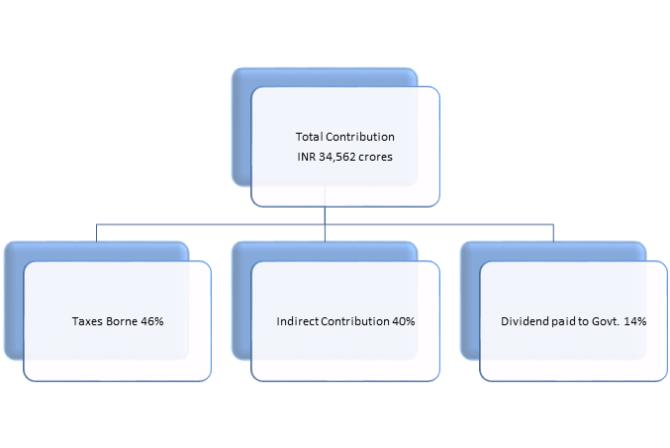

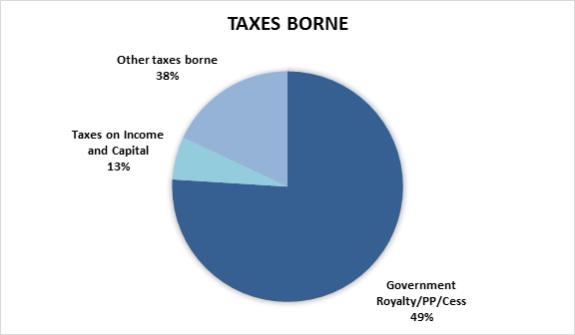

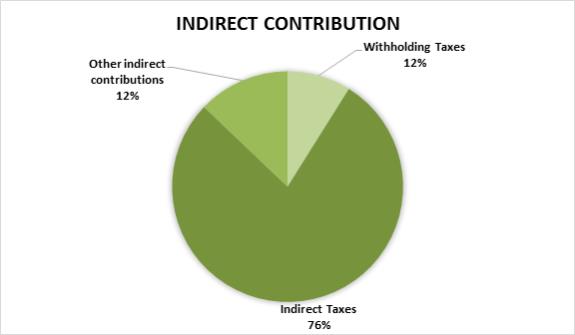

For the purpose of preparation of this table, we have shown the tax contributions under two broad categories of taxes i.e. Taxes borne and Indirect Contributions.

| | • | | Taxes borne primarily comprise Corporate income tax, royalty related tax payments, production entitlements i.e. profit oil and other material payments made to the Government such as production based Oil Cess, Stamp Duty Payments, Levies on Import/Export, Local Municipal taxes, etc. |

| | • | | Indirect Contributions primarily comprise of taxes collected and paid on behalf of our employees and vendors i.e. withholding taxes, payroll taxes (professional taxes), payments of value added taxes on sales and other Social Security Contributions to fund the Social Security program of the governments for the employees etc. |

Government Royalty, Profit Petroleum & Oil Cess - 49% - ₹ 7,880 crores

Government Royalties and oil cess – ₹ 5,044 Crores

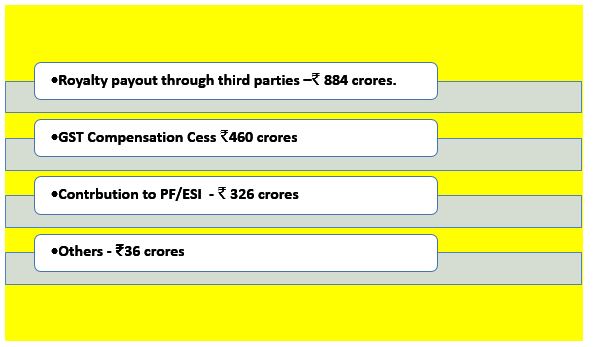

We pay royalties to the state governments of Chhattisgarh, Rajasthan, Andhra Pradesh, Goa and Karnataka in India based on extraction of bauxite, lead-zinc, silver, iron ore, Crude oil and natural gas. The most significant of these is the royalty that HZL is required to pay to the state government of Rajasthan, where all of HZL’s mines are located.

We also pay cess to the GoI (Government of India) . Generally in respect of oil and gas operations, royalty and cess payments are made by the joint operation partners in proportion to their participating interest.

Profit Petroleum- ₹ 2,836 Crores

The GoI is the owner of the hydrocarbons wherein it has assigned the responsibility to the joint operation (Contractor) to explore, develop and produce the hydrocarbons. Contractor is entitled to recover out of Petroleum produced, all the costs incurred according to the Production Sharing Contracts in exploring, developing and producing the hydrocarbons, which is known as “Cost Petroleum”. Excess of revenue (value of hydrocarbons produced) over and above the cost incurred as above, is called “Profit Petroleum”, which is shared between the GoI and Contractor Parties as per procedure laid down in Production Sharing Contracts.

Taxes on Income and capital – 13% -₹ 2,097 crores

Profits of companies in India are subject to either regular income tax or Minimum Alternate Tax (“MAT”), whichever is greater. Regular Income tax on Indian companies is charged at a statutory rate of 30.0% plus a surcharge of 12.0% on the tax and has an additional health and education cess of 4.0% on the tax including surcharge, which results in an effective statutory tax rate of 34.944%.

The effective MAT rate during the year for Indian companies was 17.47% . The excess of amounts paid as MAT over the regular income tax amount during the year may be carried forward and applied towards regular income taxes payable in any of the succeeding fifteen years subject to certain conditions.

16