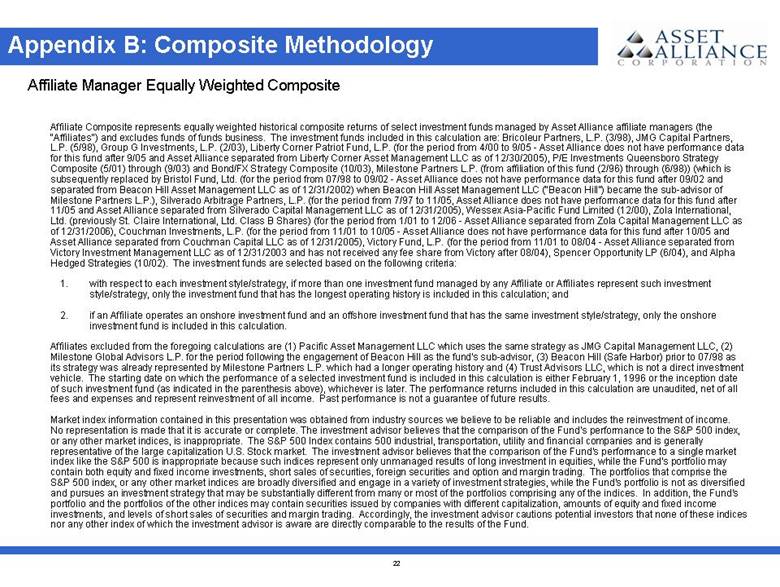

| 22 Appendix B: Composite Methodology Affiliate Manager Equally Weighted Composite Affiliate Composite represents equally weighted historical composite returns of select investment funds managed by Asset Alliance affiliate managers (the “Affiliates”) and excludes funds of funds business. The investment funds included in this calculation are: Bricoleur Partners, L.P. (3/98), JMG Capital Partners, L.P. (5/98), Group G Investments, L.P. (2/03), Liberty Corner Patriot Fund, L.P. (for the period from 4/00 to 9/05 - Asset Alliance does not have performance data for this fund after 9/05 and Asset Alliance separated from Liberty Corner Asset Management LLC as of 12/30/2005), P/E Investments Queensboro Strategy Composite (5/01) through (9/03) and Bond/FX Strategy Composite (10/03), Milestone Partners L.P. (from affiliation of this fund (2/96) through (6/98)) (which is subsequently replaced by Bristol Fund, Ltd. (for the period from 07/98 to 09/02 - Asset Alliance does not have performance data for this fund after 09/02 and separated from Beacon Hill Asset Management LLC as of 12/31/2002) when Beacon Hill Asset Management LLC (“Beacon Hill”) became the sub-advisor of Milestone Partners L.P.), Silverado Arbitrage Partners, L.P. (for the period from 7/97 to 11/05, Asset Alliance does not have performance data for this fund after 11/05 and Asset Alliance separated from Silverado Capital Management LLC as of 12/31/2005), Wessex Asia-Pacific Fund Limited (12/00), Zola International, Ltd. (previously St. Claire International, Ltd. Class B Shares) (for the period from 1/01 to 12/06 - Asset Alliance separated from Zola Capital Management LLC as of 12/31/2006), Couchman Investments, L.P. (for the period from 11/01 to 10/05 - Asset Alliance does not have performance data for this fund after 10/05 and Asset Alliance separated from Couchman Capital LLC as of 12/31/2005), Victory Fund, L.P. (for the period from 11/01 to 08/04 - Asset Alliance separated from Victory Investment Management LLC as of 12/31/2003 and has not received any fee share from Victory after 08/04), Spencer Opportunity LP (6/04), and Alpha Hedged Strategies (10/02). The investment funds are selected based on the following criteria: 1. with respect to each investment style/strategy, if more than one investment fund managed by any Affiliate or Affiliates represent such investment style/strategy, only the investment fund that has the longest operating history is included in this calculation; and 2. if an Affiliate operates an onshore investment fund and an offshore investment fund that has the same investment style/strategy, only the onshore investment fund is included in this calculation. Affiliates excluded from the foregoing calculations are (1) Pacific Asset Management LLC which uses the same strategy as JMG Capital Management LLC, (2) Milestone Global Advisors L.P. for the period following the engagement of Beacon Hill as the fund’s sub-advisor, (3) Beacon Hill (Safe Harbor) prior to 07/98 as its strategy was already represented by Milestone Partners L.P. which had a longer operating history and (4) Trust Advisors LLC, which is not a direct investment vehicle. The starting date on which the performance of a selected investment fund is included in this calculation is either February 1, 1996 or the inception date of such investment fund (as indicated in the parenthesis above), whichever is later. The performance returns included in this calculation are unaudited, net of all fees and expenses and represent reinvestment of all income. Past performance is not a guarantee of future results. Market index information contained in this presentation was obtained from industry sources we believe to be reliable and includes the reinvestment of income. No representation is made that it is accurate or complete. The investment advisor believes that the comparison of the Fund’s performance to the S&P 500 index, or any other market indices, is inappropriate. The S&P 500 Index contains 500 industrial, transportation, utility and financial companies and is generally representative of the large capitalization U.S. Stock market. The investment advisor believes that the comparison of the Fund’s performance to a single market index like the S&P 500 is inappropriate because such indices represent only unmanaged results of long investment in equities, while the Fund’s portfolio may contain both equity and fixed income investments, short sales of securities, foreign securities and option and margin trading. The portfolios that comprise the S&P 500 index, or any other market indices are broadly diversified and engage in a variety of investment strategies, while the Fund’s portfolio is not as diversified and pursues an investment strategy that may be substantially different from many or most of the portfolios comprising any of the indices. In addition, the Fund’s portfolio and the portfolios of the other indices may contain securities issued by companies with different capitalization, amounts of equity and fixed income investments, and levels of short sales of securities and margin trading. Accordingly, the investment advisor cautions potential investors that none of these indices nor any other index of which the investment advisor is aware are directly comparable to the results of the Fund. |