Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

WLDN similar filings

- 6 Nov 14 Willdan Group Reports Third Quarter 2014 Financial Results

- 13 Aug 14 Entry into a Material Definitive Agreement

- 7 Aug 14 Willdan Group Reports Second Quarter 2014 Financial Results

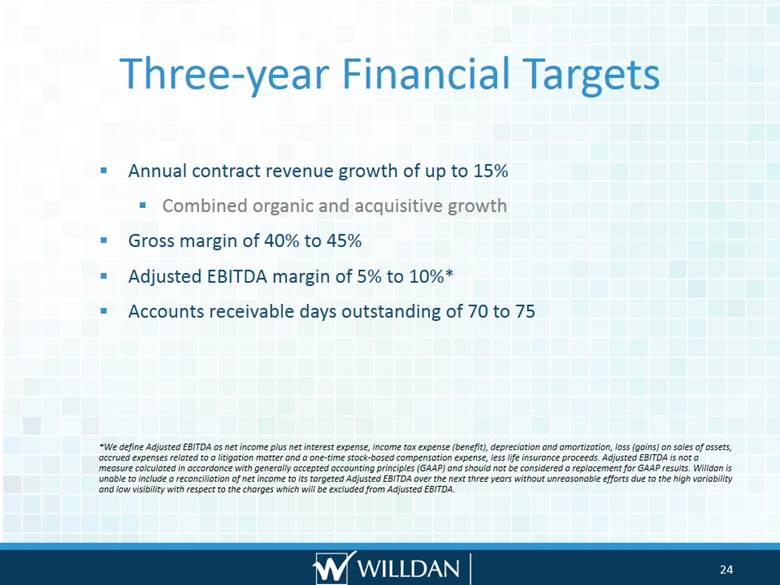

- 20 Jun 14 Willdan Outlines Strategy and Targets for Continued Growth and Profitability

- 10 Jun 14 Submission of Matters to a Vote of Security Holders

- 8 May 14 Willdan Group Reports First Quarter 2014 Financial Results

- 23 Apr 14 Submission of Matters to a Vote of Security Holders

Filing view

External links