UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SB-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Blackmont Resources Inc.

(Name of small business issuer in its charter)

Nevada | 1000 | 98-04994005 |

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (IRS Employer Identification No.) |

609-475 Howe Street Vancouver, B.C. V6C 2B3

Tel: 604-682-1643

(Address and telephone number of principal executive offices)

Aaron D. McGeary, 405 Airport Fwy, #5 Bedford, Texas 76021

(817) 268-3520

(Name, address and telephone number of agent for service)

Copies of all communication to:

Blackmont Resources Inc.

609-475 Howe Street Vancouver, B.C. V6C 2B3

Tel: 604-682-1643

| Approximate date of proposed sale to the public: As soon as practicable after the effective date of the Registration Statement. | x |

| If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. | o |

| If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. | o |

| If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. | o |

| If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. | o |

| If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. | o |

&# 160;

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered | Dollar Amount to be registered | Number of Shares to be registered | Proposed maximum offering price per unit | Amount of registration fee |

| Common stock | $25,000 | 2,500,000 | $0.01 | $2.68 |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Disclosure alternative used (check one): Alternative 1 Alternative 2 X

Subject to Completion, Dated July 20, 2006

PROSPECTUS

Blackmont Resources, Inc.

2,500,000 Shares of Common Stock

The selling shareholder named in this prospectus is offering 2,500,000 shares of common stock of Blackmont Resources, Inc. We will not receive any of the proceeds from the sale of these shares. The shares were acquired by the selling shareholder directly from us in a private offering of our common stock that was exempt from registration under the securities laws. The selling shareholder has set an offering price for these securities of $0.01 per share and an offering period of four months from the date of this prospectus. See “Security Ownership of Selling Shareholder and Management” for more information about the selling shareholder.

Our common stock is presently not traded on any market or securities exchange. The offering price may not reflect the market price of our shares after the offering.

This investment involves a high degree of risk. You should purchase shares only if you can afford a complete loss. See “Risk Factors” beginning on page 6.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of the prospectus. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Shares Offered by Selling Shareholder | Price To Public | Selling Agent Commissions | Proceeds to Selling Shareholder |

| Per Share | $0.01 | Not applicable | $0.01 |

| Minimum Purchase | Not applicable | Not applicable | Not applicable |

| Total Offering | $2,500,000 | Not applicable | $2,500,000 |

Proceeds to the selling shareholder do not include offering costs, including filing fees, printing costs, legal fees, accounting fees, and transfer agent fees estimated at $10,000. Blackmont Resources, Inc. will pay these expenses.

This Prospectus is dated July 20, 2006.

TABLE OF CONTENTS

| | Page |

| | |

PROSPECTUS SUMMARY | 4 |

| THE OFFERING | 4 |

RISK FACTORS | 5 |

| RISKS RELATED TO OUR COMPANY AND OUR INDUSTRY | 5 |

| RISKS RELATED TO OUR FINANCIAL CONDITION AND BUSINESS MODEL | 9 |

| RISKS RELATED TO THIS OFFERING AND OUR STOCK | 10 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | 12 |

DILUTION | 12 |

PLAN OF DISTRIBUTION | 12 |

USE OF PROCEEDS TO ISSUER | 14 |

BUSINESS OF THE ISSUER | 14 |

| GLOSSARY OF MINING TERMS | 14 |

| GENERAL OVERVIEW | 18 |

Property Acquisitions Details | 18 |

Land Status, Topography, Location and Access | 18 |

Mining Claims | 20 |

Geology of the Oyster Gold Claims | 21 |

Exploration History and Previous Operations | 23 |

Proposed Program of Exploration | 24 |

Cost Estimates of Exploration Programs | 24 |

| OVERVIEW OF THE GOLD INDUSTRY | 24 |

| COMPLIANCE WITH GOVERNMENT REGULATION | 24 |

| EMPLOYEES | 25 |

MANAGEMENT DISCUSSION AND ANALYSIS OR PLAN OF OPERATION | 25 |

| PLAN OF OPERATIONS | 25 |

| RESULTS OF OPERATIONS | 26 |

| LIQUIDITY AND CAPITAL RESOURCES | 26 |

DIRECTORS, EXECUTIVE OFFICERS AND SIGNIFICANT EMPLOYEES | 26 |

REMUNERATION OF DIRECTORS AND OFFICERS | 27 |

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITY HOLDERS | 27 |

INTEREST OF MANAGEMENT AND OTHERS IN CERTAIN TRANSACTIONS | 28 |

SECURITIES BEING OFFERED | 28 |

TRANSFER AGENT AND REGISTRAR | 28 |

SEC POSITION ON INDEMNIFICATION | 28 |

LEGAL MATTERS | 29 |

EXPERTS | 29 |

AVAILABLE INFORMATION | 29 |

REPORTS TO STOCKHOLDERS | 29 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 30 |

PART II - INFORMATION NOT REQUIRED IN PROSPECTUS | 40 |

ITEM 1. INDEMNIFICATION OF DIRECTORS AND OFFICERS | 40 |

ITEM 2. OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION | 40 |

ITEM 3. UNDERTAKINGS | 41 |

ITEM 4. UNREGISTERED SECURITIES ISSUED OR SOLD WITHIN ONE YEAR. | 42 |

ITEM 5. INDEX TO EXHIBITS. | 42 |

ITEM 6. DESCRIPTION OF EXHIBITS. | 42 |

SEE ITEM 5 ABOVE | 42 |

SIGNATURES | 43 |

PART I

PROSPECTUS SUMMARY

Blackmont Resources, Inc.

Blackmont Resources, Inc. (“Blackmont Resources” or the “Company”) was organized under the laws of the State of Nevada on April 7, 2006 to explore mining claims in the Province of British Columbia, Canada. We are an exploration stage company and we have not realized any revenues to date.

Blackmont Resources was formed to engage in the exploration of mineral properties for gold and other metals. The Company has staked two mineral claims containing 10 cell claim units totaling 208.637 hectares. We refer to these mining claims as the Oyster Bay Gold Property (“Oyster Bay”). We will require financing in order to commence and complete our exploration program, which is described in the section entitled, "Business of the Issuer." Our auditors have issued a going concern opinion, raising substantial doubt about Blackmont Resources’ financial prospects and the Company’s ability to continue as a going concern.

We are not a "blank check company," as we do not intend to participate in a reverse acquisition or merger transaction. A "blank check company" is defined by securities laws as a development stage company that has no specific business plan or purpose or has indicated that its business plan is to engage in a merger or acquisition with an unidentified company or companies, or other entity or person.

Our offices are located at 609 - 475 Howe Street Vancouver, B.C. V6C 2B3 Tel: 604-682-1643

The Offering

| Securities offered | 2,500,000 shares of common stock |

| Selling shareholder(s) | Lorne Chomos |

| Offering price | $0.01 per share |

| Shares outstanding prior to the offering | 5,000,000 shares of common stock |

| Shares to be outstanding after the offering | 5,000,000 shares of common stock |

| Use of proceeds | We will not receive any proceeds from the sale of the common stock by the selling shareholder. |

RISK FACTORS

INVESTING IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. IN ADDITION TO THE OTHER INFORMATION CONTAINED IN THIS PRIVATE PLACEMENT MEMORANDUM, PROSPECTIVE PURCHASERS OF THE UNITS OFFERED HEREBY SHOULD CONSIDER CAREFULLY THE FOLLOWING FACTORS IN EVALUATING THE COMPANY AND ITS BUSINESS.

IF ANY OF THE FOLLOWING RISKS OCCUR, OUR BUSINESS, OPERATING RESULTS AND FINANCIAL CONDITION COULD BE SERIOUSLY HARMED. THE RISKS AND UNCERTAINTIES DESCRIBED BELOW ARE NOT THE ONLY ONES WE FACE. ADDITIONAL RISKS AND UNCERTAINTIES, INCLUDING THOSE THAT WE DO NOT KNOW ABOUT OR THAT WE CURRENTLY DEEM IMMATERIAL, ALSO MAY ADVERSELY AFFECT OUR BUSINESS. THE TRADING PRICE OF OUR SHARES OF COMMON STOCK COULD DECLINE DUE TO ANY OF THESE RISKS, AND YOU MAY LOSE ALL OR PART OF YOUR INVESTMENT.

THE SECURITIES WE ARE OFFERING THROUGH THIS REGISTRATION STATEMENT ARE SPECULATIVE BY NATURE AND INVOLVE AN EXTREMELY HIGH DEGREE OF RISK AND SHOULD BE PURCHASED ONLY BY PERSONS WHO CAN AFFORD TO LOSE THEIR ENTIRE INVESTMENT. WE ALSO CAUTION PROSPECTIVE INVESTORS THAT THE FOLLOWING RISK FACTORS, AMONG OTHERS, COULD CAUSE OUR ACTUAL FUTURE OPERATING RESULTS TO DIFFER MATERIALLY FROM THOSE EXPRESSED IN ANY FORWARD LOOKING STATEMENTS, ORAL OR WRITTEN, MADE BY OR ON BEHALF OF US. IN ASSESSING THESE RISKS, WE SUGGEST THAT YOU ALSO REFER TO OTHER INFORMATION CONTAINED IN THIS REGISTRATION STATEMENT, INCLUDING OUR FINANCIAL STATEMENTS AND RELATED NOTES.

Risks Related to Our Company and Our Industry

THE COMPANY HAS NEVER EARNED A PROFIT. THERE IS NO GUARANTEE THAT WE WILL EVER EARN A PROFIT.

Since our inception on April 7, 2006 to the period ended May 31, 2006, the Company had no revenue producing operations. The Company is not currently producing revenue and is not operating profitably, and it should be anticipated that it will operate at a loss at least until such time when the production stage is achieved, if production is, in fact, ever achieved.

OUR COMPANY WAS RECENTLY FORMED, AND WE HAVE NOT PROVEN THAT WE CAN GENERATE A PROFIT. IF WE FAIL TO GENERATE INCOME AND ACHIEVE PROFITABILITY, AN INVESTMENT IN OUR SECURITIES MAY BE WORTHLESS.

We have no operating history and have not proved we can operate successfully. We face all of the risks inherent in a new business. If we fail, your investment in our common stock will become worthless. From inception to April 7, 2006, we have not earned any revenue. The purchase of the securities offered hereby must therefore be regarded as the placing of funds at a high risk in a new or "start-up" venture with all the unforeseen costs, expenses, problems, and difficulties to which such ventures are subject.

WE HAVE NO OPERATING HISTORY. THERE CAN BE NO ASSURANCE THAT WE WILL BE SUCCESSFUL IN GROWING OUR GOLD AND OTHER MINERAL EXPLORATION ACTIVITIES.

The Company has no history of operations. As a result, there can be no assurance that we will be successful in our exploration activities. Our success to date in entering into ventures to acquire interests in exploration blocks is not indicative that we will be successful in entering into any further ventures. Any future significant growth in our mineral exploration activities will place additional demands on our executive officers, and any increased scope of our operations will present challenges due to our current limited management resources. Our future performance will depend upon our management and their ability to locate and negotiate additional exploration opportunities in which we are solely involved or participate in as a joint venture partner. There can be no assurance that we will be successful in our efforts. Our inability to locate additional opportunities, to hire additional management and other personnel, or to enhance our management systems, could have a material adverse effect on our results of operations. There can be no assurance that the Company's operations will be profitable.

THERE IS A HIGHER RISK OUR BUSINESS WILL FAIL BECAUSE MR. LORNE CHOMOS, OUR SOLE EXECUTIVE OFFICER AND DIRECTOR DOES NOT HAVE FORMAL TRAINING SPECIFIC TO THE TECHNICALITIES OF MINERAL EXPLORATION.

Lorne Chomos, our sole Executive Officer and Director, does not have formal training as a geologist or in the technical aspects of management of a mineral exploration company. He lacks technical training and experience with exploring for, starting, and operating a mine. With no direct training or experience in these areas, he may not be fully aware of the specific requirements related to working within this industry. His decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to management's lack of experience in this industry.

WE ARE CONTROLLED BY MR. LORNE CHOMOS, OUR SOLE OFFICER AND DIRECTOR, AND, AS SUCH, YOU MAY HAVE NO EFFECTIVE VOICE IN OUR MANAGEMENT.

Upon the completion of this offering, Lorne Chomos, our sole Executive Officer and Director, will beneficially own approximately 50% of our issued and outstanding common stock. Accordingly, Mr. Chomos will be able to exercise control over all matters requiring shareholder approval, including the possible election of additional directors and approval of significant corporate transactions. If you purchase shares of our common stock, you may have no effective voice in our management.

WE ARE SOLELY GOVEREND BY MR. LORNE CHOMOS, OUR SOLE OFFICER AND DIRECTOR, AND, AS SUCH, THERE MAY BE SIGNIFICANT RISK TO THE COMPANY FROM A CORPORATE GOVERNANCE PERSPECTIVE.

Lorne Chomos, our sole Executive Officer and Director, makes decisions such as the approval of related party transactions, the compensation of Executive Officers, and the oversight of the accounting function. There will be no segregation of executive duties and there may not be effective disclosure and accounting controls to comply with applicable laws and regulations, which could result in fines, penalties and assessments against us. Accordingly, the inherent controls that arise from the segregation of executive duties may not prevail. In addition, Mr. Chomos will exercise full control over all matters that typically require the approval of a Board of Directors. Mr. Chomos’s actions are not subject to the review and approval of a Board of Directors and, as such, there may be significant risk to the Company from the corporate governance perspective.

Mr. Chomos, our sole Executive Officer and Director exercises control over all matters requiring shareholder approval including the election of directors and the approval of significant corporate transactions. We have not voluntarily implemented various corporate governance measures, in the absence of which, shareholders may have more limited protections against the transactions implemented by Mr. Chomos, conflicts of interest and similar matters.

We have not adopted corporate governance measures such as an audit or other independent committees as we presently only have one independent director. Shareholders should bear in mind our current lack of corporate governance measures in formulating their investment decisions.

WE ARE CONTROLLED BY MR. LORNE CHOMOS, OUR SOLE OFFICER AND DIRECTOR, AND, AS SUCH, THE COMPANY MAY LACK THE ABILITY TO SUCCESSFULLY IMPLEMENT ITS GROWTH PLANS.

Mr. Chomos, our sole Executive Officer and Director, has no career experience related to mining and mineral exploration. Accordingly, Mr. Chomos may be unable to successfully operate and develop our business. We cannot guarantee that we will overcome this obstacle. There may be additional risk to the Company in that the Company may lack the ability to successfully implement its growth plans given that it has no executive management team, and that it relies exclusively on the ability and management of its sole Executive Officer and Director, Mr. Chomos.

SINCE LORNE CHOMOS, OUR SOLE EXECUTIVE OFFICER AND DIRECTOR, IS NOT A RESIDENT OF THE UNITED STATES, IT MAY BE DIFFICULT TO ENFORCE ANY LIABILITIES AGAINST HIM.

Accordingly, if an event occurs that gives rise to any liability, shareholders would likely have difficulty in enforcing such liabilities because Mr. Chomos, our sole Executive Officer and Director, resides outside the United States. If a shareholder desired to sue, shareholders would have to serve a summons and complaint. Even if personal service is accomplished and a judgment is entered against that person, the shareholder would then have to locate assets of that person, and register the judgment in the foreign jurisdiction where the assets are located.

BECAUSE LORNE CHOMOS, OUR SOLE EXECUTIVE OFFICER HAS OTHER BUSINESS INTERESTS, HE MAY NOT BE ABLE OR WILLING TO DEVOTE A SUFFICIENT AMOUNT OF TIME TO OUR BUSINESS OPERATIONS, CAUSING OUR BUSINESS TO FAIL.

It is possible that the demands on our sole Executive Officer and Director from other obligations could increase with the result that he would no longer be able to devote sufficient time to the management of our business. In addition, he may not possess sufficient time for our business if the demands of managing our business increased substantially beyond current levels.

THE IMPRECISION OF MINERAL DEPOSIT ESTIMATES MAY PROVE ANY RESOURCE CALCULATIONS THAT WE MAKE TO BE UNRELIABLE.

Mineral deposit estimates and related databases are expressions of judgment based on knowledge, mining experience, and analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. By their nature, mineral deposit estimates are imprecise and depend upon statistical inferences, which may ultimately prove unreliable. Mineral deposit estimates included here, if any, have not been adjusted in consideration of these risks and, therefore, no assurances can be given that any mineral deposit estimate will ultimately be reclassified as reserves.

WE ARE SENSITIVE TO FLUCTUATIONS IN THE PRICE OF GOLD AND OTHER MINERALS, WHICH IS BEYOND OUR CONTROL. THE PRICE OF GOLD AND OTHER METALS IS VOLATILE AND PRICE CHANGES ARE BEYOND OUR CONTROL.

The prices for gold and other metals fluctuate and are affected by numerous factors beyond the Company's control. Factors that affect the price of gold and other metals include consumer demand, economic conditions, over supply from secondary sources and costs of production. Price volatility and downward price pressure, which can lead to lower prices, could have a material adverse effect on the costs of and the viability of our projects.

MINERAL EXPLORATION AND PROSPECTING IS HIGHLY COMPETITIVE AND SPECULATIVE BUSINESS AND WE MAY NOT BE SUCCESSFUL IN SEEKING AVAILABLE OPPORTUNITIES.

The process of mineral exploration and prospecting is a highly competitive and speculative business. In seeking available opportunities, the Company will compete with a number of other companies, including established, multi-national companies that have more experience and financial and human resources than does Blackmont Resources. Because we may not have the financial and managerial resources to compete with other companies, we may not be successful in our efforts to acquire new projects. However, while we compete with other exploration companies, there is no competition for the exploration or removal of mineral from our claims.

COMPLIANCE WITH ENVIRONMENTAL CONSIDERATIONS AND PERMITTING COULD HAVE A MATERIAL ADVERSE EFFECT ON THE COSTS OR THE VIABILITY OF OUR PROJECTS. THE HISTORICAL TREND TOWARD STRICTER ENVIRONMENTAL REGULATION MAY CONTINUE, AND, AS SUCH, REPRESENTS AN UNKNOWN FACTOR IN OUR PLANNING PROCESSES.

All Mining in Canada is regulated by the government agencies at the Federal and Provincial levels in that country. Compliance with such regulation could have a material effect on the economics of our operations and the timing of project development. Our primary regulatory costs will be related to obtaining licenses and permits from government agencies before the commencement of mining activities. An environmental impact study that must be obtained on each property, in order to obtain governmental approval to mine on the properties, is also a part of the overall operating costs of a mining company.

The gold and mineral mining business is subject not only to worker health and safety, and environmental risks associated with all mining businesses, but is also subject to additional risks uniquely associated with gold and other minerals mining. Although the Company believes that its operations will be in compliance, in all material respects, with all relevant permits, licenses and regulations involving worker health and safety, as well as the environment, the historical trend toward stricter environmental regulation may continue. The possibility of more stringent regulations exists in the areas of worker health and safety, the dispositions of wastes, the decommissioning and reclamation of mining and milling sites and other environmental matters, each of which could have an adverse material effect on the costs or the viability of a particular project.

MINING AND EXPLORATION ACTIVITIES ARE SUBJECT TO EXTENSIVE REGULATION BY FEDERAL AND PROVINCIAL GOVERNMENTS IN CANADA. FUTURE CHANGES IN GOVERNMENTS, REGULATIONS AND POLICIES, COULD ADVERSELY AFFECT THE COMPANY'S RESULTS OF OPERATIONS FOR A PARTICULAR PERIOD AND ITS LONG-TERM BUSINESS PROSPECTS.

Mining and exploration activities are subject to extensive regulation by Federal and Provincial Governments in Canada. Such regulation relates to production, development, exploration, exports, taxes and royalties, labor standards, occupational health, waste disposal, protection and remediation of the environment, mine and mill reclamation, mine and mill safety, toxic substances and other matters. Compliance with such laws and regulations has increased the costs of exploring, drilling, developing, constructing, operating mines and other facilities. Furthermore, future changes in governments, regulations and policies, could adversely affect the Company's results of operations in a particular period and its long-term business prospects.

The development of mines and related facilities is contingent upon governmental approvals, which are complex and time consuming to obtain and which, depending upon the location of the project, involve various governmental agencies. The duration and success of such approvals are subject to many variables outside the Company’s control.

Risks Related to Our Financial Condition and Business Model

IF WE DO NOT OBTAIN ADDITIONAL FINANCING, OUR BUSINESS WILL FAIL.

We will need to obtain additional financing in order to complete our business plan. We currently do not have any operations and we have no income. We do not have any arrangements for financing and we may not be able to find such financing if required. Obtaining additional financing would be subject to a number of factors, including investor acceptance of mineral claims and investor sentiment. These factors may adversely affect the timing, amount, terms, or conditions of any financing that we may obtain or make any additional financing unavailable to us.

IF WE DO NOT CONDUCT MINERAL EXPLORATION ON OUR MINERAL CLAIMS AND KEEP THE CLAIMS IN GOOD STANDING, THEN OUR RIGHT TO THE MINERAL CLAIMS WILL LAPSE AND WE WILL LOSE EVERYTHING THAT WE HAVE INVESTED AND EXPENDED TOWARDS THESE CLAIMS.

We must complete mineral exploration work on our mineral claims and keep the claims in good standing. If we do not fulfill our work commitment requirements on our claims or keep the claims in good standing, then our right to the claims will lapse and we will lose all interest that we have in these mineral claims.

BECAUSE OF OUR LIMITED RESOURCES AND THE SPECULATIVE NATURE OF OUR BUSINESS, THERE IS A SUBSTANTIAL DOUBT AS TO OUR ABILITY TO CONTINUE AS A GOING CONCERN.

The report of our independent auditors, on our audited financial statements for our inception on April 7, 2006 to the period ended May 31, 2006, indicates that there are a number of factors that raise substantial doubt about our ability to continue as a going concern. Our continued operations are dependent on our ability to obtain financing and upon our ability to achieve future profitable operations from the development of our mineral properties. If we are not able to continue as a going concern, it is likely investors will lose their investment.

Risks Related to This Offering and Our Stock

WE WILL NEED TO RAISE ADDITIONAL CAPITAL, IN ADDITION TO THE FINANCING AS REPORTED IN THIS REGISTRATION STATEMENT. IN SO DOING, WE WILL FURTHER DILUTE THE TOTAL NUMBER OF SHARES ISSUED AND OUTSTANDING. THERE CAN BE NO ASSURANCE THAT THIS ADDITIONAL CAPITAL WILL BE AVAILABLE OR ACCESSIBLE BY US.

Blackmont Resources will need to raise additional capital, in addition to the financing as reported in this registration statement, by issuing additional shares of common stock and will, thereby, increase the number of common shares outstanding. There can be no assurance that this additional capital will be available to meet these continuing exploration and development costs or, if the capital is available, that it will be available on terms acceptable to the Company. If the Company is unable to obtain financing in the amounts and on terms deemed acceptable, the business and future success of the Company will almost certainly be adversely affected. If we are able to raise additional capital, we cannot be assured that it will be on terms that enhance the value of our common shares.

IF WE COMPLETE A FINANCING THROUGH THE SALE OF ADDITIONAL SHARES OF OUR COMMON STOCK IN THE FUTURE, THEN SHAREHOLDERS WILL EXPERIENCE DILUTION.

The most likely source of future financing presently available to us is through the sale of shares of our common stock. Any sale of common stock will result in dilution of equity ownership to existing shareholders. This means that if we sell shares of our common stock, more shares will be outstanding and each existing shareholder will own a smaller percentage of the shares then outstanding. To raise additional capital we may have to issue additional shares, which may substantially dilute the interests of existing shareholders. Alternatively, we may have to borrow large sums, and assume debt obligations that require us to make substantial interest and capital payments.

THERE IS NO MARKET FOR OUR COMMON STOCK, WHICH LIMITS OUR SHAREHOLDERS' ABILITY TO RESELL THEIR SHARES OR PLEDGE THEM AS COLLATERAL.

There is currently no public market for our shares, and we cannot assure you that a market for our stock will develop. Consequently, investors may not be able to use their shares for collateral or loans and may not be able to liquidate at a suitable price in the event of an emergency. In addition, investors may not be able to resell their shares at or above the price they paid for them or may not be able to sell the shares at all.

THE SHARES OF COMMON STOCK ELIGIBLE FOR FUTURE SALE COULD NEGATIVELY AFFECT THE MARKET PRICE OF OUR COMMON STOCK

Sales of substantial amounts of Common Stock in the public market could adversely affect the market price of the Common Stock. There are at present 5,000,000 shares of Common Stock issued and outstanding.

THE COMPANY HAS NOT PAID ANY CASH DIVIDENDS ON ITS SHARES AND DOES NOT ANTICIPATE PAYING ANY SUCH DIVIDENDS IN THE FORESEEABLE FUTURE.

To date, the Company has not paid any cash dividends on its shares Common Stock and does not anticipate paying any such dividends in the foreseeable future. Payment of future dividends will depend on earnings and the capital requirements of the Company, the Company’s debt facilities and other factors considered appropriate by the Company’s Board of Directors.

The Shares offered hereby have not been registered under the 1933 Act, and except as described elsewhere in this Memorandum, no provision has been made for such registration or qualification under any state securities laws, so as to permit any public distribution or resale thereof. Investors must be prepared to hold the underlying shares for an indefinite period of time. There is no public market for the Units being sold under and pursuant to this Private Placement, and no assurance can be given that the Company will ever affect a public offering of its Common Stock or that a market for the Company’s securities will ever develop in the future.

OUR STOCK IS A PENNY STOCK. TRADING OF OUR STOCK MAY BE RESTRICTED BY THE SEC'S PENNY STOCK REGULATIONS AND THE NASD'S SALES PRACTICE REQUIREMENTS, WHICH MAY LIMIT A STOCKHOLDER'S ABILITY TO BUY AND SELL OUR STOCK.

The Company’s common shares may be deemed to be “penny stock” as that term is defined in Regulation Section “240.3a51-1” of the Securities and Exchange Commission (the “SEC”). Penny stocks are stocks: (a) with a price of less than U.S. $5.00 per share; (b) that are not traded on a “recognized” national exchange; (c) whose prices are not quoted on the NASDAQ automated quotation system (NASDAQ - where listed stocks must still meet requirement (a) above); or (d) in issuers with net tangible assets of less than U.S. $2,000,000 (if the issuer has been in continuous operation for at least three years) or U.S. $5,000,000 (if in continuous operation for less than three years), or with average revenues of less than U.S. $6,000,000 for the last three years.

Section “15(g)” of the United States Securities Exchange Act of 1934, as amended, and Regulation Section “240.15g(c)2” of the SEC require broker dealers dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually signed and dated written receipt of the document before effecting any transaction in a penny stock for the investor’s account. Potential investors in the Company’s common shares are urged to obtain and read such disclosure carefully before purchasing any common shares that are deemed to be “penny stock”.

Moreover, Regulation Section “240.15g-9” of the SEC requires broker dealers in penny stocks to approve the account of any investor for transactions in such stocks before selling any penny stock to that investor. This procedure requires the broker dealer to: (a) obtain from the investor information concerning his or her financial situation, investment experience and investment objectives; (b) reasonably determine, based on that information, that transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as to be reasonably capable of evaluating the risks of penny stock transactions; (c) provide the investor with a written statement setting forth the basis on which the broker dealer made the determination in (ii) above; and (d) receive a signed and dated copy of such statement from the investor confirming that it accurately reflects the investor’s financial situation, investment experience and investment objectives. Compliance with these requirements may make it more difficult for investors in the Company’s common shares to resell their common shares to third parties or to otherwise dispose of them. Stockholders should be aware that, according to Securities and Exchange Commission Release No. 34-29093, dated April 17, 1991, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include:

(i) control of the market for the security by one or a few broker-dealers that

are often related to the promoter or issuer

(ii) manipulation of prices through prearranged matching of purchases and sales

and false and misleading press releases

(iii) boiler room practices involving high-pressure sales tactics and

unrealistic price projections by inexperienced sales persons

(iv) excessive and undisclosed bid-ask differential and markups by selling

broker-dealers

(v) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses

Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains "forward-looking statements" that involve risks and uncertainties. We use words such as "anticipate", "expect", "intend", "plan", "believe", "seek" and "estimate", and variations of these words and similar expressions to identify such forward-looking statements. You should not place too much reliance on these forward-looking statements. Our actual results are most likely to differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us described in the preceding "Risk Factors" section and elsewhere in this prospectus. These forward-looking statements address, among others, such issues as:

| Ø | future earnings and cash flow |

| Ø | expansion and growth of our business and operations |

| Ø | our estimated financial information |

These statements are based on assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate under the circumstances. However, whether actual results and developments will meet our expectations and predictions depend on a number of risks and uncertainties, which could cause our actual results, performance and financial condition to differ materially from our expectation.

Consequently, these cautionary statements qualify all of the forward-looking statements made in this prospectus. We cannot assure you that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they would have the expected effect on us or our business or operations.

DILUTION

The common stock to be sold by the selling shareholder is common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing shareholders.

PLAN OF DISTRIBUTION

The Selling Shareholders or their donees, pledges, transferees or other successors-in-interest selling shares received after the date of this prospectus from a Selling Shareholder as a gift, pledge, distribution or otherwise, may, from time to time, sell any or all of their shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These sales may be at fixed prices, at prevailing market prices, at prices related to prevailing market prices, at varying prices or negotiated prices. The Selling Shareholders may use any one or more of the following methods when selling shares:

| Ø | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| Ø | block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| Ø | purchases by a broker-dealer as principal and resale by the broker-dealer for its own account; |

| Ø | an exchange distribution following the rules of the applicable exchange; |

| Ø | privately negotiated transactions; |

| Ø | short sales that are not violations of the laws and regulations of any state of the United States; |

| Ø | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| Ø | broker-dealers may agree with the Selling Shareholders to sell a specified number of such shares at a stipulated price per share; and |

| Ø | a combination of any such methods of sale or any other lawful method. |

The Selling Shareholders may, from time to time, pledge or grant a security interest in some or all of the shares of common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of Selling Shareholders to include the pledgee, transferee or other successors-in-interest as Selling Shareholders under this prospectus. The Selling Shareholders also may transfer the shares of common stock in other circumstances, in which case the transferees, pledgees or other successors-in-interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of our common stock or interests therein, the Selling Shareholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The Selling Shareholders also may sell shares of our common stock short and deliver these securities to close out their short positions, or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The Selling Shareholders also may enter into option or other transactions with broker-dealers or other financial institutions for the creation of one or more derivative securities which require the delivery to the broker-dealer or other financial institution of shares offered by this prospectus, which shares the broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect the transaction).

The aggregate proceeds to the Selling Shareholders from the sale of the common stock offered by them will be the purchase price of the common stock less discounts or commissions, if any. Each of the Selling Shareholders reserves the right to accept and, together with its agents from time to time, to reject, in whole or in part, any proposed purchase of common stock to be made directly or through agents. We will not receive any of the proceeds from this offering.

The Selling Shareholders and any underwriters, broker-dealers or agents that participate in the sale of the common stock or interests therein may be "underwriters" within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the shares may be underwriting discounts and commissions under the Securities Act. Selling Shareholders that are "underwriters" within the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act.

To the extent required, the shares of our common stock to be sold, the names of the Selling Shareholders, the respective purchase prices and public offering prices, the names of any agents, dealers or underwriters, and any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

Sales Pursuant to Rule 144

Any shares of common stock covered by this prospectus, which qualify for sale pursuant to Rule 144 under the Securities Act, as amended, may be sold under Rule 144 rather than pursuant to this prospectus.

Regulation M

We plan to advise the Selling Shareholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and to the activities of the selling security holders and their affiliates. Regulation M under the Exchange Act prohibits, with certain exceptions, participants in a distribution from bidding for, or purchasing for an account in which the participant has a beneficial interest, any of the securities that are the subject of the distribution. Accordingly, the Selling Shareholder is not permitted to cover short sales by purchasing shares while the distribution it taking place. Regulation M also governs bids and purchases made in order to stabilize the price of a security in connection with a distribution of the security. In addition, we will make copies of this prospectus available to the selling security holders for the purpose of satisfying the prospectus delivery requirements of the Securities Act.

State Securities Laws

Under the securities laws of some states, the shares may be sold in such states only through registered or licensed brokers or dealers. In addition, in some states the common shares may not be sold unless the shares have been registered or qualified for sale in the state or an exemption from registration or qualification is available and is complied with.

Expenses of Registration

We are bearing substantially all costs relating to the registration of the shares of common stock offered hereby. These expenses are estimated to be $10,000.00, including, but not limited to, legal, accounting, printing and mailing fees. The Selling Shareholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of such shares common stock.

USE OF PROCEEDS TO ISSUER

We will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling shareholder.

BUSINESS OF THE ISSUER

Glossary of Mining Terms

Archean | | Of or belonging to the earlier of the two divisions of Precambrian time, from approximately 3.8 to 2.5 billion years ago, marked by an atmosphere with little free oxygen, the formation of the first rocks and oceans, and the development of unicellular life. Of or relating to the oldest known rocks, those of the Precambrian Eon, that are predominantly igneous in composition. |

| | | |

Assaying | | Laboratory examination that determines the content or proportion of a specific metal (ie: gold) contained within a sample. Technique usually involves firing/smelting. |

| | | |

Conglomerate | | A coarse-grained clastic sedimentary rock, composed of rounded to subangular fragments larger than 2 mm in diameter (granules, pebbles, cobbles, boulders) set in a fine-grained matrix of sand or silt, and commonly cemented by calcium carbonate, iron oxide, silica, or hardened clay; the consolidated equivalent of gravel. The rock or mineral fragments may be of varied composition and range widely in size, and are usually rounded and smoothed from transportation by water or from wave action. |

| | | |

Cratons | | Parts of the Earth's crust that have attained stability, and have been little deformed for a prolonged period. |

| | | |

Development Stage | | A “development stage” project is one which is undergoing preparation of an established commercially mineable deposit for its extraction but which is not yet in production. This stage occurs after completion of a feasibility study. |

| | | |

Dolomite Beds | | Dolomite beds are associated and interbedded with limestone, commonly representing postdepositional replacement of limestone. |

| | | |

Doré | | unrefined gold bullion bars containing various impurities such as silver, copper and mercury, which will be further refined to near pure gold. |

| | | |

Dyke or Dike | | A tabular igneous intrusion that cuts across the bedding or foliation of the country rock. |

| | | |

Exploration Stage | | An “exploration stage” prospect is one which is not in either the development or production stage. |

| | | |

Fault | | A break in the continuity of a body of rock. It is accompanied by a movement on one side of the break or the other so that what were once parts of one continuous rock stratum or vein are now separated. The amount of displacement of the parts may range from a few inches to thousands of feet. |

| | | |

Feldspathic | | Said of a rock or other mineral aggregate containing feldspar. |

| | | |

Fold | | a curve or bend of a planar structure such as rock strata, bedding planes, foliation, or cleavage |

| | | |

Foliation | | A general term for a planar arrangement of textural or structural features in any type of rock; esp., the planar structure that results from flattening of the constituent grains of a metamorphic rock. |

| | | |

Formation | | a distinct layer of sedimentary rock of similar composition. |

| | | |

Gabbro | | A group of dark-colored, basic intrusive igneous rocks composed principally of basic plagioclase (commonly labradorite or bytownite) and clinopyroxene (augite), with or without olivine and orthopyroxene; also, any member of that group. It is the approximate intrusive equivalent of basalt. Apatite and magnetite or ilmenite are common accessory minerals. |

| | | |

Geochemistry | | the study of the distribution and amounts of the chemical elements in minerals, ores, rocks, solids, water, and the atmosphere. |

| | | |

Geophysicist | | one who studies the earth; in particular the physics of the solid earth, the atmosphere and the earth’s magnetosphere. |

| | | |

Geotechnical | | the study of ground stability. |

| | | |

Gneiss | | A foliated rock formed by regional metamorphism, in which bands or lens-shaped strata or bodies of rock of granular minerals alternate with bands or lens-shaped strata or bodies or rock in which minerals having flaky or elongate prismatic habits predominate. |

| | | |

Granitic | | Pertaining to or composed of granite. |

| | | |

Heap Leach | | a mineral processing method involving the crushing and stacking of an ore on an impermeable liner upon which solutions are sprayed that dissolve metals such as gold and copper; the solutions containing the metals are then collected and treated to recover the metals. |

| | | |

Intrusions | | Masses of igneous rock that, while molten, were forced into or between other rocks. |

��

| | | |

Kimberlite | | A blue/gray igneous rock that contains olivine, serpentine, calcite and silica and is the principal original environment of diamonds. |

| | | |

Lamproite | | Dark-colored igneous rocks rich in potassium and magnesium. |

| | | |

Lithospere | | The solid outer portion of the Earth. |

| | | |

Mantle | | The zone of the Earth below the crust and above the core. |

| | | |

Mapped or Geological | | the recording of geologic information such as the distribution and nature of rock |

| | | |

Mapping | | units and the occurrence of structural features, mineral deposits, and fossil localities. |

| | | |

Metavolcanic | | Said of partly metamorphosed volcanic rock. |

| | | |

Migmatite | | A composite rock composed of igneous or igneous-appearing and/or metamorphic materials that are generally distinguishable megascopically. |

| | | |

Mineral | | a naturally formed chemical element or compound having a definite chemical composition and, usually, a characteristic crystal form. |

| | | |

Mineralization | | a natural occurrence in rocks or soil of one or more metal yielding minerals. |

| | | |

Mineralized Material | | The term “mineralized material” refers to material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction. |

| | | |

Mining | | Mining is the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product. Exploration continues during the mining process and, in many cases, mineral reserves are expanded during the life of the mine operations as the exploration potential of the deposit is realized. |

| | | |

Outcrop | | that part of a geologic formation or structure that appears at the surface of the earth. |

| | | |

Pipes | | Vertical conduits. |

| | | |

Plagioclase | | Any of a group of feldspars containing a mixture of sodium and calcium feldspars, distinguished by their extinction angles. |

| | | |

Probable Reserve | | The term “probable reserve” refers to reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation. |

| | | |

Production Stage | | A “production stage” project is actively engaged in the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product. |

| | | |

Proterozoic | | Of or relating to the later of the two divisions of Precambrian time, from approximately 2.5 billion to 570 million years ago, marked by the buildup of oxygen and the appearance of the first multicellular eukaryotic life forms. |

General Overview

Blackmont Resources was incorporated in the State of Nevada on April 7, 2006, and is engaged in the exploration for gold and other metals. The Company has staked two mineral claims containing 10 cell claim units that total 208.637 hectares. We refer to these mining claims as the Oyster Gold claims (“Oyster” and “Oyster Gold”).

We are an exploration company and we cannot provide assurance to investors that our mineral claims contain a commercially exploitable mineral deposit, or reserve, until appropriate exploratory work is done and an economic evaluation based on such work concludes economic feasibility.

Property Acquisitions Details

On February 15, 2006 Blackmont Resources purchased the Oyster Gold claims for USD $5,000.

Land Status, Topography, Location and Access

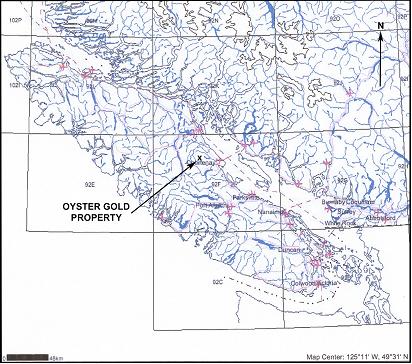

The Oyster Gold claims cover approximately 2.5 square kilometers of mineral title (10 cell units) located on Mount Washington near Courtenay, BC.

The Oyster Gold Property is located approximately 22 kilometers northwest of the town of Courtenay on Vancouver Island, BC. The property is situated on the northern flank of Mount Washington, adjacent to the Mt. Washington Mine. The property is accessed by a series of well maintained paved and gravel logging and mining roads. Seasonal accommodation is available at the nearby Mt. Washington Ski Resort. Year-round accommodations are available in Courtenay.

The property is underlain by moderate to steep topography, covered by both mature timber and clear-cut logging slash. Hemlock, fir, red and yellow cedar trees dominate the forested areas, with dense underbrush in the logging slashes and along the creeks. An average elevation of the property area would be about 1000 meters. The climate is best described overall as cool and damp, with sunny and hot summers followed by cool rainy periods in the fall and near-freezing temperatures in the winter. Substantial accumulations of snow (up to 5 meters) occur between November and early spring. The snow may persist in shaded areas until May or June. The best working season is from early June to late October.

OYSTER GOLD PROPERTY LOCATION MAP

Mining Claims

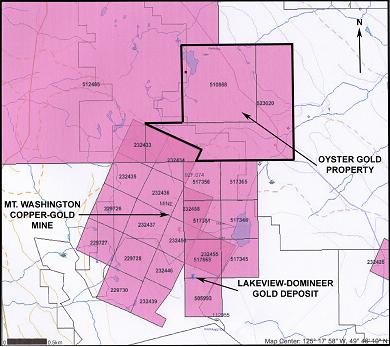

The Oyster Gold Property currently consists of two mineral claims comprised of 10 mineral claim units in total, recorded as:

| BC Tenure # | | Work Due Date Units | | Total Area (Hectares) | |

| | | | | | |

| 510868 | | | April 17, 20064 | | | 83.451 | |

| 523020 | | | Nov. 30, 20066 | | | 125.186 | |

| | | | | | | 208.637 | |

OYSTER GOLD PROPERTY CLAIM MAP

Geology of the Oyster Gold Claims

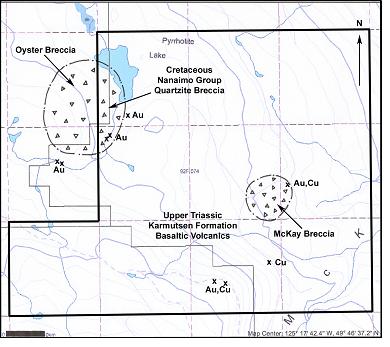

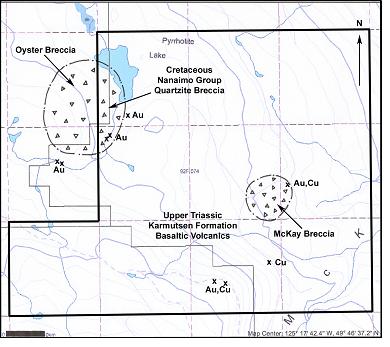

The Oyster Gold claims are underlain by Upper Triassic Karmutsen Formation basaltic volcanics overlain by Upper Cretaceous Nanaimo Group sediments, and intruded by Oligocene Mount Washington Intrusive Suite quartz diorite and porphyritic dacite. Gold-bearing quartz-sulphide veins occur peripheral to the Oyster Breccia, a mineralized, silicified collapsed breccia pipe approximately 350 metres in diameter.

The Mount Washington area is underlain by sediments of the Upper Cretaceous Nanaimo Group (Comox Formation), which uncomfortably overlie basaltic volcanic rocks of the Upper Triassic Karmutsen Formation. Intruding both formations is an Oligocene quartz diorite stock of the Mt. Washington Intrusive Suite, dated at approximately 35 million years. Several later breccia zones follow the Karmutsen-Comox unconformity and cut all rock units. They have been interpreted as stacked thrust faults or decollements and have been mineralized by a later Tertiary epithermal gold-silver-copper-arsenic event.

The Karmutsen Formation comprises basaltic flows, pillow lavas and pillow breccias, and aquagene tuffs. A few thin intra-volcanic sedimentary intervals with limestone and volcanic conglomerate occur near the top of the formation. The intra-volcanic sequences may have localized low-angle faulting and associated mineralization related to the Tertiary era. The unconformably overlying Comox Formation of the Nanaimo Group comprises fine-grained sandstone and greywacke, with interbedded siltstone. A basal conglomerate of the Comox Formation known as the Benson Member consists of rounded clasts of Karmutsen rocks. The unconformity between Comox and Karmutsen Formations is a major focus for low-angle faulting and economic mineralization.

The Oligocene quartz diorite stock is variably porphyritic and forms the core of Mount Washington. Several sills and dikes of quartz diorite and quartz diorite porphyry are related to the stock. All formations are in turn pierced by breccia systems of various composition, size, shape and possible different ages. Breccias vary from those containing mainly monolithic intrusive clasts to those composed of predominately rounded and milled heterolithic fragments. An extrusive volcanic component has been postulated to occur concurrent with breccia pipe formation, but has not been conclusively proven.

The most extensive zones of mineralization identified are associated with continuous, gently-dipping shear structures, semi-concordant with bedding of the Comox Formation. These shear structures cut all rock types, including most breccia pipes. The mineralized structures are usually marked by development of pervasive kaolinization and silicified hanging-walls. Mineralogy of the ore zones is complex on the microscopic level, but common visible minerals include quartz, pyrite, arsenopyrite, chalcopyrite, galena, sphalerite, realgar and orpiment.

On the Oyster Gold Property, the Oyster Breccia is a roughly circular feature approximately 350 metres in diameter and is thought to be a collapse breccia. The rocks surrounding the breccia are massive and/or amygdaloidal Karmutsen basalts. Outcrops of the breccia mainly consist of Comox Formation quartzite and minor porphyritic diorite. The matrix is often vuggy, with interstices lined with crystalline quartz and filled with limonite and fine fragments of limonitic quartzite. The Pyrrhotite Creek zone is an epithermal-type structure that occurs near the southern perimeter of the Oyster Breccia. It consists of a zone of silicified and kaolinized brecciated basalt, mineralized across a maximum width of 2.5 metres and dips steeply towards the Oyster Breccia. It is interpreted to be part of a ring-fracture system developed during collapse of the breccia pipe. Mineralogy includes pyrite, arsenopyrite, chalcopyrite, realgar, orpiment, galena and sphalerite. Maximum values obtained from grab samples are 14.5 g/t Au and 31.88 g/t silver.

The McKay Breccia is a poorly-defined zone of brecciation, hosted in Karmutsen formation basalts. Vein-like massive sulphide zones up to 1 metre in width comprised of pyrite, arsenopyrite and chalcopyrite form along the eastern part of the breccia. No assay data is presently available for this area. Several narrow vein zones with similar mineralogy occur on the southern part of the property. The vein systems contain appreciable gold, but do not appear to be of potential economic size at this time. Much of this area has received only a cursory degree of prospecting and holds strong potential for new discoveries.

OYSTER GOLD PROPERTY GEOLOGY MAP

Blackmont’s Oyster Gold Property

The Oyster Gold Property is situated in an area of British Columbia that is witnessing an exploration renaissance due to the occurrence of properties that have produced in the past, like the Domineer gold deposit at Mount Washington. The geological setting and mineralogy of the Blackmont’s Oyster Gold Property is analogous to the Mt. Washington Mine and Lakeview-Domineer deposit. Blackmont’s Oyster Gold property is located approximately two kilometres north of the past-producing copper-gold deposit at the Mt. Washington Mine, and the Lakeview-Domineer gold deposit.

The Oyster Gold property hosts several areas of epithermal-type gold and copper mineralization, within a geological environment similar to and contiguous with the Mt. Washington Mine property. The known showings on the property have not been drilled or extensively explored to date.

Exploration History and Previous Operations

The Mount Washington area has been explored for gold, copper and coal deposits since the mid-1800's. However, the Domineer gold deposit at Mount Washington was not discovered until 1940. Exploration and development work in the 1950’s outlined a significant copper-gold deposit adjacent to the Domineer, which was subsequently mined via open pit methods (in 1964-66), producing approximately 400,000 tonnes of 1.16% copper with gold and silver credits. The Oyster Gold Property area was first explored during the 1950’s, followed by geological mapping, soil geochemical surveys, and limited diamond drilling during the 1960’s and 70’s.

In the early 1980’s, Better Resources Ltd. (now Bluerock Resources Ltd.) acquired the Mt. Washington Mine property and staked additional ground covering the Oyster Breccia. Better Resources completed additional geophysics, soil geochemistry, mapping and diamond drilling during the 1980’s. Geological, geochemical and geophysical surveys on the Oyster Breccia were followed by an eight-hole diamond drill program that returned mixed results. Prospecting off the survey grid located several gold and copper bearing deposits in areas that now comprise the Oyster Gold Property. No follow-up to these discoveries has been recorded.

Past exploration on the Oyster Gold property has focused on a mineralized breccia pipe approximately 350 metres in diameter and at least 542 metres in depth. The Oyster Gold property covers the eastern part of the breccia, and high-grade epithermal-style gold mineralization found within fracture systems peripheral to the breccia. In 1975, Esso Resources Ltd. drilled a diamond drill hole in the central breccia. In 1988, this drill hole was deepened to 542 metres by Better Resources Ltd. Drilling encountered a silicified quartzite breccia, which contained generally low-grade metal values.

Better Resources Ltd. drilled eight holes in 1987, to explore the structurally hosted gold zones along Pyrrhotite Creek. Soil geochemistry and magnetometer survey grids partially overlapped the Oyster Gold Property. The surveys showed high gold in soil geochemistry (up to 840 ppb) in several unexplored areas around the breccia pipe. Magnetometer anomalies generally followed the mapped edge of the pipe. Prospecting on other parts of the property not covered by the survey grid, located several vein-like structures and breccias (McKay Breccia) hosting gold and copper mineralization. No follow-up surveys have been recorded since 1988.

A proposed initial exploration program is designed to locate and examine all known showings and to discover new mineralized zones, by carrying out geological mapping, rock sampling and prospecting. Following compilation of the initial results, it is recommended that soil geochemical and magnetometer grids be extended to cover parts of the Oyster Gold Property. Diamond drill targets can then be selected to test the most promising mineralized zones at depth.

Proposed Program of Exploration

A property report prepared by Greg Thomson, B.Sc., P. Geo, for Laird Exploration Ltd. suggests that the Oyster property has the potential to host gold bearing mineralized systems. Our plan is to conduct mineral exploration activities on the Oyster property in order to determine whether these claims have any potential for gold and other mineralization.

A program comprising initial geological mapping, sampling and prospecting is recommended, followed by additional soil geochemistry, geophysical surveys, and diamond drilling on the defined targets. Additional fieldwork is necessary in order to prioritize drill targets and to discover new mineral deposits. The following development program is designed to test the property for potentially mineable gold and copper deposits using locally proven geological concepts and exploration techniques.

Cost Estimates of Exploration Programs

The anticipated costs of this development are presented in three results-contingent stages.

Phase 1

| Reconnaissance geological mapping, prospecting and rock sampling | | $ | 25,000.00 | |

Phase 2

Detailed geological mapping and rock sampling, grid construction, soil geochemical survey, magnetometer survey, establish drill targets | | $ | 75,000.00 | |

Phase 3

1000 metres of diamond drilling including geological supervision,assays, report and other ancillary costs | | $ | 150,000.00 | |

Overview of the Gold Industry

Gold has two primary uses: product fabrication and bullion investment. Fabricated gold has a variety of end uses, including jewelry, electronics, dentistry, industrial and decorative uses, medals, medallions and official coins. Gold investors purchase gold bullion, official coins and high-carat jewelry. The worldwide supply of gold consists of a combination of new production from mining and existing stocks of bullion and fabricated gold held by governments, financial institutions, industrial organizations and private individuals. The price of gold is volatile and is affected by numerous factors beyond our control such as the sale or purchase of gold by various central banks and financial institutions, inflation or deflation, fluctuation in the value of the US dollar and foreign currencies, global and regional demand, and the political and economic conditions of major gold-producing countries throughout the world.

Compliance With Government Regulation

We will be required to conduct all mineral exploration activities in accordance with provincial and federal government regulations. Such operations are subject to various laws governing land use, the protection of the environment, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, well safety and other matters. Unfavorable amendments to current laws, regulations and permits governing operations and activities of resource exploration companies, or more stringent implementation thereof, could have a materially adverse impact and cause increases in capital expenditures which could result in a cessation of operations.

We have had no material costs related to compliance and/or permits in recent years, and anticipate no material costs in the next year. We will not be required to obtain a permit in order to conduct our proposed exploration program.

Employees

At present, we have no employees. We anticipate that we will be conducting most of our business through agreements with consultants and third parties.

Management Discussion and Analysis or Plan of Operation

The following discussion of our financial condition and results of operations should be read in conjunction with our consolidated financial statements and the notes to those statements included elsewhere in this prospectus. In addition to the historical consolidated financial information, the following discussion and analysis contains forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of certain factors, including those set forth under "Risk Factors" and elsewhere in this prospectus.

Plan of Operations

Our plan of operation for the next twelve months is to proceed with the exploration of the Oyster Gold mineral property to determine whether there is any potential for gold or other metals located on the mineral claims. We have decided to proceed with the three phases of a staged exploration program recommended by the geological report. We anticipate that these phases of the recommended geological exploration program will cost approximately $25,000, $75,000 and $150,000 respectively. We had $Nil in cash reserves as of May 31, 2006. The lack of cash has kept us from conducting any exploration work on the property.

We will require additional funding to commence Phase 1 of our exploration program. Phase 2 and 3 of our proposed exploration program will commence only after we complete our Phase 1 program. We anticipate that we will incur the following expenses over the next twelve months:

| Ø | $875 to be paid to the Federal government to keep the claims valid; |

| Ø | $25,000 in connection with the completion of Phase 1 of our recommended geological work program; |

| Ø | $75,000 in connection with the completion of Phase 2 of our recommended geological work program; |

| Ø | $150,000 for Phase 3 of our recommended geological work program; and |

| Ø | $10,000 for operating expenses, including professional legal and accounting expenses associated with compliance with the periodic reporting requirements after we become a reporting issuer under the Securities Exchange Act of 1934, but excluding expenses of the offering. |

If we determine not to proceed with further exploration of our mineral claims, due to a determination that the results of our initial geological program do not warrant further exploration, or due to an inability to finance further exploration, we plan to pursue the acquisition of an interest in other mineral claims. We anticipate that any future acquisition would involve the acquisition of an option to earn an interest in a mineral claim as we anticipate that we would not have sufficient cash to purchase a mineral claim of sufficient merit to warrant exploration. This means that we might offer shares of our stock to obtain an option on a property. Once we obtain an option, we would then pursue finding the funds necessary to explore the mineral claim by one or more of the following means: engaging in an offering of our stock; engaging in borrowing funds by debt financing; or locating a joint venture partner or partners.

Results of Operations

We have not yet earned any revenues. We anticipate that we will not earn revenues until such time as we have entered into commercial production, if any, of our mineral properties. We are presently in the exploration stage of our business and we can provide no assurance that we will discover commercially exploitable levels of mineral resources on our properties, or if such resources are discovered, that we will enter into commercial production of our mineral properties.

Liquidity and Capital Resources

At May 31, 2006, our cash at the end of the period was $NIL. Since our inception on April 7, 2006, to the end of the period May 31, 2006, we have incurred a loss of $5,755. We attribute our net loss to having no revenues to offset our operating expenses. For the period ended May 31, 2006 we had an accumulated deficit of $5,755.

From our inception on April 7, 2006 to the end of the period May 31, 2006, net cash after operating and financial activities was a deficit of $5,000. The Company has outstanding accounts payable of $755. Net cash used in the purchase of the Oyster Gold property was $5,000.

Based on our current operating plan, we do not expect to generate revenue that is sufficient to cover our expenses for at least the next twelve months. In addition, we do not have sufficient cash and cash equivalents to execute our operations for at least the next twelve months. We will need to obtain additional financing to operate our business for the next twelve months. We will raise the capital necessary to fund our business through a private placement and public offering of our common stock. Additional financing, whether through public or private equity or debt financing, arrangements with stockholders or other sources to fund operations, may not be available, or if available, may be on terms unacceptable to us. Our ability to maintain sufficient liquidity is dependent on our ability to raise additional capital. If we issue additional equity securities to raise funds, the ownership percentage of our existing stockholders would be reduced. New investors may demand rights, preferences or privileges senior to those of existing holders of our common stock. Debt incurred by us would be senior to equity in the ability of debt holders to make claims on our assets. The terms of any debt issued could impose restrictions on our operations. If adequate funds are not available to satisfy either short or long-term capital requirements, our operations and liquidity could be materially adversely affected and we could be forced to cease operations.

We are paying the expenses of the offering because we seek to (i) become a reporting company with the Commission under the Securities Exchange Act of 1934 (the "1934 Act"); and (ii) enable our common stock to be traded on the OTC Bulletin Board. We believe that the registration of the resale of shares on behalf of our existing shareholder may facilitate the development of a public market in our common stock if our common stock is approved for trading on the OTC Bulletin Board. We have not yet determined whether we will separately register our securities under Section 12 of the 1934 Act.

DIRECTORS, EXECUTIVE OFFICERS AND SIGNIFICANT EMPLOYEES

Information about our sole Executive Officer and Director and follows:

| NAME | | AGE | | POSITION AND TERM OF OFFICE |

| | | | | |

| Lorne Chomos | | 47 | | President, Secretary, Treasurer and Director since inception April 7, 2006 |

Our Bylaws provide for a Board of Directors ranging from 1 to 9 members, with the exact number to be specified by the board. All Directors will hold office until the next annual meeting of the stockholders following their election and until their successors have been elected and qualified. The Board of Directors appoints Officers. Officers will hold office until the next annual meeting of our Board of Directors following their appointment and until their successors have been appointed and qualified.

Set forth below is a brief description of the recent employment and business experience of our sole Executive Officer and Director:

Lorne Chomos was a partner in the Woodrich Management Group Inc., from 1999 to 2003. The Woodrich Management Group specializes in the business of acquiring and developing waterfront properties. From 2000 to 2004, Mr. Chomos was President of SafetySmart Emergency Services, a company that assists major corporations in risk mitigation, and preparing for, and recovering from, major disasters. From 2004 until the present, July 12, 2006, Mr. Chomos has worked with the Nuport Group, where he currently holds the position of President. At the Nuport Group, Mr. Chomos is responsible for finance, resource development, and strategic planning.

REMUNERATION OF DIRECTORS AND OFFICERS

The following table sets forth the remuneration of our sole Executive Officer and Director for the period from inception on April 7, 2006 through to the end of the period on May 31, 2006:

| NAME OF INDIVIDUAL | CAPACITIES IN WHICH REMUNERATION WAS RECEIVED | AGGREGATE REMUNERATION |

| Lorne Chomos | Executive Officer | $0 |

We have no employment agreements with our Executive Officers. We will not pay compensation to Directors for attendance at meetings. We will reimburse the Directors for reasonable expenses incurred during the course of their performance.

As of the date of this prospectus, Mr. Chomos was our only shareholder.

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITY HOLDERS

The following table lists the share ownership of persons who, as of the date of this prospectus owned of record or beneficially, directly or indirectly, more than five percent (5%) of the outstanding common stock, and our sole officer and director:

(1) This table is based on 5,000,000 shares of common stock outstanding,

| NAME AND ADDRESS OF OWNER | SHARES OWNED PRIOR TO THE OFFERING | SHARES TO BE OFFERED FROM THE SELLING SHAREHOLDER'S ACCOUNT | SHARES TO BE OWNED UPON COMPLETION OF The OFFERING | PERCENTAGE OF CLASS (1) |

| BEFORE OFFERING | AFTER OFFERING |

Lorne Chomos 609-475 Howe Street Vancouver, B.C. V6C 2B3 | 5,000,000 | 2,500,000 | 2,500,000 | 100% | 50% |

INTEREST OF MANAGEMENT AND OTHERS IN CERTAIN TRANSACTIONS

As of the date of this prospectus, other than the transaction described above, there are no, and have not been since inception, any material agreements or proposed transactions, whether direct or indirect, with any of the following:

| Ø | any of our directors or officers; |

| Ø | any nominee for election as a director; |

| Ø | any principal security holder identified in the preceding "Security Ownership of Selling Shareholder and Management" section; or |

| Ø | any relative or spouse, or relative of such spouse, of the above referenced persons. |

SECURITIES BEING OFFERED

We are authorized to issue up to 75,000,000 shares of common stock, par value $0.001 per share, and we have not are authorized the issuance of preferred stock.

Common Stock

The holders of common stock are entitled to one vote for each share held of record on all matters submitted to a vote of the stockholders. We do not have cumulative voting rights in the election of directors, and accordingly, holders of a majority of the voting shares are able to elect all of the directors.

Subject to preferences that may be granted, any holders of common stock are entitled to receive ratably such dividends as may be declared by the board of directors out of funds legally available therefore as well as any distributions to the stockholders. We have never paid cash dividends on our common stock, and do not expect to pay such dividends in the foreseeable future.

In the event of a liquidation, dissolution or winding up of our company, holders of common stock are entitled to share ratably in all of our assets remaining after payment of liabilities. Holders of common stock have no preemptive or other subscription or conversion rights. There are no redemption or sinking fund provisions applicable to the common stock.

TRANSFER AGENT AND REGISTRAR

West Coast Stock Transfer Inc., 850 W. Hastings, Suite 302, Vancouver, B.C. V6C 1E1, serves as the transfer agent and registrar for our common stock.

SEC POSITION ON INDEMNIFICATION

Our bylaws provide that each officer and director of our company shall be indemnified by us against all costs and expenses actually and necessarily incurred by him or her in connection with the defense of any action, suit or proceeding in which he or she may be involved or to which he or she may be made a party by reason of his or her being or having been such director or officer, except in relation to matters as to which he or she has been finally adjudged in such action, suit or proceeding to be liable for negligence or misconduct in the performance of duty.

The indemnification provisions of our bylaws diminish the potential rights of action, which might otherwise be available to shareholders by affording indemnification against most damages and settlement amounts paid by a director in connection with any shareholders derivative action. However, there are no provisions limiting the right of a shareholder to enjoin a director from taking actions in breach of his fiduciary duty, or to cause the Company to rescind actions already taken, although as a practical matter courts may be unwilling to grant such equitable remedies in circumstances in which such actions have already been taken. Also, because the Company does not presently have directors' liability insurance and because there is no assurance that we will procure such insurance or that if such insurance is procured it will provide coverage to the extent directors would be indemnified under the provisions, we may be forced to bear a portion or all of the cost of the director's claims for indemnification under such provisions. If we are forced to bear the costs for indemnification, the value of our stock may be adversely affected.