Sagent Pharmaceuticals 33 rd Annual JP Morgan Healthcare Conference January 14, 2015 A Global Pharmaceutical Company Exhibit 99.1 |

2 Disclaimer Statements contained in this presentation contain forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact included in this presentation are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give Sagent's current expectations and projections relating to its financial condition, results of operations, plans, objectives, future performance and business as of the date of this presentation. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as "anticipate," "estimate," "expect," "project," "plan," "intend," "believe," "may," "will," "should," "can have," "likely" and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. Sagent's expectations are not predictions of future performance, and future results may substantially differ from current expectations based upon a variety of factors, risks and uncertainties affecting Sagent's business, including, among others, our reliance upon our business partners for timely supply of sufficient high quality API and finished products in the quantities we require; the difficulty of predicting the timing or outcome of product development efforts and global regulatory approvals; the difficulty of predicting the timing and outcome of any pending litigation including litigation involving third parties that may have an impact on the timing of Sagent's product launches; the impact of competitive products and pricing and actions by Sagent's competitors with respect thereto; the timing of product launches; compliance with FDA and other global governmental regulations by Sagent and its third party manufacturers; changes in laws and regulations; our ability to successfully integrate our newly acquired Omega subsidiary; our ability to realize the expected benefits from our acquisition of and investment in our China and Omega subsidiaries; the additional capital investments we will be required to make in our international subsidiaries to achieve their manufacturing potential; the implementation and maintenance of our new enterprise resource planning software and other related applications and such other risks detailed in Sagent's periodic public filings with the Securities and Exchange Commission, including but not limited to Sagent's Quarterly Report on Form 10-Q for the period ended September 30, 2014, filed on November 4, 2014. Sagent disclaims and does not undertake any obligation to update or revise any forward-looking statement in this press release, except as required by applicable law. This presentation includes a discussion of certain non-GAAP financial measures. Please refer to the appendix to this presentation for further definition of these measures and a reconciliation of such non-GAAP measures to the most closely comparable GAAP measures. |

ABOUT SAGENT PHARMACEUTICALS |

4 Sagent Pharmaceuticals Overview Fastest growing Generic Injectables company in the U.S. Market Deepest product portfolio in the industry drives strong long-term margin and revenue growth Extensive global partner network with state-of-the-art facilities enabling accelerated growth Solid relationships at all levels of the supply chain enhancing responsiveness to industry demands 2013 acquisition of Sagent China Pharmaceuticals (SCP) supports vertical integration and provides additional growth opportunities and an increased presence in China Global excellence in manufacturing ; exceptional quality and safety track record Capacity to deliver multiple presentations for one product ; including single and multi-dose vials, pre-filled ready-to-use syringes, premix bags, emulsions and suspensions 2014 acquisition of Omega Laboratories supports additional vertical integration and expands global footprint, product portfolio, and industry-leading development pipeline |

5 Omega Laboratories Montreal, Canada Development Manufacturing Employees: 157 Sagent Global Headquarters Schaumburg, Illinois Administrative Corporate Office Employees: 117 Sagent China Pharmaceuticals Chengdu, China Development Manufacturing Employees: 190 Sagent Pharmaceuticals Operations |

6 Generic Market Opportunity Strictly Private and Confidential: For discussion Purposes Only, Subject to Due Diligence Significant macro economic and industry factors driving demand and creating opportunities (1) Growth Statistics based on Frost & Sullivan “Generic Pharmaceuticals Market – A Global Analysis”, December 2011 Generic Market set to increase by $100 Billion in 5 years (1) Expected to reach $231 billion globally by 2017 Injectable drugs represents largest opportunity with 10% growth rate annually Sagent delivers a consistent, reliable supply of quality products which is paramount to healthcare customers (GPOs, Hospitals, Wholesalers, Distributors) • China, India, Russia, Brazil, Turkey and S. Korea • All within Sagent’s existing footprint • As many as 300 shortages annually in U.S. • Majority are injectable products • Creating vast opportunities INDUSTRY CONSOLIDATION GLOBAL POTENTIAL DRUG SHORTAGES |

7 Business Model with Proven Track Record (1) As of December 31, 2014 44 Partners Worldwide (1) API providers, development, global manufacturing locations Sagent China Pharmaceuticals/GRC Vertically integrated manufacturing and State-of the-art research capability Omega Laboratories Market leading Canadian specialty Pharma company Sagent Agila LLC Covers 18 products represented by 28 ANDAs (1) Leveraging a global partner network, vertically integrated manufacturing and research capabilities in China and Canada and extensive product lifecycle management expertise Key Highlights • Track record of strong performance on ANDA submissions, ANDA approvals and product launches • Extensive pipeline with 75 ANDAs pending approval or launch (1) and 68 products in development or submitted in the US, 26 products in development or submitted in Canada (1) • 54 marketed products , 158 presentations in the US, and 62 marketed products , 153 presentations in Canada (1) • Indications including anti-infective, oncolytic and critical care • Multiple presentation capabilities : single and multi-dose vials, pre-filled ready-to-use syringes, premix bags, emulsions and suspensions Unique approach enables development of one of the broadest product portfolios and deepest pipelines in the industry Evolving Partnerships Sophisticated technology and low costs |

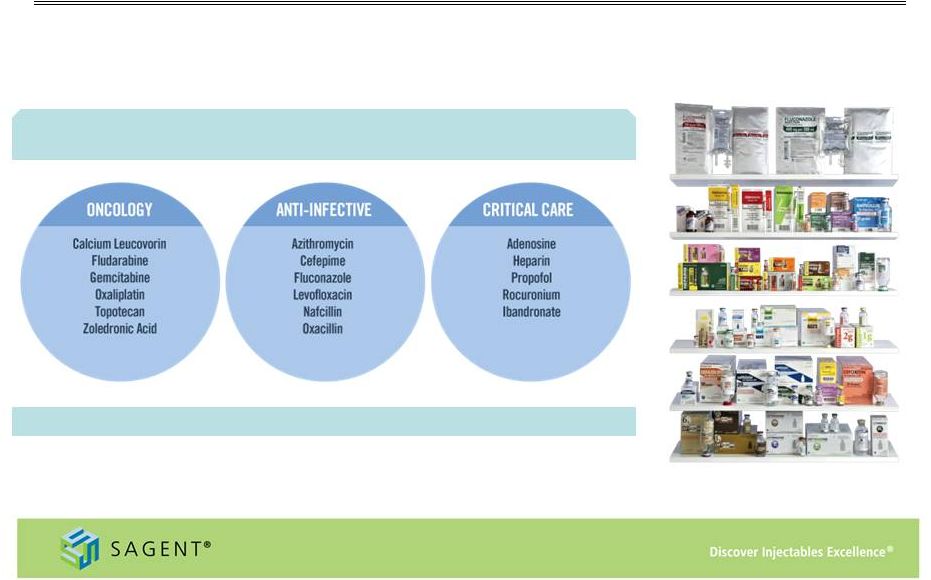

8 Growing Product Portfolio Wide range of marketed products – 54 products and 158 SKUs (1) – with 30% of the portfolio holding the #1 or #2 market position (1) As of December 31, 2014 (2) Based on November 2014 IMS data Key indication areas and products include: Filed an additional 15 products in 2014 (2) |

9 Strong Sequential Growth (1) Mid-point of Guidance as issued in 3Q’14 earnings release on November 4, 2014 (1) Revenue Forecast Revenue Adjusted GP% Heparin Topotecan Levofloxacin Gemcitabine Oxaliplatin Oxacillin Leucovorin Zoledronic Acid Docetaxel Propofol Adenosine GLYDO TM Key Launches $350 $300 $250 $200 $150 $100 $50 $0 2010 35.0% 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0% 2011 2012 2013 2014 12.8% 13.7% 20.0% 32.8% 31.5% (2) Adjusted Gross Profit as a percentage of net revenues is a non-GAAP meausre. Please refer to slide #28: Appendix – Non GAAP Reconciliation for further detail |

10 2014 Guidance Revenue Adjusted Gross Profit (3) Operating Expenses Net income (1) Guidance as issued in 4Q ’13 earnings release on February 11, 2014 (2) Guidance as issued in 3Q’14 earnings release on November 4, 2014 (3) Adjusted Gross Profit as a percentage of net revenues is a non-GAAP meausre. Please refer to slide #28: Appendix – Non GAAP Reconciliation for further detail $250M - $290M 24% - 28% Initial (1) Current (2) 30% - 33% $275M - $285M $65M - $76M $67M - $73M $10M Loss to $10M Earnings $5M - $10M Earnings |

GROWTH DRIVERS |

12 Catalysts Driving Shareholder Value Sagent’s stock does not fully reflect the multiple drivers of growth and upside opportunities History of successful product launches at market formation Leading product market share position Unmatched development capability and strong record of ANDA approvals Robust product pipeline Geographic expansion in high growth markets |

13 Robust Product Pipeline More products in the pipeline than existing portfolio, includes: Notable Pipeline Features 9 505(b)2s with $3.0 Billion Total Market Opportunity 17 Potential PIVs with over $7 Billion Total Market Opportunity 11 Novel Products with $2.3 Billion Total Market Opportunity 13 High Value Opportunities with over $8.2 Billion Total Market Opportunity (1) Based on November 2014 IMS data Pipeline represents an IMS value in excess of $11.8 billion (1) • Maintaining leading product launch track record Launched 7 products in 2014, despite a difficult FDA environment 15 ANDA filings during 2014 • 42 products represented by 64 ANDAs under review by the FDA • 3 products represented by 11 ANDAs recently approved and pending commercial launch |

14 Key Products Driving Growth Successful Launches Zoledronic Acid Propofol Adenosine Injection • Launched vials in March 2013 at market formation, followed by 4mg and 5mg pre-mixed bags in second half of 2013 • Market is approximately $200M (1) • Multiple presentation strategy demonstrates the strength of Sagent’s model • Launched in November 2013 • Market is approximately $265M (1) • Generic form of Adenoscan® • Launched product after Teva exclusivity expired in March 2014 • Market is approximately $36M (1) • Sagent sales organization has extensive historical experience with the product (1) Based on November 2014 IMS data |

15 Key Products Driving Growth (con’t) Future Launches Iron Sucrose Pentobarbital Enoxaparin Fulvestrant Bendamustine • Generic form of Venofer® • High barrier to entry for generic manufacturing • Received FDA Complete Response Letter in December 2013 • Market is ~$335M (1) • Generic form of Nembutal® • High barrier to entry for generic manufacturing; Sagent will be first generic • Anticipate approval in second half of 2015 • Market is ~$30M • Generic form of Lovenox® • Single-dose PFS’s with automatic safety device filed with FDA • High barriers to entry due to product complexity and API supply • Market is ~$1.35B (1) • Generic form of Faslodex® • Two PFS kit designed for clinician IM injection filed with FDA • Sagent to be at market formation October 2016 • Market is ~$340M (1) • Generic form of Treanda® • Both vial presentation filed with FDA • High barrier to entry due to manufacturing complexity • Market is approximately $690M (1) (1) Based on November 2014 IMS data |

16 Vertical Integration Benefiting from Sagent China Pharmaceuticals (SCP) investment Acquired remaining 50% of our JV in China (June of 2013) • State-of-the-art isolator technology for aseptic filing • FDA and current Good Manufacturing Practices compliant facility • Facility received EIR in the first half of 2013; first product launched in November 2013 • Multiple products developed and filed from SCP in 2013 and 2014 • First CBE-30 approval for Atracurium received December 2014 Unique and flexible business: • Sagent controls its own destiny • Increases responsiveness to drug shortages • Targeted to support 25% of capacity Pursuing additional product development and capacity expansion investment • $12 - $16 million annual operating costs • $30 - $35 million capital expansion in high speed isolator technology |

17 Expansion Opportunities in China Pharma Market Sagent’s FDA approved facility on mainland China creates significant competitive advantages within the domestic Chinese market opportunity • Expected to be 2nd largest pharmaceutical market • Market growth driven by increasing demand in cities and provinces and growth of the middle class • Demand for high quality drugs growing and price is aligning with developed markets • Regulatory pathway evolving • Local drug shortages may drive improved pricing and regulatory harmonization • Develop injectable formulations for the US and global markets • Focus on developing and formulating niche products and complex molecules • Located in a leading Science and Technology Center in Chengdu, China • Positions Sagent as a global thought leader China Market Opportunity Global Research Center |

18 Omega Laboratories Sagent has acquired Omega Laboratories Limited (“Omega”), a market leading specialty pharmaceutical company based in Montreal, Canada. • Transaction closed on October 1, 2014 • Sagent acquired Omega for approximately USD $83M (C$93M) • Immediately accretive to cash earnings • Financed entirely with cash on the balance sheet • Expected to contribute $6 - $8 million in revenues in 2014 The combination of Sagent and Omega creates a premier generic injectable company with a robust product portfolio, deep development pipeline and strong global presence. |

19 Omega Laboratories Profile 2011 Compound Annual Growth Rate (CAGR) = 22.6% 2013 Revenues = C$ 36.5 million Omega has been providing the Canadian market with a comprehensive line of innovative pharmaceutical products since 1958. 62 products, 153 presentations marketed in Canada International distribution in over 40 countries 26 generic injectable drugs scheduled to be launched between 2014 and 2019 2012 2013 |

20 M&A Strategy Sagent has the bandwidth and the balance sheet to pursue additional acquisitions that meet the following criteria: Strengthens product portfolio and pipeline Expands global footprint Enhances long-term growth profiles • Provides new products that can be immediately monetized • Fit well or are complementary to existing portfolio • Provide manufacturing and development capabilities • Immediately accretive to business • Organic growth investment in product development must be augmented by M&A activity |

21 Strong and Experienced Management Team Jeffrey Yordon CEO & Chairman James Hussey President Jonathon Singer EVP & CFO Michael Logerfo EVP Legal Albert Patterson EVP, Natl Accts & Corp Dev Lorin Drake Corp VP Sales Sheila Moran CVP Global QA & Facility Compliance Tom Moutvic VP RA Ravi Malhotra CSO YorPharm Inc. |

2015 OUTLOOK |

23 2015 Financial Guidance Revenue $325M - $375M Adjusted Gross Profit (1) Operating Expenses Adjusted EBITDA (2) $20M - $50M (1) Adjusted Gross Profit is a non-GAAP measure. Please refer to slide #28: Appendix – Non GAAP Reconciliation for further detail. (2) Adjusted EBITDA is a non=GAAP measure. Please refer to slide #29: Appendix – Non GAAP Reconciliation for further detail. 27% - 31% $80M - $90M |

24 Key Variables for 2015 The following variables could have a potential impact on the performance of the business in the new year, and Sagent is taking steps to maximize/mitigate the impact: ? OPPORTUNITIES CHALLENGES • Shortage strategy and investment • SCP product transfers and Global Research Center development activity • Pricing • Guaranteed supply agreements • Government contracts • GPO contract renewals • Slowdown at FDA • Key product delays (Iron Sucrose, Pentobarbital) • Actavis product bundle replacement • Mylan/Agila regulatory delays • Heparin pricing erosion due to increasingly competitive environment • GPO contract renewals |

|

APPENDIX |

27 Appendix – Non-GAAP Reconciliation Adjusted Gross Profit We use the non-GAAP financial measure “Adjusted Gross Profit” and corresponding ratios. We define Adjusted Gross Profit as gross profit plus our share of the gross profit earned through our Sagent Agila joint venture which is included in the Equity in net (income) loss of joint ventures line on the Consolidated Statements of Operations and the impact of product-related non-cash charges arising from business combinations. We believe that Adjusted Gross Profit is relevant and useful supplemental information for our investors. Our management believes that the presentation of this non-GAAP financial measure, when considered together with our GAAP financial measures and the reconciliation to the most directly comparable GAAP financial measure, provides a more complete understanding of the factors and trends affecting Sagent than could be obtained absent these disclosures. Management uses Adjusted Gross Profit and corresponding ratios to make operating and strategic decisions and evaluate our performance. We have disclosed this non-GAAP financial measure so that our investors have the same financial data that management uses with the intention of assisting you in making comparisons to our historical operating results and analyzing our underlying performance. Our management believes that Adjusted Gross Profit provides a useful supplemental tool to consistently evaluate the profitability of our products. The limitation of this measure is that it includes items that do not have an impact on gross profit reported in accordance with GAAP. The best way that this limitation can be addressed is by using Adjusted Gross Profit in combination with our GAAP reported gross profit. Because Adjusted Gross Profit calculations may vary among other companies, the Adjusted Gross Profit figures presented below may not be comparable to similarly titled measures used by other companies. Our use of Adjusted Gross Profit is not meant to and should not be considered in isolation or as a substitute for, or superior to, any GAAP financial measure. You should carefully evaluate the following tables reconciling Adjusted Gross Profit to our GAAP reported gross profit for the periods presented (dollars in thousands). EBITDA and Adjusted EBITDA We use the non-GAAP financial measures “EBITDA” and “Adjusted EBITDA” and corresponding growth ratios. We define EBITDA as net income less interest expense, net of interest income, provision for income taxes, depreciation and amortization. We define Adjusted EBITDA as net income less interest expense, net of interest income, provision for income taxes, depreciation and amortization and stock-based compensation expense. We believe that EBITDA and Adjusted EBITDA are relevant and useful supplemental information for our investors. Our management believes that the presentation of these non-GAAP financial measures, when considered together with our GAAP financial measures and the reconciliation to the most directly comparable GAAP financial measures, provides a more complete understanding of the factors and trends affecting Sagent than could be obtained absent these disclosures. Management uses EBITDA, Adjusted EBITDA and corresponding ratios to make operating and strategic decisions and evaluate our performance. We have disclosed these non-GAAP financial measures so that our investors have the same financial data that management uses with the intention of assisting you in making comparisons to our historical operating results and analyzing our underlying performance. Our management believes that EBITDA and Adjusted EBITDA are useful supplemental tools to evaluate the underlying operating performance of the company on an ongoing basis. The limitation of these measures is that they exclude items that have an impact on net income. The best way that these limitations can be addressed is by using EBITDA and Adjusted EBITDA in combination with our GAAP reported net income. Because EBITDA and Adjusted EBITDA calculations may vary among other companies, the EBITDA and Adjusted EBITDA figures presented below may not be comparable to similarly titled measures used by other companies. Our use of EBITDA and Adjusted EBITDA is not meant to and should not be considered in isolation or as a substitute for, or superior to, any GAAP financial measure. |

28 Appendix – Non-GAAP Reconciliation 2010 2011 2012 2013 2010 2011 2012 2013 Adjusted Gross Profit 9,460 $ 20,833 $ 36,746 $ 80,249 $ 12.8% 13.7% 20.0% 32.8% Sagent portion of gross profit earned by Sagent Agila joint venture 417 2,064 5,639 2,727 0.6% 1.4% 3.1% 1.1% Product-related non-cash charges from business combinations - - - - - - - - Gross Profit 9,043 $ 18,769 $ 31,107 $ 77,522 $ 12.2% 12.3% 16.9% 31.7% Sagent's business plan for fiscal 2014 and 2015 currently anticipates: 2014 2015 Adjusted Gross Profit 30% - 33% 27% - 31% Sagent portion of gross profit earned by Sagent Agila joint venture 1% - 2% 1% - 2% Product-related non-cash charges from business combinations - 1% - 2% Gross Profit 29% - 31% 25% - 27% Percentage of net revenues Year ended December 31, Year ended December 31, twelve months ended December 31, Percentage of net revenues |

29 Appendix – Non-GAAP Reconciliation Sagent's business plan for fiscal 2015 currently anticipates: Twelve months ended December 31, 2015 Adjusted EBITDA $20 million - $50 million Stock-based compensation expense $4 million - $5 million EBITDA $16 million - $45 million Depreciation and amortization expense $15 million - $17 million Interest expense, net $1 million - $2 million Provision for income taxes $3 million - $15 million Net income $ 3 million loss to $13 million earnings |