As filed with the Securities and Exchange Commission on November 27, 2006

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Genesis Lease Limited

(Exact Name of Registrant as Specified in Its Charter)

| Bermuda | 7359 | 98-0512319 | ||||

| (State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) | ||||

| Roselawn House University Business Complex National Technology Park Limerick, Ireland Tel. +353 61 633 333 | ||||||

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

| Puglisi & Associates 850 Library Avenue, Suite 204 Newark, Delaware 19711 Tel. (302) 738-6680 | ||||||

(Name, Address, Including Zip Code and Telephone Number, Including Area Code, of Agent for Service)

| Copies to: | ||||||

| David S. Lefkowitz, Esq. Boris Dolgonos, Esq. Weil, Gotshal & Manges LLP 767 Fifth Avenue New York, New York 10153 Tel. (212) 310-8000 | Elliot Gewirtz, Esq. Douglas A. Tanner, Esq. Milbank, Tweed, Hadley & McCloy LLP 1 Chase Manhattan Plaza New York, New York 10005 Tel. (212) 530-5000 | |||||

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box. ![]()

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ![]()

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ![]()

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ![]()

CALCULATION OF REGISTRATION FEE

| Title of Each Class Of Securities To Be Registered | Amount to be Registered | Proposed Maximum Offering Price Per Share | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | |||||||||||||||||

| Common shares, par value $.001 per share (1) | 32,039,000(2 | ) | $ | 23.00 | $736,897,000(2)(3) | $78,848(4) | |||||||||||||||

| (1) | American Depositary Shares issuable upon deposit of the common shares registered hereby have been registered under a separate registration statement on Form F-6. Each American Depositary Share represents one common share. |

| (2) | Includes 4,179,000 common shares that may be sold upon exercise of the underwriters' over-allotment option. |

| (3) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c). |

| (4) | Calculated in accordance with Rule 457(a). |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 27, 2006

PROSPECTUS

27,860,000 American Depositary Shares

Genesis Lease Limited

Representing 27,860,000 Common Shares

$ per ADS

We are selling 27,860,000 common shares in the form of American Depositary Shares, or ADSs. Each ADS represents one common share. The ADSs will be evidenced by American Depositary Receipts, or ADRs. We have granted the underwriters an option to purchase up to 4,179,000 additional ADSs to cover over-allotments.

This is the initial public offering of our ADSs. We currently expect the initial public offering price to be between $21.00 and $23.00 per ADS. Our ADSs have been approved for listing on the New York Stock Exchange, subject to official notice of issuance, under the symbol ‘‘GLS.’’ All of our common shares will be issued in the form of ADSs. We will pay all fees of the depositary, except in connection with cancellations of ADSs and withdrawals of common shares.

An affiliate of General Electric Company, or GE, has agreed to purchase from us, in a private placement concurrent with this offering, a number of ADSs such that after this offering GE will hold approximately 11% of the issued and outstanding ADSs, at a price per ADS equal to the initial public offering price in this offering.

Investing in our ADSs involves risks. See ‘‘Risk Factors’’ beginning on page 16.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per ADS | Total | |||||||||||

| Public Offering Price | $ | $ | ||||||||||

| Underwriting Discount | $ | $ | ||||||||||

| Proceeds to Genesis Lease Limited (before expenses) | $ | $ | ||||||||||

The underwriters expect to deliver the ADSs to purchasers on or about , 2006.

| Citigroup | JPMorgan |

| Merrill Lynch & Co. | Wachovia Securities |

, 2006

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different information, you should not rely on it. We are not, and the underwriters are not, making an offer of these securities in any jurisdiction where an offer is not permitted. The information in this prospectus is only accurate on the date of this prospectus.

TABLE OF CONTENTS

Consent under the Exchange Control Act 1972 (and its related regulations) has been obtained from the Bermuda Monetary Authority for the issue and transfer of our common shares to and between non-residents of Bermuda for exchange control purposes, provided our ADSs remain listed on an appointed stock exchange, which includes the New York Stock Exchange. This prospectus will be filed with the Registrar of Companies in Bermuda in accordance with Bermuda law. In granting such consent and in accepting this prospectus for filing, neither the Bermuda Monetary Authority nor the Registrar of Companies in Bermuda accepts any responsibility for our financial soundness or the correctness of any of the statements made or opinions expressed in this prospectus.

Until , 2007 (25 days after the date of this prospectus), all dealers that buy, sell or trade our ADSs, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to each dealer’s obligation to deliver a prospectus when acting as underwriter and with respect to its unsold allotments or subscriptions.

i

SUMMARY

This section summarizes key information contained elsewhere in this prospectus and is qualified in its entirety by the more detailed information and financial statements included elsewhere in this prospectus. You should carefully review the entire prospectus, including the risk factors, the financial statements and the notes related thereto and the other documents to which this prospectus refers, before making an investment decision.

Summaries in this prospectus of certain documents that are filed as exhibits to the registration statement of which this prospectus is a part are qualified in their entirety by reference to such documents. All information and data contained in this prospectus relating to the commercial aircraft industry has been provided to us by Simat, Helliesen & Eichner, Inc., or SH&E, an international air transport consulting firm. See ‘‘The Commercial Aircraft Industry.’’

Unless the context requires otherwise, when used in this prospectus, (1) the terms ‘‘Genesis,’’ ‘‘we,’’ ‘‘our’’ and ‘‘us’’ refer to Genesis Lease Limited and its subsidiaries, (2) all references to our shares refer to our common shares held in the form of ADSs and (3) all percentages and weighted averages of the aircraft in our portfolio have been calculated using the lower of mean or median maintenance-adjusted appraised base values as of June 30, 2006, and percentages may not total due to rounding.

Our Company

We are a newly organized company formed to acquire and lease commercial jet aircraft and other aviation assets. Our aircraft are leased under long-term contracts to a diverse group of airlines throughout the world. Our strategy is to grow our portfolio through accretive acquisitions of aircraft, while paying regular quarterly dividends to our shareholders. We intend to leverage the worldwide platform of GE Commercial Aviation Services Limited, or GECAS, to service our portfolio of leases, allowing our management to focus on executing our growth strategy.

We will acquire our initial portfolio of 41 commercial jet aircraft from affiliates of GE with the net proceeds of this offering, a concurrent private placement of shares to GE and an $810 million aircraft lease securitization. We refer to this portfolio as our Initial Portfolio. The aircraft in our Initial Portfolio are modern, operationally efficient passenger and cargo jet aircraft that have long expected remaining useful lives. As of September 30, 2006, the weighted average age of our aircraft was 5.5 years, and the weighted average remaining lease term on our aircraft was 5.9 years. All of our aircraft are subject to net operating leases under which the lessee is responsible for most operational and insurance costs, and 38 of the 41 leases in our Initial Portfolio are subject to fixed rental rates. Our leases are scheduled to expire between 2008 and 2017, and we refer to them as long-term leases. We believe the terms of our leases will provide us with a stable source of revenues and cash flows.

We believe we can capitalize on the overall size and growth of the global aircraft market by acquiring and leasing additional aircraft and other aviation assets to increase our revenues, earnings and cash flows. Between 1990 and 2005, global passenger traffic, measured in revenue passenger miles, increased by 115%, or an average of 5.2% per year, and Boeing forecasts 4.9% average annual revenue passenger mile growth from 2006 through 2025. The current global fleet of operating commercial jet aircraft consists of more than 17,000 aircraft, and the fleet is expected to increase by an average of 2.9% per year through 2023 as a result of continued growth in passenger and cargo traffic, particularly in emerging markets. Over the past 20 years, the world’s airlines have leased a growing share of their aircraft instead of owning them outright. The proportion of the global fleet under operating lease has increased from approximately 18% in 1990 to 30% in 2005. We believe these industry trends provide a large and growing available pool of aircraft and other aviation assets to acquire and lease in the future.

Pursuant to long-term agreements, GECAS will provide us with most services related to leasing our fleet, including marketing aircraft for lease and re-lease, collecting rents and other payments from the lessees of our aircraft, monitoring maintenance, insurance and other obligations under our leases

1

and enforcing rights against lessees. We will pay GECAS a base servicing fee, additional servicing fees based on rental amounts due and paid under our leases and sales fees for assisting in aircraft dispositions. The pro forma servicing fees we would have paid to GECAS in 2005 had we owned the Initial Portfolio as of January 1, 2005 would have been approximately $4.7 million.

Our arrangements with GECAS will enable our management team to focus primarily on pursuing acquisitions of additional aircraft and other aviation assets. Our founding management has substantial expertise in the acquisition, leasing, financing, technical management and sale of aircraft. To complement our management's sourcing efforts, we have entered into a business opportunities agreement with GECAS, which we expect will lead to opportunities to purchase aircraft from third-party sources that GECAS encounters in its global operations, as well as certain aircraft offered directly by GECAS.

GECAS is an affiliate of GE and is one of the world’s leading servicers of commercial aircraft. GECAS currently manages a portfolio that includes more than 1,400 owned aircraft plus more than 250 aircraft serviced for other owners. It has more than 220 passenger and cargo airline customers in over 70 countries and more than 80 employees dedicated to the marketing and technical management of leased aircraft. We will have a global reach through GECAS’s 23 worldwide offices and will benefit from GECAS’s extensive industry knowledge and contacts to manage our portfolio and to source aircraft acquisitions. We believe GECAS’s broad industry expertise as the owner and servicer of one of the world’s largest portfolios of commercial aircraft, as well as its involvement in the market for aircraft acquisitions and dispositions, will enhance our ability to manage our portfolio effectively, to acquire and lease additional aircraft and to remarket our aircraft when leases expire.

Our Competitive Strengths

We believe the following competitive strengths will enable us to capitalize on growth opportunities in the leasing industry:

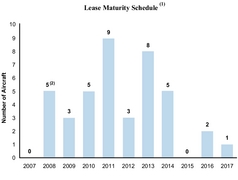

| • | Contracted revenues from a diversified lease portfolio. Our Initial Portfolio consists of 41 commercial jet aircraft that are leased on a long-term, primarily fixed rate basis to a wide range of geographically diverse lessees. The aircraft in our Initial Portfolio are leased to 30 lessees in 17 countries, with scheduled lease maturities ranging from 2008 to 2017 and a weighted average remaining lease term of 5.9 years. No single lessee is expected to contribute more than 10% of our annual lease revenue in 2007, and no more than five leases are scheduled to expire in any year until 2011. We believe these qualities will contribute to the stability of our revenues. |

| • | Young, versatile aircraft fleet. The weighted average age of the aircraft in our Initial Portfolio is 5.5 years as of September 30, 2006, and only 1.6% of the passenger aircraft were more than ten years old. Our Initial Portfolio consists of an array of asset types but is concentrated on modern, narrow-body aircraft that have a wide operator base. We believe these aircraft, and the additional aircraft we will seek to acquire, will be versatile assets with long useful lives that can be deployed worldwide. In addition, we expect that many of these aircraft have the potential to be converted into freighter aircraft, which would further extend their useful lives. |

| • | Access to market opportunities through ongoing relationships with GECAS. We believe we will benefit directly from GECAS’s global aircraft leasing network and capabilities through our servicing agreements. We also expect that, pursuant to the business opportunities agreement, GECAS will provide us with access to market opportunities to purchase aircraft from sources that it encounters in the course of its global operations as well as certain aircraft directly from GECAS’s own fleet. |

| • | Experienced management and efficient platform. Our management has extensive experience in the aviation industry. Our chief executive officer, John McMahon, has 20 years of experience in the aviation industry. Previously, Mr. McMahon was a founding member and Managing Director of debis AirFinance (now AerCap) and was instrumental in developing it |

2

| from a start-up into a global aircraft lessor with a portfolio of 220 aircraft operating with more than 80 airlines in over 40 countries. We believe our management's extensive relationships in the aviation industry, together with our operating arrangements with GECAS, provide us with an efficient platform from which to make accretive aircraft acquisitions and manage additional aircraft with limited incremental overhead cost. |

Our Growth Strategies

We intend to grow our lease portfolio and increase distributable cash flow per share by focusing on the following strategies:

| • | Capitalize on the growth in aircraft leasing by acquiring additional aircraft. We intend to acquire additional aircraft that are accretive to cash flow, while maintaining desirable portfolio characteristics in terms of fleet age, lease term and geographic concentration. We will focus primarily on acquiring high-utility commercial jet aircraft that have long useful lives and large operator bases, such as the Boeing 737 and the Airbus A320. We believe these aircraft will continue to experience strong demand as the number of low-cost carriers and passenger traffic in emerging markets continue to increase. From time to time we also intend to evaluate different aircraft asset types or lease structures that maximize returns and distributable cash flow to shareholders. |

| • | Outsource servicing functions to GECAS so that management can focus on aircraft acquisitions. We intend to leverage GECAS’s global service platform to manage our portfolio. We believe that lease servicing and remarketing is a highly technical business that benefits from a worldwide presence, well developed infrastructure and a broad network of strong customer relationships. We believe this strategy will enable management to focus on pursuing accretive acquisitions, including any presented to us by GECAS. |

| • | Efficiently raise capital to execute our growth strategy. We believe our capital structure is efficient and provides flexibility to pursue acquisitions and capitalize on market opportunities as they arise. We have a commitment for a $1 billion senior secured revolving credit facility to fund acquisitions of additional aircraft. We also expect to fund our growth through additional debt and equity offerings. The terms of our debt instruments will prevent us from paying dividends if we fail to meet financial ratios or default on our debt service obligations. |

Our Initial Aircraft Portfolio

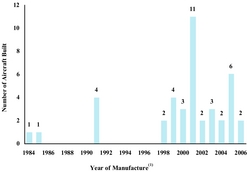

Our Initial Portfolio consists of 41 aircraft on lease to 30 airlines located in 17 countries. The following charts highlight the diversity of our Initial Portfolio in terms of airframe type, aircraft age, geographic profile and lease maturity.

| Airframe Type | Number | Percent | ||||||||||

| Narrow-body | 34 | 79.3 | % | |||||||||

| Wide-body | 1 | 6.8 | % | |||||||||

| Regional jet | 2 | 2.9 | % | |||||||||

| Cargo | 4 | 11.0 | % | |||||||||

| Total | 41 | 100 | % | |||||||||

| Aircraft Age | Number | Percent | ||||||||||

| Passenger | ||||||||||||

| 0 to 5 years | 16 | 47.1 | % | |||||||||

| 5 to 10 years | 19 | 40.4 | % | |||||||||

| 10 to 15 years | 1 | 0.7 | % | |||||||||

| 15+ years | 1 | 0.9 | % | |||||||||

| Cargo(1) | 4 | 11.0 | % | |||||||||

| Total | 41 | 100 | % | |||||||||

| (1) | The cargo aircraft were converted from passenger configuration in December 2000, March 2001, June 2006 and September 2006. |

3

| Geographic Profile(1) | Number | Percent | |||||||

| Europe | 16 | 36.4% | |||||||

| Asia/Pacific | 12 | 34.6% | |||||||

| United States and Canada | 9 | 18.0% | |||||||

| Central and South America and Mexico | 3 | 8.9% | |||||||

| Middle East | 1 | 2.0% | |||||||

| Total | 41 | 100% | |||||||

| (1) | Based on the geographic location of the lessee. |

| (1) | Assumes no lease extensions or early terminations. |

| (2) | Includes a Boeing 737-800 with respect to which a letter of intent has been executed to extend the lease to 2014, and a Boeing 737-800 that is currently being actively remarketed in anticipation of an early lease termination. See ‘‘Business — Our Leases — Lease Management and Remarketing.’’ |

Industry Trends

We believe we are well-positioned to capitalize on a number of trends in the aircraft finance and leasing industry, including:

| • | Large and growing commercial aircraft fleet to meet global demand. Globalization and economic growth throughout the developing world have led to increased demand for air travel. We expect that continued increases in the worldwide gross domestic product, economic development in emerging markets and competitive pricing resulting from the continued growth of low-cost carriers will drive further increases in air travel and aircraft demand. Boeing estimates that the current global fleet of operating commercial jet aircraft consists of 17,330 aircraft and has forecasted that by 2025 the fleet will reach 35,970 aircraft, of which 27,360 will be mainline passenger jets with 90 passenger seats or more. Airbus has estimated that the commercial jet aircraft fleet will increase to 25,375 aircraft by 2023, of which 21,759 |

4

| will be mainline passenger jets. In dollar terms, the current global fleet has an estimated value of $350 billion and is estimated to grow to approximately $777 billion by 2025. Nevertheless, the aircraft industry is subject to demand shifts, and any downturn in discretionary business or consumer spending or increased costs could have a significant impact on air traffic and aircraft demand. |

| • | Continued growth in aircraft leasing with significant consolidation opportunities. Over the past 20 years, the world’s airlines have leased a growing share of their aircraft instead of owning them outright. The proportion of the global fleet owned by operators has declined from 71% in 1990 to 54% in 2005, and the proportion of the global fleet under operating lease has increased from approximately 18% to 30% during this period. Lessors are major providers of liquidity for used aircraft and provide airlines with a valuable method of fleet management through the use of operating leases, financial leases and sale/leaseback transactions. The two largest lessors (GECAS and International Lease Finance Corporation, or ILFC) own or manage approximately 35% of the total number of aircraft under lease, while the next largest competitor’s market share is less than 5%. As a result, significant consolidation opportunities exist for lessors with adequate capital resources and financial flexibility. |

| • | Improving lease rates. With the recent recovery of much of the global commercial aviation industry, aircraft values have stabilized and have begun to increase slowly for some aircraft types. For a number of aircraft types, particularly the Boeing 737 and the Airbus A320, which are highly favored by low-cost carriers, supply is limited, and there is some concern that manufacturers will be unable to satisfy demand in the near term. Demand for larger aircraft types, such as the 767-300ER and A330, is exceptionally strong and cannot be met by current aircraft availability. Reductions in supply for many aircraft types has led to an increase in lease rental rates and, in certain cases, aircraft values. However, the airline industry has been subject to cyclical demand patterns, and a reduction in lease rates could occur. |

Our Dividend Policy

Our board of directors has adopted a policy to pay a regular quarterly cash dividend to our shareholders in an initial amount of $0.47 per share. We intend to pay a larger first dividend for the period from the completion of this offering to March 31, 2007.

Our dividend policy is based on the cash flow profile of our business. We generate significant cash flow under long-term leases with a diversified group of commercial aviation customers. We intend to distribute a portion of our cash flow to our shareholders, while retaining cash flow for reinvestment in our business. Retained cash flow may be used to fund acquisitions of aircraft and other aviation assets, make debt repayments and for other purposes, as determined by our management and board of directors. Our dividend policy reflects our judgment that by reinvesting cash flow in our business, we will be able to provide value to our shareholders by enhancing our long-term dividend paying capacity. Our objectives are to maintain and increase distributable cash flow per share through acquisitions of additional aircraft and other aviation assets beyond our Initial Portfolio of 41 aircraft.

The declaration and payment of future dividends to holders of our shares will be at the discretion of our board of directors and will depend on many factors, including our financial condition, cash flows, legal requirements and other factors our board of directors deems relevant. Please read ‘‘Dividend Policy — Possible Changes in Quarterly Dividends’’ and ‘‘Risk Factors’’ for a discussion of these factors.

5

Our Formation

We were formed at the direction of GECAS to acquire our Initial Portfolio from affiliates of GE and to develop an independent aircraft leasing business. We will use the net proceeds of this offering, together with the proceeds from a private placement of shares to GE and the net proceeds of the securitization described below, less certain expenses as described under ‘‘Use of Proceeds,’’ to finance the acquisition of our Initial Portfolio from affiliates of GE. The purchase price that we will pay for our Initial Portfolio will be determined based on the initial public offering price in this offering as described below, even if the price is above or below the price range set forth on the cover of this prospectus, and will not be based upon a valuation of such assets. The acquisition of our Initial Portfolio will be made through our subsidiary, Genesis Funding Limited, which we refer to as Genesis Funding.

On November 21, 2006, Genesis Funding entered into an agreement to complete a securitization that will close concurrently with this offering. The securitization will generate net proceeds of approximately $804.5 million through the issuance of floating-rate aircraft lease-backed notes, which will finance part of the cost of the acquisition of our Initial Portfolio. The obligations of Genesis Funding under these notes will be secured by its ownership interests in subsidiaries that own the aircraft in our Initial Portfolio and by the leases relating to those aircraft. A description of the securitization is set forth under ‘‘Description of Indebtedness — Securitization.’’

The purchase price for our Initial Portfolio will equal the sum of the net proceeds of this offering, our private placement of 3,450,000 shares to GE and the securitization, less the portion of such proceeds to be used to fund our formation and offering-related expenses, up-front costs and expenses related to our securitization, and a cash balance that we will retain for general corporate purposes. If the underwriters exercise their over-allotment option, the net proceeds from the sale of those shares and the private placement of additional shares to GE will be retained by us as additional working capital and will not increase the total purchase price. See ‘‘Use of Proceeds.’’ Based on an assumed initial public offering price of $22.00 per share, which is the midpoint of the price range set forth on the cover of this prospectus, we estimate the purchase price for our Initial Portfolio will be approximately $1,429.1 million. A description of the purchase agreement for our Initial Portfolio is set forth under ‘‘Asset Purchase Agreement.’’

In connection with this offering, our subsidiary, Genesis Acquisition Limited, has received a commitment for a $1 billion senior secured revolving credit facility that will be used to finance the acquisition of additional aircraft. A description of the credit facility is set forth under ‘‘Description of Indebtedness — Credit Facility.’’

6

The following diagram summarizes our corporate structure immediately after the completion of this offering:

| * | Genesis Lease Limited will own 100% of Genesis Funding's Class A common stock. For purposes of the securitization, a charitable trust will hold shares of Class B common stock of Genesis Funding having limited voting rights and representing less than 0.001% of the economic interest in Genesis Funding. See ‘‘Description of Indebtedness — Securitization.’’ |

Corporate Information

We are a Bermuda exempted company incorporated on July 17, 2006 under the provisions of Section 14 of the Companies Act 1981 of Bermuda. All of our outstanding common shares are currently owned by Codan Trust Company Limited, in its capacity as trustee for a Bermuda purpose trust. The purpose trust was formed at the direction of GECAS for the purpose of organizing Genesis and holding our outstanding shares until we complete this offering. We will repurchase those shares for their aggregate par value of $12,000 upon the completion of this offering. Our registered office is located at Clarendon House, 2 Church Street, Hamilton HM 11, Bermuda.

Although we, Genesis Funding and Genesis Acquisition are organized under the laws of Bermuda, we and they will be resident in Ireland for Irish tax purposes and thus will be subject to Irish corporation tax on our and their income in the same way, and to the same extent, as if we and they were organized under the laws of Ireland. Our principal executive offices are located at Roselawn House, University Business Complex, National Technology Park, Limerick, Ireland. Our telephone number at that address is +353 61 633 333. Our agent for service of process in the United States is Puglisi & Associates located at 850 Library Avenue, Suite 204, Newark, Delaware 19711.

7

The Offering

| Issuer | Genesis Lease Limited. | |

| Securities offered | 27,860,000 shares in the form of ADSs. Our common shares are being offered only in the form of ADSs. | |

| Over-allotment option | 4,179,000 shares in the form of ADSs. | |

| GE investment | An affiliate of GE has agreed to purchase from us, in a private placement exempt from registration pursuant to Section 4(2) of the Securities Act of 1933 that will be consummated concurrently with this offering, 3,450,000 ADSs at a price per share equal to the initial public offering price. If the underwriters exercise their option to purchase additional ADSs to cover over-allotments, the affiliate of GE has agreed to purchase from us, as part of the private placement, an additional number of ADSs such that, following such exercise and purchase, it will continue to hold approximately 11% of the issued and outstanding ADSs. In addition to a 180-day lock-up applicable to all of the ADSs held by GE to which it has agreed with the representatives of the underwriters, GE has agreed with us not to sell or transfer 2,000,000 of these ADSs for a period of two years from the date of this prospectus. | |

| Shares issued and outstanding immediately after this offering | 31,310,000 shares (or 36,006,500 shares if the underwriters exercise their over-allotment option in full and GE purchases additional shares as described above). | |

| Use of proceeds | We expect to use the net proceeds of this offering primarily to pay a portion of the purchase price for our Initial Portfolio. | |

| The purchase price for our Initial Portfolio that will be the initial assets of our aircraft leasing business will be determined based upon the initial public offering price in this offering, and will not be based upon a valuation of such assets. The purchase price will be equal to the sum of: | ||

| • | net proceeds from this offering after deducting the underwriters’ discounts and commissions (estimated at $580.7 million), plus | |||

| • | proceeds from the sale of shares to GE in the concurrent private placement (estimated at $75.9 million), plus | |||

| • | net proceeds of $804.5 million from the securitization, after deducting the initial purchasers' discount and fees, minus | |||

| • | $12.0 million to pay expenses related to our formation, this offering and the securitization, minus | |||

| • | a $20.0 million cash balance that we will retain for general corporate purposes. | |||

8

| Assuming an initial public offering price of $22.00 per share, which is the midpoint of the price range set forth on the cover page of this prospectus, we estimate that the purchase price for our Initial Portfolio will be $1,429.1 million. | ||

| If the underwriters exercise their over-allotment option, the net proceeds from the sale of those shares and the additional shares sold to an affiliate of GE in the private placement will be used for general corporate purposes, which may include the purchase of additional aircraft. | ||

| Dividend policy | Our board of directors has adopted a policy to pay a regular quarterly cash dividend to our shareholders in an initial amount of $0.47 per share. We intend to pay a larger first dividend for the period from the completion of this offering to March 31, 2007. | |

| The declaration and payment of future dividends to our shareholders will be at the discretion of our board of directors and will depend on many factors, including our financial condition, cash flows, legal requirements and other factors our board of directors deems relevant. Please review ‘‘Dividend Policy — Possible Changes in Quarterly Dividends’’ and ‘‘Risk Factors’’ for a discussion of these factors. | ||

| U.S. Tax Considerations | U.S. holders of our shares will be subject to U.S. tax on any taxable income attributable to holding our shares or gain from the sale of our shares. For U.S. federal income tax purposes, we will be treated as a passive foreign investment company, or PFIC. Under the PFIC rules, a U.S. holder who disposes or is deemed to dispose of our shares at a gain, or who receives or is deemed to receive certain distributions with respect to our shares, generally will be required to treat such gain or distributions as ordinary income and to pay an interest charge on the tax imposed. A qualified electing fund, or QEF, election may be used to reduce or eliminate the adverse impact of the PFIC rules for holders of our shares. This election may accelerate the recognition of taxable income and may result in the recognition of ordinary income. In addition, our distributions will not qualify for the reduced rate of U.S. federal income tax that applies to qualified dividends paid to non-corporate U.S. taxpayers. Investors should consult with their own tax advisors as to whether or not to make such an election and should carefully review the information under the heading ‘‘Taxation Considerations — U.S. Federal Income Tax Considerations.’’ | |

| Provided you make a QEF election, we estimate that if you hold the shares that you purchase in this offering through December 31, 2008, you will be allocated, on a cumulative basis, an amount of U.S. federal taxable income | ||

9

| for such period that will be less than 37.5% of the cash distributions paid to you during such period. We expect that substantially all of this income will be allocable to 2007, and very little or none of this income will be allocable to 2008. Although we have estimated that if you make a QEF election the taxable income allocated to you initially will be less than anticipated distributions, if we do not acquire additional aircraft generating sufficient depreciation deductions for U.S. tax purposes, your share of taxable income will likely exceed cash distributions at some point in the future. Please review ‘‘Tax Considerations — U.S. Federal Income Tax Considerations’’ for the basis of this estimate. | ||

| ADSs | Each ADS represents one common share. The depositary will be Deutsche Bank Trust Company Americas. The ADSs will be evidenced by American Depositary Receipts, or ADRs. The depositary through its custodian will hold the common shares underlying your ADSs. You will have rights as provided in the deposit agreement. The depositary will pay you the cash dividends and other distributions it receives on our common shares, in accordance with the terms of the deposit agreement, subject to any withholding taxes and any other applicable laws and regulations. We are offering our common shares only in the form of ADSs to facilitate the use by U.S. resident shareholders of an exemption from Irish withholding taxes available to U.S. residents. For a description of Irish withholding taxes and available exemptions for holders resident in the United States and other tax-treaty countries, you should review ‘‘Taxation Considerations — Irish Tax Considerations — Irish Dividend Withholding Tax.’’ We will pay all fees of the depositary, except in connection with cancellations of ADSs and withdrawal of common shares. For a description of the ADSs, you should review ‘‘Description of American Depositary Shares’’ in this prospectus. | |

| Listing | Our ADSs have been approved for listing on the New York Stock Exchange, subject to official notice of issuance, under the symbol ‘‘GLS.’’ | |

| Corporate Tax Residency | We and certain of our subsidiaries will be resident in Ireland for Irish tax purposes and thus subject to Irish corporation tax on our and their income in the same way, and to the same extent, as if we and they were organized under the laws of Ireland. | |

| Conditions Precedent | Completion of this offering is conditioned upon completion of the securitization and the private placement of shares to GE. | |

10

| Risk Factors | Investing in our shares involves a high degree of risk. You should carefully read and consider the information set forth under the heading ‘‘Risk Factors’’ and all other information set forth in this prospectus before investing in our shares. | |

Unless the context otherwise requires, all information in this prospectus:

| • | reflects the acquisition of our Initial Portfolio, as described above under ‘‘— Our Formation;’’ |

| • | assumes an initial public offering price of $22.00 per share, the midpoint of the price range set forth on the cover page of this prospectus; |

| • | assumes the underwriters do not exercise their over-allotment option; and |

| • | excludes approximately 33,640 restricted shares to be issued to our directors and officers prior to the completion of this offering. |

11

Summary Historical Combined and Pro Forma Financial and Other Data

The following table presents summary historical combined and pro forma financial and other data of our predecessor, which reflect the combination of the aircraft included in our Initial Portfolio and related leases as owned and operated by affiliates of GE during each of the periods presented. Our predecessor combined financial statements reflect the results of each of these aircraft and the related leases from the date that each such aircraft was acquired by an affiliate of GE.

The summary historical combined financial data presented below for each of the three years in the period ended December 31, 2005 have been derived from the audited combined financial statements of our predecessor included elsewhere in this prospectus. The summary historical combined financial data presented below for each of the nine-month periods ended September 30, 2005 and 2006 have been derived from the unaudited condensed combined financial statements of our predecessor included elsewhere in this prospectus, which have been prepared on a basis consistent with the predecessor's audited combined financial statements. Our predecessor’s combined financial statements have been prepared on a carve-out basis and do not reflect what our results of operations, financial position and cash flows would have been had we operated as a separate, stand-alone company during the periods presented, or what our results of operations, financial position and cash flows will be in the future. Instead, this financial information represents the combination of results attributable to the aircraft included in our Initial Portfolio as owned, managed, financed and operated by GE and its affiliates.

The unaudited pro forma information set forth below reflects our predecessor historical combined financial information, as adjusted to give effect to the following transactions as if each had occurred as of the assumed dates:

| • | the issuance and sale of 27,860,000 shares to the public at an assumed initial public offering price of $22.00 per share, which is the midpoint of the price range set forth on the cover page of this prospectus, resulting in gross proceeds to us of $612.9 million and net proceeds of $580.7 million after deducting the underwriters' discounts and commissions; |

| • | the issuance and sale of 3,450,000 shares to GE in the concurrent private placement at a price per share of $22.00, resulting in gross proceeds to us of $75.9 million; |

| • | the issuance of $810.0 million of aircraft lease-backed notes in the securitization for net proceeds of $804.5 million after deducting the initial purchasers' discounts and fees; |

| • | the use of $2.9 million to fund our portion of the expenses related to this offering and the private placement of shares to GE; |

| • | the use of $9.1 million to fund our portion of the expenses related to the securitization; |

| • | the use of $1,429.1 million to purchase the 41 aircraft in our Initial Portfolio; and |

| • | the retention of a $20.0 million cash balance by us for general corporate purposes. |

The unaudited pro forma statements have been prepared based upon available information and assumptions that we believe are reasonable. However, the unaudited pro forma financial statements are presented for illustrative and informational purposes only and should not be considered indicative of actual results that would have been achieved had the transactions described above actually been consummated as of the assumed dates. The unaudited pro forma statements also should not be considered representative of our future financial condition or results of operations.

The following data should be read in conjunction with ‘‘Risk Factors,’’ ‘‘Use of Proceeds,’’ ‘‘Unaudited Pro Forma Financial Statements,’’ ‘‘Management’s Discussion and Analysis of Financial Condition and Results of Operations,’’ and the combined financial statements of our predecessor company.

12

| Historical | Pro Forma | |||||||||||||||||||||||||||||||||||||||||

| Years Ended December 31, | Nine Months Ended September 30, | Year Ended December 31, 2005 | Nine Months Ended September 30, 2006 | |||||||||||||||||||||||||||||||||||||||

| 2003 | 2004 | 2005 | 2005 | 2006 | ||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||||||||||||||||||||||||

| Statement of income data: | ||||||||||||||||||||||||||||||||||||||||||

| Revenues | ||||||||||||||||||||||||||||||||||||||||||

| Rental of flight equipment | $ | 80,118 | $ | 99,414 | $ | 117,861 | $ | 86,989 | $ | 111,603 | $ | 159,801 | $ | 125,297 | ||||||||||||||||||||||||||||

| Expenses | ||||||||||||||||||||||||||||||||||||||||||

| Depreciation of flight equipment | 29,321 | 35,005 | 42,462 | 30,611 | 37,396 | 57,684 | 43,842 | |||||||||||||||||||||||||||||||||||

| Interest | 25,700 | 28,680 | 34,995 | 25,232 | 33,161 | 48,893 | 36,670 | |||||||||||||||||||||||||||||||||||

| Maintenance expense | 48 | 1,019 | 1,989 | 264 | 3,819 | 1,989 | 3,819 | |||||||||||||||||||||||||||||||||||

| Selling, general and administrative – related-party | 1,283 | 2,400 | 3,144 | 2,688 | 2,724 | 12,770 | 9,943 | |||||||||||||||||||||||||||||||||||

| Total operating expenses | 56,352 | 67,104 | 82,590 | 58,795 | 77,100 | 121,336 | 94,274 | |||||||||||||||||||||||||||||||||||

| Income before taxes | 23,766 | 32,310 | 35,271 | 28,194 | 34,503 | 38,465 | 31,023 | |||||||||||||||||||||||||||||||||||

| Provision for income taxes | 7,328 | 14,892 | 13,900 | 11,291 | 12,791 | 4,808 | 3,878 | |||||||||||||||||||||||||||||||||||

| Net income | $ | 16,438 | $ | 17,418 | $ | 21,371 | $ | 16,903 | $ | 21,712 | $ | 33,657 | $ | 27,145 | ||||||||||||||||||||||||||||

| Other data: | ||||||||||||||||||||||||||||||||||||||||||

| Net cash provided by operating activities | $ | 65,733 | $ | 85,525 | $ | 73,702 | $ | 53,681 | $ | 76,304 | ||||||||||||||||||||||||||||||||

| Net cash used in investing activities | (168,136 | ) | (178,756 | ) | (186,713 | ) | (130,622 | ) | (137,341 | ) | ||||||||||||||||||||||||||||||||

| Net cash provided by financing activities | 102,403 | 93,231 | 113,011 | 76,941 | 61,037 | |||||||||||||||||||||||||||||||||||||

| EBITDA(1) | $ | 79,094 | $ | 96,571 | $ | 113,493 | $ | 84,652 | $ | 105,541 | $ | 145,807 | $ | 112,016 | ||||||||||||||||||||||||||||

| Number of aircraft (at end of period) | 25 | 31 | 37 | 34 | 40 | 41 | 41 | |||||||||||||||||||||||||||||||||||

| Number of lessees (at end of period) | 17 | 22 | 28 | 26 | 30 | 30 | 30 | |||||||||||||||||||||||||||||||||||

| (1) | EBITDA is a measure of operating performance and liquidity that is not calculated in accordance with U.S. generally accepted accounting principles, or GAAP. We define EBITDA as net income before provision for income taxes, interest and depreciation and amortization. EBITDA is a key measure of our operating performance and liquidity that management uses to focus on consolidated operating results exclusive of expenses that relate to the financing and capitalization of our business. Our management uses EBITDA as a financial measure to evaluate the consolidated financial and operating performance and liquidity of our business that, when viewed with our GAAP results and the following reconciliation, we believe provides a more complete understanding of factors and trends affecting our business than GAAP measures alone. EBITDA assists us in comparing our operating performance on a consistent basis as it removes the impact of our capital structure (primarily interest charges), asset base (primarily depreciation and amortization) and items outside the control of our management team (taxes) from our operating results. EBITDA also assists us in comparing our liquidity on a consistent basis by providing a measure to demonstrate cash flow available for the payment of interest and dividends. We also present EBITDA because we believe it is frequently used by securities analysts, investors and other interested parties as a measure of financial performance and of debt service and dividend paying capacity. Accordingly, EBITDA is one of the metrics used by management and our board of directors to review the financial performance and liquidity of our business. |

| EBITDA should not be considered a substitute for net income, income from operations or cash flows provided by or used in operations, as determined in accordance with GAAP. In evaluating EBITDA, you should be aware that in the future we may incur expenses similar to the adjustments described above. In particular, we expect that depreciation of flight equipment and interest expense will continue to represent the substantial portion of our operating expenses. Therefore, the use of EBITDA as a measure of operating performance and liquidity is limited by |

13

| the exclusion of a majority of our operating expenses from the measure. Our presentation of EBITDA should not be construed as an implication that our future results will be unaffected by expenses that are unusual, non-routine or non-recurring items. |

| EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: |

| • | EBITDA does not reflect our cash expenditures for capital expenditures or contractual commitments; |

| • | EBITDA does not reflect changes in, or cash requirements for, our working capital requirements; |

| • | EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our indebtedness; |

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and EBITDA does not reflect cash requirements for such replacements; and |

| • | other companies may calculate EBITDA differently, which limits the usefulness of EBITDA as a comparative measure. |

| Because of these limitations, EBITDA should not be considered as the sole measure of the operating performance or liquidity of our business. We compensate for these limitations by relying primarily on our GAAP results and using EBITDA only supplementally. We strongly urge you to review the GAAP financial measures included in this prospectus, our predecessor's consolidated financial statements, including the notes thereto, our pro forma financial statements, and the other financial information contained in this prospectus, and to not rely on any single financial measure to evaluate our business. |

| The table below shows the reconciliation of net income to EBITDA for the years ended December 31, 2003, 2004 and 2005 and the nine months ended September 30, 2005 and 2006: |

| Historical | Pro Forma | |||||||||||||||||||||||||||||||||||||||||

| Years Ended December 31, | Nine Months Ended September 30, | Year Ended December 31, 2005 | Nine Months Ended September 30, 2006 | |||||||||||||||||||||||||||||||||||||||

| 2003 | 2004 | 2005 | 2005 | 2006 | ||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||||||||||||||||||||||||

| Net income | $ | 16,438 | $ | 17,418 | $ | 21,371 | $ | 16,903 | $ | 21,712 | $ | 33,657 | $ | 27,145 | ||||||||||||||||||||||||||||

| Provision for income taxes | 7,328 | 14,892 | 13,900 | 11,291 | 12,791 | 4,808 | 3,878 | |||||||||||||||||||||||||||||||||||

| Interest | 25,700 | 28,680 | 34,995 | 25,232 | 33,161 | 48,893 | 36,670 | |||||||||||||||||||||||||||||||||||

| Depreciation and amortization | 29,628 | 35,581 | 43,227 | 31,226 | 37,877 | 58,449 | 44,323 | |||||||||||||||||||||||||||||||||||

| EBITDA | $ | 79,094 | $ | 96,571 | $ | 113,493 | $ | 84,652 | $ | 105,541 | $ | 145,807 | $ | 112,016 | ||||||||||||||||||||||||||||

14

| The table below shows the reconciliation of net cash provided by operating activities to EBITDA for the years ended December 31, 2003, 2004 and 2005 and the nine months ended September 30, 2005 and 2006: |

| Historical | Pro Forma | |||||||||||||||||||||||||||||||||||||||||

| Years Ended December 31, | Nine Months Ended September 30, | Year Ended December 31, 2005 | Nine Months Ended September 30, 2006 | |||||||||||||||||||||||||||||||||||||||

| 2003 | 2004 | 2005 | 2005 | 2006 | ||||||||||||||||||||||||||||||||||||||

| Net cash provided by operating activities | $ | 65,733 | $ | 85,525 | $ | 73,702 | $ | 53,681 | $ | 76,304 | $ | 106,255 | $ | 68,380 | ||||||||||||||||||||||||||||

| Interest expense | 25,700 | 28,680 | 34,995 | 25,232 | 33,161 | 48,893 | 36,670 | |||||||||||||||||||||||||||||||||||

| Income taxes, net of changes in deferred income taxes | (13,093 | ) | (12,010 | ) | 16,053 | 14,468 | 2,287 | — | 10,201 | |||||||||||||||||||||||||||||||||

| Non-cash operating expenses | (1,283 | ) | (2,400 | ) | (2,806 | ) | (2,437 | ) | (2,691 | ) | (400 | ) | (300 | ) | ||||||||||||||||||||||||||||

| Net changes in operating assets and liabilities | 2,037 | (3,224 | ) | (8,451 | ) | (6,292 | ) | (3,520 | ) | (8,941 | ) | (2,935 | ) | |||||||||||||||||||||||||||||

| EBITDA | $ | 79,094 | $ | 96,571 | $ | 113,493 | $ | 84,652 | $ | 105,541 | $ | 145,807 | $ | 112,016 | ||||||||||||||||||||||||||||

15

RISK FACTORS

Investing in our shares involves a high degree of risk. You should carefully consider the following risks, as well as the other information contained in this prospectus, before making an investment in our company. The risks discussed below could materially and adversely affect our business, prospects, financial condition, results of operations, cash flows and ability to pay dividends and cause the trading price of our shares to decline. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business, prospects, financial condition, results of operations, cash flows and ability to pay dividends. You may lose all or a part of your investment.

Risks Related to Our Financial Information

We have no independent operating history upon which to assess our prospects or ability to pay dividends to our shareholders.

We are a newly organized company with no independent operating history, and our prospects and ability to pay dividends must be considered in light of the risks, expenses and difficulties frequently encountered when any new business is formed. Our lack of independent operating history will make it difficult for investors to assess the quality of our management and our ability to operate profitably and pay dividends to our shareholders. The historical and pro forma financial information included in this prospectus does not reflect the financial condition, results of operations or cash flows we would have achieved during the periods presented as a stand-alone company, and therefore may not be a reliable indicator of our future financial performance or ability to pay dividends. We cannot assure you that we will be able to implement our business strategies, that any of our strategies will be achieved or that we will be able to operate profitably and pay regular dividends to our shareholders. We urge you to carefully consider the basis on which the historical and pro forma financial information included in this prospectus was prepared and presented.

The historical and pro forma financial information included in this prospectus does not reflect the financial condition, results of operations or cash flows we would have achieved during the periods presented as a stand-alone company, and therefore may not be a reliable indicator of our future financial performance or ability to pay dividends.

The historical combined and pro forma financial information included in this prospectus does not reflect the financial condition, results of operations or cash flows that we would have achieved as a stand-alone company during the periods presented or that we will achieve in the future. This is primarily a result of the following factors:

| • | The historical combined financial information included in this prospectus does not reflect our ongoing cost structure, management, financing costs or business operations. Instead, this financial information represents the combination of results attributable to some of the aircraft included in our Initial Portfolio as owned, managed, financed and operated by GECAS and its affiliates. Changes will occur in the cost, financing and operation of these aircraft after we acquire them. These changes are likely to include: |

| • | the incurrence of stand-alone costs for services previously provided by GE and its affiliates; |

| • | the need for additional personnel and service providers to perform services currently provided by GECAS and other affiliates of GE; |

| ��� | legal, accounting, compliance and other costs associated with being a public company with listed equity, including compliance with the Sarbanes-Oxley Act of 2002 and rules subsequently implemented by the Securities and Exchange Commission, or the SEC, and the New York Stock Exchange, or the NYSE; and |

| • | the fact that the historical combined financial information reflects only the number of aircraft included in our Initial Portfolio owned by affiliates of GE for the periods or as of the dates specified therein, rather than all 41 of the aircraft included in our Initial Portfolio. |

16

| • | The historical financial information reflects allocations of corporate expenses from affiliates of GE and GECAS to our Initial Portfolio. These allocations are different from the comparable expenses we will incur as a stand-alone public company due to a number of factors, including the likelihood that we will not be able to realize economies-of-scale and negotiating leverage achieved by GE and GECAS. |

| • | Our predecessor’s working capital requirements were satisfied as part of GE’s corporate-wide cash management policies. Although we will have access to a credit facility for the acquisition of additional aircraft, we will not be able to obtain financing on terms as favorable as our predecessor obtained from or through GE and our cost of debt will be higher. |

| • | We expect that depreciation of capitalized major maintenance costs and our maintenance expenses will be higher in future periods than reflected in the historical and pro forma financial information due to the aging of the aircraft in our Initial Portfolio. |

| • | The pro forma financial information gives effect to this offering, the securitization, the concurrent private placement to GE and the application of the proceeds from these transactions as described under ‘‘Use of Proceeds,’’ including the purchase of the aircraft in our Initial Portfolio, as if those transactions were already consummated. This pro forma financial information has been prepared based upon available information and estimates and assumptions that we believe are reasonable. However, this pro forma financial information is presented for illustrative and informational purposes only and is not intended to represent or indicate what our financial condition or results of operations would have been had those transactions occurred as of those dates, nor what they may be in the future. |

| • | We expect that our effective tax rate will be lower than our predecessor's as a result of our tax residency in Ireland. We also expect that our cash tax payments will be lower as a result of our ability to depreciate aircraft under Irish tax law over eight years, which is a more accelerated rate than our predecessor used to depreciate aircraft under U.S. tax law. |

Our subsidiaries in many cases have owned the aircraft prior to our acquisition of them and may have unknown contingent liabilities that we may be required to fund.

There is a risk that our subsidiaries, many of which have owned the aircraft in our Initial Portfolio prior to our acquisition of such subsidiaries, could have material contingent liabilities that are unknown to us and that were incurred by third parties from operating and leasing the aircraft in our Initial Portfolio or for other reasons.

Affiliates of GE, from which we will acquire our Initial Portfolio, will make representations and warranties relating to:

| • | the existence of a valid and final transfer of the beneficial interests of entities that hold the aircraft or entities that hold the beneficial interests of any such entities and that are sold to us by affiliates of GE; |

| • | the title of our aircraft-owning subsidiaries to the applicable aircraft; and |

| • | the lack of additional liabilities of our aircraft-owning subsidiaries or liens on the aircraft other than disclosed to us. |

These representation and warranties are subject to time limits. If a liability arises and we are called on to pay it but are not able to recover any amount from the sellers for such liability, our liquidity could decrease significantly and we may be unable to pay dividends to our shareholders.

17

Risks Related to Our Dividend Policy

We may not be able to pay or maintain dividends on our shares. The failure to do so would adversely affect the trading price of our shares.

There are a number of factors that could affect our ability to pay dividends. If we are not able to refinance the notes issued in the securitization before the principal begins to amortize, our ability to pay dividends will be adversely affected if we have not developed sufficient additional sources of cash flow by then to replace the cash flows that will be applied to such principal payments. Commencing after the end of the fifth year after the issuance of the notes in the securitization, we will be required to apply all available cash flow from our Initial Portfolio to repay the principal amount thereof on a monthly basis, and commencing after the end of the third year after such issuance, we will be required to repay $1,000,000 of the principal of the notes on a monthly basis. Other factors that may cause you not to receive dividends in the expected amounts or at all, include the following:

| • | lack of availability of cash to pay dividends due to changes in our operating cash flow, capital expenditure requirements, working capital requirements and other cash needs; |

| • | our inability to make acquisitions of additional aircraft that are accretive to cash flow; |

| • | application of funds to make and finance acquisitions of aircraft and other aviation assets; |

| • | reduced levels of demand for, or value of, our aircraft; |

| • | increased supply of aircraft; |

| • | obsolescence of aircraft; |

| • | lower lease rates on new aircraft and re-leased aircraft; |

| • | delays in re-leasing our aircraft after the expiration or early termination of existing leases; |

| • | impaired financial condition and liquidity of our lessees; |

| • | deterioration of economic conditions in the commercial aviation industry generally; |

| • | unexpected or increased fees and expenses payable under our agreements with GECAS and its affiliates and other service providers; |

| • | poor performance by GECAS and its affiliates and other service providers and our limited rights to terminate them; |

| • | unexpected or increased maintenance, operating or other expenses or changes in the timing thereof; |

| • | a decision by our board of directors to modify or revoke its policy to distribute a portion of our cash flow available for distribution; |

| • | restrictions imposed by our financing arrangements, including under the notes issued in the securitization, our credit facility and any indebtedness incurred in the future to refinance our existing debt or to expand our aircraft portfolio; |

| • | changes in Irish tax law, the tax treaty between the United States and Ireland (the ‘‘Irish Treaty’’) or our ability to qualify for the benefits of such treaty; |

| • | cash reserves established by our board of directors; |

| • | restrictions under Bermuda law on the amount of dividends that we may pay: and |

| • | the other risks discussed under ‘‘Risk Factors.’’ |

The failure to maintain or pay dividends would adversely affect the trading price of our shares. See ‘‘Dividend Policy.’’

18

We are a holding company and will initially rely on Genesis Funding and its subsidiaries, the owners of the aircraft in our Initial Portfolio, to provide us with funds necessary to meet our financial obligations and pay dividends.

We are a holding company and our principal asset is the equity interest we hold in Genesis Funding, which will own, through its subsidiaries, the aircraft in our Initial Portfolio. As a result, we will depend on loans, dividends and other payments from Genesis Funding and from any other subsidiaries through which we may conduct operations in the future, to generate the funds necessary to meet our financial obligations and to pay dividends on our shares. Genesis Funding is legally distinct from us and is significantly restricted from paying dividends or otherwise making funds available to us pursuant to the agreements governing the notes issued in the securitization. See ‘‘Description of Indebtedness — Securitization.’’ Any other subsidiaries through which we may conduct operations in the future will also be legally distinct from us and may be similarly restricted from paying dividends or otherwise making funds available to us under certain conditions. Our subsidiaries will generally be required to service their debt obligations before making distributions to us, thereby reducing the amount of our cash flow available to pay dividends, fund working capital, make capital expenditures and satisfy other needs. In addition, our rights to the aircraft owned by Genesis Funding and our other subsidiaries will be structurally subordinated to the rights of the creditors of Genesis Funding. This means that the creditors of Genesis Funding and of our other subsidiaries will be paid from their assets before we would have any claims to those assets.

Other Risks Related to Our Business

Unforeseen difficulties and costs associated with the acquisition and/or management of our aircraft portfolio and other aviation assets could reduce or prevent our future growth and profitability.

Our growth strategy contemplates future acquisitions and leasing of additional commercial aircraft and other aviation assets. There is currently high market demand for certain narrow-body aircraft, and we may encounter difficulties in acquiring aircraft on favorable terms or at all, including increased competition for assets, which could reduce our acquisition opportunities or cause us to pay higher prices. Any acquisition of aircraft or other aviation assets may not be profitable to us after the acquisition and may not generate sufficient cash flow to justify our investment. In addition, our acquisition growth strategy exposes us to risks that may harm our business, financial condition, results of operations and cash flows, including risks that we may:

| • | fail to realize anticipated benefits, such as new customer relationships or cash flow enhancements; |

| • | impair our liquidity by using a significant portion of our available cash or borrowing capacity to finance acquisitions; |

| • | significantly increase our interest expense and financial leverage to the extent we incur additional debt to finance acquisitions; |

| • | incur or assume unanticipated liabilities, losses or costs associated with the aircraft or other aviation assets that we acquire; |

| • | incur other significant charges, including asset impairment or restructuring charges; or |

| • | be unable to maintain our ability to pay regular dividends to our shareholders. |

Unlike new aircraft, existing aircraft typically do not carry warranties as to their conditions. Although we may inspect an existing aircraft and its documented maintenance, usage, lease and other records prior to acquisition, such an inspection normally would not provide us with as much knowledge of an aircraft’s condition as we would have if it had been built for us. Repairs and maintenance costs for existing aircraft are difficult to predict and generally increase as aircraft age and may have been adversely affected by prior use. These costs could decrease our cash flow and reduce our liquidity and our ability to pay regular dividends to our shareholders.

19

We will need additional capital to finance our growth, and we may not be able to obtain it on acceptable terms, or at all, which may limit our ability to grow and compete in the aviation market.

We will require additional financing to expand our business through the acquisition of additional aircraft and other aviation assets. Financing may not be available to us or may be available to us only on terms that are not favorable. The terms of our credit facility and the securitization restrict our ability to incur additional debt. In addition, the terms of any other indebtedness we may incur may restrict our ability to incur additional debt. If we are unable to raise additional funds or obtain capital on acceptable terms, we may have to delay, modify or abandon some or all of our growth strategies.

We are a start-up company and need to establish our business infrastructure.

Our operational success will depend on succesfully establishing the business infrastructure, policies, procedures and systems necessary to support and grow our business. We may encounter difficulties and delays in establishing our business infrastructure, policies, procedures and systems and in integrating third-party service providers, which may affect our ability to meet reporting and other compliance requirements and to make payments on our debt in a timely manner. This may harm our business, financial condition, results of operations and cash flows and may delay or reduce our future growth and profitability.

The death, incapacity or departure of senior management could harm our business and financial results.

Our future success depends to a significant extent upon our chief executive officer, John McMahon, and our chief financial officer, Alan Jenkins. Mr. McMahon has substantial experience in the aviation industry, and his continued employment is crucial to the development of our business strategy and to the growth and development of our business. Mr. Jenkins also has significant experience in the aviation leasing industry on which we will depend. If Mr. McMahon or Mr. Jenkins were to die, become incapacitated for a short or long period, or leave our company, we may not be able to replace him with another chief executive officer or chief financial officer with equivalent talent and experience, and our business, prospects, financial condition, results of operations and cash flows may suffer. Because we have such a limited staff, the impact of either Mr. McMahon’s or Mr. Jenkins's departure could be severe to our business.

We will become subject to financial and other reporting and corporate governance requirements that may be difficult for us to satisfy.

In connection with this offering we will become obligated to file with the SEC periodic reports that are specified in Section 13 of the Securities Exchange Act of 1934, and we will be required to ensure that we have the ability to prepare financial statements that are fully compliant with all SEC reporting requirements on a timely basis. Upon completion of this offering, we will also become subject to requirements of the NYSE and certain provisions of the Sarbanes-Oxley Act of 2002 and the regulations promulgated thereunder, which will impose significant compliance obligations upon us. Pursuant to such obligations we will be required to, among other things:

| • | prepare periodic reports, including financial statements, in compliance with our obligations under U.S. federal securities laws and NYSE rules; |

| • | maintain effective internal controls over financial reporting and disclosure controls and procedures; |

| • | establish an investor relations function; and |

| • | establish internal compliance policies, such as those relating to insider trading. |

We may not be successful in implementing these requirements. If we fail to implement the requirements with respect to our internal accounting and audit functions, our ability to report our operating results on a timely and accurate basis could be impaired.

We have retained AIB International Financial Services Limited, or AIBIFS, as a corporate services provider to assist us in establishing books of account and in preparing our quarterly and annual consolidated financial statements. AIBIFS has informed us that they have not previously

20

provided these services to a company like ours that prepares its consolidated financial statements under U.S. GAAP and is subject to SEC public company requirements, including the reporting and other requirements of the Securities Exchange Act of 1934 and the Sarbanes-Oxley Act of 2002. We will retain Ernst & Young LLP to provide training and assistance regarding U.S. GAAP and SEC reporting requirements including the requirements of the Sarbanes-Oxley Act of 2002. If, due to lack of experience or otherwise, AIBIFS does not adequately perform such services and we are unable to remedy such inadequacy ourselves or through other service providers, our financial statements could contain material misstatements or omissions, we could have material weaknesses in our internal controls over financial reporting and our financial statements may not be published in a timely fashion, any of which could cause investors to lose confidence in our financial reporting and have an adverse effect on the trading price of our shares.

Risks Related to Our Indebtedness

We may not be able to refinance the notes issued by Genesis Funding on favorable terms or at all, which may require us to seek more costly or dilutive financing for our investments or to liquidate assets.

We currently intend to refinance the notes issued by Genesis Funding in the securitization through a further securitization or other long-term financing prior to the date five years after the completion of this offering after which we will be required to apply all of the available cash flow from our Initial Portfolio to repay the principal thereon. We bear the risk that we will not be able to refinance our existing indebtedness on favorable terms or at all. The inability to refinance our securitization indebtedness may require us to seek more costly or dilutive financing for our aircraft or to liquidate assets. If we are not able to refinance the notes issued in the securitization before being required to apply all of the available cash flow from our Initial Portfolio to repay the principal thereon and, as a result, excess cash available for dividends from Genesis Funding is eliminated, then our ability to continue paying dividends to our shareholders will be adversely affected if we have not developed sufficient additional sources of cash flow to replace the cash flows that will be applied to such principal amortization.

We are subject to risks related to our indebtedness that may limit our operational flexibility and our ability to pay dividends on our shares.

The terms of the notes that Genesis Funding will issue in the securitization subject us to certain risks and operational restrictions, including:

| • | all the aircraft leases in our Initial Portfolio and several of our aircraft serve as collateral for the notes issued in the securitization, the terms of which restrict our ability to sell aircraft and require us to use proceeds from sales of aircraft, in part, to repay amounts outstanding under those notes; |

| • | we will be required to dedicate a significant portion of our cash flow from operations to debt service payments, thereby reducing the amount of our cash flow available to pay dividends, fund working capital, make capital expenditures and satisfy other needs; |

| • | restrictions on Genesis Funding’s or other subsidiaries' ability to distribute excess cash flow to us under certain circumstances; |

| • | lessee, geographical and other concentration limits on flexibility in leasing our aircraft; |

| • | requirements to obtain policy provider consents and rating agency confirmations for certain actions; and |

| • | restrictions on Genesis Funding's ability to incur additional debt, create liens on assets, sell assets, make freighter conversions and make certain investments or capital expenditures. |

The restrictions described above may impair our ability to operate and to compete effectively with our competitors. Similar restrictions may be contained in the terms of future financings that we may enter into to finance our growth, including our committed credit facility.

21

The terms of the notes issued in the securitization will require us to apply funds otherwise available for paying dividends to the repayment of such notes commencing after the end of the fifth year after consummation of this offering. Additionally, if Genesis Funding does not satisfy a debt service coverage ratio for two consecutive months between the 35th and 59th months after consummation of this offering, Genesis Funding will be required to apply funds otherwise available for paying dividends to the retirement of the securitization notes.

Commencing after the end of the fifth year after consummation of this offering, Genesis Funding will be required to apply all of its available cash flow to repay the principal of the securitization notes. If Genesis Funding's debt service coverage ratio (as defined in the indenture for the securitization notes) is less than 1.80 to 1.00 on any two consecutive monthly payment dates occurring between the 35th and 59th month after consummation of this offering, Genesis Funding will be required to apply all of its available cash flow to repay the principal of the securitization notes. If Genesis Funding has not refinanced the notes prior to being required to apply all available cash flow to repay the principal amount of the notes, then the cash flow from the aircraft in our Initial Portfolio will not be available to us to pay dividends or to finance acquisitions of additional aircraft.

Genesis Funding's notes will be subject to interest rate risk, which could impair its ability to make distributions to us and our ability to pay dividends to you.

The notes that Genesis Funding will issue in the securitization will have a floating interest rate, which will subject Genesis Funding to the risk of an increase in interest rates and to the risk that its cash flow may be insufficient to make scheduled interest payments on its notes if interest rates were to increase. To limit this risk and to maintain the ratings of its notes, Genesis Funding has entered into interest rate swaps or other interest rate hedging arrangements with one or more counterparties. If any counterparty were to default on its obligations, then a mismatch in the floating rate interest obligations and fixed rate lease payments may arise, which could impair Genesis Funding's ability to make distributions to us, which would, in turn, adversely affect our ability to meet our financial obligations and pay dividends to our shareholders.

Risks Related to Our Relationships with GECAS, Its Affiliates and Other Service Providers