Exhibit 99.1

18th Floor, Jialong International Building

19 Chaoyang Park Road

Chaoyang District, Beijing 100125

People’s Republic of China

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 29, 2018

Dear Shareholder:

Notice is hereby given that the Annual General Meeting of Shareholders (the “Annual Meeting”) of China Biologic Products Holdings, Inc.,an exempted company incorporated under the laws of the Cayman Islands(the “Company”), will be held on Friday, June 29, 2018, at 10 a.m., Beijing time, at the principal office of the Company located at 18th Floor, Jialong International Building, 19 Chaoyang Park Road, Chaoyang District, Beijing 100125, People’s Republic of China.

Only registered holders of ordinary shares of the Company with par value US$0.0001 each (the “Ordinary Shares”) as at the close of business on May 11, 2018 or their proxy holders are entitled to attend and vote at the Annual Meeting or any adjournment thereof. At the Annual Meeting, you will be asked to consider and vote upon the following resolutions:

| (1) | as an ordinary resolution: |

THAT Yungang Lu be appointed as a Class III Director of the Company with immediate effect, to serve until the 2021 annual general meeting of the shareholders of the Company, until his successor shall have been duly elected and qualified, or until his earlier resignation or removal.

| (2) | as an ordinary resolution: |

THAT Zhijun Tong be appointed as a Class III Director of the Company with immediate effect, to serve until the 2021 annual general meeting of the shareholders of the Company, until his successor shall have been duly elected and qualified, or until his earlier resignation or removal.

| (3) | as an ordinary resolution: |

THAT Albert (Wai Keung) Yeung be appointed as a Class III Director of the Company with immediate effect, to serve until the 2021 annual general meeting of the shareholders of the Company, until his successor shall have been duly elected and qualified, or until his earlier resignation or removal.

| (4) | as an ordinary resolution: |

THAT the appointment of KPMG Huazhen LLP, which was selected by the Audit Committee, as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2018 is hereby approved and ratified.

A Proxy Statement describing the matters to be considered at the Annual Meeting is attached to this Notice. Our 2017 Annual Report accompanies this Notice, but it is not deemed to be part of the Proxy Statement. This Notice and Proxy Statement and our 2017 Annual Report are available online at https://www.iproxydirect.com/CBPO.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we hope that you will vote as soon as possible. You may vote your shares by either completing, signing and returning the accompanying proxy card or casting your vote over the Internet.

| | Sincerely, |

| | |

| | /s/ David (Xiaoying) Gao |

| | David (Xiaoying) Gao |

| | Chief Executive Officer |

| | May 7, 2018 |

18th Floor, Jialong International Building

19 Chaoyang Park Road

Chaoyang District, Beijing 100125

People’s Republic of China

PROXY STATEMENT

The Board of Directors (the “Board”) of China Biologic Products Holdings, Inc.,an exempted company incorporated under the laws of the Cayman Islands(the “Company,” “we,” “us” or “our”),is furnishing this proxy statement (this “Proxy Statement”) and the accompanying proxy to you to solicit your proxy for the 2018 Annual General Meeting of Shareholders (the “Annual Meeting”). The Annual Meeting will be held on Friday, June 29, 2018, at 10 a.m., Beijing time, at the principal office of the Company located at 18th Floor, Jialong International Building, 19 Chaoyang Park Road, Chaoyang District, Beijing 100125, People’s Republic of China.

It is anticipated that the Notice of the Annual Meeting will be mailed to shareholders on or about May 7, 2018.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

What is this Proxy Statement?

You have received this Proxy Statement and our 2017 annual report (the “Annual Report”) because our Board is soliciting your proxy to vote your shares at the Annual Meeting. This Proxy Statement includes information that is designed to assist you in voting your shares.

What is the purpose of the Annual Meeting?

At the Annual Meeting, our shareholders will act upon the matters described in this Proxy Statement. These actions include the election of three director nominees listed in this Proxy Statement to the Board as Class III directors1; and ratification of the appointment of the independent registered public accounting firm (which we sometimes refer to as the “independent auditors”). An additional purpose of the Annual Meeting is to transact any other business that may properly come before the Annual Meeting and any and all adjournments or postponements of the Annual Meeting.

Who can attend the Annual Meeting?

All shareholders of record at the close of business on May 11, 2018 (the “Record Date”), or their duly appointed proxies, may attend the Annual Meeting.

What proposals will be voted on at the Annual Meeting?

Shareholders will vote on two proposals at the Annual Meeting:

1 Our classified Board consists of three classes of directors. Class I directors currently consist of Mr. David (Xiaoying) Gao, Mr. Joseph Chow and Ms. Yue’e Zhang, with term expiring in 2019. Class II directors currently consist of Mr. Sean Shao, Prof. Wenfang Liu and Mr. David Hui Li, with term expiring in 2020. Class III directors currently consist of Dr. Yungang Lu, Mr. Zhijun Tong and Mr. Albert (Wai Keung) Yeung, with term expiring in 2018. See Proposal No. 1 – Election of Directors for details.

| • | the election of three director nominees listed in this Proxy Statement to the Board as Class III directors, each to serve until the 2021 annual meeting of shareholders of the Company or until such person shall resign, be removed or otherwise leave office; and |

| | • | the ratification of the appointment of KPMG Huazhen LLP as the Company’s independent auditors for the year ending December 31, 2018. |

What are the Board’s recommendations?

Our Board recommends that you vote:

| | • | FOR election of the three director nominees listed in this Proxy Statement to the Board as Class III directors; and |

| | • | FOR ratification of the appointment of KPMG Huazhen LLP as the Company’s independent auditors for the year ending December 31, 2018. |

Will there be any other business on the agenda?

The Board knows of no other matters that are likely to be brought before the Annual Meeting. If any other matters properly come before the Annual Meeting, however, the persons named in the enclosed proxy, or their duly appointed substitute acting at the Annual Meeting, will be authorized to vote or otherwise act on those matters in accordance with their judgment.

Who is entitled to vote?

Only shareholders of record at the close of business on May 11, 2018, which we refer to as the Record Date, are entitled to notice of, and to vote at, the Annual Meeting. Holders of ordinary shares as of the Record Date are entitled to one vote for each share held for each of the proposals. No other class of voting securities is outstanding on the date of mailing of this Proxy Statement.

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

Shareholder of Record.If your shares are registered directly in your name with our transfer agent, Securities Transfer Corporation, you are considered, with respect to those shares, the “shareholder of record.” This Proxy Statement and our Annual Report have been sent directly to you by us.

Beneficial Owner.If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of shares held in street name. This Proxy Statement and the Annual Report have been forwarded to you by your broker, bank or nominee who is considered, with respect to those shares, the shareholder of record. As the beneficial owner, you have the right to direct your broker, bank or nominee how to vote your shares by using the voting instructions included in with your proxy materials.

How do I vote my shares?

Whether you hold shares directly as a registered shareholder of record or beneficially in street name, you may vote without attending the Annual Meeting. You may vote by granting a proxy or, for shares held beneficially in street name, by submitting voting instructions to your stockbroker, trustee or nominee. In most cases, you will be able to do this by using the Internet or by mail, if you received a printed set of the proxy materials.

By Internet – If you have Internet access, you may submit your proxy via the Internet by following the instructions provided in the Notice of Annual Meeting of Shareholders accompanying this Proxy Statement (the “Notice”), or if you received a printed version of the proxy materials by mail, by following the instructions provided with your proxy materials and on your proxy card or voting instruction card.

By Mail – If you received printed proxy materials, you may submit your proxy by following the instructions provided on your proxy card or voting instruction card. If you received a Notice, you may also submit your proxy by mail by signing your proxy card if your shares are registered or, for shares held beneficially in street name, by following the voting instructions included by your stockbroker, trustee or nominee, and mailing it in the envelope provided. If you provide specific voting instructions, your shares will be voted as you have instructed.

Internet voting facilities for shareholders of record will be available 24 hours a day and will close at 11:59 p.m., Beijing time, on June 28, 2018.

If you vote by proxy, the individuals named on the proxy card (your “proxies”) will vote your shares in the manner you indicate. You may specify how your shares should be voted for each of the proposals. If you grant a proxy without indicating your instructions, your shares will be voted as follows:

| • | FOR election of the three director nominees listed in this Proxy Statement to the Board as Class III directors; and |

| • | FOR ratification of the appointment of KPMG Huazhen LLP as the Company’s independent auditors for the year ending December 31, 2018. |

Each ordinary share is entitled to one vote.

What constitutes a quorum?

At the Annual Meeting, the presence of shareholders, in person or by proxy, holding at least one-third of all issued and outstanding shares as of the Record Date will constitute a quorum for purposes of convening the Annual Meeting and voting on all of the matters described in this Proxy Statement. If a share is represented for any purpose at the Annual Meeting by the presence of the registered shareholder or a person holding a valid proxy for the registered shareholder, it is deemed to be present for the purpose of establishing a quorum. Therefore, valid proxies which are marked “Abstain” or as to which no vote is marked, including broker non-votes (described below), will be counted as present for purposes of determining whether there is a quorum at the Annual Meeting.

What is a broker “non-vote” and what is its effect on voting?

If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters but cannot vote on non-routine matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares does not have the authority to vote on the matter with respect to those shares. This is generally referred to as a “broker non-vote.”

Proposal No. 2 (ratification of auditors) involves a matter that we believe will be considered routine. All other proposals involve matters that we believe will be considered non-routine. We encourage you to provide voting instructions to the organization that holds your shares by carefully following the instructions provided on your proxy card.

What is required to approve each item?

| | • | For Proposal No. 1 (election of Class III directors), the three director nominees receiving a plurality of the votes cast by the shareholders present in person or represented by proxy at the Annual Meeting and entitled to vote thereon shall be elected as the Class III directors. Abstentions and broker non-votes are not counted for purposes of the election of directors. |

According to our Corporate Governance Guidelines, in an uncontested election (i.e., an election where the only nominees are those recommended by the Board), any nominee for director who receives a greater number of votes “withheld” from his/her election than votes “for” such election (a “Majority Withheld Vote”) is obligated to promptly tender his/her resignation to the Board following certification of the shareholder vote.

In the event of a tendered resignation following a Majority Withheld Vote, the Governance and Nominating Committee will thereafter promptly consider the resignation offer and recommend to the Board action with respect to the tendered resignation, and the Board shall promptly act upon such recommendation. In considering what action to recommend with respect to the tendered resignation, the Governance and Nominating Committee will take into account all factors deemed relevant by the members of the Governance and Nominating Committee including, without limitation, any stated reasons why shareholders “withheld” votes for election from such director, the length of service and qualifications of the director whose resignation has been tendered, the overall composition of the Board, the director’s contributions to us, and our Corporate Governance Guidelines.

| | • | For Proposal No. 2 (ratification of independent auditors), the affirmative vote of the holders of a majority of the shareholders’ shares present in person or represented by proxy at the Annual Meeting and entitled to vote, is required. |

| | • | For any other matters on which shareholders are entitled to vote, the affirmative vote of the holders of a majority of the shareholders’ shares present in person or represented by proxy at the Annual Meeting and entitled to vote, is required. |

For the purpose of determining whether the shareholders have approved matters other than the election of directors, abstentions are treated as shares present or represented and voting, so abstaining has the same effect as a negative vote. If shareholders hold their shares through a broker, bank or other nominee and do not instruct them how to vote, the broker has authority to vote the shares for routine matters.

Shareholders may not cumulate votes in the election of directors, which means that each shareholder may vote no more than the number of shares he or she owns for a single director nominee.

How will ordinary shares represented by properly executed proxies be voted?

All ordinary shares represented by proper proxies will, unless such proxies have previously been revoked, be voted in accordance with the instructions indicated in such proxies. If you do not provide voting instructions, your shares will be voted in accordance with the Board’s recommendations as set forth herein. In addition, if any other matters properly come before the Annual Meeting, the persons named in the enclosed proxy, or their duly appointed substitute acting at the Annual Meeting, will be authorized to vote or otherwise act on those matters in accordance with their judgment.

Can I change my vote or revoke my proxy?

Any shareholder executing a proxy has the power to revoke such proxy at any time prior to your shares being voted. You may revoke your proxy prior to your shares being voted by calling 1-866-752-VOTE (8683), or by accessing the Internet website https://www.iproxydirect.com/CBPO, or in writing by execution of a subsequently dated proxy, or by a written notice of revocation, sent to the attention of the Corporate Secretary at China Biologic Products Holdings, Inc., 18th Floor, Jialong International Building, 19 Chaoyang Park Road, Chaoyang District, Beijing 100125, People’s Republic of China, or by attending and voting in person at the Annual Meeting. Unless revoked, the shares represented by timely received proxies will be voted in accordance with the directions given therein. Your most current proxy card or Internet proxy is the one that is counted.

If the Annual Meeting is postponed or adjourned for any reason, at any subsequent reconvening of the Annual Meeting, all proxies granted according to the instructions set forth herein will be voted in the same manner as the proxies would have been voted at the previously convened Annual Meeting (except for any proxies that have at that time effectively been revoked or withdrawn), even if the proxies had been effectively voted on the same or any other matter at a previous Annual Meeting.

How are proxies solicited?

In addition to the mail solicitation of proxies, our officers, directors, employees and agents may solicit proxies by written communication, telephone or personal call. These persons will receive no special compensation for any solicitation activities. We will reimburse banks, brokers and other persons holding ordinary shares for their expenses in forwarding proxy solicitation materials to beneficial owners of our ordinary shares.

Who paid for this proxy solicitation?

The cost of preparing, printing, assembling and mailing this Proxy Statement and other material furnished to shareholders in connection with the solicitation of proxies is borne by us.

Are there any rules regarding admission to the Annual Meeting?

Yes. You are entitled to attend the Annual Meeting only if you were, or you hold a valid legal proxy naming you to act for, one of our shareholders on the Record Date. Before we admit you to the Annual Meeting, we must be able to confirm:

| | • | Your identity by reviewing a valid form of photo identification, such as your passport; and |

| | • | You were, or are validly acting for, a shareholder of record on the Record Date by: |

| o | verifying your name and share ownership against our list of registered shareholders, if you are the record holder of your shares; |

| o | reviewing other evidence of your share ownership, such as your most recent brokerage or bank statement, if you hold your shares in street name; or |

| o | reviewing a written proxy that shows your name and is signed by the shareholder you are representing, in which case either the shareholder must be a registered shareholder of record or you must have a brokerage or bank statement for that shareholder as described above. |

If you do not have a valid form of photo identification and proof that you owned, or are legally authorized to act as proxy for someone who owned our ordinary shares on May 11, 2018, you will not be admitted to the Annual Meeting.

At the entrance to the Annual Meeting, we will verify that your name appears in our register of members or will inspect your brokerage or bank statement, as your proof of ownership, and any written proxy you present as the representative of a shareholder. We will decide in our sole discretion whether the documentation you present for admission to the Annual Meeting meets the requirements described above.

How do I learn the results of the voting at the Annual Meeting?

The preliminary voting results will be announced at the Annual Meeting. The final results will be published in our report on Form 6-K to be furnished to the SEC after the Annual Meeting.

Can I receive future shareholder communications electronically through the Internet?

Yes. You may elect to receive future notices of meetings, proxy materials and annual reports electronically through the Internet. To consent to electronic delivery, vote your shares using the Internet. At the end of the Internet voting procedure, the on-screen Internet voting instructions will tell you how to request future shareholder communications be sent to you electronically.

Once you consent to electronic delivery, you must vote your shares using the Internet and your consent will remain in effect until withdrawn. You may withdraw this consent at any time during the voting process and resume receiving shareholder communications in print form.

Whom may I contact for further assistance?

If you have any questions about giving your proxy or require any assistance, please contact our Corporate Secretary:

China Biologic Products Holdings, Inc.

18th Floor, Jialong International Building

19 Chaoyang Park Road

Chaoyang District, Beijing 100125

People’s Republic of China

Attention: Corporate Secretary

| | • | by telephone at (+86) 10-6598-3111. |

PROPOSAL NO. 1

ELECTION OF DIRECTORS

There are currently nine directors serving on the Board. Pursuant to Article 28.3 of the Memorandum and Articles of Association of the Company, the directors have been designated into three Classes: Class I directors currently consist of Mr. David (Xiaoying) Gao, Mr. Joseph ChowandMs. Yue’e Zhang, with term expiring in 2019; Class II directors currently consist of Mr. Sean Shao, Prof. Wenfang Liu and Mr. David Hui Li, with term expiring in 2020; and Class III directors currently consist of Dr. Yungang Lu, Mr. Zhijun Tong and Mr. Albert (Wai Keung) Yeung, with term expiring in 2018. At each annual meeting of shareholders, directors in one class are elected for a full term of three years to succeed those directors whose terms are expiring. At the Annual Meeting, three directors will be elected as Class III directors for a three-year term expiring at the 2021 Annual Meeting of Shareholders.

The director nominees who have been nominated for election to the Board as Class III directors are listed in the table below. Each of the nominees is a current director of the Company. The shareholders are entitled to vote “withhold” or “for” with respect to each director nominee on an individual basis.

If, as a result of circumstances not now known or foreseen, any of the nominees is unavailable to serve as a nominee for director at the time of the Annual Meeting, the holders of the proxies solicited by this Proxy Statement may vote those proxies either (i) for the election of a substitute nominee who will be designated by the proxy holders or by the present Board or (ii) for the balance of the nominees, leaving a vacancy. The Board has no reason to believe that any of the nominees will be unwilling or unable to serve, if elected as a director for a three-year term expiring in 2021.

The three director nominees receiving a plurality of the votes cast by the shareholders present in person or represented by proxy at the Annual Meeting and entitled to vote thereon shall be elected as the Class III directors.

According to our Corporate Governance Guidelines, in an uncontested election (i.e., an election where the only nominees are those recommended by the Board), any nominee for director who receives a greater number of votes “withheld” from his/her election than votes “for” such election (a “Majority Withheld Vote”) is obligated to promptly tender his/her resignation to the Board following certification of the shareholder vote.

In the event of a tendered resignation following a Majority Withheld Vote, the Governance and Nominating Committee will thereafter promptly consider the resignation offer and recommend to the Board action with respect to the tendered resignation, and the Board shall promptly act upon such recommendation. In considering what action to recommend with respect to the tendered resignation, the Governance and Nominating Committee will take into account all factors deemed relevant by the members of the Governance and Nominating Committee including, without limitation, any stated reasons why shareholders “withheld” votes for election from such director, the length of service and qualifications of the director whose resignation has been tendered, the overall composition of the Board, the director’s contributions to us, and our Corporate Governance Guidelines.

Proxies submitted on the accompanying proxy card will be voted for the election of the director nominees listed below, unless the proxy card is marked otherwise.

The Board of Directors recommends a vote FOR the election of the director nominees listed below.

Set forth below are the name, age and principal occupation of each nominee for election as a Class III director and of each Class I and Class II directors who will continue to serve on the Board.

Nominees for Election (Class III Directors)

| Name | | Age | | Position with the Company |

| Yungang Lu | | 54 | | Director |

| Zhijun Tong | | 58 | | Director |

| Albert (Wai Keung) Yeung | | 75 | | Director |

The following directors will continue to serve after the Meeting:

Directors with Terms Expiring in 2019 (Class I Directors)

| Name | | Age | | Position with the Company |

| David (Xiaoying) Gao | | 67 | | Chairman of the Board, CEO & President |

| Joseph Chow | | 54 | | Director |

| Yue’e Zhang | | 55 | | Director |

Directors with Terms Expiring in 2020 (Class II Directors)

| Name | | Age | | Position with the Company |

| Sean Shao | | 61 | | Director |

| Wenfang Liu | | 80 | | Director |

| David Hui Li | | 49 | | Director |

Director Qualifications

Directors are responsible for overseeing our business consistent with their fiduciary duty to shareholders. This significant responsibility requires highly-skilled individuals with various qualities, attributes and professional experience. The Board believes that there are general requirements for service on our Board that are applicable to all directors and that there are other skills and experience that should be represented on the Board as a whole but not necessarily by each director. The Board and the Governance and Nominating Committee of the Board consider the qualifications of directors and director candidates individually and in the broader context of the Board’s overall composition and our current and future needs.

In its assessment of each potential candidate, including those recommended by shareholders, the Governance and Nominating Committee considers the nominee’s judgment, integrity, experience, independence, understanding of our business or other related industries and such other factors the Governance and Nominating Committee determines are pertinent in light of the current needs of the Board. The Governance and Nominating Committee also takes into account the ability of a director to devote the time and effort necessary to fulfill his or her responsibilities to the Company.

The Board and the Governance and Nominating Committee require that each director be a recognized person of high integrity with a proven record of success in his or her field. Each director must demonstrate innovative thinking, familiarity with and respect for corporate governance requirements and practices, an appreciation of multiple cultures and a commitment to sustainability and to dealing responsibly with social issues. In addition to the qualifications required of all directors, the Board assesses intangible qualities including the individual’s ability to ask difficult questions and, simultaneously, to work collegially.

The Board does not have a specific diversity policy, but considers diversity of race, ethnicity, gender, age, cultural background and professional experiences in evaluating candidates for Board membership. Diversity is important because a variety of points of view contribute to a more effective decision-making process.

Qualifications, Attributes, Skills and Experience to Be Represented on the Board as a Whole

The Board has identified particular qualifications, attributes, skills and experience that are important to be represented on the Board as a whole, in light of our current needs and business priorities. The Company is a NASDAQ listed biopharmaceutical company that is principally engaged in the research, development and manufacturing of plasma-based pharmaceutical products in China. Therefore, the Board believes that a diversity of professional experiences in the biopharmaceutical industry, specific knowledge of key geographic growth areas, and knowledge of U.S. capital markets and of U.S. accounting and financial reporting standards should be represented on the Board. In addition, the market in which we compete is characterized by introductions of new products and changes in customer demands and our future success depends upon our ability to keep pace through strong research and development. Therefore, the Board believes that academic and professional experience in research and development in the biopharmaceutical industry should also be represented on the Board.

Summary of Qualifications of Nominees for Class III Directors

Set forth below is a narrative disclosure that summarizes some of the specific qualifications, attributes, skills and experiences of our Class III director nominees. For more detailed information, please refer to the biographical information for such director set forth above.

Dr. Yungang Lu. Dr. Lu has been a member of our Board since March 19, 2012. Dr. Lu is the director of Time Galaxy Limited, a Hong Kong-based family office with global investment interests. Dr. Lu also serves as a director of the following listed companies: China Techfaith Wireless Communication Technology Ltd., a handheld device company in China, and China Cord Blood Corporation, a provider of cord blood storage services in China. From 2009 to 2017, Dr. Lu served as a managing director of Seres Asset Management Limited, an Asian equities investment management company based in Hong Kong. From 2004 to 2009, Dr. Lu was a managing director of APAC Capital Advisors Limited, a Hong Kong-based Greater China investment manager. Dr. Lu was a research analyst with Credit Suisse First Boston (Hong Kong), a financial services company, from 1998 to 2004, where his last position was the head of the China research department. Before moving to Credit Suisse, he worked as an equity analyst focused on the regional infrastructure at JP Morgan Securities Asia, a financial services company, in Hong Kong. Dr. Lu received a B.S. in Biology from Peking University, an M.S. in Biochemistry from Brigham Young University and a Ph.D. in Finance from the University of California, Los Angeles.

Dr. Lu has significant experience leading, managing and advising companies. Dr. Lu’s investment managing background gives him keen insight into Company’s operations. Dr. Lu also qualifies as a financial expert and is able to provide key insight to the Board on financial and other matters. In addition, Dr. Lu’s service on the boards of other public companies has given him expertise with respect to corporate governance issues. The Board believes that Dr. Lu has the qualities necessary to contribute to the Board’s overall effectiveness.

Mr. Zhijun Tong. Mr. Tong has been a member of our Board since April 20, 2012. He has served as the chairman of the board of directors of several corporations, including Spain Qifa Corporation Ltd. since 1996, Hong Kong Tong’s Group since 2007, Sunstone (Qingdao) Plant Oil Co., Ltd. since 2008, Sunstone (Qingdao) Food Co., Ltd. since 2009, Shengda (Zhangjiakou) Pharmaceutical Co., Ltd. since 2011 and Shengda (Qianxi) Chinese Medicine Cultivation Co., Ltd. since 2012. Mr. Tong has also served as a director and a vice president of Spain International Haisitan Group since 1993. From 2007 to 2011, he was the chairman of the board of directors and general manager of Sunstone Pharmaceutical Co., Ltd and also served as the president and a director of BMP Sunstone Corporation, a NASDAQ-listed pharmaceutical corporation.

Mr. Tong has significant experience leading, managing and advising companies. He also has experience leading organizations through periods of growth, including growing a startup company into a public company. His experience on the boards of both public and private pharmaceutical companies also provides significant value and adds to his diverse perspective. The Board believes that Mr. Tong has the qualities necessary to contribute to the Board’s overall effectiveness.

Mr. Albert (Wai Keung) Yeung. Mr. Yeung has been a member of our Board since July 29, 2012. Mr. Yeung has been since 2005 a partner of Albert Yeung & Associate Consulting Company, a consulting company providing M&A, leadership and executive coaching services to senior managers and chief executive officers. From August 2006 to February 2011, Mr. Yeung also served as a director of BMP Sunstone Corporation, a company listed on NASDAQ until the company’s acquisition by Sanofi. Since September 6, 2015, Mr. Yeung has been an independent director of Beijing Promed Medical Technology Co. Ltd. Prior to retirement, Mr. Yeung had spent more than 30 years in China’s pharmaceutical industry, holding various senior sales, marketing and general management positions with major pharmaceutical corporations in Hong Kong and mainland China, including Johnson & Johnson, Xian-Janssen, Burroughs Wellcome, Bristol Myers-Squibb and GlaxoSmithKline.

Mr. Yeung has significant experience leading, managing and advising companies. His experience on the boards of both public and private pharmaceutical companies also provides significant value and adds to his diverse perspective. The Board believes that Mr. Yeung has the qualities necessary to contribute to the Board’s overall effectiveness.

General Information

All directors will hold office for the terms indicated, or until their earlier death, resignation, removal or disqualification, and until their respective successors are duly elected and qualified. There are no arrangements or understandings between any of the nominees, directors or executive officers and any other person pursuant to which any of our nominees, directors or executive officers have been selected for their respective positions. No nominee, member of the Board or executive officer is related to any other nominee, member of the Board or executive officer.

PROPOSAL NO. 2

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Audit Committee has selected KPMG Huazhen LLP to serve as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2018. KPMG Huazhen LLP was the Company’s independent registered public accounting firm from August 5, 2015 through December 31, 2017. Prior to that, KPMG was the Company’s independent registered public accounting firm for the fiscal years ended December 31, 2010 to 2014.

On August 3, 2015, the Board, acting upon the recommendation of the Audit Committee, approved the dismissal of KPMG as the Company’s independent registered public accounting firm and the appointment of KPMG Huazhen LLP as the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2015, effective on August 5, 2015. The change to KPMG Huazhen LLP, based in mainland China, was intended to align the auditing process to the location where the vast majority of the Company’s operations take place and where substantial audit work is performed.

We are asking our shareholders to ratify the selection of KPMG Huazhen LLP as our independent registered public accounting firm. Although ratification is not required by our Memorandum and Articles of Association or otherwise, the Board is submitting the selection of KPMG Huazhen LLP to our shareholders for ratification as a matter of good corporate practice. In the event our shareholders fail to ratify the appointment, the Audit Committee may reconsider this appointment.

The Company has been advised by KPMG Huazhen LLP that neither the firm nor any of its associates had any relationship with the Company other than the usual relationship that exists between independent registered public accounting firms and their clients during the last fiscal year. Representatives of KPMG Huazhen LLP are expected to attend the Annual Meeting with the opportunity to make a statement and/or respond to appropriate questions from shareholders present at the Annual Meeting.

Services and Fees of Independent Public Accounting Firm

Aggregate fees billed to the Company by our independent auditor, KPMG Huazhen LLP, during the last two fiscal years were as follows:

| | | 2017 | | | 2016 | |

| Audit Fees | | $ | 821,635 | | | $ | 836,237 | |

| Audit Related Fees | | | 146,382 | | | | - | |

| Tax Fees | | | 44,138 | | | | 44,206 | |

| Total | | $ | 1,012,155 | | | $ | 880,443 | |

Audit fees paid consist of fees billed for professional services rendered for the audit of the Company’s consolidated annual financial statements and audit of the effectiveness of internal control over financial reporting, and services that are normally provided by our auditors in connection with statutory and regulatory filings or engagements.

Audit related fees paid by us refer to fees incurred for professional services rendered for due diligence pertaining to a business combination transaction.

Tax fees paid by us of $44,138 and $44,206 in 2017 and 2016, respectively, were for tax compliance services in the same periods.

In accordance with the Audit Committee’s pre-approval policies and procedures described below, in 2017, all audit, audit-related, tax and other services performed by our independent auditor were approved in advance by the Audit Committee. KPMG Huazhen LLP was our principal auditor.

Pre-Approval Policies and Procedures

Under the Sarbanes-Oxley Act of 2002, all audit and non-audit services performed by our auditors must be approved in advance by our Audit Committee to assure that such services do not impair the auditors’ independence from us.

The Board of Directors recommends a vote FOR ratification of the selection of KPMG Huazhen LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2018.

SHAREHOLDER PROPOSALS FOR THE 2019 ANNUAL MEETING

If you wish to have a proposal included in our proxy statement for next year’s annual general meeting, your proposal must be submitted in writing to the Corporate Secretary of the Company, at 18th Floor, Jialong International Building, 19 Chaoyang Park Road, Chaoyang District, Beijing 100125, People’s Republic of China, no later than the close of business on December 31, 2018. We are not obligated to include shareholder proposals in our annual proxy statements as a foreign private issuer, but we will consider proposals submitted in writing in this way. The submission of a shareholder proposal does not guarantee that it will be included in the proxy statement.

ANNUAL REPORT ON FORM 20-F

We will provide without charge to each person solicited by this Proxy Statement, on the written request of such person, a copy of our Annual Report on Form 20-F, including the financial statements and financial statement schedules, as filed with the SEC for our most recent fiscal year. Such written requests should be directed to China Biologic Products Holdings, Inc., c/o Corporate Secretary, 18th Floor, Jialong International Building, 19 Chaoyang Park Road, Chaoyang District, Beijing 100125, People’s Republic of China. A copy of our Annual Report on Form 20-F is also made available on our website athttp://www.chinabiologic.com after it is filed with the SEC.

OTHER MATTERS

As of the date of this Proxy Statement, the Board has no knowledge of any business which will be presented for consideration at the Annual Meeting other than the election of directors, the ratification of the appointment of the accountants of the Company, and the advisory vote on executive compensation. Should any other matters be properly presented, it is intended that the enclosed proxy card will be voted in accordance with the best judgment of the persons voting the proxies.

| | May 7, 2018 | By Order of the Board of Directors |

| | | /s/ Ming Yin |

| | | Ming Yin |

| | | Corporate Secretary |

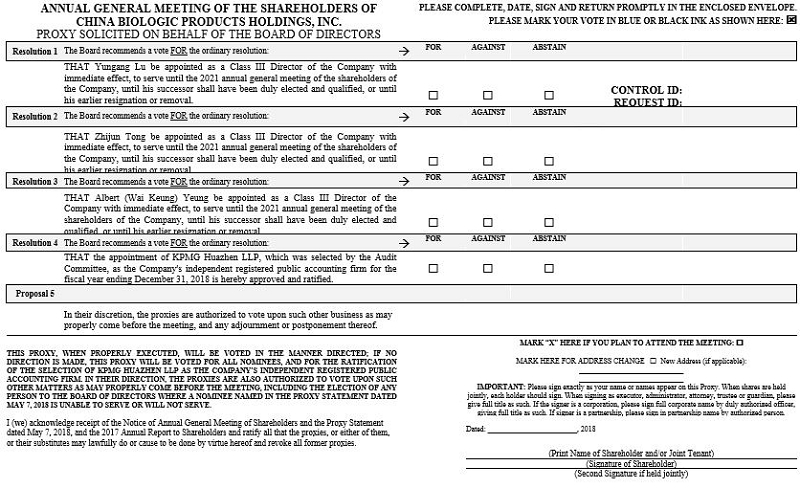

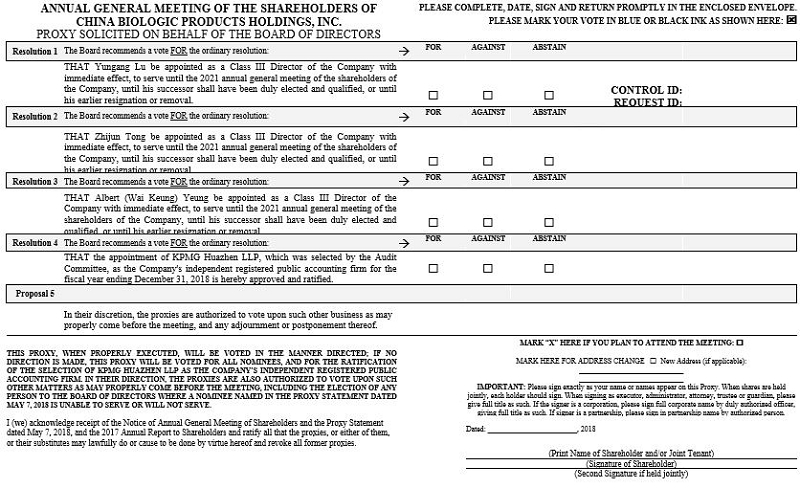

CHINA BIOLOGIC PRODUCTS HOLDINGS, INC. THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS annual GENERAL meeting OF SHAREHOLDERS JUNE 29, 2018 at 10:00 AM BEIJING TIMECONTROL ID:REQUEST ID:The undersigned shareholder of China Biologic Products Holdings, Inc., an exempted company incorporated under the laws of the Cayman Islands (the “Company”), acknowledges receipt of the Notice of Annual General Meeting of Shareholders and proxy statement, dated May 4, 2018 (the “Proxy Statement”), and hereby constitutes and appoints David (Xiaoying) Gao and Ming Yin (the “Proxies”), or either of them acting singly in the absence of the other, with full power of substitution in either of them, the proxies of the undersigned to vote, as designed below and with the same force and effect as the undersigned, all Ordinary Shares of the Company which the undersigned is entitled to vote at the 2018 Annual General Meeting of Shareholders to be held on June 29, 2018 (the “Annual Meeting”), and at any adjournment or postponement thereof, hereby revoking any proxy or proxies heretofore given and ratifying and confirming all that said proxies may do or cause to be done by virtue thereof with respect to the following matters:(CONTINUED AND TO BE SIGNED ON REVERSE SIDE.)VOTING INSTRUCTIONSIf you vote by fax or internet, please DO NOT mailyour proxy card.MAIL: Please mark, sign, date, and return this Proxy Card promptly using the enclosed envelope.FAX: Complete the reverse portion of this Proxy Card and Fax to202-521-3464.INTERNET: https://www.iproxydirect.com/CBPO

ANNUAL GENERAL MEETING OF THE SHAREHOLDERS OFCHINA BIOLOGIC PRODUCTS HOLDINGS, INC. PLEASE COMPLETE, DATE,SIGN AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWNHERE:ýPROXY SOLICITED ON BEHALF OF THE BOARD OF DIRECTORSResolution 1 The Board recommends a voteFOR the ordinaryresolution: àFOR AGAINST ABSTAINTHAT Yungang Lu be appointed as a Class III Director of the Company with immediateeffect,to serve until the 2021 annual general meeting of the shareholders of the Company, until his successor shall have been duly electedand qualified, or until his earlier resignation or removal. ¨ ¨ ¨ ControlID: REQUEST ID:Resolution 2 The Board recommends avoteFOR the ordinary resolution: àFOR AGAINST ABSTAINTHAT Zhijun Tong be appointed as a Class III Director of the Company with immediate effect, to serve until the 2021 annual general meeting of the shareholders of the Company, until his successor shall have been duly elected and qualified, or until his earlier resignation or removal.¨ ¨ ¨Resolution 3 The Board recommends a voteFOR the ordinary resolution: àFORAGAINST ABSTAINTHAT Albert (Wai Keung) Yeung be appointed as a Class III Director of the Company with immediate effect, to serve until the 2021 annual general meeting of the shareholders of the Company, until his successor shall have been duly elected and qualified, or until his earlier resignation or removal. ¨ ¨ ¨Resolution 4 The Board recommends a voteFOR the ordinary resolution:àFOR AGAINST ABSTAINTHAT the appointment of KPMG Huazhen LLP, which was selected by the Audit Committee, as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2018 is hereby approved and ratified. ¨ ¨ ¨Proposal 5 In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting, and any adjournment or postponement thereof. MARK “X” HERE IF YOU PLAN TO ATTEND THE MEETING:¨THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED; IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR ALL NOMINEES, AND FOR THE RATIFICATION OF THE SELECTION OF KPMG HUAZHEN LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM. IN THEIR DIRECTION, THE PROXIES ARE ALSO AUTHORIZED TO VOTE UPON SUCH OTHER MATTERS AS MAY PROPERLY COME BEFORE THE MEETING, INCLUDING THE ELECTION OF ANY PERSON TO THE BOARD OF DIRECTORS WHERE A NOMINEE NAMED IN THE PROXY STATEMENT DATED MAY __, 2018 IS UNABLE TO SERVE OR WILL NOT SERVE. I (we) acknowledge receipt of the Notice of Annual General Meeting of Shareholders and the Proxy Statement dated May 4, 2018, and the 2017 Annual Report to Shareholders and ratify all that the proxies, or either of them, or their substitutes may lawfully do or cause to be done by virtue hereof and revoke all former proxies. MARK HERE FOR ADDRESS CHANGE¨ New Address (if applicable): ________________________________________________________IMPORTANT:Pleasesign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor,administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by dulyauthorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person. Dated:________________________, 2018 (Print Name of Shareholder and/or Joint Tenant)(Signature of Shareholder)(Second Signature if heldjointly)