Between

Ningde Jungie Mineria Co., Ltd.

Cai Ximing

Li Chengliang

AND

New Pacific Investment Corp. Limited

Dated March 28, 2017

Table of Contents

ANNEXES

1. ANNEX 1

Detail of Company’s Transitory Authorizations (ATEs)

2. ANNEX 2

Detail of Additional Company’s TAs

3. ANNEX 3

Detail of Company Corporate Contracts

4. ANNEX 4

Jungie Company Undertaking Agreement

5. ANNEX 5

Draft Letters to be sent by Jungie to Comibol and Alcira

6. ANNEX 6

Permits, Contracts, Licenses, Transitional Authorizations, Environmental Permits and Other Licenses required from the Government of Bolivia to allow for the commercial operation of the Company

7. ANNEX 7

Company’s Financial Statements

8. ANNEX 8

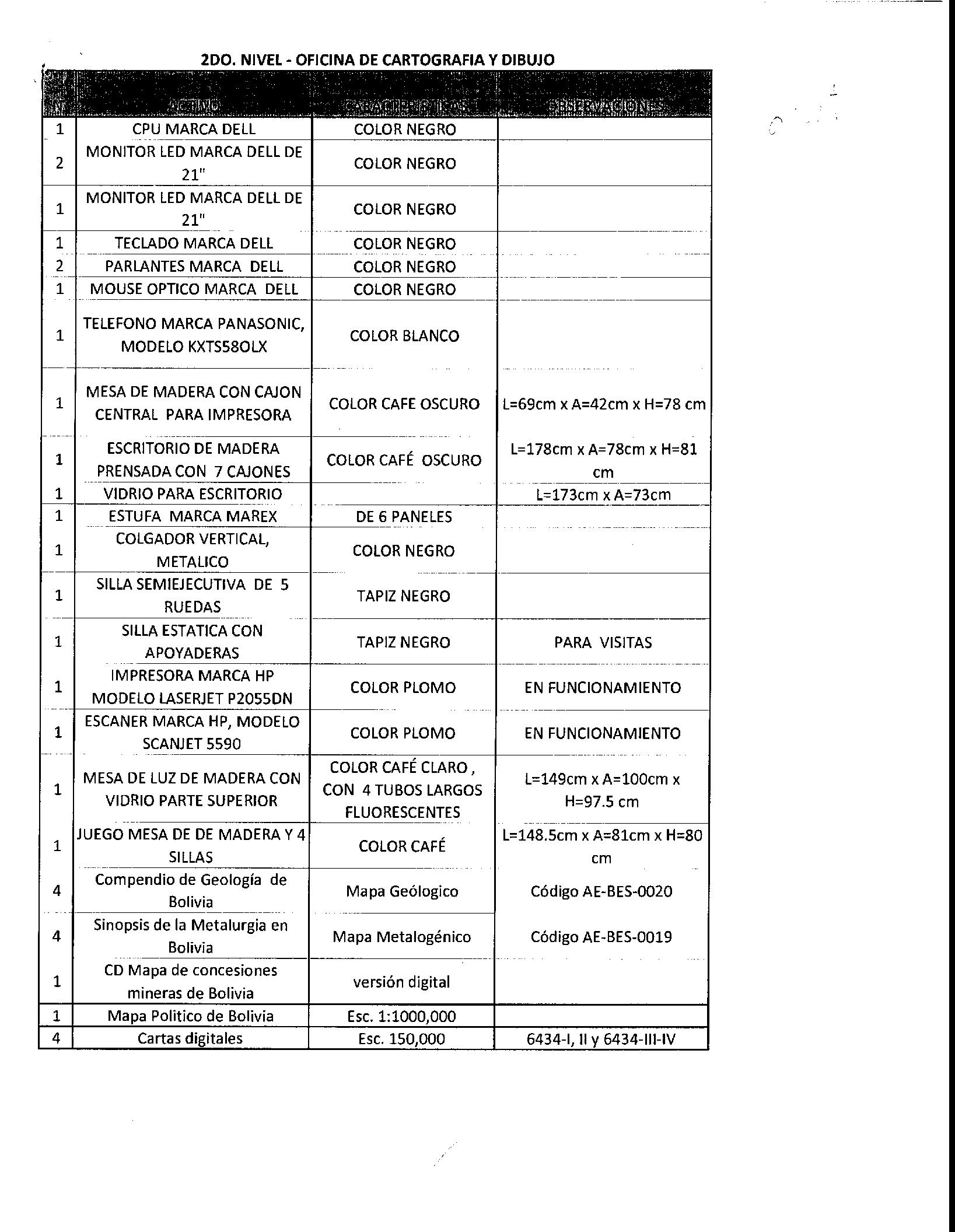

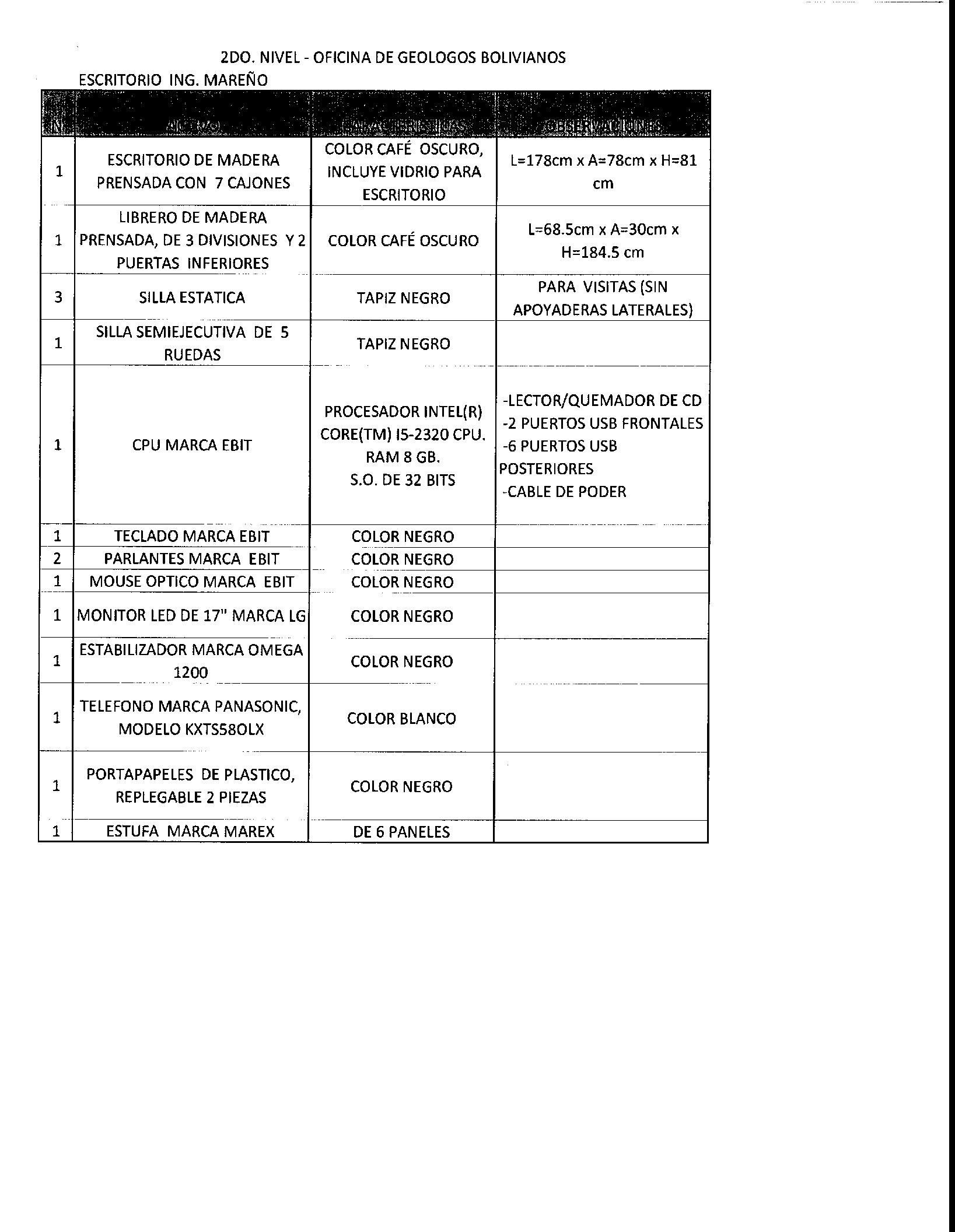

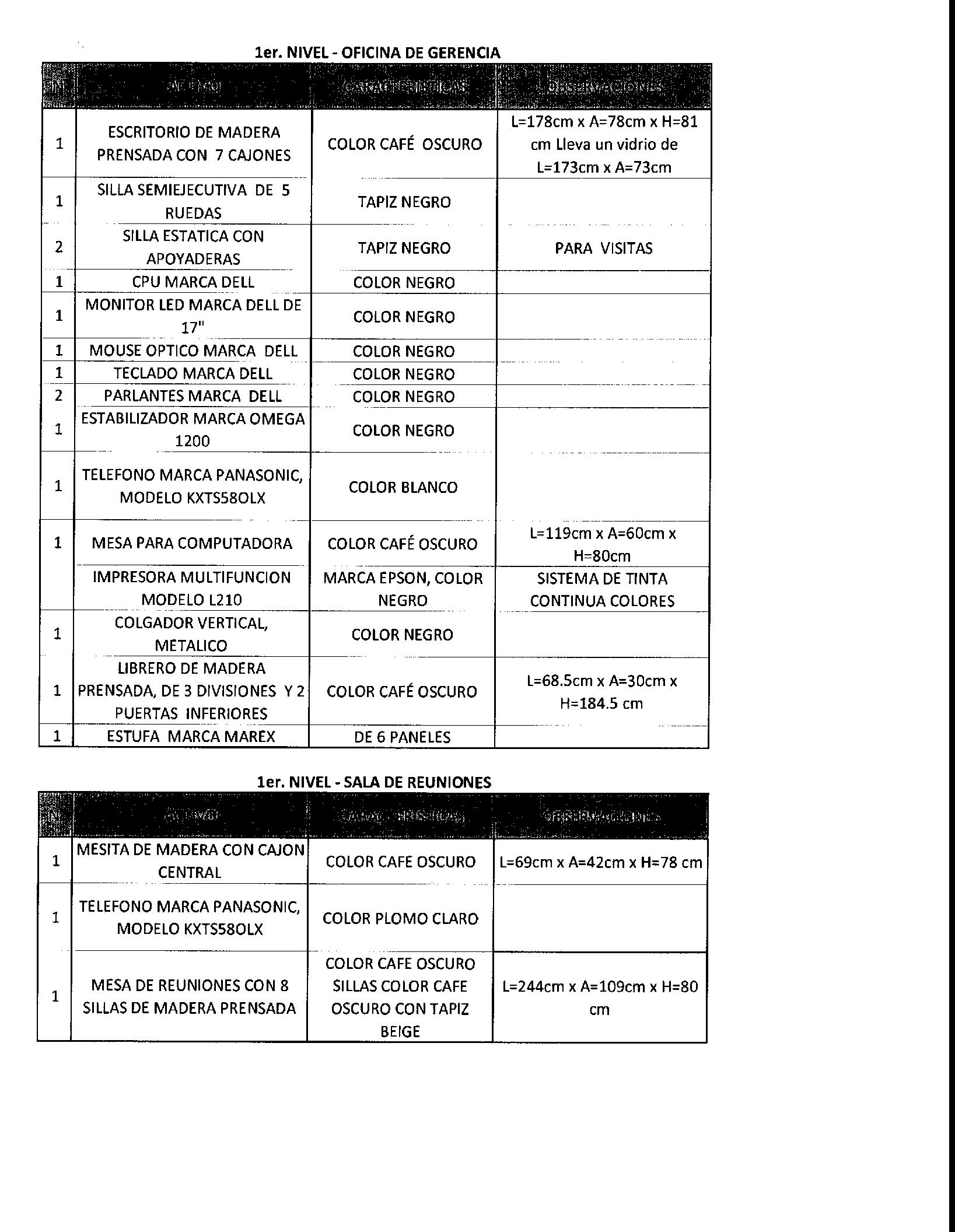

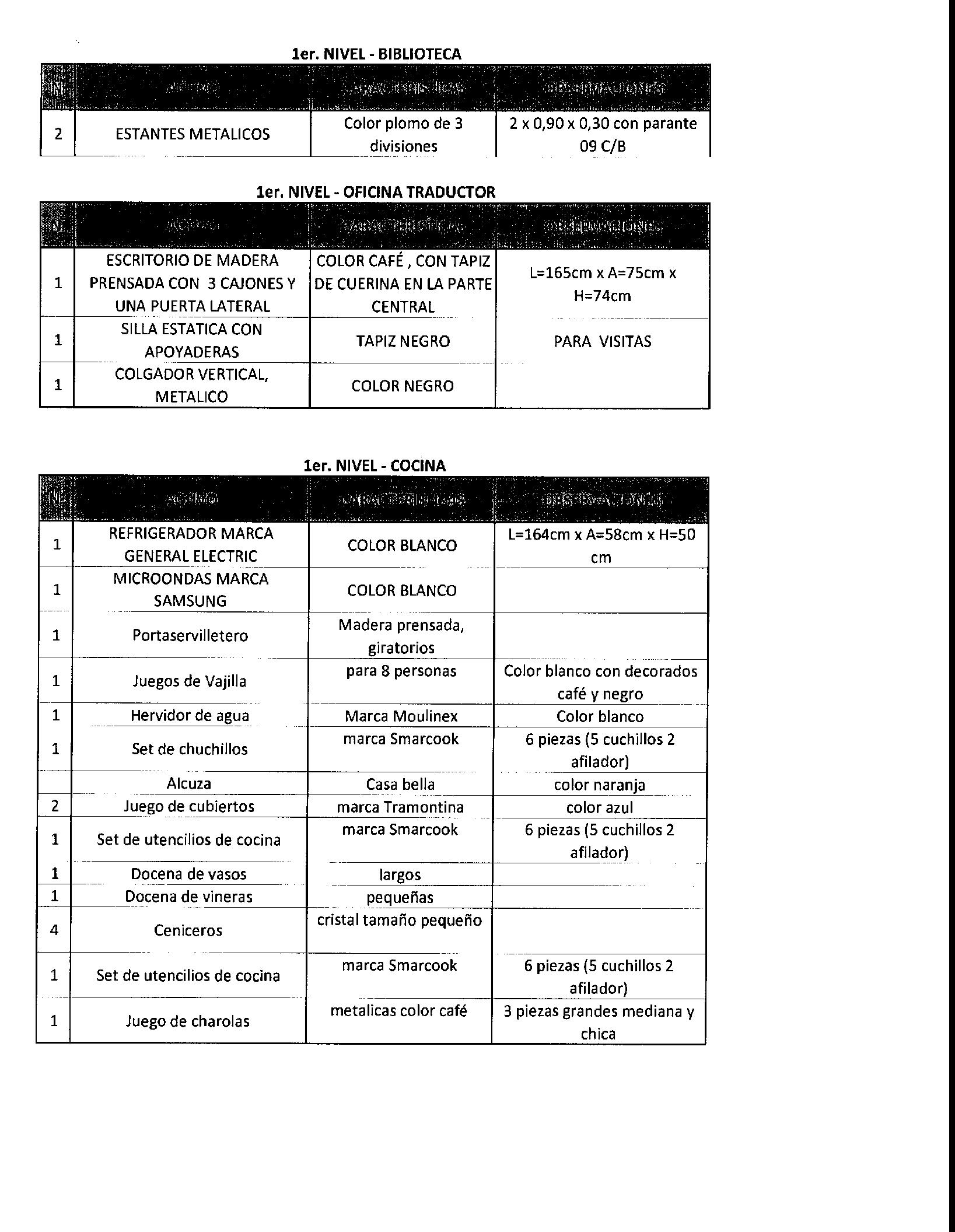

Inventory of Assets of the Company.

9. ANNEX 9

Detail of existing permits, licenses, authorizations required for mining exploration, and other related items owned by the Company

10. ANNEX 10

Lists of Powers of Attorney granted by the Company

11. ANNEX 11 Escrow Agreement

12. ANNEX 12 Promissory Note

2

13. ANNEX 13

Alcira’s Specified Liabilities Totaling US$ 1.300.000.

14. ANNEX 14

Confirmation drilling holes authorization letter

15. ANNEX 15

Payment Instruction for Deposit and Loan

16. ANNEX 16

New Pacific Holding Corp. Guarantee

3

SHARE TRANSFER AGREEMENT

The following is a private agreement for the sale and purchase of shares (the “Agreement”) that can be elevated to a public deed with the sole recognition of signatures, subscribed pursuant to the following clauses:

FIRST CLAUSE. - (Parties). The following individuals are Parties to this Agreement:

1.1. Mr. Cai Ximing, a Chinese citizen, of legal age, qualified by law, business executive by profession, [Redacted: confidential information], (hereinafter "Mr. Cai").

1.2. Mr. Li Chengliang, a Chinese citizen, of legal age, business executive by profession, [Redacted: confidential information](hereinafter "Mr. Li").

1.3. Ningde Jungie Mineria Co., Ltd., a corporation, legally incorporated under the laws of P. R. China, domiciled at [Redacted: confidential information] (hereinafter “JMI”).

1.4. New Pacific Investment Corp. Limited, a corporation, legally incorporated under the laws of Hong Kong, domiciled at [Redacted: confidential information] (hereinafter "NPIC").

Mr. Cai, Mr. Li and JMI will be referred to as the "Sellers" when collectively referred to in this document. NPIC will be referred to as the “Buyer”.

Henceforth, the Sellers, Buyer and Company (as herein below defined) may be individually or jointly called the "Party" or the "Parties".

SECOND CLAUSE. - (Background)

2.1. Sellers are the sole shareholders of Empresa Minera Alcira SA, a corporation legally incorporated under the laws of the Plurinational State of Bolivia, domiciled at Pasaje Las Higueras N° 100, zona Calacoto, registered before Fundempresa under [Redacted: confidential information] (“Company”). The Company's business registration is duly renewed for the 2016 term.

2.2. Sellers further represents that the Company has a fully subscribed and paid-in capital of Two Hundred Thousand Bolivianos (Bs. 200,000) divided into two thousand common and nominative shares, duly subscribed and paid for.

2.3. Mr. Cai is the sole and legitimate owner of ten common and nominative shares in the Company's share capital. These shares are represented by the share certificate No. 00005 of the Company, duly registered in the share registration book of said Company.

2.4. Mr. Li is the sole and legitimate owner of ten common and nominative shares in the Company's share capital. These shares are represented by the share certificate No. 00006 of the Company, duly registered in the share registration book of said Company.

2.5. JMI is the sole and legitimate owner of 1.980 common and nominative shares in the Company's share capital. These shares are represented by share certificates Nos. 00007 and 00008 of the Company, duly registered in the share registration book of said Company.

2.6. Sellers wish to sell and Buyer wishes to purchase all of the shares described in points 2.3, 2.4 and 2.5 above (hereinafter the "Shares") representing a percentage equal to one hundred percent (100%) of the common and nominative shares of the Company, subject to the terms and conditions of this Agreement and its Annexes, which are an indivisible part of this Agreement.

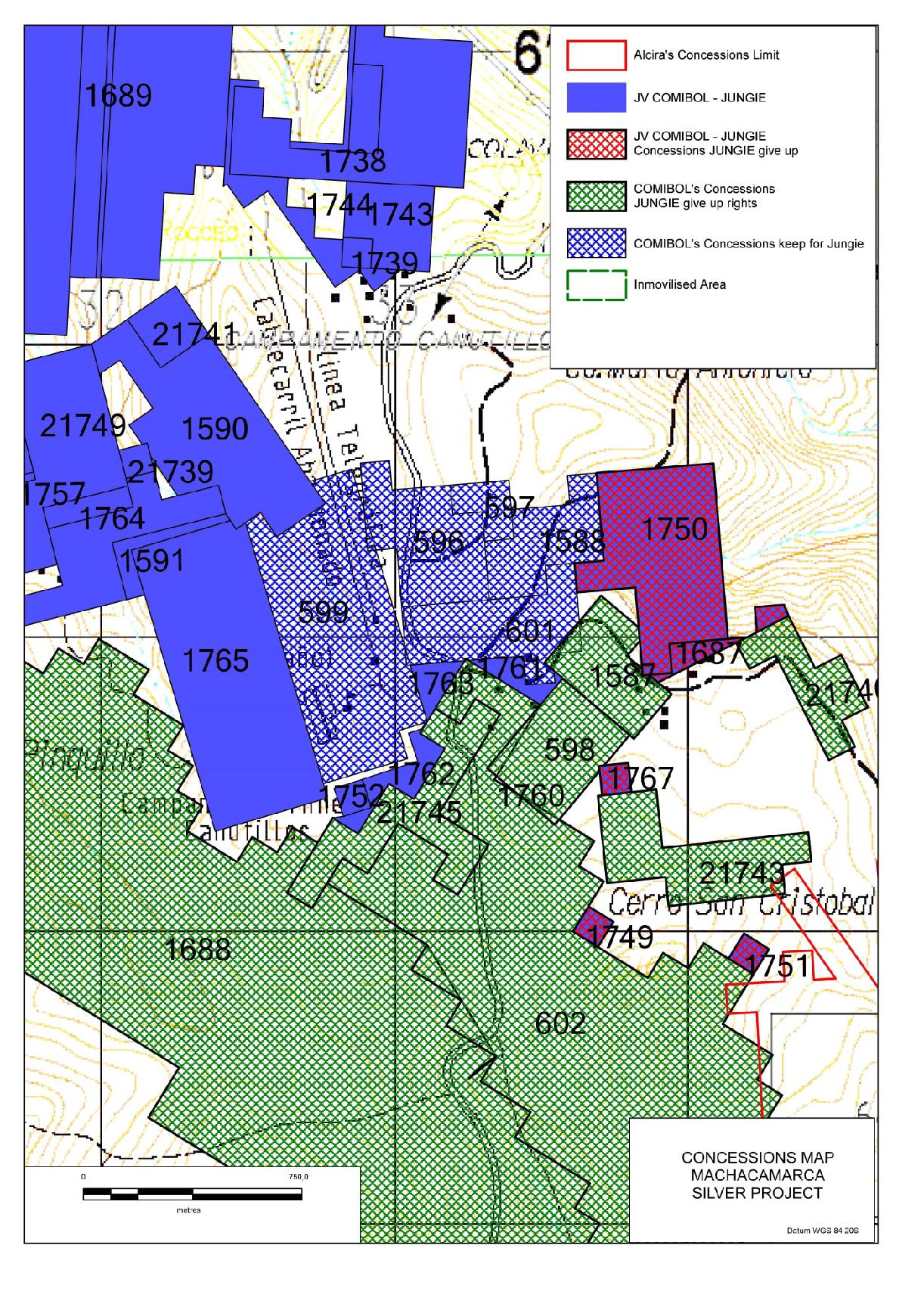

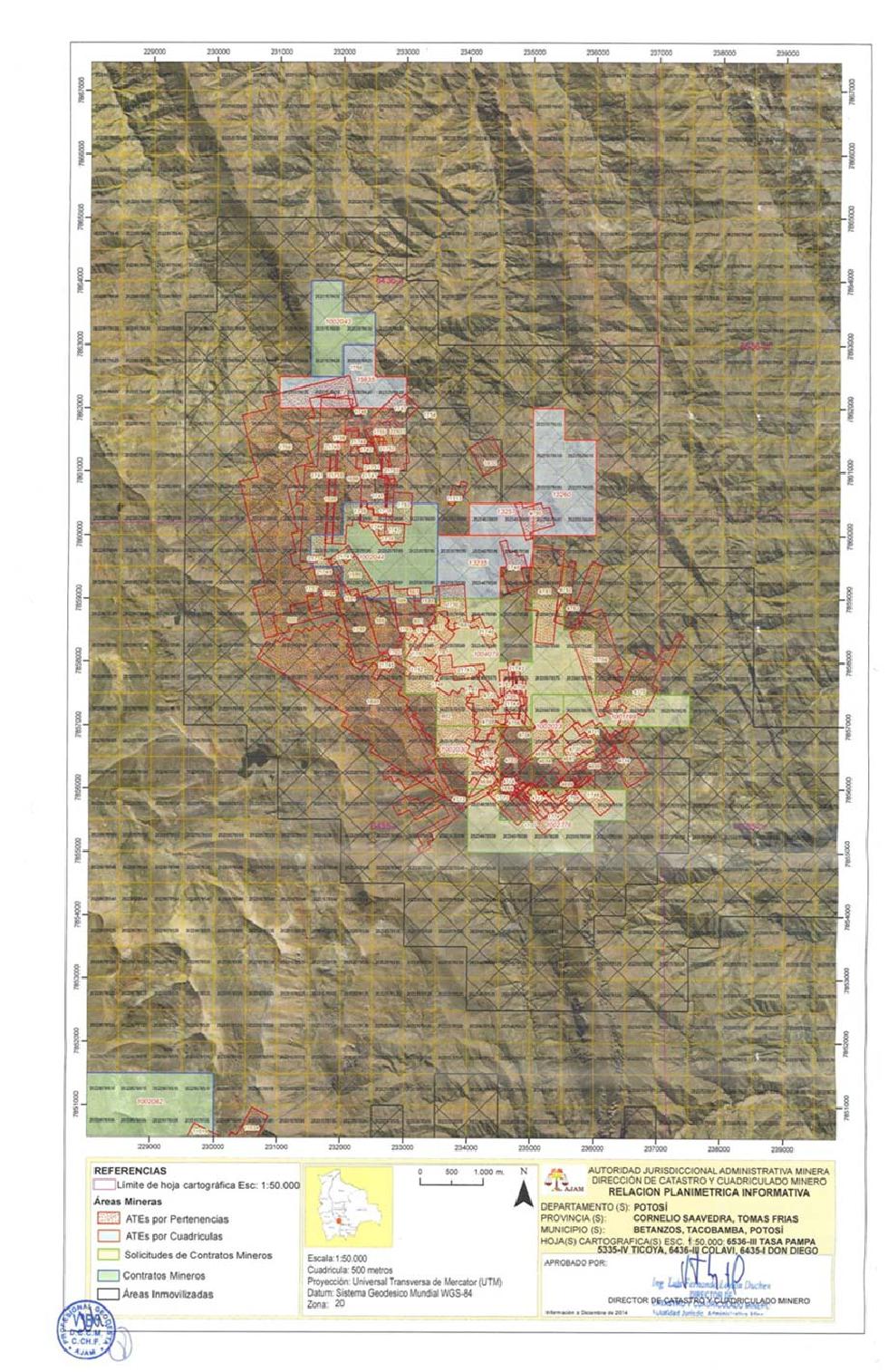

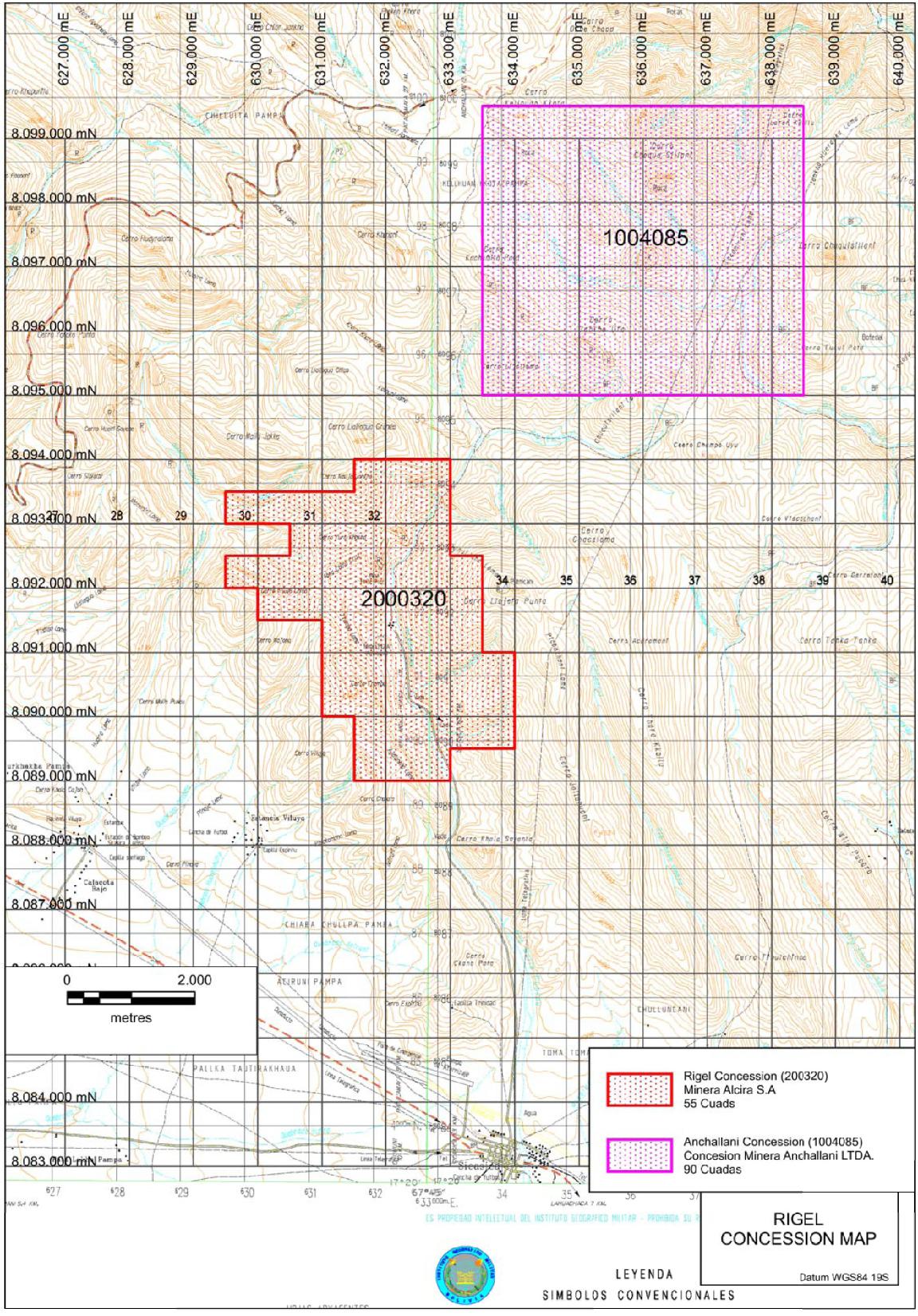

2.7. The Company is the legal and beneficial title holder to the Transitory Authorizations (TAs) detailed in Annex 1 of this Agreement.

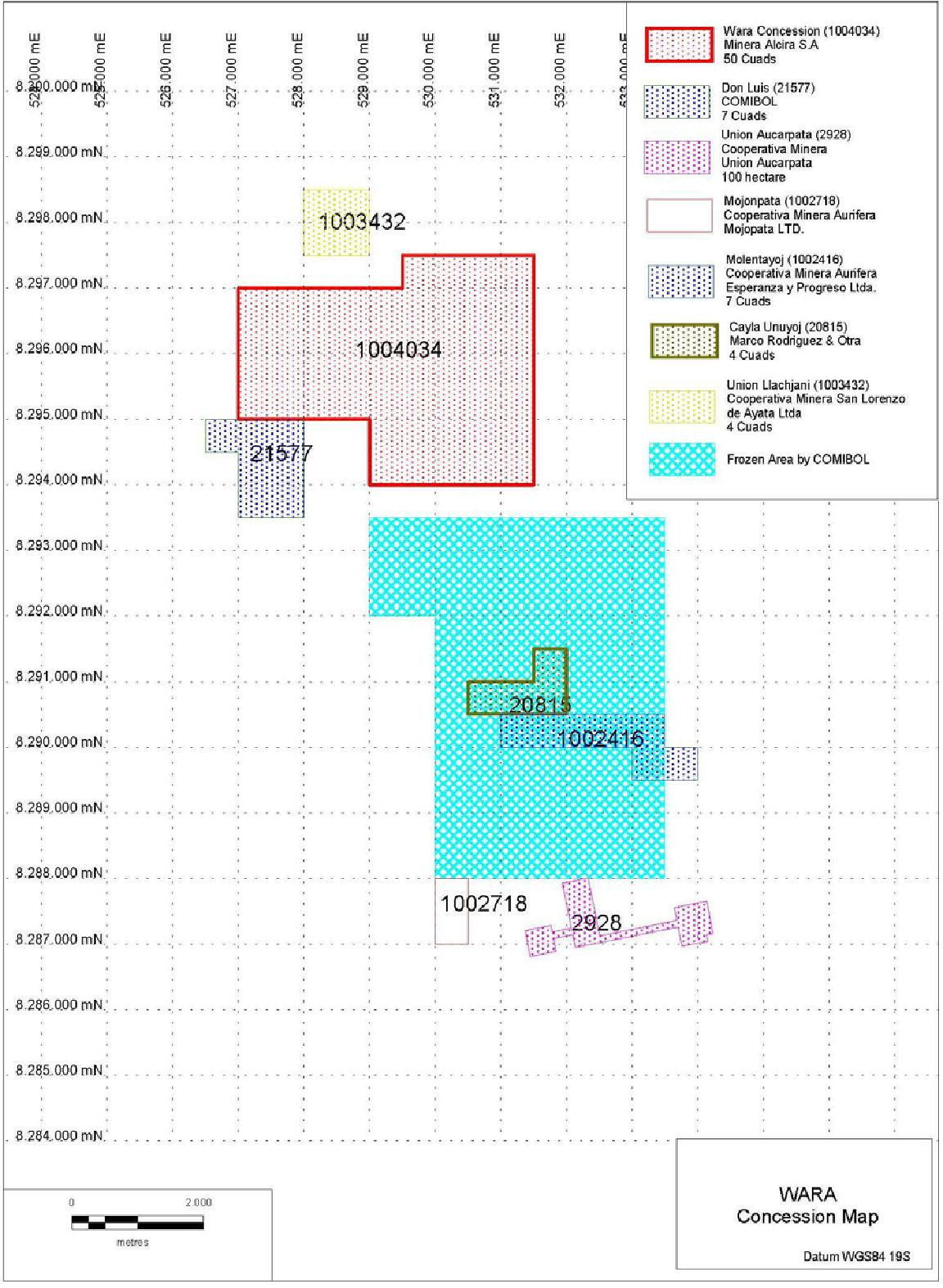

2.8. In addition, the Company is legal and beneficial title holder of the TAs or concessions detailed in Annex 2 of this Agreement (the Additional TAs).

2.9. The Company also holds the Contracts detailed in Annex 3 to this Agreement (the Corporate Contracts)

THIRD CLAUSE. - (Object of the Agreement)

The purpose of this Agreement is, on the one hand, the sale of the Shares by the Sellers to the Buyer, in the form and in the conditions detailed in the clauses that follow at the price set forth on Clause Four below.

3.1. Through this Agreement, Mr. Cai sells and transfers in favor of the Buyer (or to any third parties chosen by Buyer at the time of Closing, at Buyer’s exclusive decision), and the Buyer purchases, acquires and accepts from Mr. Cai ten (10) ordinary and nominative Shares in the share capital of the Company, together with all their rights and free of any liens, charges or conditions.

3.2. By means of this Agreement, Mr. Li sells and transfers in favor of the Buyer (or to any third parties chosen by Buyer at the time of Closing, at Buyer’s exclusive decision), and the Buyer purchases, acquires and accepts from Mr. Li ten (10) ordinary and nominative Shares in the share capital of the Company, together with all their rights and free of any liens, charges or conditions.

3.3. Through this Agreement, JMI sells and transfers in favor of Buyer (or to any third parties chosen by Buyer at the time of Closing, at Buyer’s exclusive decision), and the Buyer purchases, acquires and accepts from JMI one thousand nine hundred and eighty (1980) ordinary and nominative Shares in the share capital of the Company, together with all their rights and free of any liens, charges or conditions.

5

3.4. The Parties understand and agree that, notwithstanding the fact that Buyer may choose to have any part of the Shares transferred in favour of any third party of its choosing, all of Buyer’s obligations hereunder shall belong to and be complied with and shall constitute undertakings only of or by Buyer. Therefore, Sellers will have recourse under this Agreement for the compliance with or of, said obligations and undertakings solely against Buyer. In light of the above, the Parties agree that henceforth in this Agreement all references to Buyer shall include the right granted to Buyer under this Clause 3, to choose the third parties to whom any part of the Shares shall be eventually transferred, subject to the Closing taking place.

3.5. The Parties agree that the purchase and sale of the Shares subject to this Agreement, includes all the principal and accessory rights, arising or inherent thereto, whether current and future.

3.6. In addition, the purpose of this Agreement is to provide and detail the obligations to be assumed by the Parties under it (the “Obligations to Perform”), as well as the obligations to not do (the “Injunctions”) assumed by them.

FOURTH CLAUSE. - (Conditions Prior to Closing the Purchase)

4.1. On the date of signing hereof, Sellers must provide Buyer with Share certificates representing a total of thirty percent (30%) of the total amount of outstanding Shares of the Company, duly endorsed in property in favour of Buyer. The Parties agree that said Shares represent Buyer’s security under the Promissory Note and are subject to its terms and conditions.

4.2. Buyer acknowledges that Sellers have provided it with copies of all the information, as well as all the tests, examinations, assays, results and technical data relating to the TAs and/or concessions as per Annexes 1 and 2 hereof, and the list of Corporate Contracts (the “Mining Information”).

4.3. JMI has appointed Mr. Li who is authorized to endorse the Shares in favor of the Buyer, once the conditions provided in this Agreement have been fulfilled for that purpose The Sellers will also deliver a testimony of the respective power of attorney to the Buyer’s counsel in Bolivia no later than three days prior to the agreed date of signature of this Contract, who shall issue a Legal Report on its terms and conditions (the Powers) within twenty four hours of having received the testimonies. In case it does not, the Sellers must replace the Powers granted in order to satisfy the conditions indicated by the Buyer. All terms set forth in this Agreement will begin to be enforceable after delivery, to Buyer's satisfaction, of the Powers. Mr. Li and Mr. Cai will be acting on behalf of themselves.

4.4 No later than one hundred and five (105) days after the date of execution by both Parties of this Agreement, and provided Buyer has received the Mining Information and the Powers to its entire satisfaction, Buyer shall remit to the escrow agent set up pursuant to the escrow agreement entered into between the Buyer, Sellers and the escrow agent Computershare Trust Company (the Escrow Agent and the Escrow Agreement respectively), the amount of Thirty Two Million, Two Hundred and Fifty thousand (US$ 32.250.000) dollars of the United States of America, by way of certified cheque payable to the Escrow Agent in its capacity as escrow agent, by wire transfer, or by way of direction to transfer funds held in another account at Computershare. The escrow agent shall confirm to Buyer and Seller, in the manner set forth to that effect in the Escrow Agreement, the receipt of the full amount indicated above. The amount received by the Escrow Agent shall be held by said Escrow Agent and it shall only be released pursuant to the terms of the Escrow Agreement. The Escrow Agreement is part of this Contract as Annex 11.

6

4.5 Buyer shall appoint an external accountant and an independent audit firm to review and prepare the Company’s financial statements corresponding to the fiscal years 2015 and 2016 in accordance with Bolivian and IFRS standards, which shall, in turn, be reviewed by the auditor in order for it to issue an opinion thereon. Sellers hereby agrees to provide the accountant as well as the auditor with all necessary documents, access to its employees and officers and offices, as may be reasonably be requested by the accountant and/or auditor. Said audited financial statements must have clean opinions and be completed and produced no later than forty five (45) days after the date of signature of this Agreement. In the event the auditor is unable to issue clean opinions on both or either financial statement, Buyer shall have the right to terminate this Agreement, in this event the amount of US$ 250.000 paid by the Buyer to JMI under clause 5.1 a below, shall be consolidated in favor of Sellers.

4.6 No later than sixty (60) days after the execution hereof by all Parties, Sellers shall send to the Escrow Agent the following documentation (the Closing Documents):

(i) All of the Shares, except those described in point 4.1 above, and including all the original share certificates that include said Shares. All of the share certificates shall be endorsed in property.

(ii) evidence that the filings required to convert the ATs and mineral concession included in Annexes 1 and 2 of this Agreement into Administrative Contracts, have indeed been filed (including all the documents and information that must accompany said filings), as required by Bolivian law, to Buyer’s satisfaction and remain in good standing as of the date of Closing;

(iii) the Company's Share Registry;

(iv) all other ledgers required by law pertaining to the Company (including, but not limited to, Shareholders’ Meetings Minutes Ledger, Board Meetings Ledger and accounting books);

(v) all the irrevocable resignations delivered by the directors of the Company, subject to the Closing taking place;

(vi) the irrevocable resignation presented by the managers and attorneys of the Company, with the express declaration of having no claim against the Company for any reason, subject the Closing taking place;

(vii) all existing documents (including contracts, resolutions, background, licenses, permits and easements) corresponding to the TAs listed in Annex 1 and Annex 2, and the Corporate Contracts, which are listed in Annex 3 and documents listed in Annex 9;

7

(viii) the original letters, duly signed by Jungie Mining Industry SRL, (Jungie Bolivia) which will be sent, in the form set out in Annex 5 of this Agreement, to Alcira and the Mining Corporation of Bolivia (COMIBOL), upon the Closing.

(ix) The original auditor’s report on the Company’s 2015 and 2016 Financial Statements, as well as the quarterly reports issued by the Company corresponding to the period between the 2016 audited financial statements and the Closing.

4.7 Before the delivery of the Closing Documents to the Escrow Agent, Sellers shall deliver a copy thereof to Buyer’s Bolivian counsel for their review and conformity. Buyer’s counsel shall review the Closing Documents within seventy two (72) hours of their receipt and shall issue a Legal Report on their status. In the event any deficiencies or lack of documents is identified in said Legal Report, Buyer shall notify Sellers in writing of such deficiencies or lack of documents. Within 3 days of being notified with the deficiencies or lack of documents, Buyer and Sellers shall agree on date in which the cured deficiencies and/or the lack of documents shall be delivered, in original to the Escrow Agent, and in copies to Buyer’s Bolivian counsel. Within seventy two (72) hours of their receipt Buyer’s counsel shall issue a Legal Report on their status. If the Legal Report indicates that all deficiencies have been cured and/or all missing documents have been provided, Buyer and Sellers shall proceed to notify the escrow agent of that fact, upon which occurrence the sale object of this Contract may proceed in accordance with its terms. If the Legal Report indicates that either some deficiencies subsist and/or any documents are still missing (for clarity’s purpose, a document shall be deemed to be missing if it is delivered in a form that is not satisfactory to Buyer’s Bolivian counsel because it does not comply with all required legal formalities), Buyer may choose to waive any or all of said requirements, and grant Sellers an additional term, in which case the procedure set forth herein shall be repeated, or it may choose to terminate this Contract.

4.8 On the date of execution of this Agreement, the Sellers will provide Buyers with a letter that authorizes them to drill three confirmation holes in the TAs areas, in the form set out in Annex 14 (the Confirmation Holes). Buyer shall initiate the drilling of said Confirmation Holes in the areas detailed in Annexes 1 and 2 within two weeks following the deposit set out in Section 5.1. - a). The Confirmation Holes shall be drilled, under similar technical parameters as those performed on the original drillings performed by the Sellers, within a radius of five (5) to ten (10) meters from the location of the original drill collar locations. The Sellers will provide assistance to the drilling sites as requested by Buyer during the confirmation drillings performed by Buyer. All Confirmation Holes must be completed and Buyer shall have all the corresponding results, simultaneously, within three (3) months of the start of the drilling. The results obtained by Buyer, within that term, shall be verified by ALS or SGS Labs at the discretion of the Buyer.

If the results are not obtained and notified to the Sellers within the aforementioned term, the Parties shall negotiate an extension of the term herein and if no agreement is reached, Sellers may terminate this Agreement.

4.9 In the event the drilling is not allowed to proceed or is stopped or delayed by national, local or community authorities or individuals, for any reason, Sellers hereby undertake to solve the problem so that drilling can begin or continue, at Sellers’ expense. Any time needed to that effect shall be added to the term set forth in 4.8 above. If the confirmation drilling process is not concluded due to the causes described in this Section 4.9 for longer than an additional three months, the Parties shall negotiate for a period of up to one month to continue this Agreement. If no agreement is reached, this Agreement will be deemed terminated.

8

4.10 Once all the results of the tests carried out with the samples obtained from the Confirmation Holes have been received, the Buyer will compare them with the data included in the Mining Information. In case the results of all the tests, in terms of silver grade and intervals of mineralization, are in a range above seventy percent (70%) of those included in the Mining Information for the same drill hole locations, the Buyer will: firstly notify each of the Sellers, by means of electronic communication with confirmation of receipt, about the conformity of the tests with the ranges indicated above (the Confirmation). Secondly, the Buyer will proceed to make the Payment (as such term is defined later in the Fifth Clause), in the form and under the conditions indicated later in the Fifth Clause.

4.11 In the event that the results of the tests are not within the range indicated in the previous paragraph, the Buyer may choose to proceed with the Agreement, in which case the Buyer may make Sellers an offer which Sellers can accept or refuse at their sole discretion or may terminate this Agreement. Either option shall be performed by the Buyer and informed to the Sellers in five

(5) working days following the moment when the results become available to the Buyer. In case the latter should apply or if Buyer does not perform a choice in aforementioned term, the amount of US$ 250.000 paid by the Buyer to JMI under clause 5.1 a. below, shall be consolidated in favor of JMI. In addition, in case of termination of the Agreement, Buyer shall deliver to JMI all the results emerging from the tests derived from the Confirmation Holes and undertakes not to disclose them to any third party.

FIFTH CLAUSE. - (Price. Terms and Form of Payment, and Closing).

5.1. The Parties agree that the full amount of the price for the purchase of the Shares is of Forty Five Million Dollars of the United States of America (US$ 45.000.000) (the Price). The Price shall be paid by Buyer to Sellers in accordance with the following procedure:

a. Within 72 hours of the signing by all Parties of this Agreement, Buyer shall pay JMI the sum of Two Hundred and Fifty Thousand US Dollars (US $ 250.000) to be deposited in the bank in the account set forth in Annex 15 of this Agreement.

b. Pursuant to the Promissory Note dated on the same date hereof, Buyer agrees to lend to Sellers the amount of Three Million Five Hundred Thousand Dollars of the United States of America (US$ 3.500.000) (the Loan) to be deposited in the bank in the account set forth in Annex 15 of this Agreement. The Loan shall have a term of one hundred and twenty calendar days as of the date of the wiring of the Loan (the Term) (should the Term fall on a holiday or weekend, the Term shall be the next working day. For purposes hereof, work day shall mean a day in which banks are open for business in Vancouver, Canada) and it shall be repaid as per the terms of the promissory note. The text of the Promissory Note is included herein as Annex 12. For the sake of clarity, the amount of the Loan shall be offset against the Price upon Closing.

9

c. On the day falling on one hundred and twenty days after the signature by all Parties of this Contract and provided all conditions prior to Closing, as such conditions are set forth in Clause 4 above, have been complied with to Buyer’s satisfaction, the Parties shall meet at the offices of the Escrow Agent’s office in Vancouver, Canada at 11:00 a.m. to carry out the Closing of the purchase of the Shares. On that date, the Parties shall execute and send to the escrow agent the instruction letter included in the Escrow Agreement as Schedule B for an amount equal to Dollars of the United States of America Thirty Two Million Two Hundred and Fifty Thousand (US$ 32.250.000). Once the instructions letter is delivered to the escrow agent, the purchase object of this Contract shall be deemed to have been effected with full legal value.

d. No later than ninety (90) days from the date of Closing, Buyer shall pay the sum of Four Million Dollars of the United States of America (US$ 4.000.000). Said amount shall be disbursed in the following manner: two million and seven hundred thousand Dollars (US$ 2.700.000) shall be disbursed into the bank and the account notified to Buyer by Sellers in writing. One Million and three hundred thousand Dollars of the United States of America (U$ 1,300.000) shall be paid into the bank and the account notified by the Company to Buyer in writing. This latter amount shall be used by the Company exclusively with the purpose of canceling the liabilities listed by Sellers in Annex 13 of this Contract. Wiring instruction shall be provided by Sellers to Buyer no later than two weeks in advance of the payment date.

e. Within seven (7) days from the earlier of: (i) the date on which the Company has obtained all permits, contracts, licenses, transitional authorizations, environmental permits and other licenses for mining and milling operations of industry scale from the Government of Bolivia detailed in Annex 6 of this Agreement, or: (ii) at such time as the Company begins commercial production, Buyer shall pay to Sellers the amount of Five Million Dollars of the United States of America (US$ 5.000.000). This amount shall be disbursed into the bank and the account indicated by Sellers to Buyer in writing. Once the amount is deposited in said bank and account, Buyer shall no longer be responsible for the division or allocation or distribution of the deposited amount and Buyer’s obligation shall be deemed to have been fully and completely discharged by the deposit itself. The payment of the amount set forth in this section and subject to the terms and conditions included in this section e., shall be guaranteed by Buyer’s parent company, New Pacific Holdings Corp., as set forth in Annex 16 hereof.

5.2 For the sake of clarity and ease of understanding, the Parties agree that the following chart reflects the way the Price shall be paid:

| Purchase Price: | | US$ 45.000.000 | |

| | | | |

| Payments: | | | |

| Initial Deposit (non-refundable) | | US$ 250.000 | |

| Loan (which can be set off) | | US$ 3.500.000 | |

| Escrow Fund | | US$ 32.250.000 | |

| Payment within 90 days of Closing | | US$ 4.000.000 | |

| Payment subject to Permits | | US$ 5.000.000 | |

10

5.3. All amounts to be paid by Buyer to Sellers hereunder shall be paid into the Bank and the account indicated by Sellers to Buyer in writing, from time to time, and the receipt of deposit shall be sufficient evidence that Buyer’s obligation to pay hereunder has been fully and completely discharged. Furthermore, Buyer shall not be responsible nor accountable for the way the money paid by Buyer hereunder is divided or allocated amongst the individuals and companies that comprise Seller.

5.4. Upon signing of this Contract, Sellers, hereby agree not to enter into any agreements with any mining cooperatives, companies (juridical entities) of any type, individuals (natural persons) or COMIBOL either currently located or that could be in any way interested in working within the areas described in Annexes 1 and 2 of this Agreement as well as within a radius of five (5) kilometers of the boundaries thereof. The commitment to not submit any request as well as the commitment not to enter into any agreements indicated in the previous sentence, constitute negative covenants for Sellers, which will be extended to their subsidiaries, companies that they could incorporate in the future in which they could be shareholders or partners, their related companies in any way, as well as their heirs and successors under any title.

5.5. The obligation set forth in 5.4 above, on the part of the Sellers, shall commence on the date of execution of this Agreement and shall last indefinitely, unless the transaction contemplated in this Agreement is not carried out and completed, resulting in the termination thereof, in which case the obligation described herein shall terminate simultaneously with the termination of the Share Purchase Agreement.

5.6. In the event the Closing does not take place for any motive, Buyer hereby undertakes not to enter into any agreements with any mining cooperatives, companies (juridical entities) of any type, individuals (natural persons) or COMIBOL either currently located or that could be in any way interested in working within the areas described in Annexes 1 and 2 of this Agreement as well as within a radius of five (5) kilometers of the boundaries thereof. The commitment to not submit any request as well as the commitment not to enter into any agreements indicated in the previous sentence, constitute negative covenants for Buyer, which will be extended to its parent company, subsidiaries, companies that they could incorporate in the future in which they could be shareholders or partners, their related companies in any way, as well as their heirs and successors under any title. The provisions of this subsection shall survive the termination of this Agreement for any reason.

5.7. The enforcement of this Clause 5.1 (d) and (e) after Closing can be done under the laws of and within the jurisdiction of, Bolivia, Hong Kong or Canada at Seller’s discretion.

5.8. Each Party shall cover any expense or charge due by it, including but not limited to fees of financial institutions for administration or services arising as a result of the Payment. Likewise, any tax (including, but not limited to, the Financial Transactions Tax and Corporate Income Tax for capital gains) arising from the Payment shall be borne by the Party which the applicable law deems obligated to pay them.

11

5.9. The Parties undertake to carry out all necessary steps, as well as to carry out such acts as may be necessary, such as the preparation of reports, the delivery of information, the signing of documents and the active and timely collaboration with each other, whatever is necessary, as soon as they are required to do so, before any Bolivian authorities or entities, in order to perfect or comply with the object of this Agreement.

5.10. Any delay or partial failure to comply with post-Closing obligations, even if formally justified, will not annul and/or invalidate any part or all of the operation.

SIXTH CLAUSE. - (Representations and Warranties)

6.1. Representations and Warranties of Sellers:

Sellers represent and warrant that on the date of this Agreement and on the date of each Payment made thereunder (as this term is defined later in this Agreement):

(i) Sellers are the sole shareholders of the Company. The Company's business registration is duly renewed for the 2016 term.

(ii)

a. Mr. Cai is the sole and legitimate owner of ten common and nominative shares in the Company's share capital. These shares are represented by the share certificate No. 00005 of the Company, duly registered in the share registration book of said Company.

b. Mr. Li is the sole and legitimate owner of ten common and nominative shares in the Company's share capital. These shares are represented by the share certificate No. 00006 of the Company, duly registered in the share registration book of said Company.

c. JMI is the sole and legitimate owner of One Thousand Nine Hundred and Eighty common and nominative shares in the Company's share capital. These shares are represented by the share certificates Nos. 00007 and 00008 of the Company, duly registered in the share registration book of said Company.

(iii) In addition, the Company is the legal and beneficial title holder to all the TAs detailed in Annexes 1 and 2 of this Agreement (the TAs) and all such TAs (detailed in Annexes 1 and 2) and the applications made by the Company for their conversion into Mining Administrative Contracts have been duly filed and will be in good standing as of the Closing date.

12

(iv) The Company holds the Contracts detailed in Annex 3 to this Agreement (the Corporate Contracts) and there are no other material Contracts to which the Company is a party.

(v) The Company is a corporation duly incorporated and validly existing under the laws of the Plurinational State of Bolivia;

(vi) The Company has the capacity and has obtained all the authorizations required to own their assets, conduct their business in the manner in which they are currently conducting it and to subscribe and fulfill their obligations under this Agreement and all other Documents related thereto;

(vii) This Agreement has been duly authorized and subscribed by the Sellers and constitutes a legally enforceable obligation for each of them, executable in accordance with its terms;

(viii) Neither the subscription nor the execution of this Agreement or any of the documents related thereto, nor the fulfillment of its terms shall be in conflict with or result in a breach of any of the terms, conditions or provisions of, nor shall it constitute a violation, nor shall it require any consent under any transaction agreement, credit contract, encumbrance agreement or other instrument or agreement in which they participates or to which any of the Sellers or the Company is bound, or breach the terms or provisions of their incorporation documents or of any authorization, or any judgment, decree or order, or any applicable law or regulation;

(ix) On the date of execution of this Agreement, the Company is in compliance with all its material obligations arising from financial commitments and that they require no consent or agreement from any third party for the execution of this Agreement.

(x) The incorporation documents of the Company have not been amended since March 28, 2016;

(xi) Neither the Sellers nor the Company enjoy immunity from compensation, judgment or execution in relation to their assets or their obligations under this Agreement or any other document related thereto;

(xii) Neither the Sellers nor the Company are part of, or are committed to participate in any contract which prevents the conclusion of this Agreement or the documents related to it;

(xiii) Neither the Sellers nor the Company are involved in any litigation, arbitration or administrative proceeding, to the extent of their knowledge after careful investigation, nor have they been threatened with litigation, arbitration or any administrative proceeding, the result of which could prevent the present Agreement.

13

(xiv) The Company is not in material violation of any authorization or any law, or regulation issued by any governmental authority;

(xv) No judgment or order has been issued, or notified that has had or could prevent the conclusion of this Agreement;

(xvi) The Sellers have not authorized the additional issuance of share capital of the Company, nor the distribution of dividends;

(xvii) None of the statements and warranties contained in this clause omits any item whose omission causes any of said statements and warranties to be inaccurate in a substantial manner;

(xviii) During the due diligence process, the Sellers delivered, in good faith, to the Buyer all the documentation and information of the Company available to it, and such documentation and information reflects, to the extent it was delivered, the real and faithful situation of the Company.

(xix) The Company is in material compliance with the mining legislation applicable to it and to the TAs.

6.2. Additional Representations and Warranties of Sellers: Sellers declare that on the Closing Date and on the date of each Payment (as this term is defined later in this Agreement) made in accordance with it:

(i) Sellers will be - in the corresponding percentages expressed in clause two of this Agreement - the sole and legitimate owners and title holders of the Shares, except to the extent their corresponding percentage participation has already been transferred to Buyer;

(ii) The Shares are ordinary and nominative, will be fully paid and free from any pledge, encumbrance, charge, usufruct, preferential or other rights of third parties, and will have no other limitations that could affect the transfer of the Shares, or the exercise of any of their rights by the respective shareholders, thereby granting to the Buyer the corresponding guarantee of eviction on the Shares;

(iii) In order to transfer the ownership of the Shares there will be no need for any additional action on their part, or any of their entities, or third parties with which they have any legal, contractual, statutory or other relationship, except for the endorsement of the Shares.

(iv) The Company has not hired any individual or entity to act as a broker, and other than legal counsel, as negotiator and/or advisor for the operation contemplated in this contract sale.

14

(v) The Company's audited financial statements for the period ending on September 30, 2016 ("Financial Statements”: (a) which will have been prepared in accordance with Section 4.5 hereunder and accounting principles generally accepted in Bolivia and international accounting standards(hereinafter the "Accounting Standards") and fairly present the financial condition of the Company as of the date they were prepared, as well as the results of operations of the Company during the period then ended; and (b) present, in accordance with the Accounting Standards, all liabilities (contingent or otherwise) of the Company, as well as all reserves, if any, to cover such liabilities, as well as all unrealized or unanticipated liabilities or losses arising from commitments acquired by the Company (whether or not such commitments were disclosed in the referred Financial Statements);

(vi) As of the Closing date the Company has the liabilities set out in Annex 13 and no other material liabilities of any kind, (whether accrued, absolute, contingent or otherwise).

(vii) The Company has no encumbrances, charges or notices in force on any of its assets, outside those encumbrances arising from provisions of the law, and has no contractual or conditional or unconditional agreements under which it may be compelled to constitute a lien, and the Company is completely the owner of all its properties;

(viii) The tax payment forms and reports due by the Company, which must be presented by law, have been presented and all taxes, duties, commissions and other governmental charges owed by the Company or its properties, or by its income or assets, which are due and payable, or to be withheld, have been paid or withheld. Sellers believe, in good faith, that should any liabilities exist or appear in this regard, such liabilities should not exceed Dollars of the United States of America Fifteen Thousand (US$ 15.000). If the liabilities are equal to or less than US$ 15.000, Buyer agrees to assume payment thereof without recourse to Sellers. In the event such liabilities do exceed that amount, Sellers hereby irrevocably authorize Buyer to deduct any such amount from any pending payments owed to them at that time;

(ix) The Company has not received and is not aware of (i) any claim or lawsuit, or (ii) order, indication, summons, or notification of any governmental authority having jurisdiction over environmental, health or safety matters, in each case with respect to any matter relating to the compliance by the Company with the laws and regulations in force in Bolivia on environment, health and safety matters, including emission of gases, discharges to the surface or groundwater, noise emission, disposal of solid or liquid waste, or the use, generation, storage, transportation or disposal of toxic or dangerous substances or wastes, or related to any aspect of compliance by the Company with any rule included in Bolivian environmental legislation;

(x) The Company has not received and is not aware of (i) any claim or lawsuit, or (ii) order, indication, summons, or notification of any governmental authority having jurisdiction over labor matters or social security charges, in each case with respect to any matter relating to the Company's compliance with the labor laws and regulations in force in Bolivia or relating to any aspect of the Company's compliance with any rule within Bolivian labor legislation;

15

(xi) The Company has not received and is not aware of (i) any claim or lawsuit, or (ii) order, indication, summons, or notification of any governmental authority having jurisdiction over civil, administrative and criminal claims, in each case with respect to any matter relating to compliance by the Company with the laws and regulations in civil, administrative and criminal matters in force in Bolivia or relating to any aspect of the Company's compliance with any rule within Bolivian legislation;

(xii) The Company already has - either directly or indirectly - all rights required for the construction and operation of the facilities it uses to develop its business, including the lease of its current office premises for a period of, at least, six months from the date hereof, a copy of which contract shall be delivered to Buyer at the time of Closing, as set out in the inventory of assets of the Company is attached as Annex 8;

(xiii) The Company has –all the permits, licenses, and other authorizations required for mining exploration, detailed in Annex 9;

(xiv) The Company does not directly or indirectly control, either through a majority shareholding as a shareholder or partner in the social capital or through agreements or contracts granted by the management or administration, any subsidiary company;

(xv) Between the date of the Financial Statements and the date of signature of this Agreement, the Company has been managed within the normal course of business. Likewise, between those dates, the Company: (a) Has not issued shares, options, debentures, negotiable obligations or other rights to subscribe or purchase shares or convertible instruments or exchangeable for shares of the Company; (b) It have not redeemed, purchased or otherwise directly or indirectly acquired shares of the Company; (c) It has not made any changes to its accounting methods or practices; (d) The Company carries the books and records required by the applicable legislation in an adequate manner and in compliance with it: they give full account of the records that should be legally established there. The minutes ledgers contain truthful and sufficient transcripts of all matters that were dealt with and/or resolved in board meetings and at shareholders' meetings and adequately reflect the operations to which those transcripts relate.

(xvi) Annex 10 contains a list of the powers granted by the Company which are valid and in force at the date of Closing.

(xvii) The Company complies and has materially complied with at all times with environmental legislation, stating that there is no material liability or contingency linked to environmental issues.

(xviii) There are no land claims or title claims in any of the areas covered by the TAs and/or the Corporate Agreements filed by any third party, including, but not limited to any indigenous communities, companies, individuals and/or cooperatives.

16

(xix) Neither Mr. Cai’s nor Mr. Li’s spouses live in nor are residents nor are they citizens of Bolivia as of the day of Closing.

(xx) Sellers shall not, from the date of signing of this Agreement, until its termination, (1) solicit or engage with any other bidders; or (2) provide information to any third parties.

6.3. The Sellers represent and warrant that the statements and warranties detailed above are correct and accurate as of the date of execution of this Agreement and that they are not aware of any fact or circumstance that made them incorrect or inaccurate. They further acknowledge that the Buyer relied on the representations and warranties contained in this clause in order to enter into and sign this Agreement and its related documents and that the Buyer agrees to this Agreement and the other documents related thereto on the basis of and fully relying on each of the aforementioned declarations and guarantees.

6.4. Representations of the Buyer: The Buyer represent that:

(i) NPIC is a corporation duly incorporated and validly existing under the laws of Hong Kong, and is a subsidiary of New Pacific Holdings Corp., a public company listed on the TSX Venture;

(ii) This Agreement has been duly executed by the Buyer, authorized and subscribed by the Buyer and its legal representatives, who have acquired all corporate and legal authorizations to execute this Agreement, and constitutes a legally enforceable obligation and enforceable in accordance with its terms;

(iii) It has full financial capacity to fulfill all the payment obligations acquired hereto in favor of the Sellers.

(iv) Neither the subscription nor the execution of this Agreement nor any of the documents related to it, nor the fulfillment of its terms shall be in conflict with, nor will it result in a violation of any of the terms, conditions or provisions of, nor constitute a breach, nor will it require any consent under any compromise agreement, credit contract, encumbrance, agreement or other instrument or agreement in which it participates or to which Buyer is obligated, nor violate the terms or provisions of its incorporation documents or any authorization, any judgment, decree or order, or any applicable law or regulation;

(v) The Buyer is not involved in, nor has been threatened with litigation, arbitration or any administrative proceeding, the result of which may prevent the execution of this Agreement.

(vi) No judgment or order has been issued or notified, the result of which could impede the execution of this Agreement;

(vii) None of the statements and warranties contained in this clause omit any item whose omission makes any of said statements and warranties inaccurate in a substantial manner;

17

(viii) The Buyer conducted a best efforts due diligence process of the Company.

6.5. The Buyer represents and warrants that the statements and warranties detailed above are correct and accurate as of the date of subscription of this Agreement, and that it is not aware of any fact or circumstance that causes them to be incorrect or inaccurate. Likewise, it acknowledges that it makes the representations and warranties contained in this clause with the intention of inducing the Sellers and the Company to sign this Agreement and the related documents and that the Sellers and the Company agree to this Agreement and the other documents related to it based on and fully relying on each of said statements and warranties.

SEVENTH CLAUSE. - (Notifications)

7.1. Any notice, request or other communication that is to be given or made under this Agreement shall be made in writing - unless otherwise provided in this Agreement - and shall be delivered in person or sent by airmail, facsimile or courier service to each of the Parties to this Agreement at the following addresses. Such notification, request or other communication shall be deemed to have been delivered when it is received, or if it has been delivered to the correct address, in person, or through a courier service, in case of refusal of reception, or in the case of facsimile transmission, when the sending party receives electronic, or facsimile confirmation of receipt:

The Sellers (Mr. Li and JMI only):

Mr. Li Chengliang

[Redacted: confidential information]

Mr. Cai Ximing

[Redacted: confidential information]

The Buyer:

Dr. Rui Feng,

New Pacific Investment Corp. Limited

1378-200 Granville Street

Vancouver, British Columbia, Canada

V6C 1S4

Facsimile: 604-669-9387

Telephone: 604-633-1368

[Redacted: confidential information]

The Company:

[Redacted: confidential information]

Pursuant to this clause, changes to the addresses and contact individuals appointed to receive notifications under this Agreement shall be immediately notified in writing to the other Parties. If a Party has not received notification of the changes, any communication that a Party delivers to the addresses and individuals provided in this Agreement shall be considered valid and effective.

7.2. For legal purposes in Bolivia, the Parties declare and constitute the address indicated above as their legal domicile, with the value assigned by Article 29, paragraph II of the Bolivian Civil Code, in which proceedings for filing and notifications in civil proceedings or any other communication will take place with full legal validity and no right to protest.

EIGHTH CLAUSE. - (Severability)

If any clause, sentence, paragraph, or provision of this Agreement is legally declared prohibited, invalid, unenforceable, void or illegal, the Parties hereto agree, to the extent permitted by law, that this shall not affect the validity, legality and enforceability of the other provisions of this Agreement and the Parties agree that the portion or portions declared to be prohibited, invalid, unenforceable, unlawful or void shall be construed as being removed from this Agreement and the remainder of the Contract shall maintain the same value and force as if the portion (s) removed had never been included in this Agreement.

NINTH CLAUSE. (Absence of Waiver)

9.1. The delay in the exercise or omission of any of the Parties to exercise any right or faculty, contained in this Agreement, shall not operate as a waiver thereof or impede the exercise of any of their rights or powers. The partial exercise of any right shall not constitute a waiver of the exercise of the right in its entirety in the future, or the exercise of any other legal right. The waiver of any right will have no effect unless it is granted in writing.

9.2. The rights and powers provided for in this Agreement are cumulative and do not exclude any other right or power provided by law. The assertion or exercise of any right or faculty hereunder shall not prevent the concurrent exercise of any other right or faculty.

TENTH CLAUSE. - (Amendments, Resignations and Consent)

Any modification, waiver, or consent given under any clause of this Agreement shall necessarily be in writing, and in the case of amendments or modifications, signed by each of the Parties to this Agreement.

ELEVENTH CLAUSE. - (Notary Costs)

All notarial or registration costs of this Agreement will be paid by the Buyer.

TWELFTH CLAUSE. - (Assignment)

Neither Party may assign this Agreement in whole or in part, without the express written consent of all other Parties.

THIRTEENTH CLAUSE. - (Titles of Clauses, Definitions and References and Totality of the Agreement)

13.1.The titles, definitions and references used in this Agreement are for convenience only and do not affect the interpretation of this Agreement.

13.2.This Agreement, including its Annexes, contains the entire understanding between the Parties and supersedes any other negotiation, understanding or agreement between them with respect to the subject matter thereof.

FOURTEENTH CLAUSE. - (Confidentiality)

14.1.The Parties acknowledge and agree that in the course of the negotiations they have exchanged and in the future will exchange information not available to the public, considered confidential and exclusively owned by the other Party (the "Confidential Information"), the disclosure of which could be detrimental to that Party. The Confidential Information includes (i) information of all kinds, whether verbal, written, or otherwise recorded, including analysis, compilations, forecasts, data, studies or other documents relating to past, present or future business, (ii) the fact that negotiations and discussions regarding the operation have been carried out, and (iii) any information related to the Agreement and the resulting operation thereof, and any other agreements that have been entered into or which could be held in connection therewith.

14.2.The Parties agree as follows with respect to the Confidential Information: (i) to keep the Confidential Information confidential and not to disclose it, directly or indirectly, in whole or in part, without the prior written consent of the other Party, and notwithstanding what is otherwise provided in the Agreement; (ii) take all reasonable steps to ensure that the Confidential Information is not disclosed to third parties, and to refrain from using such Confidential Information with respect to any other purpose than that of the operation; and (iii) That they have disclosed and may in the future disclose the Confidential Information only to the representatives, agents, employees, advisers and consultants (the "Representatives") involved in the operation, and that they shall ensure that each Representative complies with the obligation to keep the Confidential Information secret and strictly observe the terms of the Agreement.

14.3.The duty of confidentiality shall not apply to Confidential Information that could be proved to be (i) available to the public by other means other than breach of duty (ii) it was in the possession of the other Party without any obligation of confidentiality prior to the date of the Agreement, or (iii) would have been legitimately received from a third party after the date of the Agreement, without restriction for its disclosure, or breach thereof, and without such third party having assumed a duty of confidentiality with the relevant Party.

20

14.4. If, under any (i) applicable law, (ii) order of a competent governmental authority or (iii) requirement or rule of any regulatory body including the rules of any stock exchange where the Buyer or its parent company may be listed, a Party is legally or contractually bound to disclose the Confidential Information, that Party must first expressly communicate such fact, in writing, to the other Party in a manner that allows it to file a precautionary measure for the protection of the Confidential Information or any other measure it deems appropriate. The Party obliged to disclose the Confidential Information must only disclose the part of the Confidential Information that it is legally required, and shall make all reasonable efforts to ensure the confidential treatment of the remaining Confidential Information. The Parties acknowledge that the Buyer will have an obligation to disclose via press release the entering into of this Agreement and the Buyer agrees to make the draft press release available to the Sellers at least 24 hours prior to the release of such press release. The Parties further acknowledge that the parent company of the Buyer will have an obligation to prepare and file a press release with the Canadian securities regulatory authorities and the TSX Venture Exchange prior to the Closing Date a National Instrument 43-101 Technical Report in relation to the TAs, which may contain technical information deemed to be Confidential Information. The Sellers and the Company agree that the Buyer may disclose such Confidential Information if it is required to be disclosed in the technical report.

FIFTEENTH CLAUSE. - (Taxes)

Except as otherwise provided in this Agreement, each Party shall be liable for the payment of their own taxes, payable in connection with the operations.

SIXTEENTH CLAUSE. - (Applicable Law, Language and Dispute Resolution)

16.1.This Agreement, its interpretation, compliance, validity, resolution and/or modification shall be subject to the laws of the Plurinational State of Bolivia.

16.2. This Agreement is entered into in both English and Spanish versions. In case of a discrepancy or a different interpretation thereof, the English version shall prevail. Any discrepancy or difference in interpretation shall be subject to the procedure for the resolution of disputes provided herein below.

16.3.Any dispute, litigation, claim or discrepancy which may arise between any of the Parties concerning the application, validity, performance, interpretation, compliance and/or resolution of this Agreement or in relation thereto (hereinafter a "Dispute"), shall first be negotiated directly between the Parties (the "Direct Negotiation"). The Direct Negotiation shall be conducted by negotiators appointed by each of the Parties involved in the Dispute for a term of thirty (30) calendar days from the date on which any Party that considers itself affected by such Dispute communicates about such Dispute to the other Party or Parties it considers are parties to the Dispute. Once the term established for the Direct Negotiation is concluded, and in case of failure by the Parties to reach an agreement, the prejudiced Party may submit the Dispute to an arbitration proceeding under the provisions of Law 708 of June 25 of 2015 and in accordance with what is set forth in clause 16.4 below.

21

16.4.In order to summon a Direct Negotiation, it shall be sufficient for the affected Party to issue a notarized letter stating the date, time and place in which the first Direct Negotiation meeting will be held. The Parties that are convened undertake to attend the call for Direct Negotiation, since their absence will be considered as a rejection of the Direct Negotiation giving rise to the beginning of the arbitration procedure, as defined below.

16.5.The Parties agree that the arbitration shall take place in the city of Hong Kong, in Spanish. In order to substantiate the arbitration, the Rules of Procedure of the International Court of Arbitration ("ICC") shall be applied, which shall also be the administrative organ of said arbitration. The arbitration shall be held before an arbitral tribunal composed of three (3) bilingual arbitrators (Spanish and Chinese). Each Party shall appoint one (1) Party arbitrator and ICC, in accordance with its rules, shall appoint a third arbitrator to serve as President of the Arbitral Tribunal. All arbitrators of the Arbitral Tribunal must be registered and qualified before the ICC.

16.6.In case more than one of the Sellers is considered to be involved in the Dispute, a Sellers Group shall be deemed to have been formed and such Sellers Group shall have the right to appoint only one arbitrator, the other being appointed by the Parties or Party that is not part of the Sellers Group and the third arbitrator as established in the previous paragraph.

SEVENTEENTH CLAUSE.- (Replacement)

The Parties agree that this Agreement supersedes and terminates all and any agreements, arrangements, covenants, or commitments, whether written or oral, that may exist between the Parties at the date of its subscription.

EIGHTEENTH CLAUSE. - (Acceptance)

The Parties hereby express their full agreement with the contents of the clauses of this Agreement, in its Spanish and English versions, and undertake to strictly comply with them. As a sign of their acceptance, they sign at the foot of this Agreement in the city of La Paz, Bolivia on March 28, 2017.

22

Li Chengliang | Rui Feng |

For: | Ningde Jungie Mineria Co., Ltd. | For: | New Pacific Investment Corp. Limited |

| | | | |

| Cai Ximing | Li Chengliang |

ANNEX 1

Detail of Company’s Transitory Authorizations (ATEs)

Alcira’s ATEs list

| # | Form No. | National Registry | Name of the Area | Titleholder | Size (has) |

| 1 | 4694 | 503‐01271 | La Sombra | Minera Alcira S.A. | 66 |

| 2 | 4695 | 503‐01275 | San Marcos Evangelista | Minera Alcira S.A. | 16 |

| 3 | 4696 | 503‐02424 | El Carmen | Minera Alcira S.A. | 6 |

| 4 | 4697 | 503‐01276 | Escuadra | Minera Alcira S.A. | 35 |

| 5 | 4698 | 503‐02423 | Perfecta | Minera Alcira S.A. | 16 |

| 6 | 4699 | 503‐01270 | Reintegrante | Minera Alcira S.A. | 3 |

| 7 | 4700 | 503‐01269 | Félix | Minera Alcira S.A. | 10 |

| 8 | 4701 | 503‐01266 | Seis de Agosto | Minera Alcira S.A. | 6 |

| 9 | 4702 | 503‐02425 | Olvidada | Minera Alcira S.A. | 15 |

| 10 | 4703 | 503‐01267 | Moria | Minera Alcira S.A. | 20 |

| 11 | 4704 | 503‐01268 | El Rodero | Minera Alcira S.A. | 37 |

| 12 | 4705 | 503‐01272 | Kirigin | Minera Alcira S.A. | 10 |

| 13 | 4706 | 503‐02426 | San Antonio | Minera Alcira S.A. | 8 |

| 14 | 4707 | 503‐02427 | Nieves | Minera Alcira S.A. | 8 |

| 15 | 4708 | 503‐02428 | Londres | Minera Alcira S.A. | 8 |

| 16 | 4709 | 503‐01273 | Santa Micaela | Minera Alcira S.A. | 31 |

| 17 | 4710 | 503‐01274 | Bertha | Minera Alcira S.A. | 20 |

| | | | | Total | 315 |

ANNEX 2

Detail of Additional Company’s TAs

Alcira's Applications to Execute Mining Administrative Contracts / Exploration Licenses

# | National Registry | Name of the Area | Applicant | Status of the Application | Size (has) |

1 | 512‐08866 | Capricornio | Minera Alcira S.A. | Not Completed / In Progress | 1250 |

2 | 210‐07716 | Constancia | Minera Alcira S.A. | Not Completed / In Progress | 1250 |

3 | 212‐07585 | Orion | Minera Alcira S.A. | Not Completed / In Progress | 1200 |

4 | 205‐07704 | Wara | Minera Alcira S.A. | On Stand by / To be Abandoned | 1250 |

5 | 2000320 | Rigel | Minera Alcira S.A. | Resolution Issued / Mining Registry pending | 1375 |

6 | 2000105 | Polaris | Minera Alcira S.A. | On Stand by / To be Abandoned | 1575 |

7 | 2000231 | Espiga | Minera Alcira S.A. | Rejected by AJAM due to total overlapping | 800 |

| | | | Total | 8700 |

ANNEX 3

Detail of Company Corporate Contracts

• Contrato para la Ejecución de Labores de Explotación Minera con el Sr. Andres Quispe Ninachi, en la Bocamina Sin Nombre ubicada dentro de la ATE La Sombra; de fecha 22/sep/2016, duración del contrato de 5 años.

• Contrato para la Ejecución de Labores de Explotación Minera con los Sres. Humberto Ninachi Vargas, Armando Ninachi Alejo, Jesús Ninachi Alejo y Saturnino Ninachi Vargas, en las Bocaminas Moria 1 y Moria 2 ubicadas dentro de la ATE Moria; fecha firma 22/sep/2016, duración del contrato de 5 años.

• Contrato para la Ejecución de Labores de Explotación Minera con los Sres. Jorge Vargas Cuenca, Victor Vargas Sarmiento, Marcelino Micacio Sarmiento, Mario Limachi Ticona y Daniel Mamani Vargas, en las Bocaminas Sombra 1 y Sombra 2 ubicadas dentro de la ATE La Sombra; fecha firma 22/sep/2016, duración del contrato de 5 años.

• Contrato para la Ejecución de Labores de Explotación Minera con el Sr. Demtrio Ninachi Irribarin, en la Bocamina Pizarro ubicada dentro de la ATE San Marcos Evangelista; fecha de firma 24/oct/2016, duración del contrato de 5 años.

• Contrato de Alquiler de Bien Inmueble con la Sra, Sandra Cecilia Rojas Villarreal, por la vivienda ubicada en La Paz, Calacoto, calle Las Higueras Nº 100 (para regularización).

• Contrato de Trabajo por tiempo indefinido con el Sr. Ángel Angulo Alanoca (Geólogo), vigente a partir de 01/marzo/2012.

• Contrato de Prestación de Servicios mediante Línea de Abonado Digital Asimétrica ADSL con AXS Bolivia S.A.

• Afiliación de Alcira S.A. a la Caja de Salud CORDES (CRP-096-12).

File: Contratos de Desmonte

• Convenio Transaccional Empresa Jungie Mining SRL - Andres Quispe Ninachi, Felipa Ninachi de Quispe. En un primer convenio, la Comunidad de Machacamarca aceptan la construcción e instalación y ejecución de un dique de colas para el Proyecto Minero de Jungie. Los propietarios de los cultivos y los berbecheros señores Andres Quispe y Felipa Ninachi de Quispe, otorgan y autorizan el derecho de uso de los terrenos donde se encuentran los cultivos, respetando la superficie de cuarenta y cinco hectáreas. Como compensación se cancela Bs. 15,000. Termino del convenio de 20 años. Firmas de las partes del convenio. 20/02/2011 (entregado al Dr. Antonio Santos)

• Convenio para la remoción y limpieza de pasivos ambientales y para la Promoción del Turismo Minero en Machacamarca - Empresa Minera

Alcira S.A. - Comunidad de Machacamarca. Municipio de Tacobamba

- Empresa Minera Tirex Ltda. - Firmas autoridades de las partes del convenio. Termino de un año. 19/04/2014

• Acta de Aval - en apoyo a los acuerdos de la Empresa Minera Alcira, para actividades de explotación de minerales en las bocaminas de Alcira denominadas Moria, Moria 2, Moria 3 y la Sombra 1 - Empresa Minera Alcira S.A. - Comunidad de Machacamarca. Municipio de Tacobamba - Empresa Minera Tirex Ltda. - Firmas autoridades de las partes del convenio. 20/04/2015

• Contrato de Explotación de minerales de plata y otros en la Bocamina La Sombra 1 - Empresa Minera Alcira S.A. - Andres Quispe y Marcial Bravo Martinez. Termino de cinco arios del contrato. 19/04/2014

• Contrato de Explotación de minerales de plata y otros en la Bocaminas Moria 2 y Moria 3 - Empresa Minera Alcira S.A. - Jorge Vargas Cuenca, Juan Vargas Cuencia, Victor Vargas Sarmiento, Marcelino Micacio Sarmiento, Juan Micacio Sarmiento - Firmas de las partes del convenio. Termino de cinco años del contrato. 19/04/2014

• Contrato para la ejecución de labores de explotación minera, explotación de plata y otros en las bocaminas San Marcos, 1 y Pizarro - Empresa Minera Alcira S.A. - Freddy Alurralde Buitrago - Firma el Sr. Freddy Alurralde. Termino de dos años del contrato. 19/04/2014

• Acuerdo Transaccional Definitivo e Irrevocable - Empresa Minera Alcira S.A. - Jungie Mining Industry - Andres Quispe Ninachi - Felipa Ninachi de Quispe - Los Srs. Quispe Ninachi declaran de manera irrevocable que ni Alcira S.A. ni Jungie Mining les adeudan dinero alguno por ningún concepto. Firmas de Alcira S.A. y de la Familia Ninachi, falta la firma del representante de Jungie Mining. 01/05/2015

• Ademdum al Contrato de Explotación de minerales de plata y otros en la Bocaminas Moria 1 - Empresa Minera Alcira S.A. - Humberto Ninachi Vargas, Armando Ninachi Alejo, Jesus Ninachi Alejo, Saturnine Ninachi Vargas - Modifican la cláusula 4.1. "deberán comercializar toda la producción en una planta expresamente autorizada por Alcira S.A. Modifica la cláusula 4.2., "Las partes acuerdan participación del valor de la liquidación de carga extraída será del 4% para Alcira S.A. y 96% para los Contratistas. Se agrega la cláusula 4.11 ven la bocamina y parajes autorizados solo podrán trabajar personalmente los señores Humberto Ninachi Vargas, Armando Ninachi Alejo y Saturnine Ninachi Vargas con un máximo de 8 peones. Todas las demás cláusulas se mantienen. Firmas de las partes del contrato. Anexo al adendum de contrato con fecha 10/06/2015. 06/05/2015

• Ademdum Contrato de Explotación de minerales de plata y otros en la Bocaminas Moria 2 y Moria 3 - Empresa Minera Alcira S.A. - Jorge Vargas Cuenca, Juan Vargas Cuenca, Victor Vargas Sarmiento, Marcelino Micacio Sarmiento, Juan Micacio Sarmiento - Modifican la cláusula 4.1. "deberán comercializar toda la producción en una planta que será expresamente autorizada por Alcira S.A. Modifica la cláusula 4.2., "Las partes acuerdan que su participación en el valor de la liquidación de la carga extraída será del 4% para Alcira S.A. y el 96% para los Contratistas. Se agrega la cláusula 4.11 "en la bocamina y parajes autorizados solo podrán trabajar personalmente los señores Jorge Vargas Cuenca, Juan Vargas Cuencia, Victor Vargas Sarmiento, Marcelino Micacio Sarmiento, Juan Micacio Sarmiento con un máximo de 8 peones. Todas las demás cláusulas se mantienen. Firmas de las partes del contrato. 06/05/2015

• Contrato de Explotación de minerales de plata y otros en la Bocaminas Moria 2 y Moria 3 - Empresa Minera Alcira S.A. - Humberto Ninachi, Armando Ninachi y Saturnine Ninachi - Firmas de las partes del convenio. Termino de cinco arios del contrato. 19/04/2014

ANNEX 4

Jungie Company Undertaking Agreement

COMPANY UNDERTAKINGS AGREEMENT

Between

Jungie Mining Industry SRL

Mr. Cai Ximing

Mr. Li Chengliang

AND

New Pacific Investment Corp. Limited

Dated March 28, 2017

Table of Contents

ANNEXES

1. ANNEX 1

Jungie Contract with Comibol.

2. ANNEX 2

Draft Letters to be sent by Jungie to Comibol and Alcira.

3. ANNEX 3

List of Areas Not Given Up

2

COMPANY UNDERTAKING AGREEMENT

The following is a private company undertakings agreement (the “Agreement”) that can be elevated to a public deed with the sole recognition of signatures, subscribed pursuant to the following clauses:

FIRST CLAUSE. - (Parties). The following persons are Parties to this Agreement:

1.1. Mr. Cai Ximing, a Chinese citizen, of legal age, qualified by law, business executive by profession,

[Redacted: confidential information]

1.2. Mr. Li Chengliang, a Chinese citizen, of legal age, business executive by profession, with

[Redacted: confidential information](hereinafter "Mr. Li").

1.3. Jungie Mining Industry SRL, a limited liability company, legally incorporated under the laws of Bolivia, domiciled at [Redacted: confidential information] (hereinafter "Jungie Bolivia").

1.4. New Pacific Investment Corp. Limited, a corporation, legally incorporated under the laws of Hong Kong, domiciled at [Redacted: confidential information] (hereinafter "NPIC").

Mr. Cai Ximing, Mr. Li Chengliang and Jungie Bolivia will be referred to as the "Obligors" when collectively referred to in this document.

Henceforth, the Obligors, NPIC and Jungie Bolivia may be individually or jointly called the "Party" or the "Parties".

SECOND CLAUSE. - (Background)

2.1. The Obligors are aware of the existence of a Share Purchase Agreement to be entered into between Mr. Cai Ximing, Mr. Li Chengliang, Ningde Jungie Minería Co., Ltd. in their condition as shareholders of Empresa Minera Alcira SA a corporation legally incorporated under the laws of the Plurinational State of Bolivia, (“Company”), and New Pacific Investment Corp. Limited (the Share and Purchase Agreement). Said Share Purchase Agreement shall be executed by the shareholders of the Company simultaneously with the execution of this Agreement.

2.2. Jungie Bolivia is party to a joint venture agreement with the Corporación Minera de Bolivia (COMIBOL), number [Redacted: confidential information] (the JV), which agreement is fully valid and remains in force and effect as of the date of execution of this Agreement, included as part of this Agreement as Annex 1.

2.3. The Parties have an interest in the execution and completion of the Share Purchase Agreement and the Obligors are aware that their compliance with the terms hereof are considered to be an essential component for the execution and compliance therewith on the part of the purchasers of the shares of the Company.

2.4. In light of the above, the Obligors have agreed to undertake the actions described in this Agreement in the terms and conditions herein set forth.

2.5. The terms defined in the Share Purchase Agreement shall be applicable to this Agreement, mutatis mutandis.

THIRD CLAUSE. - (Object of the Agreement)

The purpose of this Agreement is the undertaking, on the part of the Obligors to:

3.1. Deliver to the Escrow Agent set up under the Share Purchase Agreement (the Escrow Agent) the original and duly executed letters attached hereto as Annex 2 in two copies, each. Said delivery shall be effected no later than sixty (60) days counted from the execution date of this Agreement.

3.2. Accept and comply with the negative covenant described in Clause 4 hereof. This obligation on the part of the Obligors shall commence on the date of execution of this Agreement and shall last indefinitely, unless the transaction contemplated in the Share Purchase Agreement is not carried out and completed, resulting in the termination thereof, in which case the obligation described herein shall terminate simultaneously with the termination of the Share Purchase Agreement.

FOURTH CLAUSE. - (Negative Covenant)

4.1. Subject to the conditions set forth in 3.2 above, upon signing of this Contract the Obligors, hereby agree not to enter into any agreements with any mining cooperatives, companies (juridical entities) of any type, individuals (natural persons) or COMIBOL either currently located or that could be in any way interested in working within the areas described in Annexes 1 and 2 of the Share Purchase Agreement as well as within a radius of five (5) kilometers of the boundaries thereof. The commitment to not submit any request as well as the commitment not to enter into any agreements indicated in the previous sentence, constitute negative covenants for the Obligors, which will be extended to their subsidiaries, companies that they could incorporate in the future in which they could be shareholders or partners, their related companies in any way, as well as their heirs and successors under any title.

These provisions do not apply to the areas covered in the JV that have not been relinquished by Jungie Bolivia according to the letter included as Annex 5 of the Share Purchase Agreement. See Annex 3 of this Agreement

4.2. The Parties agree that the negative covenant set forth in 4.1 above, may be enforced by NPIC by any legal means available and more particularly by means of obtaining an injunction (prohibición de contratar y prohibición de innovar) from the corresponding legal authorities in Bolivia. In addition, the Parties likewise agree that any breach of this negative covenant can result: (i) in the obtaining of an additional injunction; and (ii) in the claiming of damages by NPIC against any and/or all of the Obligors, from and under any jurisdiction and before any court of law, at NPIC’s exclusive decision. To that effect, the Obligors hereby waive any objection to said choice and agree to subject themselves to the jurisdiction chosen by NPIC.

4

4.3. In addition, unless the Closing of the Share Purchase Agreement takes place, upon signing of this Contract, NPIC hereby agrees not to complete any agreements with any mining cooperatives, companies (juridical entities) of any type, individuals (natural persons) or COMIBOL either currently located or that could be in any way interested in working within the areas described in Annexes 1 and 2 of the Share Purchase Agreement, as well as within a radius of five (5) kilometers of the boundaries thereof. The commitment to not submit any request as well as the commitment not to complete any agreements indicated in the previous sentence, constitute negative covenants for the NPIC, which will be extended to their subsidiaries, companies that they could incorporate in the future in which they could be shareholders or partners, their related companies in any way, as well as their heirs and successors under any title.

FIFTH CLAUSE. - (Representations and Warranties)

5.1 Representations and Warranties of Obligors:

Obligors represent and warrant that on the date of this Agreement and on the date of compliance on their part, with any and all obligations undertaken by them hereunder:

(i) have the legal right as well as the necessary powers and faculties to validly execute the letters described in 3.1 above.

(ii) have the legal right as well as the necessary powers and faculties to validly Accept and comply with the negative covenant described in Clause 4 hereof.

(iii) Jungie Bolivia is a corporation duly incorporated and validly existing under the laws of the Plurinational State of Bolivia;

(iv) Jungie Bolivia has the capacity and has obtained all the authorizations required to subscribe and fulfill their obligations under this Agreement;

(v) This Agreement has been duly authorized and subscribed by the Obligors and constitutes a legally enforceable obligation for each of them, executable in accordance with its terms;

(vi) Neither the subscription nor the execution of this Agreement or any of the documents related thereto, nor the fulfillment of its terms shall be in conflict with or result in a breach of any of the terms, conditions or provisions of, nor shall it constitute a violation, nor shall it require any consent under any agreement or other instrument in which they participates or to which any of the Obligors is bound or of any authorization, or any judgment, decree or order, or any applicable law or regulation;

5

(vii) No judgment or order has been issued, or notified that has had or could prevent the conclusion of this Agreement;

(viii) None of the statements and warranties contained in this clause omits any item whose omission causes any of said statements and warranties to be inaccurate in a substantial manner;

SIXTH CLAUSE. - (Notifications)

6.1 Any notice, request or other communication that is to be given or made under this Agreement shall be made in writing - unless otherwise provided in this Agreement - and shall be delivered in person or sent by airmail, facsimile or courier service to each of the Parties to this Agreement at the following addresses. Such notification, request or other communication shall be deemed to have been delivered when it is received, or if it has been delivered to the correct address, in person, or through a courier service, in case of refusal of reception, or in the case of facsimile transmission, when the sending party receives electronic, or facsimile confirmation of receipt:

The Obligors:

Mr. Cai Ximing

[Redacted: confidential information]

NPIC:

Dr. Rui Feng,

New Pacific Investment Corp. Limited

1378-200 Granville Street

Vancouver, British Columbia, Canada

V6C 1S4

Facsimile: 604-669-9387

Telephone: 604-633-1368

Pursuant to this clause, changes to the addresses and contact individuals appointed to receive notifications under this Agreement shall be immediately notified in writing to the other Parties. If a Party has not received notification of the changes, any communication that a Party delivers to the addresses and individuals provided in this Agreement shall be considered valid and effective.

6.2 For legal purposes in Bolivia, the Parties declare and constitute the address indicated above as their legal domicile, with the value assigned by Article 29, paragraph II of the Bolivian Civil Code, in which proceedings for filing and notifications in civil proceedings or any other communication will take place with full legal validity and no right to protest.

SEVENTH CLAUSE. - (Severability)

If any clause, sentence, paragraph, or provision of this Agreement is legally declared prohibited, invalid, unenforceable, void or illegal, the Parties hereto agree, to the extent permitted by law, that this shall not affect the validity, legality and enforceability of the other provisions of this Agreement and the Parties agree that the portion or portions declared to be prohibited, invalid, unenforceable, unlawful or void shall be construed as being removed from this Agreement and the remainder of the Contract shall maintain the same value and force as if the portion (s) removed had never been included in this Agreement.

EIGHTH CLAUSE. (Absence of Waiver)

8.1 The delay in the exercise or omission of any of the Parties to exercise any right or faculty, contained in this Agreement, shall not operate as a waiver thereof or impede the exercise of any of their rights or powers. The partial exercise of any right shall not constitute a waiver of the exercise of the right in its entirety in the future, or the exercise of any other legal right. The waiver of any right will have no effect unless it is granted in writing.

8.2 The rights and powers provided for in this Agreement are cumulative and do not exclude any other right or power provided by law. The assertion or exercise of any right or faculty hereunder shall not prevent the concurrent exercise of any other right or faculty.

NINTH CLAUSE. - (Amendments, Resignations and Consent)

Any modification, waiver, or consent given under any clause of this Agreement shall necessarily be in writing, and in the case of amendments or modifications, signed by each of the Parties to this Agreement.

TENTH CLAUSE. - (Assignment)

Neither Party may assign this Agreement in whole or in part, or any of its rights or obligations under it, without the express written consent of all other Parties.

ELEVENTH CLAUSE. - (Titles of Clauses, Definitions and References and Totality of the Agreement)

11.1The titles, definitions and references used in this Agreement are for convenience only and do not affect the interpretation of this Agreement.

11.2This Agreement, including its Annexes, contains the entire understanding between the Parties and supersedes any other negotiation, understanding or agreement between them with respect to the subject matter thereof.

7

TWELFTH CLAUSE. - (Replacement)

The Parties agree that this Agreement supersedes and terminates all and any agreements, arrangements, covenants, or commitments, whether written or oral, that may exist between the Parties at the date of its subscription.

THIRTEENTH CLAUSE. - (Acceptance)

The Parties hereby express their full agreement with the contents of the clauses of this Agreement and undertake to strictly comply with them. As a sign of their acceptance, they sign at the foot of this Agreement in the city of La Paz on March 28, 2017.

Cai Ximing | Rui Feng |

For: | Jungie Mining Industry SRL | For: | New Pacific Investment Corp. Limited |

| | | | |

| Cai Ximing | Li Chengliang |

8

ANNEX 2

PLEASE REFER TO ANNEX 5 OF THE SHARE PURCHASE

AGREEMENT

List of Cocessions for Jungie to Keep Rights

[Redacted: confidential information]

List of Cocessions for Jungie to Keep Rights

[Redacted: confidential information]

Jungie to Keep Right of First Refusal

[Redacted: confidential information]

ANNEX 5

Draft Letters to be sent by Jungie to Comibol and Alcira

La Paz, March 00, 2017

CITE XXXXXXXXXXXX

Mr.

Dn. José Pimentel Castillo

CEO

Bolivia Mining Corporation

Present.-