UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21934

RiverNorth Funds

(Exact name of registrant as specified in charter)

360 S. Rosemary Avenue, Suite 1420

West Palm Beach, FL 33401

(Address of principal executive offices) (Zip code)

Marcus L. Collins

360 S. Rosemary Avenue, Suite 1420

West Palm Beach, FL 33401

(Name and address of agent for service)

Registrant's telephone number, including area code: 561-484-7185

Date of fiscal year end: 09/30

Date of reporting period: 03/31/2024

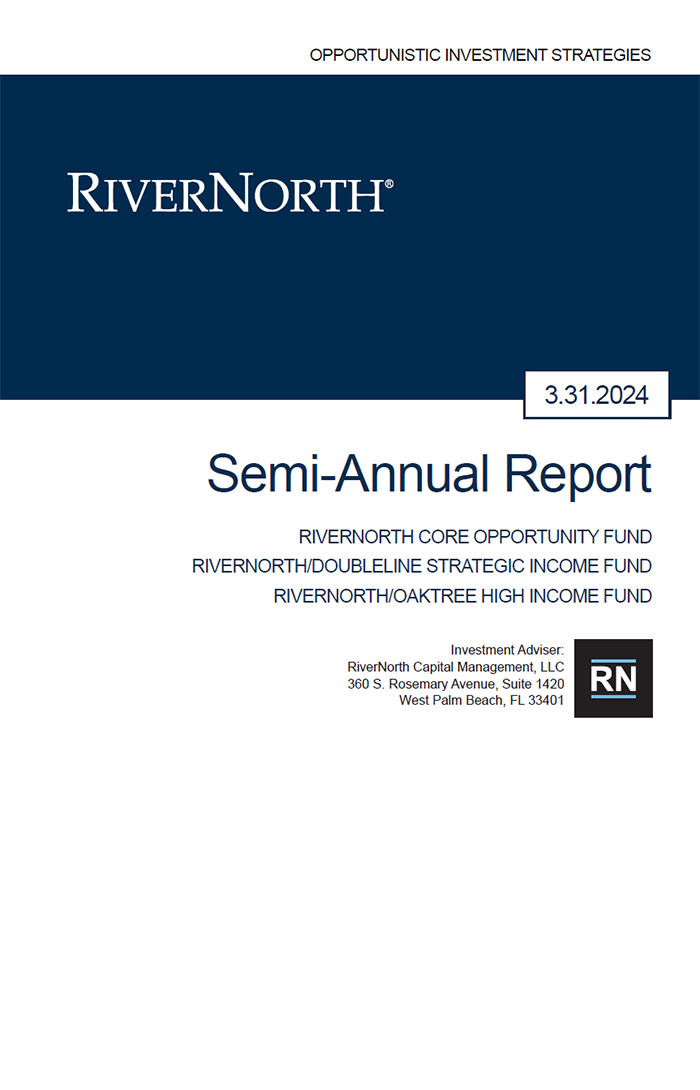

| Item 1. | Reports to Stockholders. |

| RiverNorth Funds | Table of Contents |

| Opportunistic Closed-End Fund Strategies | |

| Portfolio Update | |

| RiverNorth Core Opportunity Fund | 2 |

| RiverNorth/DoubleLine Strategic Income Fund | 5 |

| RiverNorth/Oaktree High Income Fund | 8 |

| RiverNorth Funds Schedule of Investments and Financial Statements | |

| Disclosure of Fund Expenses | 11 |

| Schedule of Investments | |

| RiverNorth Core Opportunity Fund | 13 |

| RiverNorth/DoubleLine Strategic Income Fund | 16 |

| RiverNorth/Oaktree High Income Fund | 67 |

| Statement of Assets and Liabilities | |

| RiverNorth Core Opportunity Fund | 83 |

| RiverNorth/DoubleLine Strategic Income Fund | 84 |

| RiverNorth/Oaktree High Income Fund | 86 |

| Statement of Operations | |

| RiverNorth Core Opportunity Fund | 87 |

| RiverNorth/DoubleLine Strategic Income Fund | 88 |

| RiverNorth/Oaktree High Income Fund | 89 |

| Statements of Changes in Net Assets | |

| RiverNorth Core Opportunity Fund | 90 |

| RiverNorth/DoubleLine Strategic Income Fund | 92 |

| RiverNorth/Oaktree High Income Fund | 94 |

| Financial Highlights | |

| RiverNorth Core Opportunity Fund | 96 |

| RiverNorth/DoubleLine Strategic Income Fund | 104 |

| RiverNorth/Oaktree High Income Fund | 112 |

| Notes to Financial Statements | 119 |

| Additional Information | 140 |

| Board Considerations Regarding Approval of Investment Advisory and Sub-Advisory Agreements | 141 |

| RiverNorth Funds | Portfolio Update |

March 31, 2024 (Unaudited)

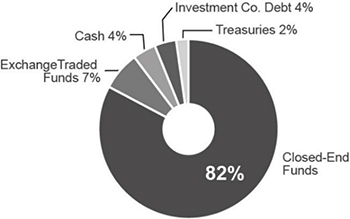

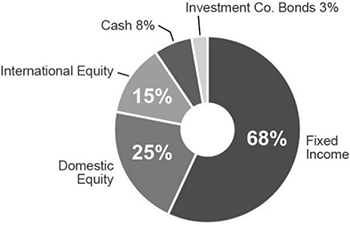

RiverNorth Core Opportunity Fund

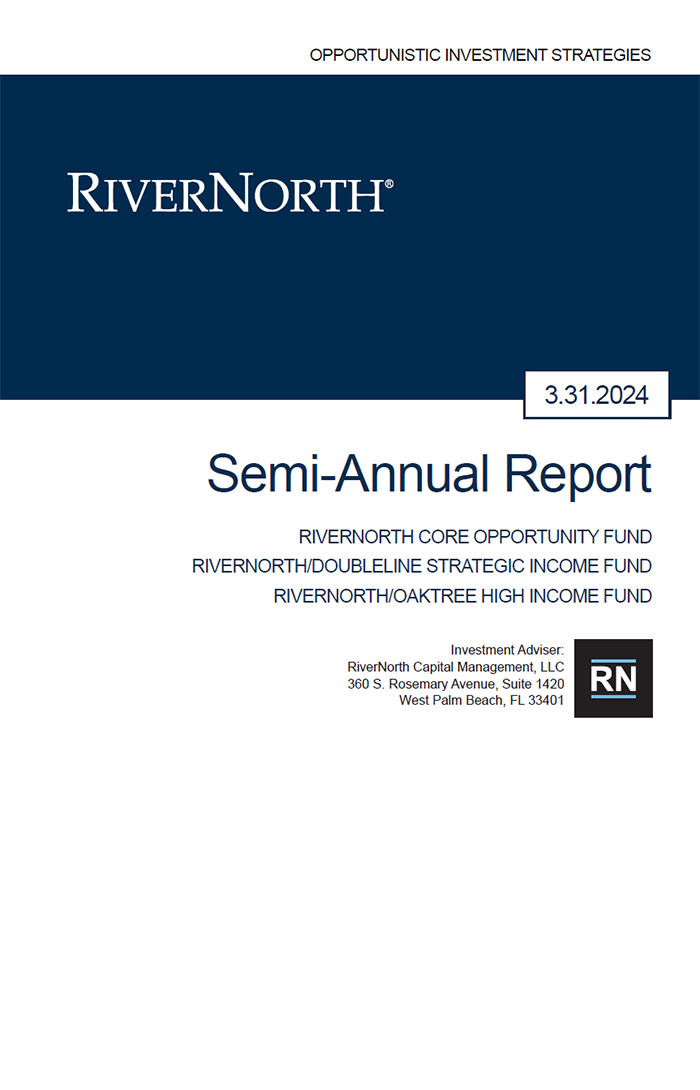

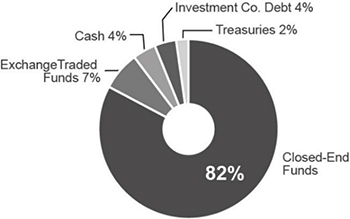

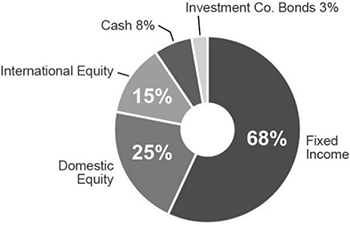

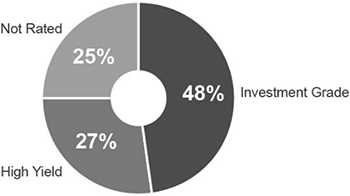

The classifications and breakouts of the Fund’s portfolio shown below are made by the Adviser as of March 31, 2024.

Investment Vehicle Allocation(1) (percentages are based on net assets)

Asset Class Allocation(1) (percentages are based on net assets)

| 2 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

March 31, 2024 (Unaudited)

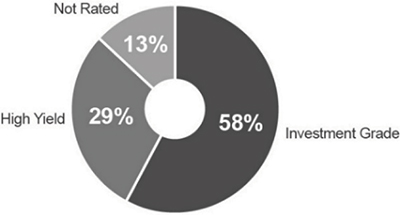

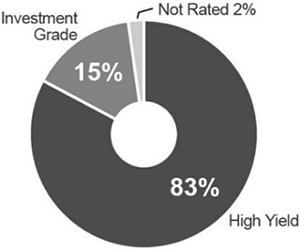

Fixed Income Allocation(1)(2) (percentages are based on net assets)

Portfolio detail statistics are estimates made by the adviser and are subject to change.

| (1) | Closed-End Fund Risk – closed-end funds are exchange traded, may trade at a discount to their net asset values and may deploy leverage. Convertible Security Risk – the market value of convertible securities adjusts with interest rates and the value of the underlying stock. Equity Risk – equity securities may experience volatility and the value of equity securities may move in opposite directions from each other and from other equity markets generally. Exchange Traded Note Risk – exchange traded notes represent unsecured debt of the issuer and may be influenced by interest rates, credit ratings of the issuer or changes in value of the reference index. Fixed Income Risk – the market value of fixed income securities adjusts with interest rates and the securities are subject to issuer default. High yield securities may provide greater income and opportunity for gain, but entail greater risk of loss of principal. Foreign/Emerging Market Risk – foreign securities may be subject to inefficient or volatile markets, different regulatory regimes or different tax policies. These risks may be enhanced in emerging markets. Management Risk – there is no guarantee that the adviser’s investment decisions will produce the desired results. Large Shareholder Purchase and Redemption Risk – The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. LIBOR Transition Risk – The discontinuation of the London Interbank Offered Rate ("LIBOR") may lead to increased volatility and illiquidity in markets that are tied to LIBOR, reduced values of LIBOR-related investments, and reduced effectiveness of hedging strategies, adversely affecting the Fund's performance or net asset value. The U.S. Federal Reserve publishes Secured Overnight Financing Rate (“SOFR”) data that has replaced U.S. dollar LIBOR in certain financial contracts. SOFR, which has been used increasingly on a voluntary basis in new instruments and transactions, is a broad measure of the cost of borrowing cash overnight collateralized by U.S. Treasury securities in the repurchase agreement market. The future performance of SOFR, and SOFR-based reference rates, cannot be predicted based on SOFR’s history or otherwise. Levels of SOFR in the future, including following the discontinuation of LIBOR, may bear little or no relation to historical levels of SOFR, LIBOR or other rates. Market Risk – economic conditions, interest rates and political events may affect the securities markets. Geopolitical and other risks, including war, terrorism, trade disputes, political or economic dysfunction within some nations, public health crises and related geopolitical events, as well as environmental disasters such as earthquakes, fires, and floods, may add to instability in world economies and markets generally. Real Estate Investment Trust ("REIT") Risk – the value of REITs changes with the value of the underlying properties and changes in interest rates and are subject to additional fees. Security Risk – The value of the Fund may decrease in response to the activities and financial prospects of individual securities in the Fund’s portfolio. Short Sale Risk – short positions are speculative, are subject to transaction costs and are riskier than long positions in securities. Special Purpose Acquisition Companies ("SPAC") Risk – The value of SPAC securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable acquisition. Certain SPACs may seek acquisitions only in limited industries or regions, which may increase the volatility of their prices. Investments in SPACs may be illiquid and/or be subject to restrictions on resale. To the extent the SPAC is invested in cash or similar securities, this may impact the Fund’s ability to meet its investment objective. Small-Cap Risk – small cap companies are more susceptible to failure, are often thinly traded and have more volatile stock prices. Structured Notes Risk – because of the imbedded derivative feature, structured notes are subject to more risk than investing in a simple note or bond. Swap Risk – swap agreements are subject to counterparty default risk and may not perform as intended. Underlying Fund Risk – underlying funds have additional fees, may utilize leverage, may not correlate to an intended index and may trade at a discount to their net asset values. |

| Semi-Annual Report | March 31, 2024 | 3 |

| RiverNorth Funds | Portfolio Update |

March 31, 2024 (Unaudited)

| (2) | Credit quality allocation reflects a fixed-income portfolio weighted average of the credit breakdown of each closed-end fund as provided by the adviser of said closed-end fund. If a credit breakdown is not provided by the adviser, Bloomberg is used. Investment grade refers to a bond rated BBB- or higher by Standard & Poor’s or Baa3 or higher by Moody’s. High yield refers to a bond rate lower than investment grade. For more information about securities ratings, please see the Fund’s Statement of Additional information at www.rivernorth.com. |

| 4 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

March 31, 2024 (Unaudited)

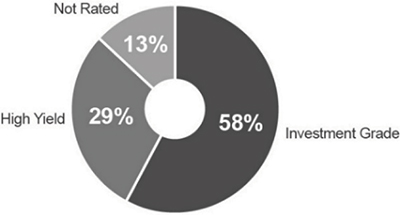

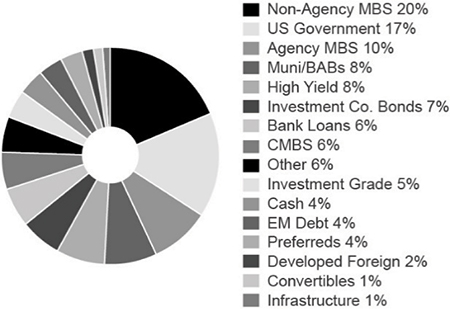

RiverNorth/DoubleLine Strategic Income Fund

The classifications and breakouts of the Fund’s portfolio shown below are made by the Adviser as of March 31, 2024.

Strategy (“Sleeve”) Allocation

Credit Quality Distribution(1)(2) (percentages are based on net assets)

| Semi-Annual Report | March 31, 2024 | 5 |

| RiverNorth Funds | Portfolio Update |

March 31, 2024 (Unaudited)

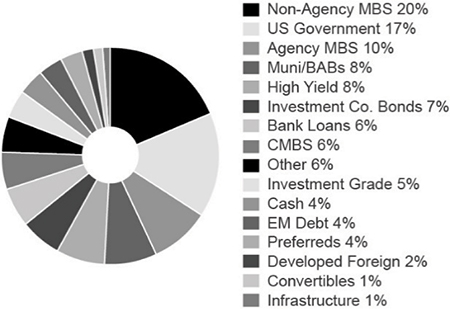

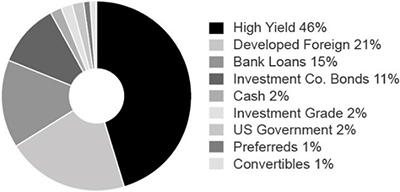

Sector Breakdown(1) (percentages are based on net assets)

The allocation does not add up to 100% as it reflects the estimated leverage utilized by the underlying funds.

Portfolio detail statistics are estimates made by the adviser and are subject to change.

| (1) | Asset-Backed Security Risk – the risk that the value of the underlying assets will impair the value of the security. Borrowing Risk – borrowings increase fund expenses and are subject to repayment, possibly at inopportune times. Closed-End Fund Risk – closed-end funds are exchange traded, may trade at a discount to their net asset values and may deploy leverage. Convertible Security Risk – the market value of convertible securities adjusts with interest rates and the value of the underlying stock. Defaulted Securities Risk – defaulted securities carry the risk of uncertainty of repayment. Derivatives Risk – derivatives are subject to counterparty risk. Exchange Traded Note Risk –exchange traded notes represent unsecured debt of the issuer and may be influenced by interest rates, credit ratings of the issuer or changes in value of the reference index. Fixed Income Risk – the market value of fixed income securities adjusts with interest rates and the securities are subject to issuer default. Foreign/Emerging Market Risk – foreign securities may be subject to inefficient or volatile markets, different regulatory regimes or different tax policies. These risks may be enhanced in emerging markets. Large Shareholder Purchase and Redemption Risk – The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. LIBOR Transition Risk – The discontinuation of the London Interbank Offered Rate ("LIBOR") may lead to increased volatility and illiquidity in markets that are tied to LIBOR, reduced values of LIBOR-related investments, and reduced effectiveness of hedging strategies, adversely affecting the Fund's performance or net asset value. The U.S. Federal Reserve publishes Secured Overnight Financing Rate (“SOFR”) data that has replaced U.S. dollar LIBOR in certain financial contracts. SOFR, which has been used increasingly on a voluntary basis in new instruments and transactions, is a broad measure of the cost of borrowing cash overnight collateralized by U.S. Treasury securities in the repurchase agreement market. The future performance of SOFR, and SOFR-based reference rates, cannot be predicted based on SOFR’s history or otherwise. Levels of SOFR in the future, including following the discontinuation of LIBOR, may bear little or no relation to historical levels of SOFR, LIBOR or other rates. Liquidity Risk – illiquid investments may be difficult or impossible to sell. Management Risk –there is no guarantee that the adviser’s or sub-adviser’s investment decisions will produce the desired results. Market Risk – economic conditions, interest rates and political events may affect the securities markets. Geopolitical and other risks, including war, terrorism, trade disputes, political or economic dysfunction within some nations, public health crises and related geopolitical events, as well as environmental disasters such as earthquakes, fires, and floods, may add to instability in world economies and markets generally. Mortgage-Backed Security Risk – mortgage backed securities are subject to credit risk, pre-payment risk and devaluation of the underlying collateral. Portfolio Turnover Risk – increased portfolio turnover results in higher brokerage expenses and may impact the tax status of distributions. Preferred Stock Risk – preferred stocks generally pay dividends, but may be less liquid than common stocks, have less priority than debt instruments and may be subject to redemption by the issuer. Rating Agency Risk – rating agencies may change their ratings or ratings may not accurately reflect a debt issuer’s creditworthiness. REIT Risk – the value of REITs changes with the value of the underlying properties and changes in interest rates and are subject to additional fees. Security Risk – The value of the Fund may decrease in response to the activities and financial prospects of individual securities in the Fund’s portfolio. Special Purpose Acquisition Companies ("SPAC") Risk – The value of SPAC securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable acquisition. Certain SPACs may seek acquisitions only in limited industries or regions, which may increase the volatility of their prices. Investments in SPACs may be illiquid and/or be subject to restrictions on resale. To the extent the SPAC is invested in cash or similar securities, this may impact the Fund’s ability to meet its investment objective. Structured Notes Risk – because of the imbedded derivative feature, structured notes are subject to more risk than investing in a simple note or bond. Swap Risk – swap agreements are subject to counterparty default risk and may not perform as intended. Underlying Fund Risk – underlying funds have additional fees, may utilize leverage, may not correlate to an intended index and may trade at a discount to their net asset values. Unrated Security Risk – Unrated securities determined by the sub-adviser to be of comparable quality to rated securities which the Fund may purchase may pay a higher interest rate than such rated securities and be subject to a greater risk of illiquidity or price changes. U.S. Government Securities Risk – There is a risk that the U.S. government will not provide financial support to its agencies, instrumentalities or sponsored enterprises if it is not obligated to do so by law. |

| 6 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

March 31, 2024 (Unaudited)

| (2) | For the sleeve managed by RiverNorth Capital Management, LLC, credit quality allocation reflects a fixed-income portfolio weighted average of the credit breakdown of each closed-end fund as provided by the advisor of said closed-end fund. If a credit breakdown is not provided by the advisor, Bloomberg is used. For the sleeves managed by DoubleLine Capital LP, credit quality allocation is determined from the highest available credit rating from any Nationally Recognized Statistical Rating Organization (Standard & Poor's, Moody’s and Fitch). Investment grade refers to a bond rated BBB- or higher by Standard & Poor’s or Baa3 or higher by Moody’s. High yield refers to a bond rated lower than investment grade. For more information about securities ratings, please see the Fund’s Statement of Additional Information at www.rivernorth.com. |

| Semi-Annual Report | March 31, 2024 | 7 |

| RiverNorth Funds | Portfolio Update |

March 31, 2024 (Unaudited)

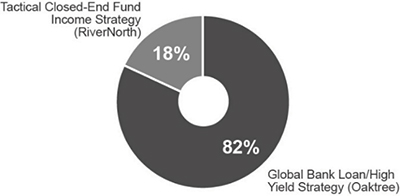

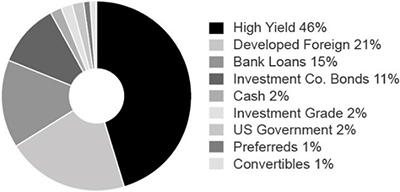

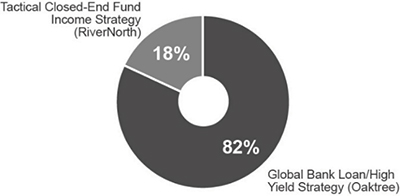

RiverNorth/Oaktree High Income Fund

The classifications and breakouts of the Fund’s portfolio shown below are made by the Adviser as of March 31, 2024.

Strategy Allocation

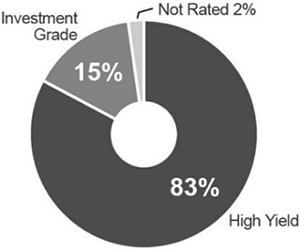

Credit Quality Distribution(1)(2) (percentages are based on net assets)

Sector Breakdown(1) (percentages are based on net assets)

| 8 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

March 31, 2024 (Unaudited)

| (1) | Borrowing Risk – borrowings increase fund expenses and are subject to repayment, possibly at inopportune times. Closed- End Fund Risk – closed-end funds are exchange traded, may trade at a discount to their net asset values and may deploy leverage. Convertible Security Risk – the market value of convertible securities adjusts with interest rates and the value of the underlying stock. Credit Derivatives Risk – the use of credit derivatives is highly specialized, involves default, counterparty and liquidity risks and may not perfectly correlate to the underlying asset or liability being hedged. Currency Risk – foreign currencies will rise or decline relative to the U.S. dollar. Distressed and Defaulted Securities Risk – defaulted securities carry the risk of uncertainty of repayment. Equity Risk – equity securities may experience volatility and the value of equity securities may move in opposite directions from each other and from other equity markets generally. Fixed Income Risk – the market value of fixed income securities adjusts with interest rates and the securities are subject to issuer default. High yield securities may provide greater income and opportunity for gain, but entail greater risk of loss of principal. Foreign/Emerging Market Risk – foreign securities may be subject to inefficient or volatile markets, different regulatory regimes or different tax policies. These risks may be enhanced in emerging markets. Floating Interest Rate Risk – loans pay interest based on the London Interbank Offered Rate ("LIBOR") and a decline in LIBOR could negatively impact the Fund’s return. Investment Style Risk – investment strategies may come in and out of favor with investors and may underperform or outperform at times. Large Shareholder Purchase and Redemption Risk – The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. LIBOR Transition Risk – The discontinuation of LIBOR may lead to increased volatility and illiquidity in markets that are tied to LIBOR, reduced values of LIBOR-related investments, and reduced effectiveness of hedging strategies, adversely affecting the Fund's performance or net asset value. The U.S. Federal Reserve publishes Secured Overnight Financing Rate (“SOFR”) data that has replaced U.S. dollar LIBOR in certain financial contracts. SOFR, which has been used increasingly on a voluntary basis in new instruments and transactions, is a broad measure of the cost of borrowing cash overnight collateralized by U.S. Treasury securities in the repurchase agreement market. The future performance of SOFR, and SOFR-based reference rates, cannot be predicted based on SOFR’s history or otherwise. Levels of SOFR in the future, including following the discontinuation of LIBOR, may bear little or no relation to historical levels of SOFR, LIBOR or other rates. Loans Risk – loans may be unrated or rated below investment grade and the pledged collateral may lose value. Secondary trading in loans is not fully-developed and may result in illiquidity. Management Risk – there is no guarantee that the adviser’s or sub-adviser’s investment decisions will produce the desired results. Market Risk – economic conditions, interest rates and political events may affect the securities markets. Geopolitical and other risks, including war, terrorism, trade disputes, political or economic dysfunction within some nations, public health crises and related geopolitical events, as well as environmental disasters such as earthquakes, fires, and floods, may add to instability in world economies and markets generally. Preferred Stock Risk – preferred stocks generally pay dividends, but may be less liquid than common stocks, have less priority than debt instruments and may be subject to redemption by the issuer. Security Risk – the value of the Fund may increase or decrease in response to the prospects of the issuers of securities and loans held in the Fund. Special Purpose Acquisition Companies ("SPAC") Risk – The value of SPAC securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable acquisition. Certain SPACs may seek acquisitions only in limited industries or regions, which may increase the volatility of their prices. Investments in SPACs may be illiquid and/or be subject to restrictions on resale. To the extent the SPAC is invested in cash or similar securities, this may impact the Fund’s ability to meet its investment objective. Swap Risk – swap agreements are subject to counterparty default risk and may not perform as intended. Underlying Fund Risk – underlying funds have additional fees, may utilize leverage, may not correlate to an intended index and may trade at a discount to their net asset values. Valuation Risk – Loans and fixed-income securities are traded “over the counter” and because there is no centralized information regarding trading, the valuation of loans and fixed-income securities may vary. |

| Semi-Annual Report | March 31, 2024 | 9 |

| RiverNorth Funds | Portfolio Update |

March 31, 2024 (Unaudited)

| (2) | For the sleeve managed by RiverNorth Capital Management, LLC, credit quality allocation reflects a fixed-income portfolio weighted average of the credit breakdown of each closed-end fund as provided by the advisor of said closed-end fund. If a credit breakdown is not provided by the advisor, Bloomberg is used. For the sleeves managed by Oaktree Capital Management, L.P., the sub-adviser uses a proprietary credit scoring matrix to rank potential investments. This process offers a systematic way of reviewing the key quantitative and qualitative variables impacting credit quality for each investment. Investment grade refers to a bond rated BBB- or higher by Standard & Poor’s or Baa3 or higher by Moody’s. High yield refers to a bond rated lower than investment grade. For more information about securities ratings, please see the Fund’s Statement of Additional Information at www.rivernorth.com. |

| 10 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Disclosure of Fund Expenses |

March 31, 2024 (Unaudited)

Expense Example

As a shareholder of the RiverNorth Funds (the "Trust" or "Funds"), you incur two types of costs: (1) transaction costs; and (2) ongoing costs, including management fees, distribution and service (12b-1) fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period, October 1, 2023, and held for the six months ended March 31, 2024.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your variable account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not each Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line for each share class of each Fund within the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher.

| Semi-Annual Report | March 31, 2024 | 11 |

| RiverNorth Funds | | Disclosure of Fund Expenses |

March 31, 2024 (Unaudited)

| | Beginning Account Value 10/01/2023 | Ending Account Value 03/31/2024 | Expense Ratio(a) | Expenses Paid During Period(b) |

| RiverNorth Core Opportunity Fund | | | |

| Class I Shares | | | | |

| Actual | $1,000.00 | $1,169.40 | 1.62% | $8.79 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,016.90 | 1.62% | $8.17 |

| | | | | |

| Class R Shares | | | | |

| Actual | $1,000.00 | $1,167.70 | 1.87% | $10.13 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.65 | 1.87% | $9.42 |

| | | | | |

| RiverNorth/DoubleLine Strategic Income Fund | | | |

| Class I Shares | | | | |

| Actual | $1,000.00 | $1,097.10 | 0.93% | $4.88 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.35 | 0.93% | $4.70 |

| | | | | |

| Class R Shares | | | | |

| Actual | $1,000.00 | $1,095.50 | 1.18% | $6.18 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.10 | 1.18% | $5.96 |

| | | | |

| RiverNorth/Oaktree High Income Fund Class I Shares | | | |

| Actual | $1,000.00 | $1,076.50 | 1.35% | $7.01 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.25 | 1.35% | $6.81 |

| | | | | |

| Class R Shares | | | | |

| Actual | $1,000.00 | $1,076.40 | 1.60% | $8.31 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.00 | 1.60% | $8.07 |

| (a) | Annualized, based on the Fund's most recent fiscal half-year expenses. |

| (b) | Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (183), then divided by 366. Note this expense example is typically based on a six-month period. |

| 12 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Core Opportunity Fund | Schedule of Investments |

March 31, 2024 (Unaudited)

| Shares/Description | | Value | |

| CLOSED-END FUNDS - 82.36% | | | | |

| | 179,087 | | | AllianzGI Convertible & Income 2024 Target Term Fund | | $ | 1,576,861 | |

| | 259,795 | | | BlackRock Capital Allocation Term Trust | | | 4,328,185 | |

| | 282,861 | | | BlackRock ESG Capital Allocation Term Trust | | | 4,910,467 | |

| | 29,722 | | | BlackRock Health Sciences Term Trust | | | 487,144 | |

| | 38,289 | | | BlackRock MuniHoldings New York Quality Fund, Inc. | | | 405,480 | |

| | 46,272 | | | BlackRock MuniYield New York Quality Fund, Inc. | | | 486,781 | |

| | 66,656 | | | BlackRock Science and Technology Term Trust | | | 1,293,126 | |

| | 73,949 | | | Blackstone/GSO Senior Floating Rate Term Fund | | | 1,059,689 | |

| | 6,934 | | | BrandywineGLOBAL - Global Income Opportunities Fund, Inc. | | | 58,800 | |

| | 64,751 | | | Calamos Long/Short Equity & Dynamic Income Trust | | | 999,108 | |

| | 186,260 | | | Clough Global Equity Fund | | | 1,212,553 | |

| | 142,496 | | | Clough Global Opportunities Fund | | | 723,880 | |

| | 127,622 | | | First Trust High Yield Opportunities 2027 Term Fund | | | 1,855,624 | |

| | 242,804 | | | First Trust New Opportunities MLP & Energy Fund | | | 1,859,879 | |

| | 50,520 | | | Flaherty & Crumrine Preferred and Income Opportunity Fund, Inc. | | | 426,389 | |

| | 40,806 | | | Nuveen AMT-Free Municipal Credit Income Fund | | | 495,793 | |

| | 86,410 | | | Nuveen AMT-Free Quality Municipal Income Fund | | | 956,559 | |

| | 184,424 | | | Nuveen Municipal Value Fund, Inc. | | | 1,606,333 | |

| | 25,938 | | | Nuveen Preferred & Income Term Fund | | | 499,047 | |

| | 109,303 | | | Nuveen Variable Rate Preferred & Income Fund | | | 1,957,617 | |

| | 97,571 | | | Pershing Square Holdings Ltd. | | | 5,034,664 | |

| | 62,956 | | | PIMCO Access Income Fund | | | 990,298 | |

| | 24,133 | | | PIMCO Dynamic Income Fund | | | 465,525 | |

| | 400,000 | | | Saba Capital Income & Opportunities Fund II | | | 1,528,000 | |

| | 85,475 | | | Special Opportunities Fund, Inc. | | | 1,080,404 | |

| | 108,862 | | | Western Asset High Income Fund II, Inc. | | | 486,613 | |

| | 127,767 | | | Western Asset High Income Opportunity Fund, Inc. | | | 498,291 | |

| | 191,185 | | | Western Asset Inflation-Linked Opportunities & Income Fund | | | 1,649,926 | |

| | | | | |

| TOTAL CLOSED-END FUNDS | | | | |

| (Cost $35,233,464) | | | 38,933,036 | |

| | | | | |

| EXCHANGE TRADED FUNDS - 7.32% | | | | |

| | 40,562 | | | Blackrock Flexible Income ETF | | | 2,127,883 | |

| | 68,427 | | | Invesco FTSE RAFI Emerging Markets ETF | | | 1,331,589 | |

| | | | | |

| TOTAL EXCHANGE TRADED FUNDS | | | | |

| (Cost $3,313,333) | | | | 3,459,472 | |

See Notes to Financial Statements.

| Semi-Annual Report | March 31, 2024 | 13 |

| RiverNorth Core Opportunity Fund | Schedule of Investments |

March 31, 2024 (Unaudited)

| Shares/Description | | Value | |

| PREFERRED STOCKS - 0.79% | | | | |

| 15,162 | | XAI Octagon Floating Rate Alternative Income Trust, Series 2026, 6.500%, 03/31/2026 | | $ | 376,776 | |

| | | | | | | |

| TOTAL PREFERRED STOCKS | | | | |

(Cost $378,879) | | | 376,776 | |

| Principal Amount/Description | | Rate | | | Maturity | | | Value | |

| U.S. CORPORATE BONDS - 3.29% | | | | | | | | | |

| Investment Companies - 2.83% | | | | | | | | | | | | |

| 150,000 | | Blackstone Private Credit Fund | | | 3.25 | % | | | 03/15/2027 | | | | 138,490 | |

| 495,561 | | Blue Owl Capital Corp. | | | 3.40 | % | | | 07/15/2026 | | | | 467,055 | |

| 249,936 | | Blue Owl Credit Income Corp. | | | 4.70 | % | | | 02/08/2027 | | | | 237,244 | |

| 500,000 | | Blue Owl Technology Finance Corp.(a) | | | 6.75 | % | | | 06/30/2025 | | | | 496,440 | |

| | | | | | | | | | | | | | 1,339,229 | |

| Private Equity - 0.46% | | | | | | | | | | | | |

| 237,712 | | Hercules Capital, Inc. | | | 2.63 | % | | | 09/16/2026 | | | | 216,113 | |

| | | | | | | | | | | | | | | |

| TOTAL U.S. CORPORATE BONDS | | | | | | | | | | | | |

(Cost $1,508,619) | | | | | | | | | | | 1,555,342 | |

| | | | | | | | | | | | | | | |

| U.S. GOVERNMENT BONDS AND NOTES - 2.10% | | | | | | | | | |

| 1,000,000 | | U.S. Treasury Notes | | | 4.25 | % | | | 12/31/2024 | | | | 993,132 | |

| | | | | | | | | | |

| TOTAL U.S. GOVERNMENT BONDS AND NOTES | | | | | | | | | |

(Cost $998,428) | | | | | | | | | | | 993,132 | |

| Shares/Description | | Value | |

| Warrants - 0.01% | | |

| | 12,899 | | | AGBA Group Holding, Ltd., Strike Price 11.50, Expires 05/10/2024(b) | | | 201 | |

| | 8,168 | | | Churchill Capital Corp. VII, Strike Price 11.50, Expires 02/29/2028(b) | | | 2,614 | |

| | 10,113 | | | Jaws Mustang Acquisition Corp., Strike Price 11.50, Expires 01/30/2026(b) | | | 2,174 | |

| | | |

| TOTAL WARRANTS | | |

(Cost $25,782) | | | 4,989 | |

See Notes to Financial Statements.

| 14 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Core Opportunity Fund | Schedule of Investments |

March 31, 2024 (Unaudited)

| Shares/Description | | Value | |

| Short-Term Investments - 3.89% | | | | |

| Money Market Fund - 3.89% | | | | |

| 1,838,041 State Street Institutional Trust (7 Day Yield 5.25%) | | $ | 1,838,041 | |

| | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | |

(Cost $1,838,041) | | | 1,838,041 | |

| | | | | |

| TOTAL INVESTMENTS - 99.76% | | | | |

| (Cost $43,296,546) | | $ | 47,160,788 | |

| OTHER ASSETS IN EXCESS OF LIABILITIES - 0.24% | | | 111,935 | |

| NET ASSETS - 100.00% | | $ | 47,272,723 | |

| (a) | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities have been deemed liquid under procedures approved by the Fund's Board of Trustees and may normally be sold to qualified institutional buyers in transactions exempt from registration. Total fair value of Rule 144A securities amounts to $496,440, which represents approximately 1.05% of net assets as of March 31, 2024. |

| (b) | Non-income producing security. |

See Notes to Financial Statements.

| Semi-Annual Report | March 31, 2024 | 15 |

| RiverNorth/DoubleLine Strategic Income Fund | Schedule of Investments |

March 31, 2024 (Unaudited)

| Shares/Description | | Value | |

| CLOSED-END FUNDS - 20.15% | | | | |

| | 768,007 | | | Allspring Income Opportunities | | $ | 5,099,566 | |

| | 383,908 | | | Barings Global Short Duration High Yield Fund | | | 5,489,884 | |

| | 161,620 | | | BlackRock MuniHoldings New York Quality Fund, Inc. | | | 1,711,556 | |

| | 195,559 | | | BlackRock MuniYield New York Quality Fund, Inc. | | | 2,057,281 | |

| | 293,653 | | | Blackstone Long-Short Credit Income Fund | | | 3,614,868 | |

| | 914,876 | | | Blackstone Strategic Credit 2027 Term Fund | | | 10,887,024 | |

| | 159,006 | | | Blackstone/GSO Senior Floating Rate Term Fund | | | 2,278,556 | |

| | 581,087 | | | BNY Mellon Strategic Municipals, Inc. | | | 3,544,631 | |

| | 479,710 | | | BrandywineGLOBAL - Global Income Opportunities Fund, Inc. | | | 4,067,941 | |

| | 695,542 | | | First Trust High Yield Opportunities 2027 Term Fund | | | 10,113,181 | |

| | 166,170 | | | Invesco Dynamic Credit Opportunity Fund | | | 1,842,824 | |

| | 200,000 | | | John Hancock Investors Trust | | | 2,638,000 | |

| | 130,831 | | | Morgan Stanley Emerging Markets Domestic Debt Fund, Inc. | | | 621,447 | |

| | 1,173,103 | | | Nuveen AMT-Free Municipal Credit Income Fund | | | 14,253,201 | |

| | 1,645,260 | | | Nuveen AMT-Free Quality Municipal Income Fund | | | 18,213,028 | |

| | 725,930 | | | Nuveen California Quality Municipal Income Fund | | | 7,999,749 | |

| | 311,508 | | | Nuveen Core Plus Impact Fund | | | 3,224,108 | |

| | 189,030 | | | Nuveen Floating Rate Income Fund | | | 1,650,232 | |

| | 121,735 | | | Nuveen Municipal Credit Income Fund | | | 1,490,036 | |

| | 713,073 | | | Nuveen Municipal Value Fund, Inc. | | | 6,210,866 | |

| | 4,188,520 | | | Nuveen Preferred Income Opportunities Fund | | | 30,115,460 | |

| | 897,485 | | | Nuveen Quality Municipal Income Fund | | | 10,285,178 | |

| | 130,162 | | | Nuveen Variable Rate Preferred & Income Fund | | | 2,331,201 | |

| | 525,911 | | | PGIM Global High Yield Fund, Inc. | | | 6,289,896 | |

| | 75,611 | | | PGIM High Yield Bond Fund, Inc. | | | 982,187 | |

| | 637,678 | | | PGIM Short Duration High Yield Opportunities Fund | | | 9,807,488 | |

| | 221,347 | | | PIMCO Access Income Fund | | | 3,481,788 | |

| | 640,907 | | | PIMCO Dynamic Income Fund | | | 12,363,096 | |

| | 3,132,640 | | | PIMCO High Income Fund | | | 15,475,242 | |

| | 1,479,932 | | | PIMCO Income Strategy Fund II | | | 11,040,293 | |

| | 189,789 | | | Saba Capital Income & Opportunities Fund II | | | 724,994 | |

| | 1,611,246 | | | Western Asset Emerging Markets Debt Fund, Inc. | | | 15,484,074 | |

| | 3,150,131 | | | Western Asset High Income Opportunity Fund, Inc. | | | 12,285,511 | |

| | 1,691,916 | | | Western Asset Inflation-Linked Opportunities & Income Fund | | | 14,601,235 | |

| | | | | | | | | |

| TOTAL CLOSED-END FUNDS | | | | |

| (Cost $258,052,667) | | | 252,275,622 | |

| | | | | |

| BUSINESS DEVELOPMENT COMPANIES - PREFERRED SHARES - 0.37% | | | | |

| | 46,046 | | | Oxford Square Capital Corp., 6.250%, 04/30/2026 | | | 1,118,918 | |

See Notes to Financial Statements.

| 16 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth/DoubleLine Strategic Income Fund | Schedule of Investments |

March 31, 2024 (Unaudited)

| Shares/Description | | Value | |

| | 3,750,000 | | | PennantPark Floating Rate Capital, Ltd., 4.250%, 04/01/2026 | | $ | 3,539,381 | |

| | | | | | | | | |

| TOTAL BUSINESS DEVELOPMENT COMPANIES - PREFERRED SHARES | | | | |

| (Cost $4,857,772) | | | 4,658,299 | |

| | | | | | | | | |

| COMMON STOCKS - 0.02% | | | | |

| | 10,651 | | | Intelsat SA/Luxembourg(a) | | | 282,252 | |

| | 259,482 | | | Pershing Square Tontine Holdings(a)(b)(c) | | | 0 | |

| | 11,202 | | | Riverbed Tech Class B-1 Partnership Units(a) | | | 1,456 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | |

| (Cost $361,352) | | | 283,708 | |

| | | | | | | | | |

| OPEN-END FUNDS - 2.80% | | | | |

| | 3,989,805 | | | RiverNorth/Oaktree High Income Fund, Class I(d) | | | 35,086,342 | |

| | | | | | | | | |

| TOTAL OPEN-END FUNDS | | | | |

| (Cost $38,158,745) | | | 35,086,342 | |

| | | | | | | | | |

| PREFERRED STOCKS - 1.11% | | | | |

| | 246,313 | | | Crescent Capital BDC, Inc., 5.000%, 05/25/2026 | | | 5,899,196 | |

| | 341,265 | | | Virtus AllianzGI Diversified Income & Convertible Fund, 5.625%, 03/08/2024(e) | | | 7,944,649 | |

| | | | | | | | | |

| TOTAL PREFERRED STOCKS | | | | |

| (Cost $14,555,923) | | | 13,843,845 | |

| Principal Amount/Description | | Rate | | | Maturity | | | Value | |

| FOREIGN CORPORATE BONDS - 4.34% |

| Argentina - 0.04% |

| $ | 700,000 | | | YPF SA | | 7.00% | | | 12/15/2047 | | | | 517,392 | |

| | | | | | | | | | | | | | | |

| Australia - 0.36% |

| | 1,000,000 | | | APA Infrastructure, Ltd.(f) | | 4.25% | | | 07/15/2027 | | | | 980,467 | |

| | 395,000 | | | Australia & New Zealand Banking Group, Ltd.(f)(g) | | 5Y US TI + 1.70% | | | 11/25/2035 | | | | 324,162 | |

| | 505,000 | | | BHP Billiton Finance USA, Ltd. | | 5.25% | | | 09/08/2030 | | | | 513,813 | |

| | 265,000 | | | Commonwealth Bank of Australia(f) | | 4.32% | | | 01/10/2048 | | | | 216,088 | |

| | 700,000 | | | Macquarie Group, Ltd.(f)(g) | | 1D US SOFR + 1.53% | | | 01/14/2033 | | | | 583,023 | |

| | 475,000 | | | National Australia Bank, Ltd.(f) | | 2.99% | | | 05/21/2031 | | | | 400,637 | |

| | 340,000 | | | NBN Co., Ltd.(f) | | 1.45% | | | 05/05/2026 | | | | 314,837 | |

See Notes to Financial Statements.

| Semi-Annual Report | March 31, 2024 | 17 |

| RiverNorth/DoubleLine Strategic Income Fund | Schedule of Investments |

March 31, 2024 (Unaudited)

| Principal Amount/Description | | Rate | | | Maturity | | | Value | |

| $ | 500,000 | | | Sydney Airport Finance Co. Pty, Ltd.(f) | | 3.38% | | | 04/30/2025 | | | $ | 488,043 | |

| | 500,000 | | | Sydney Airport Finance Co. Pty, Ltd.(f) | | 3.63% | | | 04/28/2026 | | | | 482,226 | |

| | 310,000 | | | Westpac Banking Corp.(g) | | 5Y US TI + 1.53% | | | 11/18/2036 | | | | 254,940 | |

| | | | | | | | | | | | | | 4,558,236 | |

| Brazil - 0.22% |

| | 200,000 | | | Banco do Brasil SA(e) | | 6.25% | | | Perpetual Maturity | | | | 201,120 | |

| | 200,000 | | | Banco do Estado do Rio Grande do Sul SA(g)(h) | | 5Y US TI + 4.928% | | | 01/28/2031 | | | | 193,428 | |

| | 1,100,000 | | | BRF SA | | 5.75% | | | 09/21/2050 | | | | 875,728 | |

| | 200,000 | | | CSN Resources SA(h) | | 5.88% | | | 04/08/2032 | | | | 175,114 | |

| | 856,790 | | | Guara Norte Sarl | | 5.20% | | | 06/15/2034 | | | | 782,395 | |

| | 200,000 | | | Nexa Resources SA(h) | | 5.38% | | | 05/04/2027 | | | | 195,408 | |

| | 66,103 | | | Oi SA(f)(i) | | 12.50% (5.50%) | | | 12/15/2024 | | | | 65,773 | |

| | 713 | | | Oi SA(f)(i) | | 12.50% (5.50%) | | | 12/15/2024 | | | | 709 | |

| | 950,000 | | | Oi SA(j) | | 10.00% (4.00%) | | | 07/27/2025 | | | | 16,625 | |

| | 700,000 | | | Unigel Luxembourg SA(h)(j) | | 8.75% | | | 10/01/2026 | | | | 218,191 | |

| | | | | | | | | | | | | | 2,724,491 | |

| British Virgin Islands - 0.03% |

| | 350,000 | | | TSMC Global, Ltd.(f) | | 1.25% | | | 04/23/2026 | | | | 324,158 | |

| | | | | | | | | | | | | | | |

| Canada - 0.46% |

| | 13,000 | | | 1375209 BC, Ltd.(f) | | 9.00% | | | 01/30/2028 | | | | 12,754 | |

| | 400,000 | | | Aris Mining Corp.(h) | | 6.88% | | | 08/09/2026 | | | | 360,932 | |

| | 400,000 | | | Aris Mining Corp.(h) | | 6.88% | | | 08/09/2026 | | | | 360,932 | |

| | 420,000 | | | Bank of Montreal(g) | | 3.80% | | | 12/15/2032 | | | | 392,020 | |

| | 520,000 | | | Bank of Nova Scotia(g) | | 5Y US TI + 2.05% | | | 05/04/2037 | | | | 471,789 | |

| | 170,000 | | | Bausch + Lomb Corp.(f) | | 8.38% | | | 10/01/2028 | | | | 176,105 | |

| | 50,000 | | | Bausch Health Cos., Inc.(f) | | 6.13% | | | 02/01/2027 | | | | 31,202 | |

| | 4,000 | | | Bausch Health Cos., Inc.(f) | | 14.00% | | | 10/15/2030 | | | | 2,321 | |

| | 95,000 | | | Bombardier, Inc.(f) | | 8.75% | | | 11/15/2030 | | | | 101,558 | |

| | 1,000,000 | | | Canacol Energy, Ltd.(h) | | 5.75% | | | 11/24/2028 | | | | 443,369 | |

| | 210,000 | | | CCL Industries, Inc.(f) | | 3.05% | | | 06/01/2030 | | | | 182,314 | |

| | 225,000 | | | CI Financial Corp. | | 4.10% | | | 06/15/2051 | | | | 140,727 | |

| | 255,000 | | | Element Fleet Management Corp.(f) | | 6.32% | | | 12/04/2028 | | | | 263,521 | |

| | 150,000 | | | Garda World Security Corp.(f) | | 6.00% | | | 06/01/2029 | | | | 134,437 | |

| | 55,000 | | | GFL Environmental, Inc.(f) | | 6.75% | | | 01/15/2031 | | | | 56,433 | |

| | 600,000 | | | Gran Tierra Energy, Inc.(f) | | 9.50% | | | 10/15/2029 | | | | 561,146 | |

| | 370,000 | | | Husky Injection Molding Systems, Ltd. / Titan Co.- Borrower LLC(f) | | 9.00% | | | 02/15/2029 | | | | 383,086 | |

| | 300,000 | | | IAMGOLD Corp.(h) | | 5.75% | | | 10/15/2028 | | | | 275,620 | |

See Notes to Financial Statements.

| 18 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth/DoubleLine Strategic Income Fund | Schedule of Investments |

March 31, 2024 (Unaudited)

| Principal Amount/Description | | Rate | | | Maturity | | Value | |

| $ | 245,000 | | | Kronos Acquisition Holdings, Inc. / KIK Custom Products, Inc.(f) | | 7.00% | | | 12/31/2027 | | $ | 243,583 | |

| | 140,000 | | | Mattamy Group Corp.(f) | | 4.63% | | | 03/01/2030 | | | 127,396 | |

| | 105,000 | | | Parkland Corp.(f) | | 4.50% | | | 10/01/2029 | | | 97,211 | |

| | 130,000 | | | Royal Bank of Canada | | 5.15% | | | 02/01/2034 | | | 130,185 | |

| | 100,000 | | | Superior Plus LP / Superior General Partner, Inc.(f) | | 4.50% | | | 03/15/2029 | | | 92,539 | |

| | 750,000 | | | TransCanada PipeLines, Ltd. | | 4.63% | | | 03/01/2034 | | | 708,507 | |

| | | | | | | | | | | | | 5,749,687 | |

| Cayman Islands - 0.21% |

| | 900,000 | | | Alpha Holding Escrow Shares(b)(c)(e) | | | | | Perpetual Maturity | | | 0 | |

| | 900,000 | | | Alpha Holding Escrow Shares(b)(c)(e) | | | | | Perpetual Maturity | | | 0 | |

| | 200,000 | | | Banco Mercantil del Norte SA/Grand Cayman(e)(f)(g) | | 10Y US TI + 5.03% | | | Perpetual Maturity | | | 182,875 | |

| | 200,000 | | | Banco Mercantil del Norte SA/Grand Cayman(e)(f)(g) | | 7.50% | | | 12/31/9999 | | | 199,641 | |

| | 500,000 | | | Banco Mercantil del Norte SA/Grand Cayman(e)(g)(h) | | 10Y US TI + 5.03% | | | Perpetual Maturity | | | 457,188 | |

| | 200,000 | | | Banco Mercantil del Norte SA/Grand Cayman(e)(g)(h) | | 7.63% | | | 12/31/9999 | | | 200,341 | |

| | 130,161 | | | Bioceanico Sovereign Certificate, Ltd.(h)(k) | | 0.00% | | | 06/05/2034 | | | 95,689 | |

| | 200,000 | | | Cosan Overseas, Ltd.(e) | | 8.25% | | | Perpetual Maturity | | | 204,875 | |

| | 172,473 | | | Global Aircraft Leasing Co., Ltd.(f)(i) | | 6.50% (7.25%) | | | 09/15/2024 | | | 164,222 | |

| | 162,610 | | | Interoceanica IV Finance, Ltd.(k) | | 0.00% | | | 11/30/2025 | | | 153,463 | |

| | 200,000 | | | Itau Unibanco Holding SA Island(e)(g)(h) | | 5Y US TI + 4.63% | | | Perpetual Maturity | | | 188,327 | |

| | 200,000 | | | Itau Unibanco Holding SA Island(e)(g)(h) | | 5Y US TI + 3.22% | | | 12/31/9999 | | | 188,328 | |

| | 131,027 | | | Lima Metro Line 2 Finance, Ltd.(f) | | 5.88% | | | 07/05/2034 | | | 130,089 | |

| | 87,351 | | | Lima Metro Line 2 Finance, Ltd.(h) | | 5.88% | | | 07/05/2034 | | | 86,726 | |

| | 346,667 | | | Rutas 2 & 7 Finance, Ltd.(h)(k) | | 0.00% | | | 09/30/2036 | | | 236,719 | |

| | 114,750 | | | Transocean Poseidon, Ltd.(f) | | 6.88% | | | 02/01/2027 | | | 114,957 | |

| | | | | | | | | | | | | 2,603,440 | |

| Chile - 0.23% |

| | 300,000 | | | Agrosuper SA(h) | | 4.60% | | | 01/20/2032 | | | 259,375 | |

| | 700,000 | | | CAP SA(h) | | 3.90% | | | 04/27/2031 | | | 550,315 | |

| | 198,056 | | | Chile Electricity PEC SpA(k) | | 0.00% | | | 01/25/2028 | | | 155,771 | |

| | 900,000 | | | Empresa de Transporte de Pasajeros Metro SA(f) | | 5.00% | | | 01/25/2047 | | | 784,502 | |

| | 420,680 | | | GNL Quintero SA(h) | | 4.63% | | | 07/31/2029 | | | 411,836 | |

See Notes to Financial Statements.

| Semi-Annual Report | March 31, 2024 | 19 |

| RiverNorth/DoubleLine Strategic Income Fund | Schedule of Investments |

March 31, 2024 (Unaudited)

| Principal Amount/Description | | Rate | | | Maturity | | Value | |

| $ | 750,000 | | | Transelec SA(h) | | 3.88% | | | 01/12/2029 | | $ | 709,866 | |

| | | | | | | | | | | | | 2,871,665 | |

| China - 0.00%(l) |

| | 400,000 | | | Ronshine China Holdings, Ltd.(j) | | 7.35% | | | 12/15/2023 | | | 6,080 | |

| | 600,000 | | | Ronshine China Holdings, Ltd.(j) | | 6.75% | | | 08/05/2024 | | | 11,100 | |

| | | | | | | | | | | | | 17,180 | |

| Colombia - 0.38% |

| | 450,000 | | | Banco Davivienda SA(e)(f)(g) | | 10Y US TI + 5.10% | | | Perpetual Maturity | | | 316,687 | |

| | 750,000 | | | Banco Davivienda SA(e)(g)(h) | | 10Y US TI + 5.10% | | | 12/31/9999 | | | 527,813 | |

| | 650,000 | | | Banco GNB Sudameris SA(f)(g) | | 5Y US TI + 6.66% | | | 04/16/2031 | | | 566,852 | |

| | 100,000 | | | Banco GNB Sudameris SA(g)(h) | | 5Y US TI + 4.56% | | | 04/03/2027 | | | 99,981 | |

| | 200,000 | | | Banco GNB Sudameris SA(g)(h) | | 5Y US TI + 6.66% | | | 04/16/2031 | | | 174,416 | |

| | 200,000 | | | Bancolombia SA(g) | | 4.63% | | | 12/18/2029 | | | 195,083 | |

| | 850,000 | | | Ecopetrol SA | | 5.88% | | | 05/28/2045 | | | 635,296 | |

| | 1,020,000 | | | Ecopetrol SA | | 5.88% | | | 11/02/2051 | | | 734,912 | |

| | 200,000 | | | Empresas Publicas de Medellin ESP(h) | | 4.25% | | | 07/18/2029 | | | 173,825 | |

| | 950,000 | | | Empresas Publicas de Medellin ESP(h) | | 4.38% | | | 02/15/2031 | | | 794,563 | |

| | 515,580 | | | Fideicomiso PA Pacifico Tres(h) | | 8.25% | | | 01/15/2035 | | | 490,163 | |

| | | | | | | | | | | | | 4,709,591 | |

| France - 0.05% |

| | 340,000 | | | BPCE SA(f) | | 1.00% | | | 01/20/2026 | | | 315,296 | |

| | 265,000 | | | Credit Agricole SA(f)(g) | | 1D US SOFR + 1.69% | | | 01/10/2030 | | | 264,326 | |

| | | | | | | | | | | | | 579,622 | |

| Great Britain - 0.17% |

| | 655,000 | | | HSBC Holdings PLC(g) | | 3M SOFR + 1.64% | | | 09/12/2026 | | | 662,016 | |

| | 50,000 | | | Macquarie Airfinance Holdings, Ltd.(f) | | 6.40% | | | 03/26/2029 | | | 50,828 | |

| | 50,000 | | | Macquarie Airfinance Holdings, Ltd.(f) | | 6.50% | | | 03/26/2031 | | | 50,930 | |

| | 400,000 | | | MARB BondCo PLC(h) | | 3.95% | | | 01/29/2031 | | | 330,114 | |

| | 335,000 | | | NatWest Markets PLC(f) | | 0.80% | | | 08/12/2024 | | | 329,127 | |

| | 444,000 | | | Tullow Oil PLC(f) | | 10.25% | | | 05/15/2026 | | | 422,643 | |

| | 280,000 | | | Weir Group PLC(f) | | 2.20% | | | 05/13/2026 | | | 259,988 | |

| | | | | | | | | | | | | 2,105,646 | |

| Guatemala - 0.02% |

| | 150,000 | | | Banco Industrial SA/Guatemala(g)(h) | | 5Y US TI + 4.44% | | | 01/29/2031 | | | 143,811 | |

| | 200,000 | | | CT Trust(h) | | 5.13% | | | 02/03/2032 | | | 177,453 | |

| | | | | | | | | | | | | 321,264 | |

| India - 0.26% |

| | 400,000 | | | Adani Electricity Mumbai, Ltd.(h) | | 3.87% | | | 07/22/2031 | | | 329,609 | |

See Notes to Financial Statements.

| 20 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth/DoubleLine Strategic Income Fund | Schedule of Investments |

March 31, 2024 (Unaudited)

| Principal Amount/Description | | Rate | | | Maturity | | Value | |

| $ | 532,500 | | | Adani International Container Terminal Pvt, Ltd.(h) | | 3.00% | | | 02/16/2031 | | $ | 454,337 | |

| | 200,000 | | | Adani Ports & Special Economic Zone, Ltd.(h) | | 4.38% | | | 07/03/2029 | | | 178,510 | |

| | 500,000 | | | Adani Ports & Special Economic Zone, Ltd. | | 3.10% | | | 02/02/2031 | | | 398,628 | |

| | 1,000,000 | | | Adani Ports & Special Economic Zone, Ltd.(h) | | 5.00% | | | 08/02/2041 | | | 800,397 | |

| | 200,000 | | | Network i2i, Ltd.(e)(g)(h) | | 5Y US TI + 4.274% | | | 12/31/9999 | | | 198,827 | |

| | 1,081,000 | | | Vedanta Resources, Ltd. | | 13.88% | | | 12/09/2028 | | | 947,049 | |

| | | | | | | | | | | | | 3,307,357 | |

| Indonesia - 0.06% |

| | 200,000 | | | Indonesia Asahan Aluminium PT / Mineral Industri Indonesia Persero PT(h) | | 5.45% | | | 05/15/2030 | | | 197,777 | |

| | 595,000 | | | Kawasan Industri Jababeka Tbk PT(f)(m) | | 7.50% | | | 12/15/2027 | | | 550,883 | |

| | | | | | | | | | | | | 748,660 | |

| Ireland - 0.10% |

| | 190,000 | | | AerCap Ireland Capital DAC / AerCap Global Aviation Trust | | 5.10% | | | 01/19/2029 | | | 188,976 | |

| | 340,000 | | | AIB Group PLC(f)(g) | | 1D US SOFR + 1.91% | | | 03/28/2035 | | | 341,089 | |

| | 370,000 | | | Avolon Holdings Funding, Ltd.(f) | | 5.75% | | | 03/01/2029 | | | 368,466 | |

| | 100,000 | | | GGAM Finance, Ltd.(f) | | 6.88% | | | 04/15/2029 | | | 100,625 | |

| | 280,000 | | | Smurfit Kappa Treasury ULC(f) | | 5.20% | | | 01/15/2030 | | | 279,757 | |

| | | | | | | | | | | | | 1,278,913 | |

| Isle Of Man - 0.02% |

| | 200,000 | | | Gold Fields Orogen Holdings BVI, Ltd.(h) | | 5.13% | | | 05/15/2024 | | | 199,376 | |

| Israel - 0.07% |

| | 900,000 | | | Israel Electric Corp., Ltd.(f) | | 5.00% | | | 11/12/2024 | | | 895,925 | |

| Jamaica - 0.00%(l) |

| | 7,736 | | | Digicel Group Holdings, Ltd.(f)(k) | | 0.00% | | | 12/31/2030 | | | 7,143 | |

| | 38,775 | | | Digicel Group Holdings, Ltd.(f)(k) | | 0.00% | | | 12/31/2030 | | | 5,991 | |

| | 996 | | | Digicel Group Holdings, Ltd.(f)(k) | | 0.00% | | | 12/31/2030 | | | 805 | |

| | 97,752 | | | Digicel Group Holdings, Ltd.(f)(k) | | 0.00% | | | 12/31/2030 | | | 1,122 | |

| | | | | | | | | | | | | 15,061 | |

| Japan - 0.04% |

| | 510,000 | | | Renesas Electronics Corp.(f) | | 2.17% | | | 11/25/2026 | | | 466,799 | |

| Luxembourg - 0.20% |

| | 484,850 | | | Acu Petroleo Luxembourg Sarl(h) | | 7.50% | | | 01/13/2032 | | | 472,264 | |

See Notes to Financial Statements.

| Semi-Annual Report | March 31, 2024 | 21 |

| RiverNorth/DoubleLine Strategic Income Fund | Schedule of Investments |

March 31, 2024 (Unaudited)

| Principal Amount/Description | | Rate | | | Maturity | | | Value | |

| $ | 760,601 | | | MC Brazil Downstream Trading SARL(h) | | 7.25% | | | 06/30/2031 | | | $ | 689,084 | |

| | 180,000 | | | Millicom International Cellular SA(h) | | 6.63% | | | 10/15/2026 | | | | 179,335 | |

| | 270,000 | | | Millicom International Cellular SA(h) | | 6.25% | | | 03/25/2029 | | | | 263,862 | |

| | 200,000 | | | Millicom International Cellular SA | | 4.50% | | | 04/27/2031 | | | | 171,607 | |

| | 600,000 | | | Simpar Europe SA(h) | | 5.20% | | | 01/26/2031 | | | | 524,992 | |

| | 180,934 | | | Tierra Mojada Luxembourg II Sarl | | 5.75% | | | 12/01/2040 | | | | 166,380 | |

| | | | | | | | | | | | | | 2,467,524 | |

| Mauritius - 0.04% |

| | 800,000 | | | UPL Corp., Ltd.(e)(g) | | 5Y US TI + 3.87% | | | 12/31/9999 | | | | 547,416 | |

| Mexico - 0.25% |

| | 659,912 | | | Alpha Holding SA de CV(f)(j) | | 9.00% | | | 02/10/2025 | | | | 9,899 | |

| | 188,546 | | | Alpha Holding SA de CV | | 9.00% | | | 02/10/2025 | | | | 2,828 | |

| | 250,000 | | | BBVA Bancomer SA(g)(h) | | 5.13% | | | 01/18/2033 | | | | 232,497 | |

| | 800,000 | | | Braskem Idesa SAPI(f) | | 6.99% | | | 02/20/2032 | | | | 621,528 | |

| | 200,000 | | | Buffalo Energy Mexico Holdings / Buffalo Energy Infrastructure / Buffalo Energy(f) | | 7.88% | | | 02/15/2039 | | | | 216,663 | |

| | 200,000 | | | Cemex SAB de CV(e)(g)(h) | | 5Y US TI + 4.53% | | | 12/31/9999 | | | | 193,417 | |

| | 500,000 | | | Credito Real SAB de CV SOFOM ER(h)(j) | | 9.50% | | | 02/07/2026 | | | | 69,250 | |

| | 400,000 | | | KUO SAB De CV(h) | | 5.75% | | | 07/07/2027 | | | | 377,394 | |

| | 600,000 | | | Mexarrend SAPI de CV(f) | | 10.25% | | | 07/24/2024 | | | | 126,000 | |

| | 200,000 | | | Mexarrend SAPI de CV(h) | | 10.25% | | | 07/24/2024 | | | | 42,000 | |

| | 126,425 | | | Mexico Generadora de Energia S de rl | | 5.50% | | | 12/06/2032 | | | | 124,559 | |

| | 700,000 | | | Operadora de Servicios Mega SA de CV Sofom ER(f) | | 8.25% | | | 02/11/2025 | | | | 291,375 | |

| | 750,000 | | | Petroleos Mexicanos | | 6.38% | | | 01/23/2045 | | | | 484,094 | |

| | 500,000 | | | Petroleos Mexicanos | | 6.75% | | | 09/21/2047 | | | | 332,890 | |

| | 1,000,000 | | | Unifin Financiera SAB de CV(e)(h)(j) | | 8.88% | | | Perpetual Maturity | | | | 5,100 | |

| | | | | | | | | | | | | | 3,129,494 | |

| Morocco - 0.07% |

| | 1,200,000 | | | OCP SA(h) | | 5.13% | | | 06/23/2051 | | | | 907,578 | |

| Netherlands - 0.31% |

| | 300,000 | | | Braskem Netherlands Finance BV | | 5Y US TI + 8.22% | | | 01/23/2081 | | | | 301,091 | |

| | 800,000 | | | Coruripe Netherlands BV(h) | | 10.00% | | | 02/10/2027 | | | | 725,761 | |

| | 200,000 | | | ING Groep NV(g) | | 1D US SOFR + 1.44% | | | 03/19/2030 | | | | 199,583 | |

| | 200,000 | | | Metinvest BV(h) | | 7.75% | | | 10/17/2029 | | | | 140,430 | |

See Notes to Financial Statements.

| 22 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth/DoubleLine Strategic Income Fund | Schedule of Investments |

March 31, 2024 (Unaudited)

| Principal Amount/Description | | Rate | | | Maturity | | | Value | |

| $ | 1,400,000 | | | Minejesa Capital BV | | 5.63% | | | 08/10/2037 | | | $ | 1,274,789 | |

| | 967,632 | | | MV24 Capital BV(h) | | 6.75% | | | 06/01/2034 | | | | 911,225 | |

| | 265,000 | | | NXP BV / NXP Funding LLC / NXP USA, Inc. | | 3.88% | | | 06/18/2026 | | | | 257,324 | |

| | 50,000 | | | Suzano International Finance BV | | 4.00% | | | 01/14/2025 | | | | 49,269 | |

| | | | | | | | | | | | | | 3,859,472 | |

| Panama - 0.12% |

| | 400,000 | | | Aeropuerto Internacional de Tocumen SA | | 5.13% | | | 08/11/2061 | | | | 293,479 | |

| | 900,000 | | | Empresa de Transmision Electrica SA(h) | | 5.13% | | | 05/02/2049 | | | | 654,781 | |

| | 616,298 | | | UEP Penonome II SA(f) | | 6.50% | | | 10/01/2038 | | | | 482,253 | |

| | 176,085 | | | UEP Penonome II SA | | 6.50% | | | 10/01/2038 | | | | 137,786 | |

| | | | | | | | | | | | | | 1,568,299 | |

| Paraguay - 0.03% |

| | 300,000 | | | Frigorifico Concepcion SA(f) | | 7.70% | | | 07/21/2028 | | | | 263,136 | |

| | 200,000 | | | Frigorifico Concepcion SA(h) | | 7.70% | | | 07/21/2028 | | | | 175,424 | |

| | | | | | | | | | | | | | 438,560 | |

| Peru - 0.25% |

| | 90,000 | | | Banco de Credito del Peru S.A.(g)(h) | | 5Y US TI + 3.13% | | | 07/01/2030 | | | | 86,252 | |

| | 100,000 | | | Banco de Credito del Peru S.A.(g)(h) | | 5Y US TI + 2.45% | | | 09/30/2031 | | | | 92,426 | |

| | 200,000 | | | Banco Internacional del Peru SAA Interbank | | 1Y US TI + 3.71% | | | 07/08/2030 | | | | 192,221 | |

| | 300,000 | | | Camposol SA(f) | | 6.00% | | | 02/03/2027 | | | | 231,555 | |

| | 400,000 | | | Camposol SA(h) | | 6.00% | | | 02/03/2027 | | | | 308,741 | |

| | 400,000 | | | Cia de Minas Buenaventura SAA(h) | | 5.50% | | | 07/23/2026 | | | | 386,153 | |

| | 200,000 | | | Corp Financiera de Desarrollo SA(g)(h) | | 5.61% - 3M US L | | | 07/15/2029 | | | | 199,834 | |

| | 205,000 | | | Inkia Energy, Ltd.(h) | | 5.88% | | | 11/09/2027 | | | | 200,786 | |

| | 50,000 | | | InRetail Shopping Malls | | 5.75% | | | 04/03/2028 | | | | 48,821 | |

| | 200,000 | | | Minsur SA | | 4.50% | | | 10/28/2031 | | | | 175,419 | |

| | 200,000 | | | Orazul Energy Peru SA(h) | | 5.63% | | | 04/28/2027 | | | | 189,568 | |

| | 200,000 | | | Petroleos del Peru SA(h) | | 4.75% | | | 06/19/2032 | | | | 158,317 | |

| | 1,350,000 | | | Petroleos del Peru SA(h) | | 5.63% | | | 06/19/2047 | | | | 908,091 | |

| | | | | | | | | | | | | | 3,178,184 | |

| Singapore - 0.15% |

| | 200,000 | | | DBS Group Holdings, Ltd.(g) | | 5Y US TI + 1.10% | | | 03/10/2031 | | | | 186,205 | |

| | 1,083,880 | | | LLPL Capital Pte, Ltd.(h) | | 6.88% | | | 02/04/2039 | | | | 1,085,245 | |

| | 200,000 | | | Oversea-Chinese Banking Corp., Ltd.(g)(h) | | 5Y US TI + 1.58% | | | 09/10/2030 | | | | 189,110 | |

| | 210,000 | | | Pfizer Investment Enterprises Pte, Ltd. | | 4.75% | | | 05/19/2033 | | | | 206,870 | |

See Notes to Financial Statements.

| Semi-Annual Report | March 31, 2024 | 23 |

| RiverNorth/DoubleLine Strategic Income Fund | Schedule of Investments |

March 31, 2024 (Unaudited)

| Principal Amount/Description | | Rate | | | Maturity | | | Value | |

| $ | 200,000 | | | United Overseas Bank, Ltd.(g) | | 5Y US TI + 1.75% | | | 03/16/2031 | | | $ | 185,718 | |

| | | | | | | | | | | | | | 1,853,148 | |

| Spain - 0.15% |

| | 250,000 | | | AI Candelaria Spain SA(f) | | 5.75% | | | 06/15/2033 | | | | 203,090 | |

| | 1,200,000 | | | AI Candelaria Spain SA(h) | | 5.75% | | | 06/15/2033 | | | | 974,831 | |

| | 800,000 | | | EnfraGen Energia Sur SA / EnfraGen Spain SA / Prime Energia SpA | | 5.38% | | | 12/30/2030 | | | | 664,068 | |

| | | | | | | | | | | | | | 1,841,989 | |

| Switzerland - 0.03% |

| | 330,000 | | | UBS Group AG(f)(g) | | 1Y US TI + 1.52% | | | 02/08/2030 | | | | 330,594 | |

| | | | | | | | | | | | | | | |

| Vietnam - 0.02% |

| | 230,573 | | | Mong Duong Finance Holdings BV(h) | | 5.13% | | | 05/07/2029 | | | | 220,606 | |

| | | | | | | | | | | | | | | |

| TOTAL FOREIGN CORPORATE BONDS | | | | | | | | | | |

| (Cost $62,552,945) | | | | | | | | | 54,337,327 | |

| | | | | | | | | | | | | | | |

| U.S. CORPORATE BONDS - 10.55% |

| Advertising - 0.00%(l) |

| | 50,000 | | | Clear Channel Outdoor Holdings, Inc.(f) | | 7.50% | | | 06/01/2029 | | | | 41,396 | |

| | | | | | | | | | | | | | | |

| Aerospace/Defense - 0.06% |

| | 70,000 | | | AAR Escrow Issuer LLC(f) | | 6.75% | | | 03/15/2029 | | | | 70,626 | |

| | 295,000 | | | Lockheed Martin Corp. | | 5.20% | | | 02/15/2064 | | | | 291,937 | |

| | 265,000 | | | Northrop Grumman Corp. | | 5.20% | | | 06/01/2054 | | | | 258,295 | |

| | 75,000 | | | Spirit AeroSystems, Inc.(f) | | 9.75% | | | 11/15/2030 | | | | 83,986 | |

| | | | | | | | | | | | | | 704,844 | |

| Agriculture - 0.04% |

| | 355,000 | | | BAT Capital Corp. | | 4.54% | | | 08/15/2047 | | | | 274,333 | |

| | 265,000 | | | Philip Morris International, Inc. | | 5.25% | | | 02/13/2034 | | | | 262,772 | |

| | | | | | | | | | | | | | 537,105 | |

| Airlines - 0.04% |

| | 70,000 | | | American Airlines, Inc.(f) | | 7.25% | | | 02/15/2028 | | | | 71,143 | |

| | 120,000 | | | American Airlines, Inc.(f) | | 8.50% | | | 05/15/2029 | | | | 126,850 | |

| | 130,000 | | | American Airlines, Inc./AAdvantage Loyalty IP, Ltd.(f) | | 5.75% | | | 04/20/2029 | | | | 127,887 | |

| | 145,833 | | | United Airlines 2016-1 Class B Pass Through Trust | | 3.65% | | | 01/07/2026 | | | | 139,635 | |

| | | | | | | | | | | | | | 465,515 | |

See Notes to Financial Statements.

| 24 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth/DoubleLine Strategic Income Fund | Schedule of Investments |

March 31, 2024 (Unaudited)

| Principal Amount/Description | | Rate | | | Maturity | | | Value | |

| Apparel - 0.01% | |

| $ | 125,000 | | | Tapestry, Inc. | | 7.05% | | | 11/27/2025 | | | $ | 127,628 | |

| | | | | | | | | | | | | | | |

| Auto Manufacturers - 0.12% |

| | 120,000 | | | Cummins, Inc. | | 5.45% | | | 02/20/2054 | | | | 122,774 | |

| | 320,000 | | | Ford Motor Co. | | 3.25% | | | 02/12/2032 | | | | 266,358 | |

| | 300,000 | | | General Motors Financial Co., Inc. | | 2.40% | | | 10/15/2028 | | | | 265,637 | |

| | 315,000 | | | General Motors Financial Co., Inc. | | 3.10% | | | 01/12/2032 | | | | 266,937 | |

| | 530,000 | | | Hyundai Capital America(f) | | 5.30% | | | 01/08/2029 | | | | 530,936 | |

| | | | | | | | | | | | | | 1,452,642 | |

| Banks - 0.44% |

| | 175,000 | | | Bank of America Corp.(g) | | 1D US SOFR + 1.11% | | | 04/25/2025 | | | | 174,762 | |

| | 180,000 | | | Bank of America Corp.(g) | | 1D US SOFR + 1.75% | | | 07/22/2026 | | | | 178,442 | |

| | 205,000 | | | Bank of America Corp.(g) | | 1D US SOFR + 1.21% | | | 10/20/2032 | | | | 170,142 | |

| | 210,000 | | | Bank of America Corp.(g) | | 1D US SOFR + 1.65% | | | 01/23/2035 | | | | 211,448 | |

| | 590,000 | | | Bank of America Corp.(g) | | 5Y US TI + 2.48% | | | 09/21/2036 | | | | 472,225 | |

| | 200,000 | | | BBVA Bancomer SA | | 5Y US TI + 4.308% | | | 09/13/2034 | | | | 189,398 | |

| | 120,000 | | | Citigroup, Inc.(g) | | 1D US SOFR + 0.69% | | | 01/25/2026 | | | | 116,372 | |

| | 120,000 | | | Citigroup, Inc.(g) | | 1D US SOFR + 1.28% | | | 02/24/2028 | | | | 112,903 | |

| | 590,000 | | | Goldman Sachs Group, Inc.(g) | | 3M SOFR + 1.43% | | | 05/15/2026 | | | | 595,342 | |

| | 175,000 | | | Goldman Sachs Group, Inc.(g) | | 1D US SOFR + 0.82% | | | 09/10/2027 | | | | 175,164 | |

| | 165,000 | | | JPMorgan Chase & Co.(g) | | 1D US SOFR + 0.92% | | | 02/24/2026 | | | | 160,773 | |

| | 85,000 | | | JPMorgan Chase & Co.(g) | | 1D US SOFR + 1.99% | | | 07/25/2028 | | | | 84,311 | |

| | 240,000 | | | JPMorgan Chase & Co.(g) | | 1D SOFR + 1.02% | | | 06/01/2029 | | | | 212,964 | |

| | 345,000 | | | JPMorgan Chase & Co.(g) | | 1D US SOFR + 2.04% | | | 04/22/2031 | | | | 298,293 | |

| | 290,000 | | | JPMorgan Chase & Co.(g) | | 3M SOFR + 1.25% | | | 04/22/2032 | | | | 245,263 | |

| | 290,000 | | | JPMorgan Chase & Co.(g) | | 1D US SOFR + 1.26% | | | 01/25/2033 | | | | 247,694 | |

| | 205,000 | | | Morgan Stanley(g) | | 1D US SOFR + 1.67% | | | 07/17/2026 | | | | 202,864 | |

| | 215,000 | | | Morgan Stanley(g) | | 1D US SOFR + 1.61% | | | 04/20/2028 | | | | 208,998 | |

| | 95,000 | | | Morgan Stanley(g) | | 1D US SOFR + 1.29% | | | 01/21/2033 | | | | 80,770 | |

See Notes to Financial Statements.

| Semi-Annual Report | March 31, 2024 | 25 |

| RiverNorth/DoubleLine Strategic Income Fund | Schedule of Investments |

March 31, 2024 (Unaudited)

| Principal Amount/Description | | Rate | | | Maturity | | | Value | |

| $ | 585,000 | | | Morgan Stanley(g) | | 1D SOFR + 2.48% | | | 09/16/2036 | | | $ | 462,931 | |

| | 275,000 | | | Wells Fargo & Co.(g) | | 1D US SOFR + 1.98% | | | 07/25/2028 | | | | 271,045 | |

| | 270,000 | | | Wells Fargo & Co.(g) | | 1D US SOFR + 1.43% | | | 10/30/2030 | | | | 238,767 | |

| | 370,000 | | | Wells Fargo & Co.(g) | | 1D US SOFR + 2.06% | | | 10/23/2034 | | | | 397,027 | |

| | | | | | | | | | | | | | 5,507,898 | |

| Beverages - 0.02% |

| | 260,000 | | | Triton Water Holdings, Inc.(f) | | 6.25% | | | 04/01/2029 | | | | 237,060 | |

| | | | | | | | | | | | | | | |

| Biotechnology - 0.05% |

| | 210,000 | | | Amgen, Inc. | | 5.75% | | | 03/02/2063 | | | | 214,357 | |

| | 150,000 | | | Gilead Sciences, Inc. | | 5.55% | | | 10/15/2053 | | | | 155,376 | |

| | 325,000 | | | Royalty Pharma PLC | | 2.15% | | | 09/02/2031 | | | | 262,097 | |

| | | | | | | | | | | | | | 631,830 | |

| Building Materials - 0.06% |

| | 130,000 | | | Builders FirstSource, Inc.(f) | | 6.38% | | | 06/15/2032 | | | | 132,037 | |

| | 150,000 | | | Builders FirstSource, Inc.(f) | | 6.38% | | | 03/01/2034 | | | | 150,807 | |

| | 50,000 | | | Carrier Global Corp. | | 6.20% | | | 03/15/2054 | | | | 55,098 | |

| | 120,000 | | | EMRLD Borrower LP / Emerald Co.-Issuer, Inc.(f) | | 6.63% | | | 12/15/2030 | | | | 121,301 | |

| | 130,000 | | | Griffon Corp. | | 5.75% | | | 03/01/2028 | | | | 127,407 | |

| | 25,000 | | | Miter Brands Acquisition Holdco, Inc. / MIWD Borrower LLC(f) | | 6.75% | | | 04/01/2032 | | | | 25,101 | |

| | 115,000 | | | Standard Industries, Inc.(f) | | 4.38% | | | 07/15/2030 | | | | 103,413 | |

| | | | | | | | | | | | | | 715,164 | |

| Chemicals - 0.10% |

| | 170,000 | | | ASP Unifrax Holdings, Inc.(f) | | 7.50% | | | 09/30/2029 | | | | 94,426 | |

| | 285,000 | | | CF Industries, Inc. | | 5.38% | | | 03/15/2044 | | | | 268,417 | |

| | 240,000 | | | Illuminate Buyer LLC / Illuminate Holdings IV, Inc.(f) | | 9.00% | | | 07/01/2028 | | | | 237,051 | |

| | 250,000 | | | Mosaic Co. | | 5.38% | | | 11/15/2028 | | | | 253,194 | |

| | 400,000 | | | Sasol Financing USA LLC | | 5.50% | | | 03/18/2031 | | | | 337,326 | |

| | 75,000 | | | WR Grace Holdings LLC(f) | | 5.63% | | | 08/15/2029 | | | | 67,195 | |

| | | | | | | | | | | | | | 1,257,609 | |

| Coal - 0.01% |

| | 110,000 | | | SunCoke Energy, Inc.(f) | | 4.88% | | | 06/30/2029 | | | | 99,709 | |

| | | | | | | | | | | | | | | |

| Commercial Services - 0.10% |

| | 295,000 | | | Allied Universal Holdco LLC(f) | | 7.88% | | | 02/15/2031 | | | | 299,144 | |

| | 50,000 | | | Allied Universal Holdco LLC / Allied Universal Finance Corp.(f) | | 6.63% | | | 07/15/2026 | | | | 50,009 | |

See Notes to Financial Statements.

| 26 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth/DoubleLine Strategic Income Fund | Schedule of Investments |

March 31, 2024 (Unaudited)

| Principal Amount/Description | | Rate | | | Maturity | | | Value | |

| $ | 70,000 | | | Allied Universal Holdco LLC / Allied Universal Finance Corp.(f) | | 9.75% | | | 07/15/2027 | | | $ | 70,289 | |

| | 260,000 | | | Global Payments, Inc. | | 4.95% | | | 08/15/2027 | | | | 258,070 | |

| | 105,000 | | | Mavis Tire Express Services Topco Corp.(f) | | 6.50% | | | 05/15/2029 | | | | 99,963 | |

| | 105,000 | | | Triton Container International, Ltd.(f) | | 1.15% | | | 06/07/2024 | | | | 104,067 | |

| | 200,000 | | | Triton Container International, Ltd. / TAL International Container Corp. | | 3.25% | | | 03/15/2032 | | | | 162,638 | |

| | 65,000 | | | VT Topco, Inc.(f) | | 8.50% | | | 08/15/2030 | | | | 68,675 | |

| | 75,000 | | | Wand NewCo 3, Inc.(f) | | 7.63% | | | 01/30/2032 | | | | 77,630 | |

| | 50,000 | | | WASH Multifamily Acquisition, Inc.(f) | | 5.75% | | | 04/15/2026 | | | | 48,912 | |

| | | | | | | | | | | | | | 1,239,397 | |

| Computers - 0.08% |

| | 280,000 | | | Fortinet, Inc. | | 1.00% | | | 03/15/2026 | | | | 257,766 | |

| | 205,000 | | | Hewlett Packard Enterprise Co. | | 5.90% | | | 10/01/2024 | | | | 205,340 | |

| | 255,000 | | | Kyndryl Holdings, Inc. | | 6.35% | | | 02/20/2034 | | | | 261,882 | |

| | 270,000 | | | NetApp, Inc. | | 1.88% | | | 06/22/2025 | | | | 258,329 | |

| | | | | | | | | | | | | | 983,317 | |

| Containers and Packaging - 0.02% |

| | 270,000 | | | Packaging Corp. of America | | 3.40% | | | 12/15/2027 | | | | 256,829 | |

| | | | | | | | | | | | | | | |

| Cosmetics/Personal Care - 0.01% |

| | 130,000 | | | Coty, Inc./HFC Prestige Products Inc/HFC Prestige International US LLC(f) | | 6.63% | | | 07/15/2030 | | | | 132,118 | |

| | | | | | | | | | | | | | | |

| Distribution/Wholesale - 0.04% |

| | 180,000 | | | BCPE Empire Holdings, Inc.(f) | | 7.63% | | | 05/01/2027 | | | | 175,919 | |

| | 315,000 | | | Dealer Tire LLC / DT Issuer LLC(f) | | 8.00% | | | 02/01/2028 | | | | 313,819 | |

| | | | | | | | | | | | | | 489,738 | |

| Diversified Financial Services - 0.17% |

| | 150,000 | | | Air Lease Corp. | | 1.88% | | | 08/15/2026 | | | | 138,340 | |

| | 510,000 | | | American Express Co. | | 3.95% | | | 08/01/2025 | | | | 501,255 | |

| | 415,000 | | | Aviation Capital Group LLC(f) | | 1.95% | | | 09/20/2026 | | | | 379,354 | |

| | 160,000 | | | BlackRock Funding, Inc. | | 5.25% | | | 03/14/2054 | | | | 160,937 | |

| | 450,000 | | | BlackRock, Inc. | | 4.75% | | | 05/25/2033 | | | | 447,837 | |

| | 140,000 | | | Nationstar Mortgage Holdings, Inc.(f) | | 5.75% | | | 11/15/2031 | | | | 129,263 | |

| | 95,000 | | | Navient Corp. | | 5.00% | | | 03/15/2027 | | | | 91,081 | |

| | 125,000 | | | OneMain Finance Corp. | | 6.63% | | | 01/15/2028 | | | | 125,495 | |

| | 65,000 | | | PennyMac Financial Services, Inc.(f) | | 4.25% | | | 02/15/2029 | | | | 59,481 | |

See Notes to Financial Statements.

| Semi-Annual Report | March 31, 2024 | 27 |

| RiverNorth/DoubleLine Strategic Income Fund | Schedule of Investments |

March 31, 2024 (Unaudited)

| Principal Amount/Description | | Rate | | | Maturity | | | Value | |

| $ | 70,000 | | | PennyMac Financial Services, Inc.(f) | | 7.88% | | | 12/15/2029 | | | $ | 71,991 | |

| | | | | | | | | | | | | | 2,105,034 | |

| Electric - 0.44% |

| | 55,000 | | | AEP Transmission Co. LLC | | 5.40% | | | 03/15/2053 | | | | 54,804 | |

| | 420,000 | | | DTE Energy Co. | | 5.10% | | | 03/01/2029 | | | | 418,498 | |

| | 95,000 | | | Duke Energy Corp. | | 4.30% | | | 03/15/2028 | | | | 92,853 | |

| | 325,000 | | | Duke Energy Corp. | | 3.95% | | | 08/15/2047 | | | | 252,527 | |

| | 85,000 | | | Duke Energy Corp. | | 5.00% | | | 08/15/2052 | | | | 77,023 | |

| | 130,000 | | | Entergy Corp. | | 2.80% | | | 06/15/2030 | | | | 113,707 | |

| | 265,000 | | | Eversource Energy | | 5.50% | | | 01/01/2034 | | | | 265,209 | |

| | 1,000,000 | | | Exelon Corp. | | 4.05% | | | 04/15/2030 | | | | 943,594 | |

| | 290,000 | | | Georgia Power Co. | | 2.20% | | | 09/15/2024 | | | | 285,413 | |

| | 573,000 | | | Georgia Power Co. | | 3.25% | | | 03/15/2051 | | | | 402,761 | |

| | 230,000 | | | NextEra Energy Capital Holdings, Inc. | | 4.26% | | | 09/01/2024 | | | | 228,493 | |

| | 750,000 | | | NextEra Energy Capital Holdings, Inc. | | 2.44% | | | 01/15/2032 | | | | 620,289 | |

| | 160,000 | | | NextEra Energy Capital Holdings, Inc. | | 5.55% | | | 03/15/2054 | | | | 159,078 | |

| | 160,000 | | | NRG Energy, Inc.(f) | | 2.00% | | | 12/02/2025 | | | | 150,252 | |

| | 150,000 | | | NRG Energy, Inc.(f) | | 3.63% | | | 02/15/2031 | | | | 129,595 | |

| | 320,000 | | | Pacific Gas and Electric Co. | | 2.50% | | | 02/01/2031 | | | | 266,344 | |

| | 240,000 | | | Pacific Gas and Electric Co. | | 6.75% | | | 01/15/2053 | | | | 261,785 | |

| | 135,000 | | | Pike Corp.(f) | | 5.50% | | | 09/01/2028 | | | | 129,358 | |

| | 60,000 | | | Pike Corp.(f) | | 8.63% | | | 01/31/2031 | | | | 63,835 | |

| | 85,000 | | | San Diego Gas & Electric Co. | | 5.35% | | | 04/01/2053 | | | | 83,800 | |

| | 280,000 | | | Southern Co.(g) | | 5Y US TI + 2.92% | | | 09/15/2051 | | | | 262,117 | |

| | 225,000 | | | Southwestern Electric Power Co. | | 3.25% | | | 11/01/2051 | | | | 149,524 | |

| | 85,000 | | | Vistra Operations Co. LLC(f) | | 7.75% | | | 10/15/2031 | | | | 89,081 | |

| | | | | | | | | | | | | | 5,499,940 | |

| Electronics - 0.02% |

| | 220,000 | | | Arrow Electronics, Inc. | | 3.88% | | | 01/12/2028 | | | | 208,609 | |

| | | | | | | | | | | | | | | |

| Engineering & Construction - 0.01% |

| | 185,000 | | | Jacobs Engineering Group, Inc. | | 5.90% | | | 03/01/2033 | | | | 187,434 | |

| | | | | | | | | | | | | | | |

| Engineering&Construction - 0.04% |

| | 240,000 | | | Artera Services LLC(f) | | 8.50% | | | 02/15/2031 | | | | 246,233 | |

| | 210,000 | | | Brand Industrial Services, Inc.(f) | | 10.38% | | | 08/01/2030 | | | | 227,622 | |

| | | | | | | | | | | | | | 473,855 | |

| Entertainment - 0.05% |

| | 60,000 | | | Caesars Entertainment, Inc.(f) | | 6.50% | | | 02/15/2032 | | | | 60,566 | |

| | 135,000 | | | Light & Wonder International, Inc.(f) | | 7.25% | | | 11/15/2029 | | | | 138,678 | |

See Notes to Financial Statements.

| 28 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth/DoubleLine Strategic Income Fund | Schedule of Investments |

March 31, 2024 (Unaudited)

| Principal Amount/Description | | Rate | | | Maturity | | | Value | |

| $ | 135,000 | | | Midwest Gaming Borrower LLC / Midwest Gaming Finance Corp.(f) | | 4.88% | | | 05/01/2029 | | | $ | 125,114 | |

| | 265,000 | | | Scientific Games Holdings LP/Scientific Games US FinCo, Inc.(f) | | 6.63% | | | 03/01/2030 | | | | 256,386 | |

| | | | | | | | | | | | | | 580,744 | |

| Environmental Control - 0.02% |

| | 120,000 | | | Madison IAQ LLC(f) | | 4.13% | | | 06/30/2028 | | | | 111,094 | |

| | 175,000 | | | Veralto Corp.(f) | | 5.35% | | | 09/18/2028 | | | | 177,372 | |

| | | | | | | | | | | | | | 288,466 | |

| Food - 0.09% |

| | 140,000 | | | Campbell Soup Co. | | 5.40% | | | 03/21/2034 | | | | 141,117 | |

| | 489,000 | | | Smithfield Foods, Inc.(f) | | 4.25% | | | 02/01/2027 | | | | 469,825 | |

| | 395,000 | | | Sysco Corp. | | 6.00% | | | 01/17/2034 | | | | 420,538 | |

| | 75,000 | | | United Natural Foods, Inc.(f) | | 6.75% | | | 10/15/2028 | | | | 62,386 | |

| | 90,000 | | | US Foods, Inc.(f) | | 7.25% | | | 01/15/2032 | | | | 93,778 | |

| | | | | | | | | | | | | | 1,187,644 | |

| Food Service - 0.01% |

| | 105,000 | | | TKC Holdings, Inc.(f) | | 10.50% | | | 05/15/2029 | | | | 100,712 | |

| | | | | | | | | | | | | | | |

| Gas - 0.02% |

| | 265,000 | | | NiSource, Inc. | | 5.35% | | | 04/01/2034 | | | | 263,666 | |

| | | | | | | | | | | | | | | |

| Hand/Machine Tools - 0.01% |

| | 130,000 | | | Regal Rexnord Corp.(f) | | 6.05% | | | 02/15/2026 | | | | 130,740 | |

| | | | | | | | | | | | | | | |

| Healthcare-Products - 0.02% |

| | 165,000 | | | Medline Borrower LP(f) | | 5.25% | | | 10/01/2029 | | | | 156,079 | |

| | 145,000 | | | Zimmer Biomet Holdings, Inc. | | 5.35% | | | 12/01/2028 | | | | 147,162 | |

| | | | | | | | | | | | | | 303,241 | |

| Healthcare-Services - 0.22% |

| | 425,000 | | | Centene Corp. | | 2.50% | | | 03/01/2031 | | | | 349,938 | |

| | 90,000 | | | CHS/Community Health Systems, Inc.(f) | | 6.00% | | | 01/15/2029 | | | | 78,731 | |

| | 210,000 | | | Elevance Health, Inc. | | 2.38% | | | 01/15/2025 | | | | 204,894 | |

| | 85,000 | | | Elevance Health, Inc. | | 4.55% | | | 05/15/2052 | | | | 74,794 | |

| | 70,000 | | | Fortrea Holdings, Inc.(f) | | 7.50% | | | 07/01/2030 | | | | 72,347 | |

| | 395,000 | | | HCA, Inc. | | 5.38% | | | 02/01/2025 | | | | 393,951 | |

| | 585,000 | | | HCA, Inc. | | 5.25% | | | 06/15/2049 | | | | 534,366 | |

| | 175,000 | | | IQVIA, Inc. | | 6.25% | | | 02/01/2029 | | | | 181,850 | |

| | 130,000 | | | Legacy LifePoint Health LLC(f) | | 4.38% | | | 02/15/2027 | | | | 123,985 | |

| | 85,000 | | | ModivCare Escrow Issuer, Inc.(f) | | 5.00% | | | 10/01/2029 | | | | 61,712 | |

| | 105,164 | | | Radiology Partners, Inc.(f)(i) | | 9.78% (9.781%) | | | 02/15/2030 | | | | 84,788 | |

| | 100,000 | | | Tenet Healthcare Corp. | | 6.25% | | | 02/01/2027 | | | | 100,038 | |

See Notes to Financial Statements.

| Semi-Annual Report | March 31, 2024 | 29 |

| RiverNorth/DoubleLine Strategic Income Fund | Schedule of Investments |

March 31, 2024 (Unaudited)

| Principal Amount/Description | | Rate | | | Maturity | | | Value | |

| $ | 125,000 | | | Tenet Healthcare Corp. | | 6.13% | | | 06/15/2030 | | | $ | 124,870 | |

| | 305,000 | | | UnitedHealth Group, Inc. | | 5.05% | | | 04/15/2053 | | | | 296,443 | |

| | 90,000 | | | UnitedHealth Group, Inc. | | 4.95% | | | 05/15/2062 | | | | 84,133 | |

| | | | | | | | | | | | | | 2,766,840 | |

| Home Furnishings - 0.01% |

| | 80,000 | | | Whirlpool Corp. | | 5.75% | | | 03/01/2034 | | | | 80,303 | |

| | | | | | | | | | | | | | | |

| Housewares - 0.01% | | | | | | | | | | |

| | 160,000 | | | SWF Escrow Issuer Corp.(f) | | 6.50% | | | 10/01/2029 | | | | 118,515 | |

| | | | | | | | | | | | | | | |

| Insurance - 0.18% |

| | 95,000 | | | Alliant Holdings Intermediate LLC / Alliant Holdings Co.-Issuer(f) | | 6.75% | | | 10/15/2027 | | | | 93,674 | |

| | 100,000 | | | AmWINS Group, Inc.(f) | | 4.88% | | | 06/30/2029 | | | | 93,435 | |

| | 260,000 | | | Athene Global Funding(f)(g) | | SOFRINDX + 0.56% | | | 08/19/2024 | | | | 260,174 | |

| | 290,000 | | | Athene Holding, Ltd. | | 6.25% | | | 04/01/2054 | | | | 294,664 | |

| | 215,000 | | | Berkshire Hathaway Finance Corp. | | 2.85% | | | 10/15/2050 | | | | 145,275 | |

| | 110,000 | | | Berkshire Hathaway Finance Corp. | | 3.85% | | | 03/15/2052 | | | | 89,031 | |

| | 95,000 | | | Brighthouse Financial Global Funding(f) | | 1.00% | | | 04/12/2024 | | | | 94,871 | |

| | 130,000 | | | Brighthouse Financial Global Funding(f) | | 2.00% | | | 06/28/2028 | | | | 112,266 | |

| | 90,000 | | | GTCR AP Finance, Inc.(f) | | 8.00% | | | 05/15/2027 | | | | 90,362 | |