VEDANTA LIMITED INVESTOR PRESENTATION 28th July 2022 1QFY23 Earnings Presentation Exhibit 99.4

Cautionary statement and disclaimer The views expressed here may contain information derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness, reasonableness or reliability of this information. Any forward-looking information in this presentation including, without limitation, any tables, charts and/or graphs, has been prepared on the basis of a number of assumptions which may prove to be incorrect. This presentation should not be relied upon as a recommendation or forecast by Vedanta Resources Limited and Vedanta Limited and any of their subsidiaries. Past performance of Vedanta Resources Limited and Vedanta Limited and any of their subsidiaries cannot be relied upon as a guide to future performance. This presentation contains 'forward-looking statements' – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance, and often contain words such as 'expects,' 'anticipates,' 'intends,' 'plans,' 'believes,' 'seeks,' or 'will.' Forward–looking statements by their nature address matters that are, to different degrees, uncertain. For us, uncertainties arise from the behaviour of financial and metals markets including the London Metal Exchange, fluctuations in interest and or exchange rates and metal prices; from future integration of acquired businesses; and from numerous other matters of national, regional and global scale, including those of a environmental, climatic, natural, political, economic, business, competitive or regulatory nature. These uncertainties may cause our actual future results to be materially different that those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements. We caution you that reliance on any forward-looking statement involves risk and uncertainties, and that, although we believe that the assumption on which our forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate and, as a result, the forward-looking statement based on those assumptions could be materially incorrect. This presentation is not intended, and does not, constitute or form part of any offer, invitation or the solicitation of an offer to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of, any securities in Vedanta Resources Limited and Vedanta Limited and any of their subsidiaries or undertakings or any other invitation or inducement to engage in investment activities, nor shall this presentation (or any part of it) nor the fact of its distribution form the basis of, or be relied on in connection with, any contract or investment decision.

VEDANTA LIMITED INVESTOR PRESENTATION 1QFY23 1QFY23 Review and Business Update Sunil Duggal Group CEO & Chief Safety Officer

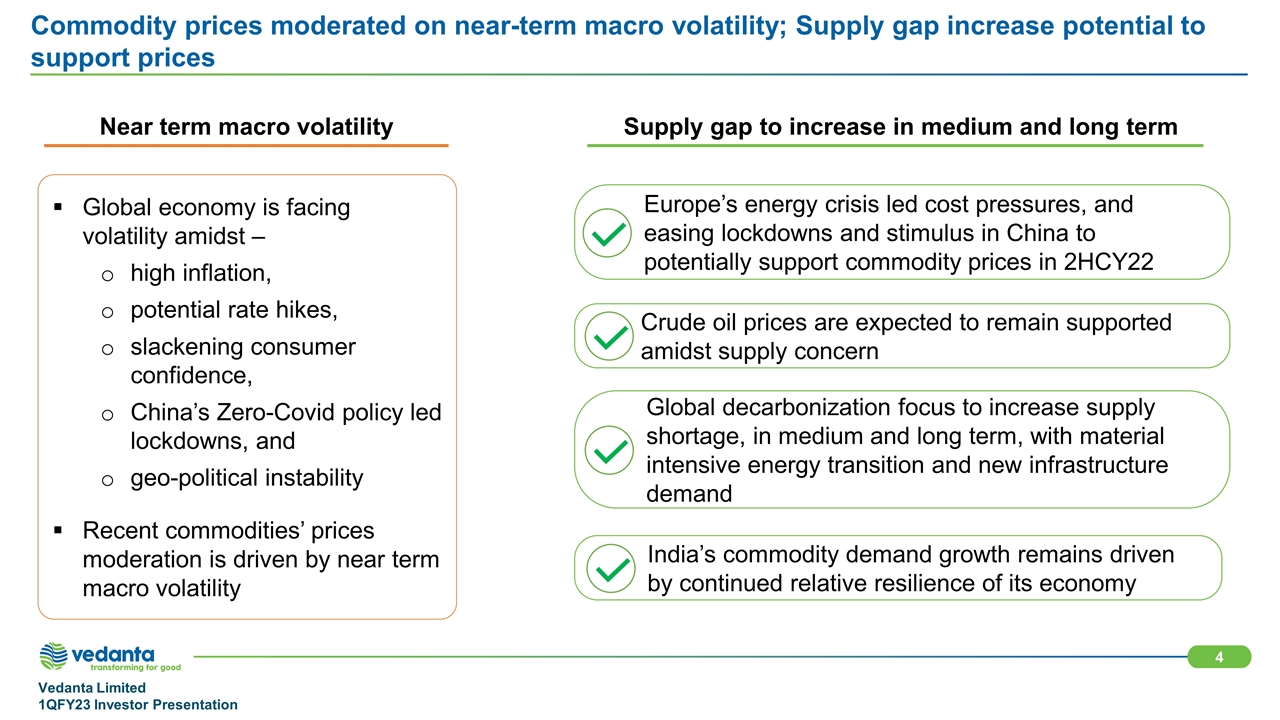

Near term macro volatility Supply gap to increase in medium and long term Commodity prices moderated on near-term macro volatility; Supply gap increase potential to support prices Global economy is facing volatility amidst – high inflation, potential rate hikes, slackening consumer confidence, China’s Zero-Covid policy led lockdowns, and geo-political instability Recent commodities’ prices moderation is driven by near term macro volatility Europe’s energy crisis led cost pressures, and easing lockdowns and stimulus in China to potentially support commodity prices in 2HCY22 Crude oil prices are expected to remain supported amidst supply concern India’s commodity demand growth remains driven by continued relative resilience of its economy Global decarbonization focus to increase supply shortage, in medium and long term, with material intensive energy transition and new infrastructure demand

Vedanta is uniquely positioned to deliver sustainable value 1 2 3 4 5 6 7 uniquely positioned to deliver sustainable value Well positioned to capitalize on India’s growth and benefit through the cycles with attractive commodity mix World-class natural resources powerhouse with low cost and long-life diversified asset base Focused on digitalization and innovation to drive efficiency and resilience Proven track record of operational excellence with well invested assets Robust financial profile with improving ROCE, increasing cash flow and a stronger balance sheet Committed to ESG leadership in the natural resources sector Disciplined capital allocation framework with emphasis on superior and consistent shareholder returns

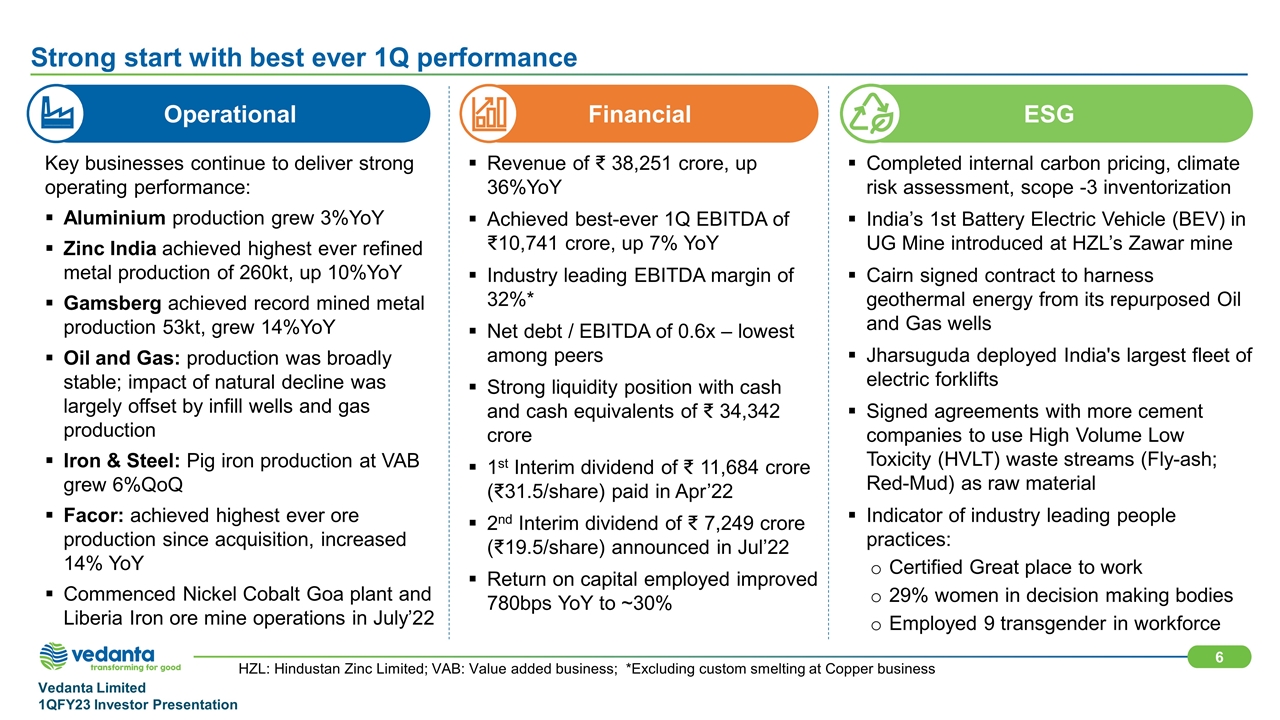

Key businesses continue to deliver strong operating performance: Aluminium production grew 3%YoY Zinc India achieved highest ever refined metal production of 260kt, up 10%YoY Gamsberg achieved record mined metal production 53kt, grew 14%YoY Oil and Gas: production was broadly stable; impact of natural decline was largely offset by infill wells and gas production Iron & Steel: Pig iron production at VAB grew 6%QoQ Facor: achieved highest ever ore production since acquisition, increased 14% YoY Commenced Nickel Cobalt Goa plant and Liberia Iron ore mine operations in July’22 Revenue of ₹ 38,251 crore, up 36%YoY Achieved best-ever 1Q EBITDA of 10,741 crore, up 7% YoY Industry leading EBITDA margin of 32%* Net debt / EBITDA of 0.6x – lowest among peers Strong liquidity position with cash and cash equivalents of 34,342 crore 1st Interim dividend of ₹ 11,684 crore (₹31.5/share) paid in Apr’22 2nd Interim dividend of ₹ 7,249 crore (₹19.5/share) announced in Jul’22 Return on capital employed improved 780bps YoY to ~30% Completed internal carbon pricing, climate risk assessment, scope -3 inventorization India’s 1st Battery Electric Vehicle (BEV) in UG Mine introduced at HZL’s Zawar mine Cairn signed contract to harness geothermal energy from its repurposed Oil and Gas wells Jharsuguda deployed India's largest fleet of electric forklifts Signed agreements with more cement companies to use High Volume Low Toxicity (HVLT) waste streams (Fly-ash; Red-Mud) as raw material Indicator of industry leading people practices: Certified Great place to work 29% women in decision making bodies Employed 9 transgender in workforce Operational HZL: Hindustan Zinc Limited; VAB: Value added business; *Excluding custom smelting at Copper business Strong start with best ever 1Q performance Financial ESG

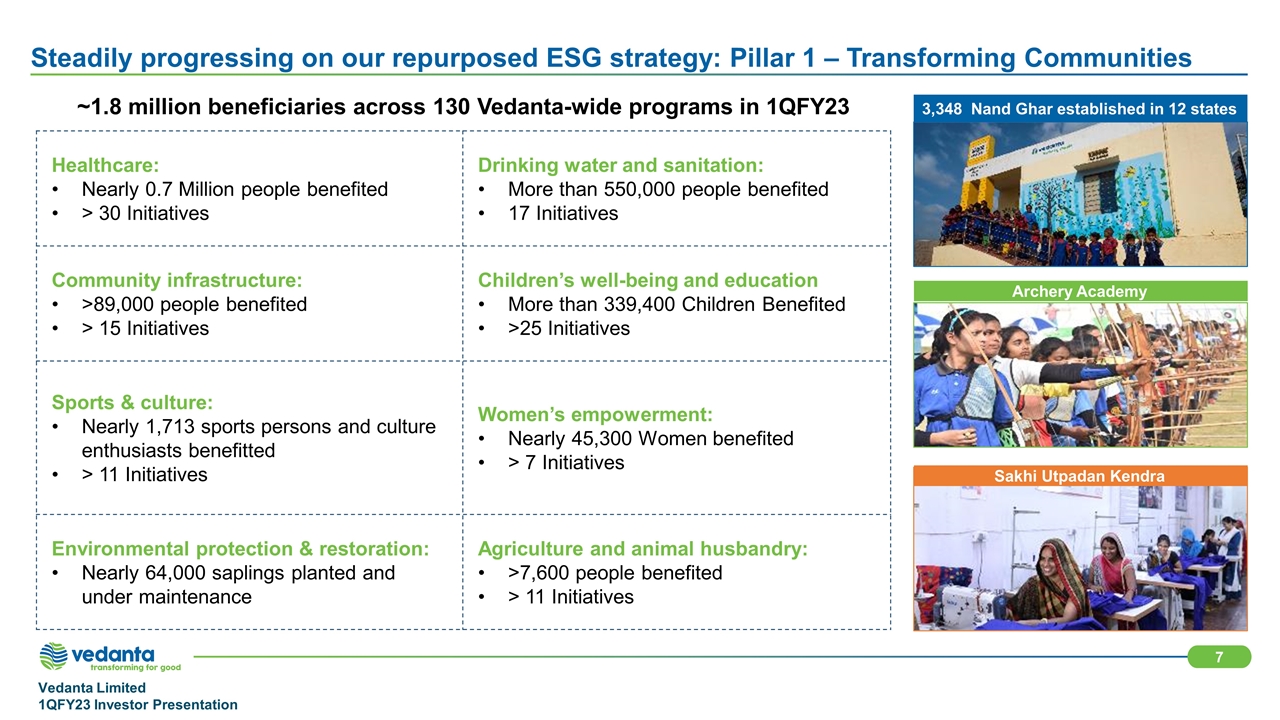

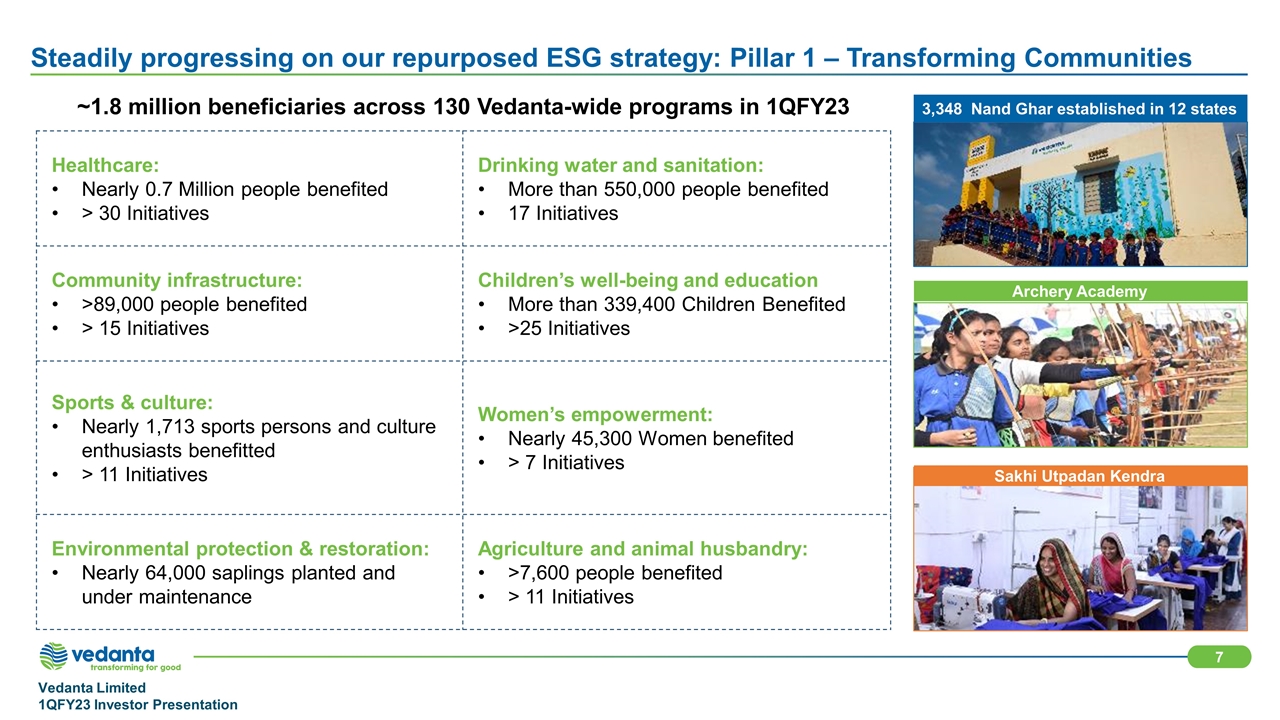

Steadily progressing on our repurposed ESG strategy: Pillar 1 – Transforming Communities Healthcare: Nearly 0.7 Million people benefited > 30 Initiatives Drinking water and sanitation: More than 550,000 people benefited 17 Initiatives Community infrastructure: >89,000 people benefited > 15 Initiatives Children’s well-being and education More than 339,400 Children Benefited >25 Initiatives Sports & culture: Nearly 1,713 sports persons and culture enthusiasts benefitted > 11 Initiatives Women’s empowerment: Nearly 45,300 Women benefited > 7 Initiatives Environmental protection & restoration: Nearly 64,000 saplings planted and under maintenance Agriculture and animal husbandry: >7,600 people benefited > 11 Initiatives ~1.8 million beneficiaries across 130 Vedanta-wide programs in 1QFY23 3,348 Nand Ghar established in 12 states Sakhi Utpadan Kendra Archery Academy

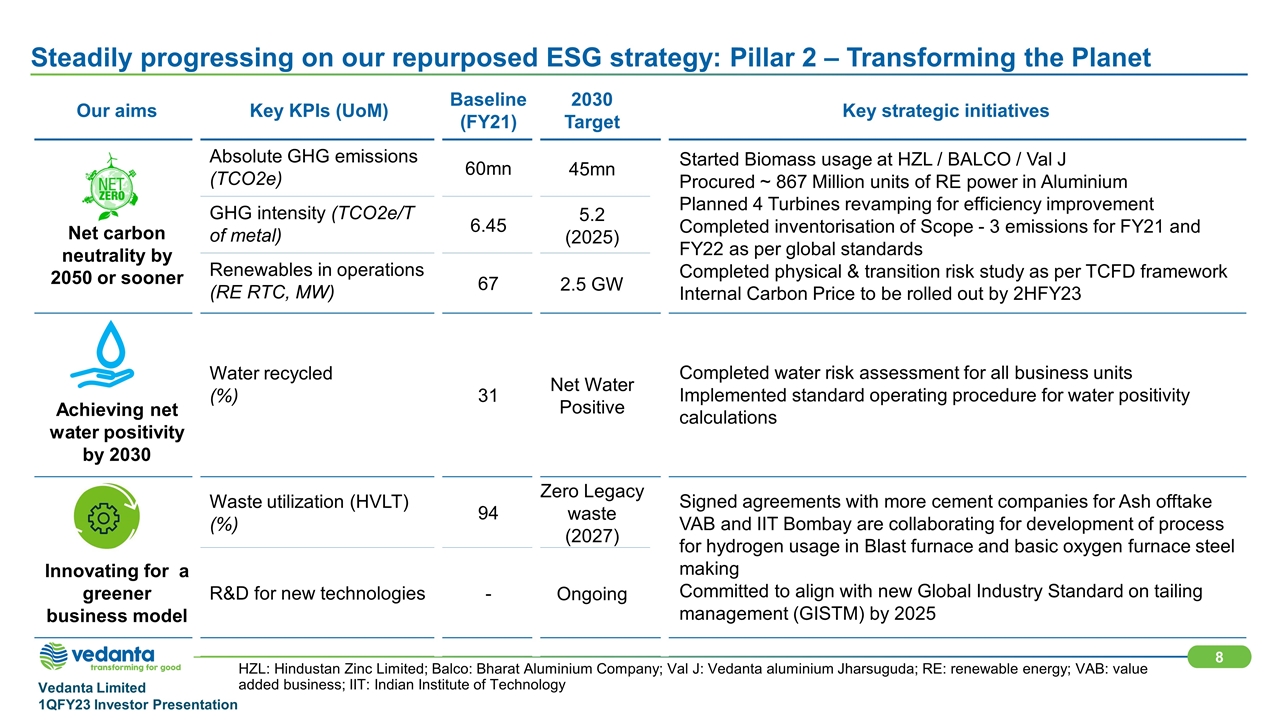

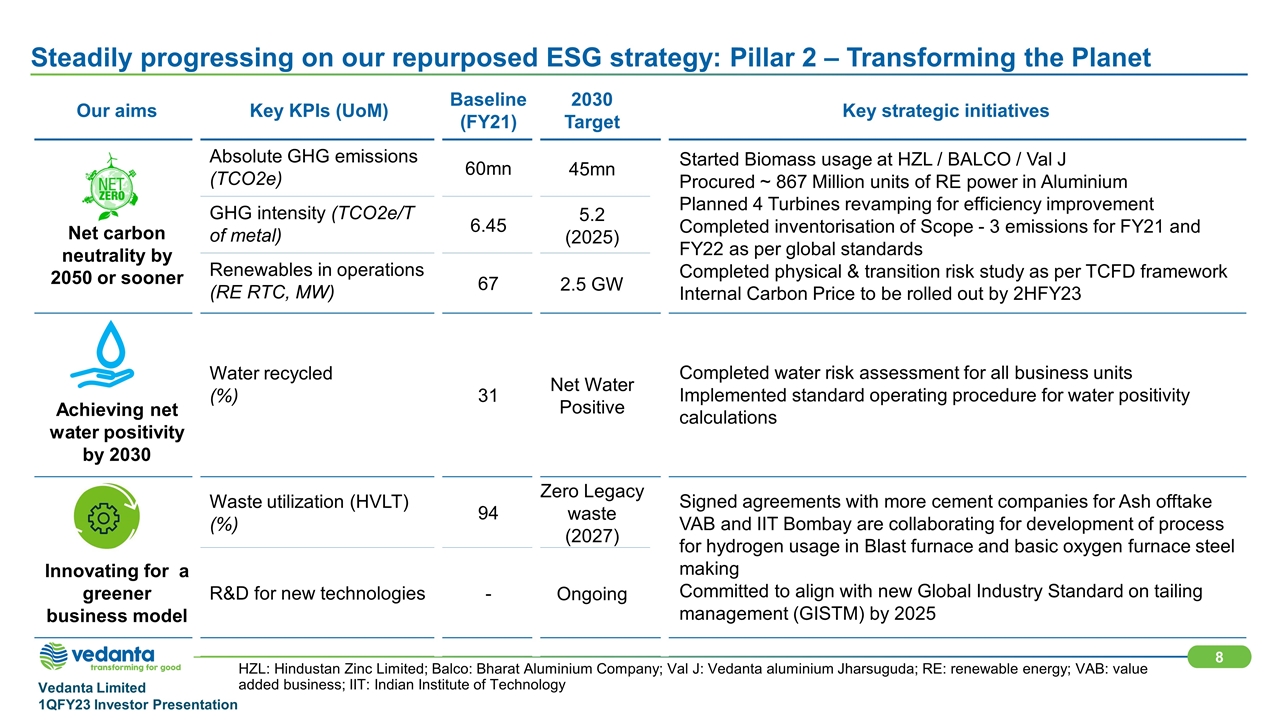

Our aims Key KPIs (UoM) Baseline (FY21) 2030 Target Key strategic initiatives Net carbon neutrality by 2050 or sooner Absolute GHG emissions (TCO2e) 60mn 45mn Started Biomass usage at HZL / BALCO / Val J Procured ~ 867 Million units of RE power in Aluminium Planned 4 Turbines revamping for efficiency improvement Completed inventorisation of Scope - 3 emissions for FY21 and FY22 as per global standards Completed physical & transition risk study as per TCFD framework Internal Carbon Price to be rolled out by 2HFY23 GHG intensity (TCO2e/T of metal) 6.45 5.2 (2025) Renewables in operations (RE RTC, MW) 67 2.5 GW Achieving net water positivity by 2030 Water recycled (%) 31 Net Water Positive Completed water risk assessment for all business units Implemented standard operating procedure for water positivity calculations Innovating for a greener business model Waste utilization (HVLT) (%) 94 Zero Legacy waste (2027) Signed agreements with more cement companies for Ash offtake VAB and IIT Bombay are collaborating for development of process for hydrogen usage in Blast furnace and basic oxygen furnace steel making Committed to align with new Global Industry Standard on tailing management (GISTM) by 2025 R&D for new technologies - Ongoing HZL: Hindustan Zinc Limited; Balco: Bharat Aluminium Company; Val J: Vedanta aluminium Jharsuguda; RE: renewable energy; VAB: value added business; IIT: Indian Institute of Technology Steadily progressing on our repurposed ESG strategy: Pillar 2 – Transforming the Planet

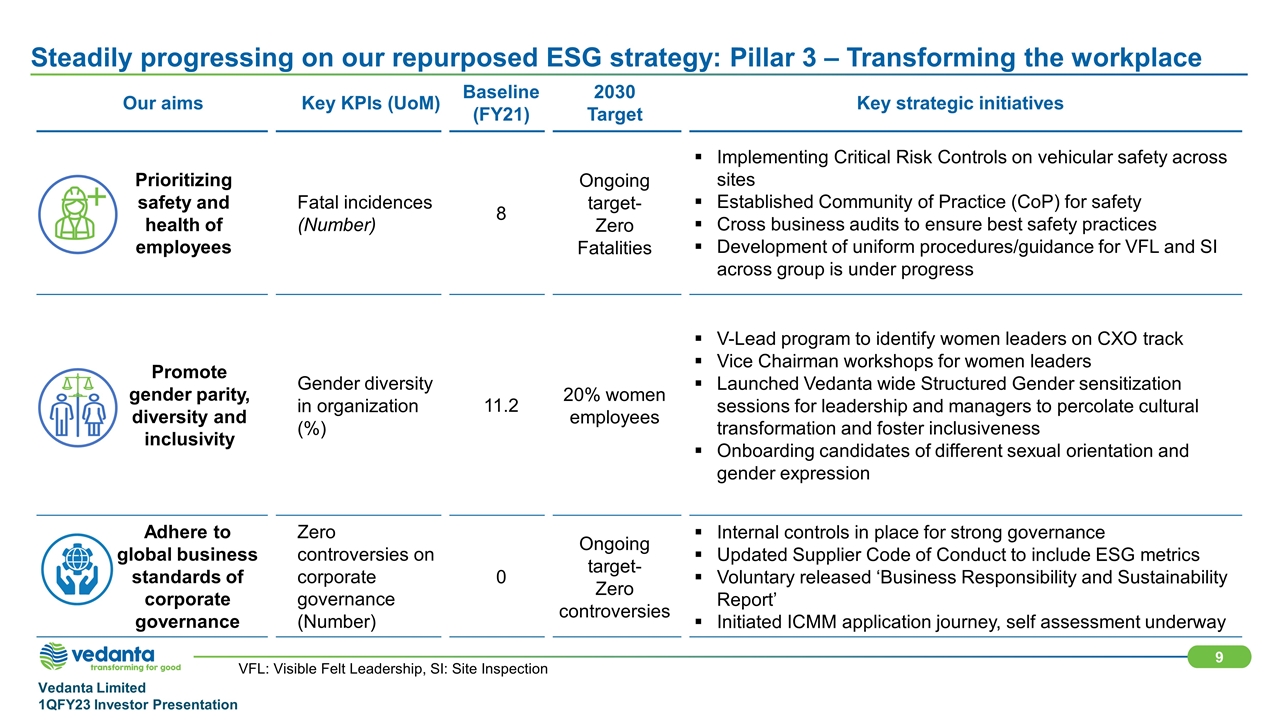

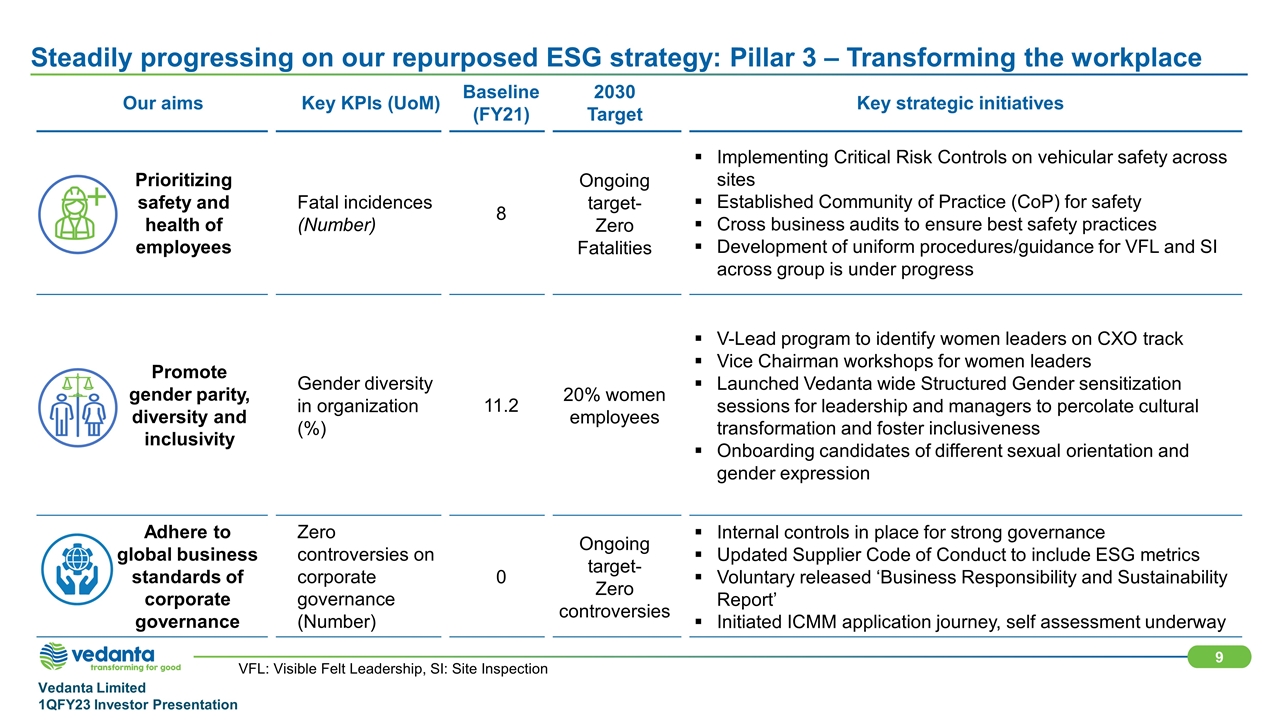

Our aims Key KPIs (UoM) Baseline (FY21) 2030 Target Key strategic initiatives Prioritizing safety and health of employees Fatal incidences (Number) 8 Ongoing target- Zero Fatalities Implementing Critical Risk Controls on vehicular safety across sites Established Community of Practice (CoP) for safety Cross business audits to ensure best safety practices Development of uniform procedures/guidance for VFL and SI across group is under progress Promote gender parity, diversity and inclusivity Gender diversity in organization (%) 11.2 20% women employees V-Lead program to identify women leaders on CXO track Vice Chairman workshops for women leaders Launched Vedanta wide Structured Gender sensitization sessions for leadership and managers to percolate cultural transformation and foster inclusiveness Onboarding candidates of different sexual orientation and gender expression Adhere to global business standards of corporate governance Zero controversies on corporate governance (Number) 0 Ongoing target- Zero controversies Internal controls in place for strong governance Updated Supplier Code of Conduct to include ESG metrics Voluntary released ‘Business Responsibility and Sustainability Report’ Initiated ICMM application journey, self assessment underway VFL: Visible Felt Leadership, SI: Site Inspection Steadily progressing on our repurposed ESG strategy: Pillar 3 – Transforming the workplace

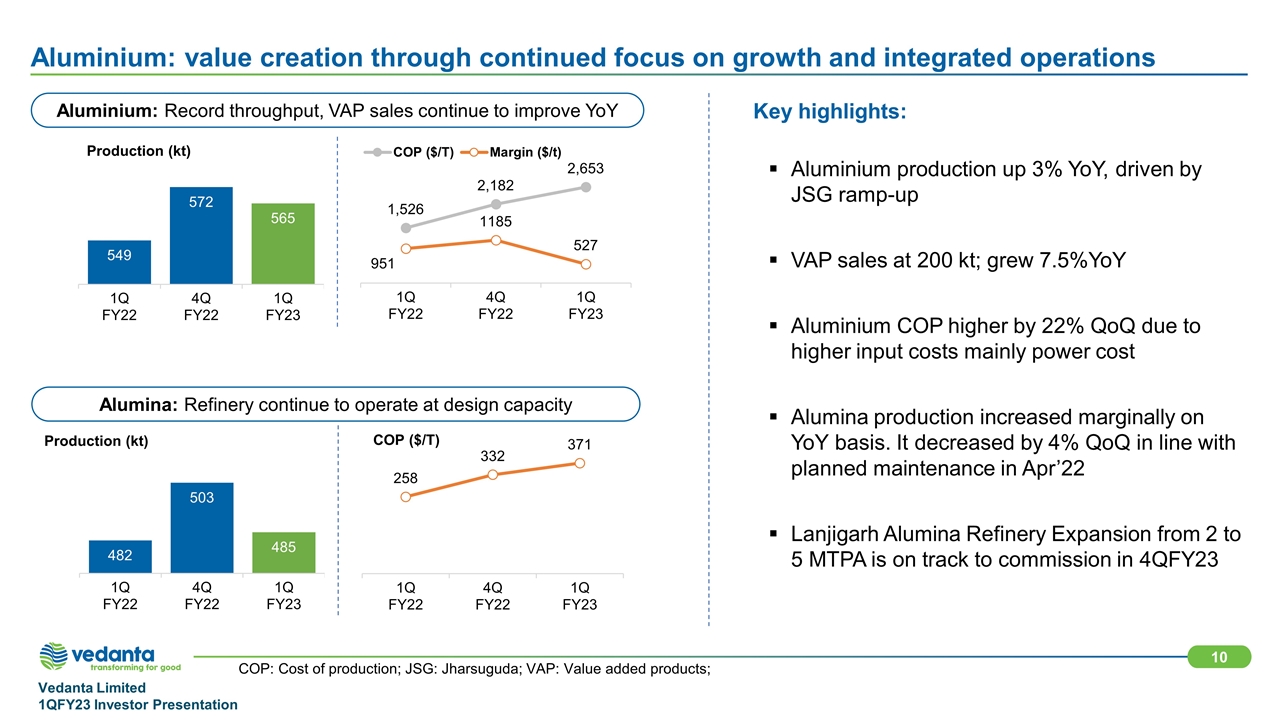

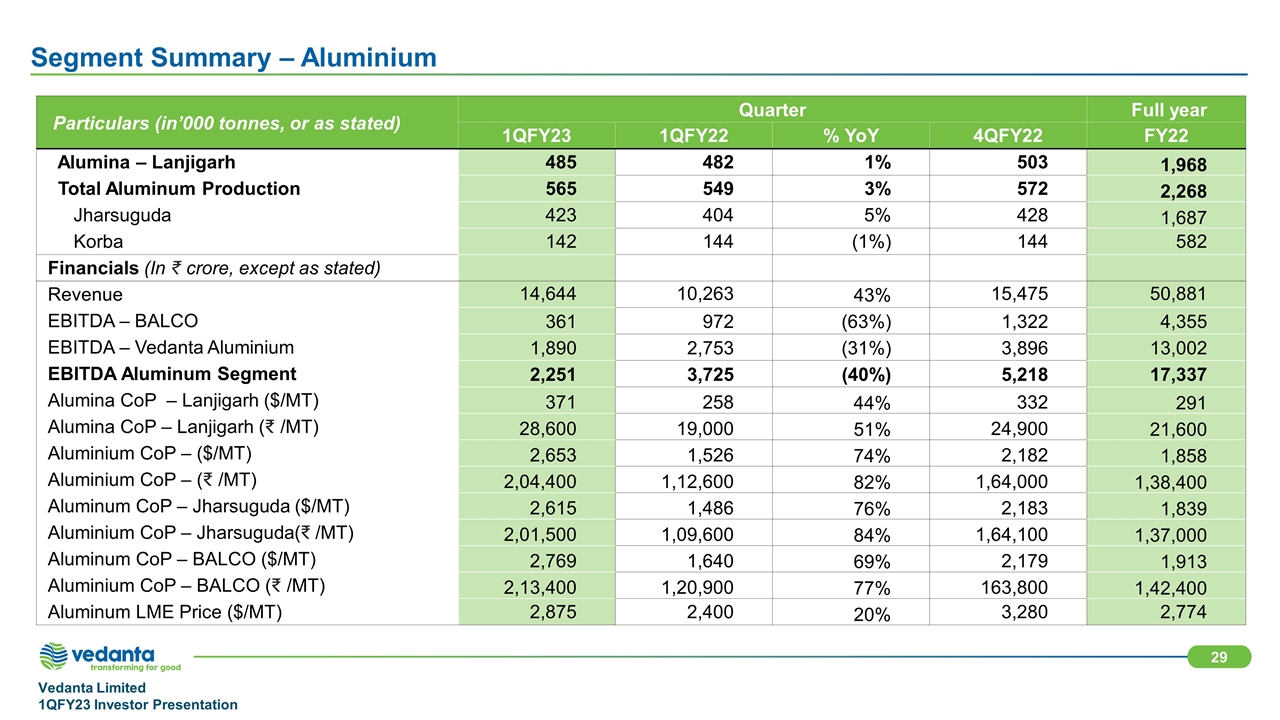

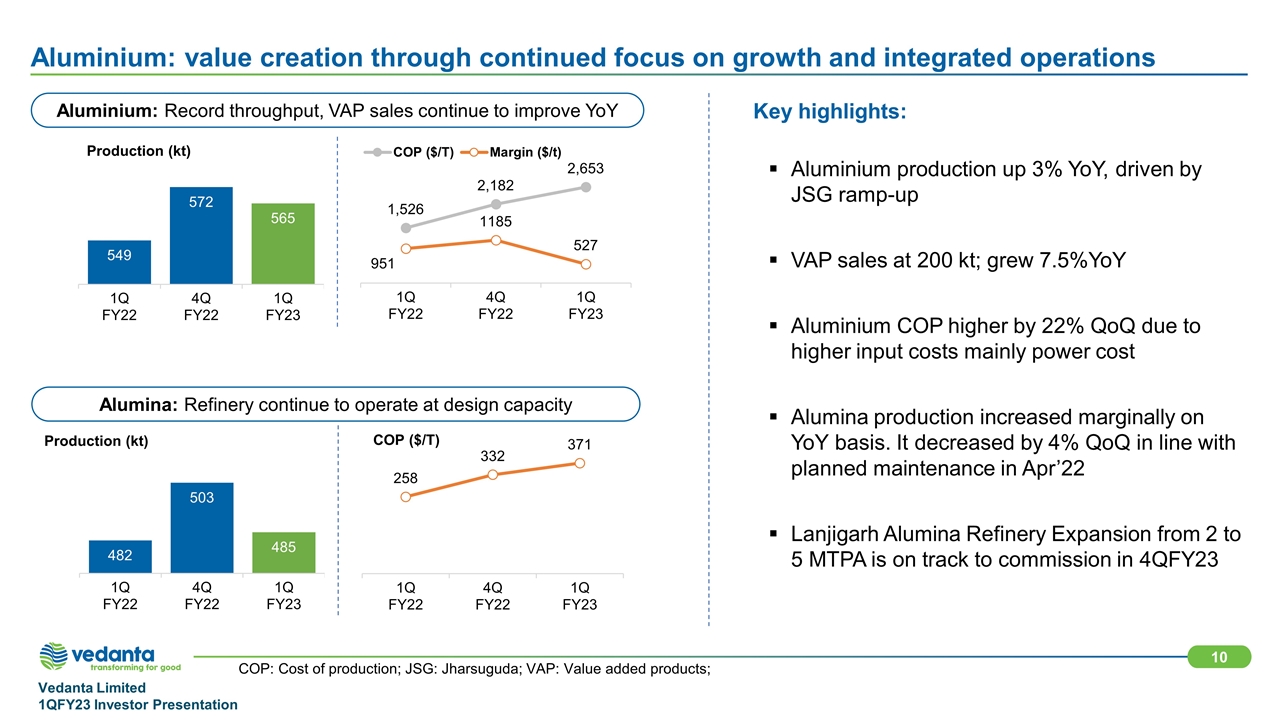

Alumina: Refinery continue to operate at design capacity COP: Cost of production; JSG: Jharsuguda; VAP: Value added products; Aluminium: value creation through continued focus on growth and integrated operations Key highlights: Aluminium production up 3% YoY, driven by JSG ramp-up VAP sales at 200 kt; grew 7.5%YoY Aluminium COP higher by 22% QoQ due to higher input costs mainly power cost Alumina production increased marginally on YoY basis. It decreased by 4% QoQ in line with planned maintenance in Apr’22 Lanjigarh Alumina Refinery Expansion from 2 to 5 MTPA is on track to commission in 4QFY23 Aluminium: Record throughput, VAP sales continue to improve YoY

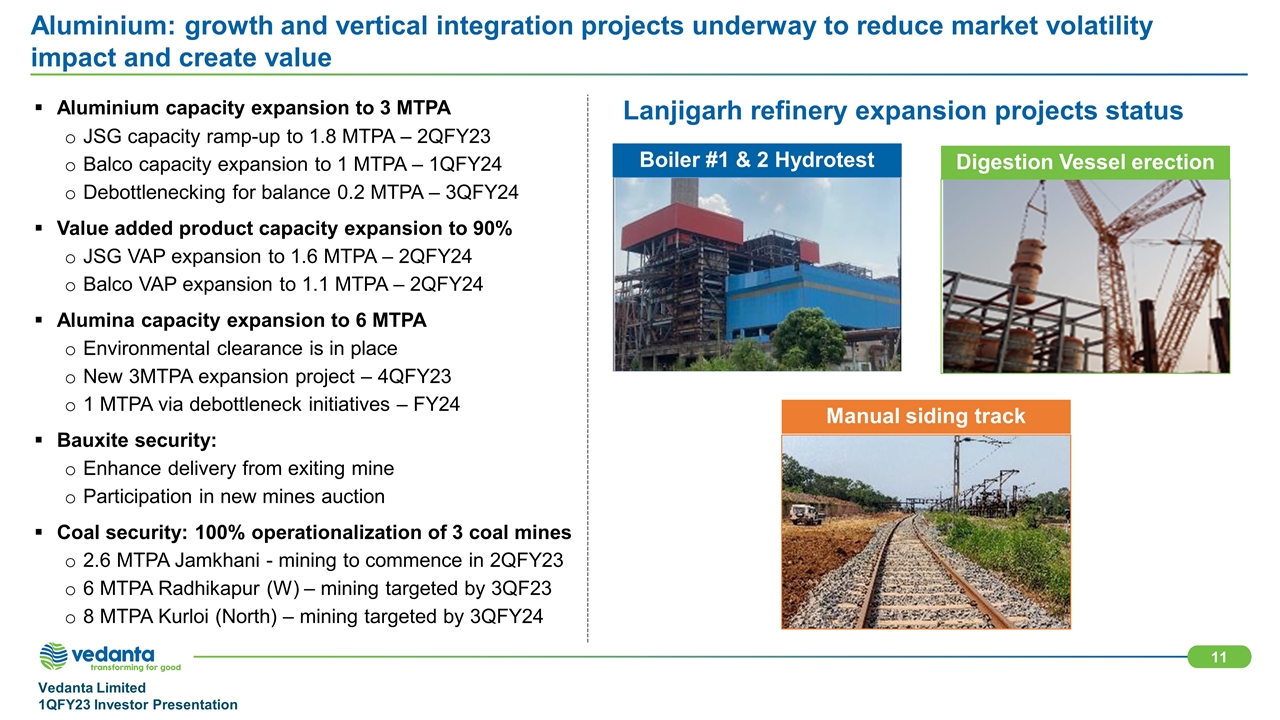

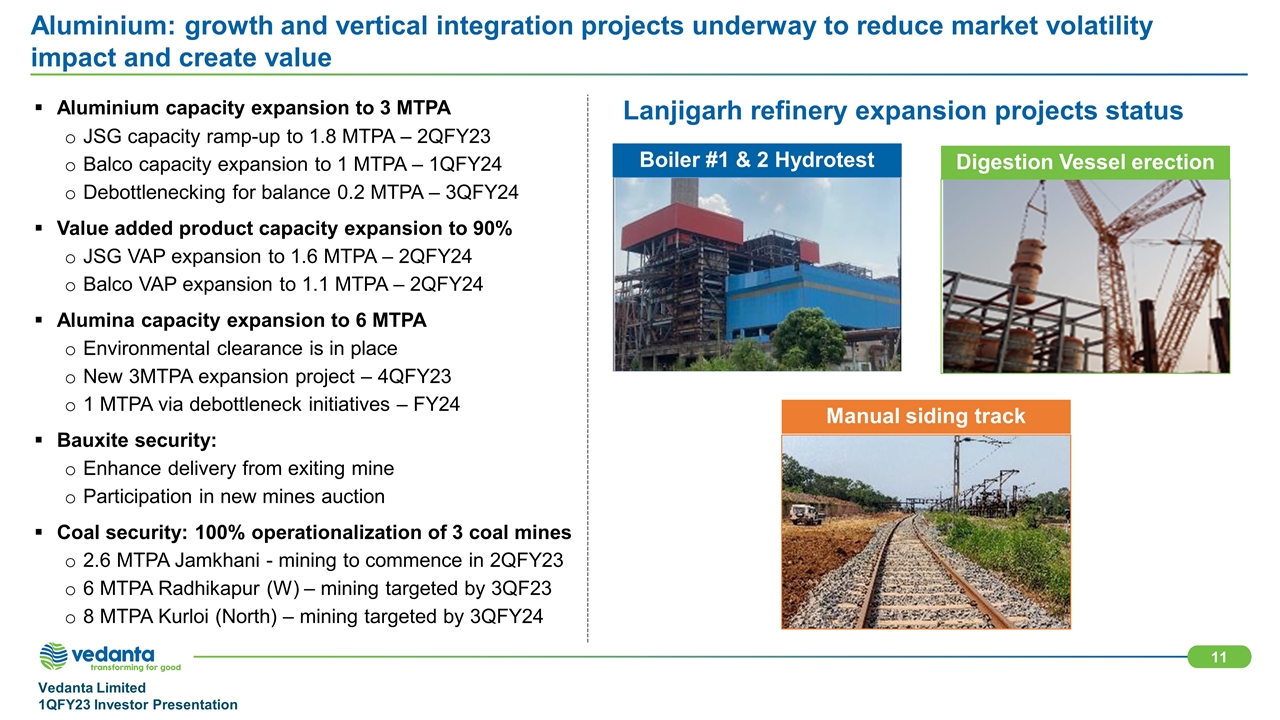

Aluminium: growth and vertical integration projects underway to reduce market volatility impact and create value Aluminium capacity expansion to 3 MTPA JSG capacity ramp-up to 1.8 MTPA – 2QFY23 Balco capacity expansion to 1 MTPA – 1QFY24 Debottlenecking for balance 0.2 MTPA – 3QFY24 Value added product capacity expansion to 90% JSG VAP expansion to 1.6 MTPA – 2QFY24 Balco VAP expansion to 1.1 MTPA – 2QFY24 Alumina capacity expansion to 6 MTPA Environmental clearance is in place New 3MTPA expansion project – 4QFY23 1 MTPA via debottleneck initiatives – FY24 Bauxite security: Enhance delivery from exiting mine Participation in new mines auction Coal security: 100% operationalization of 3 coal mines 2.6 MTPA Jamkhani - mining to commence in 2QFY23 6 MTPA Radhikapur (W) – mining targeted by 3QF23 8 MTPA Kurloi (North) – mining targeted by 3QFY24 Boiler #1 & 2 Hydrotest Digestion Vessel erection Manual siding track Lanjigarh refinery expansion projects status

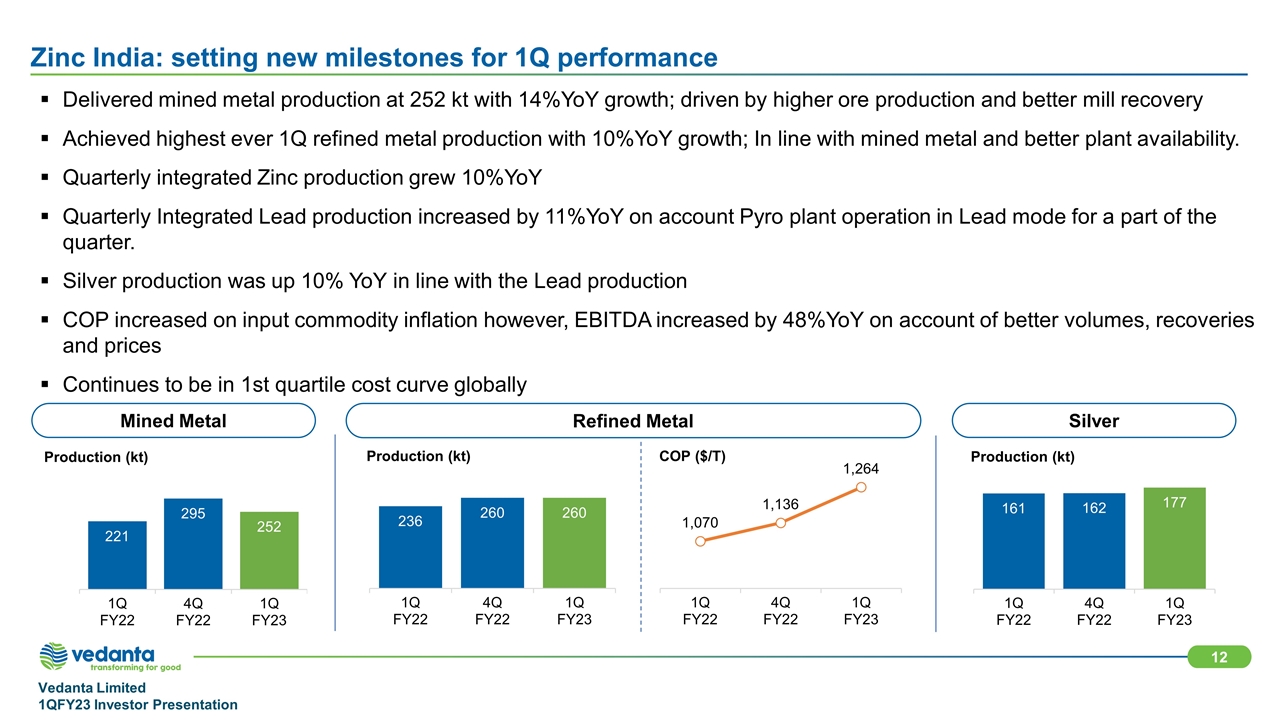

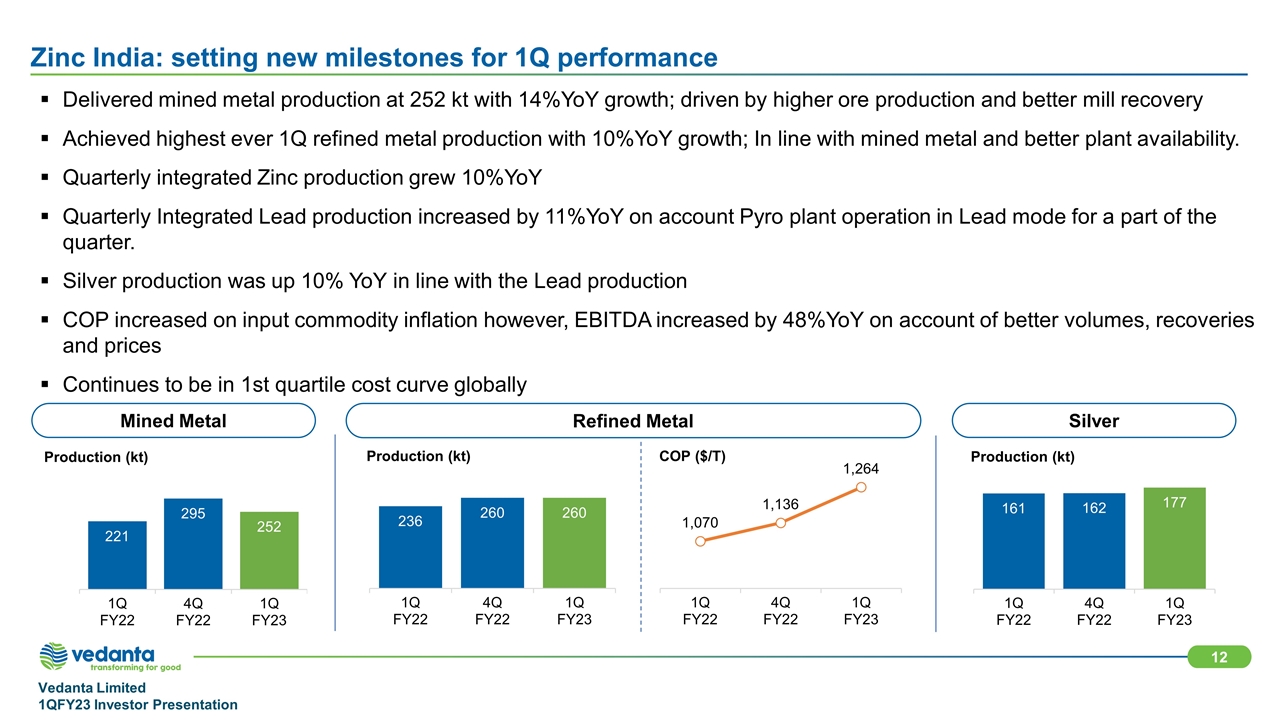

Zinc India: setting new milestones for 1Q performance Mined Metal Refined Metal Silver Delivered mined metal production at 252 kt with 14%YoY growth; driven by higher ore production and better mill recovery Achieved highest ever 1Q refined metal production with 10%YoY growth; In line with mined metal and better plant availability. Quarterly integrated Zinc production grew 10%YoY Quarterly Integrated Lead production increased by 11%YoY on account Pyro plant operation in Lead mode for a part of the quarter. Silver production was up 10% YoY in line with the Lead production COP increased on input commodity inflation however, EBITDA increased by 48%YoY on account of better volumes, recoveries and prices Continues to be in 1st quartile cost curve globally

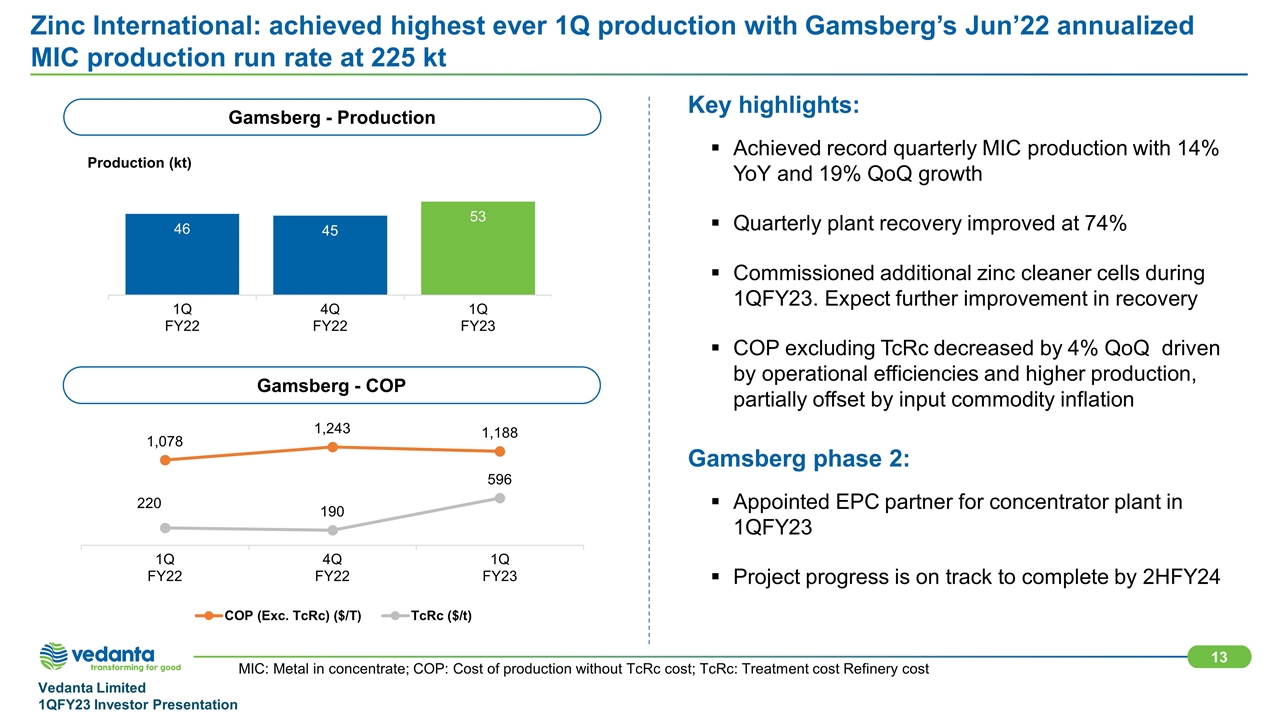

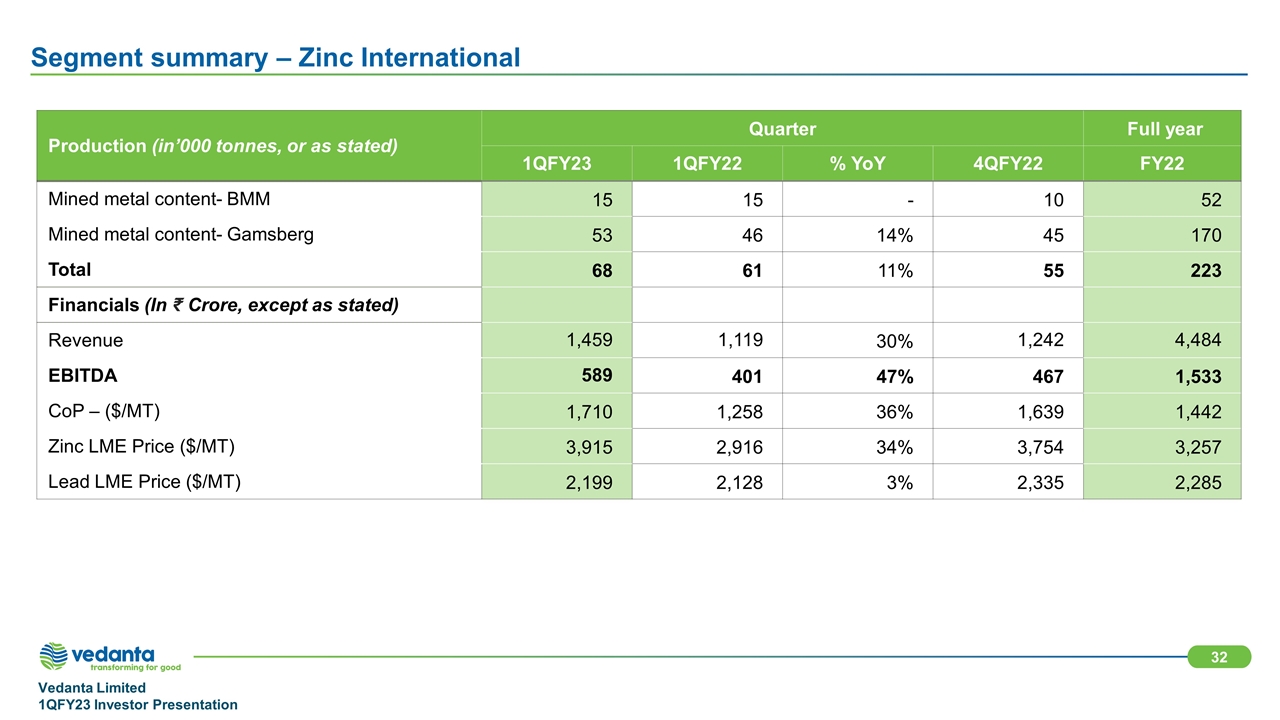

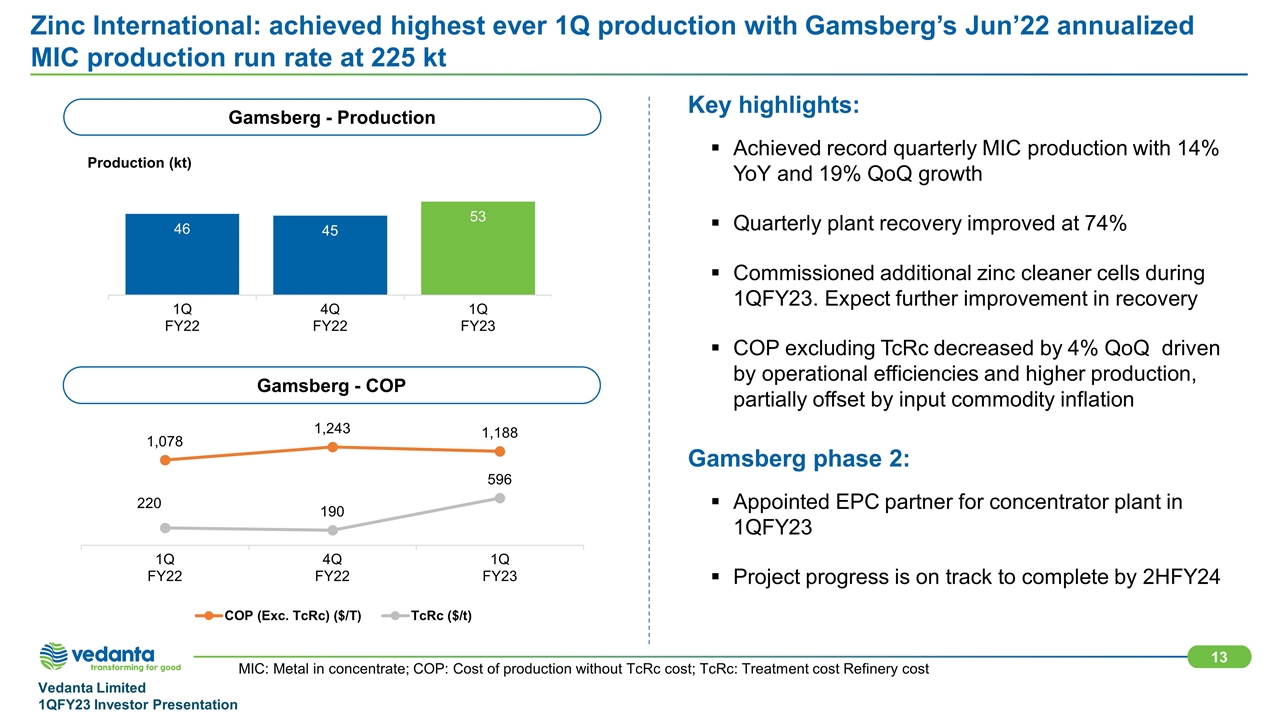

MIC: Metal in concentrate; COP: Cost of production without TcRc cost; TcRc: Treatment cost Refinery cost Gamsberg - Production Gamsberg - COP Key highlights: Achieved record quarterly MIC production with 14% YoY and 19% QoQ growth Quarterly plant recovery improved at 74% Commissioned additional zinc cleaner cells during 1QFY23. Expect further improvement in recovery COP excluding TcRc decreased by 4% QoQ driven by operational efficiencies and higher production, partially offset by input commodity inflation Gamsberg phase 2: Appointed EPC partner for concentrator plant in 1QFY23 Project progress is on track to complete by 2HFY24 Zinc International: achieved highest ever 1Q production with Gamsberg’s Jun’22 annualized MIC production run rate at 225 kt

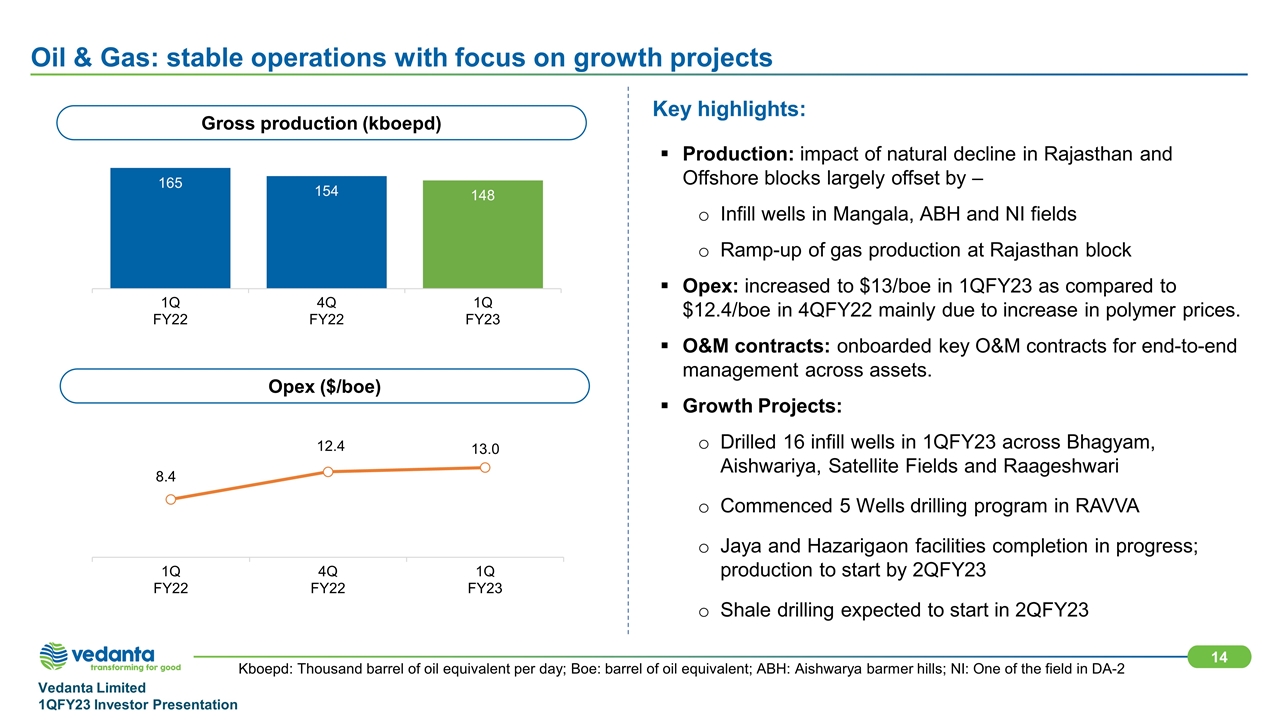

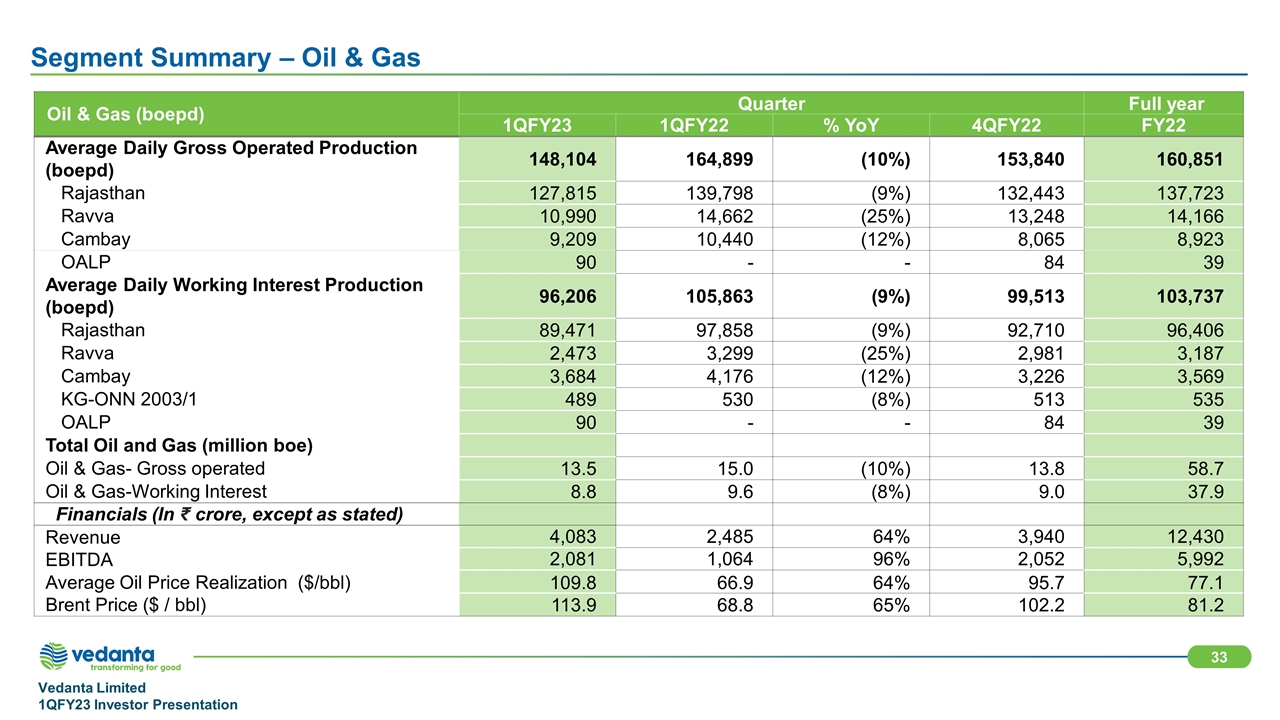

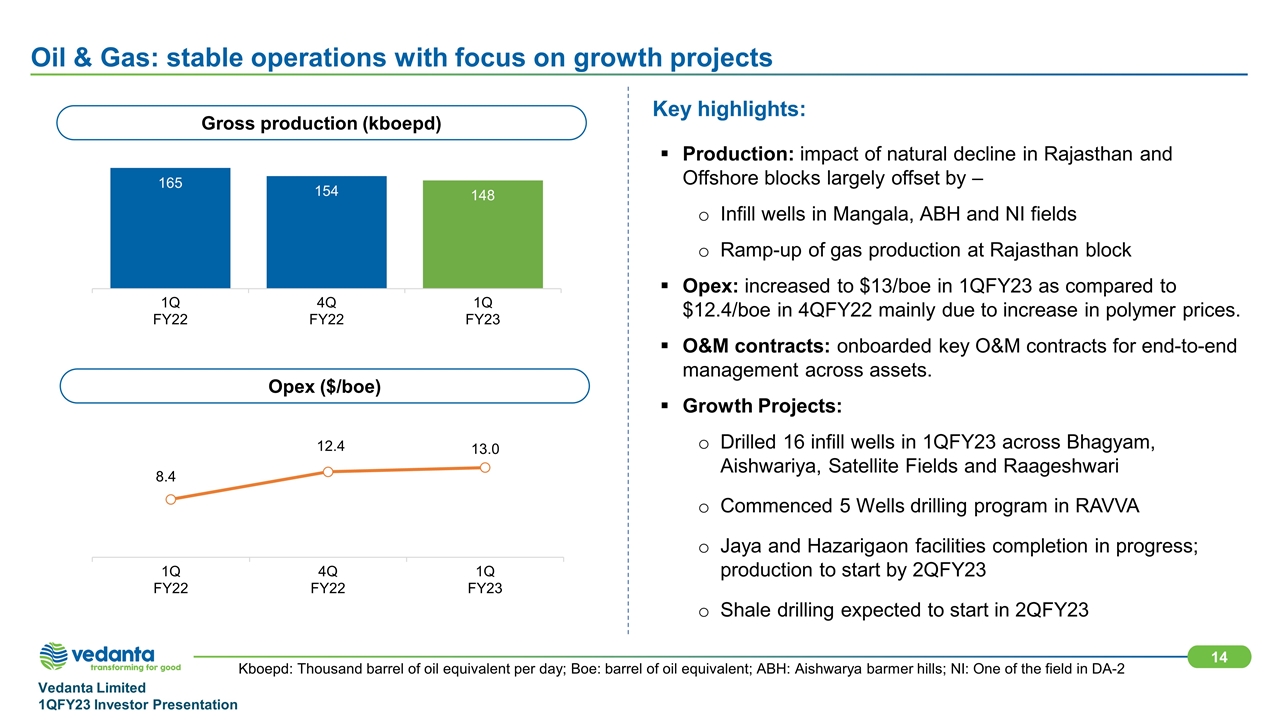

Kboepd: Thousand barrel of oil equivalent per day; Boe: barrel of oil equivalent; ABH: Aishwarya barmer hills; NI: One of the field in DA-2 Oil & Gas: stable operations with focus on growth projects Gross production (kboepd) Opex ($/boe) Key highlights: Production: impact of natural decline in Rajasthan and Offshore blocks largely offset by – Infill wells in Mangala, ABH and NI fields Ramp-up of gas production at Rajasthan block Opex: increased to $13/boe in 1QFY23 as compared to $12.4/boe in 4QFY22 mainly due to increase in polymer prices. O&M contracts: onboarded key O&M contracts for end-to-end management across assets. Growth Projects: Drilled 16 infill wells in 1QFY23 across Bhagyam, Aishwariya, Satellite Fields and Raageshwari Commenced 5 Wells drilling program in RAVVA Jaya and Hazarigaon facilities completion in progress; production to start by 2QFY23 Shale drilling expected to start in 2QFY23

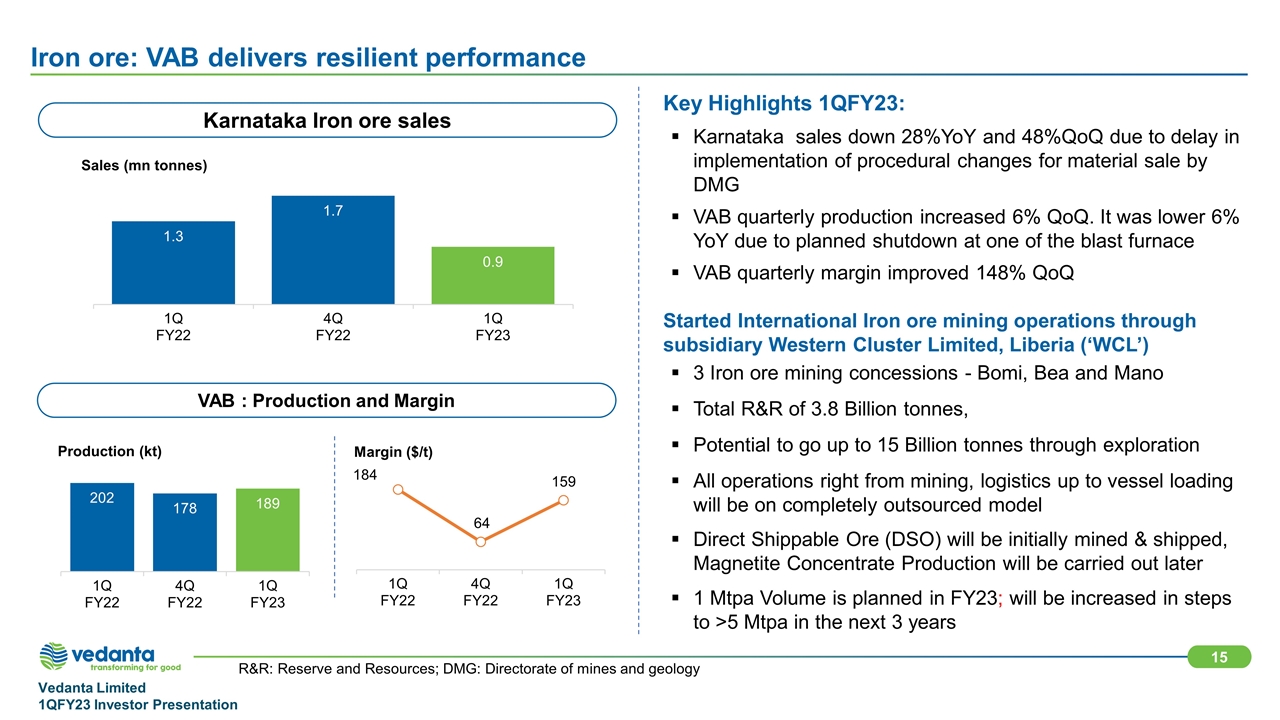

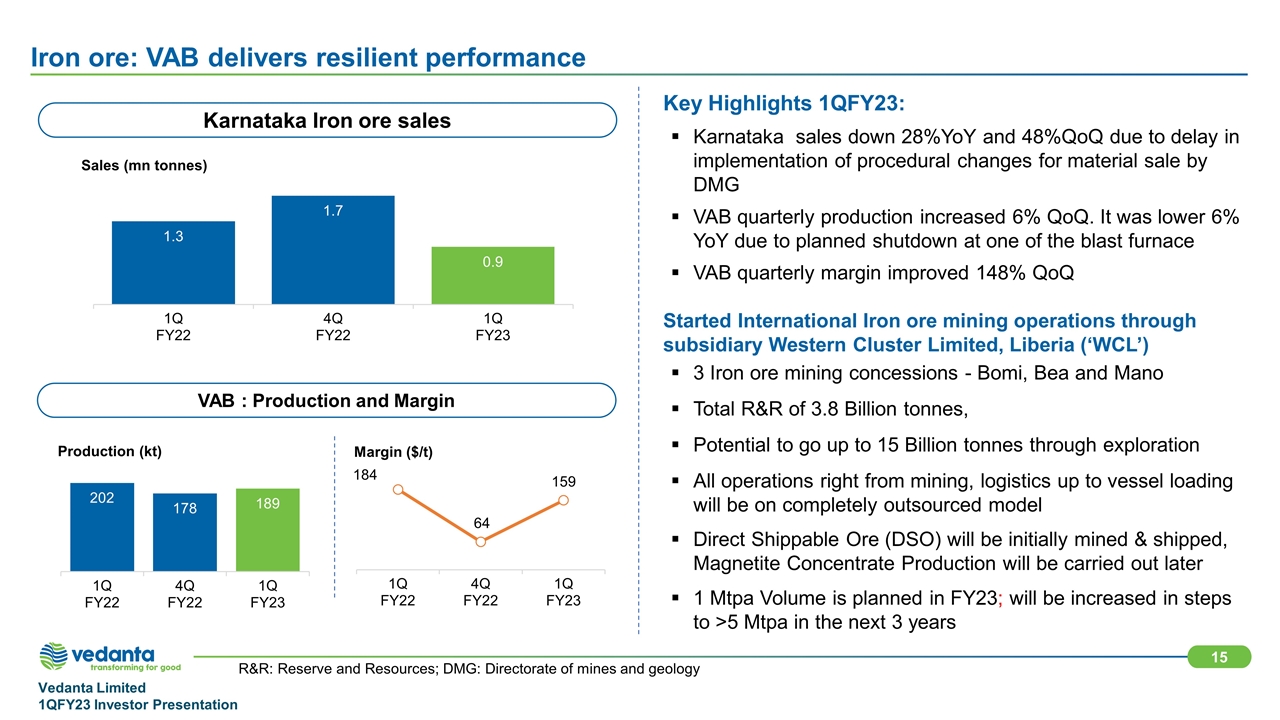

R&R: Reserve and Resources; DMG: Directorate of mines and geology Iron ore: VAB delivers resilient performance VAB : Production and Margin Karnataka Iron ore sales Key Highlights 1QFY23: Karnataka sales down 28%YoY and 48%QoQ due to delay in implementation of procedural changes for material sale by DMG VAB quarterly production increased 6% QoQ. It was lower 6% YoY due to planned shutdown at one of the blast furnace VAB quarterly margin improved 148% QoQ Started International Iron ore mining operations through subsidiary Western Cluster Limited, Liberia (‘WCL’) 3 Iron ore mining concessions - Bomi, Bea and Mano Total R&R of 3.8 Billion tonnes, Potential to go up to 15 Billion tonnes through exploration All operations right from mining, logistics up to vessel loading will be on completely outsourced model Direct Shippable Ore (DSO) will be initially mined & shipped, Magnetite Concentrate Production will be carried out later 1 Mtpa Volume is planned in FY23; will be increased in steps to >5 Mtpa in the next 3 years

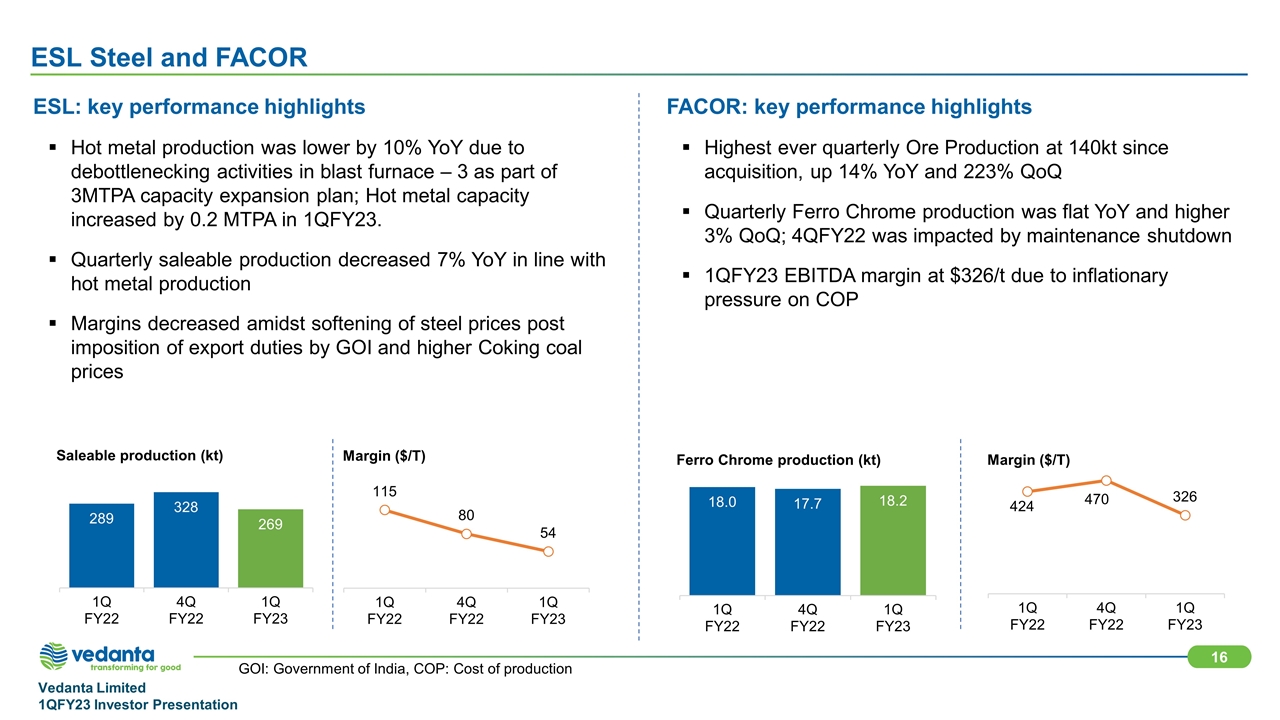

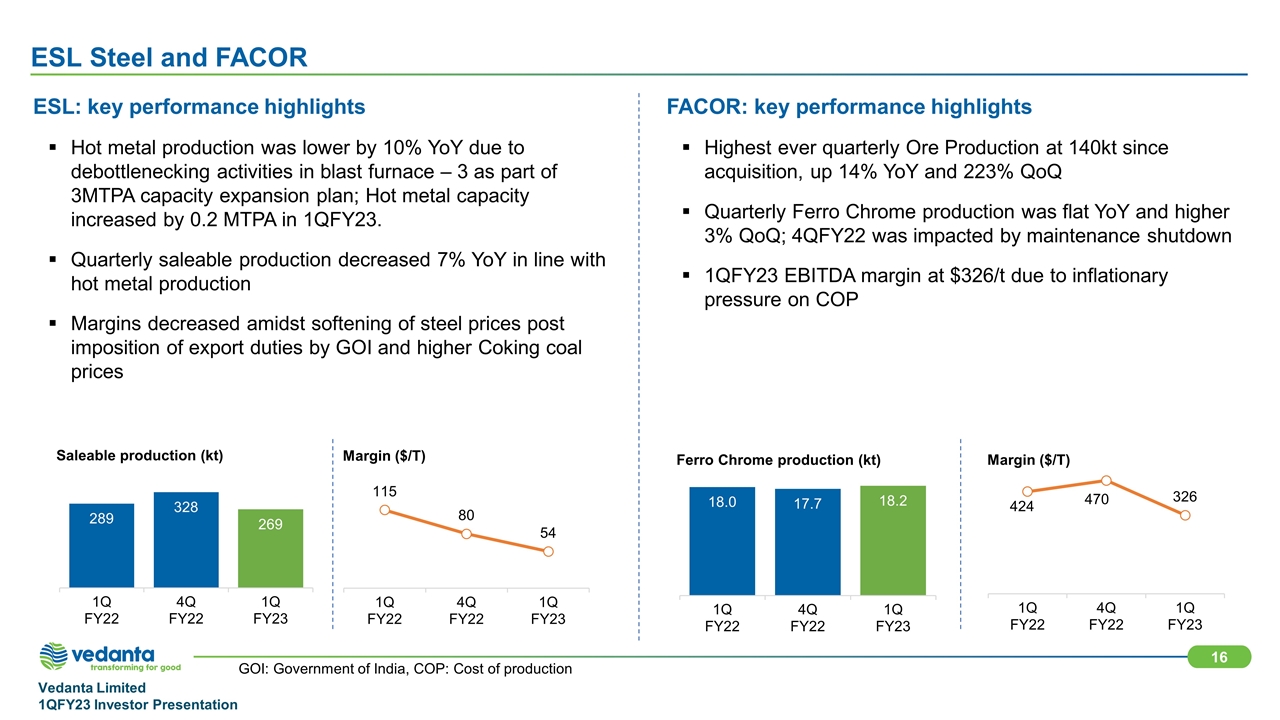

GOI: Government of India, COP: Cost of production ESL Steel and FACOR ESL: key performance highlights Hot metal production was lower by 10% YoY due to debottlenecking activities in blast furnace – 3 as part of 3MTPA capacity expansion plan; Hot metal capacity increased by 0.2 MTPA in 1QFY23. Quarterly saleable production decreased 7% YoY in line with hot metal production Margins decreased amidst softening of steel prices post imposition of export duties by GOI and higher Coking coal prices FACOR: key performance highlights Highest ever quarterly Ore Production at 140kt since acquisition, up 14% YoY and 223% QoQ Quarterly Ferro Chrome production was flat YoY and higher 3% QoQ; 4QFY22 was impacted by maintenance shutdown 1QFY23 EBITDA margin at $326/t due to inflationary pressure on COP

Strategy to enhance long term value Committed to ESG leadership Augment reserves & resources base Operational excellence and cost leadership Optimise capital allocation & maintain strong Balance Sheet Delivering on growth opportunities Achieve net zero carbon mission by 2050 and water positivity by 2030 Disciplined approach to exploration Focus on full capacity utilization Improve business efficiencies Maintain 1st quartile cost curve positioning globally Digital transformation Maximize Free cash flow and optimize leverage Disciplined capital allocation Proactive risk management Timely execution of growth projects Focus on growing our operations organically through brownfield opportunities STRATEGIC PRIORITIES FOCUS AREAS

FY23 key priorities Deliver on target volume growth across businesses Strive for timely completion of capex projects Focus on integrated Aluminum operations to reduce impact on market volatility Reduce costs to sustain and improve margins Improve free cash flow generation Proactive liability management and deleveraging Dynamic commodity hedging for proactive risk management amidst volatile environment Commitment toward repurposed ESG strategy of “transforming for good” Continued focus on sustainable shareholder value creation

VEDANTA LIMITED INVESTOR PRESENTATION 1QFY23 Finance Update Ajay Goel Acting Group Chief Financial Officer

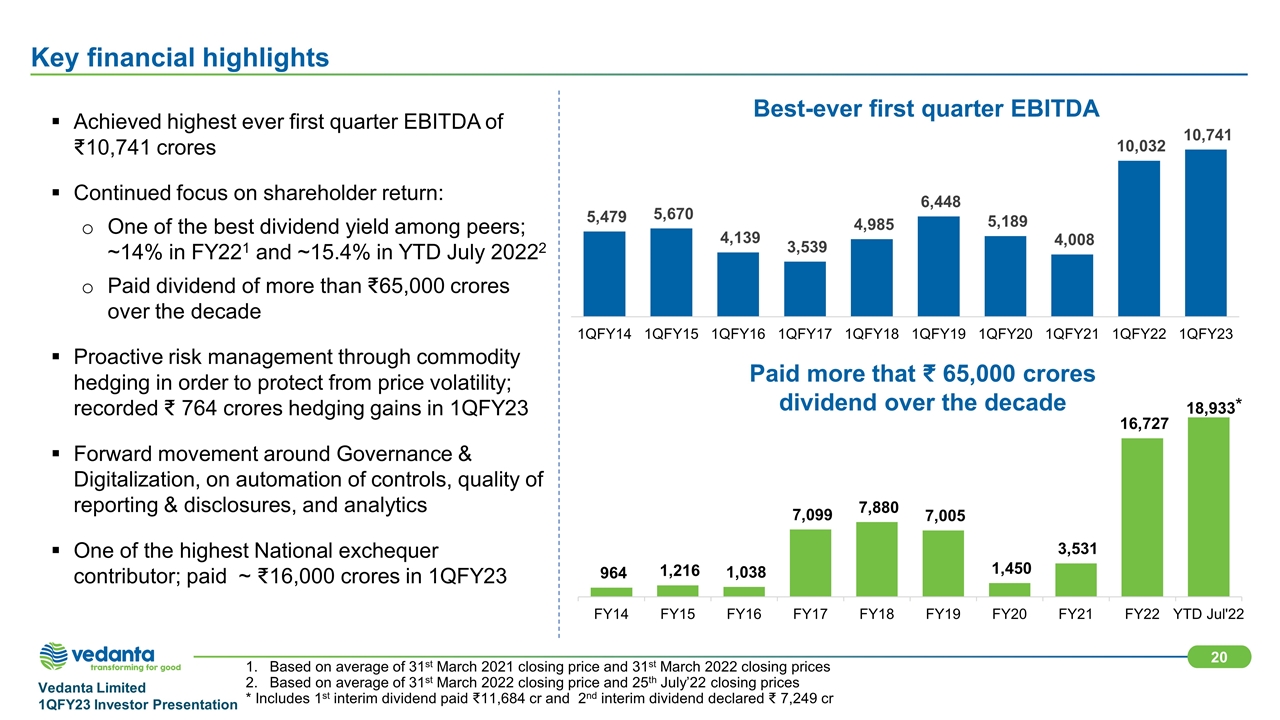

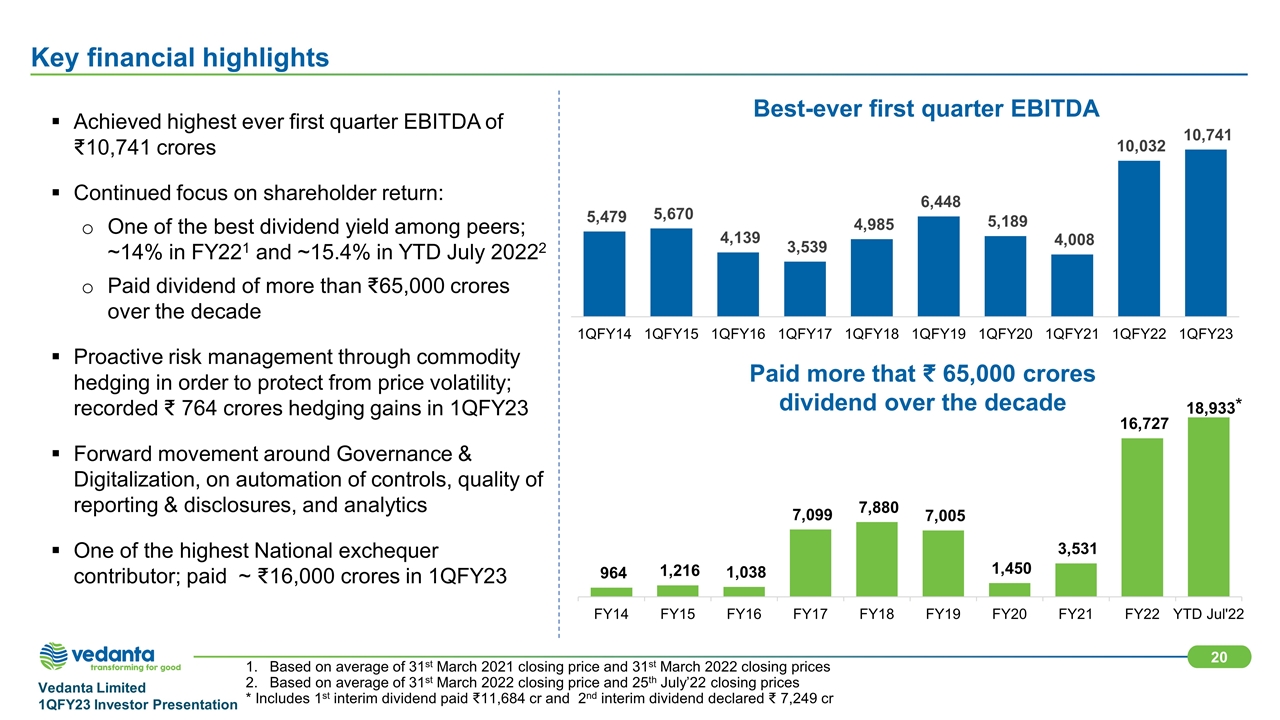

Key financial highlights Best-ever first quarter EBITDA Paid more that ₹ 65,000 crores dividend over the decade Achieved highest ever first quarter EBITDA of ₹10,741 crores Continued focus on shareholder return: One of the best dividend yield among peers; ~14% in FY221 and ~15.4% in YTD July 20222 Paid dividend of more than ₹65,000 crores over the decade Proactive risk management through commodity hedging in order to protect from price volatility; recorded ₹ 764 crores hedging gains in 1QFY23 Forward movement around Governance & Digitalization, on automation of controls, quality of reporting & disclosures, and analytics One of the highest National exchequer contributor; paid ~ ₹16,000 crores in 1QFY23 Based on average of 31st March 2021 closing price and 31st March 2022 closing prices Based on average of 31st March 2022 closing price and 25th July’22 closing prices * Includes 1st interim dividend paid 11,684 cr and 2nd interim dividend declared 7,249 cr *

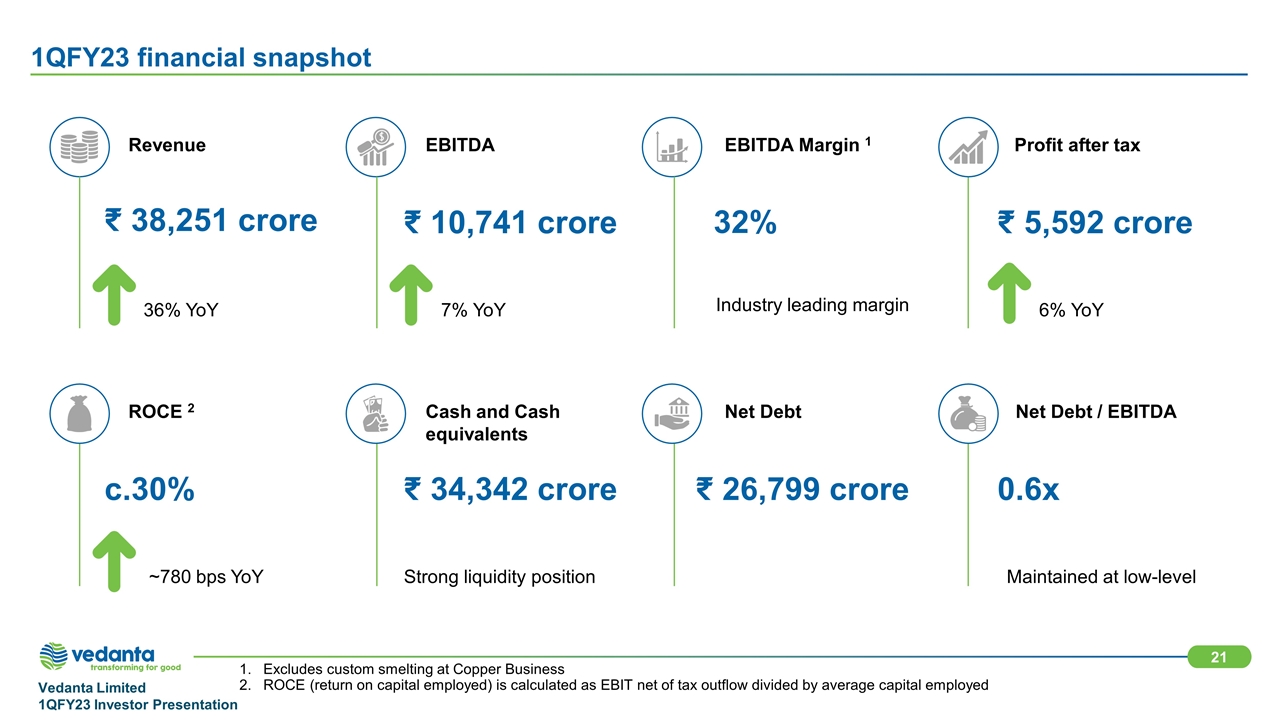

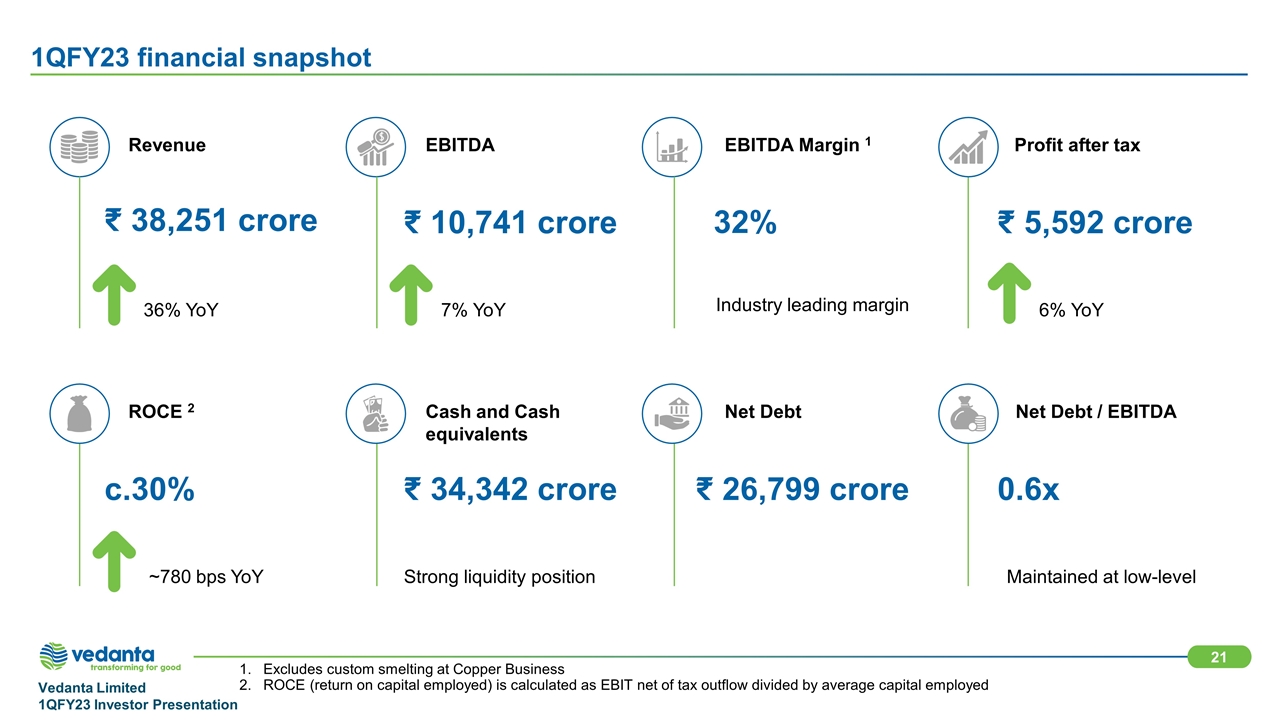

Excludes custom smelting at Copper Business ROCE (return on capital employed) is calculated as EBIT net of tax outflow divided by average capital employed 1QFY23 financial snapshot Revenue EBITDA EBITDA Margin 1 Profit after tax ₹ 38,251 crore ₹ 10,741 crore 32% ₹ 5,592 crore 36% YoY 7% YoY Industry leading margin 6% YoY ROCE 2 Cash and Cash equivalents Net Debt Net Debt / EBITDA c.30% ₹ 34,342 crore ₹ 26,799 crore 0.6x ~780 bps YoY Strong liquidity position Maintained at low-level

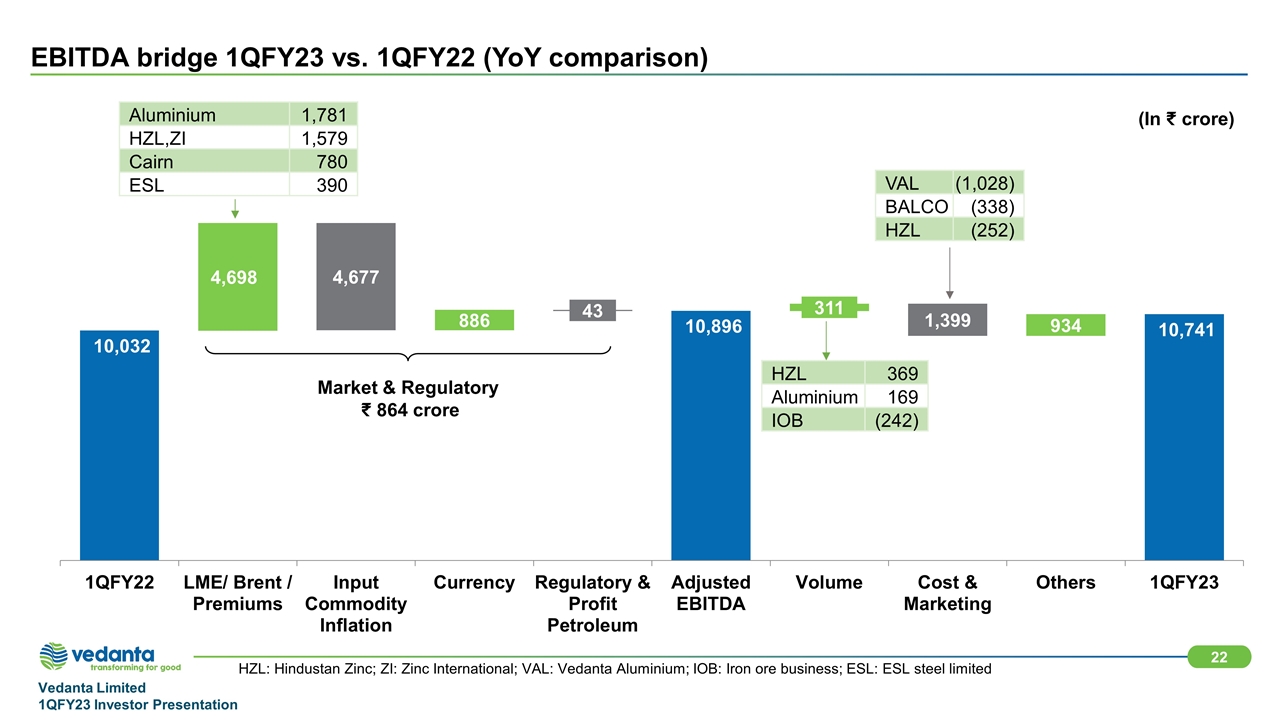

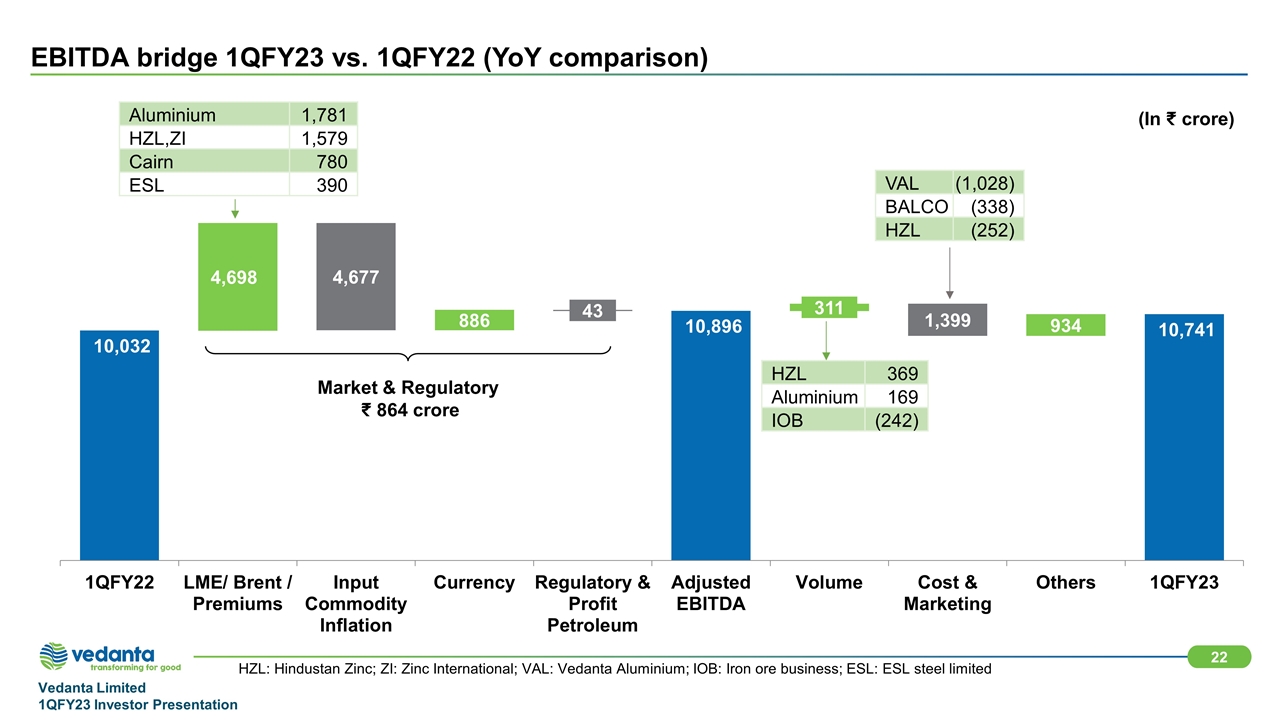

Market & Regulatory 864 crore Aluminium 1,781 HZL,ZI 1,579 Cairn 780 ESL 390 HZL 369 Aluminium 169 IOB (242) VAL (1,028) BALCO (338) HZL (252) HZL: Hindustan Zinc; ZI: Zinc International; VAL: Vedanta Aluminium; IOB: Iron ore business; ESL: ESL steel limited EBITDA bridge 1QFY23 vs. 1QFY22 (YoY comparison) (In crore)

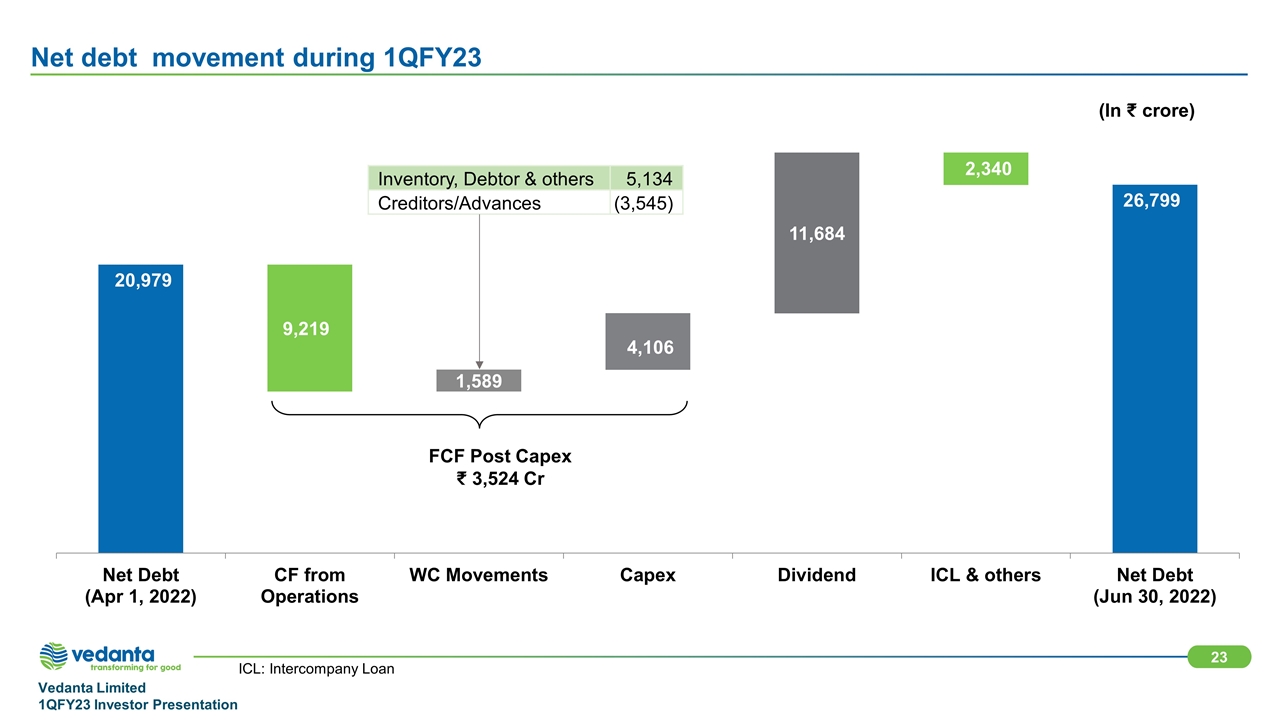

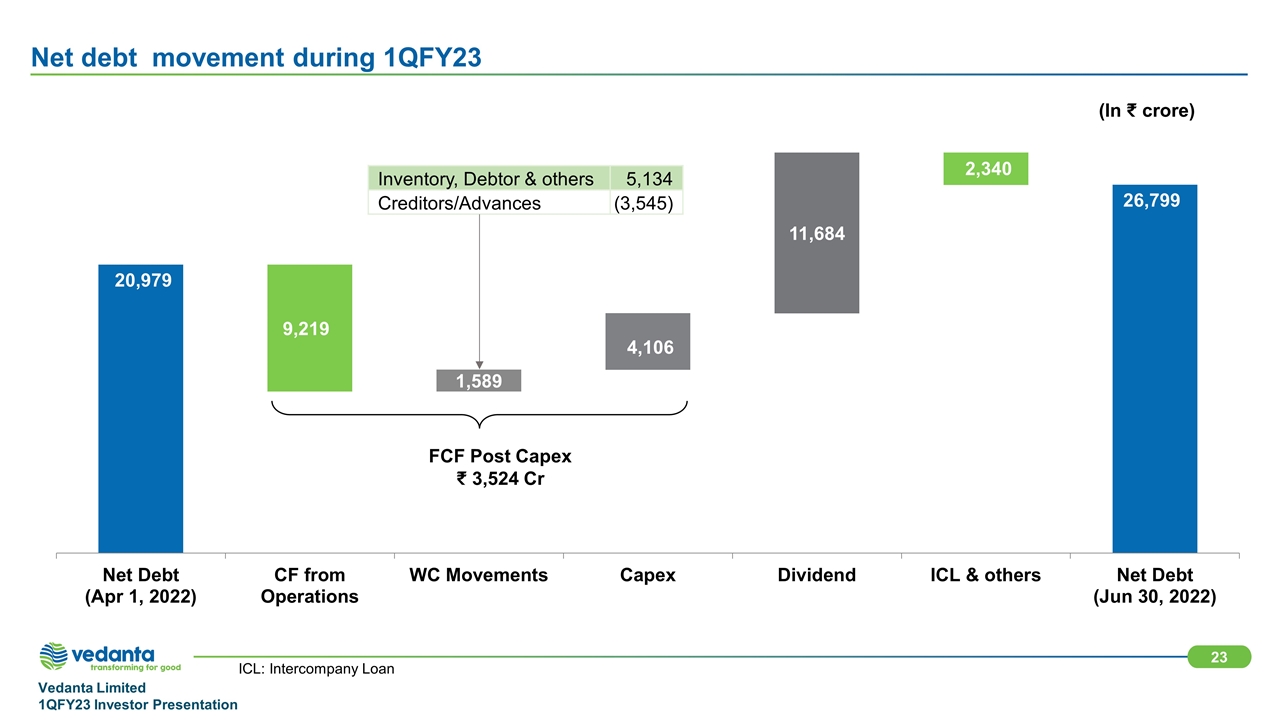

ICL: Intercompany Loan Net debt movement during 1QFY23 (In crore) Inventory, Debtor & others 5,134 Creditors/Advances (3,545) FCF Post Capex 3,524 Cr

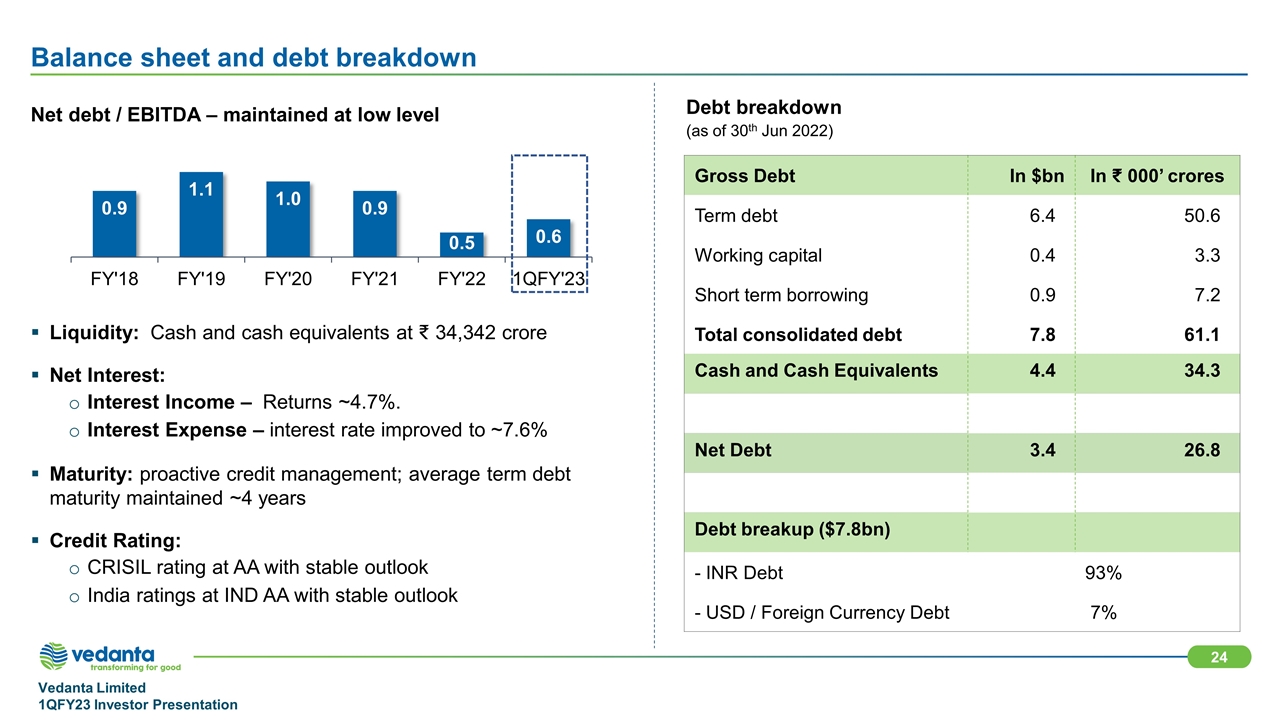

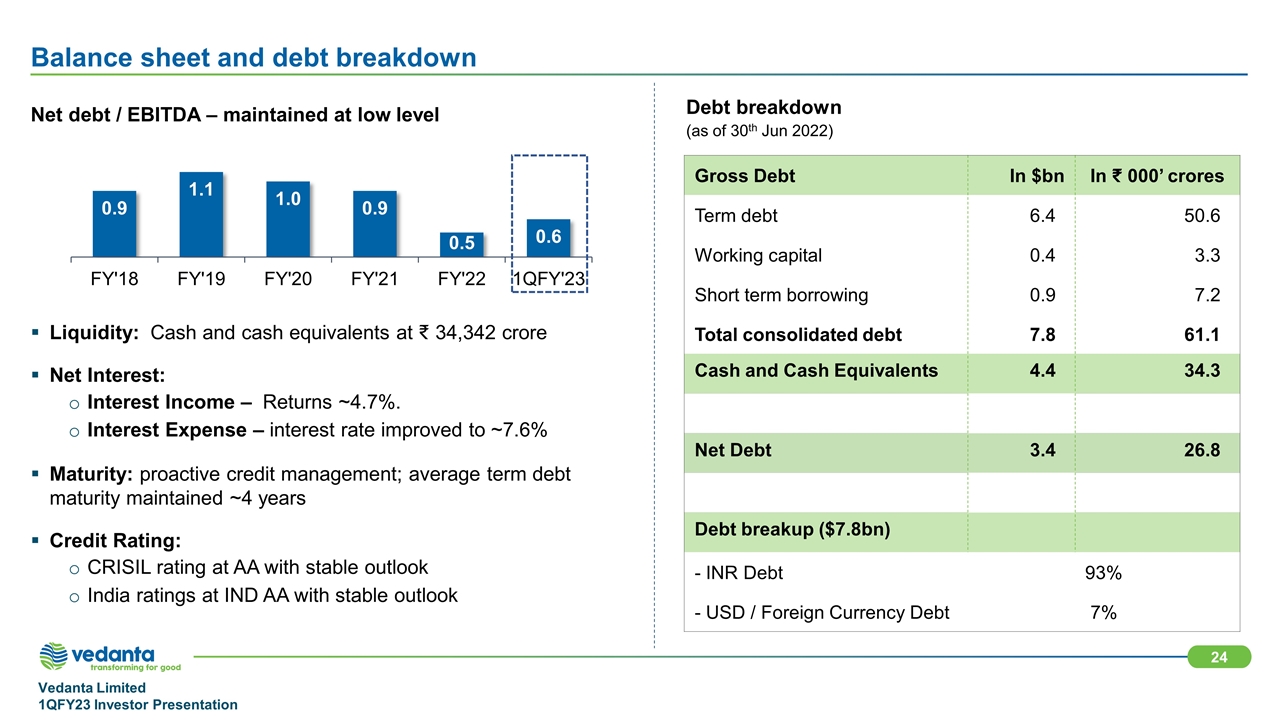

Balance sheet and debt breakdown Net debt / EBITDA – maintained at low level Liquidity: Cash and cash equivalents at 34,342 crore Net Interest: Interest Income – Returns ~4.7%. Interest Expense – interest rate improved to ~7.6% Maturity: proactive credit management; average term debt maturity maintained ~4 years Credit Rating: CRISIL rating at AA with stable outlook India ratings at IND AA with stable outlook Gross Debt In $bn In ₹ 000’ crores Term debt 6.4 50.6 Working capital 0.4 3.3 Short term borrowing 0.9 7.2 Total consolidated debt 7.8 61.1 Cash and Cash Equivalents 4.4 34.3 Net Debt 3.4 26.8 Debt breakup ($7.8bn) - INR Debt 93% - USD / Foreign Currency Debt 7% Debt breakdown (as of 30th Jun 2022)

Appendix VEDANTA LIMITED INVESTOR PRESENTATION 1QFY23

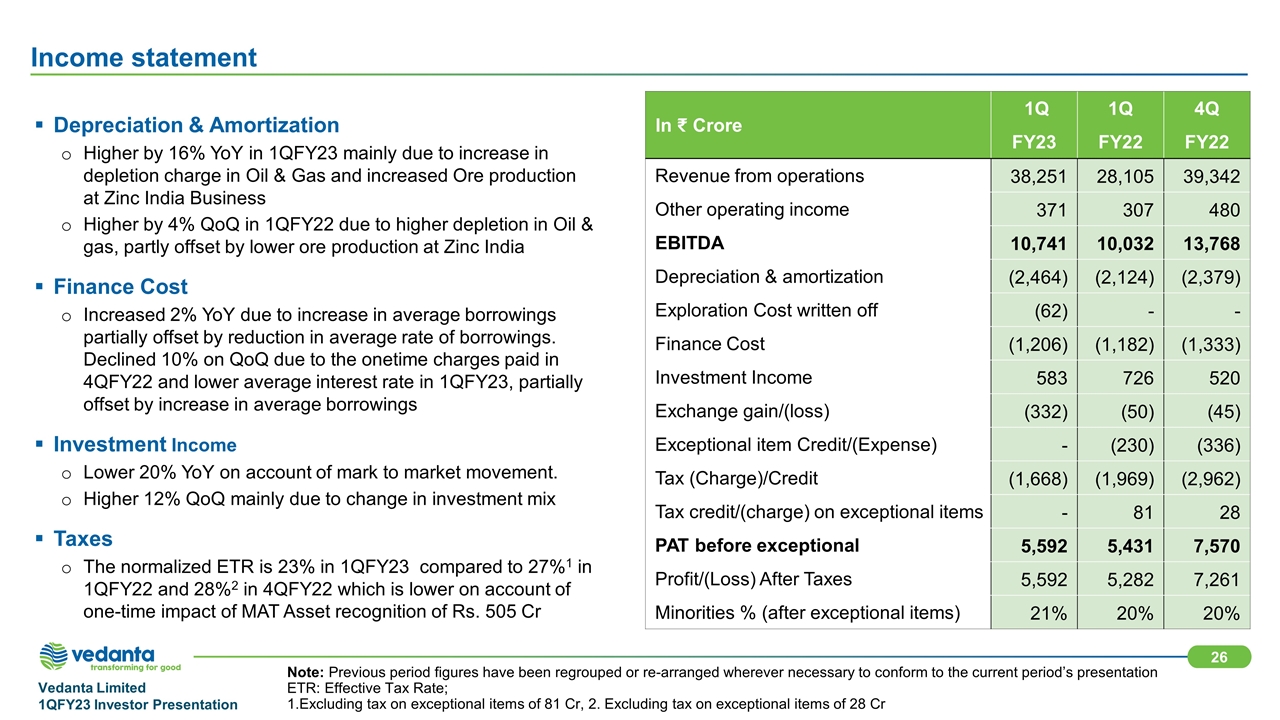

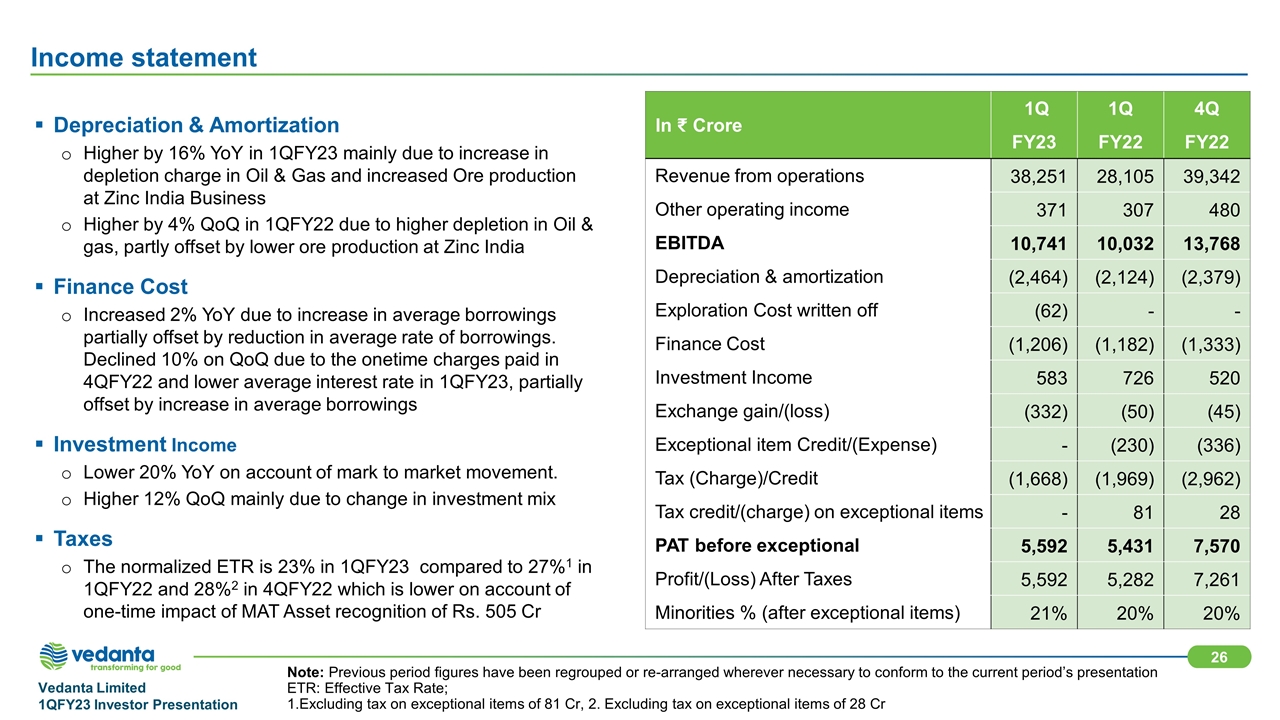

Note: Previous period figures have been regrouped or re-arranged wherever necessary to conform to the current period’s presentation ETR: Effective Tax Rate; 1.Excluding tax on exceptional items of 81 Cr, 2. Excluding tax on exceptional items of 28 Cr Income statement In ₹ Crore 1Q 1Q 4Q FY23 FY22 FY22 Revenue from operations 38,251 28,105 39,342 Other operating income 371 307 480 EBITDA 10,741 10,032 13,768 Depreciation & amortization (2,464) (2,124) (2,379) Exploration Cost written off (62) - - Finance Cost (1,206) (1,182) (1,333) Investment Income 583 726 520 Exchange gain/(loss) (332) (50) (45) Exceptional item Credit/(Expense) - (230) (336) Tax (Charge)/Credit (1,668) (1,969) (2,962) Tax credit/(charge) on exceptional items - 81 28 PAT before exceptional 5,592 5,431 7,570 Profit/(Loss) After Taxes 5,592 5,282 7,261 Minorities % (after exceptional items) 21% 20% 20% Depreciation & Amortization Higher by 16% YoY in 1QFY23 mainly due to increase in depletion charge in Oil & Gas and increased Ore production at Zinc India Business Higher by 4% QoQ in 1QFY22 due to higher depletion in Oil & gas, partly offset by lower ore production at Zinc India Finance Cost Increased 2% YoY due to increase in average borrowings partially offset by reduction in average rate of borrowings. Declined 10% on QoQ due to the onetime charges paid in 4QFY22 and lower average interest rate in 1QFY23, partially offset by increase in average borrowings Investment Income Lower 20% YoY on account of mark to market movement. Higher 12% QoQ mainly due to change in investment mix Taxes The normalized ETR is 23% in 1QFY23 compared to 27%1 in 1QFY22 and 28%2 in 4QFY22 which is lower on account of one-time impact of MAT Asset recognition of Rs. 505 Cr

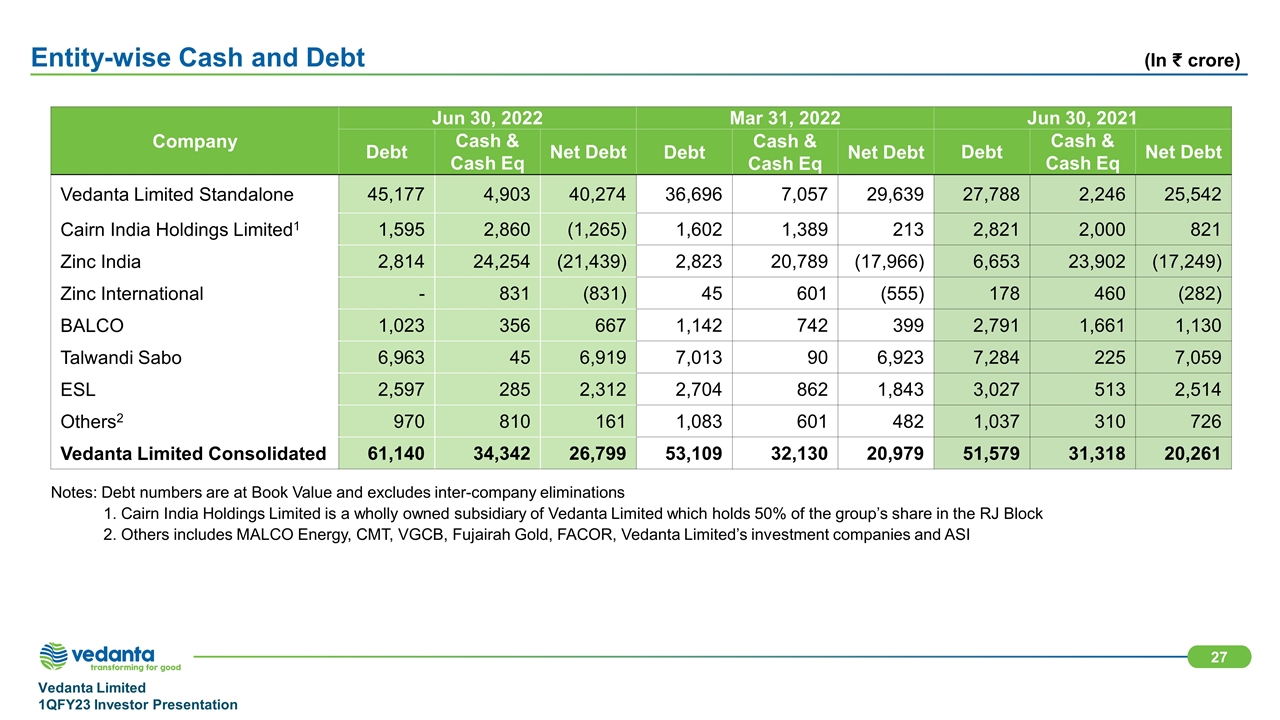

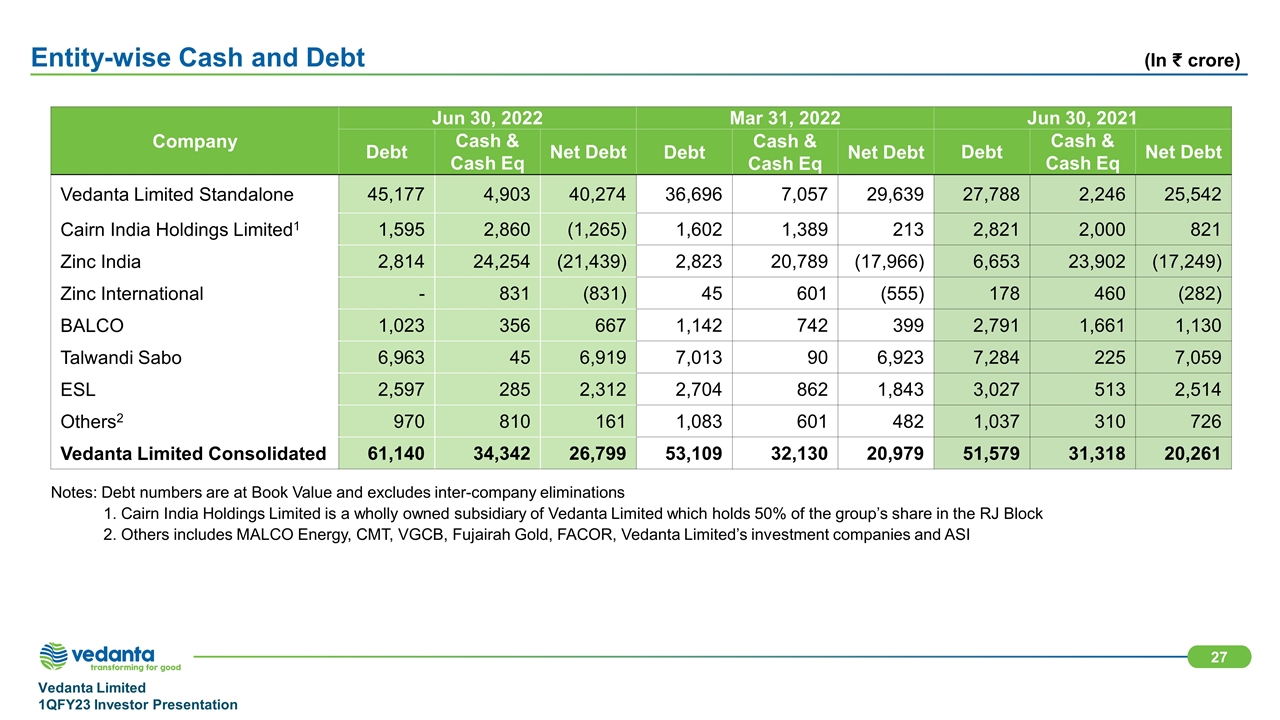

Entity-wise Cash and Debt Company Jun 30, 2022 Mar 31, 2022 Jun 30, 2021 Debt Cash & Cash Eq Net Debt Debt Cash & Cash Eq Net Debt Debt Cash & Cash Eq Net Debt Vedanta Limited Standalone 45,177 4,903 40,274 36,696 7,057 29,639 27,788 2,246 25,542 Cairn India Holdings Limited1 1,595 2,860 (1,265) 1,602 1,389 213 2,821 2,000 821 Zinc India 2,814 24,254 (21,439) 2,823 20,789 (17,966) 6,653 23,902 (17,249) Zinc International - 831 (831) 45 601 (555) 178 460 (282) BALCO 1,023 356 667 1,142 742 399 2,791 1,661 1,130 Talwandi Sabo 6,963 45 6,919 7,013 90 6,923 7,284 225 7,059 ESL 2,597 285 2,312 2,704 862 1,843 3,027 513 2,514 Others2 970 810 161 1,083 601 482 1,037 310 726 Vedanta Limited Consolidated 61,140 34,342 26,799 53,109 32,130 20,979 51,579 31,318 20,261 Notes: Debt numbers are at Book Value and excludes inter-company eliminations 1. Cairn India Holdings Limited is a wholly owned subsidiary of Vedanta Limited which holds 50% of the group’s share in the RJ Block 2. Others includes MALCO Energy, CMT, VGCB, Fujairah Gold, FACOR, Vedanta Limited’s investment companies and ASI (In crore)

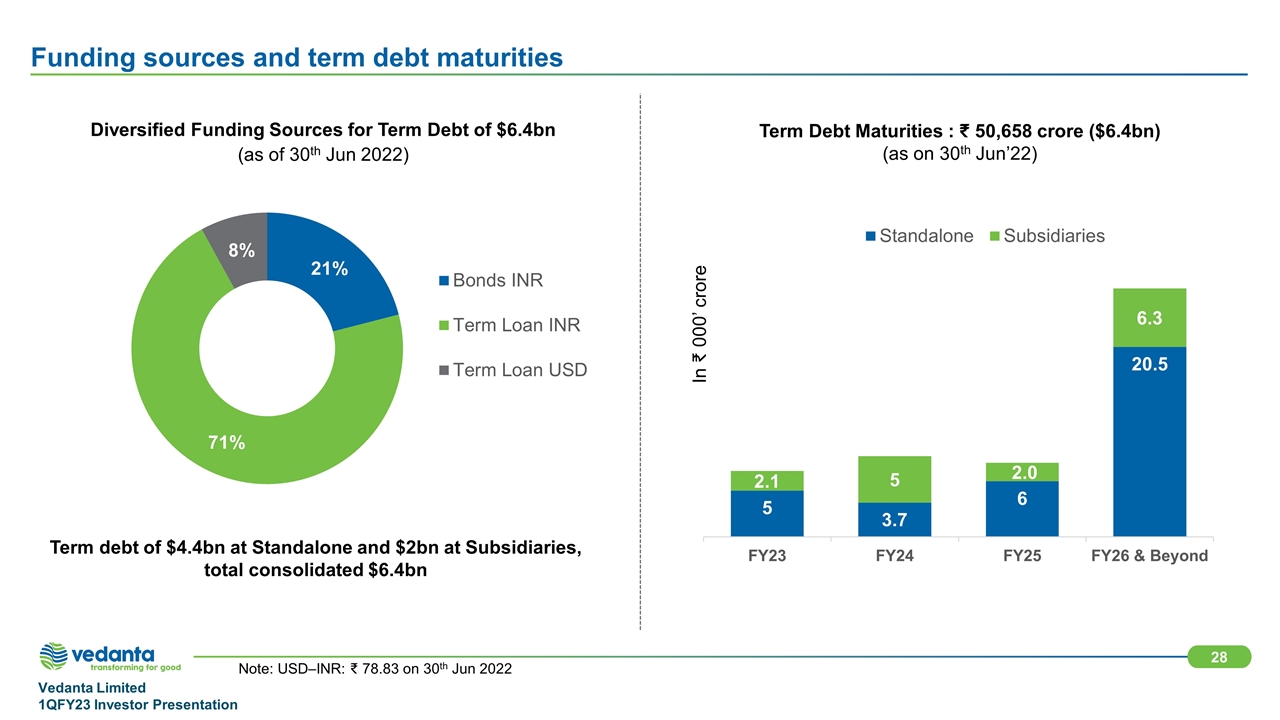

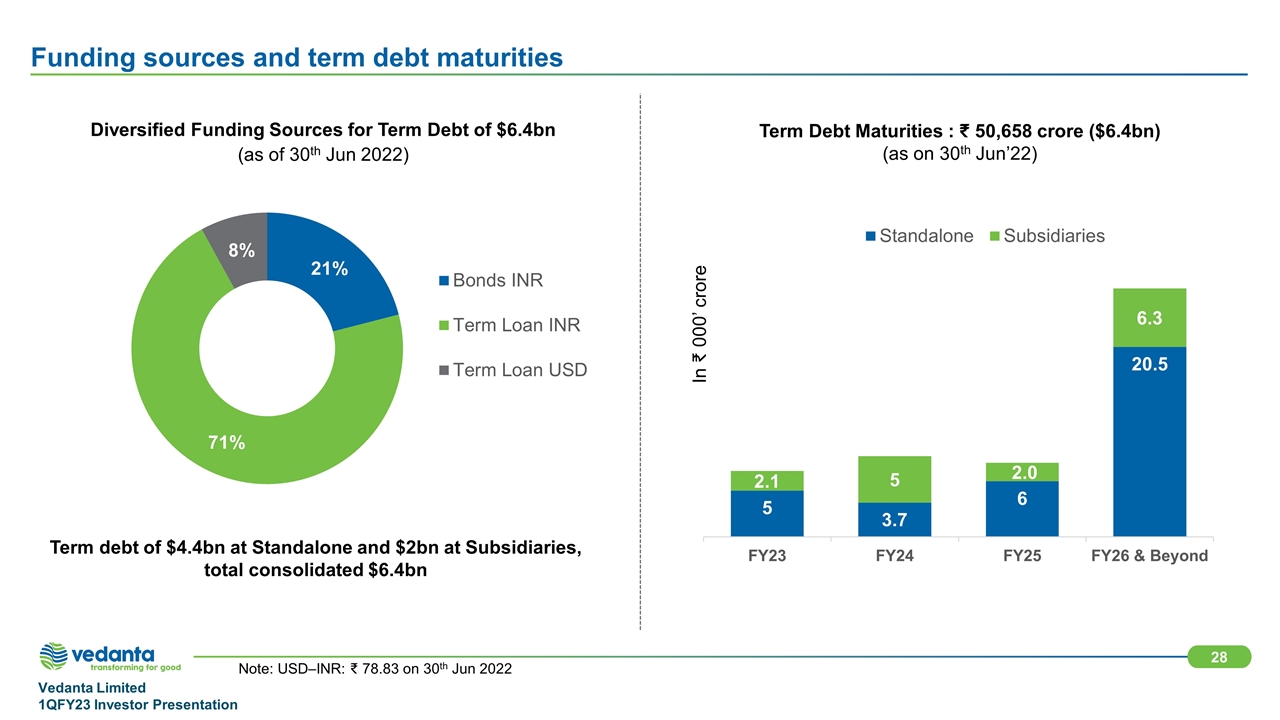

Note: USD–INR: 78.83 on 30th Jun 2022 Funding sources and term debt maturities Term debt of $4.4bn at Standalone and $2bn at Subsidiaries, total consolidated $6.4bn Diversified Funding Sources for Term Debt of $6.4bn (as of 30th Jun 2022) Term Debt Maturities : ₹ 50,658 crore ($6.4bn) (as on 30th Jun’22) In ₹ 000’ crore

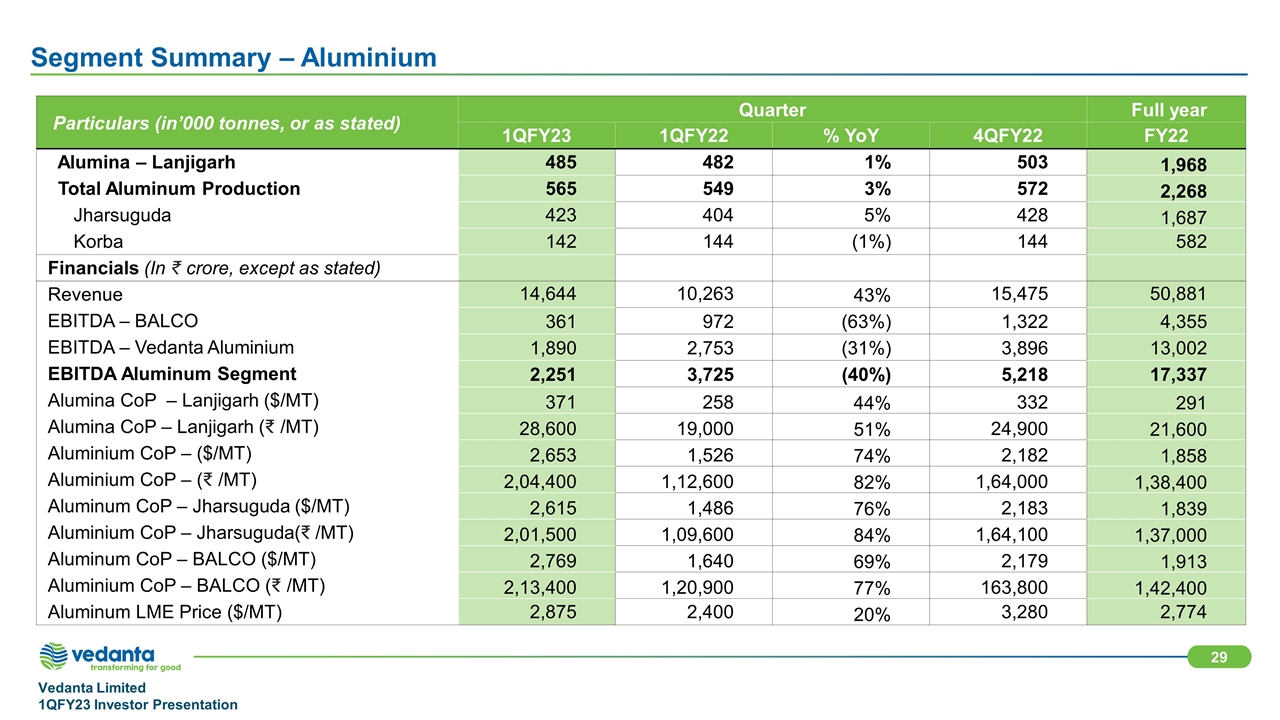

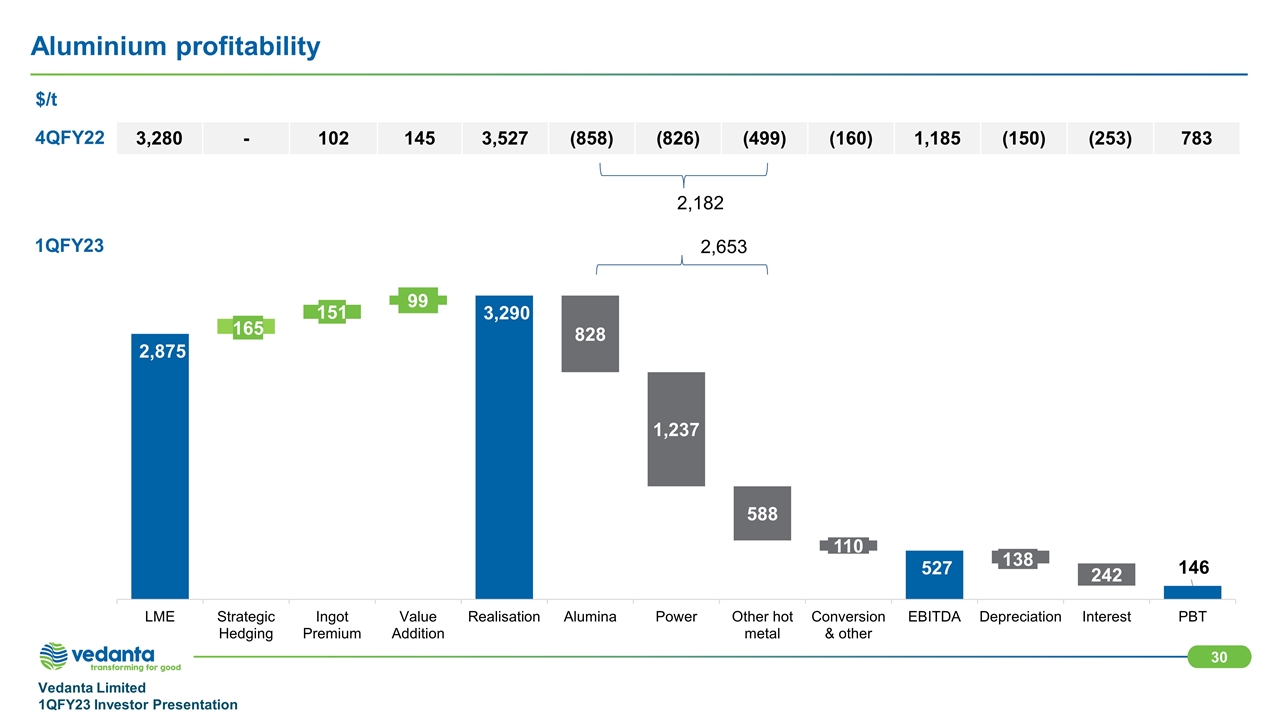

Segment Summary – Aluminium Particulars (in’000 tonnes, or as stated) Quarter Q4 Q3 Full year 1QFY23 1QFY22 % YoY 4QFY22 FY22 Alumina – Lanjigarh 485 482 1% 503 1,968 Total Aluminum Production 565 549 3% 572 2,268 Jharsuguda 423 404 5% 428 1,687 Korba 142 144 (1%) 144 582 Financials (In crore, except as stated) Revenue 14,644 10,263 43% 15,475 50,881 EBITDA – BALCO 361 972 (63%) 1,322 4,355 EBITDA – Vedanta Aluminium 1,890 2,753 (31%) 3,896 13,002 EBITDA Aluminum Segment 2,251 3,725 (40%) 5,218 17,337 Alumina CoP – Lanjigarh ($/MT) 371 258 44% 332 291 Alumina CoP – Lanjigarh ( /MT) 28,600 19,000 51% 24,900 21,600 Aluminium CoP – ($/MT) 2,653 1,526 74% 2,182 1,858 Aluminium CoP – ( /MT) 2,04,400 1,12,600 82% 1,64,000 1,38,400 Aluminum CoP – Jharsuguda ($/MT) 2,615 1,486 76% 2,183 1,839 Aluminium CoP – Jharsuguda( /MT) 2,01,500 1,09,600 84% 1,64,100 1,37,000 Aluminum CoP – BALCO ($/MT) 2,769 1,640 69% 2,179 1,913 Aluminium CoP – BALCO ( /MT) 2,13,400 1,20,900 77% 163,800 1,42,400 Aluminum LME Price ($/MT) 2,875 2,400 20% 3,280 2,774

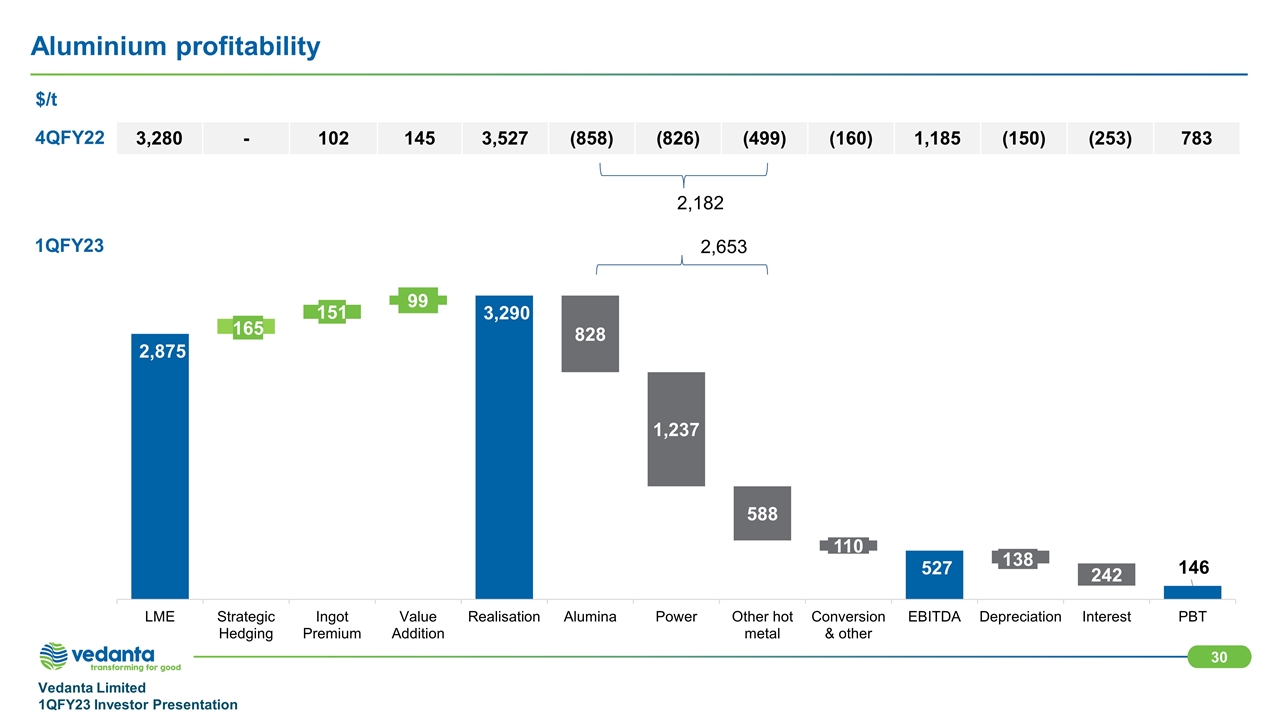

Aluminium profitability 4QFY22 $/t 1QFY23 2,182 3,280 - 102 145 3,527 (858) (826) (499) (160) 1,185 (150) (253) 783 2,653

Excludes captive consumption of 2,269 tonnes in 1Q FY 2023 vs 1,547 tonnes in 4Q FY 2022 & 1,611 tonnes in 1Q FY 2022. Excludes captive consumption of 11.7 tonnes in 1Q FY 2023 vs 7.8 tonnes in 4Q FY 2022 & 8.9 tonnes in 1Q FY 2022 . Segment Summary – Zinc India Production (in ’000 tonnes, or as stated) Quarter Q4 Q3 Full year 1QFY23 1QFY22 % YoY 4QFY22 FY22 Mined metal content 252 221 14% 295 1,017 Integrated metal 260 236 10% 260 967 Refined Zinc – Integrated 206 188 10% 211 776 Refined Lead – Integrated1 54 48 11% 49 191 Refined Saleable Silver - Integrated (in tonnes)2 177 161 10% 162 647 Financials (In crore, except as stated) Revenue 9,175 6,323 45% 8,587 28,624 EBITDA 5,230 3,508 48% 4,988 16,161 Zinc CoP without Royalty ( /MT) 97,400 79,000 23% 85,400 83,500 Zinc CoP without Royalty ($/MT) 1,264 1,070 18% 1,136 1,122 Zinc CoP with Royalty ($/MT) 1,799 1,463 23% 1,644 1,567 Zinc LME Price ($/MT) 3,915 2,916 34% 3,754 3,257 Lead LME Price ($/MT) 2,199 2,128 3% 2,335 2,285 Silver LBMA Price ($/oz) 22.6 26.7 (15%) 24.0 24.6

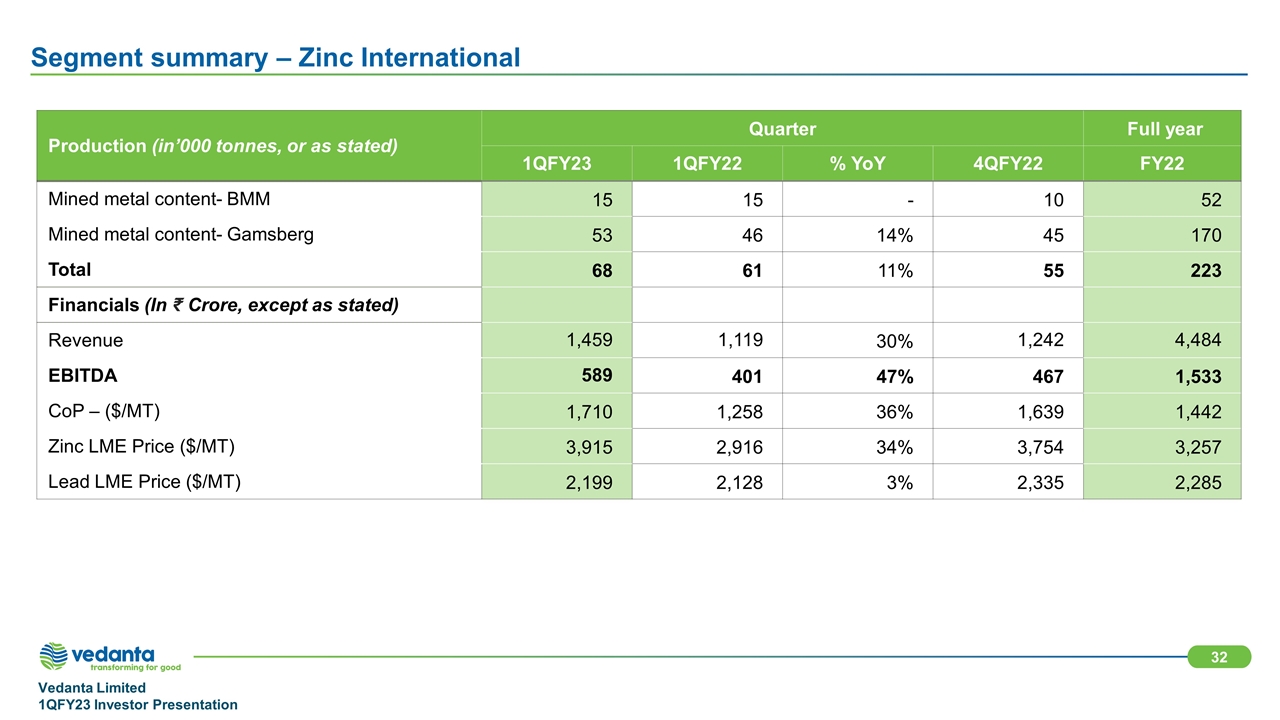

Segment summary – Zinc International Production (in’000 tonnes, or as stated) Quarter Q4 Q3 Full year 1QFY23 1QFY22 % YoY 4QFY22 FY22 Mined metal content- BMM 15 15 - 10 52 Mined metal content- Gamsberg 53 46 14% 45 170 Total 68 61 11% 55 223 Financials (In Crore, except as stated) Revenue 1,459 1,119 30% 1,242 4,484 EBITDA 589 401 47% 467 1,533 CoP – ($/MT) 1,710 1,258 36% 1,639 1,442 Zinc LME Price ($/MT) 3,915 2,916 34% 3,754 3,257 Lead LME Price ($/MT) 2,199 2,128 3% 2,335 2,285

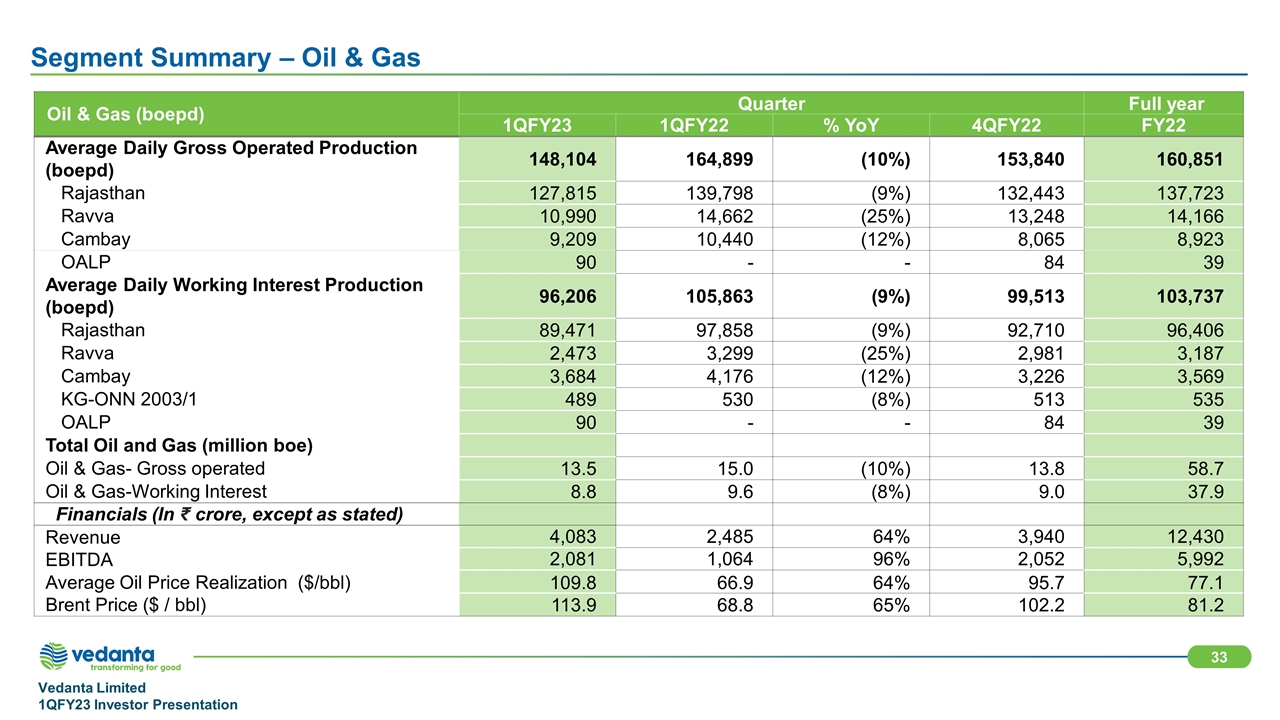

Segment Summary – Oil & Gas Oil & Gas (boepd) Quarter Q4 Q3 Full year 1QFY23 1QFY22 % YoY 4QFY22 FY22 Average Daily Gross Operated Production (boepd) 148,104 164,899 (10%) 153,840 160,851 Rajasthan 127,815 139,798 (9%) 132,443 137,723 Ravva 10,990 14,662 (25%) 13,248 14,166 Cambay 9,209 10,440 (12%) 8,065 8,923 OALP 90 - - 84 39 Average Daily Working Interest Production (boepd) 96,206 105,863 (9%) 99,513 103,737 Rajasthan 89,471 97,858 (9%) 92,710 96,406 Ravva 2,473 3,299 (25%) 2,981 3,187 Cambay 3,684 4,176 (12%) 3,226 3,569 KG-ONN 2003/1 489 530 (8%) 513 535 OALP 90 - - 84 39 Total Oil and Gas (million boe) Oil & Gas- Gross operated 13.5 15.0 (10%) 13.8 58.7 Oil & Gas-Working Interest 8.8 9.6 (8%) 9.0 37.9 Financials (In crore, except as stated) Revenue 4,083 2,485 64% 3,940 12,430 EBITDA 2,081 1,064 96% 2,052 5,992 Average Oil Price Realization ($/bbl) 109.8 66.9 64% 95.7 77.1 Brent Price ($ / bbl) 113.9 68.8 65% 102.2 81.2

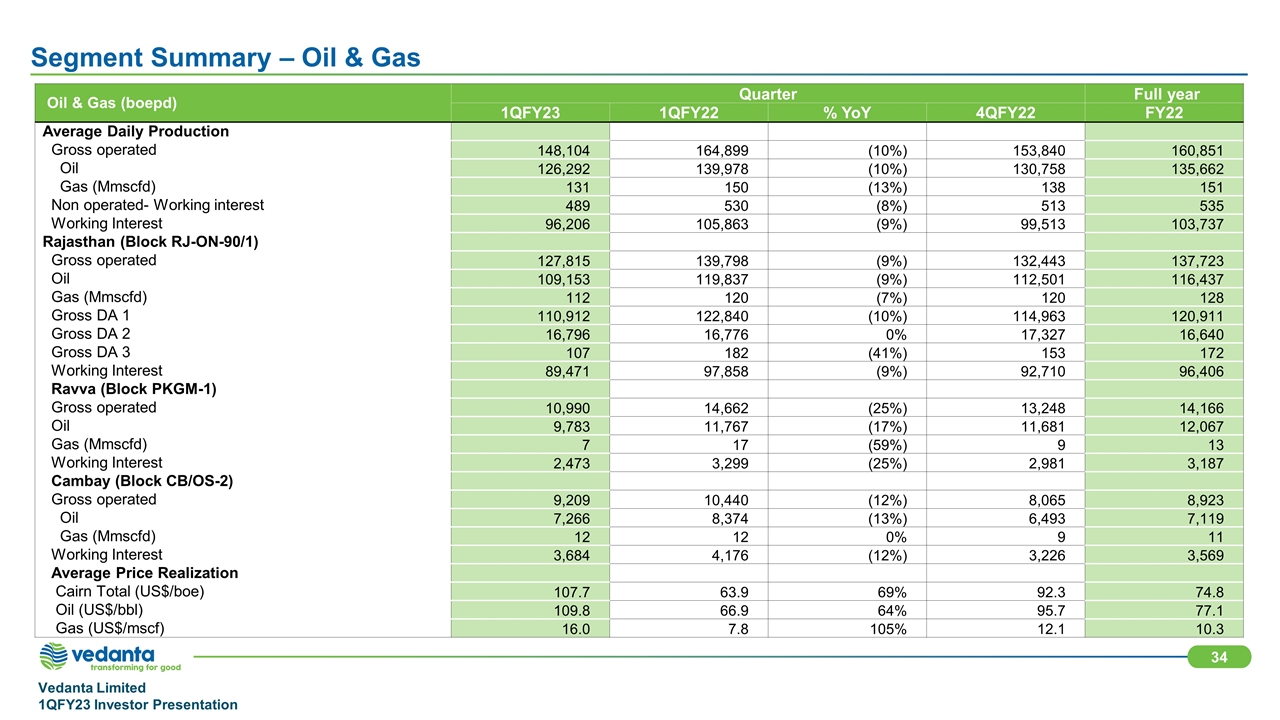

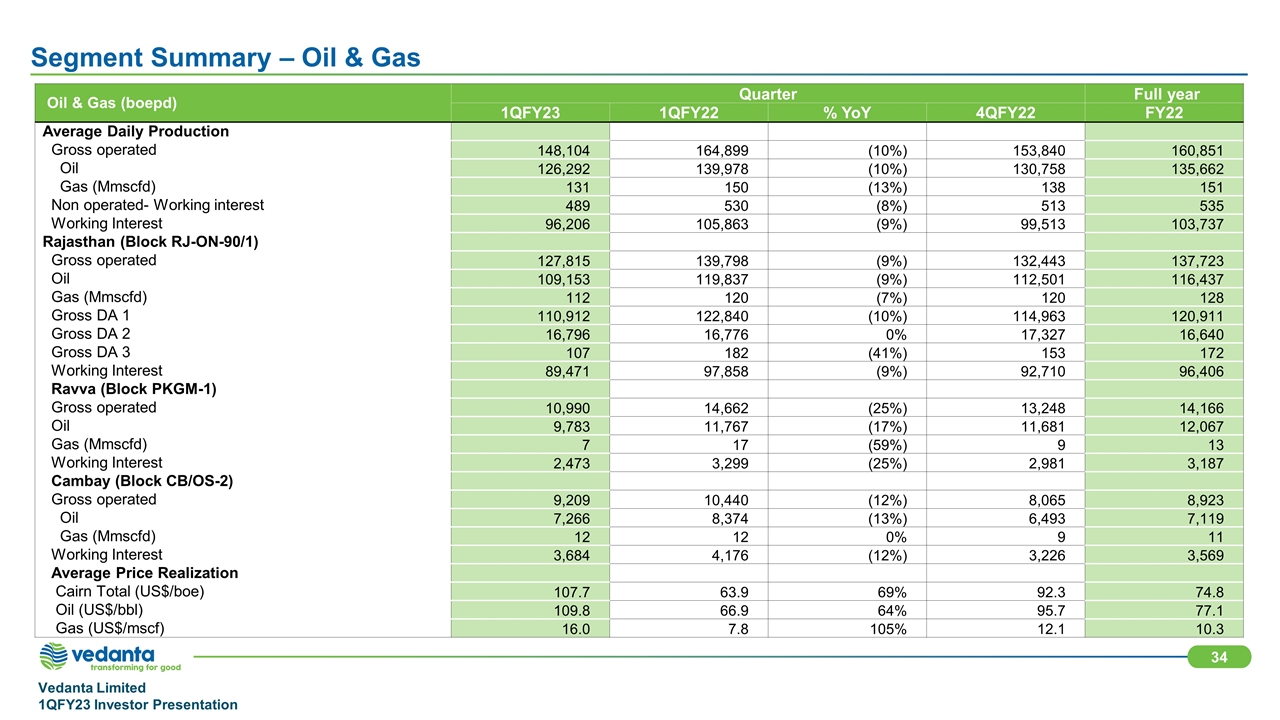

Segment Summary – Oil & Gas Oil & Gas (boepd) Quarter Q4 Q3 Full year 1QFY23 1QFY22 % YoY 4QFY22 FY22 Average Daily Production Gross operated 148,104 164,899 (10%) 153,840 160,851 Oil 126,292 139,978 (10%) 130,758 135,662 Gas (Mmscfd) 131 150 (13%) 138 151 Non operated- Working interest 489 530 (8%) 513 535 Working Interest 96,206 105,863 (9%) 99,513 103,737 Rajasthan (Block RJ-ON-90/1) Gross operated 127,815 139,798 (9%) 132,443 137,723 Oil 109,153 119,837 (9%) 112,501 116,437 Gas (Mmscfd) 112 120 (7%) 120 128 Gross DA 1 110,912 122,840 (10%) 114,963 120,911 Gross DA 2 16,796 16,776 0% 17,327 16,640 Gross DA 3 107 182 (41%) 153 172 Working Interest 89,471 97,858 (9%) 92,710 96,406 Ravva (Block PKGM-1) Gross operated 10,990 14,662 (25%) 13,248 14,166 Oil 9,783 11,767 (17%) 11,681 12,067 Gas (Mmscfd) 7 17 (59%) 9 13 Working Interest 2,473 3,299 (25%) 2,981 3,187 Cambay (Block CB/OS-2) Gross operated 9,209 10,440 (12%) 8,065 8,923 Oil 7,266 8,374 (13%) 6,493 7,119 Gas (Mmscfd) 12 12 0% 9 11 Working Interest 3,684 4,176 (12%) 3,226 3,569 Average Price Realization Cairn Total (US$/boe) 107.7 63.9 69% 92.3 74.8 Oil (US$/bbl) 109.8 66.9 64% 95.7 77.1 Gas (US$/mscf) 16.0 7.8 105% 12.1 10.3

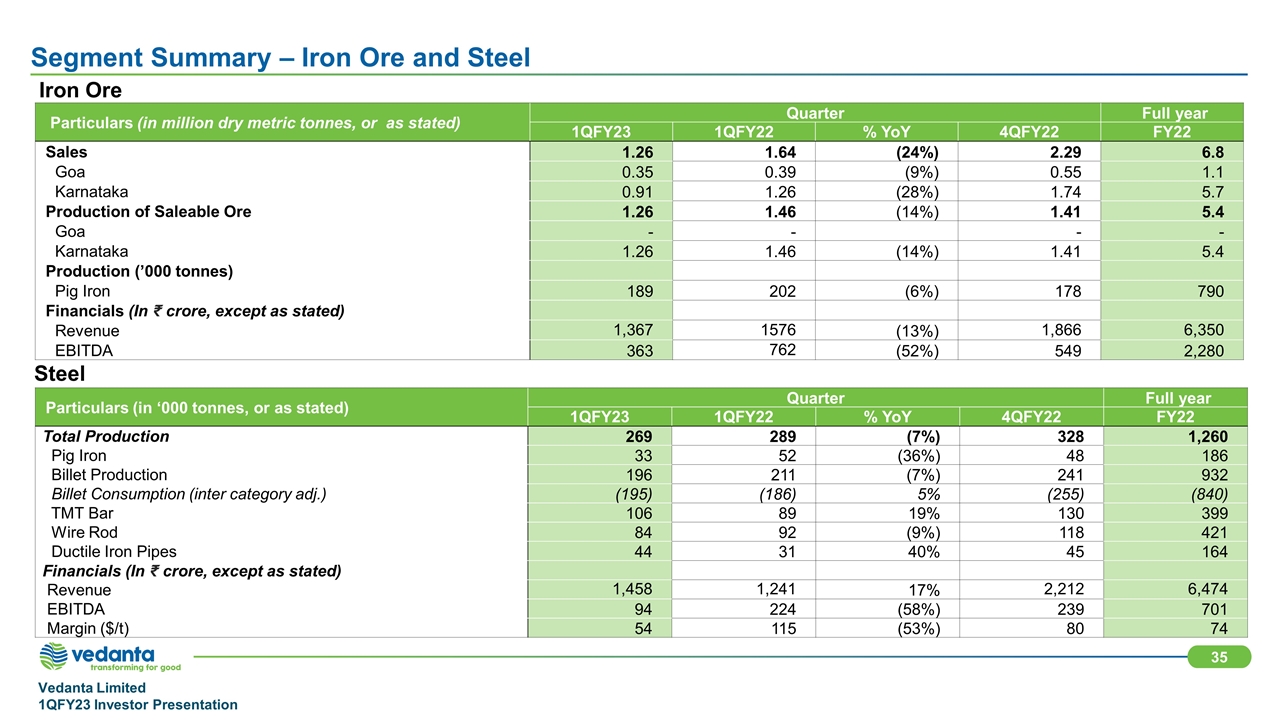

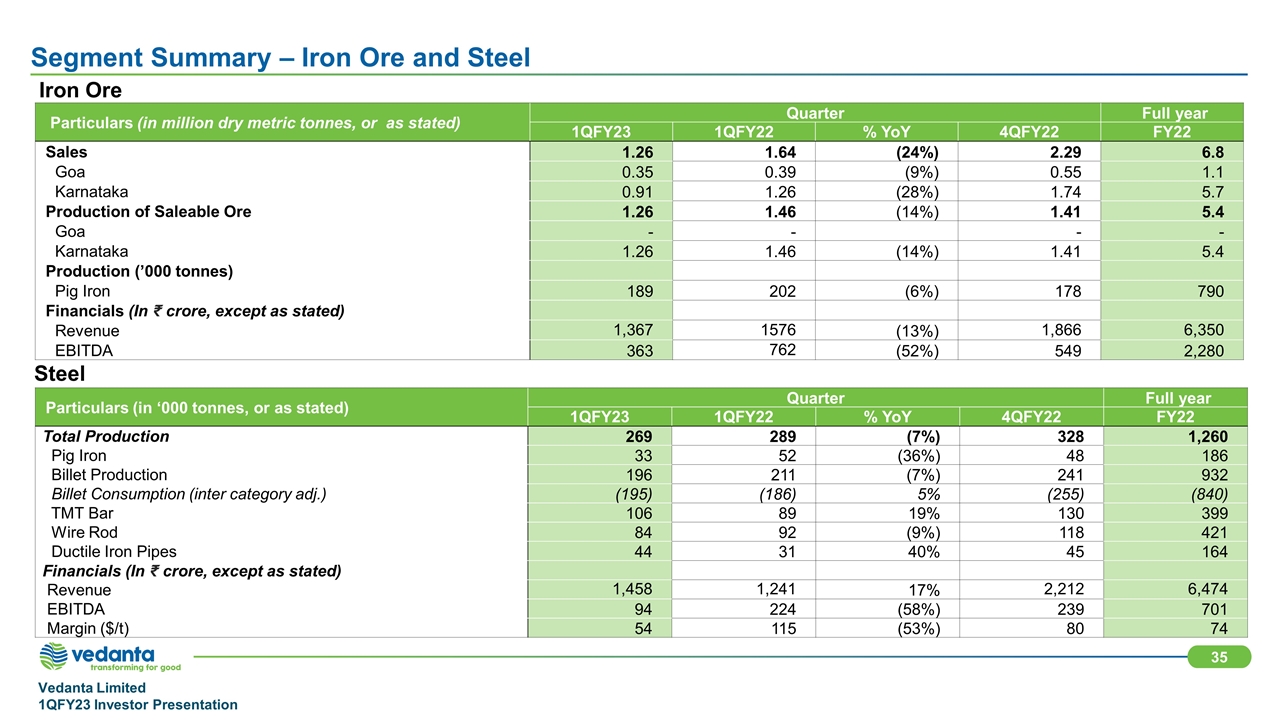

Segment Summary – Iron Ore and Steel Steel Particulars (in million dry metric tonnes, or as stated) Quarter Q4 Q3 Full year as stated) 1QFY23 1QFY22 % YoY 4QFY22 FY22 Sales 1.26 1.64 (24%) 2.29 6.8 Goa 0.35 0.39 (9%) 0.55 1.1 Karnataka 0.91 1.26 (28%) 1.74 5.7 Production of Saleable Ore 1.26 1.46 (14%) 1.41 5.4 Goa - - - - Karnataka 1.26 1.46 (14%) 1.41 5.4 Production (’000 tonnes) Pig Iron 189 202 (6%) 178 790 Financials (In crore, except as stated) Revenue 1,367 1576 (13%) 1,866 6,350 EBITDA 363 762 (52%) 549 2,280 Iron Ore Particulars (in ‘000 tonnes, or as stated) Quarter Q4 Q3 Full year as stated) 1QFY23 1QFY22 % YoY 4QFY22 FY22 Total Production 269 289 (7%) 328 1,260 Pig Iron 33 52 (36%) 48 186 Billet Production 196 211 (7%) 241 932 Billet Consumption (inter category adj.) (195) (186) 5% (255) (840) TMT Bar 106 89 19% 130 399 Wire Rod 84 92 (9%) 118 421 Ductile Iron Pipes 44 31 40% 45 164 Financials (In crore, except as stated) Revenue 1,458 1,241 17% 2,212 6,474 EBITDA 94 224 (58%) 239 701 Margin ($/t) 54 115 (53%) 80 74

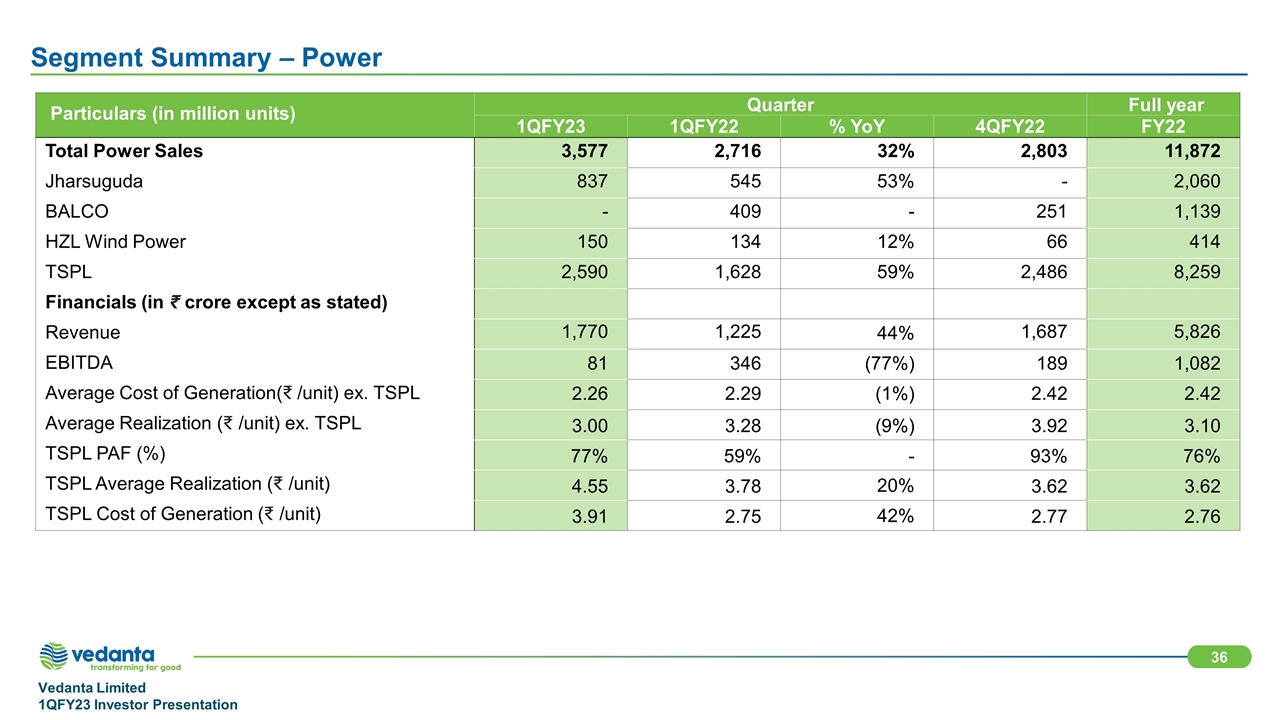

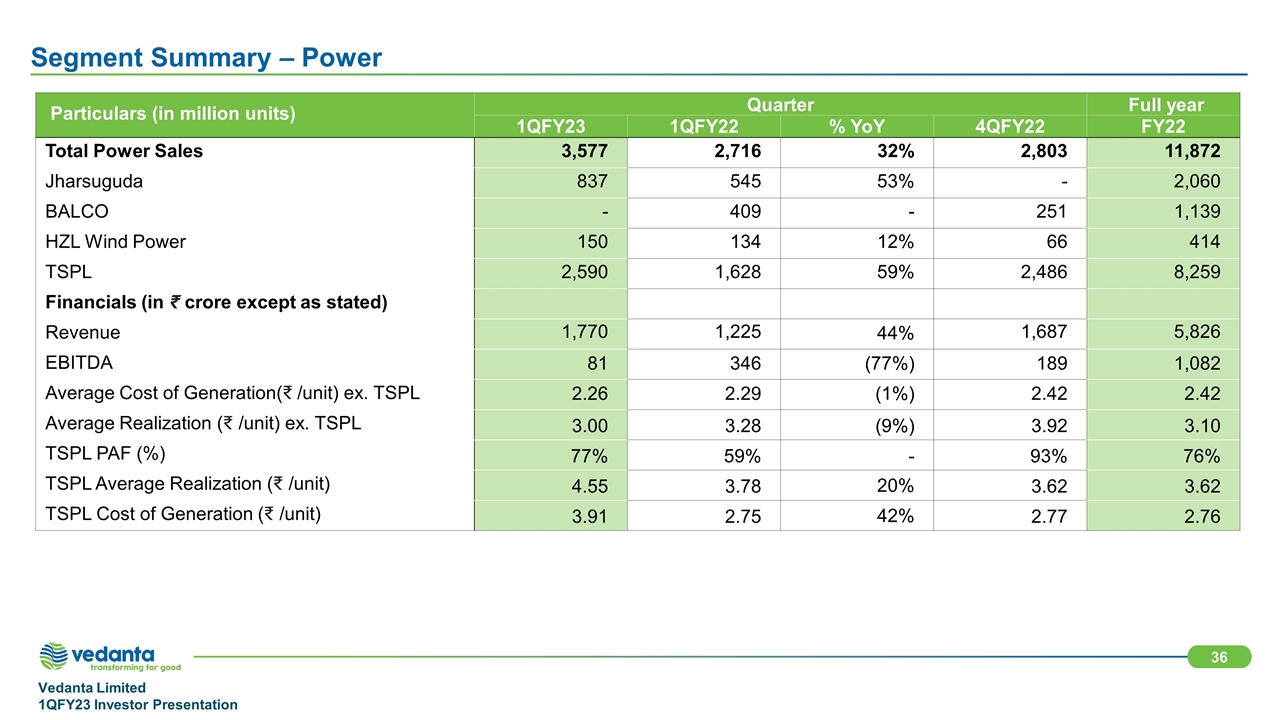

Segment Summary – Power Particulars (in million units) Quarter Q4 Q3 Full year 1QFY23 1QFY22 % YoY 4QFY22 FY22 Total Power Sales 3,577 2,716 32% 2,803 11,872 Jharsuguda 837 545 53% - 2,060 BALCO - 409 - 251 1,139 HZL Wind Power 150 134 12% 66 414 TSPL 2,590 1,628 59% 2,486 8,259 Financials (in crore except as stated) Revenue 1,770 1,225 44% 1,687 5,826 EBITDA 81 346 (77%) 189 1,082 Average Cost of Generation( /unit) ex. TSPL 2.26 2.29 (1%) 2.42 2.42 Average Realization ( /unit) ex. TSPL 3.00 3.28 (9%) 3.92 3.10 TSPL PAF (%) 77% 59% - 93% 76% TSPL Average Realization ( /unit) 4.55 3.78 20% 3.62 3.62 TSPL Cost of Generation ( /unit) 3.91 2.75 42% 2.77 2.76

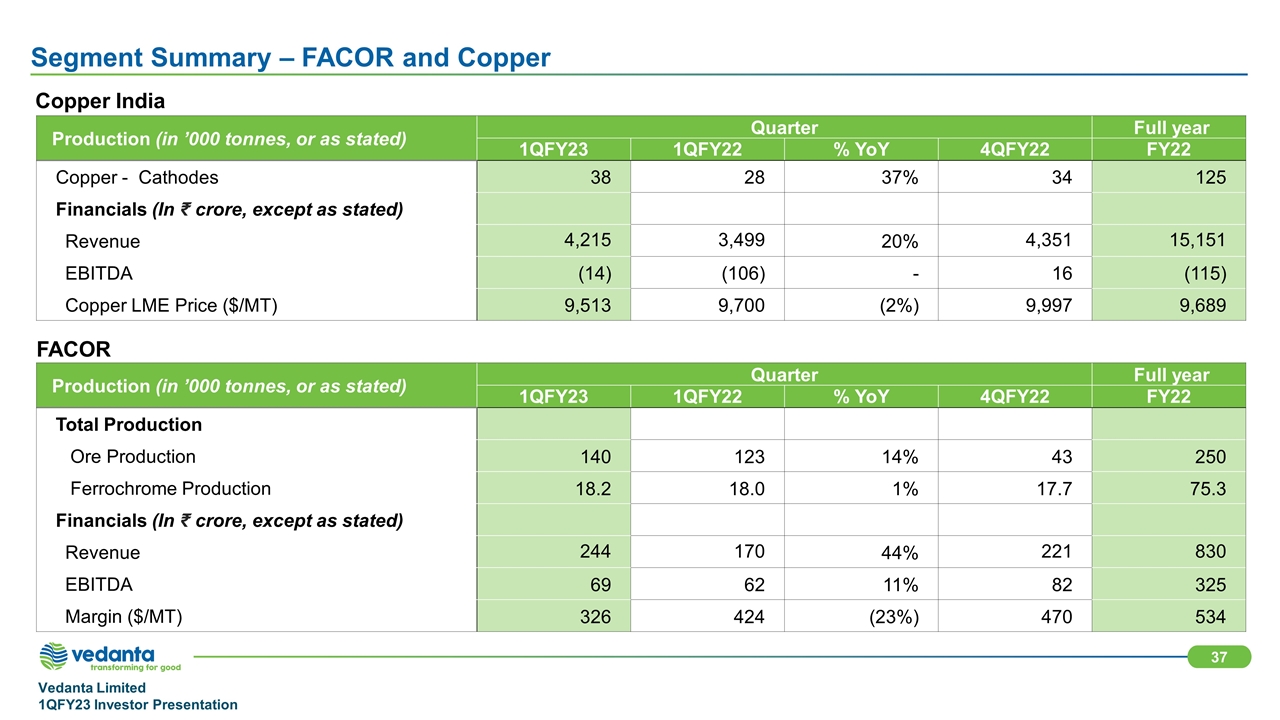

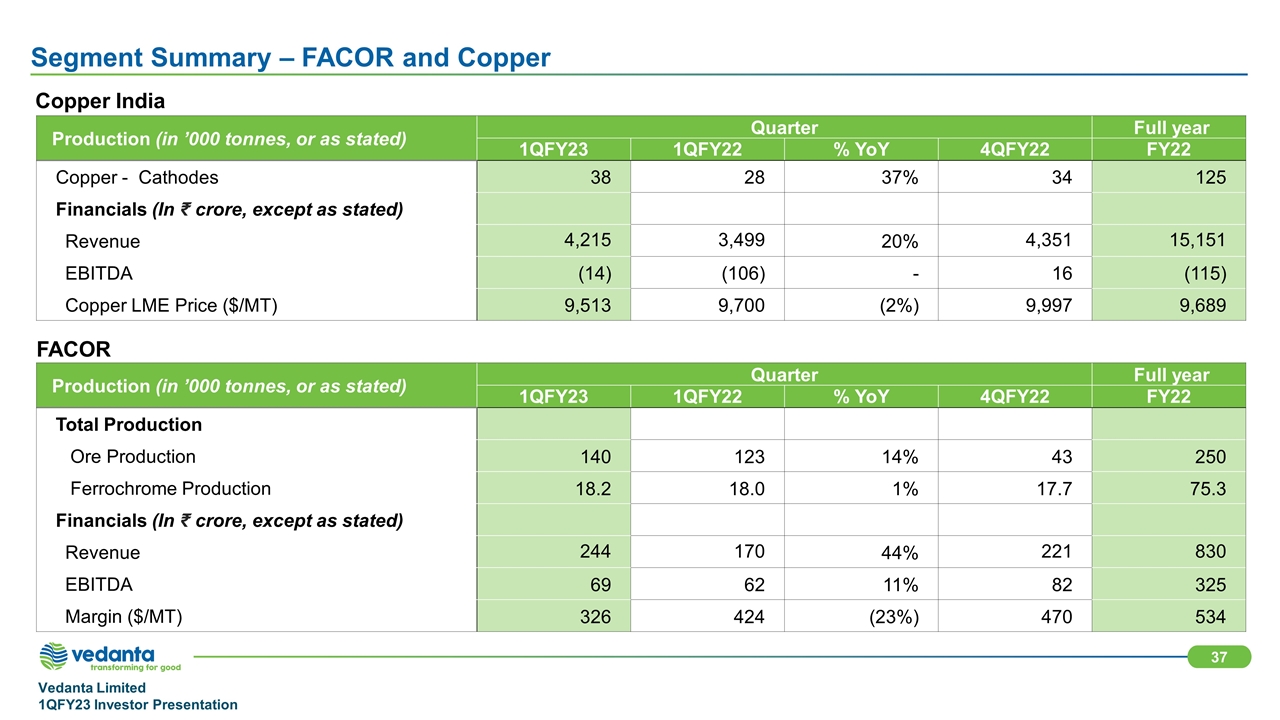

Production (in ’000 tonnes, or as stated) Quarter Q4 Q3 Full year as stated) 1QFY23 1QFY22 % YoY 4QFY22 FY22 Total Production Ore Production 140 123 14% 43 250 Ferrochrome Production 18.2 18.0 1% 17.7 75.3 Financials (In crore, except as stated) Revenue 244 170 44% 221 830 EBITDA 69 62 11% 82 325 Margin ($/MT) 326 424 (23%) 470 534 Segment Summary – FACOR and Copper FACOR Copper India Production (in ’000 tonnes, or as stated) Quarter Q4 Q3 Full year as stated) 1QFY23 1QFY22 % YoY 4QFY22 FY22 Copper - Cathodes 38 28 37% 34 125 Financials (In crore, except as stated) Revenue 4,215 3,499 20% 4,351 15,151 EBITDA (14) (106) - 16 (115) Copper LME Price ($/MT) 9,513 9,700 (2%) 9,997 9,689

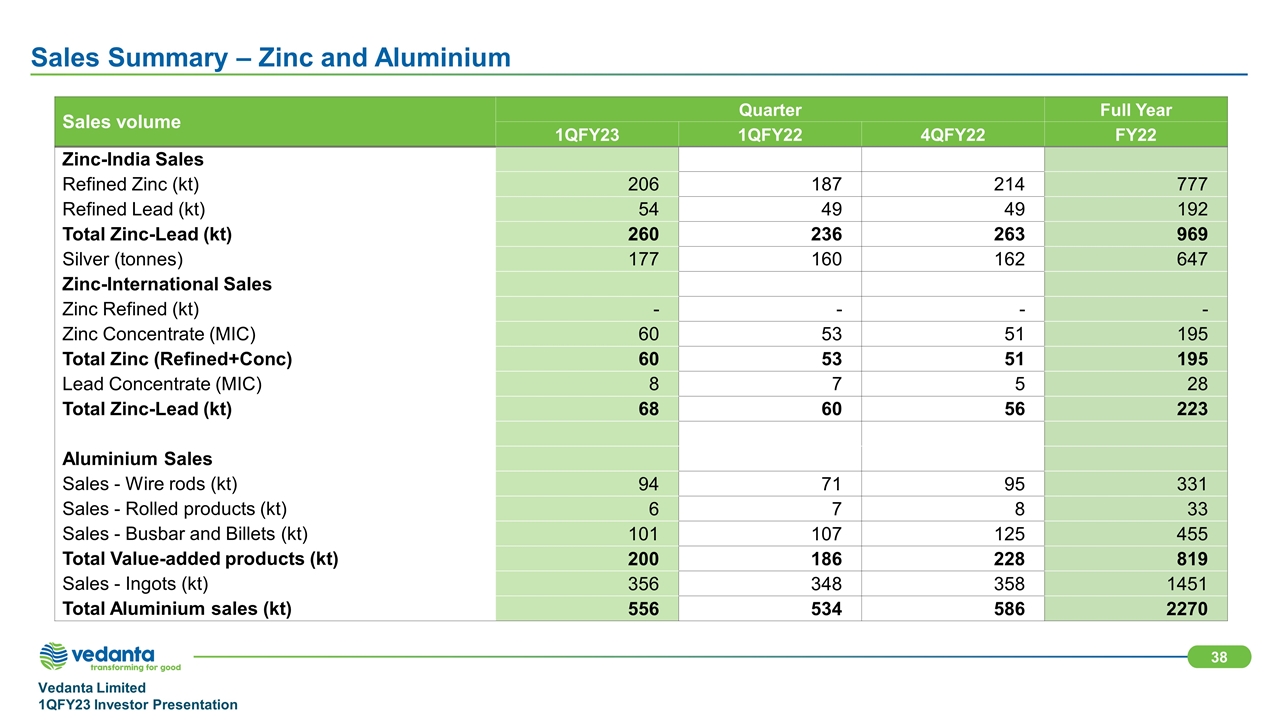

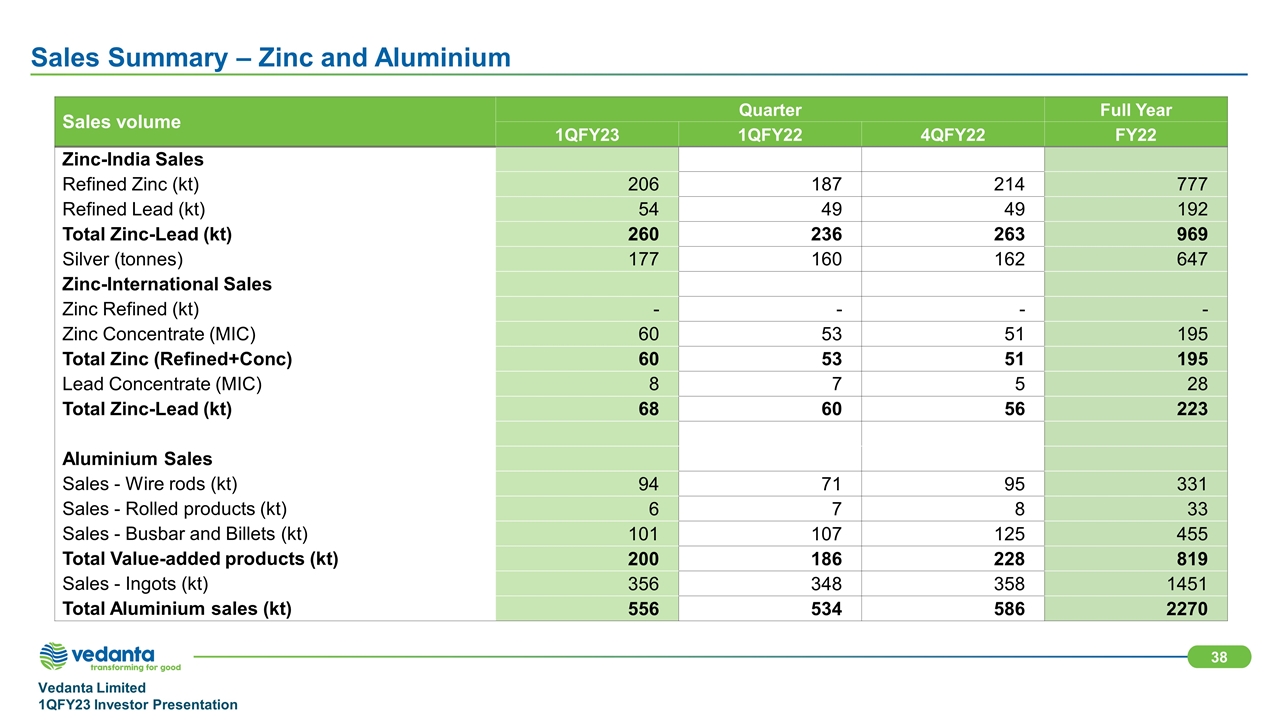

Sales Summary – Zinc and Aluminium Sales volume Quarter Full Year 1QFY23 1QFY22 4QFY22 FY22 Zinc-India Sales Refined Zinc (kt) 206 187 214 777 Refined Lead (kt) 54 49 49 192 Total Zinc-Lead (kt) 260 236 263 969 Silver (tonnes) 177 160 162 647 Zinc-International Sales Zinc Refined (kt) - - - - Zinc Concentrate (MIC) 60 53 51 195 Total Zinc (Refined+Conc) 60 53 51 195 Lead Concentrate (MIC) 8 7 5 28 Total Zinc-Lead (kt) 68 60 56 223 Aluminium Sales Sales - Wire rods (kt) 94 71 95 331 Sales - Rolled products (kt) 6 7 8 33 Sales - Busbar and Billets (kt) 101 107 125 455 Total Value-added products (kt) 200 186 228 819 Sales - Ingots (kt) 356 348 358 1451 Total Aluminium sales (kt) 556 534 586 2270

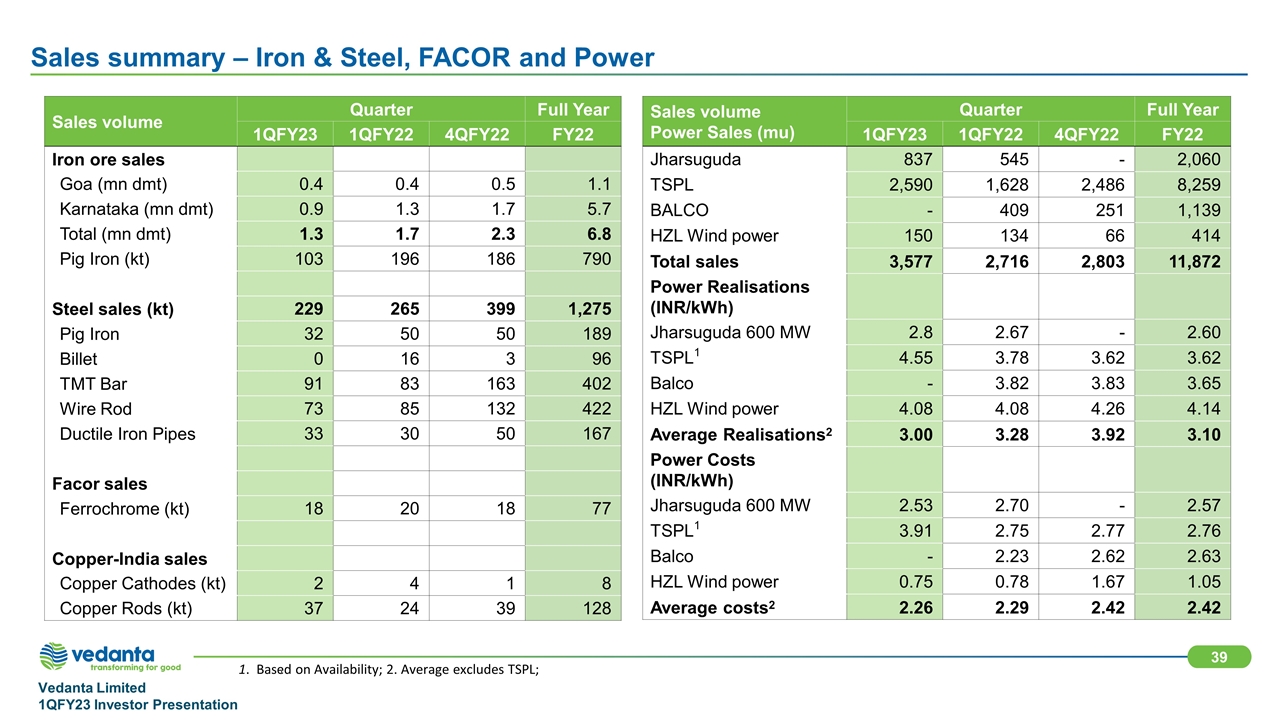

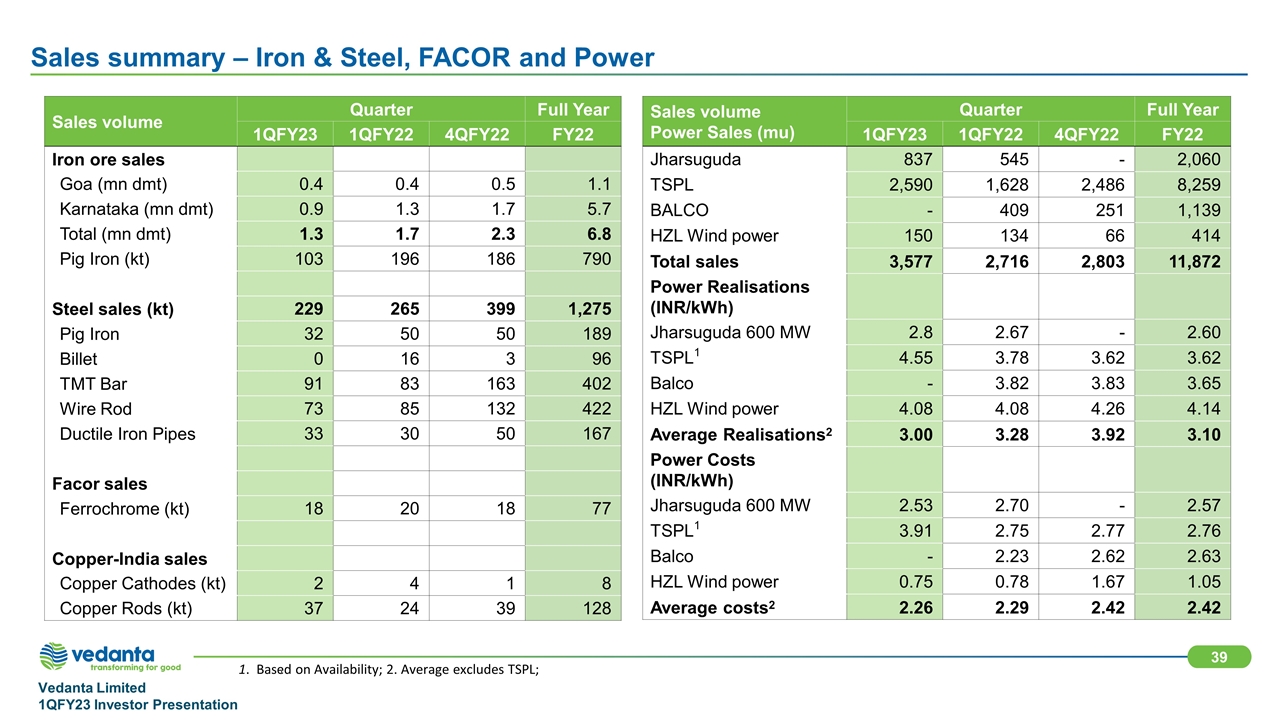

1. Based on Availability; 2. Average excludes TSPL; Sales summary – Iron & Steel, FACOR and Power Sales volume Quarter Full Year Sales volume 1QFY23 1QFY22 4QFY22 FY22 Iron ore sales Goa (mn dmt) 0.4 0.4 0.5 1.1 Karnataka (mn dmt) 0.9 1.3 1.7 5.7 Total (mn dmt) 1.3 1.7 2.3 6.8 Pig Iron (kt) 103 196 186 790 Steel sales (kt) 229 265 399 1,275 Pig Iron 32 50 50 189 Billet 0 16 3 96 TMT Bar 91 83 163 402 Wire Rod 73 85 132 422 Ductile Iron Pipes 33 30 50 167 Facor sales Ferrochrome (kt) 18 20 18 77 Copper-India sales Copper Cathodes (kt) 2 4 1 8 Copper Rods (kt) 37 24 39 128 Sales volume Power Sales (mu) Quarter Full Year 1QFY23 1QFY22 4QFY22 FY22 Jharsuguda 837 545 - 2,060 TSPL 2,590 1,628 2,486 8,259 BALCO - 409 251 1,139 HZL Wind power 150 134 66 414 Total sales 3,577 2,716 2,803 11,872 Power Realisations (INR/kWh) Jharsuguda 600 MW 2.8 2.67 - 2.60 TSPL1 4.55 3.78 3.62 3.62 Balco - 3.82 3.83 3.65 HZL Wind power 4.08 4.08 4.26 4.14 Average Realisations2 3.00 3.28 3.92 3.10 Power Costs (INR/kWh) Jharsuguda 600 MW 2.53 2.70 - 2.57 TSPL1 3.91 2.75 2.77 2.76 Balco - 2.23 2.62 2.63 HZL Wind power 0.75 0.78 1.67 1.05 Average costs2 2.26 2.29 2.42 2.42 .

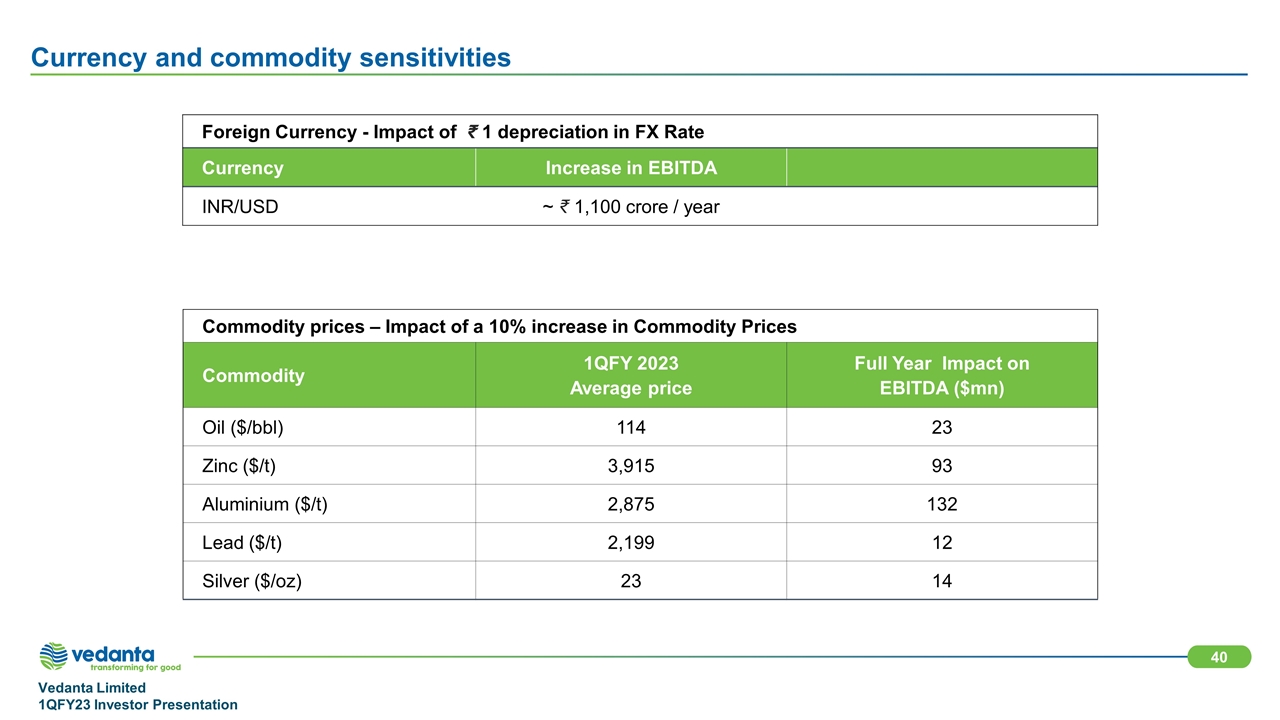

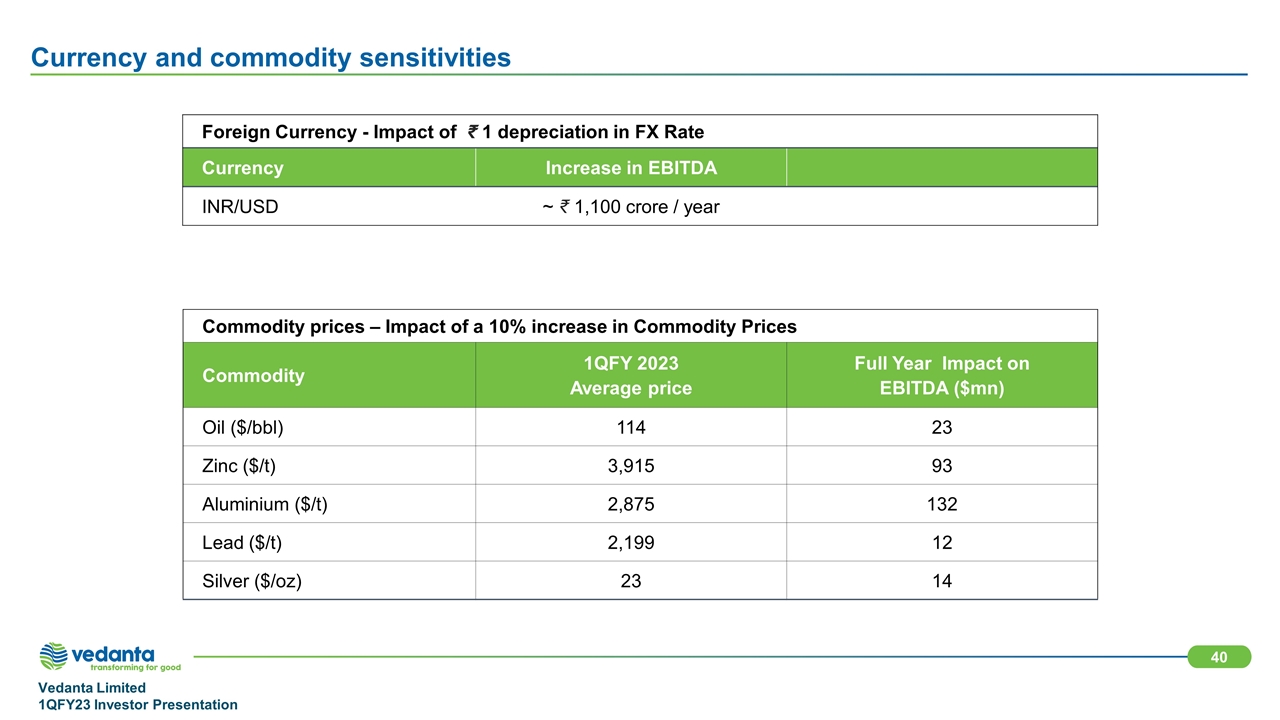

Currency and commodity sensitivities Commodity prices – Impact of a 10% increase in Commodity Prices Commodity 1QFY 2023 Average price Full Year Impact on EBITDA ($mn) Oil ($/bbl) 114 23 Zinc ($/t) 3,915 93 Aluminium ($/t) 2,875 132 Lead ($/t) 2,199 12 Silver ($/oz) 23 14 Foreign Currency - Impact of ₹ 1 depreciation in FX Rate Currency Increase in EBITDA INR/USD ~ 1,100 crore / year

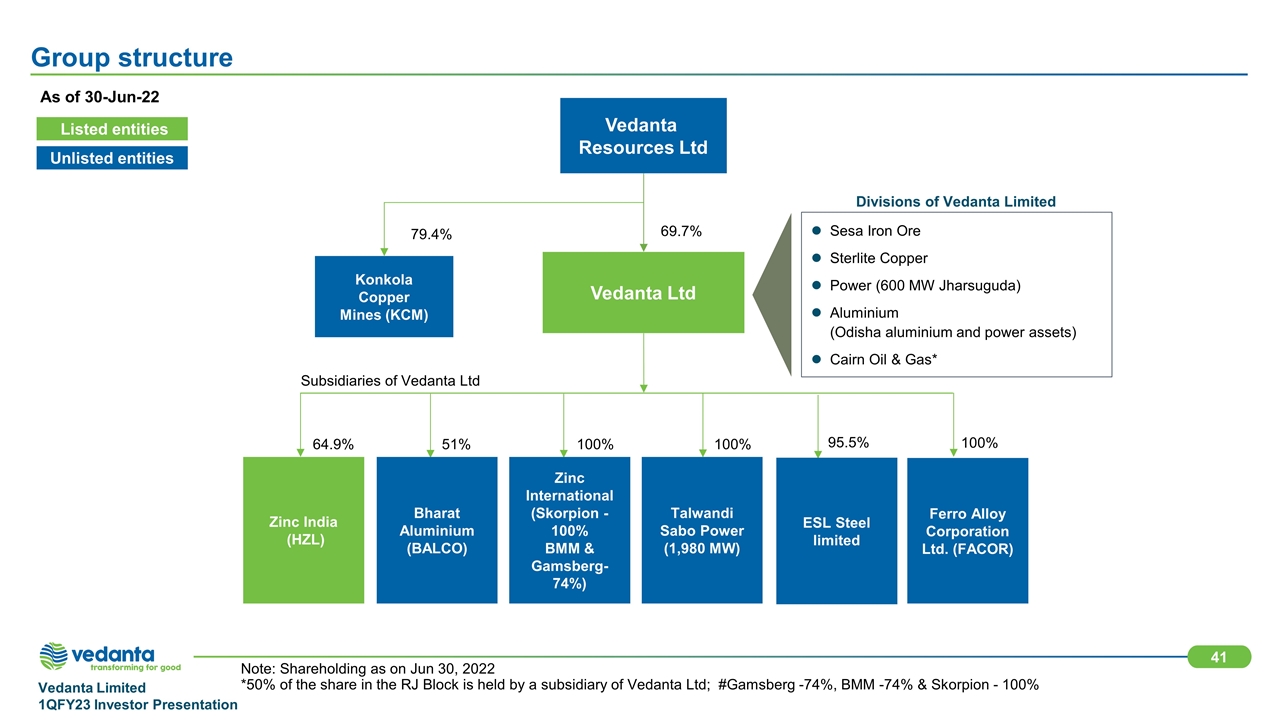

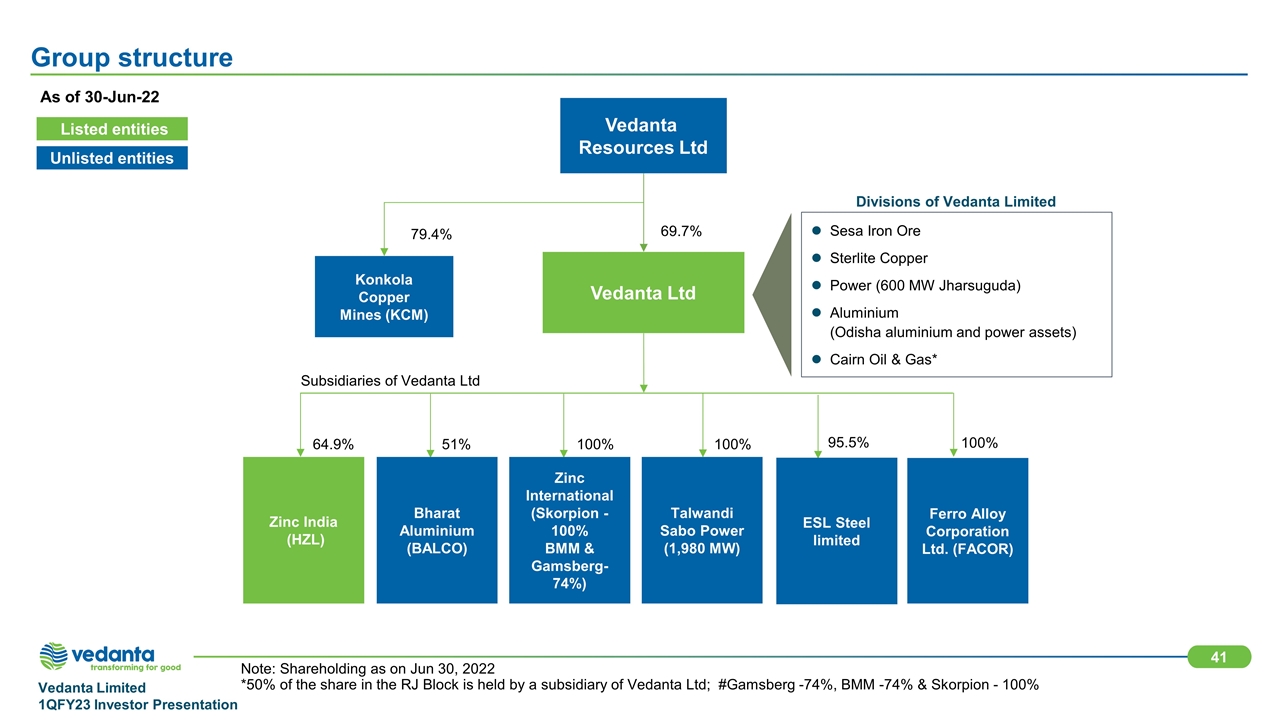

As of 30-Jun-22 Unlisted entities Listed entities Note: Shareholding as on Jun 30, 2022 *50% of the share in the RJ Block is held by a subsidiary of Vedanta Ltd; #Gamsberg -74%, BMM -74% & Skorpion - 100% Group structure Konkola Copper Mines (KCM) 69.7% Vedanta Resources Ltd 64.9% Zinc India (HZL) Vedanta Ltd 79.4% Subsidiaries of Vedanta Ltd Sesa Iron Ore Sterlite Copper Power (600 MW Jharsuguda) Aluminium (Odisha aluminium and power assets) Cairn Oil & Gas* Divisions of Vedanta Limited Talwandi Sabo Power (1,980 MW) 100% Zinc International (Skorpion -100% BMM & Gamsberg-74%) 100% 51% Bharat Aluminium (BALCO) 95.5% ESL Steel limited 100% Ferro Alloy Corporation Ltd. (FACOR)

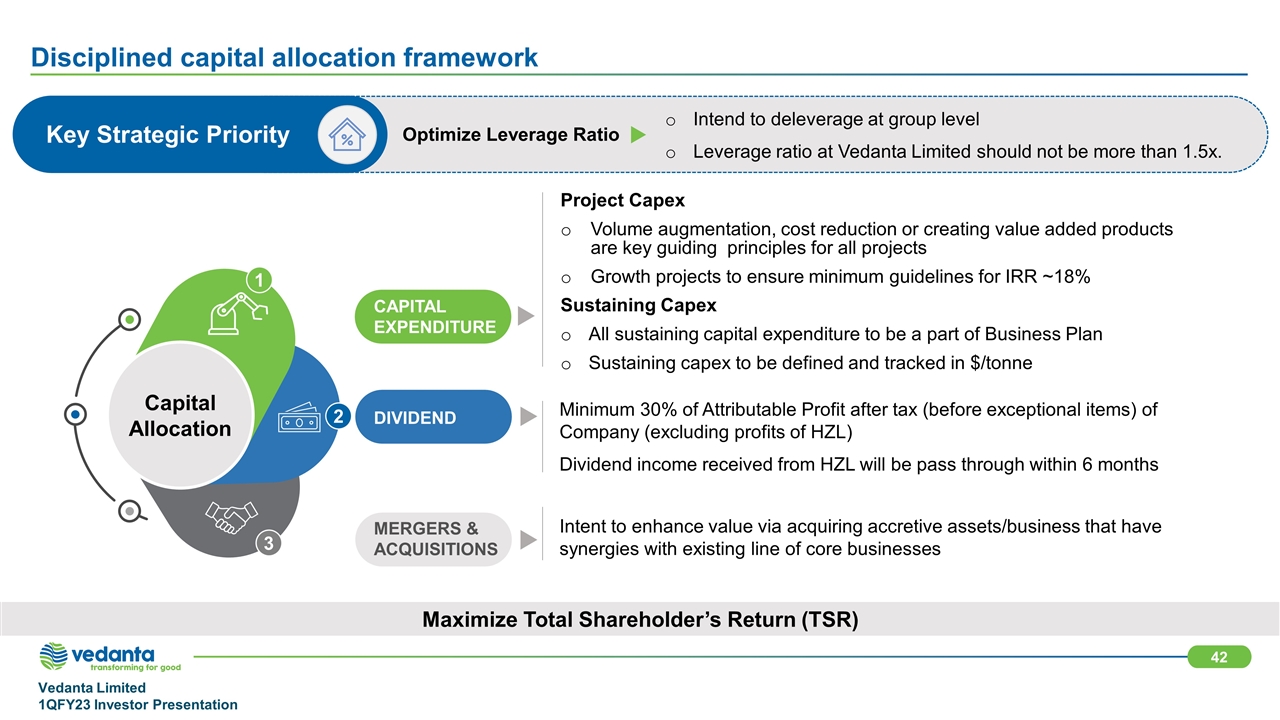

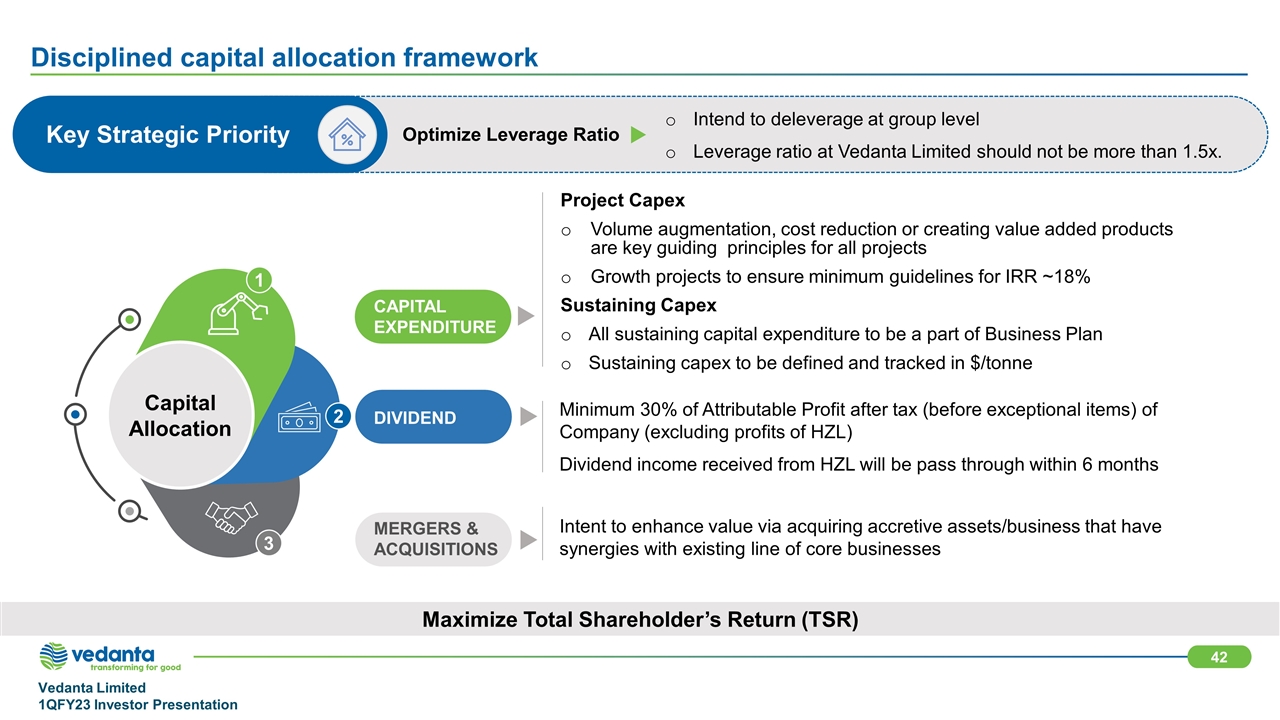

Disciplined capital allocation framework Key Strategic Priority Optimize Leverage Ratio Intend to deleverage at group level Leverage ratio at Vedanta Limited should not be more than 1.5x. Capital Allocation CAPITAL EXPENDITURE Project Capex Volume augmentation, cost reduction or creating value added products are key guiding principles for all projects Growth projects to ensure minimum guidelines for IRR ~18% Sustaining Capex All sustaining capital expenditure to be a part of Business Plan Sustaining capex to be defined and tracked in $/tonne DIVIDEND Minimum 30% of Attributable Profit after tax (before exceptional items) of Company (excluding profits of HZL) Dividend income received from HZL will be pass through within 6 months MERGERS & ACQUISITIONS Intent to enhance value via acquiring accretive assets/business that have synergies with existing line of core businesses Maximize Total Shareholder’s Return (TSR) 1 2 3

Sustainability development & CSR Cairn awarded the ‘India Sustainability Award’ under ‘social performance’ category by the ‘ India CSR Forum' Hindustan Zinc's Dariba Smelting complex and Zinc Smelter Debari won "The Coveted Green Company Rating“ HZL’s Rampura Agucha Mine Won 2 awards at Green Maple foundation pinnacle - Energy Conservation award and Water Conservation award VAL-J awarded with ‘CSR Program of the Year Award’ at Odisha Business Leader of the Year Awards 2022 Finance & Operational HZL awarded with ‘Master of Risk award in fraud prevention & ethics management’ at India Risk Management Awards Vedanta’s Value-Added Business (VAB) conferred with prestigious IMC RBNQA performance excellence award in manufacturing category at IMC Chamber of commerce and Industry VAL-J and BALCO awarded with ‘Excellence in Fly-ash Utilization’ awards for efficient management of fly-ash by both Thermal Power Plant and Captive Power Plant Health, Safety & HR HZL Won People First HR Excellence award 2022 Cairn awarded with ‘Platinum Award in Occupational Health & Safety 2022 ‘by ‘Grow Care India’ Sterlite Copper won Global HR Excellence Award 2022 – For best use of HR practices in employee engagement at Best Employer Brand Award 2022 BALCO awarded with ‘Platinum Award for Safety’ at the CII National Safety Practices Competition Our group companies received more than 100 awards in the finance, operational excellence, sustainability, CSR and HR categories VAL-J : Vedanta Limited Jharsuguda; HZL: Hindustan Zinc Ltd; VAB: Value added business; Awards and Recognition - 1QFY23

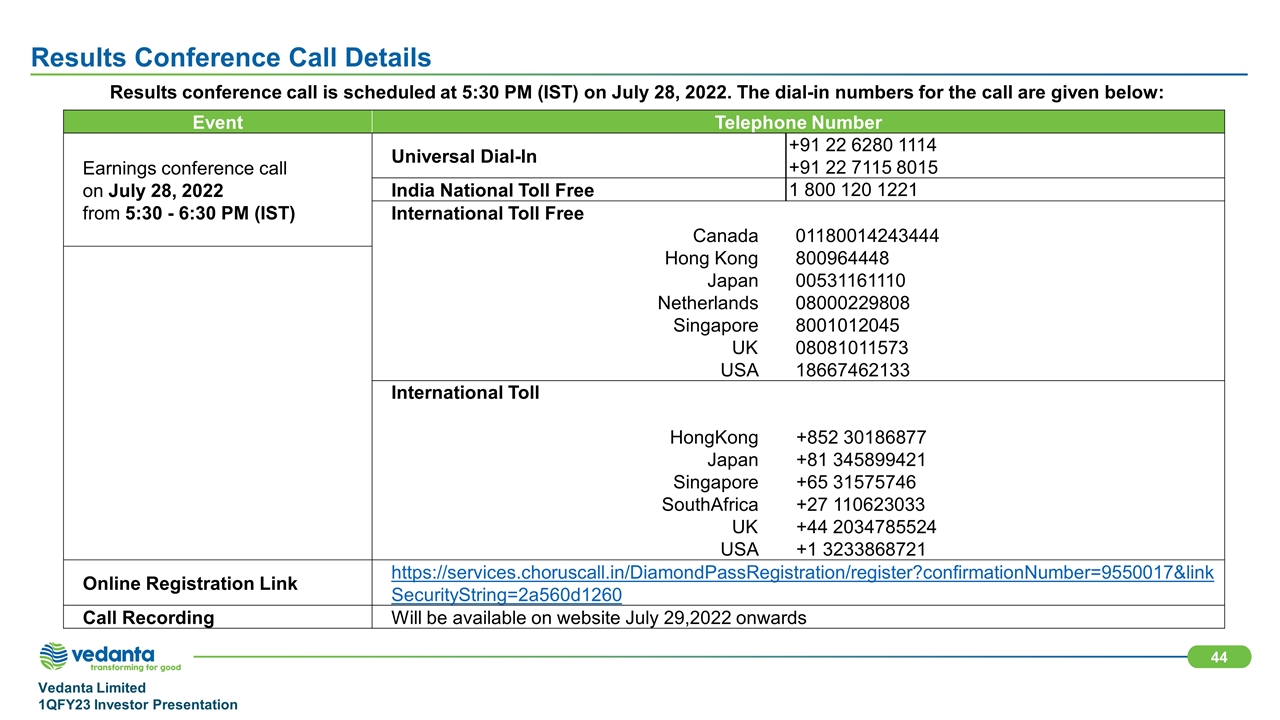

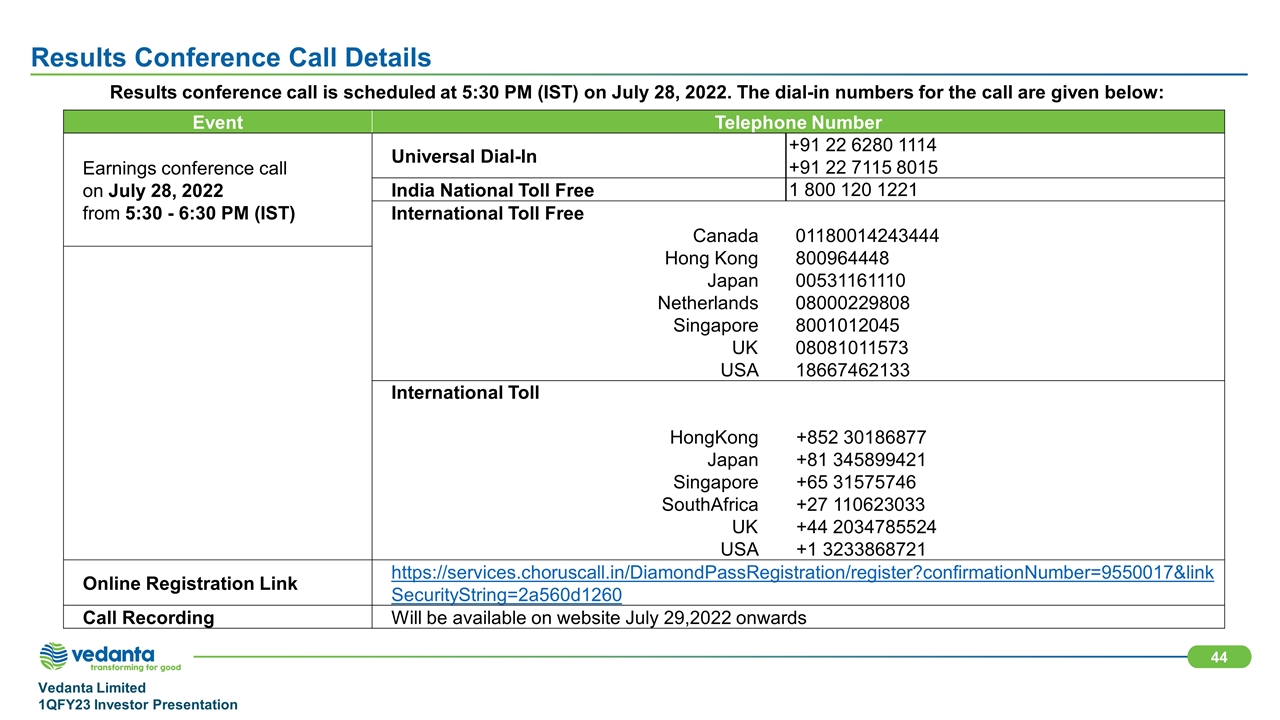

Results Conference Call Details Results conference call is scheduled at 5:30 PM (IST) on July 28, 2022. The dial-in numbers for the call are given below: Event Telephone Number Earnings conference call on July 28, 2022 from 5:30 - 6:30 PM (IST) Universal Dial-In +91 22 6280 1114 +91 22 7115 8015 India National Toll Free 1 800 120 1221 International Toll Free Canada 01180014243444 Hong Kong 800964448 Japan 00531161110 Netherlands 08000229808 Singapore 8001012045 UK 08081011573 USA 18667462133 International Toll HongKong +852 30186877 Japan +81 345899421 Singapore +65 31575746 SouthAfrica +27 110623033 UK +44 2034785524 USA +1 3233868721 Online Registration Link https://services.choruscall.in/DiamondPassRegistration/register?confirmationNumber=9550017&linkSecurityString=2a560d1260 Call Recording Will be available on website July 29,2022 onwards