VEDANTA LIMITED INVESTOR PRESENTATION 26 JULY 2021 Q1 FY2022 Earnings Presentation Exhibit 99.4

Cautionary Statement and Disclaimer The views expressed here may contain information derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness, reasonableness or reliability of this information. Any forward looking information in this presentation including, without limitation, any tables, charts and/or graphs, has been prepared on the basis of a number of assumptions which may prove to be incorrect. This presentation should not be relied upon as a recommendation or forecast by Vedanta Resources plc and Vedanta Limited and any of their subsidiaries. Past performance of Vedanta Resources plc and Vedanta Limited and any of their subsidiaries cannot be relied upon as a guide to future performance. This presentation contains 'forward-looking statements' – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance, and often contain words such as 'expects,' 'anticipates,' 'intends,' 'plans,' 'believes,' 'seeks,' or 'will.' Forward–looking statements by their nature address matters that are, to different degrees, uncertain. For us, uncertainties arise from the behaviour of financial and metals markets including the London Metal Exchange, fluctuations in interest and or exchange rates and metal prices; from future integration of acquired businesses; and from numerous other matters of national, regional and global scale, including those of a environmental, climatic, natural, political, economic, business, competitive or regulatory nature. These uncertainties may cause our actual future results to be materially different that those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements. We caution you that reliance on any forward-looking statement involves risk and uncertainties, and that, although we believe that the assumption on which our forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate and, as a result, the forward-looking statement based on those assumptions could be materially incorrect. This presentation is not intended, and does not, constitute or form part of any offer, invitation or the solicitation of an offer to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of, any securities in Vedanta Resources plc and Vedanta Limited and any of their subsidiaries or undertakings or any other invitation or inducement to engage in investment activities, nor shall this presentation (or any part of it) nor the fact of its distribution form the basis of, or be relied on in connection with, any contract or investment decision.

Contents Section Presenter Page Q1 FY22 Review & Business Update Sunil Duggal, CEO 4 Financial Update Ajay Goel, Deputy CFO 23 Appendix 30

Q1 FY2022 Review and Business Update Sunil Duggal Group CEO & Chief Safety Officer VEDANTA LIMITED INVESTOR PRESENTATION Q1 FY2022

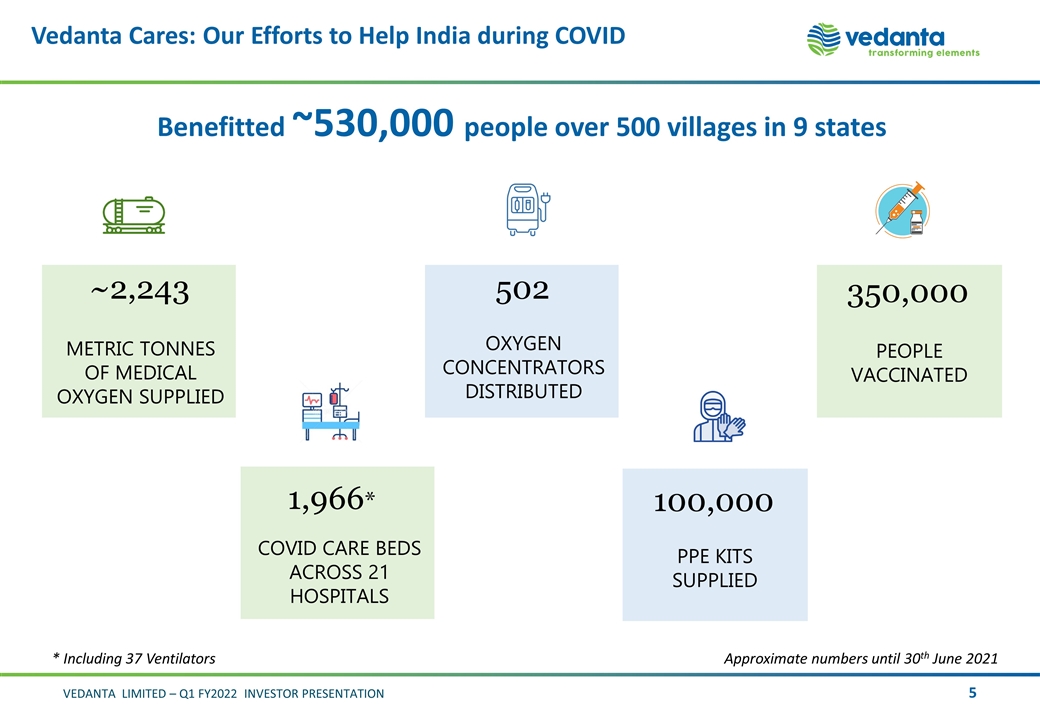

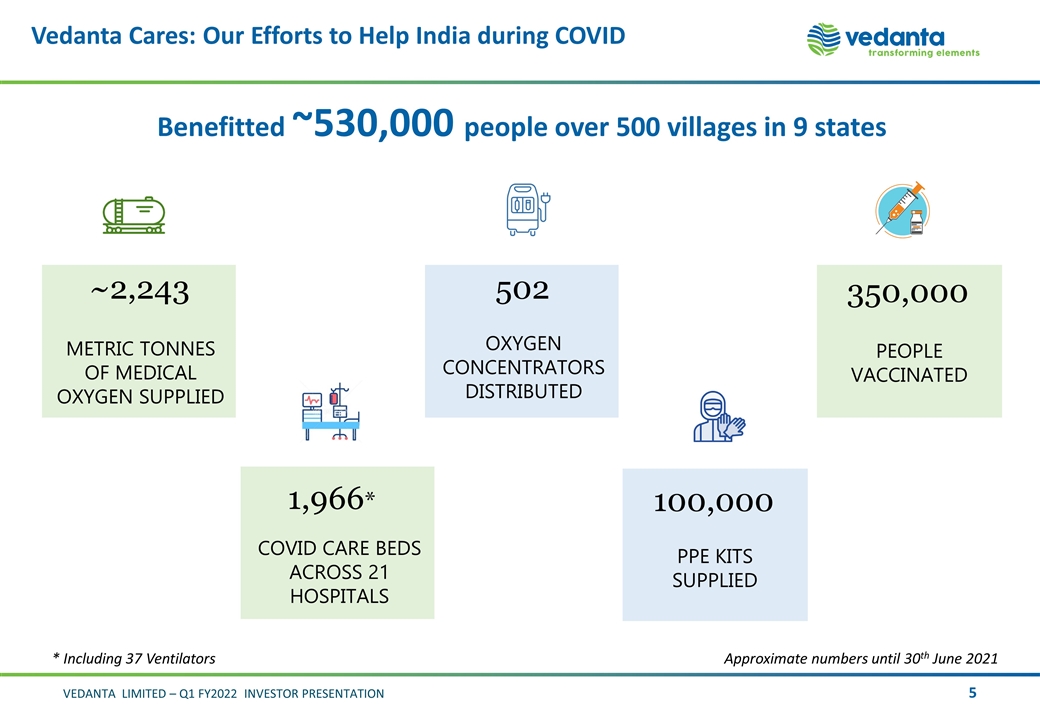

Vedanta Cares: Our Efforts to Help India during COVID Approximate numbers until 30th June 2021 ~2,243 METRIC TONNES OF MEDICAL OXYGEN SUPPLIED 1,966* 350,000 COVID CARE BEDS ACROSS 21 HOSPITALS PEOPLE VACCINATED 502 OXYGEN CONCENTRATORS DISTRIBUTED 100,000 PPE KITS SUPPLIED Benefitted ~530,000 people over 500 villages in 9 states * Including 37 Ventilators

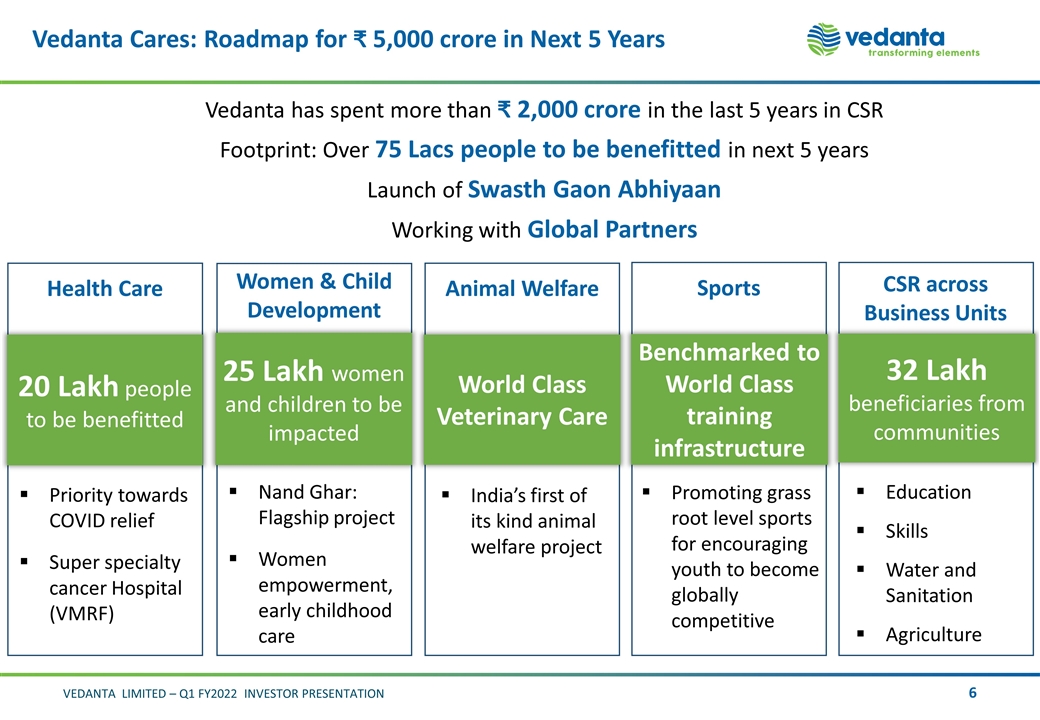

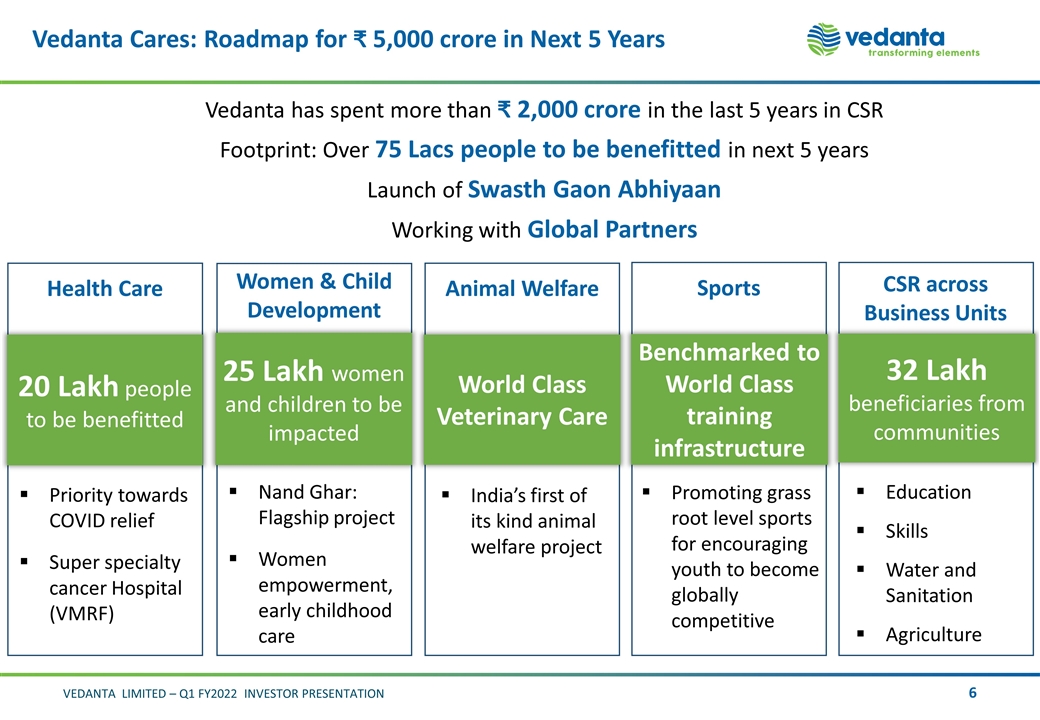

Vedanta Cares: Roadmap for ₹ 5,000 crore in Next 5 Years Vedanta has spent more than ₹ 2,000 crore in the last 5 years in CSR Footprint: Over 75 Lacs people to be benefitted in next 5 years Launch of Swasth Gaon Abhiyaan Working with Global Partners Health Care 20 Lakh people to be benefitted Priority towards COVID relief Super specialty cancer Hospital (VMRF) Women & Child Development 25 Lakh women and children to be impacted Nand Ghar: Flagship project Women empowerment, early childhood care Animal Welfare World Class Veterinary Care India’s first of its kind animal welfare project Sports Benchmarked to World Class training infrastructure Promoting grass root level sports for encouraging youth to become globally competitive CSR across Business Units 32 Lakh beneficiaries from communities Education Skills Water and Sanitation Agriculture

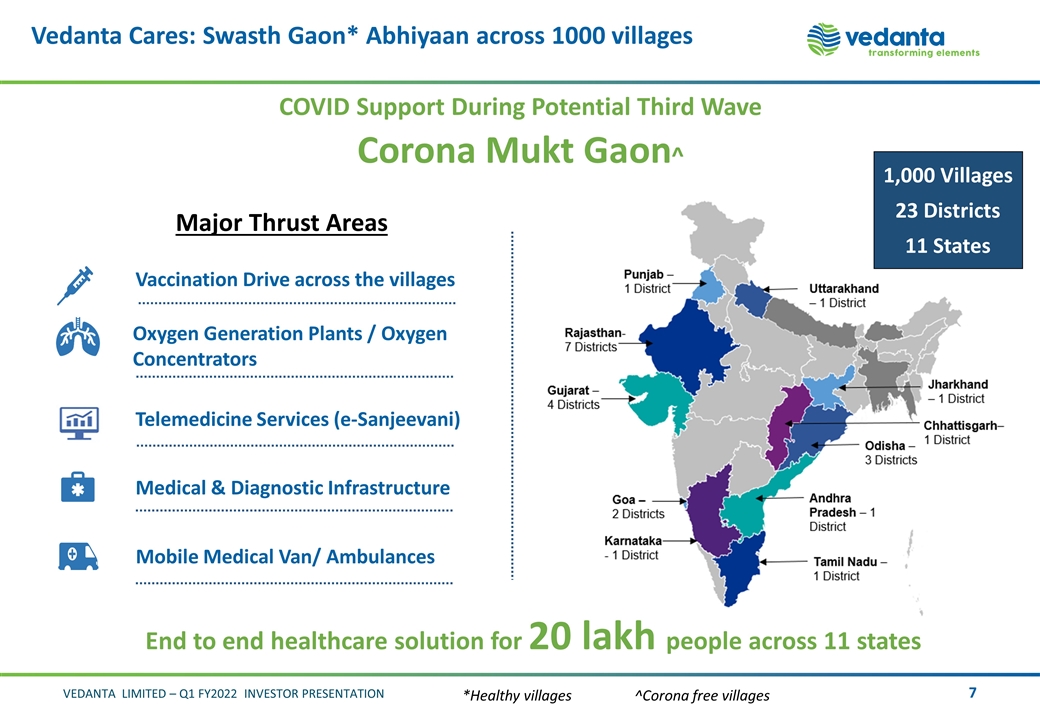

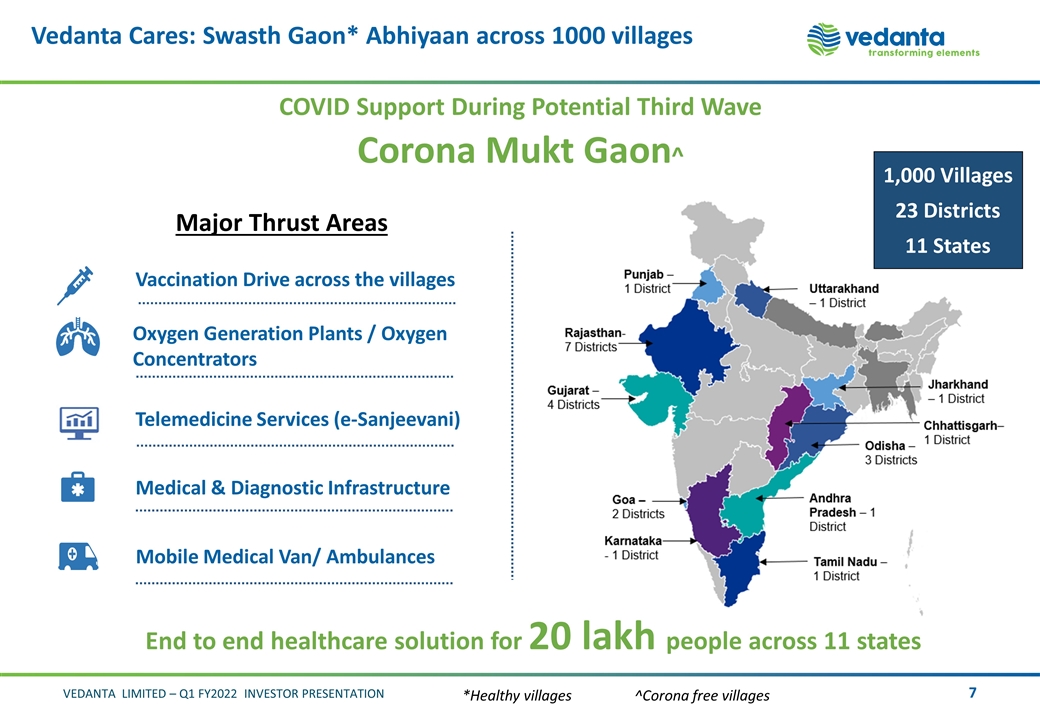

Vedanta Cares: Swasth Gaon* Abhiyaan across 1000 villages End to end healthcare solution for 20 lakh people across 11 states 1,000 Villages 23 Districts 11 States Major Thrust Areas Vaccination Drive across the villages Oxygen Generation Plants / Oxygen Concentrators Telemedicine Services (e-Sanjeevani) Medical & Diagnostic Infrastructure Mobile Medical Van/ Ambulances COVID Support During Potential Third Wave Corona Mukt Gaon^ *Healthy villages ^Corona free villages

Our Preparation For COVID All necessary infrastructure available at site; hospital beds, oxygen and doctor staff. Additionally, we have tie ups with hospitals for emergency Most of our sites are equipped with; critical care units and advanced life support systems A series of health webinars & awareness programmes for employees, business partners & community alertness conducted every month Continued vaccination drives at sites for employees, business partners and their families Global Standards to Manage Health & Hygiene at Workplace 24*7 health helpline for employees and their family members Testing of all employees, business partners and families are conducted on regular intervals

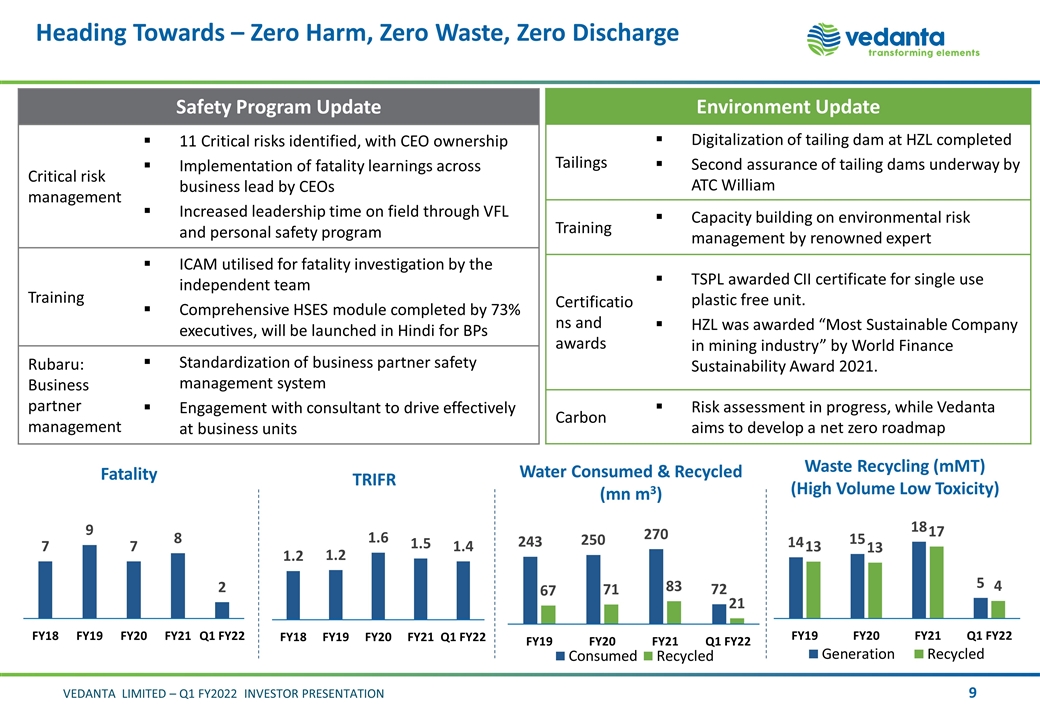

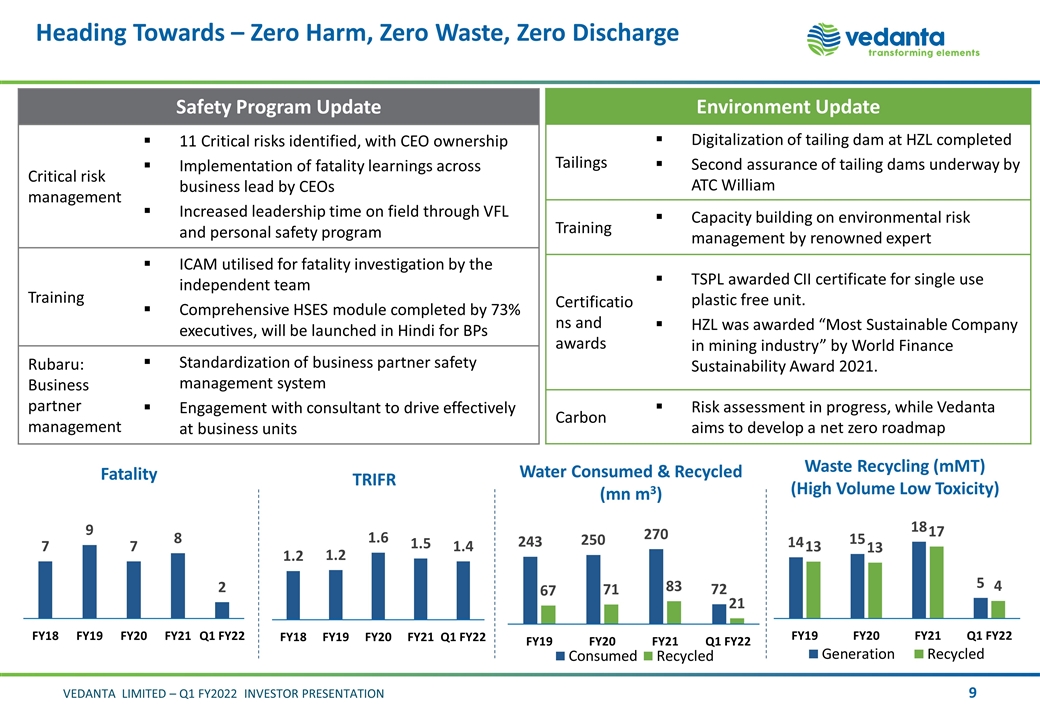

Heading Towards – Zero Harm, Zero Waste, Zero Discharge Water Consumed & Recycled (mn m3) TRIFR Fatality Waste Recycling (mMT) (High Volume Low Toxicity) Safety Program Update Critical risk management 11 Critical risks identified, with CEO ownership Implementation of fatality learnings across business lead by CEOs Increased leadership time on field through VFL and personal safety program Training ICAM utilised for fatality investigation by the independent team Comprehensive HSES module completed by 73% executives, will be launched in Hindi for BPs Rubaru: Business partner management Standardization of business partner safety management system Engagement with consultant to drive effectively at business units Environment Update Tailings Digitalization of tailing dam at HZL completed Second assurance of tailing dams underway by ATC William Training Capacity building on environmental risk management by renowned expert Certifications and awards TSPL awarded CII certificate for single use plastic free unit. HZL was awarded “Most Sustainable Company in mining industry” by World Finance Sustainability Award 2021. Carbon Risk assessment in progress, while Vedanta aims to develop a net zero roadmap

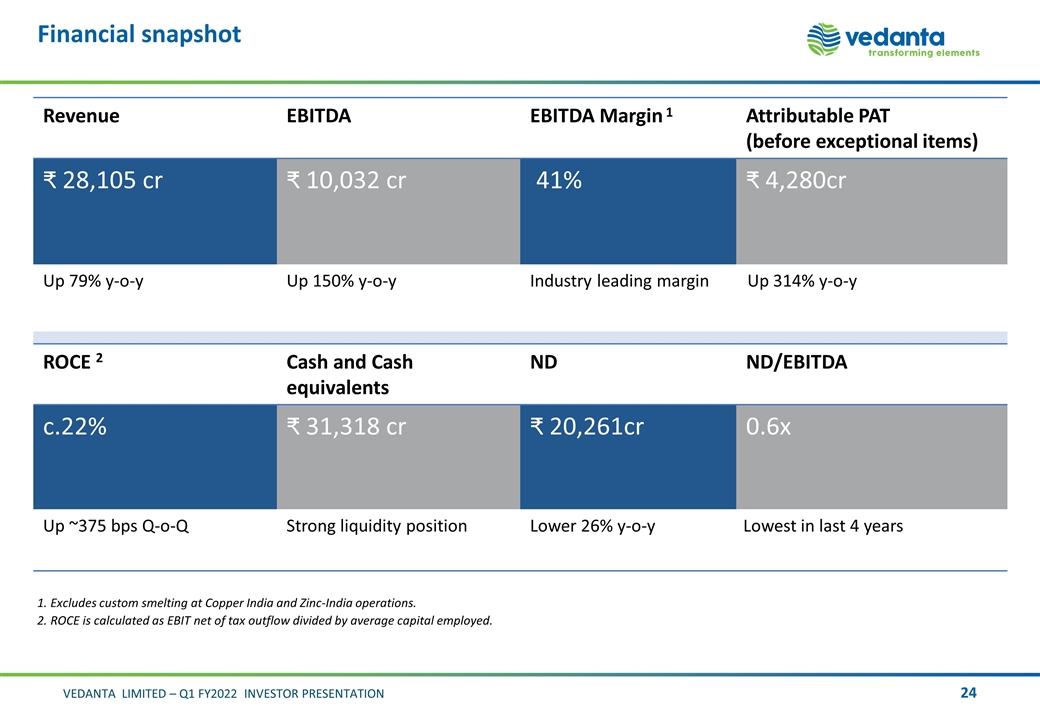

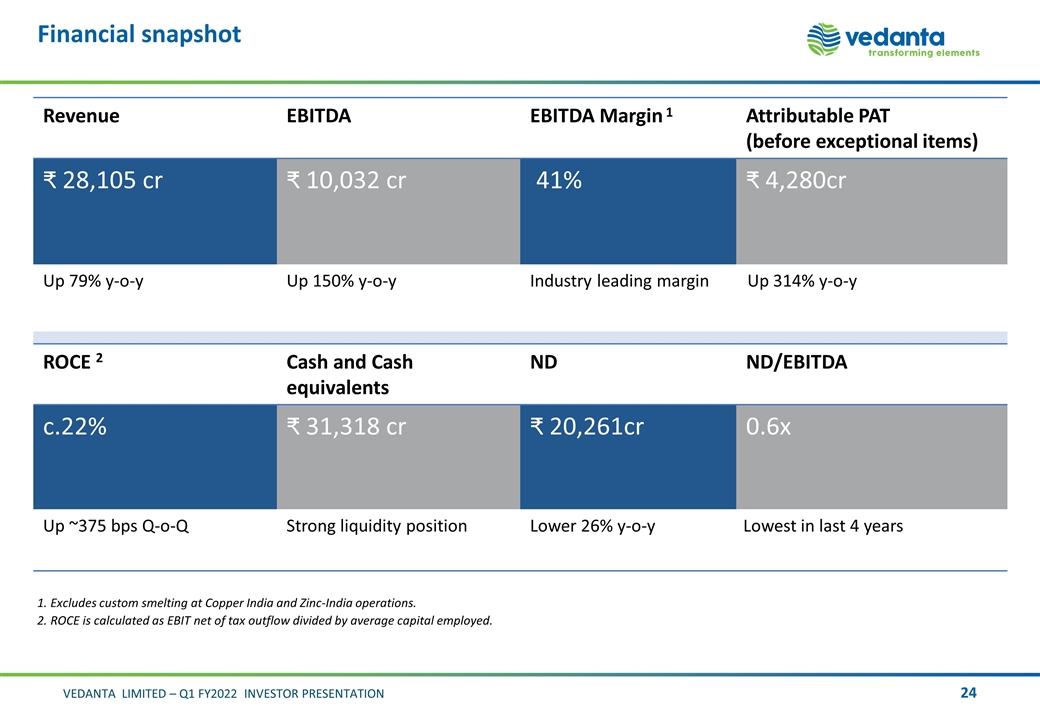

Key Highlights Continued strong momentum across all businesses Aluminium, highest ever production 549kt* and margin of 36%, won Kuraloi (A) North coal block Zinc India, sustained production, one of strongest Q1 performance Zinc International, Ever highest production at Gamsberg 46kt O&G, Gas production ramped up with new terminal fully operational Iron Ore, Successful integration of new coke plant at Gujarat - capacity 0.9 Mtpa ESL, saleable production 289kt, up 8% y-o-y, Capacity expansion underway FACOR, 3x ore production in Q1 FY22 vs June quarer last year, turnaround performance from mines Record financial performance Record consolidated quarterly Revenue of ₹ 28,105 crore, up 79% y-o-y Highest ever quarterly EBITDA ₹ 10,032 crore, up 150% y-o-y with a robust EBITDA margin^ of 41% Strong Liquidity position with cash and cash equivalents of ₹ 31,318 crore Net Debt at ₹ 20,261 crore, reduced by ₹ 6,989 crore Y-o-Y *Including trial run ^excluding custom smelting

Key Highlights Portfolio Sweet spot - production ramping up across all businesses Diversified product portfolio Best among peers with ferro chrome & Met coke recent additions Growth Continue ramp up in Oil & Gas, Zinc India, Zinc International, Steel and Aluminium Leveraging structural reduction in cost and better capital management Potential to achieve - 2.3 mtpa @ $1200 COP Aluminum, 300 Kt in Gamsberg, 300 Kboepd in Oil & Gas, 1.2 Mtpa Mined metal production and 1,000 tonnes of Silver in Zinc India and 3.0 Mtpa at ESL Steels Strategic matters Aim to resolve all regulatory matters amicably in Oil & Gas, Iron ore Goa and Tuticorin

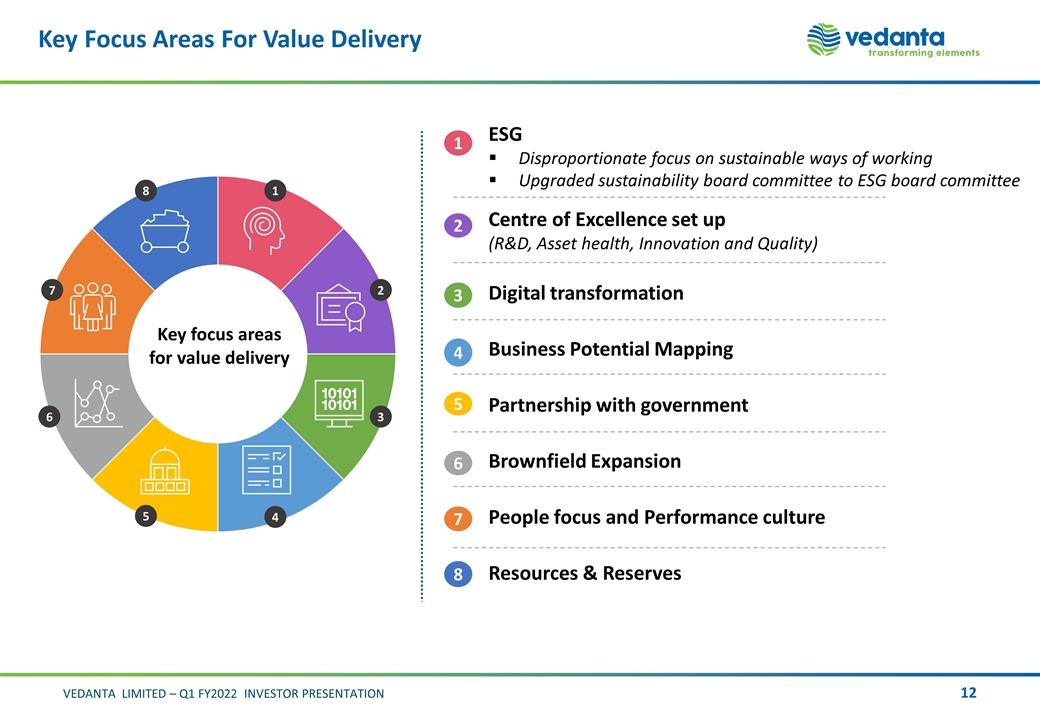

Key Focus Areas For Value Delivery 1 4 5 2 3 6 7 8 Key focus areas for value delivery People focus and Performance culture Centre of Excellence set up (R&D, Asset health, Innovation and Quality) Brownfield Expansion ESG Disproportionate focus on sustainable ways of working Upgraded sustainability board committee to ESG board committee Digital transformation Business Potential Mapping 1 2 3 4 6 7 Resources & Reserves 8 Partnership with government 5

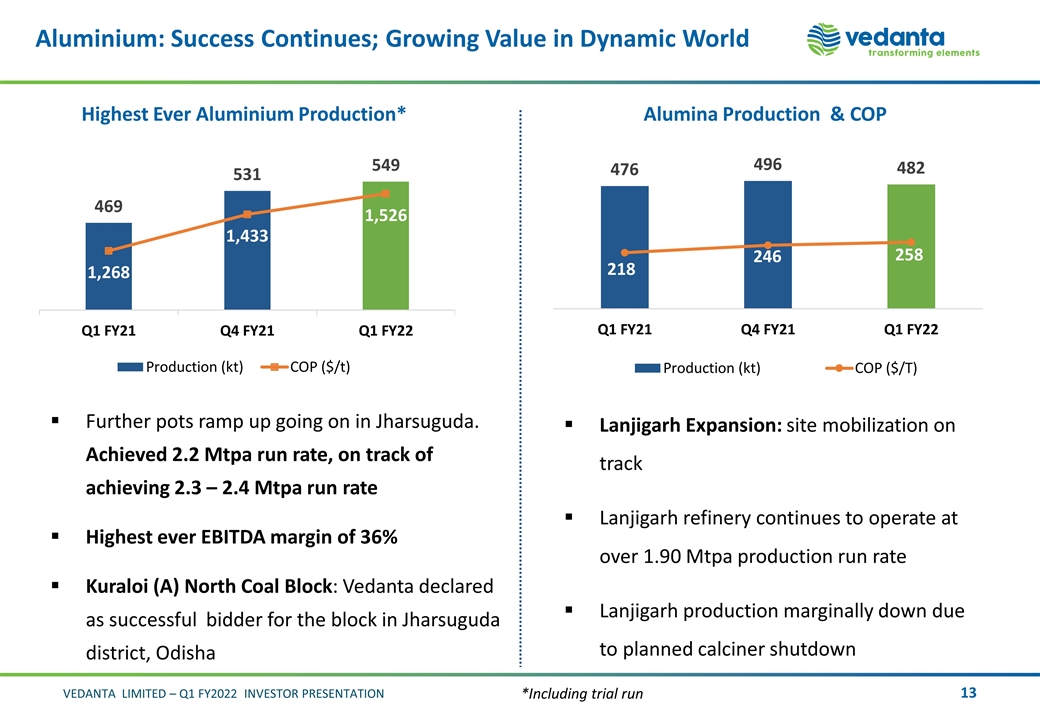

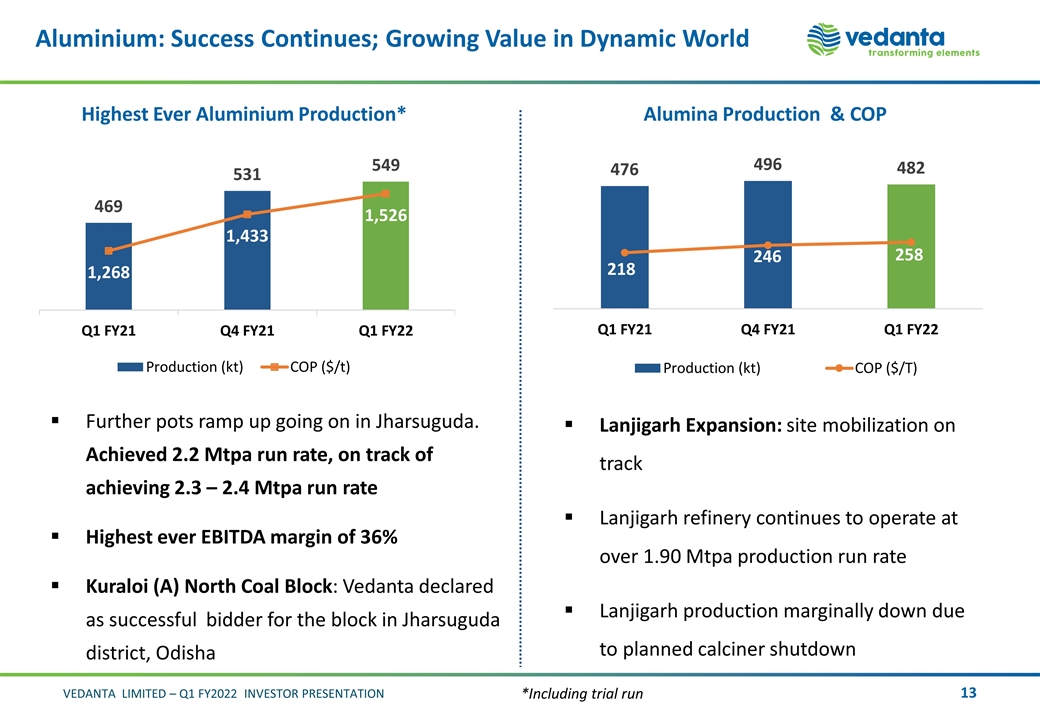

Aluminium: Success Continues; Growing Value in Dynamic World Highest Ever Aluminium Production* Alumina Production & COP *Including trial run Further pots ramp up going on in Jharsuguda. Achieved 2.2 Mtpa run rate, on track of achieving 2.3 – 2.4 Mtpa run rate Highest ever EBITDA margin of 36% Kuraloi (A) North Coal Block: Vedanta declared as successful bidder for the block in Jharsuguda district, Odisha Lanjigarh Expansion: site mobilization on track Lanjigarh refinery continues to operate at over 1.90 Mtpa production run rate Lanjigarh production marginally down due to planned calciner shutdown

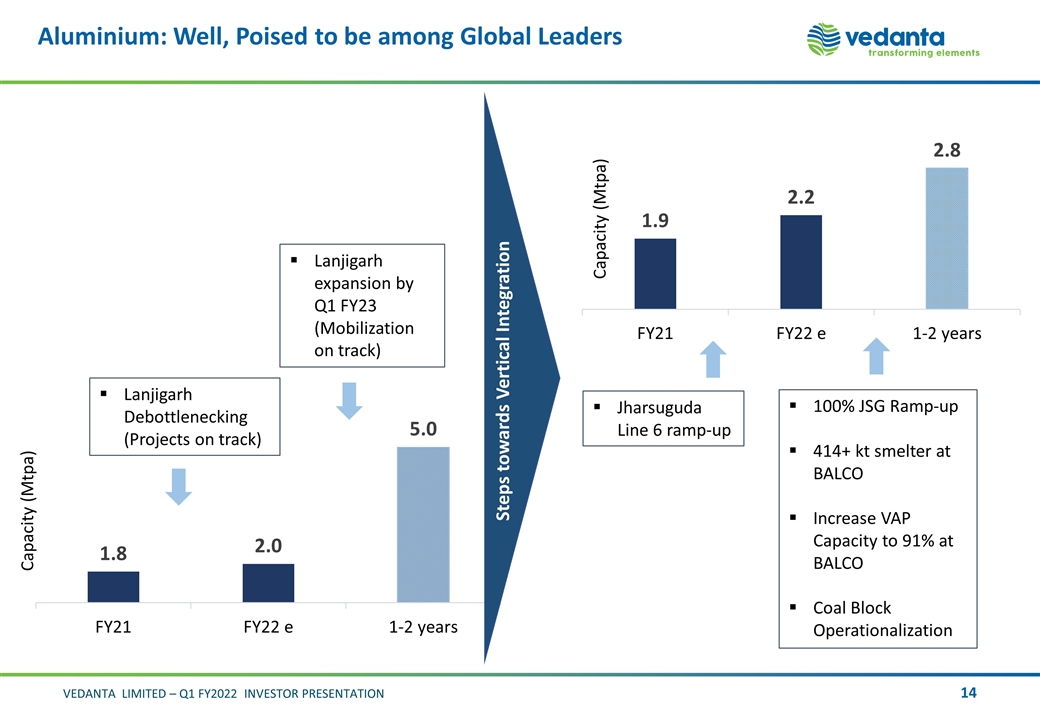

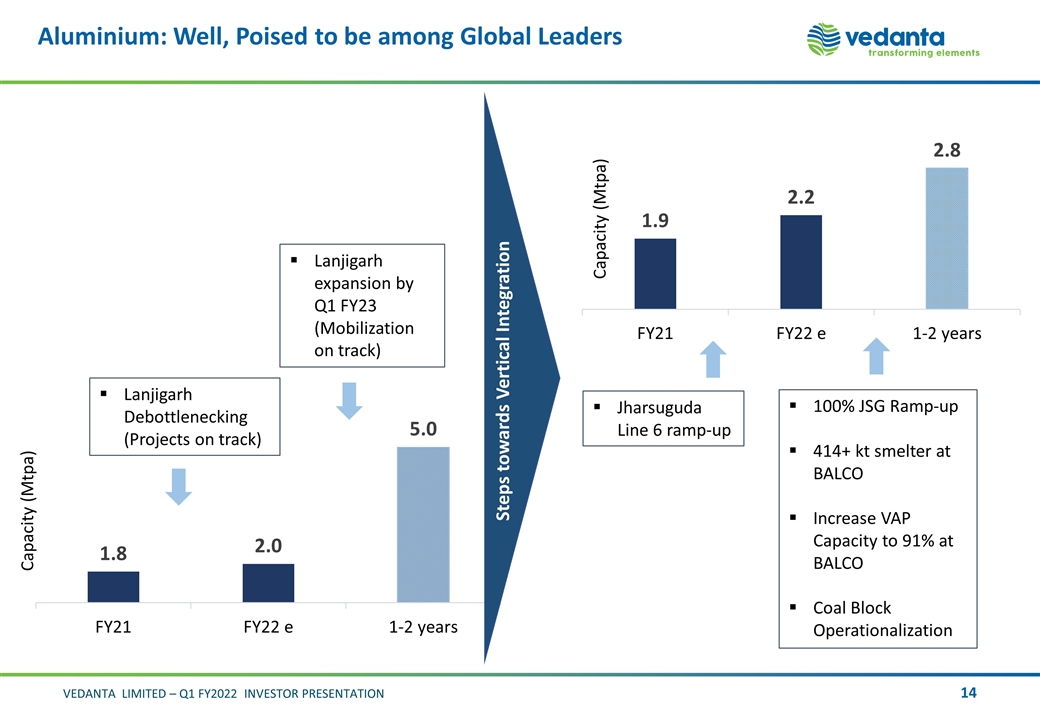

Jharsuguda Line 6 ramp-up 100% JSG Ramp-up 414+ kt smelter at BALCO Increase VAP Capacity to 91% at BALCO Coal Block Operationalization Step towards Vertical Integration Lanjigarh expansion by Q1 FY23 (Mobilization on track) Lanjigarh Debottlenecking (Projects on track) Aluminium: Well, Poised to be among Global Leaders Steps towards Vertical Integration

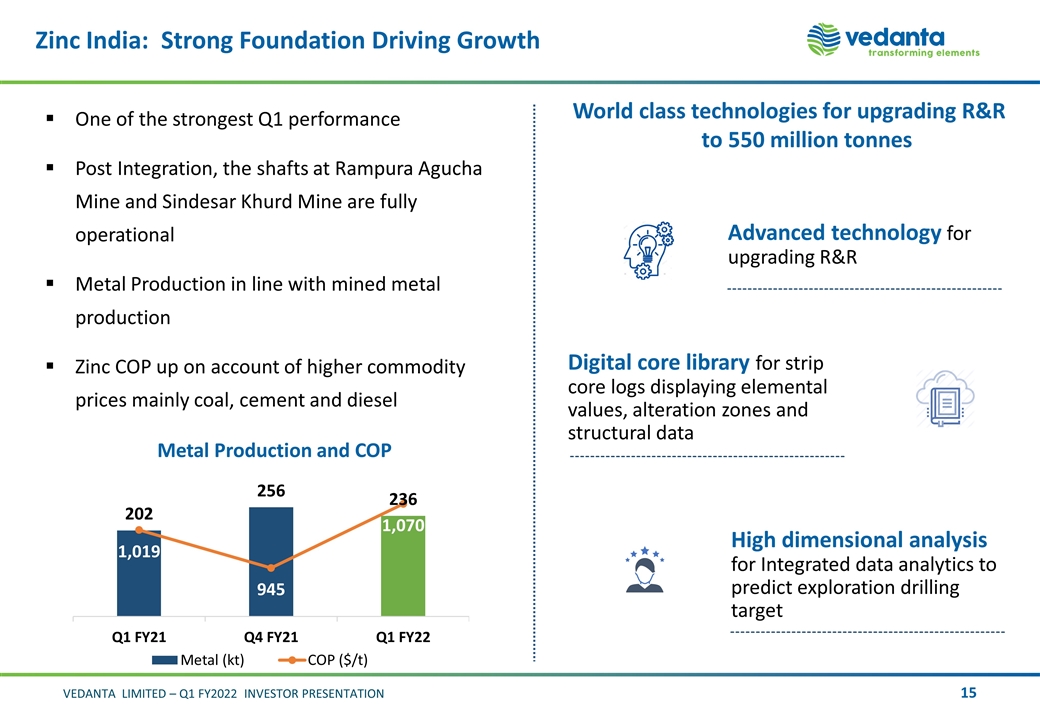

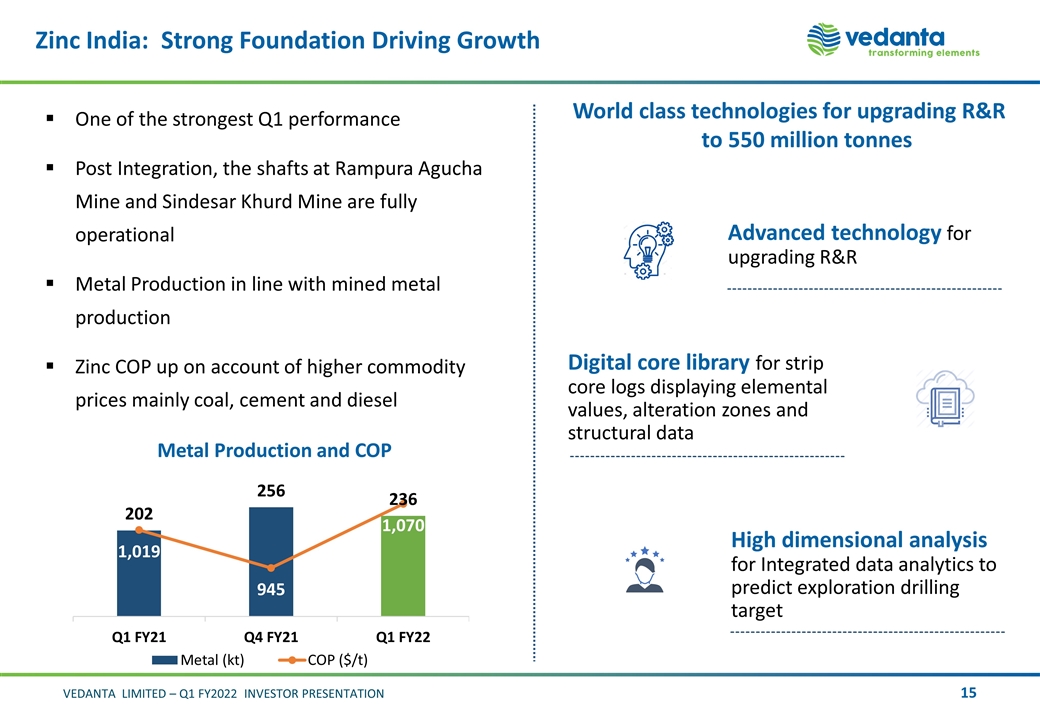

Zinc India: Strong Foundation Driving Growth Metal Production and COP One of the strongest Q1 performance Post Integration, the shafts at Rampura Agucha Mine and Sindesar Khurd Mine are fully operational Metal Production in line with mined metal production Zinc COP up on account of higher commodity prices mainly coal, cement and diesel World class technologies for upgrading R&R to 550 million tonnes Advanced technology for upgrading R&R Digital core library for strip core logs displaying elemental values, alteration zones and structural data High dimensional analysis for Integrated data analytics to predict exploration drilling target

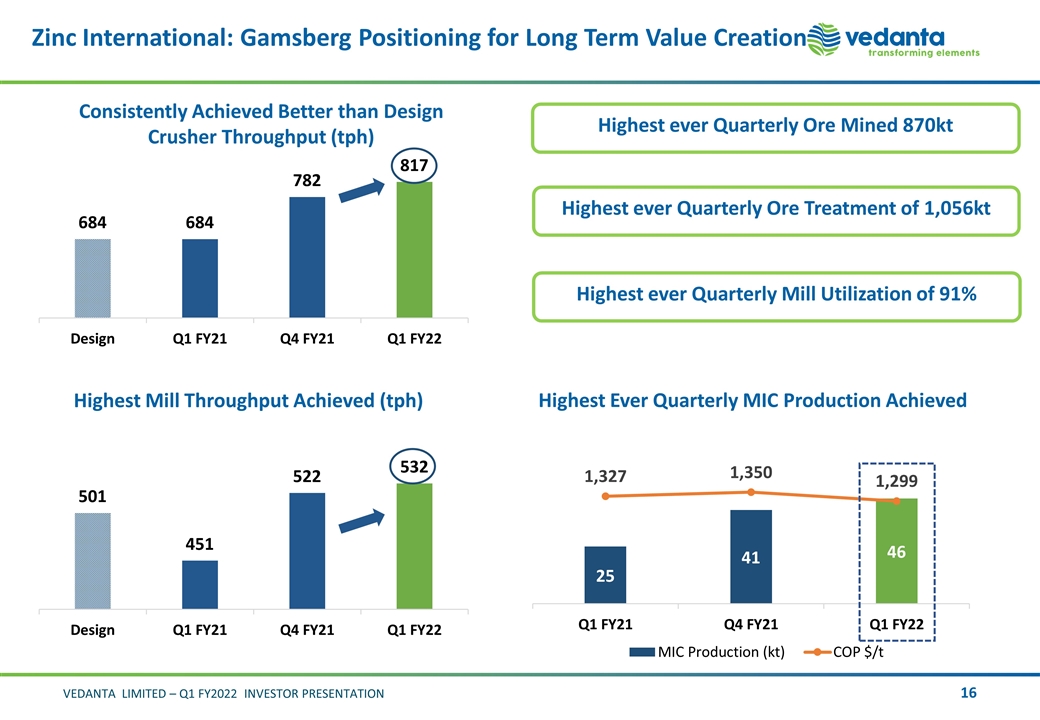

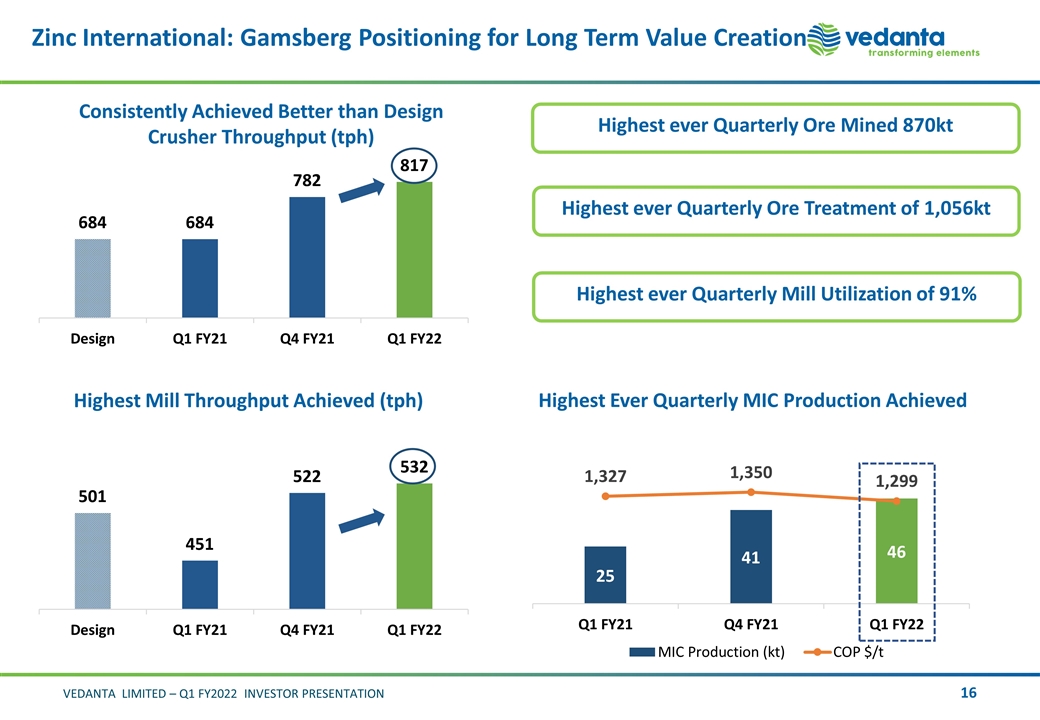

Zinc International: Gamsberg Positioning for Long Term Value Creation Highest Mill Throughput Achieved (tph) Consistently Achieved Better than Design Crusher Throughput (tph) Highest Ever Quarterly MIC Production Achieved Highest ever Quarterly Ore Mined 870kt Highest ever Quarterly Ore Treatment of 1,056kt Highest ever Quarterly Mill Utilization of 91%

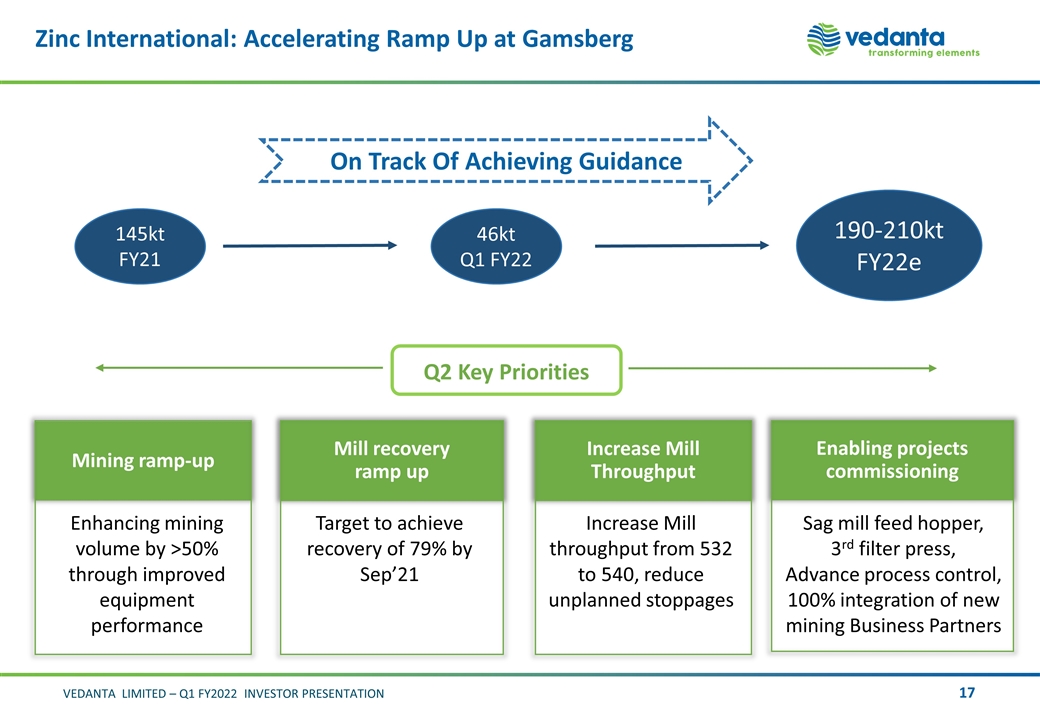

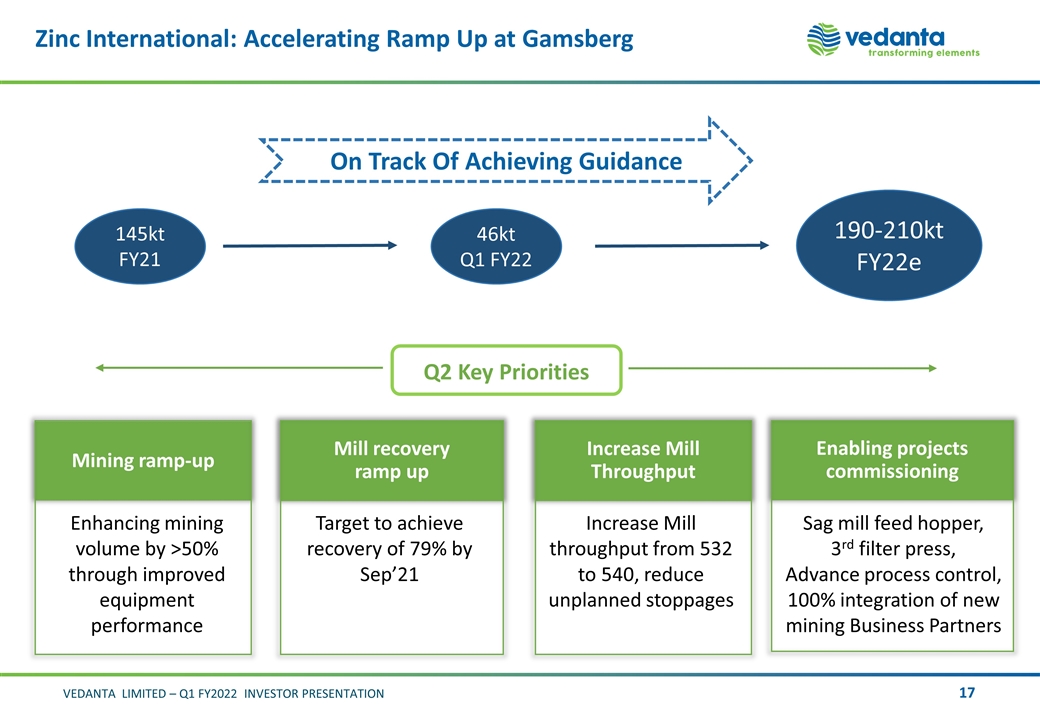

Zinc International: Accelerating Ramp Up at Gamsberg On Track Of Achieving Guidance 145kt FY21 190-210kt FY22e Mining ramp-up Enhancing mining volume by >50% through improved equipment performance Mill recovery ramp up Target to achieve recovery of 79% by Sep’21 Increase Mill Throughput Increase Mill throughput from 532 to 540, reduce unplanned stoppages Enabling projects commissioning Sag mill feed hopper, 3rd filter press, Advance process control, 100% integration of new mining Business Partners Q2 Key Priorities 46kt Q1 FY22

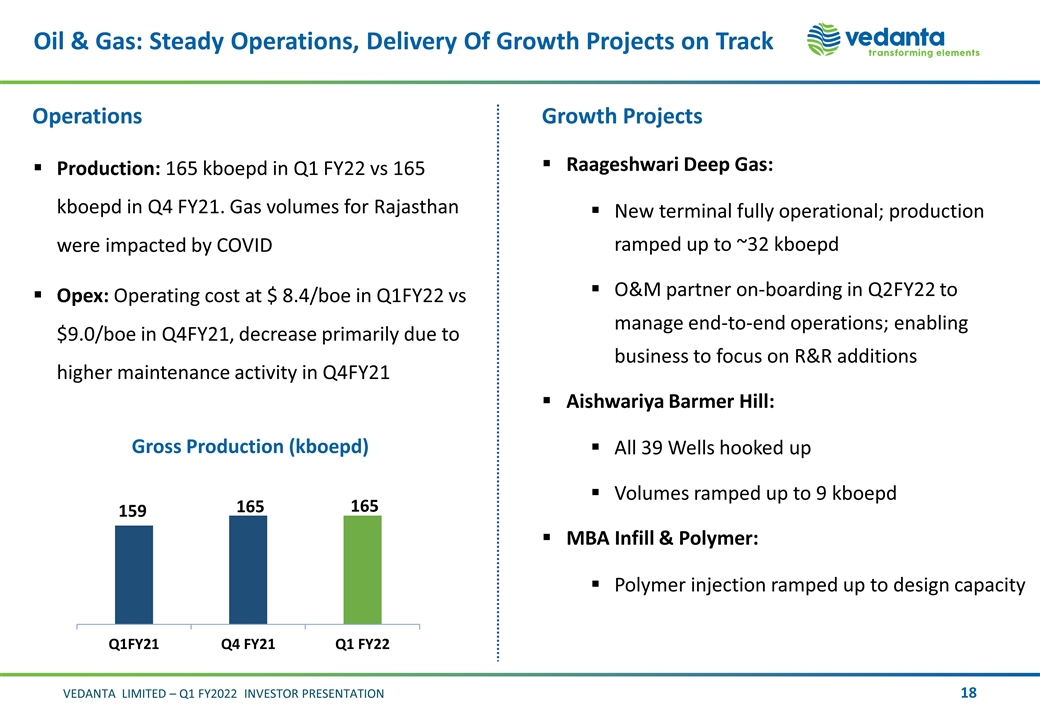

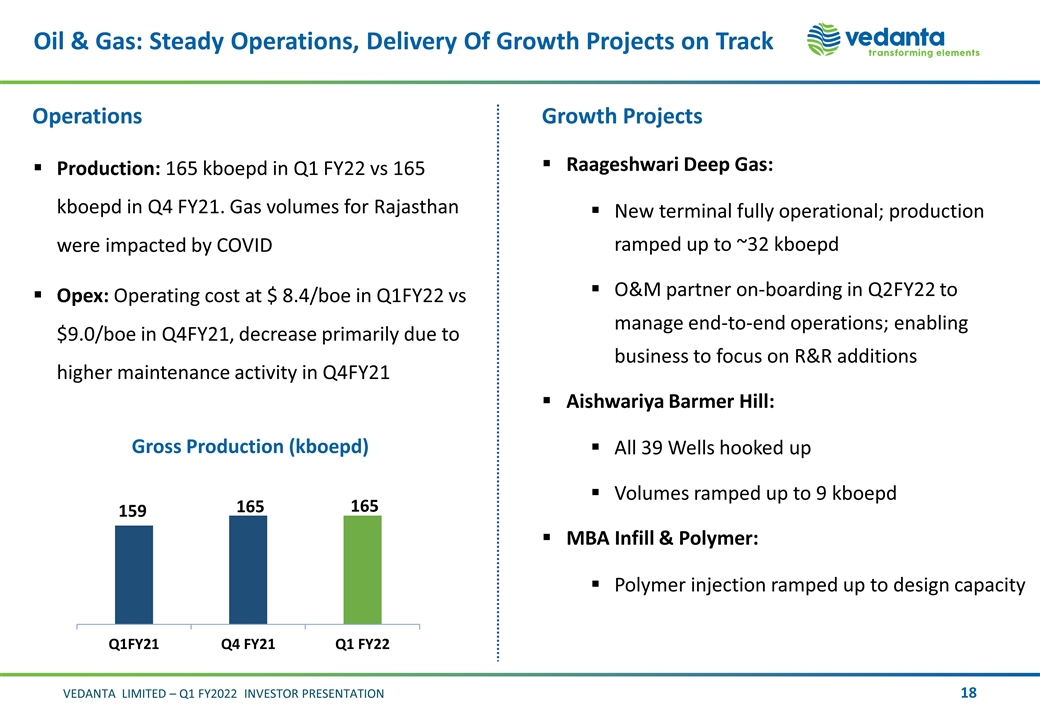

Oil & Gas: Steady Operations, Delivery Of Growth Projects on Track Operations Production: 165 kboepd in Q1 FY22 vs 165 kboepd in Q4 FY21. Gas volumes for Rajasthan were impacted by COVID Opex: Operating cost at $ 8.4/boe in Q1FY22 vs $9.0/boe in Q4FY21, decrease primarily due to higher maintenance activity in Q4FY21 Growth Projects Raageshwari Deep Gas: New terminal fully operational; production ramped up to ~32 kboepd O&M partner on-boarding in Q2FY22 to manage end-to-end operations; enabling business to focus on R&R additions Aishwariya Barmer Hill: All 39 Wells hooked up Volumes ramped up to 9 kboepd MBA Infill & Polymer: Polymer injection ramped up to design capacity Gross Production (kboepd)

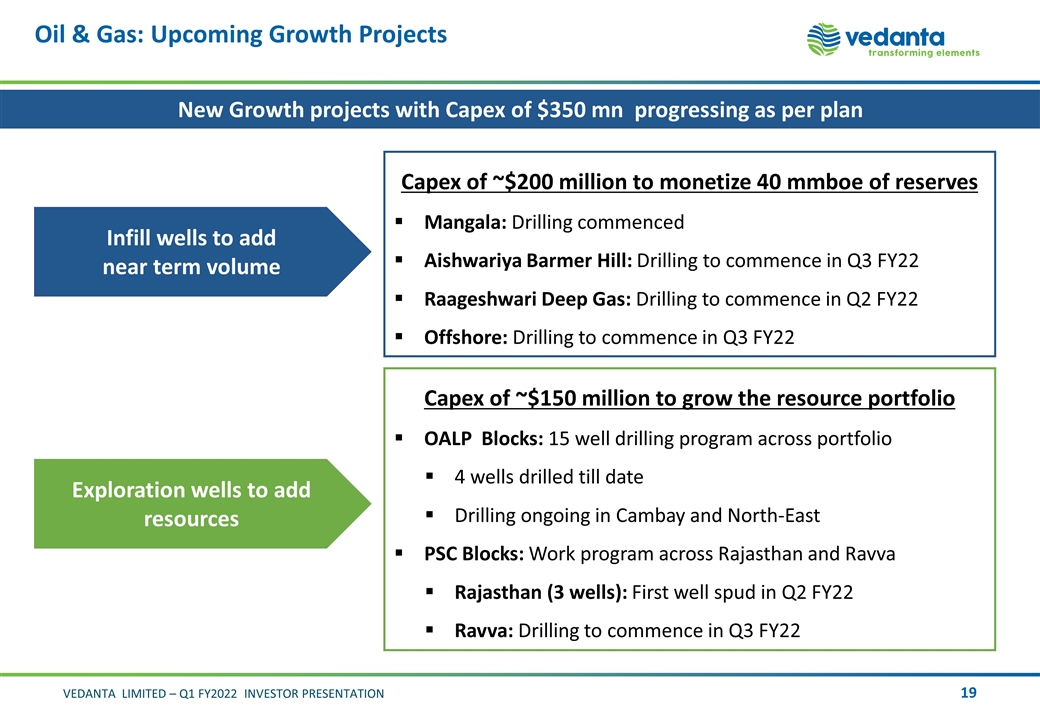

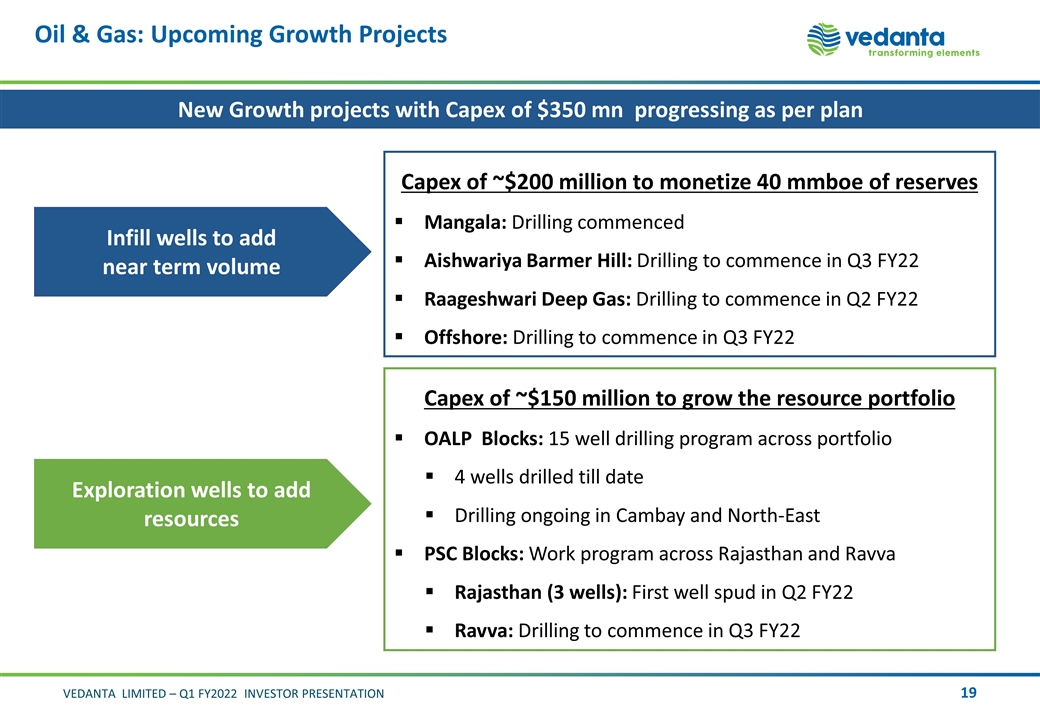

Infill wells to add near term volume Exploration wells to add resources Capex of ~$200 million to monetize 40 mmboe of reserves Mangala: Drilling commenced Aishwariya Barmer Hill: Drilling to commence in Q3 FY22 Raageshwari Deep Gas: Drilling to commence in Q2 FY22 Offshore: Drilling to commence in Q3 FY22 Capex of ~$150 million to grow the resource portfolio OALP Blocks: 15 well drilling program across portfolio 4 wells drilled till date Drilling ongoing in Cambay and North-East PSC Blocks: Work program across Rajasthan and Ravva Rajasthan (3 wells): First well spud in Q2 FY22 Ravva: Drilling to commence in Q3 FY22 Oil & Gas: Upcoming Growth Projects New Growth projects with Capex of $350 mn progressing as per plan

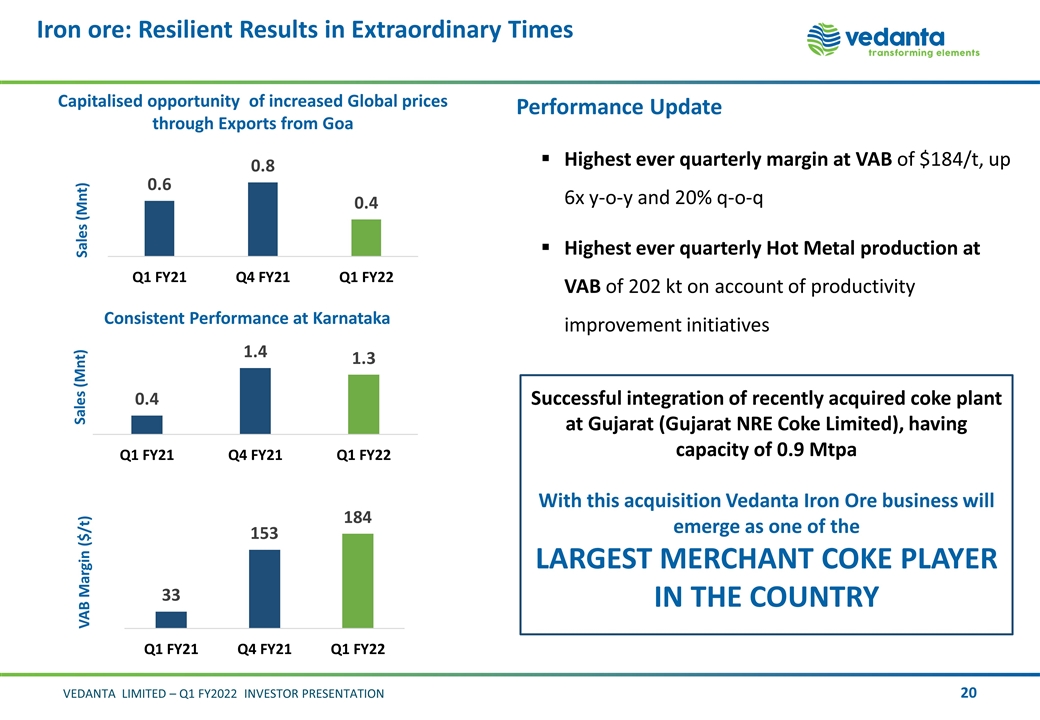

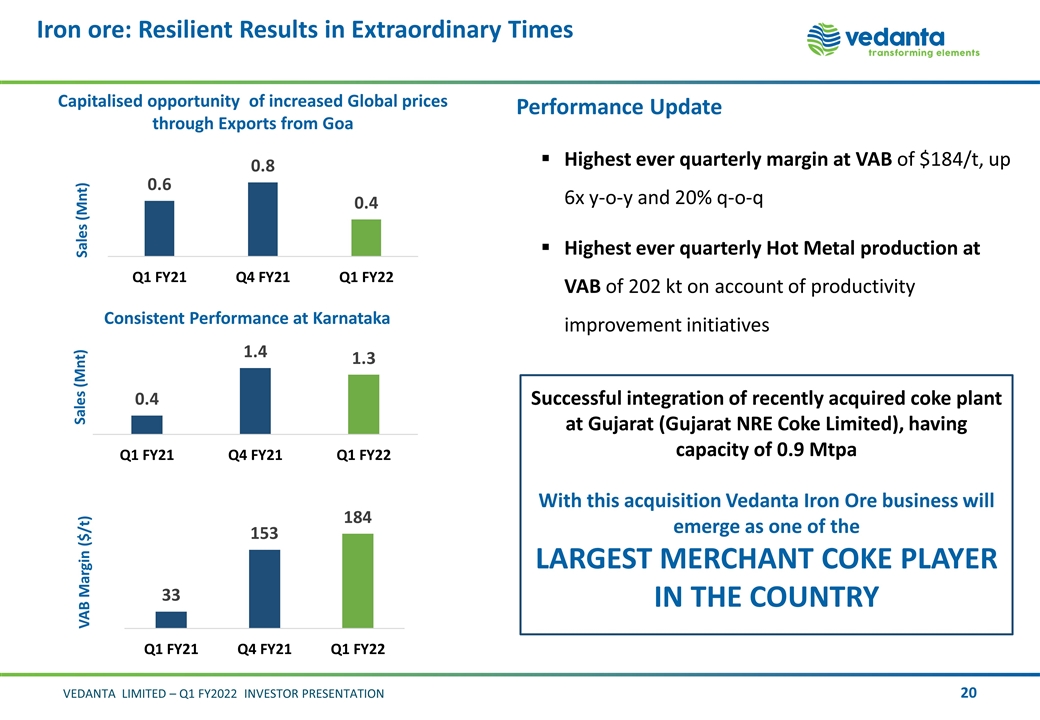

Iron ore: Resilient Results in Extraordinary Times Capitalised opportunity of increased Global prices through Exports from Goa Sales (Mnt) Consistent Performance at Karnataka Sales (Mnt) Performance Update Highest ever quarterly margin at VAB of $184/t, up 6x y-o-y and 20% q-o-q Highest ever quarterly Hot Metal production at VAB of 202 kt on account of productivity improvement initiatives VAB Margin ($/t) Successful integration of recently acquired coke plant at Gujarat (Gujarat NRE Coke Limited), having capacity of 0.9 Mtpa With this acquisition Vedanta Iron Ore business will emerge as one of the LARGEST MERCHANT COKE PLAYER IN THE COUNTRY

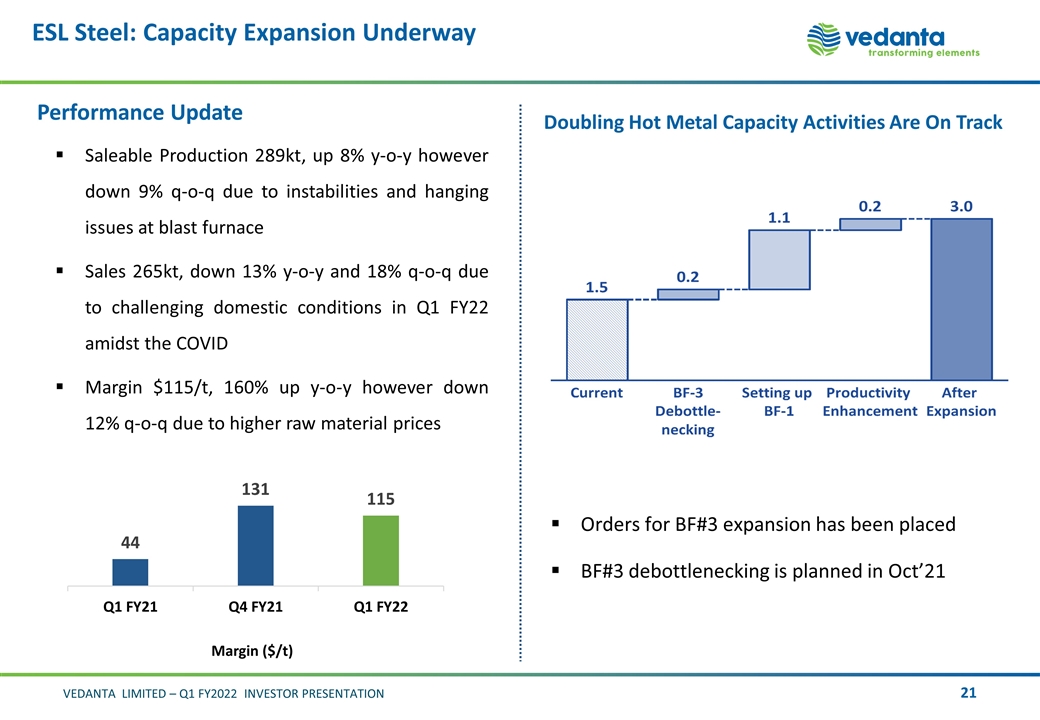

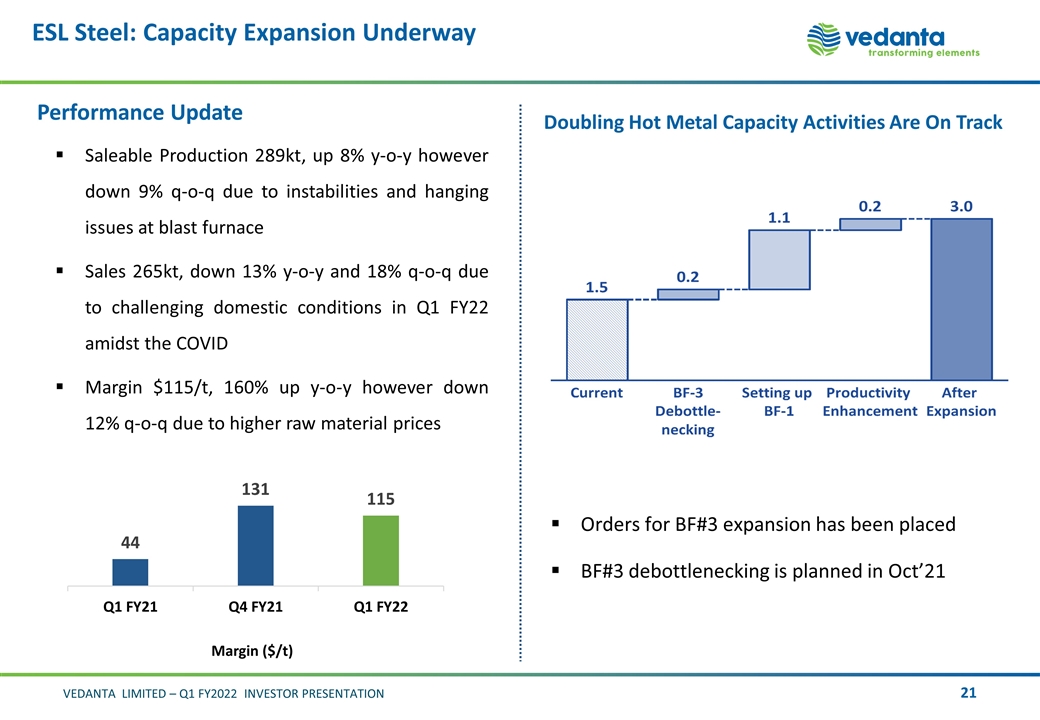

ESL Steel: Capacity Expansion Underway 0.26 Doubling Hot Metal Capacity Activities Are On Track Orders for BF#3 expansion has been placed BF#3 debottlenecking is planned in Oct’21 Performance Update Saleable Production 289kt, up 8% y-o-y however down 9% q-o-q due to instabilities and hanging issues at blast furnace Sales 265kt, down 13% y-o-y and 18% q-o-q due to challenging domestic conditions in Q1 FY22 amidst the COVID Margin $115/t, 160% up y-o-y however down 12% q-o-q due to higher raw material prices

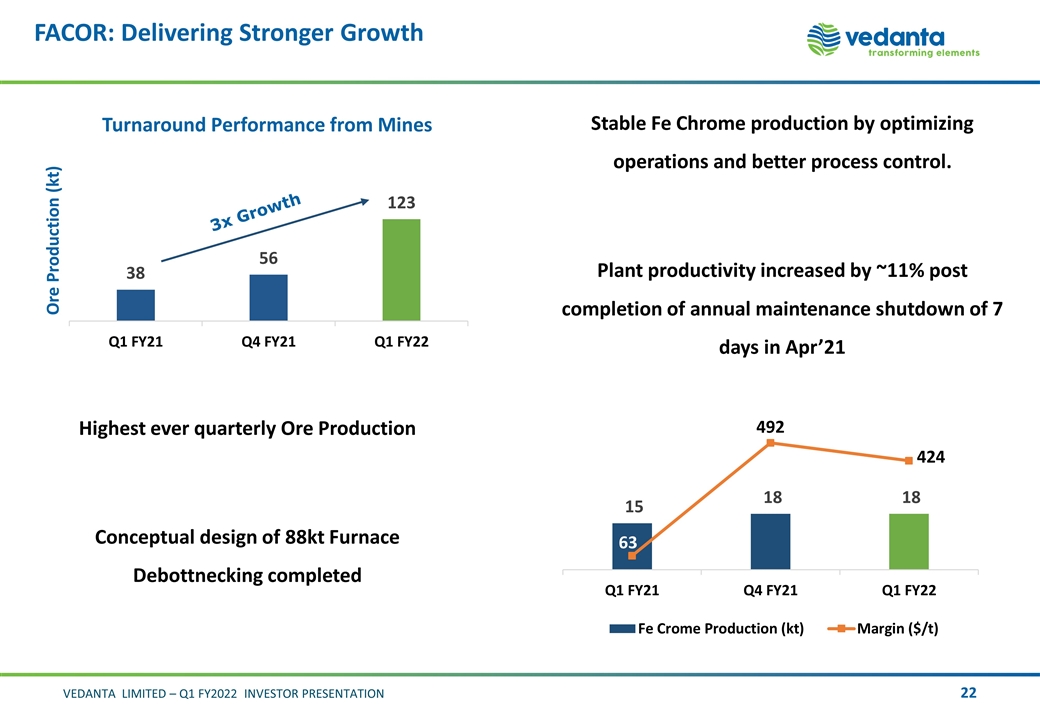

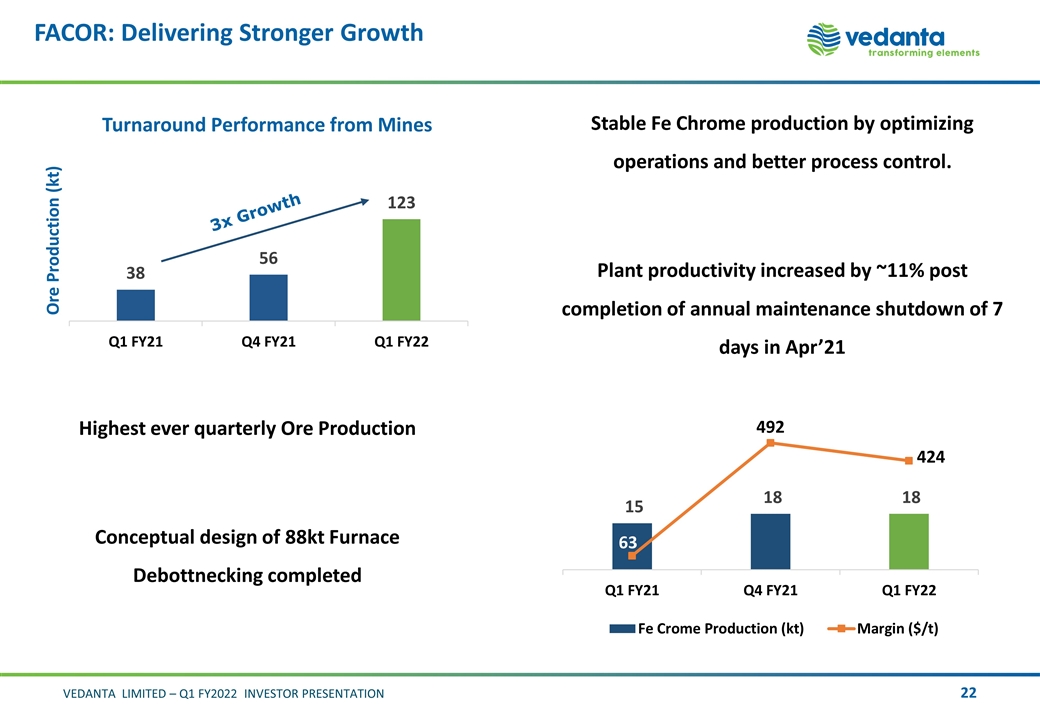

FACOR: Delivering Stronger Growth Turnaround Performance from Mines 3x Growth Highest ever quarterly Ore Production Conceptual design of 88kt Furnace Debottnecking completed Ore Production (kt) Stable Fe Chrome production by optimizing operations and better process control. Plant productivity increased by ~11% post completion of annual maintenance shutdown of 7 days in Apr’21

Finance Update Ajay Goel Deputy Chief Financial Officer VEDANTA LIMITED INVESTOR PRESENTATION Q1 FY2022

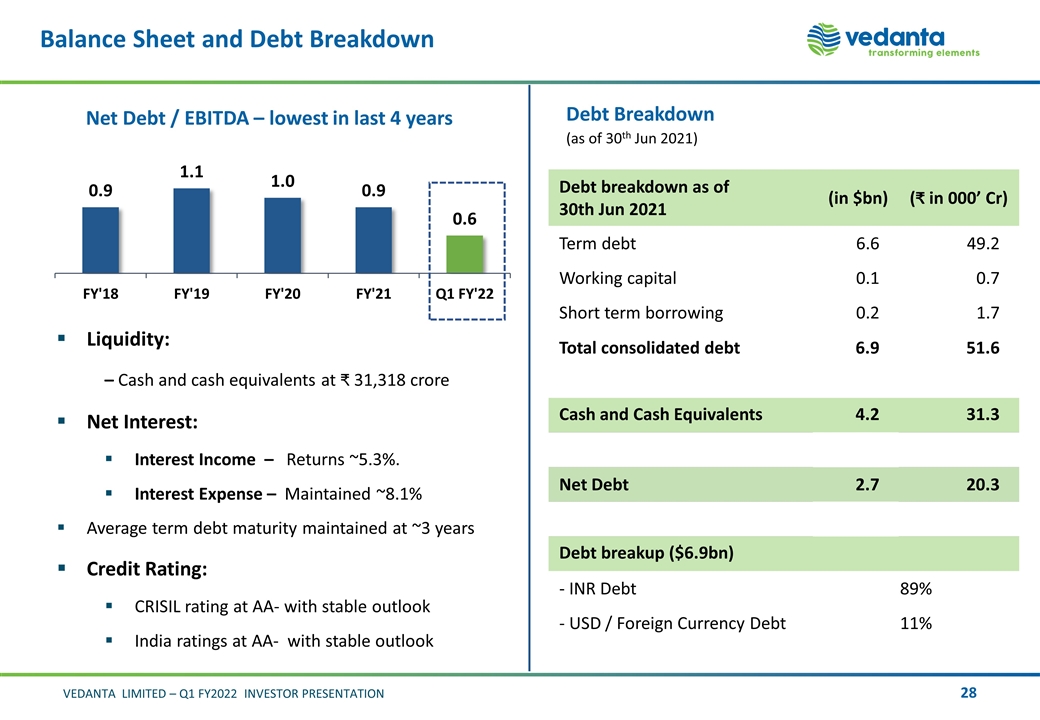

Financial snapshot Revenue EBITDA EBITDA Margin 1 Attributable PAT (before exceptional items) ₹ 28,105 cr ₹ 10,032 cr 41% 4,280cr Up 79% y-o-y Up 150% y-o-y Industry leading margin Up 314% y-o-y ROCE 2 Cash and Cash equivalents ND ND/EBITDA c.22% ₹ 31,318 cr 20,261cr 0.6x Up ~375 bps Q-o-Q Strong liquidity position Lower 26% y-o-y Lowest in last 4 years 1. Excludes custom smelting at Copper India and Zinc-India operations. 2. ROCE is calculated as EBIT net of tax outflow divided by average capital employed.

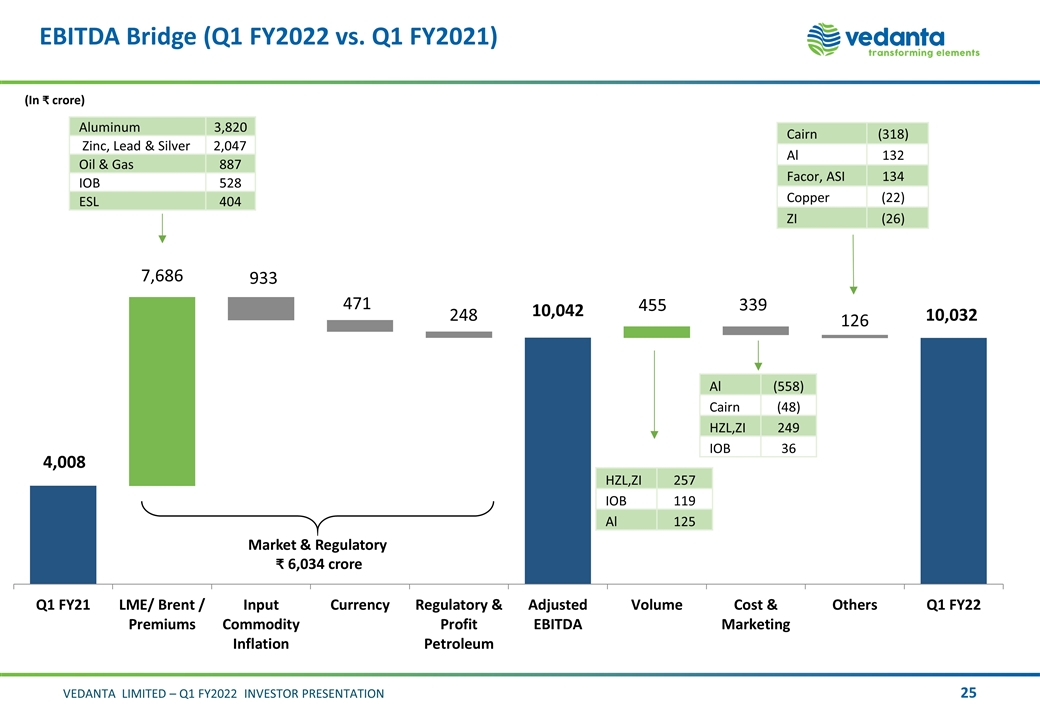

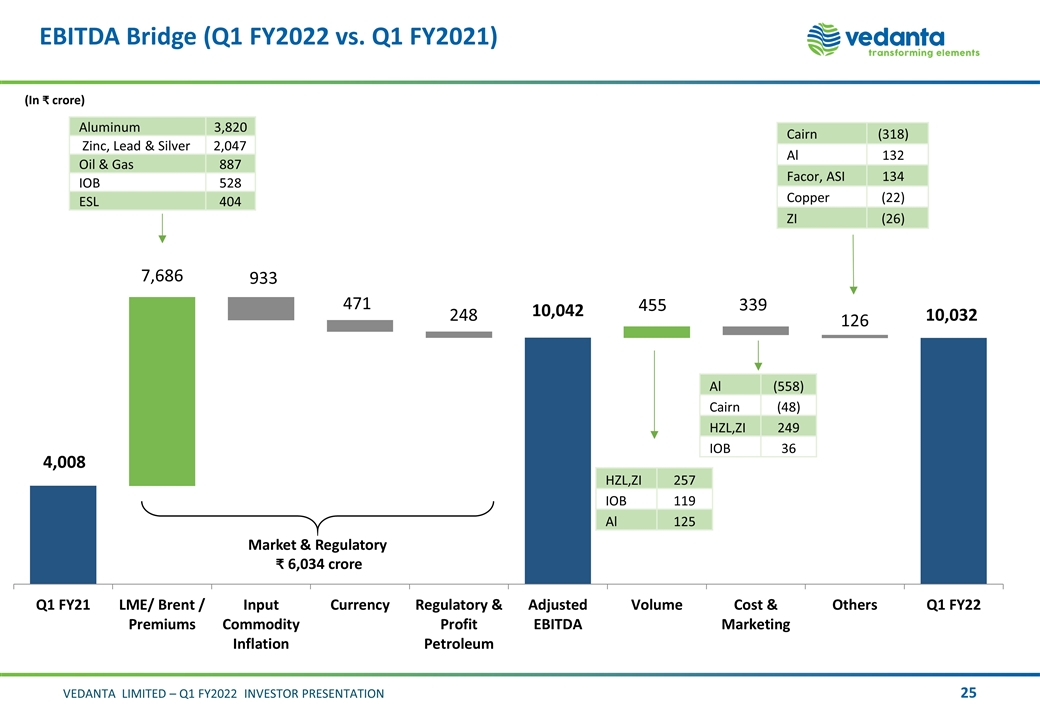

EBITDA Bridge (Q1 FY2022 vs. Q1 FY2021) (In crore) Market & Regulatory 6,034 crore Aluminum 3,820 Zinc, Lead & Silver 2,047 Oil & Gas 887 IOB 528 ESL 404 Cairn (318) Al 132 Facor, ASI 134 Copper (22) ZI (26) HZL,ZI 257 IOB 119 Al 125 Al (558) Cairn (48) HZL,ZI 249 IOB 36

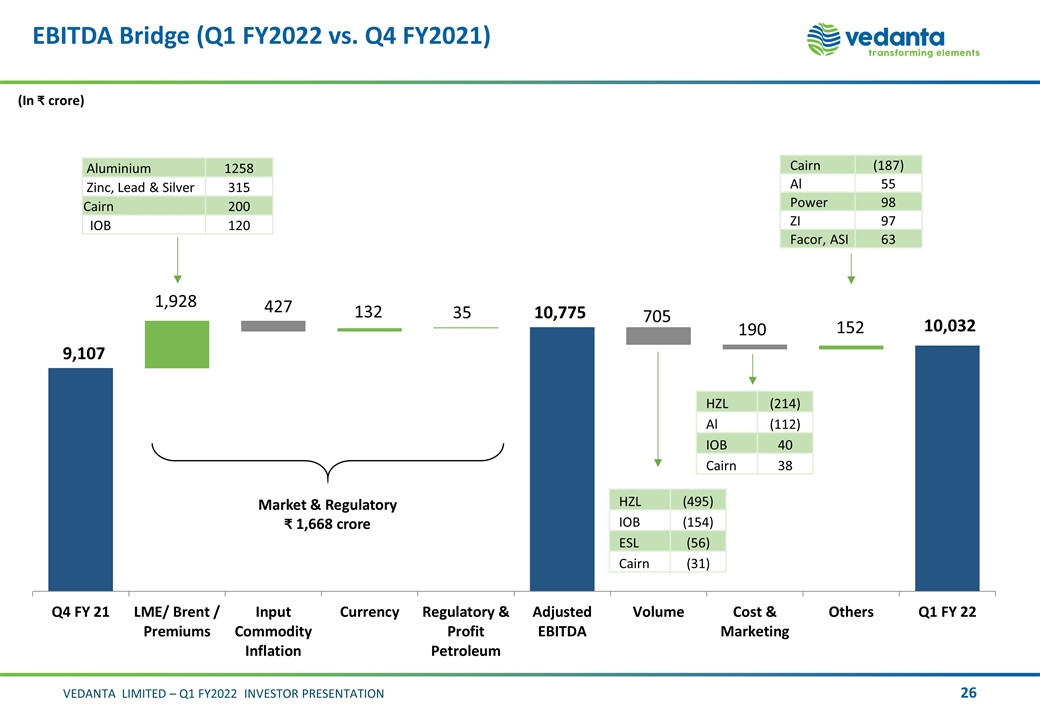

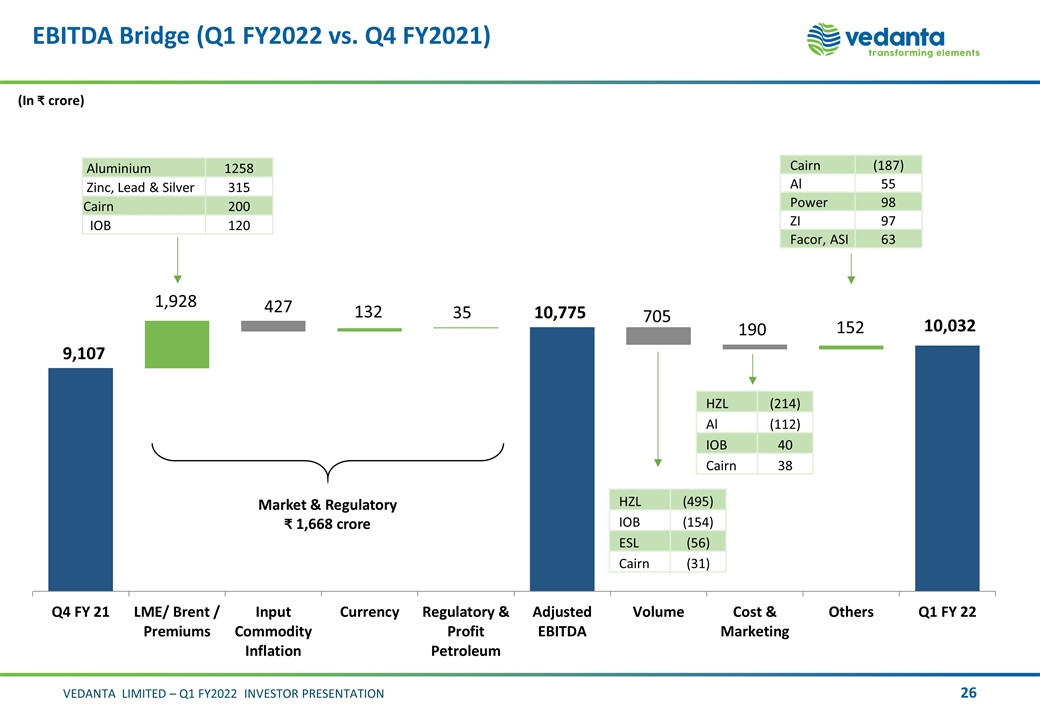

EBITDA Bridge (Q1 FY2022 vs. Q4 FY2021) (In crore) Market & Regulatory 1,668 crore Aluminium 1258 Zinc, Lead & Silver 315 Cairn 200 IOB 120 HZL (495) IOB (154) ESL (56) Cairn (31) Cairn (187) Al 55 Power 98 ZI 97 Facor, ASI 63 35 10,775 427 132 HZL (214) Al (112) IOB 40 Cairn 38 9,107

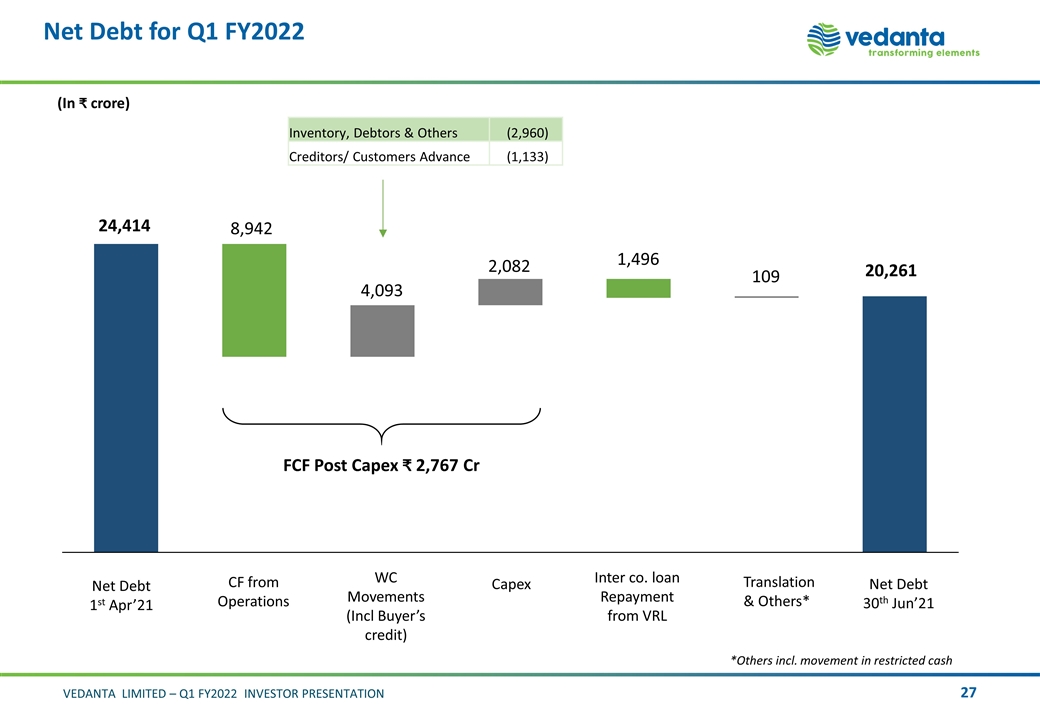

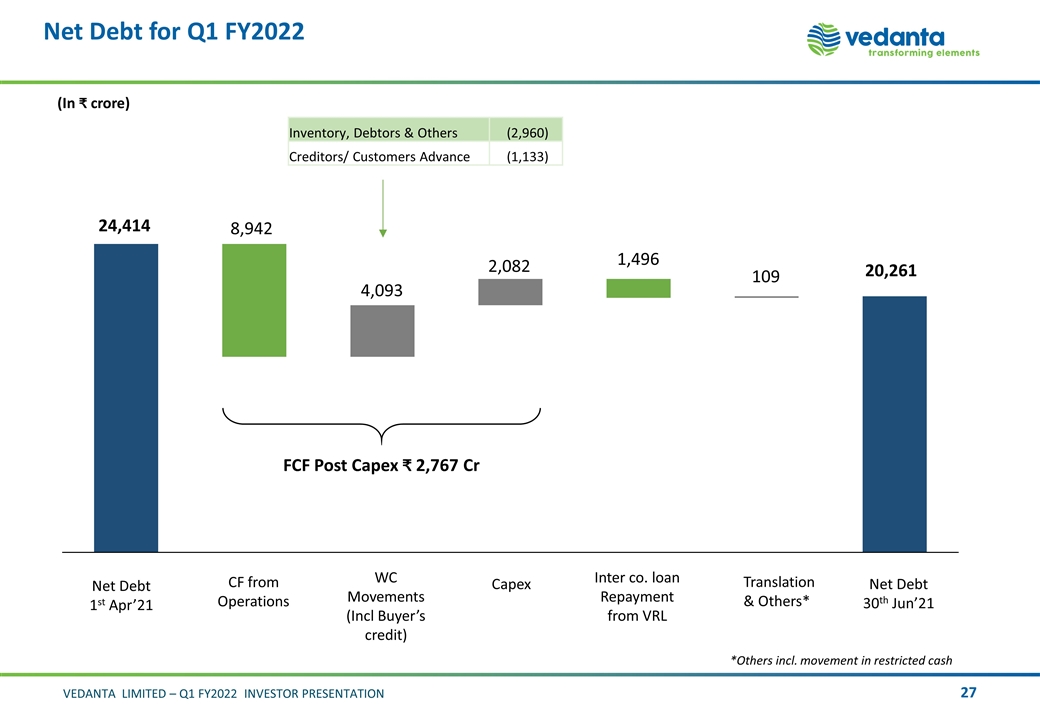

Net Debt for Q1 FY2022 (In ₹ crore) (Incl Buyer’s credit) Capex Net Debt 30th Jun’21 Net Debt 1st Apr’21 Inter co. loan Repayment from VRL Translation & Others* *Others incl. movement in restricted cash Inventory, Debtors & Others (2,960) Creditors/ Customers Advance (1,133)

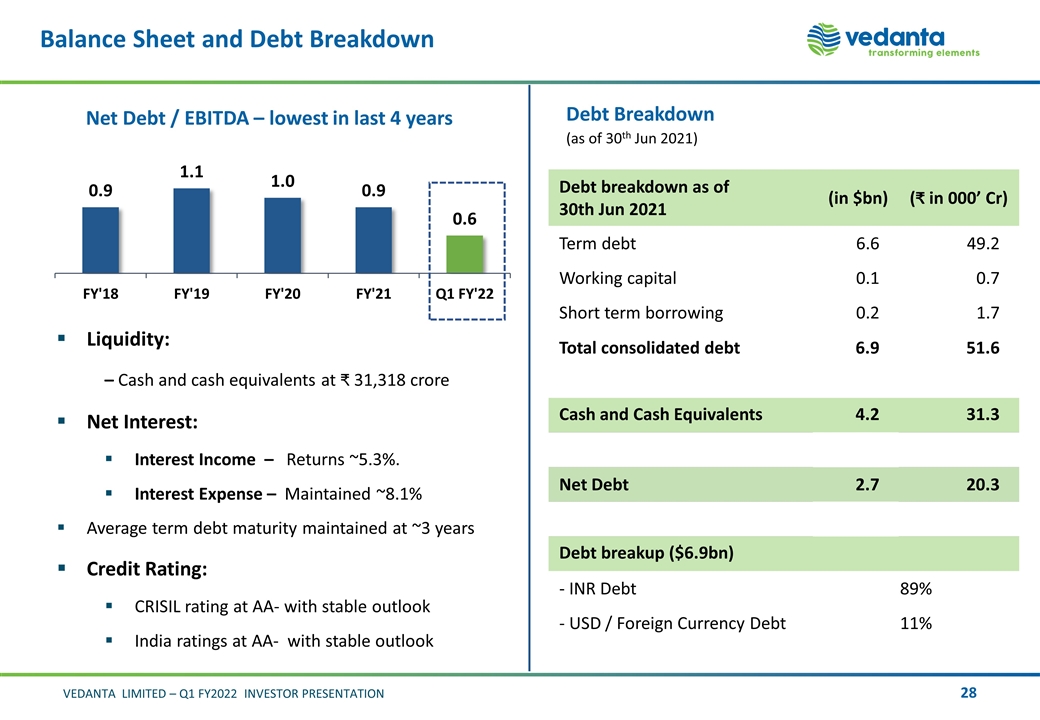

Balance Sheet and Debt Breakdown Net Debt / EBITDA – lowest in last 4 years Liquidity: – Cash and cash equivalents at 31,318 crore Net Interest: Interest Income – Returns ~5.3%. Interest Expense – Maintained ~8.1% Average term debt maturity maintained at ~3 years Credit Rating: CRISIL rating at AA- with stable outlook India ratings at AA- with stable outlook Debt breakdown as of 30th Jun 2021 (in $bn) ( in 000’ Cr) Term debt 6.6 49.2 Working capital 0.1 0.7 Short term borrowing 0.2 1.7 Total consolidated debt 6.9 51.6 Cash and Cash Equivalents 4.2 31.3 Net Debt 2.7 20.3 Debt breakup ($6.9bn) - INR Debt 89% - USD / Foreign Currency Debt 11% Debt Breakdown (as of 30th Jun 2021)

Strategy to Enhance Long Term Value Continue Focus on World Class ESG Performance Augment Our Reserves & Resources Base Delivering on Growth Opportunities Optimise Capital Allocation & Maintain Strong Balance Sheet Operational Excellence and Cost Leadership

VEDANTA LIMITED INVESTOR PRESENTATION Q1 FY2022 Appendix

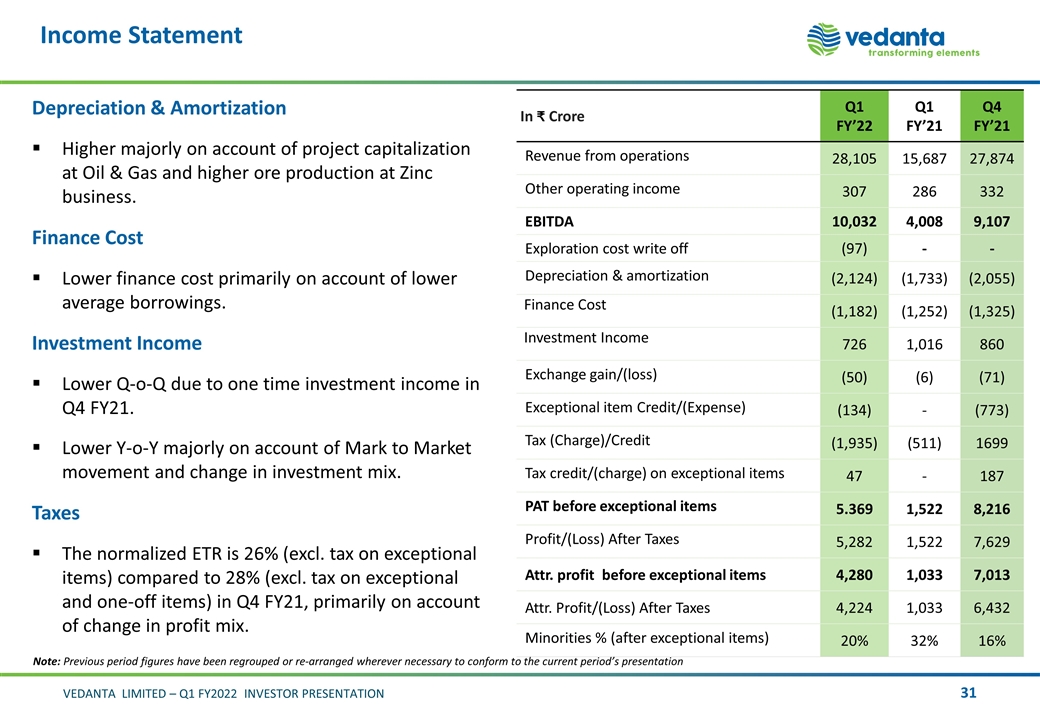

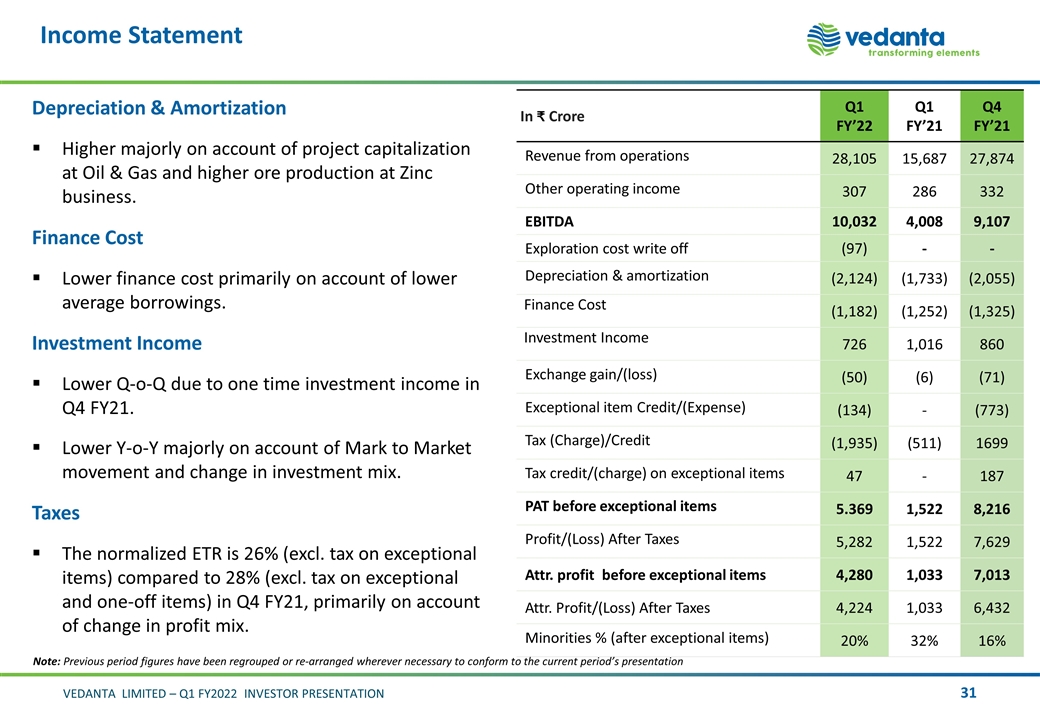

In Crore Q1 FY’22 Q1 FY’21 Q4 FY’21 Revenue from operations 28,105 15,687 27,874 Other operating income 307 286 332 EBITDA 10,032 4,008 9,107 Exploration cost write off (97) - - Depreciation & amortization (2,124) (1,733) (2,055) Finance Cost (1,182) (1,252) (1,325) Investment Income 726 1,016 860 Exchange gain/(loss) (50) (6) (71) Exceptional item Credit/(Expense) (134) - (773) Tax (Charge)/Credit (1,935) (511) 1699 Tax credit/(charge) on exceptional items 47 - 187 PAT before exceptional items 5.369 1,522 8,216 Profit/(Loss) After Taxes 5,282 1,522 7,629 Attr. profit before exceptional items 4,280 1,033 7,013 Attr. Profit/(Loss) After Taxes 4,224 1,033 6,432 Minorities % (after exceptional items) 20% 32% 16% Income Statement Depreciation & Amortization Higher majorly on account of project capitalization at Oil & Gas and higher ore production at Zinc business. Finance Cost Lower finance cost primarily on account of lower average borrowings. Investment Income Lower Q-o-Q due to one time investment income in Q4 FY21. Lower Y-o-Y majorly on account of Mark to Market movement and change in investment mix. Taxes The normalized ETR is 26% (excl. tax on exceptional items) compared to 28% (excl. tax on exceptional and one-off items) in Q4 FY21, primarily on account of change in profit mix. Note: Previous period figures have been regrouped or re-arranged wherever necessary to conform to the current period’s presentation

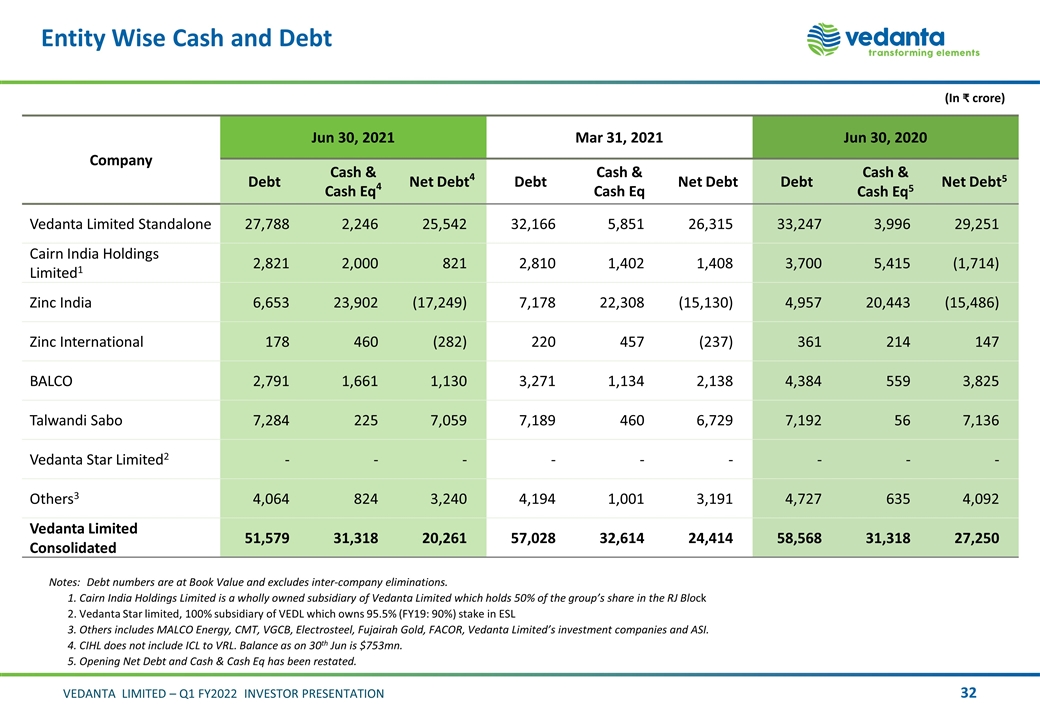

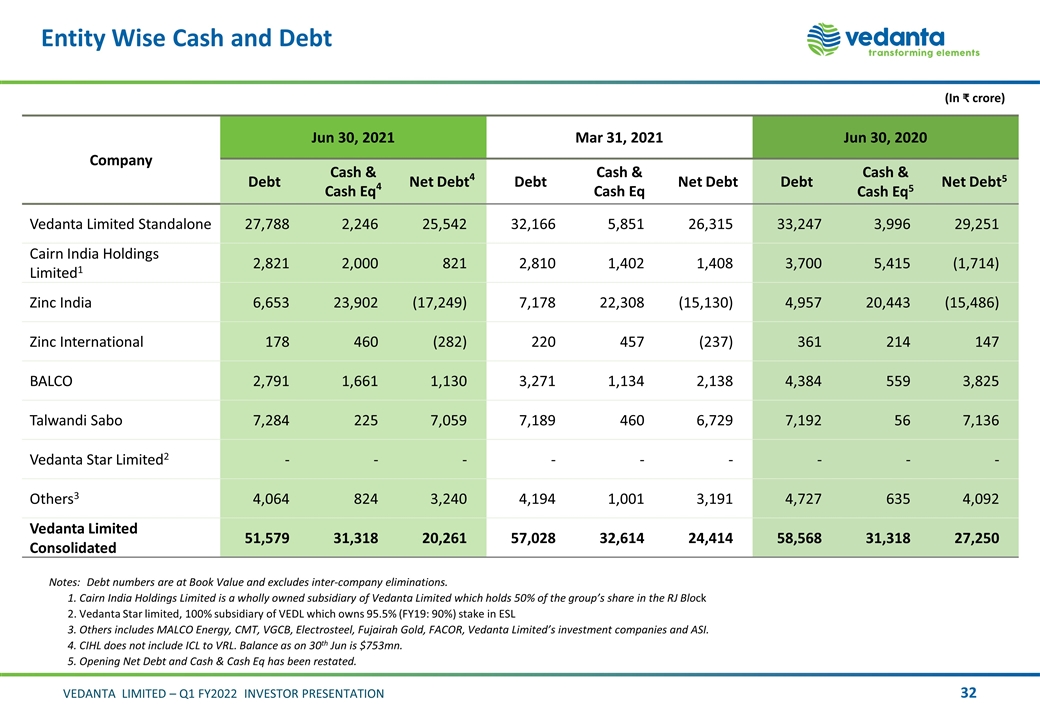

Entity Wise Cash and Debt Notes:Debt numbers are at Book Value and excludes inter-company eliminations. 1. Cairn India Holdings Limited is a wholly owned subsidiary of Vedanta Limited which holds 50% of the group’s share in the RJ Block 2. Vedanta Star limited, 100% subsidiary of VEDL which owns 95.5% (FY19: 90%) stake in ESL 3. Others includes MALCO Energy, CMT, VGCB, Electrosteel, Fujairah Gold, FACOR, Vedanta Limited’s investment companies and ASI. 4. CIHL does not include ICL to VRL. Balance as on 30th Jun is $753mn. 5. Opening Net Debt and Cash & Cash Eq has been restated. (In crore) Company Jun 30, 2021 Mar 31, 2021 Jun 30, 2020 Debt Cash & Cash Eq4 Net Debt4 Debt Cash & Cash Eq Net Debt Debt Cash & Cash Eq5 Net Debt5 Vedanta Limited Standalone 27,788 2,246 25,542 32,166 5,851 26,315 33,247 3,996 29,251 Cairn India Holdings Limited1 2,821 2,000 821 2,810 1,402 1,408 3,700 5,415 (1,714) Zinc India 6,653 23,902 (17,249) 7,178 22,308 (15,130) 4,957 20,443 (15,486) Zinc International 178 460 (282) 220 457 (237) 361 214 147 BALCO 2,791 1,661 1,130 3,271 1,134 2,138 4,384 559 3,825 Talwandi Sabo 7,284 225 7,059 7,189 460 6,729 7,192 56 7,136 Vedanta Star Limited2 - - - - - - - - - Others3 4,064 824 3,240 4,194 1,001 3,191 4,727 635 4,092 Vedanta Limited Consolidated 51,579 31,318 20,261 57,028 32,614 24,414 58,568 31,318 27,250

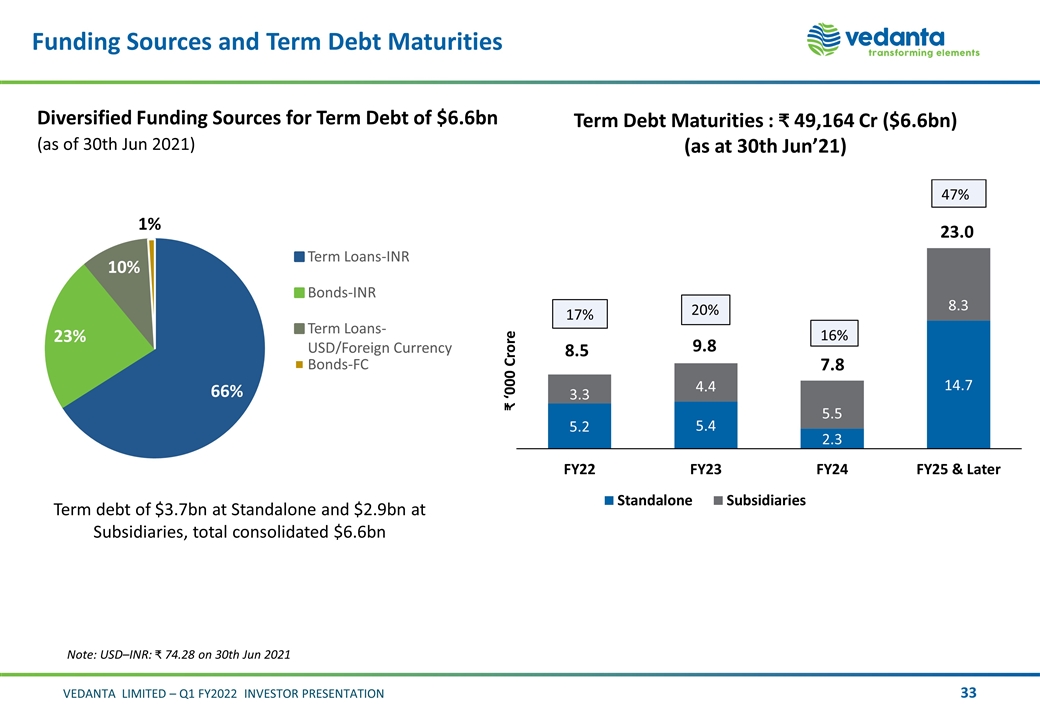

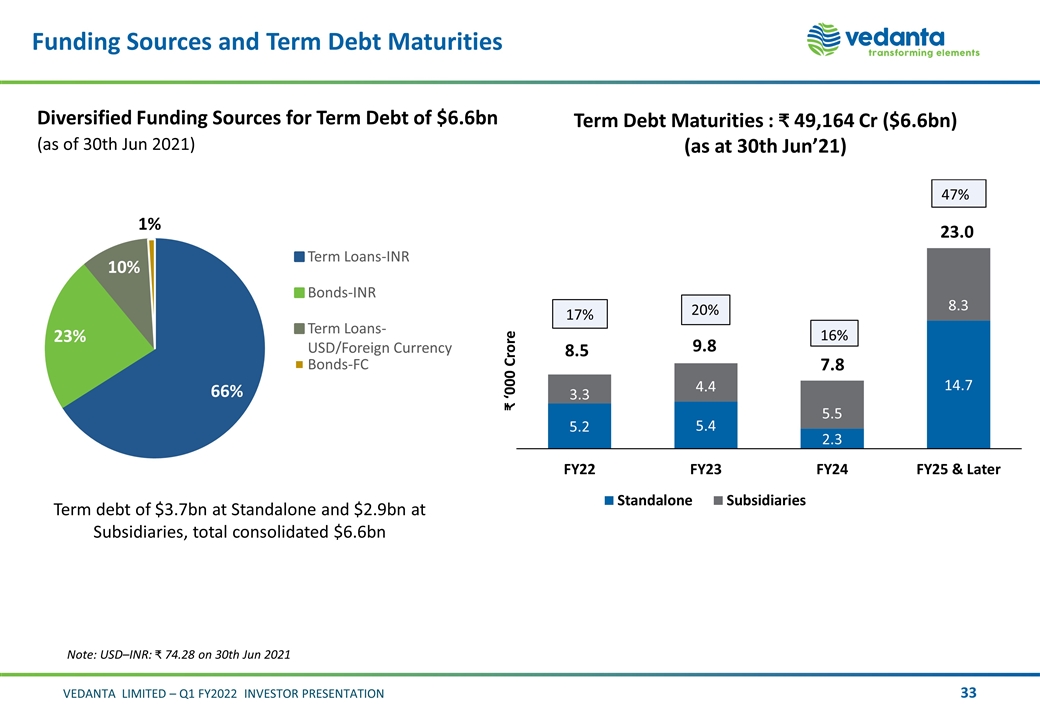

Funding Sources and Term Debt Maturities Diversified Funding Sources for Term Debt of $6.6bn (as of 30th Jun 2021) Note: USD–INR: 74.28 on 30th Jun 2021 Term debt of $3.7bn at Standalone and $2.9bn at Subsidiaries, total consolidated $6.6bn Term Debt Maturities : 49,164 Cr ($6.6bn) (as at 30th Jun’21)

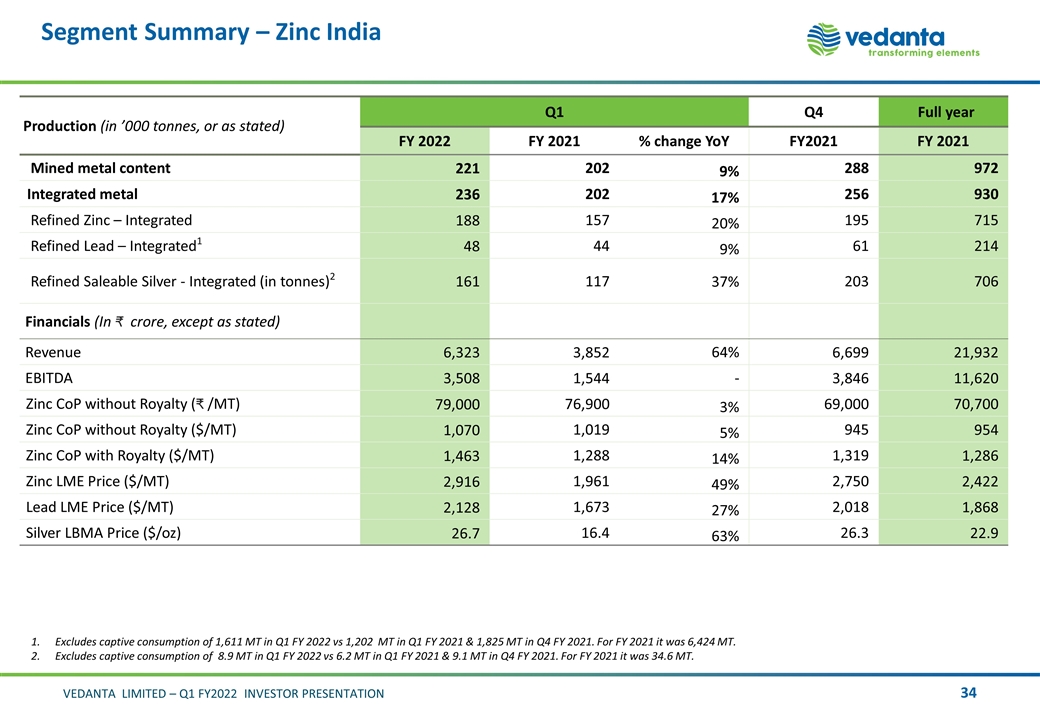

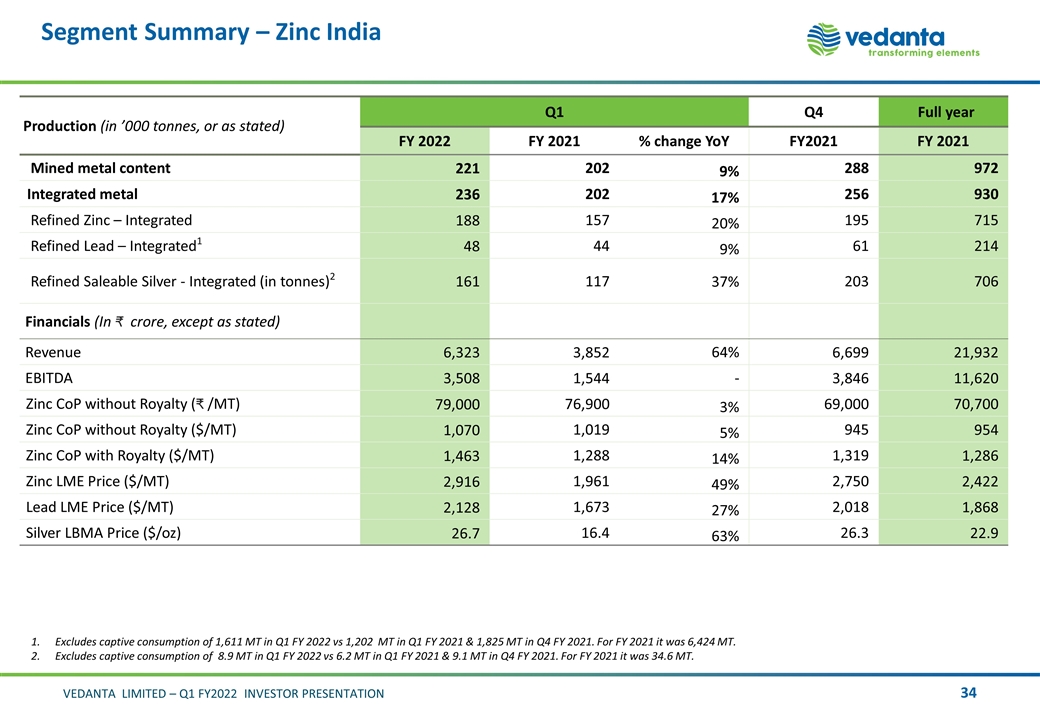

Segment Summary – Zinc India Production (in ’000 tonnes, or as stated) Q1 Q4 Full year FY 2022 FY 2021 % change YoY FY2021 FY 2021 Mined metal content 221 202 9% 288 972 Integrated metal 236 202 17% 256 930 Refined Zinc – Integrated 188 157 20% 195 715 Refined Lead – Integrated1 48 44 9% 61 214 Refined Saleable Silver - Integrated (in tonnes)2 161 117 37% 203 706 Financials (In crore, except as stated) Revenue 6,323 3,852 64% 6,699 21,932 EBITDA 3,508 1,544 - 3,846 11,620 Zinc CoP without Royalty ( /MT) 79,000 76,900 3% 69,000 70,700 Zinc CoP without Royalty ($/MT) 1,070 1,019 5% 945 954 Zinc CoP with Royalty ($/MT) 1,463 1,288 14% 1,319 1,286 Zinc LME Price ($/MT) 2,916 1,961 49% 2,750 2,422 Lead LME Price ($/MT) 2,128 1,673 27% 2,018 1,868 Silver LBMA Price ($/oz) 26.7 16.4 63% 26.3 22.9 Excludes captive consumption of 1,611 MT in Q1 FY 2022 vs 1,202 MT in Q1 FY 2021 & 1,825 MT in Q4 FY 2021. For FY 2021 it was 6,424 MT. Excludes captive consumption of 8.9 MT in Q1 FY 2022 vs 6.2 MT in Q1 FY 2021 & 9.1 MT in Q4 FY 2021. For FY 2021 it was 34.6 MT.

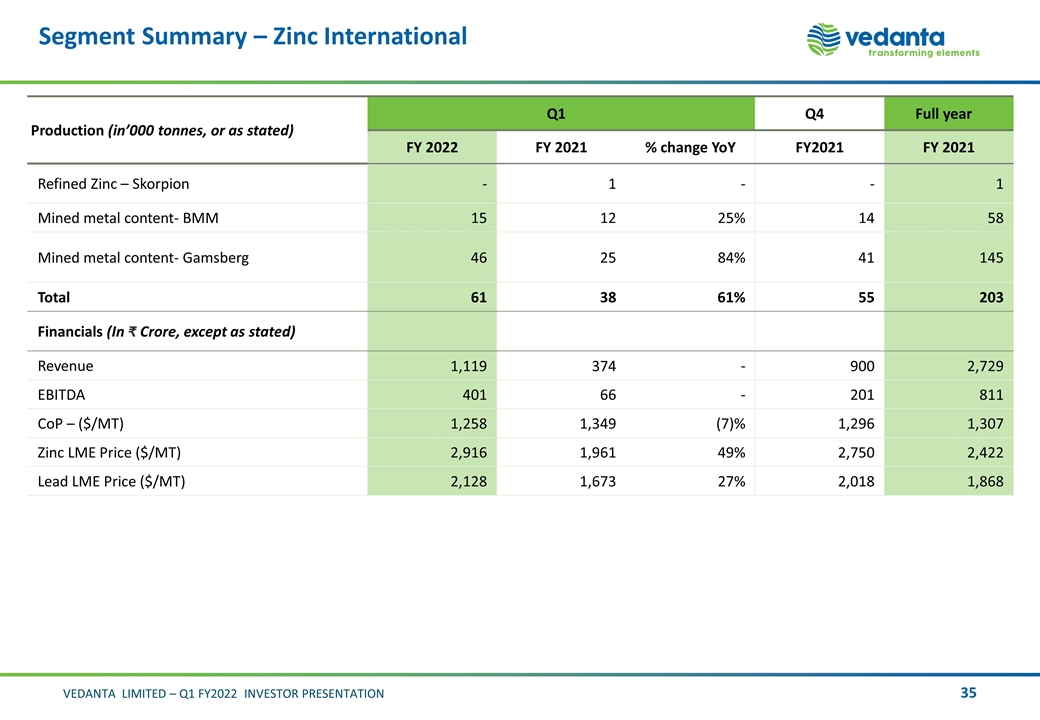

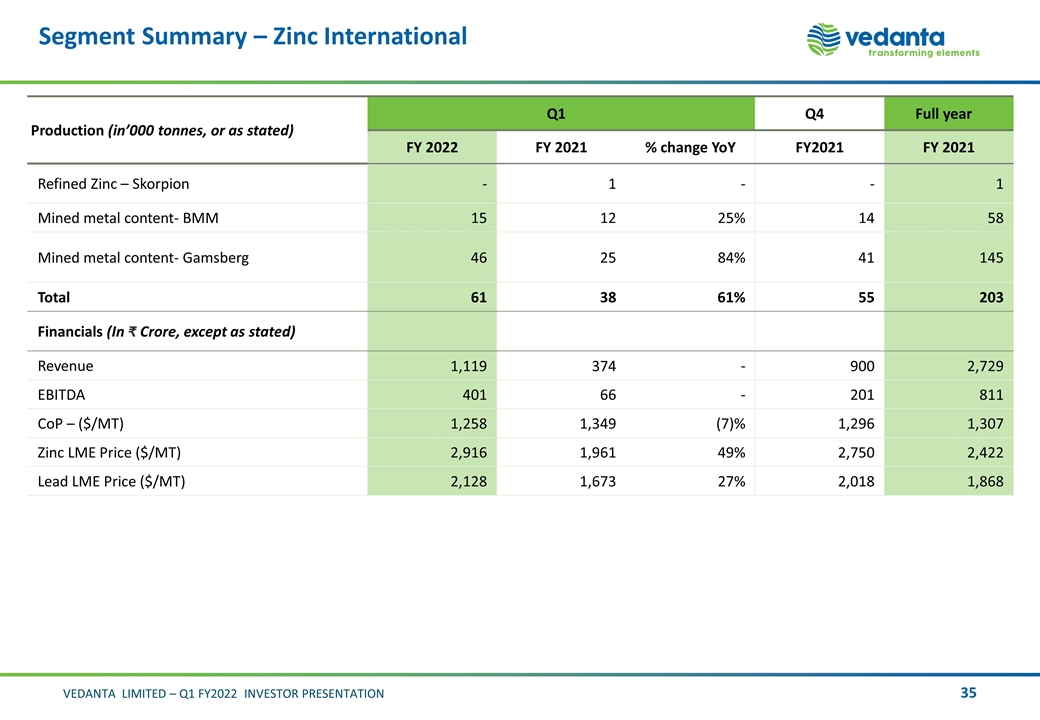

Segment Summary – Zinc International Production (in’000 tonnes, or as stated) Q1 Q4 Full year FY 2022 FY 2021 % change YoY FY2021 FY 2021 Refined Zinc – Skorpion - 1 - - 1 Mined metal content- BMM 15 12 25% 14 58 Mined metal content- Gamsberg 46 25 84% 41 145 Total 61 38 61% 55 203 Financials (In Crore, except as stated) Revenue 1,119 374 - 900 2,729 EBITDA 401 66 - 201 811 CoP – ($/MT) 1,258 1,349 (7)% 1,296 1,307 Zinc LME Price ($/MT) 2,916 1,961 49% 2,750 2,422 Lead LME Price ($/MT) 2,128 1,673 27% 2,018 1,868

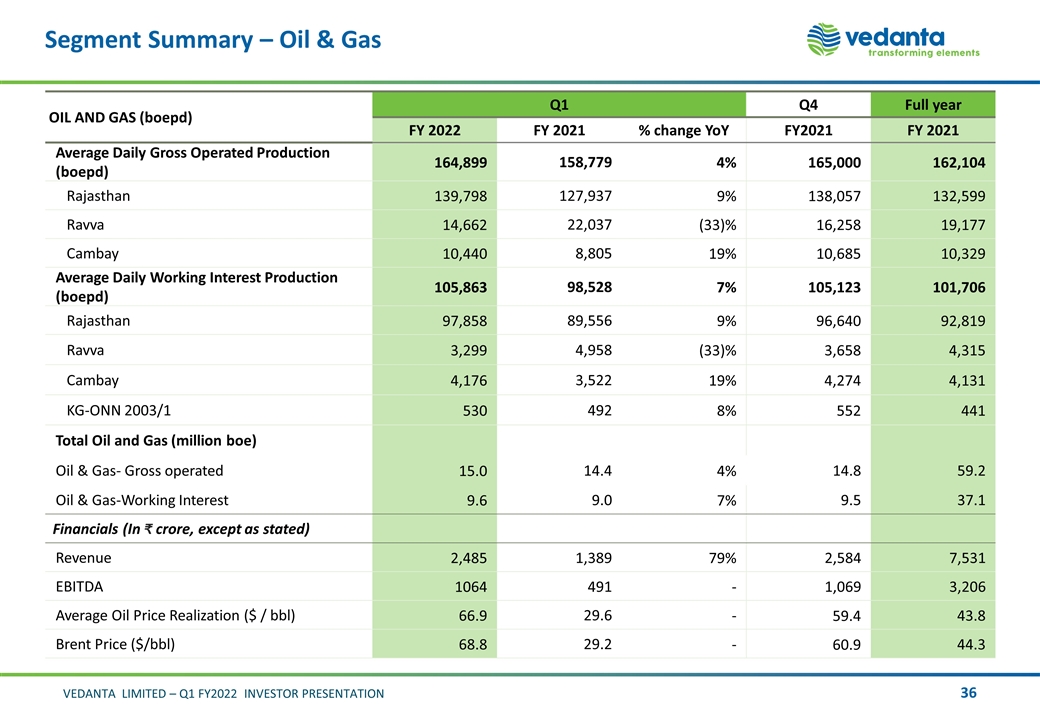

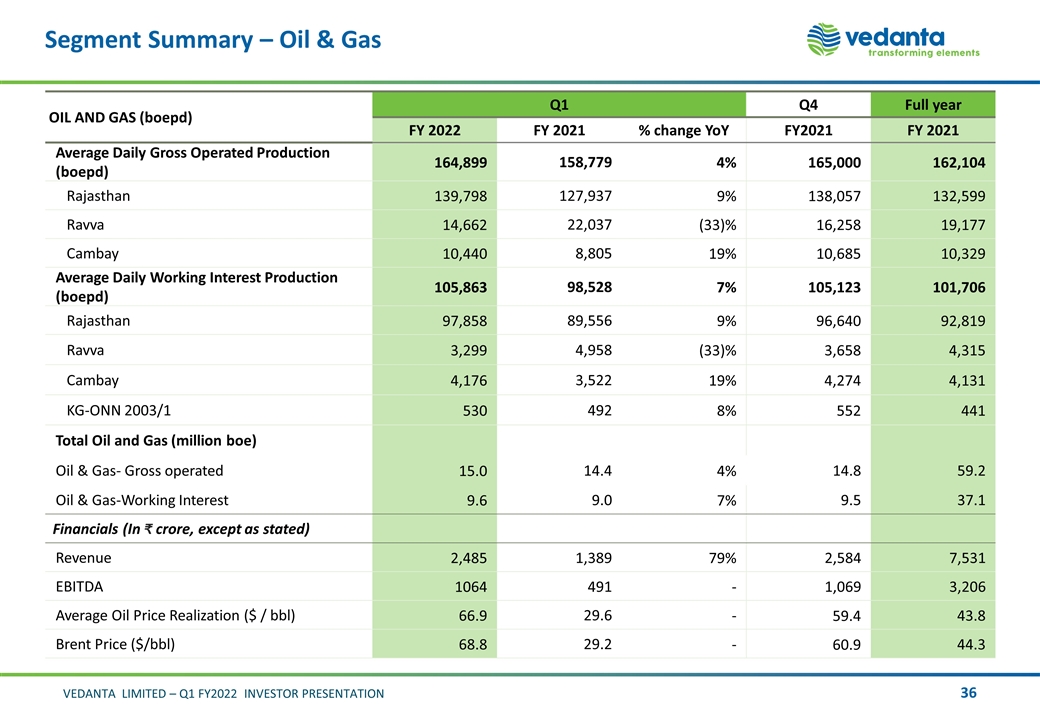

Segment Summary – Oil & Gas OIL AND GAS (boepd) Q1 Q4 Full year FY 2022 FY 2021 % change YoY FY2021 FY 2021 Average Daily Gross Operated Production (boepd) 164,899 158,779 4% 165,000 162,104 Rajasthan 139,798 127,937 9% 138,057 132,599 Ravva 14,662 22,037 (33)% 16,258 19,177 Cambay 10,440 8,805 19% 10,685 10,329 Average Daily Working Interest Production (boepd) 105,863 98,528 7% 105,123 101,706 Rajasthan 97,858 89,556 9% 96,640 92,819 Ravva 3,299 4,958 (33)% 3,658 4,315 Cambay 4,176 3,522 19% 4,274 4,131 KG-ONN 2003/1 530 492 8% 552 441 Total Oil and Gas (million boe) Oil & Gas- Gross operated 15.0 14.4 4% 14.8 59.2 Oil & Gas-Working Interest 9.6 9.0 7% 9.5 37.1 Financials (In crore, except as stated) Revenue 2,485 1,389 79% 2,584 7,531 EBITDA 1064 491 - 1,069 3,206 Average Oil Price Realization ($ / bbl) 66.9 29.6 - 59.4 43.8 Brent Price ($/bbl) 68.8 29.2 - 60.9 44.3

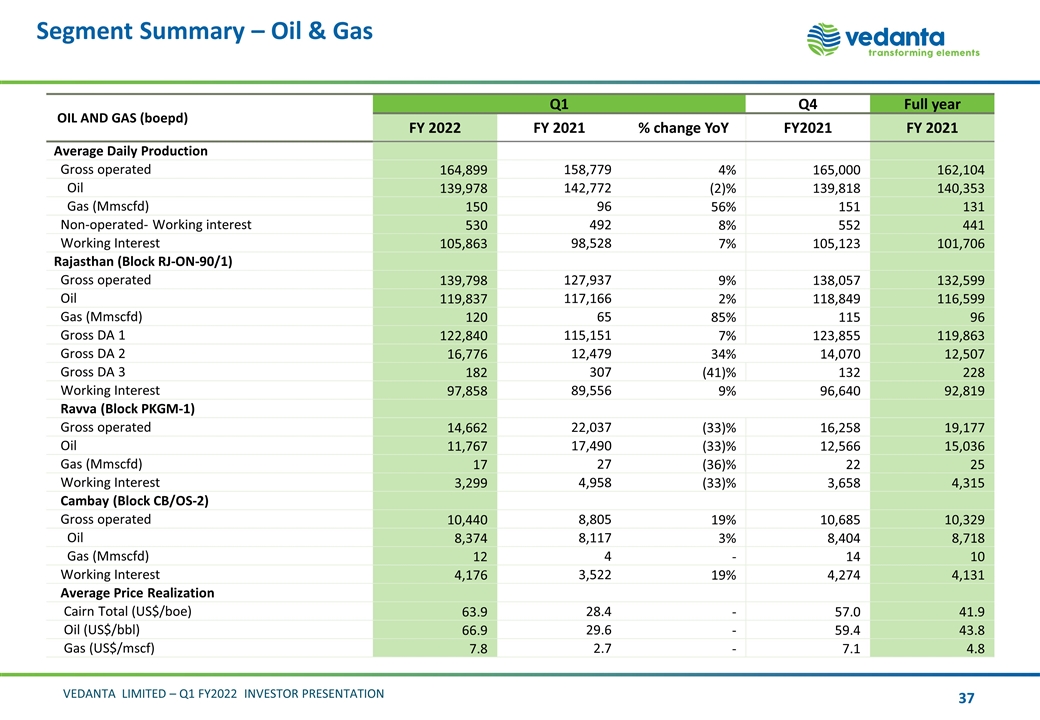

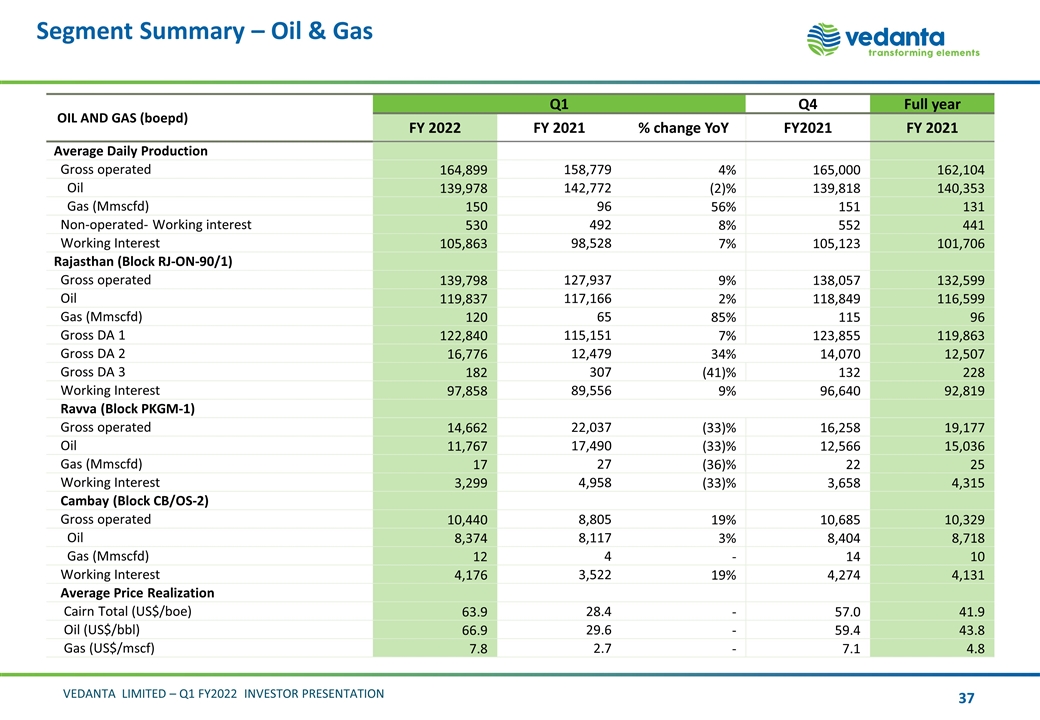

Segment Summary – Oil & Gas OIL AND GAS (boepd) Q1 Q4 Full year FY 2022 FY 2021 % change YoY FY2021 FY 2021 Average Daily Production Gross operated 164,899 158,779 4% 165,000 162,104 Oil 139,978 142,772 (2)% 139,818 140,353 Gas (Mmscfd) 150 96 56% 151 131 Non-operated- Working interest 530 492 8% 552 441 Working Interest 105,863 98,528 7% 105,123 101,706 Rajasthan (Block RJ-ON-90/1) Gross operated 139,798 127,937 9% 138,057 132,599 Oil 119,837 117,166 2% 118,849 116,599 Gas (Mmscfd) 120 65 85% 115 96 Gross DA 1 122,840 115,151 7% 123,855 119,863 Gross DA 2 16,776 12,479 34% 14,070 12,507 Gross DA 3 182 307 (41)% 132 228 Working Interest 97,858 89,556 9% 96,640 92,819 Ravva (Block PKGM-1) Gross operated 14,662 22,037 (33)% 16,258 19,177 Oil 11,767 17,490 (33)% 12,566 15,036 Gas (Mmscfd) 17 27 (36)% 22 25 Working Interest 3,299 4,958 (33)% 3,658 4,315 Cambay (Block CB/OS-2) Gross operated 10,440 8,805 19% 10,685 10,329 Oil 8,374 8,117 3% 8,404 8,718 Gas (Mmscfd) 12 4 - 14 10 Working Interest 4,176 3,522 19% 4,274 4,131 Average Price Realization Cairn Total (US$/boe) 63.9 28.4 - 57.0 41.9 Oil (US$/bbl) 66.9 29.6 - 59.4 43.8 Gas (US$/mscf) 7.8 2.7 - 7.1 4.8

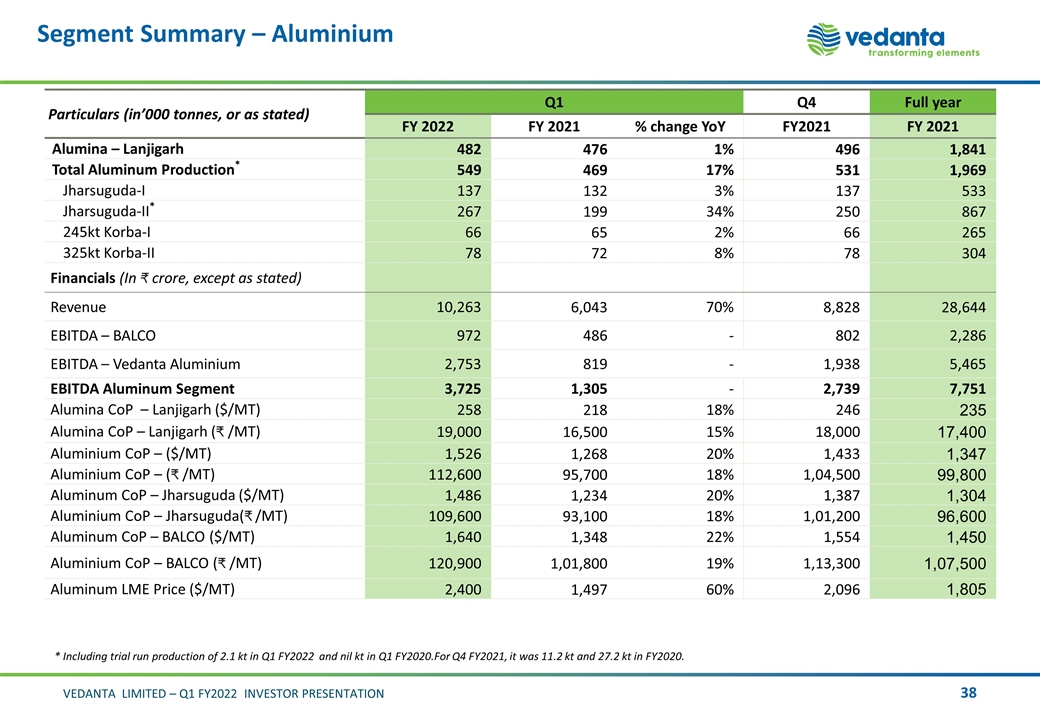

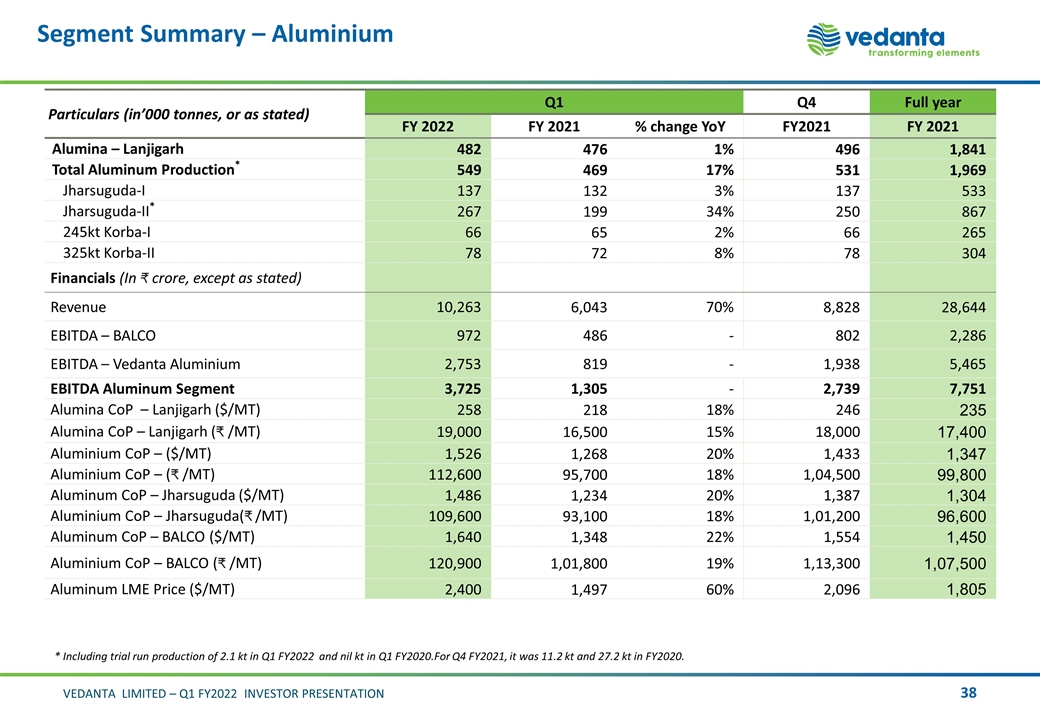

Segment Summary – Aluminium Particulars (in’000 tonnes, or as stated) Q1 Q4 Full year FY 2022 FY 2021 % change YoY FY2021 FY 2021 Alumina – Lanjigarh 482 476 1% 496 1,841 Total Aluminum Production* 549 469 17% 531 1,969 Jharsuguda-I 137 132 3% 137 533 Jharsuguda-II* 267 199 34% 250 867 245kt Korba-I 66 65 2% 66 265 325kt Korba-II 78 72 8% 78 304 Financials (In crore, except as stated) Revenue 10,263 6,043 70% 8,828 28,644 EBITDA – BALCO 972 486 - 802 2,286 EBITDA – Vedanta Aluminium 2,753 819 - 1,938 5,465 EBITDA Aluminum Segment 3,725 1,305 - 2,739 7,751 Alumina CoP – Lanjigarh ($/MT) 258 218 18% 246 235 Alumina CoP – Lanjigarh ( /MT) 19,000 16,500 15% 18,000 17,400 Aluminium CoP – ($/MT) 1,526 1,268 20% 1,433 1,347 Aluminium CoP – ( /MT) 112,600 95,700 18% 1,04,500 99,800 Aluminum CoP – Jharsuguda ($/MT) 1,486 1,234 20% 1,387 1,304 Aluminium CoP – Jharsuguda( /MT) 109,600 93,100 18% 1,01,200 96,600 Aluminum CoP – BALCO ($/MT) 1,640 1,348 22% 1,554 1,450 Aluminium CoP – BALCO ( /MT) 120,900 1,01,800 19% 1,13,300 1,07,500 Aluminum LME Price ($/MT) 2,400 1,497 60% 2,096 1,805 * Including trial run production of 2.1 kt in Q1 FY2022 and nil kt in Q1 FY2020.For Q4 FY2021, it was 11.2 kt and 27.2 kt in FY2020.

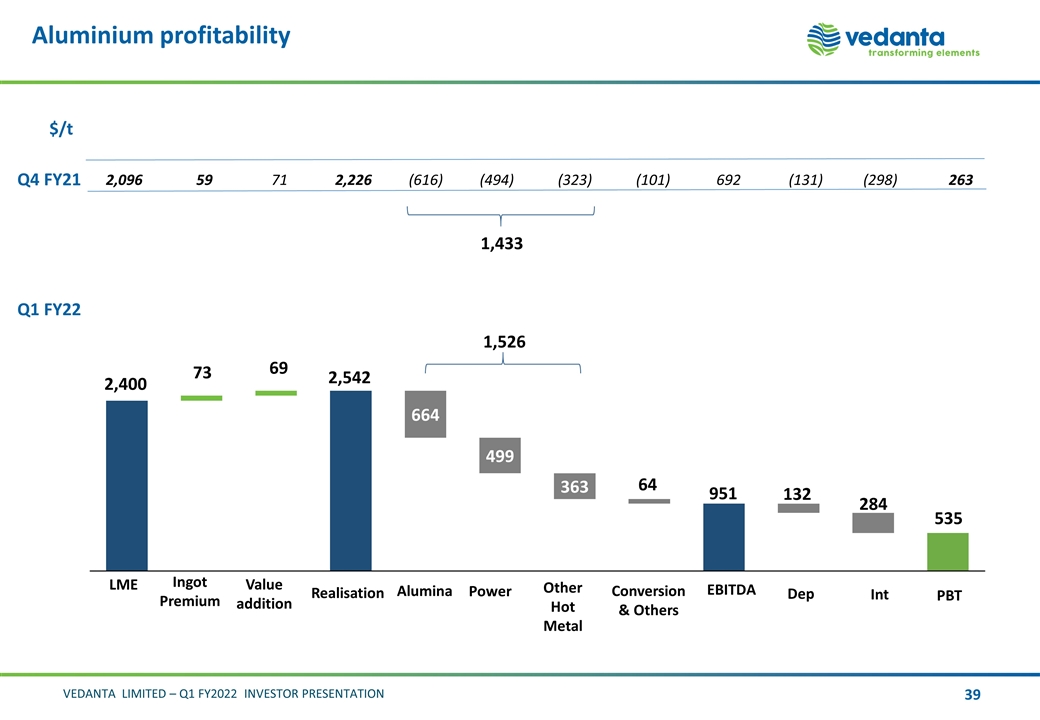

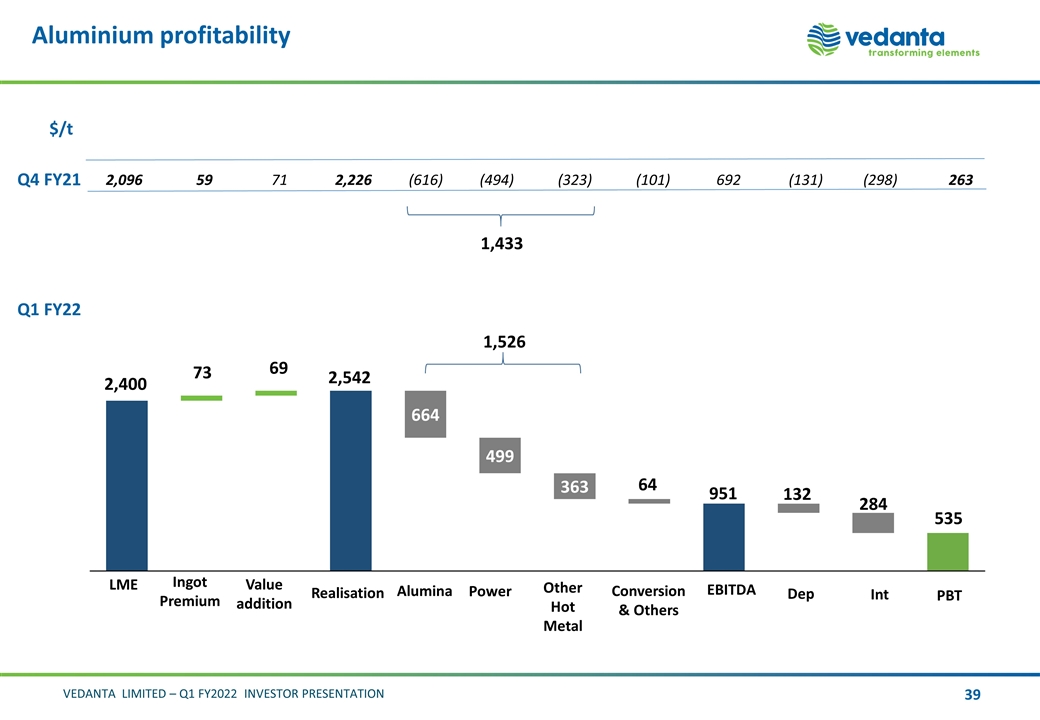

Aluminium profitability Q4 FY21 $/t Q1 FY22 69 73 284 951 535 2,096 59 71 2,226 (616) (494) (323) (101) 692 (131) (298) 263 1,433 1,526

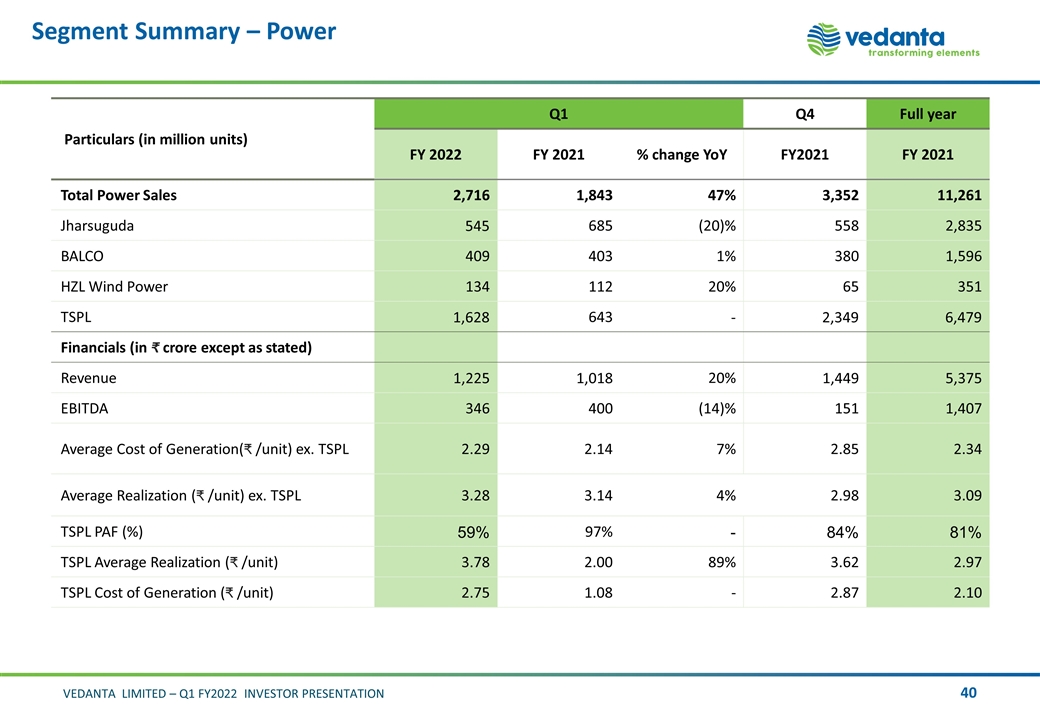

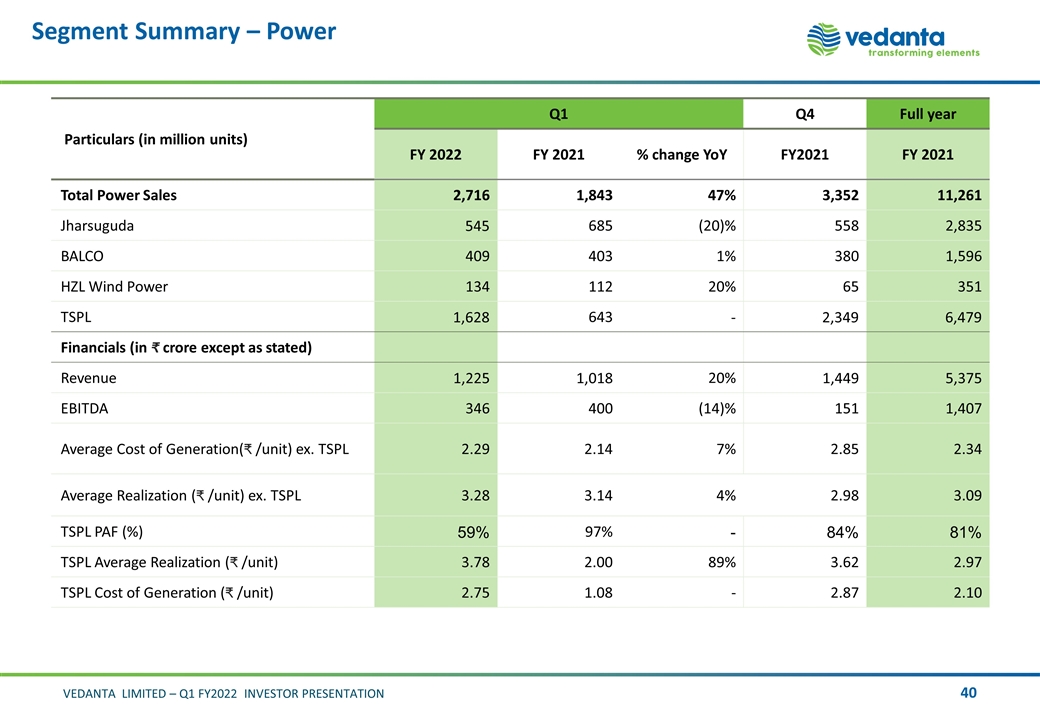

Segment Summary – Power Particulars (in million units) Q1 Q4 Full year FY 2022 FY 2021 % change YoY FY2021 FY 2021 Total Power Sales 2,716 1,843 47% 3,352 11,261 Jharsuguda 545 685 (20)% 558 2,835 BALCO 409 403 1% 380 1,596 HZL Wind Power 134 112 20% 65 351 TSPL 1,628 643 - 2,349 6,479 Financials (in crore except as stated) Revenue 1,225 1,018 20% 1,449 5,375 EBITDA 346 400 (14)% 151 1,407 Average Cost of Generation( /unit) ex. TSPL 2.29 2.14 7% 2.85 2.34 Average Realization ( /unit) ex. TSPL 3.28 3.14 4% 2.98 3.09 TSPL PAF (%) 59% 97% - 84% 81% TSPL Average Realization ( /unit) 3.78 2.00 89% 3.62 2.97 TSPL Cost of Generation ( /unit) 2.75 1.08 - 2.87 2.10

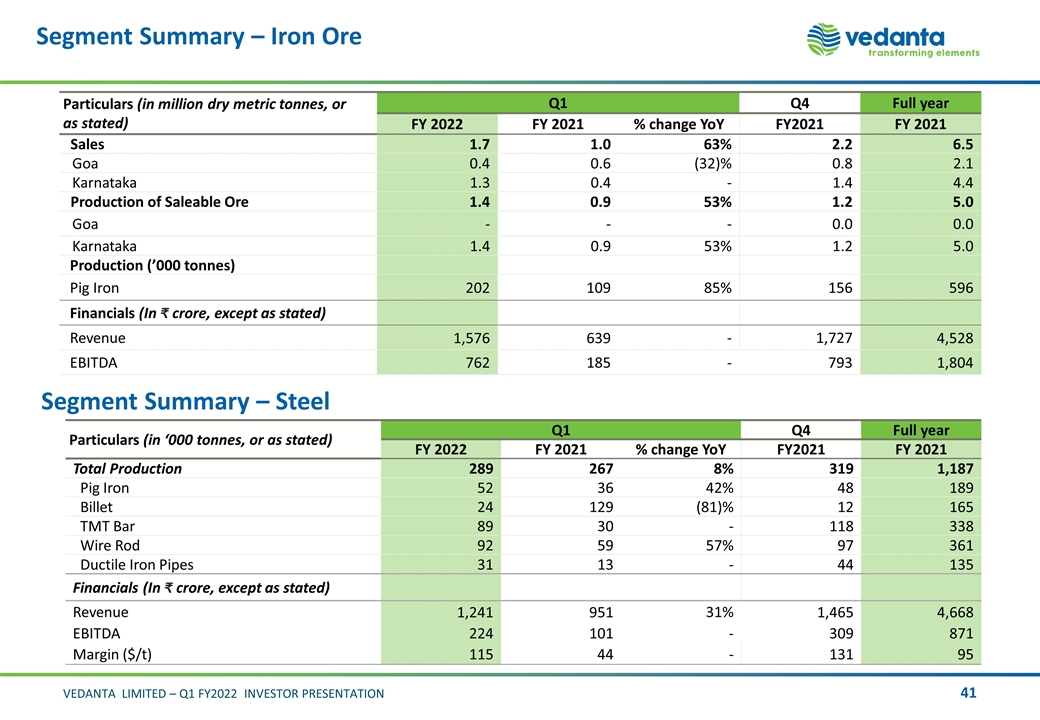

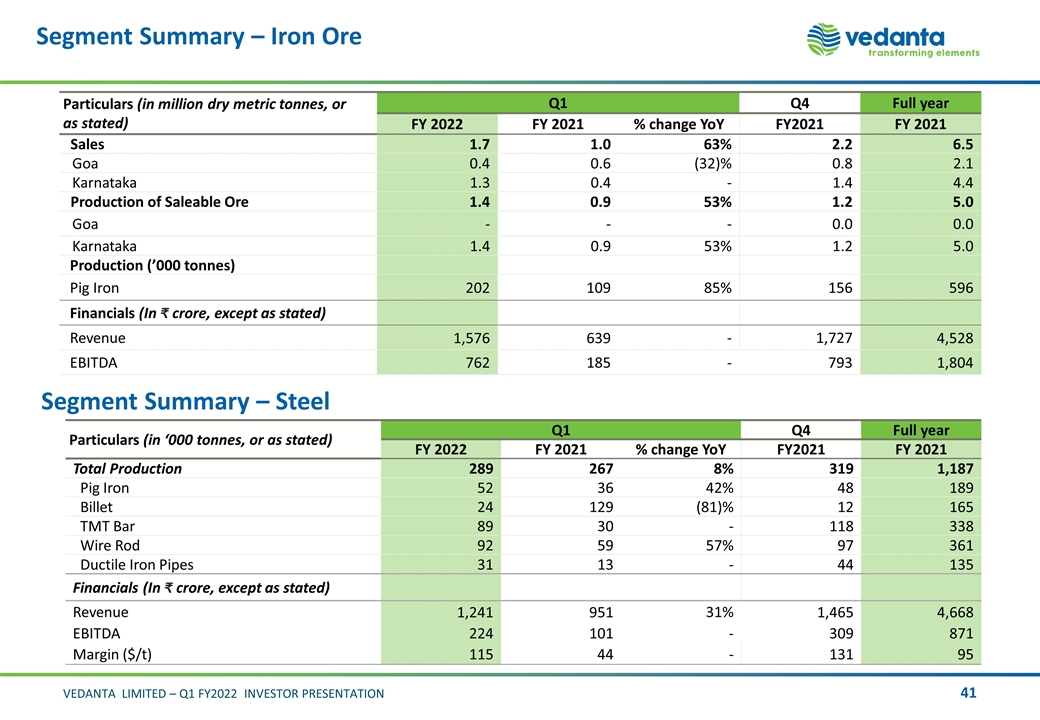

Segment Summary – Iron Ore Particulars (in million dry metric tonnes, or as stated) Q1 Q4 Full year FY 2022 FY 2021 % change YoY FY2021 FY 2021 Sales 1.7 1.0 63% 2.2 6.5 Goa 0.4 0.6 (32)% 0.8 2.1 Karnataka 1.3 0.4 - 1.4 4.4 Production of Saleable Ore 1.4 0.9 53% 1.2 5.0 Goa - - - 0.0 0.0 Karnataka 1.4 0.9 53% 1.2 5.0 Production (’000 tonnes) Pig Iron 202 109 85% 156 596 Financials (In crore, except as stated) Revenue 1,576 639 - 1,727 4,528 EBITDA 762 185 - 793 1,804 Segment Summary – Steel Particulars (in ‘000 tonnes, or as stated) Q1 Q4 Full year FY 2022 FY 2021 % change YoY FY2021 FY 2021 Total Production 289 267 8% 319 1,187 Pig Iron 52 36 42% 48 189 Billet 24 129 (81)% 12 165 TMT Bar 89 30 - 118 338 Wire Rod 92 59 57% 97 361 Ductile Iron Pipes 31 13 - 44 135 Financials (In crore, except as stated) Revenue 1,241 951 31% 1,465 4,668 EBITDA 224 101 - 309 871 Margin ($/t) 115 44 - 131 95

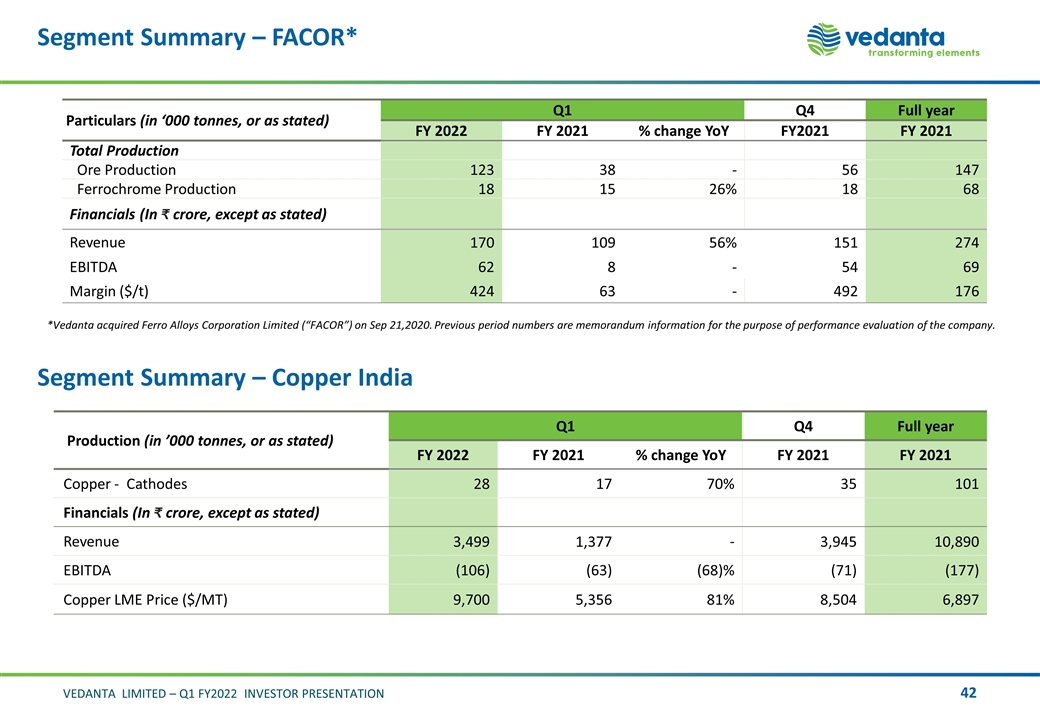

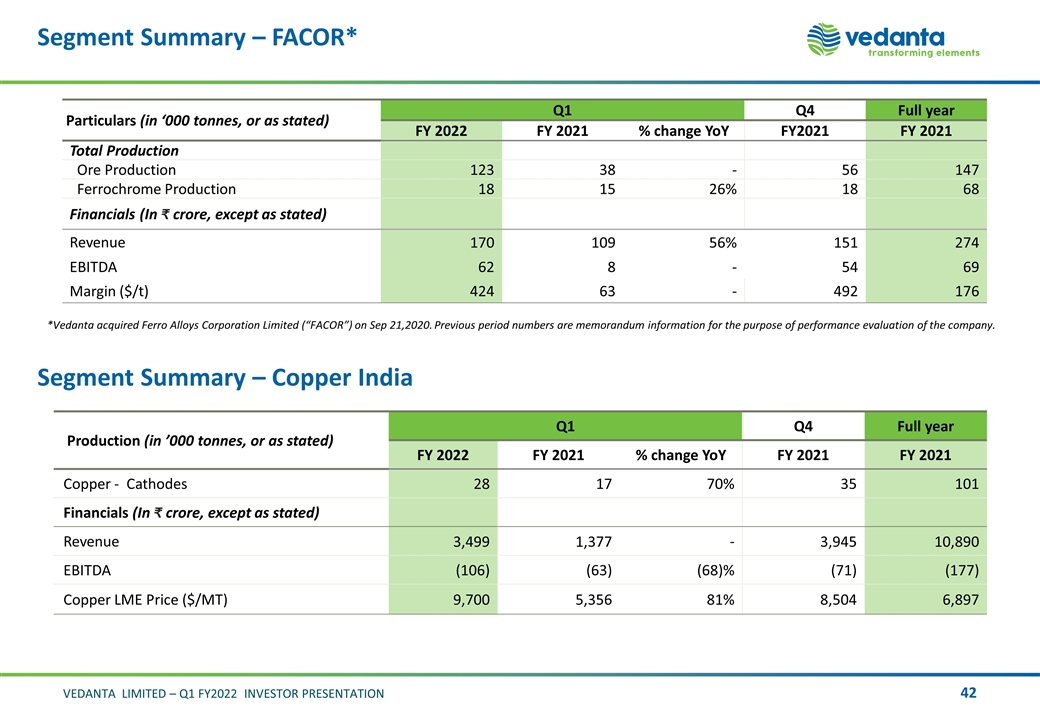

Segment Summary – FACOR* Segment Summary – Copper India Particulars (in ‘000 tonnes, or as stated) Q1 Q4 Full year FY 2022 FY 2021 % change YoY FY2021 FY 2021 Total Production Ore Production 123 38 - 56 147 Ferrochrome Production 18 15 26% 18 68 Financials (In crore, except as stated) Revenue 170 109 56% 151 274 EBITDA 62 8 - 54 69 Margin ($/t) 424 63 - 492 176 Production (in ’000 tonnes, or as stated) Q1 Q4 Full year FY 2022 FY 2021 % change YoY FY 2021 FY 2021 Copper - Cathodes 28 17 70% 35 101 Financials (In crore, except as stated) Revenue 3,499 1,377 - 3,945 10,890 EBITDA (106) (63) (68)% (71) (177) Copper LME Price ($/MT) 9,700 5,356 81% 8,504 6,897 *Vedanta acquired Ferro Alloys Corporation Limited (“FACOR”) on Sep 21,2020. Previous period numbers are memorandum information for the purpose of performance evaluation of the company.

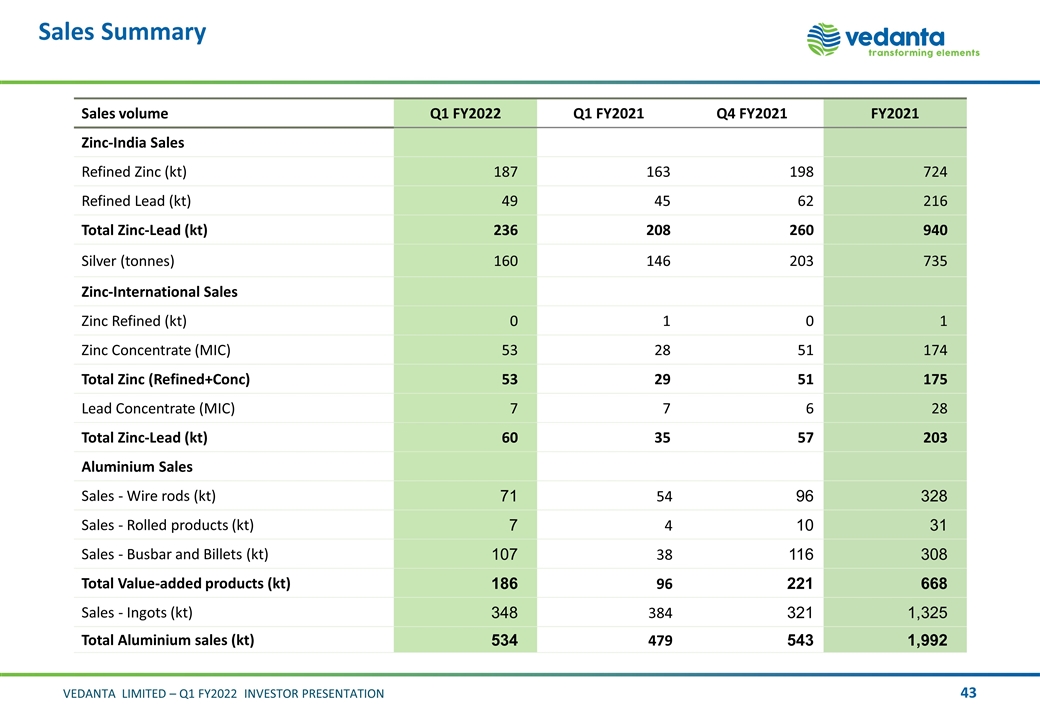

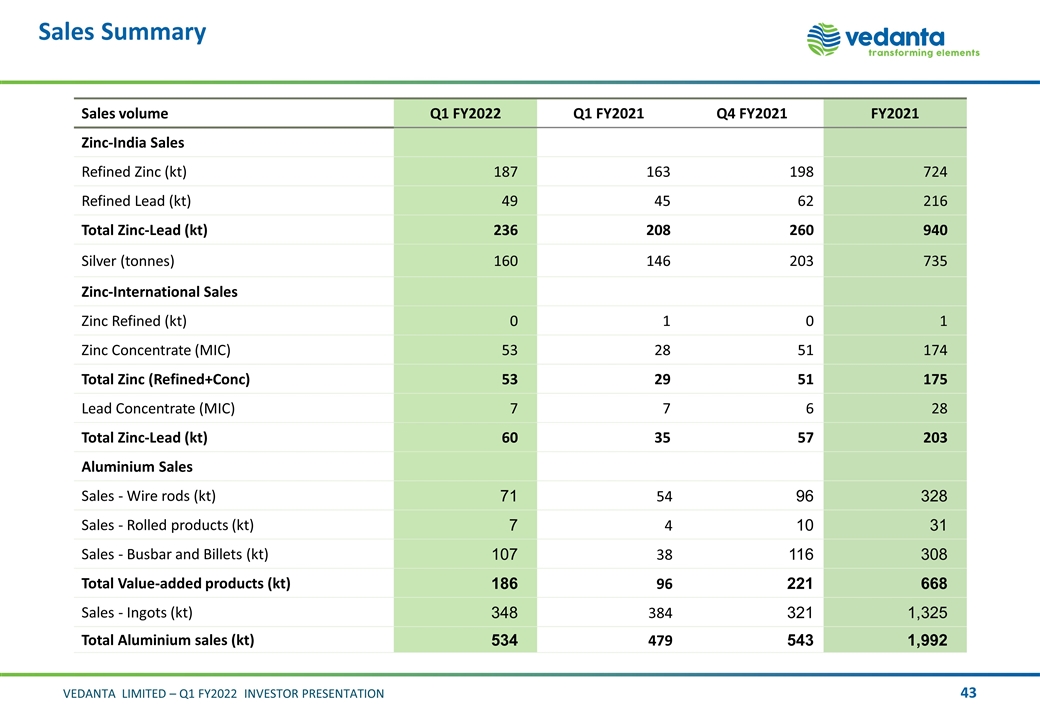

Sales Summary Sales volume Q1 FY2022 Q1 FY2021 Q4 FY2021 FY2021 Zinc-India Sales Refined Zinc (kt) 187 163 198 724 Refined Lead (kt) 49 45 62 216 Total Zinc-Lead (kt) 236 208 260 940 Silver (tonnes) 160 146 203 735 Zinc-International Sales Zinc Refined (kt) 0 1 0 1 Zinc Concentrate (MIC) 53 28 51 174 Total Zinc (Refined+Conc) 53 29 51 175 Lead Concentrate (MIC) 7 7 6 28 Total Zinc-Lead (kt) 60 35 57 203 Aluminium Sales Sales - Wire rods (kt) 71 54 96 328 Sales - Rolled products (kt) 7 4 10 31 Sales - Busbar and Billets (kt) 107 38 116 308 Total Value-added products (kt) 186 96 221 668 Sales - Ingots (kt) 348 384 321 1,325 Total Aluminium sales (kt) 534 479 543 1,992

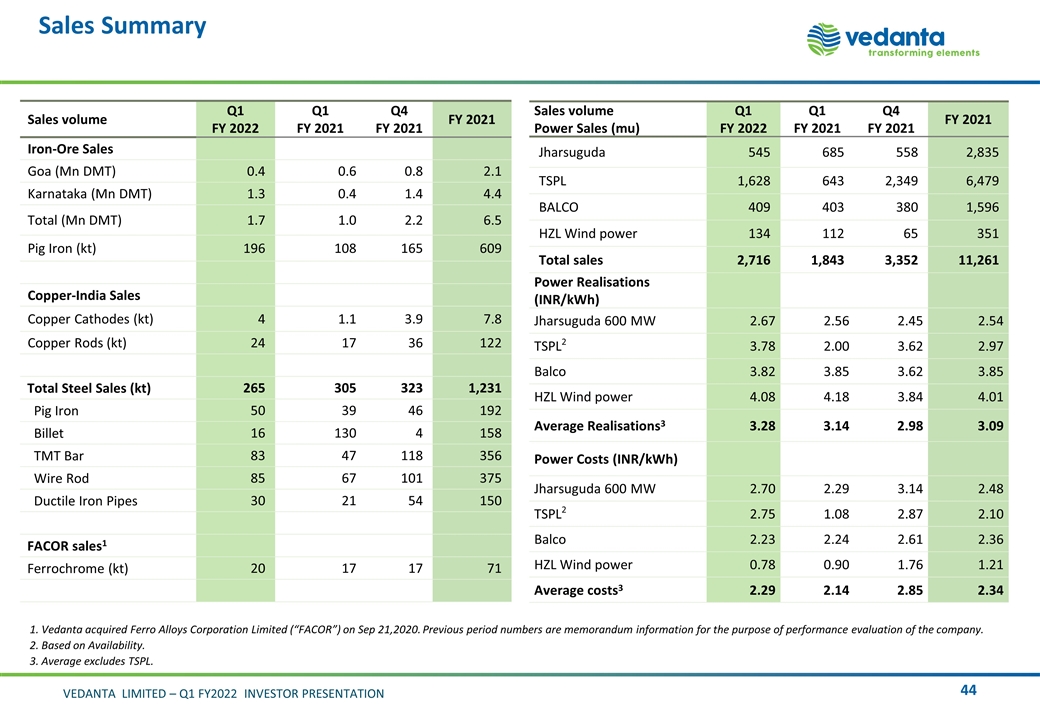

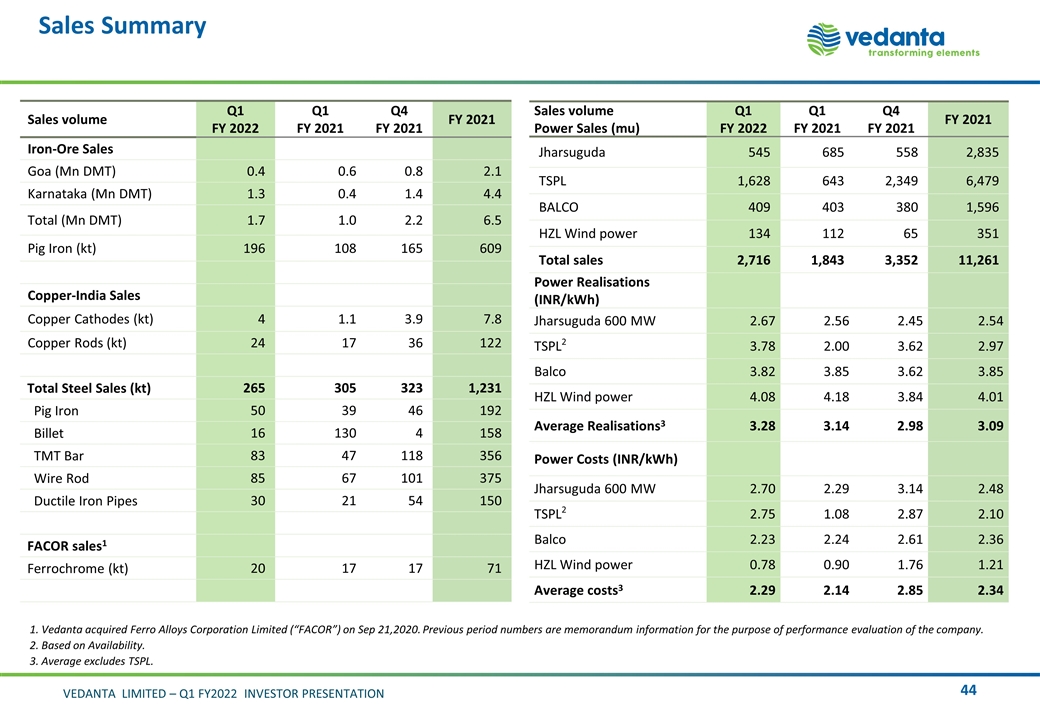

Sales Summary Sales volume Q1 FY 2022 Q1 FY 2021 Q4 FY 2021 FY 2021 Iron-Ore Sales Goa (Mn DMT) 0.4 0.6 0.8 2.1 Karnataka (Mn DMT) 1.3 0.4 1.4 4.4 Total (Mn DMT) 1.7 1.0 2.2 6.5 Pig Iron (kt) 196 108 165 609 Copper-India Sales Copper Cathodes (kt) 4 1.1 3.9 7.8 Copper Rods (kt) 24 17 36 122 Total Steel Sales (kt) 265 305 323 1,231 Pig Iron 50 39 46 192 Billet 16 130 4 158 TMT Bar 83 47 118 356 Wire Rod 85 67 101 375 Ductile Iron Pipes 30 21 54 150 FACOR sales1 Ferrochrome (kt) 20 17 17 71 Sales volume Power Sales (mu) Q1 FY 2022 Q1 FY 2021 Q4 FY 2021 FY 2021 Jharsuguda 545 685 558 2,835 TSPL 1,628 643 2,349 6,479 BALCO 409 403 380 1,596 HZL Wind power 134 112 65 351 Total sales 2,716 1,843 3,352 11,261 Power Realisations (INR/kWh) Jharsuguda 600 MW 2.67 2.56 2.45 2.54 TSPL2 3.78 2.00 3.62 2.97 Balco 3.82 3.85 3.62 3.85 HZL Wind power 4.08 4.18 3.84 4.01 Average Realisations3 3.28 3.14 2.98 3.09 Power Costs (INR/kWh) Jharsuguda 600 MW 2.70 2.29 3.14 2.48 TSPL2 2.75 1.08 2.87 2.10 Balco 2.23 2.24 2.61 2.36 HZL Wind power 0.78 0.90 1.76 1.21 Average costs3 2.29 2.14 2.85 2.34 1. Vedanta acquired Ferro Alloys Corporation Limited (“FACOR”) on Sep 21,2020. Previous period numbers are memorandum information for the purpose of performance evaluation of the company. 2. Based on Availability. 3. Average excludes TSPL.

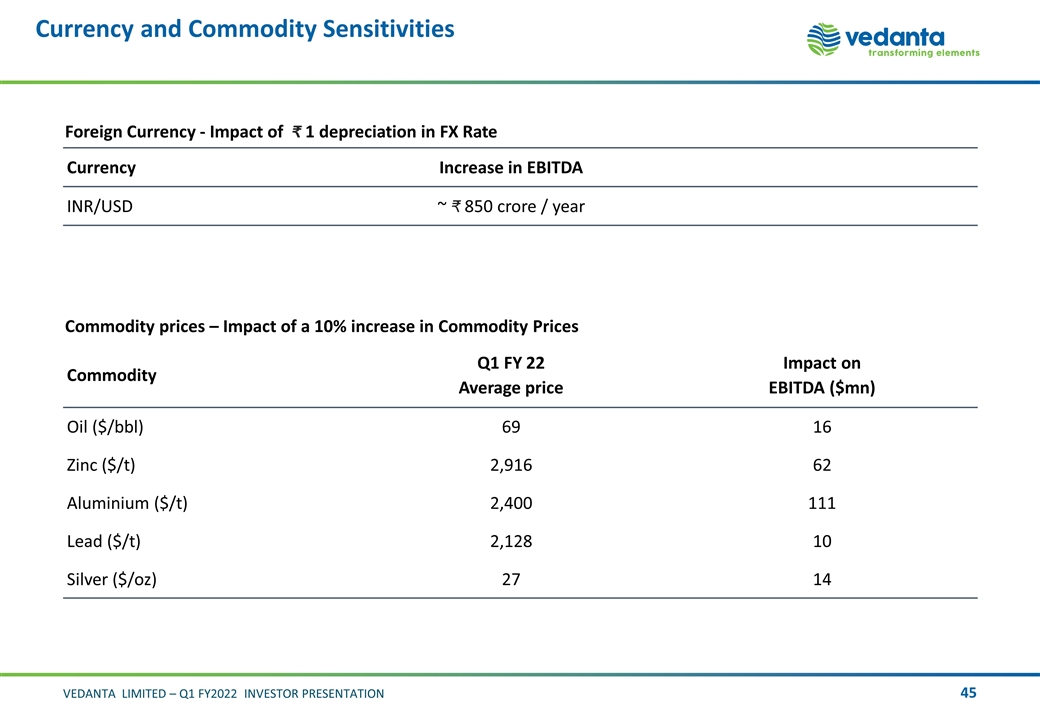

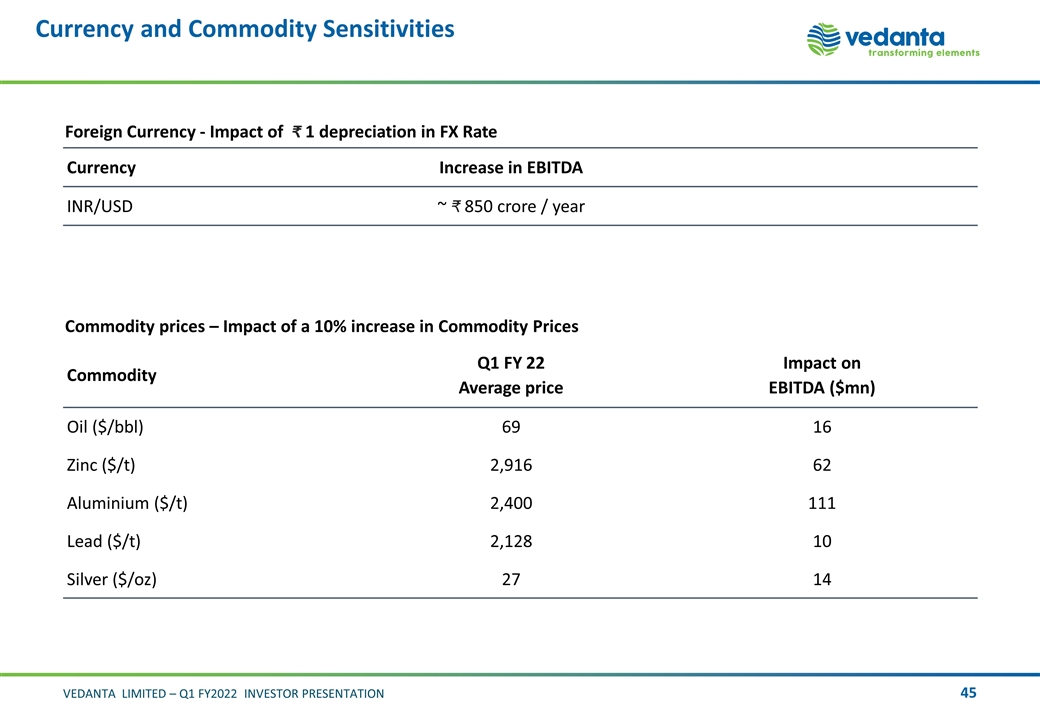

Currency and Commodity Sensitivities Commodity prices – Impact of a 10% increase in Commodity Prices Commodity Q1 FY 22 Average price Impact on EBITDA ($mn) Oil ($/bbl) 69 16 Zinc ($/t) 2,916 62 Aluminium ($/t) 2,400 111 Lead ($/t) 2,128 10 Silver ($/oz) 27 14 Foreign Currency - Impact of ₹ 1 depreciation in FX Rate Currency Increase in EBITDA INR/USD ~ 850 crore / year

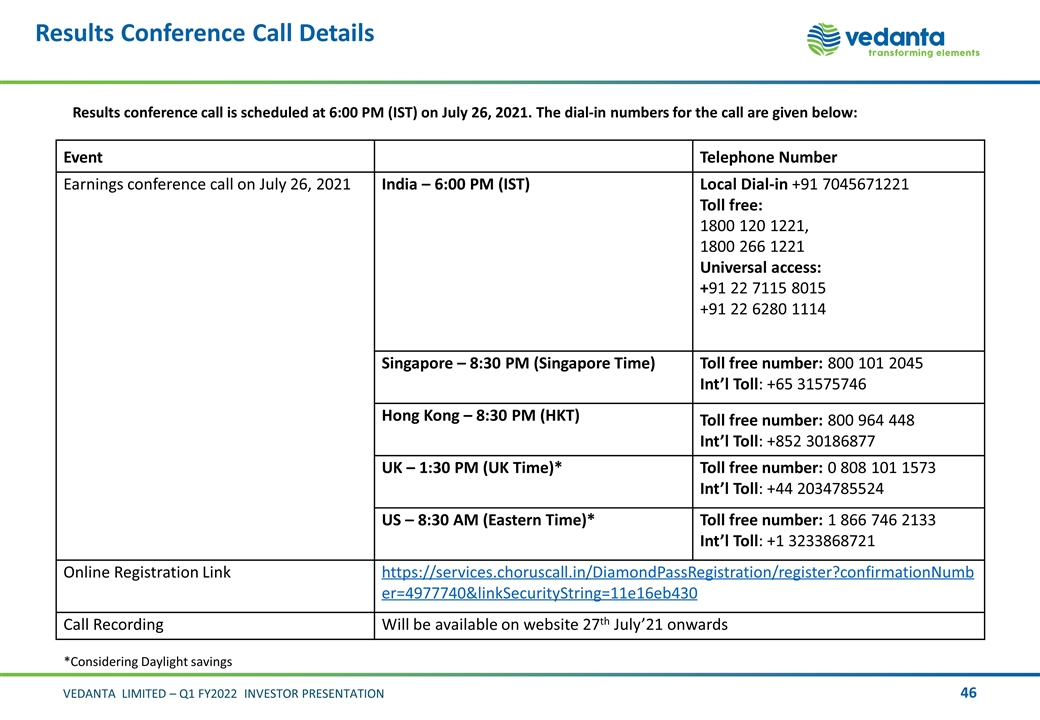

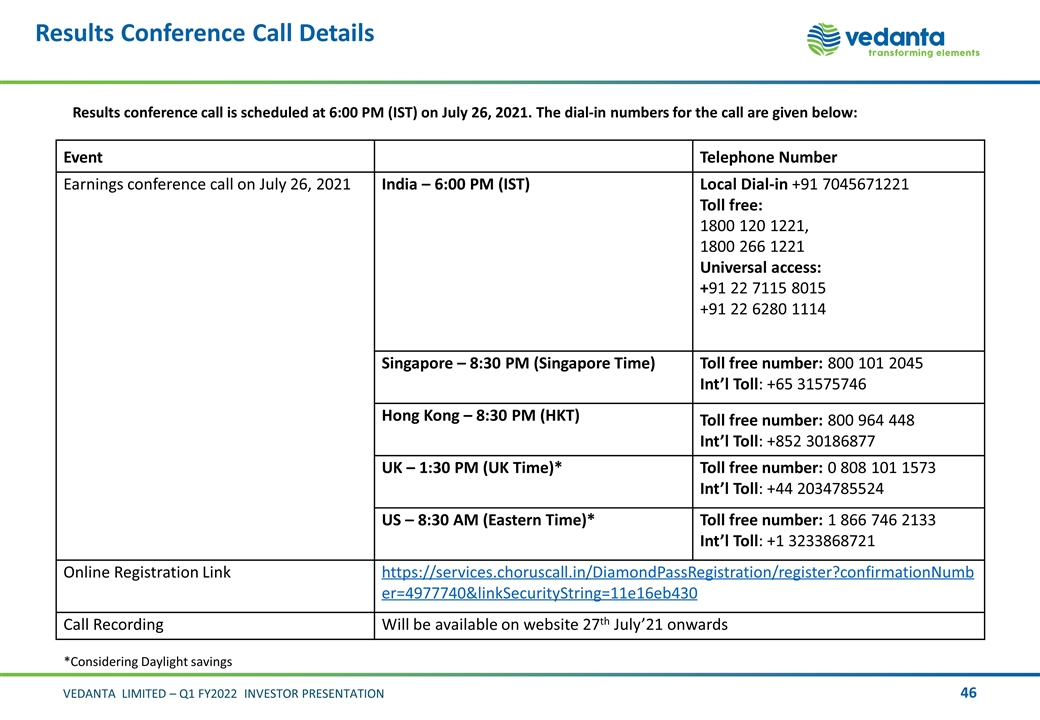

Results Conference Call Details Results conference call is scheduled at 6:00 PM (IST) on July 26, 2021. The dial-in numbers for the call are given below: Event Telephone Number Earnings conference call on July 26, 2021 India – 6:00 PM (IST) Local Dial-in +91 7045671221 Toll free: 1800 120 1221, 1800 266 1221 Universal access: +91 22 7115 8015 +91 22 6280 1114 Singapore – 8:30 PM (Singapore Time) Toll free number: 800 101 2045 Int’l Toll: +65 31575746 Hong Kong – 8:30 PM (HKT) Toll free number: 800 964 448 Int’l Toll: +852 30186877 UK – 1:30 PM (UK Time)* Toll free number: 0 808 101 1573 Int’l Toll: +44 2034785524 US – 8:30 AM (Eastern Time)* Toll free number: 1 866 746 2133 Int’l Toll: +1 3233868721 Online Registration Link https://services.choruscall.in/DiamondPassRegistration/register?confirmationNumber=4977740&linkSecurityString=11e16eb430 Call Recording Will be available on website 27th July’21 onwards *Considering Daylight savings