Q4 & FY2021 Earnings Presentation 13 May 2021 VEDANTA LIMITED INVESTOR PRESENTATION Exhibit 99.4

Cautionary Statement and Disclaimer The views expressed here may contain information derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness, reasonableness or reliability of this information. Any forward looking information in this presentation including, without limitation, any tables, charts and/or graphs, has been prepared on the basis of a number of assumptions which may prove to be incorrect. This presentation should not be relied upon as a recommendation or forecast by Vedanta Resources plc and Vedanta Limited and any of their subsidiaries. Past performance of Vedanta Resources plc and Vedanta Limited and any of their subsidiaries cannot be relied upon as a guide to future performance. This presentation contains 'forward-looking statements' – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance, and often contain words such as 'expects,' 'anticipates,' 'intends,' 'plans,' 'believes,' 'seeks,' or 'will.' Forward–looking statements by their nature address matters that are, to different degrees, uncertain. For us, uncertainties arise from the behaviour of financial and metals markets including the London Metal Exchange, fluctuations in interest and or exchange rates and metal prices; from future integration of acquired businesses; and from numerous other matters of national, regional and global scale, including those of a environmental, climatic, natural, political, economic, business, competitive or regulatory nature. These uncertainties may cause our actual future results to be materially different that those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements. We caution you that reliance on any forward-looking statement involves risk and uncertainties, and that, although we believe that the assumption on which our forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate and, as a result, the forward-looking statement based on those assumptions could be materially incorrect. This presentation is not intended, and does not, constitute or form part of any offer, invitation or the solicitation of an offer to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of, any securities in Vedanta Resources plc and Vedanta Limited and any of their subsidiaries or undertakings or any other invitation or inducement to engage in investment activities, nor shall this presentation (or any part of it) nor the fact of its distribution form the basis of, or be relied on in connection with, any contract or investment decision.

Contents Section Presenter Page Q4 & FY21 Review & Business Update Sunil Duggal, CEO 4 Financial Update Ajay Goel, Deputy CFO 23 Appendix 31

Q4 & FY2021 Review and Business Update Sunil Duggal Group CEO & Chief Safety Officer

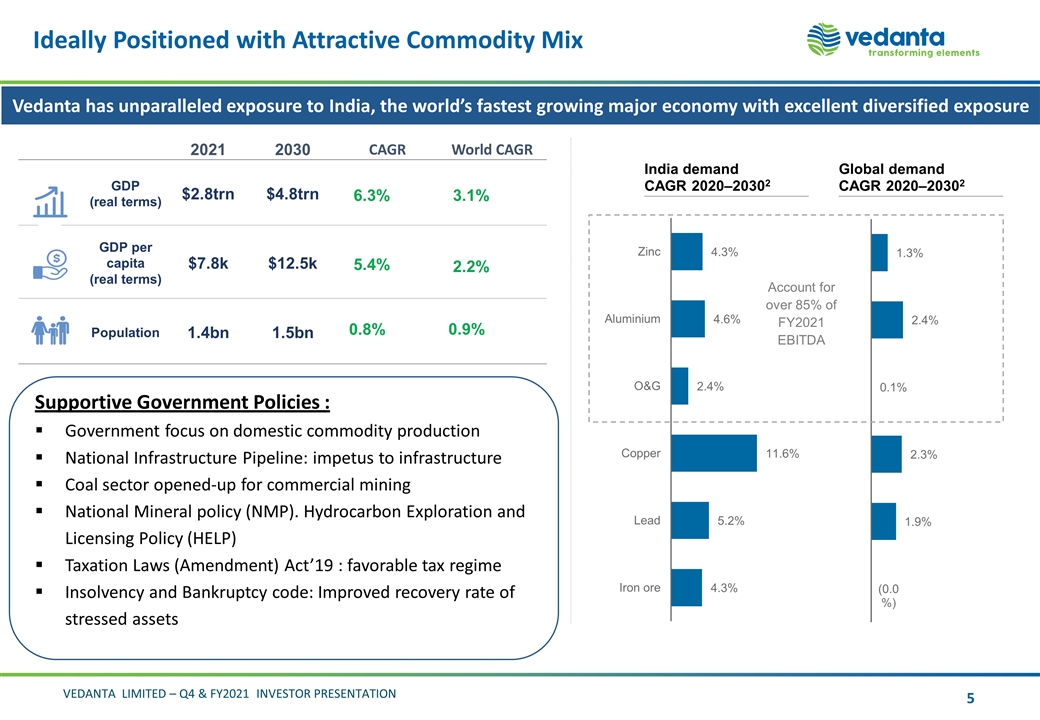

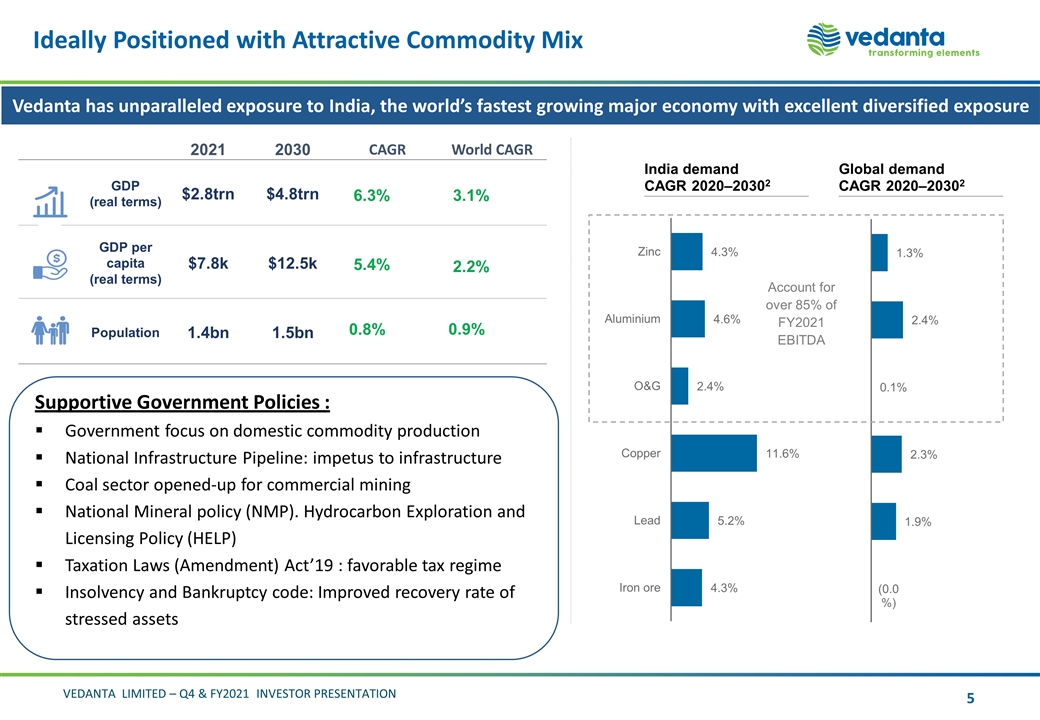

Ideally Positioned with Attractive Commodity Mix 2021 2030 CAGR World CAGR GDP (real terms) $2.8trn $4.8trn GDP per capita (real terms) $7.8k $12.5k Population 1.4bn 1.5bn 5.4% 6.3% 0.8% 3.1% 2.2% 0.9% Source: WoodMackenzie, IHS Markit Note: 1 In the process of spinning off coal divisions; 2 O&G CAGR shown on 2018-2030 basis India demand CAGR 2020–20302 Global demand CAGR 2020–20302 Account for over 85% of FY2021 EBITDA 1 Vedanta has unparalleled exposure to India, the world’s fastest growing major economy with excellent diversified exposure Supportive Government Policies : Government focus on domestic commodity production National Infrastructure Pipeline: impetus to infrastructure Coal sector opened-up for commercial mining National Mineral policy (NMP). Hydrocarbon Exploration and Licensing Policy (HELP) Taxation Laws (Amendment) Act’19 : favorable tax regime Insolvency and Bankruptcy code: Improved recovery rate of stressed assets

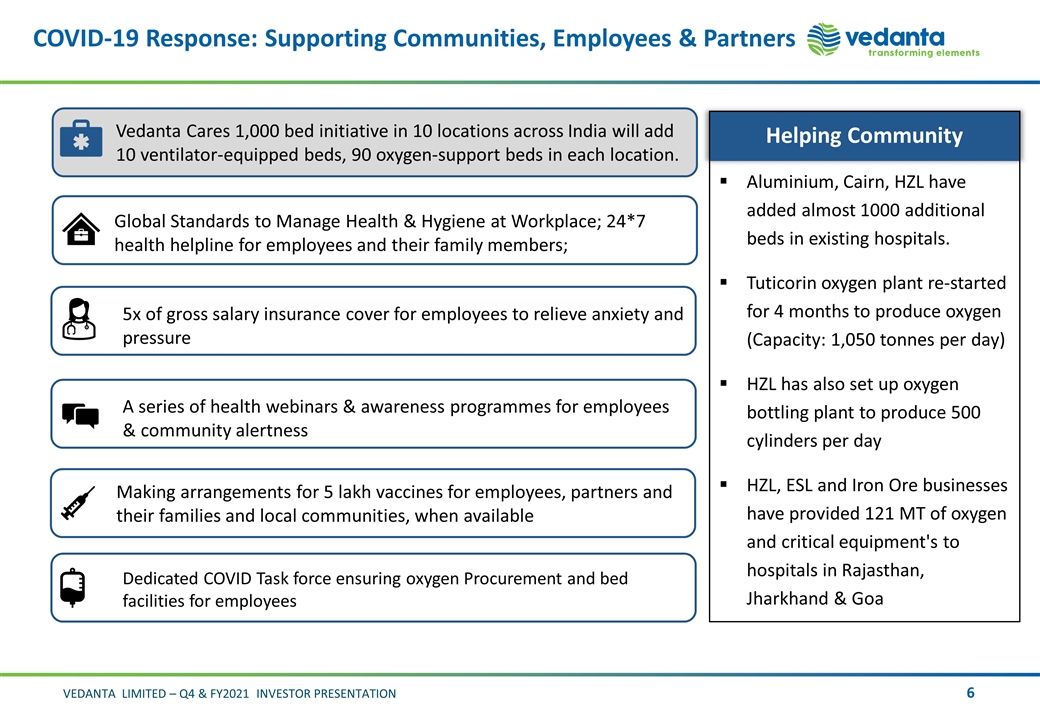

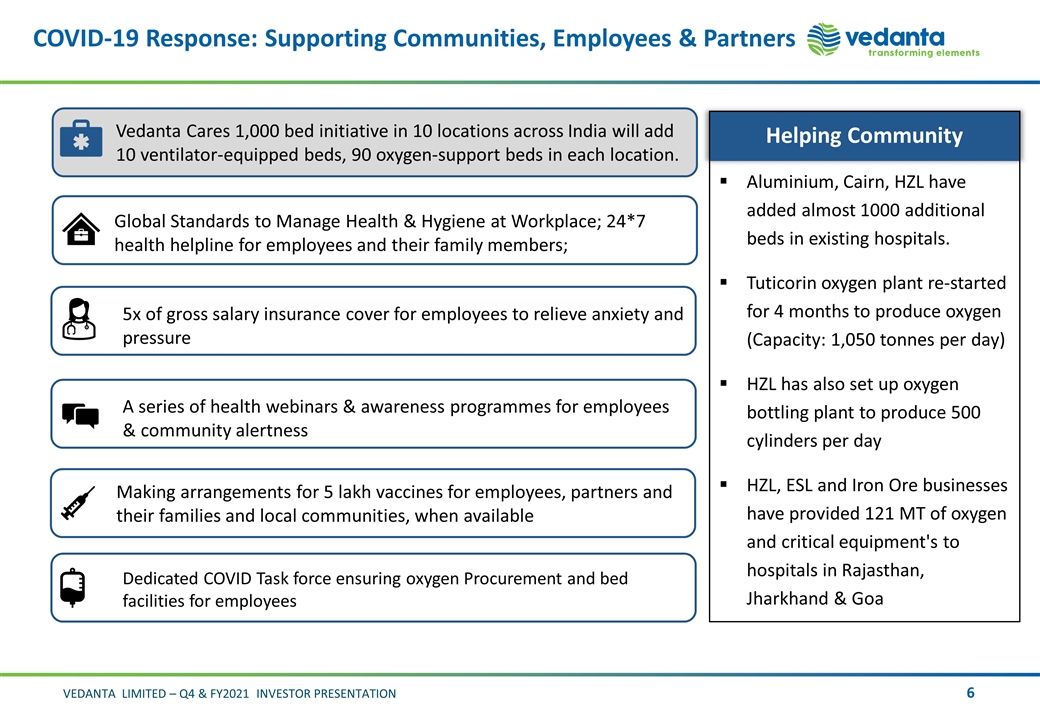

COVID-19 Response: Supporting Communities, Employees & Partners Vedanta Cares 1,000 bed initiative in 10 locations across India will add 10 ventilator-equipped beds, 90 oxygen-support beds in each location. Helping Community Aluminium, Cairn, HZL have added almost 1000 additional beds in existing hospitals. Tuticorin oxygen plant re-started for 4 months to produce oxygen (Capacity: 1,050 tonnes per day) HZL has also set up oxygen bottling plant to produce 500 cylinders per day HZL, ESL and Iron Ore businesses have provided 121 MT of oxygen and critical equipment's to hospitals in Rajasthan, Jharkhand & Goa 5x of gross salary insurance cover for employees to relieve anxiety and pressure A series of health webinars & awareness programmes for employees & community alertness Making arrangements for 5 lakh vaccines for employees, partners and their families and local communities, when available Dedicated COVID Task force ensuring oxygen Procurement and bed facilities for employees Global Standards to Manage Health & Hygiene at Workplace; 24*7 health helpline for employees and their family members;

Key Highlights: FY 2021 Production Cost of Production R&R Records At Zinc India, Aluminium & Zinc International Lower Across all the businesses Advancing Enhancing life and R&R base Reliability Technology & Digitalization COVID-19 Improved No major operational disruptions On Track Enabled operational excellence and growth Highest safety standards Ensuring well-being of employees /partners Contribution to Society

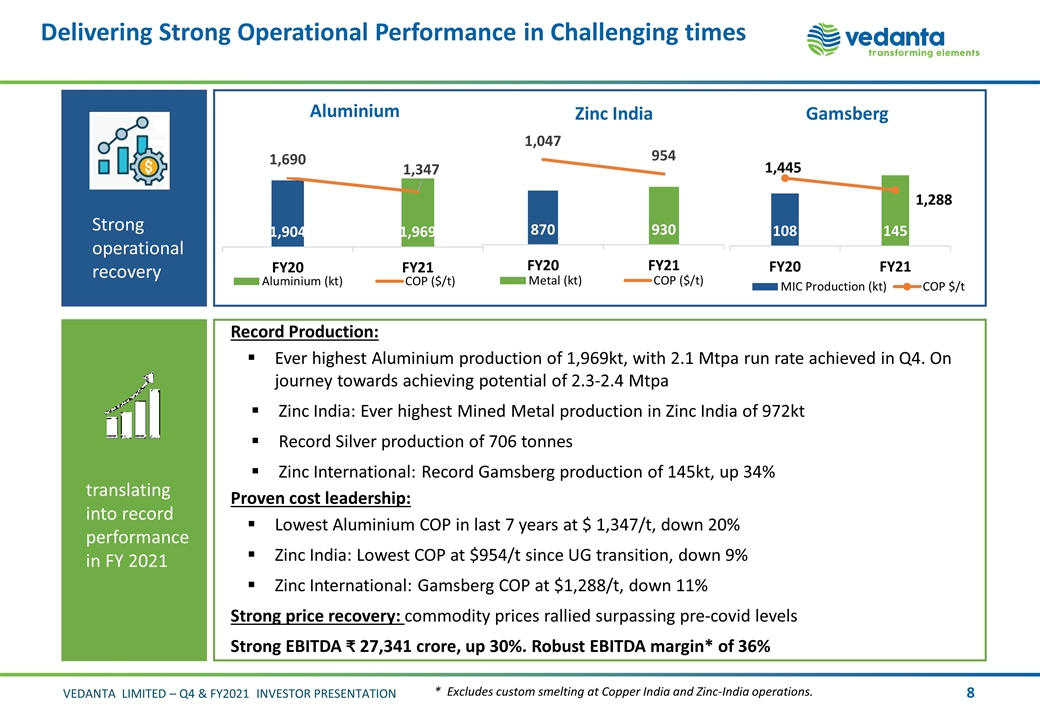

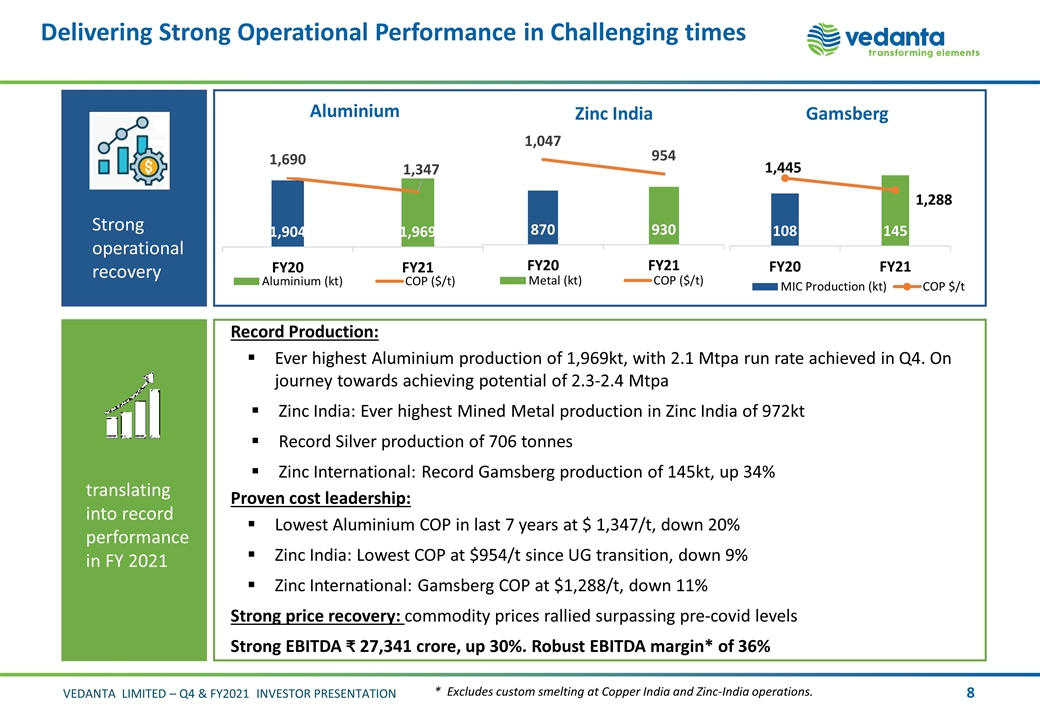

Delivering Strong Operational Performance in Challenging times translating into record performance in FY 2021 Strong operational recovery Record Production: Ever highest Aluminium production of 1,969kt, with 2.1 Mtpa run rate achieved in Q4. On journey towards achieving potential of 2.3-2.4 Mtpa Zinc India: Ever highest Mined Metal production in Zinc India of 972kt Record Silver production of 706 tonnes Zinc International: Record Gamsberg production of 145kt, up 34% Proven cost leadership: Lowest Aluminium COP in last 7 years at $ 1,347/t, down 20% Zinc India: Lowest COP at $954/t since UG transition, down 9% Zinc International: Gamsberg COP at $1,288/t, down 11% Strong price recovery: commodity prices rallied surpassing pre-covid levels Strong EBITDA 27,341 crore, up 30%. Robust EBITDA margin* of 36% Zinc India Gamsberg Aluminium * Excludes custom smelting at Copper India and Zinc-India operations.

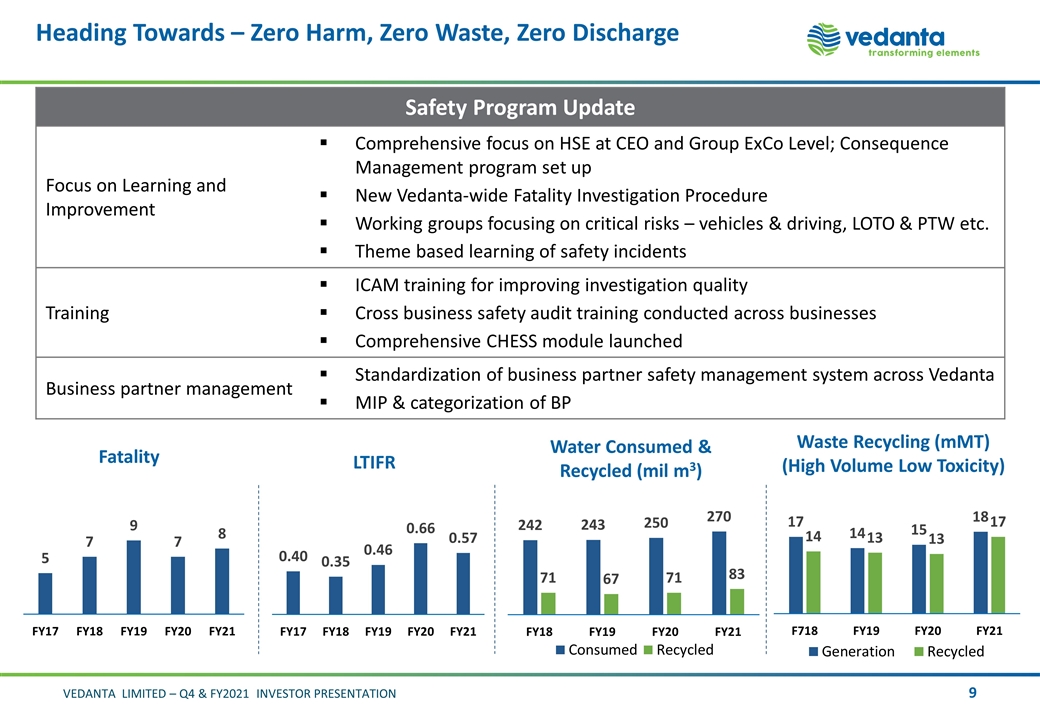

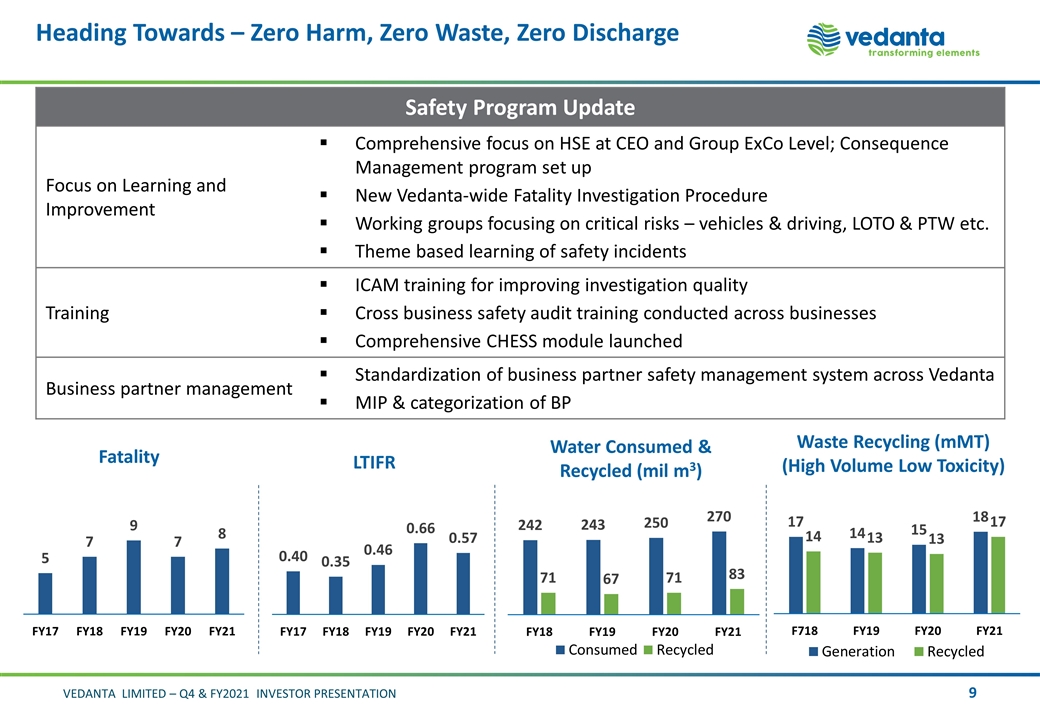

Heading Towards – Zero Harm, Zero Waste, Zero Discharge Water Consumed & Recycled (mil m3) LTIFR Fatality Waste Recycling (mMT) (High Volume Low Toxicity) Safety Program Update Focus on Learning and Improvement Comprehensive focus on HSE at CEO and Group ExCo Level; Consequence Management program set up New Vedanta-wide Fatality Investigation Procedure Working groups focusing on critical risks – vehicles & driving, LOTO & PTW etc. Theme based learning of safety incidents Training ICAM training for improving investigation quality Cross business safety audit training conducted across businesses Comprehensive CHESS module launched Business partner management Standardization of business partner safety management system across Vedanta MIP & categorization of BP

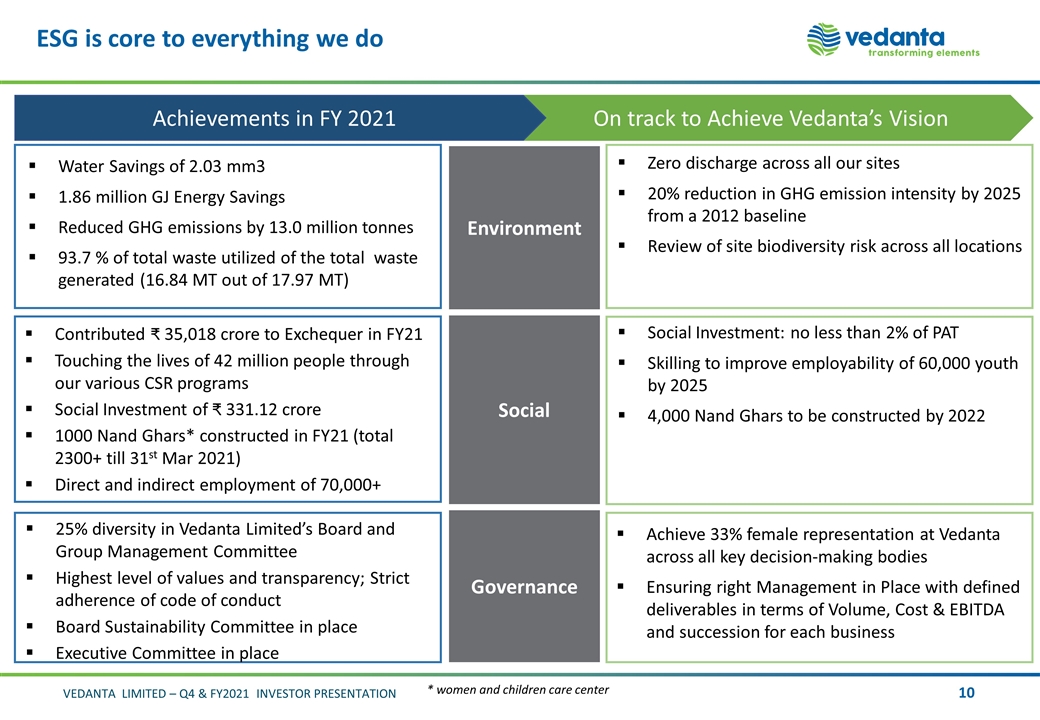

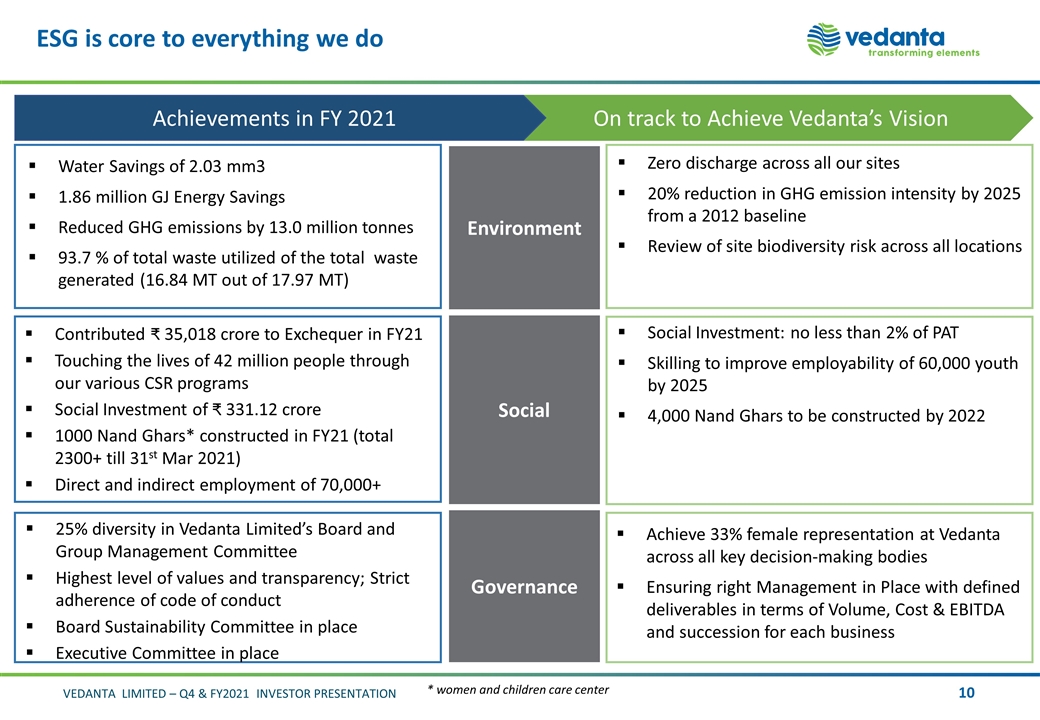

On track to Achieve Vedanta’s Vision ESG is core to everything we do Achievements in FY 2021 Environment Social Governance Water Savings of 2.03 mm3 1.86 million GJ Energy Savings Reduced GHG emissions by 13.0 million tonnes 93.7 % of total waste utilized of the total waste generated (16.84 MT out of 17.97 MT) Contributed 35,018 crore to Exchequer in FY21 Touching the lives of 42 million people through our various CSR programs Social Investment of 331.12 crore 1000 Nand Ghars* constructed in FY21 (total 2300+ till 31st Mar 2021) Direct and indirect employment of 70,000+ 25% diversity in Vedanta Limited’s Board and Group Management Committee Highest level of values and transparency; Strict adherence of code of conduct Board Sustainability Committee in place Executive Committee in place Zero discharge across all our sites 20% reduction in GHG emission intensity by 2025 from a 2012 baseline Review of site biodiversity risk across all locations Social Investment: no less than 2% of PAT Skilling to improve employability of 60,000 youth by 2025 4,000 Nand Ghars to be constructed by 2022 Achieve 33% female representation at Vedanta across all key decision-making bodies Ensuring right Management in Place with defined deliverables in terms of Volume, Cost & EBITDA and succession for each business * women and children care center

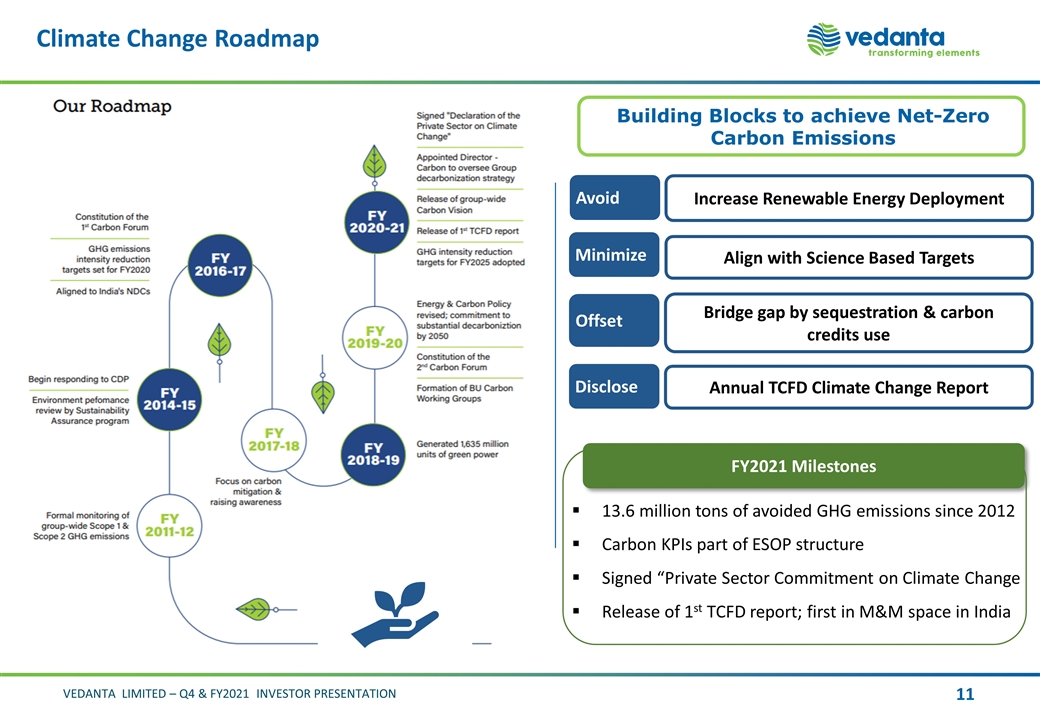

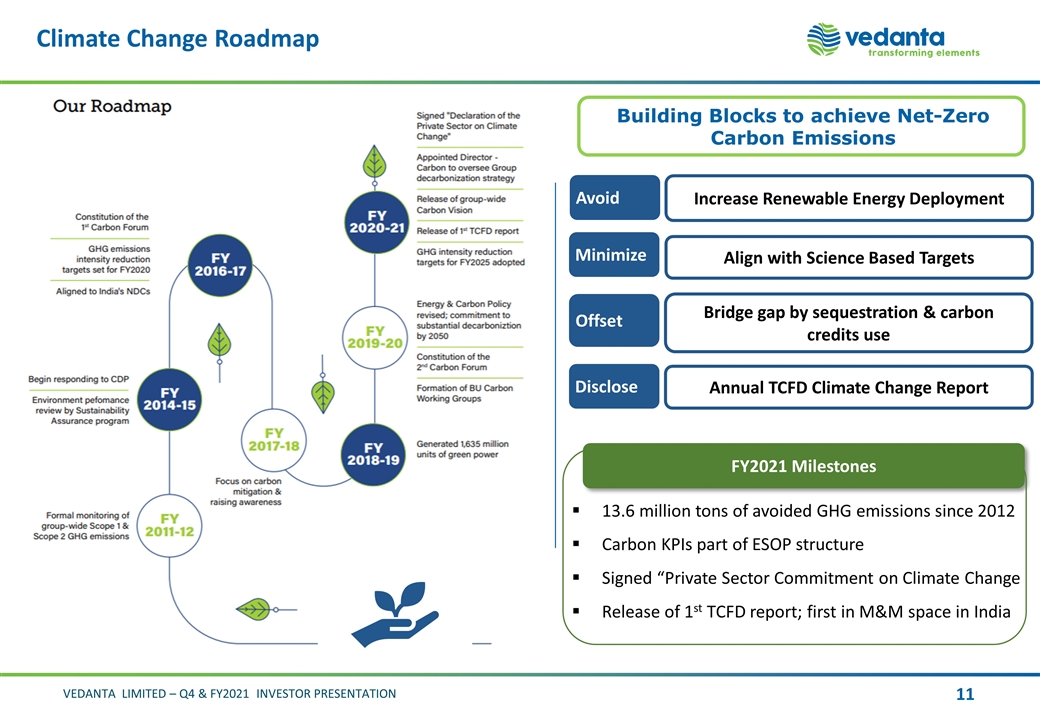

Climate Change Roadmap Increase Renewable Energy Deployment Align with Science Based Targets Bridge gap by sequestration & carbon credits use Annual TCFD Climate Change Report FY2021 Milestones Building Blocks to achieve Net-Zero Carbon Emissions 13.6 million tons of avoided GHG emissions since 2012 Carbon KPIs part of ESOP structure Signed “Private Sector Commitment on Climate Change Release of 1st TCFD report; first in M&M space in India Avoid Minimize Offset Disclose

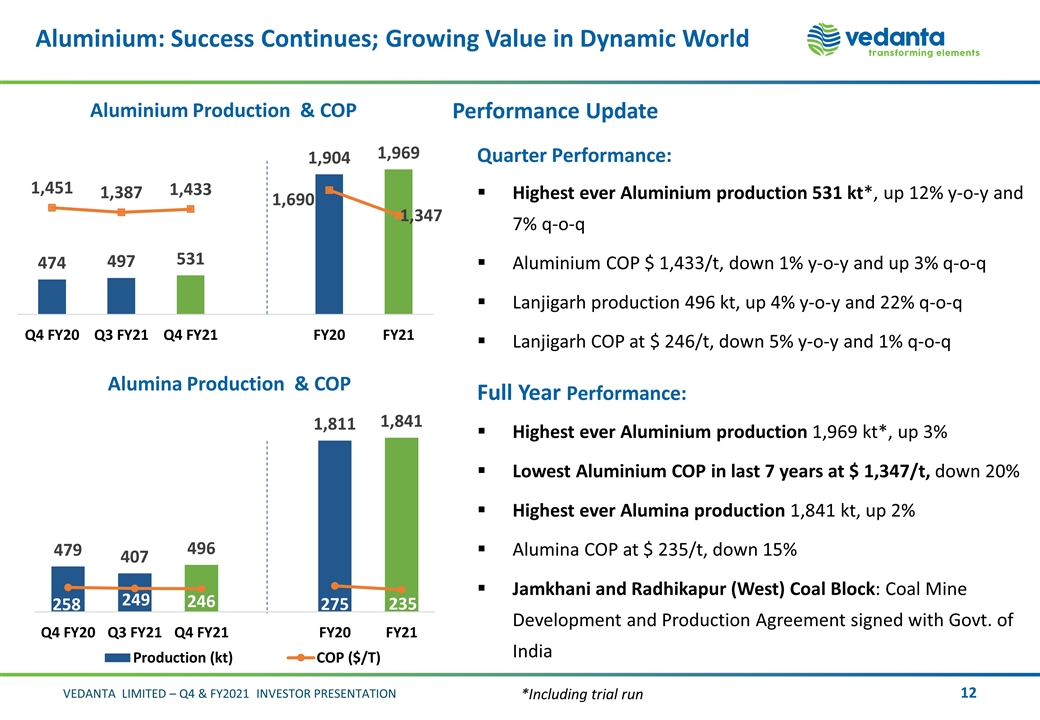

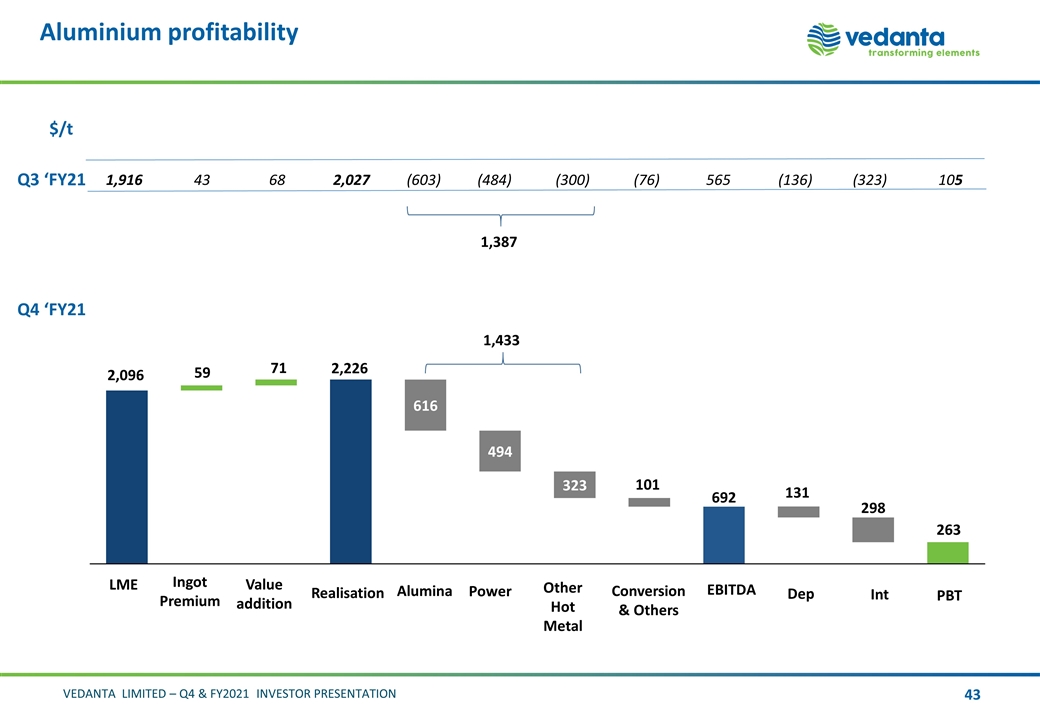

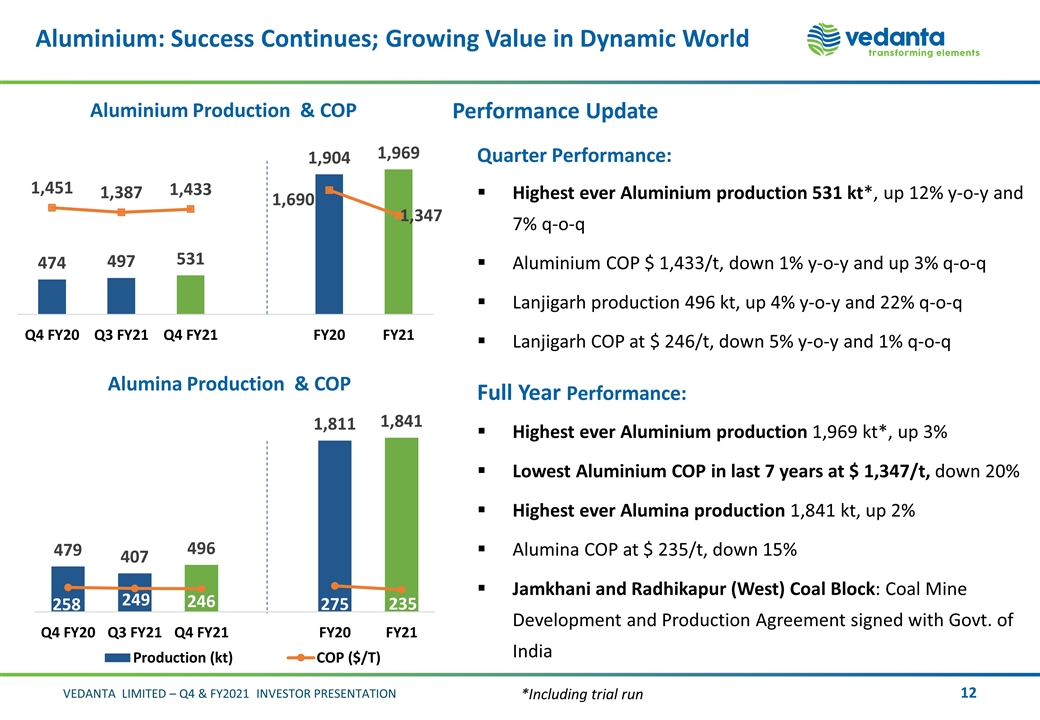

Aluminium: Success Continues; Growing Value in Dynamic World Aluminium Production & COP Alumina Production & COP Performance Update Quarter Performance: Highest ever Aluminium production 531 kt*, up 12% y-o-y and 7% q-o-q Aluminium COP $ 1,433/t, down 1% y-o-y and up 3% q-o-q Lanjigarh production 496 kt, up 4% y-o-y and 22% q-o-q Lanjigarh COP at $ 246/t, down 5% y-o-y and 1% q-o-q Full Year Performance: Highest ever Aluminium production 1,969 kt*, up 3% Lowest Aluminium COP in last 7 years at $ 1,347/t, down 20% Highest ever Alumina production 1,841 kt, up 2% Alumina COP at $ 235/t, down 15% Jamkhani and Radhikapur (West) Coal Block: Coal Mine Development and Production Agreement signed with Govt. of India *Including trial run

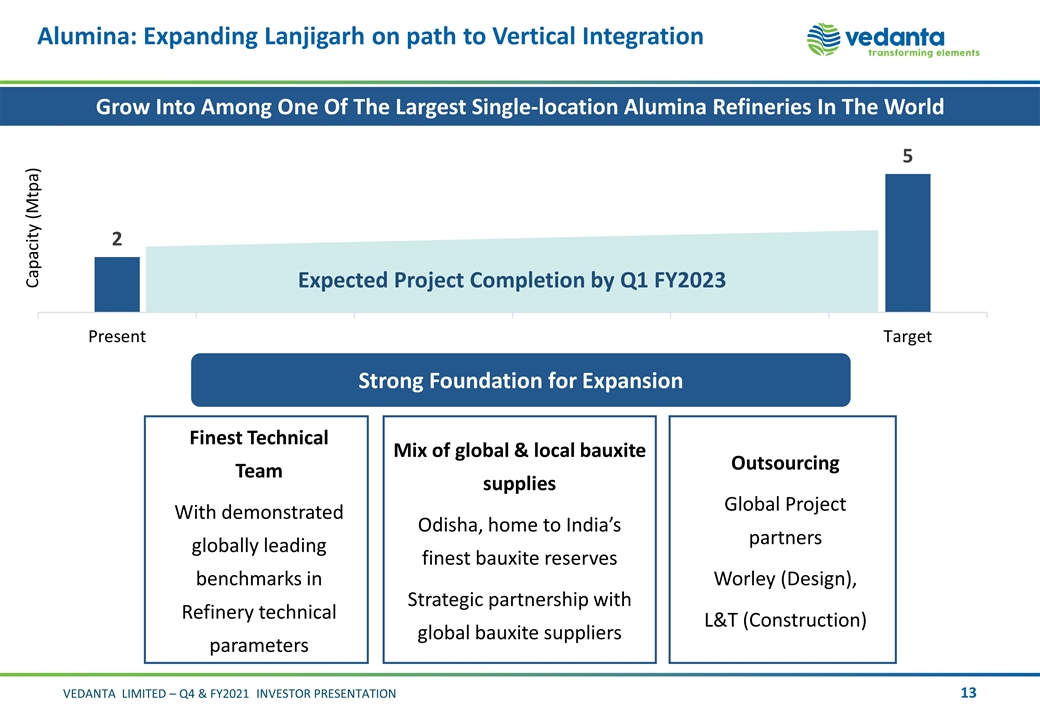

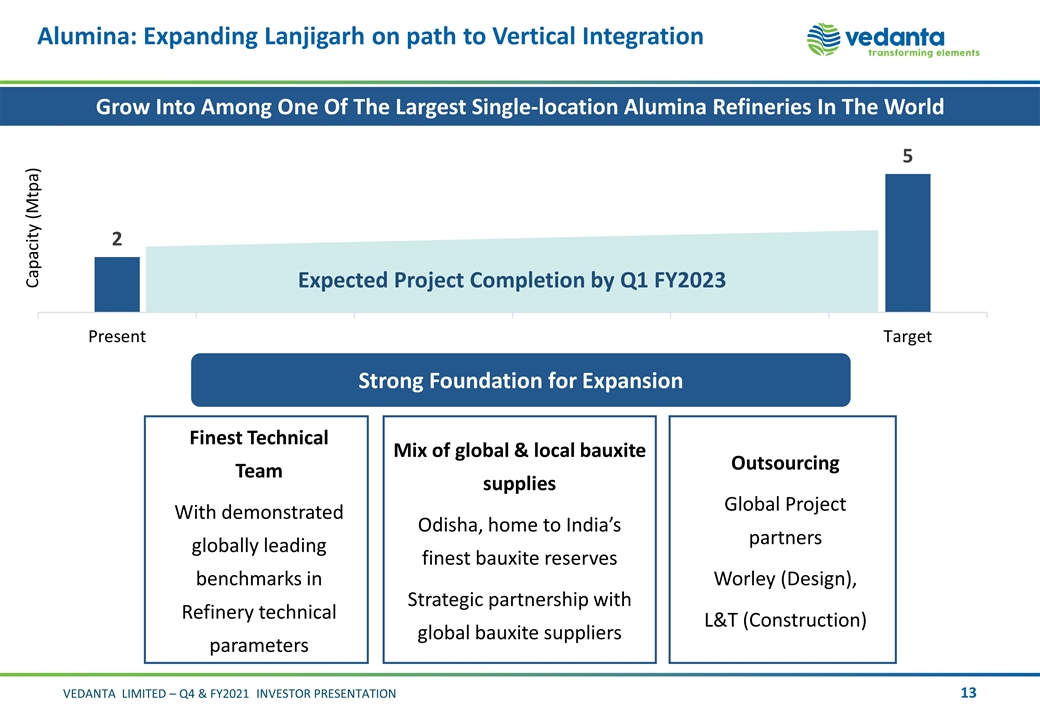

Alumina: Expanding Lanjigarh on path to Vertical Integration Finest Technical Team With demonstrated globally leading benchmarks in Refinery technical parameters Strong Foundation for Expansion Outsourcing Global Project partners Worley (Design), L&T (Construction) Mix of global & local bauxite supplies Odisha, home to India’s finest bauxite reserves Strategic partnership with global bauxite suppliers Grow Into Among One Of The Largest Single-location Alumina Refineries In The World Expected Project Completion by Q1 FY2023

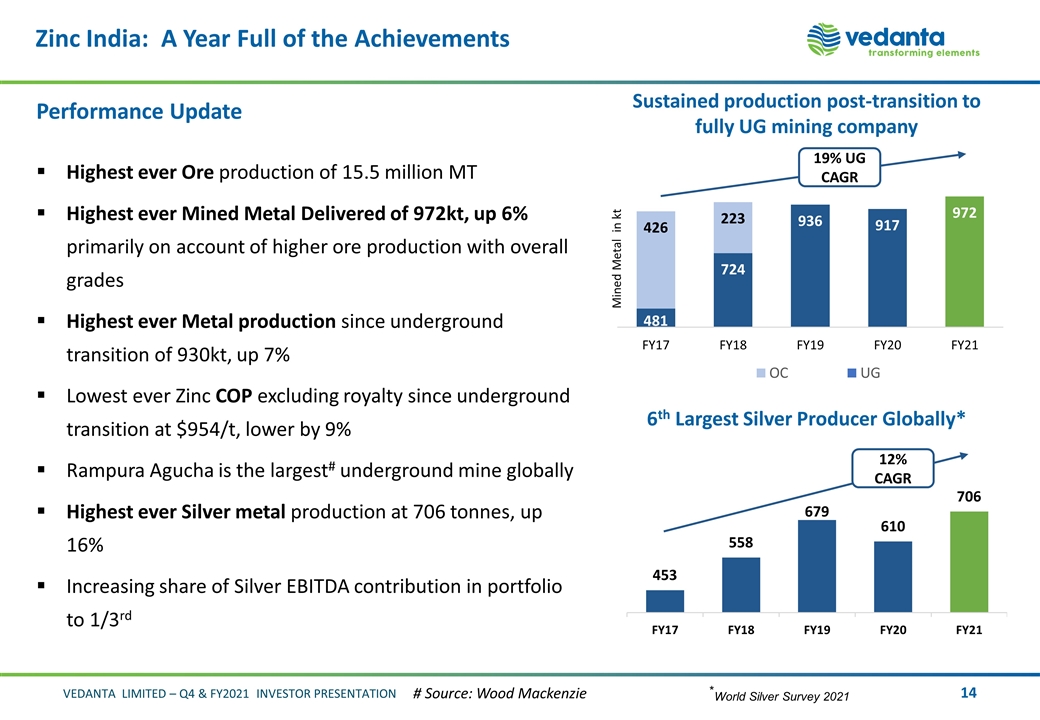

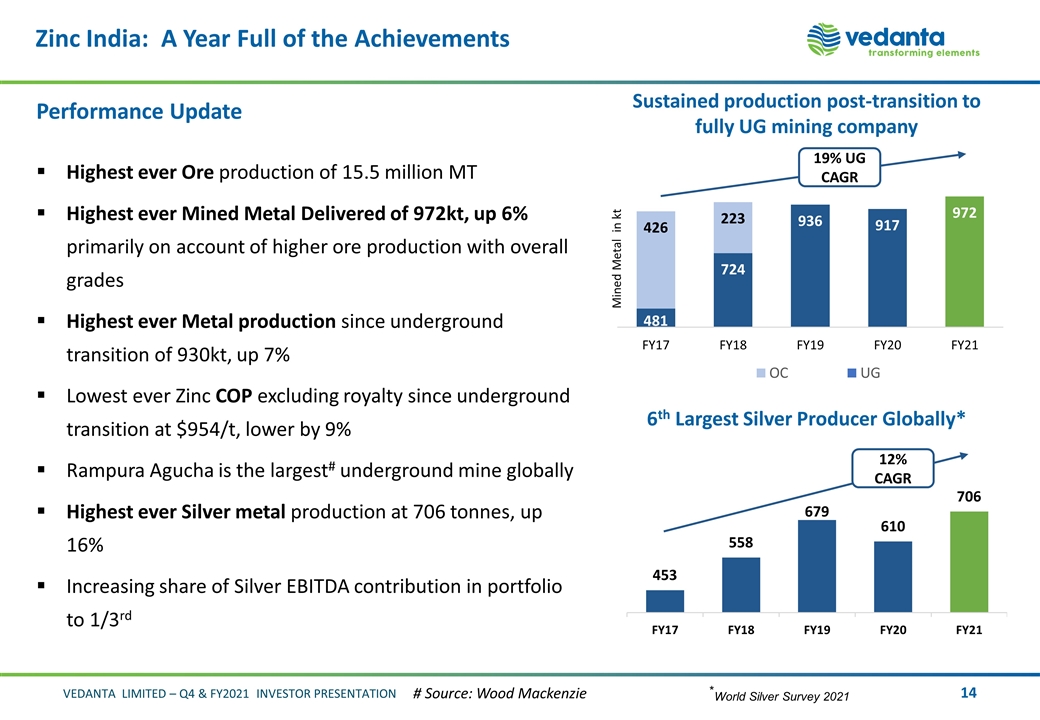

Zinc India: A Year Full of the Achievements *World Silver Survey 2021 Sustained production post-transition to fully UG mining company 12% CAGR 19% UG CAGR Performance Update Highest ever Ore production of 15.5 million MT Highest ever Mined Metal Delivered of 972kt, up 6% primarily on account of higher ore production with overall grades Highest ever Metal production since underground transition of 930kt, up 7% Lowest ever Zinc COP excluding royalty since underground transition at $954/t, lower by 9% Rampura Agucha is the largest# underground mine globally Highest ever Silver metal production at 706 tonnes, up 16% Increasing share of Silver EBITDA contribution in portfolio to 1/3rd 6th Largest Silver Producer Globally* # Source: Wood Mackenzie

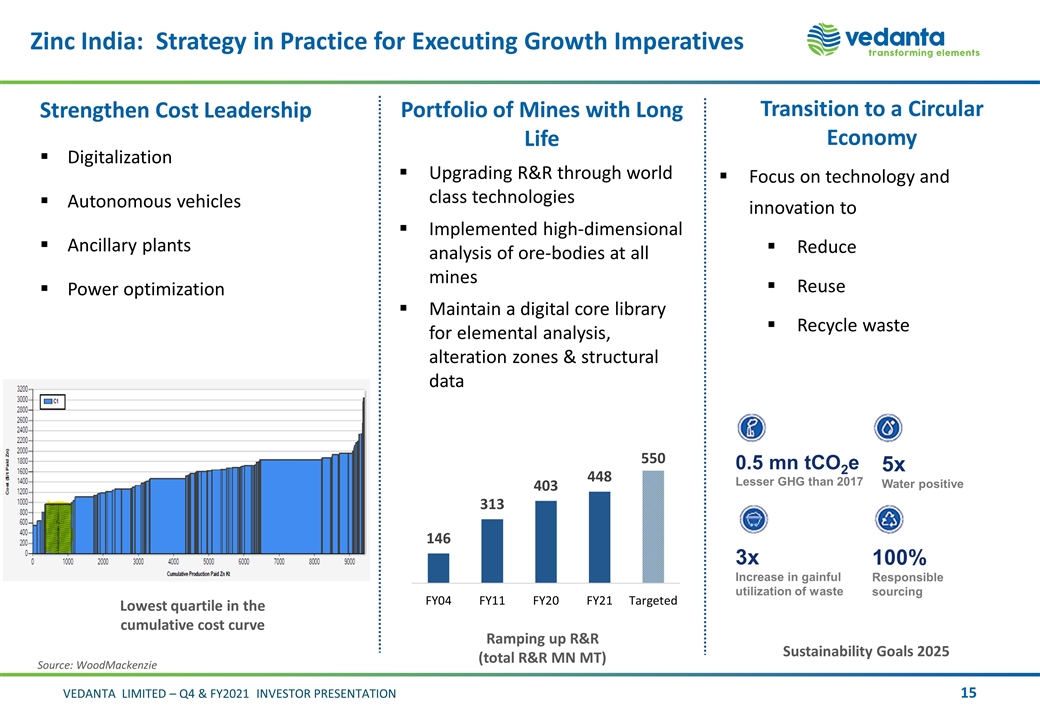

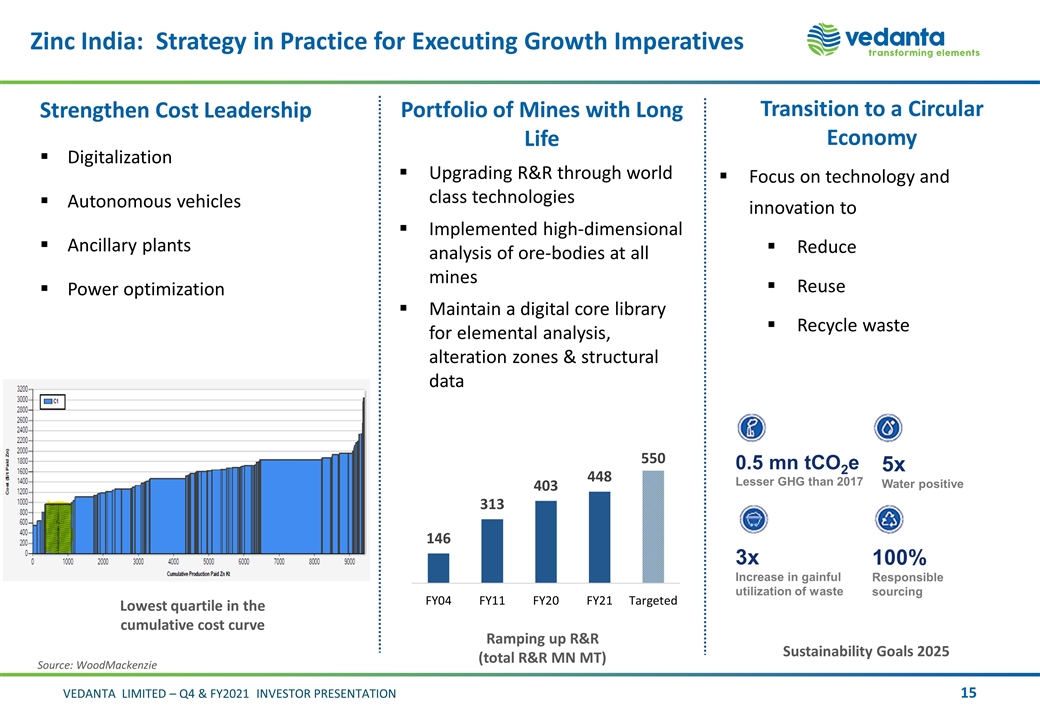

Zinc India: Strategy in Practice for Executing Growth Imperatives Transition to a Circular Economy Focus on technology and innovation to Reduce Reuse Recycle waste Strengthen Cost Leadership Digitalization Autonomous vehicles Ancillary plants Power optimization Portfolio of Mines with Long Life Upgrading R&R through world class technologies Implemented high-dimensional analysis of ore-bodies at all mines Maintain a digital core library for elemental analysis, alteration zones & structural data Lowest quartile in the cumulative cost curve Source: WoodMackenzie Ramping up R&R (total R&R MN MT) Sustainability Goals 2025 0.5 mn tCO2e Lesser GHG than 2017 5x Water positive 3x Increase in gainful utilization of waste 100% Responsible sourcing

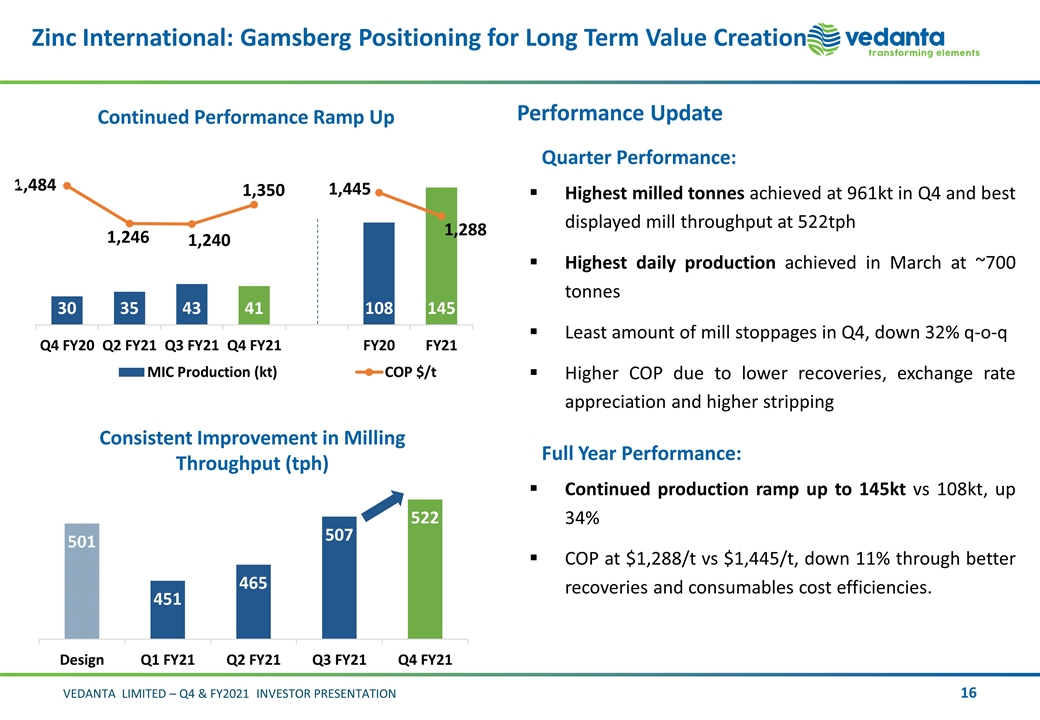

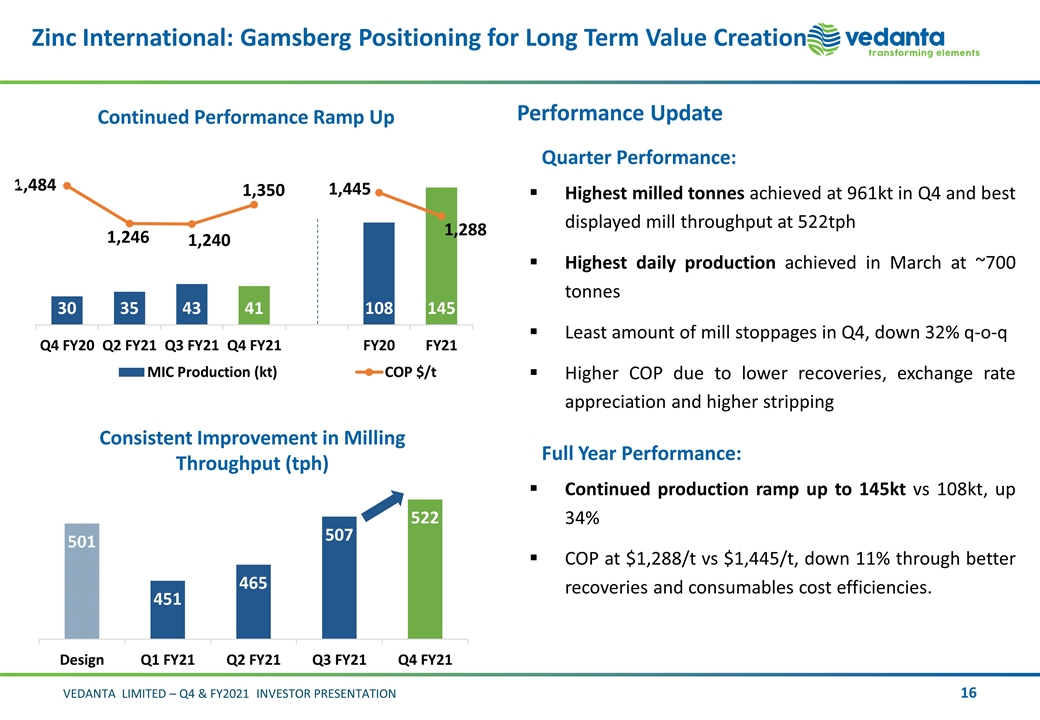

Zinc International: Gamsberg Positioning for Long Term Value Creation Continued Performance Ramp Up Performance Update Quarter Performance: Highest milled tonnes achieved at 961kt in Q4 and best displayed mill throughput at 522tph Highest daily production achieved in March at ~700 tonnes Least amount of mill stoppages in Q4, down 32% q-o-q Higher COP due to lower recoveries, exchange rate appreciation and higher stripping Full Year Performance: Continued production ramp up to 145kt vs 108kt, up 34% COP at $1,288/t vs $1,445/t, down 11% through better recoveries and consumables cost efficiencies. Consistent Improvement in Milling Throughput (tph)

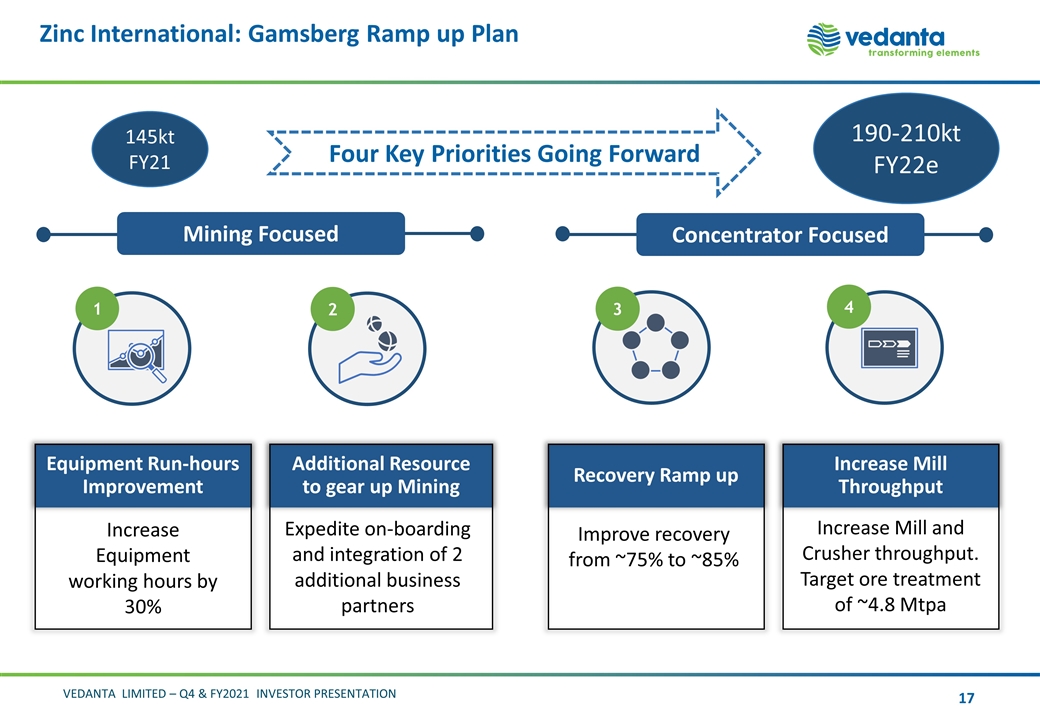

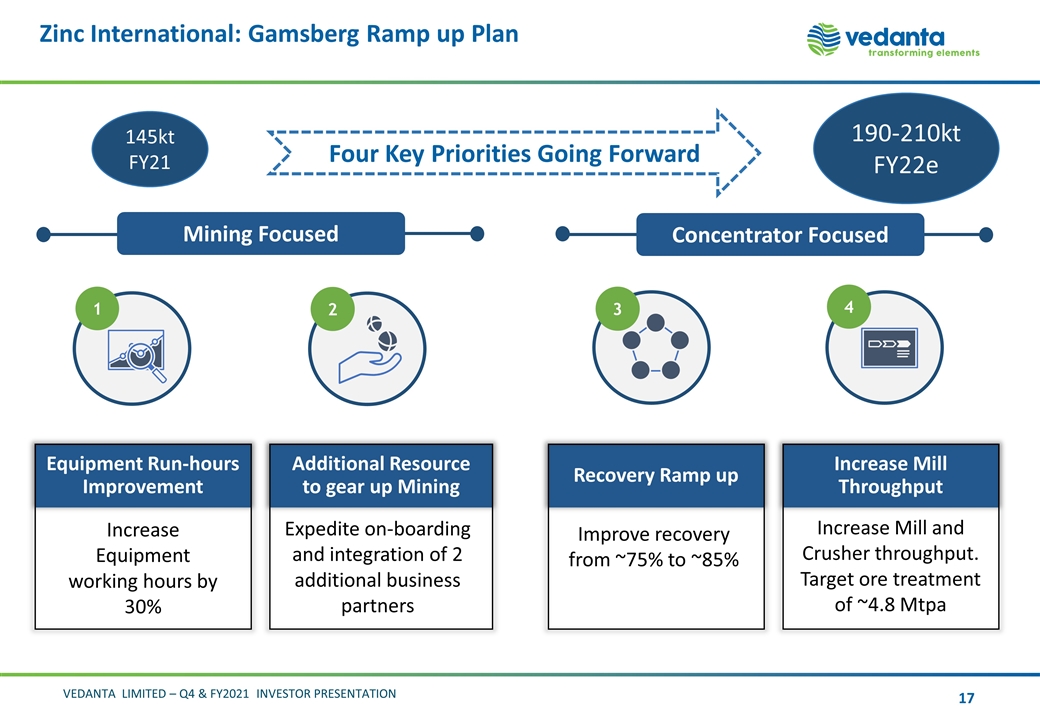

Zinc International: Gamsberg Ramp up Plan Four Key Priorities Going Forward Equipment Run-hours Improvement Increase Equipment working hours by 30% Additional Resource to gear up Mining Expedite on-boarding and integration of 2 additional business partners Recovery Ramp up Improve recovery from ~75% to ~85% Increase Mill Throughput Increase Mill and Crusher throughput. Target ore treatment of ~4.8 Mtpa Mining Focused Concentrator Focused 145kt FY21 190-210kt FY22e 1 2 3 4

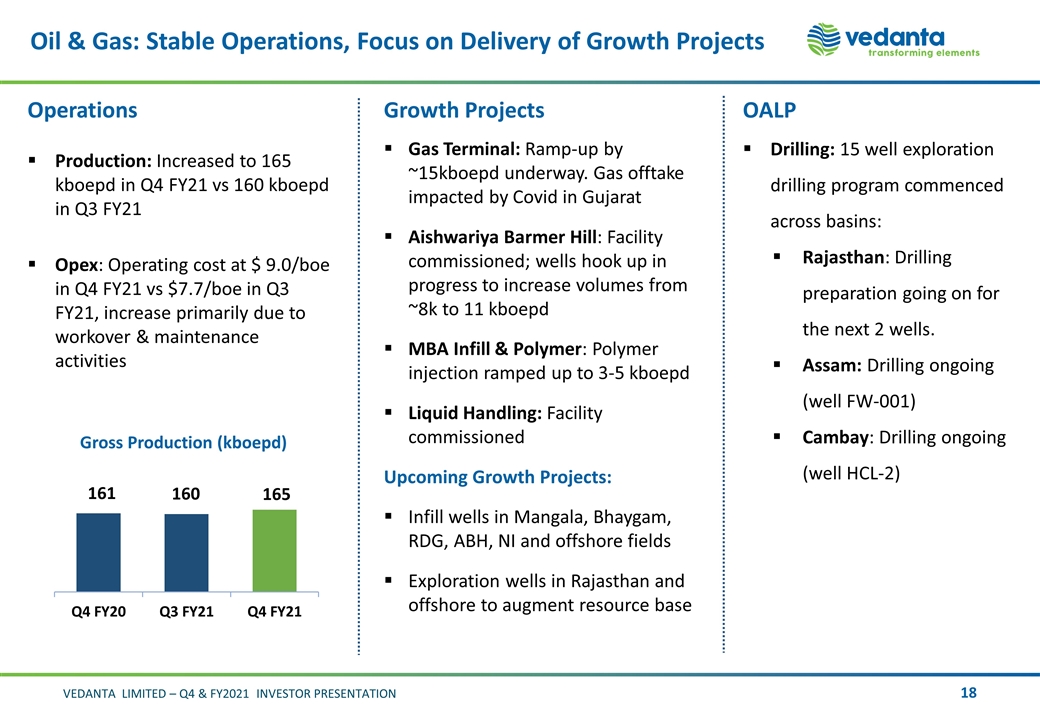

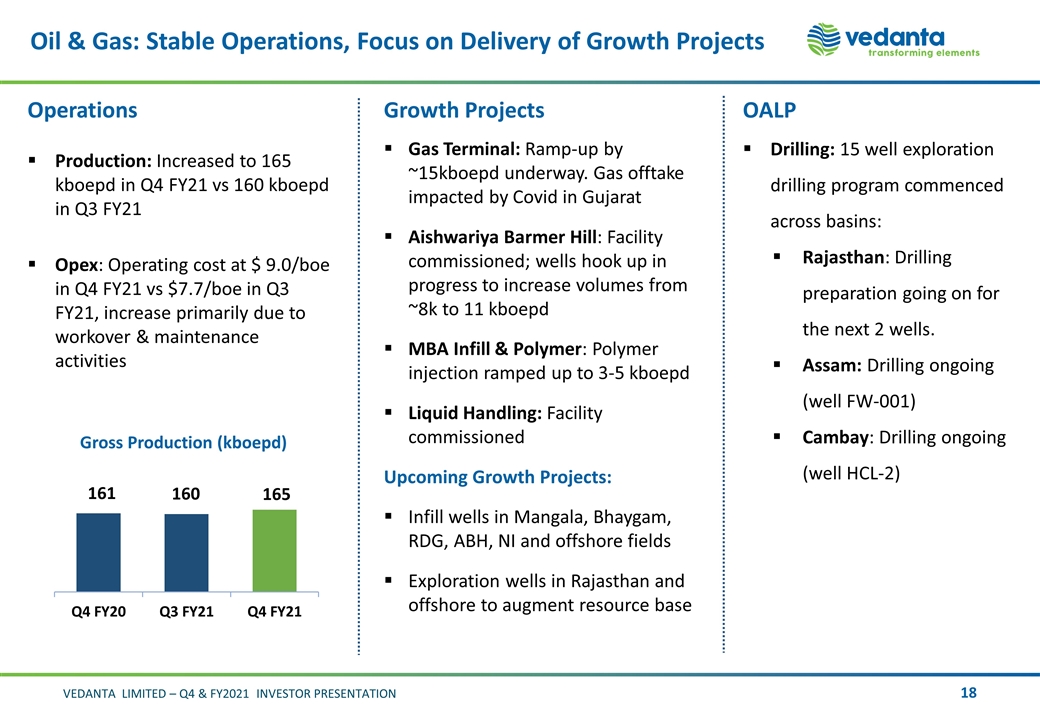

Oil & Gas: Stable Operations, Focus on Delivery of Growth Projects Operations Production: Increased to 165 kboepd in Q4 FY21 vs 160 kboepd in Q3 FY21 Opex: Operating cost at $ 9.0/boe in Q4 FY21 vs $7.7/boe in Q3 FY21, increase primarily due to workover & maintenance activities Growth Projects Gas Terminal: Ramp-up by ~15kboepd underway. Gas offtake impacted by Covid in Gujarat Aishwariya Barmer Hill: Facility commissioned; wells hook up in progress to increase volumes from ~8k to 11 kboepd MBA Infill & Polymer: Polymer injection ramped up to 3-5 kboepd Liquid Handling: Facility commissioned Upcoming Growth Projects: Infill wells in Mangala, Bhaygam, RDG, ABH, NI and offshore fields Exploration wells in Rajasthan and offshore to augment resource base OALP Drilling: 15 well exploration drilling program commenced across basins: Rajasthan: Drilling preparation going on for the next 2 wells. Assam: Drilling ongoing (well FW-001) Cambay: Drilling ongoing (well HCL-2) Gross Production (kboepd)

Oil & Gas: Digitalisation & Partnering to Drive Efficiency & Recovery Digitalization to improve asset reliability Technology to accelerate recovery Solution based Partner Approach Well interventions Process Controls Network optimization Predictive maintenance Cloud based applications Polymer & Water Management EOR ASP Advanced Reservoir Characterization Global EOI for solution & KPI driven Partnering model Focus on Well Services, Surface facilities, & Chemical Management

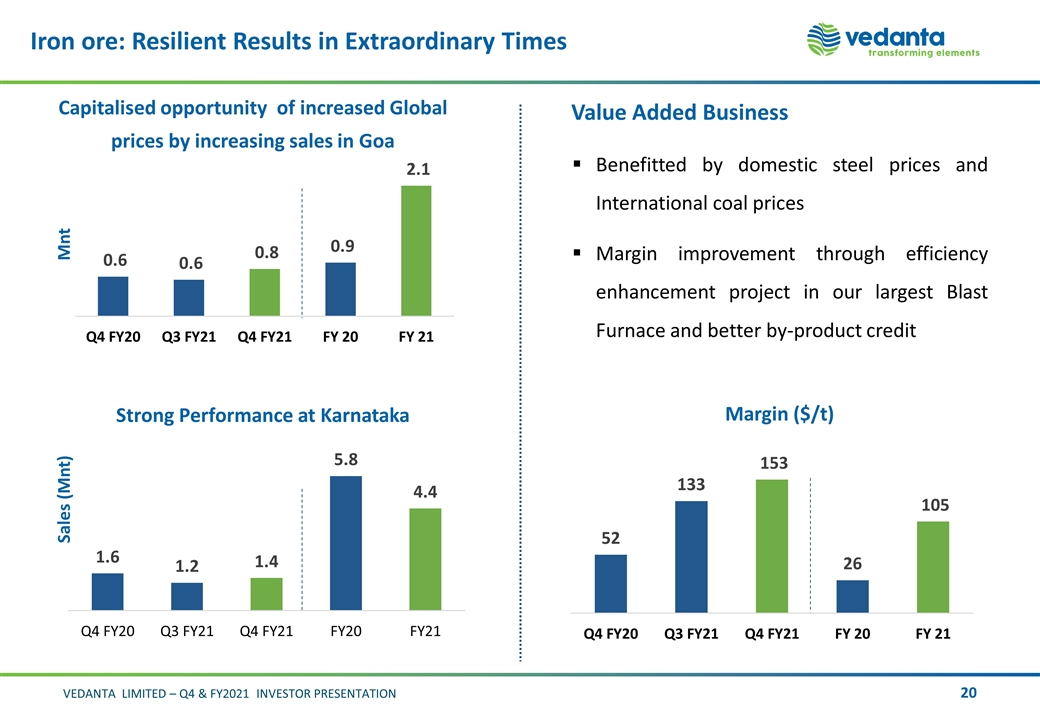

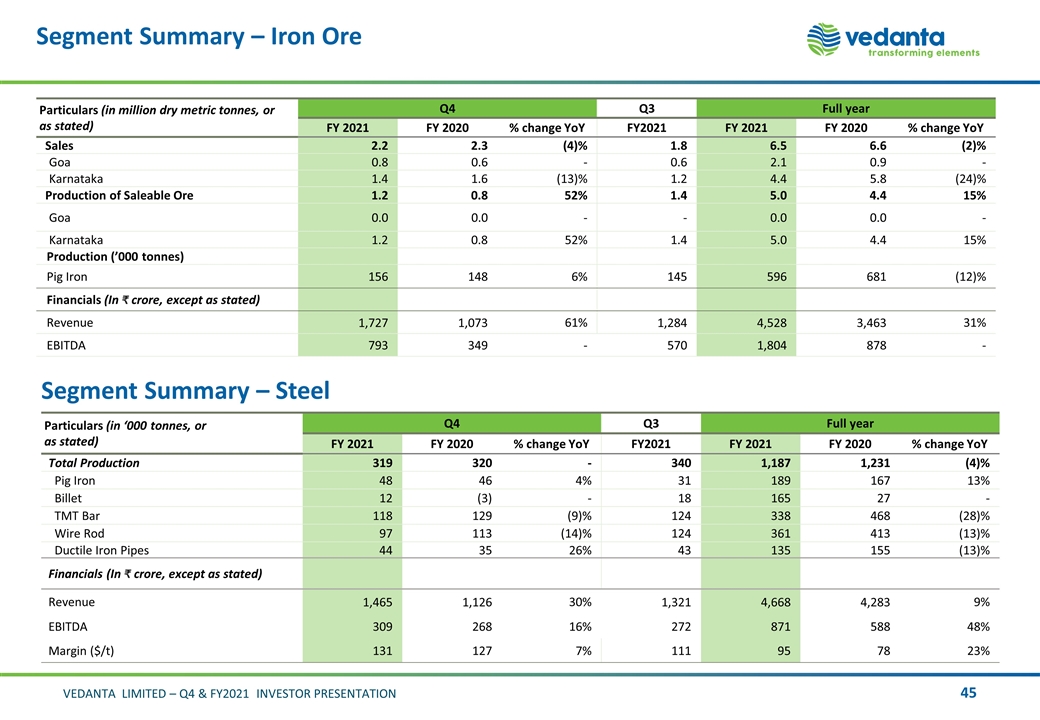

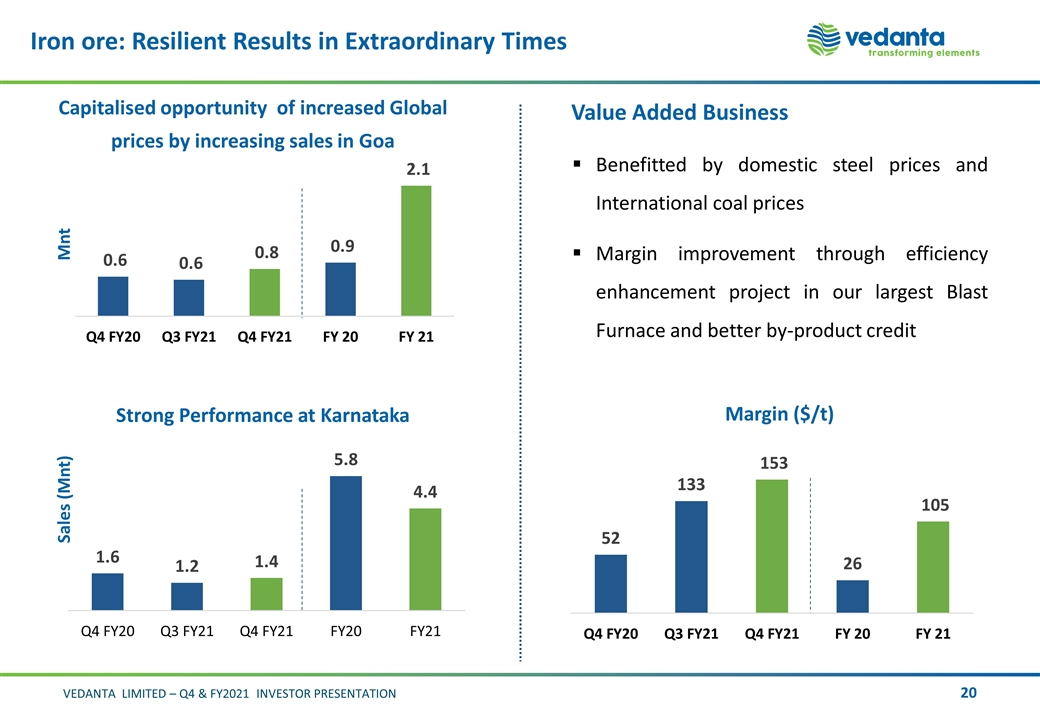

Iron ore: Resilient Results in Extraordinary Times Capitalised opportunity of increased Global prices by increasing sales in Goa Mnt Strong Performance at Karnataka Sales (Mnt) Value Added Business Benefitted by domestic steel prices and International coal prices Margin improvement through efficiency enhancement project in our largest Blast Furnace and better by-product credit Margin ($/t)

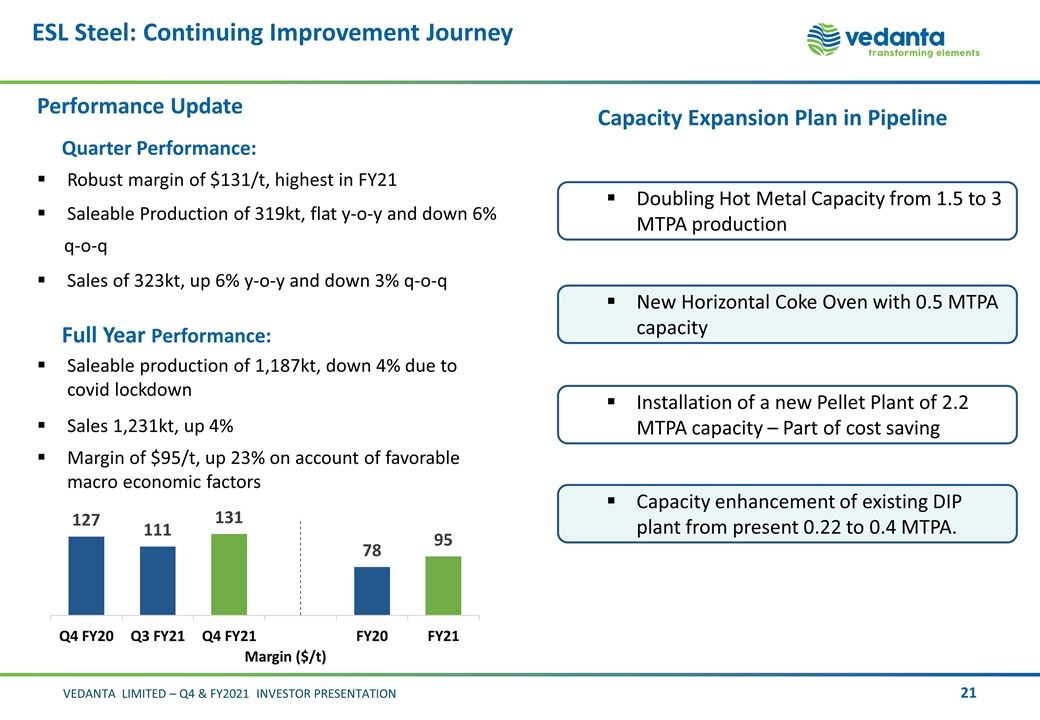

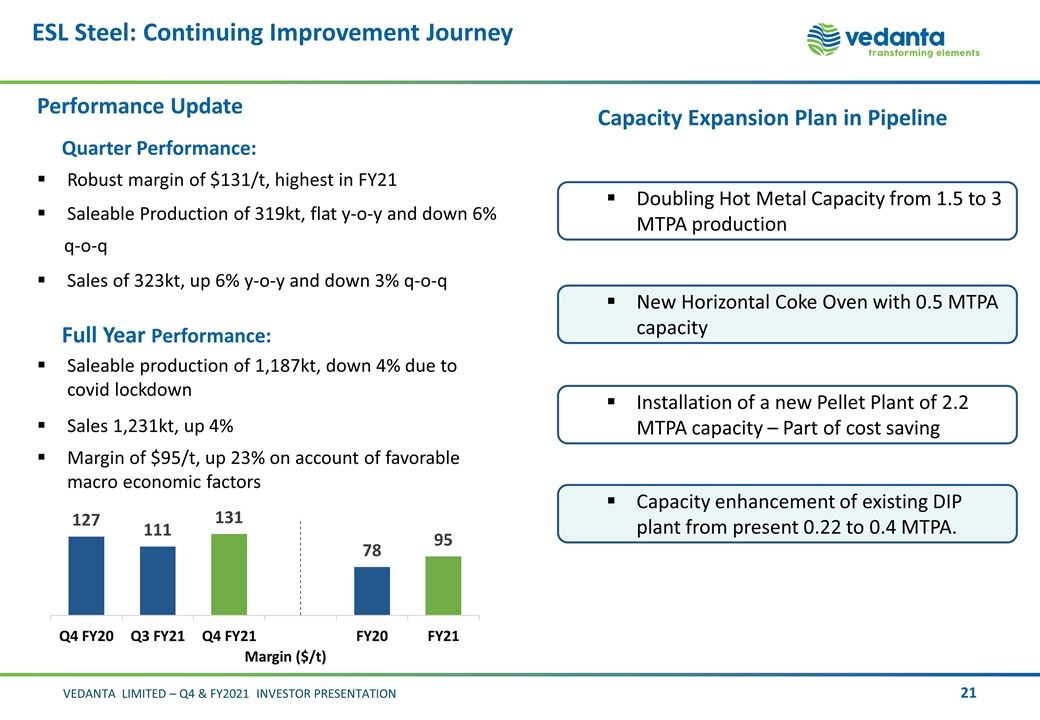

ESL Steel: Continuing Improvement Journey Performance Update Quarter Performance: Robust margin of $131/t, highest in FY21 Saleable Production of 319kt, flat y-o-y and down 6% q-o-q Sales of 323kt, up 6% y-o-y and down 3% q-o-q Full Year Performance: Saleable production of 1,187kt, down 4% due to covid lockdown Sales 1,231kt, up 4% Margin of $95/t, up 23% on account of favorable macro economic factors Capacity Expansion Plan in Pipeline Doubling Hot Metal Capacity from 1.5 to 3 MTPA production New Horizontal Coke Oven with 0.5 MTPA capacity Installation of a new Pellet Plant of 2.2 MTPA capacity – Part of cost saving Capacity enhancement of existing DIP plant from present 0.22 to 0.4 MTPA.

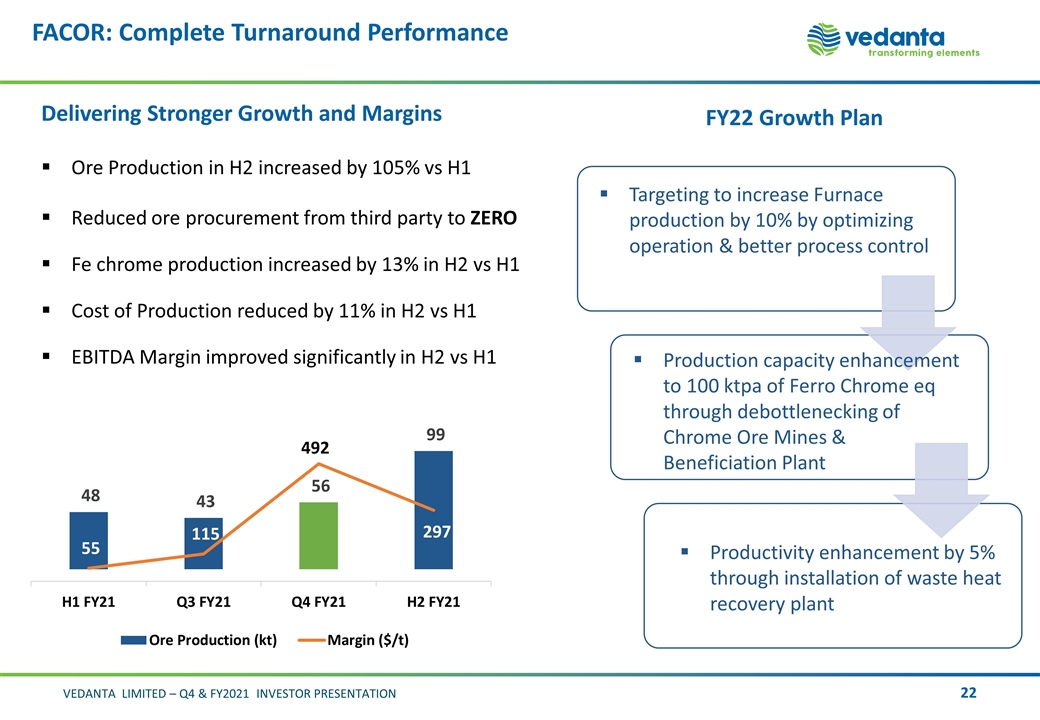

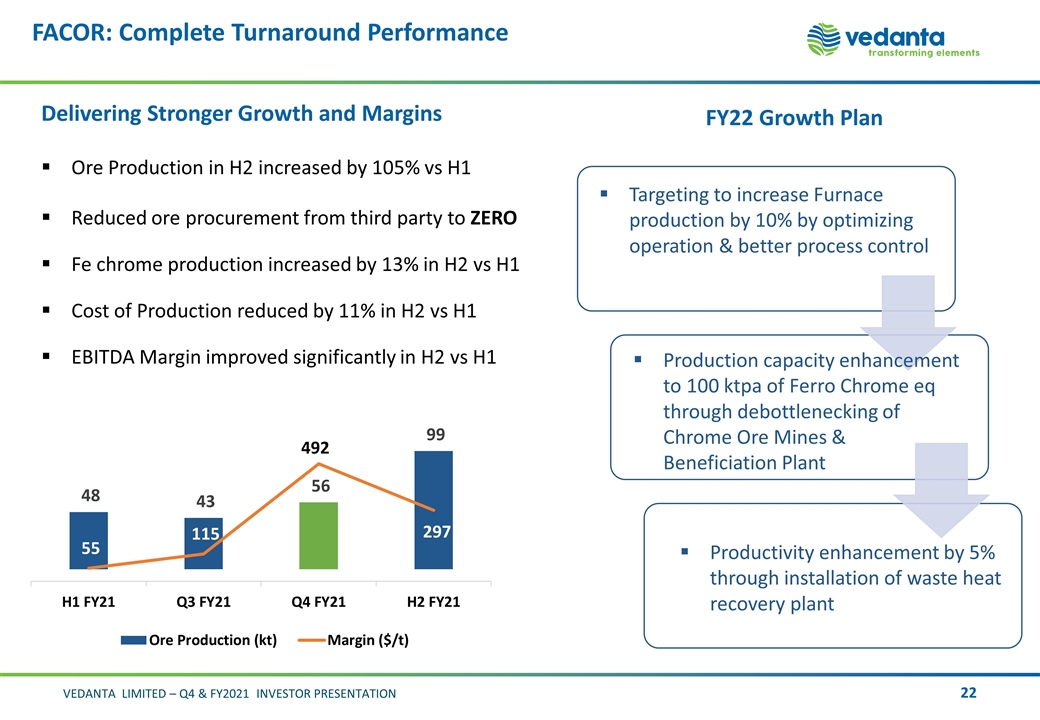

FACOR: Complete Turnaround Performance Delivering Stronger Growth and Margins Ore Production in H2 increased by 105% vs H1 Reduced ore procurement from third party to ZERO Fe chrome production increased by 13% in H2 vs H1 Cost of Production reduced by 11% in H2 vs H1 EBITDA Margin improved significantly in H2 vs H1 FY22 Growth Plan Targeting to increase Furnace production by 10% by optimizing operation & better process control Production capacity enhancement to 100 ktpa of Ferro Chrome eq through debottlenecking of Chrome Ore Mines & Beneficiation Plant Productivity enhancement by 5% through installation of waste heat recovery plant

Finance Update Ajay Goel | Deputy Chief Financial Officer Q4 & FY2021

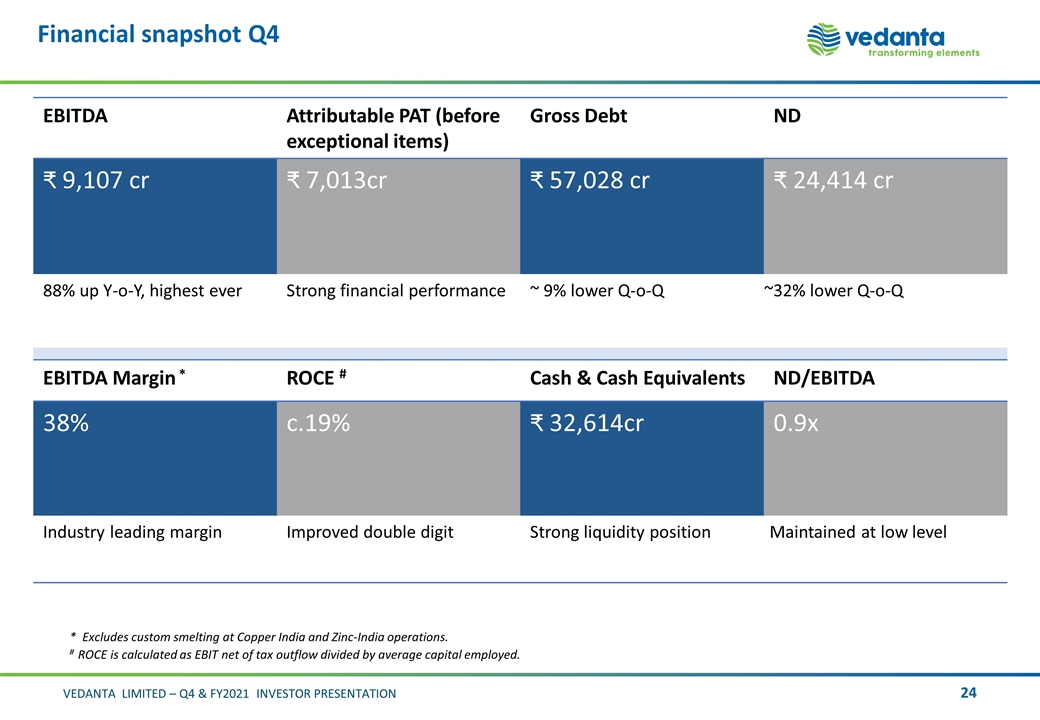

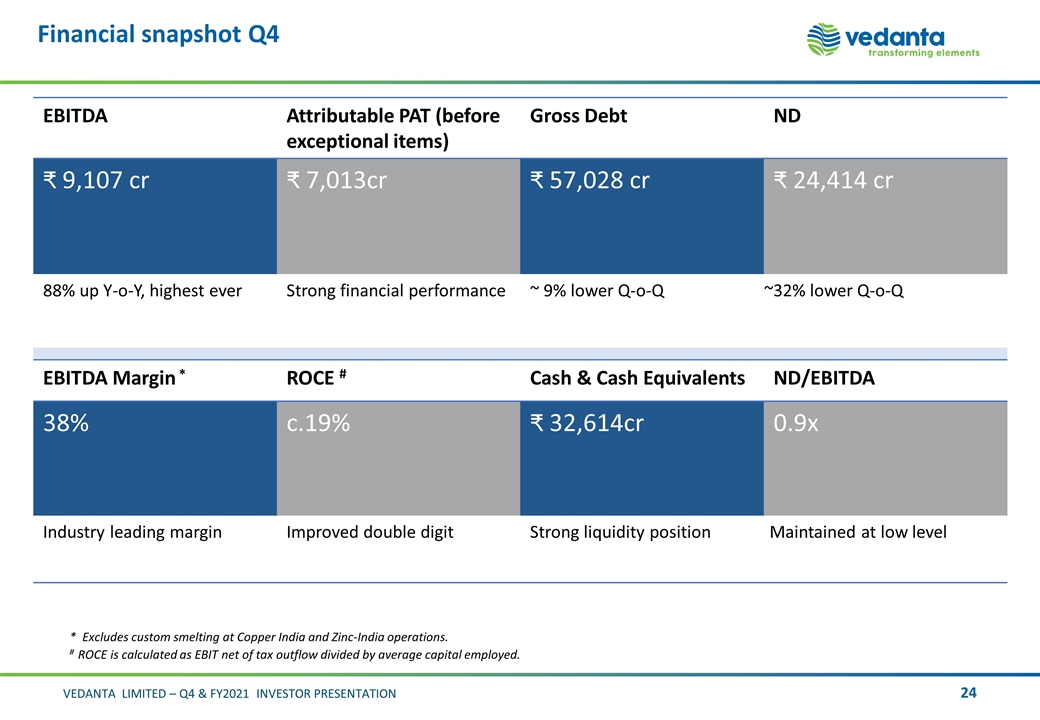

Financial snapshot Q4 EBITDA Attributable PAT (before exceptional items) Gross Debt ND ₹ 9,107 cr 7,013cr ₹ 57,028 cr ₹ 24,414 cr 88% up Y-o-Y, highest ever Strong financial performance ~ 9% lower Q-o-Q ~32% lower Q-o-Q Maintained at low level EBITDA Margin * ROCE # Cash & Cash Equivalents ND/EBITDA 38% c.19% 32,614cr 0.9x Industry leading margin Improved double digit Strong liquidity position Maintained at low level Strong liquidity position * Excludes custom smelting at Copper India and Zinc-India operations. # ROCE is calculated as EBIT net of tax outflow divided by average capital employed.

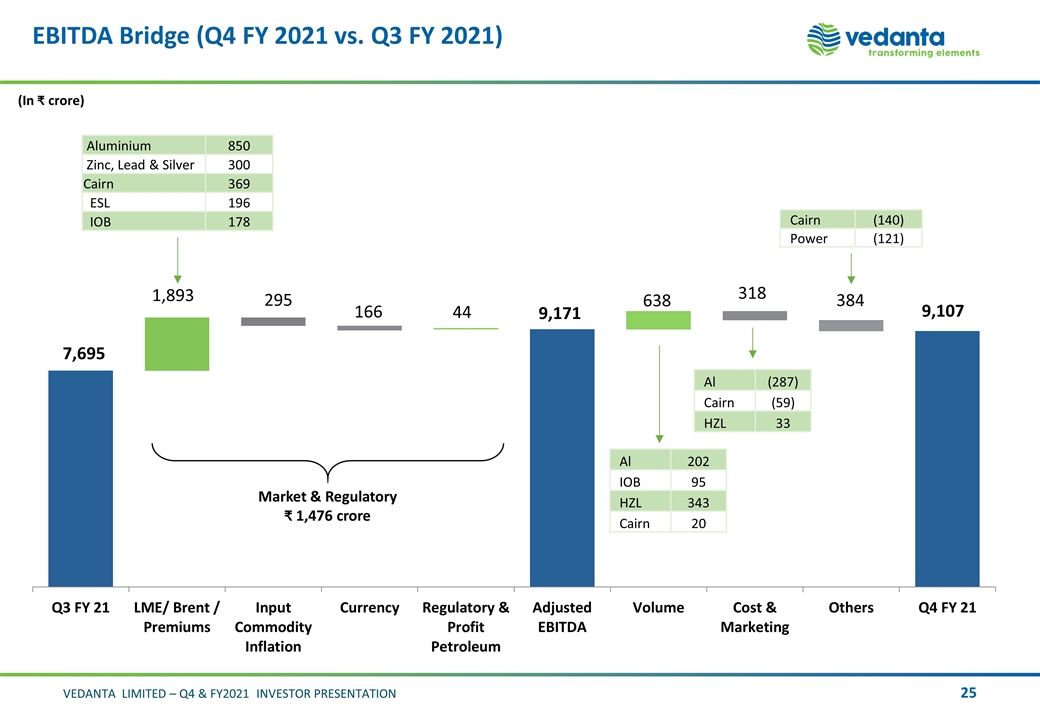

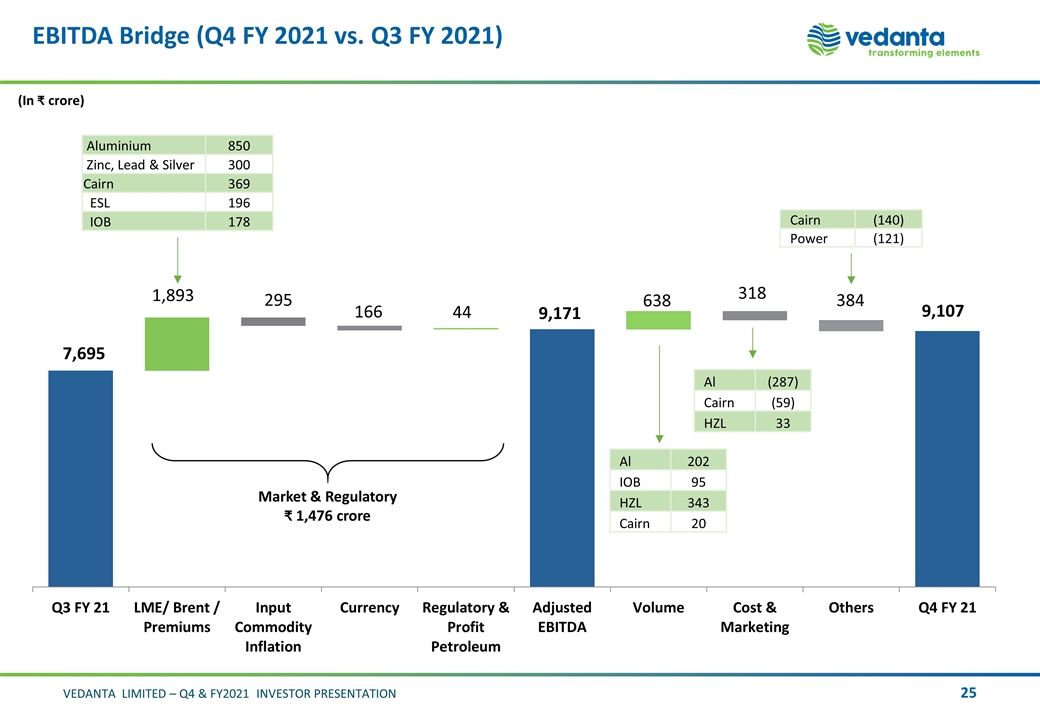

EBITDA Bridge (Q4 FY 2021 vs. Q3 FY 2021) (In crore) Market & Regulatory 1,476 crore Aluminium 850 Zinc, Lead & Silver 300 Cairn 369 ESL 196 IOB 178 Al 202 IOB 95 HZL 343 Cairn 20 Cairn (140) Power (121) 44 9,171 295 166 Al (287) Cairn (59) HZL 33 7,695

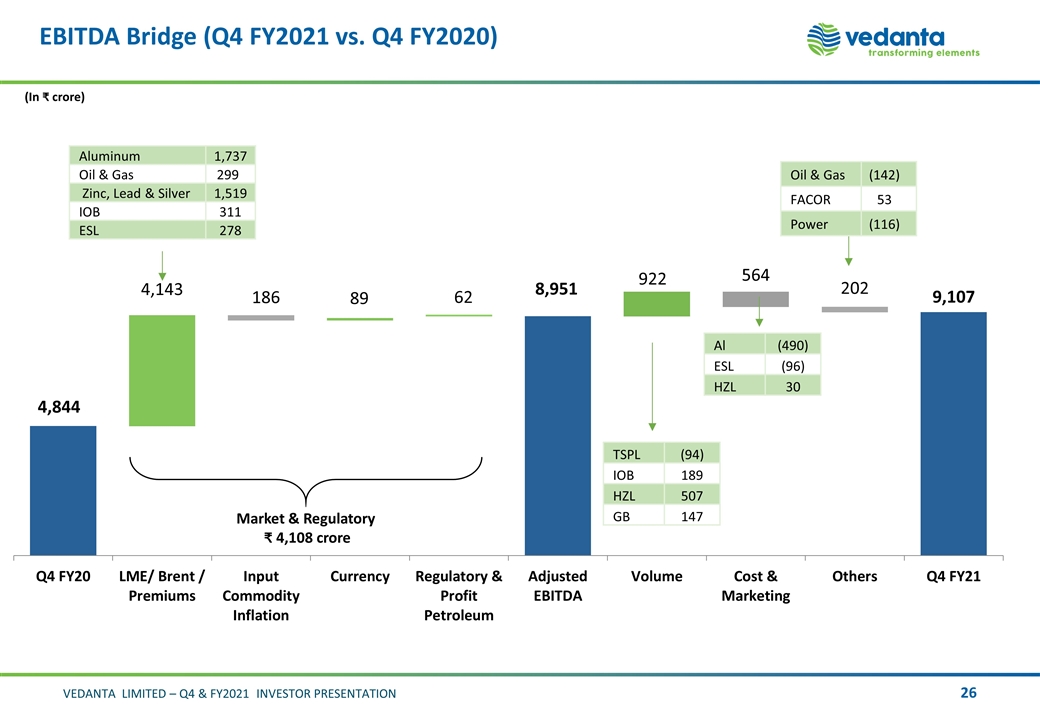

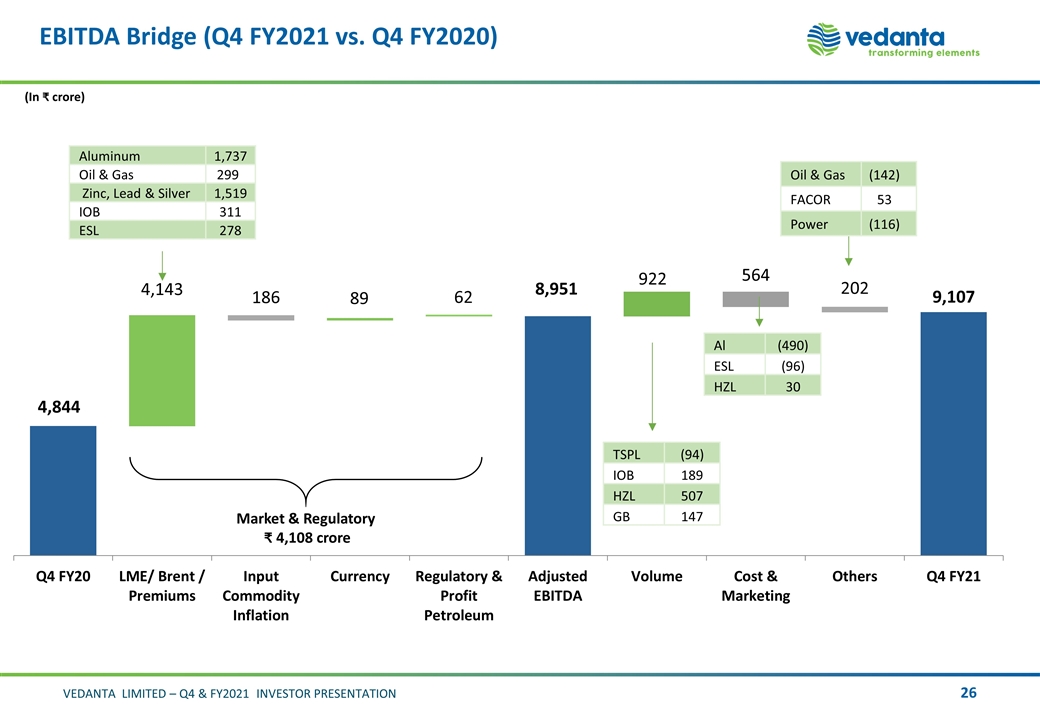

EBITDA Bridge (Q4 FY2021 vs. Q4 FY2020) (In crore) Market & Regulatory 4,108 crore Aluminum 1,737 Oil & Gas 299 Zinc, Lead & Silver 1,519 IOB 311 ESL 278 Oil & Gas (142) FACOR 53 Power (116) TSPL (94) IOB 189 HZL 507 GB 147 Al (490) ESL (96) HZL 30

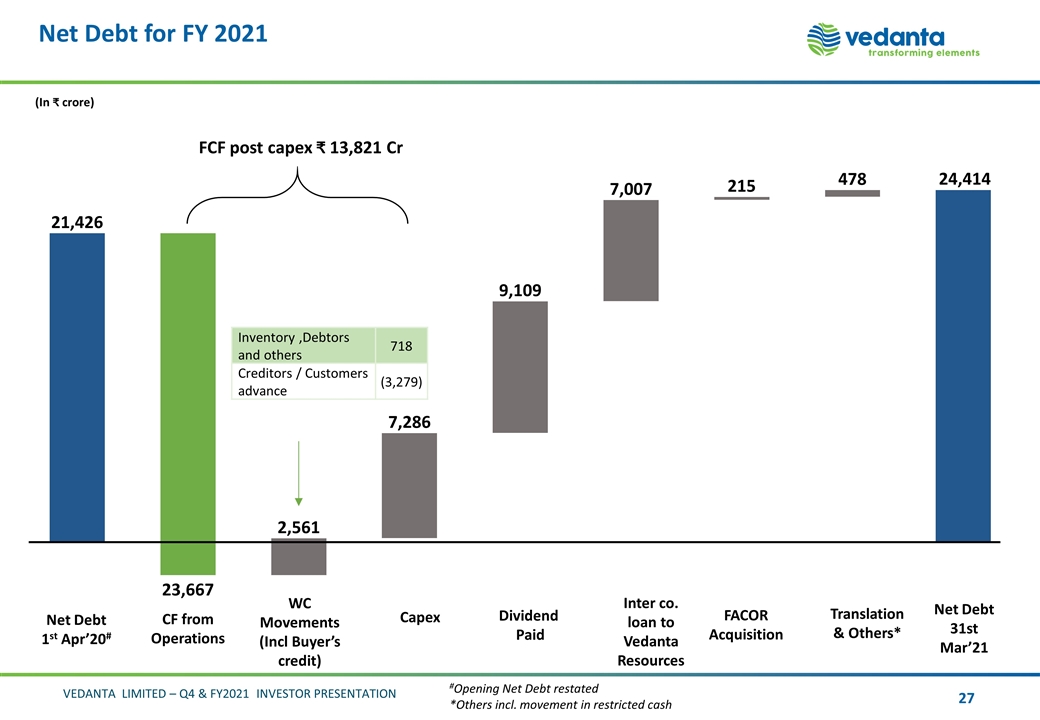

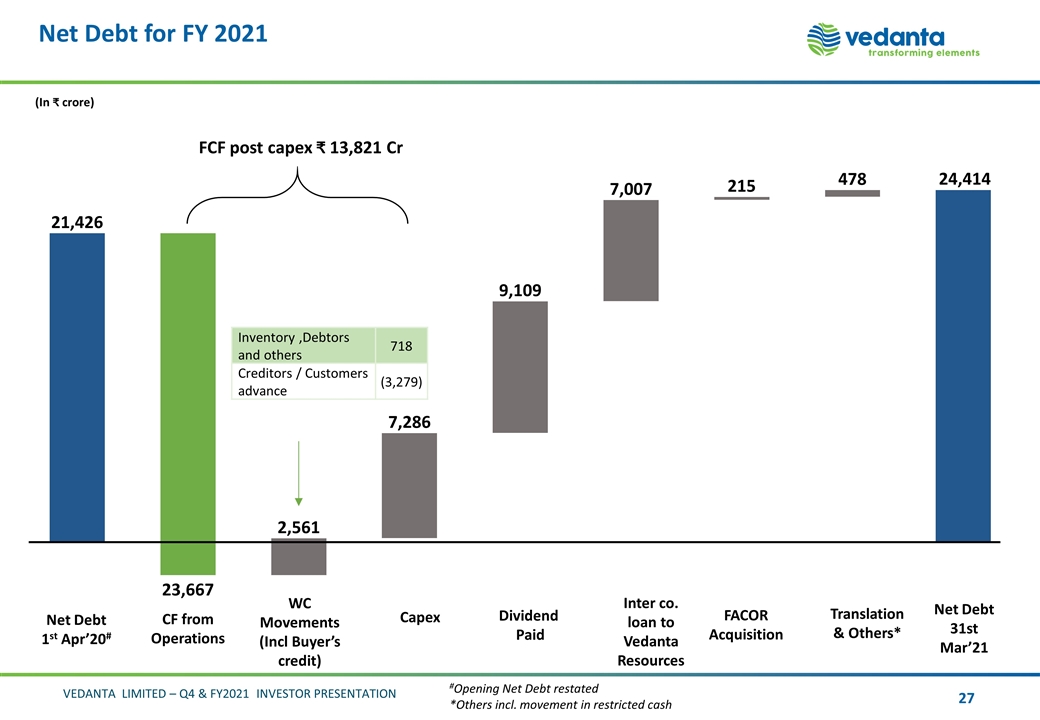

Net Debt for FY 2021 (In ₹ crore) (Incl Buyer’s credit) Dividend Paid Net Debt 31st Mar’21 Inventory ,Debtors and others 718 Creditors / Customers advance (3,279) Inter co. loan to Vedanta Resources FACOR Acquisition FCF post capex 13,821 Cr #Opening Net Debt restated *Others incl. movement in restricted cash Capex Net Debt 1st Apr’20# Translation & Others* 23,667 24,414

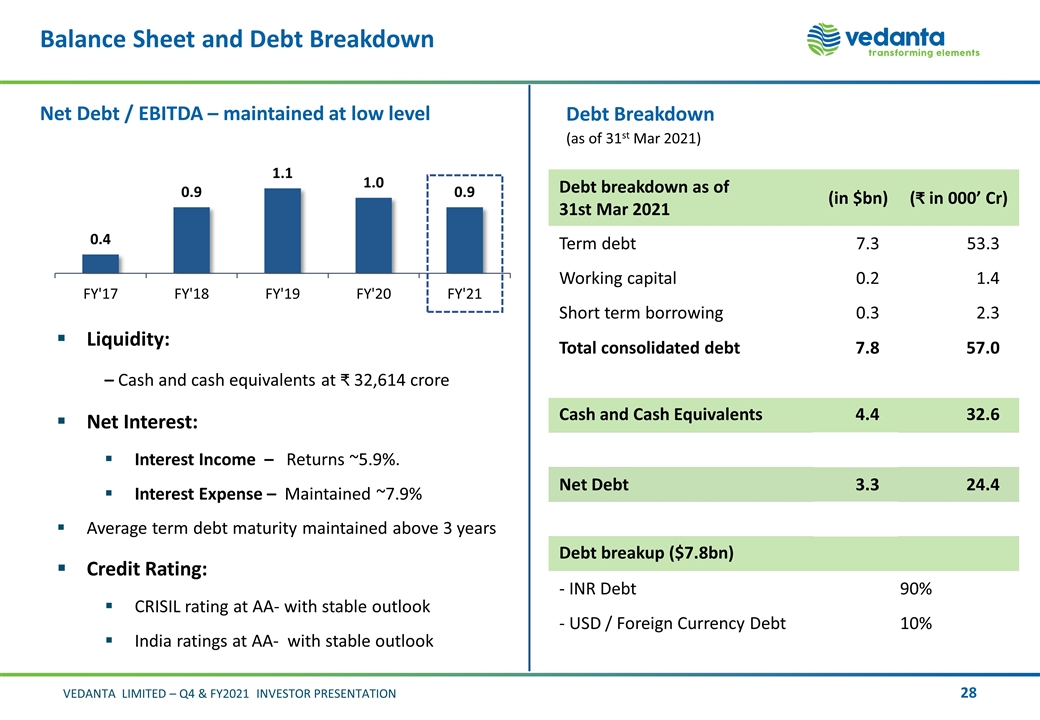

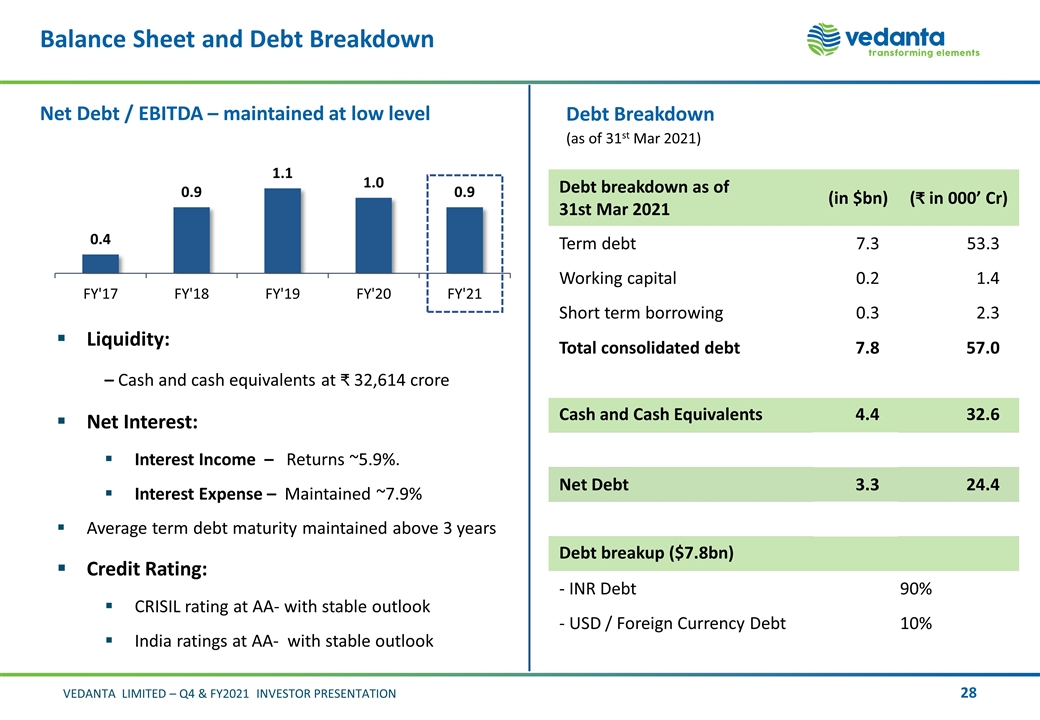

Balance Sheet and Debt Breakdown Net Debt / EBITDA – maintained at low level Liquidity: – Cash and cash equivalents at 32,614 crore Net Interest: Interest Income – Returns ~5.9%. Interest Expense – Maintained ~7.9% Average term debt maturity maintained above 3 years Credit Rating: CRISIL rating at AA- with stable outlook India ratings at AA- with stable outlook Debt breakdown as of 31st Mar 2021 (in $bn) ( in 000’ Cr) Term debt 7.3 53.3 Working capital 0.2 1.4 Short term borrowing 0.3 2.3 Total consolidated debt 7.8 57.0 Cash and Cash Equivalents 4.4 32.6 Net Debt 3.3 24.4 Debt breakup ($7.8bn) - INR Debt 90% - USD / Foreign Currency Debt 10% Debt Breakdown (as of 31st Mar 2021)

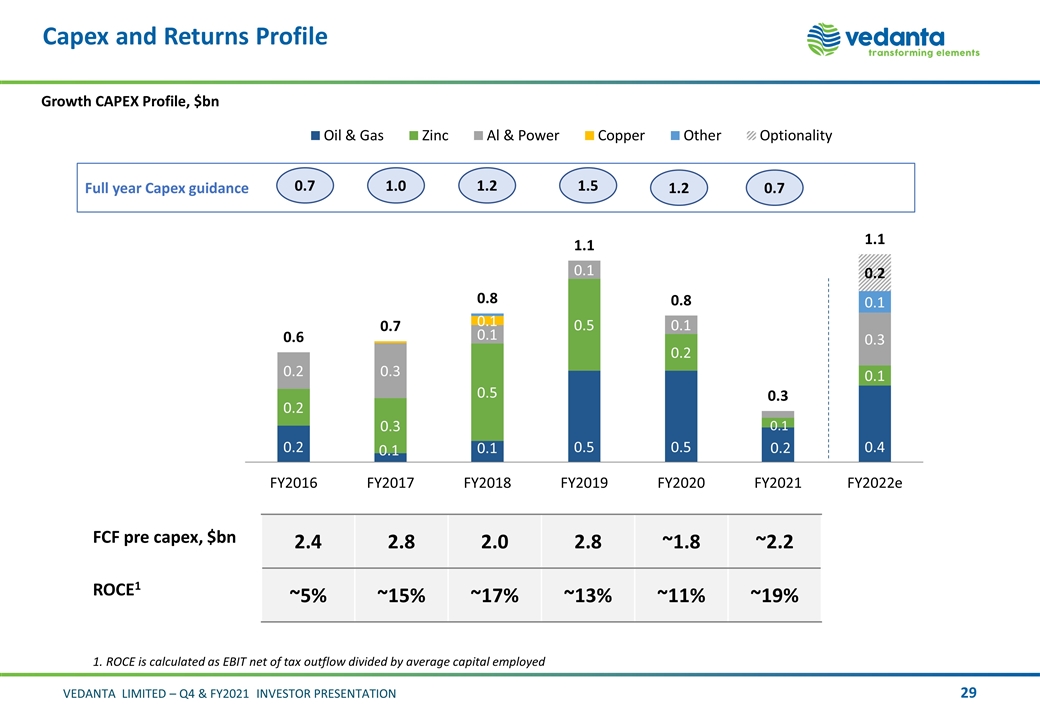

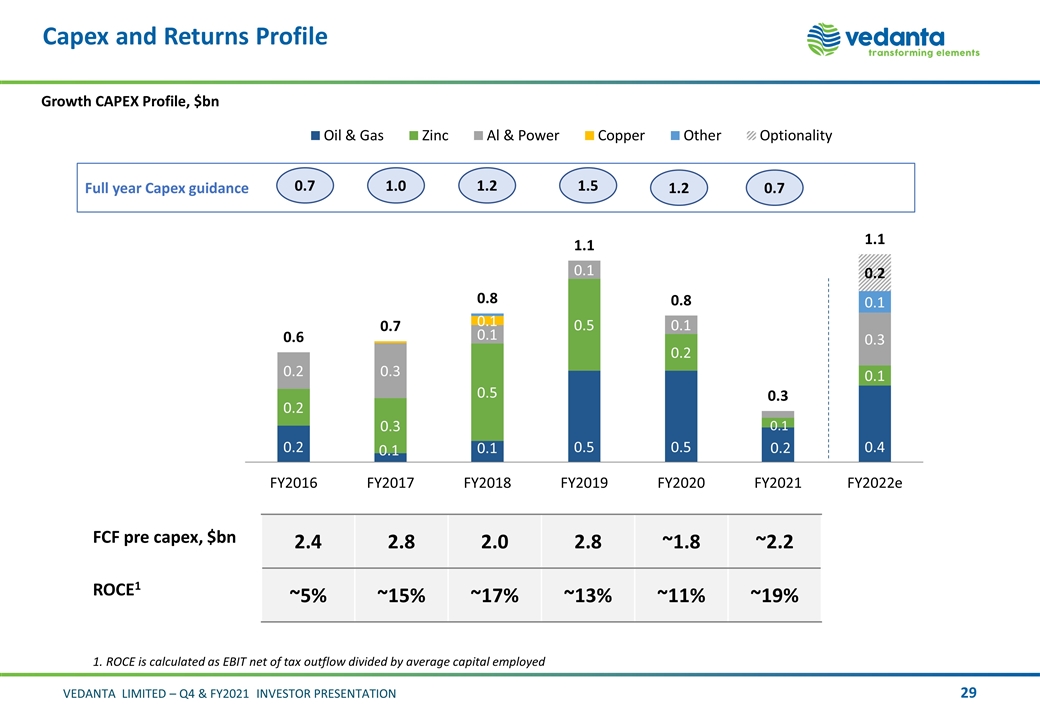

Full year Capex guidance ROCE1 2.4 2.8 2.0 2.8 ~1.8 ~2.2 ~5% ~15% ~17% ~13% ~11% ~19% Capex and Returns Profile Growth CAPEX Profile, $bn 0.7 1.0 1.2 1.5 FCF pre capex, $bn 1. ROCE is calculated as EBIT net of tax outflow divided by average capital employed 0.7 1.2

Strategy to Enhance Long Term Value Continue Focus on World Class ESG Performance Augment Our Reserves & Resources Base Delivering on Growth Opportunities Optimise Capital Allocation & Maintain Strong Balance Sheet Operational Excellence and Cost Leadership

Appendix Q4 & FY2021

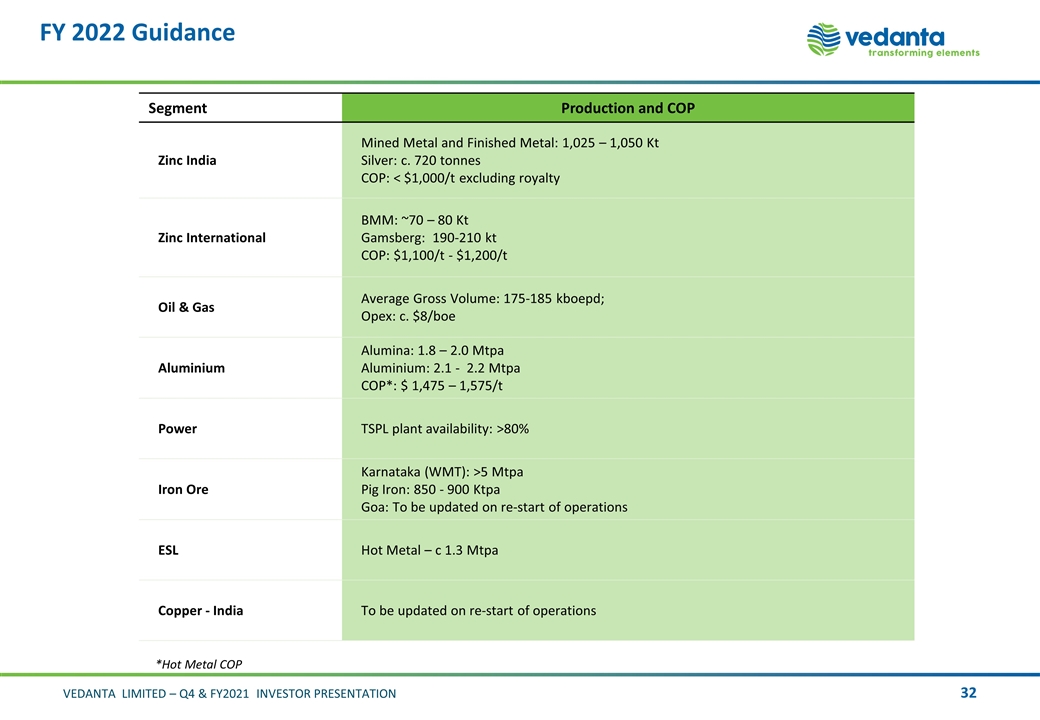

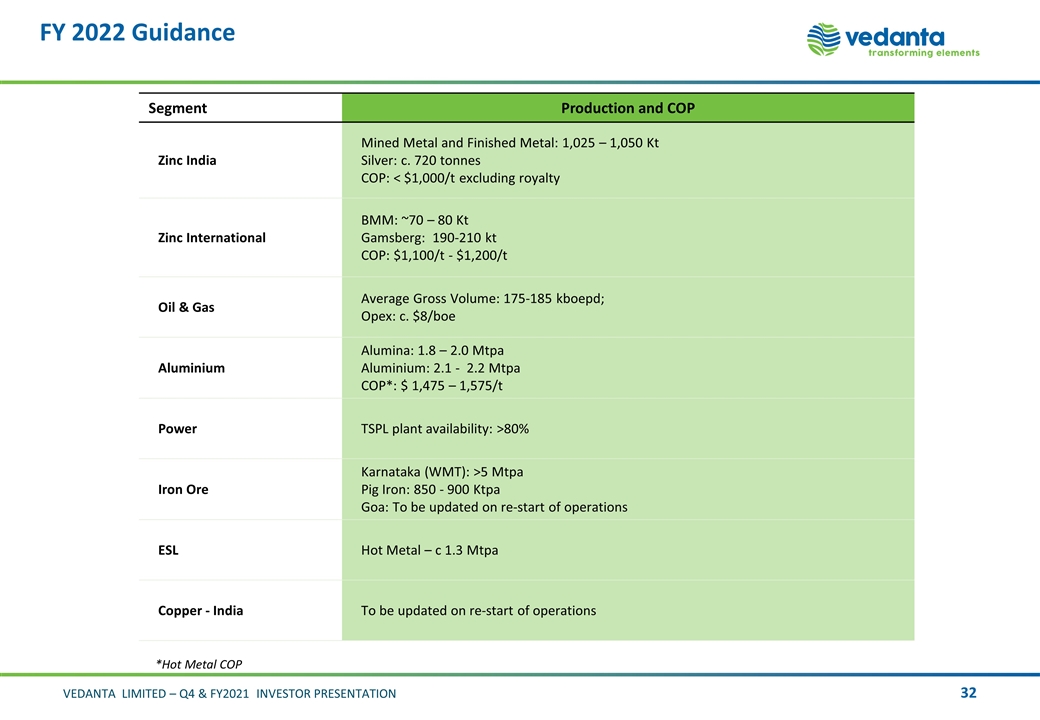

FY 2022 Guidance Segment Production and COP Zinc India Mined Metal and Finished Metal: 1,025 – 1,050 Kt Silver: c. 720 tonnes COP: < $1,000/t excluding royalty Zinc International BMM: ~70 – 80 Kt Gamsberg: 190-210 kt COP: $1,100/t - $1,200/t Oil & Gas Average Gross Volume: 175-185 kboepd; Opex: c. $8/boe Aluminium Alumina: 1.8 – 2.0 Mtpa Aluminium: 2.1 - 2.2 Mtpa COP*: $ 1,475 – 1,575/t Power TSPL plant availability: >80% Iron Ore Karnataka (WMT): >5 Mtpa Pig Iron: 850 - 900 Ktpa Goa: To be updated on re-start of operations ESL Hot Metal – c 1.3 Mtpa Copper - India To be updated on re-start of operations *Hot Metal COP

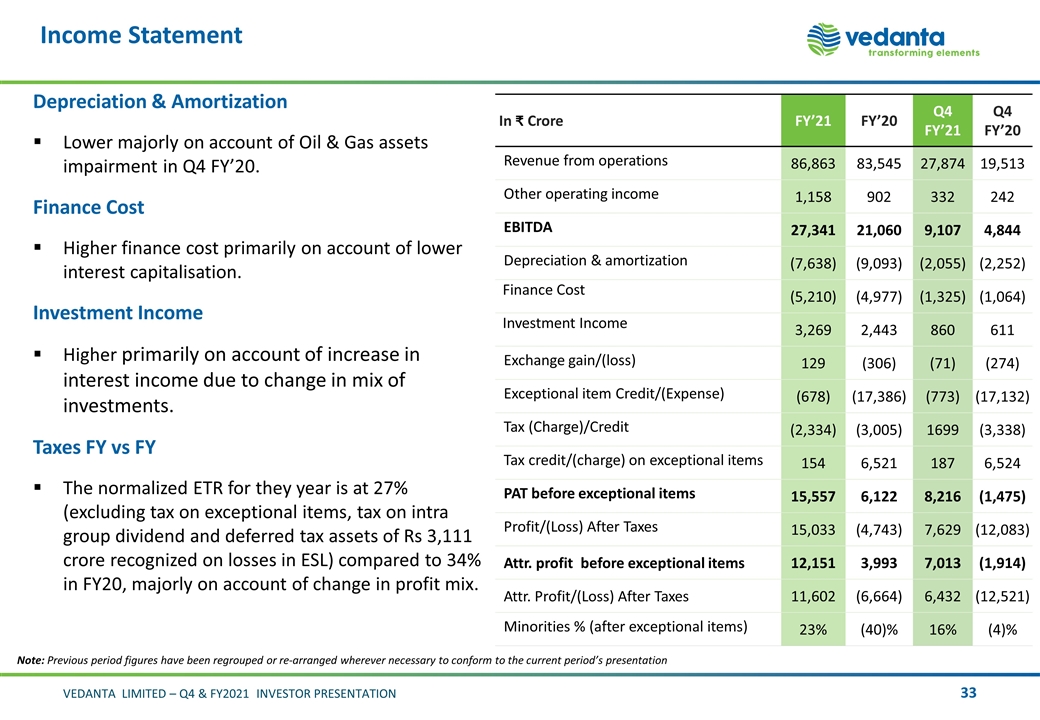

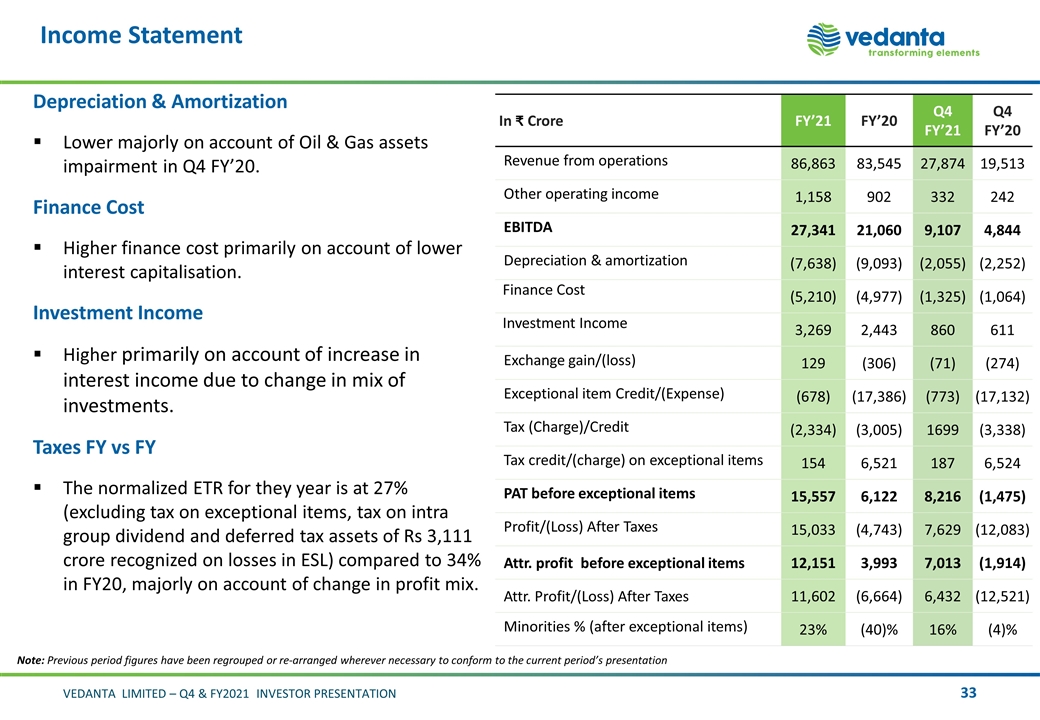

In Crore FY’21 FY’20 Q4 FY’21 Q4 FY’20 Revenue from operations 86,863 83,545 27,874 19,513 Other operating income 1,158 902 332 242 EBITDA 27,341 21,060 9,107 4,844 Depreciation & amortization (7,638) (9,093) (2,055) (2,252) Finance Cost (5,210) (4,977) (1,325) (1,064) Investment Income 3,269 2,443 860 611 Exchange gain/(loss) 129 (306) (71) (274) Exceptional item Credit/(Expense) (678) (17,386) (773) (17,132) Tax (Charge)/Credit (2,334) (3,005) 1699 (3,338) Tax credit/(charge) on exceptional items 154 6,521 187 6,524 PAT before exceptional items 15,557 6,122 8,216 (1,475) Profit/(Loss) After Taxes 15,033 (4,743) 7,629 (12,083) Attr. profit before exceptional items 12,151 3,993 7,013 (1,914) Attr. Profit/(Loss) After Taxes 11,602 (6,664) 6,432 (12,521) Minorities % (after exceptional items) 23% (40)% 16% (4)% Income Statement Depreciation & Amortization Lower majorly on account of Oil & Gas assets impairment in Q4 FY’20. Finance Cost Higher finance cost primarily on account of lower interest capitalisation. Investment Income Higher primarily on account of increase in interest income due to change in mix of investments. Taxes FY vs FY The normalized ETR for they year is at 27% (excluding tax on exceptional items, tax on intra group dividend and deferred tax assets of Rs 3,111 crore recognized on losses in ESL) compared to 34% in FY20, majorly on account of change in profit mix. Note: Previous period figures have been regrouped or re-arranged wherever necessary to conform to the current period’s presentation

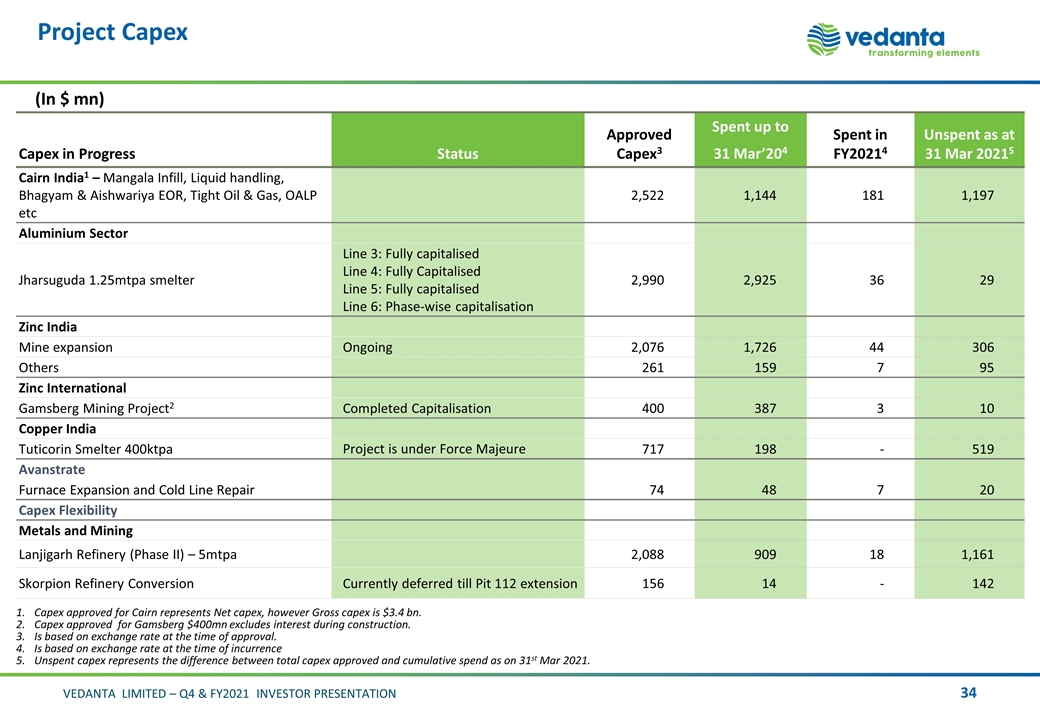

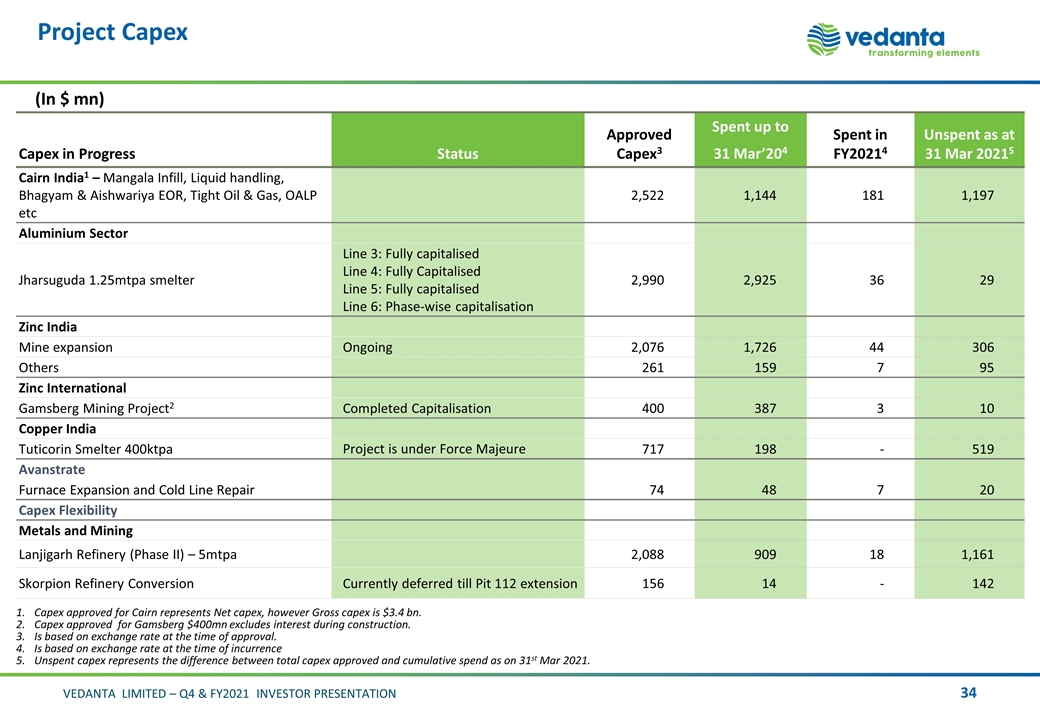

Project Capex Capex in Progress Status Approved Capex3 Spent up to 31 Mar’204 Spent in FY20214 Unspent as at 31 Mar 20215 Cairn India1 – Mangala Infill, Liquid handling, Bhagyam & Aishwariya EOR, Tight Oil & Gas, OALP etc 2,522 1,144 181 1,197 Aluminium Sector Jharsuguda 1.25mtpa smelter Line 3: Fully capitalised Line 4: Fully Capitalised Line 5: Fully capitalised Line 6: Phase-wise capitalisation 2,990 2,925 36 29 Zinc India Mine expansion Ongoing 2,076 1,726 44 306 Others 261 159 7 95 Zinc International Gamsberg Mining Project2 Completed Capitalisation 400 387 3 10 Copper India Tuticorin Smelter 400ktpa Project is under Force Majeure 717 198 - 519 Avanstrate Furnace Expansion and Cold Line Repair 74 48 7 20 Capex Flexibility Metals and Mining Lanjigarh Refinery (Phase II) – 5mtpa 2,088 909 18 1,161 Skorpion Refinery Conversion Currently deferred till Pit 112 extension 156 14 - 142 Capex approved for Cairn represents Net capex, however Gross capex is $3.4 bn. Capex approved for Gamsberg $400mn excludes interest during construction. Is based on exchange rate at the time of approval. Is based on exchange rate at the time of incurrence Unspent capex represents the difference between total capex approved and cumulative spend as on 31st Mar 2021. (In $ mn)

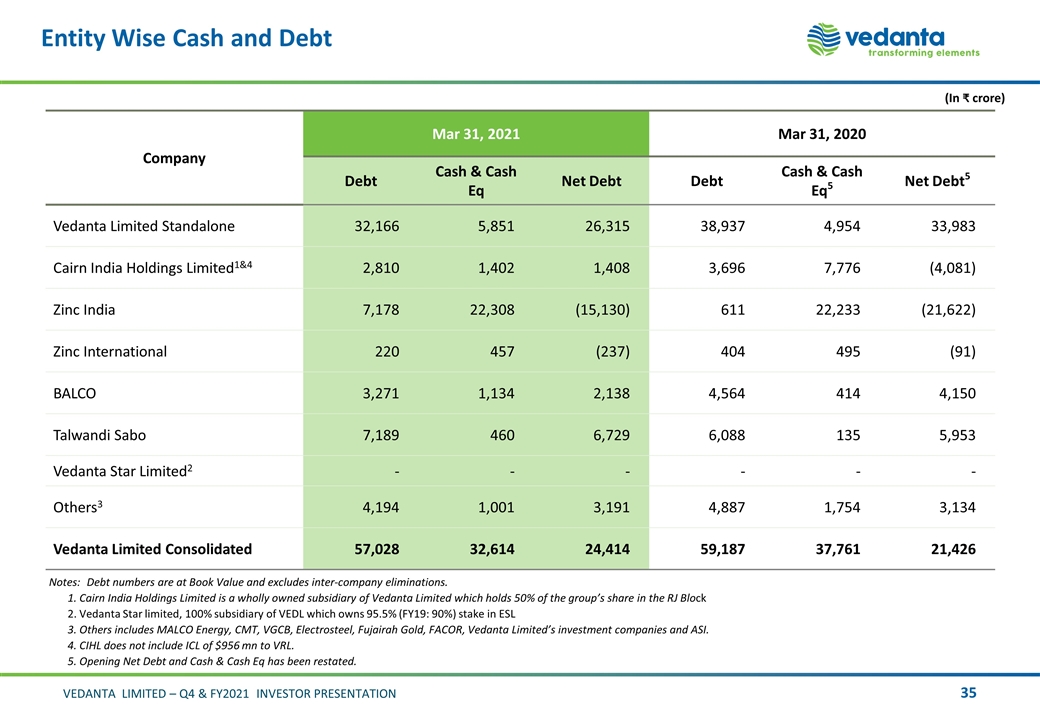

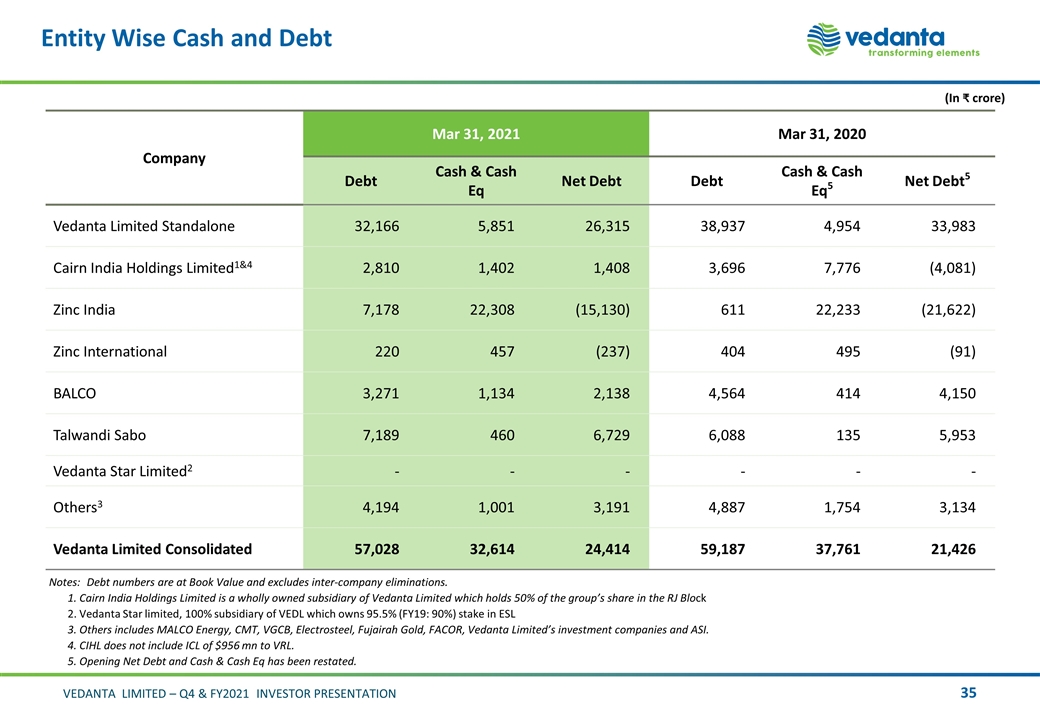

Entity Wise Cash and Debt Company Mar 31, 2021 Mar 31, 2020 Debt Cash & Cash Eq Net Debt Debt Cash & Cash Eq5 Net Debt5 Vedanta Limited Standalone 32,166 5,851 26,315 38,937 4,954 33,983 Cairn India Holdings Limited1&4 2,810 1,402 1,408 3,696 7,776 (4,081) Zinc India 7,178 22,308 (15,130) 611 22,233 (21,622) Zinc International 220 457 (237) 404 495 (91) BALCO 3,271 1,134 2,138 4,564 414 4,150 Talwandi Sabo 7,189 460 6,729 6,088 135 5,953 Vedanta Star Limited2 - - - - - - Others3 4,194 1,001 3,191 4,887 1,754 3,134 Vedanta Limited Consolidated 57,028 32,614 24,414 59,187 37,761 21,426 Notes:Debt numbers are at Book Value and excludes inter-company eliminations. 1. Cairn India Holdings Limited is a wholly owned subsidiary of Vedanta Limited which holds 50% of the group’s share in the RJ Block 2. Vedanta Star limited, 100% subsidiary of VEDL which owns 95.5% (FY19: 90%) stake in ESL 3. Others includes MALCO Energy, CMT, VGCB, Electrosteel, Fujairah Gold, FACOR, Vedanta Limited’s investment companies and ASI. 4. CIHL does not include ICL of $956 mn to VRL. 5. Opening Net Debt and Cash & Cash Eq has been restated. (In crore)

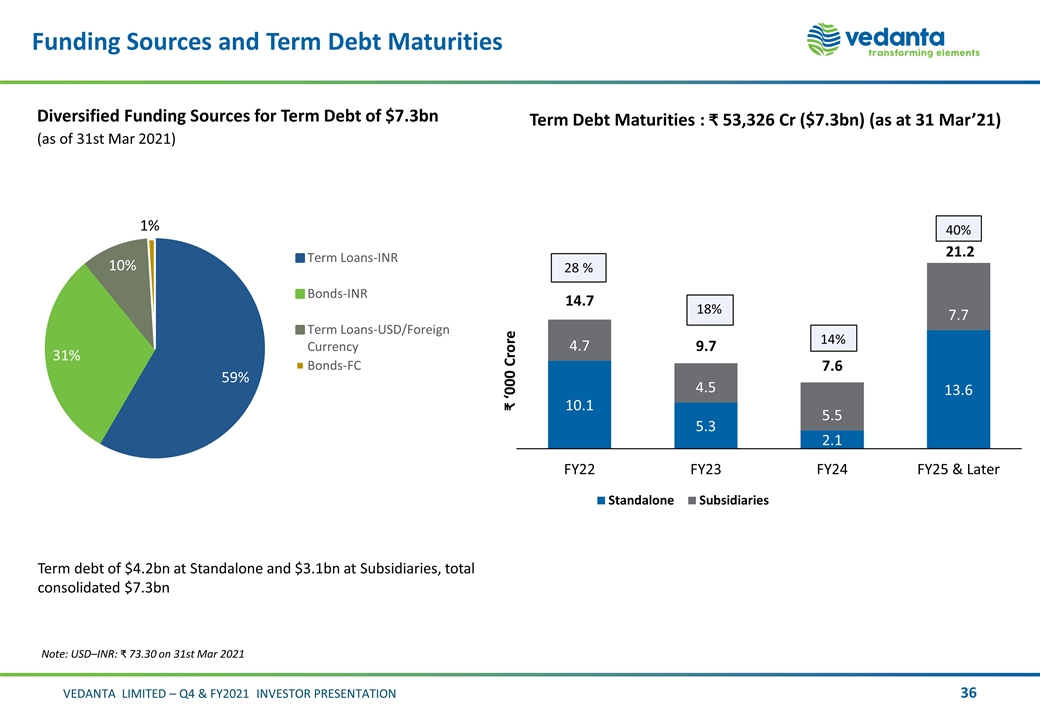

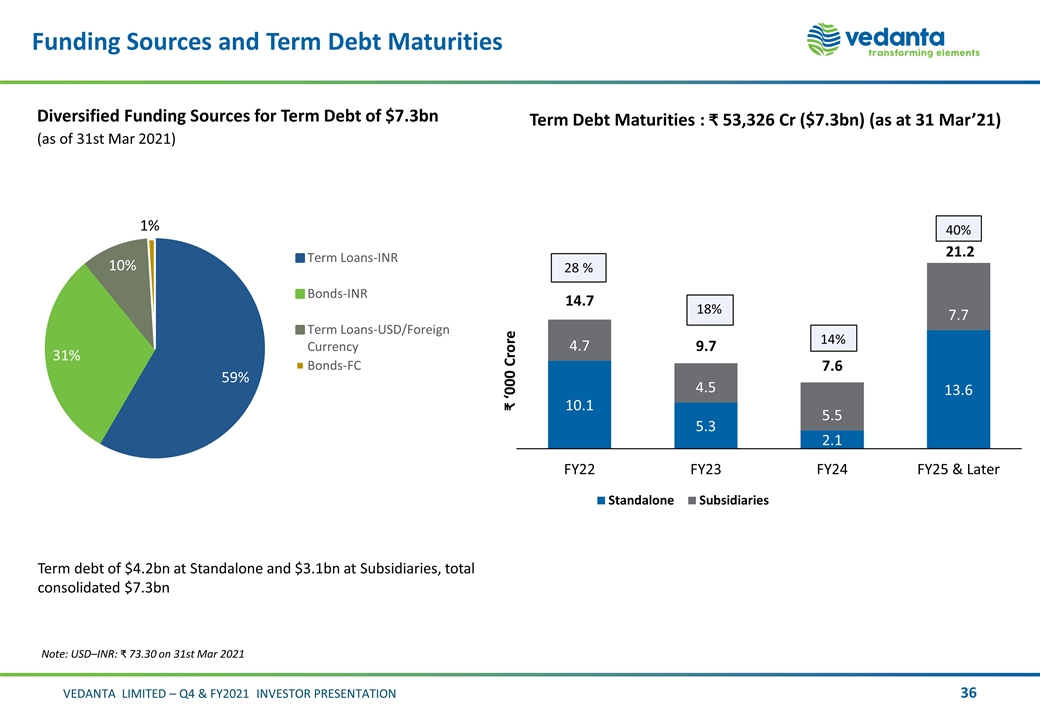

Funding Sources and Term Debt Maturities Diversified Funding Sources for Term Debt of $7.3bn (as of 31st Mar 2021) Note: USD–INR: 73.30 on 31st Mar 2021 Term debt of $4.2bn at Standalone and $3.1bn at Subsidiaries, total consolidated $7.3bn Term Debt Maturities : 53,326 Cr ($7.3bn) (as at 31 Mar’21)

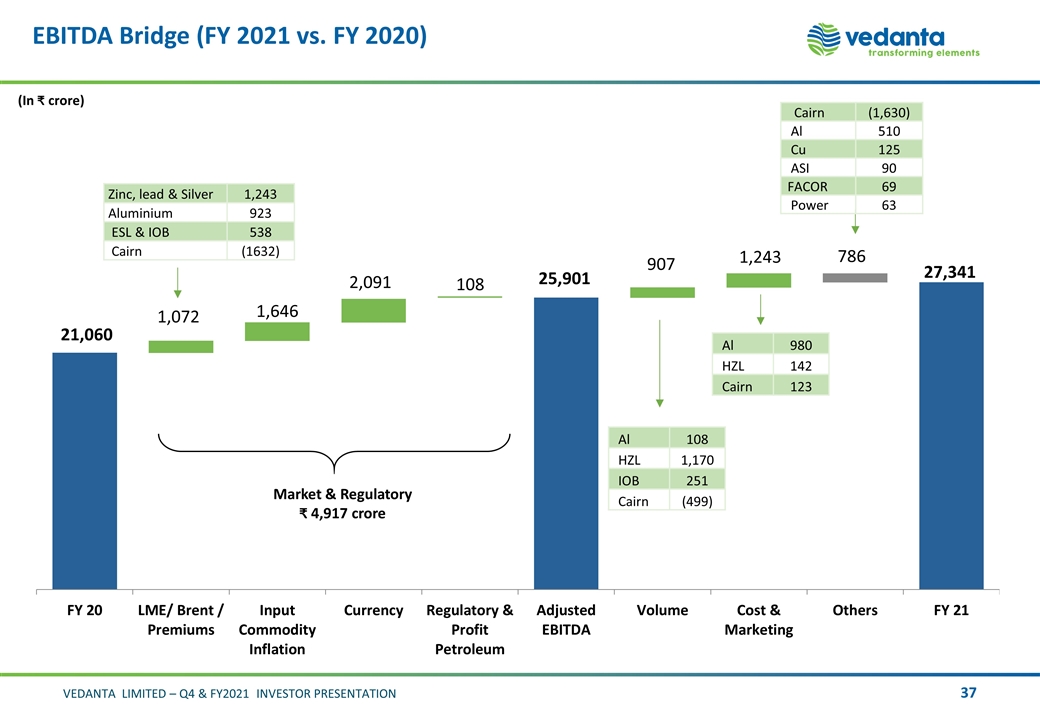

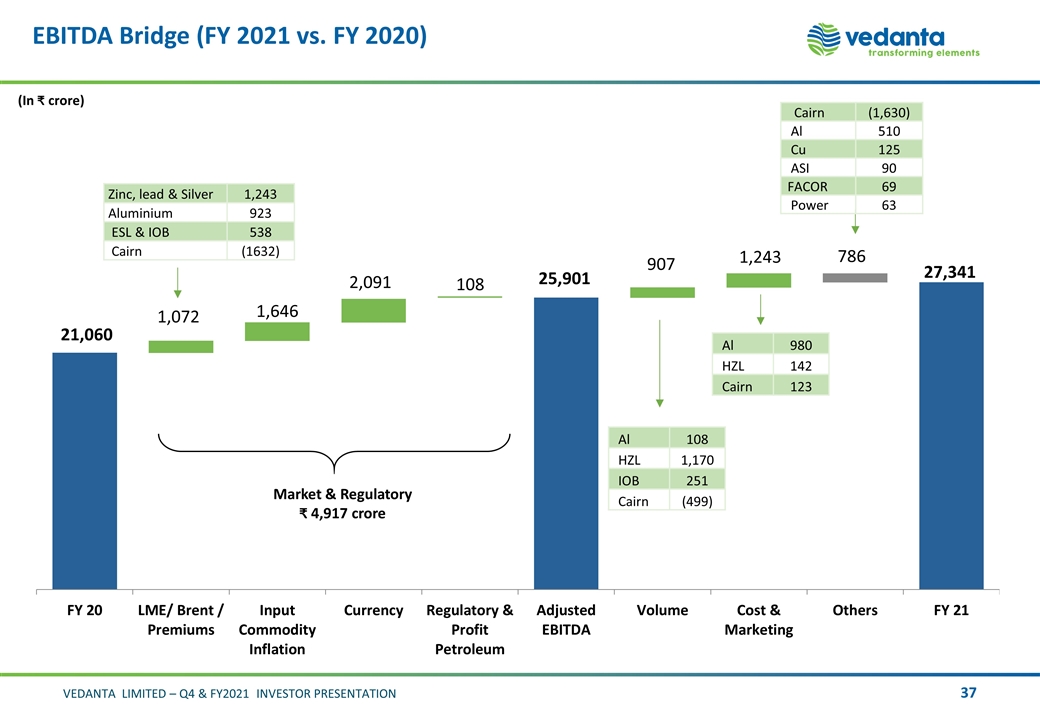

EBITDA Bridge (FY 2021 vs. FY 2020) (In crore) Market & Regulatory 4,917 crore Zinc, lead & Silver 1,243 Aluminium 923 ESL & IOB 538 Cairn (1632) Al 108 HZL 1,170 IOB 251 Cairn (499) Cairn (1,630) Al 510 Cu 125 ASI 90 FACOR 69 Power 63 108 25,901 1,646 2,091 786 Al 980 HZL 142 Cairn 123

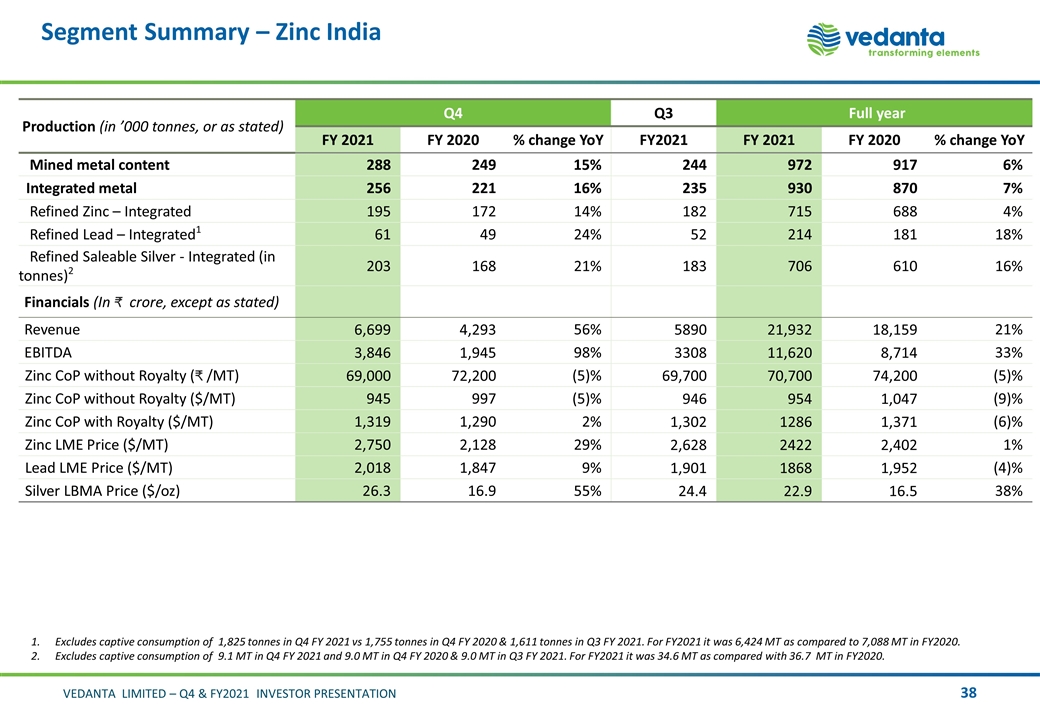

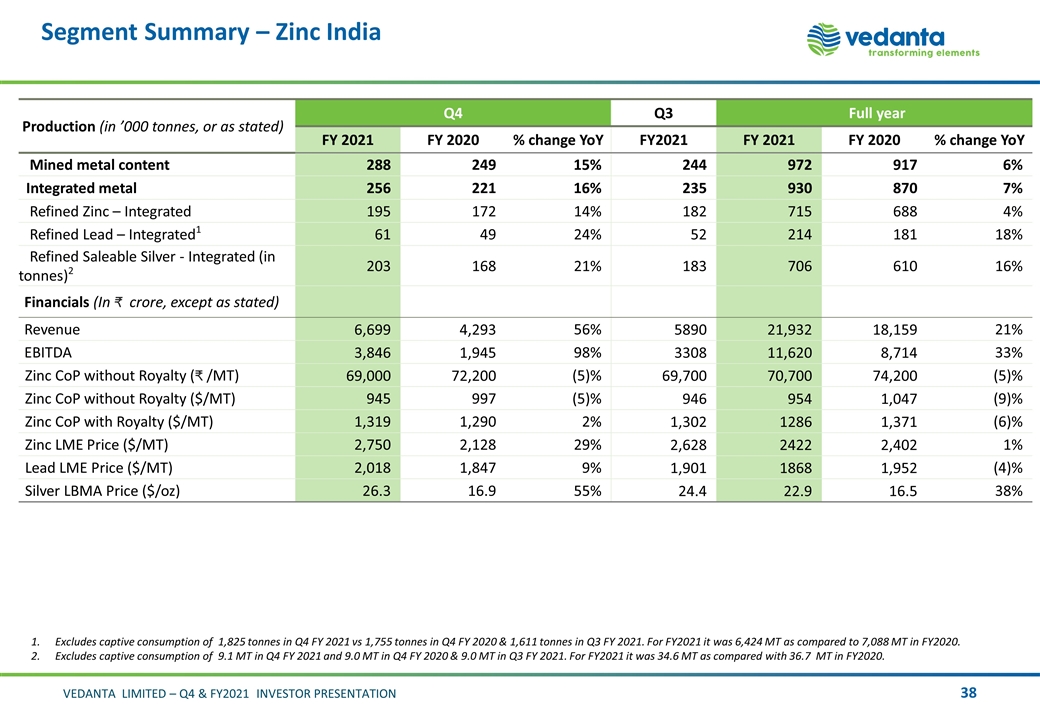

Segment Summary – Zinc India Production (in ’000 tonnes, or as stated) Q4 Q3 Full year FY 2021 FY 2020 % change YoY FY2021 FY 2021 FY 2020 % change YoY Mined metal content 288 249 15% 244 972 917 6% Integrated metal 256 221 16% 235 930 870 7% Refined Zinc – Integrated 195 172 14% 182 715 688 4% Refined Lead – Integrated1 61 49 24% 52 214 181 18% Refined Saleable Silver - Integrated (in tonnes)2 203 168 21% 183 706 610 16% Financials (In crore, except as stated) Revenue 6,699 4,293 56% 5890 21,932 18,159 21% EBITDA 3,846 1,945 98% 3308 11,620 8,714 33% Zinc CoP without Royalty ( /MT) 69,000 72,200 (5)% 69,700 70,700 74,200 (5)% Zinc CoP without Royalty ($/MT) 945 997 (5)% 946 954 1,047 (9)% Zinc CoP with Royalty ($/MT) 1,319 1,290 2% 1,302 1286 1,371 (6)% Zinc LME Price ($/MT) 2,750 2,128 29% 2,628 2422 2,402 1% Lead LME Price ($/MT) 2,018 1,847 9% 1,901 1868 1,952 (4)% Silver LBMA Price ($/oz) 26.3 16.9 55% 24.4 22.9 16.5 38% Excludes captive consumption of 1,825 tonnes in Q4 FY 2021 vs 1,755 tonnes in Q4 FY 2020 & 1,611 tonnes in Q3 FY 2021. For FY2021 it was 6,424 MT as compared to 7,088 MT in FY2020. Excludes captive consumption of 9.1 MT in Q4 FY 2021 and 9.0 MT in Q4 FY 2020 & 9.0 MT in Q3 FY 2021. For FY2021 it was 34.6 MT as compared with 36.7 MT in FY2020.

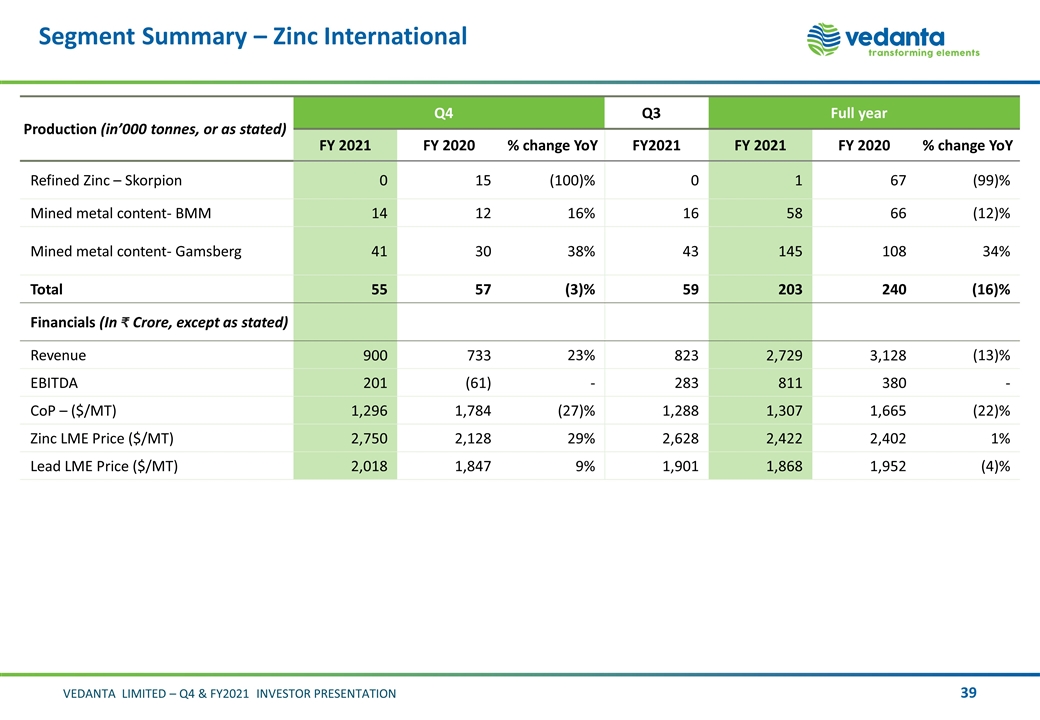

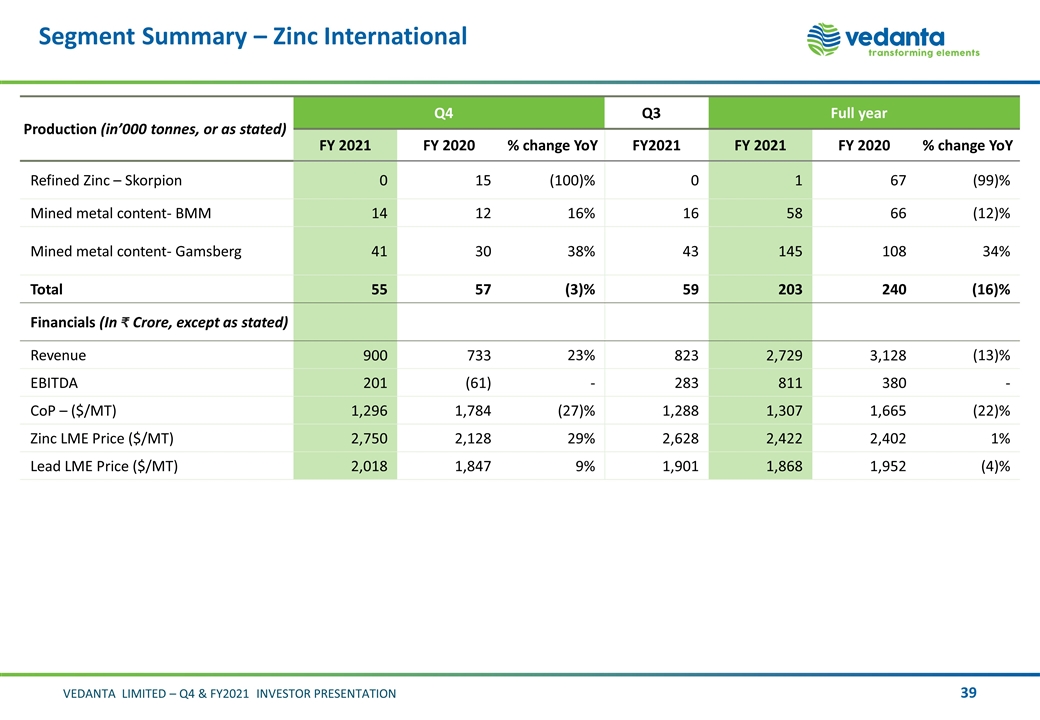

Segment Summary – Zinc International Production (in’000 tonnes, or as stated) Q4 Q3 Full year FY 2021 FY 2020 % change YoY FY2021 FY 2021 FY 2020 % change YoY Refined Zinc – Skorpion 0 15 (100)% 0 1 67 (99)% Mined metal content- BMM 14 12 16% 16 58 66 (12)% Mined metal content- Gamsberg 41 30 38% 43 145 108 34% Total 55 57 (3)% 59 203 240 (16)% Financials (In Crore, except as stated) Revenue 900 733 23% 823 2,729 3,128 (13)% EBITDA 201 (61) - 283 811 380 - CoP – ($/MT) 1,296 1,784 (27)% 1,288 1,307 1,665 (22)% Zinc LME Price ($/MT) 2,750 2,128 29% 2,628 2,422 2,402 1% Lead LME Price ($/MT) 2,018 1,847 9% 1,901 1,868 1,952 (4)%

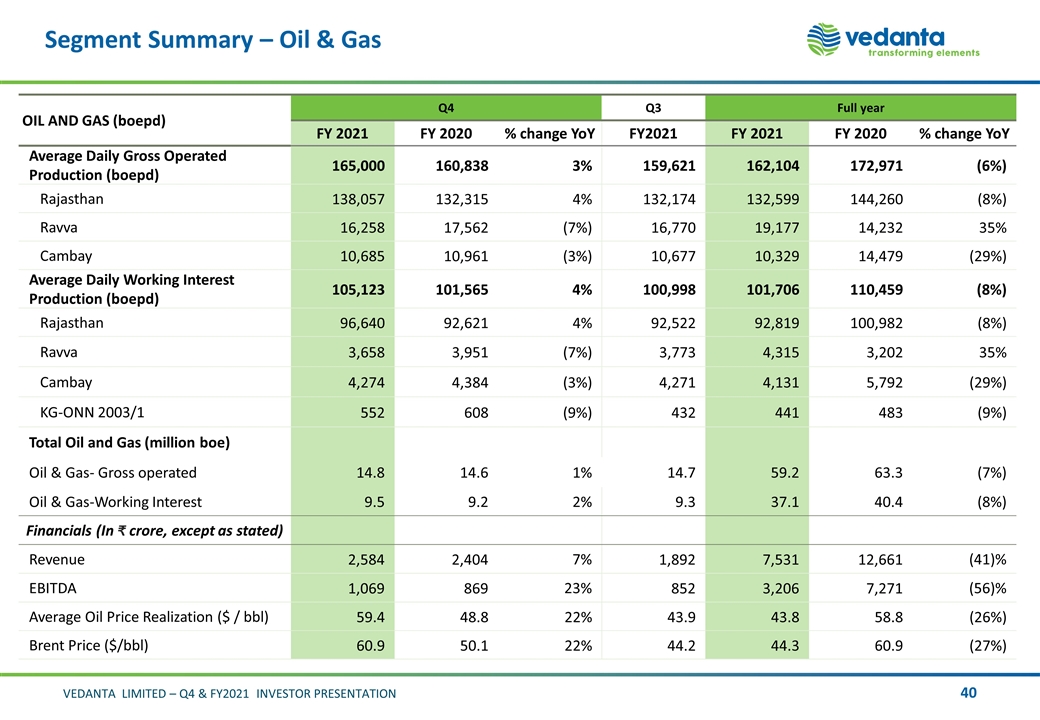

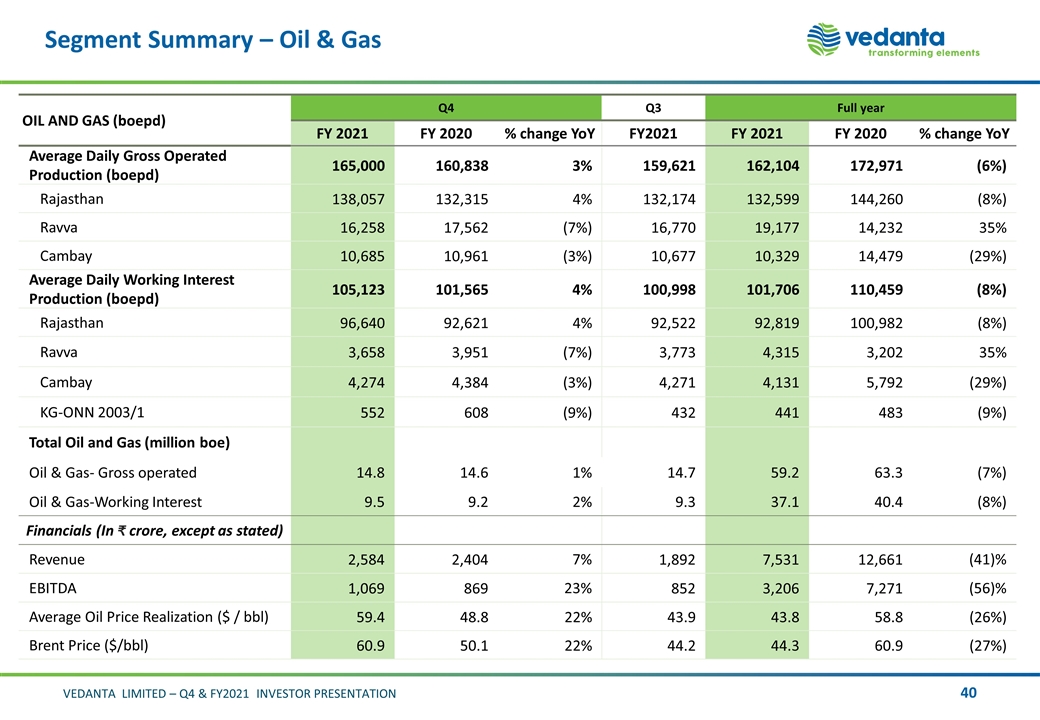

Segment Summary – Oil & Gas OIL AND GAS (boepd) Q4 Q3 Full year FY 2021 FY 2020 % change YoY FY2021 FY 2021 FY 2020 % change YoY Average Daily Gross Operated Production (boepd) 165,000 160,838 3% 159,621 162,104 172,971 (6%) Rajasthan 138,057 132,315 4% 132,174 132,599 144,260 (8%) Ravva 16,258 17,562 (7%) 16,770 19,177 14,232 35% Cambay 10,685 10,961 (3%) 10,677 10,329 14,479 (29%) Average Daily Working Interest Production (boepd) 105,123 101,565 4% 100,998 101,706 110,459 (8%) Rajasthan 96,640 92,621 4% 92,522 92,819 100,982 (8%) Ravva 3,658 3,951 (7%) 3,773 4,315 3,202 35% Cambay 4,274 4,384 (3%) 4,271 4,131 5,792 (29%) KG-ONN 2003/1 552 608 (9%) 432 441 483 (9%) Total Oil and Gas (million boe) Oil & Gas- Gross operated 14.8 14.6 1% 14.7 59.2 63.3 (7%) Oil & Gas-Working Interest 9.5 9.2 2% 9.3 37.1 40.4 (8%) Financials (In crore, except as stated) Revenue 2,584 2,404 7% 1,892 7,531 12,661 (41)% EBITDA 1,069 869 23% 852 3,206 7,271 (56)% Average Oil Price Realization ($ / bbl) 59.4 48.8 22% 43.9 43.8 58.8 (26%) Brent Price ($/bbl) 60.9 50.1 22% 44.2 44.3 60.9 (27%)

Segment Summary – Oil & Gas OIL AND GAS (boepd) Q4 Q3 Full year FY 2021 FY 2020 % change YoY FY2021 FY 2021 FY 2020 % change YoY Average Daily Production Gross operated 165,000 160,838 3% 159,621 162,104 172,971 (6)% Oil 139,818 138,205 1% 136,687 140,353 154,677 (9)% Gas (Mmscfd) 151 136 11% 138 131 110 19% Non-operated- Working interest 552 608 (9)% 432 441 483 (9)% Working Interest 105,123 101,565 4% 100,998 101,706 110,459 (8)% Rajasthan (Block RJ-ON-90/1) Gross operated 138,057 132,315 4% 132,174 132,599 144,260 (8)% Oil 118,849 115,251 3% 114,680 116,599 131,069 (11)% Gas (Mmscfd) 115 102 13% 105 96 79 21% Gross DA 1 123,855 120,424 3% 119,863 119,863 129,398 (7)% Gross DA 2 14,070 11,609 21% 12,119 12,507 14,564 (14)% Gross DA 3 132 282 (53)% 192 228 298 (23)% Working Interest 96,640 92,621 4% 92,522 92,819 100,982 (8)% Ravva (Block PKGM-1) Gross operated 16,258 17,562 (7)% 16,770 19,177 14,232 35% Oil 12,566 13,120 (4)% 12,910 15,036 10,994 37% Gas (Mmscfd) 22 27 (17)% 23 25 19 28% Working Interest 3,658 3,951 (7)% 3,773 4,315 3,202 35% Cambay (Block CB/OS-2) Gross operated 10,685 10,961 (3)% 10,677 10,329 14,479 (29)% Oil 8,404 9,833 (15)% 9,097 8,718 12,614 (31)% Gas (Mmscfd) 14 7 102% 9 10 11 (14)% Working Interest 4,274 4,384 (3)% 4,271 4,131 5,792 (29)% Average Price Realization Cairn Total (US$/boe) 57.0 46.9 22% 42.3 41.9 56.6 (26)% Oil (US$/bbl) 59.4 48.8 22% 43.9 43.8 58.8 (26)% Gas (US$/mscf) 7.1 5.6 27% 5.3 4.8 6.1 (21)%

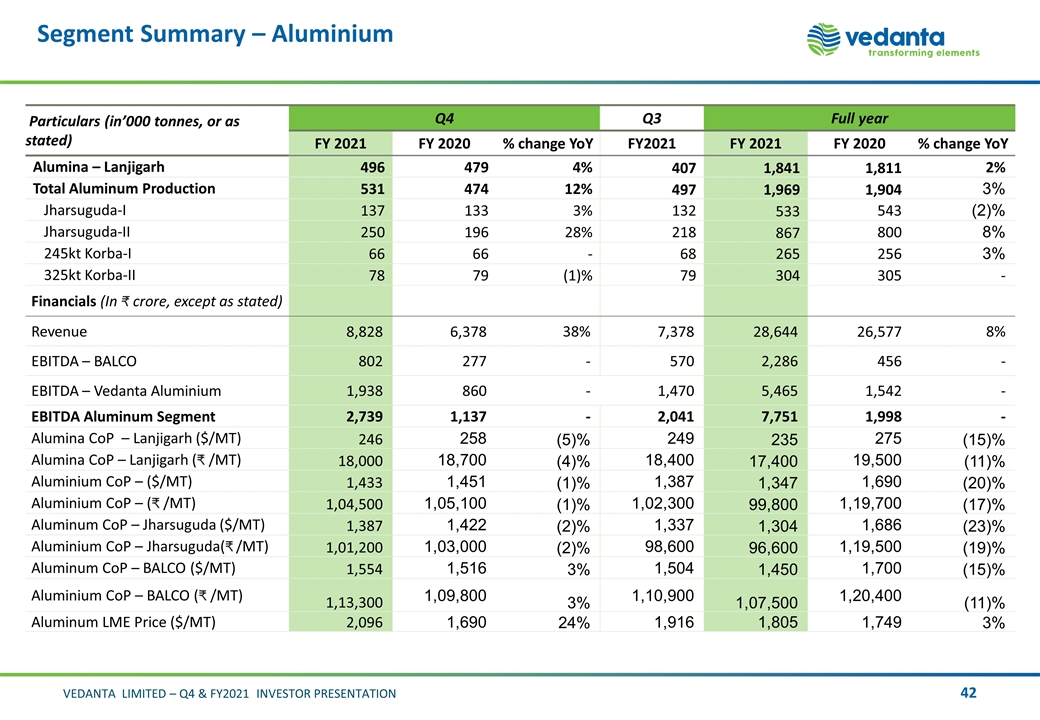

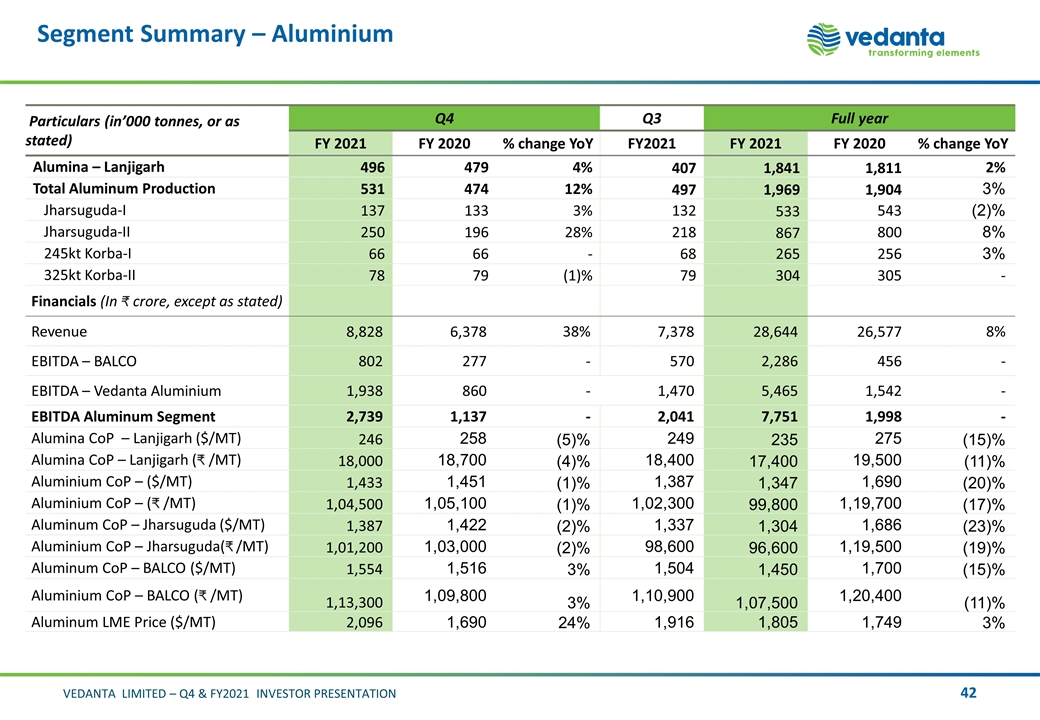

Segment Summary – Aluminium Particulars (in’000 tonnes, or as stated) Q4 Q3 Full year FY 2021 FY 2020 % change YoY FY2021 FY 2021 FY 2020 % change YoY Alumina – Lanjigarh 496 479 4% 407 1,841 1,811 2% Total Aluminum Production 531 474 12% 497 1,969 1,904 3% Jharsuguda-I 137 133 3% 132 533 543 (2)% Jharsuguda-II 250 196 28% 218 867 800 8% 245kt Korba-I 66 66 - 68 265 256 3% 325kt Korba-II 78 79 (1)% 79 304 305 - Financials (In crore, except as stated) Revenue 8,828 6,378 38% 7,378 28,644 26,577 8% EBITDA – BALCO 802 277 - 570 2,286 456 - EBITDA – Vedanta Aluminium 1,938 860 - 1,470 5,465 1,542 - EBITDA Aluminum Segment 2,739 1,137 - 2,041 7,751 1,998 - Alumina CoP – Lanjigarh ($/MT) 246 258 (5)% 249 235 275 (15)% Alumina CoP – Lanjigarh ( /MT) 18,000 18,700 (4)% 18,400 17,400 19,500 (11)% Aluminium CoP – ($/MT) 1,433 1,451 (1)% 1,387 1,347 1,690 (20)% Aluminium CoP – ( /MT) 1,04,500 1,05,100 (1)% 1,02,300 99,800 1,19,700 (17)% Aluminum CoP – Jharsuguda ($/MT) 1,387 1,422 (2)% 1,337 1,304 1,686 (23)% Aluminium CoP – Jharsuguda( /MT) 1,01,200 1,03,000 (2)% 98,600 96,600 1,19,500 (19)% Aluminum CoP – BALCO ($/MT) 1,554 1,516 3% 1,504 1,450 1,700 (15)% Aluminium CoP – BALCO ( /MT) 1,13,300 1,09,800 3% 1,10,900 1,07,500 1,20,400 (11)% Aluminum LME Price ($/MT) 2,096 1,690 24% 1,916 1,805 1,749 3%

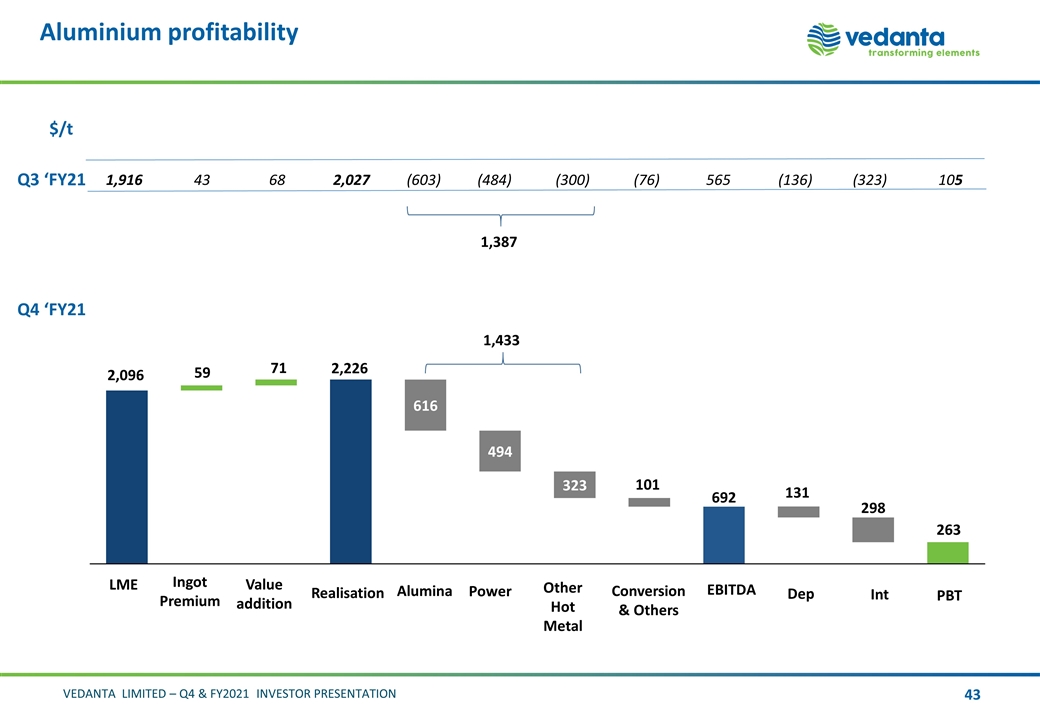

Aluminium profitability Q3 ‘FY21 $/t Q4 ‘FY21 71 59 298 692 263 1,916 43 68 2,027 (603) (484) (300) (76) 565 (136) (323) 105 1,387 1,433

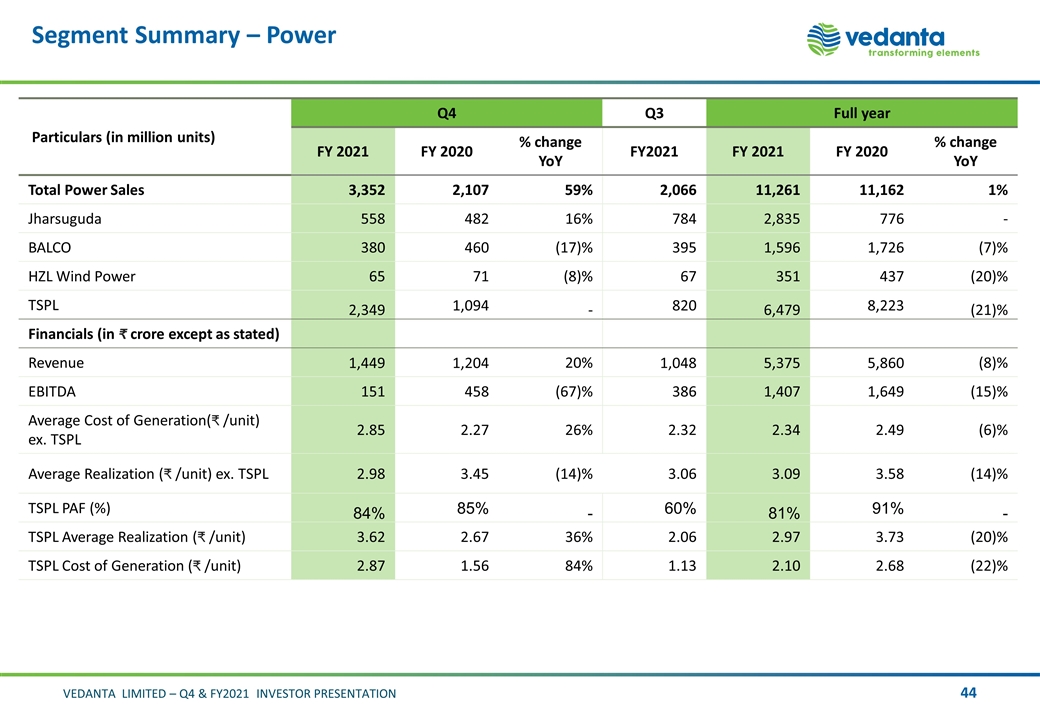

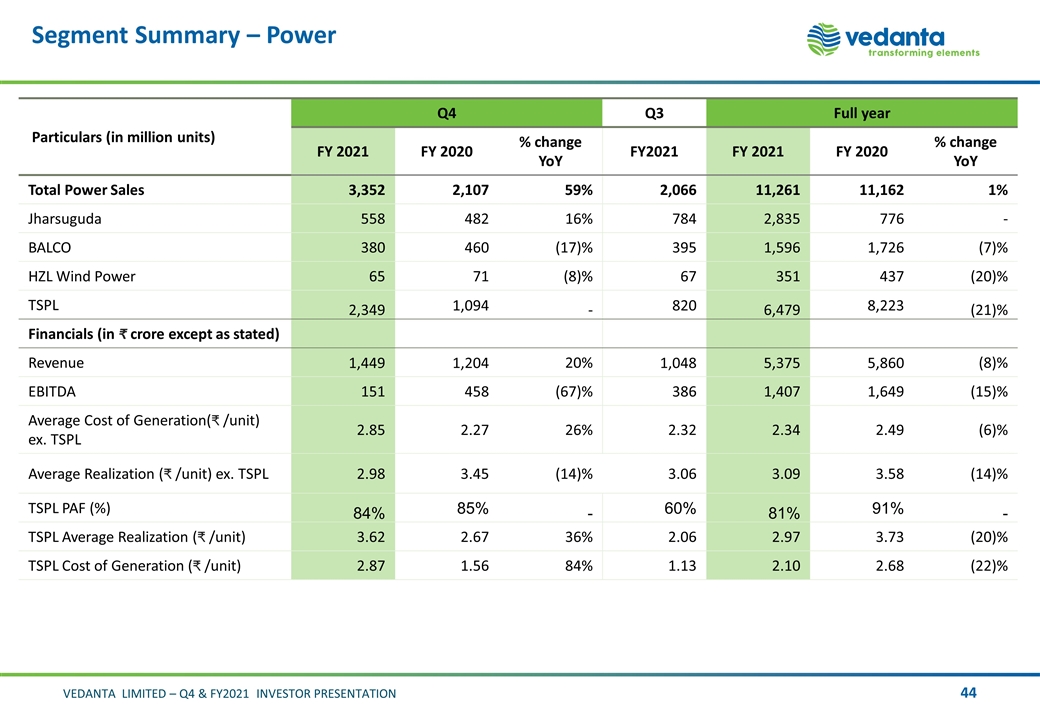

Segment Summary – Power Particulars (in million units) Q4 Q3 Full year FY 2021 FY 2020 % change YoY FY2021 FY 2021 FY 2020 % change YoY Total Power Sales 3,352 2,107 59% 2,066 11,261 11,162 1% Jharsuguda 558 482 16% 784 2,835 776 - BALCO 380 460 (17)% 395 1,596 1,726 (7)% HZL Wind Power 65 71 (8)% 67 351 437 (20)% TSPL 2,349 1,094 - 820 6,479 8,223 (21)% Financials (in crore except as stated) Revenue 1,449 1,204 20% 1,048 5,375 5,860 (8)% EBITDA 151 458 (67)% 386 1,407 1,649 (15)% Average Cost of Generation( /unit) ex. TSPL 2.85 2.27 26% 2.32 2.34 2.49 (6)% Average Realization ( /unit) ex. TSPL 2.98 3.45 (14)% 3.06 3.09 3.58 (14)% TSPL PAF (%) 84% 85% - 60% 81% 91% - TSPL Average Realization ( /unit) 3.62 2.67 36% 2.06 2.97 3.73 (20)% TSPL Cost of Generation ( /unit) 2.87 1.56 84% 1.13 2.10 2.68 (22)%

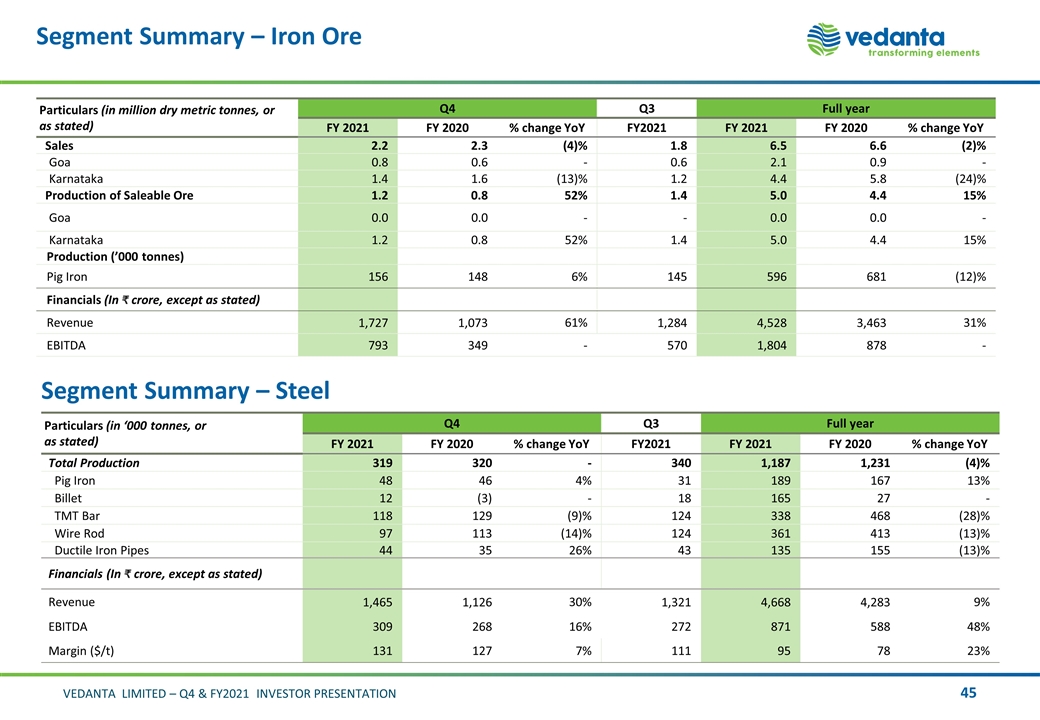

Segment Summary – Iron Ore Particulars (in million dry metric tonnes, or as stated) Q4 Q3 Full year FY 2021 FY 2020 % change YoY FY2021 FY 2021 FY 2020 % change YoY Sales 2.2 2.3 (4)% 1.8 6.5 6.6 (2)% Goa 0.8 0.6 - 0.6 2.1 0.9 - Karnataka 1.4 1.6 (13)% 1.2 4.4 5.8 (24)% Production of Saleable Ore 1.2 0.8 52% 1.4 5.0 4.4 15% Goa 0.0 0.0 - - 0.0 0.0 - Karnataka 1.2 0.8 52% 1.4 5.0 4.4 15% Production (’000 tonnes) Pig Iron 156 148 6% 145 596 681 (12)% Financials (In crore, except as stated) Revenue 1,727 1,073 61% 1,284 4,528 3,463 31% EBITDA 793 349 - 570 1,804 878 - Segment Summary – Steel Particulars (in ‘000 tonnes, or as stated) Q4 Q3 Full year FY 2021 FY 2020 % change YoY FY2021 FY 2021 FY 2020 % change YoY Total Production 319 320 - 340 1,187 1,231 (4)% Pig Iron 48 46 4% 31 189 167 13% Billet 12 (3) - 18 165 27 - TMT Bar 118 129 (9)% 124 338 468 (28)% Wire Rod 97 113 (14)% 124 361 413 (13)% Ductile Iron Pipes 44 35 26% 43 135 155 (13)% Financials (In crore, except as stated) Revenue 1,465 1,126 30% 1,321 4,668 4,283 9% EBITDA 309 268 16% 272 871 588 48% Margin ($/t) 131 127 7% 111 95 78 23%

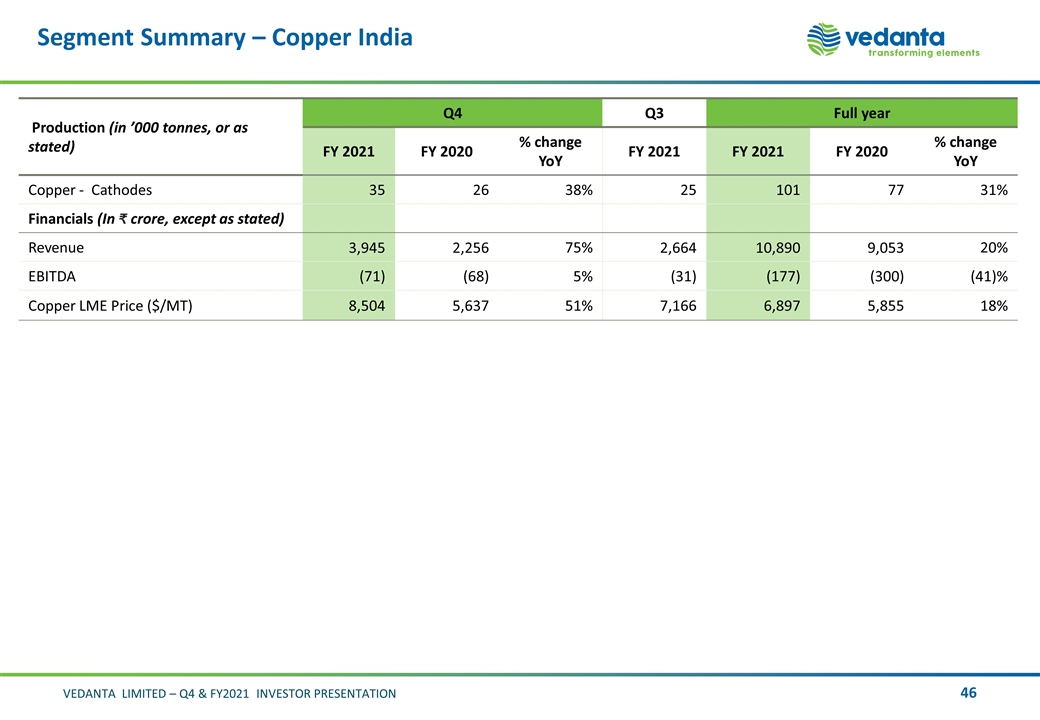

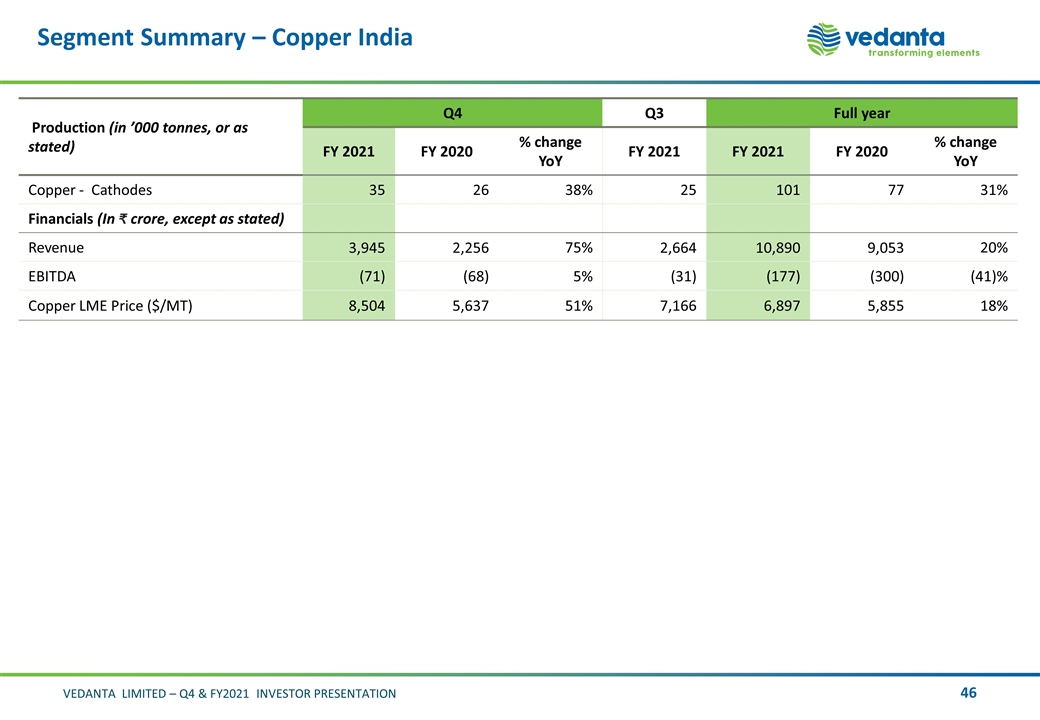

Segment Summary – Copper India Production (in ’000 tonnes, or as stated) Q4 Q3 Full year FY 2021 FY 2020 % change YoY FY 2021 FY 2021 FY 2020 % change YoY Copper - Cathodes 35 26 38% 25 101 77 31% Financials (In crore, except as stated) Revenue 3,945 2,256 75% 2,664 10,890 9,053 20% EBITDA (71) (68) 5% (31) (177) (300) (41)% Copper LME Price ($/MT) 8,504 5,637 51% 7,166 6,897 5,855 18%

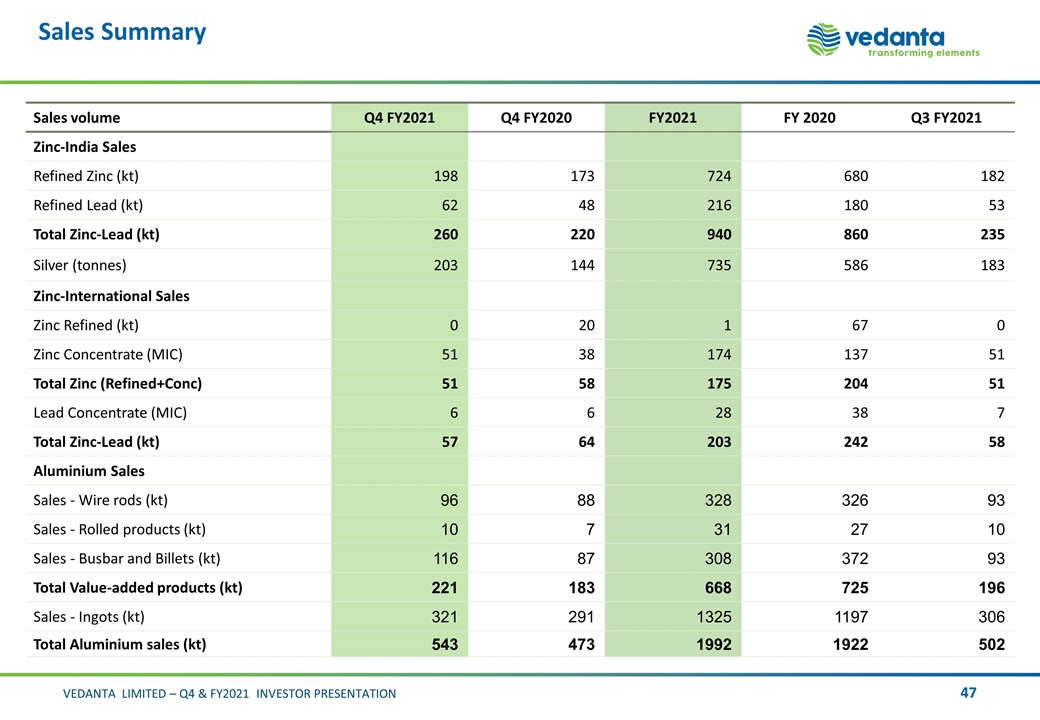

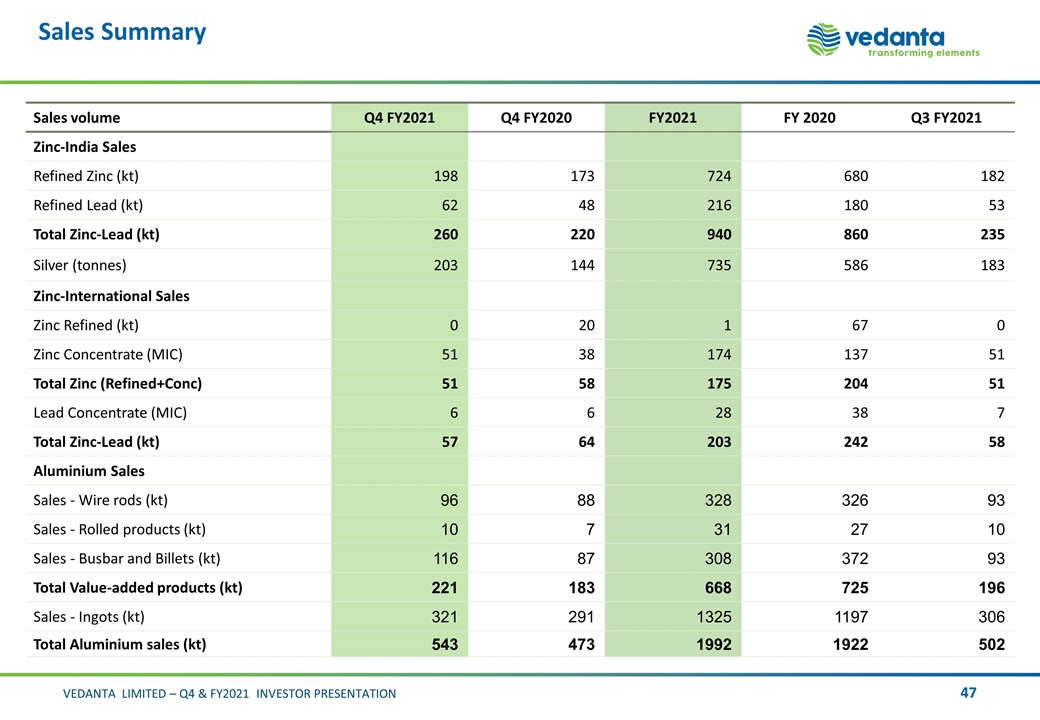

Sales Summary Sales volume Q4 FY2021 Q4 FY2020 FY2021 FY 2020 Q3 FY2021 Zinc-India Sales Refined Zinc (kt) 198 173 724 680 182 Refined Lead (kt) 62 48 216 180 53 Total Zinc-Lead (kt) 260 220 940 860 235 Silver (tonnes) 203 144 735 586 183 Zinc-International Sales Zinc Refined (kt) 0 20 1 67 0 Zinc Concentrate (MIC) 51 38 174 137 51 Total Zinc (Refined+Conc) 51 58 175 204 51 Lead Concentrate (MIC) 6 6 28 38 7 Total Zinc-Lead (kt) 57 64 203 242 58 Aluminium Sales Sales - Wire rods (kt) 96 88 328 326 93 Sales - Rolled products (kt) 10 7 31 27 10 Sales - Busbar and Billets (kt) 116 87 308 372 93 Total Value-added products (kt) 221 183 668 725 196 Sales - Ingots (kt) 321 291 1325 1197 306 Total Aluminium sales (kt) 543 473 1992 1922 502

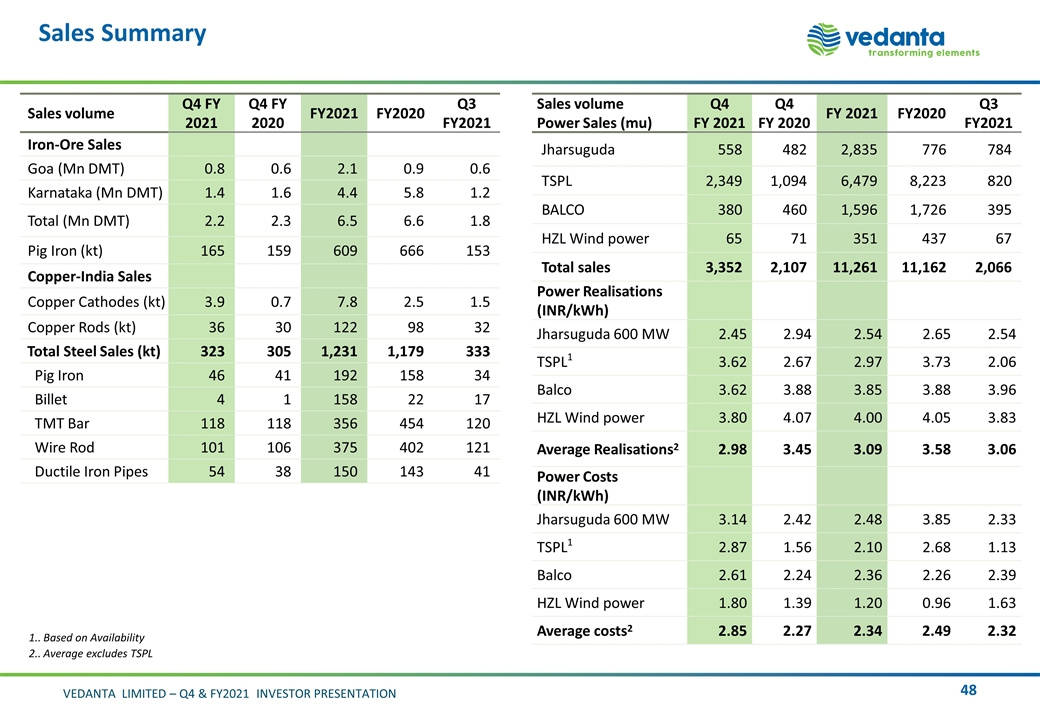

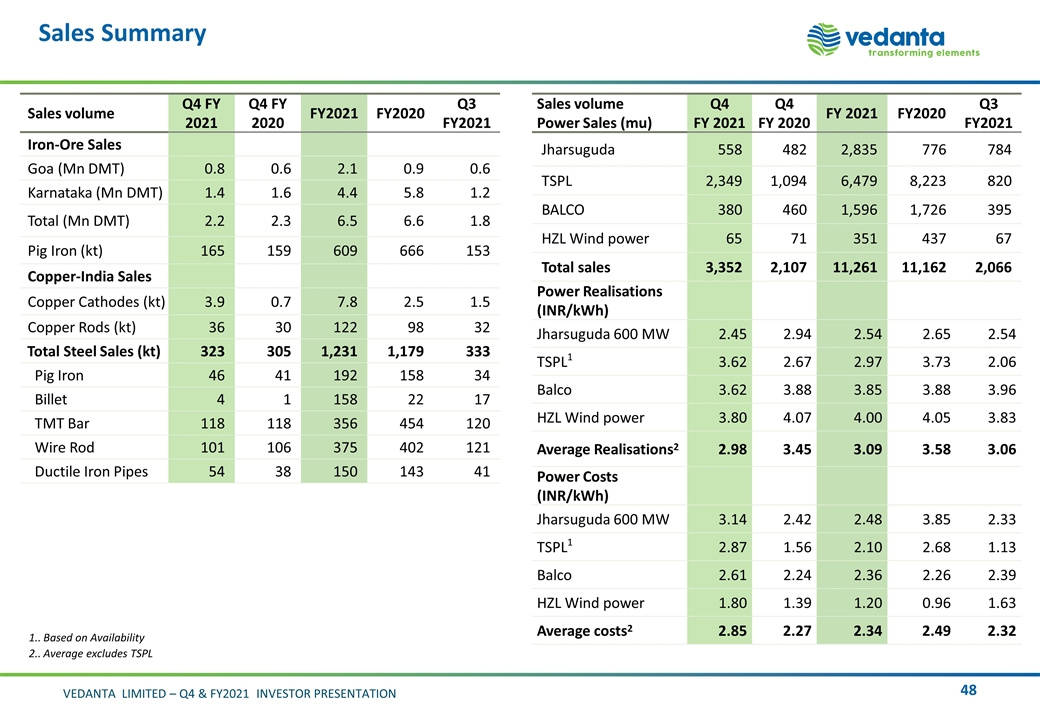

Sales Summary Sales volume Q4 FY 2021 Q4 FY 2020 FY2021 FY2020 Q3 FY2021 Iron-Ore Sales Goa (Mn DMT) 0.8 0.6 2.1 0.9 0.6 Karnataka (Mn DMT) 1.4 1.6 4.4 5.8 1.2 Total (Mn DMT) 2.2 2.3 6.5 6.6 1.8 Pig Iron (kt) 165 159 609 666 153 Copper-India Sales Copper Cathodes (kt) 3.9 0.7 7.8 2.5 1.5 Copper Rods (kt) 36 30 122 98 32 Total Steel Sales (kt) 323 305 1,231 1,179 333 Pig Iron 46 41 192 158 34 Billet 4 1 158 22 17 TMT Bar 118 118 356 454 120 Wire Rod 101 106 375 402 121 Ductile Iron Pipes 54 38 150 143 41 Sales volume Power Sales (mu) Q4 FY 2021 Q4 FY 2020 FY 2021 FY2020 Q3 FY2021 Jharsuguda 558 482 2,835 776 784 TSPL 2,349 1,094 6,479 8,223 820 BALCO 380 460 1,596 1,726 395 HZL Wind power 65 71 351 437 67 Total sales 3,352 2,107 11,261 11,162 2,066 Power Realisations (INR/kWh) Jharsuguda 600 MW 2.45 2.94 2.54 2.65 2.54 TSPL1 3.62 2.67 2.97 3.73 2.06 Balco 3.62 3.88 3.85 3.88 3.96 HZL Wind power 3.80 4.07 4.00 4.05 3.83 Average Realisations2 2.98 3.45 3.09 3.58 3.06 Power Costs (INR/kWh) Jharsuguda 600 MW 3.14 2.42 2.48 3.85 2.33 TSPL1 2.87 1.56 2.10 2.68 1.13 Balco 2.61 2.24 2.36 2.26 2.39 HZL Wind power 1.80 1.39 1.20 0.96 1.63 Average costs2 2.85 2.27 2.34 2.49 2.32 1.. Based on Availability 2.. Average excludes TSPL

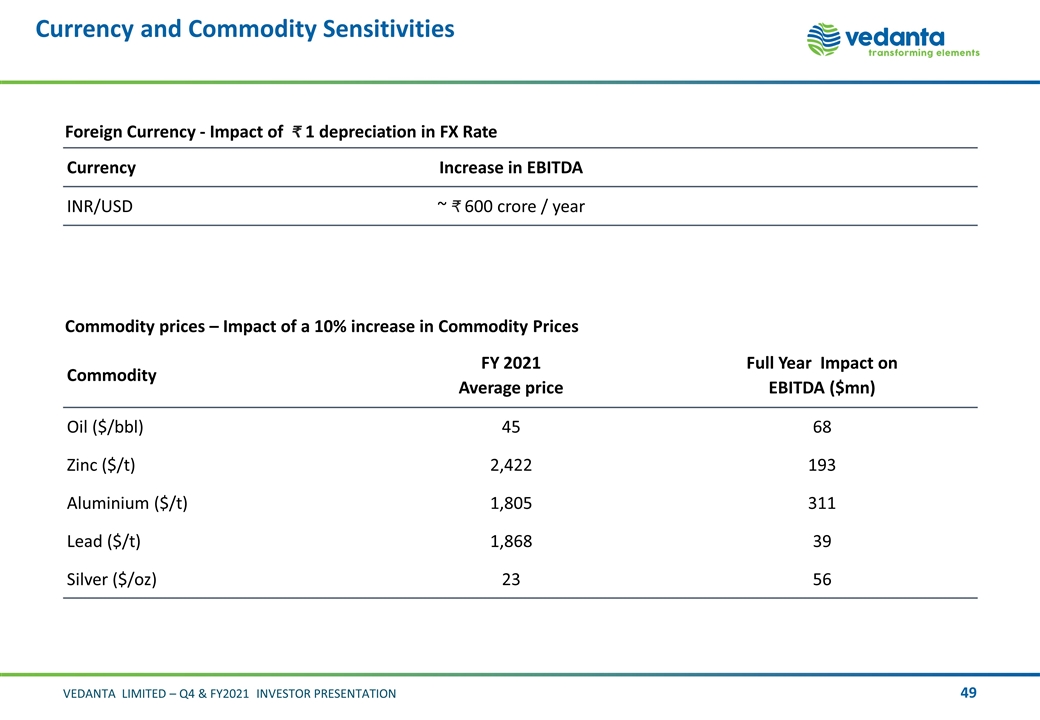

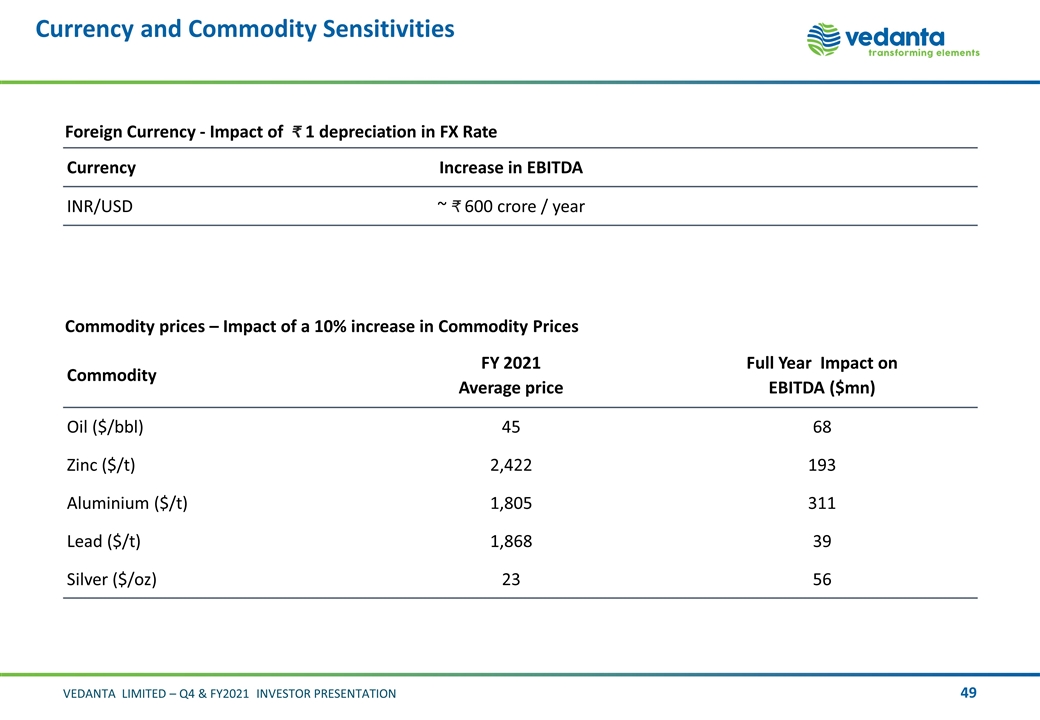

Currency and Commodity Sensitivities Commodity prices – Impact of a 10% increase in Commodity Prices Commodity FY 2021 Average price Full Year Impact on EBITDA ($mn) Oil ($/bbl) 45 68 Zinc ($/t) 2,422 193 Aluminium ($/t) 1,805 311 Lead ($/t) 1,868 39 Silver ($/oz) 23 56 Foreign Currency - Impact of ₹ 1 depreciation in FX Rate Currency Increase in EBITDA INR/USD ~ 600 crore / year

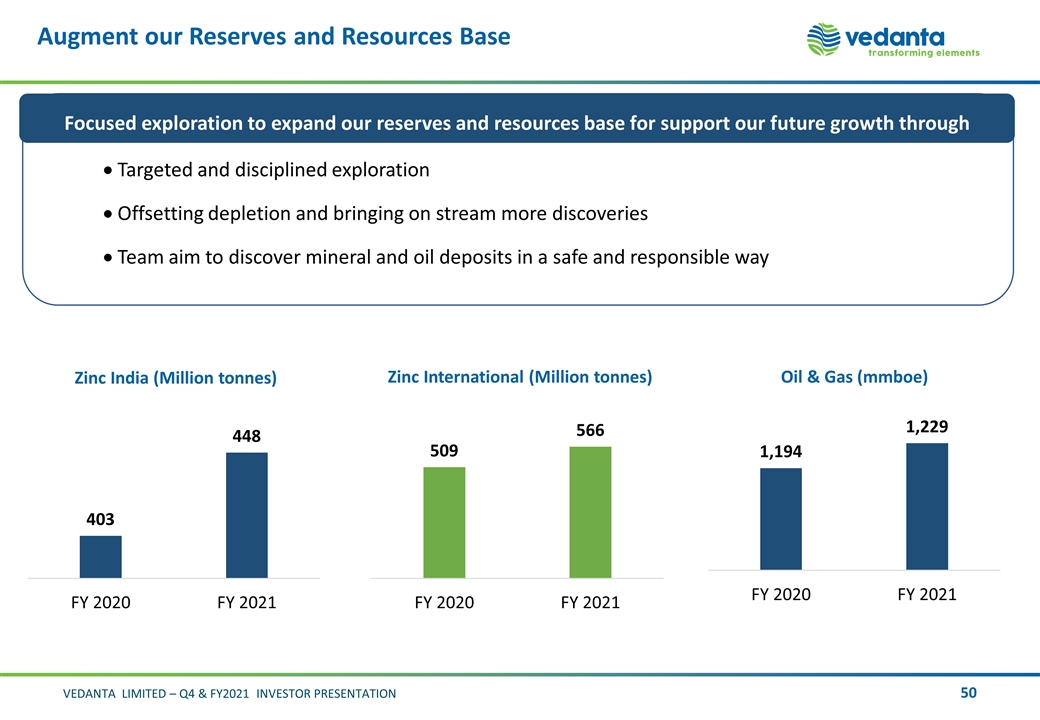

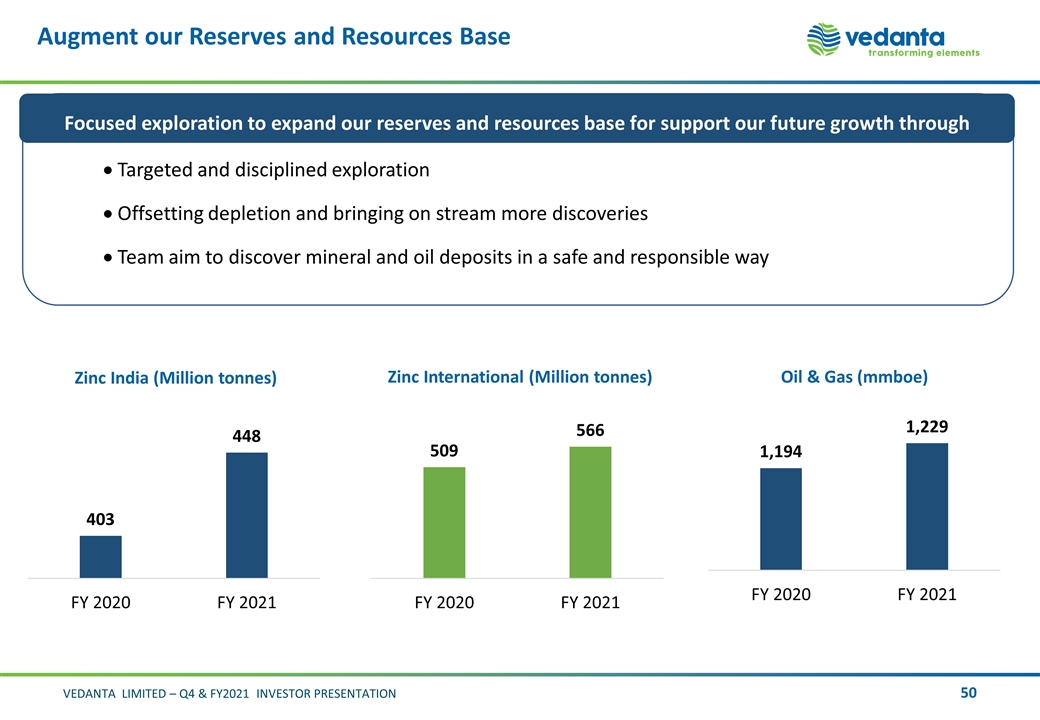

Focused exploration to expand our reserves and resources base for support our future growth through Augment our Reserves and Resources Base Targeted and disciplined exploration Offsetting depletion and bringing on stream more discoveries Team aim to discover mineral and oil deposits in a safe and responsible way Zinc India (Million tonnes) Oil & Gas (mmboe) Zinc International (Million tonnes)

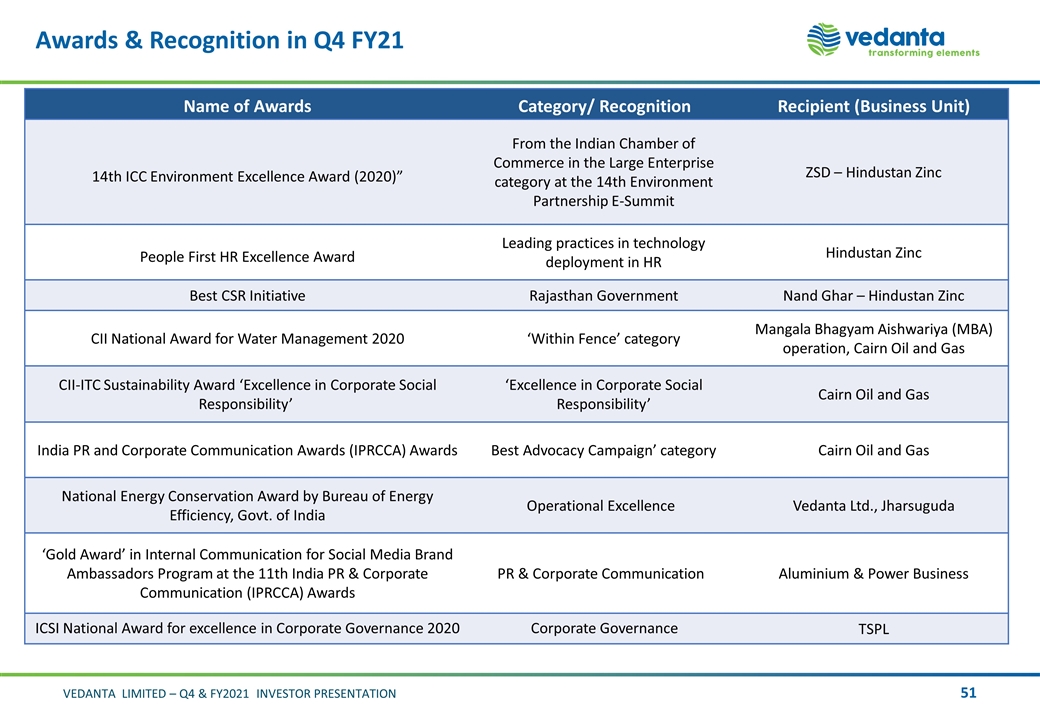

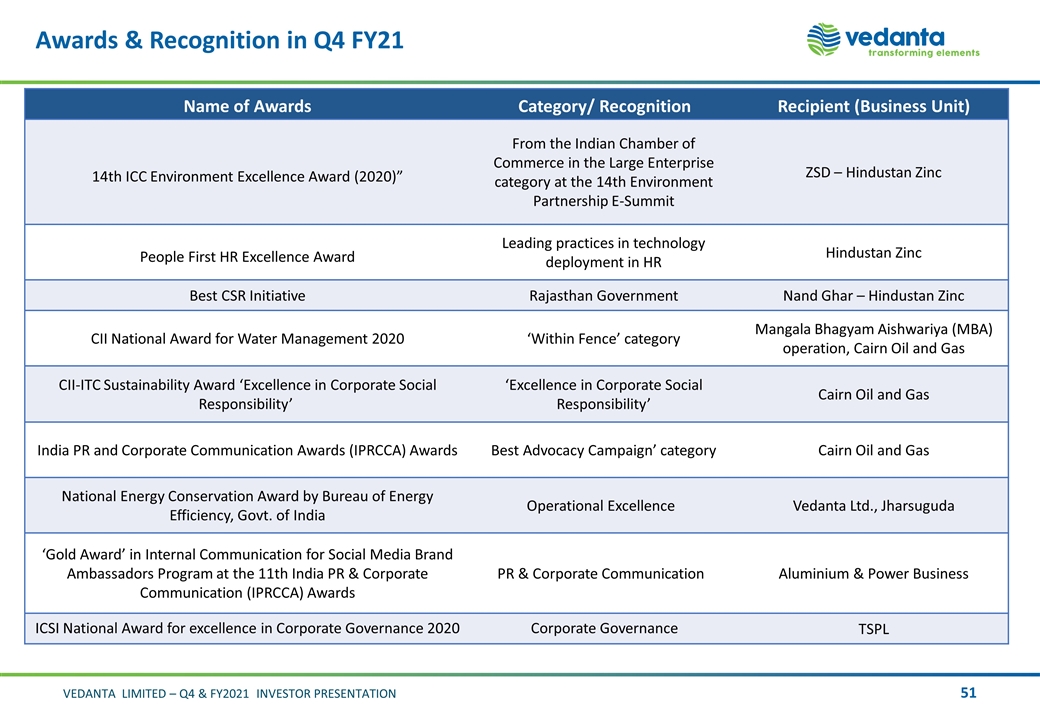

Awards & Recognition in Q4 FY21 Name of Awards Category/ Recognition Recipient (Business Unit) 14th ICC Environment Excellence Award (2020)” From the Indian Chamber of Commerce in the Large Enterprise category at the 14th Environment Partnership E-Summit ZSD – Hindustan Zinc People First HR Excellence Award Leading practices in technology deployment in HR Hindustan Zinc Best CSR Initiative Rajasthan Government Nand Ghar – Hindustan Zinc CII National Award for Water Management 2020 ‘Within Fence’ category Mangala Bhagyam Aishwariya (MBA) operation, Cairn Oil and Gas CII-ITC Sustainability Award ‘Excellence in Corporate Social Responsibility’ ‘Excellence in Corporate Social Responsibility’ Cairn Oil and Gas India PR and Corporate Communication Awards (IPRCCA) Awards Best Advocacy Campaign’ category Cairn Oil and Gas National Energy Conservation Award by Bureau of Energy Efficiency, Govt. of India Operational Excellence Vedanta Ltd., Jharsuguda ‘Gold Award’ in Internal Communication for Social Media Brand Ambassadors Program at the 11th India PR & Corporate Communication (IPRCCA) Awards PR & Corporate Communication Aluminium & Power Business ICSI National Award for excellence in Corporate Governance 2020 Corporate Governance TSPL

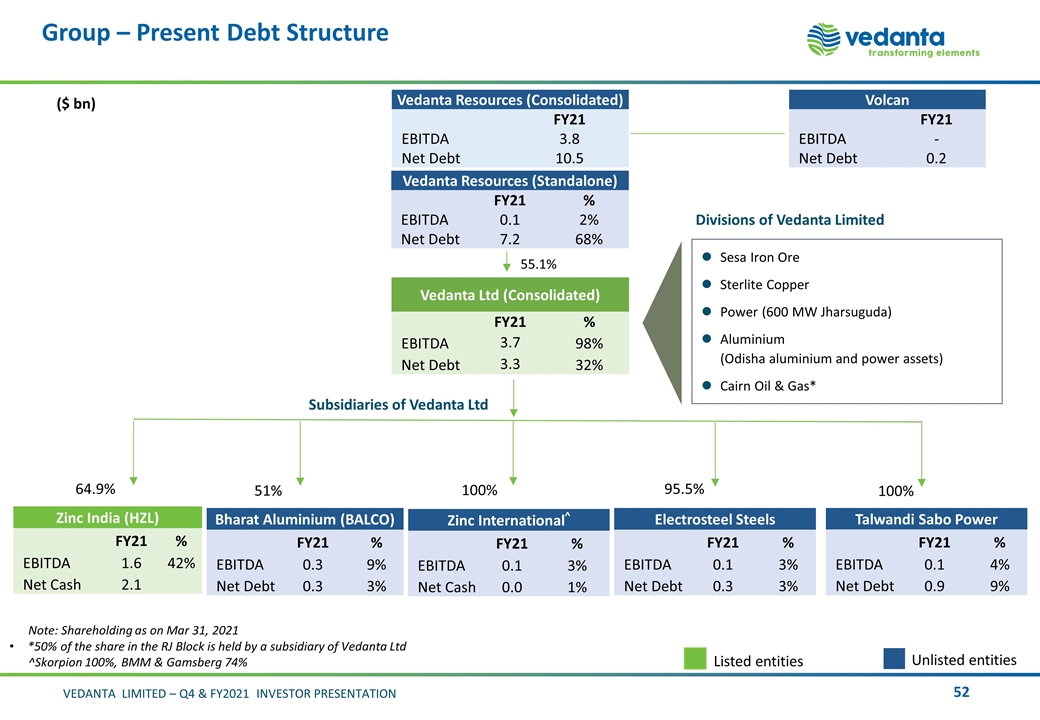

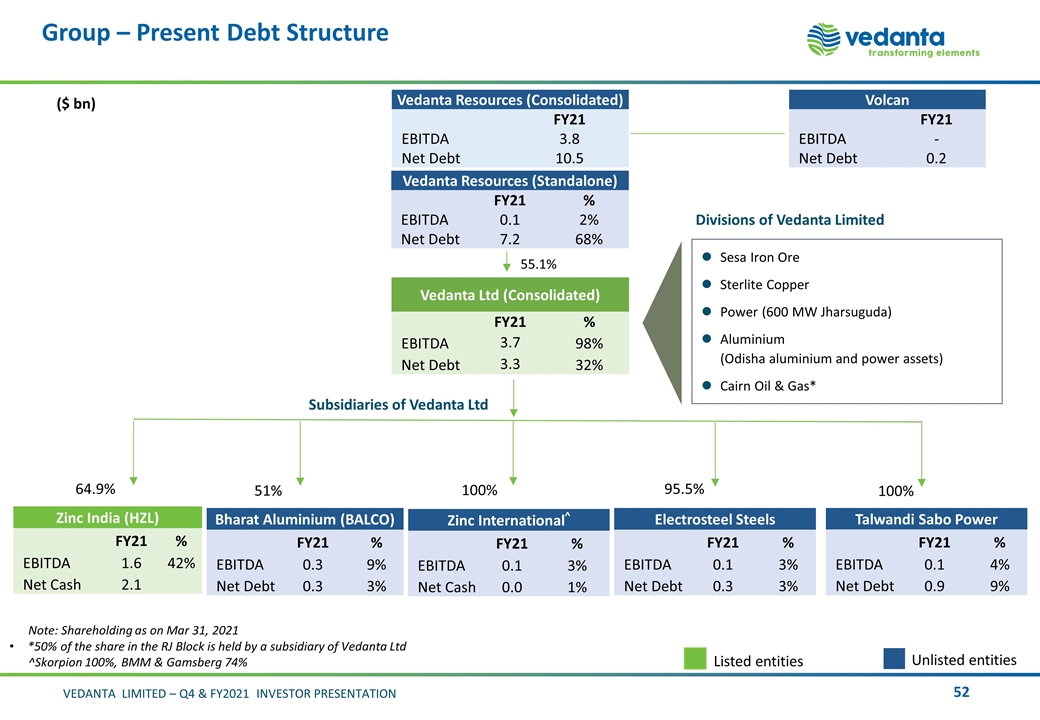

Group – Present Debt Structure 55.1% 64.9% Subsidiaries of Vedanta Ltd Sesa Iron Ore Sterlite Copper Power (600 MW Jharsuguda) Aluminium (Odisha aluminium and power assets) Cairn Oil & Gas* Divisions of Vedanta Limited Unlisted entities Listed entities 95.5% 100% 51% Note: Shareholding as on Mar 31, 2021 *50% of the share in the RJ Block is held by a subsidiary of Vedanta Ltd ^Skorpion 100%, BMM & Gamsberg 74% 100% Vedanta Resources (Consolidated) FY21 EBITDA 3.8 Net Debt 10.5 Vedanta Resources (Standalone) FY21 % EBITDA 0.1 2% Net Debt 7.2 68% Vedanta Ltd (Consolidated) FY21 % EBITDA 3.7 98% Net Debt 3.3 32% Zinc India (HZL) FY21 % EBITDA 1.6 42% Net Cash 2.1 Bharat Aluminium (BALCO) FY21 % EBITDA 0.3 9% Net Debt 0.3 3% Zinc International^ FY21 % EBITDA 0.1 3% Net Cash 0.0 1% Electrosteel Steels FY21 % EBITDA 0.1 3% Net Debt 0.3 3% Talwandi Sabo Power FY21 % EBITDA 0.1 4% Net Debt 0.9 9% Volcan FY21 EBITDA - Net Debt 0.2 ($ bn)

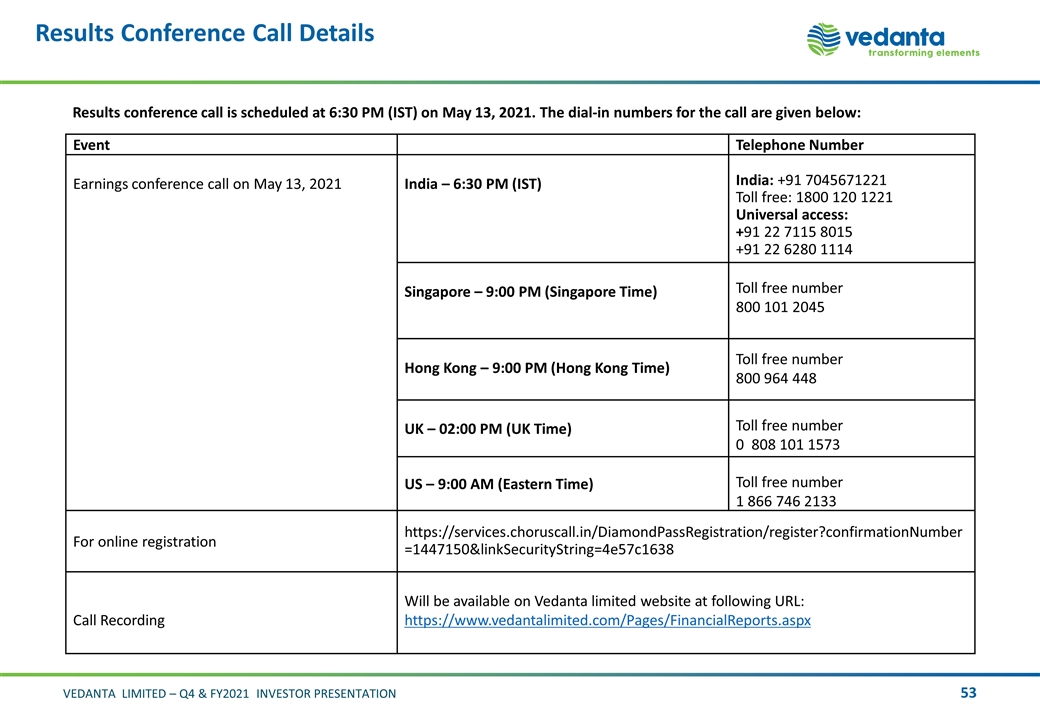

Results Conference Call Details Results conference call is scheduled at 6:30 PM (IST) on May 13, 2021. The dial-in numbers for the call are given below: Event Telephone Number Earnings conference call on May 13, 2021 India – 6:30 PM (IST) India: +91 7045671221 Toll free: 1800 120 1221 Universal access: +91 22 7115 8015 +91 22 6280 1114 Singapore – 9:00 PM (Singapore Time) Toll free number 800 101 2045 Hong Kong – 9:00 PM (Hong Kong Time) Toll free number 800 964 448 UK – 02:00 PM (UK Time) Toll free number 0 808 101 1573 US – 9:00 AM (Eastern Time) Toll free number 1 866 746 2133 For online registration https://services.choruscall.in/DiamondPassRegistration/register?confirmationNumber=1447150&linkSecurityString=4e57c1638 Call Recording Will be available on Vedanta limited website at following URL: https://www.vedantalimited.com/Pages/FinancialReports.aspx