As filed with the Securities and Exchange Commission on February 13, 2007

Registration No. 333-________

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM SB-2

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MEDIAG3, INC.

| DELAWARE | 7380 |

| (State or Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) |

14-1963980

(I.R.S. Employer Identification Number)

One Almaden Boulevard

Suite 310

San Jose, California 95113

(408) 260-5000

Mr. William Yuan

Chief Executive Officer

MediaG3, Inc.

One Almaden Boulevard

Suite 310

San Jose, California 95113

(408) 260-5000

(408) 557-8800 (Fax) &nb sp; &nb sp; &nb sp; &nb sp; &nb sp; &nb sp; &nb sp;

Copy to:

Cathryn S. Gawne, Esq.

Erin M. Adrian, Esq.

Silicon Valley Law Group

25 Metro Drive, Suite 600

San Jose, California 95110

(408) 573-5700

(408) 573-5701 (facsimile)

1

Approximate date of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If any of the securities being registered on the Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462 (b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: [_]

If this Form is a post-effective amendment filed pursuant to Rule 462 (c) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering [_]

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box: [_]

CALCULATION OF REGISTRATION FEE

| | | | |

TITLE OF EACH CLASS OF SECURITITES TO BE REGISTERED |

AMOUNT TO BE REGISTERED (1) | PROPOSED MAXIMUM OFFERING PRICE PER SHARE (2) |

PROPOSED MAXIMUM AGGREGATE OFFERING PRICE |

AMOUNT OF REGISTRATION FEE |

Common stock, $.001 par value |

20,000,000 shares |

$ 3.00 |

$60,000,000 |

$ 6,420 |

TOTAL | 20,000,000 shares | $ 3.00 | $60,000,000 | $ 6,420 |

(1) In the event of a stock split, stock dividend, or similar transaction involving the common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act of 1933, as amended.

(2) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THERAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OF UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

Subject to Completion, February 13, 2007

20,000,000 SHARES

COMMON STOCK

$3.00 Per Share

__________________________________________________

MediaG3, a Delaware corporation, is offering 20,000,000 shares of common stock, $0.001 par value, at a price of $3.00 per share. This is our initial offering of common stock, and no public market currently exists for our securities. We intend to apply for the listing of our common stock on the Over-the-Counter Bulletin Board (the “OTCBB”).

We are offering the 20,000,000 shares on a self-underwritten, best efforts basis, using the efforts of our Chief Executive Officer. There is no minimum number of shares that we must sell in order to receive any subscription. We may receive little or no funds from this offering. The funds that we receive from this offering will not be placed into an escrow account. We are not engaging underwriters for this offering.

This investment involves a high degree of risk. You should purchase shares only if you can afford a complete loss. See "Risk Factors" beginning on page 4.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE DATE OF THIS PROSPECTUS IS _____________, 2007

TABLE OF CONTENTS

Page

Prospectus Summary

3

Risk Factors

4

Forward Looking Statements

11

Use of Proceeds

13

Determination of Offering Price

13

Dividend Policy

14

Dilution

14

Capitalization

15

Selected Consolidated Financial Data

16

Management’s Discussion and Analysis or Plan of Operation

17

Business

20

Management

31

Certain Relationships and Related Party Transactions

34

Principal Shareholders

34

Description of Capital Stock

35

Shares Eligible for Future Sale

36

Plan of Distribution

37

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

37

Legal Matters

37

Experts

37

Where You Can Find Additional Information

37

Index to Financial Statements

39

You should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock. In this prospectus, "MediaG3," the "Company," "we," "us" and "our" refer to MediaG3, a Delaware corporation, and its wholly-owned subsidiaries.

All trademarks, service marks or trade names referred to in this prospectus are the property of their respective owners.

3

PROSPECTUS SUMMARY

This summary highlights information described more fully elsewhere in this prospectus. You should read the entire prospectus carefully.

The Company

We are an early stage company whose principal business objective is to deliver effective online and wireless interactive rich-media services and products. Our rich-media digital communication solution is designed to address and solve issues with the delivery and viewing of rich-media messages via either online or wireless devices in current bandwidth and services. We were formed in December 2005, and have two wholly-owned subsidiaries in China, Shanghai Oriental Media Communications, Limited and Shanghai Little Sheep Children’s Product Development Limited.

Our principal executive offices are located at One Almaden Boulevard, Suite 310, San Jose, California 95113, and our telephone number is (408) 260-5000. The address of our website iswww.MediaG3.com. Information on our website is not part of this prospectus.

The Offering

Common stock offered:

20,000,000 shares of common stock, $0.001 par value.

Common stock to be outstanding after this Offering:

30,950,000 shares.

Use of proceeds:

We plan to use the offering proceeds for potential acquisitions, sales channel and partnership development, market development, wireless product development and delivery and working capital.

Risk factors:

An investment in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 4 of this prospectus.

4

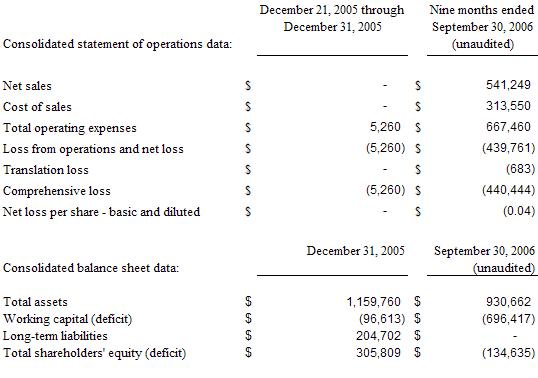

Summary Consolidated Financial Data

RISK FACTORS

An investment in our shares involves a high degree of risk. Before making an investment decision, you should carefully consider all of the risks described in this prospectus. If any of the risks discussed in this prospectus actually occur, our business, financial condition and results of operations could be materially and adversely affected. If this were to happen, the price of our shares could decline significantly and you might lose all or a part of your investment. The risk factors described below are not the only ones that may affect us. Our forward-looking statements in this prospectus are also subject to the following risks and uncertainties. Our actual results could differ materially from those anticipated by our forward-looking statements as a result of the risk factors below. See "Forward-Looking Statements."

RISK FACTORS RELATED TO OUR BUSINESS

WE ARE AN EARLY STAGE COMPANY AND HAVE A LIMITED OPERATING HISTORY ON WHICH TO EVALUATE OUR POTENTIAL FOR FUTURE SUCCESS.

Although the companies that we have acquired have from one and one-half years to almost three years of operating history, our parent company, MediaG3, was formed in December 2005, and to date has only one year of operations. Therefore, we have only a limited operating history upon which you can evaluate our business and prospects, and we have yet to develop sufficient experience regarding actual revenues to be received from our operations. In addition, we are currently refining our services and products for commercial sale, and our new products, mg3 studio and mg3 mobile, will not be available until May 2007 and October 2007, respectively. There can be no assurance that we will derive significant revenues from either of these products.

We are an early stage company. You must consider the risks and uncertainties frequently encountered by early stage companies in new and rapidly evolving markets such as competing technologies, lack of customer acceptance of a new or improved service or product and obsolescence of the technology before it can be fully commercialized. If we are unsuccessful in addressing these risks and uncertainties, our business, results of operations and financial condition will be materially and adversely affected.

OUR AUDITORS HAVE RAISED DOUBTS ABOUT OUR ABILITY TO CONTINUE AS A GOING CONCERN.

Our auditors have modified their report on our December 31, 2005 consolidated financial statements to include an uncertainty paragraph wherein they expressed substantial doubt about our ability to continue as a going concern. These concerns arise because of our operating losses and need to raise additional capital.

These conditions give rise to substantial doubt about our ability to continue as a going concern. Our consolidated financial statements do not include adjustments relating to the recoverability and classification of reported asset amounts or the amount and classification of liabilities that might be necessary should we be unable to continue as a going concern. Our future success is dependent upon our ability to achieve profitable operations and generate cash from operating activities as well as our ability to raise additional capital.

WE REQUIRE IMMEDIATE ADDITIONAL CAPITAL.

Our operating plan for 2007 is focused on development and marketing of our product applications for online and wireless marketing communications. We estimate that approximately $10 million will be required to support this plan for the next 12 months. During the period from December 21, 2005 (inception) through December 31, 2005 and during the nine months ended September 30, 2006, we did not receive any funds from the issuance of common stock. We are actively seeking additional funding, but to date have not entered into any agreements or other arrangements for such financing. There can be no assurance that the required additional financing will be available on terms favorable to us or at all.

If adequate funds are not available or are not available on acceptable terms when required, we may be required to significantly curtail our operations or may not be able to fund expansion, take advantage of unanticipated acquisition opportunities, develop or enhance services or products or respond to competitive pressures. Such inability could have a material adverse effect on our business, results of operations and financial condition. If additional funds are raised through the issuance of equity or convertible debt securities, our then existing shareholders may experience substantial dilution, and such securities may have rights, preferences and privileges senior to those of our common stock.

WE MAY NOT BE SUCCESSFUL IN INTEGRATING THE MANAGEMENT TEAMS OF SHANGHAI ORIENTAL MEDIA COMMUNICATIONS, LIMITED AND SHANGHAI LITTLE SHEEP CHILDREN’S PRODUCT DEVELOPMENT LIMITED, WHICH COULD ADVERSELY AFFECT THE LEADERSHIP OF OUR COMPANY, DIVERT MANAGEMENT TIME AND ADVERSELY AFFECT OUR BUSINESS AND RESULTS OF OPERATIONS.

Failure to successfully integrate our management team with those of our recently acquired subsidiaries, Shanghai Oriental Media Communications, Limited (“Oriental Media”) and Shanghai Little Sheep Children’s Product Development Limited (“Little Sheep”) could divert management time and resources, which could adversely affect our operations.

We intend to pursue additional acquisitions to further the development of our rich-media services and products. Our strategy is unproven and the revenue and income potential from our strategy is uncertain. We will encounter risks and difficulties frequently encountered by early-stage companies in new and rapidly changing markets, including the risks described elsewhere in this section. Our business may not be successful and we may not be able to successfully address these risks.

OUR BUSINESS REVENUE GENERATION MODEL IS UNPROVEN AND COULD FAIL.

Our revenue model is new and evolving, and we cannot be certain that it will be successful. Our ability to generate revenue depends, among other things, on our ability to provide effective online and wireless rich-media services and products to our customers. Our success will be largely dependent upon our ability to educate potential customers about the features and benefits of rich-media e-mail technology and applications. We cannot assure you that our business model will be successful or that we can sustain revenue growth or achieve or sustain profitability.

OUR FUTURE REVENUES ARE UNPREDICTABLE AND OUR QUARTERLY OPERATING RESULTS MAY FLUCTUATE SIGNIFICANTLY.

We have a very limited operating history. We cannot forecast with any degree of certainty the amount of revenue to be generated by any of our products or services. In addition, we cannot predict the consistency of our quarterly operating results. Factors which may cause our operating results to fluctuate significantly from quarter to quarter include:

- our ability to attract new and repeat customers;

- our ability to keep current with the evolving requirements of our target markets;

- our ability to protect our proprietary technology;

- the ability of our competitors to offer new or enhanced products or services; and

- unanticipated delays or cost increases with respect to research and development.

Because of these and other factors, we believe that quarter-to-quarter comparisons of our results of operations will not be good indicators of our future performance. If our operating results fall below the expectations of securities analysts and investors in some future periods, then our stock price may decline.

IF WE ARE NOT ABLE TO COMPETE EFFECTIVELY IN THE HIGHLY COMPETITIVE INTERACTIVE RICH-MEDIA MARKETING AND COMMUNCIATIONS INDUSTRY, WE MAY BE FORCED TO REDUCE OR CEASE OPERATIONS.

Our ability to compete effectively with our competitors depends on the following factors, among others:

-

the performance of our products, services and technology in a manner that meets customer expectations;

-

our ability to price our services and products at a price point that is competitive with similar or comparable services and products offered by our competitors;

-

general conditions in the interactive marketing, communications and wireless industries;

-

the success of our efforts to develop, improve and satisfactorily address any issues relating to our technology;

-

our ability to compete effectively with companies that have substantially greater market presence and financial, technical, marketing and other resources than us, including advertising agencies and print and broadcast media companies; and

-

our ability to adapt to the consolidation of our competitors or the entry into the market of new competitors.

THE LOSS OF THE SERVICES OF OUR CHIEF EXECUTIVE OFFICER WOULD ADVERSELY AFFECT OUR BUSINESS.

Our future success depends to a significant degree on the skills, experience and efforts of William Yuan, our Chief Executive Officer. We currently do not maintain key person insurance on Mr. Yuan. The loss of his services would be detrimental to our research and development, marketing and sales programs, as well as to our overall business and financial condition.

5

FAILURE TO ATTRACT AND RETAIN PERSONNEL COULD HAVE AN ADVERSE IMPACT ON OUR OPERATIONS.

Our future success depends on our ability to identify, attract, hire, retain and motivate other well-qualified managerial, technical, sales and marketing personnel. There is intense competition for these individuals, and there can be no assurance that these professionals will be available in the market or that we will be able to meet their compensation requirements.

LEGISLATIVE AND REGULATORY ACTIONS AND POTENTIAL NEW ACCOUNTING PRONOUNCEMENTS, INCLUDING BUT NOT LIMITED TO SECTION 404 OF THE SARBANES-OXLEY ACT OF 2002, ARE LIKELY TO IMPACT OUR FUTURE FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

There have been certain regulatory changes, including the Sarbanes-Oxley Act of 2002, and there may potentially be new accounting pronouncements or additional regulatory changes, which will have an impact on our future financial condition and results of operations. The Sarbanes-Oxley Act of 2002 and other rule changes as well as proposed legislative initiatives in the past four years following the Enron and WorldCom bankruptcies will increase our general and administrative costs, as we will incur increased legal and accounting fees to comply with such rule changes. In addition, proposed initiatives are expected to result in changes in certain accounting and disclosure rules. These and other potential changes could materially increase the expenses we report in our financial statements and adversely affect our operating results.

Section 404 of the Sarbanes-Oxley Act of 2002 requires management to assess its internal controls over financial reporting and requires auditors to attest to that assessment. Current regulations of the Securities and Exchange Commission will require us to include this assessment and attestation in our Annual Report on Form 10-KSB commencing with the annual report for our fiscal year ending December 31, 2008.

We will incur significant increased costs in implementing and responding to the new requirements. In particular, the rules governing the standards that must be met for management to assess its internal controls over financial reporting under Section 404 are complex and require significant documentation, testing and possible remediation. Our process of reviewing, documenting and testing our internal controls over financial reporting may cause a significant strain on our management, information systems and resources. We will have to invest in additional accounting and software systems. We may be required to hire additional personnel and to use outside legal, accounting and advisory services. We will also incur additional fees from our auditors as they perform the additional services necessary for them to provide their attestation. If we are unable to favorably assess the effectiveness of our internal control over financial reporting when we are required to, or if our independent auditors are unable to provide an unqualified attestation report on such assessment, we may be required to change our internal control over financial reporting to remediate deficiencies. In addition, investors may lose confidence in the reliability of our financial statements causing our stock price to decline.

ACTS OF TERRORISM, RESPONSES TO ACTS OF TERRORISM AND ACTS OF WAR MAY IMPACT OUR BUSINESS AND OUR ABILITY TO RAISE CAPITAL.

Future acts of war or terrorism, national or international responses to such acts, and measures taken to prevent such acts may harm our ability to raise capital or our ability to operate, especially to the extent we depend upon activities conducted in foreign countries, such as China where we currently maintain our two operating subsidiaries. In addition, the threat of future terrorist acts or acts of war may have effects on the general economy or on our business that are difficult to predict. We are not insured against damage or interruption of our business caused by terrorist acts or acts of war.

RISKS RELATED TO DOING BUSINESS IN CHINA

UNCERTAINTIES WITH RESPECT TO THE CHINESE LEGAL SYSTEM COULD HAVE A MATERIAL ADVERSE EFFECT ON US.

We will conduct a substantial portion of our operations through our subsidiaries in China. These subsidiaries are generally subject to laws and regulations applicable to foreign investment in China and, in particular, laws applicable to wholly foreign-owned enterprises. The PRC legal system is based on written statutes. Prior court decisions may be cited for reference but have limited precedential value. Since 1979, PRC legislation and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, since these laws and regulations are relatively new and the PRC legal system continues to rapidly evolve, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and rules involve uncertainties, which may limit legal protections available to us. In addition, any litigation in China may be protracted and result in substantial costs an d diversion of resources and management attention.

FLUCTUATION IN THE VALUE OF THE RENMINBI MAY HAVE A MATERIAL ADVERSE EFFECT ON YOUR INVESTMENT.

The change in value of the Renminbi against the U.S. dollar and other currencies is affected by, among other things, changes in China’s political and economic conditions. On July 21, 2005, the PRC government changed its decade-old policy of pegging the value of the Renminbi to the U.S. dollar. Under the new policy, the Renminbi is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. This change in policy has resulted in an approximately 5.0% appreciation of Renminbi against the U.S. dollar between July 21, 2005 and November 8, 2006. While the international reaction to the Renminbi revaluation has generally been positive, there remains significant international pressure on the PRC government to adopt an even more flexible currency policy, which could result in a further and more significant appreciation of the Renminbi against the U.S. dollar. As a portion of our costs and expenses is denominated in Renminbi, the revaluation in July 2005 and potential future revaluation has and could further increase our costs in U.S. dollar terms. In addition, as we will rely substantially on dividends paid to us by our operating subsidiaries in China, any significant revaluation of the Renminbi may have a material adverse effect on our revenues and financial condition, and the value of, and any dividends payable on, our common shares. For example, to the extent that we need to convert U.S. dollars we receive from this offering into Renminbi for our operations, appreciation of the Renminbi against the U.S. dollar would have an adverse effect on the Renminbi amount we receive from the conversion. Conversely, if we decide to convert our Renminbi into U.S. dollars for the purpose of making payments for dividends on our common shares or for other business purposes, appreciation of the U.S. dollar against the Renminbi would have a negative effect on the U.S.&nbs p;dollar amount available to us.

RESTRICTIONS ON CURRENCY EXCHANGE MAY LIMIT OUR ABILITY TO RECEIVE AND USE OUR REVENUES EFFECTIVELY.

Certain portions of our revenue and expenses are denominated in Renminbi. If our revenues denominated in Renminbi increase or expenses denominated in Renminbi decrease in the future, we may need to convert a portion of our revenues into other currencies to meet our foreign currency obligations, including, among others, payment of dividends declared, if any, in respect of our common shares. Under China’s existing foreign exchange regulations, our PRC subsidiaries are able to pay dividends in foreign currencies, without prior approval from the State Administration of Foreign Exchange, or SAFE, by complying with certain procedural requirements. However, we cannot assure you that the PRC government will not take further measures in the future to restrict access to foreign currencies for current account transactions.

Foreign exchange transactions by our PRC subsidiaries under most capital accounts continue to be subject to significant foreign exchange controls and require the approval of PRC governmental authorities. In particular, if we finance our PRC subsidiaries by means of additional capital contributions, these capital contributions must be approved by certain government authorities including the Ministry of Commerce or its local counterparts. These limitations could affect the ability of our PRC subsidiaries to obtain foreign exchange through equity financing.

THERE MAY BE SOME UNCERTAINTY SURROUNDING A RECENTLY ADOPTED PRC REGULATION THAT REQUIRES CERTAIN OFFSHORE LISTINGS TO BE APPROVED BY THE CHINA SECURITIES REGULATORY COMMISSION.

On August 8, 2006, six PRC regulatory agencies, including the China Securities Regulatory Commission, or CSRC, promulgated a regulation that took effect on September 8, 2006. This regulation, among other things, requires offshore special purpose vehicles, or SPVs, formed for listing purposes through acquisitions of PRC domestic companies and controlled by Chinese domestic companies or PRC individuals to obtain the approval of the CSRC prior to publicly listing their securities on an overseas stock exchange. On September 21, 2006, the CSRC published on its official website a notice specifying the documents and materials that are required to be submitted for obtaining CSRC approval. We believe that this regulation does not apply to us and that CSRC approval is not required because we are not an SPV covered by the new regulation as we are owned and controlled by non-PRC individuals. However, since the regulation has only recently been adop ted, there may be some uncertainty as to how this regulation will be interpreted or implemented. If the CSRC or other PRC regulatory body subsequently determines that we need to obtain the CSRC’s approval for this offering, we may face sanctions by the CSRC or other PRC regulatory agencies. In such event, these regulatory agencies may impose fines and penalties on our operations in the PRC, limit our operating privileges in the PRC, delay or restrict the repatriation of the proceeds from this offering into the PRC, or take other actions that could have a material adverse effect on our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our common shares.

WE FACE RISKS RELATED TO HEALTH EPIDEMICS AND OTHER OUTBREAKS.

Our business could be adversely affected by the effects of avian flu or another epidemic or outbreak. In 2005 and 2006, there have been reports on the occurrences of avian flu in various parts of China, including a few confirmed human cases and deaths. Any prolonged recurrence of avian flu or other adverse public health developments in China may have a material adverse effect on our business operations. These could include our ability to travel or ship our products outside of China, as well as temporary closure of our manufacturing facilities. Such closures or travel or shipment restrictions would severely disrupt our business operations and adversely affect our results of operations. We have not adopted any written preventive measures or contingency plans to combat any future outbreak of avian flu or any other epidemic.

RISK FACTORS RELATED TO OUR SECURITIES AND THIS OFFERING

WE HAVE A CONCENTRATION OF STOCK OWNERSHIP AND CONTROL, AND A SMALL NUMBER OF SHAREHOLDERS HAVE THE ABILITY TO EXERT SIGNIFICANT CONTROL IN MATTERS REQUIRING SHAREHOLDER VOTES AND MAY HAVE INTERESTS THAT CONFLICT WITH YOURS.

Our common stock ownership is highly concentrated. See “Principal Shareholders.” As a result, a relatively small number of shareholders, acting together, have the ability to control all matters requiring shareholder approval, including the election of directors and approval of mergers and other significant corporate transactions. This concentration of ownership may have the effect of delaying, preventing or deterring a change in control of our company. It could also deprive our shareholders of an opportunity to receive a premium for their shares as part of a sale of our company and it may affect the market price of our common stock. In deciding how to vote on such matters, those shareholders’ interests may conflict with yours.

OUR COMMON STOCK PRICE IS LIKELY TO BE HIGHLY VOLATILE; OUR COMMON STOCK IS

PENNY STOCK.

The market price of our common stock is likely to be highly volatile as the stock market in general, and the market for technology companies in particular, has been highly volatile. The trading prices of many technology companies' stocks have been highly volatile.

Factors that could cause such volatility in our common stock may include, among other things:

- actual or anticipated fluctuations in our quarterly operating results;

- announcements of technological innovations;

- changes in financial estimates by securities analysts;

- conditions or trends in our industry; and

- changes in the market valuations of other comparable companies.

In addition, we intend to apply for the trading of our common stock on the OTCBB. There can be no assurance that we will be able to successfully apply for listing on the OTCBB or eventually on the AMEX, the NASDAQ Global Select Market, the NASDAQ Global Market or the NASDAQ Capital Market due to the trading price of our common stock, our working capital and revenue history. Failure to list our shares on the OTCBB, the AMEX, the NASDAQ National Market, or one of the NASDAQ Markets will impair the liquidity of our common stock.

The Securities and Exchange Commission has adopted regulations which generally define a "penny stock" to be any security that 1) is priced under five dollars, 2) is not traded on a national stock exchange or on NASDAQ, 3) may be listed in the "pink sheets" or the OTCBB, and 4) is issued by a company that has less than $5 million in net tangible assets and has been in business less than three years, or by a company that has under $2 million in net tangible assets and has been in business for at least three years, or by a company that has revenues of less than $6 million for three years.

Penny stocks can be very risky: penny stocks are low-priced shares of small companies not traded on an exchange or quoted on NASDAQ. Prices often are not available. Investors in penny stocks are often unable to sell stock back to the dealer that sold them the stock. Thus, an investor may lose his/her investment. Our common stock is a penny stock and thus is subject to rules that impose additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors, unless the common stock is listed on one of the NASDAQ Markets. Consequently, the penny stock rules may restrict the ability of broker/dealers to sell our securities, and may adversely affect the ability of holders of our common stock to resell their shares in the secondary market.

WE WILL HAVE BROAD DISCRETION OVER THE USE OF PROCEEDS FROM THIS OFFERING AND MAY USE THE PROCEEDS IN A MANNER SIGNIFICANTLY DIFFERENT FROM OUR CURRENT PLANS.

While we currently expect to use the net proceeds from this offering for potential acquisitions, wireless product development and delivery, sales channel and partnership development, market development, product development and for working capital and general corporate purposes, we will have broad discretion to adjust the application and allocation of the net proceeds. Our expectations regarding future business needs may prove to be inaccurate. Accordingly, we will retain broad discretion in the allocation of the net proceeds from this offering, and we reserve the right to change the use of these proceeds as a result of contingencies. The success of our operations is influenced by capital expenditures and working capital allocations and will substantially depend upon our discretion and judgment with respect to the application and allocation of the net proceeds from this offering.

FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical fact, contained in this prospectus constitute forward-looking statements. In some cases you can identify forward-looking statements by terms such as “may,” “intend,” “might,” “will,” “should,” “could,” “would,” “expect,” “believe,” “estimate,” “anticipate,” “predict,” “project,” “potential,” or the negative of these terms and similar expressions intended to identify forward-looking statements.

Forward-looking statements are based on assumptions and estimates and are subject to risks and uncertainties. We have identified in this prospectus some of the factors that may cause actual results to differ materially from those expressed or assumed in any of our forward-looking statements. There may be other factors not so identified. You should not place undue reliance on our forward-looking statements. As you read this prospectus, you should understand that these statements are not guarantees of performance or results. Further, any forward-looking statement speaks only as of the date on which it is made and, except as required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. New factors emerge from time to time that may cause our business not t o develop as we expect and it is not possible for us to predict all of them. Factors that may cause actual results to differ materially from those expressed or implied by our forward-looking statements include, but are not limited to, those described under the heading “Risk Factors” beginning on page 4, as well as the following:

| | | |

| | • | | Our limited operating history and business development associated with being a growth stage company; |

| | | |

| • | | Our history of operating losses, which we expect to continue; |

| | | |

| • | | Our ability to generate enough positive cash flow to pay our creditors; |

| | | |

| • | | Our dependence on key personnel; |

6

| | | |

| • | | Our need to attract and retain technical and managerial personnel; |

| | | |

| • | | Our ability to execute our business strategy; |

| | | |

| • | | Intense competition with established leaders in the rich-media digital communications industry; |

| | | |

| • | | Our ability to protect our intellectual property and proprietary technologies; |

| | | |

| • | | Costs associated with potential intellectual infringement claims asserted by a third party; |

| | | |

| • | | Our ability to protect, and build recognition of, our trademarks and trade names; |

| | | |

| • | | Our exposure to product liability claims resulting from the use of our products; |

| | | |

| • | | General economic and capital market conditions, including political and economic uncertainty in various areas of the world where we do business; |

| | | |

| • | | Our exposure to unanticipated and uncontrollable business interruptions; |

| | | |

| • | | Pricing and product actions taken by our competitors; |

| | | |

| • | | Financial conditions of our customers; |

| | | |

| • | | Customers’ perception of our financial condition relative to that of our competitors; |

| | | |

| • | | Changes in United States or foreign tax laws or regulations; |

| | | |

| • | | Reliance upon suppliers and risks of production disruptions and supply and capacity constraints; |

| | | |

| • | | Our dependence on our marketing partners; |

| | | |

| • | | Unforeseen liabilities arising from litigation; |

| | | |

| • | | Our ability to successfully complete the integration of any future acquisitions; and |

| | | |

| • | | Our ability to project the market for our products and services based upon estimates and assumptions. |

USE OF PROCEEDS

We are offering up to a total of 20,000,000 shares of common stock in a direct public offering, without any involvement of underwriters or broker-dealers. The offering price is $3.00 per share. We believe that if all shares offered under this prospectus are sold, the proceeds will be sufficient to fund our operations for three years. The table below sets forth our proposed use of proceeds assuming the sale of all shares of common stock offered hereunder:

| |

Gross Proceeds | $60,000,000 |

Offering Expenses: | |

Legal fees | 40,000 |

Printing of prospectus | 2,000 |

Accounting and auditing fees | 155,000 |

State securities fees | 2,000 |

Transfer agent fees | 2,000 |

SEC filing fees | 6,240 |

Miscellaneous expenses | 12,000 |

Total Offering Expenses | 219,240 |

Net Proceeds | $59,780,760 |

The net proceeds will be used as follows:

First Phase

| |

Product integration | $420,000 |

Market development | $880,000 |

Sales channel development | $1,200,000 |

Wireless product development and delivery | $5,500,000 |

Possible acquisitions | $7,000,000 |

Working capital | $4,780,760 |

Second Phase

| |

Research and development | $1,200,000 |

Marketing and branding | $1,500,000 |

Sales channel and partnership development | $1,800,000 |

Wireless product development and delivery | $5,500,000 |

Technology and business acquisitions | $15,000,000 |

Working capital | $15,000,000 |

DETERMINATION OF OFFERING PRICE

The $3.00 per share offering price of our common stock was determined based on our capital requirements and our internal assessment of what the market would support. There is no relationship whatsoever between this price and our assets, earnings, book value or any other objective criteria of value. Additionally, because we have a limited operating history and have not generated significant revenues to date, the price of the shares of common stock is not based on past earnings, nor is the price of the shares indicative of current market value for the assets owned by us.

We intend to apply to the OTCBB for the trading of our common stock upon our becoming a reporting entity under the Exchange Act. We intend to file a registration statement under the Exchange Act and request effectiveness of that registration statement concurrently with the effectiveness of the registration statement of which this prospectus forms a part.

As of December 31, 2006, we had 13 shareholders of record of our common stock.

DIVIDEND POLICY

To date we have never declared or paid any cash dividends on our capital stock. We currently intend to retain any future earnings for funding growth and therefore, do not expect to pay any dividends in the foreseeable future. Payment of future dividends, if any will, be at the discretion of our Board of Directors after taking into account various factors, including our financial condition, operating results, current and anticipated cash needs and plans for expansion.

DILUTION

Dilution represents the difference between the offering price and the net tangible book value per share of common stock immediately after completion of this offering. Net tangible book value is the amount that results from subtracting total liabilities and intangible assets from total assets.

As of September 30, 2006, the net tangible book value of our shares of common stock was a negative $ 134,635 or approximately $(0.0123) per share, based upon an aggregate of 10,950,000 shares of common stock outstanding.

Upon completion of this offering, in the event all of the shares to be offered by us are sold, the net tangible book value of the 30,950,000 shares of common stock to be outstanding will be $59,646,125, or approximately $1.9272 per share. The amount of dilution you will incur will be $1.0728 per share. The net tangible book value of the shares held by our existing shareholders will be increased by $1.9395 per share without any additional investment on their part. You will incur an immediate dilution from $3.00 per share to $1.9272 per share.

After completion of this offering, if all 20,000,000 shares of common stock to be offered by us are sold, you will own approximately 64.62% of the total number of shares then outstanding for which you will have made a cash investment of $60,000,000, or $3.00 per share. Our existing shareholders as of September 30, 2006 will own approximately 35.38% of the total number of shares then outstanding, for which they have made contributions of services and assets totaling $311,069, or approximately $0.0284 per share.

The following table compares the difference between your investments in our shares of common stock with the investment of our existing shareholders.

Existing shareholders if all of the shares are sold:

Price per share

$3.00

Net tangible book value per share before offering

$(0.0123)

Potential gain to existing shareholders per share

$1.9395

Net tangible book value per share after offering

$1.9272

Increase to present shareholders in net tangible

book value per share after offering

$1.9395

Capital contributions

$311,069

Number of shares outstanding before the offering

10,950,000

Number of shares after offering held by existing shareholders

10,950,000

Percentage of ownership by existing shareholders after offering

35.38%

Purchasers of shares in this offering if all of the shares are sold:

Price per share

$3.00

Dilution per share

$1.0728

Capital contributions

$60,000,000

Number of shares after offering held by public investors

20,000,000

Percentage of ownership by public investors after offering

64.62%

CAPITALIZATION

The following table sets forth our capitalization as of September 30, 2006:

-

on an actual basis; and

-

on a pro forma as adjusted basis to reflect the sale of 20,000,000 shares of common stock offered by this prospectus, at an assumed initial price of $3.00 per share, after deducting estimated offering expenses payable by us.

This information should be read in conjunction with our Management’s Discussion and Analysis of Financial Condition or Plan of Operation and our Financial Statements and the related Notes appearing elsewhere in this prospectus.

The Company had a net loss of $439,761 for the nine months ended September 30, 2006, and a cumulative book net operating loss of $445,021, included in the accumulated deficit in the table below.

As of September 30, 2006

| | | | | | | | | | |

| |

Actual | Pro Forma As Adjusted |

Cash and cash equivalents | $ 199,413 | $ 59,980,173 |

Shareholders’ Equity: | | |

Common stock, $.001 par value; 45,000,000 shares authorized, 10,950,000 shares issued and outstanding actual; 30,950,000 shares issued and outstanding pro forma as adjusted |

10,950 |

30,950 |

Preferred stock, $.001 par value; 5,000,000 shares authorized, None issued and outstanding actual and pro forma as adjusted |

- |

- |

Paid-in capital |

300,119 | 60,078,142 |

Accumulated deficit | (445,021) | (445,021) |

| | | | | | | | | | |

Accumulated comprehensive loss | (683) | (683) |

| | | |

Total Shareholders’ Equity (Deficit) | (134,635) | 59,632,438 |

| | | |

Total Capitalization | $ (134,635) | $ 59,632,438 |

SELECTED CONSOLIDATED FINANCIAL DATA

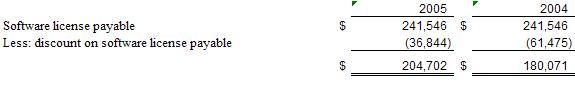

The following selected financial data as of December 31, 2005 and for the period from December 21, 2005 (inception) through December 31, 2005 are derived from our audited financial statements, which are included elsewhere in this prospectus. The consolidated statements of operations and comprehensive loss data for the nine months ended September 30, 2006 and the consolidated balance sheet data as of September 30, 2006, are derived from unaudited financial statements that, in our opinion, reflect all adjustments (consisting of normal recurring adjustments) necessary for a fair presentation of the financial position as of such date and results of operations for such period. The operating results for the nine months ended September 30, 2006 are not necessarily indicative of the operating results to be expected in the future. The data set forth below should be read in conjunction with our Consolidated Financial Statements and Notes thereto included elsewhere in this prospectus and with “Management’s Discussion and Analysis or Plan of Operation.”

MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

THIS PROSPECTUS CONTAINS FORWARD-LOOKING STATEMENTS WITHIN THE MEANING OF SECTION 27A OF THE SECURITIES ACT OF 1933 AND SECTION 21E OF THE SECURITIES EXCHANGE ACT OF 1934, INCLUDING, WITHOUT LIMITATION, STATEMENTS REGARDING OUR EXPECTATIONS, BELIEFS, INTENTIONS OR FUTURE STRATEGIES THAT ARE SIGNIFIED BY THE WORDS "EXPECTS," "ANTICIPATES," "INTENDS," "BELIEVES" OR SIMILAR LANGUAGE. THESE FORWARD-LOOKING STATEMENTS INVOLVE RISKS, UNCERTAINTIES AND OTHER FACTORS. ALL FORWARD-LOOKING STATEMENTS INCLUDED IN THIS PROSPECTUS ARE BASED ON INFORMATION AVAILABLE TO US ON THE DATE HEREOF AND SPEAK ONLY AS OF THE DATE HEREOF. THE FACTORS DISCUSSED ABOVE UNDER "RISK FACTORS" AND ELSEWHERE IN THIS PROSPECTUS ARE AMONG THOSE FACTORS THAT IN SOME CASES HAVE AFFECTED OUR RESULTS AND COULD CAUSE THE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE PROJECTED IN THE FORWARD-LOOKING STATEMENTS.

The following discussion should be read in conjunction with the Consolidated Financial Statements and Notes thereto.

Overview

We are an early stage company, and have a limited operating history and revenue to date. Our prospects must be considered in light of the risks and uncertainties encountered by companies in an early stage of development involving new technologies and overcoming regulatory approval process requirements. To date, all of our sales have been generated by our wholly-owned subsidiaries, Little Sheep and Oriental Media; all of such sales were generated in the PRC. In addition, substantially all of our fixed assets are located in the PRC.

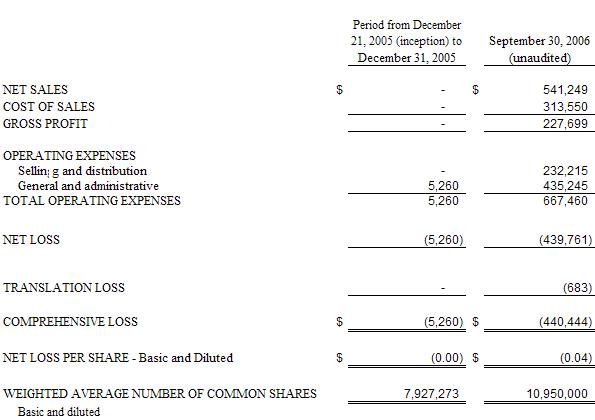

Results of Operations

Nine Months Ended September 30, 2006

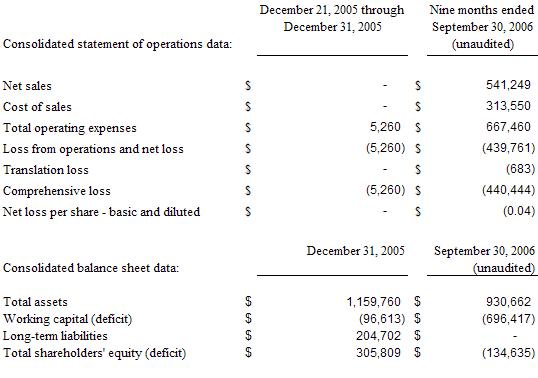

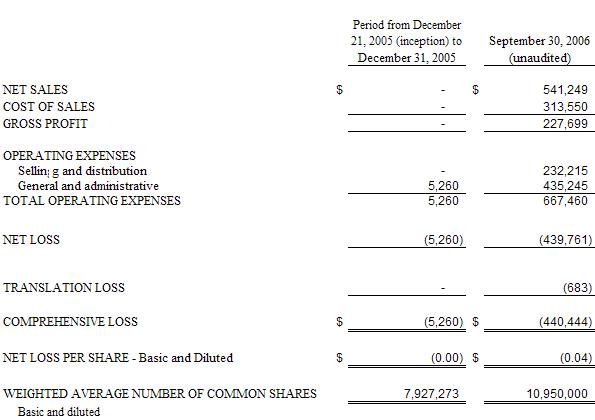

We had net sales of $541,249 in the nine months ended September 30, 2006. Of this amount, $533,089 was realized from the sales of children’s wear by Little Sheep; the balance came from sales of services by Oriental Media. Our cost of sales equaled $313,550 in the nine months ended September 30, 2006, of which $312,178 was derived from the operations of Little Sheep and the balance from Oriental Media. We therefore realized gross profit of $227,699 for the nine months ended September 30, 2006.

For the nine months ended September 30, 2006, we had total operating expenses of $667,460. Operating expenses were incurred by MediaG3 as well as our wholly owned subsidiaries. Little Sheep had $251,691 of operating expenses for the nine months ended September 30, 2006, while Oriental Media incurred $115,974 of operating expenses during that period. The balance of operating expenses, $299,795, was incurred by MediaG3. Our aggregate operating expenses were comprised of $435,245 in general and administrative expenses, including rent, wages, legal, accounting expenses and depreciation on fixed assets, and $232,215 in selling and distribution expenses for our children’s wear and software products.

Based on this, we incurred a loss from operations and a net loss of $439,761 for the nine months ended September 30, 2006, of which $30,780 was attributable to Little Sheep, $109,186 to Oriental Media, and the balance of $299,795 to our corporate parent. We also had a translation loss of $683 for the period. This resulted in a comprehensive loss of $440,444, or $0.04 per share, for the nine months ended September 30, 2006.

Period From December 21, 2005 (Inception) through December 31, 2005

As our parent corporation was not incorporated until December 2005, and we did not complete the acquisitions of Little Sheep and Oriental Media until December 28, 2005, we had minimal operations and minimal operating results in the period from December 21, 2005 (Inception) through December 31, 2005. We had no sales or cost of sales in fiscal 2005. We incurred general and administrative expenses of $5,260 for the period, consisting of the expenses of incorporation and indirect cost of acquiring our two subsidiaries. As a result, we had a loss from operations and a net loss of $5,260, or $0.00 per share, for fiscal 2005.

Liquidity and Capital Resources

From our date of inception (December 21, 2005), we have obtained the majority of our cash resources from the acquisition of subsidiaries and loans from our founders. Our operating plan for 2006 and 2007 is focused on developing a market in both the US and China. We estimate that approximately $10 million will be required to support this plan for the next 12 months. At September 30, 2006, we had $199,413 in cash and cash equivalents, and had a burn rate of approximately $110,000 per month. We will need to raise additional capital. We believe that the funds raised through this offering will be sufficient to support our operations through the year ending December 31, 2008. Once we receive the required additional financing, we anticipate continued growth in our operations and a corresponding growth in our operating expenses and capital expenditures. There can be no assurance that we will be successful in raising a ny capital.

Our negative operating losses and the need to raise additional capital give rise to substantial doubt about our ability to continue as a going concern. Our consolidated financial statements do not include adjustments relating to the recoverability and classification of reported asset amounts or the amount and classification of liabilities that might be necessary should we be unable to continue as a going concern. Our continuation as a going concern is dependent upon our ability to obtain additional financing from the sale of our common stock, as may be required, and ultimately to attain profitability.

The report of our independent registered public accounting firm, included elsewhere in this prospectus, contains a paragraph regarding our ability to continue as a going concern.

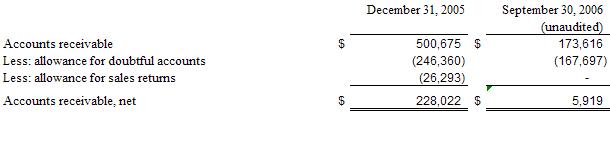

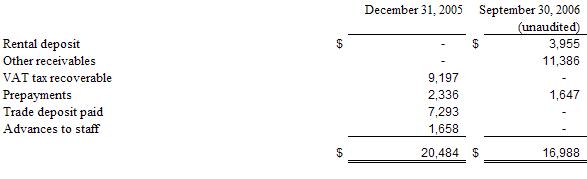

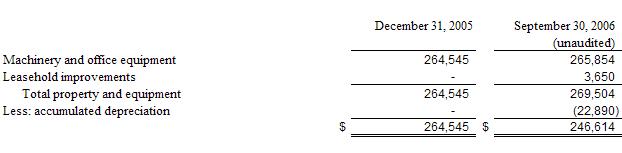

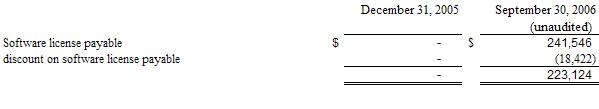

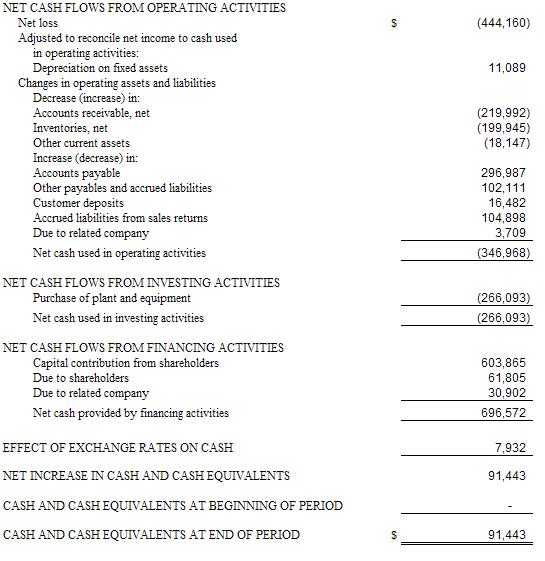

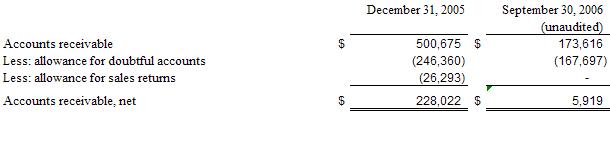

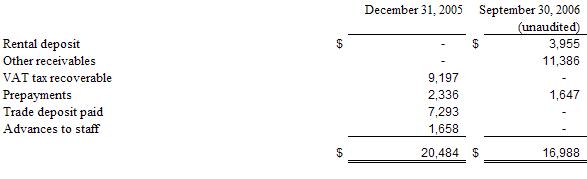

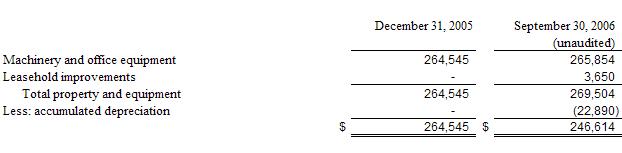

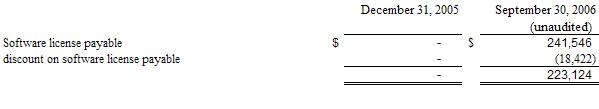

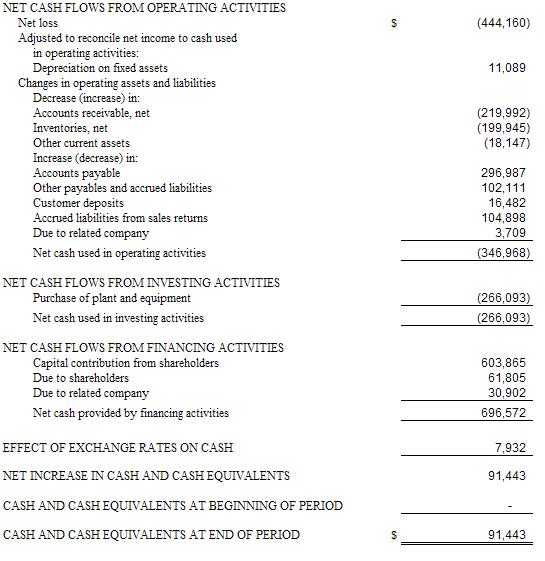

During the nine months ended September 30, 2006, we continued to spend cash to fund our operations. Cash provided from operations was $59,088, consisting of our net loss of $439,761 offset by reductions in accounts receivable of $327,059, inventory of $53,385, and other current assets of $3,496, accompanied by increases in other payable and accrued liabilities of $190,840, offset by amortization on software of $71,022, depreciation of $22,954 and $6,652 on fixed assets and trademark, respectively, discount on software license payable of $19,023 and reductions in accounts receivable allowances of $78,663 and $26,293 for doubtful accounts and sales returns, respectively, and a decrease in accounts payable of $90,626.

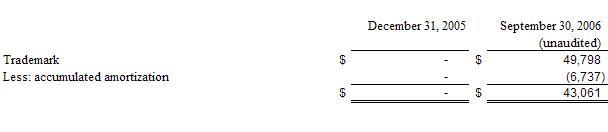

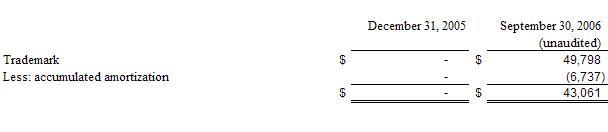

Cash flow used on investing activities was $54,757 for the nine months ended September 30, 2006. This consisted of $49,798 in the acquisition of a trademark and $4,959 in equipment purchased.

Cash flow from financing activities for the nine months ended September 30, 2006 produced a net increase in cash of $92,710, consisting of an increase of $92,025 in the amounts due to our shareholders, and an increase of $685 due to a related company.

As of September 30, 2006, we had cash and cash equivalents amounting to $199,413, an increase from the balance of $104,185 at December 31, 2005. Our working capital deficit increased to $696,417 at September 30, 2006, from $96,613 at December 31, 2005. There were no material commitments for capital expenditures at September 30, 2006.

Little Sheep, our wholly-owned subsidiary, has outstanding commitments with respect to a non-cancelable operating lease, as follows:

2006

$ 9,456

2007

4,206

2008

456

2009

456

2010

456

Thereafter

2,014

$ 17,044

Critical Accounting Policies

The preparation of consolidated financial statements and related disclosures in conformity with accounting principles generally accepted in the United States requires us to make judgments, assumptions and estimates that affect the amounts reported. Note 1 of Notes to Consolidated Financial Statements describes the significant accounting policies used in the preparation of the consolidated financial statements. Certain of these significant accounting policies are considered to be critical accounting policies, as defined below.

A critical accounting policy is defined as one that is both material to the presentation of our financial statements and requires management to make difficult, subjective or complex judgments that could have a material effect on our financial condition and results of operations. Specifically, critical accounting estimates have the following attributes: 1) we are required to make assumptions about matters that are highly uncertain at the time of the estimate; and 2) different estimates we could reasonably have used, or changes in the estimate that are reasonably likely to occur, would have a material effect on our financial condition or results of operations.

Revenue Recognition:

Revenue derived from the sale of software services is recognized when services are rendered and obligations under related contracts are fulfilled. To the extent that a website design or development contract extends over multiple accounting periods, revenues and related costs from these contracts are recognized over the installation period based on the percentage of completion method. Provisions, if any, are made on uncompleted contracts in the period that anticipated losses become apparent. As of September 30, 2006 and December 31, 2005, there were no such contracts.

Revenues from design, sales and distribution of children’s wear are recognized upon delivery or shipment of the products, at which time title passes to the customer, provided that: there are no uncertainties regarding customer acceptance; persuasive evidence of an arrangement exists; the sales price is fixed or determinable; and collectibility is deemed probable.

Little Sheep’s merchant customers can return unsold merchandise in exchange for different merchandise at full value. Due to the Company’s limited operating history, returns are provided in the allowance for sales returns based upon the individual evaluation of each customer’s potential returns. As history is developed, the Company will provide for potential returns based upon the relationship of returns to sales.

If a merchant customer can no longer operate its business due to causes beyond human control, such as war, major natural disasters or death, then Little Sheep would take back the remaining merchandise at 50% of the sales price. No provision for returns has been made, since there is no evidence or history of impairment, nor are any potential losses reasonably estimatible.

Accounting for Acquisitions:

The Company made two acquisitions in 2005. These acquisitions were valued at net book value, since current assets, as adjusted for valuation considerations, represented fair value. Fixed assets, including purchased software, was valued at net book value, due to their recent acquisition at fair market value, less depreciation and amortization. Liabilities were valued at the amounts assumed, which was face value. Certain goodwill and intangibles were considered by the Company when making these acquisitions, which were negotiated at arms’ length.

Estimates and assumptions about future events and their effects cannot be determined with certainty. We base our estimates on historical experience and on various other assumptions believed to be applicable and reasonable under the circumstances. These estimates may change as new events occur, as additional information is obtained and as our operating environment changes. To date, these changes have been minor and have been included in the consolidated financial statements as soon as they became known. Based on a critical assessment of our accounting policies and the underlying judgments and uncertainties affecting the application of those policies, management believes that our financial statements are fairly stated in accordance with accounting principles generally accepted in the United States, and present a meaningful presentation of our financial condition and results of operations.

In preparing our financial statements to conform to accounting principles generally accepted in the United States, we make estimates and assumptions that affect the amounts reported in our financial statements and accompanying notes. These estimates include useful lives for fixed assets for depreciation calculations. Actual results could differ from these estimates.

BUSINESS

General Business Overview

We were incorporated in Delaware in December 2005 to deliver effective online and wireless interactive rich-media services and products. Our products and services, developed internally and obtained through acquisitions, significantly reduce the cost of corporate marketing, advertising, communications and content delivery, achieve much broader reach and higher response rate from targeted customers, and produce greater efficiency in communication and product distribution with tangible results. We are positioned in the $7 billion online marketing space (estimated by Jupiter Communications) and are also targeting the $58 billion mobile marketing and content distribution space in the China market (estimated by Dataquest). Our operating subsidiaries include Oriental Media and Little Sheep, both located in China. We also plan to expand our business into the broadband wireless market. Our main focus for the broadband wireless business will be in the rapidly growing markets of Southeast Asia and Greater China.

MediaG3’s rich-media digital communication solution is designed to address and solve delivery and viewing issues in rich-media messages via either online or wireless devices. We deliver interactive marketing solutions for companies of all sizes. In addition to our mg3 proTM turnkey solution, we plan to apply additional technologies and to market a new generation of product line, mg3 studioTM to capture incremental license and usage revenue. We can also quickly move into the wireless market by deploying mg3 mobileTM to deliver requested content highlights to subscribers using cell phones or other wireless devices such as PDAs. Typical content highlights would consist of video clips of news, sports highlights, movie trailers, music sound tracks, and TV show promotions. mg3 mobileTM digitizes, hosts and broadcasts the content in real-time to subscribers who have signed up to r eceive such information. Subscribers can forward or email the video clips they received to their friends’ wireless devices or computers. mg3wirelessTM, which operates on the highest commercially available portion of the spectrum in the world, provides one to many connectivity, allowing over one billion people residing in China’s rural areas to receive satellite TV programs and broadband Internet access.

One of our wholly owned Chinese subsidiaries, Oriental Media, is focused on market development in China for the mg3 digital interactive communication product and services. Our other wholly owned subsidiary in China, Little Sheep, is an emerging company focused on development of children’s online platforms and forums for education, modern life style and brand loyalty. Little Sheep also owns and operates a fast growing franchised fashion distribution channel for children. We believe that Little Sheep offers an additional media channel into the vast children’s market.

In addition to developing and marketing product applications for online and wireless marketing communications, our growth strategies include acquisitions of companies in both the US and China with complementary and strategic value. We are currently involved in discussions with potential acquisition candidates in mobile and broadband wireless sector, but to date have not entered into any definitive agreement.

The Market

Consumers and corporate users of email send an average of 1.6 billion email messages a day. According toe-marketer, the current 78 million email users account for 35% of the total adult and teen U.S. population. Forrester Research reported that 250 billion emails traveled across cyber space in 2002. Jupiter’s latest research reports email ad response rates currently averaging from 10% to 17%. Both email users and email usages have been steadily and rapidly increasing.

According toe-marketer, Forrester Research and The ClickZ Network, total email advertisement spending was $2.4 billion in 2002, and online advertisement was expected to increase to $7.7 billion by 2005. IMT Strategies estimates that marketers spent at least $4 billion on permission email marketing programs in 2004.

In addition to providing a medium for basic communication, email can be used for e-commerce. The increased use of email has opened significant opportunities for the large number of businesses working on e-commerce strategies. While these companies have relied on banner advertising and other online advertising strategies to reach potential customers over the Internet, they are now turning to email as the preferred and more effective marketing tool.

Email marketing in general has greater advantage over direct marketing with much less cost and much better results. A direct marketing piece costs from $2.00 to $3.00, and produces only about a 1% response rate. The cost per email is about $0.30 and can produce more than a 30% response rate. Companies are cutting back advertising budgets and looking for more cost effective advertising campaigns. Email marketing has become the choice of media to accomplish that.

Rich-media email is substantially better than text email when used as a marketing and promotional tool. Rich-media email has proven to be impressive and persuasive when the customer can see a picture, as well as hear a promotional pitch. We believe that voice in some ways is superior to text because it is more interactive and can add a level of persuasiveness not available with text alone. Voice combined with pictures or graphics and interaction is a far more powerful marketing tool. In addition, rich-media email has proven to be an effective media not only for e-commerce but also to drive and increase foot traffic to brick and mortar retail stores.

As the online marketing is growing, the wireless market has also exploded. The number of mobile devices has proliferated throughout the world, and continues to grow at an exponential rate. Datamonitor predicts that by 2005, there will be one billion wireless device users worldwide. According to Dataquest, a unit of the Gartner Group, some 52 million U.S. households, or about 51% of the total, own a mobile phone. T-Mobile, the nation's sixth largest carrier, said it added 2.9 million new subscribers in 2002, a 40 percent increase from 2001. A market analyst at Gartner Dataquest said in a study that 423.4 million cell phones were sold in 2002 in the United States, a six percent increase from 2001. Meanwhile, other nations show even more astounding penetration of the mobile device explosion. For example, 88% of households in Finland now own a wireless phone.

Internet and Wireless service providers have excessive capacities, especially for cable, SDSL, 2.5G and upcoming 3G networks. While the growth rates of Internet, email and mobile phone users and short message services (SMS) are still robust, the large Internet and wireless service providers are looking for next generation applications to expand their revenue streams, secure their market position and prepare for fierce competitions allowed by deregulations.

Mobile phone and PDA manufacturers are looking for ways to expand their market share in China. It is a very crowded space with competition among Europeans, Japanese, Korean and domestic manufacturers with much cheaper prices. While the new mobile phones and other hand-held wireless devices are very advanced, the lack of applications and services reduce incentives for people to buy or upgrade to new mobile phones. The manufacturers need value-added applications and services.

Content providers and advertisers also need more efficient channels to deliver information to targeted customers. While more and more companies entering the short message services (SMS) business, the multi media services (MMS) market is wide open, less tapped and fast growing.

Content owners and product companies and distributors need to communicate with potential customers, who are interested in the information and products and have disposable income. The product manufacturers are seeking new media to replace or supplement expensive TV and printed advertisement and much less effective direct mailing. More importantly, the product manufacturers are searching for very well defined and fully opt-in customer bases to which they can promote and market their products and services correctly, wisely and effectively.

MediaG3 has created and acquired applications to address these customer needs. We will offer complete rich-media communication solutions for companies worldwide looking to extend and enhance branding, sales generation, communication and advertising efforts. From campaign strategy to creative design, production, deployment, hosting, tracking, reporting, plus access to mg3 dbTM, the powerful customers database, we provide comprehensive and cost-effective targeted interactive solutions that deliver effective and persuasive marketing campaigns for impressive and measurable results.

MediaG3’s targeted interactive online and wireless rich-media messages capture recipients' attention, increase response rates, shorten the sales cycle and achieve greater return-on-investment for our customers. MediaG3’s wireless rich-media messages will enhance brand recognition, product loyalty and sales growth. Considerably less expensive than direct mail and other traditional media on a cost-per-thousand basis, MediaG3’s solutions yield superior response rates, with real-time tracking and reporting capabilities for insightful marketing and advertising analysis. Customized mg3 interactive wireless rich-media messages sent to targeted customers also offers a viral marketing feature to broaden exposure and reach for each campaign.

While we can deliver results for our clients through mg3 applications, our mg3 dbTM offers our clients a powerful and targeted database, containing potential customers with wealth, sophistication, and buying power for both business products and consumer goods. The Company will help clients, such as mobile phone, PDA and other wireless device manufacturers or other consumer product companies, to promote and sell directly to the people in mg3 dbTM databases. We believe that this efficient and well-targeted marketing approach will produce tremendous results for our clients.

China Market Opportunities

Online and Wireless Market

According to CNET and the Chinese Ministry of Information Industry (MII), China's equivalent to the United States Federal Communication Commission, there are 120 million Internet and email users in China this year. That keeps China on track to easily surpass 200 million by 2007, as reported earlier.

China is the world's second-largest PC market. IDC predicts that roughly 30 million PCs will ship in 2005. China is also the world's largest cellular market, with more than 340 million subscribers in January of 2005. Analysts said stable subscriber growth, an increase in the number of provincial networks, and a more benign competitive environment resulted in more than 4 million new subscribers added every month in 2004, China is not only the largest cellular market in the world and but also a potential hotbed of 3G activities. With so many players involved from Chinese governments, equipment providers, handset manufacturers and content providers, many of them are very focused on making 3G happen.

According to Tina Xu, an In-Stat/MDR analyst based in China, "As in most regions of the world where cellular subscriber rates are rapidly increasing, the implementation of 3G in China is critical in order to accommodate a transformation of users' expectations from voice-centric communications to a more complex mixture of voice, wireless data and multimedia services." The availability of Third Generation networks such as CDMA2000, W-CDMA, and TD-SCDMA will give wireless operators improved network efficiency, higher capacity, and the ability to begin offering high-speed wireless data services.

In-Stat/MDR has also found that the number of mobile subscribers in China will grow to 497.86 million by 2008, growing at a compound annual growth rate (CAGR) of 11.7%, reaching a penetration rate of 37.6%. Commercial 3G deployment began in 2005, and it is estimated that 3G subscribers will grow to 118.13 million by 2008.

Over the past decade, the China mobile market has gradually entered the digital age, and by the end of 2003, China boasted the world's largest GSM network. Through 2008, GSM will continue to dominate the subscriber base. Wireless operators are also hopeful that a positive user experience with 2.5G will translate into rapid adoption of 3G services. However, many of the outstanding features of 3G technologies are not in demand by most subscribers for the time being and it will take at least two to three years for 3G subscribers to exhibit high growth after 3G services are launched.

According to Asia Pacific Research Group, it took 10 years to build a base of 10 million mobile phone users in China. But once the prices on handsets and access changes dropped, the number of China’s mobile subscribers increased from 10 million to 100 million in less than four years. During 2001, the China mobile telecommunications market added an average of 5 million mobile subscribers a month, and then surpassed the US to become the largest mobile phone market in the world. By 2007, the China mobile market will have over 500 million subscribers.

Children’s Development Market

In China, there is a new baby born every 1.8 seconds, or 20 million new babies every year. While this phenomenon imposes huge responsibilities for the government, it offers perpetual business opportunities for the commercial world.

In China, the expenditure on children’s products cannot be explained by any economic theory or logic. Giving children everything is the tradition of thousands of years of Chinese tradition. The structure of modern Chinese families is a pyramid, having the only child on the top, parents on the second level and paternal and maternal grand parents on the bottom. The pyramid forms a child’s consumption structure. Parents and grandparents buy everything that the child desires.

In Shanghai, China’s biggest commercial city, there are 13.5 million regular residents, plus 5 million visitors or temporary residents at any given time. Shanghai has about 5 million households, and every family spends at least 300 RMB ($35 US) per month on children, not including education. The total consumption is 1.5 billion RMB or $190 million US. Shanghai counts 8% of national children’s consumption, so nationwide, the total expenditure for children reaches 18.75 billion RMB or $2.5 billion with growth rate of 26.5% in cities and 8% in country side every year through 2008. The potential market for children’s product is immeasurable.

Education has always been the priority in Chinese culture. While children are addicted to computer games, the parents are doing everything to convert their children’s online gaming time into online education. Chinese families believe better education and better grade are paramount for a better life for their children. There are 150 million Chinese children age from K to 9. Parents typically spend $10 per month for Children’s online education, and that constitute a $1.5 billion market and growing. Studies shown that parents will pay big percentage of their disposable income on children’s education, and online education platforms and programs have taken increasing market shares.

Technology, Products and Services

Our acquired and developed technologies enable us to offer turnkey interactive rich-media services, deliver online marketing products and wireless content delivering applications and systems.

mg3 proTM

mg3 proTM is an interactive marketing solution, which brings life to permission-based online campaigns through voice, sound, dynamic graphics and streaming video. Our interactive marketing software combines compression, streaming and cross-platform technologies, which made sending and viewing quality rich-media email messages possible on multi platforms with existing bandwidth. Email marketing campaign messages created by using mg3 proTM are Java-based and can be viewed by any recipient with Java enabled email clients or computer platforms and absolutely no installation of players or plug-ins is needed.

Combining technology and professional services, we deliver turnkey digital interactive marketing campaigns for our clients in all industries. mg3 proTM service includes design, production, deployment, hosting, tracking and reporting of all online marketing campaigns and corporate communications.

mg3 proTM offers multiple distinct services:

·

Creative Design –our experienced creative designers work with clients to come up with creative advertising ideas and turn them into visual and audio storyboards.

·

Message Production –our producers create impressive MediaG3 rich-media email messages with attention-grabbing audio, graphics, sound tracks, animation, video, interaction and personalization based on visual and audio storyboards.

·

Scalable Deployment –our powerful servers deliver the rich-media email messages to any size of recipients. Each boot trap message is only 4k – 6k and does not burden recipients’ machines.

·

Intelligent Delivery –our intelligent “sniffer” can detect the recipients’ platforms and speed of connections to optimize the delivery mechanism and achieve consistent quality viewing

experience. MediaG3’s powerful and resourceful “stream servers” will stream the message content to the recipients’ email clients while the message is viewed. There is no long waiting and downloading time.

·

Accurate Tracking – Statistical information of the marketing campaign will be collected and compiled in real-time into an ROI report. Information such as total open, unique open, time spent in the message, click through rate and forward rate will be tracked and reported to clients.

mg3 studioTM

mg3 studioTM, scheduled to be introduced in May 2007, is the complete digital marketing solution that our users need to build their opt-in mailing lists and publish their dynamic rich-media online advertisement, promotion, newsletters, press release and other communications. Through an intuitive and friendly Graphic User Interface, (GUI), the users can create, deploy and manage their direct email advertising campaigns, right from their browsers.

mg3 studioTM provides rich-media email to capture customers’ attention, increase the response rate, shorten the sales cycle, and achieve greater return on investment by building brand recognition, product loyalty and sales growth. The customized rich-media email messages can be sent to targeted customers with our viral marketing feature, which broadens the exposure and reach of product and events.

With simplicity and a varying range of email messaging features, mg3 studioTM gives the user the ability to extend and enhance branding, sales generation, communication and advertising efforts. Having a user-friendly interface, the studio is a dynamic tool that adds impact and clarity to email messages using impressive and original technology.

From creative design to production, deployment and tracking, mg3 studioTM provides comprehensive and cost-effective rich-media solutions for users. Using our system, users are able to deliver effective and persuasive marketing campaigns and get impressive and measurable results.

mg3 studioTMhas the following benefits:

?

Initiative - Instead of waiting for people to come to a web site, mg3 studioTM rich-media email brings the content rich and live information to the targeted customers.

?