INVESTOR PRESENTATION-Q1 FY2019 Vedanta Limited July 2018 Channelling opportunities V E D A N T A L I M I T E D - O I L & G A S | Z I N C & S I L V E R | A L U M I N I U M | P O W E R | I R O N O R E | C O P P E R 130 199 2 0 99 168 109 110 113 growth opportunities Exhibit 99.4

Cautionary Statement and Disclaimer The views expressed here may contain information derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness, reasonableness or reliability of this information. Any forward looking information in this presentation including, without limitation, any tables, charts and/or graphs, has been prepared on the basis of a number of assumptions which may prove to be incorrect. This presentation should not be relied upon as a recommendation or forecast by Vedanta Resources plc and Vedanta Limited and any of their subsidiaries. Past performance of Vedanta Resources plc and Vedanta Limited and any of their subsidiaries cannot be relied upon as a guide to future performance. This presentation contains 'forward-looking statements' – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance, and often contain words such as 'expects,' 'anticipates,' 'intends,' 'plans,' 'believes,' 'seeks,' or 'will.' Forward–looking statements by their nature address matters that are, to different degrees, uncertain. For us, uncertainties arise from the behaviour of financial and metals markets including the London Metal Exchange, fluctuations in interest and or exchange rates and metal prices; from future integration of acquired businesses; and from numerous other matters of national, regional and global scale, including those of a environmental, climatic, natural, political, economic, business, competitive or regulatory nature. These uncertainties may cause our actual future results to be materially different that those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements. We caution you that reliance on any forward-looking statement involves risk and uncertainties, and that, although we believe that the assumption on which our forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate and, as a result, the forward-looking statement based on those assumptions could be materially incorrect. This presentation is not intended, and does not, constitute or form part of any offer, invitation or the solicitation of an offer to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of, any securities in Vedanta Resources plc and Vedanta Limited and any of their subsidiaries or undertakings or any other invitation or inducement to engage in investment activities, nor shall this presentation (or any part of it) nor the fact of its distribution form the basis of, or be relied on in connection with, any contract or investment decision.

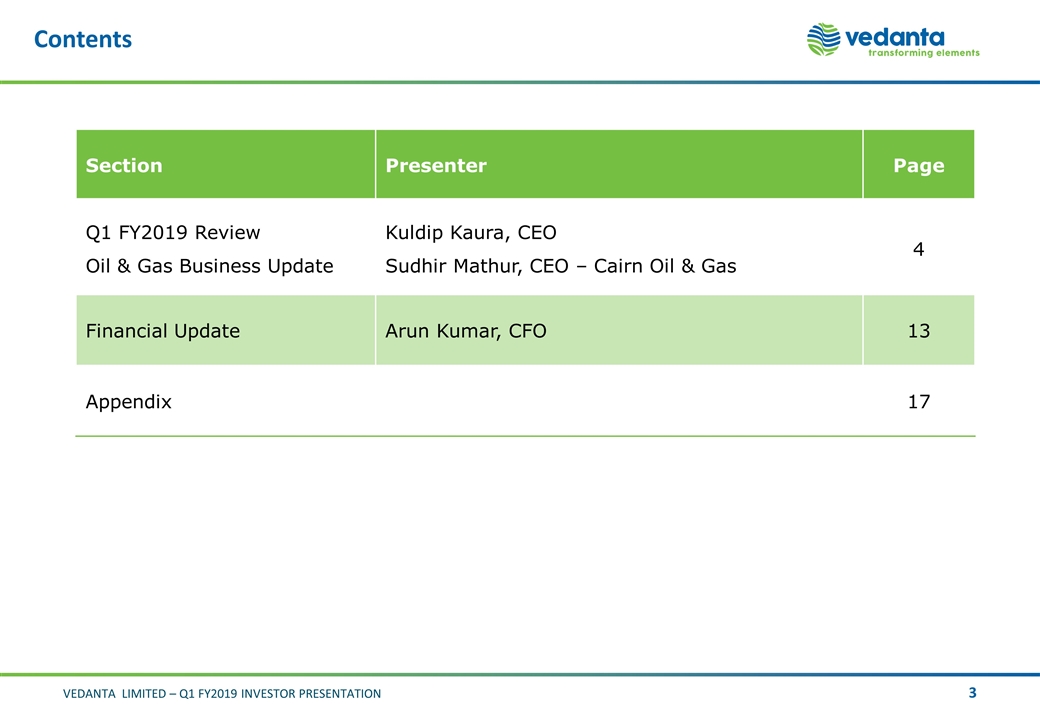

Contents Section Presenter Page Q1 FY2019 Review Oil & Gas Business Update Kuldip Kaura, CEO Sudhir Mathur, CEO – Cairn Oil & Gas 4 Financial Update Arun Kumar, CFO 13 Appendix 17

V E D A N T A L I M I T E D O I L & G A S | Z I N C & S I L V E R | A L U M I N I U M | P O W E R | I R O N O R E | C O P P E R Q1 FY2019 Review Kuldip Kaura Chief Executive Officer Sudhir Mathur CEO – Cairn Oil & Gas

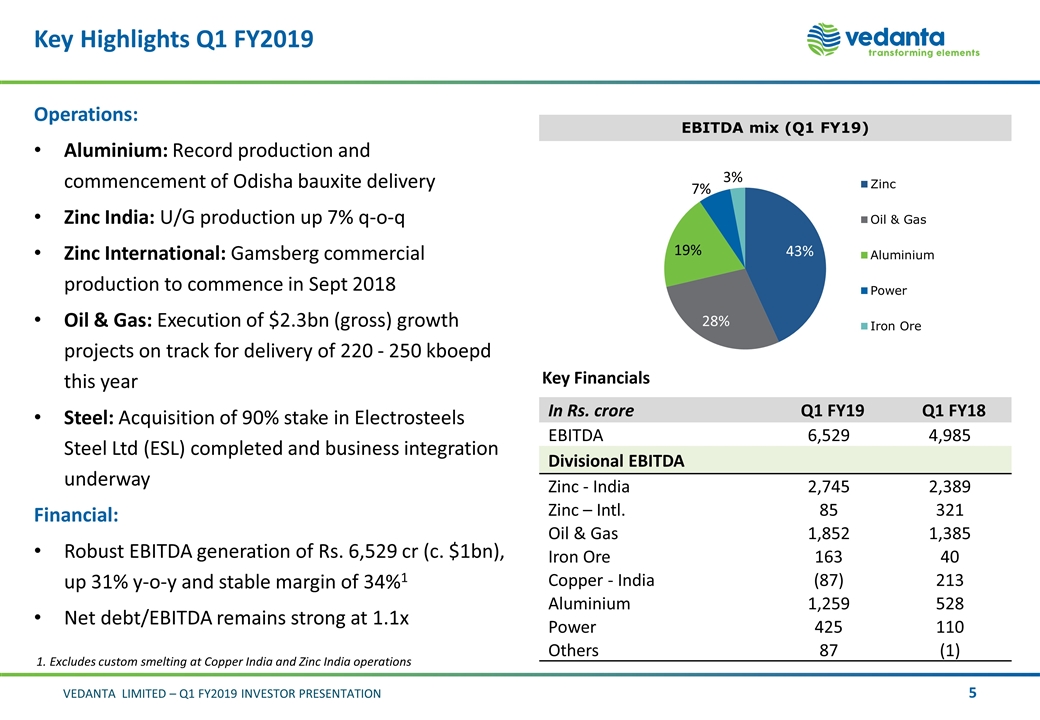

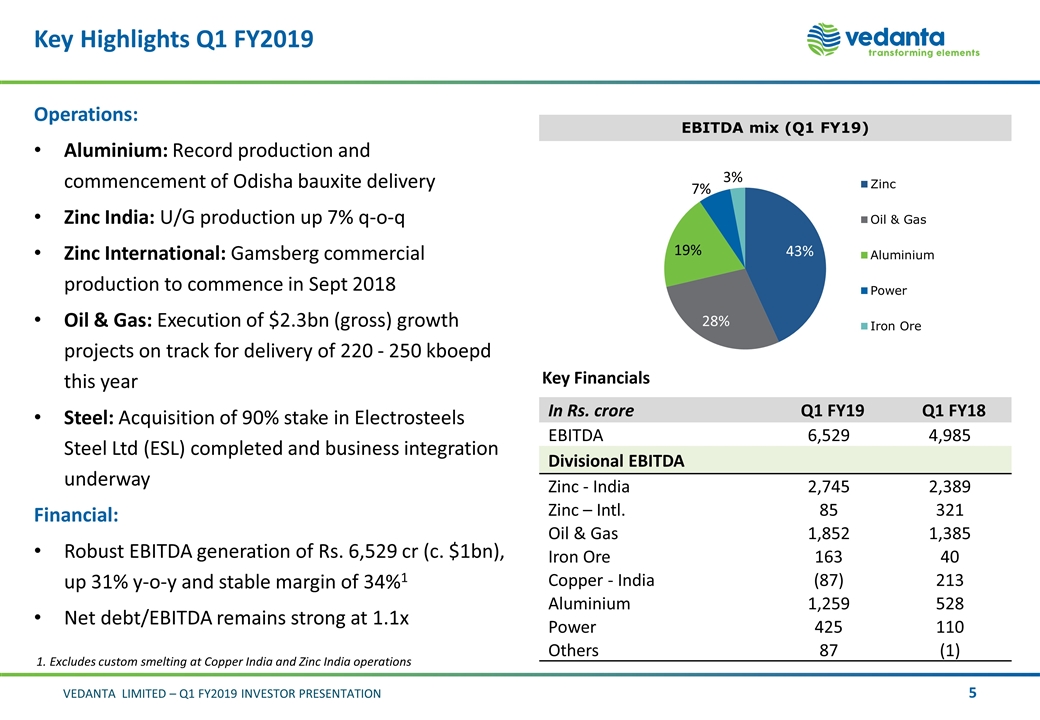

Key Highlights Q1 FY2019 Operations: Aluminium: Record production and commencement of Odisha bauxite delivery Zinc India: U/G production up 7% q-o-q Zinc International: Gamsberg commercial production to commence in Sept 2018 Oil & Gas: Execution of $2.3bn (gross) growth projects on track for delivery of 220 - 250 kboepd this year Steel: Acquisition of 90% stake in Electrosteels Steel Ltd (ESL) completed and business integration underway Financial: Robust EBITDA generation of Rs. 6,529 cr (c. $1bn), up 31% y-o-y and stable margin of 34%1 Net debt/EBITDA remains strong at 1.1x EBITDA mix (Q1 FY19) Key Financials In Rs. crore Q1 FY19 Q1 FY18 EBITDA 6,529 4,985 Divisional EBITDA Zinc - India 2,745 2,389 Zinc – Intl. 85 321 Oil & Gas 1,852 1,385 Iron Ore 163 40 Copper - India (87) 213 Aluminium 1,259 528 Power 425 110 Others 87 (1) 1. Excludes custom smelting at Copper India and Zinc India operations

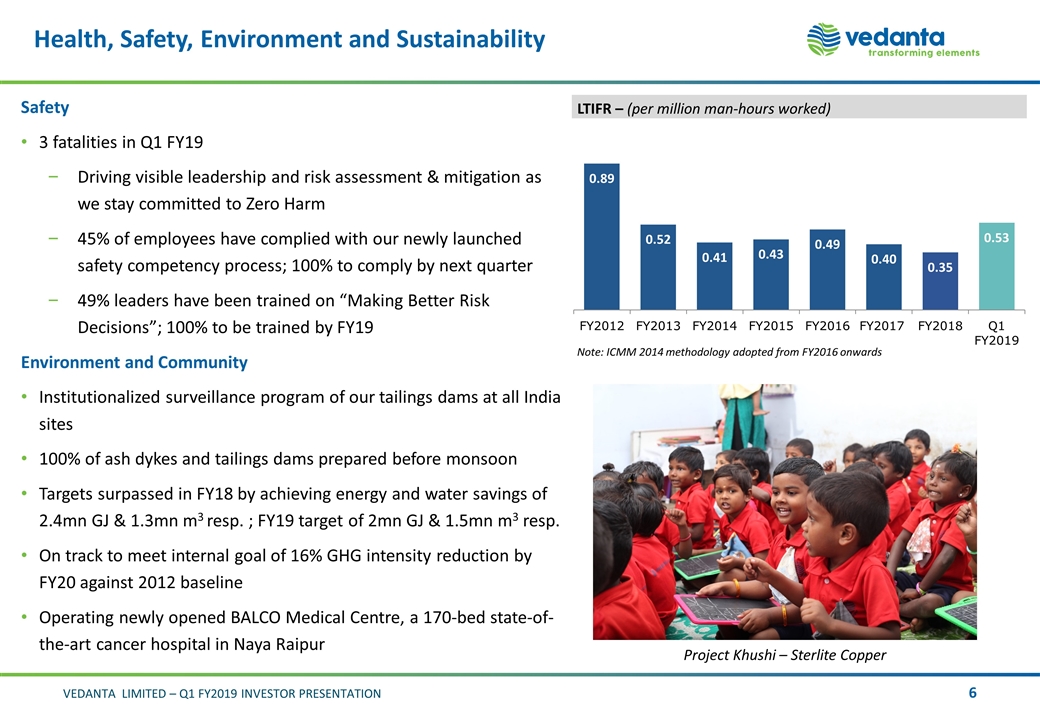

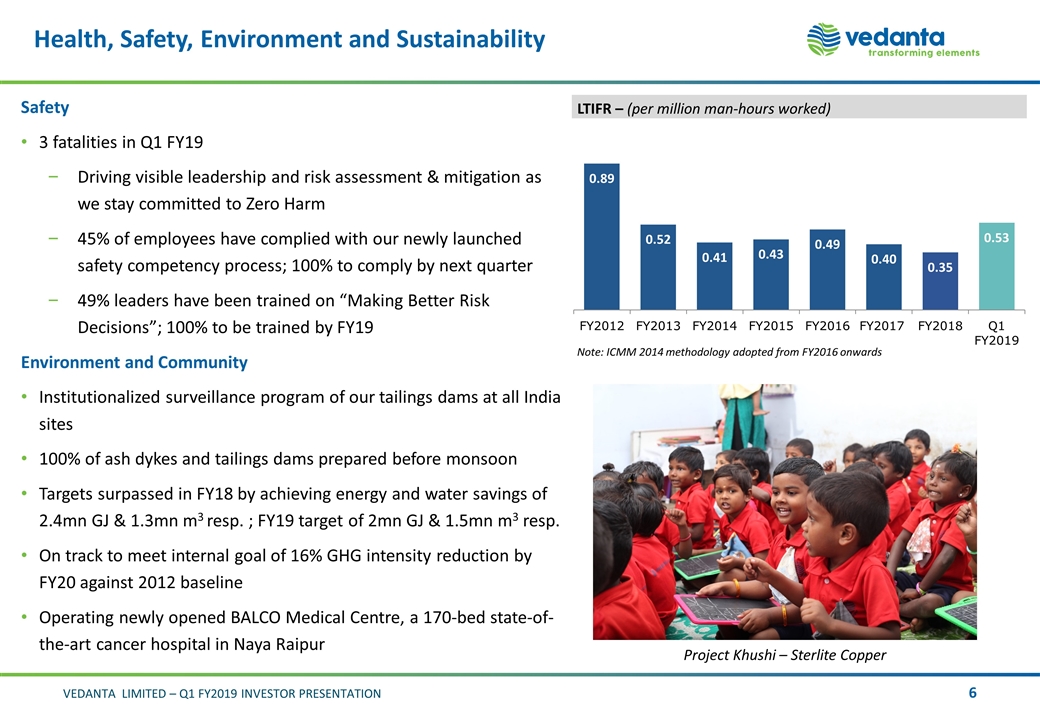

Health, Safety, Environment and Sustainability Safety 3 fatalities in Q1 FY19 Driving visible leadership and risk assessment & mitigation as we stay committed to Zero Harm 45% of employees have complied with our newly launched safety competency process; 100% to comply by next quarter 49% leaders have been trained on “Making Better Risk Decisions”; 100% to be trained by FY19 Environment and Community Institutionalized surveillance program of our tailings dams at all India sites 100% of ash dykes and tailings dams prepared before monsoon Targets surpassed in FY18 by achieving energy and water savings of 2.4mn GJ & 1.3mn m3 resp. ; FY19 target of 2mn GJ & 1.5mn m3 resp. On track to meet internal goal of 16% GHG intensity reduction by FY20 against 2012 baseline Operating newly opened BALCO Medical Centre, a 170-bed state-of-the-art cancer hospital in Naya Raipur LTIFR – (per million man-hours worked) Water consumption and Recycling rate Note: ICMM 2014 methodology adopted from FY2016 onwards Project Khushi – Sterlite Copper

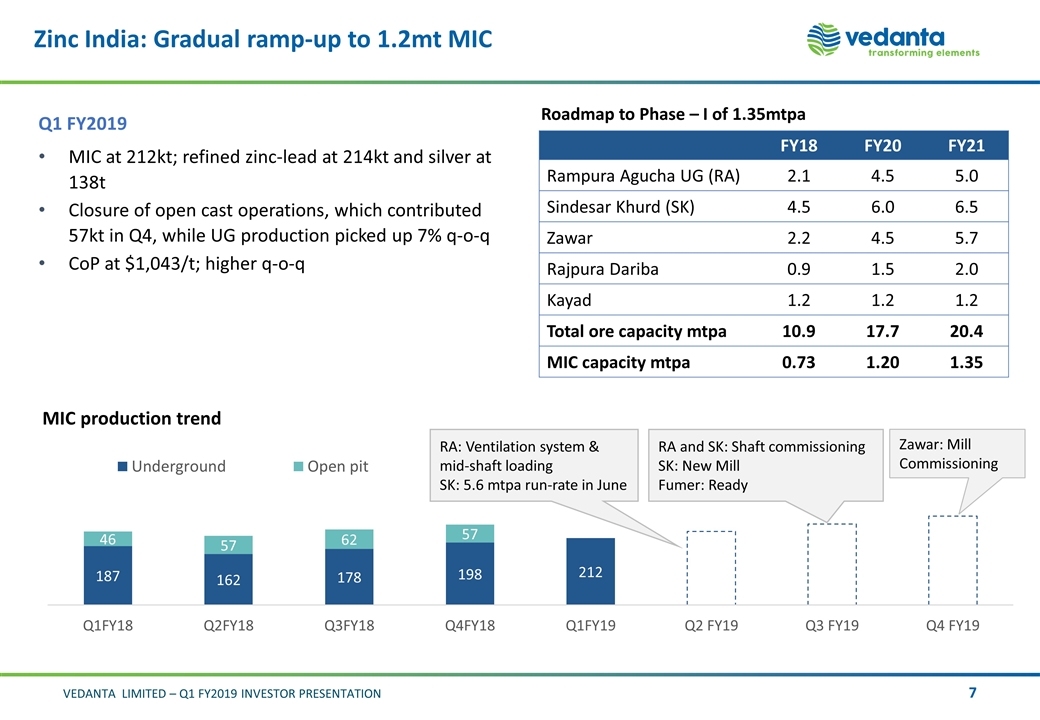

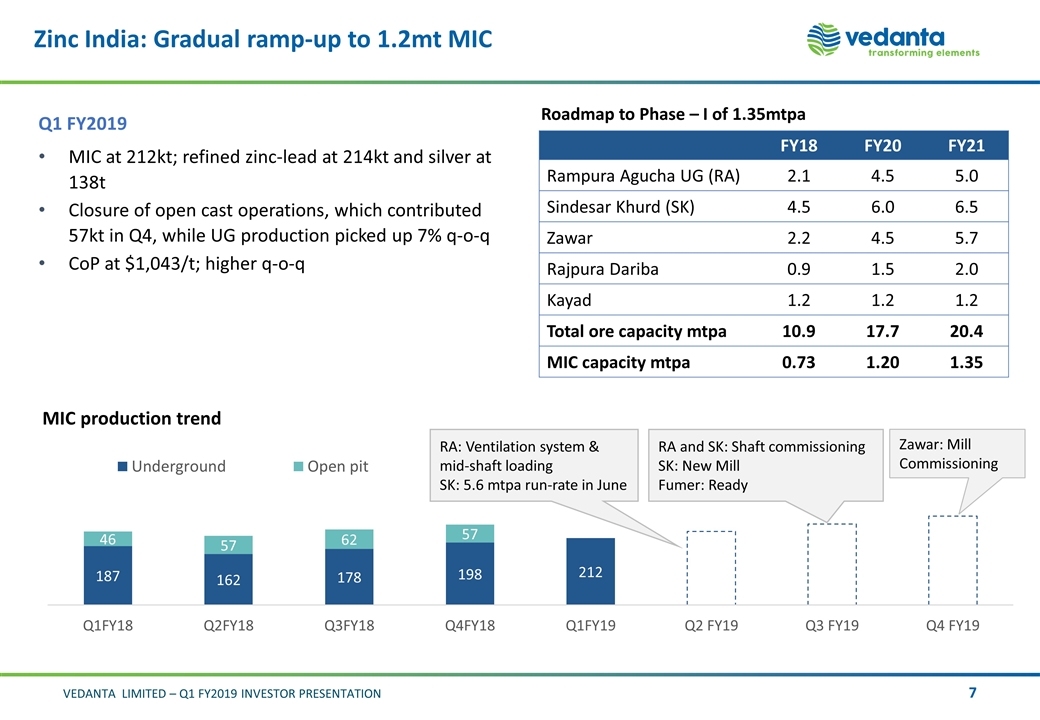

Zinc India: Gradual ramp-up to 1.2mt MIC Why short of targets: with the commission of ventilation and mid-shafts next quarter it will be fine Increased lead production: Pilot trial completed for modification of Chanderiya zinc-lead pyrometallurgical plant TT: SK mine received Environment Clearance to increase production from 4.5 to 6 mtpa FY18 FY20 FY21 Rampura Agucha UG (RA) 2.1 4.5 5.0 Sindesar Khurd (SK) 4.5 6.0 6.5 Zawar 2.2 4.5 5.7 Rajpura Dariba 0.9 1.5 2.0 Kayad 1.2 1.2 1.2 Total ore capacity mtpa 10.9 17.7 20.4 MIC capacity mtpa 0.73 1.20 1.35 Roadmap to Phase – I of 1.35mtpa Q1 FY2019 MIC at 212kt; refined zinc-lead at 214kt and silver at 138t Closure of open cast operations, which contributed 57kt in Q4, while UG production picked up 7% q-o-q CoP at $1,043/t; higher q-o-q MIC production trend Zawar: Mill Commissioning RA: Ventilation system & mid-shaft loading SK: 5.6 mtpa run-rate in June RA and SK: Shaft commissioning SK: New Mill Fumer: Ready

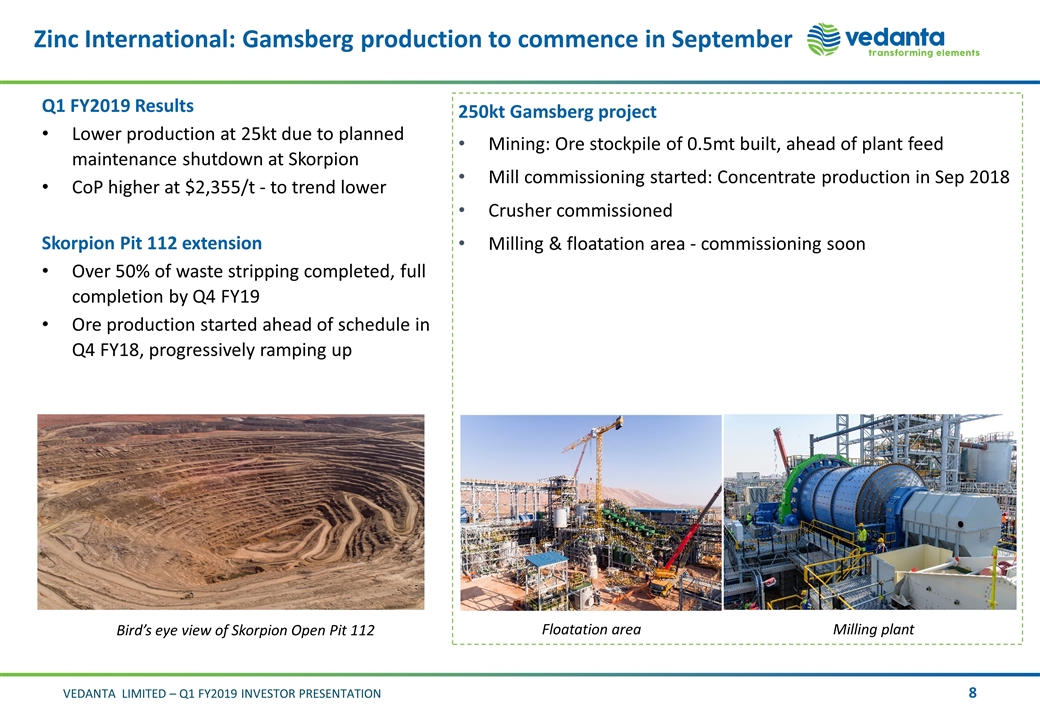

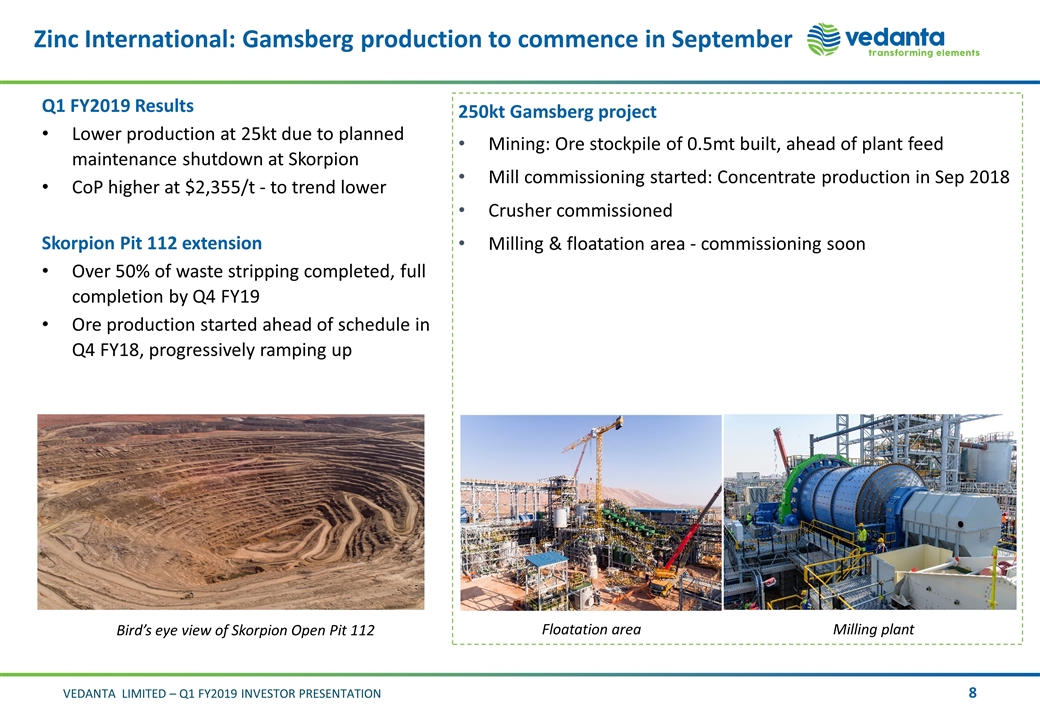

Zinc International: Gamsberg production to commence in September Q1 FY2019 Results Lower production at 25kt due to planned maintenance shutdown at Skorpion CoP higher at $2,355/t - to trend lower Skorpion Pit 112 extension Over 50% of waste stripping completed, full completion by Q4 FY19 Ore production started ahead of schedule in Q4 FY18, progressively ramping up 250kt Gamsberg project Mining: Ore stockpile of 0.5mt built, ahead of plant feed Mill commissioning started: Concentrate production in Sep 2018 Crusher commissioned Milling & floatation area - commissioning soon Bird’s eye view of Skorpion Open Pit 112 Q2 Skorpion production expected to be light Floatation area Milling plant

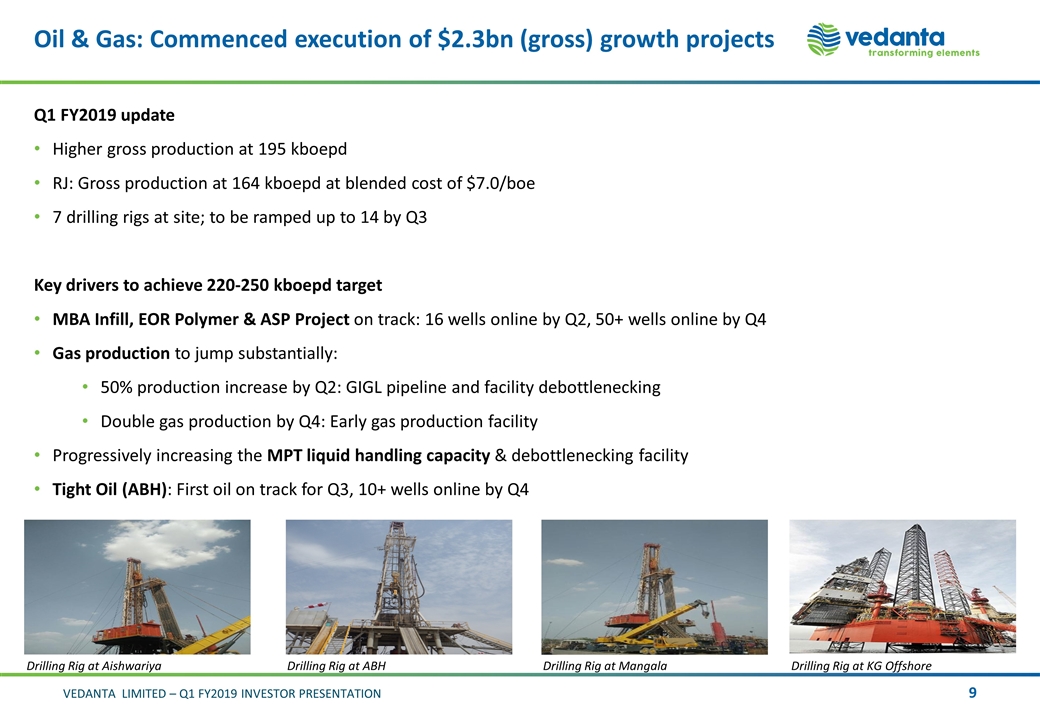

Oil & Gas: Commenced execution of $2.3bn (gross) growth projects Drilling Rig at ABH Q1 FY2019 update Higher gross production at 195 kboepd RJ: Gross production at 164 kboepd at blended cost of $7.0/boe 7 drilling rigs at site; to be ramped up to 14 by Q3 Key drivers to achieve 220-250 kboepd target MBA Infill, EOR Polymer & ASP Project on track: 16 wells online by Q2, 50+ wells online by Q4 Gas production to jump substantially: 50% production increase by Q2: GIGL pipeline and facility debottlenecking Double gas production by Q4: Early gas production facility Progressively increasing the MPT liquid handling capacity & debottlenecking facility Tight Oil (ABH): First oil on track for Q3, 10+ wells online by Q4 Drilling Rig at Aishwariya Drilling Rig at Mangala Drilling Rig at KG Offshore

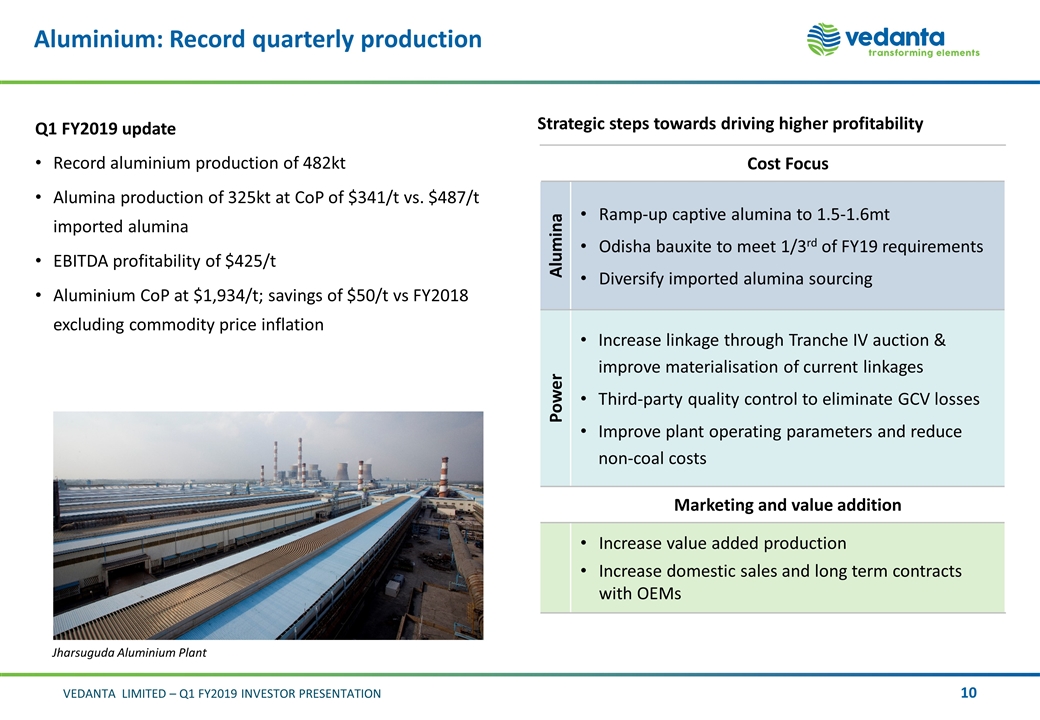

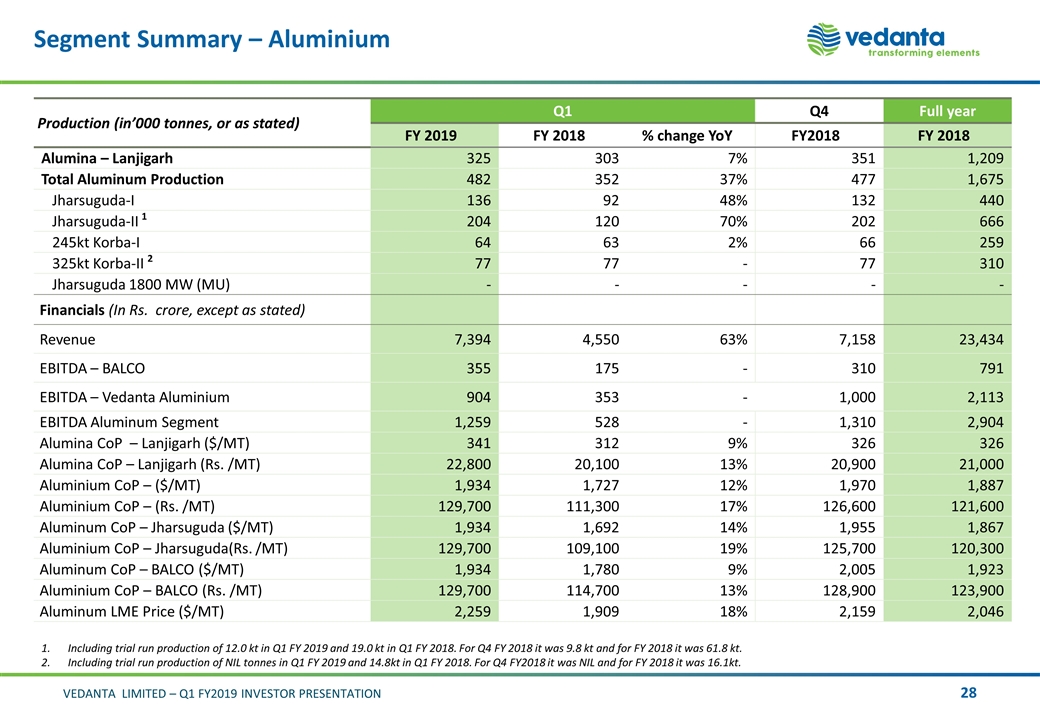

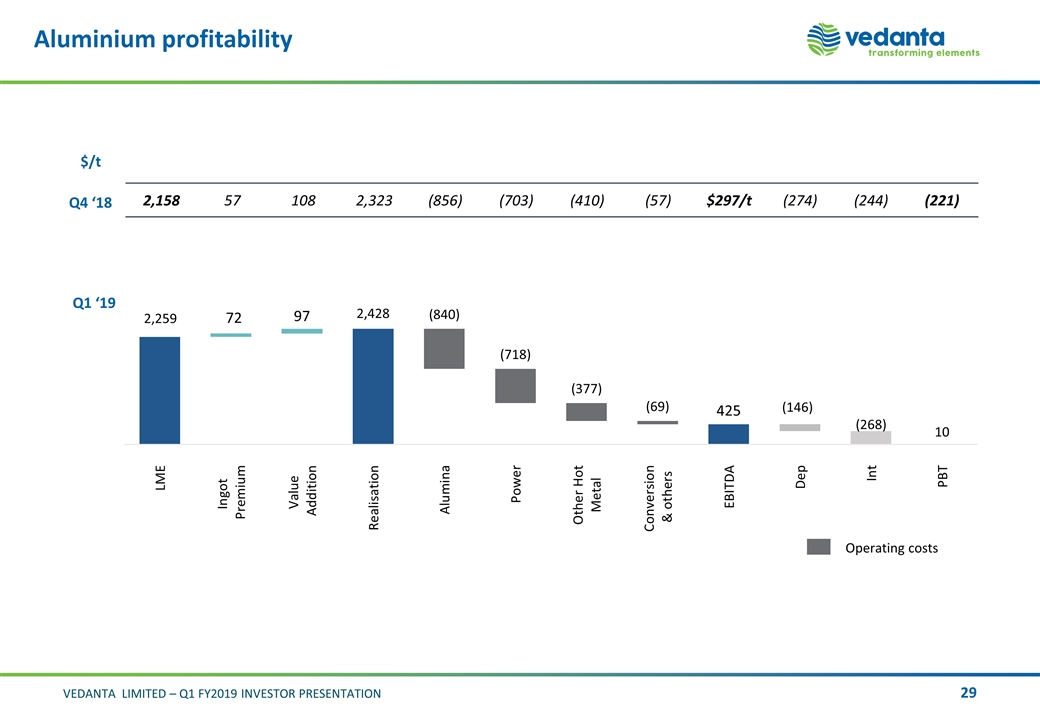

Aluminium: Record quarterly production Q1 FY2019 update Record aluminium production of 482kt Alumina production of 325kt at CoP of $341/t vs. $487/t imported alumina EBITDA profitability of $425/t Aluminium CoP at $1,934/t; savings of $50/t vs FY2018 excluding commodity price inflation Cost Focus Alumina Ramp-up captive alumina to 1.5-1.6mt Odisha bauxite to meet 1/3rd of FY19 requirements Diversify imported alumina sourcing Power Increase linkage through Tranche IV auction & improve materialisation of current linkages Third-party quality control to eliminate GCV losses Improve plant operating parameters and reduce non-coal costs Marketing and value addition Increase value added production Increase domestic sales and long term contracts with OEMs Strategic steps towards driving higher profitability Jharsuguda Aluminium Plant

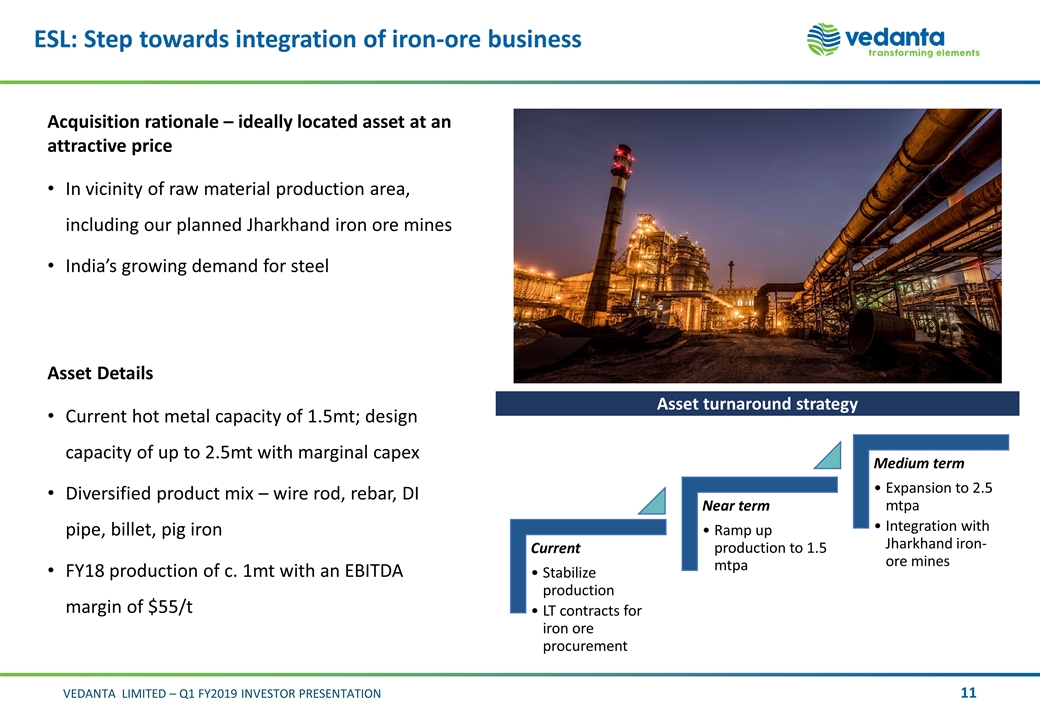

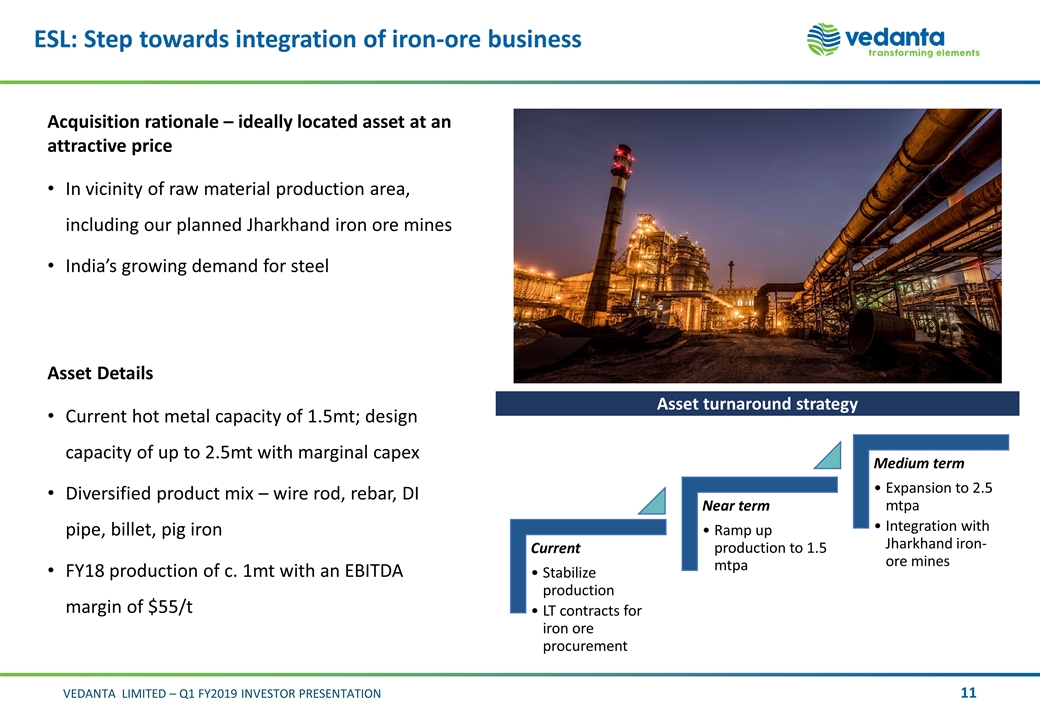

ESL: Step towards integration of iron-ore business Asset Details Current hot metal capacity of 1.5mt; design capacity of up to 2.5mt with marginal capex Diversified product mix – wire rod, rebar, DI pipe, billet, pig iron FY18 production of c. 1mt with an EBITDA margin of $55/t Acquisition rationale – ideally located asset at an attractive price In vicinity of raw material production area, including our planned Jharkhand iron ore mines India’s growing demand for steel Asset turnaround strategy 1. Industry is in the peak phase of pricing. JSW margin 2. Early days but ballpark number for EBITDA margin Current Near term Ramp up production to 1.5 mtpa Medium term Expansion to 2.5 mtpa Stabilize production LT contracts for iron ore procurement Integration with Jharkhand iron-ore mines

In summary… We are growing across businesses and reiterate FY2019 guidance Zinc India on track to gradually ramp up to 1.2mt MIC Accelerated ramp-up at Gamsberg from Sept 2018 Aluminium ramp-up on track to complete by H1 FY2019 and targeting $120-170/t savings excluding market factors as per guidance Oil & Gas development projects in execution phase; production to ramp-up as key project milestones are met ESL acquisition completed and integration underway Progressive improvement in operational performance expected in Q2-Q4 FY19

V E D A N T A L I M I T E D O I L & G A S | Z I N C & S I L V E R | A L U M I N I U M | P O W E R | I R O N O R E | C O P P E R Financial Update Arun Kumar Chief Financial Officer

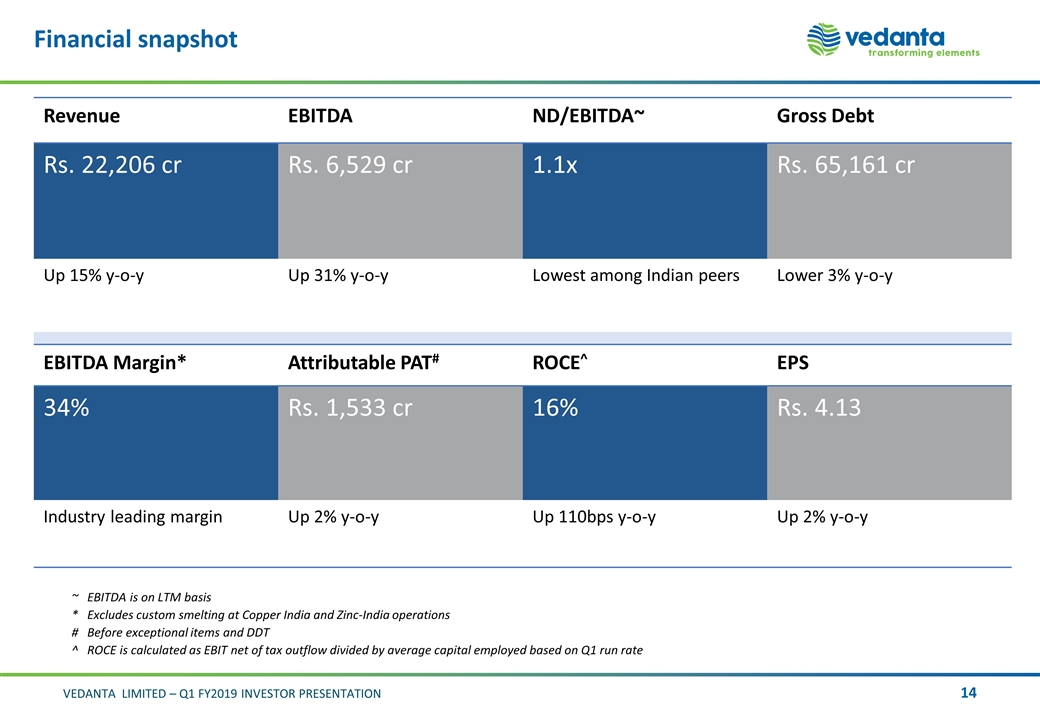

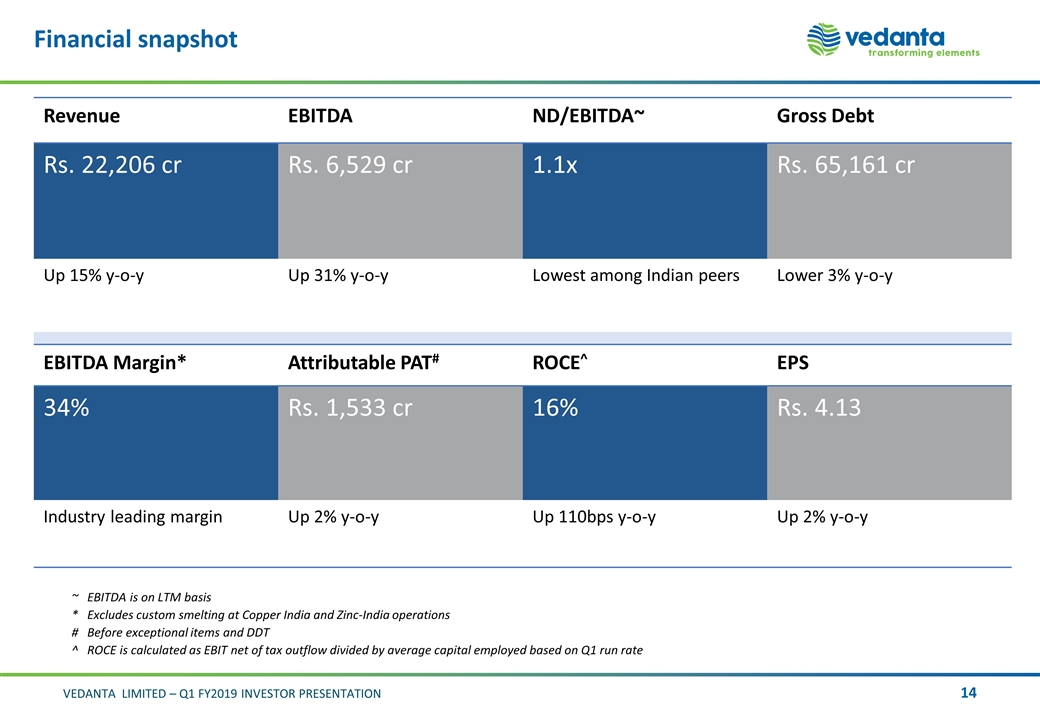

Financial snapshot Revenue EBITDA ND/EBITDA~ Gross Debt Rs. 22,206 cr Rs. 6,529 cr 1.1x Rs. 65,161 cr Up 15% y-o-y Up 31% y-o-y Lowest among Indian peers Lower 3% y-o-y EBITDA Margin* Attributable PAT# ROCE^ EPS 34% Rs. 1,533 cr 16% Rs. 4.13 Industry leading margin Up 2% y-o-y Up 110bps y-o-y Up 2% y-o-y ~ EBITDA is on LTM basis * Excludes custom smelting at Copper India and Zinc-India operations # Before exceptional items and DDT ^ ROCE is calculated as EBIT net of tax outflow divided by average capital employed based on Q1 run rate

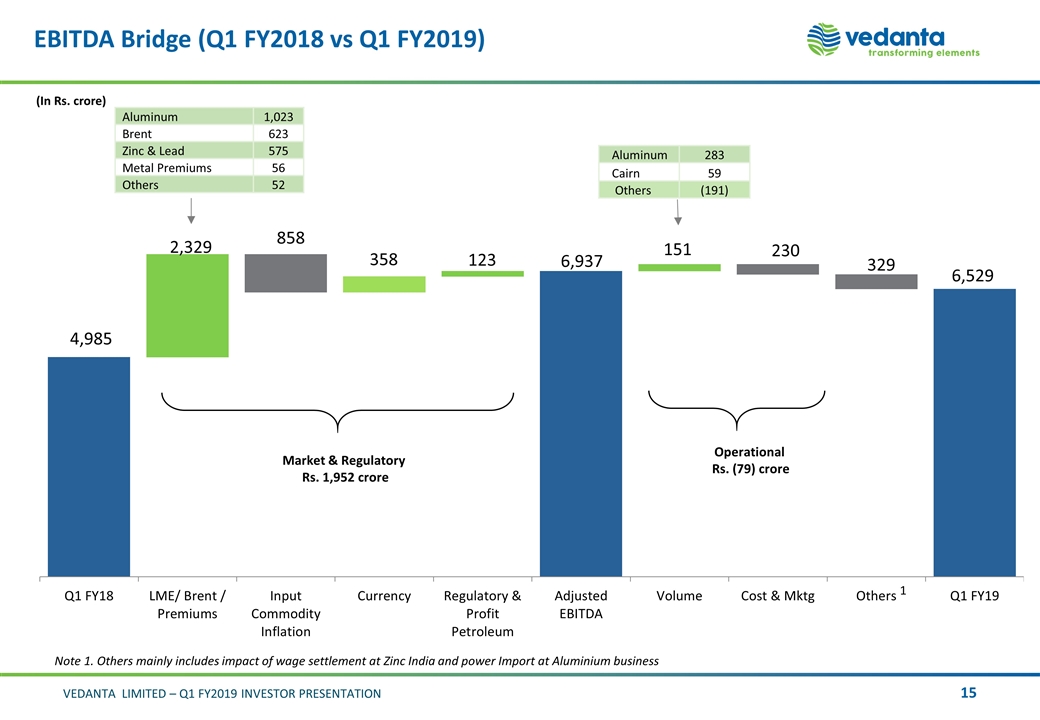

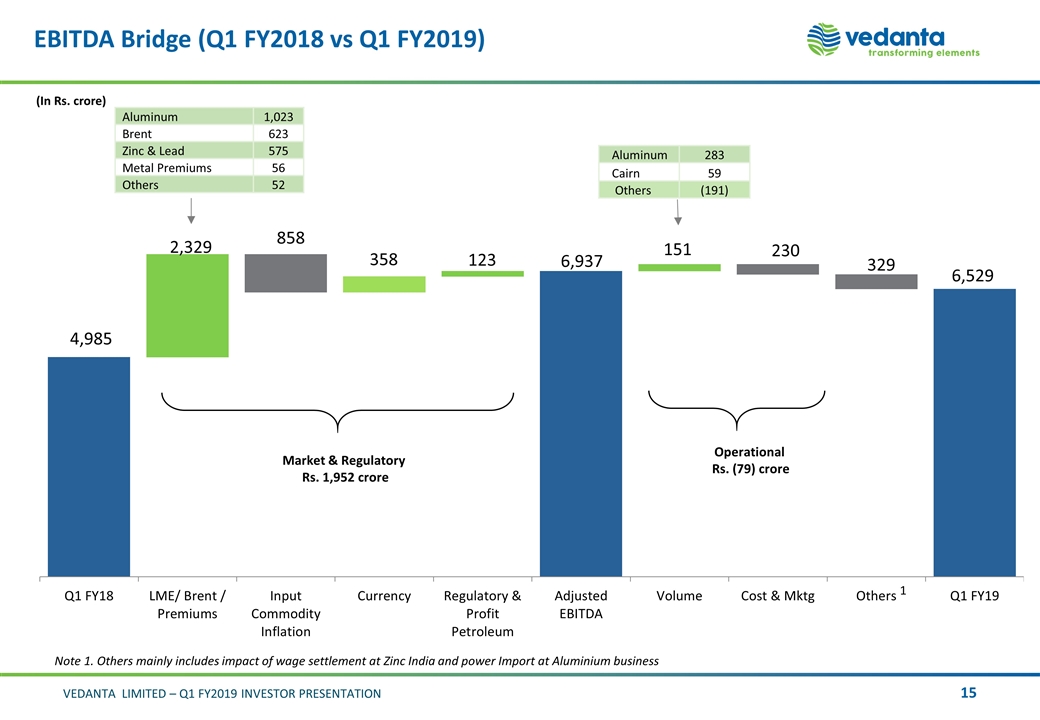

EBITDA Bridge (Q1 FY2018 vs Q1 FY2019) (In Rs. crore) Market & Regulatory Rs. 1,952 crore Operational Rs. (79) crore Aluminum 283 Cairn 59 Others (191) Aluminum 1,023 Brent 623 Zinc & Lead 575 Metal Premiums 56 Others 52 Note 1. Others mainly includes impact of wage settlement at Zinc India and power Import at Aluminium business

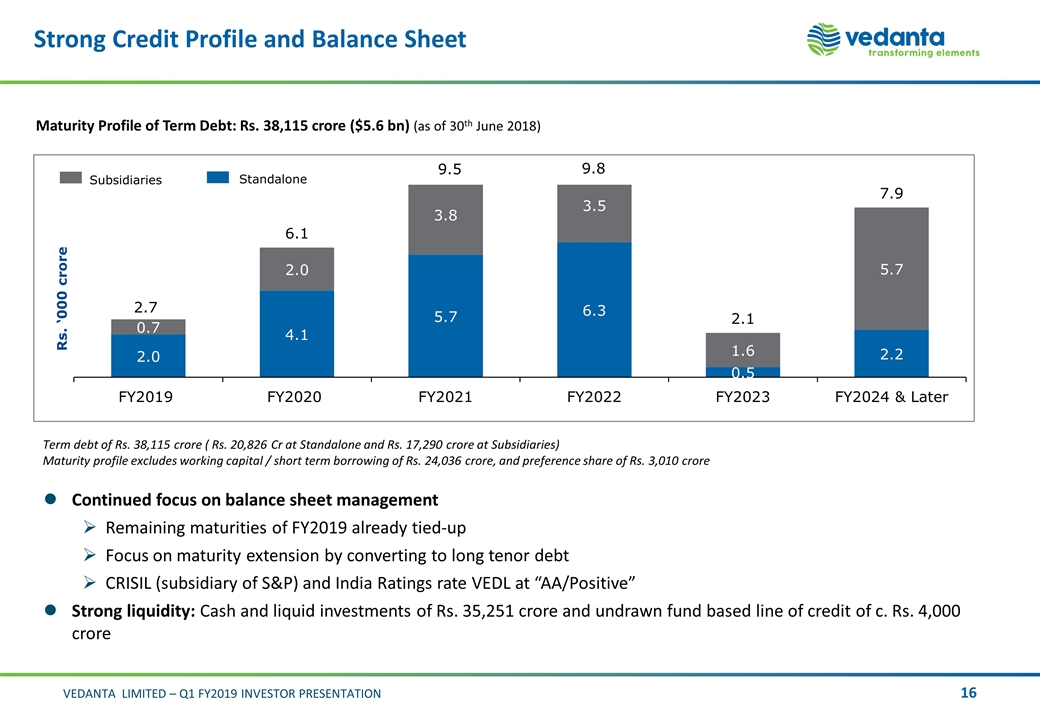

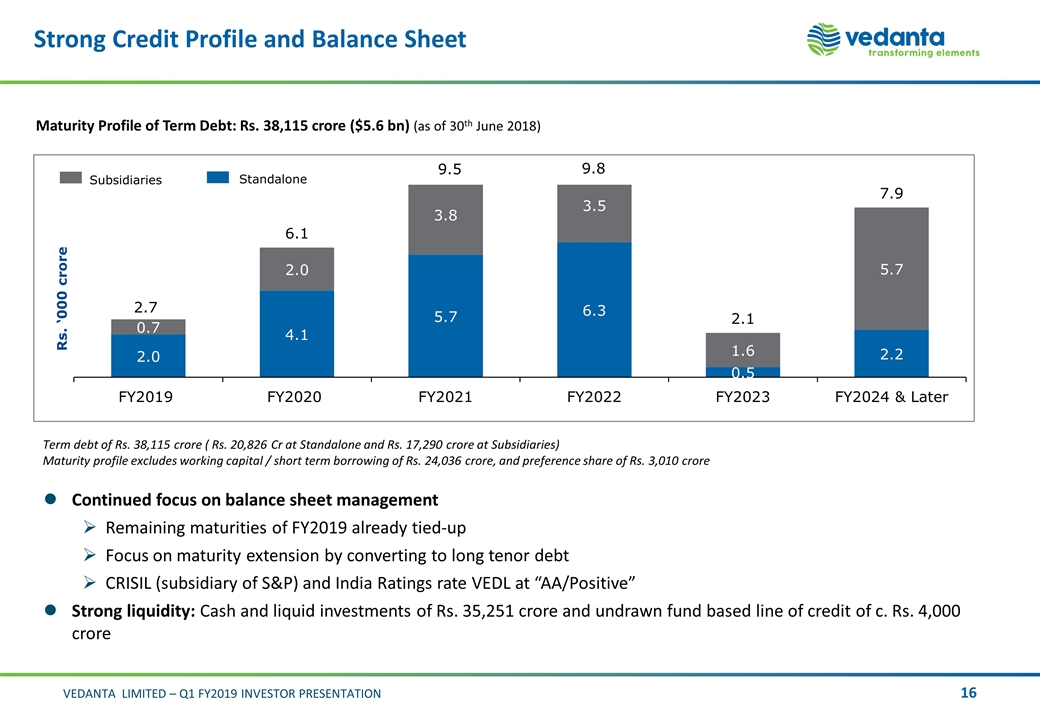

Strong Credit Profile and Balance Sheet Term debt of Rs. 38,115 crore ( Rs. 20,826 Cr at Standalone and Rs. 17,290 crore at Subsidiaries) Maturity profile excludes working capital / short term borrowing of Rs. 24,036 crore, and preference share of Rs. 3,010 crore Maturity Profile of Term Debt: Rs. 38,115 crore ($5.6 bn) (as of 30th June 2018) Continued focus on balance sheet management Remaining maturities of FY2019 already tied-up Focus on maturity extension by converting to long tenor debt CRISIL (subsidiary of S&P) and India Ratings rate VEDL at “AA/Positive” Strong liquidity: Cash and liquid investments of Rs. 35,251 crore and undrawn fund based line of credit of c. Rs. 4,000 crore 9.8

Appendix V E D A N T A L I M I T E D O I L & G A S | Z I N C & S I L V E R | A L U M I N I U M | P O W E R | I R O N O R E | C O P P E R

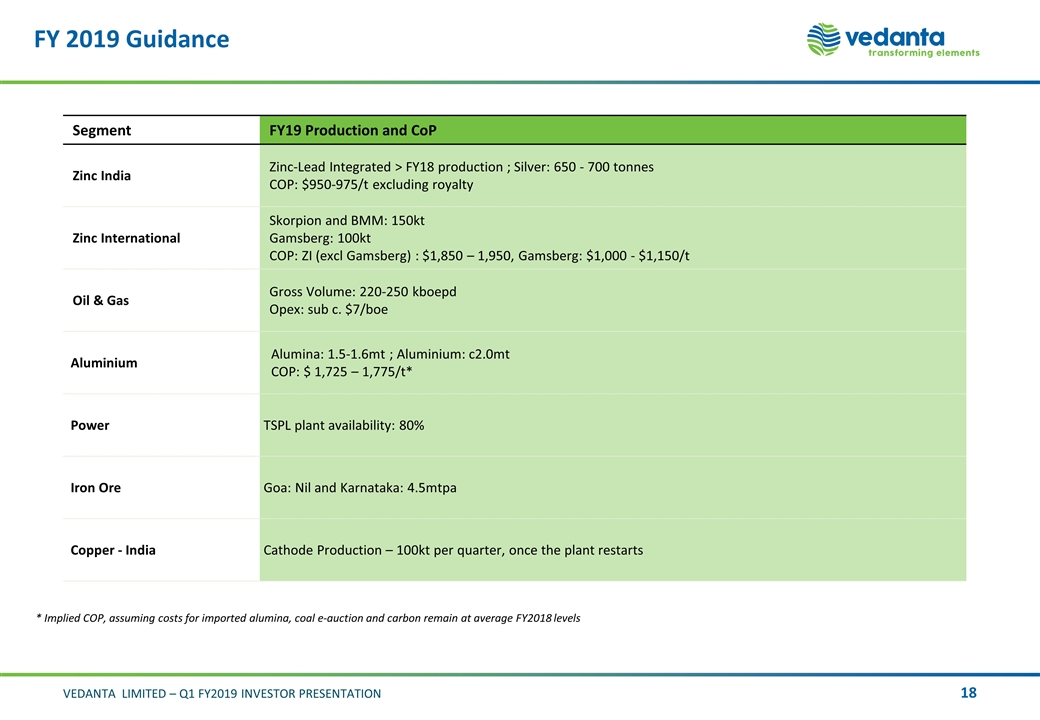

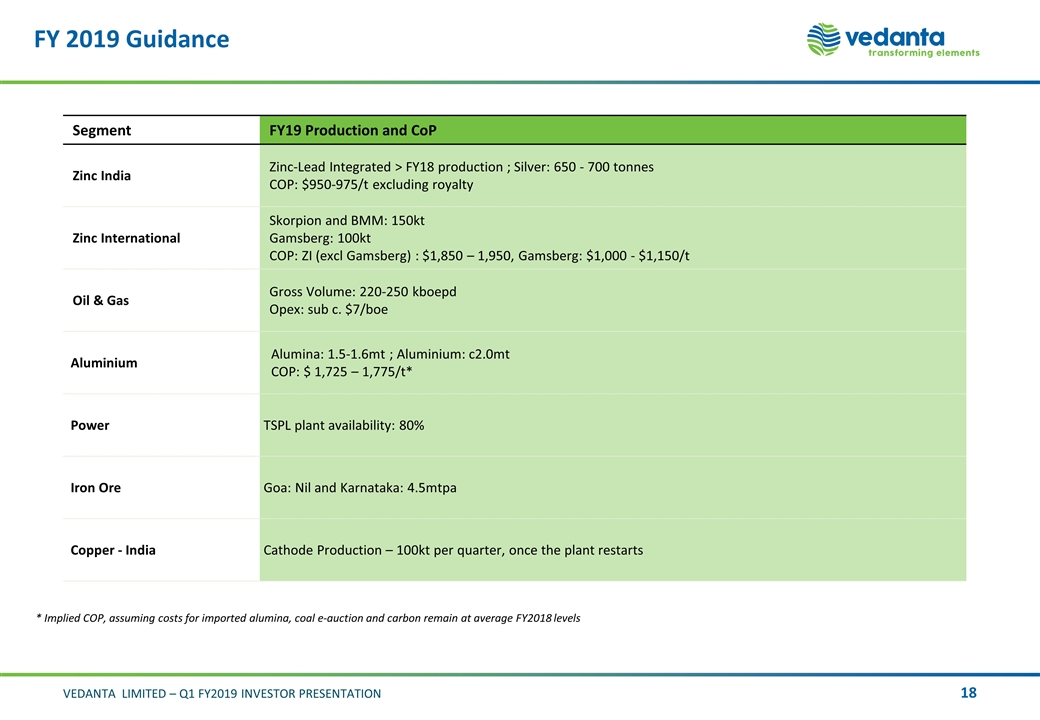

FY 2019 Guidance Segment FY19 Production and CoP Zinc India Zinc-Lead Integrated > FY18 production ; Silver: 650 - 700 tonnes COP: $950-975/t excluding royalty Zinc International Skorpion and BMM: 150kt Gamsberg: 100kt COP: ZI (excl Gamsberg) : $1,850 – 1,950, Gamsberg: $1,000 - $1,150/t Oil & Gas Gross Volume: 220-250 kboepd Opex: sub c. $7/boe Aluminium Alumina: 1.5-1.6mt ; Aluminium: c2.0mt COP: $ 1,725 – 1,775/t* Power TSPL plant availability: 80% Iron Ore Goa: Nil and Karnataka: 4.5mtpa Copper - India Cathode Production – 100kt per quarter, once the plant restarts * Implied COP, assuming costs for imported alumina, coal e-auction and carbon remain at average FY2018 levels

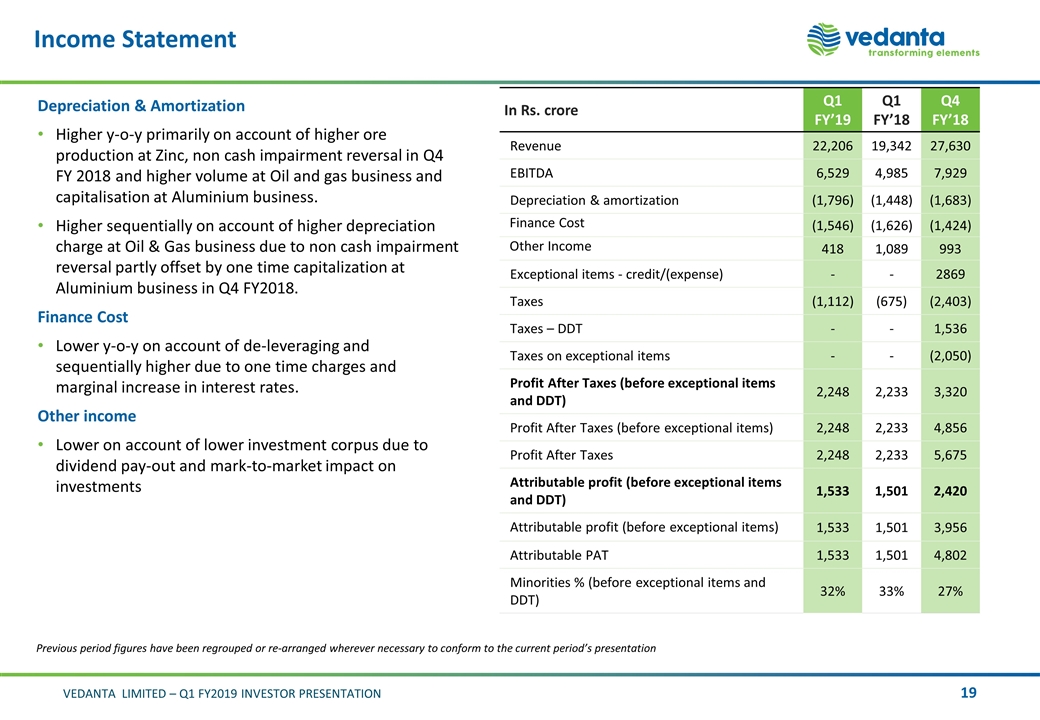

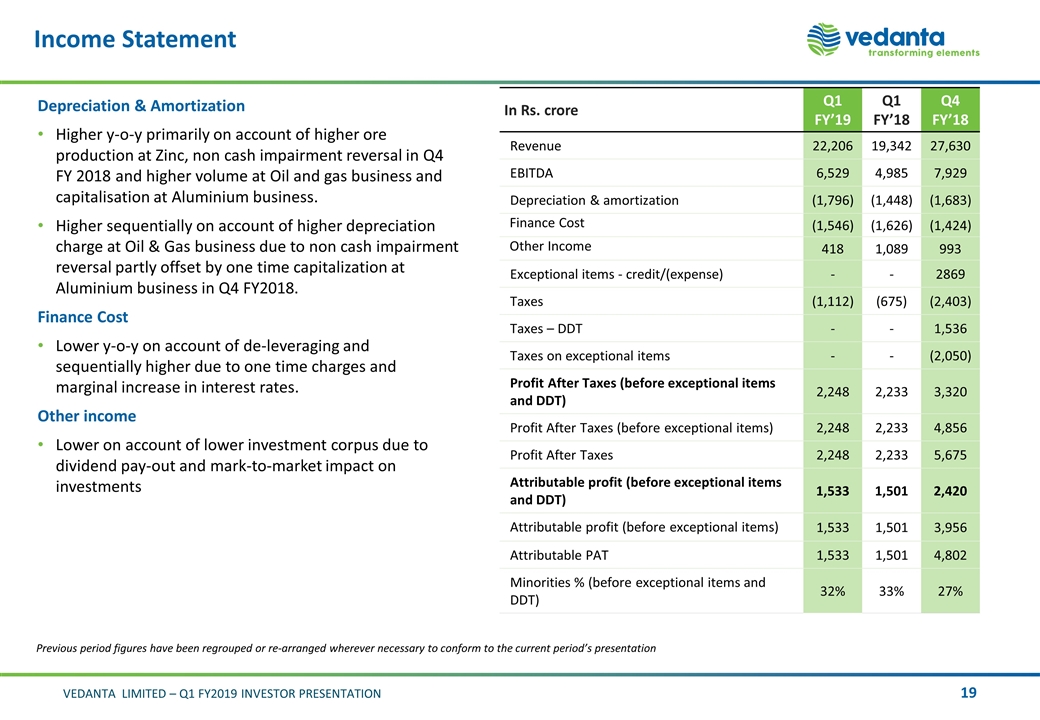

Income Statement In Rs. crore Q1 FY’19 Q1 FY’18 Q4 FY’18 Revenue 22,206 19,342 27,630 EBITDA 6,529 4,985 7,929 Depreciation & amortization (1,796) (1,448) (1,683) Finance Cost (1,546) (1,626) (1,424) Other Income 418 1,089 993 Exceptional items - credit/(expense) - - 2869 Taxes (1,112) (675) (2,403) Taxes – DDT - - 1,536 Taxes on exceptional items - - (2,050) Profit After Taxes (before exceptional items and DDT) 2,248 2,233 3,320 Profit After Taxes (before exceptional items) 2,248 2,233 4,856 Profit After Taxes 2,248 2,233 5,675 Attributable profit (before exceptional items and DDT) 1,533 1,501 2,420 Attributable profit (before exceptional items) 1,533 1,501 3,956 Attributable PAT 1,533 1,501 4,802 Minorities % (before exceptional items and DDT) 32% 33% 27% Previous period figures have been regrouped or re-arranged wherever necessary to conform to the current period’s presentation Depreciation & Amortization Higher y-o-y primarily on account of higher ore production at Zinc, non cash impairment reversal in Q4 FY 2018 and higher volume at Oil and gas business and capitalisation at Aluminium business. Higher sequentially on account of higher depreciation charge at Oil & Gas business due to non cash impairment reversal partly offset by one time capitalization at Aluminium business in Q4 FY2018. Finance Cost Lower y-o-y on account of de-leveraging and sequentially higher due to one time charges and marginal increase in interest rates. Other income Lower on account of lower investment corpus due to dividend pay-out and mark-to-market impact on investments

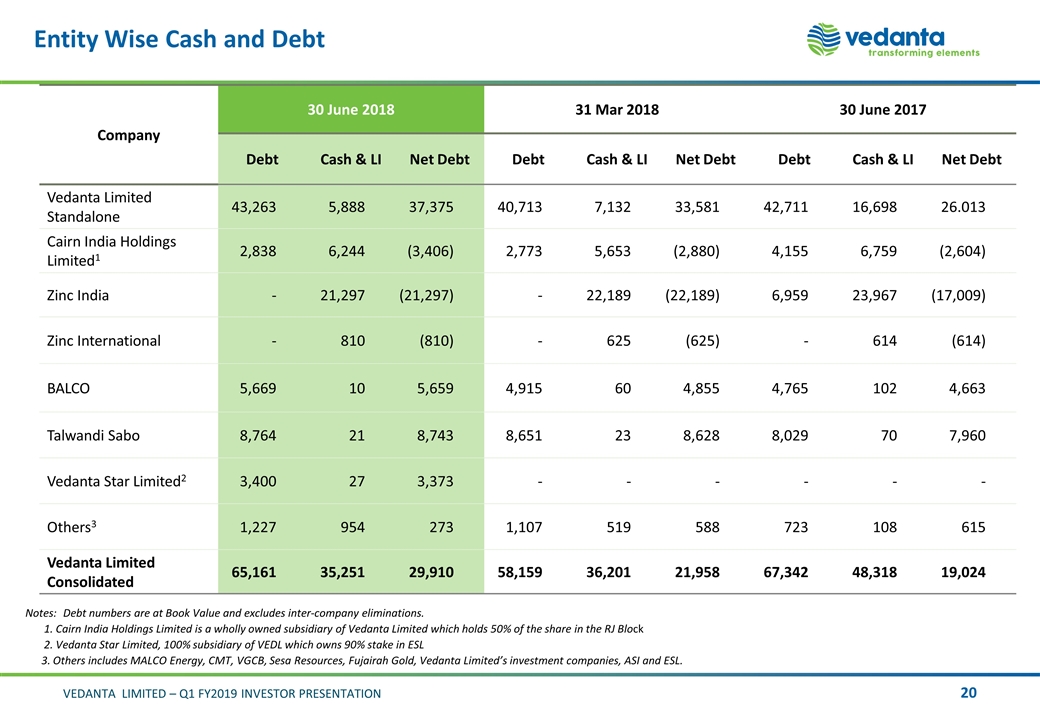

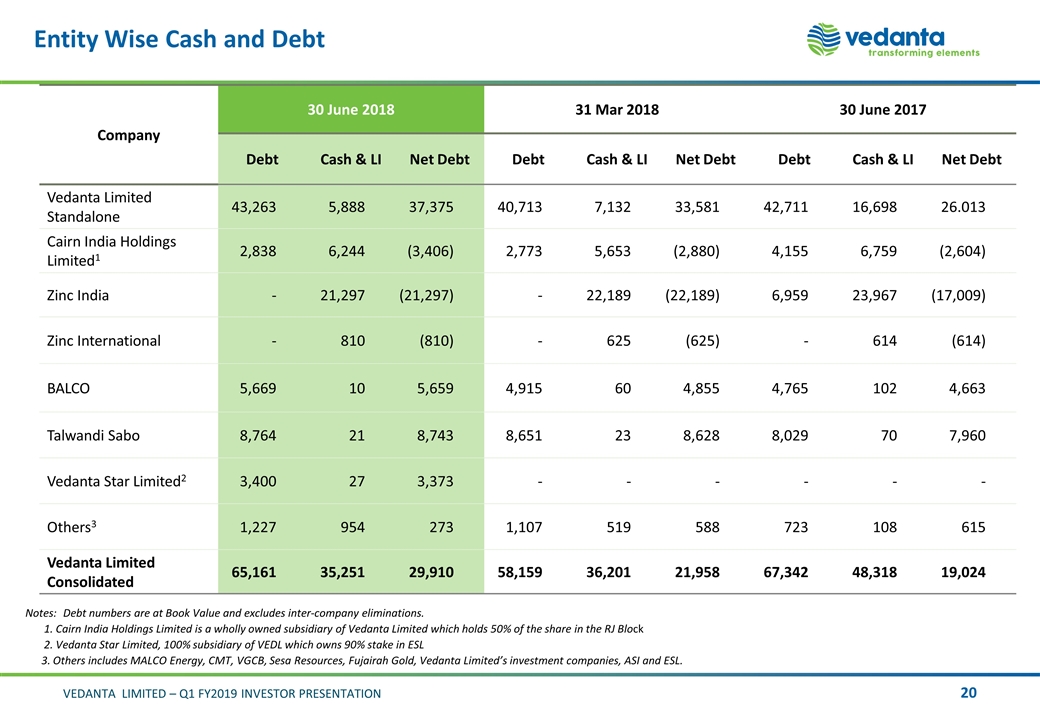

Entity Wise Cash and Debt Company 30 June 2018 31 Mar 2018 30 June 2017 Debt Cash & LI Net Debt Debt Cash & LI Net Debt Debt Cash & LI Net Debt Vedanta Limited Standalone 43,263 5,888 37,375 40,713 7,132 33,581 42,711 16,698 26.013 Cairn India Holdings Limited1 2,838 6,244 (3,406) 2,773 5,653 (2,880) 4,155 6,759 (2,604) Zinc India - 21,297 (21,297) - 22,189 (22,189) 6,959 23,967 (17,009) Zinc International - 810 (810) - 625 (625) - 614 (614) BALCO 5,669 10 5,659 4,915 60 4,855 4,765 102 4,663 Talwandi Sabo 8,764 21 8,743 8,651 23 8,628 8,029 70 7,960 Vedanta Star Limited2 3,400 27 3,373 - - - - - - Others3 1,227 954 273 1,107 519 588 723 108 615 Vedanta Limited Consolidated 65,161 35,251 29,910 58,159 36,201 21,958 67,342 48,318 19,024 Notes:Debt numbers are at Book Value and excludes inter-company eliminations. 1. Cairn India Holdings Limited is a wholly owned subsidiary of Vedanta Limited which holds 50% of the share in the RJ Block 2. Vedanta Star Limited, 100% subsidiary of VEDL which owns 90% stake in ESL 3. Others includes MALCO Energy, CMT, VGCB, Sesa Resources, Fujairah Gold, Vedanta Limited’s investment companies, ASI and ESL.

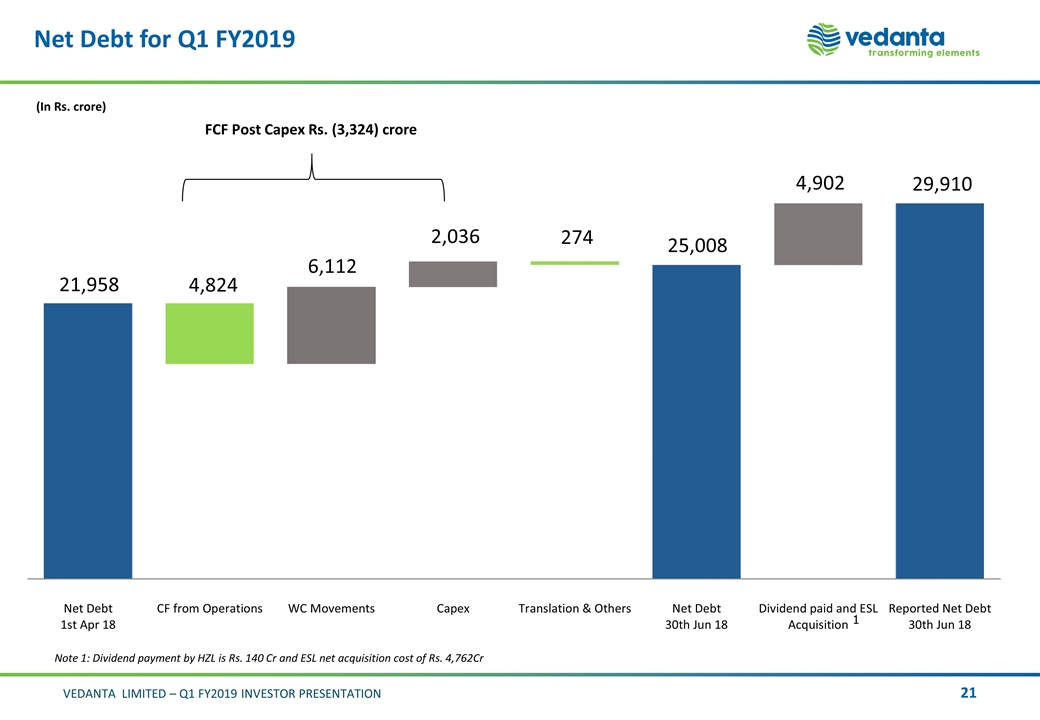

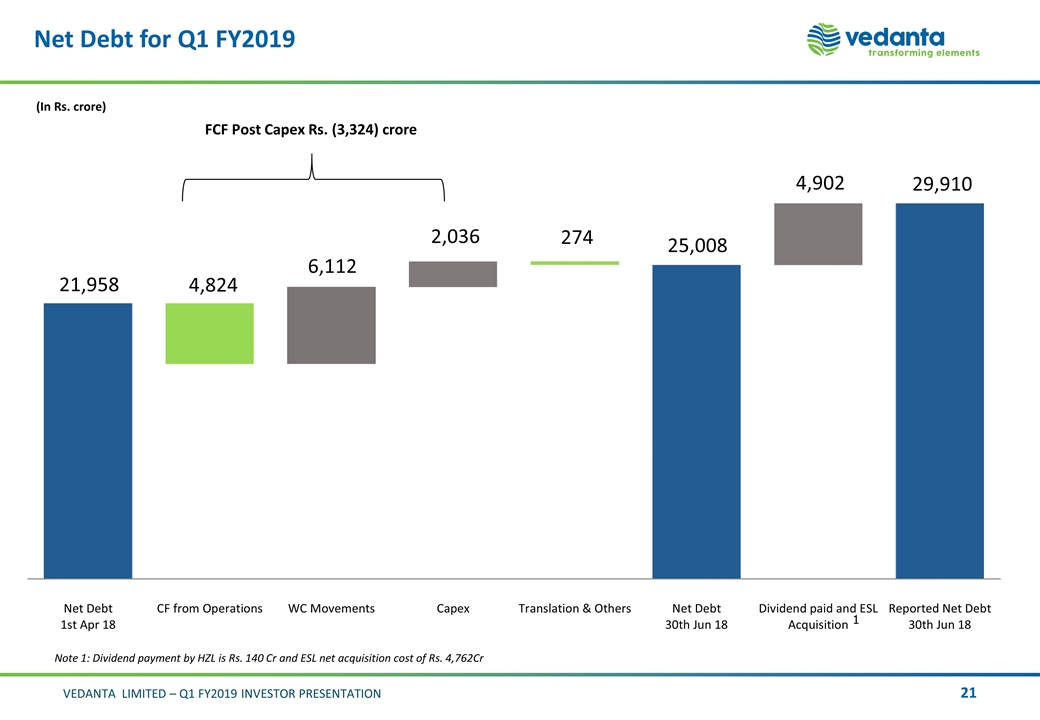

Net Debt for Q1 FY2019 FCF Post Capex Rs. (3,324) crore 1 Note 1: Dividend payment by HZL is Rs. 140 Cr and ESL net acquisition cost of Rs. 4,762Cr (In Rs. crore)

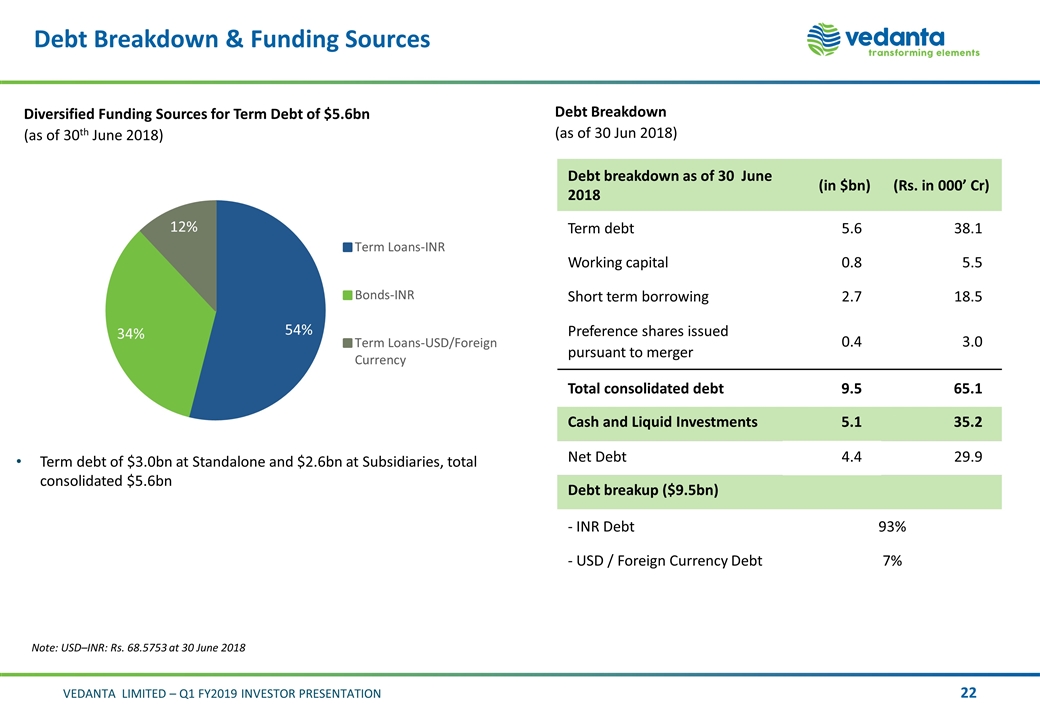

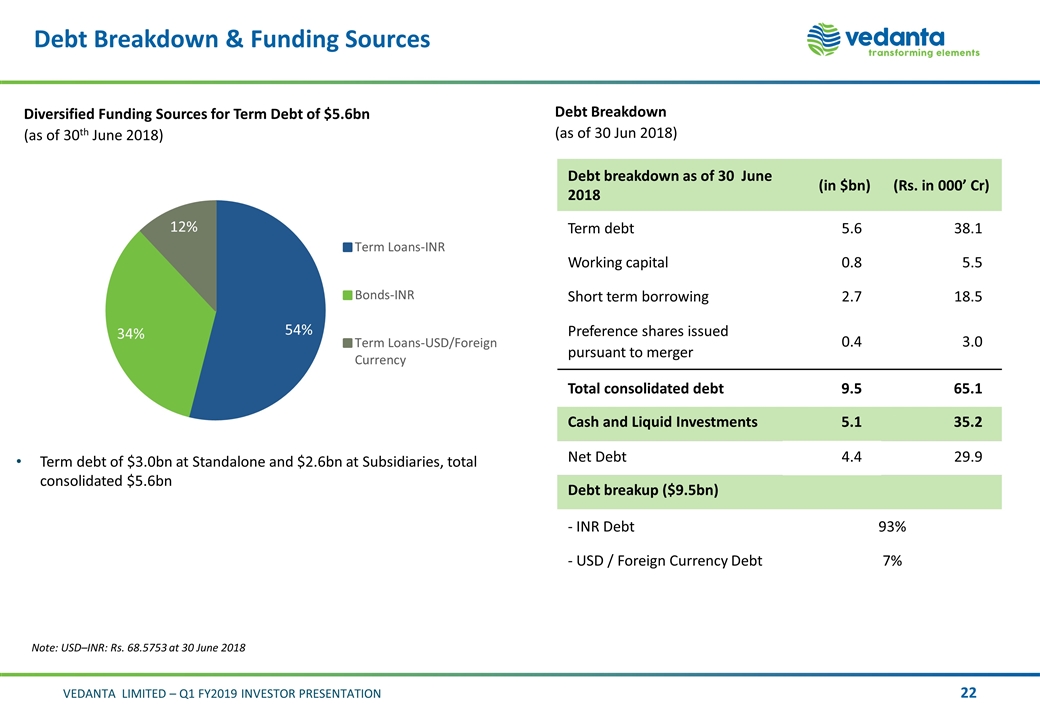

Debt Breakdown & Funding Sources Debt breakdown as of 30 June 2018 (in $bn) (Rs. in 000’ Cr) Term debt 5.6 38.1 Working capital 0.8 5.5 Short term borrowing 2.7 18.5 Preference shares issued pursuant to merger 0.4 3.0 Total consolidated debt 9.5 65.1 Cash and Liquid Investments 5.1 35.2 Net Debt 4.4 29.9 Debt breakup ($9.5bn) - INR Debt 93% - USD / Foreign Currency Debt 7% Diversified Funding Sources for Term Debt of $5.6bn (as of 30th June 2018) Note: USD–INR: Rs. 68.5753 at 30 June 2018 Term debt of $3.0bn at Standalone and $2.6bn at Subsidiaries, total consolidated $5.6bn Debt Breakdown (as of 30 Jun 2018)

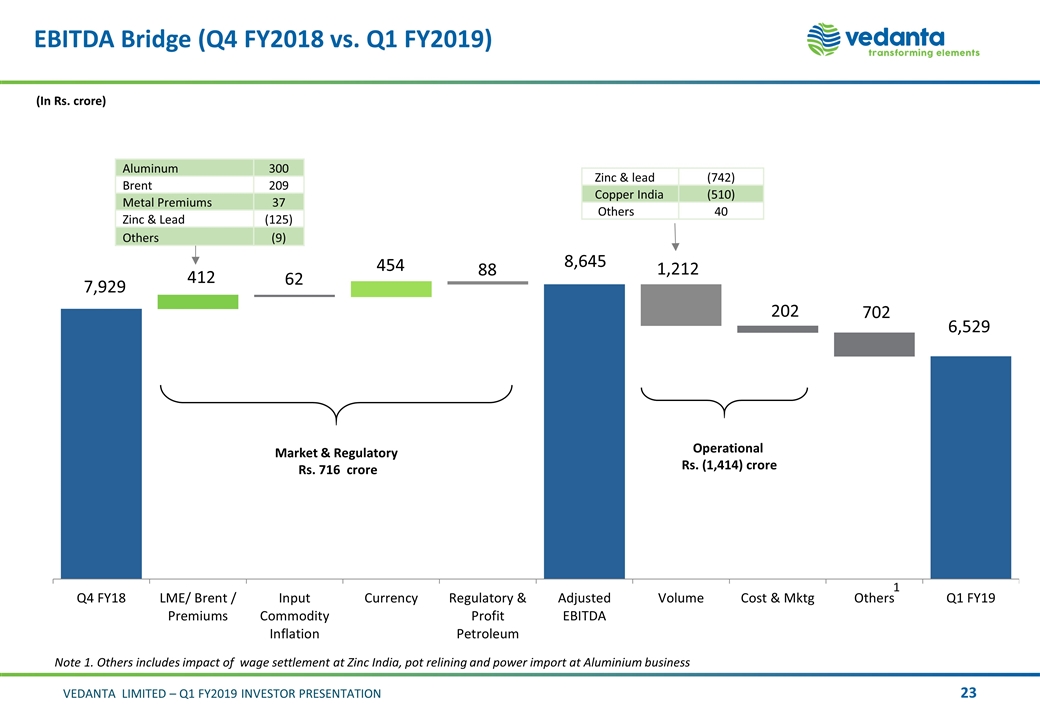

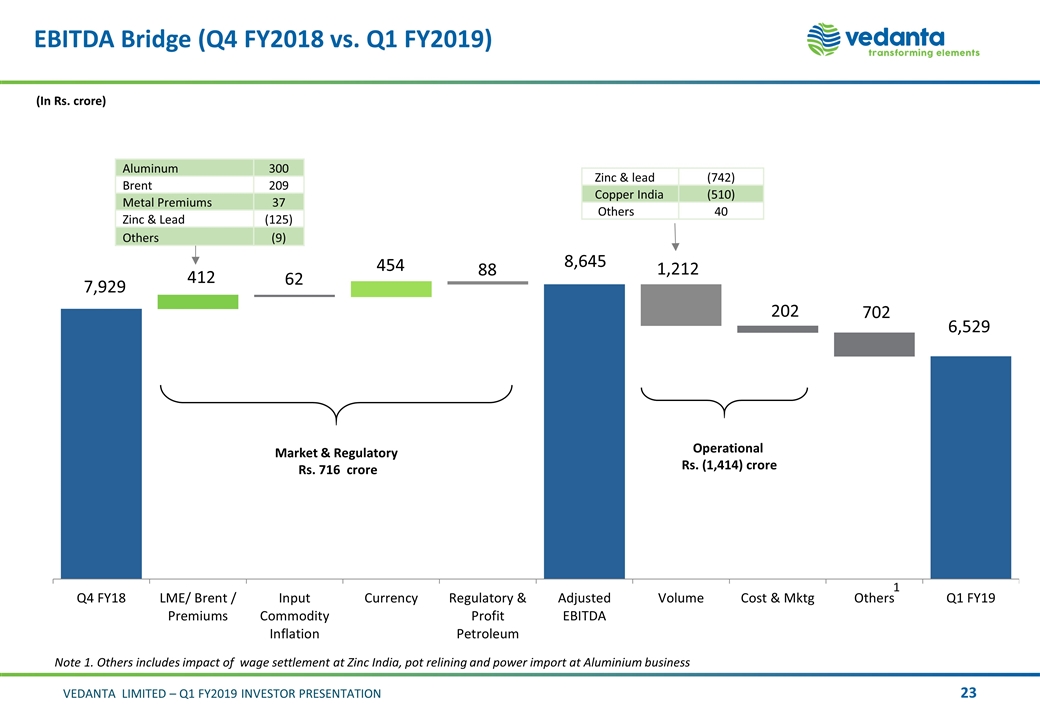

EBITDA Bridge (Q4 FY2018 vs. Q1 FY2019) (In Rs. crore) Market & Regulatory Rs. 716 crore Operational Rs. (1,414) crore Zinc & lead (742) Copper India (510) Others 40 Aluminum 300 Brent 209 Metal Premiums 37 Zinc & Lead (125) Others (9) Note 1. Others includes impact of wage settlement at Zinc India, pot relining and power import at Aluminium business

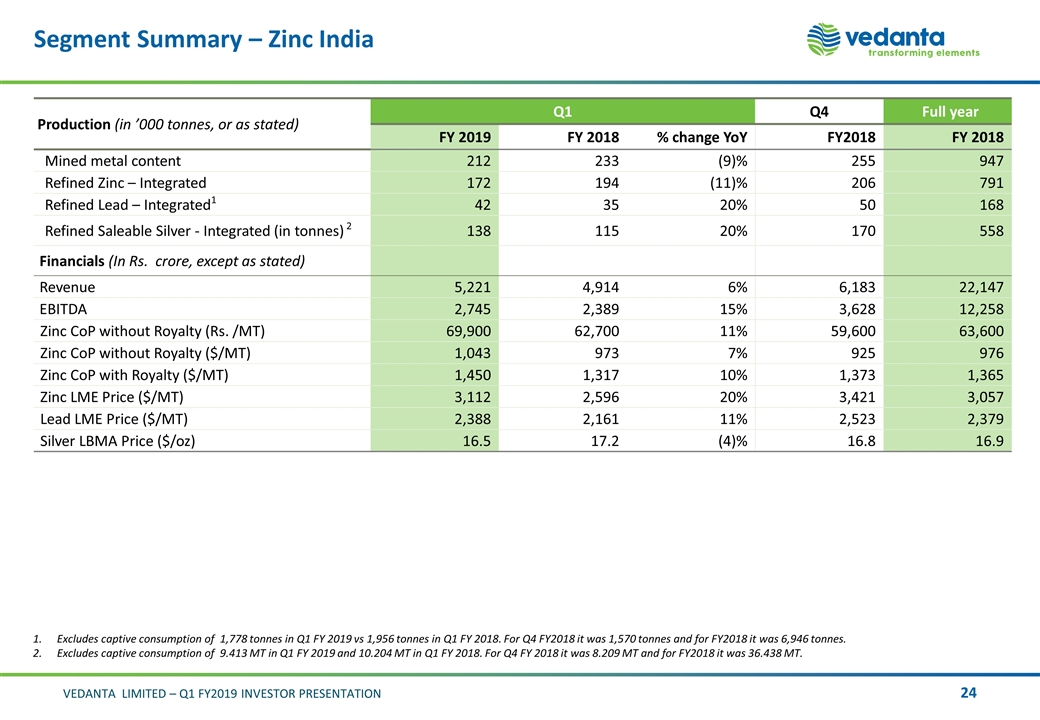

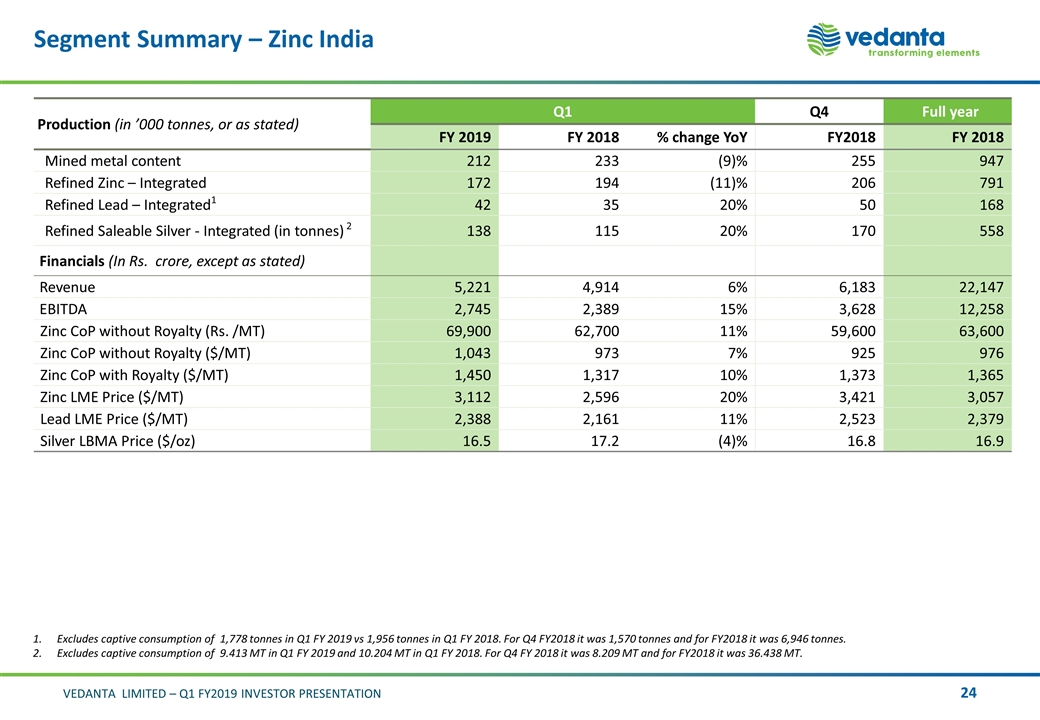

Segment Summary – Zinc India Production (in ’000 tonnes, or as stated) Q1 Q4 Full year FY 2019 FY 2018 % change YoY FY2018 FY 2018 Mined metal content 212 233 (9)% 255 947 Refined Zinc – Integrated 172 194 (11)% 206 791 Refined Lead – Integrated1 42 35 20% 50 168 Refined Saleable Silver - Integrated (in tonnes) 2 138 115 20% 170 558 Financials (In Rs. crore, except as stated) Revenue 5,221 4,914 6% 6,183 22,147 EBITDA 2,745 2,389 15% 3,628 12,258 Zinc CoP without Royalty (Rs. /MT) 69,900 62,700 11% 59,600 63,600 Zinc CoP without Royalty ($/MT) 1,043 973 7% 925 976 Zinc CoP with Royalty ($/MT) 1,450 1,317 10% 1,373 1,365 Zinc LME Price ($/MT) 3,112 2,596 20% 3,421 3,057 Lead LME Price ($/MT) 2,388 2,161 11% 2,523 2,379 Silver LBMA Price ($/oz) 16.5 17.2 (4)% 16.8 16.9 Excludes captive consumption of 1,778 tonnes in Q1 FY 2019 vs 1,956 tonnes in Q1 FY 2018. For Q4 FY2018 it was 1,570 tonnes and for FY2018 it was 6,946 tonnes. Excludes captive consumption of 9.413 MT in Q1 FY 2019 and 10.204 MT in Q1 FY 2018. For Q4 FY 2018 it was 8.209 MT and for FY2018 it was 36.438 MT.

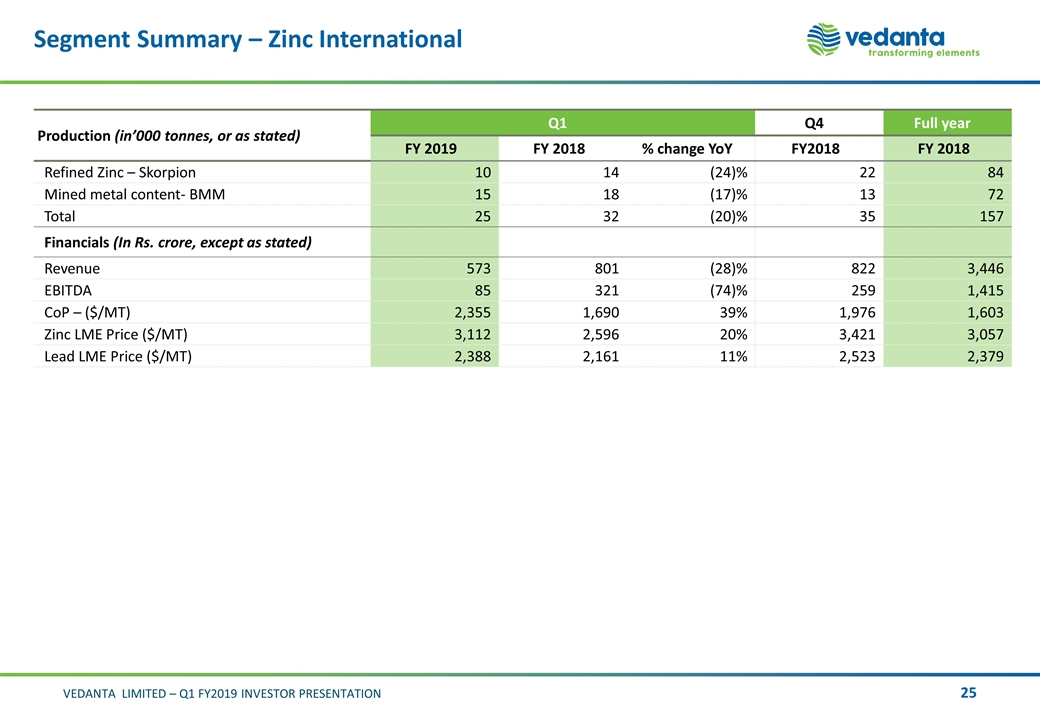

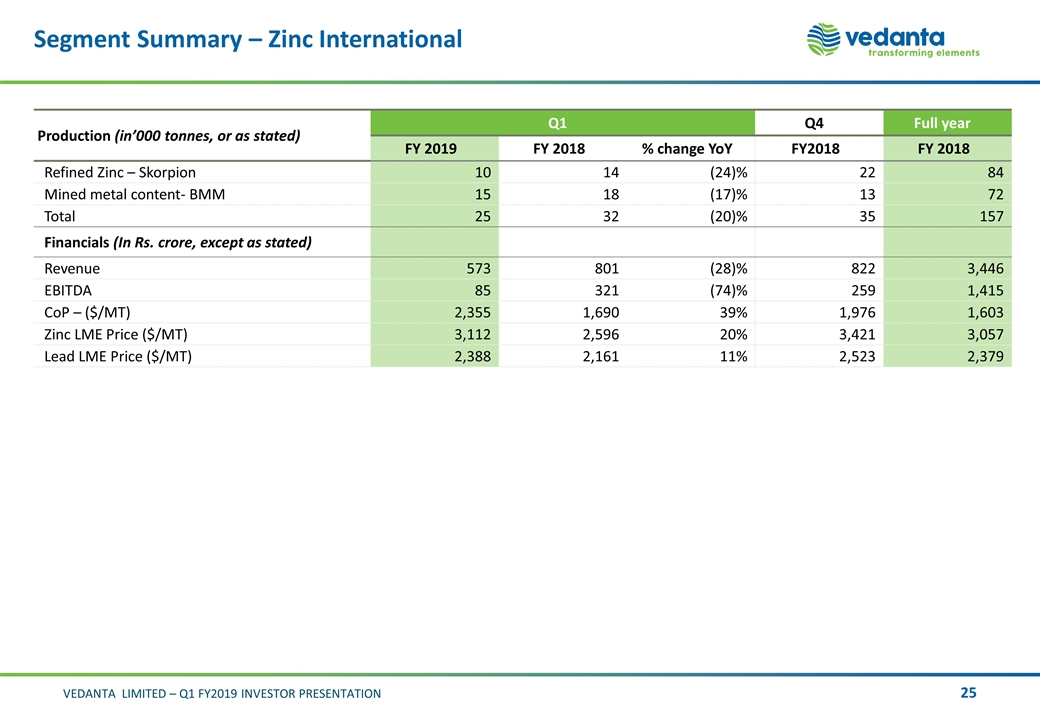

Segment Summary – Zinc International Production (in’000 tonnes, or as stated) Q1 Q4 Full year FY 2019 FY 2018 % change YoY FY2018 FY 2018 Refined Zinc – Skorpion 10 14 (24)% 22 84 Mined metal content- BMM 15 18 (17)% 13 72 Total 25 32 (20)% 35 157 Financials (In Rs. crore, except as stated) Revenue 573 801 (28)% 822 3,446 EBITDA 85 321 (74)% 259 1,415 CoP – ($/MT) 2,355 1,690 39% 1,976 1,603 Zinc LME Price ($/MT) 3,112 2,596 20% 3,421 3,057 Lead LME Price ($/MT) 2,388 2,161 11% 2,523 2,379

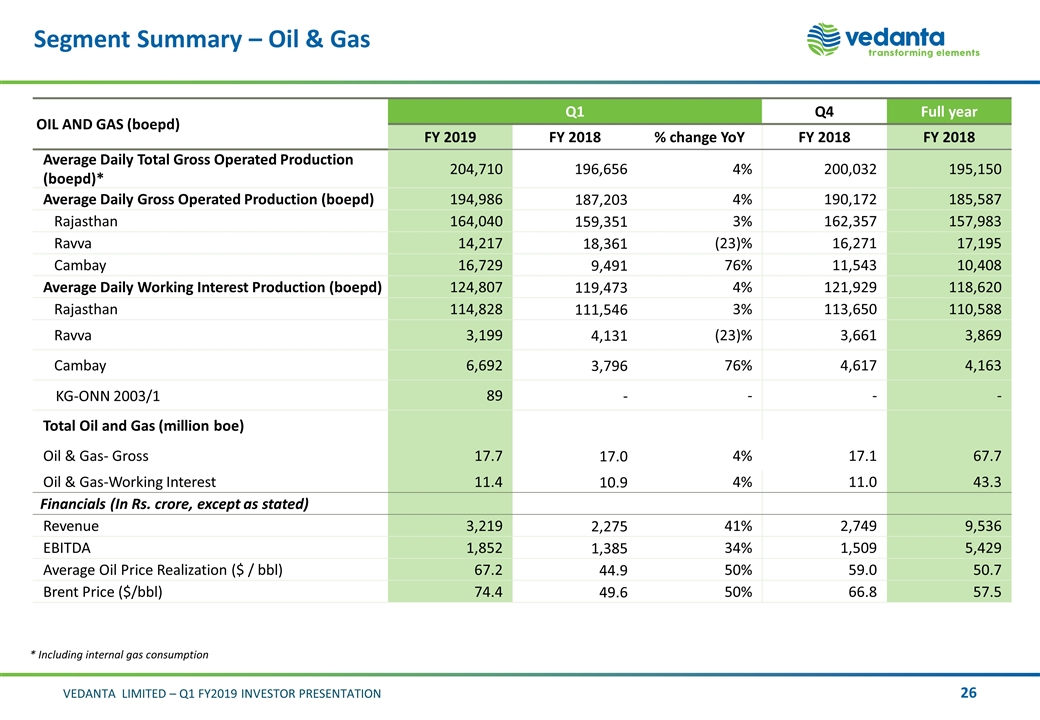

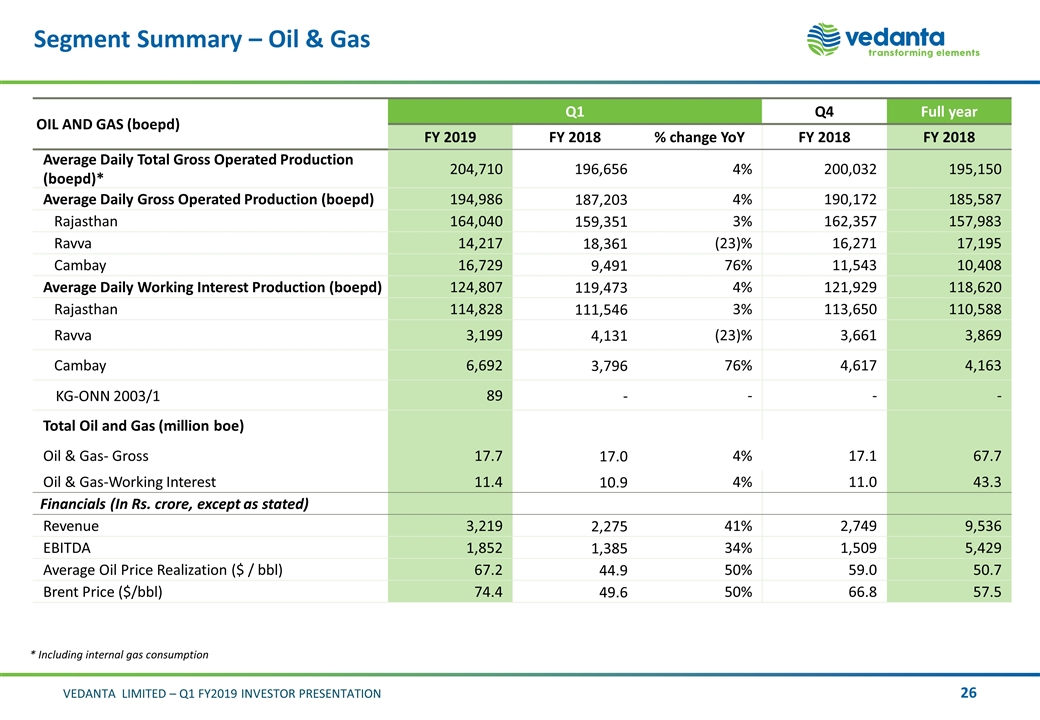

Segment Summary – Oil & Gas OIL AND GAS (boepd) Q1 Q4 Full year FY 2019 FY 2018 % change YoY FY 2018 FY 2018 Average Daily Total Gross Operated Production (boepd)* 204,710 196,656 4% 200,032 195,150 Average Daily Gross Operated Production (boepd) 194,986 187,203 4% 190,172 185,587 Rajasthan 164,040 159,351 3% 162,357 157,983 Ravva 14,217 18,361 (23)% 16,271 17,195 Cambay 16,729 9,491 76% 11,543 10,408 Average Daily Working Interest Production (boepd) 124,807 119,473 4% 121,929 118,620 Rajasthan 114,828 111,546 3% 113,650 110,588 Ravva 3,199 4,131 (23)% 3,661 3,869 Cambay 6,692 3,796 76% 4,617 4,163 KG-ONN 2003/1 89 - - - - Total Oil and Gas (million boe) Oil & Gas- Gross 17.7 17.0 4% 17.1 67.7 Oil & Gas-Working Interest 11.4 10.9 4% 11.0 43.3 Financials (In Rs. crore, except as stated) Revenue 3,219 2,275 41% 2,749 9,536 EBITDA 1,852 1,385 34% 1,509 5,429 Average Oil Price Realization ($ / bbl) 67.2 44.9 50% 59.0 50.7 Brent Price ($/bbl) 74.4 49.6 50% 66.8 57.5 * Including internal gas consumption

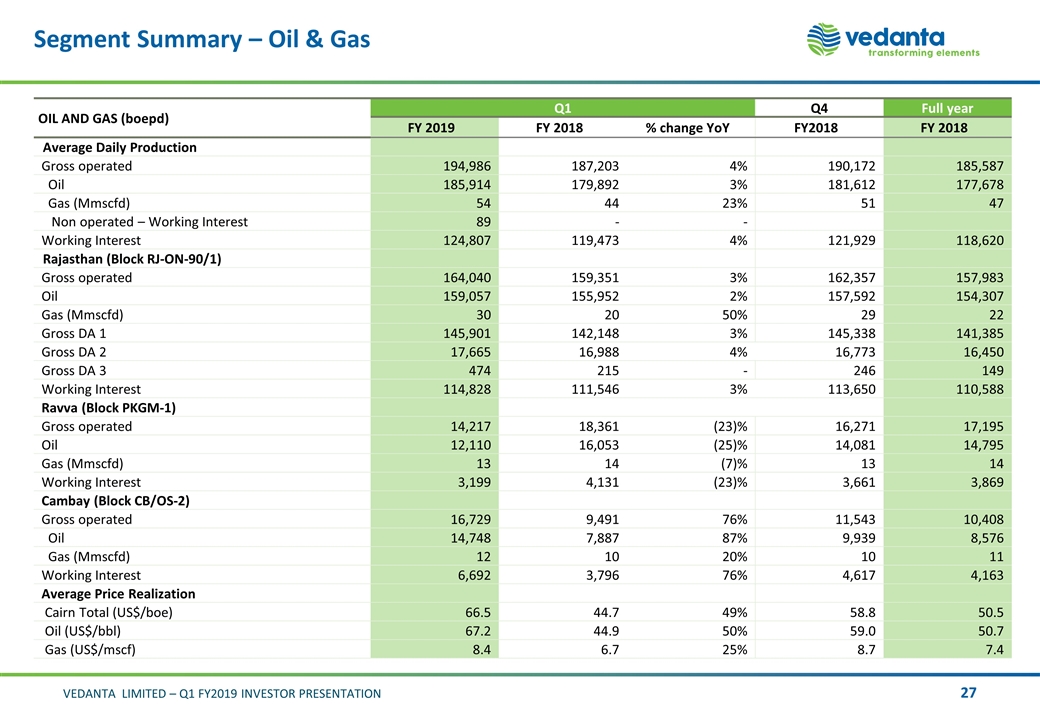

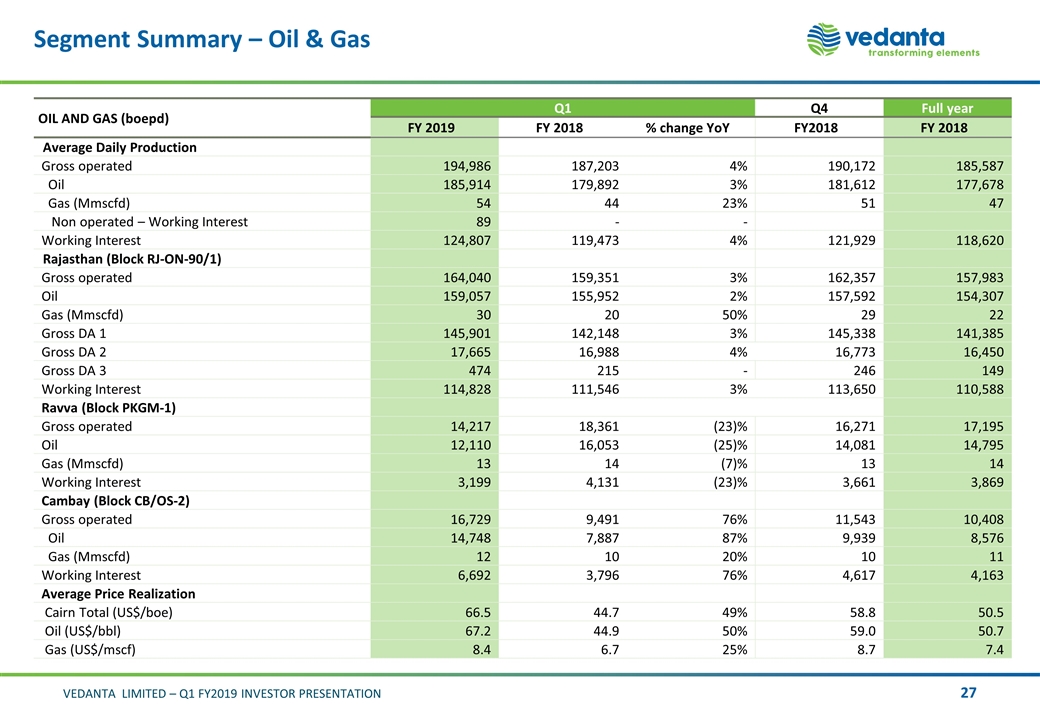

Segment Summary – Oil & Gas OIL AND GAS (boepd) Q1 Q4 Full year FY 2019 FY 2018 % change YoY FY2018 FY 2018 Average Daily Production Gross operated 194,986 187,203 4% 190,172 185,587 Oil 185,914 179,892 3% 181,612 177,678 Gas (Mmscfd) 54 44 23% 51 47 Non operated – Working Interest 89 - - Working Interest 124,807 119,473 4% 121,929 118,620 Rajasthan (Block RJ-ON-90/1) Gross operated 164,040 159,351 3% 162,357 157,983 Oil 159,057 155,952 2% 157,592 154,307 Gas (Mmscfd) 30 20 50% 29 22 Gross DA 1 145,901 142,148 3% 145,338 141,385 Gross DA 2 17,665 16,988 4% 16,773 16,450 Gross DA 3 474 215 - 246 149 Working Interest 114,828 111,546 3% 113,650 110,588 Ravva (Block PKGM-1) Gross operated 14,217 18,361 (23)% 16,271 17,195 Oil 12,110 16,053 (25)% 14,081 14,795 Gas (Mmscfd) 13 14 (7)% 13 14 Working Interest 3,199 4,131 (23)% 3,661 3,869 Cambay (Block CB/OS-2) Gross operated 16,729 9,491 76% 11,543 10,408 Oil 14,748 7,887 87% 9,939 8,576 Gas (Mmscfd) 12 10 20% 10 11 Working Interest 6,692 3,796 76% 4,617 4,163 Average Price Realization Cairn Total (US$/boe) 66.5 44.7 49% 58.8 50.5 Oil (US$/bbl) 67.2 44.9 50% 59.0 50.7 Gas (US$/mscf) 8.4 6.7 25% 8.7 7.4

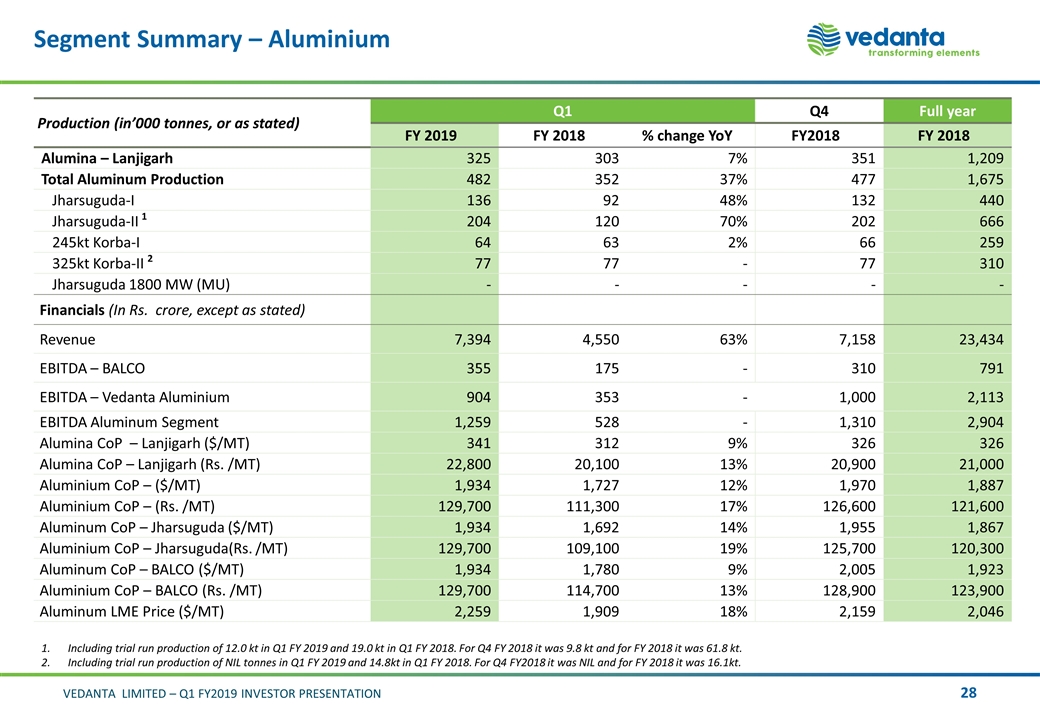

Segment Summary – Aluminium Production (in’000 tonnes, or as stated) Q1 Q4 Full year FY 2019 FY 2018 % change YoY FY2018 FY 2018 Alumina – Lanjigarh 325 303 7% 351 1,209 Total Aluminum Production 482 352 37% 477 1,675 Jharsuguda-I 136 92 48% 132 440 Jharsuguda-II 1 204 120 70% 202 666 245kt Korba-I 64 63 2% 66 259 325kt Korba-II 2 77 77 - 77 310 Jharsuguda 1800 MW (MU) - - - - - Financials (In Rs. crore, except as stated) Revenue 7,394 4,550 63% 7,158 23,434 EBITDA – BALCO 355 175 - 310 791 EBITDA – Vedanta Aluminium 904 353 - 1,000 2,113 EBITDA Aluminum Segment 1,259 528 - 1,310 2,904 Alumina CoP – Lanjigarh ($/MT) 341 312 9% 326 326 Alumina CoP – Lanjigarh (Rs. /MT) 22,800 20,100 13% 20,900 21,000 Aluminium CoP – ($/MT) 1,934 1,727 12% 1,970 1,887 Aluminium CoP – (Rs. /MT) 129,700 111,300 17% 126,600 121,600 Aluminum CoP – Jharsuguda ($/MT) 1,934 1,692 14% 1,955 1,867 Aluminium CoP – Jharsuguda(Rs. /MT) 129,700 109,100 19% 125,700 120,300 Aluminum CoP – BALCO ($/MT) 1,934 1,780 9% 2,005 1,923 Aluminium CoP – BALCO (Rs. /MT) 129,700 114,700 13% 128,900 123,900 Aluminum LME Price ($/MT) 2,259 1,909 18% 2,159 2,046 Including trial run production of 12.0 kt in Q1 FY 2019 and 19.0 kt in Q1 FY 2018. For Q4 FY 2018 it was 9.8 kt and for FY 2018 it was 61.8 kt. Including trial run production of NIL tonnes in Q1 FY 2019 and 14.8kt in Q1 FY 2018. For Q4 FY2018 it was NIL and for FY 2018 it was 16.1kt.

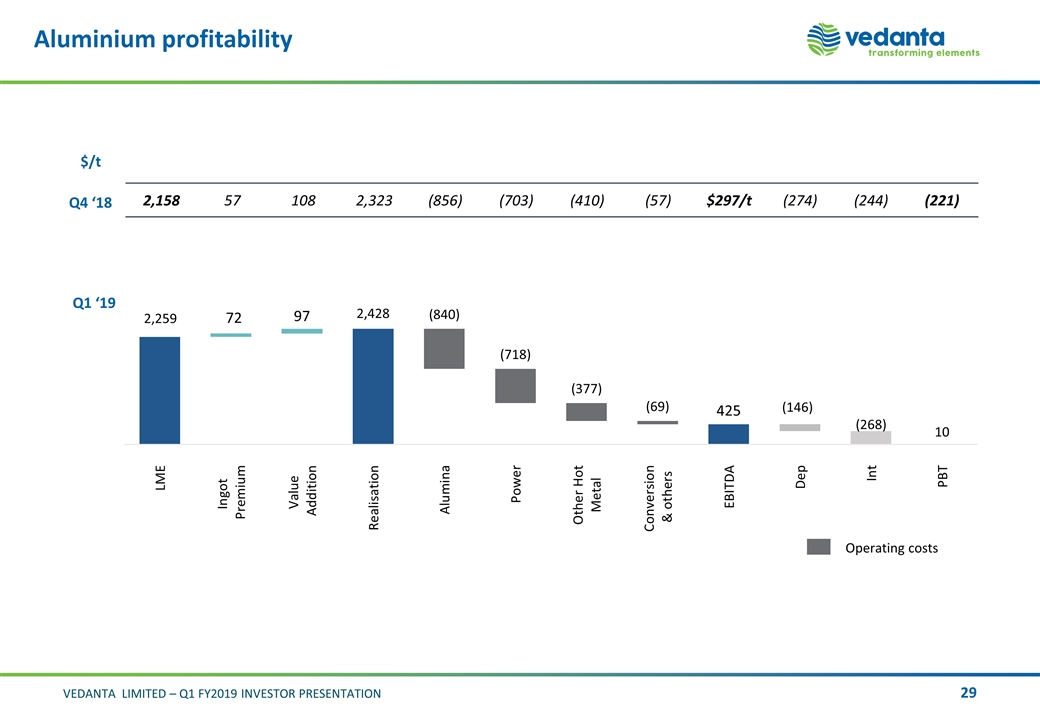

Aluminium profitability 2,158 57 108 2,323 (856) (703) (410) (57) $297/t (274) (244) (221) Q4 ‘18 Q1 ‘19 $/t

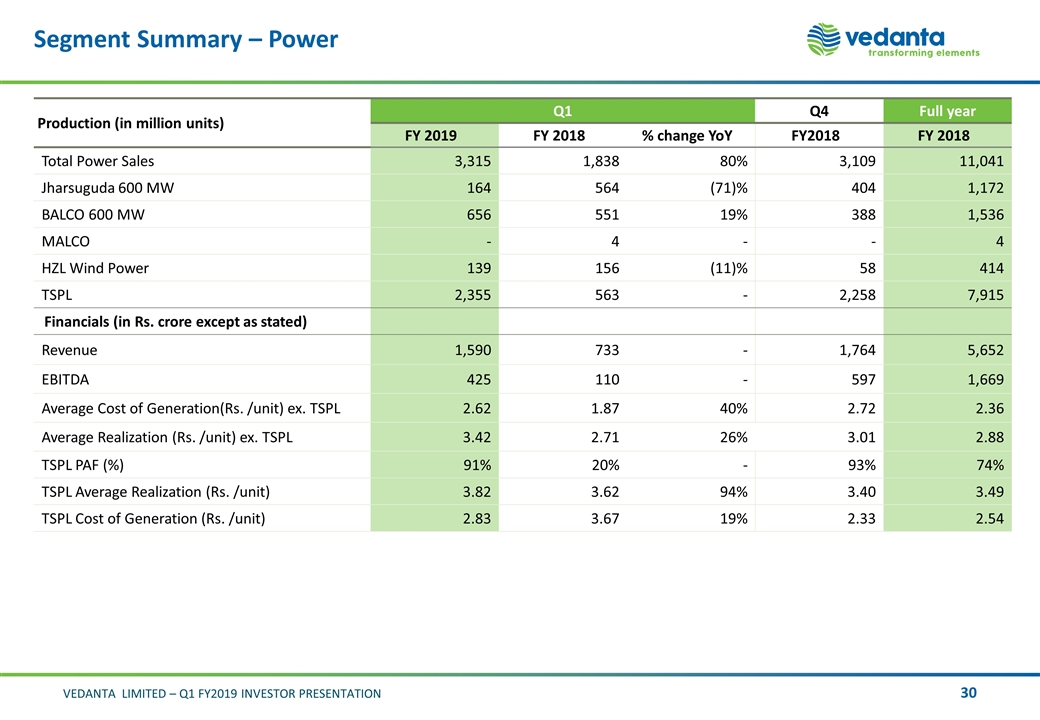

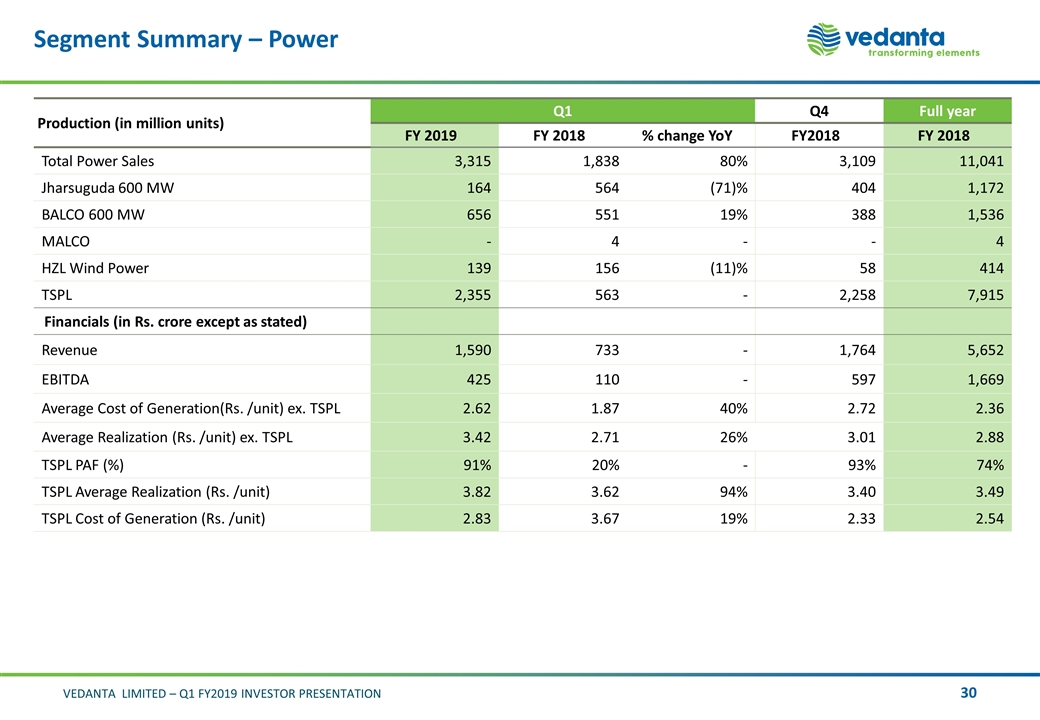

Segment Summary – Power Production (in million units) Q1 Q4 Full year FY 2019 FY 2018 % change YoY FY2018 FY 2018 Total Power Sales 3,315 1,838 80% 3,109 11,041 Jharsuguda 600 MW 164 564 (71)% 404 1,172 BALCO 600 MW 656 551 19% 388 1,536 MALCO - 4 - - 4 HZL Wind Power 139 156 (11)% 58 414 TSPL 2,355 563 - 2,258 7,915 Financials (in Rs. crore except as stated) Revenue 1,590 733 - 1,764 5,652 EBITDA 425 110 - 597 1,669 Average Cost of Generation(Rs. /unit) ex. TSPL 2.62 1.87 40% 2.72 2.36 Average Realization (Rs. /unit) ex. TSPL 3.42 2.71 26% 3.01 2.88 TSPL PAF (%) 91% 20% - 93% 74% TSPL Average Realization (Rs. /unit) 3.82 3.62 94% 3.40 3.49 TSPL Cost of Generation (Rs. /unit) 2.83 3.67 19% 2.33 2.54

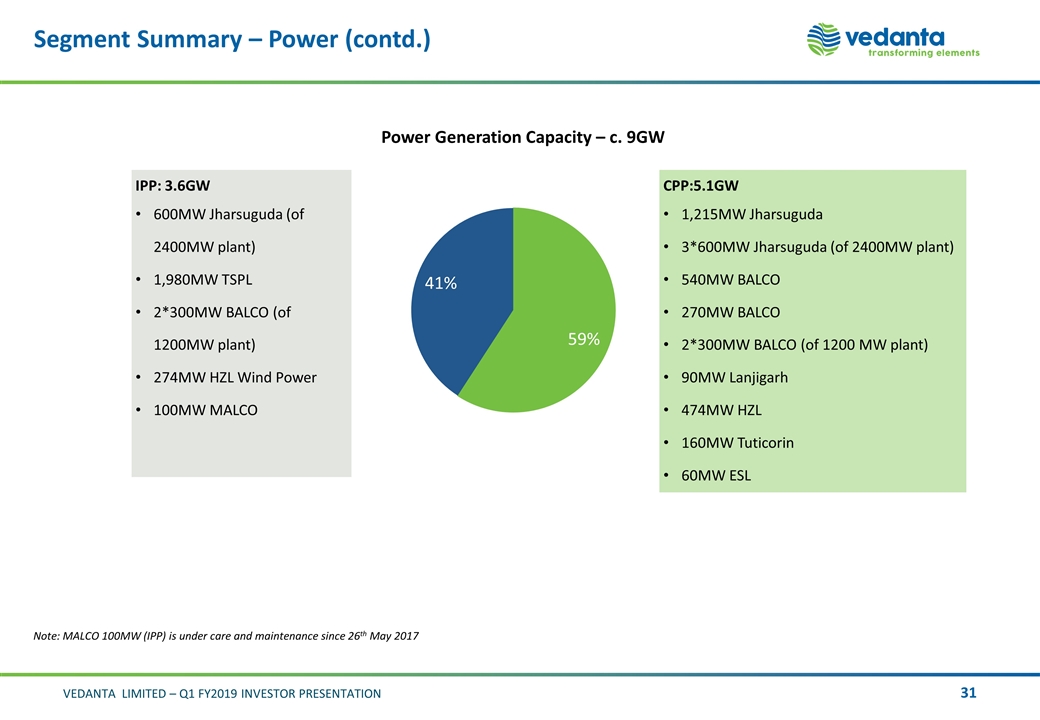

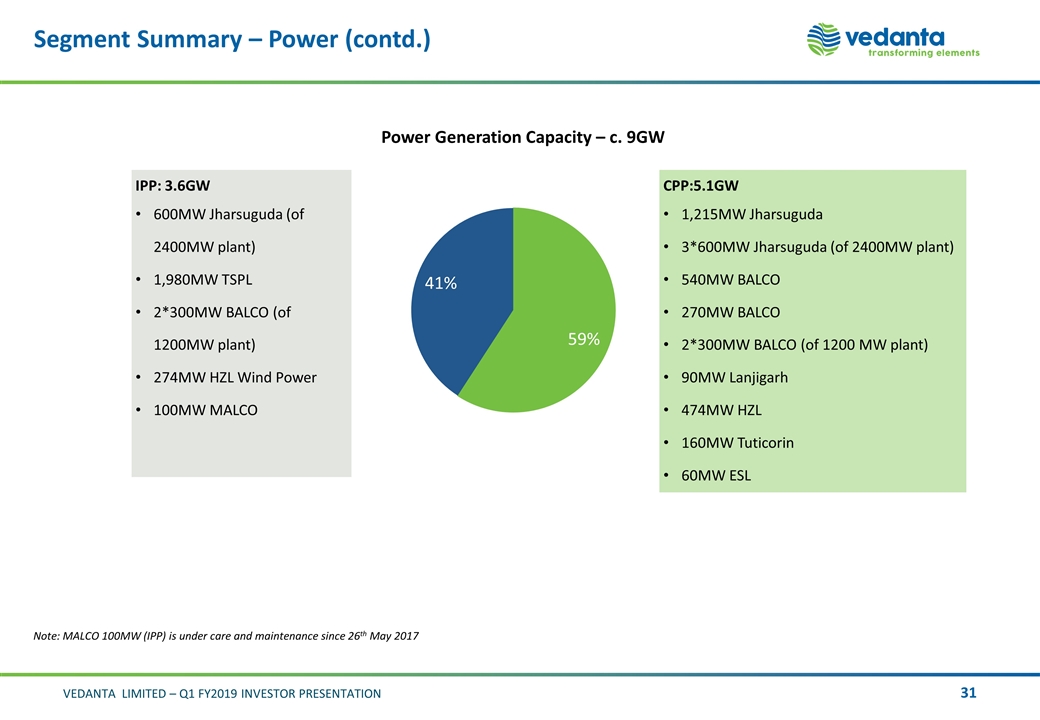

Segment Summary – Power (contd.) CPP:5.1GW 1,215MW Jharsuguda 3*600MW Jharsuguda (of 2400MW plant) 540MW BALCO 270MW BALCO 2*300MW BALCO (of 1200 MW plant) 90MW Lanjigarh 474MW HZL 160MW Tuticorin 60MW ESL IPP: 3.6GW 600MW Jharsuguda (of 2400MW plant) 1,980MW TSPL 2*300MW BALCO (of 1200MW plant) 274MW HZL Wind Power 100MW MALCO Power Generation Capacity – c. 9GW Note: MALCO 100MW (IPP) is under care and maintenance since 26th May 2017

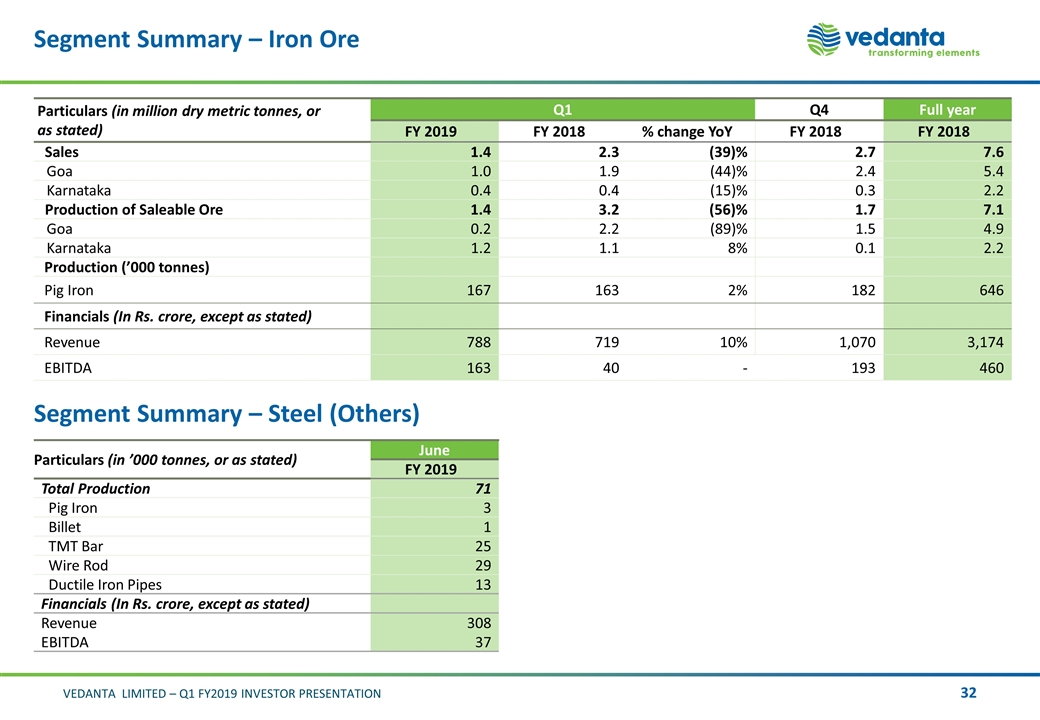

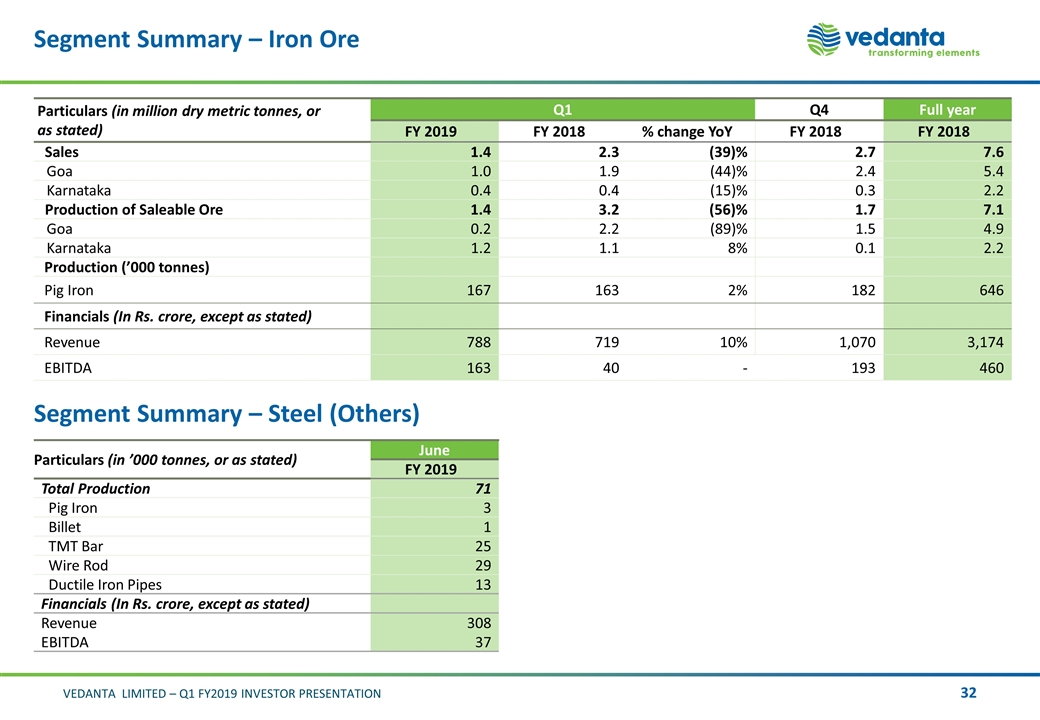

Segment Summary – Iron Ore Particulars (in million dry metric tonnes, or as stated) Q1 Q4 Full year FY 2019 FY 2018 % change YoY FY 2018 FY 2018 Sales 1.4 2.3 (39)% 2.7 7.6 Goa 1.0 1.9 (44)% 2.4 5.4 Karnataka 0.4 0.4 (15)% 0.3 2.2 Production of Saleable Ore 1.4 3.2 (56)% 1.7 7.1 Goa 0.2 2.2 (89)% 1.5 4.9 Karnataka 1.2 1.1 8% 0.1 2.2 Production (’000 tonnes) Pig Iron 167 163 2% 182 646 Financials (In Rs. crore, except as stated) Revenue 788 719 10% 1,070 3,174 EBITDA 163 40 - 193 460 Particulars (in ’000 tonnes, or as stated) June FY 2019 Total Production 71 Pig Iron 3 Billet 1 TMT Bar 25 Wire Rod 29 Ductile Iron Pipes 13 Financials (In Rs. crore, except as stated) Revenue 308 EBITDA 37 Segment Summary – Steel (Others)

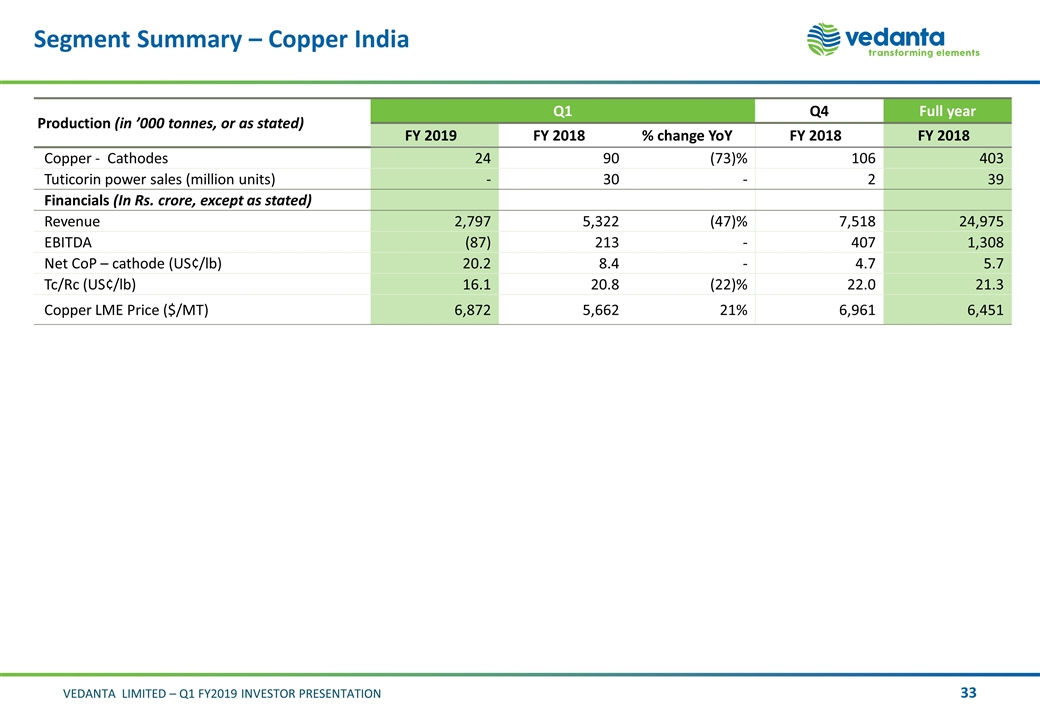

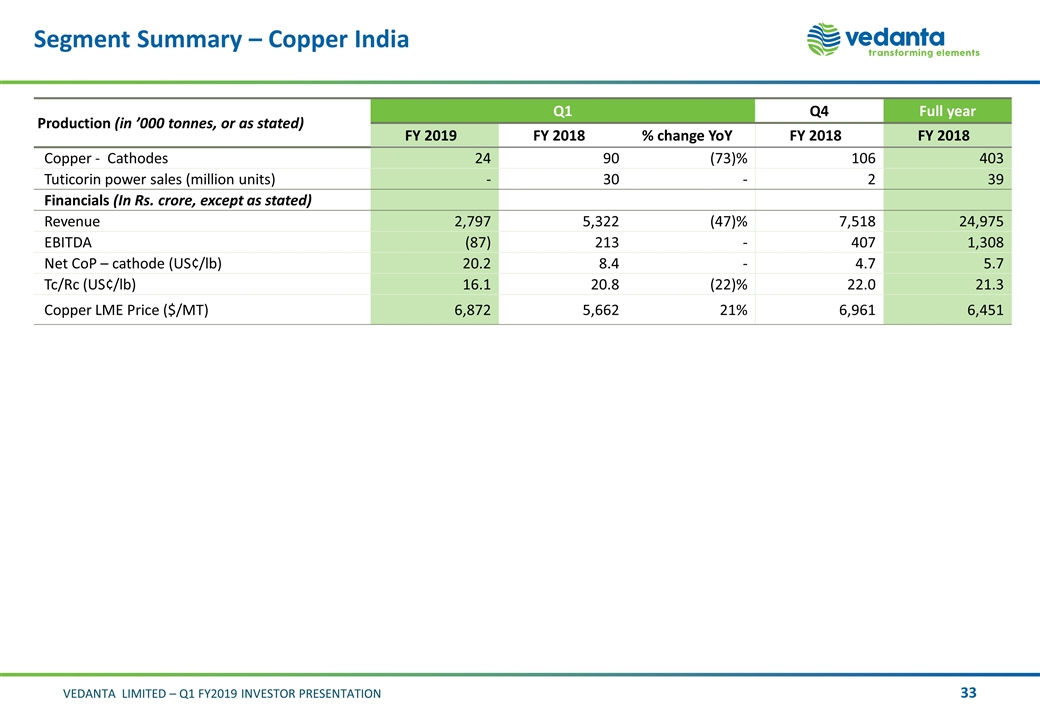

Segment Summary – Copper India Production (in ’000 tonnes, or as stated) Q1 Q4 Full year FY 2019 FY 2018 % change YoY FY 2018 FY 2018 Copper - Cathodes 24 90 (73)% 106 403 Tuticorin power sales (million units) - 30 - 2 39 Financials (In Rs. crore, except as stated) Revenue 2,797 5,322 (47)% 7,518 24,975 EBITDA (87) 213 - 407 1,308 Net CoP – cathode (US¢/lb) 20.2 8.4 - 4.7 5.7 Tc/Rc (US¢/lb) 16.1 20.8 (22)% 22.0 21.3 Copper LME Price ($/MT) 6,872 5,662 21% 6,961 6,451

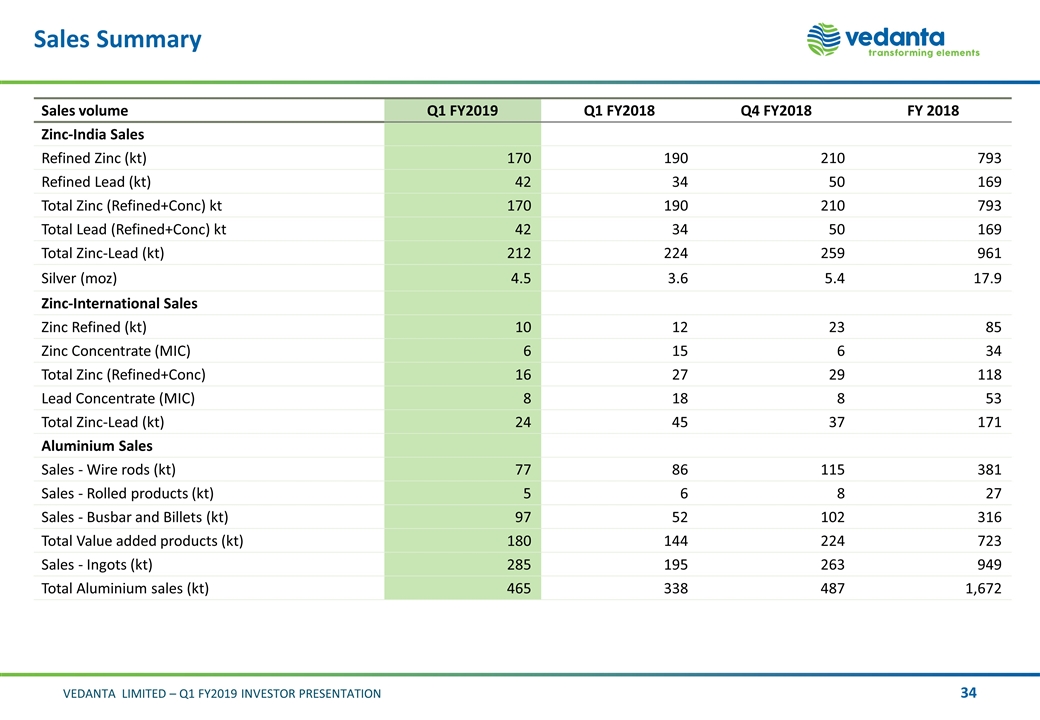

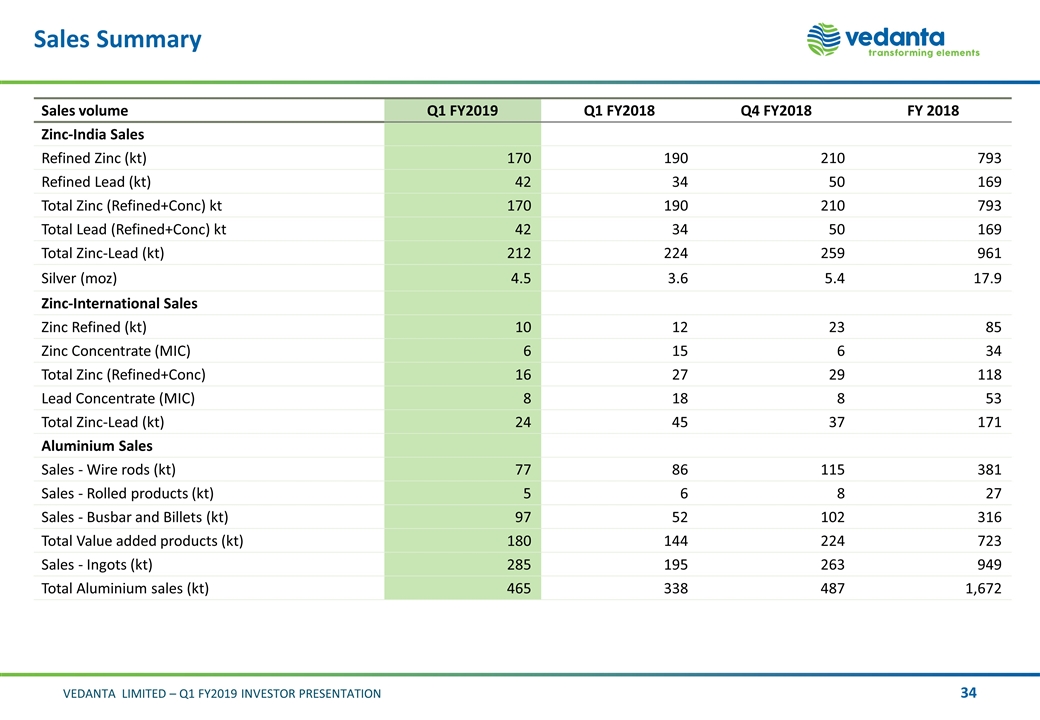

Sales Summary Sales volume Q1 FY2019 Q1 FY2018 Q4 FY2018 FY 2018 Zinc-India Sales Refined Zinc (kt) 170 190 210 793 Refined Lead (kt) 42 34 50 169 Total Zinc (Refined+Conc) kt 170 190 210 793 Total Lead (Refined+Conc) kt 42 34 50 169 Total Zinc-Lead (kt) 212 224 259 961 Silver (moz) 4.5 3.6 5.4 17.9 Zinc-International Sales Zinc Refined (kt) 10 12 23 85 Zinc Concentrate (MIC) 6 15 6 34 Total Zinc (Refined+Conc) 16 27 29 118 Lead Concentrate (MIC) 8 18 8 53 Total Zinc-Lead (kt) 24 45 37 171 Aluminium Sales Sales - Wire rods (kt) 77 86 115 381 Sales - Rolled products (kt) 5 6 8 27 Sales - Busbar and Billets (kt) 97 52 102 316 Total Value added products (kt) 180 144 224 723 Sales - Ingots (kt) 285 195 263 949 Total Aluminium sales (kt) 465 338 487 1,672

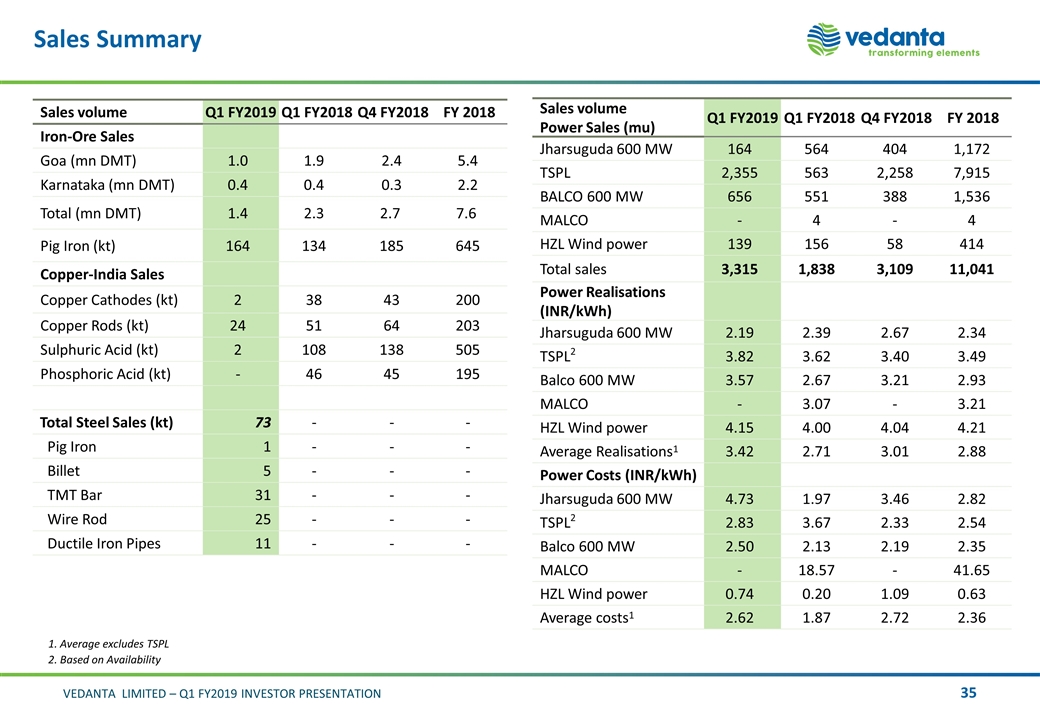

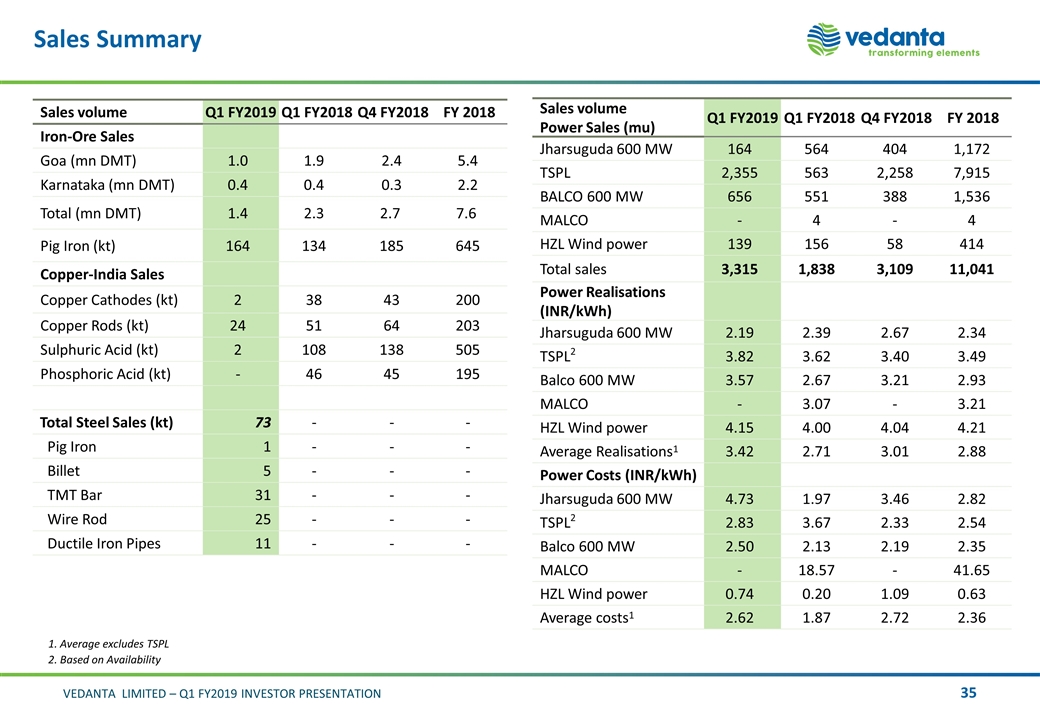

Sales Summary Sales volume Q1 FY2019 Q1 FY2018 Q4 FY2018 FY 2018 Iron-Ore Sales Goa (mn DMT) 1.0 1.9 2.4 5.4 Karnataka (mn DMT) 0.4 0.4 0.3 2.2 Total (mn DMT) 1.4 2.3 2.7 7.6 Pig Iron (kt) 164 134 185 645 Copper-India Sales Copper Cathodes (kt) 2 38 43 200 Copper Rods (kt) 24 51 64 203 Sulphuric Acid (kt) 2 108 138 505 Phosphoric Acid (kt) - 46 45 195 Total Steel Sales (kt) 73 - - - Pig Iron 1 - - - Billet 5 - - - TMT Bar 31 - - - Wire Rod 25 - - - Ductile Iron Pipes 11 - - - Sales volume Power Sales (mu) Q1 FY2019 Q1 FY2018 Q4 FY2018 FY 2018 Jharsuguda 600 MW 164 564 404 1,172 TSPL 2,355 563 2,258 7,915 BALCO 600 MW 656 551 388 1,536 MALCO - 4 - 4 HZL Wind power 139 156 58 414 Total sales 3,315 1,838 3,109 11,041 Power Realisations (INR/kWh) Jharsuguda 600 MW 2.19 2.39 2.67 2.34 TSPL2 3.82 3.62 3.40 3.49 Balco 600 MW 3.57 2.67 3.21 2.93 MALCO - 3.07 - 3.21 HZL Wind power 4.15 4.00 4.04 4.21 Average Realisations1 3.42 2.71 3.01 2.88 Power Costs (INR/kWh) Jharsuguda 600 MW 4.73 1.97 3.46 2.82 TSPL2 2.83 3.67 2.33 2.54 Balco 600 MW 2.50 2.13 2.19 2.35 MALCO - 18.57 - 41.65 HZL Wind power 0.74 0.20 1.09 0.63 Average costs1 2.62 1.87 2.72 2.36 1. Average excludes TSPL 2. Based on Availability

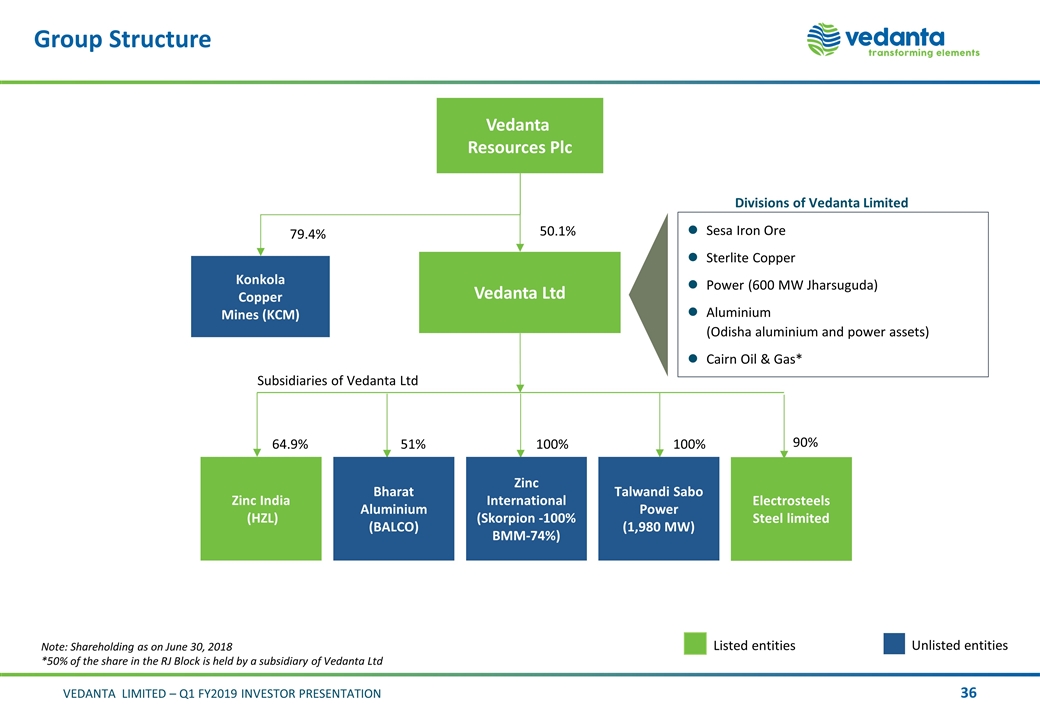

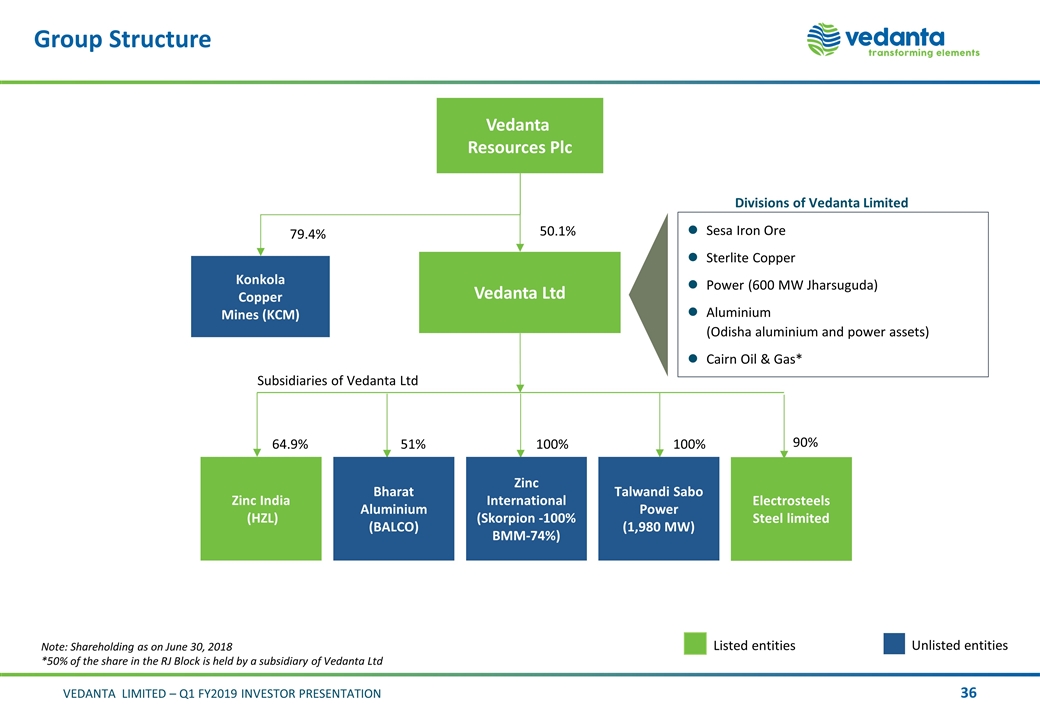

Group Structure Konkola Copper Mines (KCM) 50.1% Vedanta Resources Plc 64.9% Zinc India (HZL) Vedanta Ltd 79.4% Subsidiaries of Vedanta Ltd Sesa Iron Ore Sterlite Copper Power (600 MW Jharsuguda) Aluminium (Odisha aluminium and power assets) Cairn Oil & Gas* Divisions of Vedanta Limited Unlisted entities Listed entities Talwandi Sabo Power (1,980 MW) 100% Zinc International (Skorpion -100% BMM-74%) 100% 51% Bharat Aluminium (BALCO) Note: Shareholding as on June 30, 2018 *50% of the share in the RJ Block is held by a subsidiary of Vedanta Ltd Electrosteels Steel limited 90%

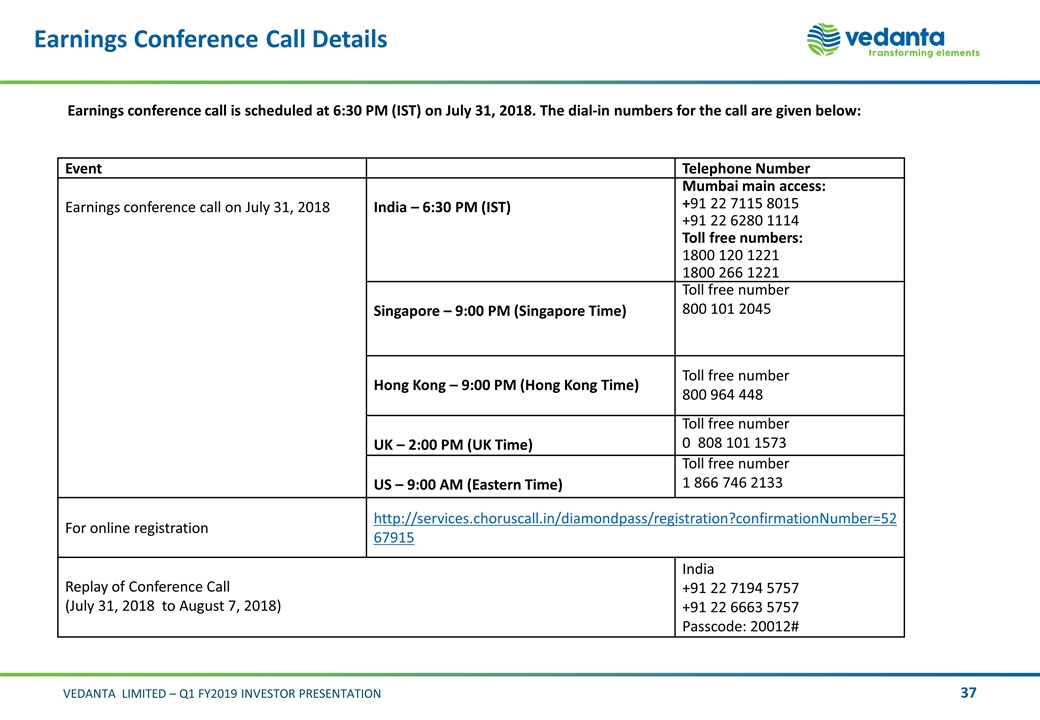

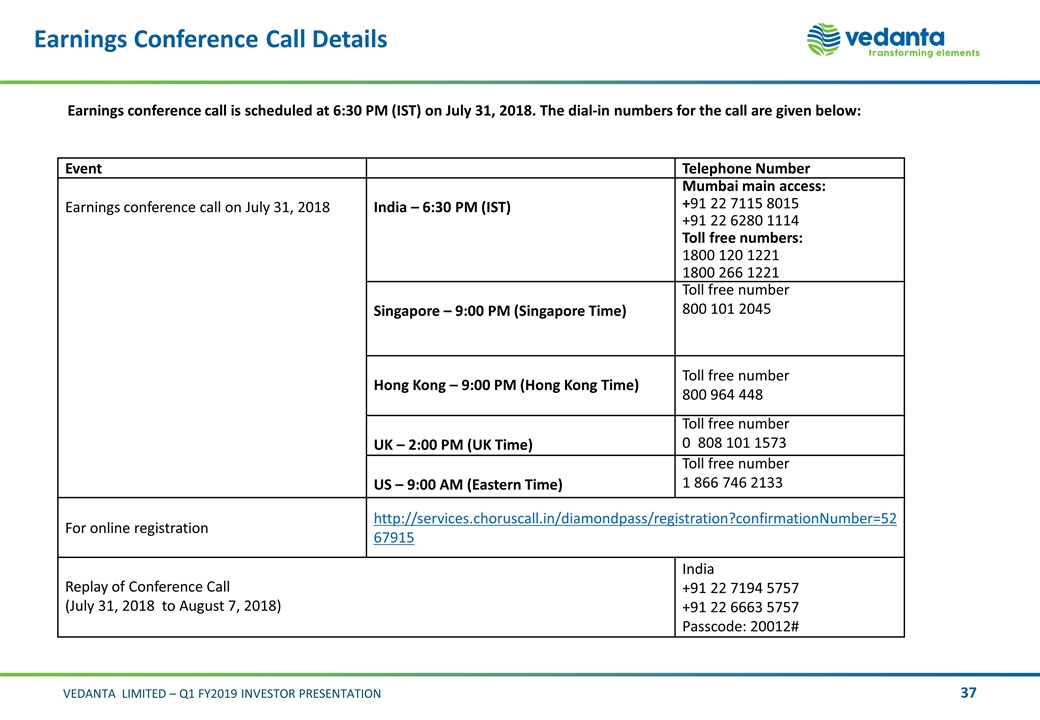

Earnings Conference Call Details Earnings conference call is scheduled at 6:30 PM (IST) on July 31, 2018. The dial-in numbers for the call are given below: Event Telephone Number Earnings conference call on July 31, 2018 India – 6:30 PM (IST) Mumbai main access: +91 22 7115 8015 +91 22 6280 1114 Toll free numbers: 1800 120 1221 1800 266 1221 Singapore – 9:00 PM (Singapore Time) Toll free number 800 101 2045 Hong Kong – 9:00 PM (Hong Kong Time) Toll free number 800 964 448 UK – 2:00 PM (UK Time) Toll free number 0 808 101 1573 US – 9:00 AM (Eastern Time) Toll free number 1 866 746 2133 For online registration http://services.choruscall.in/diamondpass/registration?confirmationNumber=5267915 Replay of Conference Call (July 31, 2018 to August 7, 2018) India +91 22 7194 5757 +91 22 6663 5757 Passcode: 20012#