ATLAS ENERGY RESOURCES, LLC

Mr. H. Roger Schwall

Assistant Director

Division of Corporation Finance

Mail Stop 7010

United States Securities and

Exchange Commission

100 F Street, NE

Washington, D.C. 20549-7010

| Re: | Atlas Energy Resources, LLC |

Form 10-K for Fiscal Year Ended December 31, 2007

Filed March 6, 2008

Form 10-Q for Fiscal Quarter Ended March 31, 2008

Filed May 5, 2008

File No. 001-33193

Dear Mr. Schwall:

A copy of this letter has been furnished through EDGAR as correspondence.

This letter sets forth the Registrant’s responses to the comments and requests for additional information of the Staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) in its comment letter dated September 11, 2008 (the “Comment Letter”). For your convenience, the comments and requests for additional information provided by the Staff have been repeated in bold type exactly as set forth in the comment letter. The Registrant’s response to each comment and request is set forth immediately below the text of the applicable comment or request.

Form 10-K for the Fiscal Year Ended December 31, 2007

Financial Statements

Note 2 – Summary of Significant Accounting Policies, page 73

Impairment of Long-Lived Assets, page 76

1. | We note your response to prior comment 8, explaining how you have applied the guidance of EITF 00-1 in accounting for your investments in limited partnerships, clarifying that you have not accounted for your proportionate share of partnership DD&A or impairment charges. While we recognize that EITF 00-1 provides guidance on the presentation of activity associated with equity method investees under the proportionate consolidation method, we do not believe it changes how APB 18 is to be applied. The guidance of APB 18 appears to require you as the investor to account for your investments in the limited partnerships as follows: |

| · | Your share of each line item in the investees’ financial statements should be recognized in your financial statements. |

Mr. H. Roger Schwall

Page 2

| · | Any basis differences between your acquisition costs and your share of the net assets of the limited partnerships should be allocated to the underlying assets (and liabilities) and amortized accordingly (or not amortized but tested for impairment if allocated to indefinite lived intangibles or goodwill at the investee level). |

| · | Your share of any intercompany gains and losses should be eliminated. |

| · | To the extent your net basis in an investment was lower than your share of the net assets of the equity investee, an adjustment to your share of any impairment charge that would otherwise be recognized may be necessary. |

| · | Any other-than-temporary declines in the value of your net investments after the above noted adjustments are made should be recognized. |

Further, given that the partnerships are equity method investees, it remains unclear to us why you believe it is appropriate to recalculate reserve quantities using different assumptions, and to group your share of the investees’ properties with other interests you own in the same field for purposes of recalculating DD&A and assessing impairment. In part, your approach seems to imply that you would continue operating properties held by partnerships in periods after which the partnerships conclude that operations would cease, although you have not mentioned reversionary rights or arrangements of this sort. Based on the information you provided us to-date, it appears that the limited partnerships should calculate DD&A and evaluate impairment using SFAS 144 at the entity level; and that you should recognize your share of these costs in accordance with APB 18 when applying the proportionate consolidation method. Please advise us of any additional information that you believe would further clarify or support your position.

Response: The Registrant (or “the Company”) acknowledges your concurrence with its application of EITF 00-01, paragraph 2 on the presentation of its proportionate share of its investments in its oil and gas partnerships as it relates to the application of APB 18. The Registrant believes that it has met the intent of the guidance of APB 18 as it pertains to basis differences of its investors in partnership oil and gas properties and subsequent amortization thereof, including the calculation of DD&A and assessing impairment. The Registrant also believes that the mechanical application of APB 18 as it relates to proportionate consolidation for DD&A and impairment would result in a basis difference that does not reflect the underlying value of that investment to the Registrant as it relates solely to its investment in oil and gas properties. As such, the Registrant will address each bullet point item you specified above as it is applied to the Registrant’s accounting records and ultimately included in its consolidated financial statements.

Mr. H. Roger Schwall

Page 3

| · | Your share of each line item in the investees’ financial statements should be recognized in your financial statements. |

Response: The Registrant includes its share of each line item in the investees’ financial statements related to receivables, oil and gas revenues, lease operating and general and administrative expenses in its consolidated financial statements. Upon consolidation, contract operating revenues and contract operating and administrative fee are eliminated from partnership wells in which it has an ownership interest.

| · | Any basis differences between your acquisition costs and your share of the net assets of the limited partnerships should be allocated to the underlying assets (and liabilities) and amortized accordingly (or not amortized but tested for impairment if allocated to indefinite lived intangibles or goodwill at the investee level). |

Response: Because the partnerships sharing arrangements related to capital costs require special allocations and include a profit margin to the GP, there are basis differences in the Registrant’s acquisition costs and its pro-rata share of the partnerships capital costs. These basis differences are allocated to the underlying oil and gas properties and amortized accordingly and tested for impairment. The Registrant’s calculation of its basis differences and depletion methodology are further explained in detail in the section titled: Calculation of Depletion, Reserve Information, and Evaluation of Impairment below. There are no other basis differences between the partnerships and the Registrant.

| · | Your share of any intercompany gains and losses should be eliminated. |

Response: The Registrant eliminates its share of intercompany revenues and gains from operating fees and administrative fees from partnership wells in which it has an interest.

| · | To the extent your net basis in an investment was lower than your share of the net assets of the equity investee, an adjustment to your share of any impairment charge that would otherwise be recognized may be necessary. |

Response: The Registrant computes its net basis in an investment partnership which is included in, and is a part of, its total net basis of oil and gas properties. Please refer to the section titled: Calculation of Depletion, Reserve Information, and Evaluation of Impairment for more information.

| · | Any other-than-temporary declines in the value of your net investments after the above noted adjustments are made should be recognized. |

Response: The Registrant evaluates its net investments for other-than-temporary declines in value in accordance with SFAS 144, Accounting for the Impairment or Disposal of Long-lived Assets. Please refer to the section titled: Calculation of Depletion, Reserve Information, and Evaluation of Impairment.

Mr. H. Roger Schwall

Page 4

Further, given that the partnerships are equity method investees, it remains unclear to us why you believe it is appropriate to recalculate reserve quantities using different assumptions, and to group your share of the investees’ properties with other interests you own in the same field for purposes of recalculating DD&A and assessing impairment. In part, your approach seems to imply that you would continue operating properties held by partnerships in periods after which the partnerships conclude that operations would cease, although you have not mentioned reversionary rights or arrangements of this sort. Based on the information you provided us to-date, it appears that the limited partnerships should calculate DD&A and evaluate impairment using SFAS 144 at the entity level; and that you should recognize your share of these costs in accordance with APB 18 when applying the proportionate consolidation method. Please advise us of any additional information that you believe would further clarify or support your position.

Response: The Registrant believes it is critical to understand the nature of its business as it relates to its investment in limited partnerships in order to understand its application of current accounting literature in the calculation of its depletion and assessment of impairment. The Registrant has set forth general background information related to its business as well as additional details of its calculation of depletion and assessment for impairment in the following paragraphs to further clarify and support its position.

Throughout this response, references are made from the textbook Petroleum Accounting Principles, Procedures and Issues, 6th Ed. (“Petroleum Accounting”) which includes FASB Current Text Industry Standards, Oi5, Oil and Gas Producing Activities, January 10, 2006, which is a summary of the applicable accounting standards related to oil and gas producing activities. The applicable pages of Petroleum Accounting have been attached to this letter as Exhibit C.

Background

The Registrant’s business model is different than the typical E & P Company. The Company is a leading sponsor and manager of tax-advantaged direct investment natural gas and oil partnerships in the United States. The partnerships are structured as limited partnerships as a tax planning tool to provide the limited partners with tax deductions. For the general partner, they provide financing and revenue streams from drilling and operating the oil and gas assets, while also adding to its reserves. The Registrant’s partnership agreements include special allocations of capital costs, revenues and expenses, and also an allocation of an interest in specific assets of the partnership. The Registrant believes that its application of proportional consolidation of the partnership operations with its other oil and gas operations provides disclosure of the homogenous operations of the general partner, and therefore provides a more complete economic picture of the Registrant’s financial condition.

Mr. H. Roger Schwall

Page 5

The accounting literature that addresses the specific nature of the Registrant’s business is very limited. Various accounting literature referred to herein has been used by the Registrant such that the accounting appropriately presents the economics of the transactions. The Registrant believes that it has accounted for its oil and gas properties, specifically its calculation of depletion expense and its assessment for impairment, correctly within the scope of accounting literature and published guidance. In doing so, the accounting treatment appropriately matches the economics of the transactions and ultimately the Registrant believes it has prepared its financial statements showing a fair and complete representation of its financial position and operations. In the following paragraphs, the Registrant will address its accounting treatment with regard to depletion, the preparation of its reserve report to its own economics and impairment testing.

Calculation of Depletion, Reserve Information, and Evaluation of Impairment

Calculation of Depletion. The Registrant calculates its depletion of oil and gas properties in accordance with SFAS 19, Financial Accounting and Reporting by Oil and Gas Producing Companies (“SFAS No. 19”). SFAS No. 19, paragraph 30, Amortization (Depletion) of Acquisition Costs of Proved Properties reproduced in Exhibit C in Petroleum Accounting, page 2-8 (Current text Oi5, para.121) to “Capitalized acquisition costs of proved properties shall be amortized (depleted) by the unit-of-production method so that each unit produced is assigned a pro rata portion of the unamortized acquisition costs. Under the unit-of-production method, amortization (depletion) may be computed either on a property-by-property basis or on the basis of some reasonable aggregation of properties with a common geological structural feature or stratigraphic condition, such as a reservoir or field.” The Registrant follows this method by grouping its oil and gas investments and properties, including its properties attributed to investments in limited partnerships, into cost centers on a field basis.

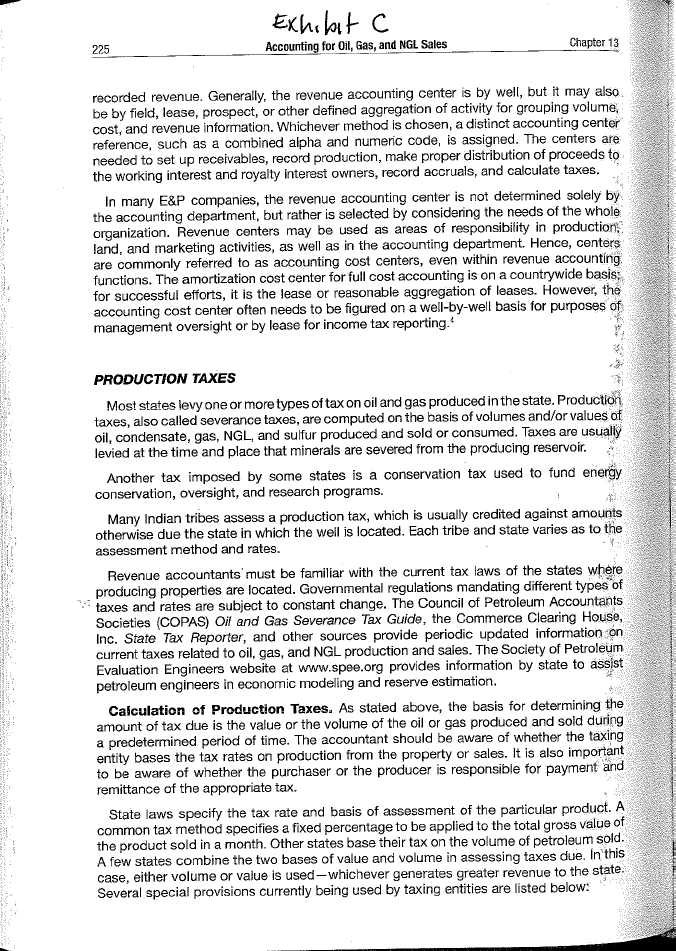

The Registrant applies the definition of cost center to define its fields in calculating its depletion, depreciation and amortization on its oil and gas properties. A cost center is defined in Exhibit C, Petroleum Accounting, page G-6 as “any geological, geographical, or legal unit by which costs and revenues are identified and accumulated. Examples are the lease, the field, and the country”. Therefore, the Registrant includes all costs incurred in each field as applicable to the minerals within that field and each individual type of capital cost (such as oil and gas assets purchased in an acquisition, shared in a joint venture, internally developed, or included in a partnership) conceptually loses its identity. Exhibit C, Petroleum Accounting, Chapter 13, page 225, Accounting for Oil, Gas and NGL Sales states “The amortization cost center for full cost accounting is on a countrywide basis; for successful efforts, it is the lease or reasonable aggregation of leases.” The Registrant applies the successful efforts accounting method and its cost centers have been defined on a field basis and include its aggregation of leases in accordance with the above guidance. It also includes those costs of property interests proportionately consolidated from investment partnerships, wells drilled solely by the Registrant, properties purchased and working interests with other outside operators.

Mr. H. Roger Schwall

Page 6

Furthermore, Financial Reporting Release (“FRR”) Sec. 406.01c.v., Consolidated Financial Statements, ASR 258, states that “The rules specify that a registrant must apply its accounting method to the operations of its subsidiaries.” Rule 4-10(C)(3)(v) of S-X requires that amortization rates be determined on a consolidated basis even though this may result in a consolidated amortization provision that is not equal to the sum of the expenses for the individual members of the consolidated group. This same concept applies to the determination of the limitation on capitalized cost centers.” Additionally, Rule 4-10(C)(3)(v) specifies that amortization computations shall be made on a consolidated basis, including investees accounted for on a proportionate consolidated basis. Investees accounted for on the equity method shall be treated separately. Although the Registrant accounts for its oil and gas properties under the successful efforts method, and both FRR Sec. 406.01c.v. and Rule 4-10(C)(3)(v) pertain to the full cost method of accounting, the Company believes that the analogy exists that this guidance would be applicable to it in computing DD&A and assessing impairment on its oil and gas properties by grouping its interests into specific fields on a consolidated basis, including its oil and gas properties from its limited partnership investments.

Reserve Information. With regard to the Registrant’s separate reserve report, it should be noted that the same information related to quantities produced to the partnership and the Registrant’s interests is used to prepare both the partnership’s and the Registrant’s reserve reports in accordance with the definitions of Reg. S-X Rule 4-10 using each entity’s existing economic and operating conditions.

In addition, the Registrant has consistently followed SFAS 69, para, 14 (b) Disclosures about Oil and Gas Producing Activities, found in Exhibit C, Petroleum Accounting, page 2-19 Current text Oi5, para.164(b), in its preparation and disclosure regarding supplemental oil and gas information, which states “if the enterprise’s financial statements include investments that are proportionately consolidated, the enterprise’s reserve quantities shall include its proportionate share of the investees’ net oil and gas reserves”. Using these assumptions, the Registrant believes that the separate reserve reports prepared for the partnerships and the Registrant is consistent with the requirements of SFAS 69 and are correct and valid even though they lead to different results for calculating depletion and assessing impairment. The following information describes the details related to the assumptions used in preparing a separate reserve report which includes all of the registrant’s oil and gas interests. In addition, the Registrant has attached a chart (Exhibit A) which summarizes the special allocations and sharing arrangements associated with its partnerships as more fully described below:

The partnership reserve reports and accounting records include the following economics:

Mr. H. Roger Schwall

Page 7

1. A cost basis for its wells that includes a profit margin, generally 15%.

2. A contractual obligation to pay monthly operating and general and administrative fees with a profit margin to the General Partner (“GP”).

3. The recording of initial capital raised, net of syndication and offering costs.

4. Expenses related to general and administrative fees paid to third parties for the preparation of reserve reports, tax returns and audits.

5. A disproportionate share of salvage value upon plugging of the wells (generally 75% GP/25% LP) which could result in out-of-pocket costs to the limited partners.

In contrast, the Registrant’s reserve report and accounting records include the following economics:

1. A cost basis for its wells that is at cost, without any profit margin.

2. The elimination of the Registrant’s share of the monthly operating and administrative fees charged to the partnership, which fees contribute to the wells becoming uneconomic to the partnership; therefore, the Registrant’s financial statements reflect the same lease operating expenses as its reserve report.

3. A credit for its contribution to the partnership and an additional carried interest in partnership revenues and expenses, generally of 7%.

4. Although no contractual obligation exists pertaining to reversionary interests, part of the Registrant’s past practices and current business model assumes that when the well becomes uneconomic to the partnership because of declining reserves and contractual operating and general and administrative fees charged at the partnership level, the Registrant could either assume or purchase the remaining partnership interest in the well in return for assuming the plugging liability. The Registrant believes that this assumption is valid as it does not need to complete any additional due diligence because all of the production data and the well operating infrastructure has been established, making it an attractive asset for the Registrant to own. Even though the GP would own the remaining interest in the well at the time it became uneconomic to the partnership, in its reserve report the well interests have not been converted to a 100% working interest. The Registrant believes this presents a conservative estimate of its reserve quantities and values.

5. A disproportionate share of salvage value upon plugging of the wells (generally 75% GP/25% LP), resulting in a reduction of its depletion expense.

Mr. H. Roger Schwall

Page 8

Evaluation of Impairment. With regard to impairment testing, the Registrant applies SFAS 144, Accounting for the Impairment or Disposal of Long-lived Assets, (“SFAS No. 144”) in evaluating its oil and gas properties for impairment. SFAS No. 144, para 17 states: “Estimates of future cash flows used to test the recoverability of a long-lived asset (asset group) shall incorporate the entity’s own assumptions about its use of the asset (asset group) and shall consider all available evidence.” Accordingly, the Registrant applies its definition of cost center in grouping its oil and gas properties for depletion purposes and in testing for impairment, including those properties from its investments in the limited partnerships.

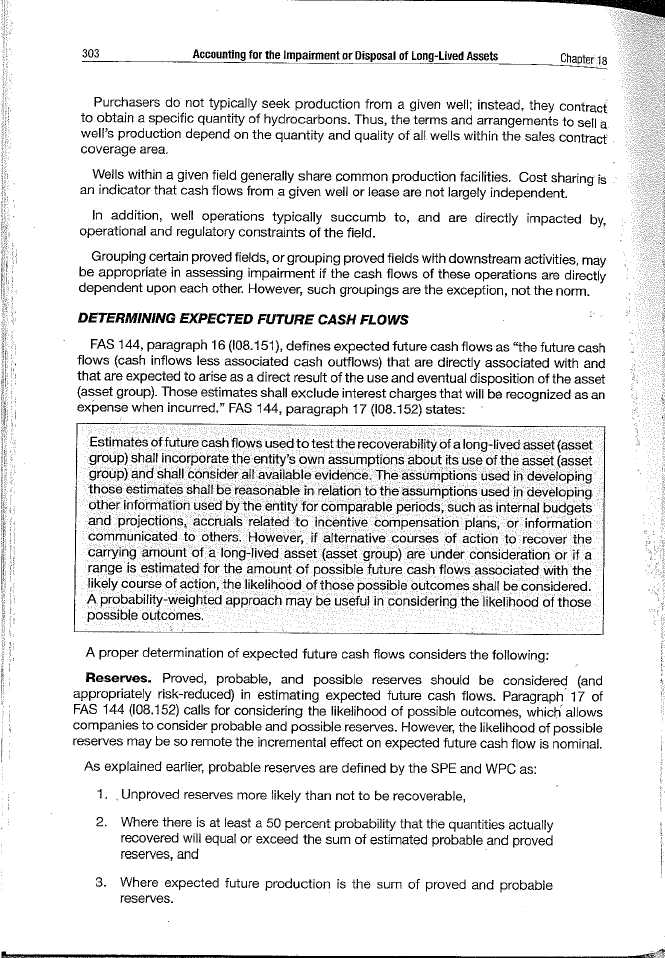

In addition, page 303 of Petroleum Accounting (Exhibit C) states that proved, probable and possible reserves should be considered in estimating expected future cash flows. This would presumably mean one would group these reserves in each appropriate cost center along with its proved reserves.

Additional Supporting Accounting Literature

The Registrant believes that it is industry practice for entities that sponsor limited partnerships to prepare reserves to their own economics and that this method follows applicable accounting pronouncements for oil and gas producing entities. This practice results in a calculation of depletion and impairment at the cost center level which includes consolidated capitalized costs. Through inquiries with other public entities, the Registrant has determined that at least four out of five of the largest public accounting firms have affirmed this method of accounting. While there are only a few public companies that currently sponsor limited partnerships, those that the Registrant is aware of are also using this method of accounting.

The Registrant is supplementally providing the applicable accounting literature cited in our response from Petroleum Accounting, Principles, Procedures, & Issues, 6th Ed. (“Petroleum Accounting”) (Exhibit C) with its response to support its accounting treatment of its investment in limited partnerships. In addition, the following publication provides further guidance and additional information to support its position.

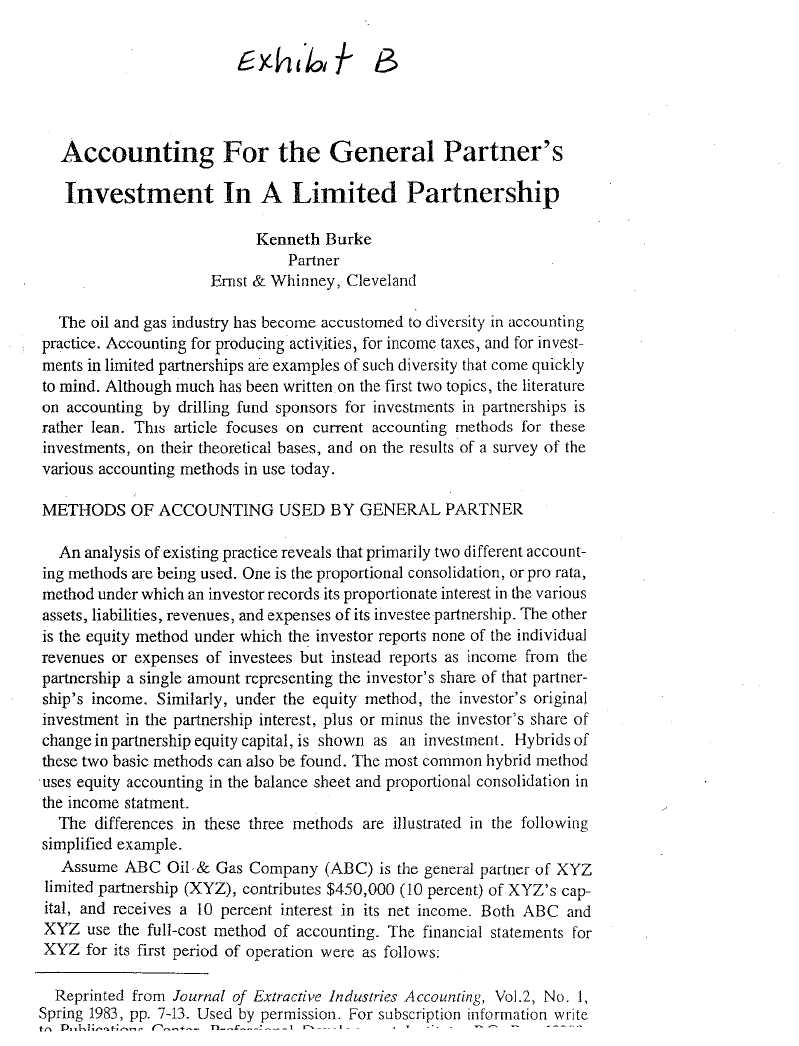

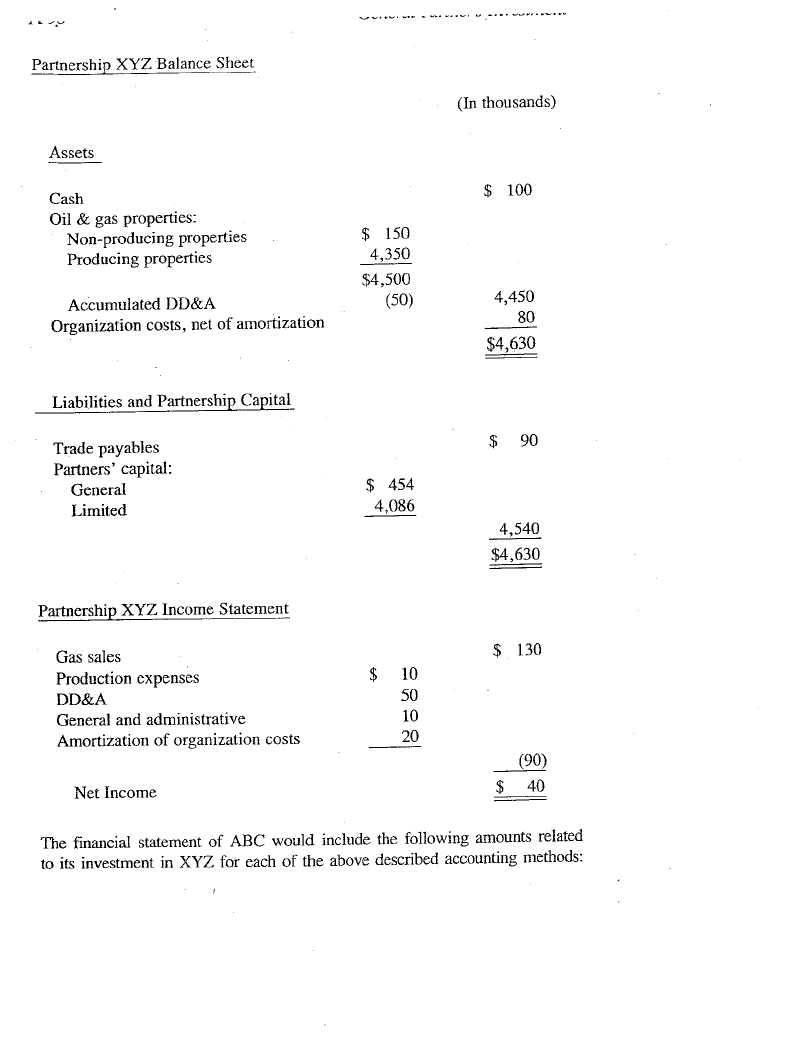

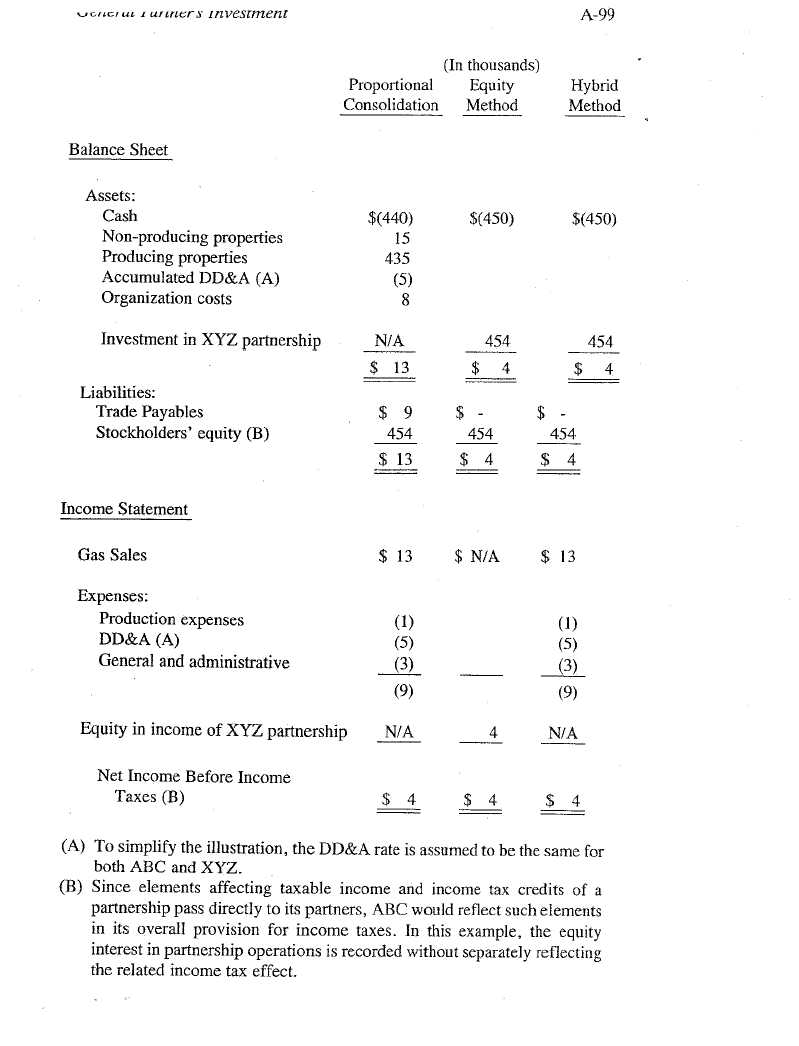

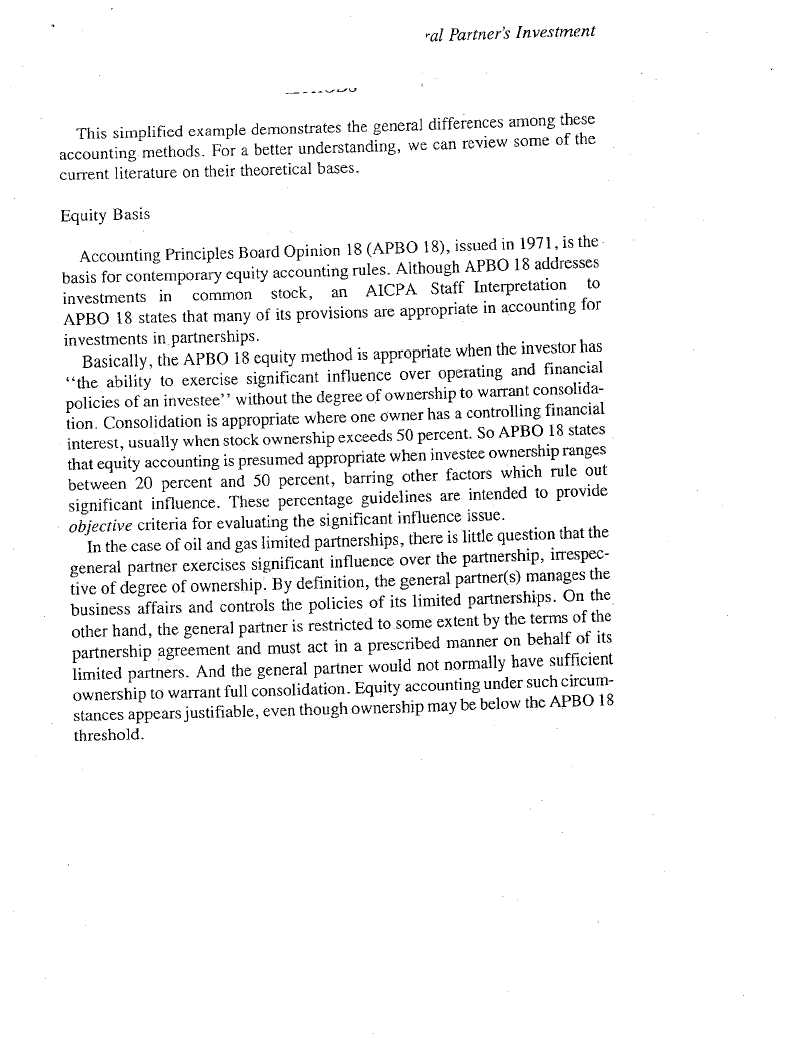

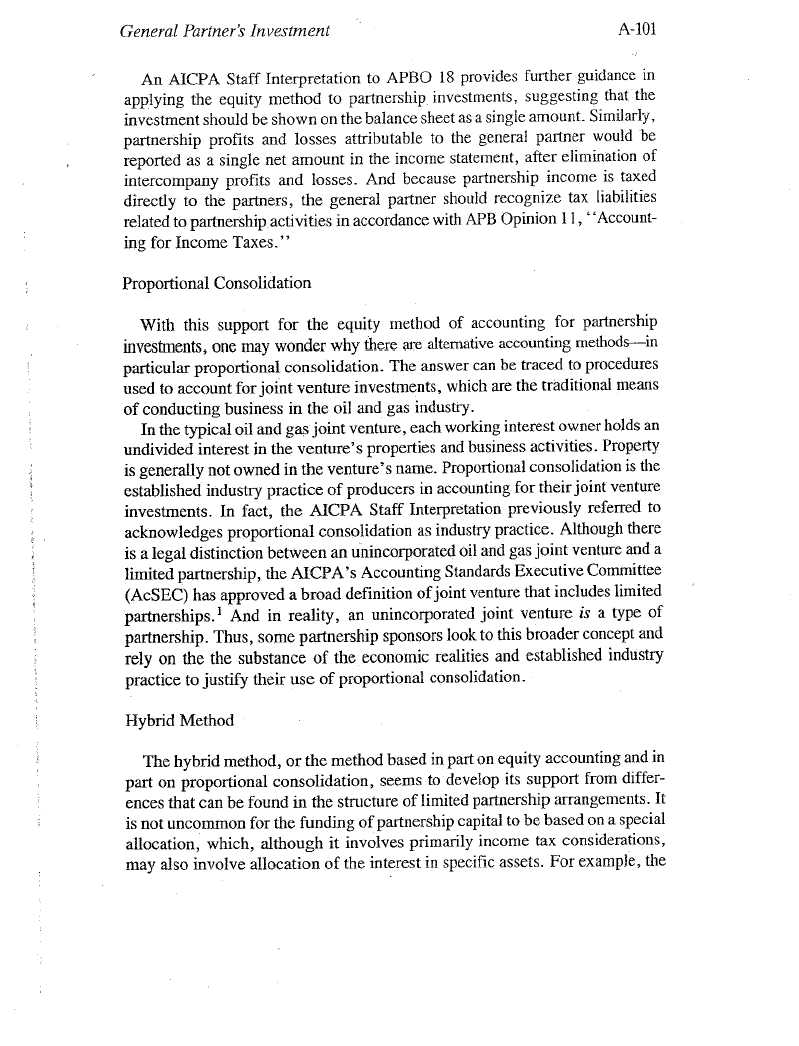

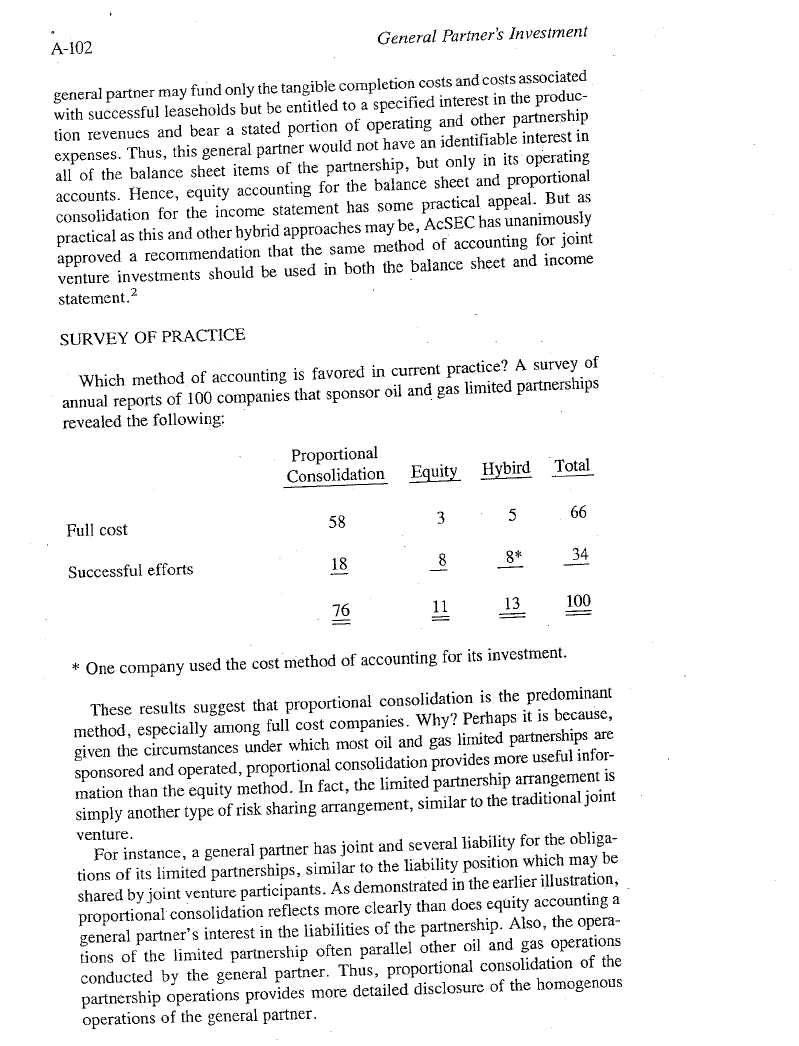

· Exhibit B. An article written by Ernst & Whinney, which is included in Oil & Gas Limited Partnerships, Accounting, Reporting, & Taxation, written by Kenneth M. Burke & Francis l. Durand published in 1984. (“E&W article”) This article discusses the diversity in accounting practice pertaining to the accounting for the general partner’s interest in a limited partnership in the oil and gas industry.

The article states that an AICPA Staff Interpretation to APB 18 acknowledges proportional consolidation as industry practice, and that the AICPA’s Accounting Standards Executive Committee “has approved a broad definition of joint venture that includes limited partnerships. And in reality, an unincorporated joint venture is a type of partnership”. The Registrant believes that established industry practice supports treating its investments as joint ventures and such treatment appropriately reflects the substance of the economic realities. The E & W article also notes that the operations of the limited partnerships often parallel other oil and gas operations conducted by the general partner. This is the case for the Registrant.

Mr. H. Roger Schwall

Page 9

Article 4.04(a)(3)(g) of the partnership agreement which supports the right of the GP to remove its interest from the partnership, which would lead one to treat the well as a joint venture interest reads as follows:

Right of Managing General Partner to Hypothecate Its Interests. The Managing General Partner shall have the authority without the consent of the Participants and without affecting the allocation of costs and revenues received or incurred under this Agreement, to hypothecate, pledge, or otherwise encumber, on any terms it chooses for its own general purposes, either:

(i) its Partnership interest; or

(ii) an undivided interest in the assets of the Partnership equal to or less than its respective interest as Managing General Partner in the revenues of the Partnership.

All repayments of these borrowings and costs, interest or other charges related to the borrowings shall be borne and paid separately by the Managing General Partner. In no event shall the repayments, costs, interest, or other charges related to the borrowing be charged to the account of the Participants.

Upon exercise of this provision, the Registrant would convert its partnership interest into a working interest, or an undivided interest. Thus, an undivided interest in the assets of a partnership as described in the above partnership agreement, is essentially the same as a joint venture interest and would lead the investor to account for its interest in the wells the same as and along with its other investments in oil and gas properties; at cost, grouped by cost center.

The Registrant believes that in essence, its partnership operations should be treated no differently than its other oil and gas operations, and believes the E & W article supports this position. For this reason, the Registrant believes that it is appropriate to include its share of the oil and gas properties of the partnerships when grouping its oil and gas interests in its cost centers and calculate depletion and assess impairment at that level. The Registrant is not aware of any accounting literature that requires that partnership or joint venture interests be in separate cost centers for depletion purposes, or that the legal structure in any way should affect the determination of an entity’s cost centers. Accordingly, any basis difference between the Registrant’s costs and its share of the net assets of the partnerships is amortized in its depletion calculation.

| · | Exhibit C Petroleum Accounting, Principles, Procedures, & Issues, 6th Ed. (“Petroleum Accounting”). |

1. Chapter 13, page 225, Accounting for Oil, Gas, and NGL Sales

2. Chapter 18, page 303, Accounting for Impairment or Disposal of Long - Lived Assets

Mr. H. Roger Schwall

Page 10

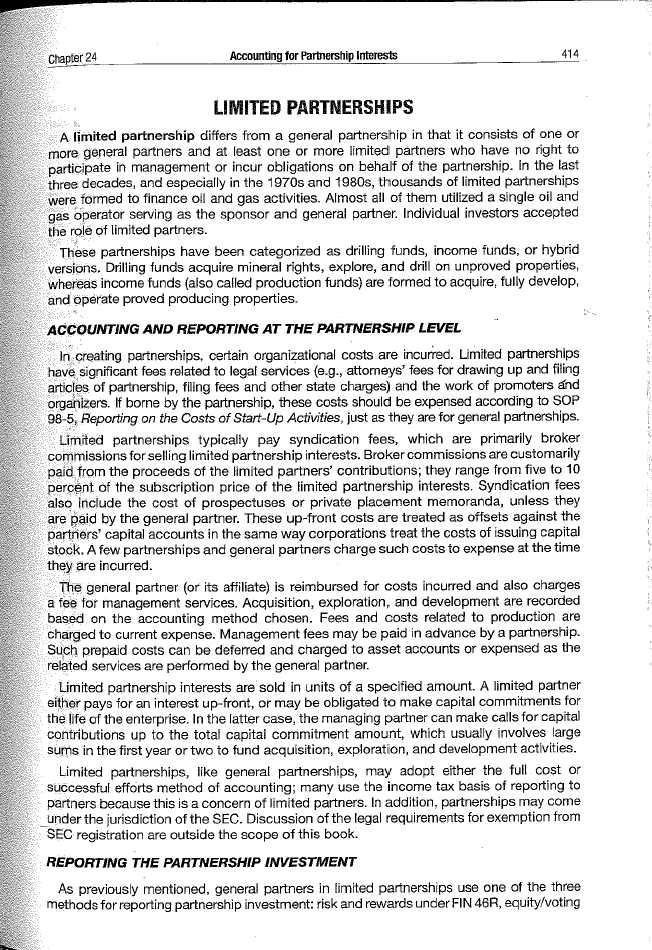

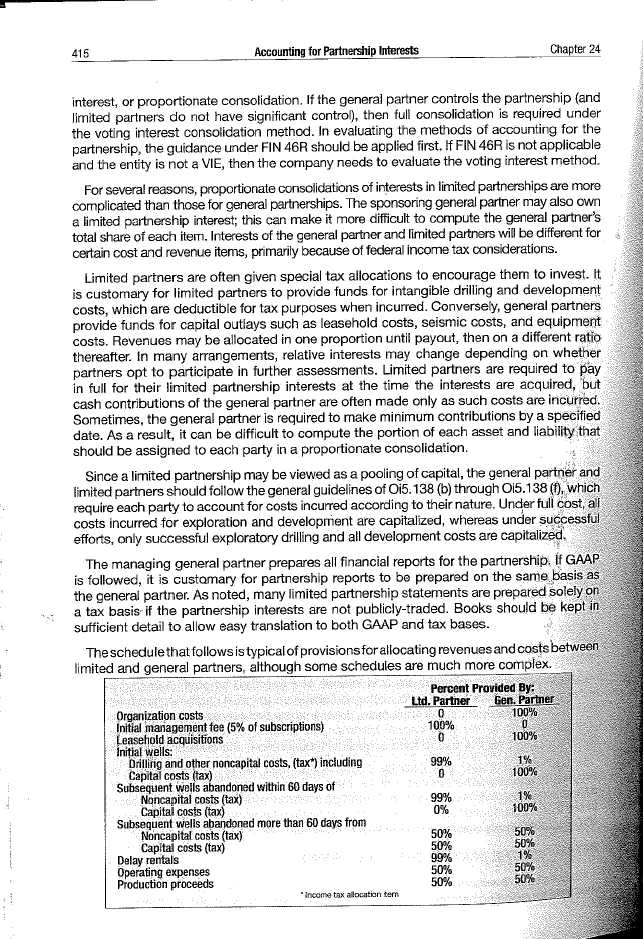

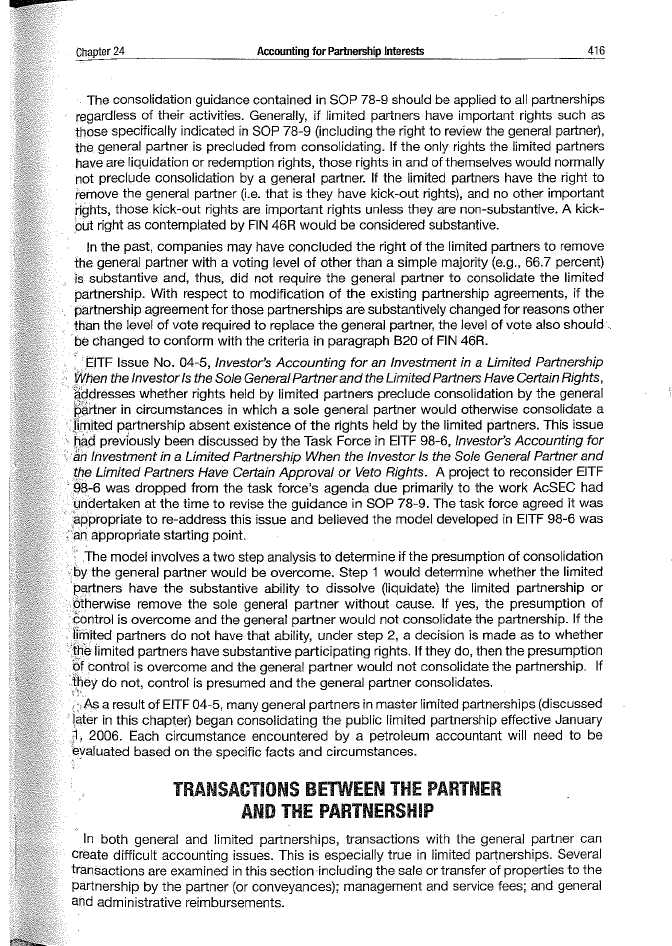

3. Chapter 24, pages 414-417, Accounting for Partnership Interests,

4. Appendix 2; pages 2-8 to 2-10, para. .121 to 126, pages 2-13 to 2-14, para. .138(b) through para. .138(f) and page 2-19, para. .164 Financial Accounting Standards Board (“FASB”) Current Text Industry Standards, Oi5, Oil and Gas Producing Activities, January 10, 2006, and

5. Glossary, page G-6, Cost Center definition.

Chapter 24, pages 414-417, provides accounting information on the structure and sharing arrangements very similar to the Registrant’s oil and gas partnerships. Page 415, para. 4 states that “limited partnerships may be viewed as a pooling of capital, the general partner and limited partners should follow the general guidelines of Oi5.138(b) through Oi5.138(f) which require each party to account for costs incurred according to their nature.” The Registrant includes all development costs in its specific cost center, whether it acquired the asset through its own development, joint venture, acquisition or investment in a limited partnership which is proportionately consolidated.

Based on the analysis provided herein, the Registrant believes that it has correctly accounted for its investments in its partnerships based on current accounting standards and industry practice. The Registrant believes the E&W article and the references in the Petroleum Accounting book support grouping all the Registrant’s oil and gas properties by cost center, regardless of legal structure and assessing impairment at that same level. The Registrant believes it is common industry practice to prepare a consolidated reserve report to the Registrant’s own economics. In addition, the operating expenses used in preparing the reserve report agree with the presentation in the Registrant’s financial statements. The Registrant respectfully requests a conference call at your earliest convenience to discuss this response letter respectfully submitted. If you have any questions or comments regarding this letter, please contact Nancy J. McGurk, Chief Accounting Officer, at (330) 896-8510 ext. 201 or Lisa Washington, Chief Legal Officer, at (215) 717-3387.

| Atlas Energy Resources, LLC | |

| By: | /s/ Nancy J. McGurk |

| Nancy J. McGurk | |

Exhibit A

Sample Allocation of Costs and Expenses for financial reporting and reserve preparation | ||||

| Partnership Accounting Records and | Registrant Accounting Records and | |||

| Reserve Report | Reserve Report | |||

| Type of expenditure | ||||

| Intangible well costs | Cost + 15% mark-up | None, paid 100% by limited partners | ||

| Tangible well costs | Cost + 15% mark-up | At Cost - approximately 75% paid by GP | ||

| Leasehold costs | At Cost | At Cost | ||

| Syndication and offering costs | Cost is netted with capital contributions in first year | Cost is capitalized and subsequently depleted within cost center | ||

| Contractual obligation to pay monthly operating and monthly general & administrative fees | Includes a profit margin paid to the GP (Registrant) | Profit is eliminated with GP share of operating and general & administrative fees | ||

| Reserve report preparation, tax preparation, and audit fees related to the partnerships | Included as expense on reserve report | Excluded as expense on reserve report | ||

| 7% Carried interest | Subtracted from LP ownership interest and added to GP for no additional cost | Added to GP ownership interest from LP interest for no cost | ||

| Salvage value | Approx. 75% allocable to GP, 25% to LP | Approx. 75% allocable to GP%, 25% to LP | ||

| Production revenues and operating expenses | Working interest, net to the partnership | Working interest, net to the Registrant based on contribution plus 7% carried interest |