Table of Contents

Forward-Looking Information | 2021

Reference and Forward-Looking Information

In this Annual Information Form ("AIF") references to "Westport Fuel Systems", "Westport", "the Company", "we", "us" and "our" refer to Westport Fuel Systems Inc. and its subsidiaries, collectively, unless the context otherwise requires. All dollar amounts set forth in this AIF are in U.S. dollars unless specifically stated otherwise. Except where otherwise indicated, all information presented is as of December 31, 2021.

Some of the historical data, statistics, and certain other industry information contained in this AIF are derived by the Company from industry consultants or from recognized industry reports regularly published by independent consulting and data compilation organizations, including IHS Markit ("IHS") and the International Council on Clean Transportation ("ICCT"). Industry consultants and publications generally state that the information provided has been obtained from sources believed to be reliable. We have not independently verified any of the data from third party sources nor have we ascertained the underlying economic assumptions relied upon in these reports.

Certain statements contained in this AIF and in certain documents incorporated by reference in this AIF, constitute "forward-looking statements". When used in this document, the words "may", "would", "could", "will", "intend", "plan", "anticipate", "believe", "estimate", "expect", "project" and similar expressions, as they relate to us or our management, are intended to identify forward-looking statements. Such statements are subject to certain risks and uncertainties and are based on a number of assumptions, all of which are outlined in Schedule "A" : Forward Looking Information. While the Company has a reasonable basis for such forward-looking statements, readers are cautioned that actual results may vary materially from the forward-looking statements in this AIF. Corporate Structure

Westport Fuel Systems governing corporate statute is the Business Corporations Act (Alberta). Our head office and principal place of business is at 1750 West 75th Avenue, Suite 101, Vancouver, British Columbia V6P 6G2. Our registered office is at 4500, 855 2nd Street SW, Calgary, Alberta T2P 4K7. In 2016 Westport Fuel Systems amended its articles to change its name from Westport Innovations Inc. to Westport Fuel Systems Inc. following a merger with Fuel Systems Solutions Inc. on June 1, 2016.

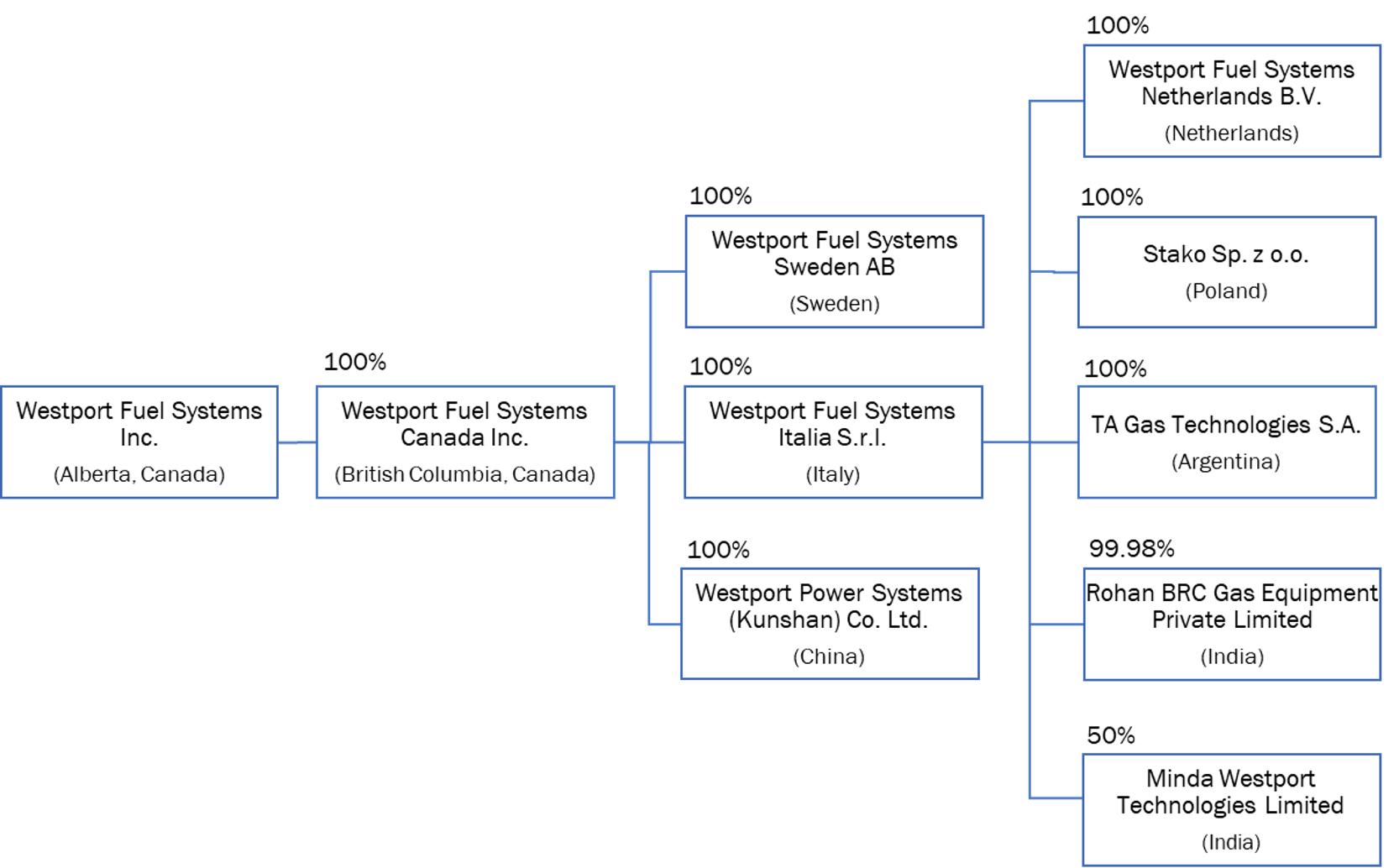

The following chart includes the Company’s principal operating subsidiaries as of March 14, 2022 and, for each subsidiary, its place of organization and the Company’s percentage of voting interests beneficially owned or over which the Company exercises control or direction. The structure is not necessarily indicative of our operational structure.

WESTPORT FUEL SYSTEMS INC. 2021 ANNUAL INFORMATION FORM | 1

About Westport Fuel Systems | 2021 Company Highlights

About Westport Fuel Systems

We are Driving Innovation to Power a Cleaner Tomorrow. And We Are Doing It Today.

Westport Fuel Systems is a global company focused on engineering, manufacturing, and supplying alternative fuel systems and components for transportation applications. Our diverse product offerings sold under a wide range of established global brands enable the use of a number of alternative fuels in the transportation sector which provide environmental and/or economic advantages as compared to diesel, gasoline, batteries or fuel cell powered vehicles. The Company's fuel systems and associated components control the pressure and flow of these alternative fuels, including liquid petroleum gas ("LPG"), compressed natural gas ("CNG"), liquified natural gas ("LNG"), renewable natural gas ("RNG")(1) or biomethane, and hydrogen. We supply our products in more than 70 countries through a network of distributors, service providers for the aftermarket and directly to original equipment manufacturers (“OEMs”) and Tier 1 and Tier 2 OEM suppliers. We also provide delayed OEM (“DOEM”) offerings and engineering services to our customers and partners globally. Today, our products and services are available for passenger car and light-, medium- and heavy-duty truck and off-road applications.

Westport Fuel Systems believes it is well positioned to increase revenues and market share as new stringent environmental regulations mandating greenhouse gas emission ("GHG") and air pollutant reductions have been introduced in key markets around the world. We are leveraging our market-ready products and customer base to capitalize on these opportunities. In addition to our significant operational competency in well-established transportation markets, our development of new technologies provides us a leadership position in gaseous alternative fuel systems which is expected to drive future growth. Westport Fuel Systems has a decades long track record of innovation and specialized engineering capabilities. It has resulted in a strong and unique intellectual property position exemplified in its substantial patent portfolio, trade secrets and copyrights and other intellectual property rights.

Notes:

1.The terms RNG, biomethane, and renewable gas are used interchangeably. These terms refer to pipeline-quality gas derived from a variety of renewable feedstock sources that is fully blendable with conventional natural gas and can be delivered in the form of CNG or LNG. Therefore, our references to natural gas in this AIF include both geologic natural gas and renewable natural gas.

2021 Company Highlights

| | | | | | | | | | | | | | |

10 Brands | 70 Countries | $312M + in Revenue | $13.7M + in Net Income | 1,797 Global Workforce |

2 | WESTPORT FUEL SYSTEMS INC. 2021 ANNUAL INFORMATION FORM

Market Overview | Market Dynamics

Market Overview

Alternative Fuels in Vehicles

The manufacturing sector for commercial and passenger vehicles faces an inflection point due to regulatory and societal pressures to decarbonize transportation in an effort to mitigate the impacts of climate change and pollution. Capital investment, energy costs, energy consumption, available infrastructure, sustainability goals, and a host of alternative fuels are key factors to consider in a global industry that faces a broad range of macroeconomic, political and sustainability trends.

Diesel has long been the standard fuel used by commercial vehicles but the global goal of reducing carbon emissions has led to increased interest in alternative powertrain solutions such as battery electric, fuel cell and alternative fuel internal combustion engines ("ICE"). Of these different approaches, alternative fuels (such as natural gas, hydrogen and biomethane) utilized in ICE have proven to deliver significant well to wheel and life cycle reductions of carbon emissions. Leveraging commercially available products today means customers can experience the expected and proven performance that is the hallmark of ICE while delivering carbon reduction today that, in most cases, are more economical than their conventionally fuelled competition and other fuel cell and battery electric alternatives.

Total Addressable Market (TAM) for Vehicle Segments

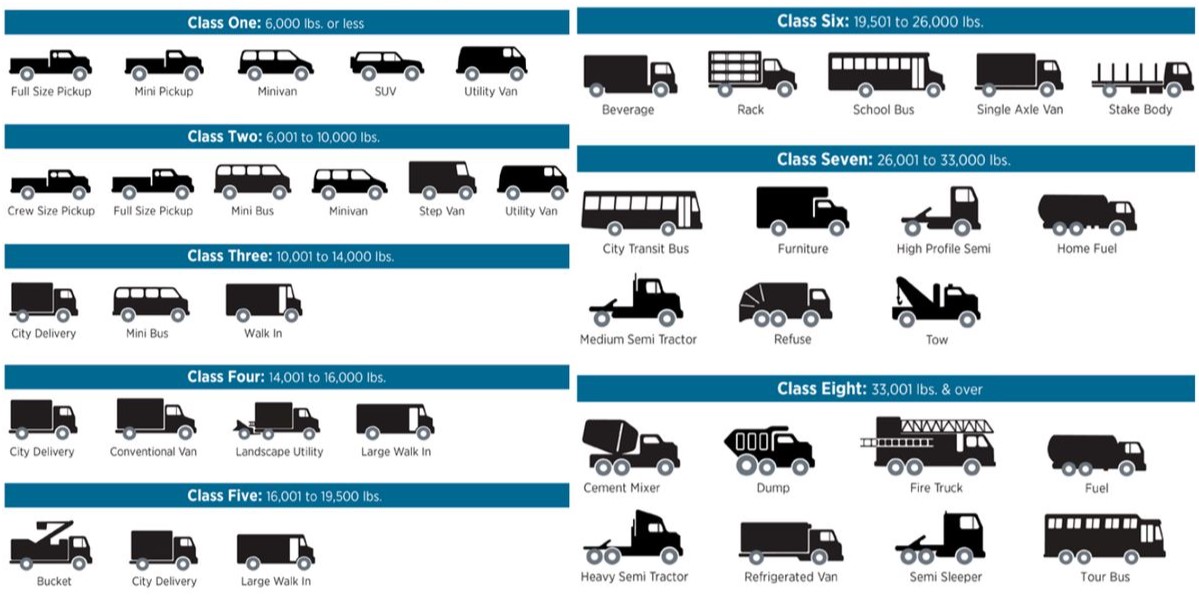

Trucks are largely classified by their weight and payload, and segmented into light, medium and heavy-duty market segments. The truck market is also divided by length of haul into short-haul, medium-haul and long-haul. Each category having their own unique set of requirements and needs that play a factor in the determination of what powertrain approaches are utilized.

The chart below describes the types of trucks by weight class in the United States:

Source: US Department of Energy

WESTPORT FUEL SYSTEMS INC. 2021 ANNUAL INFORMATION FORM | 3

Market Overview | Market Dynamics

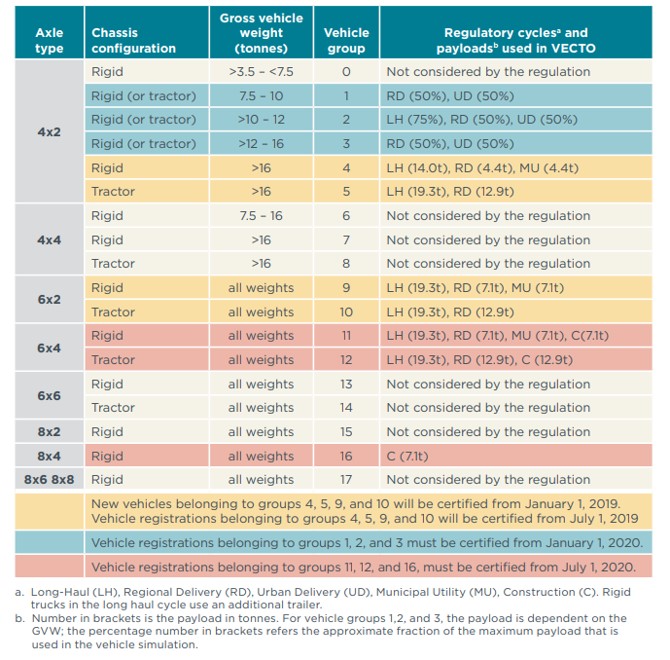

The European Union has established regulations for the requirements of heavy-duty vehicles with respect to emissions. The following table outlines the European Union's heavy-duty vehicle classification for the purpose of CO2 emissions and fuel consumption certification:

Source: ICCT Policy Update: Certification of CO2 Emissions and Fuel Consumption of On-Road Heavy-Duty Vehicles in the European Union (February 2018)

Global Automotive Production Markets

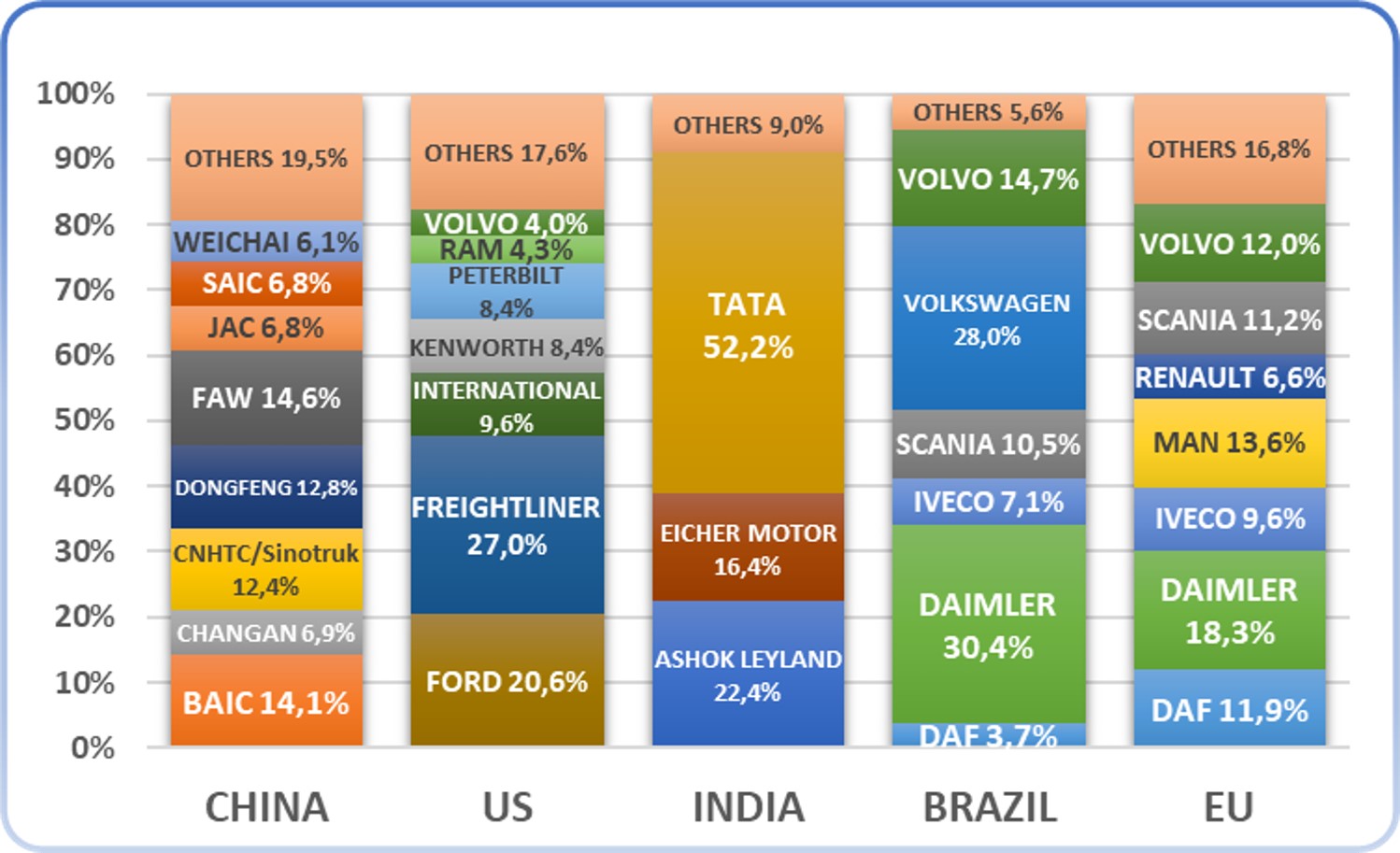

Global automotive production is a complex, high-tech manufacturing industry. As a Tier 1 supplier of alternative fuel systems, components, and related services, Westport supplies its products and services in over 70 countries around the world through a network of distributors, service providers, and OEMs that build vehicles in the regions where those vehicles are primarily sold. China, United States, India, Brazil and Europe represent among the largest heavy-duty vehicle production markets globally.

4 | WESTPORT FUEL SYSTEMS INC. 2021 ANNUAL INFORMATION FORM

Market Overview | Market Dynamics

Heavy Duty Vehicle Manufacturer Breakdown of Main Global Markets in 2021

Source: IHS

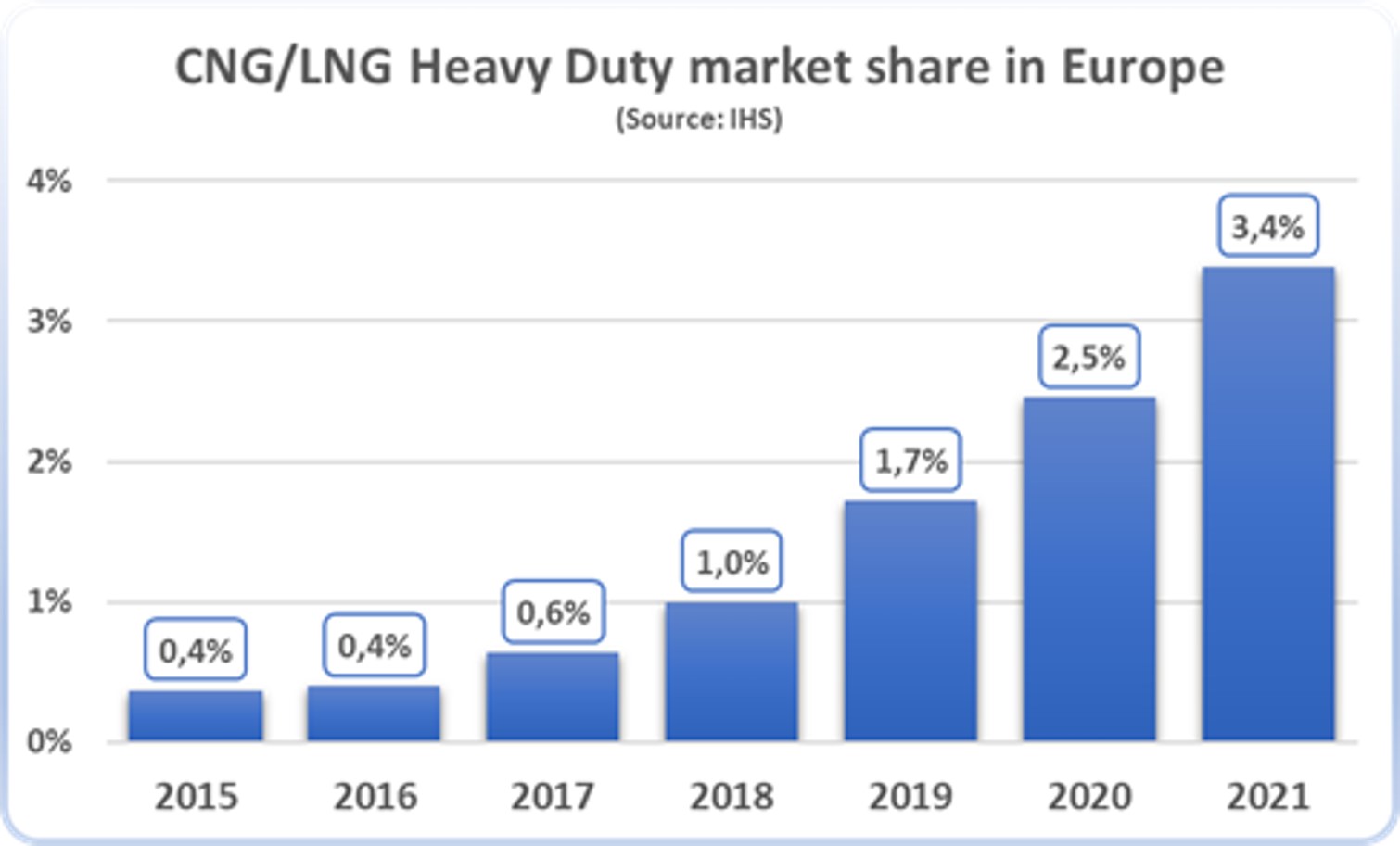

In Europe, the market share of CNG or LNG powered trucks in the heavy-duty segment continues to grow. With progressive environmental regulations, Europe represents the most concrete prospect of a transition towards a more environmentally friendly use of ICEs.

Market Dynamics

Automotive Industry Trends

The following is a brief description of several key automotive industry trends that are shaping our long-term strategy:

| | | | | |

| Continuing focus on reducing vehicle energy consumption and CO2 emissions | •Sustainability and regulatory considerations accelerating push for more efficient, cleaner alternative fuel systems and components |

| Increase in R&D spending | •Significant development and engineering costs for OEMs may drive increased outsourcing to suppliers and collaboration |

| OEM cooperative alliances/consolidation | •Joint platform development and costs sharing/joint purchasing |

| Emergence of new “best-cost” automotive markets | •New “best-cost” automotive markets, which are close to larger established manufacturing markets |

Source: Westport Fuel Systems Analysis

Near Term Industry Challenges

Russian-Ukraine Conflict:

We conduct a substantial portion of our light-duty OEM and Independent Aftermarket (“IAM”) businesses in Russia by selling our products to numerous OEMs and other IAM customers. This Russian business has been a growing and important market for gaseous fuel systems and components. Due to the Russian invasion of Ukraine in late February 2022, the United States, European Union, Canada and other western countries and organizations have announced and enacted numerous sanctions against Russia to impose severe economic pressure on the Russian economy and government. Potential consequences of the sanctions that could impact our business in Russia include but are not limited to: (1) limiting and/or banning the use of the

WESTPORT FUEL SYSTEMS INC. 2021 ANNUAL INFORMATION FORM | 5

Market Overview | Market Dynamics

SWIFT financial and payment system by Russian entities to buy and pay for our products; (2) devaluation of the ruble and the related impact on applicable exchange rates to negatively impact the competitiveness of our products; (3) government-owned entities (or partially owned entities) being potentially limited by sanctions from purchasing our products; and (4) a general deterioration of the Russian economy which may limit the ability for end customers to purchase our products. Moreover, any perceived or actual interruptions in Russia's natural gas supply or pricing, as has been the case since this conflict began, is having a significant impact on global natural gas prices, especially in Europe which may impact the sales of our products globally. The full impact of the commercial and economic consequences of the conflict are uncertain at this time, and we cannot provide assurance that future developments in the Russian-Ukraine conflict would not have an adverse impact on the ongoing operations and financial condition of our business in Russia.

Global Supply Chain Challenges and Shortages of Semiconductors:

•Due to the impact of COVID-19, the global automotive industry is currently experiencing global supply chain challenges to source semiconductors and other production inputs due to supply shortages that are creating production delays

•Consequently, these supply chain challenges are creating price inflation in sourcing semiconductors, raw materials and other parts for OEM and IAM businesses

Fuel Prices:

•Significant increases and continued fluctuations in global fuel prices including oil, gas, LPG, LNG and CNG over the year continue to persist due to uncertainty in supply levels and geopolitical risk, including the Russian-Ukraine conflict

•Fuel price increases of gaseous fuels that negatively impact the price differential between alternative gaseous fuels versus diesel and gasoline, can impact customers' decision to adopt such gaseous fuels as a transportation energy solution in the short term

Industry Growth Drivers

Regulation, technology advancements and improving total cost of ownership ("TCO") are three key growth drivers in the commercial vehicle market:

1.According to the ICCT, trucking is responsible for approximately 40% of the transportation industry’s GHG emissions. Many cities, countries and states have begun to take steps to limit carbon emissions from commercial vehicles through regulations and emission reduction targets. Environmental, social and governance ("ESG") policies at the corporate level are also driving changes. Commercial truck fleets, including UPS, DHL and Amazon for example, are making pledges to reduce their carbon emissions, further accelerating lower to zero emission powertrain adoptions.(1)

2.With such strong sentiment to reduce global GHG emissions from leading governments, OEMs will have to spend significant time and resources in research and development ("R&D") to meet regulatory demands. European Union regulations have set CO2 emissions targets for certain vehicles corresponding to rigid and tractor trucks with a 4x2 axle configuration and a gross vehicle weight above 16 tonnes and all 6x2 vehicles. These are common configurations of European heavy duty trucks. These targets amount to a 15% reduction in CO2 emissions by 2025 and a 30% reduction target by 2030, attaching a financial penalty for failure to achieve these targets. Conventional diesel technology will most likely not be able to meet these European targets.(2)

3.Clean energy technology advancements in the transportation sector are undergoing an unprecedented transformation. Improvements in fuel cells technology have rejuvenated interest in the potential of hydrogen as a source of clean energy. ICE fuelled by diesel power the majority of commercial vehicles globally through sustained technological and manufacturing improvements and breakthroughs. The medium and heavy-duty commercial transportation sectors have been typically dominated by the diesel engine due to its superior attributes in terms of torque, efficiency, reliability, and TCO. Due to the higher manufacturing costs and TCO of BEV and FCEV, many OEM's and Westport Fuel Systems have responded by developing ICE utilizing hydrogen fuel.(3)

6 | WESTPORT FUEL SYSTEMS INC. 2021 ANNUAL INFORMATION FORM

Market Overview | Market Dynamics

4.TCO is the total cost to purchase and operate a vehicle for its entire lifecycle. Fleet TCO, refers to the total cost of buying, running, and maintaining a fleet. There are many elements to consider when calculating TCO, including fuel, operating and maintenance. Improving economics of alternative transportation fuels versus traditional diesel, and their respective operating/maintenance costs plays a significant factor in the potential growth and adoption rate of alternative transportation fuel systems.

Sources:

1.Morgan Stanley Research (March 2021): Global Commercial Vehicles: Mapping Alternative Powertrain Adoption.

2.NGVA Europe (April 2021) "CO2 Emissions Abatement Costs of Gas Mobility and other Road Transport Options.

3.Mumford, Baker & Munshi (January 2022): High Performance Hydrogen Engine Applications Using Westport Fuel Systems’ Commercially Available HPDI.

Competitive Conditions

Tier 1 Automotive Supply Industry

Competition in the global Tier 1 automotive supply industry continues to intensify. This is happening despite high barriers to entry and the capital-intensive nature of the business. Competition comes primarily from automakers and other Tier 1 suppliers. To cut costs, automakers are building different vehicle models utilizing similar base platforms. This has allowed them to streamline the number of Tier 1 suppliers they partner with.

Automakers select their suppliers based on many factors, including price, proprietary technologies and innovation, testing ability to validate new technologies for application, scope of in-house engineering and tooling capabilities, quality, manufacturing footprint, timeliness of delivery, financial strength, carbon footprint and alignment with sustainability goals/targets. As a Tier 1 supplier, Westport Fuel Systems must distinguish itself on such bases against its competition.

Specifically, Westport’s products and related technologies compete with:

Manufacturers of on-engine and off-engine components and systems for alternative fuels

•These companies produce sub-set components, or manufacture or assemble complete systems and may also manufacture or assemble conversion kits used to convert vehicles fueled by diesel or gasoline to an alternative fuel

•The Company works with certain OEMs as customers, but also competes with other OEMs that develop fuel systems in-house and may also compete with traditional automotive component suppliers in the future

Conversion specialists

•Companies that convert vehicles to run on alternative fuels by installing alternative fuel components or systems on vehicles or by installing aftermarket components and conversion kits that were originally fueled by diesel or gasoline

Conventional spark-ignited or direct injection combustion technology and related systems

•These incumbent technologies such as engines powered by diesel or gasoline produced by global manufacturers, hold a very large market share in our target applications. Although we compete with these systems, our business is based on the conversion of these platforms to enable them to utilize alternative fuels

Alternative-fuel engines and related technologies using broadly the same technical approaches as used by Westport Fuel Systems

•Early and late cycle direct injection fuel system technology, spark-ignited natural gas and dual-fuel engines, LNG tanks, and new and aftermarket fuel system components.

Battery electric vehicles (BEVs) & hydrogen fuel cell electric vehicles (FCEV)

WESTPORT FUEL SYSTEMS INC. 2021 ANNUAL INFORMATION FORM | 7

Business Overview | Competitive Conditions

•BEVs and FCEVs are emerging in some markets and applications, primarily in the passenger car, transit bus and urban delivery vehicle segments.

•BEVs and FCEVs currently represent a small share of global vehicle sales to date. Stricter emissions regulations, battery advancements, increasing viability of hydrogen technology in a FCEV and capital being deployed, has fuelled debate around the timeline and adoption rates of these products

•While BEVs and FCEVs are being developed, many variables are still in play including battery cell availability, manufacturing capabilities, the build out of charging/refueling infrastructure, reliability, the durability of FCEVs in heavier duty vehicle applications, economic viability, and well to wheel and total lifecycle carbon emissions

Our Business and Strategy

Three Year History

2022

On February 7, 2022, the Company announced that Cummins Inc. ("Cummins") and Westport Fuel Systems Inc. agreed to a share purchase agreement for the sale of Westport's stake in the Cummins Westport Inc. ("CWI") joint venture for proceeds of approximately $22 million. Westport Fuel Systems also sold its interest in the intellectual property of CWI for proceeds of $20 million. Cummins and Westport also agreed to conduct an initial technical assessment of Westport's HPDI™ fuel system for potential use on Cummins' hydrogen applications, an application designed to directly inject a fuel into the combustion chamber of an ICE. Westport’s HPDI™ fuel system is designed to directly inject a fuel into the combustion chamber of an internal combustion engine.

On January 27, 2022, the Company announced that it joined the internationally-recognized Hydrogen Council (www.hydrogencouncil.com) as a supporting member. The Hydrogen Council is a global CEO-level advisory body providing a long-term vision for the important role of hydrogen technologies in an energy transition for cleaner transportation solutions.

On January 25, 2022, the Company announced the appointment of Philip B. Hodge to the Company’s Board of Directors (the "Board").

2021

On December 16, 2021, the Company announced that it had refinanced a US$20 million term loan from Export Development Canada ("EDC") providing for the extension of the maturity of the indebtedness to EDC and a reduction in interest rate.

On November 2, 2021, the Company announced the award of a tender issued by NAFTAL, a branch of SONATRACH, the national Algerian Oil & Gas company. Pursuant to the terms of the tender, Westport Fuel Systems will supply 60,000 liquefied petroleum gas systems over the next 18 months with related spare parts for a total value of approximately €9 million.

On September 20, 2021, the Company released its 2020 Environmental, Social and Governance Report (“ESG Report”) outlining the Company’s progress and sharing its forward plans to evolve and mature an embedded ESG strategy.

On July 7, 2021, the Company announced a joint collaboration with TUPY and AVL List GmbH ("AVL") to develop a highly efficient hydrogen ("H2") ICE for heavy goods transportation.

On June 8, 2021, the Company announced the closing of an underwritten marketed public offering of Common Shares ("Common Shares") in the United States and Canada for gross proceeds to the Company of US $115,115,000 (the "Offering"). The Company issued a total of 20,930,000 Common Shares, including 2,730,000 Common Shares following the exercise in full by the underwriters of their over-allotment option. The shares were issued at a price to the public of US $5.50 per share.

8 | WESTPORT FUEL SYSTEMS INC. 2021 ANNUAL INFORMATION FORM

Our Business and Strategy | Three Year History

On May 28th, 2021, the Company announced the acquisition of Stako sp. z o.o., the liquified petroleum gas fuel storage manufacturing subsidiary of Worthington Industries Inc. in a transaction valued at €5 Million.

On March 18, 2021, the Company announced a co-investment with its Tier 1 global injector manufacturing partner to expand their production facility in Yantai, China to supply jointly developed and proprietary fuel injectors to the growing global market for Westport's HPDI 2.0™ fuel system.

On March 17, 2021, the Company announced that its Weichai Westport Inc. joint venture ("WWI") agreed to modified terms for the supply of Westport's HPDI 2.0 fuel systems.

On March 15, 2021, the Company announced its inclusion in the S&P/TSX Composite Index.

On March 10, 2021, the Company announced successful startup and initial trials of a heavy-duty ICE running on hydrogen fuel, using its patented and proprietary Westport HPDI 2.0 fuel system.

On February 25, 2021, the Company announced a joint publication with AVL relating to their comprehensive analysis of the total cost of ownership for heavy duty hydrogen fueled powertrains, applying inputs from the Company’s hydrogen simulations and operating costs for Westport's HPDI 2.0 fuel system with AVL’s existing total cost of ownership models for diesel and fuel cell powertrains.

On January 21, 2021, the Company announced it had agreed to commence a research project with Scania AB ("Scania") to apply its Westport HPDI 2.0 fuel system with hydrogen to the latest Scania commercial vehicle engine.

On January 7, 2021, the Company announced the appointment of Anthony Guglielmin to the Company’s Board. Mr. Guglielmin was also appointed to the Audit Committee and the Nominating and Corporate Governance Committee.

2020

On November 19, 2020, the Company announced that its joint venture, CWI, announced changes to its Board of Directors and Management in accordance with the terms of the 50/50 Joint Venture Agreement between Cummins Inc. and Westport Fuel Systems Inc. ("CWI JVA") The changes took effect January 1, 2021.

On November 16, 2020, the Company announced a follow-on contract for new product development work with its current European-based OEM partner to apply the Westport HPDI 2.0 fuel system to an updated base engine platform. The program is intended to incorporate new features for the resulting HPDI 2.0 fuel system as well as certification to meet Euro VI Step E emission regulations that take effect in 2024.

On November 11, 2020, the Company announced it had established an at-the-market equity offering program (the "ATM Program") to allow the Company to issue up to $50 million (or the equivalent in Canadian dollars) of Common Shares from treasury to the public from time to time, at the Company's discretion and subject to regulatory requirements.

On September 18, 2020, the Company announced that its Weichai Westport Inc. joint venture received certification from the Ministry of Ecology and Environment of China for its 12-liter engine equipped with the HPDI 2.0 fuel system.

On September 15, 2020, the Company announced it signed definitive agreements with its joint venture partner in India, UNO MINDA Group (“UNO MINDA"), to sell the assets of its wholly owned subsidiary Rohan BRC Gas Equipment Pvt. Ltd. to Minda Emer Technologies Ltd., a 50/50 joint venture owned by Westport Fuel Systems and UNO MINDA.

On August 31, 2020, the Company announced it had been awarded a long-term agreement for the supply of electronic control units to a leading Tier 1 automotive supplier involving the manufacture and supply of electronic control units that will be integrated in the electric water pumps of two light-duty vehicle models of the counterparty automotive OEM in Europe. The electronic control units are to be supplied over a seven-year period with an estimated sales value of US $58 million.

On August 11, 2020, the Company released its inaugural ESG Report outlining the Company’s progress and focus on strengthening ESG performance and enhanced disclosures.

WESTPORT FUEL SYSTEMS INC. 2021 ANNUAL INFORMATION FORM | 9

Our Business and Strategy | Three Year History

On August 11, 2020, the Company announced that it had secured a €7 million loan from Deutsche Bank to improve liquidity during the COVID-19 pandemic and finance capital investments for long-term growth. The six-year €7 million term loan was issued to Westport Fuel Systems’ Italian subsidiary, Emer S.p.A, ("Emer") under the Italian government’s Decreto Liquidità ("Liquidity Decree"), an enhanced framework of business support established to help manage the challenges associated with COVID-19.

On August 4, 2020, the Company announced a new contract between MTM (the fully owned Italian subsidiary of Westport Fuel Systems) and NAFTAL (Algerian State Owned Agency for Distribution and Sale of Oil and Gas) to supply 30,000 LPG systems into the growing Algerian market.

On July 24, 2020, the Company announced that it had secured a €15 million loan from UniCredit Italia (“UniCredit”) to improve liquidity during the COVID-19 pandemic. The six-year €15 million term loan was issued to Westport Fuel Systems’ Italian subsidiary, MTM, under the Italian government’s Liquidity Decree. The loan provided MTM with improved liquidity for working capital, payroll, and capital investment.

On July 24, 2020, the Company announced that it had entered into an agreement for the refinancing of its convertible notes held by funds associated with Pangaea Two Management, LP and Cartesian Capital Group (“Cartesian”), a global private equity firm. Under the terms of the agreement, the Company agreed to pay down the principal amount of then outstanding existing convertible notes from $17.5 million to $10 million. Concurrent with such repayment, the maturity of the remaining amended notes was extended to three years from the date of the amendments, the coupon rate was reduced from 9% annually to 6.5% annually, and the conversion price was revised from $2.17 per share to $1.42 per share. Peter Yu, Managing Partner of Cartesian, resigned his seat on the Westport Fuel Systems Board.

On July 23, 2020, the Company announced that it had closed a $10 million non-revolving term credit facility from (“EDC”) to bolster liquidity during the COVID-19 pandemic. The Credit Facility enables the Company to make periodic requests for advances for a period of nine months from the date of the Amended and Restated Loan Agreement and has a final maturity date twelve months from the date of the agreement. The Credit Facility’s interest rate is US Prime + 3.00% per annum on drawn amounts and has no prepayment penalty or standby charge.

On May 28, 2020, the Company announced that it had secured a €5 million loan from UniCredit to bolster liquidity during the COVID-19 pandemic. The loan, guaranteed by the Central Guarantee Fund for 90% of its countervalue has a five-year term, in accordance with Article 13 of the Liquidity Decree.

On May 26, 2020, the Company announced it was awarded a competitive tender bid by the Egyptian International Gas Technology Company ("GASTEC") to supply 6,300 CNG sequential injection fuel systems into the growing Egyptian market in 2020.

On April 28th, 2020, the Company announced that production and manufacturing would fully resume at its facilities in Cherasco, Brescia, and Albinea, Italy on May 4, 2020 given the Italian Government’s decree of April 24, 2020 regarding the COVID-19 pandemic.

On March 25, 2020, the Company announced that it had amended the terms of its secured term loan with EDC to defer $6.0 million in principal payments in 2020 and to extend the term of the loan until September 30, 2022.

On March 23, 2020, the Company announced the temporary suspension of production in Cherasco and Albinea, Italy pursuant to the Italian Government’s decree issued on March 22, 2020 regarding COVID-19.

On March 16, 2020, The Company announced the temporary suspension of production in Brescia, Italy, in light of the COVID-19 pandemic.

On January 9, 2020, CWI announced that it had received certifications from both the U.S. Environmental Protection Agency (“EPA”) and Air Resources Board ("ARB") in California for its B6.7N natural gas engine, thereby meeting 2021 EPA GHG requirements.

10 | WESTPORT FUEL SYSTEMS INC. 2021 ANNUAL INFORMATION FORM

Our Business and Strategy | Three Year History

2019

On September 27, 2019, the Company announced it had reached a settlement with the U.S. Securities Exchange and Commission ("SEC"), resolving the SEC's investigation into the Company's compliance with the U.S Foreign Corrupt Practices Act ("FCPA"), initiated in June 2017.

On September 5, 2019, Natural Gas Innovation Fund announced an investment of $500,000 towards the development and testing of Westport Fuel Systems’ high performance CNG storage system. This is in partnership with the project co-funders and supporters including Natural Resources Canada, Ford Motor Company and Linamar Corporation.

On August 22, 2019, the Company announced the appointment of Richard Orazietti as Chief Financial Officer ("CFO") effective September 3, 2019.

On June 18, 2019, CWI announced that Gordon Exel of Westport Fuel Systems had been appointed as President of CWI effective July 8, 2019. Gordon previously held the position of President of CWI in 2014.

On March 4, 2019, the Company stated their support in the upcoming Plenary vote in the European Parliament to pass Europe’s first CO2 regulations which set CO2 emission reduction targets for heavy-duty vehicles.

On February 4, 2019, the Company announced the resignation of Michael J. Willis as CFO. Jim MacCallum, Vice-President, Finance and Corporate Controller, was named acting CFO.

On January 15, 2019, the Company announced the appointment of David M. Johnson as Chief Executive Officer ("CEO") and the retirement of Nancy S. Gougarty as Westport Fuel Systems' CEO and as a member of the Board of Westport Fuel Systems.

Significant Acquisitions

In May 2021, Westport Fuel Systems reached an agreement to acquire Stako sp. z.o.o., (“Stako”), the liquid petroleum gas fuel storage manufacturing subsidiary of Worthington Industries Inc. The acquisition of Stako represents a fundamental step towards the Company's ability to supply completely integrated fuel systems. This acquisition also brings extensive manufacturing and operational excellence that complements the Company's existing in-house manufacturing capability and capacity.

Based in Słupsk, Poland, Stako is a world leading manufacturer of LPG fuel storage, supplying the aftermarket and OEM market segments through a worldwide network of dealers. Stako’s current product range includes over 1,000 models of LPG storage tanks. Over the last 30 years, the company has supplied tanks to leading automobile manufacturers worldwide, including VW, Renault, Fiat, Hyundai, Opel, Ford, Maruti Suzuki and many others.

With almost 27 million vehicles powered by LPG globally, it is the most common alternative fuel used in the world today, due in large part because of the price advantage offered in many countries to operate an LPG vehicle versus higher operating costs for an equivalent model fueled by petrol or diesel. The company is one of the largest suppliers of LPG fuel storage tanks to the aftermarket segment, establishing valuable relationships with important OEMs over many years. It is a world leader in the production of LPG fuel storage for automotive applications.

Strategy

The market dynamics and global trends impacting the continued adoption of alternative fuel systems and components for transportation applications have shaped our corporate strategy to realize the opportunities ahead for Westport Fuel Systems. The foundation of our strategic pillars is based on the continued strengthening of our organizational capability and a focus on operational excellence. Our people are at the heart of what we do. We leverage technology to turn data into insights, driving smart decisions and accelerating sustainable, principled growth. We strive to deliver valuable, impactful products and services to customers around the world, enabling a collective contribution to a decarbonized transportation sector.

WESTPORT FUEL SYSTEMS INC. 2021 ANNUAL INFORMATION FORM | 11

Our Business and Strategy | Operating Business Segments

Our strategy to leverage innovation and technology to grow our business as the leading Tier 1 supplier towards sustainable profitability is based on the following pillars:

1. Principled Growth Realized through a Diverse Portfolio of Technology, Products, and Services

Our diverse portfolio of technology, products, and services are sold today under a wide range of established brands. They provide the foundation for sustainable growth in existing markets and guide our expansion into new and emerging markets around the world.

•Responsibly achieve sustainable profitability in businesses focused on growth in key markets – Europe, India, North America and China – to satisfy demand for clean, low emissions transportation with our diverse portfolio of technology solutions for low carbon gaseous fuels

•Complement our growth and scale efficiencies through strategic merger and acquisition ("M&A") and corporate development activities

2. Quality and Reliability will drive our reputation as a Leading Tier I Supplier

We strive for operational excellence in our approach to manufacturing and supply chain management. The goal to achieve greater profitability is also predicated on our ability to enhance quality, production efficiency, and reliability that fosters strong long-term partnerships with OEMs, distributors, and customers. This is accomplished in line with our focus on our ESG goals.

•Aim to reduce GHG emissions throughout the value chain while embedding these efforts in our day-to-day business

•Adherence to the WFS Quality Management System across all global operations, validated by requisite ISO certifications

•Improving our business processes and interactions within our ESG framework to guide our actions and improvements

3. Deliver clean, affordable transportation solutions through our innovation & technology that power a cleaner future

Investing in innovation and delivering new technology to the market is a critical aspect to our future growth and building opportunities in our business that address global trends impacting the evolution and diversification of sustainable transportation fuel alternatives. This includes, but is not limited to, advancing our HPDI fuel system, including Westport's HPDI 3.0™ fuel system and hydrogen fuelled H2 HPDI™ fuel system and advancements in our direct injection aftermarket technologies.

•Provide customers the ability to preserve investments in capital and manufacturing infrastructure while achieving the goal of reducing their carbon footprint with Westport's H2 HPDI fuel system, and seamlessly integrated engineering services

•Strengthen our product portfolio by identifying and addressing strategic opportunities for growth that complements our business and our technology

Description of the Business

Westport Fuel Systems is a leading global organization for the engineering, manufacturing, and supply of alternative fuel systems and components for transportation applications. The Company believes that gaseous fuels such as LPG, natural gas, biomethane, and hydrogen provide the best alternative to common liquid fossil fuels like gasoline and diesel fuels in many applications, offering compelling environmental, economic, and energy security benefits.

Our Portfolio

12 | WESTPORT FUEL SYSTEMS INC. 2021 ANNUAL INFORMATION FORM

Our Business and Strategy | Description of the Business

Our Products: Fuel System Components and Systems

Westport Fuel Systems designs, manufactures, develops, validates, certifies, and sells alternative fuel (LPG, CNG, LNG, RNG, and hydrogen) components and systems for passenger car and light-, medium- and heavy-duty commercial vehicles, and material handling applications.

Our portfolio of products includes pressure regulators, injectors, electronic control units, valves and filters, complete bi-fuel, mono-fuel and dual-fuel LPG and natural gas conversion kits and high-pressure hydrogen components. Our product portfolio also includes Westport’s HPDI 2.0, a complete fully-OEM-integrated LNG system that enables heavy-duty trucks to operate on natural gas and biomethane.

HPDI 2.0™ Fuel System

The heavy-duty commercial vehicle sector has historically been difficult to decarbonize given the challenge of replacing diesel without compromising on vehicle performance and economics. Westport’s HPDI 2.0 fuel system is a fully OEM integrated system that enables heavy-duty trucks to operate on natural gas or biomethane with, in most cases, reduced fuel costs, reduced CO2 emissions, and diesel-like performance and efficiency. Westport's HPDI 2.0 fuel system consists of a fully integrated “tank to tip” solution, with a cryogenic tank and integral high pressure LNG pump mounted on the chassis of the truck and plumbed to the engine where fuel pressure is regulated before being supplied to the injectors via high pressure fuel rails. At the heart of the engine is the unique patented injector.

Our HPDI fuel system business is in the early stages of commercialization after launching the product with our initial European OEM launch partner in 2018. Meaningful increases in sales volumes are required for the HPDI fuel system business to benefit from economies of scale. Sales volumes with our initial European launch partner have grown despite the economic impact of COVID-19 and related supply chain challenges. We are poised to supply HPDI systems to the Chinese market, the largest market in the world for commercial vehicles and for natural gas fueled commercial vehicles. We anticipate growth from our supply arrangement with WWI, our joint venture in China with Weichai Holdings Group Co., Ltd. and two other minority shareholders.

Production capacity of the LNG tank assembly for HPDI fuel system applications doubled in 2020 to accommodate the expected ramp-up in sales volumes. In March 2021, we entered into an investment agreement with our Tier 1 global injector manufacturing partner, to expand production at their facility in Yantai, China in anticipation of increased demand for fuel injectors to the growing global market for Westport's HPDI 2.0 fuel system. In the third quarter of 2020, WWI's HPDI fuel system engine was certified to meet China VI emissions, which is an important step in the commercialization in the Chinese market.

Operating Business Segments

We manage and report the results of our business through three segments: OEM, IAM, and Corporate. As noted above, the CWI joint venture ended as at December 31, 2021 and our 50% share in the joint venture was sold to Cummins on February 7, 2022. We recorded the investment as asset held for sale as at December 31, 2021 and no longer considered it as an operating segment, however the income from the investment in the CWI joint venture remained as the Corporate equity income in 2021. Financial information related to each operating segment is provided in the Company’s financial statements for the year ended December 31, 2021 and in our 2021 Management's Discussion & Analysis ("MD&A").

WESTPORT FUEL SYSTEMS INC. 2021 ANNUAL INFORMATION FORM | 13

Business Overview | Operating Business Segments

| | | | | | | | | | | |

| CHANNELS TO MARKET |

| Original Equipment Manufacturers | Independent Aftermarket |

| Market Segments | Light- and Medium-Duty OEMs | Heavy-Duty OEMs | Light- and Medium-Duty |

| Westport Products | Components | HPDI 2.0 Systems | Conversion Kit Components |

| Fuels | LPG, CNG, LNG, RNG, and Hydrogen | CNG and LPG |

| Current Geographic Focus | Europe, China, India | Italy, Russia, Turkey, Poland, Algeria, Argentina |

OEM

Westport Fuel Systems designs, manufactures, and sells alternative fuel systems, components and electronics, and related engineering services, to OEMs that serve the light-duty, medium-duty and heavy-duty customers. In the medium-duty segment, the Company serves clients such as YaMZ, Tata Motors and Mahindra. YaMZ is the powertrain division of GAZ in Russia and is a leading manufacturer of diesel and CNG engines, powering Liaz, Paz, Ural and GAZ vehicles. The YaMZ CNG 530 engine family includes engines equipped with Westport's engine management system, complete fuel systems and off engine high pressure components.

The Company's product portfolio also includes the supply of hydrogen fuel system components for light-, medium- and heavy-duty applications, supporting the growing interest for fuel-cell powered vehicles. Our customers include leading OEMs in this space like Plug Power and Ballard Power Systems. Today, our portfolio includes 350 bar hydrogen fuel control components and solutions covering a complete spectrum of alternative fuel systems, with 700 bar options under development.

In the heavy-duty segment, Westport's HPDI 2.0 fuel system is a complete fully-OEM-integrated system that enables heavy-duty trucks to operate primarily on natural gas. The Westport HPDI 2.0 fuel system provides global OEMs an integrated solution with attractive price, performance, and fuel economy and can be integrated into diesel engines of approximately 10 litres or higher displacement with minimal mechanical change.

Delayed OEM Vehicle Solutions

Westport Fuel Systems provides Delayed OEM ("DOEM") solutions to address local market needs where an OEM alternative fuel vehicle platform is not available. The DOEM model is an opportunity for OEMs and their channels to increase local market share in countries with relevant alternative fuel presence with a shorter time to market, higher flexibility in tracking market demand and the ability to offer an extension of an LPG/CNG model range without requiring typical OEM investments.

The Company offers turnkey solutions covering all process phases including prototyping, development, calibration, validation, homologation, vehicle conversion and logistic services. Vehicle conversions are performed inside DOEM conversion centers (at 0km) either directly operated by Westport Fuel Systems or in cooperation with local distributors or dealers.

•The Company's main DOEM clients are Kia, Hyundai, Nissan, Mitsubishi, Suzuki, Piaggio, and Ssangyong. In relation to the Italian market, the conversion of the cars is completed at the Cherasco facility. Westport Fuel Systems also provides DOEM solutions in other geographic areas through local conversion centers such as for Honda Turkey, Ford Turkey and Tofas

•Westport Fuel Systems designs, develops, certifies, integrates, sells and supports best-in-class bi-fuel systems to enable petrol vehicles to operate with LPG or CNG. The Company offers a range of bi-fuel products under various brand names, for the latest petrol direct injection (DI) engines as well as for port injection petrol engines. The Company’s bi-fuel systems are available for a range of market applications, including emissions-leading markets and developing markets, via the Company’s DOEM channels and via a network of distributors and importers, enabling end users to achieve emissions benefits and operating cost savings by consuming clean and affordable gaseous fuels

14 | WESTPORT FUEL SYSTEMS INC. 2021 ANNUAL INFORMATION FORM

Business Overview | Operating Business Segments

•Westport Fuel Systems also offers systems for diesel-powered vehicles in developing markets, enabling operation with clean and affordable gaseous fuels. The Company’s dual fuel conversion systems are tailored for medium to large-sized fleet, ensuring a high level of system integration and optimal fuel utilization

Independent Aftermarket

The world market of LPG/CNG conversion kits is estimated to be in the range of 1 to 1.3 million units per year and Westport is recognized as a leader, with roughly 25% market share globally. Our rich portfolio of IAM products, conversion kits and components allow for the conversion of vehicles after being sold to the end-user through an extensive network of dealers and installers.

Our diverse and complete product offerings sold under various recognized brands including BRC, Prins, Zavoli, OMVL, TA Gas Technology and Valtek and range from premium to value solutions, allowing us to support a broad spectrum of IAM business. Our primary markets include Italy, Russia, Turkey, Poland, Algeria, and Argentina.

CWI Joint Venture

Through the Company's 50:50 joint venture with Cummins, CWI sold spark-ignited natural gas engines in North America. The joint venture term ended on December 31, 2021 as per the terms of the JVA. On February 7, 2022, Westport Fuel Systems and Cummins agreed to a share purchase agreement for the sale of the Company's stake in CWI with Cummins continuing to operate the business as the sole owner. Cummins also agreed to buy Westport Fuel Systems' interest in CWI's intellectual property as provided for in the JVA.

Cummins has also agreed to conduct an initial technical assessment of our hydrogen high pressure direct injection system for potential use on Cummins' hydrogen applications. We continue to believe an integrated solution for natural gas and/or hydrogen using HPDI 2.0 fuel system has an important role to play in markets around the world, including North America, as part of ongoing efforts to reduce GHG emissions in heady-duty transportation applications.

Weichai Westport Inc.

WWI is the Company's joint venture in China with Weichai Holdings Group Co., Ltd., China's largest manufacturer of heavy-duty truck engines. Weichai Holdings Group Co., Ltd., specializes in the research and development, R&D manufacturing and sale of diesel engines for varying transportation sectors including, trucks, buses and construction machinery.

The Company, indirectly through its wholly-owned subsidiary, Westport Innovations (Hong Kong) Limited (“Westport HK”),is the registered holder of a 23.33% equity interest in WWI. In April 2016, the Company sold a derivative economic interest to Cartesian granting it the right to receive an amount of future income received by Westport HK from WWI equivalent to having an 18.78% equity interest in WWI and concurrently granted a Cartesian entity an option to acquire all of the equity securities of Westport HK for a nominal amount. The Company retained the right to transfer any equity interest held by Westport HK in WWI that was in excess of an 18.78% interest in the event that such option was exercised. As a result of such transactions, the Company’s residual 23.33% equity interest in WWI currently corresponds to an economic interest in WWI equivalent to 4.55%.

Minda Westport Technologies

India is one of the largest and fastest growing markets for CNG and LPG vehicles given its commitment to sustainable and cost-competitive transportation. In September 2020, the Company signed definitive agreements with its joint venture partner in India, UNO MINDA Group (“UNO MINDA”), to sell the assets of its wholly owned subsidiary Rohan BRC Gas Equipment Pvt. Ltd. to Minda Emer Technologies Ltd., a 50/50 joint venture owned by Westport Fuel Systems and UNO MINDA. In March 2021, Minda Emer Technologies Limited changed its name to Minda Westport Technologies. UNO MINDA, a technology leader in the auto components industry, is a leading Tier-1 supplier of proprietary automotive solutions to OEMs. It manufactures automobile components for OEMs.

WESTPORT FUEL SYSTEMS INC. 2021 ANNUAL INFORMATION FORM | 15

Business Overview | Operating Business Segments

Rohan BRC Gas Equipment primarily manufactures and sells CNG pressure reducers to automotive OEMs and sells CNG conversion kits to the aftermarket under the “Rohan BRC” brand in India. Minda Westport Technologies primarily manufactures and sells CNG valves to automotive OEMs in India. Minda Westport Technologies purchased the assets of Rohan BRC Gas Equipment to combine the product lines, provide a single point of contact and offer a better selection for automotive customers in India.

The manufacturing facility of Rohan BRC Gas Equipment is currently located in Ahmedabad, Gujarat, and this manufacturing capability was consolidated into Minda Westport Technologies manufacturing location in Manesar, Haryana, providing cost efficiencies and furthering the partnership. Additional Westport Fuel Systems products were consolidated into Minda Westport Technologies and, where possible, manufacturing for the India market will be localized in the joint venture. The joint venture is Westport Fuel Systems’ operational hub to serve the Indian market for passenger cars, commercial vehicles and the large three-wheel vehicle segment.

Innovation, Research and Development

Intellectual Property

The goal of our intellectual property strategy is to capture, protect, and utilize our intellectual property in coordination with our business and technology plans to best enable the successful commercialization of our proprietary products. The Company's intellectual property strategy is designed to be adaptive to our target markets to support the commercial launch of new products, and to sustain Westport’s long-term competitive advantage. As a result, we rely on a combination of patents, trade secrets, trademarks, copyrights and contracts to protect our proprietary technology.

We use patents as the primary means of protecting our technological advances and innovations. They include proprietary claims to components, materials, operating techniques, and systems. We have a proactive approach to identifying, evaluating and choosing strategic inventions to protect through the timely filing and prosecution of patent applications. Patent applications are filed in various jurisdictions internationally, which are carefully chosen based on the likely value and enforceability of intellectual property rights, and to strategically protect anticipated major commercial markets.

Research and Development

HPDI 3.0™ Fuel System

Westport Fuel Systems continues to develop the Westport HPDI fuel system and components to simplify the system architecture, improve engine performance and thermal efficiency, further reduce GHG emissions, and extend the durability of certain key components. These R&D activities are intended to position the market-leading Westport HPDI fuel system for long-term compatibility with anticipated advancements in diesel base engine platforms, including higher peak cylinder pressure, that are expected to be introduced in the next generations of diesel engine platforms.

H2 HPDI™ Fuel System

The Company is adapting the Westport HPDI fuel system to operate with high pressure hydrogen, which is expected to enable zero or near-zero CO2 emissions and yield significant benefits in TCO compared to other low emission transportation solutions such as fuel cell electric vehicles and battery electric vehicles. Adapting the Westport HPDI fuel system for operation with hydrogen is expected to require only modest development of the existing on-engine HPDI fuel system components, and to leverage existing, commercially-available high-pressure hydrogen storage and fuel delivery equipment (complemented by our own GFI branded line of high pressure components). The majority of the development work necessary to adapt the Westport HPDI fuel system to operate with hydrogen is expected to be technology development and subsequent product development for onboard hydrogen compression, and overall system integration and injection calibration development to optimize the combustion, performance and emissions of the resulting H2 HPDI fuel system.

In 2021, the Company:

16 | WESTPORT FUEL SYSTEMS INC. 2021 ANNUAL INFORMATION FORM

Business Overview | Innovation, Research and Development

•in conjunction with TUPY, a world-leading specialist of casting and machining of highly engineered structural components, and AVL, the world’s largest independent company for development, simulation and testing in the automotive industry, announced a collaboration to develop a highly efficient hydrogen ICE for heavy goods transportation

•commenced a research project with Scania to apply Westport’s HPDI 2.0 fuel system with hydrogen to the latest Scania commercial vehicle engine. Scania is a world-leading provider of transport solutions, including trucks and buses for heavy transport applications

•released a joint publication with AVL, the world's largest independent company for the development, simulation and testing of powertrain systems, entitled “Total Cost of Ownership (TCO) Analysis for Heavy Duty Hydrogen Fueled Powertrains.” The analysis presented the case for hydrogen use in an ICE with Westport Fuel Systems’ patented HPDI 2.0 fuel system, as the most cost-competitive near-term pathway to reduce CO2 emissions to near-zero from on-road long-haul transportation

Hydrogen Components

Westport Fuel Systems, via our GFI brand, is a leader in the development and supply of fuel containment and fuel pressure management components for hydrogen fuel storage and fuel delivery systems. With 700 bar hydrogen fuel storage and fuel delivery systems improving the fuel storage density versus existing 350 bar hydrogen systems, the Company is investing in the development and commercial launch of a comprehensive range of 700 bar hydrogen components, including automated shutoff valves for hydrogen storage cylinders, fuel pressure regulators, and pressure relief devices, to complement its existing, extensive product line of 350 bar components.

Production and Operations

Most of the Company's production is localized to respond quickly and efficiently to customer and market demands and to assure a high level of service and support.

Europe

Production activities are carried out in several plants located in Italy and the Netherlands which have automated assembly lines, sophisticated lathes, milling and cutting equipment, robots to perform machining and assembly of critical electronic components, and automated testing capabilities. All Italian facilities are certified to ISO 9001, IATF 16949 and ISO 14001 standards. In the Netherlands, products are assembled and packaged in facilities which are NEN-EN-ISO-9001:2015 certified.

All manufacturing planning activities and current customer management for Westport's HPDI 2.0 fuel system are coordinated from Sweden, allowing rapid response to customer demand. Our Brescia, Italy facility, which supports numerous light- and medium-duty OEM customers, also assembles LNG tanks on a build-to-order system to serve Westport HPDI 2.0 fuel system customer requirements, as well as future needs for tanks and cryogenic systems.

In May 2021, Westport acquired Stako, a manufacturer of LPG fuel storage tanks based in Słupsk, Poland. It supplies the aftermarket and OEM market segments through a worldwide network of dealers. The Company believes that the acquisition will help develop its ability to supply completely integrated fuel systems.

Asia

Minda Westport Technologies Limited is a joint venture between Minda Group and Emer S.p.A. that produces and markets LPG and CNG alternative fuel systems and products in India, Bhutan, Sri Lanka and Nepal. This includes forging, machining and assembly of valves.

In September 2020, Minda Westport Technologies purchased the assets of Rohan BRC Gas Equipment, which manufactures and supplies CNG and LPG components for OEM and aftermarket customers in India.

WESTPORT FUEL SYSTEMS INC. 2021 ANNUAL INFORMATION FORM | 17

Business Overview | Production and Operations

South America

In Buenos Aires, CNG reducers, valves and injectors are manufactured by TA Gas Technology and distributed in Argentina, Brazil, Perú, Colombia, Bolivia and Mexico. This facility is certified to ISO 9001: 2015 standards.

Operational Procurement

Westport Fuel Systems organizes operational planning into different models to adapt to our diverse customer base and expectations. We operate to optimize our inventories based on customer deliveries, or in a traditional manufacturing planning technique that directly undertakes operational procurement activities. Our procurement is divided into three general categories depending on the type of goods: raw materials, commercial off-the-shelf parts, and custom made-to-order parts. Raw materials are typically sourced from large-scale trading partners and are purchased at the fair market value when benefit can be gained. When practical, the Company will sign long-term agreements on commodity pricing to access lower market prices. Commercial off-the-shelf parts are typically sourced in local regions and can be shared across the organization to ensure a consistent supply where it is needed and to leverage our purchasing power. Custom made-to-order parts are sourced from strategic suppliers, or jointly developed with partners, to ensure the best combination of price, quality and delivery. Our supply base is subject to our general terms and conditions or unique long term supply agreements and is subject to review against key performance indicators to ensure we are getting optimal performance and value.

Environmental and Social Policies

Westport Fuel Systems strives to create leading edge technologies that meet or exceed the requirements of regulation, industry codes and standards to shift the transportation sector to alternative fuels. Working in conjunction with our partners, we are committed to delivering low-emission fuel solutions that will meet the demand for high-efficiency, high-performance, and low-carbon transportation. Risks to our business which are a result of environmental legislation are described in the section "Risk Factors: Risks Related to our Business and the Automotive Industry."

As we grow, we are strengthening our governance practices and management processes, advancing our stakeholder engagement practices, and taking steps to amplify our impact on our customers, supply chain and the wider world. In early 2021 we launched a management ESG Steering Committee, which is led by our CEO and includes our CFO, executive vice-presidents and vice-presidents from across our businesses, regions and functions. The 10-member committee oversees ESG management, approves core programs and targets, and works to integrate ESG into the company’s goals and processes. Through this steering committee we released the company's first stakeholder informed ESG Strategy (the "ESG Strategy"). Approved by the Board in early 2021, the ESG Strategy is aligned with our business strategy and informed by external research, recent materiality assessment outcomes, and ongoing internal and external stakeholder engagement. It focuses our efforts on four key areas across our value chain of climate action, safe, diverse and inclusive culture, responsible sourcing and our continued commitment to integrity.

Westport Fuel Systems is committed to an operating philosophy based on fairness and concern for employees, customers, the public, protection of the work environment and the safe design and operation of our products, facilities and equipment, and the communities in which it operates. The health and safety of employees and their active participation in ensuring a safe and healthy workplace is an integral part of our operations. Our Joint Health and Safety Committee members are champions for workplace safety and help to monitor, collect feedback and advise on programs and initiatives. More than 96% of employees work in facilities with a formal joint management-employee health and safety committee. Our committees are made up of cross-functional management and employee representatives who advise and recommend action on any workplace health and safety issues brought to them. We continually seek improvements to our work practices to ensure that they are the most efficient, effective and environmentally prudent in the long run while, at the same time, satisfying or exceeding all applicable government laws and regulations in the various jurisdictions in which we operate.

We are also committed to the protection of the environment and the prevention of pollution and strives to be an industry leader in mitigating the environmental impacts of fuel system research, development, testing and assembly. The Company has established an environmental policy (the "Environmental Policy") which guides how our operating sites support this

18 | WESTPORT FUEL SYSTEMS INC. 2021 ANNUAL INFORMATION FORM

Business Overview | Environmental and Social Policies

commitment and assess our environmental performance, compliance with applicable environmental legislation and adherence to our Environmental Policy. Certain production facilities have implemented Environmental Management Systems ("EMS") certified to ISO 14001 standards. A copy of the Environmental Policy can be found on the Company website at wfsinc.com/about/environmental-policy/.

ESG Report Highlights

We published our most recent ESG Report in September 2021. This report provides an overview of our progress and shares our forward plans to evolve and mature a corporate wide embedded ESG strategy. The ESG Report provides three years of environmental and social performance data across our global operations providing a valuable tool for investors and stakeholders to review specific material ESG topics, opportunities and performance.

| | | | | | | | | | | | | | |

| ESG Report Highlights (% comparison of 2020 vs 2019) |

| Carbon Footprint | Energy Consumption: | 74,405 GJ (↓ 30.97%) | GHG Emissions(1): | 2,933 tonnes CO2 (↓ 34.41%) |

| Health and Safety | Recordable Injury Rate: | 0.93 (↓ 20.5%) | Lost-Time Injury Rate: | 0.77 (↓ 10.4%) |

| Gender Diversity | Total Workforce: | 36% women (↑ 1% ) | Total Management: | 18% women (↑ 1%) |

| Business Ethics Training | Anti-Bribery Training: | 90% targeted employees trained | Cybersecurity Training: | 98% targeted employees trained |

1.Calculated greenhouse gas emissions (GHG) are inclusive of direct (scope 1) and indirect (scope 2) emissions only.

Our most recent ESG Report can be found on our website at wfsinc.com/sustainability/ which provides a full review of Westport Fuel System’s social and environmental performance including additional policies, procedures, and disclosures.

Human Resources and Related Policies

Westport Fuel Systems employs a highly educated and experienced team of professionals focused on the development and commercialization of a portfolio of products and technologies. The Company actively recruits skilled individuals with diverse backgrounds from around the world and provides them with specific training relating to our product and technology portfolios and retains consultants and contract workers with specific expertise when appropriate. Each employee is required to execute confidentiality and proprietary rights agreements and must certify to having read, understood, and agrees to abide by the Company's Code of Conduct (the "Code of Conduct"). Online training is also available to ensure our global and diverse workforce is empowered to do the right thing, for the right reason, and in the right way.

As at December 31, 2021 our global workforce was 1,797 individuals, which includes direct employees, individuals contracted directly for twelve months or longer and temporary or seasonal workers. Our workforce includes, but is not limited to, of a mix of engineers, manufacturing technicians, and commercial professionals that have experience with alternative fuel systems, combustion technologies, controls and engine management, and fuel storage and delivery systems, including cryogenics and high-pressure storage and delivery systems. Our direct employees are represented by labor unions in Italy and Argentina.

We are committed to a workplace free of discrimination and harassment. Our expectations for individual integrity and ethical, moral, and legal conduct are outlined in the Code of Conduct which applies to everyone in Westport Fuel Systems, including directors, officers, employees, contractors, agents, and consultants who act on behalf of Westport Fuel Systems in any business dealings. An anonymous ethics hotline is made available as an avenue for employees to raise concerns about corporate conduct. The Company's whistleblower policy (the "Whistleblower Policy") includes the reassurance that individuals will be protected from reprisals or victimization for "whistle blowing" in good faith.

WESTPORT FUEL SYSTEMS INC. 2021 ANNUAL INFORMATION FORM | 19

Risk Factors

An investment in our business involves risk, and readers should carefully consider the risks described below and in our other filings on www.sedar.com. Our ability to generate revenue and profit from our technologies is dependent on a number of factors, and the risks identified below, if they were to occur, could have a material impact on our business, financial condition, liquidity, results of operations or prospects. Additional risks and uncertainties not presently known to us or that we currently consider immaterial may also impair our business operations. These risk factors could materially affect our future operating results and could cause actual events to differ materially from those described in our forward-looking statements.

Risks Related to our Business and the Automotive Industry

We currently face, and will continue to face, significant competition.

Our products face, and will continue to face, significant competition from competing alternative powertrain technologies, including from incumbent technologies, and in particular increased market competition with respect to aftermarket kit providers. As the market for natural gas engine products continues to grow this competition may increase. New developments in technology may negatively affect the development or sale of some or all of our products or make our products noncompetitive or obsolete. Other companies, many of which have substantially greater customer bases, businesses, and financial and other resources than us, are currently engaged in the development of products and technologies that are similar to, or may be competitive with, certain of our products and technologies. In addition, the terms of some of our joint venture agreements allow for the potential for the introduction of competing products in certain markets by our joint venture partners.

Competition for our products may come from current power technologies, improvements to current power technologies and new alternative power technologies (such as fuel cell and battery electric technologies), including other fuel systems and in particular increased competition with respect to natural gas tanks and aftermarket kit providers. Each of our target markets is currently serviced by existing manufacturers with existing customers and suppliers using proven and widely accepted technologies. Many existing manufacturers have or had natural gas engine programs and could develop new engines without our help or components, using more conventional technologies or technologies from competitive companies. Additionally, there are competitors working on developing technologies such as cleaner diesel engines, bio-diesel, fuel cells, advanced batteries and hybrid battery/internal combustion engines, and new fuels in each of our targeted markets. Each of these competitors has the potential to capture market share in various markets, which could have a material adverse effect on our position in the industry and our financial results. For our products to be successful against competing technologies, especially diesel engines, they must offer advantages in one or more of these areas: regulated or unregulated emissions performance, including CO2 reduction; fuel economy; fuel cost; engine performance; power density; engine and fuel system weight; and engine and fuel system price. There can be no assurance that our products will be able to offer advantages in all or any of these areas.

The market for engines with our fuel systems may be limited or may take longer to develop than we anticipate and/or certain products may not achieve widespread adoption.

Engines with alternative fuel systems represent an emerging market, and we do not know whether end-users will ultimately want to use them or to pay for their initial incremental purchase price. The development of a mass market for our fuel systems may be affected by many factors, some of which are beyond our control, including: the emergence of newer, more competitive technologies and products; the future cost of natural gas and other fuels used by our systems; the future cost of diesel, gasoline and other alternative fuels that may be used by competitive technologies; the ability to successfully build the refuelling infrastructure necessary for our systems; changes to regulatory requirements; availability of government incentives; customer perceptions of the safety of our products; and customer reluctance to try a new product. If a market fails to develop or develops more slowly than we anticipate, we may be unable to recover the investments we will have made in the development of our products and may never achieve profitability.

Our technologies have been commercialized in heavy-duty trucks, medium-duty, light-duty vehicles, and they have demonstrated in high horsepower applications. However, we do not know whether we will successfully grow all of these market offerings as

20 | WESTPORT FUEL SYSTEMS INC. 2021 ANNUAL INFORMATION FORM

Risk Factors | Risks Related to Our Business

required to realize a long-term sustainable business where higher volumes are important drivers to bring costs in line with customer expectations.

Our growth is dependent on available refuelling infrastructure, fuel price differentials and environmental regulations, policies and government incentives which may not persist or develop as we anticipate.

Natural gas must be carried on board in liquefied or compressed form and refuelling infrastructure is not as well developed as gasoline and diesel fuel infrastructure in many jurisdictions, including for example, Canada and the U.S. Although gaseous refueling infrastructure is expanding rapidly, there can be no assurance of the successful expansion of the availability of natural gas as a vehicle fuel or that companies will develop refuelling stations to meet projected demand. If customers are unable to obtain fuel conveniently and affordably, a mass market for vehicles with our technology is unlikely to develop.

The acceptance of natural gas-fuelled engines by customers may depend in large part on the price differential between natural gas, diesel and gasoline. Current oil price volatility and natural gas price volatility may change what has historically been a price advantage for natural gas, including RNG and LPG. This price differential is affected by many factors, including changes in the resource base for natural gas compared with crude oil, availability of shale gas, pipeline transportation capacity for natural gas, refining capacity for crude oil, exports for refined products and government excise and fuel tax policies and geopolitical pressures such as those arising from the conflict between Russia and the Ukraine. There can be no assurance that natural gas or LPG will remain less expensive than diesel and gasoline fuels. This may impact upon potential customers' decisions to adopt gaseous fuels as a transportation energy solution in the short term.

While we have benefited historically from certain government environmental policies, mandates and regulations around the world, there are indications this may change in regard to fossil natural gas in particular, where some jurisdictions are keen to move to incentive for only carbon neutral or carbon free fuels. Examples of such regulations include those that provide economic incentives, subsidies, tax credits and other benefits to purchasers of low emission vehicles, restrict the sale of engines that do not meet emission standards, fine the sellers of non-compliant engines, tax the operators of diesel engines and require the use of more expensive ultra-low sulfur diesel fuel. There can be no assurance that these policies, mandates and regulations will be continued. Incumbent industry participants with a vested interest in gasoline and diesel, many of which have substantially greater resources than we do, may invest significant time and money to influence environmental regulations in ways that delay or repeal requirements for clean vehicle emissions. If these are discontinued, if current requirements are relaxed, or if other regulations (for example those related to zero carbon) are implemented that may impact our business, we may experience a material impact on our competitive position.

Failure of our products to perform as expected could negatively impact our ability to develop, market and sell our products.

If our products contain defects in design and manufacture that cause them not to perform as expected or that require repair, our ability to develop, market and sell our products could be impaired. While we attempt to address any identified product issues as effectively and rapidly as possible, any lack of timeliness may impede production or not satisfy our customers. While we have performed extensive quality control on our products, we cannot provide assurance that we will be able to detect and fix all defects in our products prior to their sale to or installation for customers.

Any product defects, delays or legal restrictions on product features, or other failure of our products to perform as expected, could harm our reputation and result in delivery delays, product recalls, product liability claims, breach of warranty claims, and significant warranty and other expenses, and could have a material adverse impact on our business, financial condition, operating results and prospects.

We may need or want to raise additional funds to grow our business and meet our financial obligations. If we cannot raise additional funds when we need or want them, our operations and prospects could be negatively affected.

WESTPORT FUEL SYSTEMS INC. 2021 ANNUAL INFORMATION FORM | 21

Risk Factors | Risks Related to Our Business

The design and manufacture of gaseous fuel systems is a capital intensive business, and the specific timing of cash inflows and outflows may fluctuate substantially from period to period. We have made significant strides in improving the profitability our businesses especially with the rapid growth of Heavy Duty OEM business using Westport's HPDI fuel system technology, but until we are consistently generating positive free cash flows, we may need or want to raise additional funds through the issuance of equity, equity-related or debt securities or through obtaining credit from financial institutions to fund, together with our organic cash flows from operations, the costs of developing and manufacturing our current or future products, to pay any significant unplanned or accelerated expenses or for new significant strategic investments, or to refinance our indebtedness, even if not required contractually. We need sufficient capital to fund our ongoing operations, ramp up our production of HPDI, and continue R&D projects for future generations of our products and/or technologies. We cannot be certain that additional funds will be available to us on favorable terms when required, or at all. If we cannot raise additional funds when we need them, our financial condition, results of operations, business and prospects could be materially and adversely affected.