As filed with the Securities and Exchange Commission on August 3, 2006

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Saxon Capital, Inc.

(Exact name of registrant as specified in its charter)

| | | | |

| Maryland | | 6798 | | 30-0228584 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

Saxon Funding Management, Inc.

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 6798 | | 20-0870693 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

Saxon Capital Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 6700 | | 20-0804949 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

SCI Services, Inc.

(Exact name of registrant as specified in its charter)

| | | | |

| Virginia | | 7380 | | 54-1802882 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

Saxon Mortgage Services, Inc.

(Exact name of registrant as specified in its charter)

| | | | |

| Texas | | 7380 | | 75-1071561 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

Saxon Mortgage, Inc.

(Exact name of registrant as specified in its charter)

| | | | |

| Virginia | | 6162 | | 52-1805887 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

Saxon Holding, Inc.

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 6700 | | 80-0083863 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

4860 Cox Road

Suite 300

Glen Allen, Virginia 23060

(804) 967-7400

(Address, including zip code, and telephone number, including area code, of registrants’ principal executive offices)

Michael L. Sawyer

Chief Executive Officer

Saxon Capital, Inc.

4860 Cox Road, Suite 300

Glen Allen, Virginia 23060

(804) 967-7400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Howard B. Adler, Esq.

Gibson, Dunn & Crutcher LLP

1050 Connecticut Avenue, N.W.

Washington, DC 20036

(202) 955-8500

Joerg H. Esdorn, Esq.

Gibson, Dunn & Crutcher LLP

200 Park Avenue

New York, New York 10166

(212) 351-4000

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this registration statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

Title of each class of securities to be registered | | Amount to be

registered | | Proposed maximum

offering price

per unit(1) | | Proposed

maximum aggregate offering price(1) | | Amount of registration fee |

12% Senior Notes due 2014 | | $150,000,000 | | 100% | | $150,000,000 | | $16,050 |

Guarantees of 12% Senior Notes due 2014 | | — | | — | | — | | (2) |

| (1) | Exclusive of accrued interest, if any, and estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(f) under the Securities Act of 1933, as amended. |

| (2) | The guarantees by Saxon Funding Management, Inc., Saxon Capital Holdings, Inc., SCI Services, Inc., Saxon Mortgage Services, Inc., Saxon Mortgage, Inc. and Saxon Holding, Inc. of the obligations of Saxon Capital, Inc. under the notes are also being registered hereby. No additional registration fee is due for the guarantees pursuant to Rule 457(n) under the Securities Act of 1933, as amended. |

The registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. This prospectus is not an offer to sell these securities nor a solicitation of an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective.

Subject to Completion, dated August 3, 2006

PROSPECTUS

$150,000,000

Saxon Capital, Inc.

Guaranteed by

Saxon Funding Management, Inc.

Saxon Capital Holdings, Inc.

SCI Services, Inc.

Saxon Mortgage Services, Inc.

Saxon Mortgage, Inc.

Saxon Holding, Inc.

Exchange Offer for All Outstanding

12% Senior Notes due 2014

(CUSIP Nos. 80556PAA2, U8038TAA0 and 80556PAB0)

for new 12% Senior Notes due 2014

in an offering registered under the Securities Act of 1933

This exchange offer will expire at 5:00 p.m., New York City time, on , 2006, unless extended.

The exchange notes:

| | • | | The terms of the registered 12% Senior Notes due 2014 to be issued in the exchange offer are substantially identical to the terms of the outstanding 12% Senior Notes due 2014, except that the exchange notes will not be subject to the transfer restrictions, registration rights and liquidated damages provisions that relate to the outstanding notes. |

| | • | | We are offering the exchange notes pursuant to a registration rights agreement that we entered into in connection with the issuance of the outstanding notes. |

Material terms of the exchange offer:

| | • | | The exchange offer expires at 5:00 p.m., New York City time, on , 2006, unless extended. |

| | • | | Upon expiration of the exchange offer, all outstanding notes that are validly tendered and not withdrawn will be exchanged for an equal principal amount of exchange notes. |

| | • | | You may withdraw tendered outstanding notes at any time prior to the expiration of the exchange offer. |

| | • | | The exchange offer is not subject to any minimum tender condition, but is subject to customary conditions. |

| | • | | The exchange of the exchange notes for outstanding notes will not be a taxable exchange for U.S. federal income tax purposes. |

| | • | | There is no existing public market for the outstanding notes or the exchange notes. We do not intend to list the exchange notes on any securities market. |

You should carefully consider therisk factors beginning on page 10 of this prospectus before deciding whether or not to participate in the exchange offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or the accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated , 2006

Table of contents

We have not authorized anyone to give any information or make any representation about us that is different from or in addition to that contained in this prospectus. Therefore, if anyone does give you information of this sort, you should not rely on it as authorized by us. If you are in a jurisdiction where offers to sell, or solicitations of offers to purchase, the securities offered by this document are unlawful, or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this document does not extend to you. You should assume that the information contained in this prospectus is accurate only as of the date on the front of this prospectus, regardless of the date of delivery of this prospectus or the sale of the securities made hereunder.

Where you can find more information

We have filed with the Securities and Exchange Commission (the “Commission”) a registration statement on Form S-4 (File No. 333- ) with respect to the securities we are offering for exchange. This prospectus, which forms part of the registration statement, does not contain all of the information included in the registration statement, including its exhibits. For further information about us and the securities described in this prospectus, you should refer to the registration statement and its exhibits. We will provide without charge to each person to whom a copy of this prospectus has been delivered, who makes a written or oral request, this information and any and all of the documents referred to herein, except the exhibits to those documents (unless they are specifically incorporated by reference in those documents), including the registration rights agreement and indenture for the notes, which are summarized in this prospectus, by writing or calling us at the following address or telephone number.

Investor Relations

Saxon Capital, Inc.

4860 Cox Road, Suite 300

Glen Allen, Virginia 23060

(804) 967-7400

email address: InvestorRelations@saxonmtg.com

In order to ensure timely delivery, you must request the information no later than five business days before the expiration of the exchange offer. Therefore, you must request this information no later than , 2006.

i

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We file annual, quarterly and current reports, proxy statements and other information required by the Exchange Act with the Commission. You may read and copy our filings, including the registration statement of which this prospectus forms a part, at the Commission’s public reference room located at 100 F Street, N.E., Washington, D.C. 20549. Please call the Commission at 1-800-SEC-0330 for further information regarding the Commission’s public reference room. Our Commission filings are also available to the public from the Commission’s website at www.sec.gov.

Our website is www.saxonmortgage.com. We make available free of charge on our website, via a link to a third-party website, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and proxy statements, and forms 3, 4 and 5 filed on behalf of directors and executive officers, and any amendments to such reports filed or furnished pursuant to the Exchange Act as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Commission. Information contained on our website is not, and should not be interpreted to be, part of this prospectus.

We incorporate by reference into this prospectus some of the information that we file with the Commission, which means that we can disclose important business and financial information to you by referring you to those filings. We incorporate by reference into this prospectus the documents listed below and any future filings made by us with the Commission under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus and prior to the completion of the exchange offer:

| | • | | our Annual Report on Form 10-K for the year ended December 31, 2005, filed on March 31, 2006 (the “2005 Form 10-K”), which incorporates by reference certain portions of our proxy statement dated April 20, 2006; |

| | • | | our Quarterly Report on Form 10-Q for the quarter ended March 31, 2006, filed on May 9, 2006 (the “First Quarter 2006 Form 10-Q”); and |

| | • | | our Current Reports on Form 8-K filed on March 10, 2006, March 16, 2006, March 24, 2006, May 2, 2006, May 5, 2006, May 12, 2006, June 9, 2006, June 20, 2006, and June 23, 2006. |

Nothing in this prospectus is to be deemed to incorporate information furnished but not filed with the Commission pursuant to Item 2.02 or Item 7.01 of Form 8-K other than the information furnished in our Current Reports on Form 8-K filed on March 24, 2006 and June 23, 2006.

Our Commission file number is 001-32447. Any statements made in future Commission filings that are incorporated by reference into this prospectus will automatically update this prospectus, and any statements made in this prospectus update and supersede the information contained in past Commission filings incorporated by reference into this prospectus.

Saxon Funding Management, Inc., Saxon Capital Holdings, Inc., SCI Services, Inc., Saxon Mortgage Services, Inc., Saxon Mortgage, Inc. and Saxon Holding, Inc., which are guaranteeing the obligations of Saxon Capital, Inc. under the notes, are consolidated wholly-owned subsidiaries of Saxon Capital, Inc. Under Commission rules, the guarantors are not required to file separate reports with the Commission, although certain consolidated financial information about the guarantors can be found in the footnotes to our financial statements.

ii

Special note regarding forward-looking statements

Certain information contained in this prospectus constitutes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, or the Securities Act, and Section 21E of the Exchange Act. Generally, forward-looking statements can be identified by the use of forward-looking terminology including, but not limited to, “may,” “expect,” “intend,” “should,” “anticipate,” “estimate,” “is likely to,” “could,” “are confident that” or “believe” or comparable terminology. All statements in this prospectus addressing our operating performance, events or developments that we expect or anticipate will occur in the future, including statements relating to net interest income growth, earnings or earnings per share growth and market share, as well as statements expressing optimism or pessimism about future operating results, are forward-looking statements. The forward-looking statements are based upon management’s views and assumptions as of the date of this prospectus, regarding future events and operating performance and are applicable only as of the dates of such statements. By their nature, all forward-looking statements involve risk and uncertainties. Actual results may differ materially from those contemplated by the forward-looking statements for a number of reasons, including, but not limited to, those addressed in “Risk factors” below and in the 2005 Form 10-K and the First Quarter 2006 Form 10-Q, as well as the following risks and uncertainties:

| | • | | decreases in residential real estate values, which could reduce both the credit quality of our mortgage loan portfolio and the ability of borrowers to use their home equity to obtain cash through mortgage loan refinancings, would adversely impact our ability to produce new mortgage loans; |

| | • | | changes in overall regional or local economic conditions or changes in interest rates, particularly those conditions that affect demand for new housing, housing resales or the value of houses; |

| | • | | our ability to successfully implement our growth strategy throughout the various cycles experienced by our industry; |

| | • | | greater than expected declines in consumer demand for residential mortgage loans, particularly sub-prime loans; |

| | • | | our ability to sustain loan production growth at historical levels; |

| | • | | continued availability of financing facilities and access to the securitization markets or other funding sources; |

| | • | | our ability to securitize our loans at favorable financing rates; |

| | • | | deterioration in the credit quality of our loan portfolio and the loan portfolios of others serviced by us; |

| | • | | lack of access to the capital markets for additional funding if our existing sources of funding become unavailable; |

| | • | | challenges in successfully expanding our servicing platform and technological capabilities; |

| | • | | our ability to maintain our current servicer ratings; |

| | • | | difficulty in satisfying complex rules in order for us to maintain qualification as a real estate investment trust, or REIT, for federal income tax purposes; |

| | • | | the ability of certain of Saxon Capital’s subsidiaries to continue to qualify as qualified REIT subsidiaries for federal income tax purposes; |

| | • | | our ability to operate effectively within the limitations imposed by the federal income tax laws and regulations applicable to REITs; |

| | • | | changes in federal income tax laws and regulations applicable to REITs; |

| | • | | changes in mortgage loan prepayment speeds; |

iii

| | • | | decreased valuations of our mortgage loan portfolio and mortgage servicing rights, or MSRs, due to a variety of factors, including catastrophic environmental influences or natural disasters such as hurricanes, tornados and earthquakes; |

| | • | | future litigation developments or regulatory or enforcement actions; |

| | • | | continued increased competitive conditions; and |

| | • | | changes in the legal and regulatory environment in our industry. |

These risks and uncertainties should be considered in evaluating forward-looking statements, and undue reliance should not be placed on such statements. We undertake no obligation to update publicly any of these statements in light of future events except as required in subsequent periodic reports we file with the Commission.

iv

Summary

The following summary contains basic information about us and this exchange offer, but does not contain all the information that may be important to you. For a more complete understanding of this exchange offer, we encourage you to read this entire prospectus and the documents incorporated by reference in this prospectus before making a decision whether to tender your outstanding notes in exchange for exchange notes.

In this prospectus, unless the context states or suggests otherwise, references to “we,” “us,” and “our” refer to Saxon Capital, Inc., a Maryland corporation formerly known as Saxon REIT, Inc., which we refer to as “Saxon Capital,” and its direct and indirect subsidiaries, including, among others: Saxon Capital Holdings, Inc., a Delaware corporation, which we refer to as “Saxon Capital Holdings;” Saxon Mortgage, Inc., a Virginia corporation, which we refer to as “Saxon Mortgage;” Saxon Mortgage Services, Inc., a Texas corporation, which we refer to as “Saxon Mortgage Services;” Saxon Funding Management, Inc., a Delaware corporation, which we refer to as “Saxon Funding Management;” and SCI Services, Inc., a Virginia corporation, which we refer to as “SCI Services.” References to “Old Saxon” refer to Saxon Capital, Inc., a Delaware corporation, which was formed on April 23, 2001 and acquired all of the issued and outstanding capital stock of our predecessor from Dominion Capital, Inc., a wholly-owned subsidiary of Dominion Resources, Inc., which we refer to as “Dominion Capital,” on July 6, 2001. Saxon Capital succeeded to the business of Old Saxon effective September 24, 2004. References to “America’s MoneyLine” refer to America’s MoneyLine, Inc., a Virginia corporation, which was merged into Saxon Mortgage effective December 31, 2005. In this prospectus, all references to our mortgage loans and the loans we service for others are references to primarily sub-prime mortgage loans unless the context otherwise requires.

Unless otherwise indicated, financial information included in this prospectus is presented on a historical basis, consolidated to include the financial information of Saxon Capital and its subsidiaries. The historical financial results may not be indicative of future financial performance.

In this prospectus, the term “initial notes” refers to Saxon Capital’s outstanding 12% senior notes due 2014, which were issued on May 4, 2006, and the term “exchange notes” refers to Saxon Capital’s 12% senior notes due 2014 offered by this prospectus. Unless the context states or suggests otherwise, the term “notes” refers to the initial notes and the exchange notes, and the term “indenture” refers to the indenture that governs both the initial notes and the exchange notes.

Our company

We are a real estate investment trust, or REIT, that originates, purchases, securitizes and services residential mortgage loans and manages a portfolio of mortgage assets. Our mortgage loans and the mortgage loans we service for others are considered non-conforming because of the credit profiles of the borrowers (generally referred to as sub-prime mortgage loans) or the size of the loans (generally referred to as jumbo mortgage loans), or both.

We have been originating, purchasing and managing a portfolio of mortgage loans and servicing mortgage loans since 1995. We have been securitizing mortgage loans since 1996, and we began operating as a REIT in September 2004. We believe that the combination of our disciplined underwriting standards and our strong servicing capabilities differentiates us from our competitors. As of December 31, 2005 and March 31, 2006, the principal balance of our owned mortgage loan portfolio was $6.4 billion and $6.5 billion, respectively, and our servicing portfolio consisted of $24.8 billion and $26.8 billion, respectively, in principal balances of mortgage loans.

1

Our primary business strategy is to generate stable income from managing and growing our on-balance sheet portfolio of mortgage loans and from servicing our own and third-party mortgage loans. We operate through three business segments:

| | • | | Mortgage loan production. We originate and purchase mortgage loans through our three loan production channels—wholesale, correspondent and retail. We conduct our mortgage loan production and limited whole loan sale activities, as well as administrative functions, primarily through Saxon Mortgage, a taxable REIT subsidiary, or TRS. |

| | • | | Portfolio. We hold and securitize our mortgage loans primarily in Saxon Funding Management, a qualified REIT subsidiary, or QRS. We also securitize mortgage servicing advance receivables and perform master servicing primarily through Saxon Funding Management. In addition, we originate a portion of our mortgage loans through Saxon Funding Management. |

| | • | | Mortgage loan servicing. We service our owned mortgage loan portfolio, as well as loans owned by third parties, through Saxon Mortgage Services, a TRS. |

Our borrowers typically have limited credit histories, have high levels of consumer debt or have experienced credit difficulties in the past. Mortgage loans to such borrowers are generally classified as “non-conforming” because they do not conform to or meet the underwriting guidelines of government-sponsored entities, or GSEs, such as the Government National Mortgage Association, or Ginnie Mae, Fannie Mae, or the Federal Home Loan Mortgage Corporation, or Freddie Mac, and “sub-prime” because of the borrowers’ credit profiles. We originate and purchase loans on the basis of our assessment of the borrower’s ability to repay the mortgage loan, the borrower’s historical pattern of debt repayment and the sufficiency of the loan collateral, including the amount of equity in the borrower’s property (as measured by the borrower’s loan-to-value ratio, or LTV). With respect to the loans we originate, the interest rate we charge on a loan and the maximum loan amount we extend are determined based upon our underwriting guidelines and risk-based pricing matrices.

We generate revenues primarily from the net interest income earned on our mortgage loans as well as from mortgage loan servicing fees from third parties. For the year ended December 31, 2005, net interest income after provision for mortgage loan losses was 59%, and servicing income, net of amortization and impairment was 28%, of our total net revenues and gains. The remainder of our total net revenues and gains for the year ended December 31, 2005 consisted of derivatives gains and gains on sale of assets (primarily mortgage loans). For the three months ended March 31, 2006, net interest income after provision for mortgage loan losses was 55%, and servicing income, net of amortization and impairment was 31%, of our total net revenues and gains. Derivatives gains contributed the remainder of our total net revenues and gains for the three months ended March 31, 2006, offset by losses on sale of assets. For the year ended December 31, 2005 and the three months ended March 31, 2006, we generated total net revenues and gains of $258.5 million and $63.8 million, respectively.

For the years ended December 31, 2004 and 2005, we originated or purchased (including loans acquired in clean-up calls of securitization pools serviced by us in 2004) $3.8 billion and $3.3 billion, respectively, in principal balances, of residential mortgage loans. For the three months ended March 31, 2005 and 2006, we originated or purchased $0.7 billion and $0.8 billion, respectively, in principal balances, of residential mortgage loans. Of the loans we originated and purchased in the year ended December 31, 2005, 45% came from our wholesale channel, 34% came from our correspondent channel and 21% came from our retail channel. Of the loans we originated and purchased in the three months ended March 31, 2006, 49% came from our wholesale channel, 33% came from our correspondent channel and 18% came from our retail channel.

Generally, we initially finance our mortgage loan originations and purchases, and our acquisition of mortgage servicing rights, or MSRs, through one of several short-term committed warehouse lines of credit or repurchase facilities. Subsequently, we finance the mortgage loans on a long-term basis using asset-backed securities issued through securitization trusts. We structure our mortgage loan securitizations as financing

2

transactions, which means that the mortgage loans and asset-backed securitizations remain on our balance sheet as assets and liabilities, respectively. For the years ended December 31, 2004 and 2005, we securitized $3.2 billion and $3.4 billion, respectively, of residential mortgage loans. For the three months ended March 31, 2005 and 2006, we securitized $1.0 billion and $0.1 billion, respectively, of residential mortgage loans.

Our mortgage loan servicing portfolio grew from $20.2 billion as of December 31, 2004 to $24.8 billion as of December 31, 2005, including $18.4 billion of loans serviced for third parties as of December 31, 2005. Our mortgage loan servicing portfolio was $26.8 billion as of March 31, 2006, including $20.3 billion of loans serviced for third parties.

Corporate information

Saxon Capital was incorporated in Maryland on February 5, 2004 and is the issuer of the notes.

Saxon Funding was incorporated in Delaware on March 12, 2004 and is guaranteeing the notes.

Saxon Capital Holdings was incorporated in Delaware on February 18, 2004 and is guaranteeing the notes.

SCI Services was incorporated in Virginia on April 1, 1996 and is guaranteeing the notes.

Saxon Mortgage Services was incorporated in Texas on August 10, 1960 and is guaranteeing the notes.

Saxon Mortgage was incorporated in Virginia on January 15, 1993 and is guaranteeing the notes.

Saxon Holding, Inc. was incorporated in Delaware on November 4, 2003 and is guaranteeing the notes.

Our principal executive offices are located at 4860 Cox Road, Suite 300, Glen Allen, Virginia 23060, and our telephone number is (804) 967-7400. Our Internet website address iswww.saxonmortgage.com. None of the information contained on our website is a part of this prospectus. Saxon Capital’s common stock currently trades on the New York Stock Exchange under the symbol “SAX.”

3

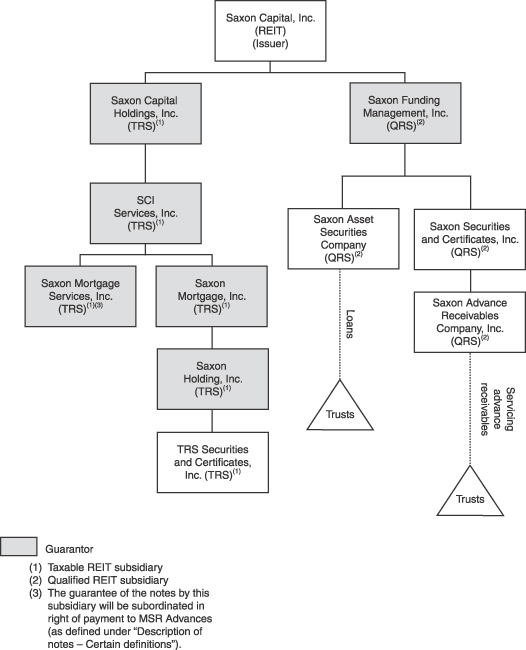

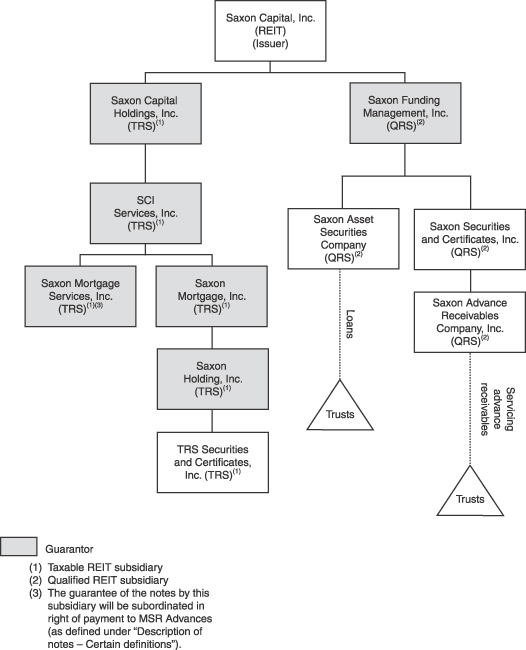

Our organizational structure

The following chart shows our organizational structure as of the date of this prospectus. This chart is provided for illustrative purposes only and does not represent all of our legal entities or all obligations of such entities. For more information about our outstanding indebtedness, see “Description of certain indebtedness.”

4

Summary of the exchange offer

The following is a summary of the principal terms of the exchange offer. A more detailed description is contained in the section of this prospectus entitled “The exchange offer.”

Exchange notes offered | $150,000,000 aggregate principal amount of exchange 12% senior notes due 2014, the offering and sale of which will have been registered under the Securities Act. The terms of the exchange notes are substantially identical to the terms of the initial notes, except that the transfer restrictions, registration rights and rights to increased interest in addition to the stated interest rate on the initial notes (“Liquidated Damages”) provisions relating to the initial notes will not apply to the exchange notes. See “Description of notes” for a full description of which restrictions, rights and interest provisions do not apply to the exchange notes. |

Initial notes | $150,000,000 aggregate principal amount of outstanding 12% senior notes due 2014 issued on May 4, 2006. |

The exchange offer | We are offering to issue exchange notes in a registered offering in exchange for a like principal amount and like denomination of our initial notes. We are offering to issue these exchange notes in this registered offering to satisfy our obligations under a registration rights agreement that we entered into with the initial purchaser of the initial notes when we sold the initial notes in a transaction that was exempt from the registration requirements of the Securities Act. You may tender your initial notes for exchange in whole or in part in minimum denominations of $2,000 and integral multiples of $1,000 by following the procedures described under the caption “The exchange offer.” |

Tenders; Expiration date; Withdrawal | The exchange offer will expire at 5:00 p.m., New York City time, on , , which is 20 business days after the date of mailing of notice of the exchange offer, unless we extend it. If you decide to exchange your initial notes for exchange notes, you must acknowledge that you are not engaging in, and do not intend to engage in, a distribution of the exchange notes. You may withdraw any initial notes that you tender for exchange at any time prior to the expiration of the exchange offer. If we decide for any reason not to accept any initial notes you have tendered for exchange, those initial notes will be returned to you without cost promptly after the expiration or termination of the exchange offer. See “The exchange offer—Terms of the exchange offer” for a more complete description of the tender and withdrawal provisions. |

Conditions to the exchange offer | The exchange offer is subject to customary conditions, some of which we may waive. See “The exchange offer—Conditions to the exchange offer” for a description of the conditions. Other than the federal securities laws, we are not subject to federal or state regulatory requirements in connection with the exchange offer. |

5

U.S. federal income tax considerations | Your exchange of initial notes for exchange notes to be issued in the exchange offer will not result in any gain or loss to you for U.S. federal income tax purposes. |

Regulatory approvals | No material federal or state regulatory approval will be necessary in connection with the exchange offer, other than the effectiveness of the exchange offer registration statement under the Securities Act. |

Use of proceeds | We will not receive any cash proceeds from the exchange offer. |

Exchange agent | We expect to appoint Deutsche Bank Trust Company Americas as our exchange agent for the exchange offer. |

Consequences of failure toexchange your initial notes | Initial notes that are not tendered or that are tendered but not accepted will remain outstanding, continue to accrue interest and continue to be subject to the restrictions on transfer that are described in the legend on those notes. In general, you may offer or sell your initial notes only in a transaction registered under, or pursuant to an exemption from, the Securities Act and applicable state securities laws. Except in limited circumstances with respect to specific types of holders of initial notes, we, however, will have no further obligation to register the offering and sale of initial notes. If you do not participate in the exchange offer, the liquidity of your initial notes could be adversely affected. |

Consequences of exchangingour initial notes | Based on interpretations of the staff of the Commission, we believe that you may offer for resale, resell or otherwise transfer the exchange notes that we issue in the exchange offer without complying with the registration and prospectus delivery requirements of the Securities Act if you: |

| | • | | acquire the exchange notes issued in the exchange offer in the ordinary course of your business; |

| | • | | are not participating, do not intend to participate, and have no arrangement or undertaking with anyone to participate, in the distribution of the exchange notes issued to you in the exchange offer; and |

| | • | | are not an “affiliate” of our company as defined in Rule 405 of the Securities Act. |

If any of these conditions is not satisfied and you transfer any exchange notes issued to you in the exchange offer without delivering a proper prospectus or without qualifying for a registration exemption, you may incur liability under the Securities Act. We will not be responsible for or indemnify you against any liability you may incur.

Any broker-dealer that acquires exchange notes in the exchange offer for its own account in exchange for initial notes which it acquired through market-making or other trading activities, must acknowledge that it will deliver a prospectus when it resells or transfers any exchange notes issued in the exchange offer. See “Plan of distribution” for a description of the prospectus delivery obligations of broker-dealers in the exchange offer.

6

Summary of the terms of the exchange notes

The terms of the exchange notes are substantially the same as the initial notes, except that the exchange notes:

| | • | | will be issued and sold in an offering registered under the Securities Act; |

| | • | | will not contain transfer restrictions and registration rights that relate to the initial notes; and |

| | • | | will not contain Liquidated Damages provisions, which relate to the payment of additional interest to be made to the holders of the initial notes under circumstances related to the timing of the exchange offer. |

The indenture governing the initial notes will also govern the exchange notes. The following summary contains basic information about the notes upon completion of the exchange offer and is not intended to be complete. It does not contain all the information that is important to you. For a more complete understanding of the exchange notes, please refer to the section of this prospectus entitled “Description of notes.”

Issuer | Saxon Capital, Inc. |

Securities offered | $150.0 million aggregate principal amount of 12% Senior Notes due 2014 in exchange for a like amount of initial notes. |

Interest payment dates | May 1 and November 1 of each year, beginning November 1, 2006. |

Guarantees | The notes will be guaranteed by certain of Saxon Capital’s subsidiaries. |

Ranking | The notes will be Saxon Capital’s general unsecured obligations and will rank senior to all of Saxon Capital’s future debt that is expressly subordinated in right of payment to the notes. The notes will rank equally with all of Saxon Capital’s existing and future liabilities that are not so subordinated and will be effectively subordinated to all of Saxon Capital’s secured debt (to the extent of the value of the collateral securing such debt) and structurally subordinated to all of the liabilities of any of Saxon Capital’s subsidiaries that do not guarantee the notes. |

| | The guarantees will be general unsecured obligations of the guarantors and will rank senior to all of their existing and future debt that is expressly subordinated in right of payment to the guarantees. The guarantees will rank equally with all existing and future liabilities of such guarantors that are not so subordinated and will be effectively subordinated to all of such guarantors’ secured debt to the extent of the collateral securing such debt. However, the guarantee of certain guarantors will be subordinated in right of payment to the obligations of such guarantors under any warehouse facility with respect to, and to the extent of, MSR Advances (as defined under “Description of notes—Certain definitions”). |

7

Optional redemption uponequity offerings | At any time (which may be more than once), on or prior to May 1, 2009, Saxon Capital may, at its option, redeem up to 35% of the outstanding principal amount of outstanding notes with money raised in certain equity offerings, at a redemption price of 112.000%, plus accrued interest, if any. |

Make whole redemption | Saxon Capital may redeem the notes, in whole or in part, at any time, at a redemption price equal to 100% of the principal amount of the notes redeemed plus accrued interest and a make whole premium. |

Change of control; asset sales;and excess cash flow | If Saxon Capital experiences specific kinds of changes of control and unless Saxon Capital has previously exercised its right to redeem all of the outstanding notes as described under “Description of notes— Redemption,” Saxon Capital will be required to make an offer to purchase the notes at a purchase price of 101% of the principal amount thereof, plus accrued but unpaid interest to the purchase date. See “Description of notes—Change of control.” |

| | If Saxon Capital sells assets under certain circumstances, it will be required to make an offer to purchase the notes at their face amount, plus accrued and unpaid interest to the purchase date. See “Description of notes—Limitation on asset sales.” |

| | For certain six-month periods, if we have Excess Cash Flow (as defined under “Description of notes—Certain definitions”), Saxon Capital may be required to offer to purchase an aggregate principal amount of notes equal to the lesser of such Excess Cash Flow and $10.0 million for such periods at a purchase price of 100% of their principal amount, plus any accrued and unpaid interest to the date of repurchase. See “Description of notes—Excess cash flow offer.” |

Certain covenants | The indenture restricts Saxon Capital’s ability and the ability of Saxon Capital’s restricted subsidiaries to, among other things: |

| | • | | incur certain additional indebtedness; |

| | • | | make certain distributions, investments and other restricted payments; |

| | • | | agree to any restrictions on the ability of restricted subsidiaries to make payments to Saxon Capital; |

| | • | | merge, consolidate or sell substantially all of Saxon Capital’s assets; and |

| | • | | enter into certain transactions with affiliates. |

8

The indenture also includes a maintenance of total unencumbered assets covenant (as defined under “Description of notes—Maintenance of total unencumbered assets”).

These covenants are subject to important exceptions and qualifications described under the heading “Description of notes.” The indenture does not restrict the ability of Saxon Capital or its restricted subsidiaries to incur Funding Indebtedness (as defined in the indenture). In addition, the indenture does not restrict Saxon Capital from paying a dividend on its common stock to the extent necessary to maintain its status as a REIT so long as no Default or Event of Default (as defined in the indenture) has occurred and is continuing with respect to the notes. Most of these covenants will be suspended during any time that the notes have investment grade ratings by both Standard & Poor’s and Moody’s Investors Service. However, such covenants will apply and such suspension will no longer be in effect if and when the notes cease to have investment grade ratings from either Standard & Poor’s or Moody’s Investors Service.

Risk factors

See “Risk factors” and other information included in this prospectus and in the 2005 Form 10-K and the First Quarter 2006 Form 10-Q for a discussion of factors you should consider carefully before investing in the exchange notes.

9

Risk factors

The exchange notes involve substantial risks similar to those associated with the initial notes. Before you tender your initial notes in the exchange offer, you should carefully consider the following factors in addition to the other information contained in or incorporated by reference in this prospectus and the risks and information contained in the 2005 Form 10-K and the First Quarter 2006 Form 10-Q.

Risks relating to the exchange

We cannot assure you that an active trading market for the exchange notes will exist if you desire to sell the exchange notes.

There is no existing public market for the initial notes or the exchange notes. The liquidity of any trading market in the exchange notes, and the market prices quoted for the exchange notes, may be adversely affected by changes in the overall market for these types of securities, and by changes in our financial performance or prospects or in the prospects for companies in our industry generally. As a result, we cannot assure you that you will be able to sell the exchange notes or that, if you can sell your exchange notes, you will be able to sell them at an acceptable price.

You may have difficulty selling any initial notes that you do not exchange.

If you do not exchange your initial notes for exchange notes in the exchange offer, you will continue to hold initial notes subject to restrictions on their transfer. Those transfer restrictions are described in the indenture governing the initial notes and in the legend set forth on the initial notes, and arose because we originally issued the initial notes under an exemption from the registration requirements of the Securities Act.

In general, you may offer or sell your initial notes only in a transaction registered under the Securities Act and applicable state securities laws or pursuant to an exemption from those requirements. We do not currently intend to register the offering and sale of initial notes under the Securities Act or any state securities laws. If a substantial amount of the initial notes is exchanged for a like amount of the exchange notes issued in the exchange offer, the liquidity of your initial notes could be adversely affected. See “The exchange offer—Consequences of failure to exchange initial notes” for a discussion of additional consequences of failing to exchange your initial notes.

If you do not exchange your initial notes for exchange notes, you will continue to have restrictions on your ability to resell them.

The offering and sale of the initial notes was not registered under the Securities Act or under the securities laws of any state and the initial notes may not be resold, offered for resale or otherwise transferred other than in a registered offering or pursuant to an exemption from the registration requirements of the Securities Act and applicable state securities laws. If you do not exchange your initial notes for exchange notes pursuant to the exchange offer, you will not be able to resell, offer to resell or otherwise transfer the initial notes other than in an offering registered under the Securities Act or unless you resell them, offer to resell them or otherwise transfer them under an exemption from the registration requirements of, or in a transaction not subject to, the Securities Act. In addition, once the exchange offer has terminated, we will no longer be under an obligation to register the initial notes under the Securities Act except in the limited circumstances provided in the registration rights agreement. In addition, to the extent that initial notes are tendered for exchange and accepted in the exchange offer, any trading market for the untendered and tendered but unaccepted initial notes could be adversely affected.

10

Risks relating to the notes

Our substantial indebtedness could adversely affect our operations and financial condition and such indebtedness (together with our annual REIT dividend requirement) could prevent us from fulfilling our obligations under the notes.

We have a substantial amount of indebtedness. As of March 31, 2006, we had $6,655 million of total debt outstanding. On a pro forma basis, as of March 31, 2006, assuming we had completed, but had not applied the proceeds from, the offering of the initial notes, our aggregate outstanding indebtedness would have been $6,805 million. Our substantial indebtedness could have important consequences. For example, it may:

| | • | | limit our ability to invest operating cash flows in our business due to debt service requirements; |

| | • | | increase our vulnerability to economic downturns and changing market conditions; |

| | • | | make it more difficult for us to meet our debt service requirements if we experience a substantial decrease in our revenues or an increase in our expenses or a decline in the market value of the mortgage loans securing our borrowings; |

| | • | | increase our vulnerability to fluctuations in market interest rates, to the extent that the spread we earn between the interest we receive on our mortgage loans and the interest we pay under our indebtedness is reduced. |

| | • | | limit our ability to obtain short-term credit, including warehouse lines of credit or repurchase facilities, and to securitize our mortgage loans; |

| | • | | limit our ability to obtain additional financing to fund growth, working capital, acquisitions, capital expenditures, debt service requirements, including relating to the notes, or other cash requirements; |

| | • | | limit our operational flexibility in planning for and reacting to changes in our business, the industry in which we operate and the economy in general; and |

| | • | | place us at a competitive disadvantage compared to competitors that are not as highly leveraged and that may be better positioned to withstand economic downturns. |

Certain of our indebtedness contains financial covenants and other covenants that, if breached, would result in an event of default under such indebtedness.

In addition, to maintain our status as a REIT, we intend to pay annual cash dividends to our shareholders in an amount equal to at least 90% of our REIT taxable income (determined without regard to the dividends paid deduction and by excluding net capital gains and including, in some instances, taxable income recognized where we do not receive corresponding cash).

The notes and the guarantees are effectively junior to all of Saxon Capital’s and the guarantors’ secured indebtedness, structurally junior to all of the liabilities of Saxon Capital’s non-guarantor subsidiaries and are subordinated in right of payment to obligations of certain of Saxon Capital’s subsidiaries under any warehouse facility with respect to, and to the extent of, MSR Advances.

The notes are Saxon Capital’s general unsecured obligations. The notes are effectively junior to all of Saxon Capital’s secured debt (to the extent of the value of the collateral securing such debt) and structurally junior to all liabilities of any of Saxon Capital’s subsidiaries that do not guarantee the notes.

The notes are guaranteed by certain of Saxon Capital’s restricted subsidiaries. The guarantees are effectively junior to all of such guarantors’ secured debt to the extent of the collateral securing such debt. The guarantee of Saxon Mortgage Services is subordinated to its obligations under any warehouse facility with respect to, and to the extent of, MSR Advances. Saxon Capital’s subsidiaries that issue mortgage or asset-backed securities or mortgage pass-through securities, Saxon Capital’s special purpose, bankruptcy remote subsidiaries established in

11

connection with the issuance of any such securities and Saxon Capital’s bankruptcy remote subsidiaries principally engaged in holding residual interests and other interest in securitizations do not guarantee the notes.

In the event of a bankruptcy, liquidation or reorganization or similar proceeding relating to Saxon Capital or the guarantors, upon any distribution to Saxon Capital’s creditors or the creditors of the guarantors in a bankruptcy or similar proceeding relating to Saxon Capital or the guarantors, or if there is a payment default under, or an acceleration of, any secured indebtedness, the holders of Saxon Capital’s and the guarantors’ secured indebtedness will be entitled to claim their collateral. Because Saxon Mortgage Services has agreed that its obligations under any warehouse facility with respect to, and to the extent of, MSR Advances must be paid before it makes any payment on the notes, you may receive proportionately less than other unsubordinated creditors in any such proceeding. Accordingly Saxon Capital and the guarantors may not have enough assets remaining to pay you.

In the event of a bankruptcy, liquidation or reorganization or similar proceeding relating to any of Saxon Capital’s non-guarantor subsidiaries, holders of those entities’ indebtedness and their trade creditors will generally be entitled to payment of their claims from the assets of those subsidiaries before any assets are made available for distribution to Saxon Capital or the guarantor subsidiaries.

The indenture allows Saxon Capital and its subsidiaries to (1) incur substantial additional debt in the future without compliance with any incurrence-based test, (2) make substantial dividends and other restricted payments and (3) make investments, which could adversely affect our operations and financial condition and prevent Saxon Capital from fulfilling its obligations under the notes.

The terms of the indenture allow us to incur additional debt or to take other actions under certain specified circumstances that could substantially increase our debt-to-equity ratio or otherwise materially change our operations. Specifically, the indenture permits us to, among other things:

| | • | | incur unlimited debt under our warehouse lines of credit, repurchase facilities, securitizations and other Funding Indebtedness; |

| | • | | pay dividends to our shareholders of up to (1) while we are a REIT, the sum of 95% of our consolidated net income plus amortization expense associated with mortgage servicing rights, which expense (together with 95% of our consolidated net income) may not exceed the amount necessary to be paid as a dividend to maintain our status as a REIT or (2) if we are not a REIT, 50% of our cumulative consolidated net income (or, in either case, minus cumulative consolidated net loss); and |

If new debt is added to our current debt levels, we make substantial dividend distributions or we otherwise enter into transactions that affect our operations, the related risks that we now face could intensify.

The agreements and instruments governing Saxon Capital’s debt and the debt of its subsidiaries contain restrictions and limitations that could significantly affect our ability to operate our business, as well as significantly affect our liquidity, and adversely affect the holders of the notes.

The warehouse lines of credit and repurchase facilities and the indenture contain a number of significant covenants that could adversely affect the holders of the notes and our ability to operate our business, as well as significantly affect our liquidity. These covenants will restrict Saxon Capital’s and its subsidiaries’ ability to:

| | • | | incur additional debt, except for warehouse lines of credit, repurchase facilities, securitizations and other Funding Indebtedness; |

| | • | | repurchase or redeem debt; |

| | • | | make certain investments or acquisitions; |

12

| | • | | receive distributions from subsidiaries; |

| | • | | dispose of assets or merge; |

| | • | | enter into related party transactions; and |

Furthermore, our warehouse lines of credit and repurchase facilities require us to, among other things, comply with specified financial ratio requirements, meet specified financial tests and provide audited financial statements. Our ability to comply with these provisions may be affected by events beyond our control.

The breach of any covenants or obligations in the foregoing indebtedness, not otherwise waived or amended, could result in a default under the applicable debt agreement or instrument and could trigger acceleration of the related debt, which in turn could trigger defaults under other agreements governing our other indebtedness. Our warehouse lines of credit and repurchase facilities prohibit Saxon Capital’s subsidiaries from making distributions to Saxon Capital if a default has occurred and is continuing under those agreements. In addition, the secured lenders under our facilities could foreclose on their collateral and exercise other rights of secured creditors. Any default under those facilities, the indenture or our other debt could adversely affect our growth, our financial condition and our results of operations and our ability to make payments on the notes.

If our cash flow from operations is not sufficient to enable us to manage our debt levels, our interest expense could be materially higher than anticipated and our financial performance could be adversely affected and we may be required to refinance our debt, sell assets, borrow additional money or raise equity.

Our ability to generate the funds necessary to pay our expenses (in addition to the cash dividends to our shareholders required to maintain our status as a REIT) and to pay the principal and interest on the notes issued in connection with this offering, and our other outstanding debt, from the net interest earned on our mortgage loan portfolio, our servicing income and our other operations depends on many factors, some of which are beyond our control. Our ability to meet our expenses and debt service obligations will depend on our future performance, which will be affected by financial, business, economic, legislative, regulatory and other factors, including the demand for our mortgage loans, interest rate levels, our ability to securitize or otherwise monetize our inventory of mortgage loans, regulatory developments, prepayment speeds on our servicing portfolio and pressure from competitors. Any factor that negatively affects our results of operations, including our cash flow, may also negatively affect our ability to pay the principal and interest on our outstanding debt. If we are unable to manage our debt levels, our interest expense could be materially higher than anticipated and our financial performance could be adversely affected. We also may not be able to raise additional equity.

If we do not have enough funds to pay our debt service obligations, we may be required to refinance all or part of our existing debt, sell assets, borrow more money or raise equity. We may not be able to refinance any of our indebtedness, including the notes, on commercially reasonable terms or at all.

The issuer, Saxon Capital, is a holding company with no business operations or assets other than the equity interests it holds in its subsidiaries.

The issuer, Saxon Capital, is a holding company with no business operations or assets other than the equity interests it holds in its subsidiaries. It conducts substantially all of its operations through its subsidiaries. Saxon Capital’s access to cash comes from external financings, from dividends and advances from its subsidiaries and from cash flow on investments. The amount of dividends available to Saxon Capital depends largely upon the subsidiaries’ earnings and operating capital requirements. In addition, the terms of Saxon Capital’s subsidiaries’ warehouse lines of credit and repurchase facilities, other borrowing arrangements and restrictions relating to our securitizations may limit their ability to provide liquidity to Saxon Capital. Saxon Capital’s subsidiaries’ warehouse lines of credit and repurchase facilities prohibit them from making distributions to Saxon Capital if a default has occurred and is continuing under those agreements. The ability of the subsidiaries to make any

13

payments to Saxon Capital also depends on their business and tax considerations and legal restrictions as well as regulatory and rating agency considerations that may be applicable to our mortgage loan production, securitization trusts or servicing subsidiaries. The subsidiaries are separate and distinct legal entities and the non-guarantor subsidiaries are not obligated to pay any amounts due under the notes or to make any funds available therefor, whether by dividend, loan or other payment.

The guarantees may be unenforceable due to fraudulent conveyance statutes.

The guarantee obligations of Saxon Capital’s subsidiary guarantors may be subject to a challenge under state or federal fraudulent transfer laws. In general, under fraudulent transfer laws, a court can subordinate or void an obligation such as a guarantee if it determines that the obligation was incurred with actual intent to hinder, delay or defraud creditors or if the guarantor did not receive fair consideration or reasonably-equivalent value for the guarantee and:

| | • | | was insolvent or rendered insolvent as a result of the guarantee; |

| | • | | was engaged in a business or transaction for which the guarantor’s remaining assets constituted unreasonably small capital; or |

| | • | | intended to incur, or believed that it would incur, debts beyond its ability to pay as they mature. |

In addition, if a guarantee is voided, a court could void any payment by a guarantor pursuant to its guarantee and require that payment to be returned to the guarantor or to a fund for the benefit of the creditors of the guarantor.

The measures of insolvency for purposes of fraudulent transfer laws vary depending upon the law of the jurisdiction that is being applied in any proceeding to determine whether a fraudulent transfer had occurred. Generally an entity is insolvent if:

| | • | | the sum of its debts, including contingent or unliquidated debts, is greater than all of its property at a fair valuation; or |

| | • | | the present fair saleable value of its assets is less than the amount required to pay its probable liability on existing debts as they become due. |

The liability of each guarantor under the indenture is limited to the amount that will result in its guarantee not constituting a fraudulent conveyance, and there can be no assurance as to what standard a court would apply in making a determination as to what would be the maximum liability of each guarantor.

Your ability to resell the exchange notes may be limited by a number of factors; prices for the exchange notes may be volatile.

For purposes of resales, the exchange notes will be a new class of securities for which there currently is no established market, and an active or liquid trading market may never develop for the exchange notes. Although we intend to apply for the exchange notes to be eligible for reporting in The PORTAL® Market, a subsidiary of The Nasdaq Stock Market, Inc.®, we do not intend to apply for listing of the exchange notes on any securities exchange or on any automated dealer quotation system. A market may not develop for the exchange notes. Although we were informed by the initial purchaser of the initial notes that it intended to make a market in the exchange notes if they are issued, it is not obligated to do so, and any market-making may be discontinued at any time without notice by it. If a market for the exchange notes were to develop, the exchange notes could trade at prices that may be higher or lower than reflected by their initial offering price, depending on many factors, including among other things:

| | • | | changes in the overall market for non-investment grade securities; |

| | • | | changes in our financial performance or prospects; |

14

| | • | | rating agency downgrades; |

| | • | | the prospects for companies in our industry generally; |

| | • | | the number of holders of the notes; |

| | • | | the interest of securities dealers in making a market for the notes; and |

| | • | | prevailing interest rates. |

In addition, the market for non-investment grade indebtedness has been historically subject to disruptions that have caused substantial volatility in the prices of securities similar to the notes offered hereby. The market for the exchange notes, if any, may be subject to similar disruptions. Any such disruption could adversely affect the value of your exchange notes.

We may be unable to purchase your notes upon a change of control.

Upon the occurrence of specified “change of control” events, Saxon Capital will be required to offer to purchase all outstanding notes at 101% of the principal amount thereof, plus accrued and unpaid interest to the date of repurchase. The occurrence of a change of control or the financial effect of such repurchase also could constitute an event of default under the terms of our other indebtedness, which may entitle the holders thereof to declare such indebtedness to be immediately due and payable. In addition, the terms of our other indebtedness may prohibit Saxon Capital from repurchasing the notes. We may not have sufficient financial resources for Saxon Capital to purchase all of the notes that holders tender to it upon a change of control offer and to pay any such indebtedness that may be declared due and payable. See “Description of notes—Change of control.”

15

Use of proceeds

We will not receive any cash proceeds from the issuance of the exchange notes.

Capitalization

The following table sets forth the following as of March 31, 2006:

| | • | | our capitalization on an actual basis; and |

| | • | | our capitalization on an as adjusted basis to give effect to (a) the sale of the initial notes and our receipt of the net proceeds therefrom, after deducting the initial purchaser’s discounts and commissions and our expenses of that offering and (b) the temporary application of the net proceeds to pay down outstanding balances under our committed facilities, in each case as if they had occurred on March 31, 2006. |

This table should be read in conjunction with the sections captioned “Management’s discussion and analysis of financial condition and results of operations” in our 2005 Form 10-K and our First Quarter 2006 Form 10-Q and “Selected consolidated historical financial data” and our historical financial statements and the related notes and other information included elsewhere in this prospectus.

| | | | | | |

| | | As of March 31, 2006 |

(In thousands) | | Actual | | As adjusted |

Total debt: | | | | | | |

Mortgage loan-related debt: | | | | | | |

Committed facilities(1) | | $ | 980,669 | | $ | 836,137 |

Securitization financing | | | 5,599,832 | | | 5,599,832 |

| | | | | | |

Total mortgage loan-related debt | | | 6,580,501 | | | 6,435,969 |

12% Senior Notes due 2014 | | | — | | | 150,000 |

| | | | | | |

Total debt | | | 6,580,501 | | | 6,585,969 |

Total shareholders’ equity | | | 595,268 | | | 595,268 |

| | | | | | |

Total capitalization | | $ | 7,175,769 | | $ | 7,181,237 |

| | | | | | |

| (1) | As of March 31, 2006, our committed facilities consisted of $1.7 billion of committed warehouse lines of credit and repurchase agreement facilities. |

16

Selected consolidated historical financial data

The following selected statement of operations data for the years ended December 31, 2003, 2004 and 2005, the following selected statement of cash flow data for the years ended December 31, 2004 and 2005 and the following selected balance sheet data as of December 31, 2004 and 2005 have been derived from, and should be read in conjunction with, our audited consolidated financial statements that are included elsewhere in this prospectus. The following selected statement of operations data for the period from July 6, 2001 to December 31, 2001 and for the year ended December 31, 2002 and the following selected balance sheet data as of December 31, 2001, 2002 and 2003 have been derived from our consolidated financial statements that are not included in this prospectus. The following selected statement of operations data for the period January 1, 2001 to July 5, 2001 have been derived from our predecessor’s audited consolidated financial statements which are not included in this prospectus. The following selected statement of operations and statement of cash flow data for the three months ended March 31, 2005 and 2006 and the following selected balance sheet data as of March 31, 2006 have been derived from, and should be read in conjunction with, our unaudited consolidated financial statements that are included elsewhere in this prospectus. The selected statement of operations data for the period from July 6, 2001 to December 31, 2001, for the years ended December 31, 2002, 2003 and 2004 and for the three months ended March 31, 2005 and the selected balance sheet data as of December 31, 2001, 2002, 2003 and 2004 have been restated primarily to reflect the elimination of the use of hedge accounting treatment for our derivative instruments held during these periods as well as to restate certain amounts previously recorded in interest income to provision for mortgage loan losses and servicing income on our consolidated statement of operations. See Note 25 to our audited consolidated financial statements and Note 12 to our unaudited consolidated financial statements contained elsewhere in this prospectus. You should read the information below along with all other financial information and analysis presented and incorporated by reference in this prospectus, including the section captioned “Management’s discussion and analysis of financial condition and results of operations” in the 2005 Form 10-K and the First Quarter 2006 Form 10-Q, and our consolidated financial statements and related notes included elsewhere in this prospectus.

Prior to July 6, 2001, we sold our mortgage loans, while retaining certain residual interests, through securitizations structured as sales, with a corresponding one-time recognition of gain or loss, under generally accepted accounting principles in the United States, or GAAP. Since July 6, 2001, we structure our securitizations as financing transactions. These securitizations do not meet the qualifying special purpose entity criteria under Statement of Financial Accounting Standards No. 140, or SFAS No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities, because after the loans are securitized, the securitization trust may acquire derivatives relating to beneficial interests retained by us; also we as servicer, subject to applicable contractual provisions, have sole discretion to use our best commercial judgment in determining whether to sell or work out any loans securitized through the securitization trust that become troubled. Accordingly, following a securitization, the mortgage loans remain on our consolidated balance sheet, and the securitization indebtedness replaces the warehouse and repurchase debt associated with the securitized mortgage loans. We record interest income on the mortgage loans and interest expense on the securities issued in the securitization over the life of the securitization and do not recognize a gain or loss upon completion of the securitization. We believe this accounting treatment more closely matches the recognition of income with the actual receipt of cash payments.

17

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Predecessor | | | Saxon Capital, Inc. | |

| | | January 1,

2001 to July 5, 2001 | | | July 6, 2001 to December 31, 2001 (as restated)** | | | Year ended December 31, | | | Three months ended

March 31, | |

(In thousands) | | | | 2002 (as restated)** | | | 2003 (as restated)* | | | 2004 (as restated)* | | | 2005 | | | 2005 (as restated)# | | | 2006 | |

Statement of operations data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest income | | $ | 15,331 | | | $ | 53,024 | | | $ | 233,446 | | | $ | 350,851 | | | $ | 407,845 | | | $ | 458,658 | | | $ | 112,422 | | | $ | 121,280 | |

Interest expense | | | (11,524 | ) | | | (23,457 | ) | | | (88,450 | ) | | | (120,293 | ) | | | (152,498 | ) | | | (263,809 | ) | | | (54,991 | ) | | | (85,767 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income | | | 3,807 | | | | 29,567 | | | | 144,996 | | | | 230,558 | | | | 255,347 | | | | 194,849 | | | | 57,431 | | | | 35,513 | |

Provision for mortgage loan losses | | | (8,423 | ) | | �� | (11,565 | ) | | | (26,367 | ) | | | (19,364 | ) | | | (31,627 | ) | | | (42,344 | ) | | | (2,308 | ) | | | (577 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income after provision for mortgage loan losses | | | (4,616 | ) | | | 18,002 | | | | 118,629 | | | | 211,194 | | | | 223,720 | | | | (152,505 | ) | | | 55,123 | | | | 34,936 | |

Servicing income, net of amortization and impairment(1) | | | 16,670 | | | | 11,459 | | | | 19,967 | | | | 27,214 | | | | 28,260 | | | | 71,222 | | | | 13,566 | | | | 19,640 | |

Derivatives (losses) gains | | | — | | | | (18,082 | ) | | | (50,625 | ) | | | (23,885 | ) | | | (510 | ) | | | 32,436 | | | | 21,234 | | | | 10,639 | |

Gain (loss) on sale of assets | | | 32,892 | | | | — | | | | 365 | | | | 2,533 | | | | 3,500 | | | | 2,359 | | | | 1,701 | | | | (1,422 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total net revenues and gains | | | 44,946 | | | | 11,379 | | | | 88,336 | | | | 217,056 | | | | 254,970 | | | | 258,522 | | | | 91,624 | | | | 63,793 | |

Total operating expenses | | | (96,062 | ) | | | (37,122 | ) | | | (90,824 | ) | | | (109,269 | ) | | | (143,661 | ) | | | (153,795 | ) | | | (40,982 | ) | | | (34,482 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(Loss) income before taxes | | | (51,116 | ) | | | (25,743 | ) | | | (2,488 | ) | | | 107,787 | | | | 111,309 | | | | 104,727 | | | | 50,642 | | | | 29,311 | |

Income tax (benefit) expense | | | (21,609 | ) | | | (9,944 | ) | | | (850 | ) | | | 40,105 | | | | 4,987 | | | | (5,902 | ) | | | (3,327 | ) | | | 2,912 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cumulative effect of change in accounting principle (SFAS 123(R)) | | | — | | | | — | | | | — | | | | — | | | | — | | | | 31 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income | | $ | (29,507 | ) | | $ | (15,799 | ) | | $ | (1,638 | ) | | $ | 67,682 | | | $ | 106,322 | | | $ | 110,660 | | | $ | 53,969 | | | $ | 26,399 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Statement of cash flow data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Payment of dividends(2)(3) | | | — | | | | — | | | | — | | | | — | | | $ | 85,732 | | | $ | 110,032 | | | $ | 28,909 | | | $ | 32,539 | |

| | | | | | | | | | | | | | | | | | |

| | | December 31, | | March 31, 2006 |

(In thousands) | | 2001 (as restated)** | | 2002 (as restated)** | | 2003 (as restated)** | | 2004 (as restated)* | | 2005 | |

Balance sheet data: | | | | | | | | | | | | | | | | | | |

Mortgage loan portfolio, net allowance for loan losses | | $ | 1,692,516 | | $ | 3,514,511 | | $ | 4,648,867 | | $ | 5,972,484 | | $ | 6,408,233 | | $ | 6,522,669 |

Mortgage servicing rights, net | | | 33,847 | | | 24,971 | | | 41,255 | | | 98,995 | | | 129,742 | | | 143,748 |

Servicing related advances | | | 101,429 | | | 101,416 | | | 96,749 | | | 109,848 | | | 185,297 | | | 204,106 |

Total assets | | | 1,893,047 | | | 4,111,785 | | | 5,031,502 | | | 6,508,529 | | | 7,232,078 | | | 7,250,738 |

Warehouse financing(4) | | | 283,370 | | | 474,442 | | | 427,969 | | | 600,646 | | | 378,144 | | | 980,669 |

Securitization financing | | | 1,326,660 | | | 3,347,251 | | | 4,237,375 | | | 5,258,344 | | | 6,182,389 | | | 5,599,832 |

Total liabilities | | | 1,650,561 | | | 3,869,201 | | | 4,717,772 | | | 5,921,456 | | | 6,638,943 | | | 6,655,470 |

Shareholders’ equity | | | 242,486 | | | 242,584 | | | 313,730 | | | 587,073 | | | 593,135 | | | 595,268 |

18

The following data are derived from our financial records, which are unaudited.

| | | | | | | | | | | | | | | | | | | | | |

| | | Predecessor | | | Saxon Capital, Inc. | |

| | | January 1,

2001 to

July 5, 2001 | | | July 6, 2001 to December 31, 2001 (as restated)** | | | Year ended December 31, | | | Three months ended

March 31, 2006 | |

| | | | | 2002 (as restated)** | | | 2003 (as restated)* | | | 2004 (as restated)* | | | 2005 | | |

Other financial data: | | | | | | | | | | | | | | | | | | | | | |

Ratio of earnings to fixed charges(5) | | 2.0 | x | | 1.3 | x | | 1.0 | x | | 1.9 | x | | 1.7 | x | | 1.4 | x | | 1.3 | x |

Average equity to average assets(6)(7) | | 36.9 | x | | 15.1 | x | | 8.1 | x | | 6.1 | x | | 7.8 | x | | 8.6 | x | | 8.2 | x |

Return on average equity(6)(7) | | (23.2 | )% | | (15.5 | )% | | (0.7 | )% | | 24.3 | % | | 23.6 | % | | 18.8 | % | | 17.8 | % |

Return on average assets(6)(7) | | (8.6 | )% | | (2.3 | )% | | (0.1 | )% | | 1.5 | % | | 1.8 | % | | 1.6 | % | | 1.5 | % |

| (1) | Servicing income, net of amortization and impairment does not include contractual servicing fees relating to our owned mortgage loan portfolio, as those fees are recorded as a component of interest income. |

| (2) | We began operating as a REIT in 2004. In order to remain qualified as a REIT, we generally must distribute annually to our shareholders at least 90% of our REIT taxable income (determined without regard to the dividends paid deduction and by excluding any net capital gain or loss). In addition, we are subject to a 4% nondeductible excise tax on the amount, if any, by which certain distributions we make with respect to the calendar year are less than the sum of (a) 85% of our ordinary income, (b) 95% of our capital gain net income for that year and (c) any undistributed taxable income from prior periods. Prior to becoming a REIT, we had not paid dividends on our common stock. |

| (3) | Dividends paid in 2004 consist of a $1.72 per share special dividend declared and paid in the fourth quarter of 2004. Dividends paid in 2005 consist of: a $0.58 per share regular dividend declared in 2004 and paid in the first quarter of 2005; and regular dividends in the aggregate amount of $1.60 per share declared and paid in 2005. Dividends paid in the first quarter of 2006 consist of a regular dividend of $0.50 per share and a special dividend of $0.14 per share declared in the fourth quarter of 2005. |

| (4) | Includes borrowings under warehouse lines of credit and repurchase facilities. |

| (5) | Calculated as (a) net income adjusted for income tax expense (benefit) and fixed charges and (b) fixed charges. As of the date of this prospectus, we do not have any preferred stock outstanding. Under Regulation S-K, “fixed charges” means the sum of the following: (a) interest expensed and capitalized; (b) amortized premiums, discounts and capitalized expenses related to indebtedness; (c) an estimate of the interest within rental expense; and (d) preference security dividend requirements of consolidated subsidiaries. |

| (6) | Average equity and average assets are calculated as a simple average over the relevant year. |

| (7) | Ratios are annualized. |

| * | See Note 25 to our audited consolidated financial statements appearing elsewhere in this prospectus. |

| ** | Gives effect to the restatement discussed in Note 25 to our audited consolidated financial statements appearing elsewhere in this prospectus. |

| # | See Note 12 to our unaudited consolidated financial statements appearing elsewhere in this prospectus. |

19

The exchange offer

Terms of the exchange offer

General. We issued the initial notes on May 4, 2006 in a transaction exempt from the registration requirements of the Securities Act.

In connection with the sale of initial notes, the holders of the initial notes became entitled to the benefits of the registration rights agreement, dated May 4, 2006, among Saxon Capital, the guarantors and the initial purchaser.