- ETSY Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Etsy (ETSY) DEF 14ADefinitive proxy

Filed: 20 Apr 18, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under Rule 14a-12 | |

ETSY, INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

NOTICE OF 2018 Annual Meeting of Stockholders and Proxy Statement

|

117 Adams Street Brooklyn, NY 11201

April 20, 2018

To our stockholders:

I was honored to join Etsy as President and CEO in May 2017. It has been a year of significant transformation and progress for Etsy, and we are proud that our efforts have resulted in improved performance.

I am pleased to invite you to attend Etsy, Inc.’s 2018 Annual Meeting of Stockholders to be held on Thursday, June 7, 2018 at 9:00 a.m., Eastern Time. Our Annual Meeting will be a “virtual meeting” of stockholders, which will be conducted exclusively online via live webcast.

By hosting our meeting virtually, we are able to expand access, improve communication, and lower costs. This approach also enables participation from our global community and aligns with our broader sustainability goals.

Your vote is very important. Whether you plan to participate in the Annual Meeting or not, please be sure to vote. Voting instructions can be found on page 2 of the proxy statement.

On behalf of the Board of Directors and the management team, thank you for your ongoing support of, and continued interest in Etsy.

Sincerely,

Josh Silverman President, CEO & Director

|

| ||||||

Notice of 2018 Annual Meeting of Stockholders

| ||||||

Date: June 7, 2018

Time: 9:00 a.m. Eastern Time

Place: ETSY.onlineshareholdermeeting.com

Record Date: April 12, 2018 | Meeting Agenda:

• Elect Gary S. Briggs, Edith W. Cooper, and Melissa Reiff as Class III directors to serve until our 2021 Annual Meeting of Stockholders and until their respective successors have been elected and qualified or until they resign, die, or are removed from the Board of Directors;

• Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018;

• Consider an advisory vote to approve executive compensation; and

• Transact any other business that may properly come before the Annual Meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we encourage you to read the accompanying proxy statement and to submit your proxy or voting instructions as soon as possible. Even if you have voted by proxy, you may still vote during the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank, trustee, or nominee and you wish to vote during the Annual Meeting, you must follow the instructions from such broker, bank, trustee, or nominee.

Jill Simeone General Counsel and Secretary

April 20, 2018

| |||||

Important Notice Regarding the Availability of Proxy Materials for the 2018 Annual Meeting of Stockholders to be Held on June 7, 2018:The proxy statement and the annual report to stockholders are available at http://www.proxyvote.com.

| ||||||

i

ii

About Etsy

Etsy is the global marketplace for unique and creative goods. We connect creative entrepreneurs with thoughtful consumers looking for items made by real people. Our mission is to “Keep Commerce Human” and we’re committed to using the power of business to strengthen communities and empower people.

As of December 31, 2017, our marketplace connected 1.9 million active Etsy sellers and 33.4 million active Etsy buyers, in nearly every country in the world. Our sellers are the heart and soul of Etsy, and our technology platform allows our sellers to turn their creative passions into economic opportunity. We have a seller-aligned business model: we make money when our sellers make money. We offer a wide range of Seller Services and tools that are specifically designed to help creative entrepreneurs start, manage, and scale their businesses.

2017 Business Highlights

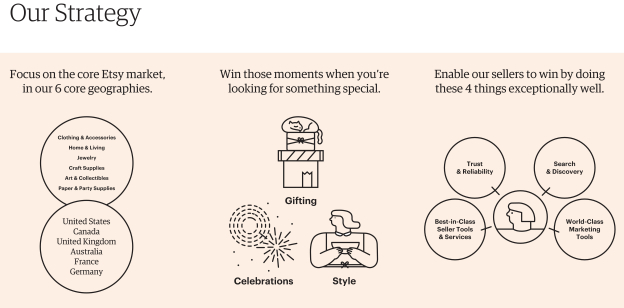

2017 was a transformational year for Etsy. In May 2017, we appointed Josh Silverman as our Chief Executive Officer and Rachel Glaser as our Chief Financial Officer, and in July 2017, we appointed Mike Fisher as our Chief Technology Officer. Jill Simeone joined as our General Counsel in January 2017. Since joining us, our new management team has sought to sharpen our focus on key initiatives and realign our internal resources to pursue the highest growth opportunities in order to deliver value to our stakeholders. Our new management team identified and began implementing a new business strategy and began executing on the four key initiatives that we believe will help Etsy and our sellers succeed. | ||

| * | This summary highlights the financial, compensation, and corporate governance information described in more detail elsewhere in this Proxy Statement. This summary does not contain all the information that you should consider, and you should read the entire Proxy Statement before voting. |

iii

|

2017 Operational and Financial Highlights

With this greater focus on our four key initiatives, we increased the pace of our product experiments and the rate at which we are going from idea, to experiment, to test, to launch. These actions collectively enabled us to achieve the following 2017 results:

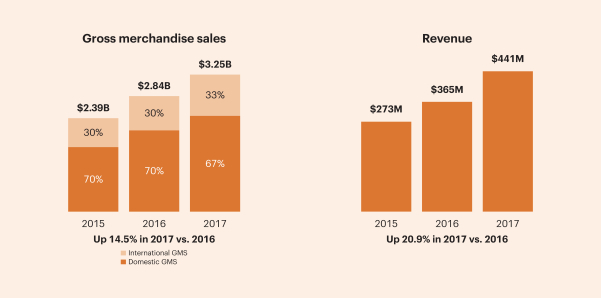

• Gross merchandise sales (“GMS”) grew by 14.5% year-over-year to $3.25 billion, up from $2.84 billion in 2016, with 33.0% of sales involving a buyer and/or seller outside of the U.S. We accelerated GMS growth for the third and fourth quarter of 2017 and delivered our first-ever billion dollar quarter of GMS in the fourth quarter of 2017, following a strong holiday season.

• Revenue rose by 20.9% year-over-year to a total of $441.2 million, compared to $365.0 million in 2016, led by Seller Services revenue growth of 28.7%.

• Our active seller community grew to 1.9 million (up about 11% from 2016) and our active buyer community grew to 33.4 million (up about 17% from 2016).

• Net income was $81.8 million compared with a net loss of $29.9 million in 2016.

• Non-GAAP Adjusted EBITDA* was $80.0 million, representing an increase of 40.1% year-over-year, compared to $57.1 million in 2016.Non-GAAP Adjusted EBITDA margin (i.e.,non-GAAP Adjusted EBITDA divided by revenue) was 18.1%, compared to 15.7% in 2016. | ||

| * | See“Non-GAAP Financial Measures” for a reconciliation of Adjusted EBITDA to net income (loss), the most directly comparable financial measure calculated in accordance with GAAP. |

iv

|

Our Impact Strategy | ||

Etsy’s impact strategy focuses on leveraging Etsy’s core business to generate value for our community and stakeholders through positive economic, social, and environmental efforts. We believe that aligning our impact strategy with our core business will lead to positive outcomes. We aim to create more economic opportunity for sellers, greater diversity in our workforce and build long-term resilience by reducing our carbon footprint. We believe that consumers are demanding more of the businesses they support and that the companies best positioned to succeed will buildwin-win solutions that are good for people, the planet, and profit. The alignment of our mission, values, and impact strategy alongside our business strategy is critical to growing sustainably and positioning us for continued success.

For 2018, we have set key performance indicators (“KPIs”) in order to measure our impact progress. | ||

v

| ||||||||

| OVERARCHING GOAL | Economic Impact | Social Impact | Ecological Impact | |||||

| Make creative entrepreneurship a path to economic security and personal empowerment | Enable equitable access to the opportunities we create | Build long-term resilience by eliminating our carbon impacts and fostering responsible resource use | ||||||

| ||||||||

KEY INITIATIVES | — Ensure the economic opportunities Etsy creates meaningfully benefit across a broad swath of our seller community — Foster economic security and personal empowerment for creative entrepreneurs through charitable and in-kind contributions — Advance public policies that increase economic security and reduce administrative burdens for creative entrepreneurs | — Meaningfully increase representation of underrepresented groups and ensure equity in Etsy’s workforce — Build a diverse, equitable, and sustainable supply chain to support our operations and bring value to both Etsy and our vendors — Increase the presence of underrepresented populations within the Etsy seller community | — Utilize and source energy responsibly so that we can power our operations with 100% renewable electricity by 2020 and reduce the intensity of our energy use by 25% by 2025 — In 2018, develop a plan and set a goal to mitigate the carbon impacts of our marketplace that aligns with business growth — Run zero waste operations by 2020 | |||||

| ||||||||

2018 KPI | Increase the number of sellers whose sales on Etsy serve as a meaningful source of personal income | Interview at least two candidates from underrepresented backgrounds for each role filled | Reduce the carbon dioxide emissions generated from our offices by at least 5% in 2018 compared to 2016 |

Leadership and Corporate Governance

Executive Team We believe that we have built a highly qualified and effective executive team. Each person brings fresh perspectives and deep expertise to their particular roles. We’re proud that 60% of our team identifies as women.

Our executive officers are:

• Chief Executive Officer, Josh Silverman, leading Etsy in its growth and strategic direction

• Chief Financial Officer, Rachel Glaser, overseeing our global financial operations

• Chief Technology Officer, Mike Fisher, leading our engineering team

• Chief Operating Officer, Linda Kozlowski, overseeing our markets and seller services organizations

• General Counsel and Secretary, Jill Simeone, leading our legal, policy, and advocacy teams | ||

vi

Director Nominees and Continuing Directors The following table provides summary information about each director nominee and continuing director. See pages 6 to 20 for more information. | ||

Name | Age | Etsy Director Since | Independent | Audit Committee | Compensation Committee | Nominating and Corporate Governance | ||||||

Nominees for election at the 2018 Annual Meeting (Class III)

| ||||||||||||

Gary S. Briggs

| 55

| 2018

| Yes

|

| ||||||||

Edith W. Cooper

| 56

| 2018

| Yes

|

| ||||||||

Melissa Reiff

| 63

| 2015

| Yes

|

| ||||||||

Nominees for election at the 2019 Annual Meeting (Class I)

| ||||||||||||

Jonathan D. Klein

| 57

| 2011

| Yes

|

| ||||||||

Margaret M. Smyth

| 54

| 2016

| Yes

|

| ||||||||

Nominees for election at the 2020 Annual Meeting (Class II)

| ||||||||||||

M. Michele Burns

| 60

| 2014

| Yes

|

|

| |||||||

Josh Silverman

| 49

| 2016

| No

| |||||||||

Fred Wilson (Board Chair)

| 56

| 2007

| Yes

|

|

|

| ||||||

| Chair |

| Member |

| Financial Expert |

| Director Dashboard | ||||

| ||||

vii

Corporate Governance Strengths We believe that effective corporate governance is notone-size-fits-all. We carefully consider our corporate governance practices to ensure that they are appropriately tailored to our business and promote the long-term interests of our stockholders.

Our corporate governance practices include:

• Independent Board Chair

• Except for our CEO, all directors on the Board are independent

• 100% independent Committee members

• Regular executive sessions of independent directors

• A Board that is comprised of sophisticated and fully engaged directors with different areas of relevant expertise, including two new directors with expertise in marketing and human resources who joined our Board in 2018 and who bring fresh perspectives to our business and operations

• Active role in risk management oversight

• Annual Board and Committee self-evaluations overseen by the lead independent director and Nominating and Corporate Governance Committee

• Robust code of conduct applicable to directors, officers, and employees

• Periodic reviews of our corporate governance structure, including committee charters, corporate governance guidelines, and code of conduct, to ensure they are typical and appropriate for a company of our stage of development and market size

• Rigorous CEO evaluation process

• Independent director oversight of executive succession planning

• Strict policy of no pledging or hedging of Etsy shares for current employees and directors

Shareholder Engagement

We maintain active, year-round engagement with the Etsy community—we regularly meet with our stockholders and other key constituents like Etsy sellers. In 2017, we held over 430 meetings with our stockholders who, in the aggregate, held over 45% of our outstanding shares. We discussed a variety of topics, including but not limited to, our financial performance, our business and growth strategy, corporate governance practices, and executive compensation matters. Our discussions with investors have been productive and informative and have provided valuable feedback to our Board to help ensure that its decisions are aligned with stockholder objectives.

| ||

viii

Executive Compensation

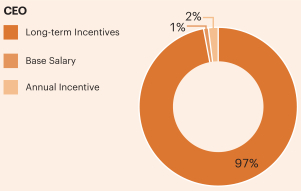

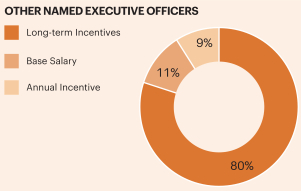

In light of the substantial changes in our management team and the changes flowing from our business transformation, our compensation program in 2017 reflected our company’s challenging and changing circumstances. The Committee was largely guided by the need to recruit and hire the appropriate individuals at our most critical senior leadership positions and to ensure the retention and continued service of the remaining senior executive officers. In filling each of the executive positions in 2017, we recognized the need to develop competitive compensation packages to attract qualified candidates in a dynamic labor market. For a detailed discussion of our executive compensation program, please see the section titled “Executive Compensation—Compensation Discussion and Analysis”.

We maintain the following practices that we believe help support the effectiveness of our executive compensation program.

What We Do

| What We Don’t Do

| |

✓ We maintain a fully (100%) independent Compensation Committee | × We do not provide our executive officers with guaranteed annual base salary increases

| |

✓ We retain an independent compensation advisor who performs no other services for us

| × We do not provide excessive perquisites | |

✓ Our Compensation Committee conducts an annual executive compensation review, including a review of its compensation peer group and a compensation-related risk assessment

| × We do not offer defined benefit retirement programs | |

✓ We use variable pay, including long-term equity awards, as a substantial portion of our executive officers’ target total direct compensation opportunity

| × We do not offerchange-in-control excise tax payments or“gross-ups” | |

✓ Our executive officers are employed “at will” | × We do not permit hedging or pledging of our equity securities by current employees or directors

| |

× We do not permit stock option exchanges orre-pricings without stockholder approval

| ||

ix

| Voting and Meeting Information |

What is the purpose of this proxy statement?

We are sending you this proxy statement because the Board of Directors of Etsy, Inc. (which we refer to as “Etsy,” “we,” “us,” or “our”) is inviting you to vote (by soliciting your proxy) at our 2018 Annual Meeting of Stockholders, which will take place online on June 7, 2018 at 9:00 a.m. Eastern Time. You can attend the Annual Meeting by visiting ETSY.onlineshareholdermeeting.com, where you will be able to listen to the meeting live, submit questions, and vote online. We have decided to hold a virtual meeting because it improves stockholder access, encourages greater global participation, and aligns with our broader sustainability goals.

This proxy statement summarizes information that is intended to assist you in making an informed vote on the proposals described in this proxy statement.

Why did I receive aone-page notice in the mail regarding the internet availability of proxy materials instead of a full set of proxy materials?

We are providing access to our proxy materials over the internet, which reduces both the costs and the environmental impact of sending our proxy materials to stockholders. We mailed a Notice of Internet Availability (the “Notice”) to our stockholders (other than those who previously requested paper copies) on or about April 20, 2018.

The Notice contains instructions on how to:

| • | access and view the proxy materials over the internet; |

| • | vote; and |

| • | request a paper ore-mail copy of the proxy materials. |

In addition, if you received paper copies of our proxy materials and wish to receive all future proxy materials, proxy cards, and annual reports electronically, please follow the electronic delivery instructions on www.proxyvote.com. We encourage stockholders to take advantage of the availability of the proxy materials on the internet to help reduce the cost and environmental impact of the Annual Meeting.

What am I being asked to vote on?

You are being asked to vote on:

• The election of Gary S. Briggs, Edith W. Cooper, and Melissa Reiff as Class III directors to serve until the 2021 Annual Meeting of Stockholders and until their successors have been elected and qualified or until they resign, die, or are removed from the Board;

• The ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018; and

• An advisory vote to approve executive compensation, which is commonly referred to as the“say-on-pay” vote. | ||

| Etsy | 2018 Proxy Statement | 1 |

How does the Board recommend that I vote?

Our Board recommends that you vote:

• “FOR” the election of Gary S. Briggs, Edith W. Cooper, and Melissa Reiff as Class III directors;

• “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018; and

• “FOR” the approval, on an advisory basis, of executive compensation.

Who is entitled to vote at the Annual Meeting?

Stockholders as of the close of business on April 12, 2018, the record date, are entitled to vote. On the record date, there were approximately 119,908,305 shares of common stock outstanding and entitled to vote. Stockholders may cast one vote per share on all matters.

How do I vote?

If on April 12, 2018 your Etsy shares were registered directly in you name with our transfer agent, Computershare Trust Company, N.A., then you are a shareholder of record and you can vote your shares in one of two ways: either by proxy or during the virtual Annual Meeting by webcast.

If you choose to vote by proxy, you may do so:

| By Internet You can vote over the internet at www.proxyvote.com by following the instructions on the Notice or proxy card; | |||

| By Telephone You can vote by telephone by calling toll-free1 (800) 690-6903 and following the instructions on the Notice or proxy card; | |||

| By Mail You can vote by mail by signing, dating and mailing the proxy card (if you received one by mail); or | |||

| By Smartphone or Tablet Scan this QR code:

|

| ||

Even if you plan to attend the virtual Annual Meeting at ETSY.onlineshareholdermeeting.com (following the instructions below), we recommend that you submit your proxy in advance via one of the methods above. This way, your shares of common stock will be voted as you direct if your plans change or you are unable to attend the Annual Meeting.

If on April 12, 2018 your Etsy shares were held in an account with a broker, bank, trustee, or nominee, you will receive instructions on how to vote from your broker, bank, trustee, or nominee. Please follow those instructions in order to vote your shares. If you would like to vote your shares at the virtual Annual Meeting, you will need to obtain a valid proxy from the broker, bank, trustee, or nominee that holds your shares giving you the right to vote the shares at the meeting.

| 2 | 2018 Proxy Statement | Etsy |

How can I attend the Annual Meeting?

You can attend the virtual Annual Meeting by visiting ETSY.onlineshareholdermeeting.com. To participate in the virtual Annual Meeting, you will need the control number included on your Notice or proxy card. The Annual Meeting webcast will begin promptly at 9:00 a.m. Eastern Time on June 7, 2018. We encourage you to access the meeting website prior to the start time. Onlinecheck-in will begin at 8:45 a.m. Eastern Time, and you should allow ample time for thecheck-in procedures. You will be able to ask questions and vote your shares electronically at the virtual Annual Meeting by following the instructions on the website.

What is the deadline for voting?

If you are a shareholder of record, your ability to vote by internet or telephone will end at 11:59 p.m. Eastern Time on June 6, 2018. If you prefer to vote by mail, you should complete and return the proxy card as soon as possible, so that it is received no later than the closing of the polls at the Annual Meeting on June 7, 2018.

If your Etsy shares are held in an account with a broker, bank, trustee, or nominee, you should vote in accordance with the instructions from your broker, bank, trustee, or nominee.

What if I return a proxy card but do not make specific choices?

If you submit a proxy card but do not provide any voting instructions, the persons named as proxies will vote in accordance with the recommendations of the Board, which are indicated above and with each proposal in this proxy statement. We know of no other business that will be presented at the Annual Meeting. However, if any other matter is properly presented at the meeting, the persons named as proxies will vote your shares using his or her best judgment.

Can I change my vote or revoke my proxy?

Yes. If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you may change your vote or revoke your proxy at any time prior to the final vote at the virtual Annual Meeting on June 7, 2018 by:

• providing a new proxy bearing a later date (which automatically revokes the earlier proxy) by internet, telephone, or mail (and until the applicable deadline for each method);

• attending and voting at the virtual Annual Meeting; or

• by providing written notice to our Secretary at Etsy, Inc., 117 Adams Street, Brooklyn, NY 11201.

Your most recent proxy submitted by proxy card, internet, or telephone is the one that will count. Your attendance at the virtual Annual Meeting by itself will not revoke your proxy if you do not also submit a proxy card or vote at the virtual Annual Meeting.

If you hold shares in an account with a broker, bank, trustee, or nominee, you may change your vote by submitting new voting instructions to your broker, bank, trustee, or nominee in accordance with the instructions they provide to you. If you have obtained a valid proxy from your broker, bank, trustee, or nominee giving you the right to vote your shares, you may change your vote by attending the virtual Annual Meeting and voting.

| Etsy | 2018 Proxy Statement | 3 |

How many votes are required to approve each proposal?

| Proposal | Vote Required to Approval | Effect of Abstentions | Effect of Broker Non-Votes* | |||

Election of Directors | Each director is elected by a plurality of the votes cast. The director nominees receiving the highest number of “FOR” votes will be elected.

| Not applicable | No effect; Brokers may not vote the shares if not instructed by the proxyholder, as this matter is considered“non-routine” | |||

Ratification of Auditors | Decided by a majority of the votes cast. This proposal will be approved if the number of votes cast “FOR” the proposal exceeds the number of votes cast “AGAINST” the proposal.

| Not applicable | Not applicable; Brokers may vote the shares if not instructed by the proxyholder, as this matter is considered “routine” | |||

Advisory vote on say on pay | Decided by a majority of the votes cast. This proposal will be approved if the number of votes cast “FOR” the proposal exceeds the number of votes cast “AGAINST” the proposal.

| Not applicable | No effect; Brokers may not vote the shares if not instructed by the proxyholder, as this matter is considered“non-routine” | |||

| * | A “brokernon-vote” occurs when a beneficial owner of shares held by a broker, bank, trustee, or nominee does not give voting instructions to his or her broker, bank, or other securities intermediary as to how to vote on matters deemed to be“non-routine” and, as a result, the broker, bank or other securities intermediary may not vote the shares on those matters. As discussed above, this would be the case for Proposals No. 1 and No. 3, which are considered“non-routine” matters. Therefore, we would expect brokernon-votes to result from these proposals. We urge you to provide instructions so that your shares held in a stock brokerage account or by a bank or other record holder may be voted. |

Who will count the votes?

Representatives of Broadridge Financial Services, Inc. will tabulate the votes and act as inspectors of election.

What happens if I do not vote?

If you are a shareholder of record and do not vote by completing your proxy card, by telephone, through the internet or online during the meeting, your shares will not be voted.

If your Etsy shares are held in an account with a broker, bank, trustee, or nominee, and you do not instruct your broker, bank, trustee, or nominee how to vote your shares, your broker, bank, trustee, or nominee may still be able to vote your shares in its discretion. In this regard, brokers, banks, and other securities intermediaries may use their discretion to vote your “uninstructed” shares with respect to matters considered under applicable exchange rules to be “routine,” but not with respect to“non-routine” matters. See “How many votes are required to approve each proposal?” for more information.

| 4 | 2018 Proxy Statement | Etsy |

What is a quorum?

A quorum is the minimum number of shares required to be present at the Annual Meeting for any business to be conducted. For our Annual Meeting, a majority of the shares entitled to vote must be present, either during the Annual Meeting or represented by proxy. If a quorum is not present, we will not be able to conduct any business, and the Annual Meeting will be rescheduled for a later date.

Instructions to “withhold” authority to vote in the election of directors, abstentions and brokernon-votes will be counted as present for determining whether or not a quorum is present.

Where can I find the voting results of the Annual Meeting?

We plan to announce preliminary voting results at the Annual Meeting and will report the final voting results in a current report on Form8-K within four business days of the Annual Meeting.

Who pays for the proxy solicitation expenses?

We are soliciting proxies on behalf of our Board and will pay the related costs. As part of this process, we reimburse brokers and other custodians, nominees, and fiduciaries for theirout-of-pocket expenses for forwarding proxy materials to our stockholders. Our directors, officers, and employees may also solicit proxies in person, by telephone, or by other means of communication, and will not receive any additional compensation for soliciting proxies. In addition, we have retained Saratoga Proxy Consulting, LLC at a fee estimated to be approximately $15,000, plus reasonableout-of-pocket expenses, to assist in the solicitation of proxies.

What does it mean if I receive more than one set of materials?

If you receive more than one set of materials that means you hold your shares in more than one name or account. In order to vote all of your shares, you should sign and return all of the proxy cards you receive or follow the instructions for any alternative voting procedures on the proxy cards or the Notice you receive.

How do I obtain a separate set of proxy materials or request a single set for my household?

We have adopted a practice approved by the SEC called ‘‘householding.’’ This means that stockholders who have the same address and last name and do not participate in electronic delivery of proxy materials will receive only one copy of the Notice and our annual report and proxy statement unless one or more of these stockholders notifies us that they wish to continue receiving individual copies. This procedure reduces printing costs, postage fees, and the environmental impact. Each stockholder who participates in householding will continue to be able to access or receive a separate proxy card.

If you prefer to receive a separate Notice, or if you currently receive multiple copies and would like to request “householding” of your communications, please contact Broadridge by phone at1(866) 540-7095 or by mail to Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717. If any stockholders in your household would like to receive a separate annual report or proxy statement, please send an email to ir@etsy.com or call1(347) 382-7582. We will strive to promptly address your request.

| Etsy | 2018 Proxy Statement | 5 |

Election of Directors

Our Board has eight members. In accordance with our amended and restated certificate of incorporation, our Board is divided into three staggered classes of directors. At the Annual Meeting, three Class III directors are standing for election, each for a three-year term.

The Board has nominated Gary S. Briggs, Edith W. Cooper, and Melissa Reiff for election as Class III directors at the Annual Meeting.

Each director is elected by a plurality of the votes cast. The three director nominees receiving the highest number of “FOR” votes will be elected. If elected at the Annual Meeting, the nominees will serve until our 2021 Annual Meeting of Stockholders and until their successors have been elected and qualified or until they resign, die, or are removed from the Board. For information about the nominees and each director whose term is continuing after the Annual Meeting, please see “Information Regarding Director Nominees and Current Directors.”

The nominees have consented to serve as director, if elected. We have no reason to believe that any of the nominees will be unable or unwilling to serve as director. If, however, a nominee is unavailable for election, your proxy authorizes us to vote for a replacement nominee if the Board names one.

The Board of Directors recommends a vote “FOR” each of the director nominees named above.

| 6 | 2018 Proxy Statement | Etsy |

INFORMATION REGARDING DIRECTOR NOMINEES AND CURRENT DIRECTORS

Below is information regarding our director nominees and directors whose terms are continuing after the Annual Meeting. |

| Name | Age | Etsy Director Since

| Independent | Committee Membership

| ||||

Nominees for election at the 2018 Annual Meeting (Class III)

| ||||||||

Gary S. Briggs | 55

| 2018

| Yes

|

Compensation Committee

| ||||

Edith W. Cooper

|

56

|

2018

|

Yes

|

Compensation Committee

| ||||

Melissa Reiff

|

63

|

2015

|

Yes

|

Compensation Committee

| ||||

Directors with terms expiring at the 2019 Annual Meeting (Class I)

| ||||||||

Jonathan D. Klein

|

57

|

2011

|

Yes

|

Compensation Committee (Chair)

| ||||

Margaret M. Smyth

|

54

|

2016

|

Yes

|

Audit Committee (Chair)

| ||||

Directors with terms expiring at the 2020 Annual Meeting (Class II)

| ||||||||

M. Michele Burns

|

60

|

2014

|

Yes

|

Audit Committee

Nominating and Corporate Governance Committee

| ||||

Josh Silverman

|

49

|

2016

|

No

| |||||

Fred Wilson (Board Chair)

|

56

|

2007

|

Yes

|

Audit Committee Compensation Committee Nominating and Corporate Governance Committee (Chair)

|

Nominees for Election to a Three-Year Term Expiring at the 2021 Annual Meeting of Stockholders

Gary S. Briggs has served as the Vice President and Chief Marketing Officer of Facebook, Inc. since August 2013. In 2017, he announced that he planned to leave Facebook in 2018. Prior to Facebook, in 2013, Mr. Briggs served as an Adviser to the Chief Executive Officer of Motorola Mobility, a Google LLC company, and prior to that, in various executive roles at Motorola Mobility and Google from 2010 to 2013. Prior to that, from 2008 to 2010, he was the Chief Executive Officer of Plastic Jungle, Inc., ane-commerce company focused on the unspent gift card market. He has also served in various executive and marketing roles at Ebay, Inc. and othere-commerce and consumer goods companies. Mr. Briggs serves on the advisory boards of LendingClub Corporation, Lagunitas Brewing Company and ISDI Digital University. During the past five years, he served as a director of LifeLock, Inc. |

| Etsy | 2018 Proxy Statement | 7 |

Gary S. Briggs should serve as a member of our Board because of his significant brand strategy and marketing expertise and his executive and leadership experience, particularly in technology ande-commerce companies.

Edith W. Cooper served as executive vice president, global head, human capital management of Goldman Sachs Group, Inc. from March 2008 to December 2017, and, prior to that, she held various leadership positions in Goldman Sachs’ securities division from 1996 to 2008. Ms. Cooper began her career in derivative sales at Bankers Trust and Morgan Stanley. She currently serves on the board of directors of Slack Technologies, Inc., the Museum of Modern Art and Mt. Sinai Hospital. |

Edith W. Cooper should serve as a member of our Board due to her extensive expertise in the human resources field, including recruiting, development and compensation, as well as her strong financial background and public company experience.

Melissa Reiff serves as chief executive officer of The Container Store Group, Inc. (“TCS”), the nation’s originator and leader of the storage and organization category of retail. Prior to that, she served as president and chief operating officer of TCS from March 2013 to June 2016, and as president of TCS from early 2006 to February 2013. She has served on the board of directors of TCS since August 2007. She is a member of the Dallas chapter of the American Marketing Association, International Women’s Foundation, and C200. She also serves on the board of Southern Methodist University’s Cox School of Business Executive Board and is a sustaining member of the Junior League of Dallas.

Melissa Reiff should serve as a member of our Board because of her significant operational experience and her expertise in retail, marketing, and merchandising, and her experience as CEO and director of a public company.

Directors Continuing in Office Until the 2019 Annual Meeting of Stockholders

Jonathan D. Klein is co-founder and chairman of Getty Images, Inc., a global digital media company. Mr. Klein has served as a member of the board of directors of Getty Images, Inc. (and its predecessor company Getty Communications) since March 1995 and served as chief executive officer from inception in March 1995 to October 2015. Mr. Klein also serves as a member of the boards of directors ofnumerous non-profit organizations, including the Committee to Protect Journalists, the Groton School, where he serves as President, and Friends of the Global Fight Against HIV, Tuberculosis and Malaria, where he serves as chairman. Mr. Klein also serves on the board of directors of these private companies: Helix Sleep, Inc., Squarespace, Inc. and Getty Investments.

Jonathan D. Klein should serve as a member of our Board due to his extensive experiencewith e-commerce and digital media companies and his experience as both a public company CEO and a director of a number of public and private companies. |

| 8 | 2018 Proxy Statement | Etsy |

Margaret M. Smyth has served as the U.S. chief financial officer of National Grid plc since October 2014. Previously, Ms. Smyth was vice president of finance at ConEdison, Inc. from August 2012 through September 2014. Prior to that, Ms. Smyth served as vice president and chief financial officer of Hamilton Sundstrand, which is part of United Technologies Corp., a provider of products and services to the aerospace and building systems industries, from October 2010 to June 2011. Prior to that, she served as vice president and corporate controller of United Technologies Corp. from August 2007 to September 2010 and vice president and chief accounting officer of 3M Corporation from April 2005 to August 2007. Prior to that, Ms. Smyth served as a senior managing partner at Deloitte & Touche and Arthur Andersen. During the past five years, she served as a director of Martha Stewart Living Omnimedia and Vonage Holdings Corporation.

Margaret M. Smyth should serve as a member of our Board due to her expertise in public company finance, accounting, and strategic planning, including experience gained as a chief financial officer and chief accounting officer. In addition, she brings significant international experience and leadership through her service as an executive and director of global public companies. |

Directors Continuing in Office Until the 2020 Annual Meeting of Stockholders

M. Michele Burns has served as the Center Fellow and Strategic Advisor to the Stanford Center on Longevity at Stanford University since August 2012. Ms. Burns served as the chief executive officer of the Retirement Policy Center sponsored by Marsh & McLennan Companies, Inc., an insurance brokerage and consulting firm, from October 2011 to February 2014; as chairman and chief executive officer of Mercer LLC (a subsidiary of Marsh & McLennan Companies, Inc.), a human resources consulting firm, from September 2006 to October 2011; as chief financial officer of Marsh & McLennan Companies, Inc. from March 2006 to September 2006; and as chief financial officer and chief restructuring officer of Mirant Corporation, an energy company, from May 2004 to January 2006. Ms. Burns joined Delta Airlines in January 1999 and served as chief financial officer from August 2000 until April 2004. She began her career at Arthur Andersen in 1981, serving ultimately as the Senior Partner, Southern Region Federal Tax Practice until December 1998. Ms. Burns is a member of the boards of directors of Cisco Systems, Inc.; Goldman Sachs Group, Inc.; and Anheuser-Busch InBev. Ms. Burns also serves on the board of directors of Alexion Pharmaceuticals, Inc. but will not stand forre-election at its 2018 Annual Meeting on May 8, 2018. During the past five years, she served as a director ofWal-Mart Stores, Inc. She also serves on the boards of directors of, or as an advisor to, several private companies. She is also a member of the executive board of directors of the Elton John AIDS Foundation, where she serves as Treasurer.

M. Michele Burns should serve as a member of our Board due to her expertise in corporate finance, accounting, governance, and strategy, including experience gained as the chief financial officer of public companies. She also brings expertise in global and operational management, including a background in organizational leadership and human resources, and experience as a public company director.

| Etsy | 2018 Proxy Statement | 9 |

Josh Silverman has served as our Chief Executive Officer since May 2017 and as a member of our Board since November 2016. Prior to joining Etsy as our CEO, he served as the Senior Operating Advisor at Hellman & Friedman, a private equity investment firm, since January 2017. In 2016, Mr. Silverman served as Executive in Residence at Greylock Partners, a venture capital firm. Prior to that, Mr. Silverman served as President of Consumer Products and Services at American Express Company from June 2011 to December 2015. Before joining American Express, he was the CEO of Skype from February 2008 to September 2010. Mr. Silverman served as CEO of Shopping.com, an eBay company from July 2006 to February 2008 and, prior to that, in various executive roles at eBay. Mr. Silverman was alsoco-founder and CEO of Evite, Inc. He serves on the board of directors of Shake Shack Inc.

Josh Silverman should serve as a member of our Board due to his deep familiarity with our business through his tenure as CEO and his significant executive, operational, and marketing experience and expertise in building and leading online marketplaces and technology companies.

Fred Wilson has served as the Chair of our Board since May 2017, and prior to that, as our lead independent director since October 2014. Mr. Wilson has been a venture capitalist for over 30 years. He is a founder and has served as partner of Union Square Ventures, a venture capital firm, since June 2003. Mr. Wilson also serves on the boards of directors of various private companies in connection with his role at Union Square Ventures. He is a well-known thought leader on technology, venture capital, and management matters.

Fred Wilson should serve as a member of our Board due to his extensive experience with technology and social media companies and his deep understanding of our business and operations through his tenure on the Board and as one of our early investors.

| 10 | 2018 Proxy Statement | Etsy |

Information Regarding the Board and Corporate Governance

In May 2017, the Board separated the positions of Chair and CEO. The Board appointed Fred Wilsonas non-executive Chair to provide independent leadership and to enable Josh Silverman, as incoming CEO, to concentrate on Etsy’s business operations.

Under our Corporate Governance Guidelines, our Board may separate or combine the roles of CEO and Chair when and if it believes it advisable and in the best interests of Etsy and its stockholders to do so. The Board has determined that having an independent director serve as Chair of the Board is in the best interests of our stockholders at this time. The structure ensures a greater role for the independent directors in the oversight of Etsy and active participation of the independent directors in setting agendas and establishing priorities and procedures for the work of the Board. Our Bylaws and Corporate Governance Guidelines provide the Board with flexibility to make determinations as circumstances require and in a manner that it believes is in the best interests of the company. The Board will continue to evaluate our leadership structure periodically and make changes in the future as it deems appropriate.

One of the key functions of our Board is to provide informed oversight of our risk management process while management is responsible for theday-to-day management of the material risks we face. Our full Board has overall responsibility for risk management and, in particular, oversees topics such as our strategic plan, capital structure, information security, and privacy. The Board also oversees risk through its standing committees, which regularly report back to the Board. For example, our Audit Committee oversees the management of risks associated with financial reporting, accounting and auditing matters; our Compensation Committee oversees the management of risks associated with executive compensation policies and programs; and our Nominating and Corporate Governance Committee oversees the management of risks associated with director independence, conflicts of interest, composition, and organization of our Board and director succession planning.

| Etsy | 2018 Proxy Statement | 11 |

Our Board assesses the independence of each director at least annually and has determined that, other than Josh Silverman, all current directors and director nominees are independent in accordance with the listing standards of Nasdaq and the applicable rules and regulations of the SEC. Josh Silverman is not considered independent because he is our CEO. In making these determinations, our Board considered the current and prior relationships that eachnon-employee director has with our company and all other facts and circumstances our Board deemed relevant. The independent members of our Board hold separate regularly scheduled executive session meetings at which only independent directors are present.

In addition, our Board has determined that each member of our Audit Committee and Compensation Committee is independent and meets the heightened independence requirements applicable to each such committee in accordance with the listing standards of Nasdaq and the applicable rules and regulations of the SEC.

Our Board met 18 times during 2017. Each director attended at least 75% of the total number of 2017 meetings of the Board and of each committee on which he or she served. We encourage all directors and director nominees to attend the Annual Meeting; however, attendance is not mandatory. Five of our six directors serving at the time attended the 2017 Annual Meeting of Stockholders.

Our Board has the following standing committees: Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. Members of these committees serve until their resignation or until otherwise determined by our Board. The composition and functions of each committee are described below. The charters of each committee, our Corporate Governance Guidelines, and our Code of Conduct are available on our investor website (investors.etsy.com) under “Leadership & Governance.”

| 12 | 2018 Proxy Statement | Etsy |

| Director | Independent | Audit Committee(1) | Compensation Committee(2) | Nominating and Corporate Governance Committee | ||||

Gary S. Briggs

| Yes

|

| ||||||

M. Michele Burns

| Yes

|

|

| |||||

Edith W. Cooper

| Yes

|

| ||||||

Jonathan D. Klein

| Yes

|

| ||||||

Melissa Reiff

| Yes

|

| ||||||

Josh Silverman

| No

| |||||||

Margaret M. Smyth

| Yes

|

| ||||||

Fred Wilson (Board Chair)

| Yes

|

|

|

| ||||

(1) On June 8, 2017, Margaret M. Smyth replaced M. Michele Burns as Audit Committee Chair.

(2) On May 1, 2017, Fred Wilson replaced Josh Silverman as a member of the Compensation Committee. On April 5, 2018, Gary S. Briggs and Edith W. Cooper joined the Compensation Committee in connection with their appointments to the Board.

(3) On June 7, 2018, following the Annual Meeting, Fred Wilson will rotate off of the Compensation Committee.

| ||||

Audit Committee

| 2017 Meetings: | 10 | |

| Members: | Margaret M. Smyth (Chair) M. Michele Burns Fred Wilson |

As described in more detail in its charter, among other responsibilities, the Audit Committee:

| • | appoints and oversees our independent registered public accounting firm, including its qualifications, independence, and performance, andpre-approves the scope and plans for audits, all audit engagement fees, and all permissiblenon-audit engagements; |

| • | reviews and discusses with management and the independent registered public accounting firm our annual audited and quarterly unaudited financial statements and annual and quarterly reports on Forms10-K and10-Q and related matters; |

| • | oversees the performance of our internal audit function; |

| Etsy | 2018 Proxy Statement | 13 |

| • | oversees our procedures for the receipt, retention, and treatment of any complaints regarding accounting, internal accounting controls, or auditing matters, and for the confidential and anonymous submissions by our employees concerning questionable accounting or auditing matters; |

| • | reviews and oversees related person transactions; and |

| • | oversees the management of risks associated with financial reporting, accounting, and auditing matters, including our guidelines and policies with respect to risk assessment and risk management. |

Each member and prospective member of our Audit Committee can read and understand fundamental financial statements. Our Board has determined that each of M. Michele Burns and Margaret M. Smyth qualifies as an audit committee financial expert in accordance with the applicable rules and regulations of the SEC and meets the financial sophistication requirements of Nasdaq.

Compensation Committee

| 2017 Meetings: | 10 | |

| Members: | Jonathan D. Klein (Chair) Gary S. Briggs Edith W. Cooper Melissa Reiff Fred Wilson |

As described in more detail in its charter, among other responsibilities, our Compensation Committee:

| • | oversees and reviews our compensation philosophy and strategy; |

| • | establishes goals and objectives relevant to compensation for the CEO and other senior officers and evaluates their performance against those goals; |

| • | administers our incentive plans, including approving the terms and conditions or awards; |

| • | recommends the form and amount of compensation to be paid tonon-employee Board members; |

| • | oversees our employee development programs, including periodically reviewing succession planning for key roles other than the CEO; and |

| • | oversees the management of risks associated with our compensation policies, programs and practices, including an annual risk assessment to determine whether our compensation program encourages inappropriate risk-taking. |

A description of the role of the compensation consultant engaged by the Committee, scope of authority of the Committee, and the role of executive officers in determining executive compensation is on page 30 under “Executive Compensation—Compensation Discussion and Analysis—Compensation-Setting Process.”

| 14 | 2018 Proxy Statement | Etsy |

Nominating and Corporate Governance Committee

| 2017 Meetings: | 2 | |

| Members: | Fred Wilson (Chair) M. Michele Burns |

As described in more detail in its charter, among other responsibilities, our Nominating and Corporate Governance Committee:

| • | reviews the composition and size of the Board and makes recommendations to the Board; |

| • | recommends to the Board criteria for Board membership, including qualifications, qualities, skills, areas of expertise, and other relevant factors; |

| • | reviews and recommends to the Board the director nominees; |

| • | oversees the annual evaluation of the Board and each Committee; |

| • | reviews the composition of each Board committee and recommends members and chairs; |

| • | reviews the structure and operations of our Board committees; |

| • | reviews director orientation and continuing education offerings and makes recommendations, as needed; |

| • | oversees the management of risks associated with director independence, conflicts of interest, board composition and organization, and director succession planning; and |

| • | periodically reviews our progress against our economic, social and ecological impact goals. |

Compensation Committee Interlocks and Insider Participation

During 2017, Fred Wilson, Jonathan D. Klein, Melissa Reiff, and Josh Silverman served on our Compensation Committee. No member of the Compensation Committee had served as one of our officers or employees at the time that they were a member of the Compensation Committee. Josh Silverman stepped down from the Compensation Committee on May 3, 2017, prior to his appointment as our CEO. During 2017, none of our executive officers served as a member of the board of directors or as a member of a compensation committee of any other company that has an executive officer serving as a member of our Board or Compensation Committee.

Although the Nominating and Corporate Governance Committee has the authority to recommend prospective director candidates for the Board’s consideration, the Board retains the ultimate

| Etsy | 2018 Proxy Statement | 15 |

authority to nominate a candidate for election by the stockholders as a director or to fill any vacancy. Gary S. Briggs and Edith W. Cooper were recommended as nominees to the Board by members of the Nominating and Corporate Governance Committee and/or our CEO.

Identifying and Evaluating Nominees

When identifying and evaluating potential director nominees, including current members of the Board who are eligible forre-election, the Nominating and Corporate Governance Committee seeks a balance of knowledge, experience, and capability on the Board and may consider the following:

| • | the current size and composition of the Board and the needs of the Board and Board committees; |

| • | high integrity and adherence to our values; |

| • | qualities such as character, judgment, independence, relationships, experience, length of service, and the like; |

| • | commitment to enhancing long-term stockholder value; |

| • | diversity of backgrounds, which is construed broadly to include differences of viewpoint, age, skill, gender, race, and other individual characteristics; |

| • | financial literacy or financial expertise or other requirements as may be required by applicable rules; |

| • | sufficiency of time to carry out their Board and committee duties; |

| • | the range of expertise and experience of the Board at the policy-making level in business, government, or technology and in areas relevant to our business; and |

| • | other factors, including conflicts of interest or competitive issues. |

Stockholder Recommendations and Nominees

The Nominating and Corporate Governance Committee will consider stockholder recommendations, so long as they comply with applicable law, our Bylaws and the procedures described below. Stockholder recommendations for candidates to the Board must be received in writing by December 31st of the year prior to the year in which the recommended candidates will be considered for nomination at the next Annual Meeting of Stockholders and sent to our headquarters, Etsy, Inc., 117 Adams Street, Brooklyn, NY 11201, to the attention of our General Counsel and Secretary. The recommendation must include the candidate’s name, home and business contact information, detailed biographical data and qualifications, information regarding any relationships between the candidate and Etsy within the last three years, and evidence of the recommending person’s ownership of Etsy stock. Recommendations must also include a statement from the recommending stockholder in support of the candidate that addresses the criteria for Board membership, personal references, and confirmation of the candidate’s willingness to serve.

The Nominating and Corporate Governance Committee will review the qualifications of any candidate recommended by stockholders in accordance with the criteria described above. In addition, in the Nominating and Corporate Governance Committee’s discretion, its review may

| 16 | 2018 Proxy Statement | Etsy |

include interviewing references, performing background checks, direct interviews with the candidate, or other actions it deems necessary or proper.

Stockholders may also nominate candidates for election to our Board by following the procedures described in our Bylaws.

Stockholders or other interested parties may contact the Board or one or more of our directors with issues or questions about Etsy, by mailing correspondence to our General Counsel and Secretary at our Brooklyn headquarters, Etsy, Inc., 117 Adams Street, Brooklyn, NY 11201. Our legal team will review incoming communications directed to the Board and, if appropriate, will forward such communications to the appropriate member(s) of the Board or, if none is specified, to the Chair of the Board. For example, we will generally not forward a communication that is primarily commercial in nature, is improper or irrelevant, or is a request for general information about Etsy.

| Etsy | 2018 Proxy Statement | 17 |

The following table discloses compensation received by ournon-employee directors during 2017 pursuant to ournon-employee director compensation program. |

Director

| Fees Earned or

| Stock

| Option Awards ($)(3)(4)

| Total Compensation ($)

| ||||||||||||

M. Michele Burns

|

| 129,500

|

|

| 49,026

|

|

| 43,780

|

|

| 222,306

|

| ||||

Jonathan D. Klein

|

| 127,500

|

|

| 49,026

|

|

| 43,780

|

|

| 220,306

|

| ||||

Melissa Reiff

|

| 92,500

|

|

| 49,026

|

|

| 43,780

|

|

| 185,306

|

| ||||

Margaret M. Smyth

|

| 70,500

|

|

| 68,640

|

|

| 61,303

|

|

| 200,443

|

| ||||

Fred Wilson(5)

|

| 50,000

|

|

| 92,788

|

|

| 187,588

|

|

| 330,376

|

| ||||

(1) The value disclosed is the aggregate grant date fair value of 3,522 restricted stock units (“RSUs”) granted to M. Michele Burns, Jonathan D. Klein, and Melissa Reiff, 4,931 RSUs granted to Margaret M. Smyth, and 5,689 granted to Fred Wilson in 2017, computed in accordance with FASB ASC Topic 718. Assumptions used in the calculation of the grant date fair value are set forth in Note 11—Stock-based Compensation in our Annual Report on Form10-K for the fiscal year ended December 31, 2017 that accompanies this proxy statement. The number of RSUs granted is set by Etsy using the average closing price of Etsy’s common stock on Nasdaq (rounded to the nearest hundredth) for the 30 trading days up to and including the grant date.

(2) The aggregate number of RSUs held by each director listed in the table above as of December 31, 2017 was as follows:

• M. Michele Burns: 3,522 • Jonathan Klein: 3,522 • Melissa Reiff: 3,522 • Margaret M. Smyth: 18,218 • Fred Wilson: 5,689

(3) The value disclosed is the aggregate grant date fair value of 7,358 options to purchase shares granted to M. Michele Burns, Jonathan D. Klein, and Melissa Reiff, 10,303 options to purchase shares granted to Margaret M. Smyth, and 27,832 options to purchase shares granted to Fred Wilson in 2017, computed in accordance with FASB ASC Topic 718. Assumptions used in the calculation of the grant date fair value are set forth in Note 11—Stock-based Compensation in our Annual Report on Form10-K for the fiscal year ended December 31, 2017 that accompanies this proxy statement.

|

| 18 | 2018 Proxy Statement | Etsy |

(4) The aggregate number of stock options held by each director listed in the table above as of December 31, 2017 was as follows:

• M. Michele Burns: 181,378 • Jonathan Klein: 43,869 • Melissa Reiff: 71,300 • Margaret M. Smyth: 51,832 • Fred Wilson: 27,832

(5) Fred Wilson was appointed Chair of the Board in May 2017. Accordingly, in addition to his annual director fee, he received a Board Chair equity award comprised of stock options with a fair value on the grant date equal to $100,000.

|

Director Compensation Program

The Compensation Committee reviews pay levelsfor non-employee directors at least annually with assistance from Compensia, Inc., a national compensation consulting firm (“Compensia”), who prepares a comprehensive assessment ofour non-employee director compensation program. That assessment includes benchmarking of director compensation against the same peer group used for executive compensation purposes, an update on recent trends in director compensation, and a review of related corporate governance best practices.

NewNon-employee Directors

Under ournon-employee director compensation program, each newnon-employee director who joins our Board is granted equity compensation (50% in stock options and 50% in RSUs) with a fair value at the time of grant of $262,500 on the first business day of the month following the month in which his or her appointment to the Board became effective. Equity awards for new directors vest in equal annual installments on the first three anniversaries of the grant date subject to the director serving continuously as a Board member through the applicable vesting date. In addition, equity awards for new directors vest in full in the event that we are subject to a change in control or upon certain other events. A director who receives a new director fee will not receive an annual retainer in the same calendar year.

Incumbent Directors

Each year on the date of our Annual Meeting, each incumbentnon-employee director receives an award with a fair value at the time of grant equal to approximately $185,000. In January 2018, ournon-employee director compensation program was amended to increase the fair value ofnon-employee director awards from $175,000 to $185,000. In 2018, like 2017, the award will be made up equally of stock options and restricted stock units. The equity portion of the award will vest in full on the date of our next Annual Meeting if the director has served continuously as a Board member through the date of that meeting. In addition, annual retainer equity awards vest in full in the event that we are subject to a change in control or upon certain other events.

| Etsy | 2018 Proxy Statement | 19 |

In addition to the annual and newnon-employee director equity awards described above,non-employee directors receive the annual cash payments below.

Role

| Annual Cash Payments ($) | ||||

Audit Committee Chair

|

| 18,000

|

| ||

Audit Committee Member

|

| 9,000

|

| ||

Compensation Committee Chair

|

| 10,000

|

| ||

Compensation Committee Member

|

| 5,000

|

| ||

Nominating and Corporate Governance Committee Chair

|

| 6,000

|

| ||

Nominating and Corporate Governance Committee Member

|

| 3,000

|

| ||

Member of any other Committee constituted by the Board

|

| 40,000

|

| ||

| 20 | 2018 Proxy Statement | Etsy |

Etsy’s Audit Committee is comprised entirely of independent directors who meet the independence requirements of the Listing Rules of the Nasdaq Stock Market and the SEC. The Audit Committee operates pursuant to a charter that is available on the Investor Relations section of our website: https://investors.etsy.com.

The principal purpose of the Audit Committee is to assist the Board in its oversight of our accounting practices, system of internal controls, audit processes, and financial reporting processes. The Audit Committee is responsible for appointing and retaining our independent auditor and approving the audit andnon-audit services to be provided by the independent auditor. The audit committee’s function is more fully described in its charter.

Management is responsible for preparing our financial statements and ensuring they are complete and accurate and prepared in accordance with generally accepted accounting principles. PricewaterhouseCoopers LLP (“PwC”), our independent registered public accounting firm, was responsible for performing an independent audit of our consolidated financial statements and expressing an opinion on the conformity of those financial statements with generally accepted accounting principles and as to the effectiveness of our internal control over financial reporting.

In performing its responsibilities, the Audit Committee has:

| • | reviewed and discussed with management our audited financial statements for the fiscal year ended December 31, 2017; |

| • | discussed with our independent registered public accounting firm, PwC, the matters required to be discussed by Auditing Standard No. 1301, Communications with Audit Committees, adopted by the Public Company Accounting Oversight Board (the “PCAOB”); and |

| • | received the written disclosures and the letter from PwC required by the applicable PCAOB requirements for the independent accountant communications with audit committees concerning auditor independence, and has discussed with PwC its independence. |

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements be included in our Annual Report on Form10-K for the fiscal year ended December 31, 2017.

Respectfully submitted by:

Margaret M. Smyth (Chair)

M. Michele Burns

Fred Wilson

| Etsy | 2018 Proxy Statement | 21 |

Ratification of the Appointment of Independent

Registered Public Accounting Firm

The Audit Committee has appointed PwC as our independent registered public accounting firm for 2018 and recommends that stockholders vote to ratify the appointment. Although we are not required by law to obtain such ratification from our stockholders, we believe it is good practice to do so. If our stockholders do not ratify the appointment of PwC, the Audit Committee may reconsider its appointment. The Audit Committee, in its discretion, may appoint a new independent registered public accounting firm at any time during the year if the Audit Committee believes that such a change would be in the best interests of Etsy and our stockholders.

PwC has audited our consolidated financial statements since 2012. A representative of PwC will be present at our Annual Meeting to respond to appropriate questions and to make a statement if they so desire.

This proposal is decided by a majority of the votes cast. This proposal will be approved if the number of votes cast “FOR” the proposal exceeds the number of votes cast “AGAINST” the proposal.

The following table presents fees for professional audit services and other services rendered to us by PwC for the fiscal years ended December 31, 2016 and December 31, 2017.

Year Ended December 31,

| ||||||||

2017

| 2016

| |||||||

(in thousands)

| ||||||||

Audit Fees

|

| $2,374

|

|

| $3,097

|

| ||

Audit-Related Fees

|

| 50

|

|

| 75

|

| ||

Tax Fees

|

| 391

|

|

| 517

|

| ||

Other Fees

|

| 71

|

|

| 87

|

| ||

Total Fees

|

| $2,886

|

|

| $3,776

|

| ||

| 22 | 2018 Proxy Statement | Etsy |

Audit Fees. These amounts consist of fees and expenses for professional services necessary to perform an audit or review in accordance with the standards of the PCAOB, including services rendered for the audit of Etsy’s annual financial statements and review of quarterly financial statements. These amounts also include fees for services that are normally incurred in connection with regulatory filings, such as comfort letters, consents, and review of documents filed with the SEC. These amounts also include fees for professional services incurred with rendering an opinion under Section 404 of the Sarbanes-Oxley Act of 2002, as a result of exiting “emerging growth status” under the JOBS Act in 2016.

Audit-related Fees. These amounts consist of the aggregate fees for assurance and related services performed by PwC that are reasonably related to the performance of the audit or review of our financial statements and are not reported under “Audit Fees.” These services include work related to an acquisition and work supporting the assessment of controls in 2016, and in 2017, fees associated with the implementation of Accounting Standards Codification (“ASC”) 606,Revenue from Contracts with Customers.

Tax Fees. These amounts consist of fees for tax compliance, tax planning, and tax advice. Corporate tax services encompass a variety of permissible services, including technical tax advice related to U.S. and international matters, assistance with foreign income and withholding tax matters, and assistance with tax audits.

Other Fees. These amounts consist of the aggregate fees for other services performed or provided by PwC not included in the categories above. These amounts include fees for subscriptions to online accounting reference material and PwC’s review of our sustainability data.

Pre-Approval Policies and Procedures

The Audit Committee is required topre-approve all audit andnon-audit services performed by PwC to ensure that the provision of such services does not impair the public accounting firm’s independence. The Audit Committeepre-approved all of the services described above.

The Board of Directors recommends that you vote “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as independent registered public accounting firm for 2018.

| Etsy | 2018 Proxy Statement | 23 |

Below is information regarding each of our current executive officers. Our executive officers serve at the discretion of our Board. There are no family relationships among any of our directors or executive officers.

Name

| Age

| Position

| |||||

Josh Silverman

| 49

| President and Chief Executive Officer

| |||||

Mike Fisher

| 49

| Chief Technology Officer

| |||||

Rachel Glaser

| 56

| Chief Financial Officer

| |||||

Linda Findley Kozlowski

| 44

| Chief Operating Officer

| |||||

Jill Simeone

| 51

| General Counsel and Secretary

| |||||

Josh Silverman has served as our Chief Executive Officer since May 2017 and as a member of our Board since November 2016. Prior to joining Etsy as our CEO, he served as the Senior Operating Advisor at Hellman & Friedman, a private equity investment firm since January 2017. In 2016, Mr. Silverman served as Executive in Residence at Greylock Partners, a venture capital firm. Prior to that, Mr. Silverman served as President of Consumer Products and Services at American Express Company from June 2011 to December 2015. Before joining American Express, he was the CEO of Skype from February 2008 to September 2010. Mr. Silverman served as CEO of Shopping.com, an eBay company from July 2006 to February 2008 and, prior to that, in various executive roles at eBay. Mr. Silverman was alsoco-founder and CEO of Evite, Inc. He serves on the board of directors of Shake Shack Inc.

Mike Fisher has served as Etsy’s chief technology officer since July 2017. Prior to Etsy, he was theco-founder of AKF Partners, a technology consulting company, from February 2008 to July 2017. Prior to that, Mr. Fisher served as an executive at a number of technology companies, including as the Chief Technology Officer of Quigo, a startup internet advertising company and as Vice President, Engineering & Architecture for PayPal, Inc., an eBay company. Prior to PayPal, he served in various technology roles at General Electric. Mr. Fisher is also an Adjunct Professor at Case Western Reserve University’s School of Management, and has authored multiple books on the subject of scalability. Mr. Fisher has also served as a Captain and pilot in the U.S. Army.

Rachel Glaser has served as our Chief Financial Officer since May 2017. Prior to that, Ms. Glaser was Chief Financial Officer of Leaf Group, a diversified Internet company that owns and operates marketplace and media businesses, since April 2015. From January 2012 to March 2015, Ms. Glaser served as Chief Financial Officer of Move, Inc. (operator of Realtor.com), an online network of websites for real estate search and home enthusiasts, and Ms. Glaser helped lead the sale of Move,

| 24 | 2018 Proxy Statement | Etsy |

Inc. to News Corporation, a diversified media and information services company, in November 2014. From April 2008 to November 2011, Ms. Glaser served as Chief Operating and Financial Officer of MyLife.com, a subscription-based people search business, and from May 2005 to April 2008, she was the Senior Vice President of Finance at Yahoo! Inc. Between 1986 and 2005, Ms. Glaser held finance and operations positions of increasing responsibility at The Walt Disney Company and was Vice President of Operations and Business Planning for the Consumer Products group at the time of her departure. From August 2010 to July 2014, Ms. Glaser served on the board of directors of Sport Chalet, Inc., a full service specialty retailer. Since January 2018, Ms. Glaser has served on the Board of the New York Times Company.

Linda Findley Kozlowski has served as our Chief Operating Officer since May 2016. Prior to Etsy, Ms. Kozlowski was the Chief Operating Officer of Evernote, where she oversaw worldwide operations, and led cross-functional teams in offices across seven countries, from May 2015 to December 2015. Prior to that, she served as Vice President of Worldwide Operations at Evernote from May 2014 to May 2015, as Vice President of International Marketing from April 2013 to May 2014, and as Director of Market Development from October 2012 to April 2013. Before joining Evernote, Ms. Kozlowski was the Director of Global Marketing and Customer Experience at Alibaba.com from June 2011 to October 2012, and the Director of International Corporate Affairs from July 2009 to June 2011. She has also held leadership positions in several communications firms including Fleishman-Hillard, Text 100, and Schwartz Communications.

Jill Simeone has served as our General Counsel and Secretary since January 2017. Prior to Etsy, Ms. Simeone was the Vice President, Senior Counsel, and Assistant Secretary at American Express Global Business Travel, where she led the legal side of their mergers and acquisitions program from January 2016 to January 2017. Prior to that, she served as the General Counsel and Chief Compliance Officer at KCAP Financial, Inc., a publicly traded financial services company, from July 2013 to January 2016. Before joining KCAP Financial, she was an attorney at American Express advising on divestitures and investments in technology startups from January 2013 to June 2013. Prior to American Express, she served as the General Counsel at Roadify from January 2012 through December 2012. From 1999-2011 Ms. Simeone served as U.S. General Counsel and then North America General Counsel of CEMEX, a multinational building materials company.

| Etsy | 2018 Proxy Statement | 25 |

Compensation Discussion and Analysis

This Compensation Discussion and Analysis section is intended to provide our stockholders with a clear understanding of our compensation philosophy, objectives and practices; our compensation-setting process; our executive compensation program components; and the decisions made with respect to the 2017 compensation of each of our Named Executive Officers (“NEOs”). For 2017, our NEOs were:

| • | Josh Silverman, President and Chief Executive Officer; |

| • | Rachel Glaser, Chief Financial Officer; |

| • | Mike Fisher, Chief Technology Officer; |

| • | Linda Findley Kozlowski, Chief Operating Officer; |

| • | Jill Simeone, General Counsel and Secretary; |

| • | Chad Dickerson, former President and Chief Executive Officer; |

| • | Kristina Salen, former Chief Financial Officer; and |

| • | Karen Mullane, former Vice President and Controller, and Interim Chief Financial Officer. |

Executive Summary

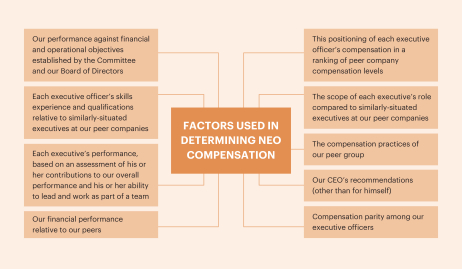

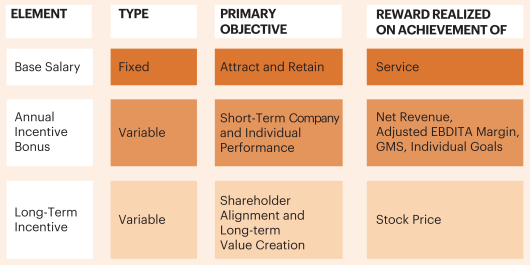

Business Overview