in proportion to the outstanding shares held by such shareholders of each Bus Company, respectively, constituting the merger consideration.

Distribution of earnings and profits

As part of becoming a REIT, we intend, after the mergers, to make a distribution of the Bus Companies' undistributed historical earnings and profits, estimated to be not more than $62,000,000 to GTJ REIT stockholders as of the record date of such distribution. We intend to distribute, in 2007, $20,000,000 in cash, and the remainder in shares of GTJ REIT common stock valued by its Board of Directors. There is no assurance that our shareholders, after the Reorganization, will be able to realize that value (or any other particular value) for a share of our Common Stock. We expect that each shareholder may elect a combination of cash and stock, or exclusively cash or stock. If more than $20,000,000 of cash is elected in the aggregate, we expect that, for some or all of the Bus Company shareholders, the cash paid would be less than the cash elected, and the cash will be distributed pro rata to each stockholder electing to receive some or all of his or her distribution in cash, in an amount totaling $20,000,000, and the balance of the distribution to each such stockholder will be made in shares of our Common Stock.

Annual Dividends

In order to remain a REIT, GTJ REIT will be required to pay dividends to our stockholders each year equal to at least 90% of our net income, and exclusive of real property capital gains if any.

Recommendation of Bus Companies' Board of Directors

The Board of Directors of the Bus Companies recommends that you vote FOR approval and adoption of the merger agreement and approval of the mergers.

Risk Factors

In evaluating the merger agreement, the merger and the Reorganization, you should be aware that there are a number of risks related to the same. See "Risk Factors" beginning on page 15 of this proxy statement/prospectus.

Share ownership of Bus Company directors and executive officers

The directors and officers of the Bus Companies own, collectively, 121.50 shares of Green (approximately 3.2% of the Green common stock outstanding on the record date), 70.7 shares of Triboro (approximately 5.5% of the Triboro common stock outstanding on the record date/and 459.0 shares of Jamaica (approximately 4.5% of the Jamaica common stock outstanding on the record date), The foregoing does not include common stock held by voting trusts, since the voting trustee will not be voting such common stock in connection with the merger agreement or the mergers.

Interests of Bus Company directors and executive officers in the mergers and the Reorganization

No director or executive officer of the Bus Companies has any interest in the mergers and the Reorganization other than as a shareholder of the Bus Companies. None of such persons hold options on common stock of the Bus Companies nor will receive any payment in connection with the mergers and the Reorganization.

It should be noted that Jerome Cooper will act as President and Chief Executive Officer and Chairman of the Board of Directors of GTJ REIT, Paul Cooper will act as a Vice President and a director of GTJ REIT, Douglas Cooper, a former director, will act as a Vice President and Director of GTJ REIT and Michael Kessman will act as Chief Accounting Officer of GTJ REIT. See "Management of Our

7

Company" beginning on page 120 of this proxy statement/prospectus for information on the proposed compensation and stock options of such persons.

Right of Appraisal

Shareholders of the Bus Companies who do not vote FOR the mergers and who strictly adhere to procedures specified by applicable law will be entitled to seek appraisal for their shares of common stock. However, the merger agreement provides that if appraisal is sought for Bus Company common stock otherwise entitled to an aggregate of 3% or more of the 10,000,000 shares of GTJ REIT common stock to be issued in the mergers, GTJ REIT can terminate the merger agreement. See "Rights of Dissenting Shareholders" beginning on page 166 of this proxy statement/prospectus.

No listing of GTJ REIT common stock

It is not presently anticipated that GTJ REIT will list its common stock on a securities exchange or electronic trading system. Accordingly, it is not anticipated that a trading market will develop for the GTJ REIT common stock. The board of directors of GTJ REIT may, however, determine to effect such listing or otherwise assist in the creation of a trading market in the future, but there can be no assurance of the same.

Conditions to the completion of the mergers

A number of conditions must be satisfied or waived before the mergers can be completed. These include, among others:

GTJ REIT's obligation to complete the mergers is conditioned upon the satisfaction or waiver in writing by us, on or before the effectiveness of the mergers, of the following conditions:

- •

- The Bus Companies' representations and warranties contained in the merger agreement must be accurate in all material respects as of the effective time of the mergers as if made at the effective time of the mergers.

- •

- Each covenant or obligation that each of the Bus Companies is required to comply with or to perform at or prior to the closing of the mergers shall have been complied with and performed in all material respects.

- •

- The Registration Statement of which this proxy statement/prospectus is a part shall have been declared effective by the Securities and Exchange Commission and shall remain effective through closing of the mergers.

- •

- All consents, approvals and other authorizations of any governmental body (including from all applicable state securities regulatory agencies) required to consummate the mergers and the other transactions contemplated by this Agreement (other than the delivery of the certificates of merger with the Department of State of the State of New York) shall have been obtained, free of any condition that would reasonably be expected to have a material adverse effect on us or our subsidiaries.

- •

- No temporary restraining order, preliminary or permanent injunction or other order preventing the consummation of the mergers shall have been issued by any court of competent jurisdiction and remain in effect, and there shall not be any legal requirement enacted or deemed applicable to the mergers that makes consummation of the mergers illegal.

- •

- There shall not be pending or threatened any legal proceeding: (i) challenging or seeking to restrain or prohibit the consummation of the mergers or any of the other transactions contemplated by the

8

merger agreement; (ii) relating to the mergers and seeking to obtain from each of the Bus Companies or us or any of their or our respective subsidiaries any damages that may be material to each of the Bus Companies or us or any of their or our subsidiaries; (iii) seeking to prohibit or limit in any material respect each of the Bus Companies stockholders' ability to vote, receive dividends with respect to or otherwise exercise ownership rights with respect to our common stock; (iv) which would materially and adversely affect our rights to own the assets or operate the business of the Bus Companies; or (v) seeking to compel any of the Bus Companies or us or to dispose of or hold separate any material assets, as a result of the mergers or any of the other transactions contemplated by the merger agreement.

- •

- Appraisal rights shall not have been perfected pursuant to Section 623 of the New York Business Corporation Law by shareholders or beneficial owners thereof of the Bus Companies with respect to more than 3% of the number of shares of our common stock issuable in connection with the mergers.

- •

- Each Bus Company shall have received written resignation letters from each of the directors and officers of the Bus Companies requested by us effective as of the effective time of the Reorganization.

The Bus Companies' obligation to complete the mergers is conditioned upon the satisfaction or waiver in writing by them, at or before the effective time of the mergers, of the following conditions:

- •

- Each covenant and obligation that GTJ REIT is required to comply with or to perform at or prior to the closing of the mergers shall have been complied with and performed in all material respects.

- •

- The Registration Statement shall have been declared effective by the Securities and Exchange Commission and shall remain effective through closing of the mergers.

- •

- The merger agreement shall have been duly adopted by affirmative vote of the holders of two-thirds of the outstanding stock of each of the Bus Companies, voting separately.

- •

- All consents, approvals and other authorizations of any governmental body (including from all applicable state securities regulatory authorities) required to consummate the mergers and the other transactions contemplated by the merger agreement (other than the delivery of the certificate of merger with the Department of State of the State of New York) shall have been obtained, free of any condition that would reasonably be expected to have a material adverse effect on the Bus Companies.

- •

- No temporary restraining order, preliminary or permanent injunction or other order preventing the consummation of the mergers by each of the Bus Companies shall have been issued by any court of competent jurisdiction and remain in effect, and there shall not be any legal requirement enacted or deemed applicable to the mergers that makes consummation of the mergers by each of the Bus Companies illegal.

Termination of the merger agreement

Either GTJ REIT or the Bus Companies can terminate the merger agreement as follows:

- (a)

- A non-breaching party can terminate on account of a breach by the other party

- (b)

- Either GTJ REIT or the Bus Companies can terminate upon an adverse action by a governmental entity

- (c)

- Either GTJ REIT or the Bus Companies can terminate if the mergers have not occurred by January 31, 2007, subject to extension by agreement of the parties.

9

United States federal income tax consequences

We expect the mergers to qualify as reorganizations within the meaning of Section 368(a) of the Internal Revenue Code. If the mergers qualify as reorganizations under Section 368(a), Bus Company shareholders generally will not recognize any gain or loss upon the receipt of GTJ REIT common stock in exchange for Bus Company common stock in connection with the mergers. As part of attaining REIT status, GTJ REIT intends to make a distribution, in 2007 of undistributed historical earnings and profits of the Bus Companies of a sum expected to be not more than $62,000,000, $20,000,000 in cash and $42,000,000 in GTJ REIT common stock, as elected by each GTJ REIT stockholder as of the record date of such distribution. It is anticipated that if shareholders elect to receive at least 32% in cash, such funds will be sufficient to satisfy tax liabilities arising from this distribution. Tax matters are complicated, and the tax consequences of the mergers to each Bus Company shareholder will depend on the facts of each shareholder's situation. You are urged to read carefully the discussion in the section entitled "Federal Income Tax Consequences of the Reorganization and Our Proposed Status as a REIT" beginning on page 130 of this proxy statement/prospectus and to consult with your tax advisor for a full understanding of the tax consequences of your participation in this transaction.

Material Difference in rights of Bus Company shareholders and GTJ REIT shareholders

As part of the proposed Reorganization, the Bus Company shareholders are being requested to approve mergers of the Bus Companies with and into subsidiaries of GTJ REIT, and in exchange for their common stock of the Bus Companies, which are New York corporations, they would receive common stock of GTJ REIT, which is a Maryland corporation.

There are differences between the rights of New York shareholders in view of New York law and the Bus Companies' articles of incorporation and by-laws, as compared with and rights of Maryland stockholders in view of Maryland law and GTJ REIT's certificate of incorporation and by-laws. The following is only a summary and is qualified by the terms of the laws and documents referred to above.

The following table summarizes the material differences:

| | Bus Company Shareholders

| | GTJ REIT Stockholders

|

|---|

Notice of Meetings |

|

No less than 10 and no more than 40 days notice. |

|

No less than 10 and no more than 90 days notice. |

Quorum |

|

At least one third for Green and Triboro, at least 50% for Jamaica. |

|

At least 50% |

Voting |

|

Majority present unless otherwise required by law. |

|

Majority present unless otherwise required by law. |

Dividends |

|

Within discretion of the Board of Directors. |

|

Within discretion of the Board of Directors except that for so long as the Board deems it in the best interest of GTJ REIT to qualify as a REIT, at least 90% of net income to be paid in dividends. |

Written Consent |

|

Shareholders may act by unanimous written consent. |

|

Stockholders may act by unanimous written consent. |

| | | | | |

10

Dissenting

Shareholders |

|

A shareholder has the right to receive payment of the fair value

of his shares if he does not assent

to: |

|

A stockholder has a right to demand and receive payment of the fair market value of the stockholder's stock if: |

| | | A. a merger or consolidation except when:

The shareholder is a

member of the parent in

a merger;

The shareholder is a

member of the surviving

corporation unless the

merger changes the

rights of the

shareholder;

The shares are listed.

B. a sale, lease, exchange or other disposition of all or substantially all of the assets of a corporation which requires shareholder approval.

C. a share exchange. (Section 910 of the New York Business Corporation Law). | | A. the corporation consolidates or merges.

B. The stockholder's stock is to be acquired in a share exchange.

C. The corporation transfers its assets in a manner requiring shareholder consent.

D. The corporation amends its charter in a way that alters the contract rights of any outstanding stock and substantially adversely affects the stockholder's rights, unless the right to do so is reserved in the charter.

E. Business combination with an interested stockholder or affiliate. (Section 3-202 of the Maryland General Corporation Law). |

Voting |

|

Shareholders' voting is required for mergers, consolidation, dissolution and election of directors. |

|

Stockholders' voting is required for mergers, consolidation, dissolution and election of directors. |

Shareholding |

|

No restriction on amount. |

|

No person may hold more than 9.9% of the outstanding common stock. |

Other differences in the rights of the Bus Company shareholders and GTJ REIT shares should be noted, although they are based on agreements and not corporate law:

(a) The holders of up to 90% of the common stock of the Bus Companies are now parties to voting trust agreements, under which the voting trustee exercises substantially all of the voting rights of such shareholders. By contrast, there will be no voting trusts related to GTJ REIT.

(b) GTJ REIT expects to enter into a Stockholders' Rights Agreement before the mergers (the Bus Companies do not have this). The Stockholders' Rights Agreement provides for the issuance of rights to purchase Series A preferred stock which are convertible into common stock, or common stock, at below market values to all stockholders of GTJ REIT other than one or more persons owning, or seeking to own, collectively, 15% or more of the GTJ REIT common stock without approval by the Board of Directors. The effect of the Stockholders Rights Agreement is to discourage tender offers for or purchases of common stock of GTJ REIT, by an individual or a group, of 15% or more, without Board of Directors approval, thereby providing a barrier to a takeover not approved by the Board of Directors.

11

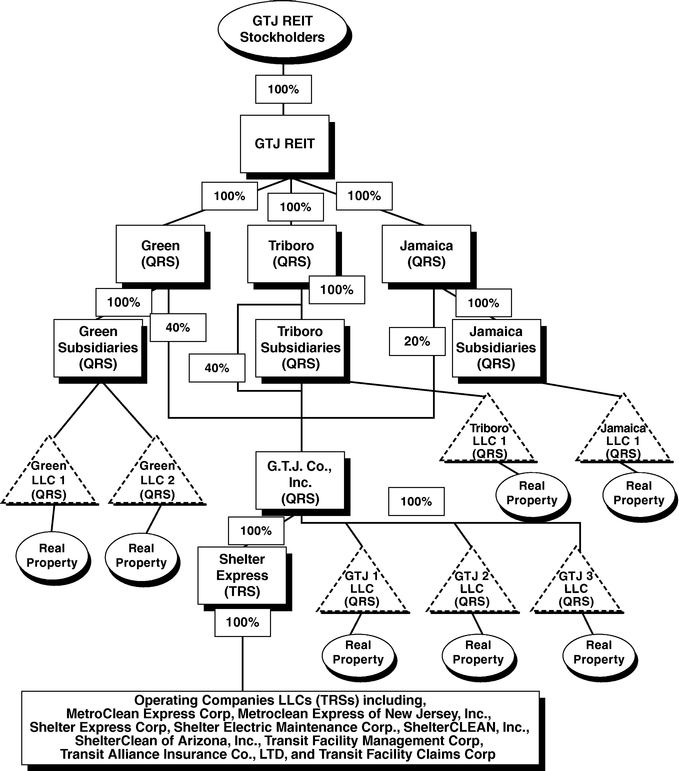

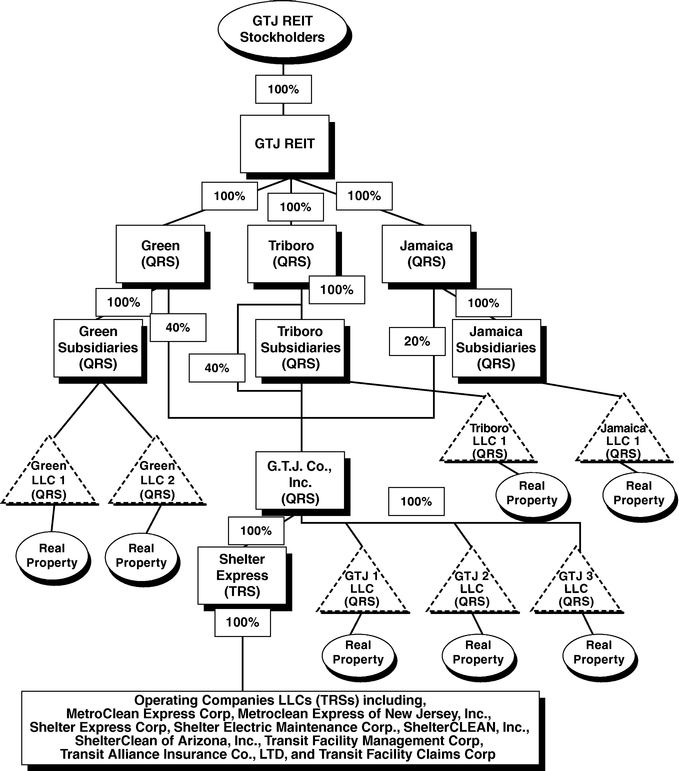

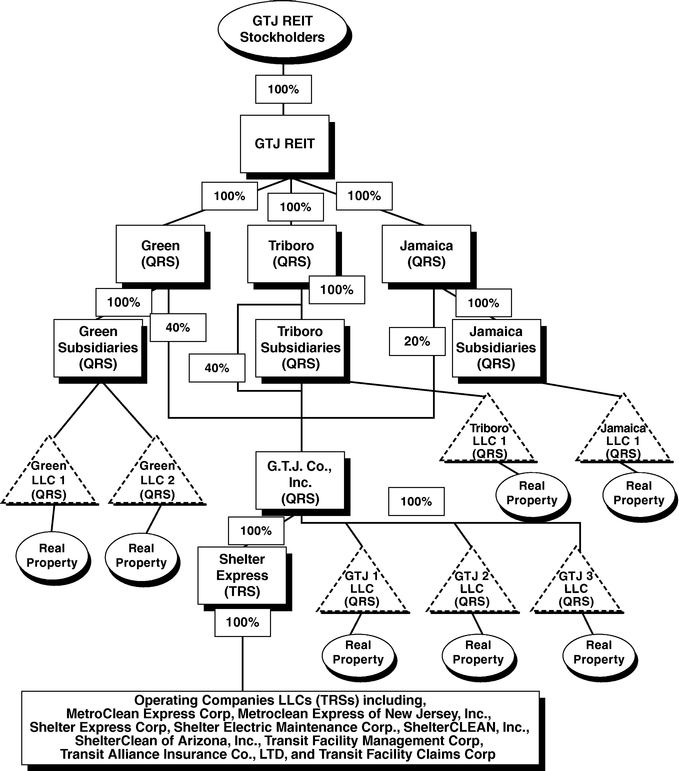

Expected Organizational chart after the Reorganization

The following chart represents our organization after the Reorganization ("QRS" means qualified REIT subsidiary, and "TRS" means taxable REIT subsidiary):

The above chart reflects the following. First Green, Triboro and Jamaica are merged into subsidiaries of GTJ REIT. Each of them has a subsidiary or subsidiaries ("Subsidiaries") holding their respective real

12

property. Green's Subsidiary would form two LLCs and transfer a real property to each of the same. Triboro and Jamaica's Subsidiaries each have one real property, and they would each form an LLC and transfer a real property to it. GTJ would form three LLCs and transfer its real properties to them. GTJ would designate Shelter Express as a TRS ("Opco Holdco") before the mergers and transfer to it all of its non-real estate subsidiaries ("OpCos"). From a REIT perspective, each of Green, Triboro and Jamaica and their respective Subsidiaries, GTJ, and all of the LLCs holding GTJ's real properties, are expected to be treated as qualified REIT subsidiaries or disregarded for federal tax purposes. Opco Holdco and the OpCos are expected to be treated as taxable REIT subsidiaries.

Summary of pro forma consolidated financial data

Assuming approval by the Bus Companies' shareholders and consummation of the Reorganization, our pro forma operations for the year ended December 31, 2005, the nine months ended September 30, 2006, and our pro forma financial position at September 30, 2006 are as follows:

Summary unaudited pro forma combined condensed financial consolidated information

The following summary unaudited pro forma combined condensed consolidated financial data of GTJ REIT, Inc. The unaudited pro forma consolidated financial statement information is based on, and should be read together with the consolidated financial statements as of September 30, 2006 (unaudited) and for the nine months ended September 30, 2006 (unaudited) and for the year ended December 31, 2005 which are found elsewhere in this prospectus.

| | GTJ REIT, INC.

| |

|---|

| | Nine months

ended

| | Year ended

December 31,

| |

|---|

| | September 30, 2006

| | 2005

| |

|---|

| | (in thousands)

(unaudited)

| | (in thousands)

| |

|---|

| Operating revenue | | $ | 23,773 | | $ | 27,527 | |

| Rental income | | | 7,541 | | | 9,648 | |

| | |

| |

| |

| | Total | | | 31,314 | | | 37,175 | |

| Operating expenses—other | | | 25,648 | | | 28,006 | |

| Operating expenses—rental operations | | | 3,790 | | | 2,280 | |

| | |

| |

| |

| Income (loss) from operations | | | 1,876 | | | 6,889 | |

| Other income (expense) | | | (732 | ) | | (1,673 | ) |

| | |

| |

| |

| Income (loss) from continuing operations before income taxes | | | 1,144 | | | 5,216 | |

| Provision for income tax expense | | | 517 | | | 1,891 | |

| | |

| |

| |

| Income (loss) from continuing operations before income (loss) of unconsolidated affiliates | | | 627 | | | 3,325 | |

| | |

| |

| |

| Income (loss) from continuing operations | | $ | 627 | | $ | 3,325 | |

| | |

| |

| |

13

Pro forma combined condensed consolidated balance sheet data:

| | September 30, 2006

| |

|---|

| | (in thousands)

(unaudited)

| |

|---|

| Cash and cash equivalents and restricted cash | | $ | 1,405 | |

| | |

| |

| Working capital deficiency | | $ | (145 | ) |

| | |

| |

| Total assets | | $ | 130,671 | |

| | |

| |

| Total liabilities | | $ | 29,895 | |

| | |

| |

| Total shareholders' equity | | $ | 100,776 | |

| | |

| |

Changes in Control

Under the provisions of our charter, no individual may own more than 9.9% of our outstanding common stock, in order to insure that REIT ownership rules are not violated. In addition, our board of directors has approved a Stockholder Rights Agreement to be entered into before the mergers, which is designed to discourage any group from acquiring, or seeking to acquire, in the aggregate, more than 15% of our outstanding common stock, without our board of directors' approval. In addition, Maryland law has a number of provisions that would discourage or prohibit takeovers of our company without the approval of our board of directors.

Risk Factors

Our company, following the Reorganization, will be subject to a number of risks, among which are the following:

- •

- We are not raising any financing in this offering, so that we will have to obtain other sources of funding for our growth.

- •

- We may incur debt up to 75% of our gross assets to expand our business, which could lead to an inability to pay distributions to our stockholders; additionally, distributions payable to our stockholders may include a return of capital.

- •

- If we do not qualify as a REIT for federal income tax purposes, we will be taxed as a corporation.

- •

- We may be required to borrow money, sell assets or issue new securities for cash to pay distributions required of us as a REIT.

- •

- As with the common stock of the Bus Companies, there is no public market for our common stock and none may develop in the foreseeable future. Thus, although your shares are freely transferable, there may not be a market for the same.

For further information, see "Risk Factors" commencing on page 15.

14

RISK FACTORS

Before you vote on the mergers described in this proxy statement/prospectus, you should be aware that we are subject to various risks, including those described below. You should carefully consider these risks together with all of the other information included in this prospectus before you decide to approve the Reorganization. The following include the material risks known to us at this time, other than those which are generic and applicable to a variety of businesses.

Transaction risks

Our company is newly formed and has not yet commenced business operations, which makes our future performance and the performance of your investment difficult to predict.

Our company was incorporated on June 26, 2006. We have no prior operating history as a REIT. Therefore, our future performance and the performance of your investment can not be predicted at this time.

Our failure to qualify as a REIT would subject us to corporate income tax, which would materially impact funds available for distribution.

We intend to operate in a manner so as to qualify as a REIT for federal income tax purposes beginning with the tax year ending December 31, 2007. Qualifying as a REIT will require us to meet several tests regarding the nature of our assets and income on an ongoing basis. A number of the tests established to qualify as a REIT for tax purposes are factually dependent. Therefore, you should be aware that while we intend to qualify as a REIT, it is not possible at this early stage to assess our ability to satisfy these various tests on a continuing basis. Therefore, we cannot assure you that our company will in fact qualify as a REIT or remain qualified as a REIT.

If we fail to qualify as a REIT in any year, we would pay federal income tax on our net income. We might need to borrow money or sell assets to pay that tax. Our payment of income tax would substantially decrease the amount of cash available to be distributed to our stockholders. In addition, we no longer would be required to distribute substantially all of our taxable income to our stockholders. Unless our failure to qualify as a REIT is excused under relief provisions of the federal income tax laws, we could not re-elect REIT status until the fifth calendar year following the year in which we failed to qualify.

In addition, even if we qualify as a REIT in any year, we would still be subject to federal taxation on certain types of income. For example, we would be subject to federal income taxation on the net income earned by our "taxable REIT subsidiaries", that is, our corporate subsidiaries with respect to which elections are made to treat the same as separate, taxable subsidiaries, presently including our outdoor maintenance and para transit businesses.

The proposed distribution of undistributed historical earnings and profits to the Bus Company shareholders, consisting of cash and/or common stock, will be taxable to them as a dividend, resulting in tax liability to such shareholders.

The proposed earnings and profits distribution would be taxable to the Bus Company shareholders as a dividend. The federal tax rate will be 15%, based on present tax law, and the state taxes will vary from state to state. Any shareholder electing cash of less than the tax on the distribution to such shareholder will be required to pay taxes on some or all of such distribution from a source other than the distribution.

15

We may have to spinoff our taxable REIT subsidiaries, which would reduce our value.

On a going forward basis, at least 75% of our assets must be those which may be held by REITs. Our outdoor maintenance and para transit business assets, and any other assets we may add to that group, are not qualified to be held directly by a REIT. Accordingly, we may be required, in the future, to spinoff these businesses in order to protect our status as a REIT. If we do so, we may be distributing a significant portion of our assets, which could materially and adversely affect the value of our common stock. It should be noted, however, that such distribution would be made to the then holders of our common stock.

Real property business risks

Our real property portfolio is derived from the Bus Companies and we may not grow or diversify our real estate portfolio in the foreseeable future, leaving us vulnerable to New York area problems.

We will own six income producing real properties which are presently owned, collectively, by the Bus Companies. We are raising no funds in this offering and so, without a sale of an existing real property, which is not contemplated for at least 10 years, the raising of funds by the sale of debt or equity securities or significant mortgage financing, our real property portfolio will not grow or be diversified.

We have not determined what other kinds of real property may be the subject of a future investment, which may create uncertainty.

The formation of the Company and the Reorganization are based on the Bus Companies' real property and outdoor maintenance businesses and a paratransit business. We have formulated no plans with respect to future real property investments. Therefore, we can not predict the future business direction of the Company.

Adverse financial conditions in New York City will adversely affect all of our initial portfolio of real properties.

All of our real property is commercial and is located in Queens and Brooklyn, New York and New York City is the sole tenant of four of the properties. The lack of diversity in the properties which we will own, and their principal tenant, New York City, should we not diversify after the Reorganization, could increase your risk of owning our shares. We are not raising any funds in this offering for diversification. Adverse conditions at that limited number of properties or in the location in which the properties exist would have a direct negative impact on your return as a stockholder.

Negative characteristics of real property investments

The growth and diversification of our real property business is expected to be financed, in substantial part, by mortgage financing. We may borrow sums up to 75% of the value of our real property portfolio. Such loans may result in substantial interest charges which can materially reduce distributions to our stockholders. The documentation related to such loans is expected to contain covenants regulating the manner in which we may conduct our businesses and may restrict us from pursuing opportunities which could be beneficial to our stockholders. In addition, if we are unable to meet our payment or other obligations to our lenders, we risk loss of some or all of our real property portfolio.

We depend upon our tenants to pay rent, and their inability or refusal to pay rent will substantially reduce our collections and payment of our indebtedness, leading to possible defaults, and reduce cash available for distribution to our stockholders.

Our real property, particularly those we may purchase after the Reorganization, will be subject to varying degrees of risk that generally arise from such ownership. The underlying value of our properties and the ability to make distributions to you depend upon the ability of the tenants of our properties to

16

generate enough income to pay their rents in a timely manner. Their inability or unwillingness to do so may be impacted by employment and other constraints on their finances, including debts, purchases and other factors. Additionally, the ability of commercial tenants of commercial properties would depend upon their ability to generate income in excess of their operating expenses to make their lease payments to us. Changes beyond our control may adversely affect our tenants' ability to make lease payments and consequently would substantially reduce both our income from operations and our ability to make distributions to you. These changes include, among others, the following:

- •

- changes in national, regional or local economic conditions;

- •

- changes in local market conditions; and

- •

- changes in federal, state or local regulations and controls affecting rents, prices of goods, interest rates, fuel and energy consumption.

Due to these changes or others, tenants may be unable to make their lease payments. A default by a tenant, the failure of a tenant's guarantor to fulfill its obligations or other premature termination of a lease could, depending upon the size of the leased premises and our ability to successfully find a substitute tenant, have a materially adverse effect on our revenues and the value of our common stock or our cash available for distribution to our stockholders.

If we are unable to find tenants for our properties, particularly those we may purchase after the Reorganization, or find replacement tenants when leases expire and are not renewed by the tenants, our revenues and cash available for distribution to our stockholders will be substantially reduced.

Lack of diversification and liquidity of real estate will make it difficult for us to sell underperforming properties or recover our investment in one or more properties.

Our business will be subject to risks associated with investment primarily in real property. Real property investments are relatively illiquid. Our ability to vary our portfolio in response to changes in economic and other conditions will be limited. We cannot assure you that we will be able to dispose of a property when we want or need to. Consequently, the sale price for any property we may purchase of the Reorganization may not recoup or exceed the amount of our investment.

Lack of geographic diversity may expose us to regional economic downturns that could adversely impact our real property operations or our ability to recover our investment in one or more properties.

All of the properties we will initially own are located in the counties of Queens and Brooklyn, New York City. Geographic concentration of properties will expose us to economic downturns in New York City. A recession in this area could adversely affect our ability to generate or increase operating revenues, attract new tenants or dispose of unproductive properties.

Each of the Bus Company real properties has been, and continues to be, used as a bus depot or automobile facility and has certain environmental conditions resulting in continuing exposure to environmental liabilities.

Generally all the Bus Companies' real property have had activity regarding removal and replacement of underground storage tanks and soil removal. Upon removal of the old tanks, any soil found to be unacceptable was heated off site to burn off contaminants. Fresh soil was brought in to replace earth which had been removed. There are still some levels of contamination at the sites, and groundwater monitoring programs have been put into place. Closures of existing New York State Department of Environmental Control spill numbers may be warranted if it can be shown that the remaining degree of impact is non threatening and within acceptable levels. Each of the properties is in a commercial zone and is still used as a transit depot including maintenance of vehicles. We can not assess what further liability may arise from

17

these sites. For further information on existing conditions, remediation and related costs, see "Environmental Issues" commencing on page 66 of this proxy statement/prospectus.

Discovery of previously undetected environmentally hazardous conditions at our real properties would result in additional expenses, resulting in a decrease in our revenues and the return on your shares of common stock.

Under various federal, state and local environmental laws, ordinances and regulations, a current or previous real property owner or operator may be liable for the cost to remove or remediate hazardous or toxic substances on, under or in such property. These costs could be substantial. Such laws often impose liability whether or not the owner or operator knew of, or was responsible for, the presence of such hazardous or toxic substances. Environmental laws also may impose restrictions on the manner in which property may be used or businesses may be operated, and these restrictions may require substantial expenditures or prevent us from entering into leases with prospective tenants that may be impacted by such laws. Environmental laws provide for sanctions for noncompliance and may be enforced by governmental agencies or, in certain circumstances, by private parties. Certain environmental laws and common law principles could be used to impose liability for release of and exposure to hazardous substances, including asbestos-containing materials into the air. Third parties may seek recovery from real property owners or operators for personal injury or property damage associated with exposure to released hazardous substances. The cost of defending against claims of liability, of complying with environmental regulatory requirements, of remediating any contaminated property, or of paying personal injury claims could reduce the amounts available for distribution to you.

A number of risks to which our real properties may be exposed may not be covered by insurance, which could result in losses which are uninsured.

We could suffer a loss due to the cost to repair any damage to properties that are not insured or are underinsured. There are types of losses, generally of a catastrophic nature, such as losses due to terrorism, wars, earthquakes or acts of God, that are either uninsurable or not economically insurable. We may acquire properties that are located in areas where there exists a risk of hurricanes, earthquakes, floods or other acts of God. Generally, we will not obtain insurance for hurricanes, earthquakes, floods or other acts of God unless required by a lender or we determine that such insurance is necessary and may be obtained on a cost-effective basis. If such a catastrophic event were to occur, or cause the destruction of one or more of our properties, we could lose both our invested capital and anticipated profits from such property.

You may not receive any distributions from the sale of one of our properties, or receive such distributions in a timely manner, because we may have to provide financing to the purchaser of such property, resulting in an inability or delay of distributions to stockholders.

If we sell a property or our company, you may experience a delay before receiving your share of the proceeds of such liquidation. In a forced or voluntary liquidation, we may sell our properties either subject to or upon the assumption of any then outstanding mortgage debt or, alternatively, may provide financing to purchasers. We may take a purchase money obligation secured by a mortgage as partial payment. To the extent we receive promissory notes or other property instead of cash from sales, such proceeds, other than any interest payable on those proceeds, will not be included in net sale proceeds until and to the extent the promissory notes or other property are actually paid, sold, refinanced or otherwise disposed of. In many cases, we will receive initial down payments in the year of sale in an amount less than the selling price and subsequent payments will be spread over a number of years. Therefore, you may experience a delay in the distribution of the proceeds of a sale until such time.

18

Our outdoor maintenance businesses and paratransit business depend on large direct or indirect municipal contracts, which are subject to the conduct of customers and municipalities and require substantial capital, which may be difficult to obtain.

We will operate several outdoor maintenance businesses including bus shelters, bill boards advertising displays and outdoor construction and maintenance support. Much of this business is related to large customer contracts with municipalities. The loss by customers of one or more of those contracts could have a material adverse effect on our business. In addition, these businesses have required significant capital and may require significant additional capital in the future. In addition to the risk related to additional investment, the capital may have to be funded by borrowing or asset sales in order to have funds available for REIT mandated distributions to our stockholders, increasing the cost of such capital. In addition, our paratransit business depends on the continuance of one major agreement with the Metropolitan Transit Authority.

Risks related to possible conflicts of interest

Our officers and directors may have other interests which may conflict with their duties to us and our stockholders, and which may have adverse effects on the interests of us and our stockholders

Our officers and directors may have other interests which could conflict with their duties to us and our stockholders, and which may have adverse effects on the interests of us and our stockholders. For example, certain of such persons may have interests in other real estate related ventures and may have to determine how to allocate an opportunity between us and such other ventures. Also, such persons may have to decide on whether we should purchase or dispose of real property from or to an entity with which they are related, or conduct other transactions, and if so, the terms thereof. Such determinations may either benefit us or be detrimental to us. Our officers and directors are expected to behave in a fair manner toward us, and we require that potential conflicts be brought to the attention of our board of directors and that determinations will be made by a majority of directors who have no interest in the transaction. As of this time, only one officer and director, Paul Cooper, conducts a real property business apart from his activities with us.

Risks related to our common stock

The absence of a public market for our common stock will make it difficult for you to sell your shares, which may have to be held for an indefinite period.

Prospective stockholders should understand that our common stock, like that of the Bus Companies, is illiquid, and they must be prepared to hold their shares of common stock for an indefinite length of time. Before this offering, there has been no public market for our common stock, and initially we do not expect a market to develop. We have no current plans to cause our common stock to be listed on any securities exchange or quoted on any market system or in any established market either immediately or at any definite time in the future. While our board of directors may attempt to cause our common stock to be listed or quoted in the future, there can be no assurance that this event will occur. Accordingly, stockholders will find it difficult to resell their shares of common stock. Thus, our common stock should be considered a long-term investment. In addition, there are restrictions on the transfer of our common stock. In order to qualify as a REIT, our shares must be beneficially owned by 100 or more persons at all times and no more than 50% of the value of our issued and outstanding shares may be owned directly or indirectly by five or fewer individuals and certain entities at all times. Our charter provides that no person may own more than 9.9% of the issued and outstanding shares of our common stock. Any attempted ownership of our shares that would result in a violation of one or more of these limits will result in such shares being transferred to an "excess share trust" so that such shares will be disposed of in a manner consistent with the REIT ownership requirements. In addition, any attempted transfer of our shares that

19

would cause us to be beneficially owned by less than 100 persons will be void ab initio (i.e., the attempted transfer will be considered to never have occurred).

The allocation of our common stock among the Bus Companies' shareholders has been established by appraisals and a fairness opinion, rather than market values, and could be deemed arbitrary.

We have allocated 10,000,000 shares, the initial amount of our outstanding common stock, among the stockholders of the Bus Companies, as follows: 4,208,800 shares for the Green shareholders, 3,828,700 shares for the Triboro shareholders and 1,962,500 shares for the Jamaica shareholders. These allocations are based on appraisals of the Bus Companies' real property and outdoor maintenance businesses' and a paratransit business's assets and liabilities, and a fairness opinion provided by Ryan Beck & Co., Inc. There is no external reference for the value of the Bus Companies and their holdings based on either a market capitalization basis or a recent sale basis. While we do not consider the allocation arbitrary, it is not referenced to actual trading or sale transactions.

Our stockholders' interests may be diluted by the proposed earnings and profits distribution, issuances under our Stock Option Plan, and other common stock issuances, which could result in lower returns to our stockholders.

Our board of directors is authorized, without stockholder approval, to cause us to issue additional shares of our common stock, or shares of preferred stock on which it can set the terms, and to raise capital through the issuance of options, warrants and other rights, on terms and for consideration as the board of directors in its sole discretion may determine, subject to certain restrictions in our charter in the instance of options and warrants. Any such issuance could result in dilution of the equity of the stockholders. The board of directors may, in its sole discretion, authorize us to issue common stock or other interests or our securities to persons from whom we purchase real property or other assets, as part or all of the purchase price. The board of directors, in its sole discretion, may determine the value of any common stock or other equity or debt securities issued in consideration of property or services provided, or to be provided, to us.