UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 30, 2010

Lions Gate Lighting Corp.

(Exact name of registrant as specified in its charter)

| Nevada | 000-52401 | 47-0930829 |

| (State or Other Jurisdiction | (Commission File | (I.R.S. Employer |

| of Incorporation) | Number) | Identification Number) |

405 Lexington Avenue

26th Floor, Suite 2640

New York, NY 10174

(Address of principal executive offices) (zip code)

212-907-6492

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Copies to:

Louis A. Brilleman, Esq.

110 Wall Street, 11th Floor

New York, New York 10005

Phone: (212) 709-8210

Fax: (212) 943-2300

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

FORWARD LOOKING STATEMENTS

Some of the statements contained in this Form 8-K that are not historical facts are “forward-looking statements” which can be identified by the use of terminology such as “estimates,” “projects,” “plans,” “believes,” “expects,” “anticipates,” “intends,” or the negative or other variations, or by discussions of strategy that involve risks and uncertainties. We urge you to be cautious of the forward-looking statements, in that such statements, which are contained in this Form 8-K, reflect our current beliefs with respect to future events and involve known and unknown risks, uncertainties, and other factors affecting our operations, market growth, services, products, and licenses. No assurances can be given regarding the achievement of future results, as actual results may differ materially as a result of the risks we face, and actual events may differ from the assumptions underlying the statements that have been made regarding anticipated events. Such statements reflect our current view with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report entitled “Risk Factors”) relating to our industry, operations and results of operations and any businesses that we may acquire, and include, without limitation:

1. Our ability to attract and retain management, and to integrate and maintain technical information and management information systems;

2. Our ability to generate customer demand for our products;

3. The intensity of competition; and

4. General economic conditions.

Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

All written and oral forward-looking statements made in connection with this Form 8-K that are attributable to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results. Given the uncertainties that surround such statements, you are cautioned not to place undue reliance on such forward-looking statements.

In this report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to shares of our common stock. The following discussion should be read in conjunction with the audited annual financial statement, unaudited interim financial statements and pro forma financial statements and the related notes filed herein.

Unless otherwise indicated or the context otherwise requires, all references below in this current report on Form 8-K to “we”, “us”, “our”, and “the Company”, refer to Lions Gate Lighting Corp, a Nevada corporation, and its wholly-owned subsidiaries, Bluefin Acquisition Group Inc. and Kali Tuna d.o.o.

Item 1.01 Entry into a Material Definitive Agreement.

Share Exchange Agreement

As disclosed previously, on May 3, 2010, the Company entered into a Share Exchange Agreement (the “Exchange Agreement”) with Atlantis Group HF, an Icelandic company and the sole indirect shareholder (the “Shareholder”) of Kali Tuna d.o.o., a Croatian limited liability company (“Kali Tuna”), pursuant to which the Company purchased from the Shareholder all issued and outstanding shares of Bluefin Acquisition Group Inc., a New York company and wholly owned subsidiary of the Shareholder that was created for the specific purpose of holding the Kali Tuna shares, in consideration for the issuance to the Shareholder of 30,000,000 shares of common stock of the Company (the “Share Exchange”).

Also, as disclosed previously, completion of the Share Exchange Agreement was subject to a number of conditions, including the deposit into escrow of a minimum of $15,000,000 by private investors. This condition was waived by the Shareholder as permitted under the Exchange Agreement, and the minimum funding requirement was reduced to $6,000,000.

-2-

Subscription Agreements

On June 30, 2010, the Company entered into a series of identical subscription agreements with a number of accredited investors (the “Investors”), pursuant to which the Investors purchased from the Company 7,300,000 units (the “Units”), with each Unit consisting of one share of common stock of the Company and a five-year warrant to purchase 0.2 shares of the Company’s common stock at $2.00 per whole share (the “Warrants”). The purchase price per Unit was $1.00. Total gross proceeds to the Company resulting from the financing transaction (the “Financing”) were $7,300,000.

Endeavor Holdings, Inc. (“Endeavor”), which served as the Company’s exclusive placement agent in connection with the offer and sale of the Units, will receive aggregate placement agent fees of approximately $73,000 as well as five-year warrants to purchase 730,000 shares of common stock at $2.00 per share.

In addition to Endeavor, Jones Gable & Company Limited (“Jones Gable”) also acted as a placement agent in connection with the offer and sale of the Units and will receive placement agent fees through the issuance of approximately 511,000 shares of common stock of the Company.

The Company claims an exemption from the registration requirements of the Securities Act of 1933, as amended (the “Act”), for the securities issued in the Share Exchange and the Financing pursuant to Section 4(2) of the Act and/or Regulation D promulgated there under since, among other things, the transaction did not involve a public offering, the Investors are accredited investors and/or qualified institutional buyers, the Investors had access to information about the Company and their investment, the Investors took the securities for investment and not resale, and the Company took appropriate measures to restrict the transfer of the securities. As such, none of these securities may be offered or sold in the United States unless they are registered under the Act, or an exemption from the registration requirements of the Act is available. No registration statement covering these securities has been filed with the Securities Exchange Commission or with any state securities commission.

Item 2.01 Completion of Acquisition or Disposition of Assets

On June 30, 2010, the Company completed the transactions contemplated under the Exchange Agreement and the Financing. The Share Exchange resulted in a change in control of the Company with the Shareholder owning 30,000,000 shares of common stock of the Company out of a total of 45,261,000 issued and outstanding shares after giving effect to the Share Exchange and the Financing. In connection with the Share Exchange, Robert Fraser and William Grossholz, being all of the directors and officers of the Company prior to the Share Exchange, resigned their positions effective at the closing of the Share Exchange, and the Shareholder’s nominees were elected directors of the Company and appointed as its executive officers.

Pursuant to the Exchange Agreement, the Shareholder transferred to the Company all of the issued and outstanding shares of common stock of Bluefin Acquisition Group Inc., a New York corporation (“Bluefin”). Bluefin is the holder of all issued and outstanding shares of Kali Tuna. In consideration for the transfer of the shares of Bluefin, the Company issued 30,000,000 shares of common stock of the Company to the Shareholder.

As a result of the Exchange Agreement, (i) Kali Tuna became an indirect wholly-owned subsidiary of the Company and (ii) the Company succeeded to the business of Kali Tuna as its sole business. The Company intends to change its name to “Umami Sustainable Seafood Inc.”, subject to regulatory approvals.

For accounting purposes, the Share Exchange was treated as an acquisition of the Company and a recapitalization of Bluefin. Bluefin is the accounting acquirer and the results of its operations will be the results of the Company’s operations going forward.

Immediately prior to the completion of the Share Exchange, the Company divested itself of its wholly-owned subsidiary, LG Lighting Corp., in consideration for the satisfaction of debt owed to affiliated parties.

DESCRIPTION OF KALI TUNA’S BUSINESS

NOTE: The discussion contained in this Item 2.01 relates primarily to Kali Tuna. Information relating to the business and results of operations of the Company and all other information relating to the Company prior to the Share Exchange has been previously reported in its Annual Report on Form 10-K for the year ended February 28, 2010, and subsequent periodic filings with the Securities and Exchange Commission and is herein incorporated by reference to those reports.

Company Overview

Through our indirect wholly-owned subsidiary, Kali Tuna, a limited liability company organized under the laws of the Republic of Croatia, we own and operate facilities and equipment in Croatia where we farm Northern Bluefin Tuna for sale mostly into the Japanese sushi and sashimi market. The Company believes that Kali Tuna is considered one of the most respected and trusted suppliers of premium sushi and sashimi grade tuna in Japan and sells almost all of its products to large Japanese trading houses.

-3-

Kali Tuna was organized in 1996 under the laws of the Republic of Croatia by individuals who had gained considerable experience in the area of tuna fishing, farming and trading in Southern Australia for a period of approximately 30 years before moving their operations to Croatia.

In 2005, Kali Tuna was acquired by Atlantis, an Iceland based holding company that seeks to produce and distribute high quality, healthy and sustainable seafood to satisfy the world’s growing protein need in an economical, efficient and environmentally friendly manner. In March 2010, Atlantis created Bluefin, a New York based holding company and wholly owned subsidiary of Atlantis, for the sole purpose of holding the shares of Kali Tuna.

Kali Tuna’s activities consist of: (a) tuna farming and processing, (b) sales and exports of tuna products, and (c) processing of fish feed for its tuna farming operations. Through an affiliated entity, it also operates a fleet of seven fishing vessels that typically catch Northern Bluefin Tuna and small pelagic fish used for tuna feed in the Adriatic and transport the live tuna back to its farming sites off the Croatian coast for further cultivation.

Recently, Atlantis has entered into an agreement with Daito Gyouri of Japan (the “Daito Agreement”) for the sale and delivery of at least 500 metric tons of frozen Northern Bluefin Tuna on an annual basis. On June 30, 2010, the Company entered into a sales agency agreement with Atlantis. Under the terms of the agreement, Atlantis will be granted the exclusive right to sell, on the Company’s behalf, all of the Company’s Northern Bluefin Tuna products into the Japanese market. As a result of the sales agency agreement, it is contemplated that tuna to be delivered under the Daito Agreement by Atlantis will be filled by fish that was farmed by us. We have agreed to pay Atlantis an agency commission of 2% of all sales to be made under this agency agreement.

Our objective is to become a world leader in the Northern Bluefin Tuna industry. In addition, we will seek to create a self sustaining farm environment where tuna fish spawn, and the resultant eggs are hatched in captivity, without having to rely on the capture of fish in the open seas thereby depleting the natural stock of Bluefin Tuna.

Industry Overview

Aquaculture Industry

Aquaculture is the farming of aquatic organisms including fish, molluscs, crustaceans and aquatic plants. Farming implies some form of intervention in the rearing process to enhance production, such as regular stocking, feeding, protection from predators, etc. Farming also implies individual or corporate ownership of the stock being cultivated. For statistical purposes, aquatic organisms which are harvested by an individual of corporate body which has owned them throughout their rearing period contribute to aquaculture while aquatic organisms which are exploitable by the public as a common property resource, with or without appropriate licenses, are the harvest of fisheries. Aquaculture production specifically refers to output from aquaculture activities, which are designated for final harvest for consumption.

Aquaculture is the world’s fastest growing segment in the food production system and has been for the past two decades. According to a recent study by the Food and Agriculture Organization of the United Nations (herein, the “FAO”) published on March 2, 2009, world fisheries production reached a high of 143.6 million metric tons in 2006. The contribution of aquaculture to the world fisheries production in 2006 was 51.7 million tons of fish, which is 36% of world fisheries production, up from 3.6% in 1970. Global aquaculture accounted for 6% of the fish available for human consumption in 1970. In 2006, global aquaculture accounted for 47% of the fish available for human consumption according to the FAO. The FAO report also describes that over half of the global aquaculture in 2006 was freshwater finfish. Based on the FAO’s projections, it is estimated that in order to maintain the current level of per capita consumption, global aquaculture production will need to reach in excess of 80 million tons of fish by 2050.

According to the FAO, per capita supply from aquaculture increased from 0.7 kg in 1970 to 7.8 kg in 2006, an average annual growth rate of 6.9%. It is set to overtake capture fisheries as a source of food fish. From a production of less than 1 million tons per year in the early 1950s, production in 2006 was reported to be 51.7 million tons with a value of US$78.8 billion, representing an annual growth rate of nearly 7%.

As the availability of sites for aquaculture is becoming increasingly limited and the ability to develop non-agricultural land is restricted, the competition to develop additional aquaculture production systems is intensifying. As the intensification for aquaculture production systems increases, the demand for institutional support, services and skilled persons is anticipated to increase, along with the demand for more knowledge-based aquaculture education and training as aquaculture becomes more important worldwide.

Tuna Industry

Tuna and tuna-like species are of great economic importance and represent a significant source of food. They include approximately forty species occurring in the Atlantic, Indian and Pacific Oceans and in the Mediterranean Sea. Their global production has increased from less than 0.6 million tons in 1950 to almost six million tons in 2006.

-4-

The so-called principal market tuna species are the most economically important among the tuna and tuna-like species. They are landed in numerous locations around the world, traded on a nearly global scale and also processed and consumed in many locations worldwide. According to the FAO, in 2007, their catch was approximately four million tons, which represents about 65% of the total catch of all tuna and tuna-like species. Most catches of the principal market tuna species are taken from the Pacific (69.0% of the total catch of principal market tuna species in 2007), with the Indian contributing much more (21.7% in 2007) than the Atlantic and the Mediterranean Sea (9.5% in 2007).

Approximate contributions of individual principal market tuna species to their 2007 total catch is given below.

| Principal market tunas | ||

| Albacore (ALB) | 5.4% |

| Atlantic bluefin tuna (BFT) | less than 1% |

| Bigeye tuna (BET) | 10.0 % |

| Pacific bluefin tuna (PBF) | less than 1% |

| Southern bluefin tuna (SBF) | less than 1% |

| Skipjack tuna (SKJ) | 59.1% |

| Yellowfin tuna (YFT) | 24.0% |

Source: FAO (http://www.fao.org/fishery/statistics/tuna-catches/en)

Bluefin Tuna Trade

The bluefin trade includes three species of tuna: the Pacific Bluefin, the Southern Bluefin and the Atlantic or Northern Bluefin. In 2007, the total global bluefin trade was estimated to be in excess of US$1 billion on a wholesale basis.

The Northern Bluefin Tuna (Thunnus thynnus) is native to both the western and eastern Atlantic Ocean, the Mediterranean and the Black Sea. It can live up to 30 years and can reach weights of over 1,100 pounds.

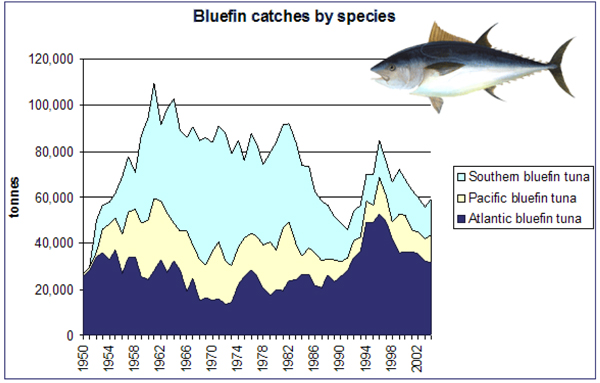

The following graph shows catches for each species of bluefin in metric tons per year.

-5-

Source: Fish Info Network (http://www.eurofish.dk/dynamiskSub.php4?id=3416)

As concerns over depleting the natural stock of bluefin tuna have increased in recent years, international organizations have increased regulation relating to and imposed strict quota on bluefin catches. The main international body that regulates fishing activities and trade in the Atlantic Bluefin is the International Commission for the Conservation of Atlantic Tunas or ICCAT. It describes itself as an inter-governmental fishery organization responsible for the conservation of tunas and tuna-like species in the Atlantic Ocean and its adjacent seas. Its primary tool in its conservation efforts is its ability to impose quotas. The organization was established in 1966 and covers 30 species of tuna, including the Atlantic or Northern Bluefin Tuna.

In November 2006, the ICCAT reached an agreement to reduce the bluefin tuna quota in the Mediterranean Sea from 32,000 metric tons in 2006 to 25,500 metric tons in 2010. In November 2008, the ICCAT set the annual quota at 22,000 metric tons, gradually reducing it to 18,500 tons by 2011. Environmentalist groups claim that this quota is too high and that 15,000 tons should have been set as an appropriate level. In October 2009 at an ICCAT meeting in Brazil it was agreed to shorten the fishing period to one month and reduce the quotas to 13,500 tonnes annually. The quota is now close to the figure supported by the company. Following this, to reduce further pressure on the stock, Italy decided not to catch any tuna in 2010 - reducing this number to roughly 11,500 tonnes.

In 2008, the ICCAT adopted measures which include a 15 year recovery plan for bluefin tuna starting in 2007 and running through 2022. Among other things, the plan calls for 6-month off seasons for specific types of boats, bans the use of aircraft in spotting tuna, forbids the capture of tuna under 30 kg except in certain specific circumstances, and requires better reporting of tuna catches. It also allows tuna to only be offloaded at designated ports and obliges countries to place observers on fishing boats to monitor their adherence to regulations.

In March 2010, at a meeting of the Conference of the Parties to the Convention on International Trade in Endangered Species of Wild Fauna and Flora, or CITES, in Doha, Qatar, a proposal for a total ban on the trade in Atlantic Bluefin was defeated by a wide majority of participants. As a result, for the foreseeable future, fishing regulation regarding the species will remain in the hands of ICCAT.

-6-

Japan has traditionally been one of the largest consumers of tuna, especially the bluefin tuna which is used as a premium ingredient for sushi and sashimi. The following table details the annual Japanese imports of various species of fresh and chilled tuna.

Fresh/chilled Tuna: Imports Japan (1000 tonnes) | ||||||||||||||||||||||||

2004 | 2005 | 2006 | 2007 | Jan - Jun 2008 | Jan - Jun 2009 | |||||||||||||||||||

| Yellowfin | 24,1 | 21,4 | 19 | 16,9 | 9,2 | 8 | ||||||||||||||||||

| Bigeye | 18,9 | 16,8 | 15,8 | 14,5 | 7,2 | 7,5 | ||||||||||||||||||

| Skipjack | 10 | 9,9 | 7,4 | 5,1 | 2,6 | 1,9 | ||||||||||||||||||

| S. Bluefin | 3,1 | 2,5 | 1,8 | 1,2 | 0,2 | 0,5 | ||||||||||||||||||

| Albacore | 0,4 | 0,2 | 0,3 | 0,3 | 0,1 | 0,1 | ||||||||||||||||||

| N. Bluefin | 0,1 | 0 | 0 | 0,1 | 0 | 0 | ||||||||||||||||||

| Total | 56,6 | 50,8 | 44,3 | 38,1 | 19,3 | 18 | ||||||||||||||||||

Source: Fish Info Network (http://www.eurofish.dk/dynamiskSub.php4?id=3595)

The following table details the annual Japanese imports of various species of frozen whole tuna. Annual tuna imports have been declining as a result of international regulations and the imposition of strict quotas by the ICCAT and other similar organizations.

| Frozen Tuna: Imports Japan (1000 tonnes) | ||||||||||||||||||||||||

2004 | 2005 | 2006 | 2007 | Jan - Jun 2008 | Jan - Jun 2009 | |||||||||||||||||||

| Yellowfin | 109,2 | 123,5 | 90,3 | 58,7 | 31,4 | 27 | ||||||||||||||||||

| Bigeye | 116,3 | 101,9 | 86,3 | 86,8 | 41,7 | 45 | ||||||||||||||||||

| Skipjack | 81,2 | 52 | 50,5 | 31,3 | 11,2 | 16,9 | ||||||||||||||||||

S. Bluefin | 8,2 | 7,2 | 7,9 | 8,4 | 0,1 | 0 | ||||||||||||||||||

| Albacore | 6,5 | 6,1 | 6,2 | 6 | 4,7 | 1,9 | ||||||||||||||||||

| N. Bluefin | 6,6 | 4,2 | 5,2 | 6,3 | 1,3 | 3,9 | ||||||||||||||||||

| Total | 328 | 294,9 | 246,4 | 197,5 | 90,4 | 94,7 | ||||||||||||||||||

Source: Fish Info Network (http://www.eurofish.dk/dynamiskSub.php4?id=3595)

The following table details the annual Japanese imports of various species of frozen tuna fillets and loins processed from whole fish.

Japan Imports of Frozen Tuna Fillets, Loins & Meat (in MT) | ||||||||||||||||||||||||||||||||||||

Jan - Jun 2008 | Jan - Jun 2007 | Jan - Jun 2006 | Jan - Jun 2005 | Annual 2007 | Annual 2006 | Annual 2005 | Annual 2004 | Annual 2003 | ||||||||||||||||||||||||||||

| Tuna* | 8932 | 8376 | 9103 | 7296 | 18369 | 17402 | 16222 | 13292 | 11919 | |||||||||||||||||||||||||||

| Bluefin | 10899 | 9679 | 9810 | 7865 | 13451 | 15542 | 10456 | 8841 | 5906 | |||||||||||||||||||||||||||

| Bluefin (meat) | 268 | 216 | 218 | 153 | 284 | 365 | 191 | 126 | 101 | |||||||||||||||||||||||||||

| Southern Bluefin | 0,58 | 2 | 26 | 128 | 5 | |||||||||||||||||||||||||||||||

| Total | 20099 | 18271 | 19131 | 15314 | 32125 | 33311 | 26895 | 22387 | 17931 | |||||||||||||||||||||||||||

*Excluding Bluefin and Southern Bluefin

Source: Fish Info Network (http://www.eurofish.dk/dynamiskSub.php4?id=3595)

-7-

The Company’s focus has been on sales of bluefin tuna into Japan where a single large size bluefin tuna can fetch as much as $100,000 in Tsukiji fish market. The Company believes that it is regarded by the Japanese as a highly reputable wholesaler of premium fish products. Its reputation was further enhanced following the acquisition of the Company by Atlantis Group in 2005 as a result of that entity’s solid ties in the Japanese fish market which is built on strong personal relationships with key players in the Japanese fish market.

The following table sets forth fresh bluefin tuna imports into Japan by country.

| Fresh Bluefin imports into Japan (in tonnes) | ||||||||||||||||||||

2003 | 2004 | 2005 | Jan-Nov 2005 | Jan-Nov 2006 | ||||||||||||||||

| Mexico | 1896 | 3849 | 4097 | 3318 | 2359 | |||||||||||||||

| Australia | 2769 | 2839 | 2343 | 2343 | 1693 | |||||||||||||||

| Spain | 2537 | 2693 | 2277 | 1757 | 1643 | |||||||||||||||

| Rep. of Korea | 2579 | 667 | 1479 | 1464 | 1001 | |||||||||||||||

| Italy | 366 | 346 | 314 | 304 | 254 | |||||||||||||||

| Turkey | 896 | 1011 | 522 | 273 | 190 | |||||||||||||||

| Croatia | 226 | 123 | 240 | 101 | 162 | |||||||||||||||

| Tunisia | 221 | 144 | 212 | 180 | 106 | |||||||||||||||

| Malta | 647 | 449 | 180 | 122 | 97 | |||||||||||||||

| Others | 1487 | 909 | 729 | 862 | 559 | |||||||||||||||

| Total | 13624 | 13030 | 12393 | 10724 | 8064 | |||||||||||||||

Source: Fish Info Network (http://www.eurofish.dk/dynamiskSub.php4?id=3416)

The following table sets forth whole frozen bluefin tuna imports into Japan by country.

Frozen Atlantic Bluefin imports into Japan (in tonnes) | ||||||||||||||||||||

2003 | 2004 | 2005 | Jan-Nov 2005 | Jan-Nov 2006 | ||||||||||||||||

| Croatia | 2294 | 3492 | 2013 | 2013 | 3056 | |||||||||||||||

| Tunisia | 236 | 274 | 452 | 414 | 452 | |||||||||||||||

| Spain | 514 | 417 | 336 | 336 | 278 | |||||||||||||||

| Turkey | 477 | 1094 | 464 | 456 | 273 | |||||||||||||||

| Malta | 39 | 85 | 250 | 240 | 208 | |||||||||||||||

| Others | 1232 | 1263 | 705 | 668 | 631 | |||||||||||||||

| Total | 4792 | 6625 | 4220 | 4127 | 4898 | |||||||||||||||

Source: Fish Info Network (http://www.eurofish.dk/dynamiskSub.php4?id=3416)

In recent years, many Japanese vessel operators have gone out of business as a result of high fuel prices and scarce fishing resources. There is a national effort by Japanese authorities underway to scrap or buy out the old long liners which have found themselves deep in debt and have become a burden to their communities.

-8-

Fish Supply

We procure live bluefin tuna primarily through MB Lubin, a company owned by Dino Vidov, our General Manager. MB Lubin owns and operates a fleet of seven vessels. They catch fish primarily off the coast of Croatia. Occasionally, we may purchase live tuna from other local and foreign based suppliers that catch tuna off the coast of Malta and Libya and other Mediterranean locations. The tuna is deposited into special towing cages that are towed back to our two farming sites off the Croatian coast for transfer into permanent holding cages. Fishing takes place during the months of May and June only as permitted by international regulations. Transport of the catch to our farms is a slow process that can take many weeks to complete with speeds of the transport rarely exceeding one mile per hour to ensure survival of the live fish.

MB Lubin sells its live fish to us under an exclusive arrangement as memorialized in the Live Tuna Supply Contract dated July 1, 2009. Under the terms of the agreement, MB Lubin has undertaken to sell all its bluefin tuna catches to us. Under the agreement, which has a term of 20 years, all deliveries of tuna will be made at the market price prevailing at the time of delivery.

In addition, we have entered into an agreement with MB Lubin that provides for the sale and delivery to us of small fish that are used for feeding the tuna.

A portion of our farmed tuna production is performed jointly with our partner, Bluefin Tuna Hellas A.E., a Greece based entity. Together, we purchase live bluefin tuna from various international suppliers. In addition, we are partners with Bluefin Tuna Hellas in a 50-50 joint venture under the name Kali Tuna Trgovina, which purchases from us and exports our tuna products.

Although we do not believe that any of our suppliers of live tuna or fish feed are critical to our business, if for any reason we would be unable to procure fish from a particular supplier, this would likely lead to a temporary interruption in the supply of fish at least until we find another entity that can provide these services for us.

Customers and Marketing

We sell our fish mainly to three large Japanese importers who account for more than 90% of our sales. In March 2009, Atlantis entered into the Daito Agreement for the sale and delivery of at least 500 metric tons of frozen Northern Bluefin Tuna annually. We believe that we will benefit from this arrangement and are confident that the relationship with each of our customers is of a long term nature, whether or not there is a written agreement.

On June 30, 2010, the Company entered into a sales agency agreement with Atlantis. Under the terms of the agreement, Atlantis will be granted the exclusive right to sell, on the Company’s behalf, all of the Company’s Northern Bluefin Tuna products into the Japanese market. As a result of the sales agency agreement, it is contemplated that tuna to be delivered under the Daito Agreement by Atlantis will be filled by fish that was farmed by us. We have agreed to pay Atlantis an agency commission of 2% of all sales to be made under this agency agreement.

Harvesting the tuna from the cages occurs typically during the months of December and January when low outside temperatures facilitate optimal firmness of tuna meat. When selling frozen fish, each customer typically sends its own specially equipped freezer vessels to pick up the product from our farming site for freezing and transport to Japan. When selling fresh fish, we will ship the processed fish by overnight delivery to the requested location.

Research and Development

We conduct extensive research and development in two specific areas:

| · | We research the feeding habits of the bluefin tuna for the purpose of determining the optimal way of feeding the fish on our sites. Improving the so-called Food Conversion Ratio or FCR, which represents the number of kilograms of feed needed to produce one kilogram of fish, facilitates achieving maximum feeding efficiencies and cost savings. |

| · | We have also been conducting research and testing in the area of spawning the bluefin in captivity with the objective of closing the full circle farming process, i.e. farming bluefin tuna that is born and raised in captivity. In June 2009, we reached a major breakthrough when some of our tuna spawned in our farm facility. We believe that this was the first time tuna has spawned naturally in captivity without any hormone injections. In collaboration with the Institute of Oceanography and Fisheries in Split, Croatia, we managed to hatch the resultant eggs in a laboratory environment. We are in the final stages of preparing a hatchery for use during the next spawning season to allow us to advance our research. |

As a result of our recent successes in researching the creation of a closed life cycle in the Bluefin Tuna farming process, we believe that we will become less dependent on the capture of wild tuna. Therefore, we believe that we will be uniquely positioned to address the expected shortage in the supply of tuna, especially as it relates to the Japanese market.

-9-

Our Principal Competitive Strengths

We believe that we have the following competitive strengths:

| · | We have the most seasoned operation in our geographic area. We were the first commercial tuna farm in the Mediterranean and Adriatic areas. The farm was built by émigrés from Australia who had previously been leaders in the tuna farming business in Port Lincoln, Australia. All farm operations were set up according to the high standards used in Australia. Most of the key crew members have been with us from inception. |

| · | We have strong personal relationships within our target market. Following the acquisition of the Company by Atlantis Group in 2005, we were able to enhance our already considerable reputation in the Japanese fish market as a result of strong personal relationships between Atlantis executives and Japanese market leaders. Japanese business is generally built on personal trust, extensive knowledge regarding product quality assurance and a high level of expertise. Oli Steindorsson, Atlantis’s and our Chairman, is fluent in Japanese and has spent extended periods of time residing in that country. This has allowed us to capitalize on his experience, together with the team at Atlantis’s Japanese subsidiary, and further solidify our position as a trusted source of high quality fish products. |

| · | We have a unique farming cycle. Following the catch of fish, they are transferred into cages where they are fed and nurtured for up to three years. As a result, our output is less impacted by quota reductions and each wild caught fish (between 20-300 pounds) can be leveraged by a factor of up to 10 times given livestock gains over the period. We also have full traceability on the tuna feed, which means that every batch of feed we purchase may be tracked from the area where it was caught, to the boat catching it and to any other intermediaries until its delivery to our farm sites. Most of our competitors have shorter farming cycles (up to six months) or they practice “catch and kill”. |

| · | We operate in a unique farming environment. The waters where our farming sites are located are pristine with no cases of red or blue tide caused by the damaging build up of algae. There are no predators, such as sea otters, sea lions or sharks, in Adriatic waters that might be attacking the fish in captivity. With the islands surrounding the farm sites, we are sheltered naturally against storms. In addition, the salt and oxygen levels and the water temperature offer the best combination of conditions for sustainable growth of our tuna. |

| · | We have an experienced and knowledgeable workforce and a very low employee turnover. A number of our employees have been working for us for more than 10 years. Our employees have regularly been requested to assist in external operations worldwide as far as Australia and Mexico. All of the management in Croatia is fluent in English while a number of our key marketing people have multilingual skills that include Japanese. |

| · | We have reached major breakthroughs in our research and development efforts to close the full circle farming process. If our success in spawning and hatching in captivity can be sustained, we will become less dependent on wild catches of tuna. |

Our Growth Strategies

International concerns have been focused on over-catching and poaching of various tuna species, primarily concentrating on the Bluefin Tuna’s diminishing stock in the Mediterranean.

In response, ICCAT has been taking measures to regulate the catching of the Atlantic-Mediterranean territory covering the migration of Northern Bluefin Tuna looking at its “colleague organization”, the Commission for the Conservation of Southern Bluefin Tuna or CCSBT, and its measures taken to promote the conservation of Southern Bluefin Tuna in the southern hemisphere.

We endorse the efforts of these organizations and believe that it is critical to create world-wide industry leadership that will regulate the fishing for endangered species. Short term profit considerations will result in a failure to act and conserve and will lead to extinction of the bluefin tuna and the demise of our industry. We believe that we have an important role to play in the adoption of rules aimed at ensuring the long-term survival of the bluefin tuna. We further believe that we can be active in this area while generating profits for our shareholders, as reducing the supply of bluefin tuna will increase its price.

We believe that the following will be some of the critical elements in fulfilling our strategy to become the world leader in the bluefin tuna trade:

| · | Build up enough livestock to create carry-over inventories. Our objective has been to lengthen the farming cycle. This is expected to result in the greatest weight growth and an increase in the price paid per kilo of fish by our buyers (the bigger the fish, the better the price). In addition, it will mitigate the effects of short-term fluctuations in catching due to weather or other abnormal situations that may occur. |

-10-

| · | Strategic investments. We will seek to acquire stakes in tuna farming and fisheries with farming and/or fishing licenses in selected areas in countries with successful bluefin tuna farming history. We have already identified a number of targets. |

| · | Cooperate closely with regulators. With the assistance of scientists, we intend to assist regulators in formulating regulatory proposals aimed at the conservation of the bluefin tuna. We might also lobby for distribution of individual transferable quotas, or ITQs, and monitoring systems based on the experiences of leading countries in the seafood industry that have historically had to rely on sustainable usage of their fishery by strictly regulating and controlling the volume of catching. |

| · | Consolidating and upgrading of the fleet. We intend to reduce the existing catching capacity to fewer and more efficient vessels as the quota system develops. One of the important factors in sustainable fisheries management is to avoid overcapacity of fleet which is caused by underdevelopment in regulatory environments, for example with Olympic catch systems (first in gets the fish), versus the highly controlled ITQ system. |

| · | Increase our research and development. We intend to increase our efforts on closing the Northern Bluefin Tuna cycle in cooperation with leading research institutes in this field (i.e. intense farming) as well as enhancing feeding techniques to reduce the FCR of Tuna. We also intend to establish and fund a research centre in Kali, Croatia to focus on these issues. |

| · | Upgrade and invest in feed procurement. We intend to achieve greater cost efficiency in feed procurement by focusing on our catching activities. We expect this to result in greater profitability, especially in light of our efforts to lengthen the farming cycle. |

We expect that these factors will enhance sustainability and traceability of the final products that we are offering to the market. These actions will also help prevent a collapse in the natural fish stocks and ensure food security for one of the most popular sashimi grade products of the world.

Sustainable Farming

The concept of sustainable development has been popularized by the 1987 World Commission on Environment and Development. It defined “sustainable development” as meeting the needs of the present generation, without compromising the needs of future generations. The idea of sustainability has caught up with aquaculture partly because of pressure from environmental groups. In 1998, the Holmenkollen Guidelines for Sustainable Aquaculture were formulated. These guidelines recommended, among other things, that new technologies and management procedures should be utilized so that the quality and quantity of aquaculture products is improved and the risk of adverse effects on the environment and on the livelihood of other people, including future generations, is reduced. The guidelines also recommended (1) strict compliance with the internationally agreed food safety, environmental safety and ethical criteria if genetically modified organisms or hormones are utilized in the production, as well as (2) giving priority to the development of integrated fish farming and of sources for animal feed other than fish protein and fish lipid.

We fully endorse the idea of sustainable farming. Our scientists have achieved some encouraging results in the area of breeding tuna in captivity. We are committed to continuing this research project with the ultimate goal of commercializing the full circle farming process. We have consistently worked closely with the local fisheries Ministry to formulate rules governing the industry.

Competition

In general, the aquaculture industry is intensely competitive and highly fragmented. We compete with various companies, many of which are developing or can be expected to develop products similar to ours in the future. However, we believe that the competition from such producers is minimal because, to the best of our knowledge, there are no competitors in Croatia or other places in the Mediterranean that have a similar operating scale, production capacity, brand recognition, long history and as much market representation as we have.

We are aware of competitors in the Adriatic and Mediterranean that produce bluefin tuna, including Fuentes e Hijos (Spain), Aquadem (Turkey), Azzopardi (Malta), Sagun (Turkey) and Balfego (Spain). However, we are one of the largest operations in the area. In addition, we have strong relationships with Japanese purchasers. We also produce a premium product “toro” tuna which is a high fat content belly tuna commanding the highest prices at auction in Tokyo, with a consistently spotless record for 14 years in the market in maintaining quality and traceability of products. We also enjoy close ties with regulators responsible for bluefin quota implementation and have developed a viable business plan for long term growth against a background of declining quota worldwide.

Some of our foreign competitors may be more established than we are, and have significantly greater financial, technical, marketing and other resources than we presently possess. Some of our competitors may have a larger customer base. These competitors may be able to respond more quickly to new or changing opportunities and customer requirements, and may be able to undertake more extensive promotional activities, offer more attractive terms to customers, and adopt more aggressive pricing policies.

-11-

With respect to potential new competitors, although there are no formal barriers to entry for engaging in similar aquaculture processing production and activities in Croatia, we believe that it will be very difficult and costly to start an operation comparable to ours. The principal barrier to entry is the shortage of available sites for farms in the local Croatian waters. As a result, concessions for such sites are almost impossible to obtain. In addition, our labor force is highly specialized and individuals with the requisite expertise who could manage this type of business are in short supply. Finally, to build a consistent farming cycle of three years like we have already achieved is highly capital intensive, time consuming and can only be done with high expertise, experience and research.

Regulation

Our company is subject to international quotas and to various national, provincial and local environmental protection laws and regulations, as well as certifications and inspections relating to the quality control of our production.

Internationally, ICCAT regulates Atlantic bluefin tuna quotas that are allocated to and enforced by individual states, including Croatia.

Our farming sites are operated under concessions granted by the local authorities. These concessions are of a long term temporary nature and are subject to renewal from time to time. Currently, we operate a 1,240 metric ton farm site and a 500 metric ton farm site under concessions that expire in 17 years and 10 years, respectively.

In addition, Croatian governmental agencies require commercial fishing vessels to be licensed. Individual operators of the vessels are also subject to permit requirements.

We believe that we, and our suppliers are currently in compliance with all material aspects of these quota and licensing requirements.

Employees

As of July 1, 2009, we had 72 full-time employees. None of our employees is represented by a labor union, and we consider our employee relations to be excellent.

Facilities

We own approximately 75,000 square feet of land in Lamjana Bay, Community of Kali, Croatia, consisting of approximately 53,000 square feet of working area, housing the main office building, cold storage building processing plant and two warehouses. We also have the right of use of a ship wharf located adjacent to the property. We believe that suitable additional space to accommodate our anticipated growth will be available in the future on commercially reasonable terms.

Our properties have been mortgaged as collateral security for a working capital facility in the amount of approximately $13,500,000.

Legal Proceedings

From time to time we may be named in claims arising in the ordinary course of business. Currently, no legal proceedings or claims are pending against or involve us that could reasonably be expected to have a material adverse effect on our business and financial condition.

There was pending against Kali Tuna a tax enforcement action commenced by the Croatian Tax Authority, potentially subjecting us to a liability of approximately $1,600,000 plus interest and penalties for purported unpaid value added and income taxes for calendar year 2006. We argued that the Authority’s claim was without merit and the Croatian Appellate Institution ruled in our favor. It ordered the Authority to reevaluate all evidence against us. The Croatian Tax Authority has since reinstated the enforcement action based on the same claim notwithstanding the Appellate Institution’s ruling. We intend to defend ourselves vigorously against this action.

-12-

MANAGEMENT’S DISCUSSION AND ANALYSIS AND PLAN OF OPERATION

The following discussion and analysis relates to the results of Kali Tuna only and should be read in conjunction with the consolidated financial statements and the related notes thereto and other financial information contained elsewhere in this Form 8-K.

General Overview

We are a leader in long term farming of Northern Bluefin Tuna in the Mediterranean with farming facilities located in Kali, Croatia, along with a processing plant, freezing storage and wharf. We cultivate our tuna with special reliance on technology and experience to grow the tuna for two to three years following their capture in the wild. Our operations include farming, feeding and harvesting Northern Bluefin Tuna that was caught in the Mediterranean and the Adriatic Sea. The fishing process is outsourced to an affiliated party. During the past three years, we have been increasing our carry-over stock of tuna to increase output quantities each year. We will seek to expand our operations by acquiring additional licenses, vessels and/or companies in the years to come, both in the Mediterranean and other regions suitable for sustainable catching and farming methods.

Our objective is to create a self sustaining farm environment where tuna fish spawn, and the resultant eggs are hatched, in captivity, without having to rely on the capture of fish in the open seas thereby depleting the natural stock of Bluefin Tuna.

We have marketed our products mainly in Japan through our ultimate parent company, Atlantis. In addition, during the past year, we have increased sales of fresh tuna to Europe and the US. We intend to increase our total production worldwide to 5,000 metric tons per year which will be marketed into Japan, the US and the EU.

Recently, Atlantis has entered into the Daito Agreement for the sale and delivery of at least 500 metric tons of frozen Northern Bluefin Tuna on an annual basis. On June 30, 2010, the Company entered into a sales agency agreement with Atlantis. Under the terms of the agreement, Atlantis will be granted the exclusive right to sell on the Company’s behalf all of its Northern Bluefin Tuna products into the Japanese market. As a result of the sales agency agreement, it is contemplated that tuna to be delivered under the Daito Agreement by Atlantis will be filled by fish that was farmed by us. We have agreed to pay Atlantis an agency commission of 2% of all sales to be made under this agency agreement.

Recent Developments

We share the concern of international organizations and others as it relates to the depletion of bluefin tuna stocks in the Mediterranean. We have been lobbying strongly with various industry associations and national governments to reduce existing catch quotas that will enable wild tuna stocks to recover to sustainable levels. We have focused on building our business based on a model of sustainable fishery development. We believe that our longer farming cycle (up to three years) and the higher biomass of our stock set us apart from and offer a distinct advantage over the business practices of competitors such as “catch and kill” operators and farming companies with shorter growth cycles.

During the past three years, annual catch quotas for Bluefin Tuna have been reduced by approximately 60% from 30,000 metric tons to 13,500 metric tons with increased monitoring being imposed on fisheries worldwide. We support these restrictions and have lobbied for the imposition of even smaller quotas. As a result of the quotas that are currently in effect, we foresee increased scarcity in the supply of Bluefin Tuna in the Japanese market. The Japanese are estimated to consume between 70% to 80% of the world supply of Bluefin Tuna.

We have been conducting research on the reproduction of tuna in captivity which, in June 2009, resulted in a major breakthrough when some of our tuna spawned in our farm facility. We believe this to have been the first time tuna has spawned naturally in captivity without any hormone injections. In collaboration with a local research institution, we managed to hatch the resultant eggs in a laboratory environment. We are currently constructing a hatchery for use during the next spawning season to allow us to advance our research.

As a result of recent successes in our quest to create a closed life cycle in the Bluefin Tuna farming process, we believe that we will become less dependent on the capture of wild tuna. Therefore, we believe that we will be uniquely positioned to address the expected shortage in the supply of tuna, especially as it relates to the Japanese market.

Critical Accounting Policies and Estimates

We prepare our consolidated financial statements in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires the use of estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Our management periodically evaluates the estimates and judgments made. Management bases its estimates and judgments on historical experience and on various factors that are believed to be reasonable under the circumstances. Actual results may differ from these estimates.

-13-

The following critical accounting policies affect the more significant judgments and estimates used in the preparation of the Company’s consolidated financial statements.

Inventories

Inventories are stated at the lower of cost and net realizable value. Cost is calculated on a weighted average basis and includes all costs to acquire and to bring the inventories to their present location and condition. Tuna weighing less than 30kg is stated at cost value, as international regulations prohibit the sales of tuna under 30kg. The Company evaluates the net realizable value of its inventories on a regular basis and records a provision for loss to reduce the computed weighted average cost if it exceeds the net realizable value.

Consolidation

The Company has determined that (i) Kali Tuna Trgovina d.o.o., a joint venture owned 50% each by the Company and Bluefin Tuna Hellas A.E, ( the “BTH Joint Venture”) and (ii) MB Lubin d.o.o., an entity owned by one of the Kali Tuna’s executive officers, are variable interest entities of which the Company is the primary beneficiary. These entities are therefore consolidated in the Company’s financial statements. The 50% of the BTH Joint Venture owned by Bluefin Tuna Hellas A.E. has been reflected as non-controlling interest in the financial statements. All material inter-company transactions and balances have been eliminated in consolidation.

Related Parties

Parties are considered to be related if one party has the ability, directly or indirectly, to control the other party or exercise significant influence over the other party in making financial and operational decisions. Parties are also considered to be related if they are subject to common control or common significant influence. Related parties may be individuals or corporate entities.

Revenue recognition

The Company recognizes revenue when the significant risks and rewards of ownership have been transferred to the customer, including factors such as when persuasive evidence of an arrangement exists, delivery has occurred, the sales price is fixed and determinable, and collectability is probable. The Company recognizes sales when its tuna inventory is shipped, title has passed to the customers and collectability is reasonably assured.

Concentration of credit risk

Financial instruments that potentially subject our company to significant concentrations of credit risk consist primarily of trade accounts receivable. We perform ongoing credit evaluations with respect to the financial condition of our debtors, but do not require collateral. In order to determine the value of our accounts receivable, we record an allowance for doubtful accounts to cover probable credit losses. Our management reviews and adjusts this allowance periodically based on historical experience and their evaluation of the collectability of outstanding accounts receivable.

Results of Operations

Year Ended June 30, 2009 Compared to Year Ended June 30, 2008

Sales. For the year ended June 30, 2009, sales increased by $12,405,000 from $11,665,000 to $24,070,000, an increase of 106% compared to the year ended June 30, 2008. This increase in sales resulted from an increase in carry over stock that has been built up through the gradual lengthening of the farming cycle described above. Stock sold during the period accounted for significantly higher biomass compared with previous years as the average cycle of farmed fish reached approximately 30 months.

Cost of Sales. The cost of sales as a percentage of sales decreased from 86.5% of sales in 2008 to 72% in 2009. This was due to an increase in the total size of the biological assets from a total of approximately 738,000 kilograms on July 1, 2007 to approximately 1,316,000 kilograms on June 30, 2009. While variable costs such as bait increase in proportion to the size of the biological assets, there are economies of scale that reduce the total production cost per kilogram.

Administrative and General Expenses. Administrative costs remained at a similar level in the 2009 fiscal year as was incurred in the 2008 fiscal year, despite the increases in sales volume and size of the biological assets.

-14-

Operating Profit. During the year ended June 30, 2009, we generated an operating profit of $5,834,000, an increase of $5,390,000 compared to the operating profit for the year ended June 30, 2008. The increase is the result of higher sales levels, better margins on those sales and control of administration expenses.

Foreign Currency Gains and Losses. The financial meltdown during late 2008 and the ensuing currency exchange turmoil between EUR and JPY led to a loss of $2,893,000 on the maturity of our JPY denominated liabilities. This liability consisted of advances received from customers for contracted sales. During the previous financial year, we had a net foreign exchange gain of $470,000.

Interest Expense. Interest expenses increased to $710,000 during the year ended June 30, 2009, an increase of $198,000 compared to the prior year. This was caused by increased borrowings and higher interest rates resulting from an extension of the farming cycle.

Income Before Income Taxes and Minority Interests. Profit before income taxes for the year ended June 30, 2009 was $2,010,000, an increase of $1,053,000, or 110%, compared to the year ended June 30, 2008.

Income Tax Expense. Deferred income tax liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. The deferred tax liabilities increased by $20,000 during the year ended June 30, 2009. Income tax expense was $510,000 for the year ended June 30, 2009.

Net Income. Net income increased to $1,331,000 for the year ended June 30, 2009, compared to a profit of $455,000 for the previous year.

Three and Nine Months Ended March 31, 2010 Compared to Three and Nine Months Ended March 31, 2009

Sales. Sales of tuna typically occur in winter (November to March) when the sea temperature is lowest to maximize the quality and value of the product. During the nine months ended March 31, 2010, approximately 28% of our net sales occurred in the three months ended December 31, 2009 and 72% in the three months ended March 31, 2010. In the year ended June 30, 2009, 49% of the net sales occurred in the three months ended December 31, 2008 and 51% in the three months ended March 31, 2009.

During the quarter ended March 31, 2010, the Company’s net revenue and cost of goods sold included $7,935,000 and $5,974,000, respectively, in connection with transactions that involved the purchase of tuna from another Croatian farming operation and the immediate sale of the product to one of the Company’s customers.

As a result, net sales for the nine month period ended March 31, 2010 increased by $2,894,000 to $25,172,000 from $22,278,000 in the corresponding period of the previous year.

Excluding the sale transaction involving the other tuna farming operation, net sales from the Company’s own farms decreased by $5,041,000 to $17,237,000. This was caused by a decline in the volume of sales to 924 metric tons in the nine months ended March 31, 2010 from 1,055 metric tons in the corresponding nine months ended March 31, 2009. There was also a decline in the average sales price from $21.11 per kg to $18.65 per kg.

Cost of Sales. The cost of sales as a percentage of sales from the Company’s farming operations increased from 69% of sales in the nine months ended March 31, 2009 to 84% in the corresponding period ended March 31, 2010. This was partly due to the reduction in average sales price per kg of 12% which increased the cost of goods sold percentage by approximately 10%, and partly due to a loss of $236,000 in Lubin which increased the percentage by 2%.

Gross Profit. The gross profit generated from the sale of tuna decreased by $2,215,000 in the nine month period ended March 31, 2010 compared with the corresponding period in 2009. The gross profit from the Company’s farmed products was reduced by $4,176,000 due to the reduction in the volume of sales, the reduction in selling price achieved and the losses in Lubin.

Other operating income (expenses). Other operating income improved from a net expense of $24,000 in the nine months ended March 31, 2009 to income of $427,000 for the corresponding period in 2010. This was mainly due to Croatian Government grants received in the nine months ended March 31, 2010.

Administrative and General Expenses. Administrative costs in the nine months to March 31, 2010 were at a similar level to those incurred in the same period in the previous year. The reduction was from $1,351,000 in the nine months ended March 31, 2009 to $1,340,000 in the nine months ended March 31, 2010.

-15-

Foreign Currency Gains and Losses. We suffered during the financial meltdown of late 2008 and the ensuing currency exchange turmoil between EUR and JPY led to a loss of $3,021,000 for the nine month period ended March 31, 2009. In the nine months ended March 31, 2010, our net losses in foreign currency were $1,353,000 of which $1,036,000 was incurred in the three months ended March 31, 2010 primarily as a result of the Euro decreasing in value against major currencies, especially the US Dollar and the Japanese Yen, due to the current economic crisis in Europe related to Greece and potentially other countries in Europe.

Interest Expense. Interest expense increased from $663,000 in the nine months ended March 31, 2009 to $796,000 in the corresponding period of the current year. This was due to an increase in the borrowings of the Company.

Liquidity and Capital Resources

Years ended June 30, 2009 and 2008

At June 30, 2009, we reported working capital of approximately $1,577,000 compared to approximately $1,600,000 at June 30, 2008. At June 30, 2009, we had cash and cash equivalents in the amount of $1,421,000.

Cash Flows

The following table summarizes our cash flows for the years ended June 30, 2009 and 2008:

| Years Ended June 30, | ||||||||

| 2009 | 2008 | |||||||

| Total cash provided by (used in): | ||||||||

| Operating activities | $ | (5,494,000 | ) | $ | (1,613,000 | ) | ||

| Investing activities | (1,466,000 | ) | (192,000 | ) | ||||

| Financing activities | 5,736,000 | 4,786,000 | ||||||

| Effects of exchange rate changes | (375,000 | ) | (24,000 | ) | ||||

| Increase/(Decrease) in cash and cash equivalents | $ | (1,599,000 | ) | $ | 2,957,000 | |||

Net cash used in operating activities for the year ended June 30, 2009 totaled $5,494,000, compared to $1,613,000 provided by operating activities for the year ended June 30, 2008. The change is primarily due to the increase in the size of the inventory and the repayment of a loan relating to an advance payment received in connection with a sale completed in fiscal year 2009.

Cash used in investing activities for the year ended June 30, 2009 was $1,466,000 compared to $192,000 for the year ended June 30, 2008. The change is due primarily to higher investment in new tangible assets, including a new boat for MB Lubin d.o.o.

Cash provided by financing activities for the year ended June 30, 2009 totaled $5,736,000, compared to $4,786,000 of cash provided by financing activities for the year ended June 30, 2008. The change is due primarily to an increase in bank loans from Erste & Steirmaerkische of HRK 29,000,000 ($5,438,000)

Nine months ended March 31, 2010 and 2009

At March 31, 2010, we had working capital of approximately $2,570,000 compared to approximately $2,948,000 (after the reclassification of $1,371,000 of related parties liabilities to non-controlling interest in variable interest entities (VIE), as described in Note 2 to the consolidated financial statements) at June 30, 2009. At March 31, 2010, we had cash and cash equivalents in the amount of $1,079,000.

Cash Flows

The following table summarizes our cash flows for the nine months ended March 31, 2010 and 2009:

| Nine months ended March 31, | ||||||||

| 2010 | 2009 | |||||||

| Total cash provided by (used in): | ||||||||

| Operating activities | $ | (751,000 | ) | $ | (3,616,000 | ) ) | ||

| Investing activities | (2,267,000 | ) | (2,483,000 | ) ) | ||||

| Financing activities | 2,533,000 | 4,364,000 | ||||||

| Effects of exchange rate changes | 143,000 | (265,000 | ) | |||||

| Increase/(Decrease) in cash and cash equivalents | $ | (342,000 | ) | $ | (2,000,000 | ) | ||

-16-

Net cash used in operating activities for the nine months ended March 31, 2010 totaled $751,000 compared to $3,616,000 used in operating activities for the nine months ended March 31, 2009. In the nine months ended March 31, 2010, the Company decreased its net inventory by $2,498,000. Fish feed and supplies were reduced by $1,068,000 as a result of lower quantity of fish feed on hand at March 31, 2010. The live stock inventory had approximately the same quantity of biomass but the cost per kg of biomass was lower primarily due to the purchase of 330 metric tons of live tuna from another Croatian farming entity at favorable prices which brought the average cost per kg of carrying value down.

Cash used in investing activities for the nine months ended March 31, 2010 was $2,267,000 compared to $2,483,000 for the nine months ended March 31, 2009. These investments included additional infrastructure to increase the capacity of freezing and storing of fish feed primarily involving the purchase of specialized freezer equipment to improve the handling and efficiency of the stock feeding system.

Cash provided by financing activities for the nine months ended March 31, 2010 totaled $2,533,000, compared to $4,364,000 of cash provided by financing activities for the nine months ended March 31, 2009. The sources of the new funding were a new bank loan from Erste & Steirmaerkische of JPY 180,000,000 ($1,939,000) and additional loans from Atlantis of $439,000.

Sources of Liquidity

Our most significant sources of liquidity have been cash generated by operations as well as lines of credit with commercial banks and by advances made by Atlantis. Additionally, Atlantis has provided loan guarantees and other credit support through its banking relationships.

Sales of tuna occur during the winter when the sea temperature is lowest to maximize the quality and value of the product (November to February). There are generally no sales generated during the rest of the year. Accordingly, the Company needs to finance its operations with available capital during the non-selling months.

We raised initial net proceeds of approximately $7.3 million in a financing transaction that was completed on June 30, 2010. Additionally, we have an agreement in principle with Atlantis providing for a $15 million line of credit. The details of this line of credit are being negotiated and we expect to enter into a definitive agreement with Atlantis shortly. We believe that the proceeds from the financing, the proposed Atlantis line of credit and cash generated by operations will be sufficient to continue to finance our present operations through the harvest season and for the remainder of our fiscal year ending June 30, 2011.

We will need to obtain additional capital in order to expand operations and remain profitable. We plan to pursue sources of additional capital by issuing securities through various financing transactions or arrangements, including joint venturing of projects, debt financing, equity financing or other means. We may also consider advance sales of tuna to customers. Additionally, we are pursuing increases in available bank lines and borrowings that may be available to us once we have completed this Offering and/or raised additional capital. There can be no assurance that any additional financing on commercially reasonable terms or at all will be available when needed. The inability to obtain additional capital may reduce our ability to continue to conduct business operations as currently contemplated. Any additional equity financing may involve substantial dilution to our then existing stockholders.

Seasonality

As explained above, sales of tuna occur during the winter when the sea temperature is lowest to maximize the quality and value of the product (November to March). There are generally no sales generated during the rest of the year.

Off Balance Sheet Arrangements

We do not have any off balance sheet arrangements that are reasonably likely to have a current or future effect on our consolidated financial condition, revenues, results of operations, liquidity or capital expenditures.

-17-

Pro Forma Balance sheet at March 31, 2010 - Unaudited

(In thousands of USD)

The following pro-forma balance sheet gives effect to the completion of the reverse merger of Kali Tuna into the Company in exchange for 30,000,000 common shares and the effect of a private placement of 7,300,000 Units for $1.00 per Unit consisting of 7,300,000 shares of common stock and warrants to purchase 1,460,000 shares of common stock for $2.00 per share. It also reflects issuance of 511,000 shares as placement agent compensation.

Pro-forma Adjustments | ||||||||||||||||||||||||

Lions Gate Lighting Corp. at February 28, 2010 - Historical (Unaudited) | Kali Tuna at March 31, 2010 - Historical (Unaudited) | Settlement of Liabilities | Reverse Merger | Proceeds of offering | Pro-forma adjusted at March 31, 2010 | |||||||||||||||||||

| Cash | 14 | 1,079 | (14 | )(1) | 7,300 | (3) | 8,206 | |||||||||||||||||

| (173 | )(3) | |||||||||||||||||||||||

| Inventory | 16,948 | 16,948 | ||||||||||||||||||||||

| Receivable from related party for advance received by related party | 5,897 | 5,897 | ||||||||||||||||||||||

| Other Current Assets | 2,959 | 2,959 | ||||||||||||||||||||||

| Total Current Assets | 14 | 26,883 | (14 | ) | 7,127 | 34,010 | ||||||||||||||||||

| Property and equipment, net | 9,626 | 9,626 | ||||||||||||||||||||||

| Other assets | 13 | 13 | ||||||||||||||||||||||

| Total assets | 14 | 36,522 | (14 | ) | 7,127 | 43,649 | ||||||||||||||||||

| Accounts payable | 2,257 | 2,257 | ||||||||||||||||||||||

| Due to related parties | 132 | 290 | (132 | )(1) | 1,000 | (3) | 1,790 | |||||||||||||||||

| 500 | (4) | |||||||||||||||||||||||

| Loan from shareholder | 957 | 957 | ||||||||||||||||||||||

| Borrowings | 13,557 | 13,557 | ||||||||||||||||||||||

| Liability for advance received by related party | 5,897 | 5,897 | ||||||||||||||||||||||

| Other current liabilities | 1,355 | 1,355 | ||||||||||||||||||||||

| 132 | 24,313 | (132 | ) | 1,500 | 25,813 | |||||||||||||||||||

| Non-current liabilities | 34 | 34 | ||||||||||||||||||||||

| Total liabilities | 132 | 24,347 | (132 | ) | 1,500 | 25,847 | ||||||||||||||||||

| Common Stock | ||||||||||||||||||||||||

| Authorized: 100,000,000 common shares, par value $0.001 per share | ||||||||||||||||||||||||

| Issued and outstanding: 7,450,000 shares historical; 45,261,000 pro-forma | 7 | 30 | (2) | 8 | (3) | 45 | ||||||||||||||||||

| Capital | 4 | (4 | )(2) | - | ||||||||||||||||||||

| Additional Paid in Capital | 46 | (79 | )(2) | 6,119 | (3) | 6,086 | ||||||||||||||||||

| Accumulated comprehensive income (loss) | (2 | ) | 3,593 | 2 | (2) | 3,593 | ||||||||||||||||||

| Retained Earnings (Deficit) | (169 | ) | 9,185 | 118 | (1) | 51 | (2) | (500 | )(4) | 8,685 | ||||||||||||||

| Total Stockholders' equity (deficiency) | (118 | ) | 12,782 | 118 | - | 5,627 | 18,409 | |||||||||||||||||

| Noncontrolling interest | (607 | ) | (607 | ) | ||||||||||||||||||||

| Total Equity (deficit) | (118 | ) | 12,175 | 118 | - | 5,627 | 17,802 | |||||||||||||||||

| Total liabilities and equity | 14 | 36,522 | (14 | ) | 7,127 | 43,649 | ||||||||||||||||||

| (1) | Represents settlement of all liabilities in accordance with the share exchange agreement. |

| (2) | To adjust for the issuance of 30,000,000 shares of common stock in exchange for 100% of the ownership interest of Kali Tuna and to eliminate the historical equity accounts of Lions Gate as Kali Tuna is the successor to Lions Gate for accounting purposes. |

| (3) | To adjust for the issuance of 7,300,000 units for cash proceeds of $7,300,000, net of estimated offering costs of $1,173,000 comprised of Placement Fees of $73,000 and other expenses of $1,100,000. Also includes issuance of 511,000 shares as placement agent compensation. |

| (4) | To adjust for an estimated $500,000 in pre-startup and formation costs incurred by Atlantis that are to be reimbursed by Umami upon the successful completion of the Exchange and Offering. |

-18-

RISK FACTORS

An investment in our securities involves a high degree of risk. In determining whether to purchase our securities, you should carefully consider all of the material risks described below, together with the other information contained in this current report on Form 8-K before making a decision to purchase our securities. You should only purchase our securities if you can afford to suffer the loss of your entire investment.

RISKS RELATED TO OUR BUSINESS

Proceeds from the Financing may not be sufficient to sustain our operations

We anticipate, based on currently proposed plans and assumptions relating to our ability to market and sell our products, that our cash on hand including the proceeds from the Financing and amounts expected to be made available by Atlantis under a proposed line of credit facility will satisfy our operational and capital requirements for the next 12 months. However, without additional capital we will be unable to significantly expand our markets or make significant acquisitions. Also, if we fail to finalize the agreement providing for the line of credit and if we are unable to realize satisfactory revenue in the near future, we will be required to seek additional financing to continue our operations beyond that period. There can be no assurance that any additional financing on commercially reasonable terms will be available when needed. The inability to obtain additional capital may reduce our ability to continue to conduct business operations as currently contemplated. Any additional equity financing may involve substantial dilution to our then existing stockholders.

Regulation of our industry may have an adverse impact on our business.

For years, the international community has been aware of and concerned with the worldwide problem of depletion of natural fish stocks. In the past, these concerns have resulted in the imposition of quotas that subject individual countries to strict limitations on the amount of fish they are allowed to catch. Environmental groups have been lobbying to have additional limitations on fishing imposed and have even made suggestions that would limit the activities of fish farms. If international organizations or national governments were to impose additional limitations on fishing and fish farm operations, this could have a negative impact on our results of operations.

Our lack of diversification may increase the risk of an investment in Kali Tuna, and our financial condition and results of operations may deteriorate if we fail to diversify.

Our business focus is on the farming and processing of Northern Bluefin Tuna in Croatia. We lack diversification, in terms of both the nature and geographic scope of our business. As a result, we will likely be impacted more acutely by factors affecting our industry or the regions in which we operate than we would if our business were more diversified, enhancing our risk profile. If we fail to diversify our operations either through natural growth or through acquisitions, our financial condition and results of operations could deteriorate.

Concerns about the state of the bluefin tuna population may lead some customers to look for alternatives.

In the Mediterranean, large quantities of bluefin tuna are taken for on-growing in fish cages. Statistics for culturing are even less accurate than official catch statistics. Experts estimated the total Atlantic bluefin aquaculture production during 2006 at between 20,000 and 30,000 metric tons.

Responding to fears of a collapse of bluefin tuna stock in the Mediterranean, a number of tuna buyers have occasionally threatened boycotts unless drastic measures are taken to protect the threatened tuna stock. In addition, some restaurants in Europe have stopped buying Mediterranean bluefin tuna and replaced the bluefin with other tuna species, such as yellowfin, albacore and bigeye. If these boycotts become more widespread, they may have a negative impact on our results of operations.

The growth of our business depends on our ability to secure fishing licenses directly or through third parties and concessions for our farm locations.

Fish farming is a highly regulated industry. Our operations require licenses, permits and in some cases renewals of licenses and permits from various governmental authorities. For example, commercial fishing operations are subject to government license requirements that permit them to make their catch. In addition, our offshore farms that harbor the cages containing our tuna livestock are constructed pursuant to concessions granted by the local government that has jurisdiction over the waters where our farms are located. Our ability to obtain, sustain or renew such licenses and permits on acceptable terms is subject to change in regulations and policies and to the discretion of the applicable governments, among other factors. Our inability to obtain, or a loss of or denial of extension, to any of these licenses or permits could hamper our ability to produce revenues from our operations.

-19-

We are dependent on an affiliate for our fishing and towing operations.

A large portion of our fishing and towing operations is conducted by M.B. Lubin, an affiliated entity because it is owned by Dino Vidov, our General Manager. M.B. Lubin owns a fleet of seven fishing vessels that catch fish, typically in the Adriatic, store them in cages and tow those cages back to our farming locations where they are transferred into permanent holding pens. We do not have our own fishing vessels and, moreover, do not possess the requisite licenses to catch our own fish. If for any reason, M.B. Lubin would be unable or unwilling to continue to provide its services to us, this would likely lead to a temporary interruption in the supply of fish at least until we find another entity that can provide these services for us. Failure to find a replacement for M.B. Lubin even on a temporary basis, may have an adverse effect on our results of operations.

Almost all our products are sold to only three customers.