Confidential treatment has been requested pursuant to 17 C.F.R. §200.83. This letter omits certain confidential information that was provided separately to the Division of Corporation Finance. Asterisks denote such omissions.

October 9, 2012

Ms. Linda Cvrkel

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549

Form 10-K for the year ended January 1, 2012

Filed March 8, 2012

File No. 001-33091

Dear Ms. Cvrkel:

Set forth below is the response of GateHouse Media, Inc. (the “Company”) to the comments of the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) contained in your letter dated September 13, 2012 to Ms. Melinda A. Janik, Chief Financial Officer of the Company.

Form 10-Q for the period ended July 1, 2012

Note 1. Unaudited Financial Statements, page 7

| | 1. | Comment: We note that during the first quarter of 2012, the Company reorganized its management structure to align with its publication types. We also note the new reporting units, Small Community Newspapers, Large Daily Newspapers, and Metro Newspapers, have all been aggregated into one reportable business segment. As these reporting units appear to target different markets, advertising packages, and circulation patterns, please explain to us how management considered each factor in ASC Topic 280-10-50-11 in determining that the aggregation of all operating segments into one reportable segment is appropriate. As part of your response, please provide us with an organizational flowchart of the reorganized management structure and tell us how resources are allocated to the operating segments. Please also provide us with discrete separate financial information for each operating segment and a representative copy of the discrete financial information that is regularly furnished (on a quarterly or annual basis) to the CODM. We may have further comment upon receipt of your response. |

Response:

Company Structure

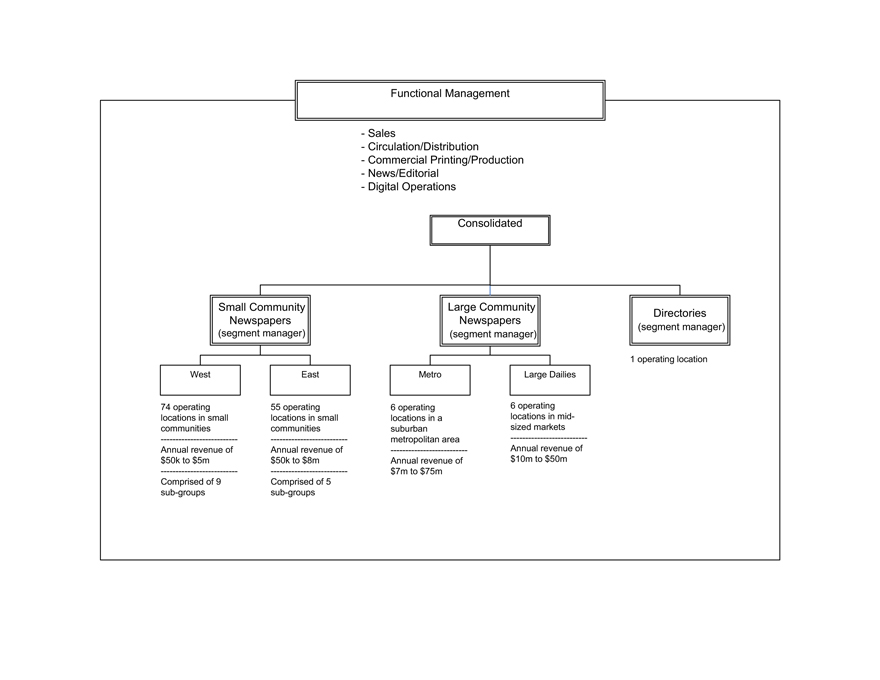

The Company is comprised of 435 print publications and 410 websites at approximately 140 operating locations, collectively referred to as “Publishing,” and

directories at one operating location, referred to as “Directories.” The operating location is the lowest level that financial information is available and may include multiple publications or websites. Although financial information is available for each of these operating locations (including revenue, expense and gross margin), certain revenue and expense items are not allocated to individual operating locations, as discussed below.

As Adjusted EBITDA (which is a non GAAP measure that reflects income (loss) from continuing operations before interest, income tax expense (benefit), depreciation and amortization and other non-recurring or non-cash items and is used in identifying trends in our day-to-day performance and when adjustments to current spending decisions are needed) is a key measure used by the Chief Operating Decision Maker (“CODM”) to assess performance and determine resource allocations at the consolidated level. This would include the determination of total company capital spending and headcount levels. As certain costs and revenue are not allocated to its operating locations, As Adjusted EBITDA is only an accurate measure at the consolidated level (“Consolidated As Adjusted EBITDA”). The operating location As Adjusted EBITDA (“Site As Adjusted EBITDA”) does not include the corporate expenses necessary to run the operations (including, functional management compensation, certain IT infrastructure costs, legal expenses, audit fees, etc.) along with shared service costs (for example, central costs to design ads at locations that have implemented the central service). Due to the size of these expenditures, Site As Adjusted EBITDA and Consolidated As Adjusted EBITDA will vary.

The majority of performance assessment targets and resource allocation decisions are made by the CODM at the consolidated level, including:

| | • | | Digital revenue growth targets |

| | • | | Circulation revenue growth targets |

| | • | | Printing consolidation and outsourcing |

| | • | | Resource allocations related to centralized services |

In certain situations where the size of the market served impacts the CODM’s assessment, primarily in the area of cost reductions, targets may be tailored to the large community and small community groups. Accordingly, the CODM reviews financial information at the large community and small community level to make such decisions. The Company has determined that it has the operating segments large community and small community, as detailed in Schedule A. These two operating segments are aggregated into one reportable segment.

The Company’s Chief Operating Officer is considered its CODM, as described below. The Company’s underlying organizational structure is consistent across all operating locations and its management hierarchy is based solely on the size of the market served. The Company’s large number of operating locations would make it extremely difficult for an individual to manage or analyze results at the operating location level.

While the Company changed its management structure from geographic to market type beginning in the first quarter of fiscal 2012, such change did not result in a difference in advertising packages or circulation patterns. In fact, given the Company’s continued move toward centralization and consolidation of similar functions and commonality of selling tools, sales commission programs, products and processes, the editorial process and advertising products are becoming increasingly uniform on a Company-wide basis. For example, a consistent sales tool kit, including extensive print and digital products, is offered at all of the Company’s operating locations. Moreover, each operating segment also includes a mix of daily, weekly, shopper and digital products and, as such, there is not a substantial difference in circulation patterns or types.

The Company also has centralized management of key functional areas across all operating locations, including: sales, circulation and distribution, commercial printing and production, news and editorial and digital operations. This centralized management is responsible both for monitoring performance on a Company-wide basis and for identifying action plans to improve results. These action plans include, among other things, the consolidation of print operations, adjustments to the Company-wide sales commission program, advertising and circulation price increases, addition of new sales products and promotions, and distribution outsourcing. A variety of functional areas provide centralized services to the operating locations (including, among other things, editorial layout, advertising layout and general content).

Operating Segments

For purposes of determining the appropriate reporting pursuant to ASC 280, the Company considered the following factors:

| | • | | Publishing includes relatively homogeneous activities comprised primarily of acquiring and creating content, selling advertisements and subscriptions, printing and distribution. Revenues are earned primarily through advertising and subscription. Expenses are primarily comprised of (i) salaries, (ii) newsprint/paper, (iii) depreciation and amortization of fixed and intangible assets such as customer and subscriber lists, and (iv) interest on debt. |

| | • | | Access to capital and prudent allocation of resources are essential to support the Company’s strategy and all of the Company’s operations are currently financed at the consolidated level. |

| | • | | The Company’s publishing activities have similar economic characteristics and target similar long-term Site As Adjusted EBITDA and contribution margins, as discussed in greater detail below. |

In analyzing the above factors, the Company considered the provisions of ASU 280-10-50 “Segment Reporting” which defines an operating segment as a component of a public entity that has all of the following characteristics:

| | a. | It engages in business activities from which it may earn revenues and incur expenses (including revenues and expenses related to transactions with other components of the same public entity). |

Business activities are engaged in at the operating location level which are then rolled up to the large community and small community newspapers levels and then to the consolidated level.

| | b. | Its operating results are regularly reviewed by the public entity’s chief operating decision maker to make decisions about resources to be allocated to the segment and assess its performance. |

The discussion below provides information on how the CODM makes decisions about resource allocations and assesses performance. A number of these determinations are made at the consolidated level, however, certain assessments are made at the large community and small community levels. As the large community and small community newspapers are the lowest levels at which these decisions or assessments are typically made by the CODM, they have been deemed the appropriate level to utilize in assessing its operating segments. Refer to the discussion below for a detailed analysis.

| | c. | Its discrete financial information is available. |

Certain financial information is available at the operating location level which is rolled up to the large community and small community newspapers levels and then to the consolidated level. As certain expense and revenue amounts are not allocated to the operating locations, an accurate As Adjusted EBITDA measure is only available at the consolidated level and this is the key measure the CODM uses to assess performance and allocate resources.

While financial information is available from the operating location to the consolidated level, refer to Schedule B, that was supplementally provided to the Staff, “Monthly Operational Review Reports” for an example of the type of information provided to the CODM, the CODM typically makes decisions about resource allocations and assesses performance at the consolidated level. The CODM’s responsibilities include:

| | • | | Allocation of resources and providing operational targets/goals. |

| | • | | Reviewing and assessing potential investments including new equipment and capital expenditures (such as printing presses, computer equipment, etc.). |

| | • | | Vendor selection and negotiation of major supply relationships (such as newsprint, business insurance, health insurance and other benefits, etc.). |

| | • | | Reviewing publication divestitures. |

| | • | | Managing business relationships with key revenue partners. |

| | • | | Determining structure of bonus plans to ensure consolidated targets are met. |

The CODM’s focus in assessing performance is the total Company revenue performance compared to prior year, with a focus on digital and circulation growth, and Consolidated As Adjusted EBITDA performance compared to budget and prior year. While the CODM has access to certain financial information for each of the operating locations, assessment of performance and asset allocation decisions are not made at this level. Also, as certain expense and revenue amounts are not allocated to the operating locations, an accurate As Adjusted EBITDA measure is only available at the consolidated level.

The majority of performance assessment targets and resource allocation decisions are made at the consolidated level. These include the key performance criteria listed below, but are not limited to:

| | • | | Digital revenue growth targets are made by the CODM at the total Company level. These targets are provided to the corporate sales team which is responsible for determining the specific targets for each operating location or group and assessing their performance. |

| | • | | Circulation revenue growth targets are made by the CODM at the total Company level and the circulation group is responsible for assessing the impact on operating locations to achieve the target. |

| | • | | Commercial Printing/Production management was given a target to reduce the number of printing locations by the CODM and that team determined the specific locations that would be consolidated or outsourced. |

| | • | | The CODM makes resource allocations related to centralized services (i.e., advertising operations and editorial layout at the total Company level). The functional managers of each area, who report to the CODM, are responsible for assigning resources to address the needs of each operating location. |

| | • | | Capital budget targets are set at the total Company level and operating locations submit desired projects. The funding determination for a project is made based on the need for the project and related return on investment and is not based on the size or performance of the operating location. |

In certain situations where the size of the market served impacts the CODM’s assessment, primarily in the area of cost reductions, targets may be tailored to the large community and small community groups. Cost reduction targets are typically developed at the total Company level, with greater targeted reduction levels at the large community newspapers due to their larger cost base and greater opportunities to outsource production or distribution activities. The CODM reviews the expense performance of the large community and small community operating segments against prior year levels to determine the level of expense reductions targets. Given the ongoing focus on cost reductions by the Company, this led to the determination that the large community and small community newspapers should be treated as separate operating segments.

The lowest level that the Company’s typical assessment decisions are made is the large community and small community newspapers level, and these were deemed the operating segments for the publishing business.

Reportable Segments

The Company reviewed the aggregation criteria of ASC 280-10-50-11 in relation to its large community and small community operating segments to determine if a single segment was present for reporting purposes:

| | a. | The nature of the product and services |

The Company’s publications in each of its operating segments rely on local content to attract readers and the delivery to the readers enables the Company to attract advertisers. All of the Company’s publications are initially printed materials with certain information then posted on digital platforms. The print and digital products have similar layout and national/general content is shared across all newspapers. Throughout the Company, there are similar production facilities, equipment, labor forces and production/service offering capabilities.

| | b. | The nature of the production processes |

The production process for each of the Company’s operating segments follows a similar process. Content is obtained or created, edited, laid-out and then printed. The Company is undertaking an initiative to centralize the lay-out and editing of products for the majority of operating locations and has centralized the advertising lay out for a number of locations.

| | c. | The type or class of customer for their products and services |

The Company derives a majority of its revenues in each of its operating segments from local display advertising. Additionally, subscription revenues in each of its operating segments are derived from paid circulation.

| | d. | The methods used to distribute their products or provide their services |

The Company distributes its newspapers via contracted delivery services and resellers in each of its operating segments. Sales are made with a direct sales force and to a lesser degree national ad referrals in each of the Company’s operating segments.

| | e. | If applicable, the nature of the regulatory environment |

The Company is subject to environmental regulations and other laws of general application; however, there are no industry specific regulations applicable to the Company.

Review of the specific factors identified in ASC 280-10-50-11 indicates that aggregation of the Company’s operating segments is appropriate. Further, operating segments often exhibit similar long-term financial performance if they have similar economic characteristics. For example, similar long-term average gross margins for two operating segments would be expected if their economic characteristics were similar. Historical Site As Adjusted EBITDA margins have been in a narrow range of between 20-25% for the large community and small community operating segments.

Over the next few years, these margins are anticipated to be closer to the 25% range as revenue performance stabilizes and centralization projects result in a lower cost basis across the company. The June 2012 trailing twelve month Site As Adjusted EBITDA margins were **.*%1 for the large community and **.*%1 for the small community operating segments. Both the large community and small community operating segments have experienced declining revenue and expense trends. ASC 280 provides that separate reporting of operating units that have characteristics so similar that they are expected to have essentially the same future prospects is not required. As such, the Company believes it is appropriate to aggregate the large and small community operating segments.

As a result of a review of the way in which the Company conducts its business activities, the existence of segment managers for each operating segment, the way in which the CODM reviews the operating results and allocates resources and its internal financial management reports, the Company determined it has two operating segments. As the aggregation criteria of ASC 280-10-50-11 are met, the Company has concluded that the two operating segments are similar and can be aggregated into one reportable segment.

Directories

The Company’s directories business engages in business activities from which it may earn revenues and incur expenses, its operating results are regularly reviewed by the CODM to make decisions about resources to be allocated to the segment and assess its performance and have discrete financial information available, which meets the definition of an operating segment under ASU 280-10-50.

ASC 280-10-50-12 provides quantitative thresholds for separate reporting of operating segments. If an operating segment meets any of the following quantitative thresholds they should be reported separately:

| | a. | Its reported revenue is 10 percent or more of the combined revenue of all operating segments. |

| | b. | The absolute amount of its reported profit or loss is 10 percent or more of the greater in absolute amount, of either: |

| | 1. | The combined reported profit of all operating segments that did not report a loss |

| 1 | Rule 83 Confidential Treatment Request made by GateHouse Media, Inc.; Request Number 1. |

| | 2. | The combined reported loss of all operating segments that did report a loss |

| | c. | Its assets are 10 percent of more of the combined assets of all operating segments. |

During the year ended January 1, 2012, the Company’s directory operating segment’s revenue represented less than 2 percent of total Company revenue, less than 2 percent of total Company net loss and less than 3 percent of total Company assets. The Company has reviewed the aggregation criteria of ASC 280-10-50-11 and determined that the nature of products, production process, types of customers, distribution methods and regulatory environment are similar between the directory and publishing operating segments. As none of the quantitative thresholds discussed above were met and the aggregation criteria of ASC 280 were met, separate reporting of the directory operating segment is not necessary and, therefore, the Company does not provide segment level disclosure for this immaterial operating segment.

Schedule B has been provided separately to the Staff as a supplemental submission pursuant to Rule 12b-4 of the Securities Exchange Act of 1934, as amended. In accordance with Rule 12b-4, the Company requests that the materials be returned to it following completion of your review, and requests confidential treatment of those materials pursuant to Rule 83 of the Commission’s Rules of Procedure.

In response to your letter, the Company also acknowledges that:

| | • | | The Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| | • | | Staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| | • | | The Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Should members of the Staff have any questions or require any additional information, they should call the undersigned at (585) 598-0032.

Very truly yours,

Polly Grunfeld Sack, Esq.

Sr. Vice President, Secretary and General Counsel

SCHEDULE A