UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

ANNUAL REPORT PURSUANT TO SECTIONS 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

| | þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | For the fiscal year ended December 31, 2006 |

OR

| | ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | For the transition period from to |

Commission File No.: 000-52498

FIRST CALIFORNIA FINANCIAL GROUP, INC.

(Exact Name of Registrant as Specified in its Charter)

| | |

| Delaware | | 38-3737811 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | |

1880 Century Park East, Suite 800 Los Angeles, California | | 90067 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(310) 277-2265

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Stock, Par Value $0.01 Per Share | | Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer þ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of common stock, held by non-affiliates of the registrant as of June 30, 2006, was $0 (at such time, the registrant was a wholly-owned subsidiary of National Mercantile Bancorp the common stock of which was registered under Section 12(b) of the Exchange Act). For purposes of the foregoing computation, all executive officers, directors and 5 percent beneficial owners of the registrant are deemed to be affiliates. Such determination should not be deemed to be an admission that such executive officers, directors or 5 percent beneficial owners are, in fact, affiliates of the registrant.

Common Stock — As of April 16, 2007, there were approximately 11,548,233 shares of the issuer’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

Explanatory Note

First California Financial Group, Inc. (“First California”) is filing this Amendment No. 1 to Form 10-K for the fiscal year ended December 31, 2006 to incorporate information previously omitted from Part III, Items 10, 11, 12 and 14 and to include the performance graph indicated by Item 201(e) of Regulation S-K.

***

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

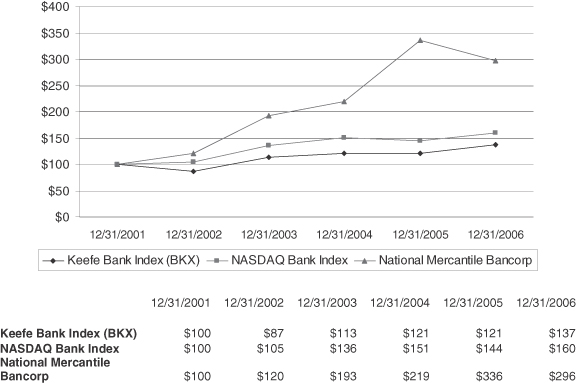

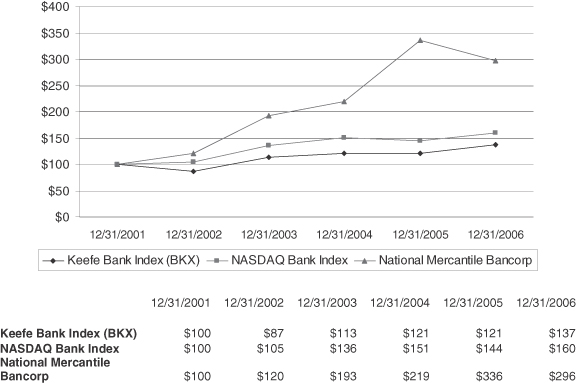

Five-Year Stock Performance Graph

The following chart compares the yearly percentage change in the cumulative shareholder return of National Mercantile Bancorp (“National Mercantile”) during the five years ended December 31, 2006 with the cumulative total return of the Keefe Bank Index and the NASDAQ Bank Stocks Index. First California, as successor to National Mercantile, had no class of securities registered under the Securities Exchange Act of 1934, as amended, or the Exchange Act, at any point during or prior to the fiscal year ended December 31, 2006. This comparison assumes $100 was invested on December 31, 2001, in National Mercantile common stock and the comparison groups and assumes the reinvestment of all dividends. National Mercantile’s total cumulative return was 196% over the five year period ending December 31, 2006 compared to 37% and 60% for the Keefe Bank Index and NASDAQ Bank Stocks Index, respectively.

The stock price performance of the common stock shown in the graph below represents past performance only and does not necessarily indicate future performance.

1

| Item 9A. | Controls and Procedures. |

As of the end of the period covered by this report, an evaluation was carried out by First California’s management, with the participation of the Chief Executive Officer and the Chief Financial Officer, of the effectiveness of First California’s disclosure controls and procedures (as defined in Rule 13a-15(e) under the Securities Exchange Act of 1934). Based upon that evaluation, the Chief Executive Officer and Chief Financial Officer concluded that these disclosure controls and procedures were effective.

There have not been any changes in First California’s internal control over financial reporting (as defined in Rule 13a-15(f) under the Securities Exchange Act of 1934) during our most recent fiscal quarter ending December 31, 2006 that have materially affected, or are reasonably likely to materially affect, First California’s internal control over financial reporting.

This annual report does not include a report of management’s assessment regarding internal control over financial reporting or an attestation report of the Company’s registered public accounting firm due to a transition period established by the rules of the Securities and Exchange Commission (the “SEC”) for newly public companies.

2

PART III

| Item 10. | Directors, Executive Officers and Corporate Governance. |

Executive Officers and Directors

The table below sets forth our current executive officers and directors, their ages as of December 31, 2006, and their positions. All of our executive officers and directors were appointed to their respective positions pursuant to the terms of the Agreement and Plan of Merger, dated as of June 15, 2006 (the “Merger Agreement”), by and among First California, FCB Bancorp, a California corporation, and National Mercantile.

| | | | |

Name | | Age | | Position |

C. G. Kum | | 52 | | Director, President and Chief Executive Officer |

Thomas E. Anthony | | 57 | | Executive Vice President and Head of Commercial Banking |

Romolo Santarosa | | 50 | | Executive Vice President and Chief Financial Officer |

David R. Brown | | 47 | | Executive Vice President and Chief Strategy Officer |

Robert W. Bartlett | | 60 | | Executive Vice President and Chief Credit Officer |

Richard D. Aldridge | | 58 | | Director |

Donald E. Benson | | 76 | | Director |

John W. Birchfield | | 54 | | Vice Chairman |

Joseph N. Cohen | | 60 | | Director |

Robert E. Gipson | | 60 | | Chairman of the Board |

W. Douglas Hile | | 53 | | Director |

Antoinette Hubenette, M.D. | | 58 | | Director |

Syble R. Roberts | | 69 | | Director |

Thomas Tignino | | 58 | | Director |

As used throughout this annual report on Form 10-K, the term “executive officer” means our President and Chief Executive Officer, our Executive Vice President and Chief Credit Officer, our Executive Vice President and Chief Financial Officer, our Executive Vice President and Chief Strategy Officer and our Executive Vice President, Head of Commercial Banking. Our Chairman of the Board, Corporate Secretary and other Vice Presidents are not executive officers.

Biographical Information Regarding Our Executive Officers

C. G. Kum, Director, President and Chief Executive Officer. Mr. Kum began his banking career in 1977 as a corporate banking trainee with Bank of California in San Francisco, California. He served as Regional Vice President and Manager of Asset Quality Administration for United Banks of Colorado from 1984 until 1987. Mr. Kum then served as Vice President and Division Manager of Special Projects Division for Colorado National Bank from 1987 until 1993. Mr. Kum moved to California in 1993 and served as Executive Vice President and Chief Credit Officer of City Commerce Bank, from 1993 until 1999.

Mr. Kum was appointed to his position as the President and the Chief Executive Officer of First California Bank (formerly known as Camarillo Community Bank) on September 1, 1999. Under his leadership, the Bank grew from total assets of $100 million and two branches in 1999, to total assets as of September 30, 2006 of $502.6 million and eight branches. He is a graduate of University of California at Berkeley and received his Masters Degree in Business Administration from Pepperdine University. Mr. Kum also is a graduate of Stonier Graduate School of Banking. He was elected to the position of the President of the board of directors of Community Bankers of California, an association of California community bank presidents, for the fiscal year of 2005-06.

Thomas E. Anthony, Executive Vice President and Head of Commercial Banking. Mr. Anthony moved from Illinois and began his banking career in 1970 as a commercial loan trainee with the then United California Bank

3

in Los Angeles. He served as Vice President—Commercial Lender at Independence Bank from 1988 to 1992. He then served as Executive Vice President and Chief Credit Officer at Channel Islands National Bank from 1992 until 1998 when it was merged with American Commercial Bank, where he served in the same capacity from 1998 until 1999. Mr. Anthony joined First California Bank in 1999 as Executive Vice President and Chief Credit Officer.

Mr. Anthony graduated from Northern Illinois University with a degree in management.

Romolo Santarosa, Executive Vice President and Chief Financial Officer. Mr. Santarosa began his banking career in 1991 with Shawmut National Corporation as its Controller. In 1995, Mr. Santarosa joined Sanwa Bank California and served as Controller until 1997. He then served as Chief Financial Officer of Southern Pacific Bank from 1997 until 2000, of Eldorado Bancshares, Inc. from 2000 to 2001, and of Treasury Bank, N.A. from 2001 to 2002. Mr. Santarosa joined First California Bank in November 2002 as Executive Vice President and Chief Financial Officer.

Mr. Santarosa is a graduate (1978) of Ithaca College, Ithaca, New York. He began his career in public accounting with Price Waterhouse, an international public accounting firm. He also is a certified public accountant in New York and Connecticut.

David R. Brown, Executive Vice President and Chief Strategy Officer. Mr. Brown served as Chief Financial Officer for Eldorado Bancorp from 1986 to 1997. In November 1997, he organized PriVest Bank in Costa Mesa, California and served as its President, Chief Operating Officer, Chief Financial Officer and a director until 2001. He was appointed Chief Financial Officer of National Mercantile in June 2001, and served in the same position for its subsidiary banks—Mercantile National Bank and South Bay Bank. Mr. Brown graduated from California State Polytechnic University with a degree in business administration. He is a certified public accountant licensed in California and began his career in public accounting in 1981 with Arthur Andersen & Co.

Robert W. Bartlett, Executive Vice President and Chief Credit Officer. Mr. Bartlett began his banking career at Bank of America in 1974 and over fifteen years held various positions in commercial banking and credit administration, including Commercial Banking Manager for the Long Beach, California regional office. From 1989 to 1994 he served in credit administration, including Chief Credit Officer, for West Coast Bancorp and its subsidiary bank, Sunwest Bank. From 1994 to 2000 he served as Chief Credit Officer for Tokai Bank of California and from 2000 to 2001 he was Senior Vice President—Commercial Banking for Pacific Century Bank. Mr. Bartlett joined National Mercantile in 2001 as Chief Credit Officer for its subsidiary, South Bay Bank. His role was expanded in 2003 to include Chief Credit Officer for subsidiary Mercantile National Bank and in 2005 he was appointed Chief Operating Officer for National Mercantile.

Biographical Information Regarding Our Directors

Richard O. Aldridgeserved as the Vice Chairman of the Board of FCB Bancorp from October 2005 until the completion of the mergers contemplated by the Merger Agreement (the “Mergers”) and has been a director since 1993. He was employed for 19 years by Weyerhaeuser Company in Longview, Washington. He served on the company’s Top Safety Committee, and represented Weyerhaeuser nationally serving on the board of directors of Forest Industries Telecommunications, an F.C.C. certified trade association. Mr. Aldridge began investing in real estate in 1988 and community banking in 1990, acquiring his first shares in First California Bank (formerly Camarillo Community Bank). Since 1990, he has held investments in Channel Islands Bank, City Commerce Bank, American Commercial Bank, Mid-State Bank and Trust, and First California Bank. While serving as a director of FCB Bancorp, Mr. Aldridge served on several committees including CRA, Audit, Loan, funds management, and executive committees. Mr. Aldridge also served as interim Chairman of the Board of FCB Bancorp from 1998 to 1999. First California Bank represents the largest single investment in his portfolio.

Donald E. Benson is Executive Vice President and a director of Marquette Financial Companies, Minneapolis, Minnesota, a financial services holding company (formerly Marquette Bancshares, Inc.). He has

4

served in that position since 1992. Mr. Benson is also a director of MAIR Holdings, Inc., a commuter airline; Mass Mutual Corporate Investors, a mutual fund; and Mass Mutual Participation Investors, a mutual fund.

John W. Birchfield served as the Chairman of the Board of FCB Bancorp from October 2005 until the completion of the Mergers and was a director from 1993 until the completion of the Mergers. Since 1995, Mr. Birchfield has served as the Chairman of the Board at B & R Supply Inc. He is also the managing partner of Ralston Properties LP, a privately held real estate management company.

Joseph N. Cohen has been President of American Entertainment Investors, Inc., a media financing and consulting firm, since February 1996, a Principal of Abel’s Hill Capital Corp., an investment banking firm, since October 1996, and a Principal of EFS Advisors, LLC, which co-manages an entertainment investment fund, since June 2006.

Robert E. Gipson is President of Alpha Analytics Investment Group, LLC, a registered investment advisor, and has served in that capacity since its organization in 1998. Mr. Gipson is Of Counsel to the law firm of Gipson Hoffman & Pancione and has been a lawyer with that firm since 1982. Mr. Gipson is also President of Corporate Management Group, Inc., a financial management company, since 1988. Mr. Gipson was Chairman of National Mercantile from June 1997 until the completion of the Mergers and was Chairman of Mercantile National Bank from June 1997 to December 1998. He also serves as a director of South Bay Bank, N.A. and Business First National Bank, Santa Barbara, California. He now serves as Chairman of the Board for First California.

W. Douglas Hile is Chairman and Chief Executive Officer of Meridian Bank, a position he has held since October of 2002. He also serves as Senior Vice President and Regional President for Marquette Financial Companies, a diversified financial services holding company headquartered in Minneapolis, Minnesota. He has almost thirty years of experience in the financial services business, including management roles for Northern Trust and Bank One. Prior to joining Meridian Bank, he served as President and Chief Executive Officer of the Marquette Banks, a $3 billion commercial banking group based in Minneapolis, Minnesota.

Dr. Antoinette Hubenette was President and a director of Cedars-Sinai Medical Group, Beverly Hills, California (formerly Medical Group of Beverly Hills), a physicians’ medical practice group, from 1994 to 2000. She has been a practicing physician since 1982. She continues in part-time practice of general internal medicine.

Syble R. Roberts was a director of First California Bank from 1989 until the completion of the Mergers and was the personnel committee chairman. Ms. Roberts was also a Founding Director of City Commerce Bank, Santa Barbara, opened in 1978 and now owned by Mid-State Bank. Ms. Roberts’ background is in the legal, title insurance and escrow, and real estate investment fields. Ms. Roberts became a specialist in the escrow field of multiple tax-deferred exchanges and long order leasehold estates and was involved in the start-ups of a title insurance company and several escrow and mortgage banking companies.

Thomas Tigninoserved as a director of FCB Bancorp from January 2006 until the completion of the Mergers. Mr. Tignino is the founder and President of Thomas Tignino & Associates, a multi-service accountancy firm established in 1980. His firm specializes in tax planning and compliance, estate planning and investment review.

Code of Ethics

First California has adopted a written code of ethics that applies to all of its directors, officers and employees, including the chief executive officer and the chief financial officer of the company, in accordance with Section 406 of the Sarbanes-Oxley Act of 2002 and the rules of the SEC promulgated thereunder. The code of ethics is available on the company’s website atwww.fcalgroup.com. First California intends to satisfy the disclosure requirement under Item 10 of Form 8-K regarding an amendment to, or a waiver from, a provision of the code of ethics by posting such information on the company’s website.

5

Corporate Governance

First California’s by-laws provide that stockholders who desire to nominate any person as a candidate for election to the board of directors or submit any other stockholder proposal must send a written notice to the corporate secretary of such nomination or proposal that will also contain certain additional information required by the bylaws. The relevant stockholder notice must be delivered to the Secretary of the Corporation (1) in the case of the first annual meeting, a reasonable time before First California begins to print and mail its proxy materials and (2) thereafter not less than 90 nor more than 120 days prior to the first anniversary date of the annual meeting for the preceding year. There were no material changes to the procedures by which security holders are able to recommend nominees to First California’s board of directors.

First California’s newly constituted audit committee is responsible for providing assistance to the First California board of directors in fulfilling its legal and fiduciary obligations with respect to matters involving the accounting, auditing, financial reporting, internal control and legal compliance function, as well as those of First California’s subsidiaries. The audit committee consists of John W. Birchfield, Robert E. Gipson, Syble R. Roberts and Thomas Tignino. First California’s board of directors has determined that all of the members of the audit committee are “independent” in accordance with applicable Nasdaq Marketplace Rules and SEC rules. The board of directors has also determined that Thomas Tignino is an “audit committee financial expert” as that term is defined in Regulation S-K of the SEC.

Section 16(a) Beneficial Ownership Reporting Compliance

We had no class of securities registered under the Exchange Act, at any point during the fiscal year ended December 31, 2006. Accordingly, none of our executive officers or directors were required to file reports under Section 16(a) of the Exchange Act with respect to such fiscal year.

| Item 11. | Executive Compensation. |

First California Compensation Matters

First California was formed in May 2006 for the purpose of holding the bank subsidiaries of National Mercantile and FCB Bancorp following completion of the Mergers. As a newly formed company with no operations, First California has yet to finalize or adopt its own executive compensation programs. First California’s newly constituted compensation committee consists of Donald E. Benson, Richard D. Aldridge, John W. Birchfield, W. Douglas Hile and Antoinette Hubenette. As members of the compensation committee, these individuals will exercise the board of directors’ authority with respect to the implementation and administration of the executive compensation programs and policies of First California.

At this time, such programs and policies have not been determined. Accordingly, the compensation amounts and other information presented in the tables below represent information with respect to First California’s immediate predecessor in its reincorporation merger, National Mercantile. Such information, and the compensation discussion and analysis of National Mercantile presented below, may not be indicative of future compensation that First California will pay or award to its executive officers or directors. In addition, the philosophy and objectives of First California’s future compensation programs have not yet been determined. This philosophy and these objectives and the adoption and implementation of First California’s compensation programs are being undertaken subject to the oversight of the company’s compensation committee.

Compensation Discussion and Analysis Related to National Mercantile

Overview

The overriding goal of National Mercantile’s compensation programs was to recruit, retain and motivate highly qualified and competent executive and senior officers in the highly competitive southern California

6

commercial banking market. To a lesser extent, through the incentive arrangements built into National Mercantile’s employment agreement with its former chief executive officer, Scott A. Montgomery, an additional objective of the compensation programs was to align his interests with those of the shareholders generally.

The stock option and compensation committee of National Mercantile’s board of directors was responsible for reviewing and approving National Mercantile’s overall compensation and benefit programs and for administering the compensation of the Chief Executive Officer, or CEO. In addition, the stock option and compensation committee was also responsible for administering National Mercantile’s various stock option plans. The CEO was generally responsible for determining all elements of compensation for National Mercantile’s two other named executive officers and other senior management, subject to the approval of the stock option and compensation committee. The stock option and compensation committee, on the basis of recommendations from the CEO, determined the compensation of the CEO.

Executive Compensation Policy

National Mercantile’s compensation policy consisted primarily of the following components:

| | • | | long-term award(s) and compensation—including stock option grants and severance arrangements. |

Historically, neither National Mercantile nor its stock option and compensation committee employed compensation consultants to determine executive compensation. However, in February 2006, the committee retained John Parry & Alexander, a human resources and administrative services consulting company, to review and analyze the compensation structure with respect to each of National Mercantile’s three named executive officers—Mr. Montgomery, the CEO, David Brown, Chief Financial Officer, or CFO, and Robert Bartlett, Chief Operating Officer, or COO. The compensation consultants considered information for peer companies as collected from various sources, including the 2005 California Bankers Association Compensation & Benefits Survey and a third-party benchmark compensation report, among others. Among other things, the report concluded that the CEO’s base salary was approximately fifteen percent above the market median, while the base salary for the CFO and COO were generally at the market median. For all three named executive officers, bonus payments were generally below market medians. The information provided by the compensation consultants was not used to benchmark compensation amounts for National Mercantile’s named executive officers, in large part because the committee had recently made its compensation decisions with respect to 2005 including increases in the named executive officer’s base salaries. Going forward, First California has retained Clark Consulting, Inc. as its independent compensation consultant for 2007 to advise on all matters related to compensation and general compensation programs and to improve the links between senior and executive compensation and performance.

National Mercantile did not employ formulas to determine the relationship of one element of compensation to another nor does it determine the amount of one form of compensation based solely on the amount of another form of compensation.

Base Salary.Other than with respect to the CEO, base salary for the National Mercantile named executive officers was determined by the CEO, subject to approval by the stock option and compensation committee, based on the experience, skills, knowledge and responsibilities required of the executive officers, and based on National Mercantile’s performance. Salaries for executive officers were reviewed on an annual basis as well as at the time of a promotion or other change in level of responsibilities.

The salaries paid during fiscal year 2006 to National Mercantile’s named executive officers are shown in the Summary Compensation Table below. The CEO was subject to an employment agreement with National Mercantile that provided for a base salary of $310,000 subject to adjustment annually based on changes in a

7

consumer price index for Los Angeles. In addition, in connection with the Merger Agreement, Mr. Montgomery and National Mercantile entered into a letter agreement amending the employment agreement to provide, among other things, that his salary for the remainder of 2006 would be at the per annum rate of $349,456.

Short-Term Annual Cash Bonuses. National Mercantile historically awarded annual cash bonuses to the named executive officers to reward individual performance during the fiscal year. Annual cash bonuses were typically determined in February or March of a given year with respect to performance in the immediately preceding year. Other than with respect to the CEO, such bonuses were not determined pursuant to pre-established performance targets or achievement of such targets, but rather on an overall assessment of the company’s performance for the prior year and the given executive’s contributions.

In order to align the CEO’s interests with those of shareholders generally, Mr. Montgomery’s employment agreement provided that he was entitled to an incentive bonus tied to the achievement by the company of net income before income tax provision, or pretax profit. Specifically, the agreement provided that Mr. Montgomery was entitled to 3% of the first $3 million of any such pretax profit, 4% of the next $2 million of any such pretax profit and 5% of any such pretax profit in excess of $5 million. However, in no event could his incentive bonus in any year exceed his base salary for such year. In connection with the letter agreement amending his employment agreement entered into at the time of the Merger Agreement, and in order to secure the services of Mr. Montgomery through the merger process, National Mercantile and Mr. Montgomery agreed to fix his incentive bonus for 2006 at $349,456.

Long-Term Incentive Awards.Any long-term incentive awards paid by National Mercantile to the named executive officers were paid in the form of options to acquire National Mercantile common stock under one or more of National Mercantile’s various stock option plans, including the National Mercantile Bancorp 2005 Stock Incentive Plan. Awards were not necessarily made on an annual basis. In fact, the award to Mr. Montgomery in 2006 was the first award to him in ten years. The stock options were designed to align the interests of the executive officers with the shareholders’ long-term interests by providing them with equity awards that vest over a period of time, generally over two years in equal installments, and became exercisable upon the occurrence of certain events, as well as to reward the senior and executive officers for performance. National Mercantile did not have stock ownership guidelines for its executive officers (or its directors), although First California expects that such guidelines will be considered by it and its board and compensation committee in setting new policies for First California.

Based on the recommendations of the CEO, the stock option and compensation committee determined the number of stock options to be granted to the named executive officers, taking into account the company’s and the individual’s performance. As noted above, awards were not necessarily annual and varied from grant to grant. All stock options were made at the market price at the time of the award. National Mercantile did not grant stock options with an exercise price less than the closing price of National Mercantile’s common stock on the grant date, nor did it grant stock options which were priced on a date other than the grant date.

Employment Arrangements. As noted above, since 1999 the components of the CEO’s compensation were largely determined by the terms and conditions of his employment agreement with National Mercantile. Concurrently with execution of the Merger Agreement, National Mercantile and Mr. Montgomery entered into an amendment of Mr. Montgomery’s employment agreement. The amendment provided that Mr. Montgomery would retire after assisting in the transition through March 31, 2007. Under the employment agreement as amended, Mr. Montgomery is entitled to receive severance of $1,325,838 payable in 60 monthly installments of $22,097 commencing October 1, 2007. First California must also continue to provide medical and other insurance coverage, to the extent permitted by the benefit plans, for two years from the termination of his employment and provide him title to his company car. The amended employment agreement also fixed Mr. Montgomery’s incentive compensation for 2006 at the amount of his salary for the year ($349,456) and provided that he would receive his full salary through the end of 2006. His compensation from January 1, 2007 through March 31, 2007 was set by the amended employment agreement at $74,728.

8

Second Amended and Restated Severance Agreements for David R. Brown and Robert W. Bartlett.Concurrently with execution of the Merger Agreement, National Mercantile amended and restated the severance agreements of David R. Brown and Robert W. Bartlett. Under each of their prior agreements, if a change of control occurred and within one year thereafter National Mercantile terminated the executive’s employment “without cause” (as defined in the severance agreements) or the executive voluntarily terminated his employment, the executive would be entitled to a lump sum payment of 15 months’ base salary and twice his bonus for the prior year. National Mercantile believed that change in control severance arrangements stabilized its workforce given the uncertainty associated with change of control events. The amendment to each of their severance agreements: (i) specifically provided that the consummation of the transactions contemplated by the Merger Agreement constituted a change of control under the agreements; (ii) provided that the bonus component of the severance would be not less than twice the amount of the bonus they earned in fiscal 2005; and (iii) under certain limited circumstances in which a severance payment is made, subjects the recipient to a one-year non-solicitation provision.

Other Programs.National Mercantile also provided its named executive officers with perquisites and other personal benefits that it believed were reasonable and consistent with its overall compensation program to attract and retain qualified executive officers and to facilitate the performance of executives’ management responsibilities.

National Mercantile maintained a section 401(k) employee savings and retirement plan for substantially all employees who had at least six months of service. National Mercantile’s matching contribution to the plan was equal to 50% of the first 6% of pay that is contributed to the 401(k) savings and retirement plan.

National Mercantile also paid the premiums associated with life insurance coverage for the named executive officers. In addition, the named executive officers were provided with one or more of the following: club memberships, an automobile allowance, and cell phones, as well as benefits available to all employees such as medical, dental and vision insurance.

Deferred Compensation Arrangements. Prior to the Mergers, National Mercantile’s Deferred Compensation Plan sought to provide specified benefits to a select group of management or highly compensated employees who contributed materially to the growth, development and future business of the company. The plan allowed eligible participants to select a certain amount of their annual compensation to be set aside in an interest-bearing account at a annual rate equal to prime plus 150 basis points with a maximum rate of 9% and a minimum rate of 5%. Upon the participant’s termination of employment and subject to a six month delay in distributions under Internal Revenue Code Section 409A, National Mercantile would pay the participant the sum of all amounts and interest accrued in monthly installments for up to five years or in one lump sum payment, to be selected by the participant. If, however, the participant was terminated for cause, all interest accrued would be eliminated and the participant would receive only the amount of compensation deferred.

Tax and Accounting Information

Deductibility of Executive Compensation. The qualifying compensation regulations issued by the Internal Revenue Service under Internal Revenue Code section 162(m) provide that no deduction is allowed for applicable employee remuneration paid by a publicly held corporation to a covered employee to the extent that the remuneration exceeds $1.0 million for the applicable taxable year, unless specified conditions are satisfied. Generally, remuneration at National Mercantile was not expected to exceed $1.0 million for any employee. Therefore, National Mercantile did not expect that compensation would be affected by the qualifying compensation regulations.

Compensation Committee Report

The compensation committee of First California has reviewed and discussed with current management of First California the Compensation Discussion and Analysis set forth above. Based on this review and discussion,

9

the compensation committee of First California has recommended to the board of directors of the First California that the Compensation Discussion and Analysis be included in this Annual Report on Form 10-K.

This report of the compensation committee of the First California board of directors is included herein at the direction of its members:

Donald E. Benson

Richard D. Aldridge

John W. Birchfield

W. Douglas Hile

Antoinette Hubenette

Summary Compensation Table

The following table contains summary compensation information for the fiscal year ended December 31, 2006 with respect to the President and Chief Executive Officer, Executive Vice President and Chief Financial Officer and Executive Vice President and Chief Operating Officer of National Mercantile. Such executive officers are referred to in this item as the National Mercantile named executive officers.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | | |

Name and Principal Position(1) | | Year | | Salary

($) | | Bonus

($)(5) | | Option

Awards

($)(2) | | Nonqualified

Deferred

Compensation

Earnings

($)(3) | | All Other

Compensation

($)(4) | | Total

($) |

Scott A. Montgomery President and Chief Executive Officer | | 2006 | | $ | 349,456 | | $ | 349,456 | | $ | 65,151 | | $ | 8,658 | | $ | 9,212 | | $ | 781,933 |

David R. Brown Executive Vice President and Chief Financial Officer | | 2006 | | $ | 190,000 | | $ | 100,000 | | $ | 18,651 | | $ | 4,008 | | $ | 12,280 | | $ | 324,939 |

Robert W. Bartlett Executive Vice President and Chief Operating Officer | | 2006 | | $ | 225,304 | | $ | 112,652 | | $ | 15,549 | | $ | 0 | | $ | 19,304 | | $ | 372,809 |

| (1) | Positions shown are those held with National Mercantile during fiscal year 2006. |

| (2) | The amounts in this column represents the dollar amount recognized for financial statement reporting purposes for the fiscal year ended December 31, 2006, in accordance with FAS 123R, of stock options granted in and prior to 2006 under National Mercantile’s Amended 1996 Stock Incentive Plan. The National Mercantile named executive officers do not have any options outstanding under the 2005 Stock Incentive Plan and the 1994 Stock Option Plan. These plans are described in “—Holdings of Previously Awarded Equity.” The amount recognized for these awards was calculated based on the lattice option pricing model using the assumptions described in Note 7 of National Mercantile’s audited financial statements for the year ended on December 31, 2006 included in this annual report. |

| (3) | This column represents the abovemarket earnings on compensation that is deferred on a basis that is not tax-qualified. |

| (4) | The amounts in this column reflect for each National Mercantile named executive officer (1) matching contributions made by National Mercantile pursuant to its 401(k) Plan, (2) the amount of premium paid by National Mercantile with respect to group life insurance for the benefit of the National Mercantile named executive officers, (3) the value of gift cards, (4) the incremental cost of perquisites including the value of the monthly amounts paid to the National Mercantile named executive officers for the use of personally |

10

| | owned automobiles, (5) the amount of recreational club membership dues paid by National Mercantile for use by its named executive officers and (6) amounts paid for overnight lodging related expenses. |

| (5) | This column represents annual cash bonuses paid to the National Mercantile named executive officers in 2007 for fiscal year 2006. Mr. Montgomery, Mr. Brown and Mr. Bartlett received $320,177, $85,500 and $92,500 in bonus, respectively, for fiscal 2005 which amounts were paid in 2006 and are not included in this column. |

2006 Grants of Plan-Based Awards

There were no grants of plan-based awards to the National Mercantile named executive officers during 2006.

Non-equity Incentive Plans

Prior to the Mergers, National Mercantile did not maintain any non-equity incentive plans for the National Mercantile named executive officers. Scott Montgomery, the former CEO, was entitled under the terms of his employment agreement to an annual incentive bonus tied to the Company’s net income before income tax provision. For a description of this arrangement, see “Compensation Discussion and Analysis Related to National Mercantile—Executive Compensation Policy—Short-Term Annual Cash Bonuses.”

Employment Agreements and Other Factors Affecting 2006 Compensation

For a description of employment and severance agreements between National Mercantile and its named executive officers, see “—Post-Employment Compensation—Potential Payments on Termination or Change-in-Control—Amendment to Employment Agreement with Scott A. Montgomery” and “—Second Amended and Restated Severance Agreements for David R. Brown and Robert W. Bartlett.”

Holdings of Previously Awarded Equity

Outstanding Equity Awards at Fiscal Year End

Prior to the Mergers, National Mercantile had three outstanding equity incentive plans, the National Mercantile Bancorp 2005 Stock Incentive Plan, the Amended 1996 Stock Incentive Plan and the 1994 Stock Option Plan. Equity awards held at the end of 2006 by each of the National Mercantile named executive officers were issued only under the National Mercantile Bancorp Amended 1996 Stock Incentive Plan. The three plans are described below. All outstanding equity incentive plans were assumed by First California in connection with the Mergers. At the effective time of the Mergers, each outstanding option to purchase shares of National Mercantile, vested or unvested, was converted into an option to acquire an equal number of shares of First California common stock at an exercise price per share equal to the exercise price per share of such National Mercantile option.

11

The following table sets forth outstanding equity awards consisting solely of stock options held by each of the National Mercantile named executive officers as of December 31, 2006. As of December 31, 2006, there were no other stock-based awards held by the named executive officers of National Mercantile.

2006 Outstanding Equity Awards at Fiscal Year-End

| | | | | | | | | |

Name | | Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable | | Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable | | Option

Exercise

Price

($) | | Expiration

Date |

Scott A. Montgomery | | 33,189 | | 0 | | $ | 5.276 | | 10/3/2007 |

| | 8,558 | | 0 | | $ | 5.276 | | 10/3/2007 |

| | 31,250 | | 0 | | $ | 12.560 | | 10/28/2015 |

| | | | |

David R. Brown | | 4,688 | | 4,687 | | $ | 9.99 | | 4/22/2015 |

| | 6,250 | | 0 | | $ | 8.l2 | | 4/23/2014 |

| | | | |

Robert W. Bartlett | | 4,688 | | 4,687 | | $ | 9.99 | | 4/22/2015 |

| | 9,375 | | 0 | | $ | 8.91 | | 11/21/2013 |

| | 12,500 | | 0 | | $ | 5.60 | | 6/1/2013 |

| | 5,000 | | 0 | | $ | 5.52 | | 2/3/2013 |

| | 12,500 | | 0 | | $ | 4.66 | | 12/26/2011 |

| (1) | Stock option grants vest over two years in equal installments and have an exercise price equal to the closing market price on the date of grant. |

The following table sets forth information with respect to the vesting of option awards by the National Mercantile named executive officers in 2006.

Option Exercises and Stock Vested

| | | | | |

| | | Option Awards |

Name

| | Number of Shares

Acquired on

Exercise

(#)

| | Value

Realized on

Exercise

($)

|

| (a) | | (b) | | (c) |

Scott A. Montgomery | | 82,692 | | $ | 659,386 |

David R. Brown | | 12,500 | | $ | 110,875 |

Robert W. Bartlett | | N/A | | | N/A |

2005 Stock Incentive Plan

The National Mercantile Bancorp 2005 Stock Incentive Plan, or the NMB Plan, was assumed by First California in connection with the Mergers. The following is a brief summary of the material features of the NMB Plan.

Administration. The NMB Plan was administered by the National Mercantile board of directors or, at the discretion of the board, a committee of the board of directors, or the administrator. The board of directors delegated the administration of the NMB Plan to the Stock Option and Compensation Committee.

The administrator had full and final authority to select the recipients of awards and to grant such awards. Subject to the provisions of the NMB Plan, the administrator had sole and absolute discretion in determining the terms and conditions of awards and the number of shares to be issued pursuant thereto, including the exercise

12

price and conditioning the receipt or vesting of awards upon the achievement of specified performance criteria. Subject to limitations imposed by law, the board of directors could amend or terminate the NMB Plan at any time and in any manner. However, no such amendment or termination could deprive the recipient of an award previously granted under the NMB Plan of any rights thereunder without the consent of the recipient.

Terms of Awards. The NMB Plan authorized the administrator to enter into any type of arrangement with an eligible recipient that, by its terms, involved or might have involved the issuance of National Mercantile common stock or any other security or benefit with a value derived from the value of National Mercantile common stock. Awards were not restricted to any specified form or structure and may include, without limitation, sales or bonuses of stock, restricted stock, stock options, reload stock options, stock purchase warrants, other rights to acquire stock, securities convertible into or redeemable for stock, stock appreciation rights, or SARs, phantom stock, dividend equivalents, performance units or performance shares. Stock options granted under the NMB Plan could be either incentive stock options under Section 422 of the Code, as amended or options that were not intended to qualify as incentive stock options (referred to as nonqualified stock options). Each award would be evidenced by an agreement between National Mercantile and the grantee which would contain the terms and conditions required by the NMB Plan and such other terms and conditions not inconsistent therewith as the administrator could deem appropriate. However, all stock options and SARs granted under the NMB Plan would have an exercise price and a base value, respectively, not less than the fair market value of the National Mercantile common stock on the date of grant. The benefit with respect to SARs would be payable solely in shares of National Mercantile common stock with a fair market value equal to the benefit.

An award granted under the NMB Plan could include a provision accelerating the receipt of benefits upon the occurrence of specified events, such as a change of control of National Mercantile or a dissolution, liquidation, merger, reclassification, sale of substantially all of the property and assets of National Mercantile or other significant corporate transactions. Any stock option granted to an employee could be an incentive stock option or a non-qualified stock option. Awards to nonemployee directors could only be non-qualified stock options.

An award could permit the recipient to pay all or part of the purchase price of the shares or other property issuable pursuant thereto, or to pay all or part of such employee’s tax withholding obligation with respect to such issuance, by (a) cash, (b) delivering previously owned shares of National Mercantile’s capital stock or other property, or (c) reducing the amount of shares or other property otherwise issuable pursuant to the award. If an option permitted the recipient to pay for the shares issuable pursuant thereto with previously owned shares, the recipient would be able to exercise the option in successive transactions, starting with a relatively small number of shares and, by a series of exercises using shares acquired from each such transaction to pay the purchase price of the shares acquired in the following transaction, to exercise an option for a large number of shares with no more investment than the original share or shares delivered.

Termination. The NMB Plan will terminate on March 24, 2015, except as to awards then outstanding, which awards will remain in effect until they have been exercised, the restrictions have lapsed or the awards have expired or been forfeited. The board of directors of National Mercantile could also amend, modify, suspend or terminate the NMB Plan from time to time although no such action can be taken without shareholder approval if required by applicable law.

1996 Plan

The 1996 Plan, as amended on June 6, 2002 and which terminated in April 2005, provided for the grant of either incentive stock options or non-qualified stock options covering up to an aggregate of 835,638 shares of National Mercantile common stock. As of December 31, 2006, there were 383,379 stock options granted under the 1996 Plan still outstanding. First California assumed the 1996 Plan in connection with the Mergers.

1994 Plan

The 1994 Plan which terminated in February 2004, provided for the grant of either incentive stock options or non-qualified stock options covering up to an aggregate of 200,000 shares of National Mercantile common

13

stock. As of December 31, 2006, there were 1,375 stock options granted under the 1994 Plan still outstanding. First California assumed the 1994 Plan in connection with the Mergers.

Post-Employment Compensation

Pension Benefits

Prior to the Mergers, National Mercantile did not provide pension benefits to any of its named executive officers in 2006.

Non-qualified Deferred Compensation

The following table sets forth information with respect to non-qualified deferred compensation for the National Mercantile named executive officers in 2006.

Non-qualified Deferred Compensation

| | | | | | | | | | | | | | | |

Name

| | Executive

Contributions

in last FY

($) | | Registrant

Contributions

in last FY

($) | | Aggregate

Earnings

in last FY

($)

| | Aggregate

Withdrawals/

Distributions

($)

| | Aggregate

Balance at

last FYE

($)

|

| (a) | | (b) | | (c) | | (d) | | (e) | | (f) |

Scott A. Montgomery | | $ | 160,088 | | $ | 0 | | $ | 25,590 | | $ | 0 | | $ | 320,107 |

David R. Brown | | $ | 89,789 | | $ | 0 | | $ | 11,883 | | $ | 0 | | $ | 157,473 |

| (1) | In February 2007, Messrs. Montgomery and Brown deferred $174,728 and $85,473, respectively, as bonus awards for service in fiscal year 2006. These amounts are included in the Summary Compensation Table above, but are not included in column (b) of the Non-qualified Deferred Compensation table. |

National Mercantile Deferred Compensation Plan.

Prior to the Mergers, National Mercantile’s Deferred Compensation Plan sought to provide specified benefits to a select group of management or highly compensated employees who contributed materially to the growth, development and future business of the company. The plan allowed eligible participants to select a certain amount of their annual compensation to be set aside in an interest-bearing account at a annual rate equal to prime plus 150 basis points with a maximum rate of 9% and a minimum rate of 5%. Upon the participant’s termination of employment and subject to a six month delay in distributions under Internal Revenue Code Section 409A, National Mercantile would pay the participant the sum of all amounts and interest accrued in monthly installments for up to five years or in one lump sum payment, to be selected by the participant. If, however, the participant was terminated for cause, all interest accrued would be eliminated and the participant would receive only the amount of compensation deferred.

Potential Payments on Termination or Change-in-Control

Amendment to Employment Agreement with Scott A. Montgomery.Concurrently with execution of the Merger Agreement, National Mercantile and Mr. Montgomery entered into an amendment of Mr. Montgomery’s employment agreement. The amendment provided that Mr. Montgomery would retire after assisting in the transition through March 31, 2007. Under the employment agreement as amended, Mr. Montgomery is entitled to receive severance of $1,325,838 payable in 60 monthly installments of $22,097 commencing October 1, 2007. First California must also continue to provide medical and other insurance coverage, to the extent permitted by the benefit plans, for two years from the termination of his employment and provide him title to his company car. The amended employment agreement also fixed Mr. Montgomery’s incentive compensation for 2006 at the amount of his salary for the year ($349,456) and provided that he would receive his full salary through the end of 2006. His compensation from January 1, 2007 through March 31, 2007 was set by the amended employment agreement at $74,728.

14

Second Amended and Restated Severance Agreements for David R. Brown and Robert W. Bartlett. Concurrently with execution of the Merger Agreement, National Mercantile amended and restated the severance agreements of David R. Brown and Robert W. Bartlett. Under each of their prior agreements, if a change of control occurred and within one year thereafter National Mercantile terminated the executive’s employment “without cause” (as defined in the severance agreements) or the executive voluntarily terminated his employment, the executive would be entitled to a lump sum payment of 15 months’ base salary and twice his bonus for the prior year. National Mercantile believed that change of control severance arrangements stabilized its workforce given the uncertainty with change of control events. The amendment to each of their severance agreements: (i) specifically provided that the consummation of the transactions contemplated by the Merger Agreement constituted a change of control under the agreements; (ii) provided that the bonus component of the severance would be not less than twice the amount of the bonus they earned in fiscal 2005; and (iii) under certain limited circumstances in which a severance payment is made, subjects the recipient to a one-year non-solicitation provision.

Treatment of Outstanding Stock Options upon Termination or Change-in-Control.

Termination of Employment or Affiliation. Under the terms of the National Mercantile’s 1994, 1996 and 2005 Stock Incentive Plans, in the event an optionee ceased to be affiliated with National Mercantile or a subsidiary for any reason other than death or permanent disability, the stock options granted to such optionee would expire at the earlier of the expiration dates specified for the options, or three months after the optionee ceased to be so affiliated. During such period after cessation of affiliation, the optionee could exercise the option to the extent that it was exercisable as of the date of such termination, and thereafter the option expired in its entirety. If the optionee ceased to be employed by National Mercantile or a subsidiary by reason of death or permanent disability, the stock options granted to such optionee expired at the earlier of the expiration dates specified for the options, or one year after the date of such death or permanent disability. During such period, the optionee could exercise the option to the extent it was exercisable on the date of permanent disability or death.

Liquidation or Change in Control. An award granted under the National Mercantile’s 1994, 1996 and 2005 Stock Incentive Plans could include a provision accelerating the receipt of benefits upon the occurrence of specified events, such as a change of control of National Mercantile or a dissolution, liquidation, merger, reclassification, sale of substantially all of the property and assets of National Mercantile or other significant corporate transactions.

15

Termination Payments & Benefits

The table below reflects the amount of compensation to each of the former National Mercantile named executive officers in the event of termination of such executive’s employment for “Cause”, early retirement, involuntary not-for-“Cause” termination, termination following a change in control and in the event of disability or death of the executive. The amounts shown assume that such termination was effective as of the last business day of fiscal year end 2006, and thus includes amounts earned through such time and are estimates of the amounts which would be paid out to the executives upon their termination. The actual amounts to be paid out can only be determined at the time of such executive’s separation from First California.

| | | | | | | | | |

Name | | Employment

Arrangement

($) | | Life

Insurance

($) | | Total

($) |

Scott A Montgomery | | | | | | | | | |

By National Mercantile for “Cause” or early voluntary retirement | | | — | | | | | | — |

Retirement upon normal retirement age (annual benefit) | | | — | | | | | | — |

Early Involuntary Termination (1) | | $ | 873,640 | | | | | $ | 873,640 |

Change in Control (lump sum) (2) (3) | | $ | 1,325,838 | | | | | $ | 1,325,838 |

Death | | | | | $ | 500,000 | | $ | 500,000 |

Disability (annual benefit) | | $ | 120,000 | | | | | $ | 114,000 |

| | | |

David R. Brown | | | | | | | | | |

By National Mercantile for “Cause” or early voluntary retirement | | | — | | | | | | — |

Retirement upon normal retirement age (annual benefit) | | | — | | | | | | — |

Early Involuntary or Voluntary Termination (lump sum) | | | — | | | | | | — |

Change in Control (lump sum) (2) (4) | | $ | 437,500 | | | | | $ | 437,500 |

Death | | | — | | $ | 475,000 | | $ | 475,000 |

Disability (annual benefit) | | $ | 114,000 | | | | | $ | 120,000 |

| | | |

Robert W. Bartlett | | | | | | | | | |

By National Mercantile for “Cause” or early voluntary retirement | | | — | | | | | | — |

Retirement upon normal retirement age (annual benefit) | | | — | | | | | | — |

Early Involuntary Termination (lump sum) | | | — | | | | | | — |

Change in Control (lump sum) (2) (4) | | $ | 506,934 | | | | | $ | 506,934 |

Death (lump sum) | | | — | | $ | 500,000 | | $ | 500,000 |

Disability (annual benefit) | | $ | 120,000 | | | | | $ | 120,000 |

| (1) | $524,184 paid semi-monthly over 18 months and $349,456 paid upon termination. |

| (2) | A “change of control” is defined under the severance agreements as the consummation or a reorganization, merger or consolidation, or sale or other disposition of all or substantially all of the assets of the company, unless certain conditions are satisfied. The consummation of the Mergers was specifically deemed to be a “change of control.” |

| (3) | Paid in 60 monthly installments of $22,097.30 commencing on October 1, 2007 and includes COBRA reimbursement of $27,799. |

| (4) | In the event of termination without cause or voluntary termination within one year following a change in control, a lump sum payment will be paid at the time of termination if terminated without cause, or within 30 days following termination if employment is voluntarily terminated. The lump sum includes reimbursement of COBRA payments for Messrs. Brown and Bartlett of $10,413 and $16,140, respectively. |

16

Compensation of Directors

The following table sets forth information concerning the compensation paid by National Mercantile during the 2006 fiscal year to each of its directors:

Director Compensation for 2006

| | | | | | | | | | | | |

Name (1) | | Fees Earned

or Paid in

Cash

(2) ($) | | Option

Awards

(3) ($) | | All Other

Compensation

(4) ($) | | Total

($) |

Donald E. Benson | | $ | 25,500 | | $ | 3,220 | | $ | 1,000 | | $ | 29,720 |

Joseph N. Cohen | | $ | 31,200 | | $ | 3,220 | | $ | 1,000 | | $ | 35,420 |

Robert E. Gipson | | $ | 26,850 | | $ | 3,220 | | $ | 1,000 | | $ | 31,070 |

W. Douglas Hile | | $ | 27,350 | | $ | 3,220 | | $ | 1,000 | | $ | 31,570 |

Antoinette Hubenette, M.D. | | $ | 29,900 | | $ | 3,220 | | $ | 1,000 | | $ | 34,120 |

Judge Dion G. Morrow | | $ | 32,150 | | $ | 3,220 | | $ | 1,000 | | $ | 36,370 |

Carl R. Terzian | | $ | 24,750 | | $ | 3,220 | | $ | 1,000 | | $ | 28,970 |

Robert E. Thomson | | $ | 33,100 | | $ | 3,220 | | $ | 1,000 | | $ | 37,320 |

| (1) | None of the directors included in this table was also an employee of National Mercantile prior to the Mergers. Scott A. Montgomery, who served as President and Chief Executive Officer of National Mercantile prior to the completion of the Mergers, did not receive any additional compensation for his service as a director during 2006. |

| (2) | Includes a special bonus award of $5,000 paid to non-employee directors in February 2007 for services performed in 2006. Does not include a $5,000 bonus paid to non-employee directors in 2006 for services performed in 2005. |

| (3) | No stock options were awarded to non-employee directors in 2006. The amounts in this column represents the dollar amount recognized for financial statement reporting purposes for the fiscal year ended December 31, 2006, in accordance with SFAS 123R, of stock options granted in and prior to 2006 under National Mercantile Bancorp’s Amended 1996 and the 2005 Stock Incentive Plans. National Mercantile’s directors named above do not have any options outstanding under the 1994 Stock Option Plan. These plans are described in “—Holdings of Previously Awarded Equity.” Furthermore, the amount recognized for these awards was calculated based on the lattice option pricing model using the assumptions described in Note 8 of National Mercantile’s audited financial statements for the year ended on December 31, 2006 included in this annual report. The number of options outstanding as of December 31, 2006 held by each director is: 0 (Benson), 6,250 (Cohen), 6,250 (Gipson), 2,500 (Hile), 3,750 (Hubenette), 6,250 (Morrow), 6,250 (Terzian) and 6,250 (Thomson). |

| (4) | All directors received $1,000 gift cards. |

Prior to the Mergers, National Mercantile compensated its non-employee directors through fees and stock options. Directors who were employees received no separate compensation for their services as directors. Throughout 2006, National Mercantile Bancorp and Mercantile National Bank paid directors’ fees in accordance with the following:

| | • | | The Chairman of National Mercantile and the Chairman of Mercantile National Bank received a monthly retainer of $1,100 and an additional $550 for each Board of Directors meeting attended and $250 for each Board committee meeting attended. |

| | • | | Each other non-employee director received a monthly retainer of $1,000 and an additional $550 for each Board of Directors meeting attended. |

| | • | | The Chairman of the Loan Committee received a monthly retainer of $350 and each other non-employee member of the Loan Committee received a monthly retainer of $300. |

17

| | • | | The Chairman of each Board committee received $300 for each Board committee meeting attended and each other non-employee Board committee member received $250 for each Board committee meeting attended. |

| | • | | In 2006, each director of South Bay other than the Chairman and the non-employee directors who are directors of National Mercantile (Messrs. Benson, Gipson and Hile) received a monthly retainer of $1,750; the Chairman received a monthly retainer of $1,900 and each director who was also a director of National Mercantile received a monthly retainer of $1,250. |

| | • | | In 2006, each director of National Mercantile received a $5,000 bonus award for services performed in 2005. National Mercantile declared a $5,000 bonus to its directors in February 2007 for services performed in 2006. |

No options to purchase shares of National Mercantile common stock were awarded to non-employee directors in 2006. National Mercantile does not reimburse directors for travel and other related expenses incurred in attending shareholders, board of directors or committee meetings.

Compensation Committee Interlocks and Insider Participation

The newly constituted compensation committee of First California recommends to the board of directors all elements of compensation for the executive officers and administers the stock option plans of First California assumed in connection with the Mergers. The members of the compensation committee of the First California board of directors are: Donald E. Benson, Richard D. Aldridge, John W. Birchfield, W. Douglas Hile and Antoinette Hubenette, none of whom are executive officers of First California.

None of First California’s executive officers served on the board of directors or compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served on First California’s compensation committee or First California’s board of directors during fiscal year 2006.

18

| Item 12. | Security Ownership Of Certain Beneficial Owners and Management and Related Stockholder Matters. |

The following table provides information as of April 16, 2007 regarding our common stock and series A convertible perpetual preferred stock (“Series A Preferred Stock”) owned by: (i) each person we know to beneficially own more than 5% of the outstanding common stock or outstanding Series A Preferred Stock; (ii) each of our directors; (iii) each of our executive officers named in the Summary Compensation Table included in this annual report on Form 10-K; and (iv) all of our executive officers and directors as a group. Except as may be indicated in the footnotes to the table and subject to applicable community property laws, to our knowledge each person identified in the table has sole voting and investment power with respect to the shares shown as beneficially owned.

| | | | | | | | | | |

Name of Beneficial Owners | | Amount of

Beneficial

Ownership of

FCFG Common

Stock (1) | | Approximate

Percentage of

Outstanding

Shares | | | Amount of

Beneficial

Ownership of

FCFG Preferred

Stock (7) | | Approximate

Percentage of

Outstanding

FCFG Preferred

Stock (7) | |

Directors and Executive Officers: | | | | | | | | | | |

C. G. Kum | | 50,041 | | * | | | 0 | | * | |

Thomas E. Anthony | | 27,253 | | * | | | 0 | | * | |

Romolo Santarosa | | 2,685 | | * | | | 0 | | * | |

David R. Brown | | 15,625 | | * | | | 0 | | * | |

Robert W. Bartlett | | 48,750 | | * | | | 0 | | * | |

Richard Aldridge(2) | | 466,828 | | 4.04 | % | | 0 | | * | |

Donald E. Benson | | 80,437 | | * | | | 0 | | * | |

John W. Birchfield(3) | | 570,337 | | 4.94 | % | | 0 | | * | |

Joseph N. Cohen | | 9,562 | | * | | | 0 | | * | |

Robert E. Gipson | | 45,470 | | * | | | 0 | | * | |

W. Douglas Hile | | 2,676 | | * | | | 0 | | * | |

Antoinette Hubenette, M.D | | 8,187 | | * | | | 0 | | * | |

Syble R. Roberts | | 414,932 | | 3.59 | % | | 0 | | * | |

Thomas Tignino | | 0 | | * | | | 0 | | * | |

All directors and executive officers as a group (18 persons) | | 1,742,783 | | 15.09 | % | | 0 | | * | |

| | | | |

Greater than 5% stockholders not listed above: | | | | | | | | | | |

James O. Pohlad (4)(5) | | 927,891 | | 7.98 | % | | 334 | | 33.4 | % |

Robert C. Pohlad (4)(5) | | 927,808 | | 7.97 | % | | 333 | | 33.3 | % |

William M. Pohlad (4)(5) | | 927,806 | | 7.97 | % | | 333 | | 33.3 | % |

Carl R. Pohlad (6) | | 387,496 | | 3.36 | % | | 0 | | * | |

Total Pohlad Family | | 3,171,001 | | 27.46 | % | | 1,000 | | 100 | % |

James O. Birchfield | | 868,655 | | 7.52 | % | | 0 | | * | |

| * | Represents less than 1% of total estimated shares outstanding after the consummation of the Mergers. |

| (1) | Shares of common stock subject to options currently exercisable, or exercisable within 60 days of September 30, 2006 are deemed outstanding for computing the ownership percentage of the person holding such options or warrants, but are not deemed outstanding for computing the ownership percentage of any other person. Unless otherwise noted in a footnote to this table, the number of shares reflected in the table includes shares held by or with such person’s spouse (except where legally separated) and minor children; shares held by any other relative of such person who has the same home; shares held by a family trust as to which such person is a trustee with sole voting and investment power (or shares power with a spouse); shares held as custodian for minor children; or shares held in an Individual Retirement Account or pension plan as to which such person has pass-through voting rights and investment power. |

19

| (2) | This figure includes 52,469 shares held by the Brian J. Aldridge Trust, of which Lynda J. Aldridge, the spouse of Richard Aldridge, is the sole trustee. |

| (3) | This figure includes 49,227 shares held by the Shane O. Birchfield Trust, of which John W. Birchfield is the sole trustee. |

| (4) | The share numbers do not include 39,702 shares of common stock issuable upon the exercise of options to purchase common stock by Scott A. Montgomery which Elaine B. Montgomery, The Montgomery Living Trust Dated September 28, 2000 (the “Montgomery Trust” and collectively with Elaine B. Montgomery and Scott A. Montgomery, the “Sellers”) have the right to cause James O. Pohlad, Robert C. Pohlad and William M. Pohlad (the “Purchasers”) to purchase upon the exercise of options. Commencing upon the second anniversary of the termination of Mr. Montgomery’s employment and ending on the fifth anniversary of such termination, each Purchaser has the one-time right and option to purchase 39,702 shares. |

| (5) | The share numbers do not include (i) 10,000 shares of common stock to be acquired from David R. Brown (the “Seller”) on February 9, 2008 pursuant to the terms of the of the Securities Purchase and Option Agreement dated December 15, 2006 (the “Brown Agreement”), entered into by and between David R. Brown with James O. Pohlad, Robert C. Pohlad and William M. Pohlad (the “Purchasers”) and (ii) 5,625 shares of common stock issuable upon the exercise of options to purchase common stock by the Seller, which pursuant to the terms of the Brown Agreement, the Seller has agreed to sell to the Purchasers on the tenth business day following the one-year anniversary of each option exercise. |

| (6) | Owned in two separate revocable trusts. |

| (7) | Each share of First California preferred stock is convertible into a number of shares of common stock equal to the liquidation preference of $1,000 and any accumulated dividends thereon, divided by 5.63. |

Securities Authorized for Issuance Under Equity Compensation Plans

As of December 31, 2006, First California did not have any compensation plans, including any plans under which our equity securities could be issued.

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. |

From our inception until the completion of the Mergers, First California was a business combination shell company and did not conduct any business operations other than in preparation for the completion of the Mergers. Accordingly, prior to the Mergers, First California did not participate in any transactions in which any of its officers, directors and employees had a direct or indirect material interest. However, in connection with the Mergers, First California assumed all outstanding rights and obligations of its predecessor, National Mercantile. We describe below transactions that have occurred since the beginning of National Mercantile’s last fiscal year in which National Mercantile was a participant in which:

| | • | | the amounts involved exceeded or will exceed $120,000; and |

| | • | | any individual who was, prior to the Mergers, an employee of National Mercantile, and who is currently an employee of First California, or any member of their immediate family, had or will have a direct or indirect material interest. |

From time to time prior to the Mergers, National Mercantile made loans to directors and executive officers through its subsidiary banks, which are currently subsidiaries of First California. All of these loans which were made or were outstanding during the period since January 1, 2006 were made in the ordinary course of business and on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable loans with others not related to National Mercantile. These loans did not involve more than the normal risk of collectibility or present other unfavorable features.

Director and Officer Indemnification

First California’s amended and restated certificate of incorporation contains provisions limiting the liability of First California’s directors. First California’s amended and restated by-laws provide that First California must indemnify its directors and officers and may indemnify First California’s other employees and agents to the

20

fullest extent permitted by the Delaware General Corporation Law. First California’s amended and restated by-laws also permit First California to secure insurance on behalf of any officer, director, employee or other agent for any liability arising out of his or her actions in that capacity, regardless of whether First California’s amended and restated by-laws would otherwise permit indemnification. First California has entered and expects to continue to enter into agreements to indemnify its directors, executive officers and other employees as determined by First California’s board of directors. These agreements provide for indemnification for related expenses including attorneys’ fees, judgments, fines and settlement amounts incurred by any of these individuals in any action or proceeding. First California believes that the amended and restated by-law provisions and indemnification agreements are necessary to attract and retain qualified persons as directors and officers. First California also maintain directors’ and officers’ liability insurance.

Policies and Procedures Concerning Related Party Transactions

First California is a newly formed company that recently constituted its board of directors and formed its board committees. First California has not yet established any policies or procedures for the review, approval or ratification of transactions with directors, executive officers or other affiliates. First California expects to establish these policies and procedures subject to the oversight of the audit committee of its board of directors. While First California currently does not have established policies or procedures for the review, approval or ratification of transactions with directors, executive officers or other affiliates under which the above-mentioned transactions were reviewed, our subsidiary banks have detailed policies for reviewing and approving bank level transactions. These policies are designed to comply with laws and regulations, such as Federal Reserve Board Regulations O and W, which address loans to, and various specific transactions, including property sales and leases, with directors, executive officers, principal shareholders and other affiliates of the banks.

Director Independence

First California has identified as independent directors the following individuals currently serving on its board of directors: directors Aldridge, Birchfield, Roberts, Tignino, Cohen, Gipson, Benson, Hile and Hubenette. In making this determination, First California applied Rule 4200(a)(15) of the Nasdaq Marketplace Rules. First California’s board of directors has an audit committee and compensation committee. It does not currently have a nominating committee. The entire board effectively functions as a nominating committee, as was the case at FCB Bancorp. The composition of the board permits candid and open discussion regarding potential new candidates for director. First California has determined that the independent directors identified above also qualify as independent members of its audit and compensation committees and fulfill the independence requirements in connection with the nomination of directors in accordance with Rule 4350 of the Nasdaq Marketplace Rules. Mr. Kum is also a member of the board of directors of First California but, as the president and chief executive officer of First California, he is not “independent.”

In making these determinations of independence, First California considered applicable Nasdaq Marketplace Rules and, with respect to members of its audit committee, SEC rules. In addition, with respect to Messrs. Hile and Benson, First California considered employment relationships with affiliates of National Mercantile’s largest shareholders.

| Item 14. | Principal Accountant Fees and Services. |

As a newly-formed company, First California did not pay for any professional services rendered by an independent registered public accountant. First California has recently engaged the independent registered public accounting firm of Moss Adams LLP used by its predecessor National Mercantile, as our principal accountant to audit our financial statements.

Moss Adams LLP audited National Mercantile’s financial statements for the year ended December 31, 2005 and 2006.

21

On June 16, 2005, the National Mercantile dismissed Ernst & Young LLP (“E&Y”) as its independent registered public accountants. E&Y’s reports on the National Mercantile’s consolidated financial statements for the years ended December 31, 2003 and December 31, 2004 did not contain an adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles. There were no disagreements with E&Y, whether or not resolved, on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which, if not resolved to E&Y’s satisfaction, would have caused it to make reference to the subject matter of the disagreement(s) in connection with its report. National Mercantile engaged Moss Adams LLP effective June 16, 2005 as its new principal accountant to audit its financial statements. This dismissal of E&Y and the engagement of Moss Adams were both approved by the Audit Committee. The decision to change independent auditors was based upon economic considerations and was not a reflection of E&Y’s commitment or on the quality of the services provided to the Company.