INVESTOR PRESENTATION-Q2 FY2019 Vedanta Limited 31 October 2018 Channelling O I L & G A S | Z I N C & S I L V E R | A L U M I N I U M | P O W E R | I R O N O R E | S T E E L | C O P P E R 130 199 2 0 99 168 109 110 113 growth opportunities Exhibit 99.4

Cautionary Statement and Disclaimer The views expressed here may contain information derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness, reasonableness or reliability of this information. Any forward looking information in this presentation including, without limitation, any tables, charts and/or graphs, has been prepared on the basis of a number of assumptions which may prove to be incorrect. This presentation should not be relied upon as a recommendation or forecast by Vedanta Resources plc and Vedanta Limited and any of their subsidiaries. Past performance of Vedanta Resources plc and Vedanta Limited and any of their subsidiaries cannot be relied upon as a guide to future performance. This presentation contains 'forward-looking statements' – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance, and often contain words such as 'expects,' 'anticipates,' 'intends,' 'plans,' 'believes,' 'seeks,' or 'will.' Forward–looking statements by their nature address matters that are, to different degrees, uncertain. For us, uncertainties arise from the behaviour of financial and metals markets including the London Metal Exchange, fluctuations in interest and or exchange rates and metal prices; from future integration of acquired businesses; and from numerous other matters of national, regional and global scale, including those of a environmental, climatic, natural, political, economic, business, competitive or regulatory nature. These uncertainties may cause our actual future results to be materially different that those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements. We caution you that reliance on any forward-looking statement involves risk and uncertainties, and that, although we believe that the assumption on which our forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate and, as a result, the forward-looking statement based on those assumptions could be materially incorrect. This presentation is not intended, and does not, constitute or form part of any offer, invitation or the solicitation of an offer to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of, any securities in Vedanta Resources plc and Vedanta Limited and any of their subsidiaries or undertakings or any other invitation or inducement to engage in investment activities, nor shall this presentation (or any part of it) nor the fact of its distribution form the basis of, or be relied on in connection with, any contract or investment decision.

Contents Q2 FY2019 Review Venkat, CEO Financial Update Arun Kumar, CFO Growth Projects and Business Deep Dive Venkat, CEO O&G Business Sudhir Mathur, CEO - Cairn Oil & Gas

Q2 FY2019 Review Venkat Chief Executive Officer

Health, Safety, Environment and Sustainability Safety 3 fatalities in Q2 FY19 Environment and Sustainability HZL - 1st in Environment category, DJSI global rankings for metals & mining; Overall ranking improves to #5 from #11 Fly-ash recycling rate at 107% in H1FY19 (90% in FY18) Community 32,000+ women part of 2,600+ Vedanta promoted self-help-groups and related programs such as Sakhi at HZL 3,400+ youths trained in different trades through 11 projects like Tamira Muthukkal at Tuticorin Water Management Water risk mitigation measures for water self-sufficiency Dariba, HZL - uses treated water from Sewage Treatment plant TSPL - Onsite storage increase Commitment to conserve 1.5 million m3 of water in FY19 - Greater than 600km3 saved in Q2

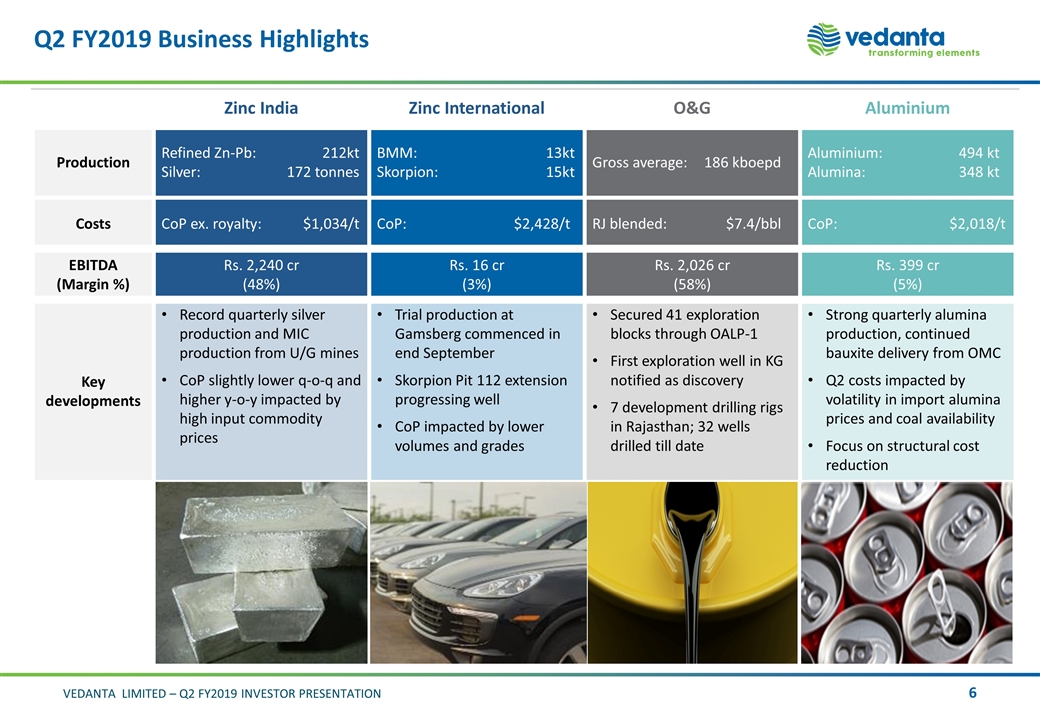

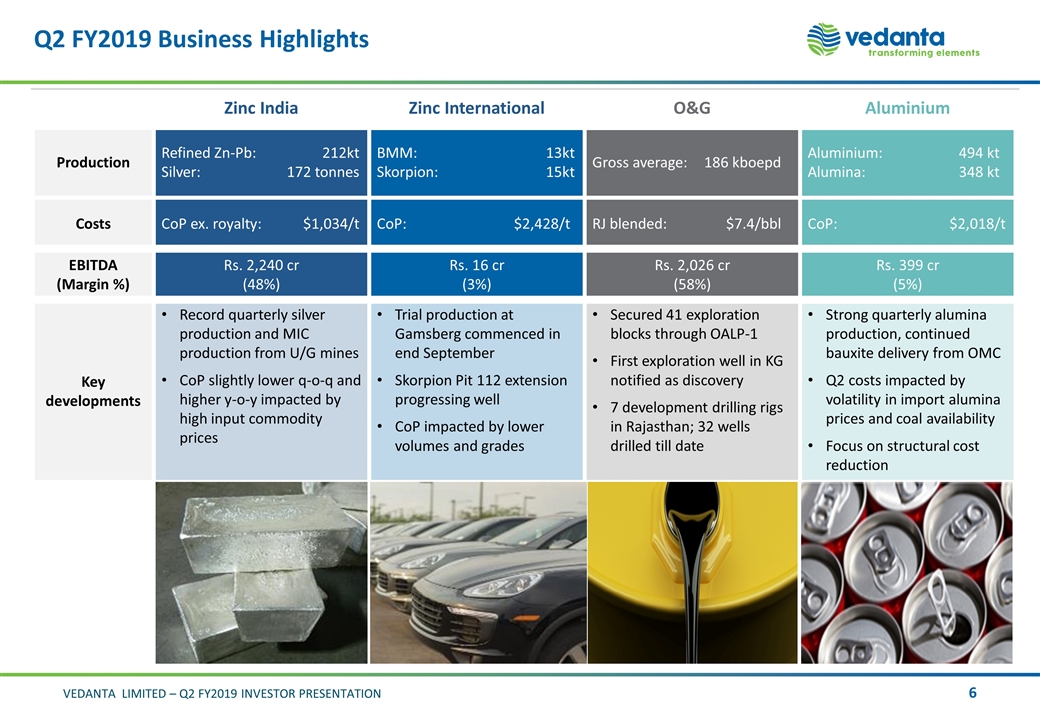

Q2 FY2019 Business Highlights Zinc India Zinc International O&G Aluminium Production Refined Zn-Pb: 212kt Silver:172 tonnes BMM:13kt Skorpion:15kt Gross average: 186 kboepd Aluminium: 494 kt Alumina:348 kt Costs CoP ex. royalty: $1,034/t CoP:$2,428/t RJ blended: $7.4/bbl CoP:$2,018/t EBITDA (Margin %) Rs. 2,240 cr (48%) Rs. 16 cr (3%) Rs. 2,026 cr (58%) Rs. 399 cr (5%) Key developments Record quarterly silver production and MIC production from U/G mines CoP slightly lower q-o-q and higher y-o-y impacted by high input commodity prices Trial production at Gamsberg commenced in end September Skorpion Pit 112 extension progressing well CoP impacted by lower volumes and grades Secured 41 exploration blocks through OALP-1 First exploration well in KG notified as discovery 7 development drilling rigs in Rajasthan; 32 wells drilled till date Strong quarterly alumina production, continued bauxite delivery from OMC Q2 costs impacted by volatility in import alumina prices and coal availability Focus on structural cost reduction

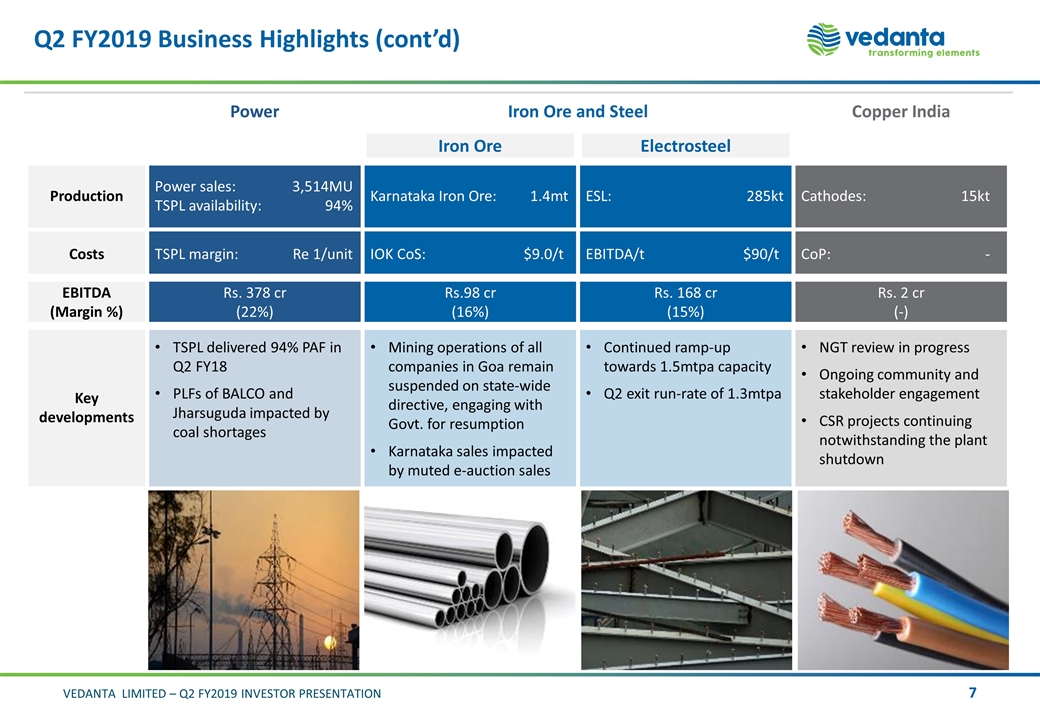

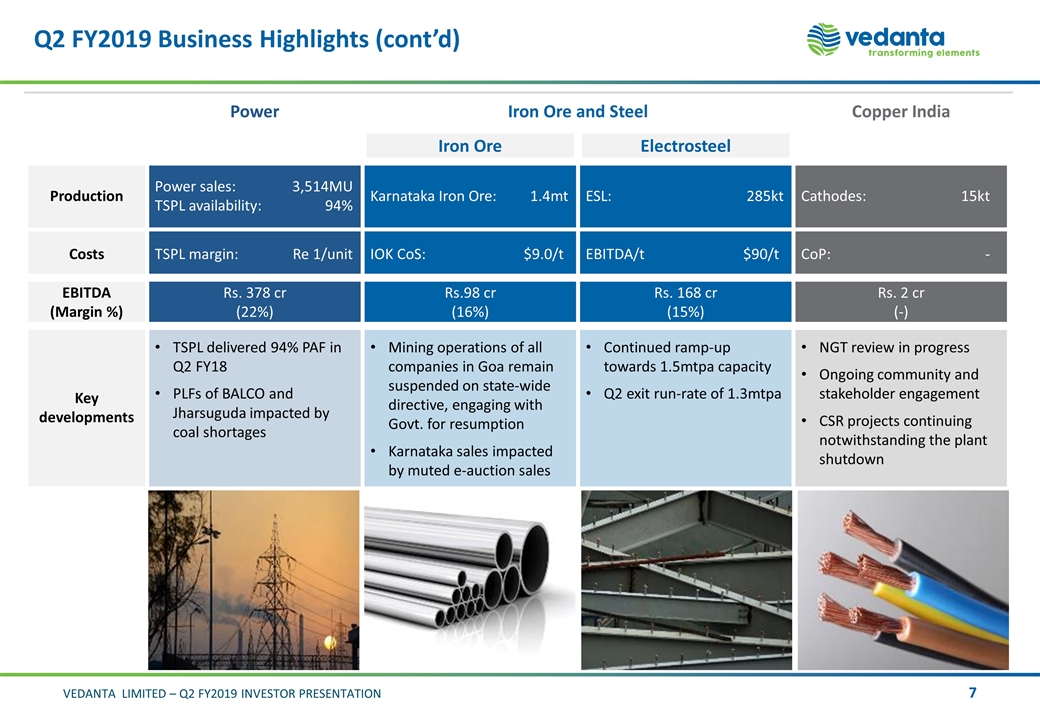

Q2 FY2019 Business Highlights (cont’d) Power Iron Ore and Steel Copper India Iron Ore Electrosteel Production Power sales: 3,514MU TSPL availability:94% Karnataka Iron Ore:1.4mt ESL:285kt Cathodes: 15kt Costs TSPL margin: Re 1/unit IOK CoS:$9.0/t EBITDA/t$90/t CoP: - EBITDA (Margin %) Rs. 378 cr (22%) Rs.98 cr (16%) Rs. 168 cr (15%) Rs. 2 cr (-) Key developments TSPL delivered 94% PAF in Q2 FY18 PLFs of BALCO and Jharsuguda impacted by coal shortages Mining operations of all companies in Goa remain suspended on state-wide directive, engaging with Govt. for resumption Karnataka sales impacted by muted e-auction sales Continued ramp-up towards 1.5mtpa capacity Q2 exit run-rate of 1.3mtpa NGT review in progress Ongoing community and stakeholder engagement CSR projects continuing notwithstanding the plant shutdown

Financial Update Arun Kumar Chief Financial Officer

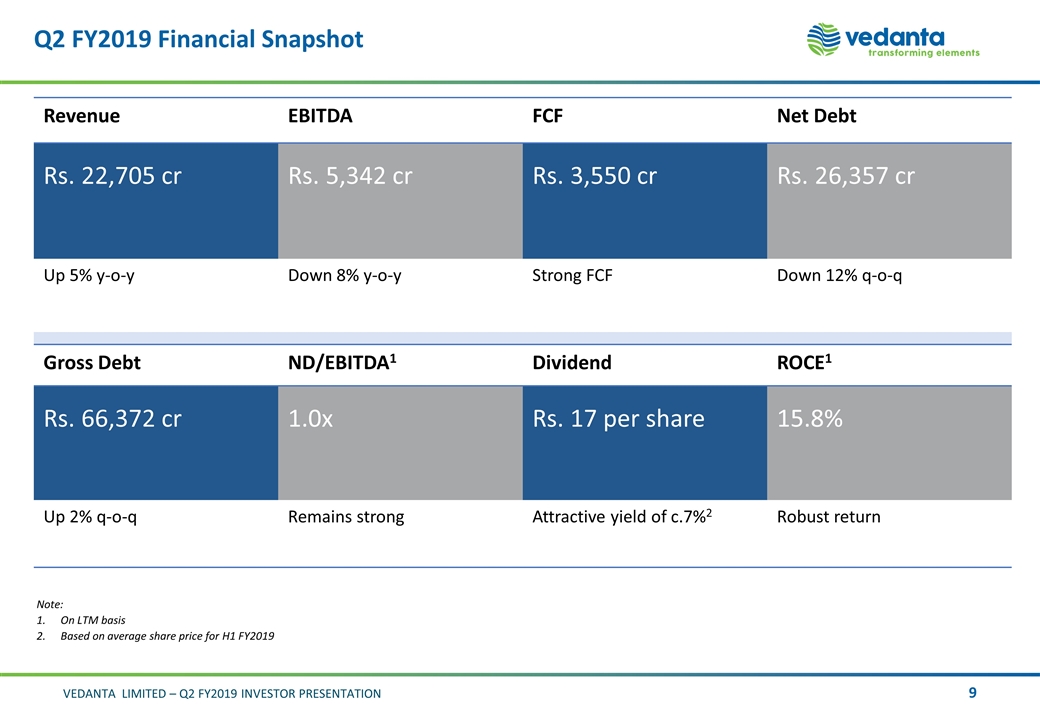

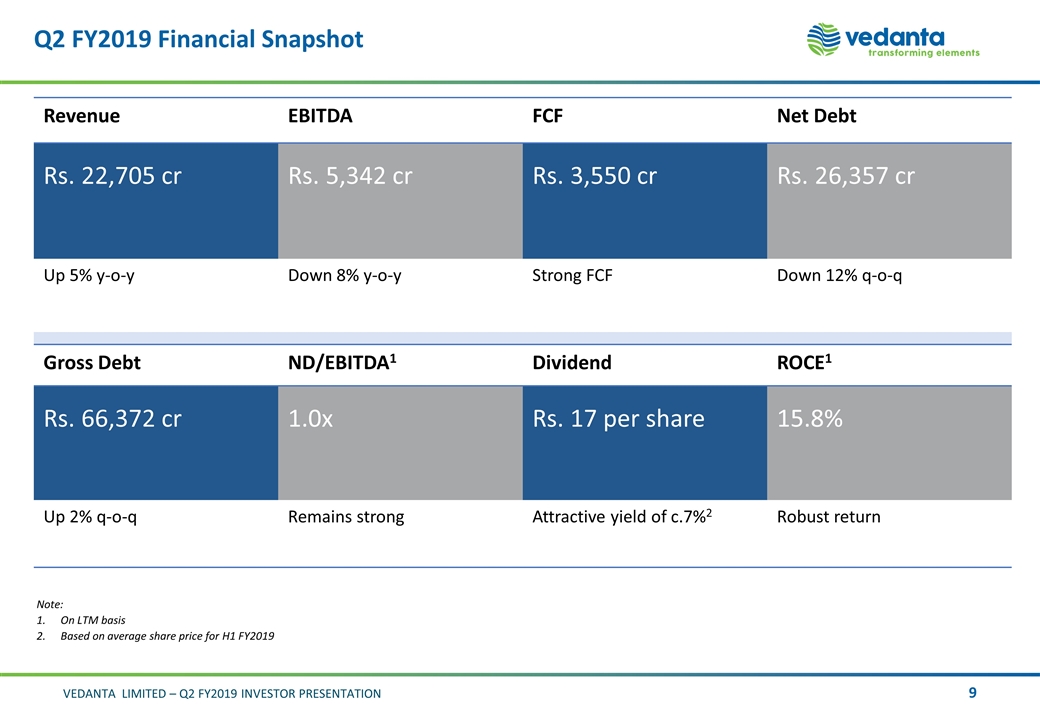

Q2 FY2019 Financial Snapshot Revenue EBITDA FCF Net Debt Rs. 22,705 cr Rs. 5,342 cr Rs. 3,550 cr Rs. 26,357 cr Up 5% y-o-y Down 8% y-o-y Strong FCF Down 12% q-o-q Gross Debt ND/EBITDA1 Dividend ROCE1 Rs. 66,372 cr 1.0x Rs. 17 per share 15.8% Up 2% q-o-q Remains strong Attractive yield of c.7%2 Robust return Note: On LTM basis Based on average share price for H1 FY2019

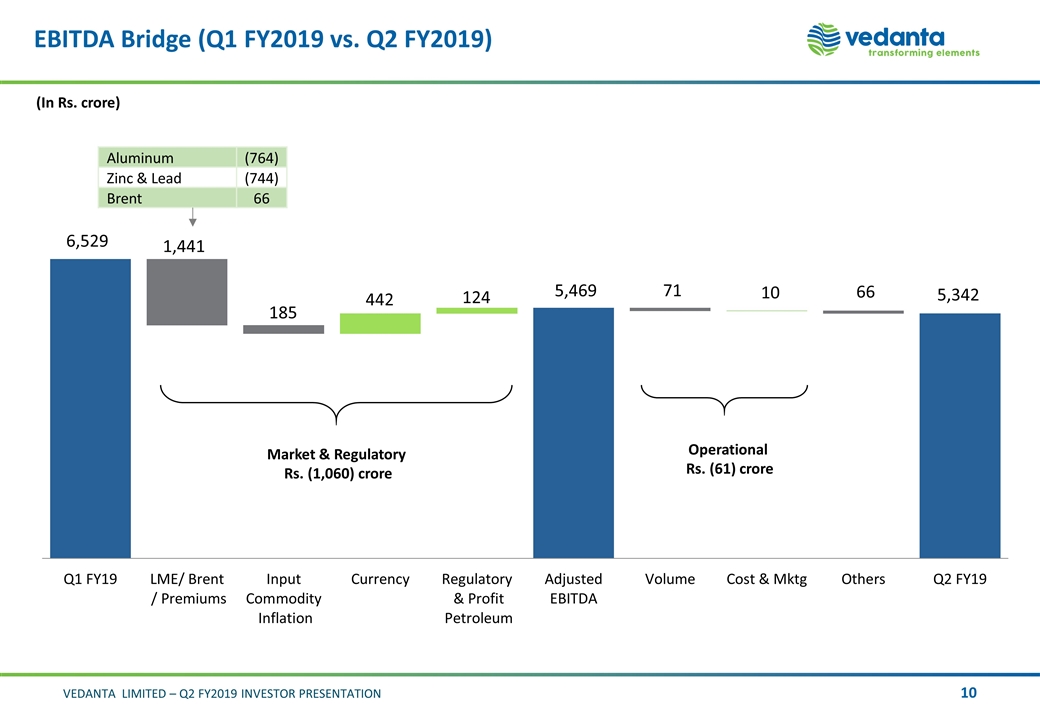

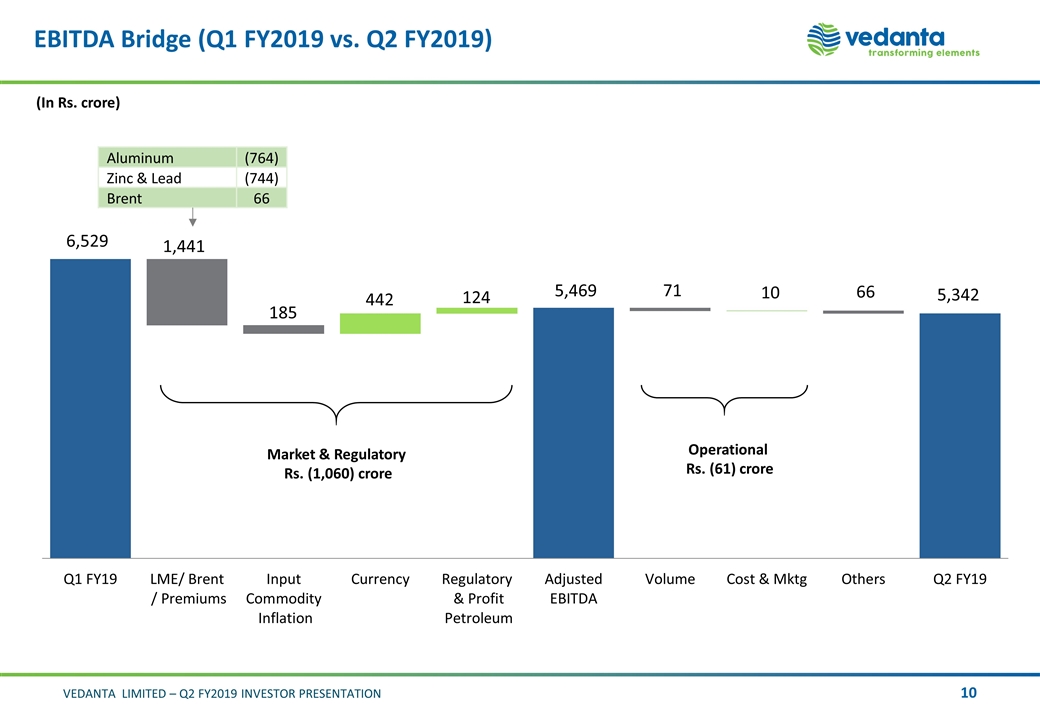

EBITDA Bridge (Q1 FY2019 vs. Q2 FY2019) (In Rs. crore) Market & Regulatory Rs. (1,060) crore Operational Rs. (61) crore Aluminum (764) Zinc & Lead (744) Brent 66

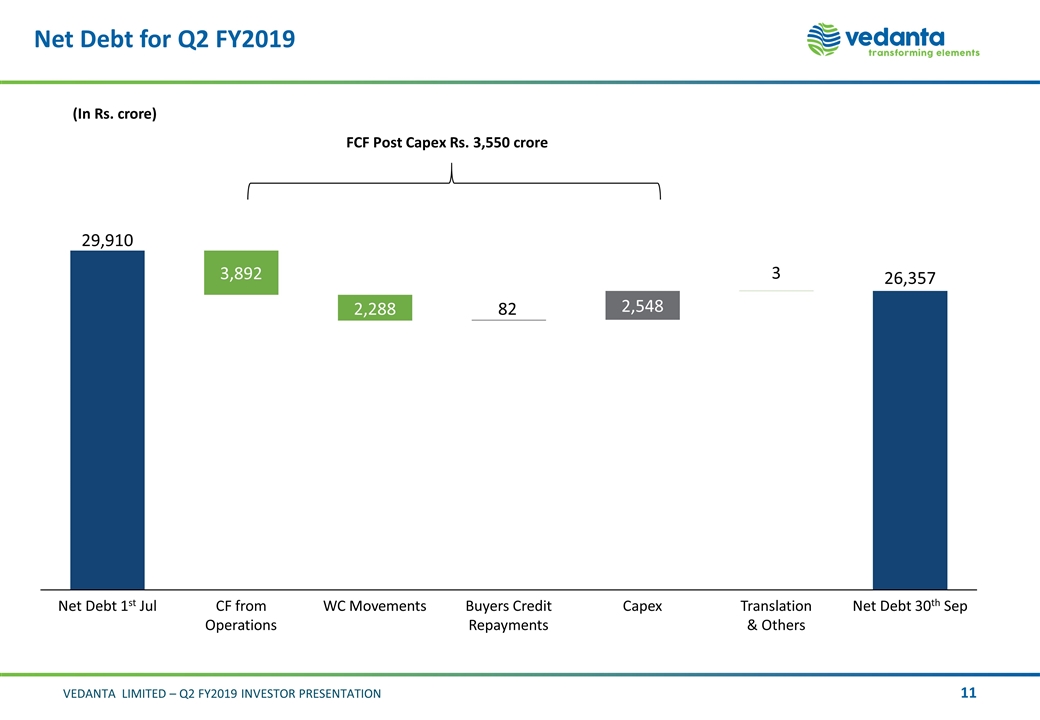

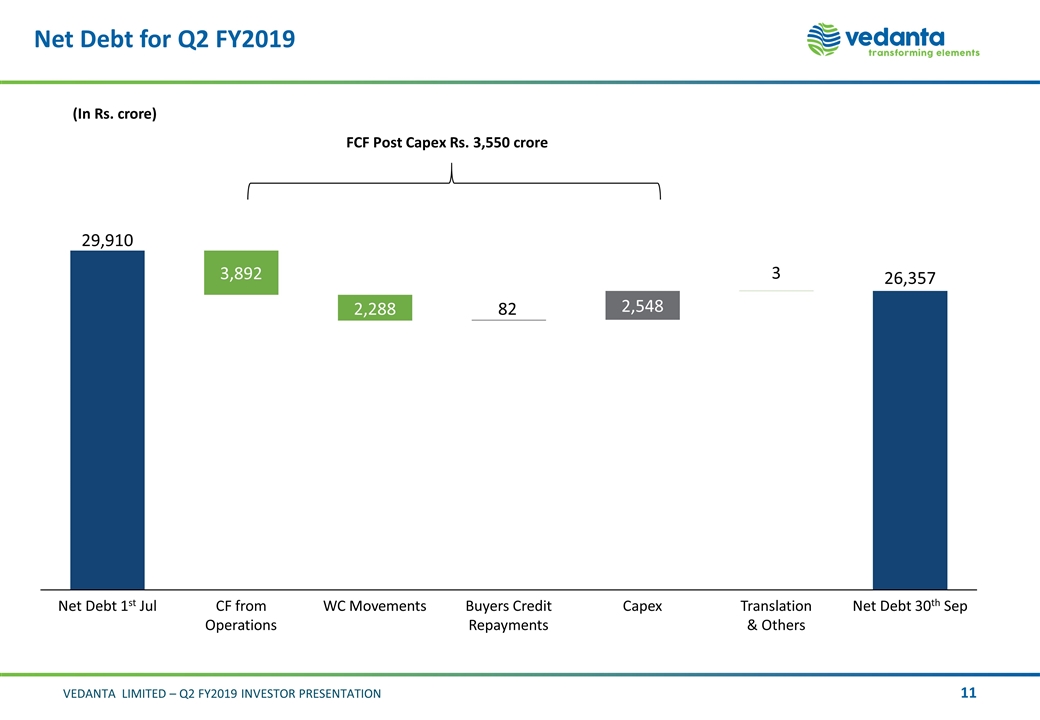

Net Debt for Q2 FY2019 FCF Post Capex Rs. 3,550 crore (In Rs. crore) Net Debt 1st Jul Net Debt 30th Sep

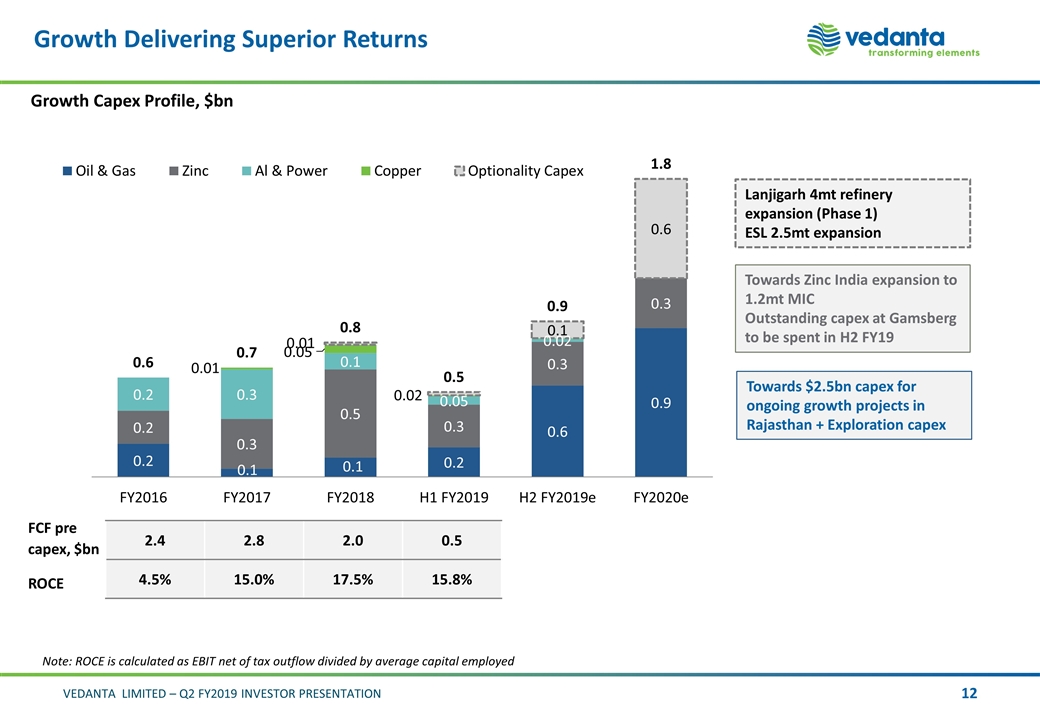

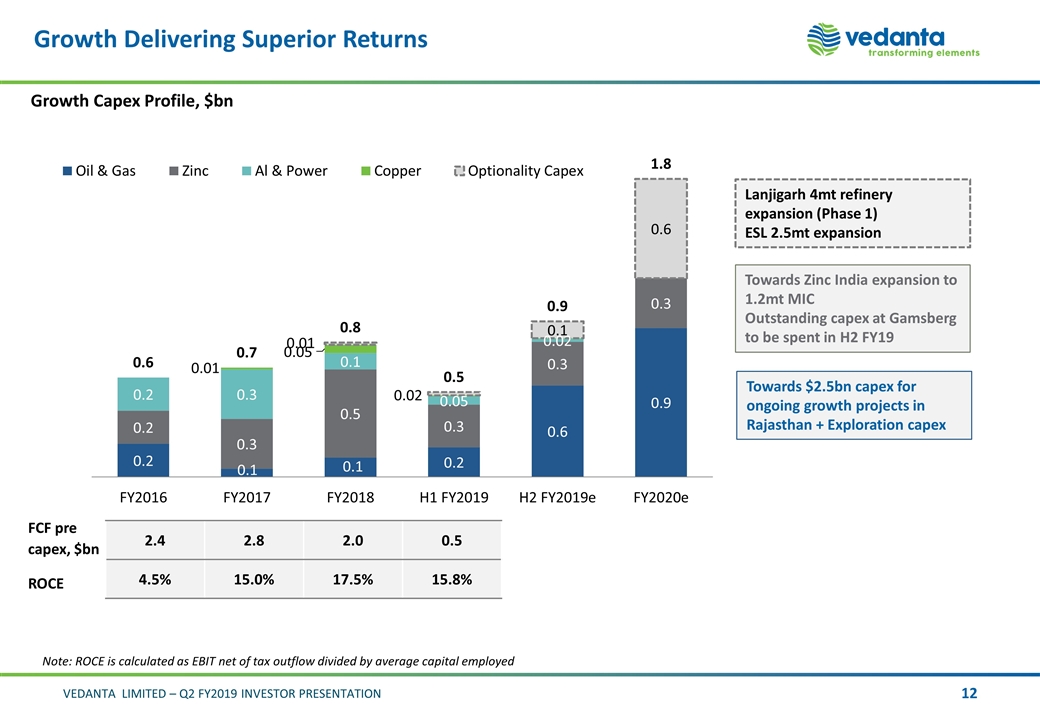

Growth Delivering Superior Returns Growth Capex Profile, $bn Note: ROCE is calculated as EBIT net of tax outflow divided by average capital employed FCF pre capex, $bn ROCE 2.4 2.8 2.0 0.5 4.5% 15.0% 17.5% 15.8% Towards $2.5bn capex for ongoing growth projects in Rajasthan + Exploration capex Towards Zinc India expansion to 1.2mt MIC Outstanding capex at Gamsberg to be spent in H2 FY19 Lanjigarh 4mt refinery expansion (Phase 1) ESL 2.5mt expansion

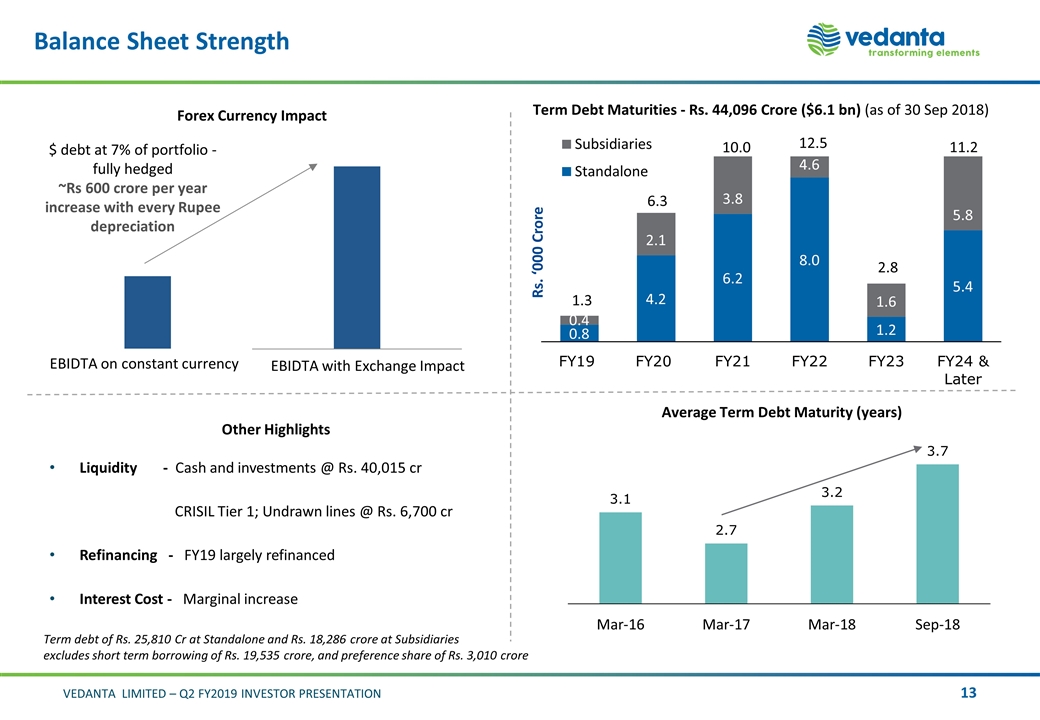

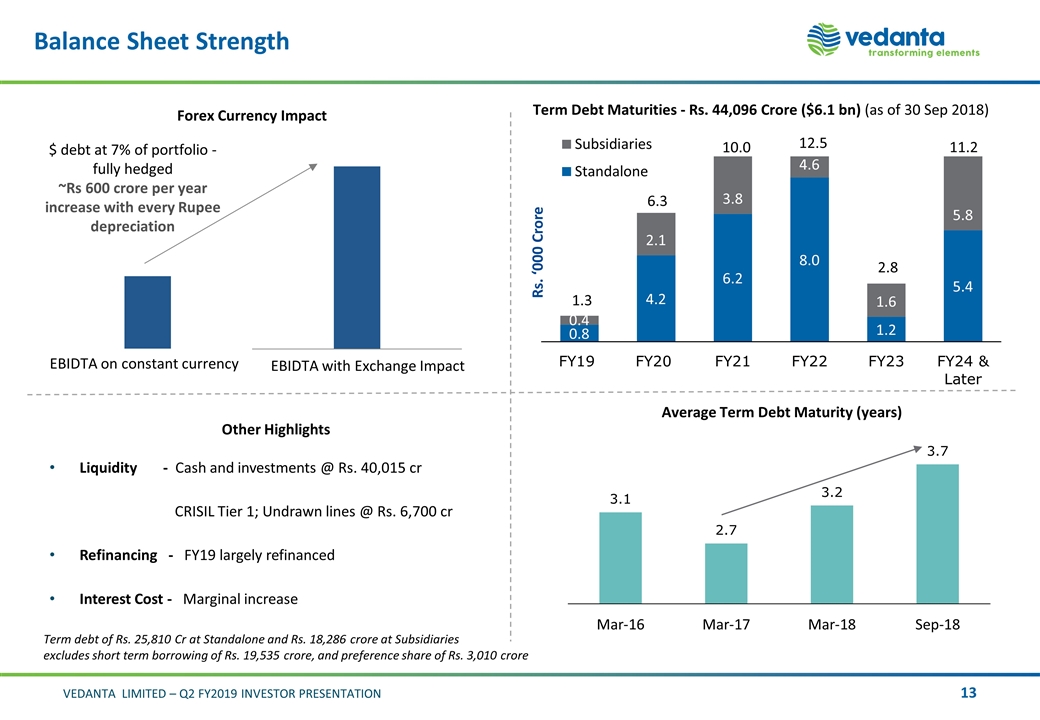

Balance Sheet Strength Term debt of Rs. 25,810 Cr at Standalone and Rs. 18,286 crore at Subsidiaries excludes short term borrowing of Rs. 19,535 crore, and preference share of Rs. 3,010 crore Other Highlights Liquidity - Cash and investments @ Rs. 40,015 cr CRISIL Tier 1; Undrawn lines @ Rs. 6,700 cr Refinancing - FY19 largely refinanced Interest Cost - Marginal increase

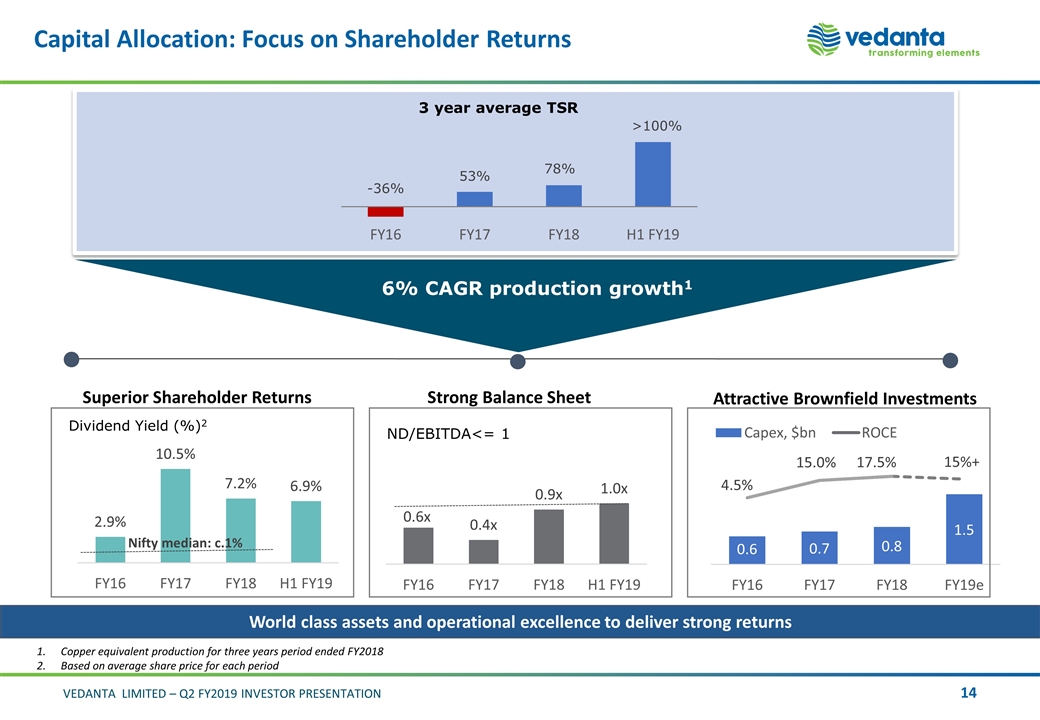

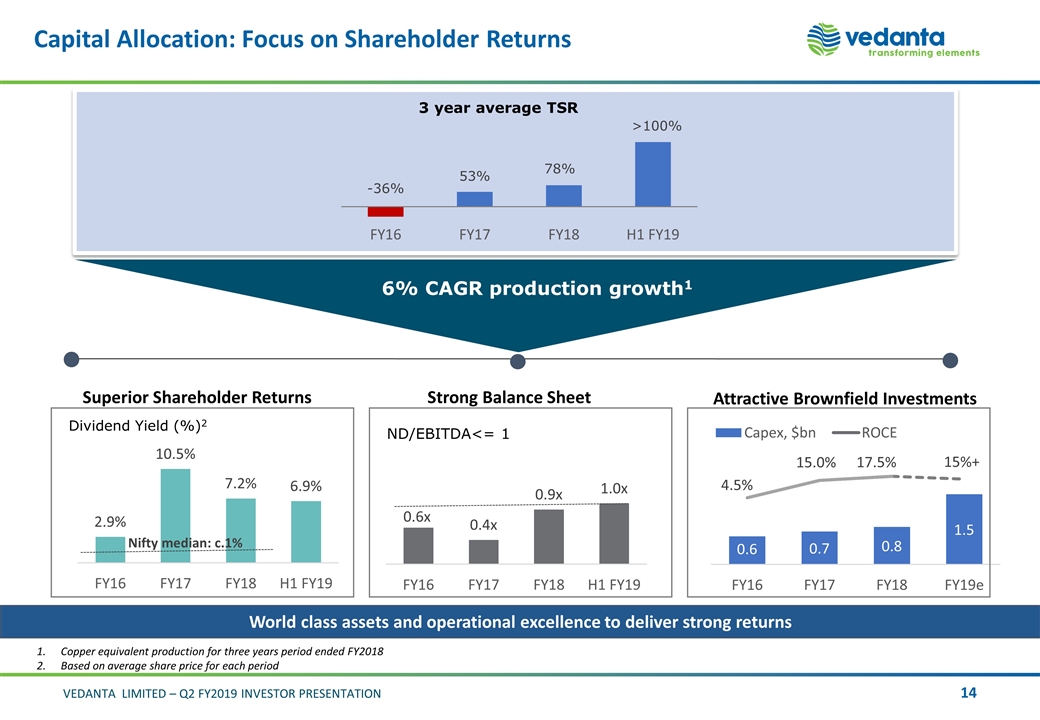

Capital Allocation: Focus on Shareholder Returns 6% CAGR production growth1 Dividend Yield (%)2 ND/EBITDA<= 1 World class assets and operational excellence to deliver strong returns 3 year average TSR Copper equivalent production for three years period ended FY2018 Based on average share price for each period Superior Shareholder Returns Strong Balance Sheet Attractive Brownfield Investments 15%+ Nifty median: c.1%

Growth Projects and Business Deep Dive Venkat Chief Executive Officer Sudhir Mathur CEO – Cairn Oil & Gas

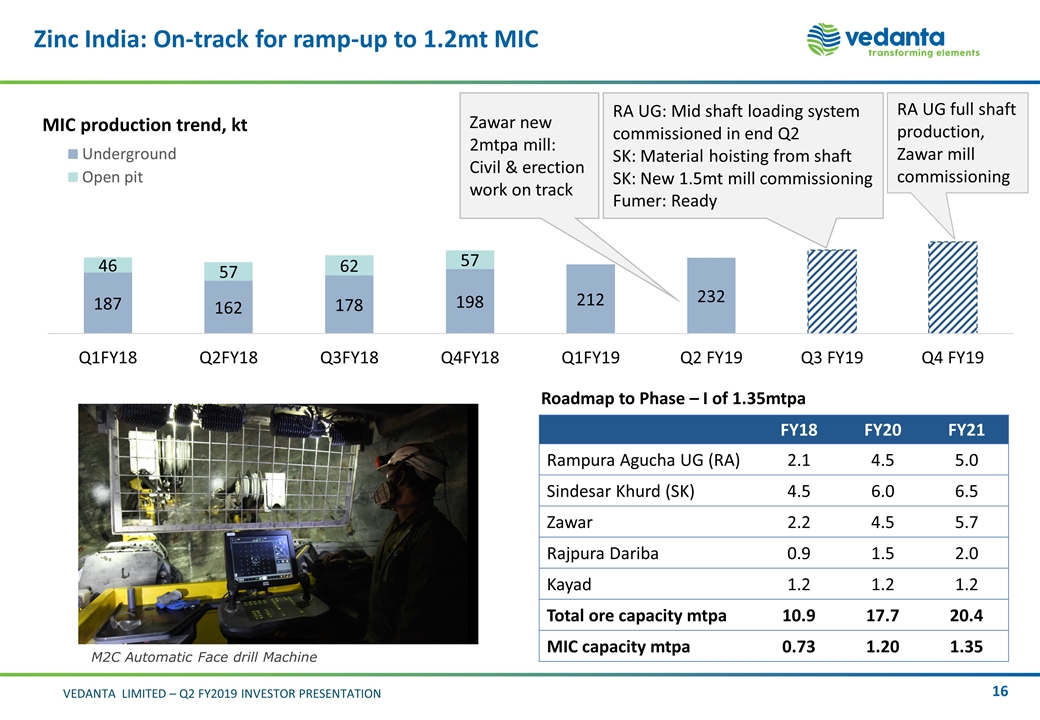

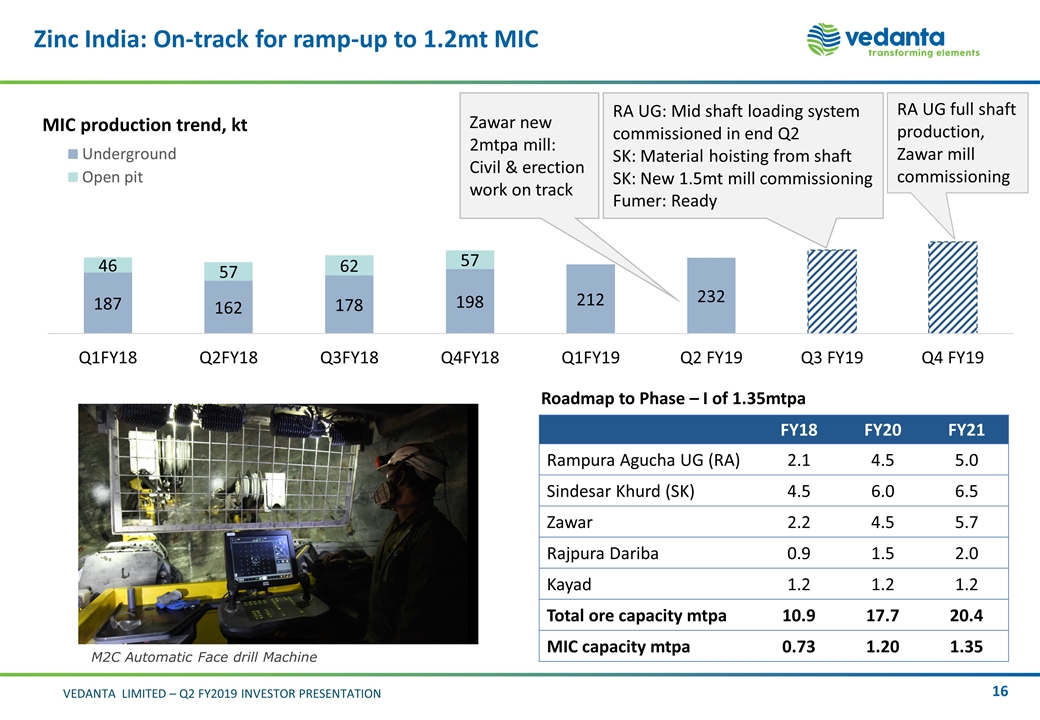

Zinc India: On-track for ramp-up to 1.2mt MIC FY18 FY20 FY21 Rampura Agucha UG (RA) 2.1 4.5 5.0 Sindesar Khurd (SK) 4.5 6.0 6.5 Zawar 2.2 4.5 5.7 Rajpura Dariba 0.9 1.5 2.0 Kayad 1.2 1.2 1.2 Total ore capacity mtpa 10.9 17.7 20.4 MIC capacity mtpa 0.73 1.20 1.35 Roadmap to Phase – I of 1.35mtpa MIC production trend, kt RA UG full shaft production, Zawar mill commissioning RA UG: Mid shaft loading system commissioned in end Q2 SK: Material hoisting from shaft SK: New 1.5mt mill commissioning Fumer: Ready Zawar new 2mtpa mill: Civil & erection work on track M2C Automatic Face drill Machine

Zinc International: Gamsberg starts trial production Skorpion Pit 112 extension Over 65% of waste stripping completed, full completion by Q4 FY19 In H2 higher grades expected, with mine fully ramped up 250kt Gamsberg project 100% of pre-stripping completed in July Trial production of concentrate commenced in end September Crusher commissioned; 750kt of ore stockpile built ahead of plant feed Bird’s eye view of Skorpion Open Pit 112 Crushed ore stock pile Concentrator Plant Floatation area Production (kt)

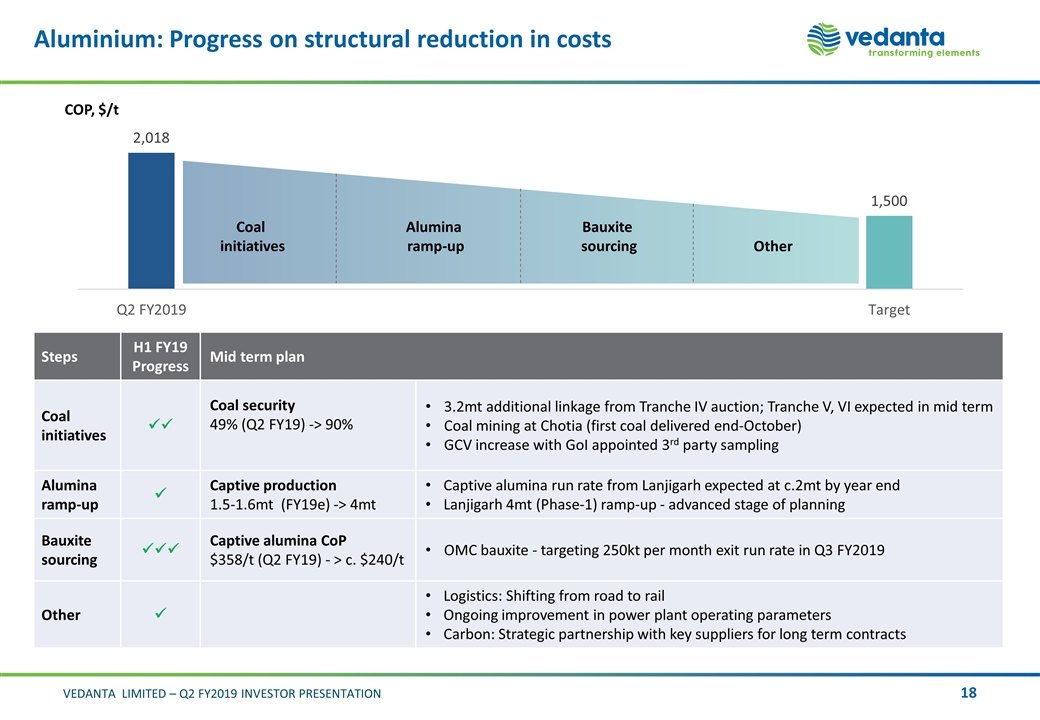

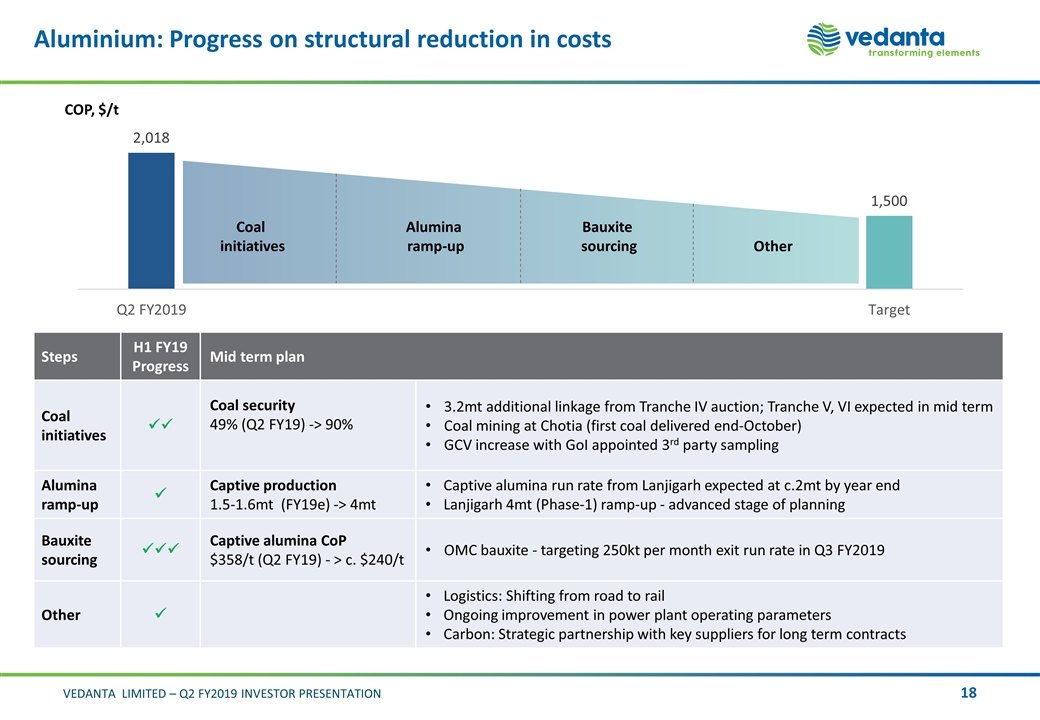

Aluminium: Progress on structural reduction in costs Steps H1 FY19 Progress Mid term plan Coal initiatives üü Coal security 49% (Q2 FY19) -> 90% 3.2mt additional linkage from Tranche IV auction; Tranche V, VI expected in mid term Coal mining at Chotia (first coal delivered end-October) GCV increase with GoI appointed 3rd party sampling Alumina ramp-up ü Captive production 1.5-1.6mt (FY19e) -> 4mt Captive alumina run rate from Lanjigarh expected at c.2mt by year end Lanjigarh 4mt (Phase-1) ramp-up - advanced stage of planning Bauxite sourcing üüü Captive alumina CoP $358/t (Q2 FY19) - > c. $240/t OMC bauxite - targeting 250kt per month exit run rate in Q3 FY2019 Other ü Logistics: Shifting from road to rail Ongoing improvement in power plant operating parameters Carbon: Strategic partnership with key suppliers for long term contracts Coal initiatives Alumina ramp-up Bauxite sourcing Other COP, $/t

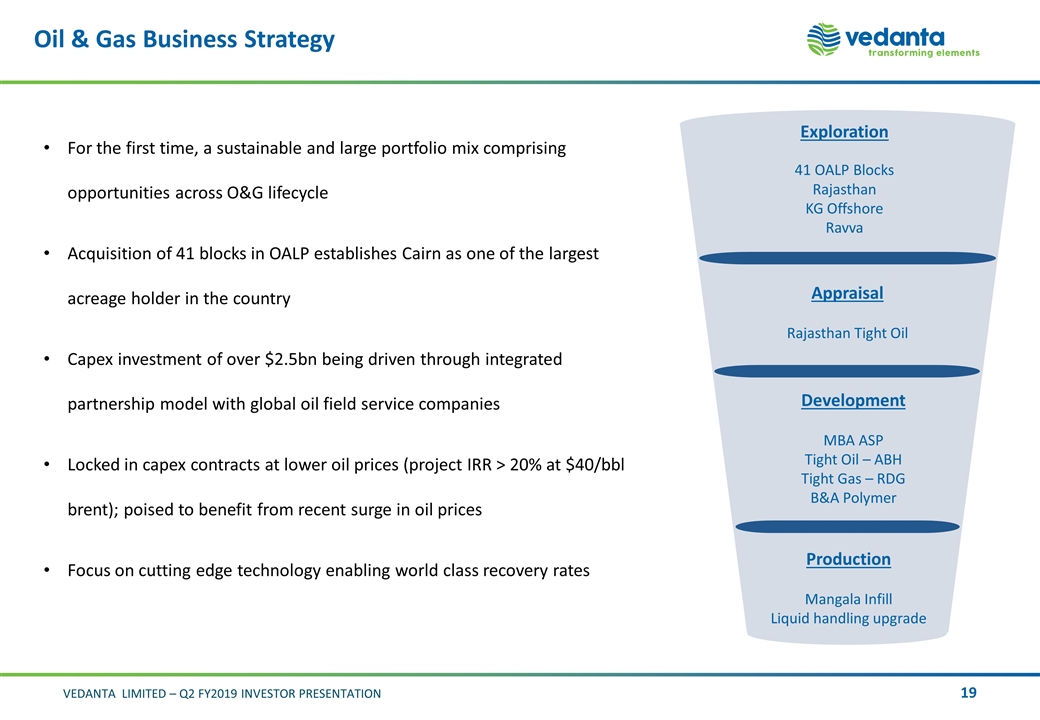

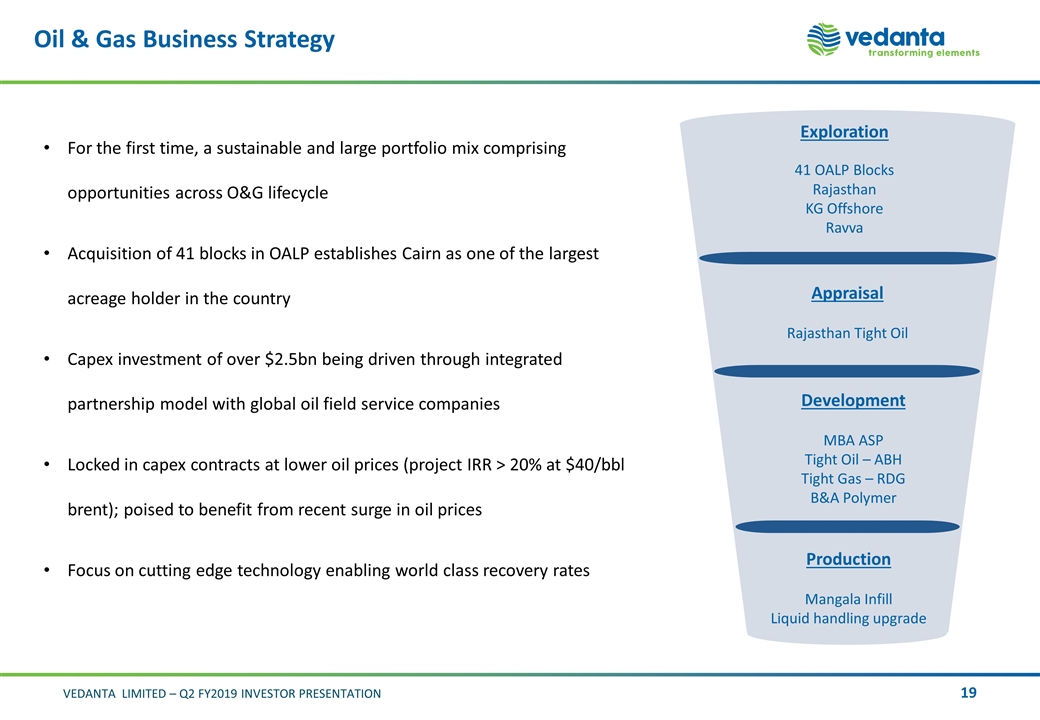

Oil & Gas Business Strategy For the first time, a sustainable and large portfolio mix comprising opportunities across O&G lifecycle Acquisition of 41 blocks in OALP establishes Cairn as one of the largest acreage holder in the country Capex investment of over $2.5bn being driven through integrated partnership model with global oil field service companies Locked in capex contracts at lower oil prices (project IRR > 20% at $40/bbl brent); poised to benefit from recent surge in oil prices Focus on cutting edge technology enabling world class recovery rates Exploration 41 OALP Blocks Rajasthan KG Offshore Ravva Appraisal Rajasthan Tight Oil Development MBA ASP Tight Oil – ABH Tight Gas – RDG B&A Polymer Production Mangala Infill Liquid handling upgrade

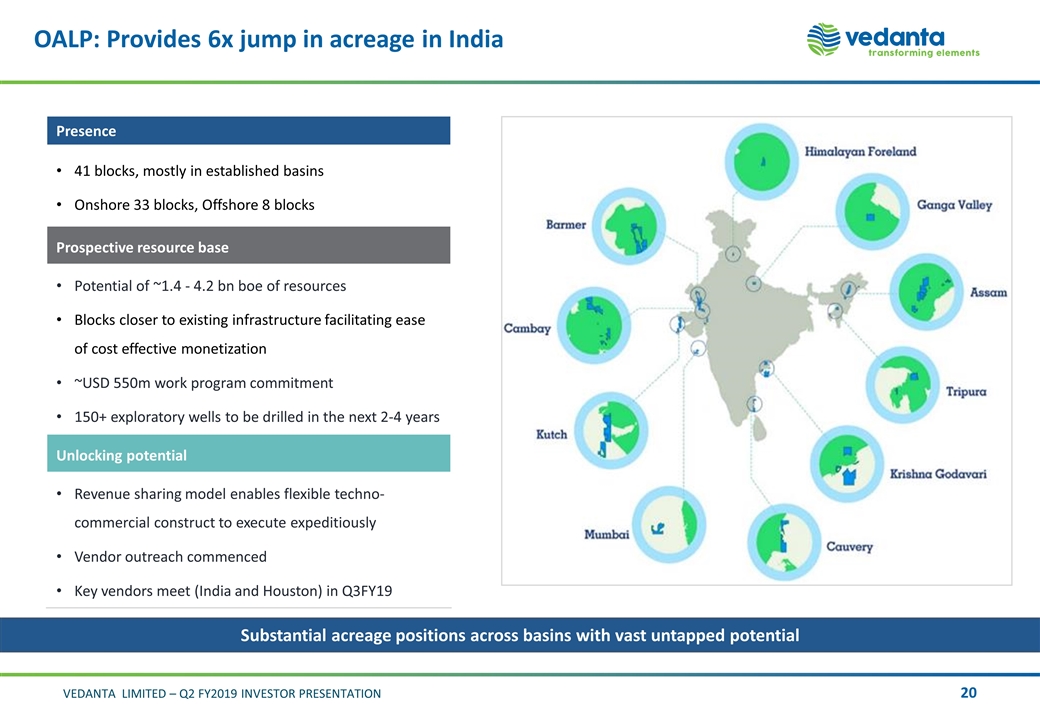

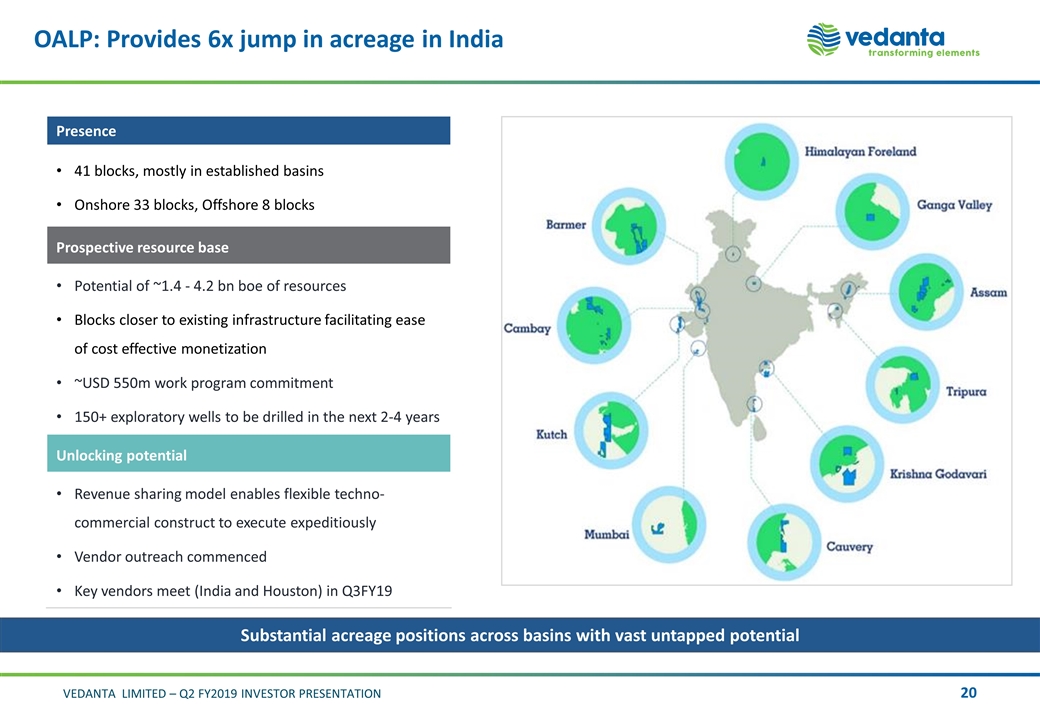

OALP: Provides 6x jump in acreage in India Substantial acreage positions across basins with vast untapped potential 60000 Sq. Kms 10000 Sq. Kms Presence 41 blocks, mostly in established basins Onshore 33 blocks, Offshore 8 blocks Prospective resource base Potential of ~1.4 - 4.2 bn boe of resources Blocks closer to existing infrastructure facilitating ease of cost effective monetization ~USD 550m work program commitment 150+ exploratory wells to be drilled in the next 2-4 years Unlocking potential Revenue sharing model enables flexible techno- commercial construct to execute expeditiously Vendor outreach commenced Key vendors meet (India and Houston) in Q3FY19

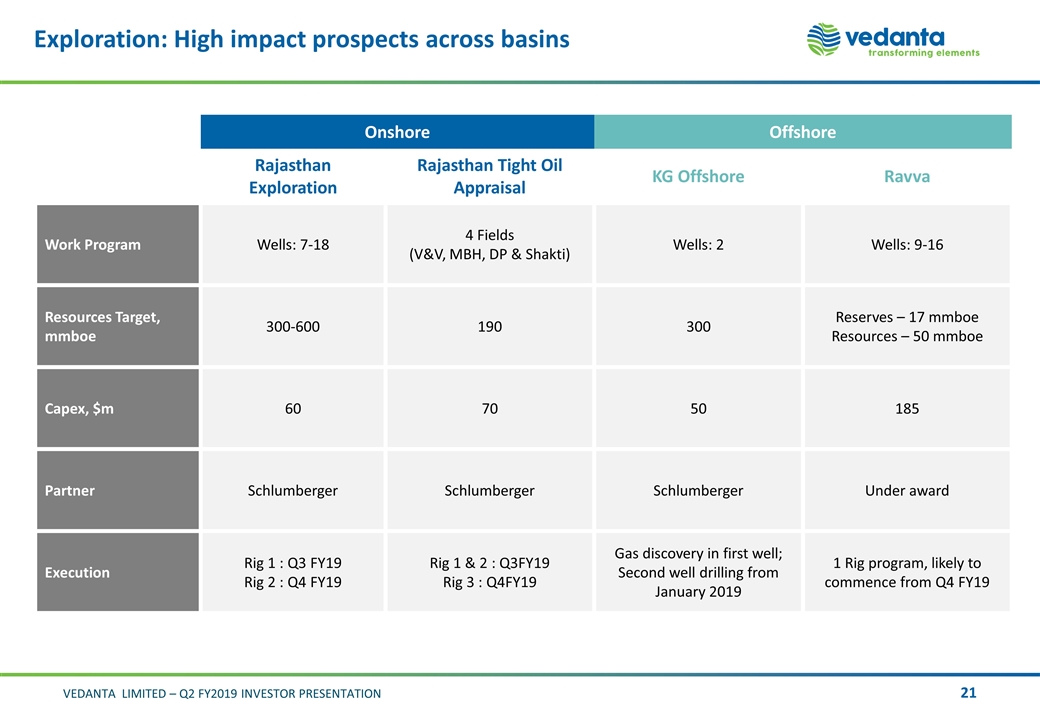

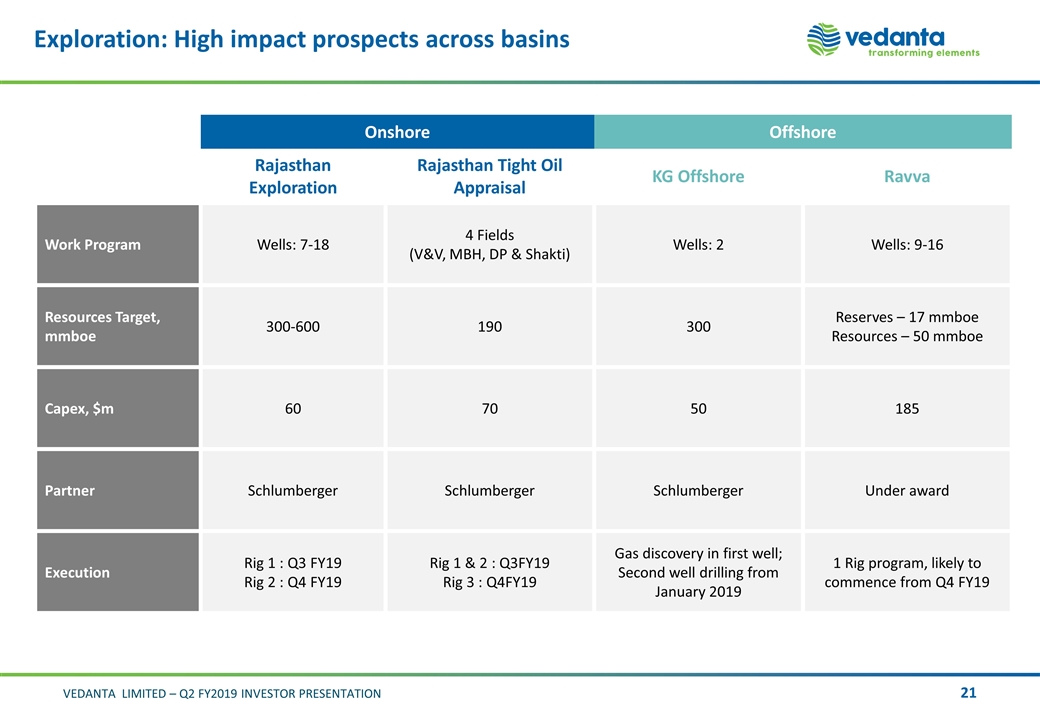

Exploration: High impact prospects across basins Onshore Offshore Rajasthan Exploration Rajasthan Tight Oil Appraisal KG Offshore Ravva Work Program Wells: 7-18 4 Fields (V&V, MBH, DP & Shakti) Wells: 2 Wells: 9-16 Resources Target, mmboe 300-600 190 300 Reserves – 17 mmboe Resources – 50 mmboe Capex, $m 60 70 50 185 Partner Schlumberger Schlumberger Schlumberger Under award Execution Rig 1 : Q3 FY19 Rig 2 : Q4 FY19 Rig 1 & 2 : Q3FY19 Rig 3 : Q4FY19 Gas discovery in first well; Second well drilling from January 2019 1 Rig program, likely to commence from Q4 FY19

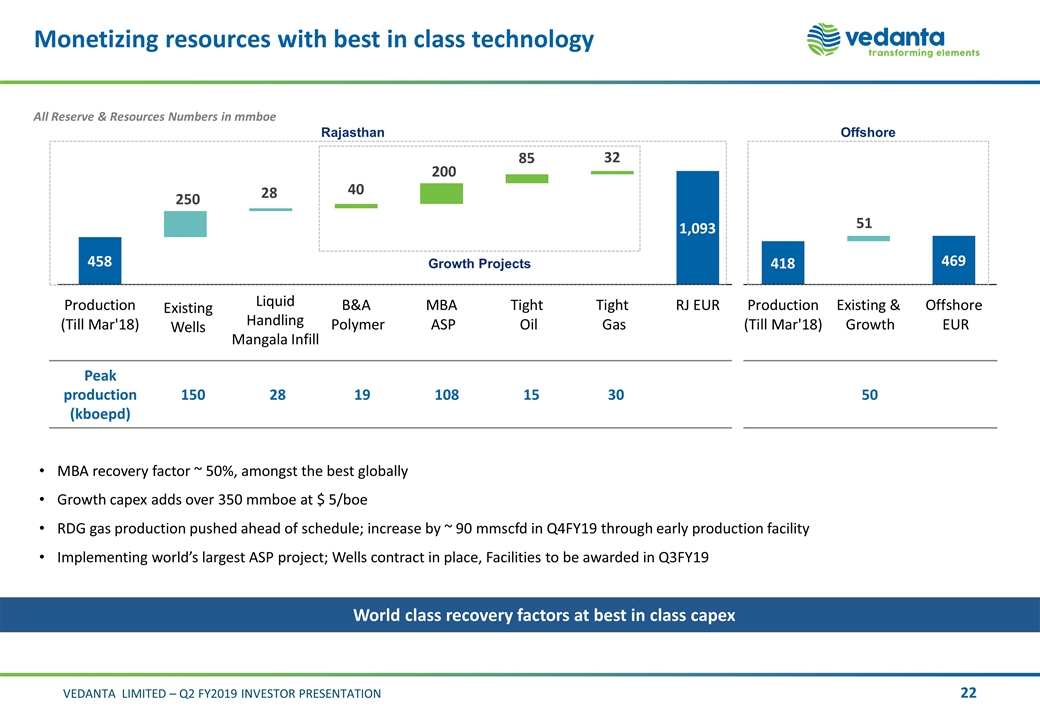

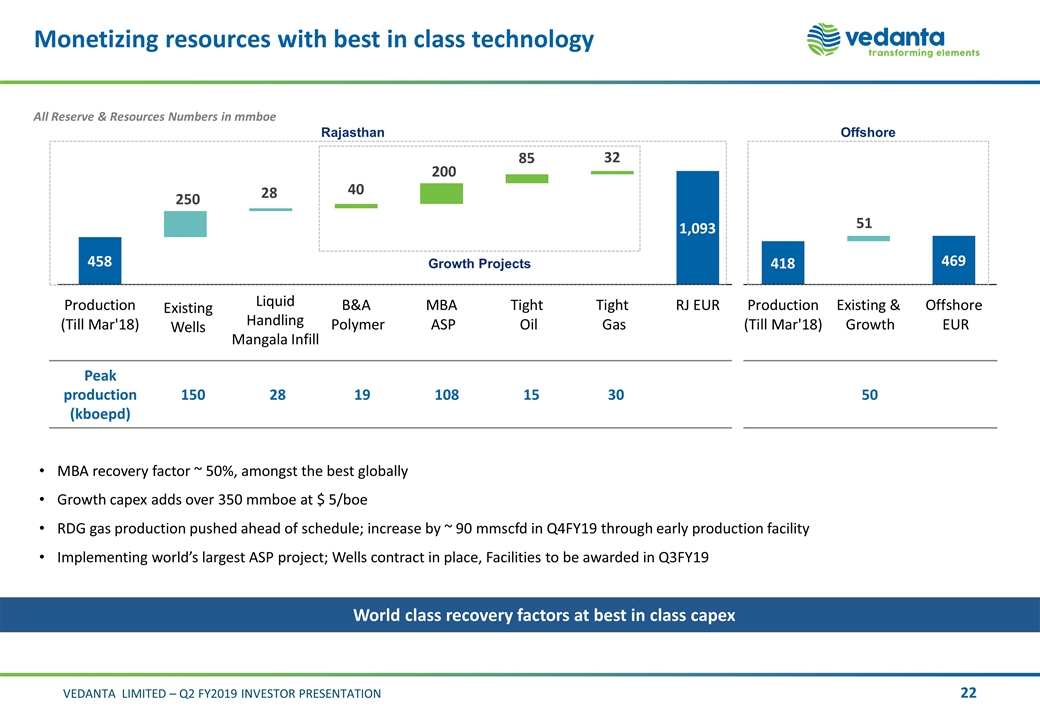

MBA recovery factor ~ 50%, amongst the best globally Growth capex adds over 350 mmboe at $ 5/boe RDG gas production pushed ahead of schedule; increase by ~ 90 mmscfd in Q4FY19 through early production facility Implementing world’s largest ASP project; Wells contract in place, Facilities to be awarded in Q3FY19 All Reserve & Resources Numbers in mmboe Monetizing resources with best in class technology World class recovery factors at best in class capex Liquid Handling Mangala Infill Peak production (kboepd) 150 28 19 108 15 30 50 Rajasthan Offshore Growth Projects Existing Wells

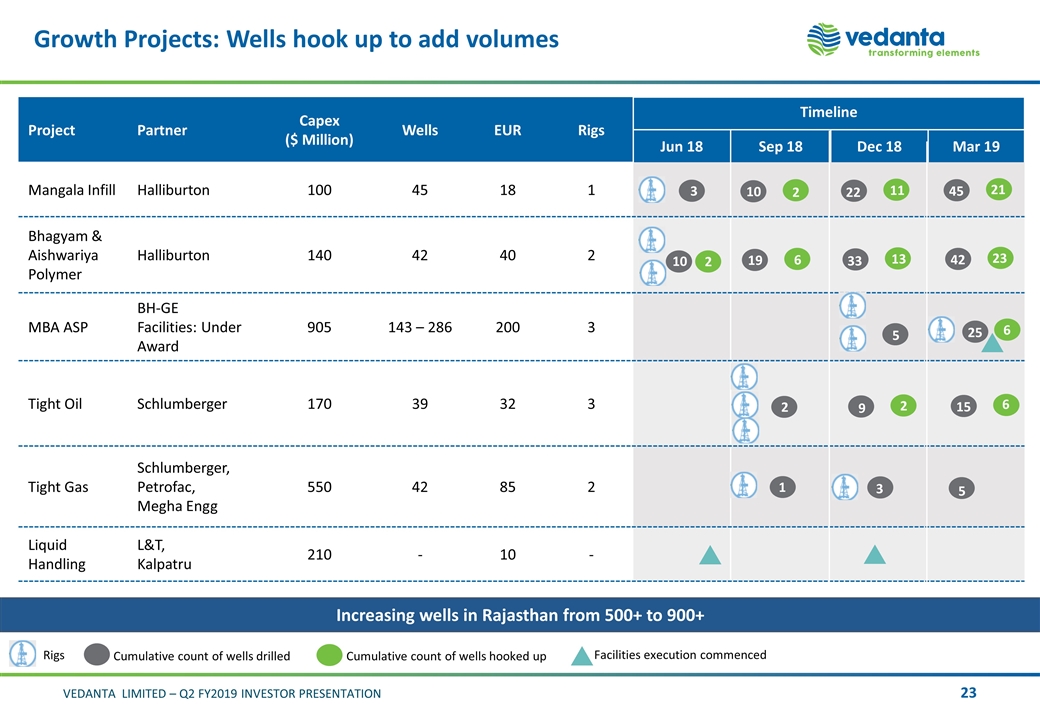

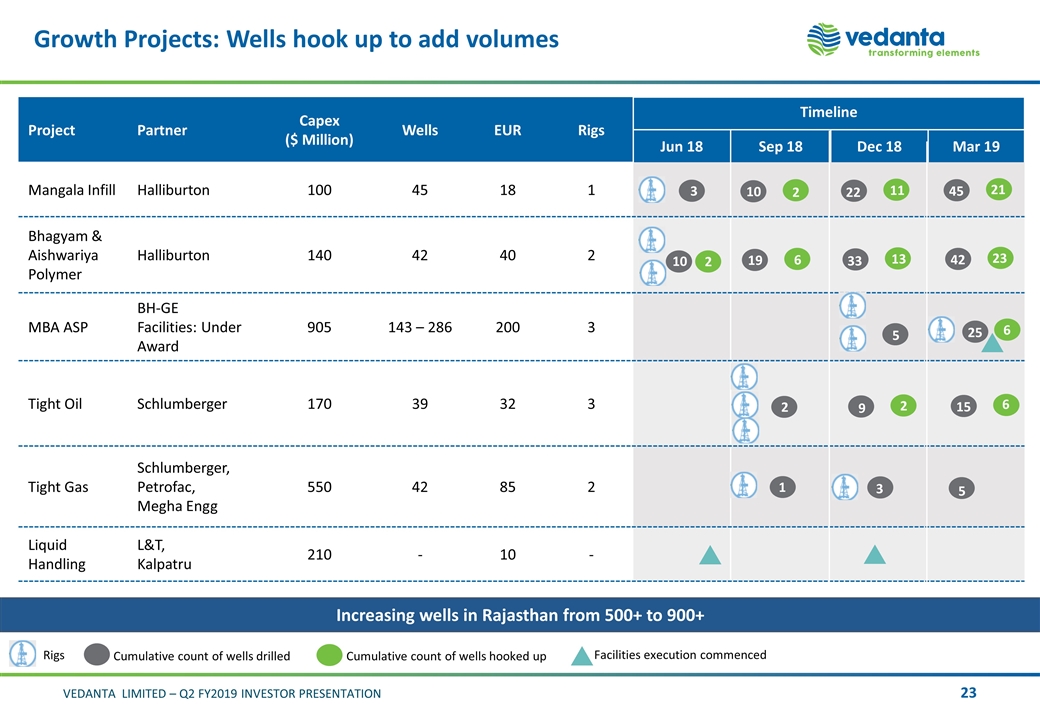

Project Partner Capex ($ Million) Wells EUR Rigs Timeline Jun 18 Sep 18 Dec 18 Mar 19 Mangala Infill Halliburton 100 45 18 1 Bhagyam & Aishwariya Polymer Halliburton 140 42 40 2 MBA ASP BH-GE Facilities: Under Award 905 143 – 286 200 3 Tight Oil Schlumberger 170 39 32 3 Tight Gas Schlumberger, Petrofac, Megha Engg 550 42 85 2 Liquid Handling L&T, Kalpatru 210 - 10 - Growth Projects: Wells hook up to add volumes Rigs Cumulative count of wells drilled Cumulative count of wells hooked up Facilities execution commenced 2 3 10 22 11 45 21 6 19 33 13 42 23 10 2 25 6 5 2 9 2 15 6 5 3 1 Increasing wells in Rajasthan from 500+ to 900+

Delivering on our Strategic Priorities Operational Excellence Augment our Reserves & Resources base Preserve our License to Operate Optimise Capital Allocation & Maintain Strong Balance Sheet Develop brownfield growth opportunities Acquisition of attractive, complementary assets, but only for value Operate as a responsible business Continue to focus on Zero Harm, Zero Discharge and Zero Wastage Ensure social inclusion of the community to promote inclusive growth Well developed exploration programs Zinc India R&R of 411mt with 25+ years of mine life Karnataka iron-ore R&R of 100mt with 20 years of mine life Focus on greenfield and brownfield exploration Volume growth and asset optimisation Optimise costs Adopt digitalisation and technology solutions Improved realisations Reduce working capital Improving cash flows Strict Capital discipline Invest in high IRR projects Deleveraging the balance sheet Shareholder returns Delivering on Growth Opportunities

Appendix

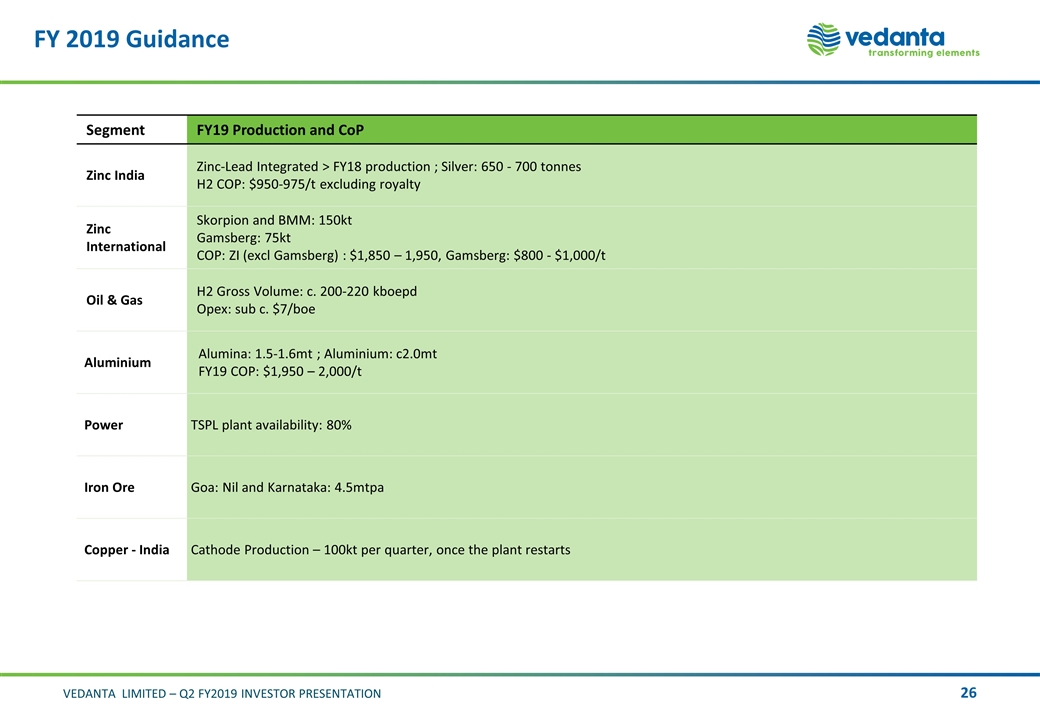

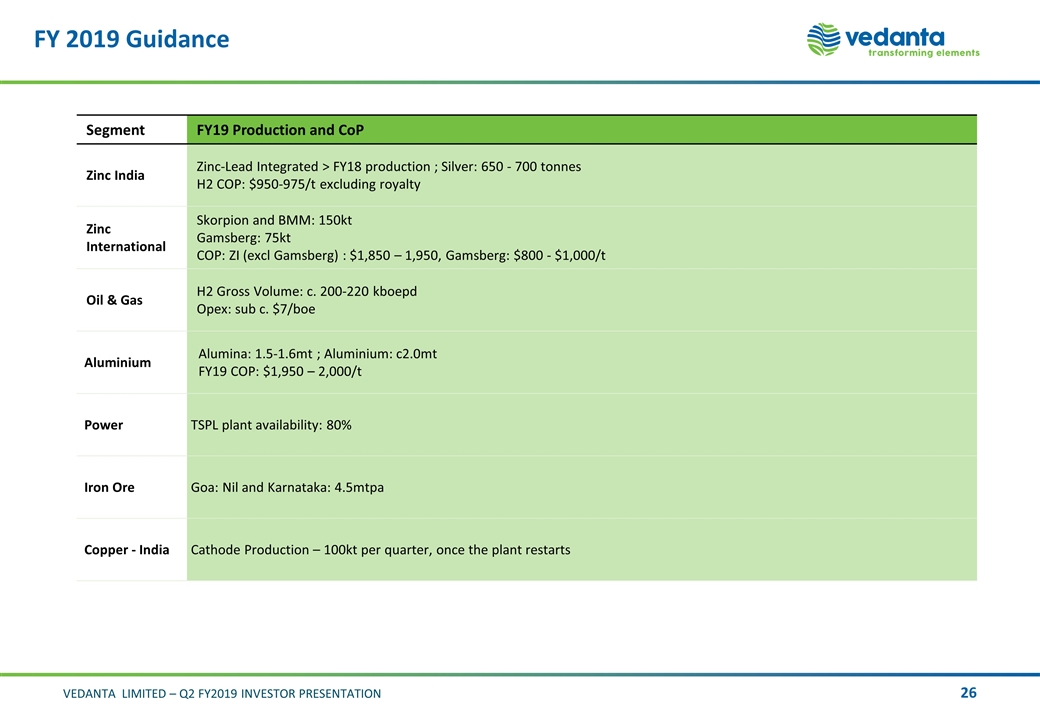

FY 2019 Guidance Segment FY19 Production and CoP Zinc India Zinc-Lead Integrated > FY18 production ; Silver: 650 - 700 tonnes H2 COP: $950-975/t excluding royalty Zinc International Skorpion and BMM: 150kt Gamsberg: 75kt COP: ZI (excl Gamsberg) : $1,850 – 1,950, Gamsberg: $800 - $1,000/t Oil & Gas H2 Gross Volume: c. 200-220 kboepd Opex: sub c. $7/boe Aluminium Alumina: 1.5-1.6mt ; Aluminium: c2.0mt FY19 COP: $1,950 – 2,000/t Power TSPL plant availability: 80% Iron Ore Goa: Nil and Karnataka: 4.5mtpa Copper - India Cathode Production – 100kt per quarter, once the plant restarts

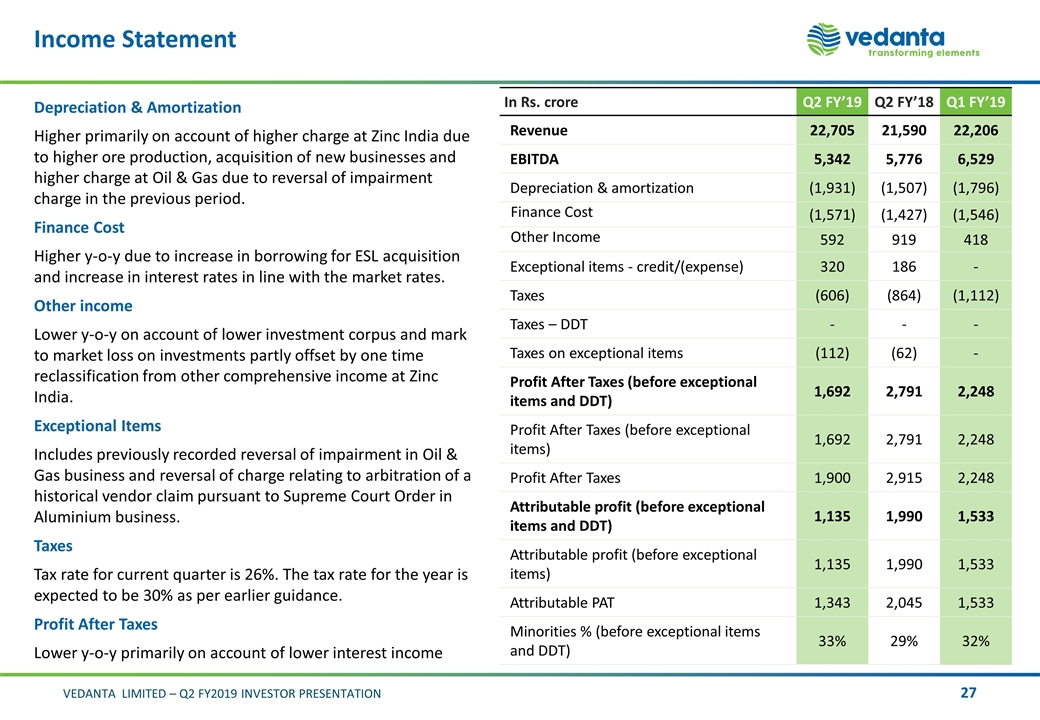

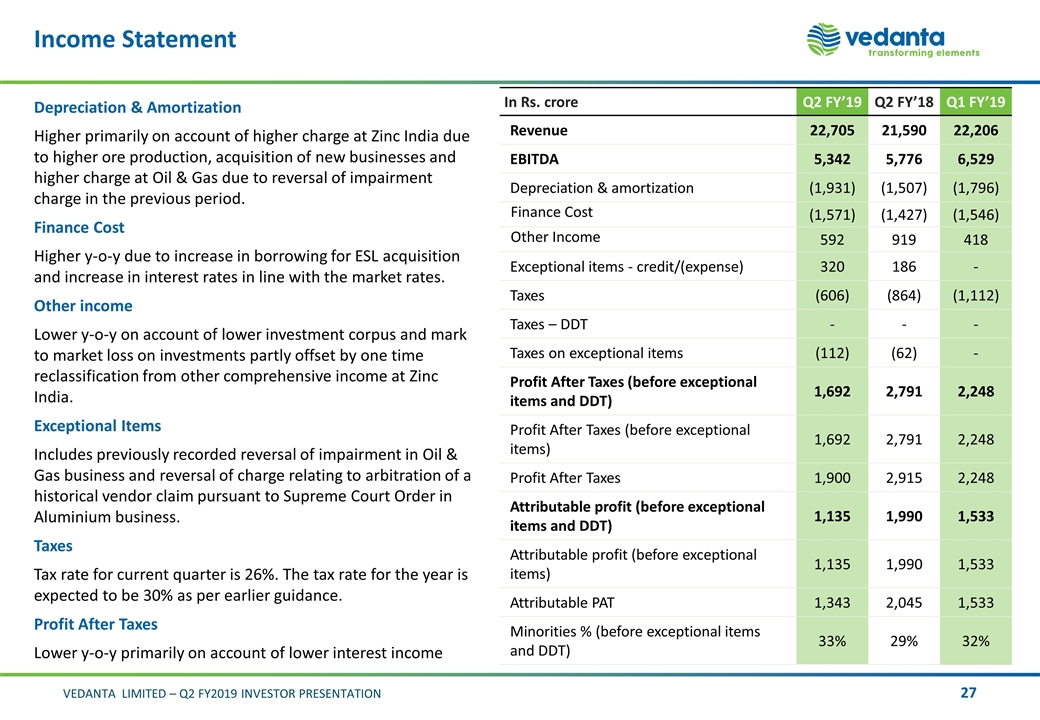

Income Statement In Rs. crore Q2 FY’19 Q2 FY’18 Q1 FY’19 Revenue 22,705 21,590 22,206 EBITDA 5,342 5,776 6,529 Depreciation & amortization (1,931) (1,507) (1,796) Finance Cost (1,571) (1,427) (1,546) Other Income 592 919 418 Exceptional items - credit/(expense) 320 186 - Taxes (606) (864) (1,112) Taxes – DDT - - - Taxes on exceptional items (112) (62) - Profit After Taxes (before exceptional items and DDT) 1,692 2,791 2,248 Profit After Taxes (before exceptional items) 1,692 2,791 2,248 Profit After Taxes 1,900 2,915 2,248 Attributable profit (before exceptional items and DDT) 1,135 1,990 1,533 Attributable profit (before exceptional items) 1,135 1,990 1,533 Attributable PAT 1,343 2,045 1,533 Minorities % (before exceptional items and DDT) 33% 29% 32% Depreciation & Amortization Higher primarily on account of higher charge at Zinc India due to higher ore production, acquisition of new businesses and higher charge at Oil & Gas due to reversal of impairment charge in the previous period. Finance Cost Higher y-o-y due to increase in borrowing for ESL acquisition and increase in interest rates in line with the market rates. Other income Lower y-o-y on account of lower investment corpus and mark to market loss on investments partly offset by one time reclassification from other comprehensive income at Zinc India. Exceptional Items Includes previously recorded reversal of impairment in Oil & Gas business and reversal of charge relating to arbitration of a historical vendor claim pursuant to Supreme Court Order in Aluminium business. Taxes Tax rate for current quarter is 26%. The tax rate for the year is expected to be 30% as per earlier guidance. Profit After Taxes Lower y-o-y primarily on account of lower interest income

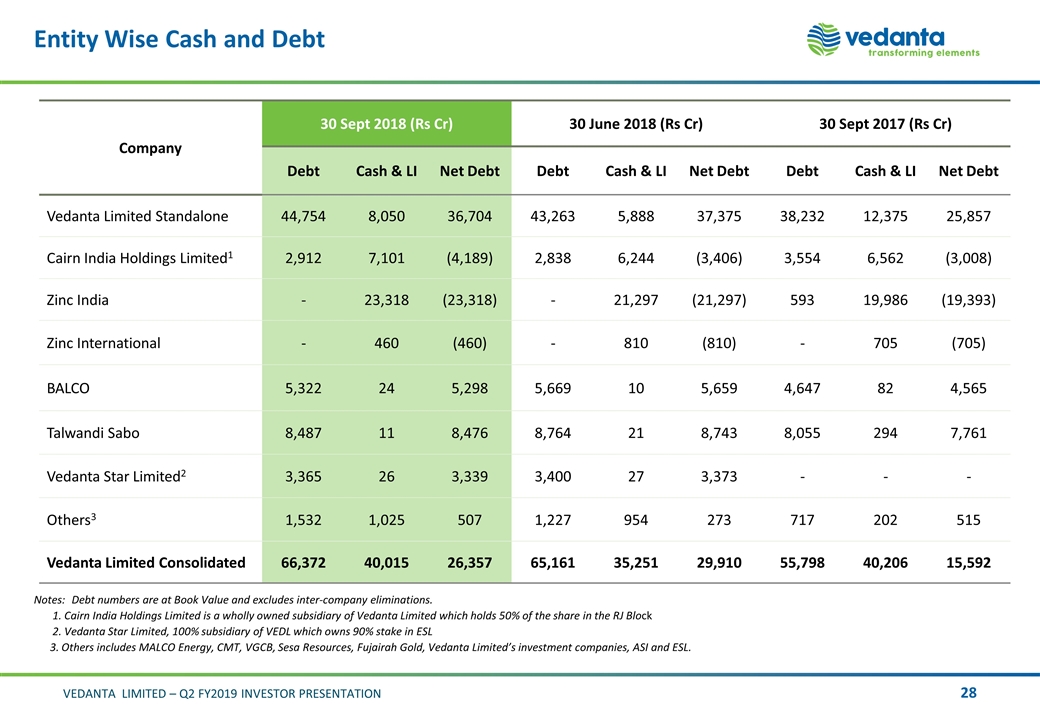

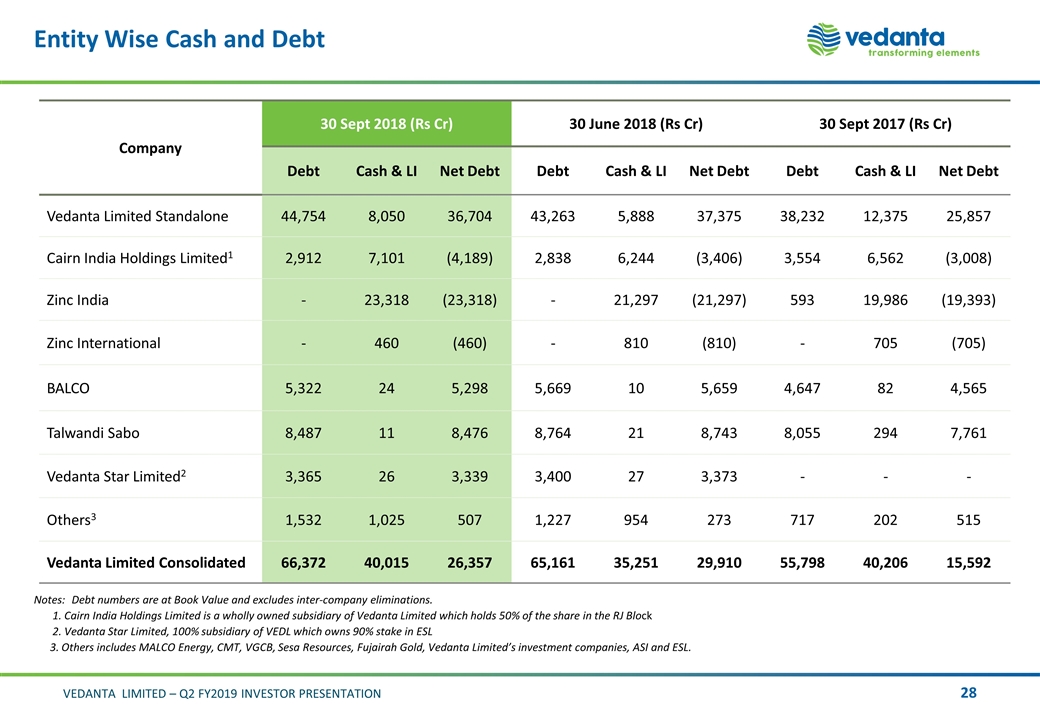

Entity Wise Cash and Debt Company 30 Sept 2018 (Rs Cr) 30 June 2018 (Rs Cr) 30 Sept 2017 (Rs Cr) Debt Cash & LI Net Debt Debt Cash & LI Net Debt Debt Cash & LI Net Debt Vedanta Limited Standalone 44,754 8,050 36,704 43,263 5,888 37,375 38,232 12,375 25,857 Cairn India Holdings Limited1 2,912 7,101 (4,189) 2,838 6,244 (3,406) 3,554 6,562 (3,008) Zinc India - 23,318 (23,318) - 21,297 (21,297) 593 19,986 (19,393) Zinc International - 460 (460) - 810 (810) - 705 (705) BALCO 5,322 24 5,298 5,669 10 5,659 4,647 82 4,565 Talwandi Sabo 8,487 11 8,476 8,764 21 8,743 8,055 294 7,761 Vedanta Star Limited2 3,365 26 3,339 3,400 27 3,373 - - - Others3 1,532 1,025 507 1,227 954 273 717 202 515 Vedanta Limited Consolidated 66,372 40,015 26,357 65,161 35,251 29,910 55,798 40,206 15,592 Notes:Debt numbers are at Book Value and excludes inter-company eliminations. 1. Cairn India Holdings Limited is a wholly owned subsidiary of Vedanta Limited which holds 50% of the share in the RJ Block 2. Vedanta Star Limited, 100% subsidiary of VEDL which owns 90% stake in ESL 3. Others includes MALCO Energy, CMT, VGCB, Sesa Resources, Fujairah Gold, Vedanta Limited’s investment companies, ASI and ESL.

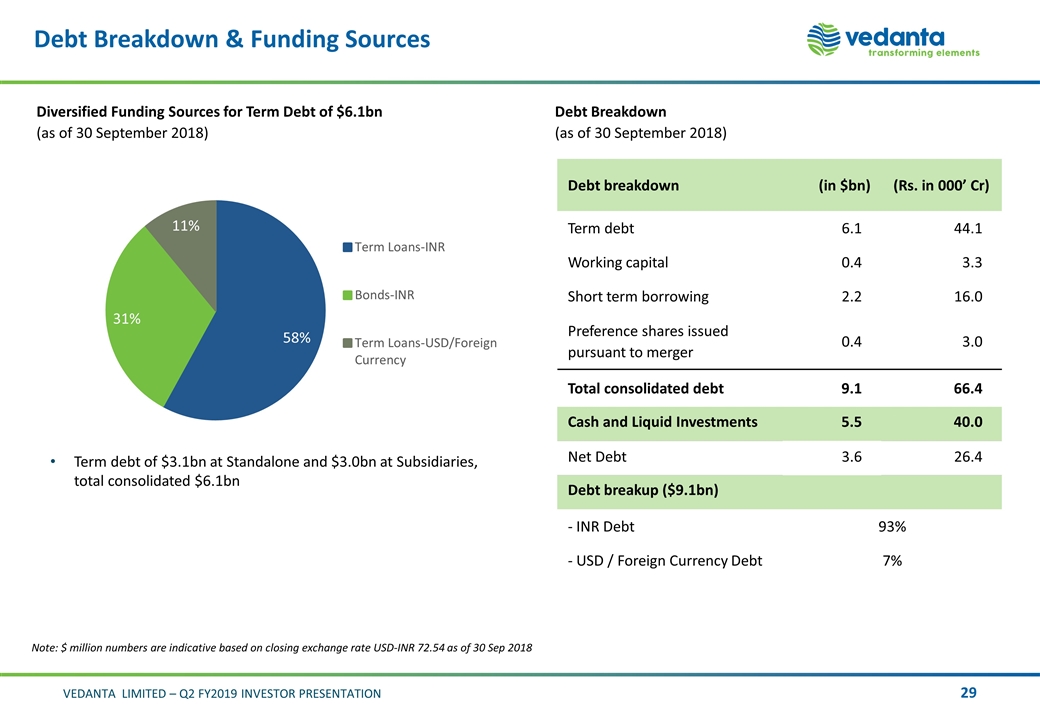

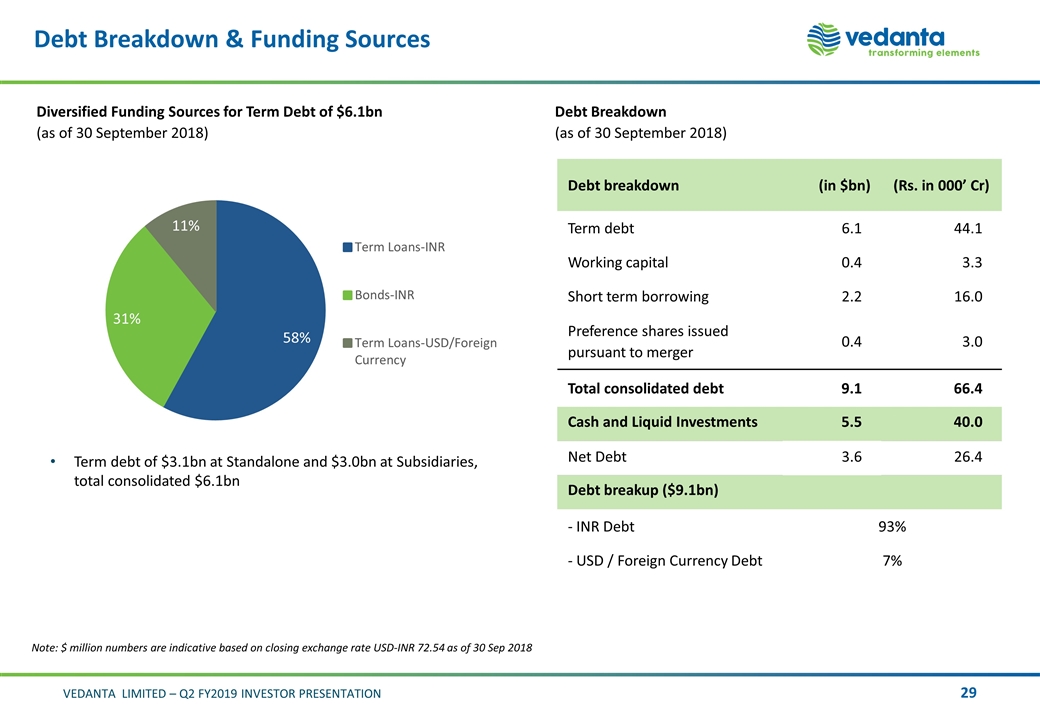

Debt Breakdown & Funding Sources Debt breakdown (in $bn) (Rs. in 000’ Cr) Term debt 6.1 44.1 Working capital 0.4 3.3 Short term borrowing 2.2 16.0 Preference shares issued pursuant to merger 0.4 3.0 Total consolidated debt 9.1 66.4 Cash and Liquid Investments 5.5 40.0 Net Debt 3.6 26.4 Debt breakup ($9.1bn) - INR Debt 93% - USD / Foreign Currency Debt 7% Diversified Funding Sources for Term Debt of $6.1bn (as of 30 September 2018) Note: $ million numbers are indicative based on closing exchange rate USD-INR 72.54 as of 30 Sep 2018 Term debt of $3.1bn at Standalone and $3.0bn at Subsidiaries, total consolidated $6.1bn Debt Breakdown (as of 30 September 2018)

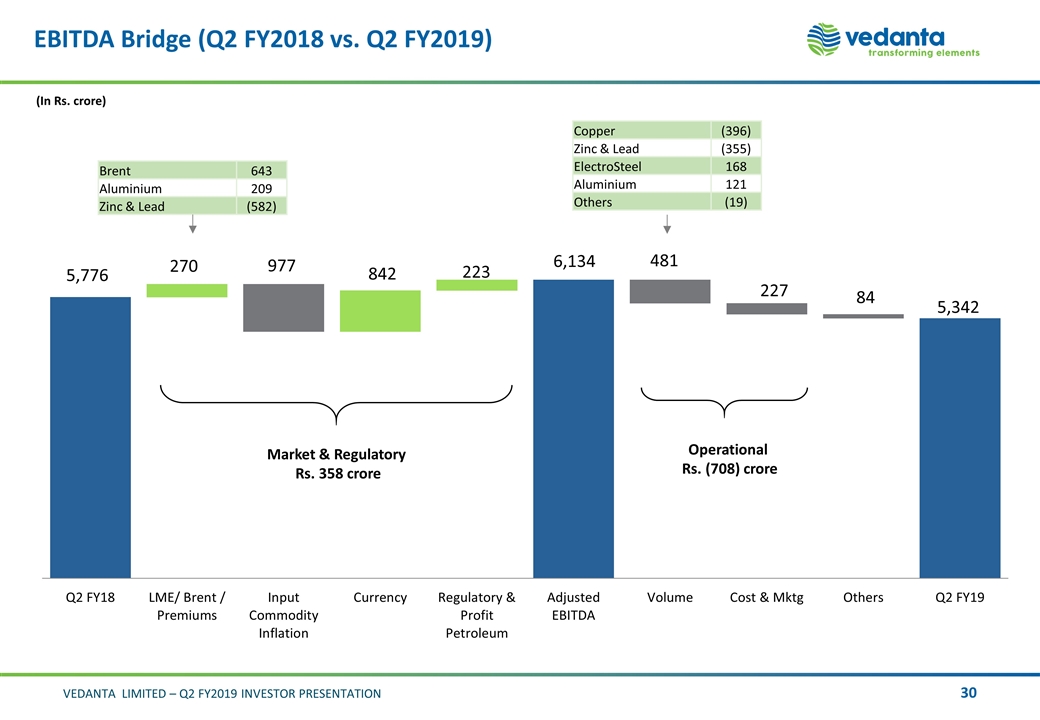

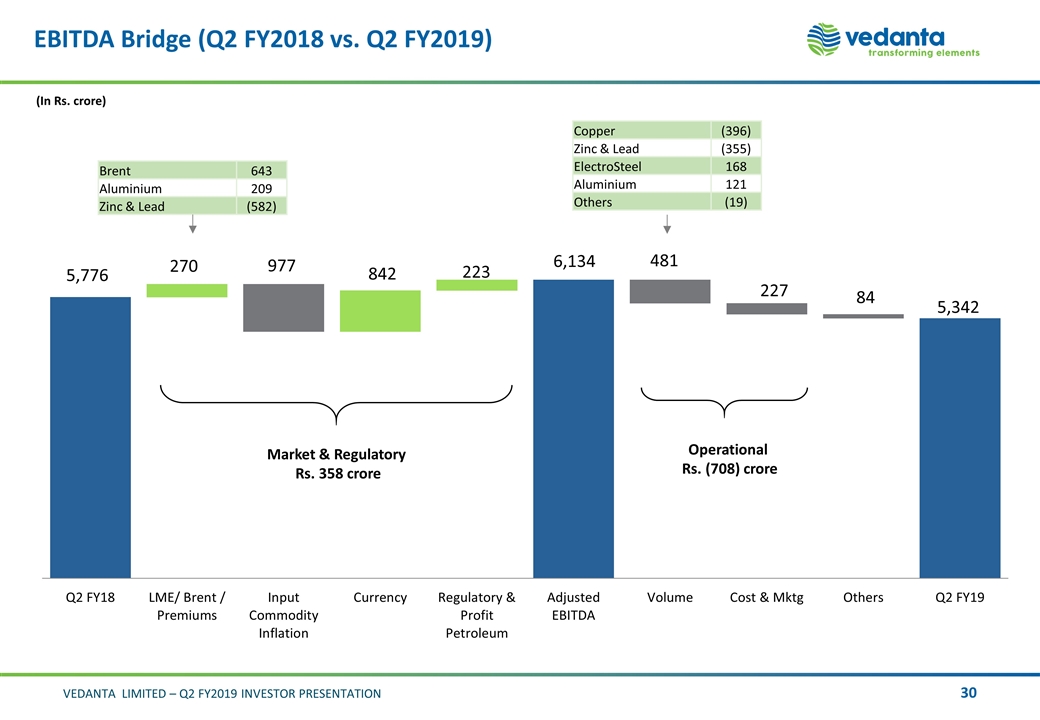

EBITDA Bridge (Q2 FY2018 vs. Q2 FY2019) (In Rs. crore) Market & Regulatory Rs. 358 crore Operational Rs. (708) crore Brent 643 Aluminium 209 Zinc & Lead (582) Copper (396) Zinc & Lead (355) ElectroSteel 168 Aluminium 121 Others (19)

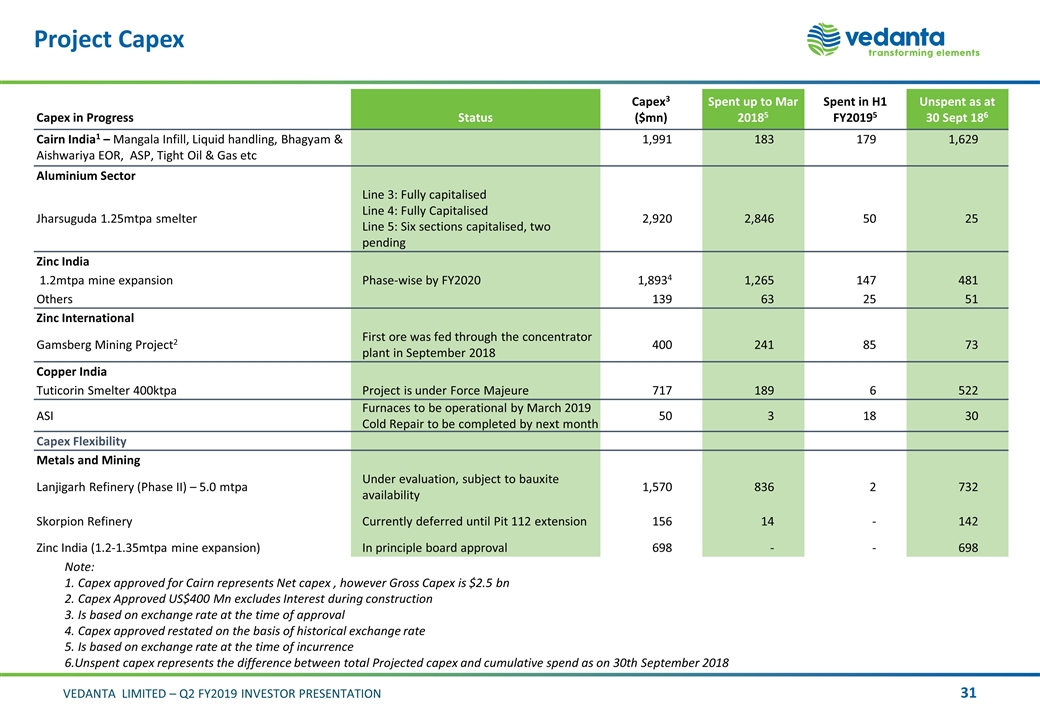

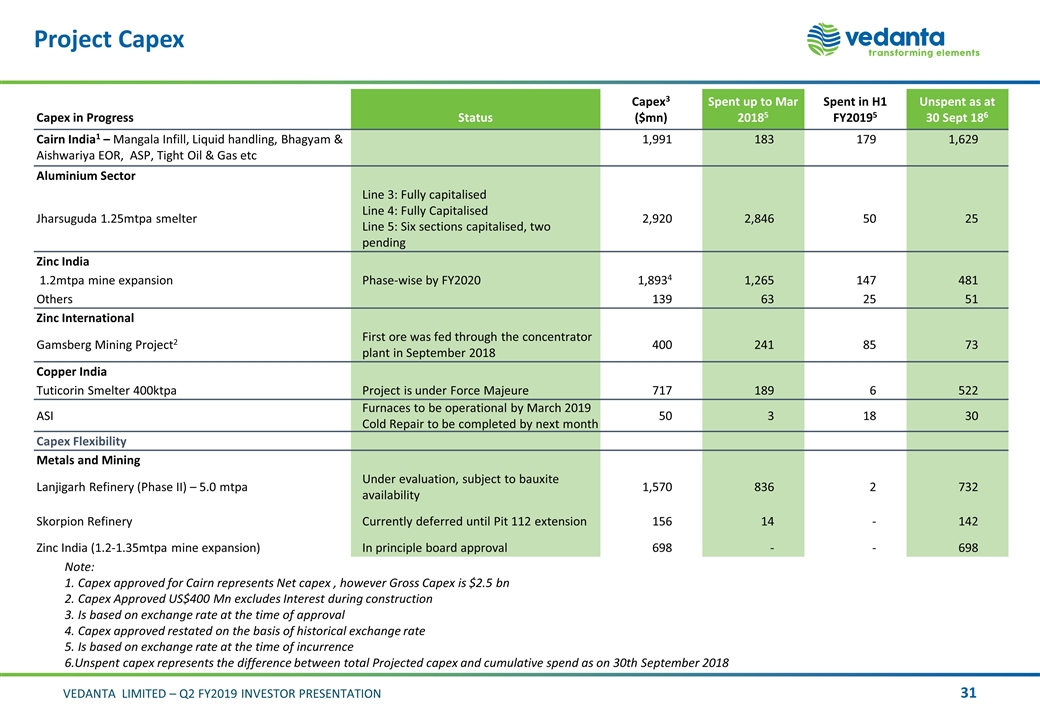

Capex in Progress Status Capex3 ($mn) Spent up to Mar 20185 Spent in H1 FY20195 Unspent as at 30 Sept 186 Cairn India1 – Mangala Infill, Liquid handling, Bhagyam & Aishwariya EOR, ASP, Tight Oil & Gas etc 1,991 183 179 1,629 Aluminium Sector Jharsuguda 1.25mtpa smelter Line 3: Fully capitalised Line 4: Fully Capitalised Line 5: Six sections capitalised, two pending 2,920 2,846 50 25 Zinc India 1.2mtpa mine expansion Phase-wise by FY2020 1,8934 1,265 147 481 Others 139 63 25 51 Zinc International Gamsberg Mining Project2 First ore was fed through the concentrator plant in September 2018 400 241 85 73 Copper India Tuticorin Smelter 400ktpa Project is under Force Majeure 717 189 6 522 ASI Furnaces to be operational by March 2019 Cold Repair to be completed by next month 50 3 18 30 Capex Flexibility Metals and Mining Lanjigarh Refinery (Phase II) – 5.0 mtpa Under evaluation, subject to bauxite availability 1,570 836 2 732 Skorpion Refinery Currently deferred until Pit 112 extension 156 14 - 142 Zinc India (1.2-1.35mtpa mine expansion) In principle board approval 698 - - 698 Project Capex Note: 1. Capex approved for Cairn represents Net capex , however Gross Capex is $2.5 bn 2. Capex Approved US$400 Mn excludes Interest during construction 3. Is based on exchange rate at the time of approval 4. Capex approved restated on the basis of historical exchange rate 5. Is based on exchange rate at the time of incurrence 6.Unspent capex represents the difference between total Projected capex and cumulative spend as on 30th September 2018

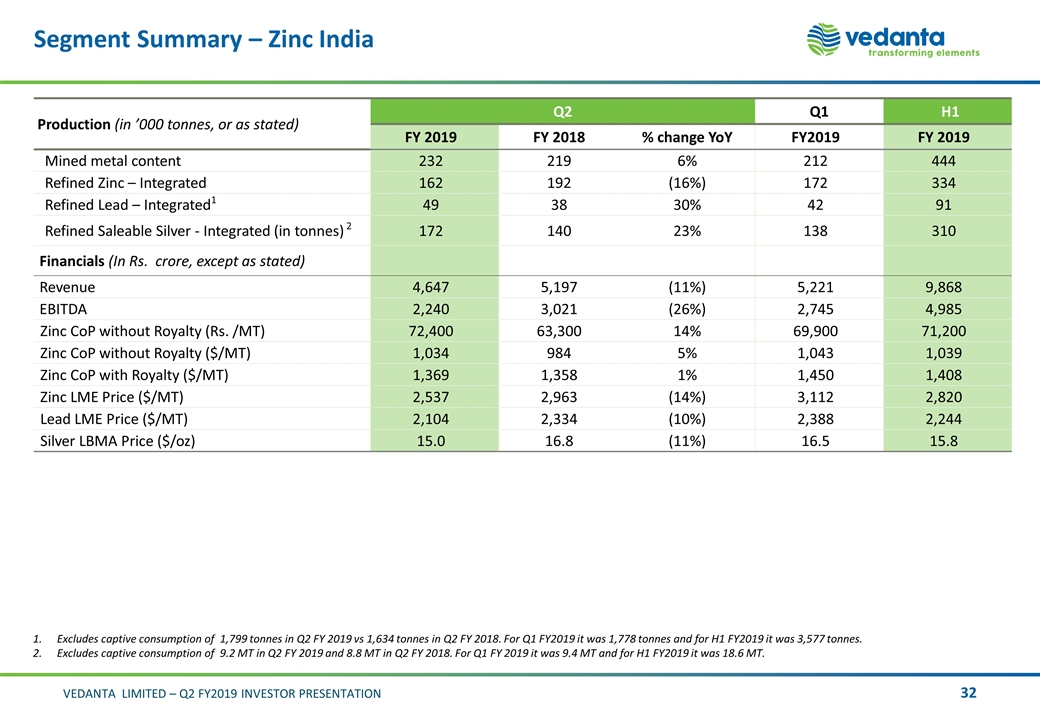

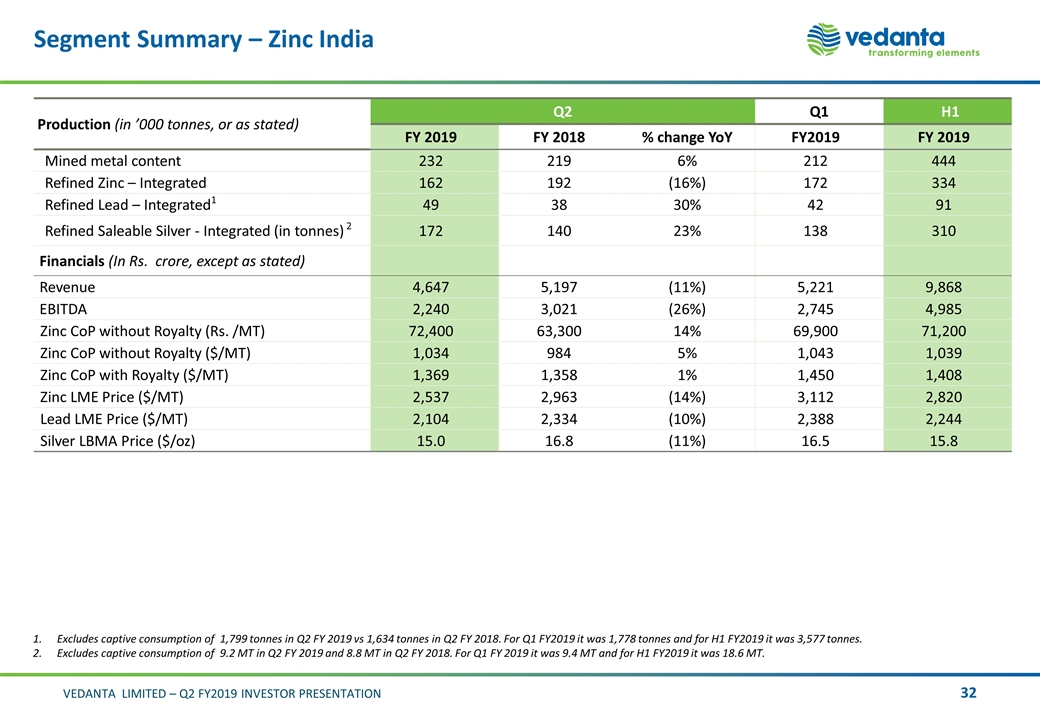

Segment Summary – Zinc India Production (in ’000 tonnes, or as stated) Q2 Q1 H1 FY 2019 FY 2018 % change YoY FY2019 FY 2019 Mined metal content 232 219 6% 212 444 Refined Zinc – Integrated 162 192 (16%) 172 334 Refined Lead – Integrated1 49 38 30% 42 91 Refined Saleable Silver - Integrated (in tonnes) 2 172 140 23% 138 310 Financials (In Rs. crore, except as stated) Revenue 4,647 5,197 (11%) 5,221 9,868 EBITDA 2,240 3,021 (26%) 2,745 4,985 Zinc CoP without Royalty (Rs. /MT) 72,400 63,300 14% 69,900 71,200 Zinc CoP without Royalty ($/MT) 1,034 984 5% 1,043 1,039 Zinc CoP with Royalty ($/MT) 1,369 1,358 1% 1,450 1,408 Zinc LME Price ($/MT) 2,537 2,963 (14%) 3,112 2,820 Lead LME Price ($/MT) 2,104 2,334 (10%) 2,388 2,244 Silver LBMA Price ($/oz) 15.0 16.8 (11%) 16.5 15.8 Excludes captive consumption of 1,799 tonnes in Q2 FY 2019 vs 1,634 tonnes in Q2 FY 2018. For Q1 FY2019 it was 1,778 tonnes and for H1 FY2019 it was 3,577 tonnes. Excludes captive consumption of 9.2 MT in Q2 FY 2019 and 8.8 MT in Q2 FY 2018. For Q1 FY 2019 it was 9.4 MT and for H1 FY2019 it was 18.6 MT.

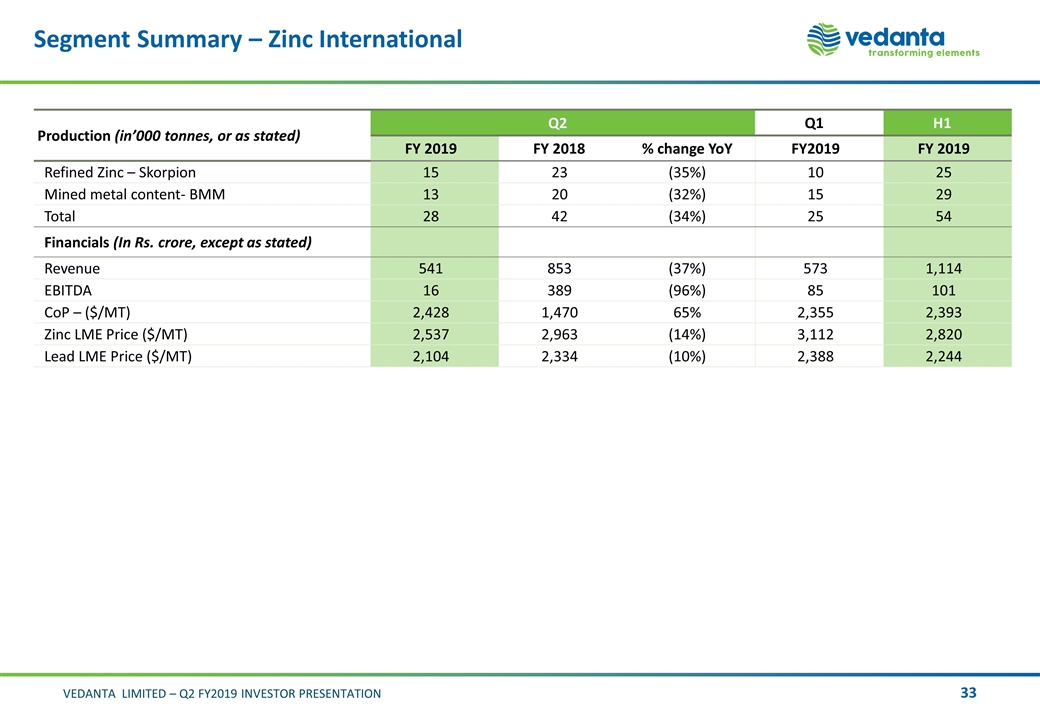

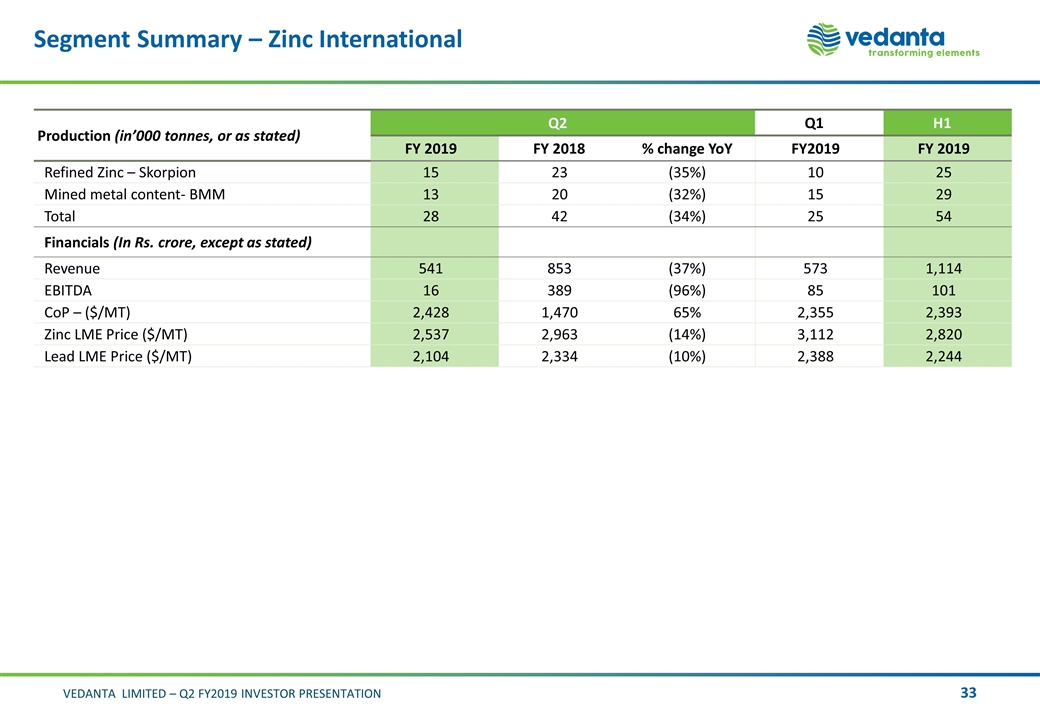

Segment Summary – Zinc International Production (in’000 tonnes, or as stated) Q2 Q1 H1 FY 2019 FY 2018 % change YoY FY2019 FY 2019 Refined Zinc – Skorpion 15 23 (35%) 10 25 Mined metal content- BMM 13 20 (32%) 15 29 Total 28 42 (34%) 25 54 Financials (In Rs. crore, except as stated) Revenue 541 853 (37%) 573 1,114 EBITDA 16 389 (96%) 85 101 CoP – ($/MT) 2,428 1,470 65% 2,355 2,393 Zinc LME Price ($/MT) 2,537 2,963 (14%) 3,112 2,820 Lead LME Price ($/MT) 2,104 2,334 (10%) 2,388 2,244

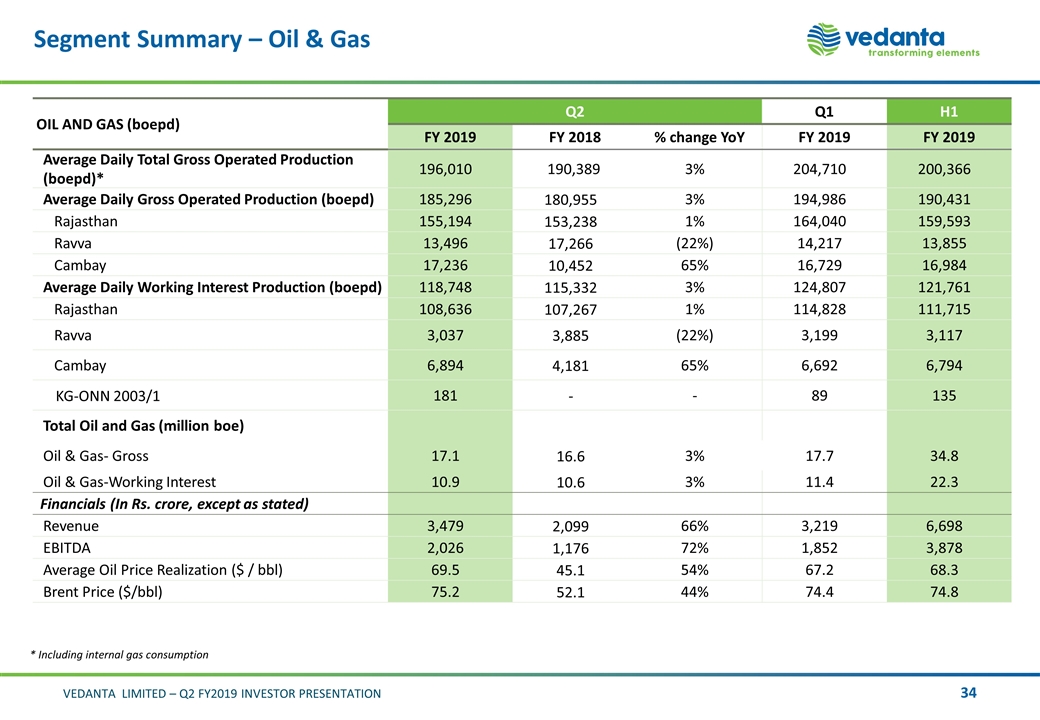

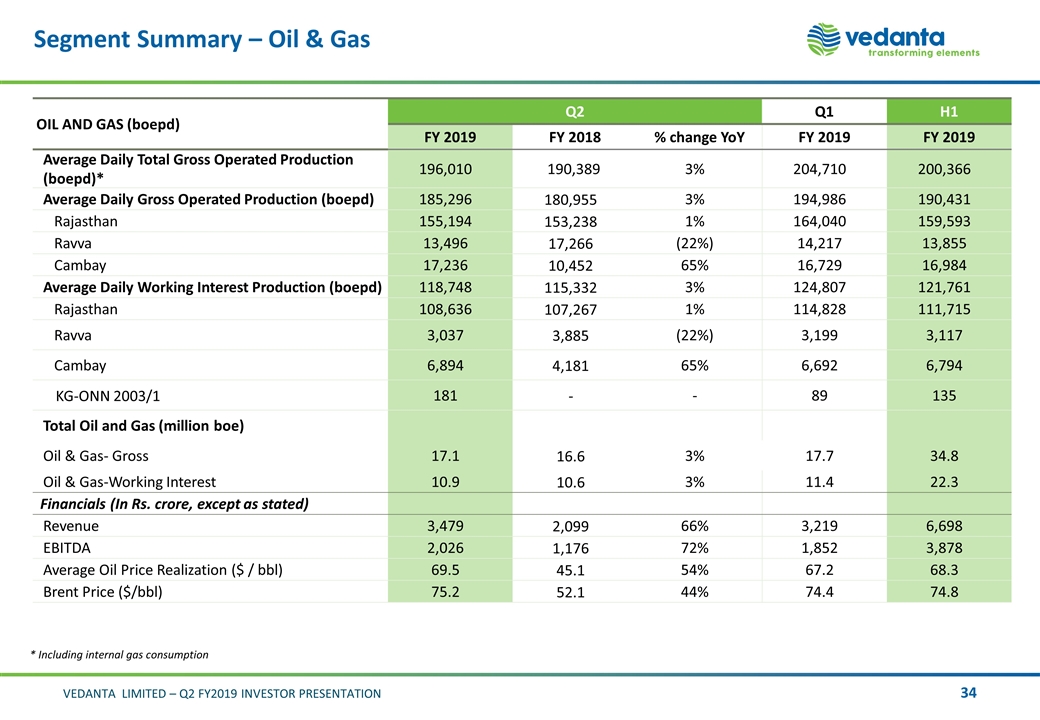

Segment Summary – Oil & Gas OIL AND GAS (boepd) Q2 Q1 H1 FY 2019 FY 2018 % change YoY FY 2019 FY 2019 Average Daily Total Gross Operated Production (boepd)* 196,010 190,389 3% 204,710 200,366 Average Daily Gross Operated Production (boepd) 185,296 180,955 3% 194,986 190,431 Rajasthan 155,194 153,238 1% 164,040 159,593 Ravva 13,496 17,266 (22%) 14,217 13,855 Cambay 17,236 10,452 65% 16,729 16,984 Average Daily Working Interest Production (boepd) 118,748 115,332 3% 124,807 121,761 Rajasthan 108,636 107,267 1% 114,828 111,715 Ravva 3,037 3,885 (22%) 3,199 3,117 Cambay 6,894 4,181 65% 6,692 6,794 KG-ONN 2003/1 181 - - 89 135 Total Oil and Gas (million boe) Oil & Gas- Gross 17.1 16.6 3% 17.7 34.8 Oil & Gas-Working Interest 10.9 10.6 3% 11.4 22.3 Financials (In Rs. crore, except as stated) Revenue 3,479 2,099 66% 3,219 6,698 EBITDA 2,026 1,176 72% 1,852 3,878 Average Oil Price Realization ($ / bbl) 69.5 45.1 54% 67.2 68.3 Brent Price ($/bbl) 75.2 52.1 44% 74.4 74.8 * Including internal gas consumption

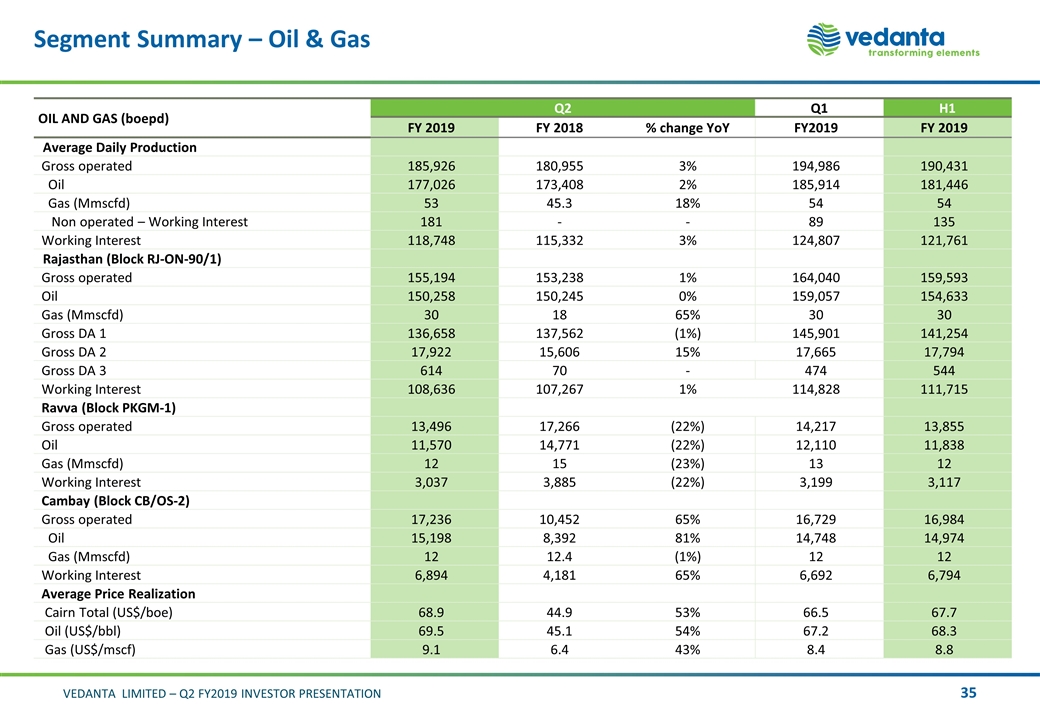

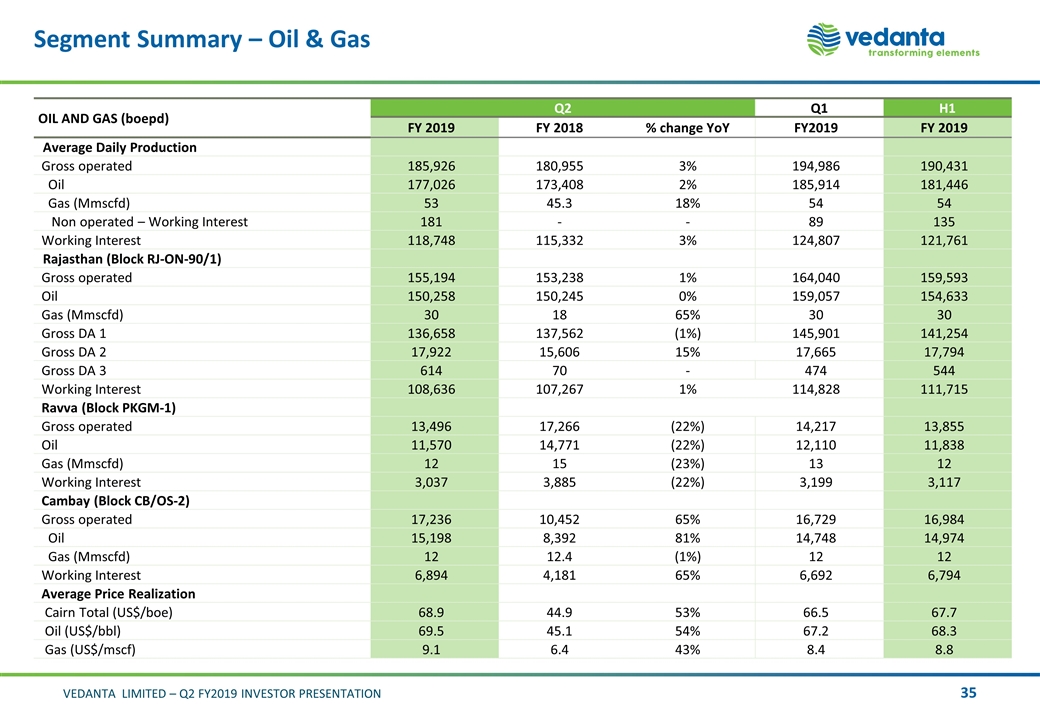

Segment Summary – Oil & Gas OIL AND GAS (boepd) Q2 Q1 H1 FY 2019 FY 2018 % change YoY FY2019 FY 2019 Average Daily Production Gross operated 185,926 180,955 3% 194,986 190,431 Oil 177,026 173,408 2% 185,914 181,446 Gas (Mmscfd) 53 45.3 18% 54 54 Non operated – Working Interest 181 - - 89 135 Working Interest 118,748 115,332 3% 124,807 121,761 Rajasthan (Block RJ-ON-90/1) Gross operated 155,194 153,238 1% 164,040 159,593 Oil 150,258 150,245 0% 159,057 154,633 Gas (Mmscfd) 30 18 65% 30 30 Gross DA 1 136,658 137,562 (1%) 145,901 141,254 Gross DA 2 17,922 15,606 15% 17,665 17,794 Gross DA 3 614 70 - 474 544 Working Interest 108,636 107,267 1% 114,828 111,715 Ravva (Block PKGM-1) Gross operated 13,496 17,266 (22%) 14,217 13,855 Oil 11,570 14,771 (22%) 12,110 11,838 Gas (Mmscfd) 12 15 (23%) 13 12 Working Interest 3,037 3,885 (22%) 3,199 3,117 Cambay (Block CB/OS-2) Gross operated 17,236 10,452 65% 16,729 16,984 Oil 15,198 8,392 81% 14,748 14,974 Gas (Mmscfd) 12 12.4 (1%) 12 12 Working Interest 6,894 4,181 65% 6,692 6,794 Average Price Realization Cairn Total (US$/boe) 68.9 44.9 53% 66.5 67.7 Oil (US$/bbl) 69.5 45.1 54% 67.2 68.3 Gas (US$/mscf) 9.1 6.4 43% 8.4 8.8

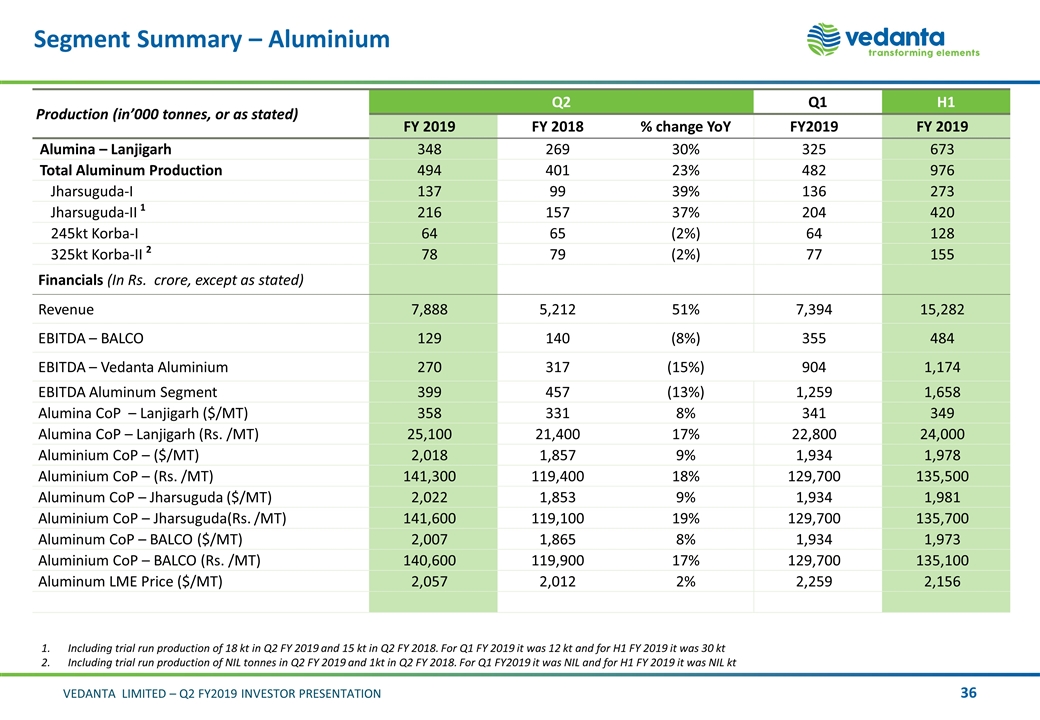

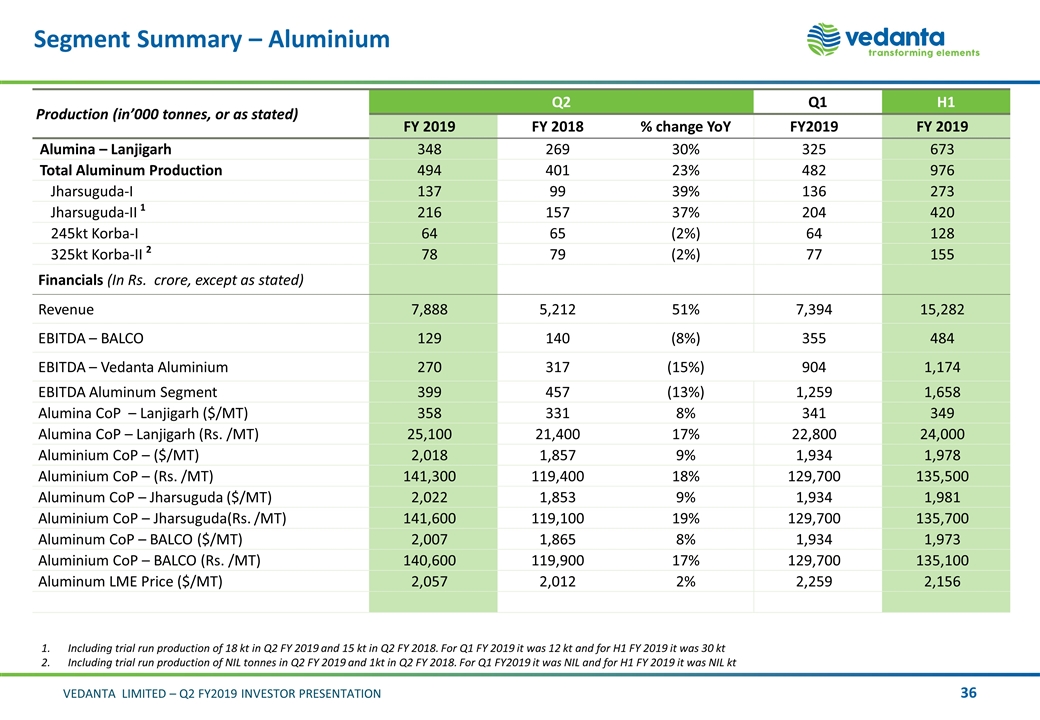

Segment Summary – Aluminium Production (in’000 tonnes, or as stated) Q2 Q1 H1 FY 2019 FY 2018 % change YoY FY2019 FY 2019 Alumina – Lanjigarh 348 269 30% 325 673 Total Aluminum Production 494 401 23% 482 976 Jharsuguda-I 137 99 39% 136 273 Jharsuguda-II 1 216 157 37% 204 420 245kt Korba-I 64 65 (2%) 64 128 325kt Korba-II 2 78 79 (2%) 77 155 Financials (In Rs. crore, except as stated) Revenue 7,888 5,212 51% 7,394 15,282 EBITDA – BALCO 129 140 (8%) 355 484 EBITDA – Vedanta Aluminium 270 317 (15%) 904 1,174 EBITDA Aluminum Segment 399 457 (13%) 1,259 1,658 Alumina CoP – Lanjigarh ($/MT) 358 331 8% 341 349 Alumina CoP – Lanjigarh (Rs. /MT) 25,100 21,400 17% 22,800 24,000 Aluminium CoP – ($/MT) 2,018 1,857 9% 1,934 1,978 Aluminium CoP – (Rs. /MT) 141,300 119,400 18% 129,700 135,500 Aluminum CoP – Jharsuguda ($/MT) 2,022 1,853 9% 1,934 1,981 Aluminium CoP – Jharsuguda(Rs. /MT) 141,600 119,100 19% 129,700 135,700 Aluminum CoP – BALCO ($/MT) 2,007 1,865 8% 1,934 1,973 Aluminium CoP – BALCO (Rs. /MT) 140,600 119,900 17% 129,700 135,100 Aluminum LME Price ($/MT) 2,057 2,012 2% 2,259 2,156 Including trial run production of 18 kt in Q2 FY 2019 and 15 kt in Q2 FY 2018. For Q1 FY 2019 it was 12 kt and for H1 FY 2019 it was 30 kt Including trial run production of NIL tonnes in Q2 FY 2019 and 1kt in Q2 FY 2018. For Q1 FY2019 it was NIL and for H1 FY 2019 it was NIL kt

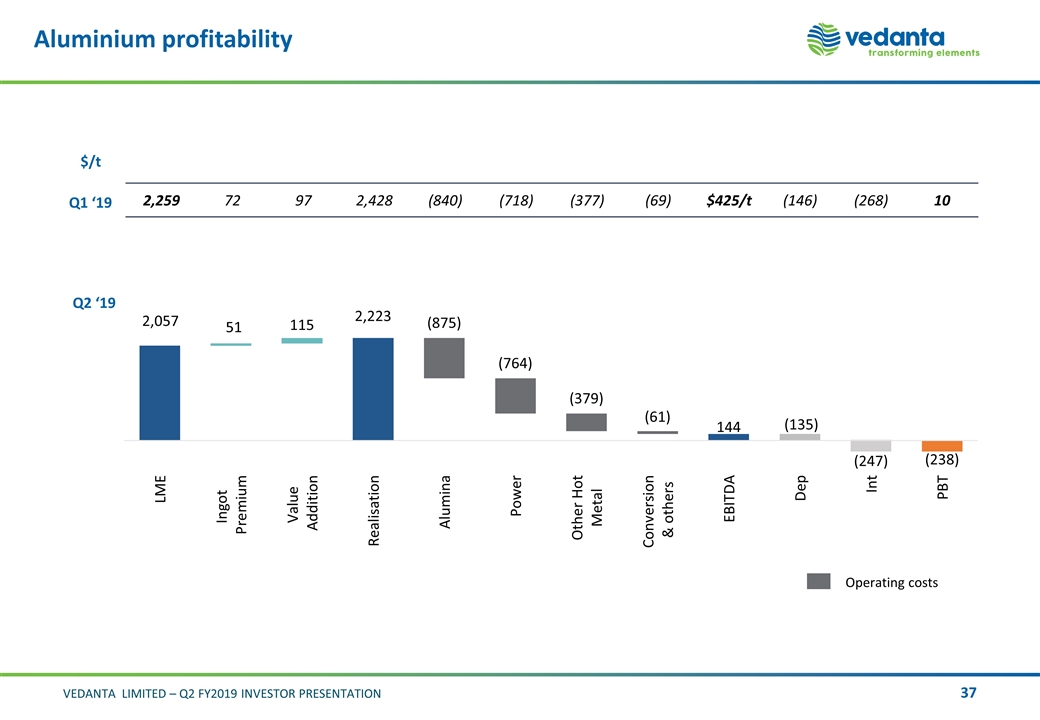

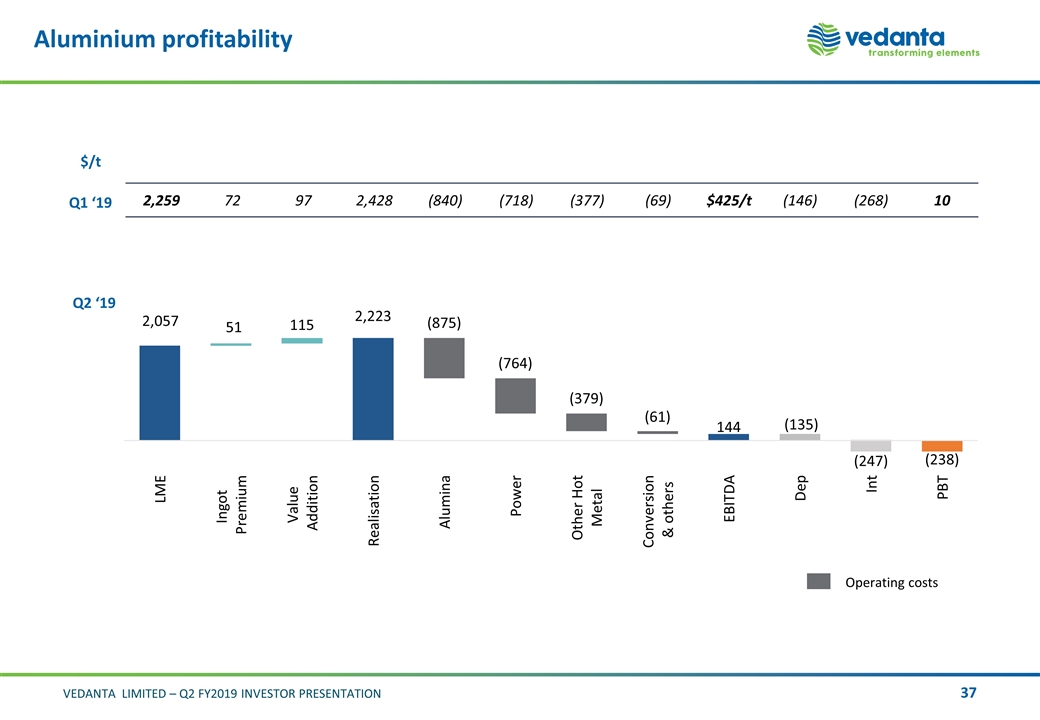

Aluminium profitability 2,259 72 97 2,428 (840) (718) (377) (69) $425/t (146) (268) 10 Q1 ‘19 Q2 ‘19 $/t

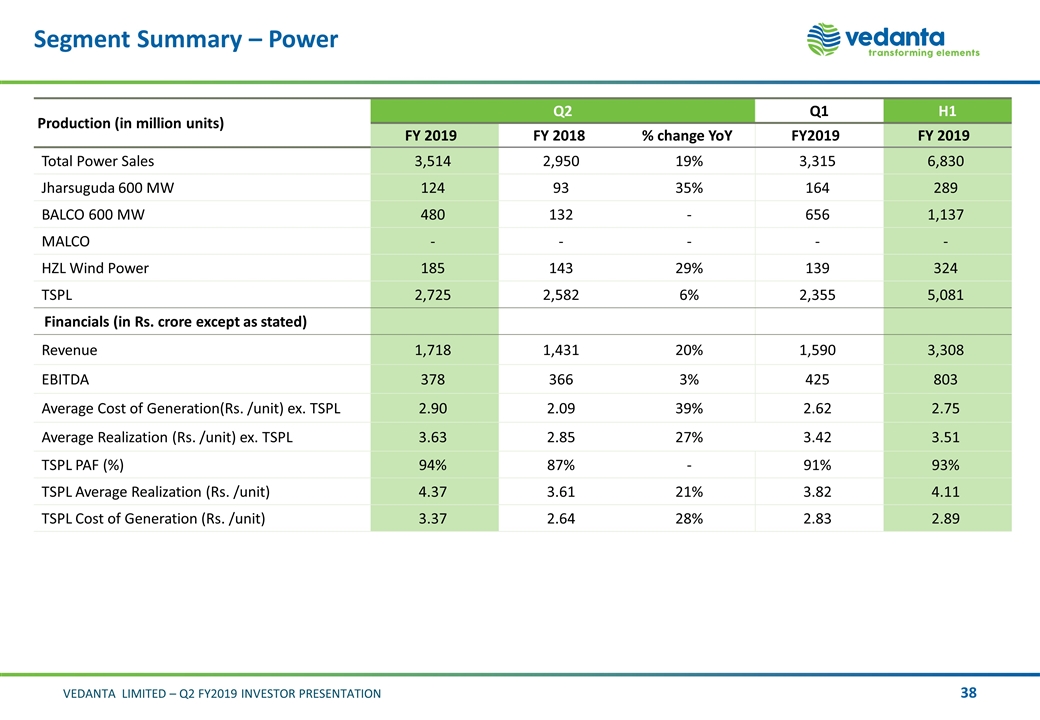

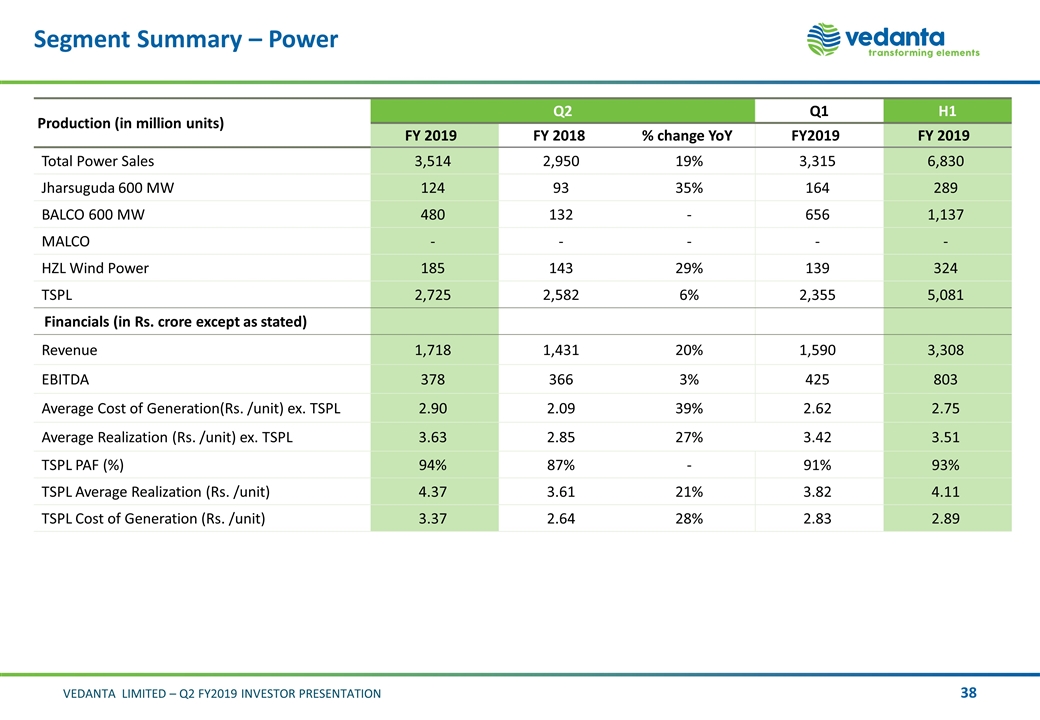

Segment Summary – Power Production (in million units) Q2 Q1 H1 FY 2019 FY 2018 % change YoY FY2019 FY 2019 Total Power Sales 3,514 2,950 19% 3,315 6,830 Jharsuguda 600 MW 124 93 35% 164 289 BALCO 600 MW 480 132 - 656 1,137 MALCO - - - - - HZL Wind Power 185 143 29% 139 324 TSPL 2,725 2,582 6% 2,355 5,081 Financials (in Rs. crore except as stated) Revenue 1,718 1,431 20% 1,590 3,308 EBITDA 378 366 3% 425 803 Average Cost of Generation(Rs. /unit) ex. TSPL 2.90 2.09 39% 2.62 2.75 Average Realization (Rs. /unit) ex. TSPL 3.63 2.85 27% 3.42 3.51 TSPL PAF (%) 94% 87% - 91% 93% TSPL Average Realization (Rs. /unit) 4.37 3.61 21% 3.82 4.11 TSPL Cost of Generation (Rs. /unit) 3.37 2.64 28% 2.83 2.89

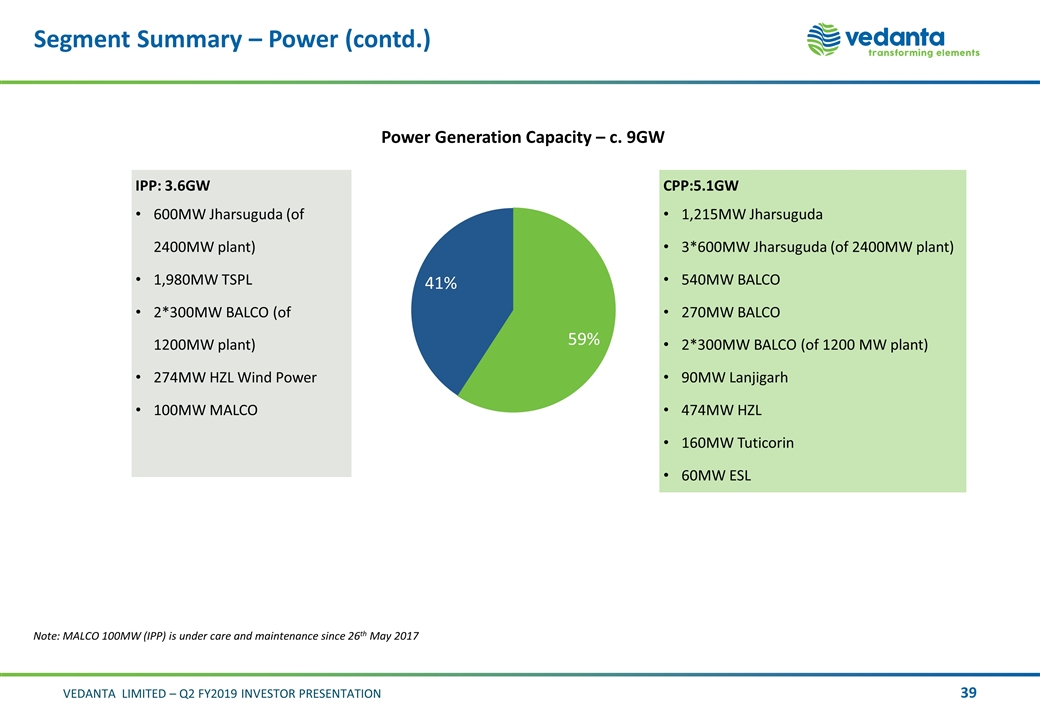

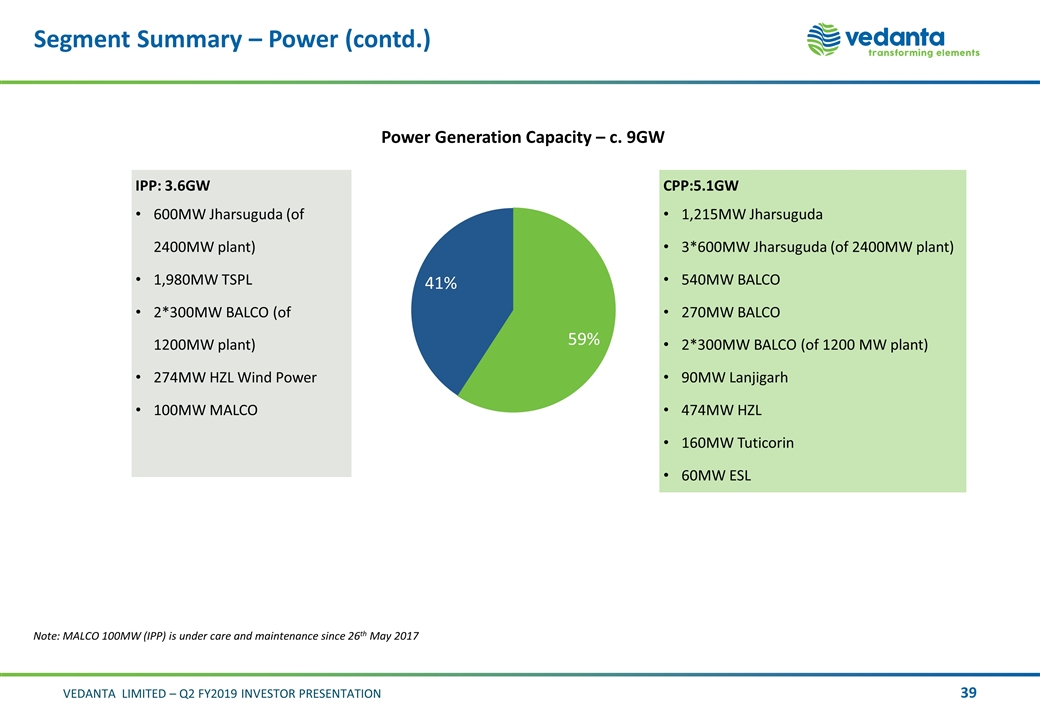

Segment Summary – Power (contd.) CPP:5.1GW 1,215MW Jharsuguda 3*600MW Jharsuguda (of 2400MW plant) 540MW BALCO 270MW BALCO 2*300MW BALCO (of 1200 MW plant) 90MW Lanjigarh 474MW HZL 160MW Tuticorin 60MW ESL IPP: 3.6GW 600MW Jharsuguda (of 2400MW plant) 1,980MW TSPL 2*300MW BALCO (of 1200MW plant) 274MW HZL Wind Power 100MW MALCO Power Generation Capacity – c. 9GW Note: MALCO 100MW (IPP) is under care and maintenance since 26th May 2017

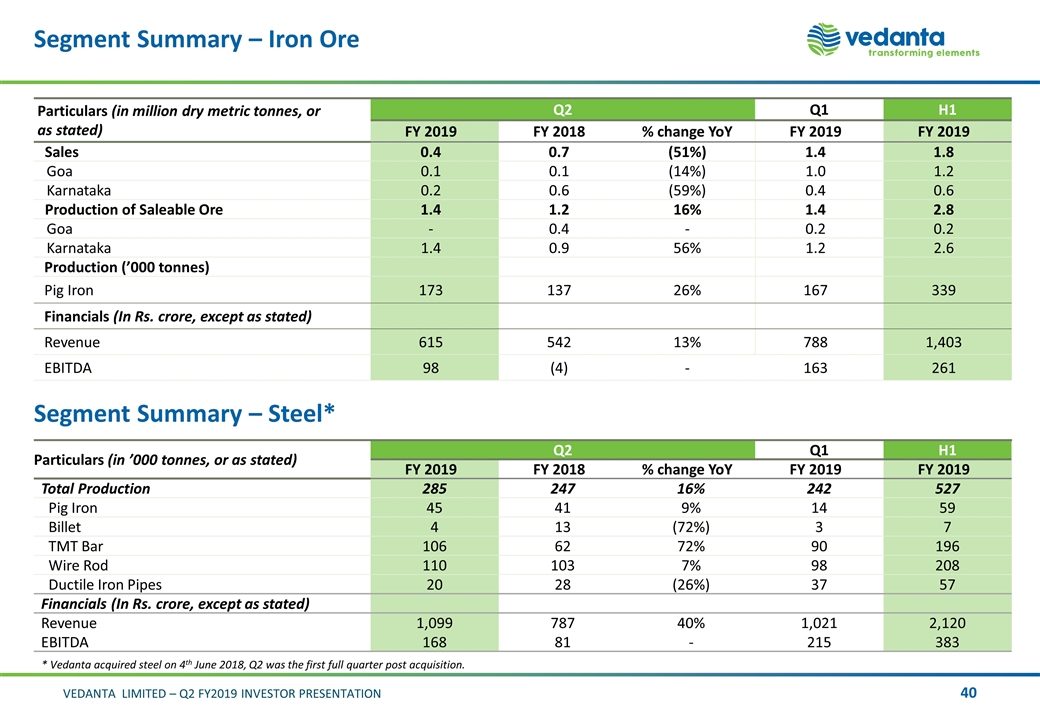

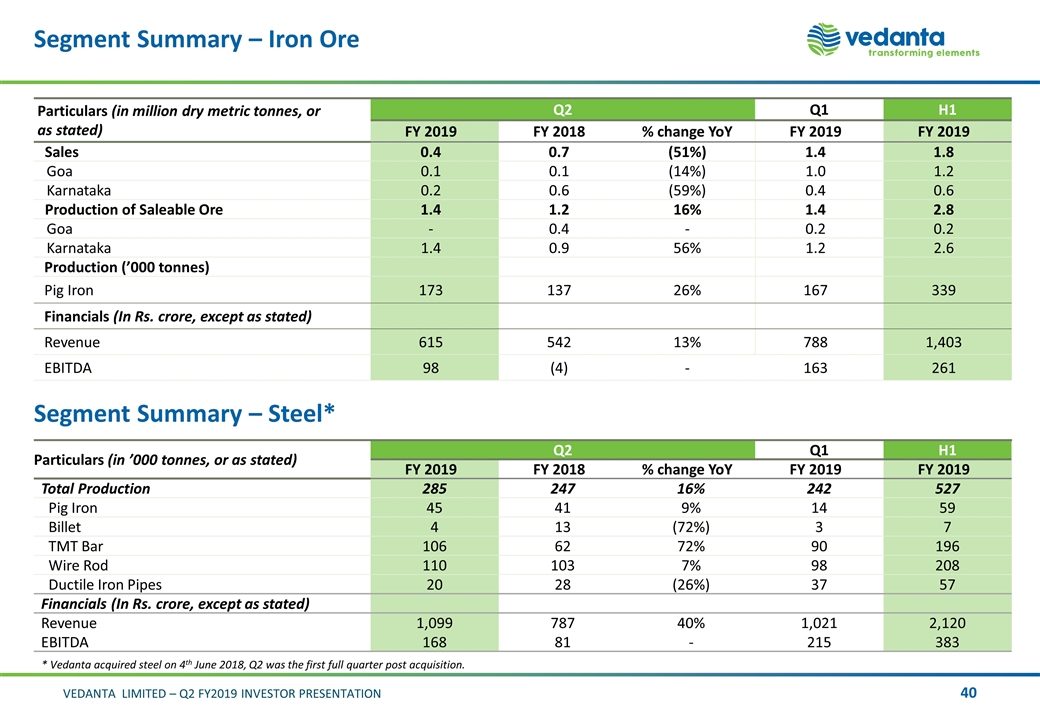

Segment Summary – Iron Ore Particulars (in million dry metric tonnes, or as stated) Q2 Q1 H1 FY 2019 FY 2018 % change YoY FY 2019 FY 2019 Sales 0.4 0.7 (51%) 1.4 1.8 Goa 0.1 0.1 (14%) 1.0 1.2 Karnataka 0.2 0.6 (59%) 0.4 0.6 Production of Saleable Ore 1.4 1.2 16% 1.4 2.8 Goa - 0.4 - 0.2 0.2 Karnataka 1.4 0.9 56% 1.2 2.6 Production (’000 tonnes) Pig Iron 173 137 26% 167 339 Financials (In Rs. crore, except as stated) Revenue 615 542 13% 788 1,403 EBITDA 98 (4) - 163 261 Particulars (in ’000 tonnes, or as stated) Q2 Q1 H1 FY 2019 FY 2018 % change YoY FY 2019 FY 2019 Total Production 285 247 16% 242 527 Pig Iron 45 41 9% 14 59 Billet 4 13 (72%) 3 7 TMT Bar 106 62 72% 90 196 Wire Rod 110 103 7% 98 208 Ductile Iron Pipes 20 28 (26%) 37 57 Financials (In Rs. crore, except as stated) Revenue 1,099 787 40% 1,021 2,120 EBITDA 168 81 - 215 383 Segment Summary – Steel* * Vedanta acquired steel on 4th June 2018, Q2 was the first full quarter post acquisition.

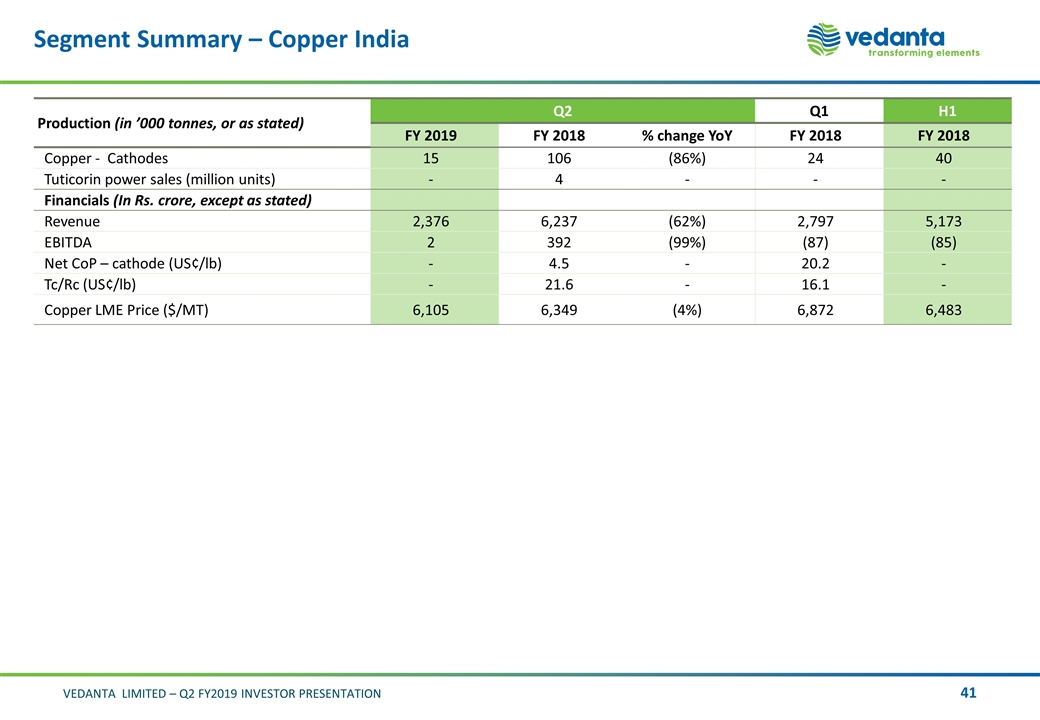

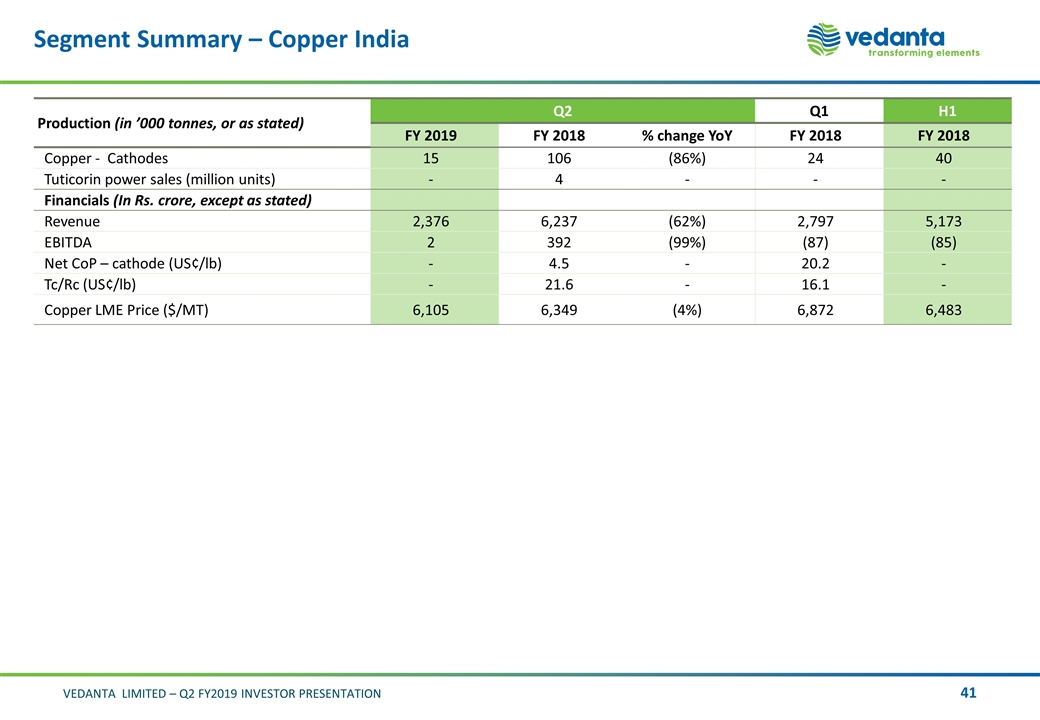

Segment Summary – Copper India Production (in ’000 tonnes, or as stated) Q2 Q1 H1 FY 2019 FY 2018 % change YoY FY 2018 FY 2018 Copper - Cathodes 15 106 (86%) 24 40 Tuticorin power sales (million units) - 4 - - - Financials (In Rs. crore, except as stated) Revenue 2,376 6,237 (62%) 2,797 5,173 EBITDA 2 392 (99%) (87) (85) Net CoP – cathode (US¢/lb) - 4.5 - 20.2 - Tc/Rc (US¢/lb) - 21.6 - 16.1 - Copper LME Price ($/MT) 6,105 6,349 (4%) 6,872 6,483

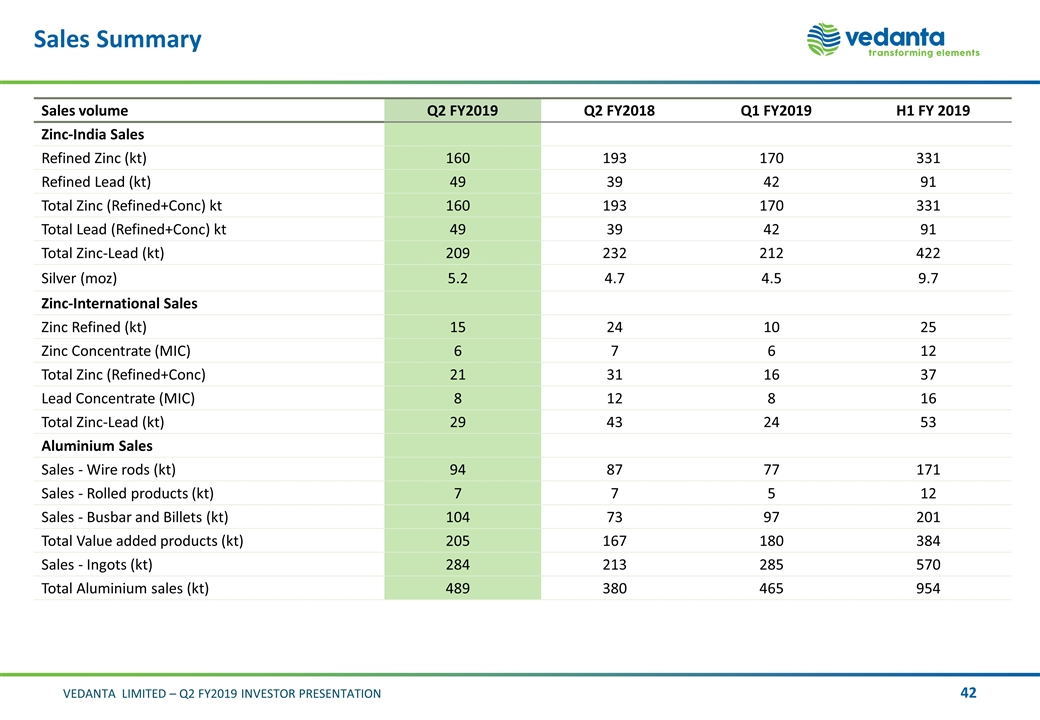

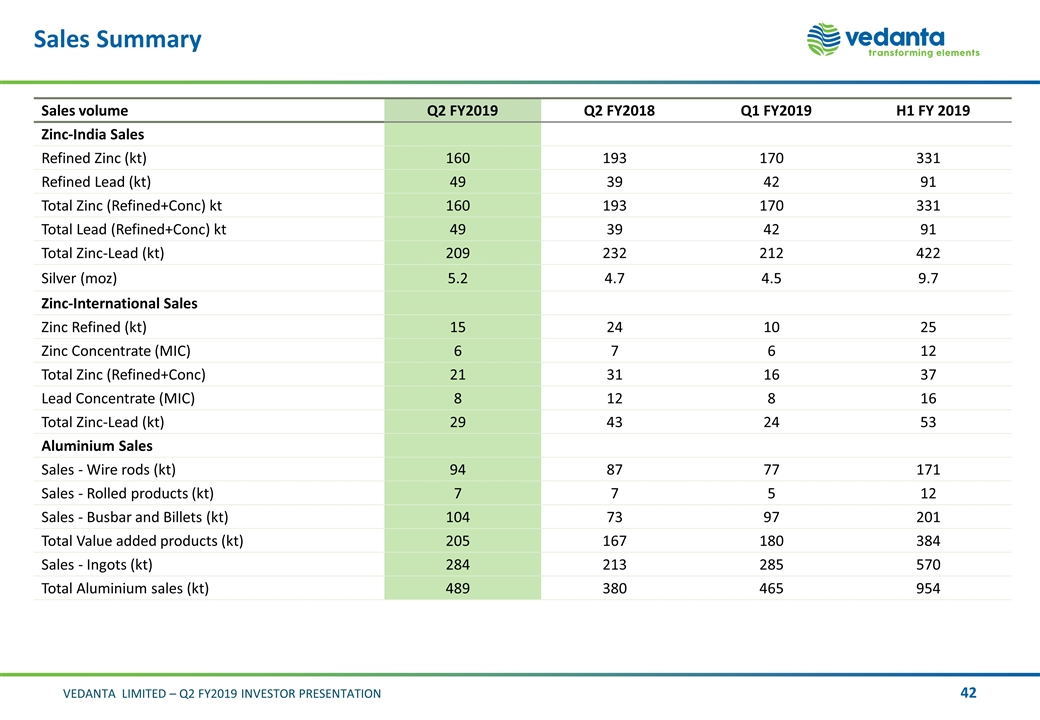

Sales Summary Sales volume Q2 FY2019 Q2 FY2018 Q1 FY2019 H1 FY 2019 Zinc-India Sales Refined Zinc (kt) 160 193 170 331 Refined Lead (kt) 49 39 42 91 Total Zinc (Refined+Conc) kt 160 193 170 331 Total Lead (Refined+Conc) kt 49 39 42 91 Total Zinc-Lead (kt) 209 232 212 422 Silver (moz) 5.2 4.7 4.5 9.7 Zinc-International Sales Zinc Refined (kt) 15 24 10 25 Zinc Concentrate (MIC) 6 7 6 12 Total Zinc (Refined+Conc) 21 31 16 37 Lead Concentrate (MIC) 8 12 8 16 Total Zinc-Lead (kt) 29 43 24 53 Aluminium Sales Sales - Wire rods (kt) 94 87 77 171 Sales - Rolled products (kt) 7 7 5 12 Sales - Busbar and Billets (kt) 104 73 97 201 Total Value added products (kt) 205 167 180 384 Sales - Ingots (kt) 284 213 285 570 Total Aluminium sales (kt) 489 380 465 954

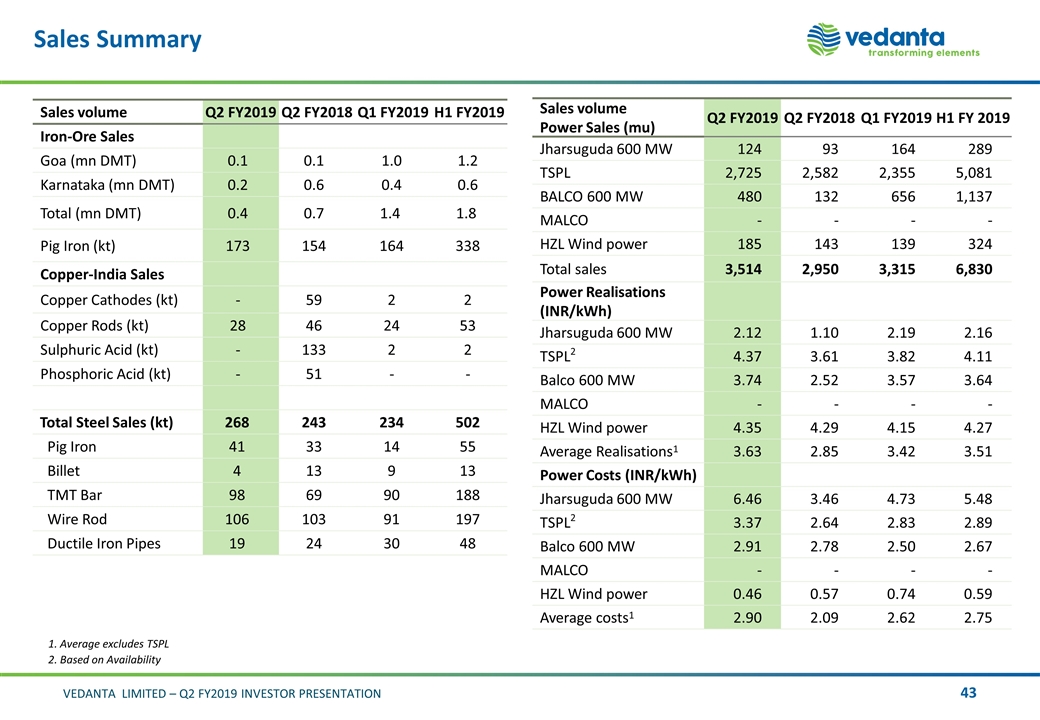

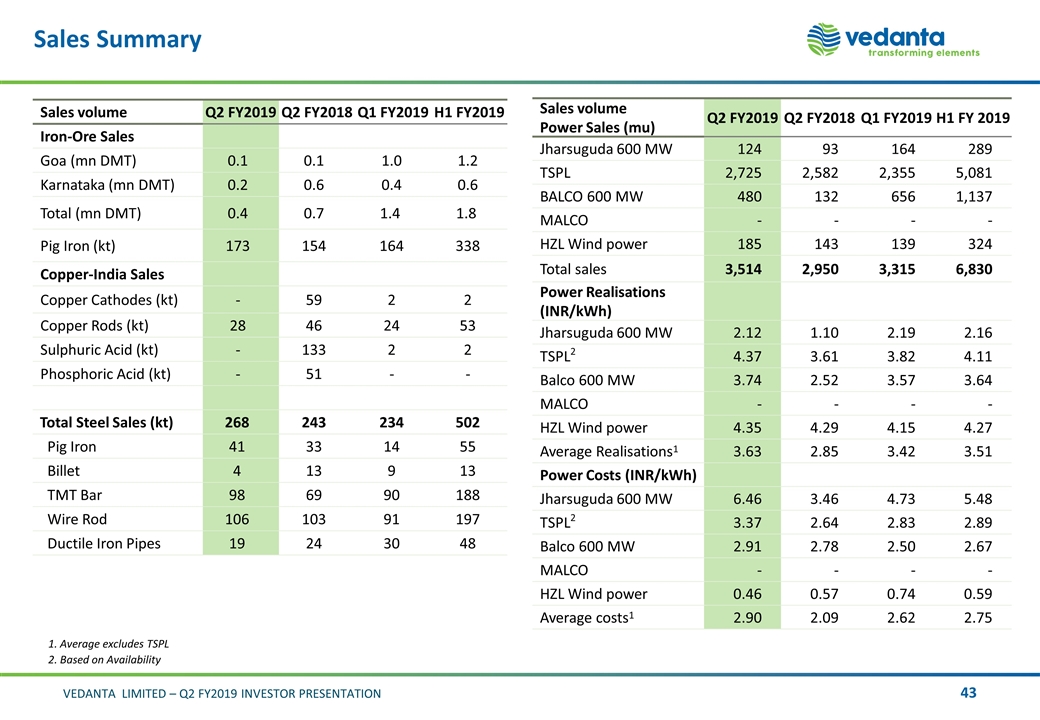

Sales Summary Sales volume Q2 FY2019 Q2 FY2018 Q1 FY2019 H1 FY2019 Iron-Ore Sales Goa (mn DMT) 0.1 0.1 1.0 1.2 Karnataka (mn DMT) 0.2 0.6 0.4 0.6 Total (mn DMT) 0.4 0.7 1.4 1.8 Pig Iron (kt) 173 154 164 338 Copper-India Sales Copper Cathodes (kt) - 59 2 2 Copper Rods (kt) 28 46 24 53 Sulphuric Acid (kt) - 133 2 2 Phosphoric Acid (kt) - 51 - - Total Steel Sales (kt) 268 243 234 502 Pig Iron 41 33 14 55 Billet 4 13 9 13 TMT Bar 98 69 90 188 Wire Rod 106 103 91 197 Ductile Iron Pipes 19 24 30 48 Sales volume Power Sales (mu) Q2 FY2019 Q2 FY2018 Q1 FY2019 H1 FY 2019 Jharsuguda 600 MW 124 93 164 289 TSPL 2,725 2,582 2,355 5,081 BALCO 600 MW 480 132 656 1,137 MALCO - - - - HZL Wind power 185 143 139 324 Total sales 3,514 2,950 3,315 6,830 Power Realisations (INR/kWh) Jharsuguda 600 MW 2.12 1.10 2.19 2.16 TSPL2 4.37 3.61 3.82 4.11 Balco 600 MW 3.74 2.52 3.57 3.64 MALCO - - - - HZL Wind power 4.35 4.29 4.15 4.27 Average Realisations1 3.63 2.85 3.42 3.51 Power Costs (INR/kWh) Jharsuguda 600 MW 6.46 3.46 4.73 5.48 TSPL2 3.37 2.64 2.83 2.89 Balco 600 MW 2.91 2.78 2.50 2.67 MALCO - - - - HZL Wind power 0.46 0.57 0.74 0.59 Average costs1 2.90 2.09 2.62 2.75 1. Average excludes TSPL 2. Based on Availability

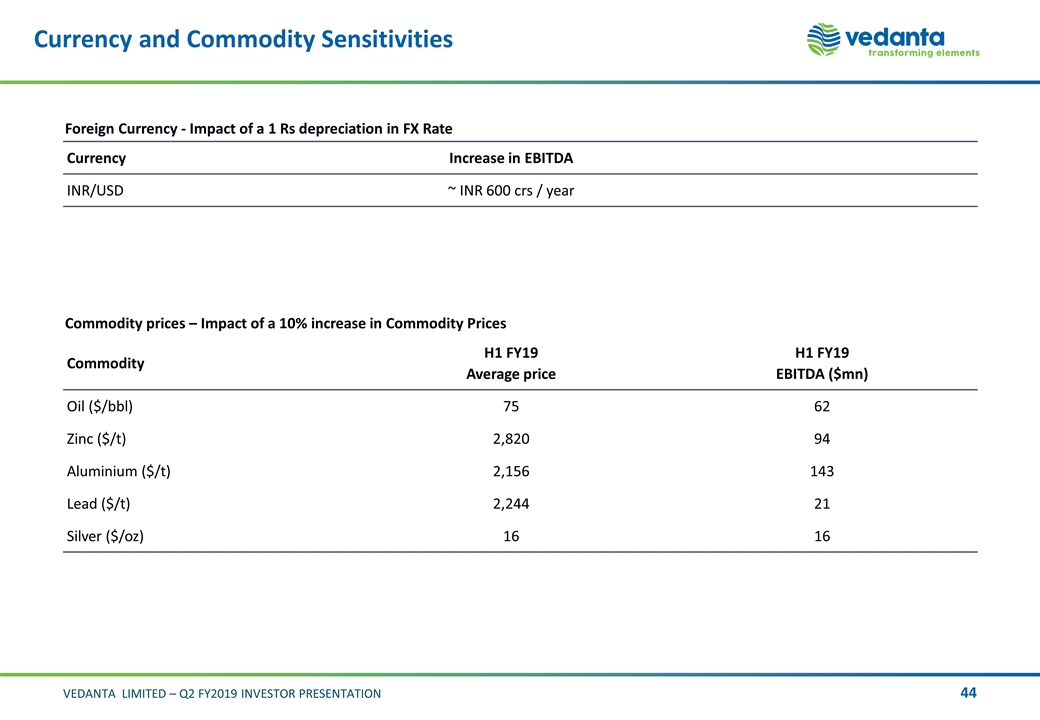

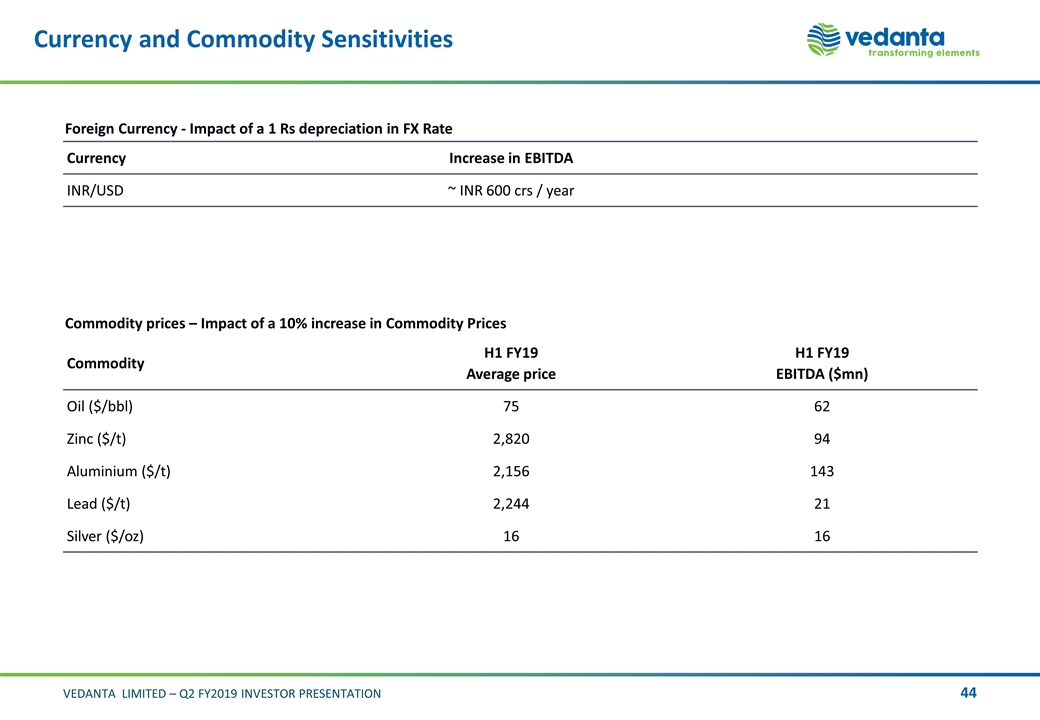

Currency and Commodity Sensitivities Commodity prices – Impact of a 10% increase in Commodity Prices Commodity H1 FY19 Average price H1 FY19 EBITDA ($mn) Oil ($/bbl) 75 62 Zinc ($/t) 2,820 94 Aluminium ($/t) 2,156 143 Lead ($/t) 2,244 21 Silver ($/oz) 16 16 Foreign Currency - Impact of a 1 Rs depreciation in FX Rate Currency Increase in EBITDA INR/USD ~ INR 600 crs / year

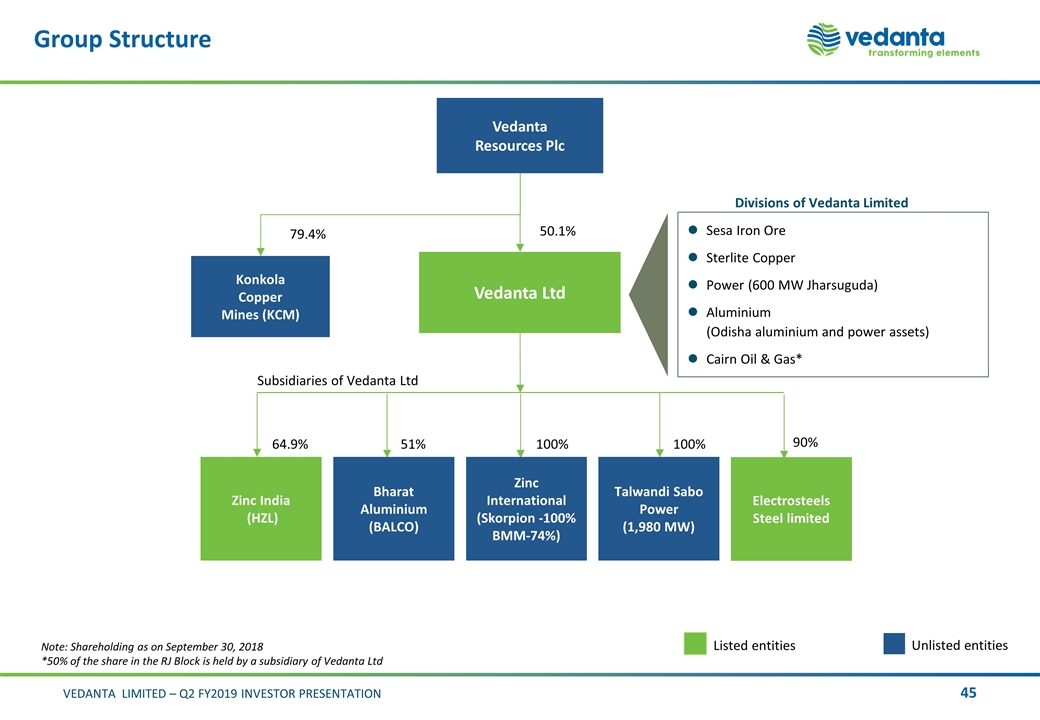

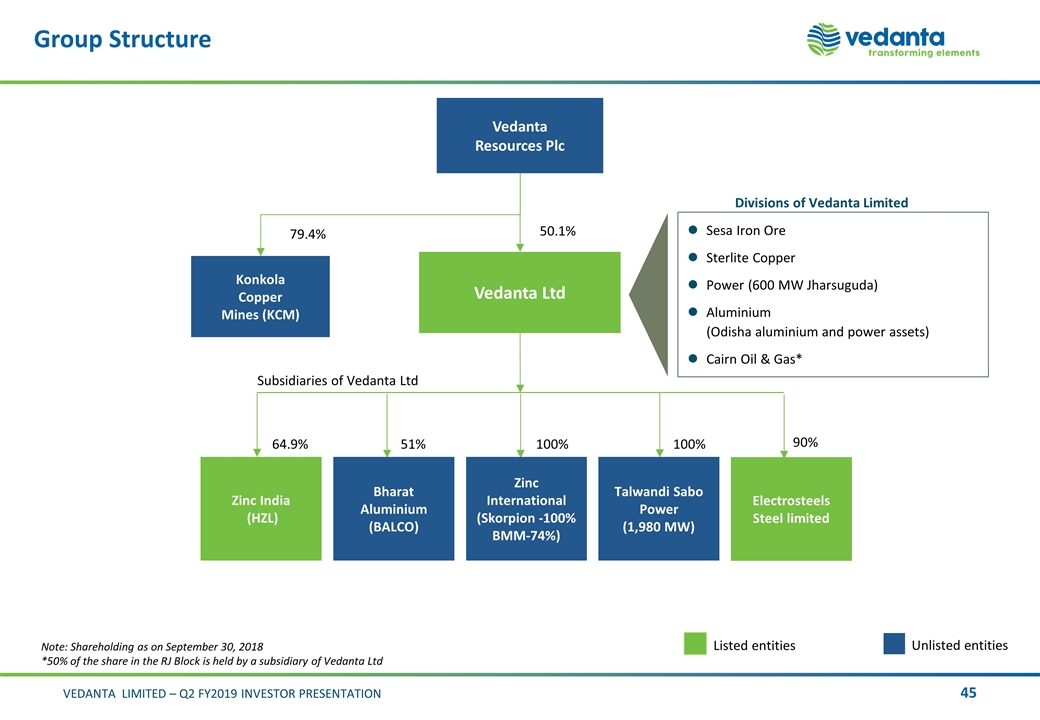

Group Structure Konkola Copper Mines (KCM) 50.1% Vedanta Resources Plc 64.9% Zinc India (HZL) Vedanta Ltd 79.4% Subsidiaries of Vedanta Ltd Sesa Iron Ore Sterlite Copper Power (600 MW Jharsuguda) Aluminium (Odisha aluminium and power assets) Cairn Oil & Gas* Divisions of Vedanta Limited Unlisted entities Listed entities Talwandi Sabo Power (1,980 MW) 100% Zinc International (Skorpion -100% BMM-74%) 100% 51% Bharat Aluminium (BALCO) Note: Shareholding as on September 30, 2018 *50% of the share in the RJ Block is held by a subsidiary of Vedanta Ltd Electrosteels Steel limited 90%

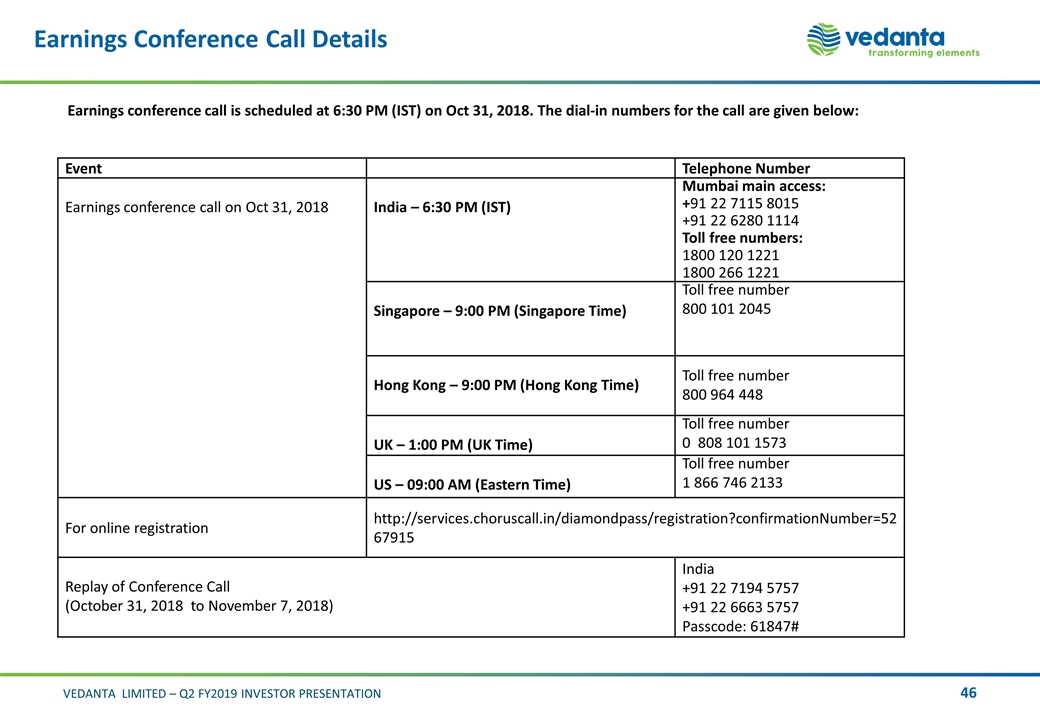

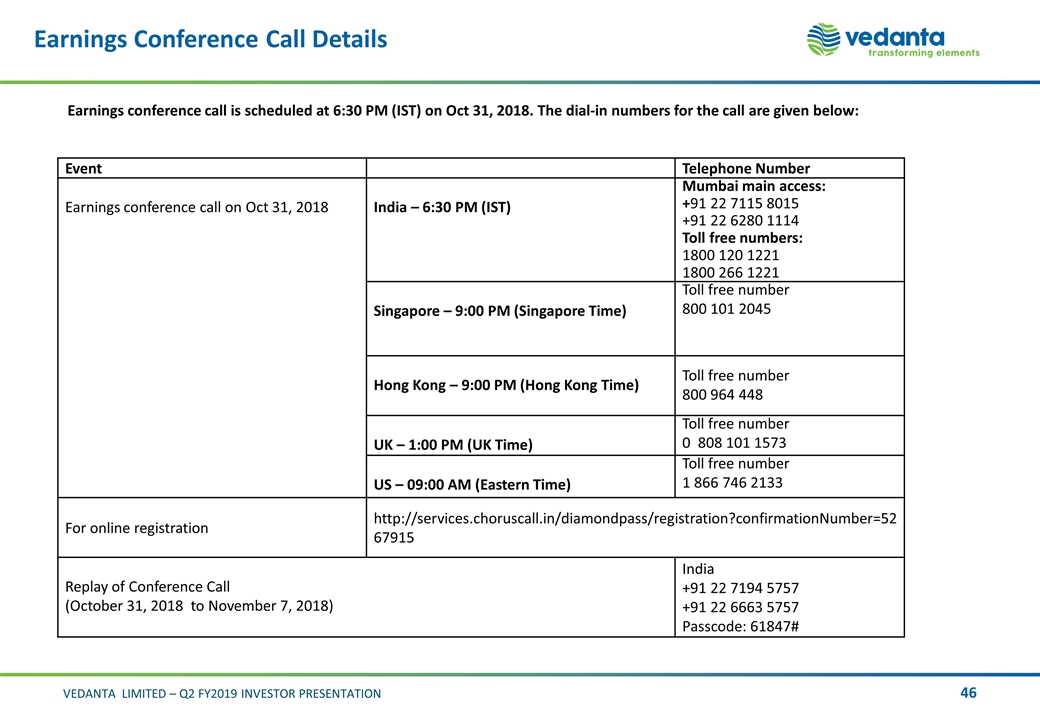

Earnings Conference Call Details Earnings conference call is scheduled at 6:30 PM (IST) on Oct 31, 2018. The dial-in numbers for the call are given below: Event Telephone Number Earnings conference call on Oct 31, 2018 India – 6:30 PM (IST) Mumbai main access: +91 22 7115 8015 +91 22 6280 1114 Toll free numbers: 1800 120 1221 1800 266 1221 Singapore – 9:00 PM (Singapore Time) Toll free number 800 101 2045 Hong Kong – 9:00 PM (Hong Kong Time) Toll free number 800 964 448 UK – 1:00 PM (UK Time) Toll free number 0 808 101 1573 US – 09:00 AM (Eastern Time) Toll free number 1 866 746 2133 For online registration http://services.choruscall.in/diamondpass/registration?confirmationNumber=5267915 Replay of Conference Call (October 31, 2018 to November 7, 2018) India +91 22 7194 5757 +91 22 6663 5757 Passcode: 61847#