UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☒ | | Soliciting Material under § 240.14a-12 |

QUANTENNA COMMUNICATIONS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

ACQUISITION OF QUANTENNA COMMUNICATIONS MARCH 27, 2019ACQUISITION OF QUANTENNA COMMUNICATIONS MARCH 27, 2019

SAFE HARBOR STATEMENT AND NON-GAAP AND FORECAST INFORMATION This presentation contains “forward-looking statements,” as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements include, but are not limited to, statements related to the consummation and benefits of the acquisition by ON Semiconductor of Quantenna. Forward-looking statements are often characterized by the use of words such as “believes,” “estimates,” “expects,” “projects,” “may,” “will,” “intends,” “plans,” or “anticipates” or by discussions of strategy, plans, or intentions. These forward-looking statements are based on information available to each of ON Semiconductor and Quantenna as of the date of this presentation and current expectations, forecasts, estimates, and assumptions and involve a number of risks and uncertainties that could cause actual results to differ materially from those anticipated by these forward-looking statements. These forward-looking statements include, but are not limited to, statements related to the consummation and benefits of the acquisition by ON Semiconductor of Quantenna. Such risks and uncertainties include a variety of factors, some of which are beyond the control of ON Semiconductor and Quantenna. In particular, such risks and uncertainties include, but are not limited to: the risk that one or more closing conditions to the transaction may not be satisfied or waived, on a timely basis or otherwise; the risk that the transaction does not close when anticipated, or at all, including the risk that the requisite regulatory approvals may not be obtained; matters arising in connection with the parties’ efforts to comply with and satisfy applicable regulatory approvals and closing conditions relating to the transaction; there may be a material adverse change of ON Semiconductor or Quantenna, or their respective businesses may suffer as a result of uncertainty surrounding the transaction; the transaction may involve unexpected costs, liabilities, or delays; difficulties encountered in integrating Quantenna, including the potentially accretive and synergistic benefits; difficulties leveraging desired growth opportunities and markets; the possibility that expected benefits and cost savings may not materialize as expected; the costs and outcome of any litigation involving ON Semiconductor, Quantenna, or the acquisition transaction; integration plans, plans to finance the transaction, and pro-forma financial information for the transaction; revenue and operating performance; economic conditions and markets (including current financial conditions); risks related to our ability to meet our assumptions regarding outlook for revenue and gross margin as a percentage of revenue; effects of exchange rate fluctuations; the cyclical nature of the semiconductor industry; changes in demand for our products; changes in inventories at our customers and distributors; technological and product development risks; enforcement and protection of our intellectual property rights and related risks; risks related to the security of our information systems and secured network; availability of raw materials, electricity, gas, water, and other supply chain uncertainties; our ability to effectively shift production to other facilities when required in order to maintain supply continuity for our customers; variable demand and the aggressive pricing environment for semiconductor products; our ability to successfully manufacture in increasing volumes on a cost-effective basis and with acceptable quality for our current products; risks associated with other acquisitions and dispositions, including our ability to realize the anticipated benefits of our acquisitions and dispositions; risks that acquisitions or dispositions may disrupt our current plans and operations, the risk of unexpected costs, charges, or expenses resulting from acquisitions or dispositions and difficulties arising from integrating and consolidating acquired businesses, our timely filing of financial information with the Securities and Exchange Commission (“SEC”) for acquired businesses, and our ability to accurately predict the future financial performance of acquired businesses); competitor actions, including the adverse impact of competitor product announcements; pricing and gross profit pressures; loss of key customers or distributors; order cancellations or reduced bookings; changes in manufacturing yields; control of costs and expenses and realization of cost savings and synergies from restructurings; significant litigation; risks associated with decisions to expend cash reserves for various uses in accordance with our capital allocation policy such as debt prepayment, stock repurchases, or acquisitions rather than to retain such cash for future needs; risks associated with our substantial leverage and restrictive covenants in our debt agreements that may be in place from time to time; risks associated with our worldwide operations, including changes in trade policies, foreign employment and labor matters associated with unions and collective bargaining arrangements, as well as man-made and/or natural disasters affecting our operations or financial results; the threat or occurrence of international armed conflict and terrorist activities both in the United States and internationally; risks of changes in U.S. or international tax rates or legislation, including the impact of the recent U.S. tax legislation; risks and costs associated with increased and new regulation of corporate governance and disclosure standards; risks related to new legal requirements; and risks involving environmental or other governmental regulation. Additional factors that could affect our future results or events are described under Part I, Item 1A “Risk Factors” in our 2018 Annual Report on Form 10-K filed with the SEC on February 20, 2019 (our 2018 Form 10-K ) and from time-to-time in our other SEC reports. Readers are cautioned not to place undue reliance on forward-looking statements. We assume no obligation to update such information, except as may be required by law. You should carefully consider the trends, risks, and uncertainties described in this presentation, our 2018 Form 10-K, and other reports filed with or furnished to the SEC before making any investment decision with respect to our securities. If any of these trends, risks, or uncertainties actually occurs or continues, our business, financial condition, or operating results could be materially adversely affected, the trading prices of our securities could decline, and you could lose all or part of your investment. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement. 2SAFE HARBOR STATEMENT AND NON-GAAP AND FORECAST INFORMATION This presentation contains “forward-looking statements,” as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements include, but are not limited to, statements related to the consummation and benefits of the acquisition by ON Semiconductor of Quantenna. Forward-looking statements are often characterized by the use of words such as “believes,” “estimates,” “expects,” “projects,” “may,” “will,” “intends,” “plans,” or “anticipates” or by discussions of strategy, plans, or intentions. These forward-looking statements are based on information available to each of ON Semiconductor and Quantenna as of the date of this presentation and current expectations, forecasts, estimates, and assumptions and involve a number of risks and uncertainties that could cause actual results to differ materially from those anticipated by these forward-looking statements. These forward-looking statements include, but are not limited to, statements related to the consummation and benefits of the acquisition by ON Semiconductor of Quantenna. Such risks and uncertainties include a variety of factors, some of which are beyond the control of ON Semiconductor and Quantenna. In particular, such risks and uncertainties include, but are not limited to: the risk that one or more closing conditions to the transaction may not be satisfied or waived, on a timely basis or otherwise; the risk that the transaction does not close when anticipated, or at all, including the risk that the requisite regulatory approvals may not be obtained; matters arising in connection with the parties’ efforts to comply with and satisfy applicable regulatory approvals and closing conditions relating to the transaction; there may be a material adverse change of ON Semiconductor or Quantenna, or their respective businesses may suffer as a result of uncertainty surrounding the transaction; the transaction may involve unexpected costs, liabilities, or delays; difficulties encountered in integrating Quantenna, including the potentially accretive and synergistic benefits; difficulties leveraging desired growth opportunities and markets; the possibility that expected benefits and cost savings may not materialize as expected; the costs and outcome of any litigation involving ON Semiconductor, Quantenna, or the acquisition transaction; integration plans, plans to finance the transaction, and pro-forma financial information for the transaction; revenue and operating performance; economic conditions and markets (including current financial conditions); risks related to our ability to meet our assumptions regarding outlook for revenue and gross margin as a percentage of revenue; effects of exchange rate fluctuations; the cyclical nature of the semiconductor industry; changes in demand for our products; changes in inventories at our customers and distributors; technological and product development risks; enforcement and protection of our intellectual property rights and related risks; risks related to the security of our information systems and secured network; availability of raw materials, electricity, gas, water, and other supply chain uncertainties; our ability to effectively shift production to other facilities when required in order to maintain supply continuity for our customers; variable demand and the aggressive pricing environment for semiconductor products; our ability to successfully manufacture in increasing volumes on a cost-effective basis and with acceptable quality for our current products; risks associated with other acquisitions and dispositions, including our ability to realize the anticipated benefits of our acquisitions and dispositions; risks that acquisitions or dispositions may disrupt our current plans and operations, the risk of unexpected costs, charges, or expenses resulting from acquisitions or dispositions and difficulties arising from integrating and consolidating acquired businesses, our timely filing of financial information with the Securities and Exchange Commission (“SEC”) for acquired businesses, and our ability to accurately predict the future financial performance of acquired businesses); competitor actions, including the adverse impact of competitor product announcements; pricing and gross profit pressures; loss of key customers or distributors; order cancellations or reduced bookings; changes in manufacturing yields; control of costs and expenses and realization of cost savings and synergies from restructurings; significant litigation; risks associated with decisions to expend cash reserves for various uses in accordance with our capital allocation policy such as debt prepayment, stock repurchases, or acquisitions rather than to retain such cash for future needs; risks associated with our substantial leverage and restrictive covenants in our debt agreements that may be in place from time to time; risks associated with our worldwide operations, including changes in trade policies, foreign employment and labor matters associated with unions and collective bargaining arrangements, as well as man-made and/or natural disasters affecting our operations or financial results; the threat or occurrence of international armed conflict and terrorist activities both in the United States and internationally; risks of changes in U.S. or international tax rates or legislation, including the impact of the recent U.S. tax legislation; risks and costs associated with increased and new regulation of corporate governance and disclosure standards; risks related to new legal requirements; and risks involving environmental or other governmental regulation. Additional factors that could affect our future results or events are described under Part I, Item 1A “Risk Factors” in our 2018 Annual Report on Form 10-K filed with the SEC on February 20, 2019 (our 2018 Form 10-K ) and from time-to-time in our other SEC reports. Readers are cautioned not to place undue reliance on forward-looking statements. We assume no obligation to update such information, except as may be required by law. You should carefully consider the trends, risks, and uncertainties described in this presentation, our 2018 Form 10-K, and other reports filed with or furnished to the SEC before making any investment decision with respect to our securities. If any of these trends, risks, or uncertainties actually occurs or continues, our business, financial condition, or operating results could be materially adversely affected, the trading prices of our securities could decline, and you could lose all or part of your investment. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement. 2

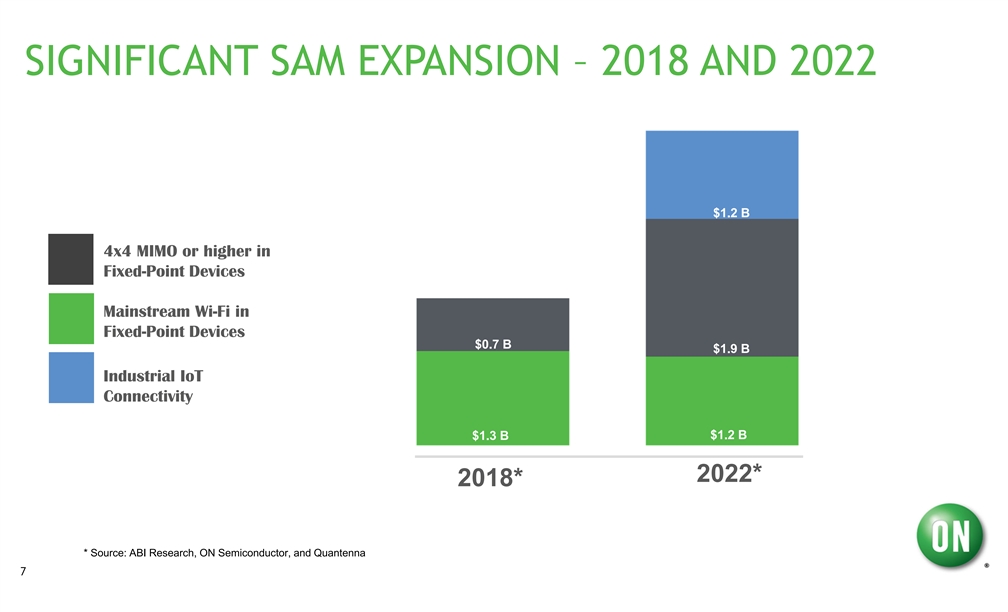

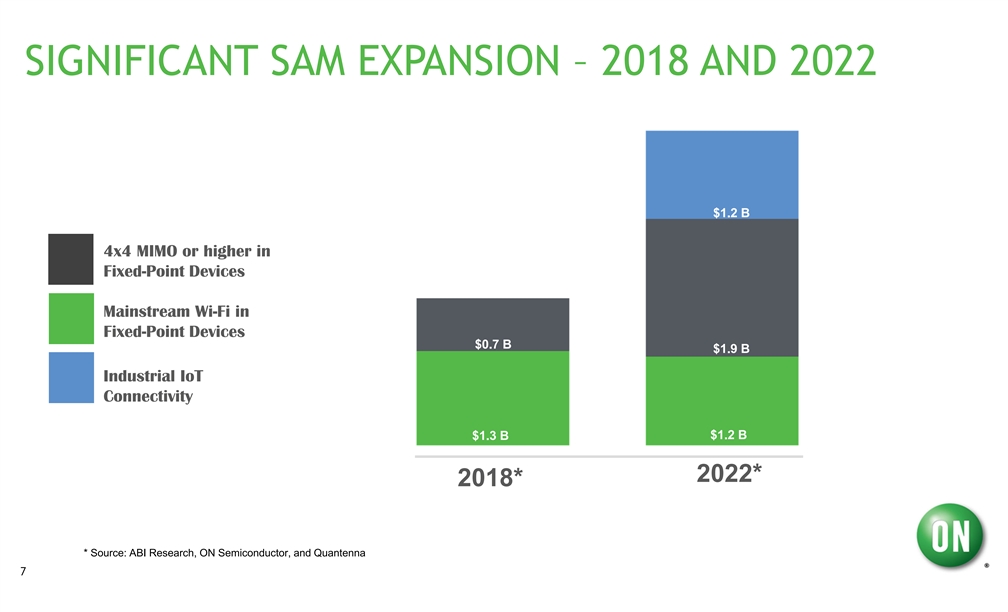

STRATEGIC RATIONALE Creates strong platform for Attractive markets – ON’s scale and addressing connectivity market for sales reach to accelerate growth industrial IoT Ø Market for premium WiFi products to continue to grow at a rapid pace driven by video Ø Combination of ON’s expertise in power content and gaming management and Bluetooth technologies with Quantenna’s WiFi technologies and software Ø ON’s scale and sales reach can further capabilities accelerate Quantenna’s growth in the market Ø ON’s sales reach and distribution presence in industrial and automotive markets Complementary markets and Attractive financial profile customer base Ø Quantenna to be immediately accretive to non-GAAP EPS Ø Adds potential SAM opportunity of $2 billion in 2018 and $4.3 billion in 2022 Ø Attractive gross margin profile with room for further improvement Ø Minimal overlap in end-markets and customers 3STRATEGIC RATIONALE Creates strong platform for Attractive markets – ON’s scale and addressing connectivity market for sales reach to accelerate growth industrial IoT Ø Market for premium WiFi products to continue to grow at a rapid pace driven by video Ø Combination of ON’s expertise in power content and gaming management and Bluetooth technologies with Quantenna’s WiFi technologies and software Ø ON’s scale and sales reach can further capabilities accelerate Quantenna’s growth in the market Ø ON’s sales reach and distribution presence in industrial and automotive markets Complementary markets and Attractive financial profile customer base Ø Quantenna to be immediately accretive to non-GAAP EPS Ø Adds potential SAM opportunity of $2 billion in 2018 and $4.3 billion in 2022 Ø Attractive gross margin profile with room for further improvement Ø Minimal overlap in end-markets and customers 3

BUILDING STRONG INDUSTRIAL IoT CONNECTIVITY PLATFORM + § High efficiency Power § Industry leading industrial, Management automotive, and service § Industry leading Wi-Fi technology § Low Energy Bluetooth provider connectivity portfolio § Multi-Protocol Radios § Strong software capabilities § Sales and distribution reach in § Strong global sales, distribution, automotive and industrial and FAE network markets 4BUILDING STRONG INDUSTRIAL IoT CONNECTIVITY PLATFORM + § High efficiency Power § Industry leading industrial, Management automotive, and service § Industry leading Wi-Fi technology § Low Energy Bluetooth provider connectivity portfolio § Multi-Protocol Radios § Strong software capabilities § Sales and distribution reach in § Strong global sales, distribution, automotive and industrial and FAE network markets 4

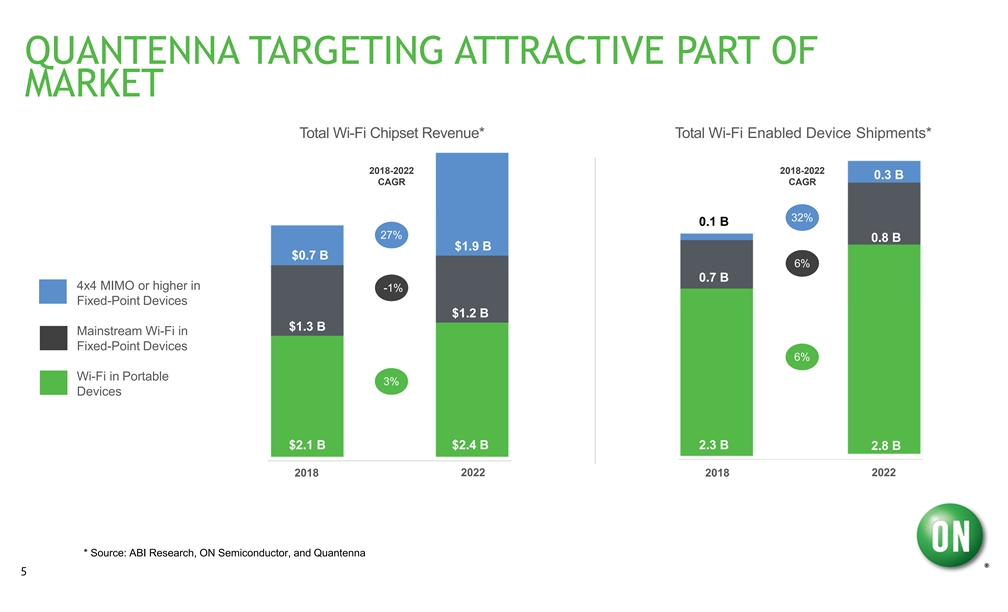

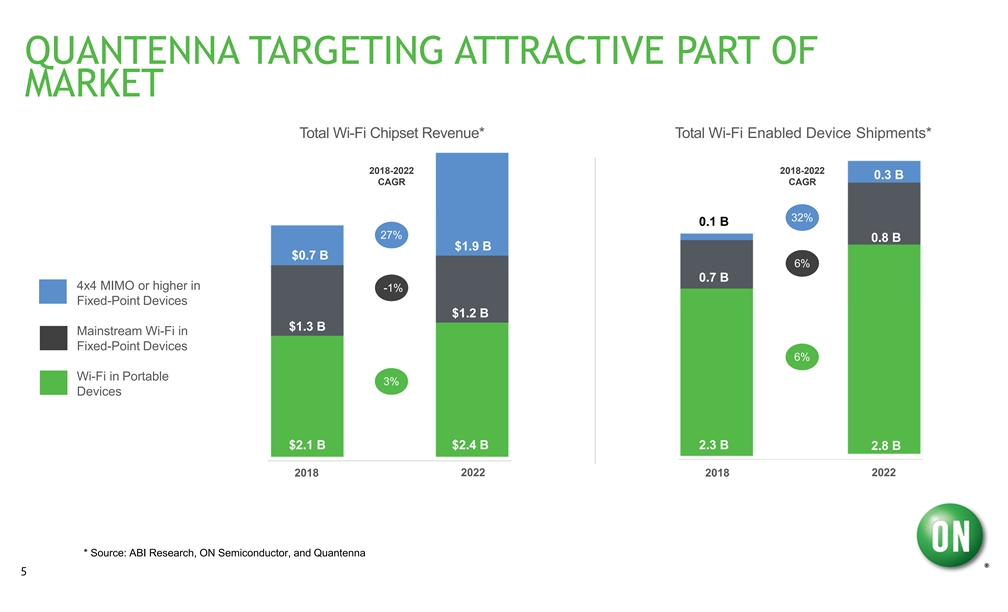

QUANTENNA TARGETING ATTRACTIVE PART OF MARKET Total Wi-Fi Chipset Revenue* Total Wi-Fi Enabled Device Shipments* 2018-2022 2018-2022 0.3B CAGR CAGR 32% 0.1B 27% 0.8B $1.9B $0.7B 6% 0.7B 4x4 MIMO or higher in -1% Fixed-Point Devices $1.2B $1.3B Mainstream Wi-Fi in Fixed-Point Devices 6% Wi-Fi in Portable 3% Devices $2.1B $2.4B 2.3B 2.8B 2022 2022 2018 2018 * Source: ABI Research, ON Semiconductor, and Quantenna 5QUANTENNA TARGETING ATTRACTIVE PART OF MARKET Total Wi-Fi Chipset Revenue* Total Wi-Fi Enabled Device Shipments* 2018-2022 2018-2022 0.3B CAGR CAGR 32% 0.1B 27% 0.8B $1.9B $0.7B 6% 0.7B 4x4 MIMO or higher in -1% Fixed-Point Devices $1.2B $1.3B Mainstream Wi-Fi in Fixed-Point Devices 6% Wi-Fi in Portable 3% Devices $2.1B $2.4B 2.3B 2.8B 2022 2022 2018 2018 * Source: ABI Research, ON Semiconductor, and Quantenna 5

ACCELERATING DEMAND FOR HIGH-PERFORMANCE WI-FI Increasing over the top (OTT) & cloud video HD Video getting increasingly bandwidth intensive content Customers demand better experience even under Wi-Fi is becoming the network bottleneck interference and at distance 6ACCELERATING DEMAND FOR HIGH-PERFORMANCE WI-FI Increasing over the top (OTT) & cloud video HD Video getting increasingly bandwidth intensive content Customers demand better experience even under Wi-Fi is becoming the network bottleneck interference and at distance 6

SIGNIFICANT SAM EXPANSION – 2018 AND 2022 $1.2B 4x4 MIMO or higher in Fixed-Point Devices Mainstream Wi-Fi in Fixed-Point Devices $0.7B $1.9B Industrial IoT Connectivity $1.2B $1.3B 2022* 2018* * Source: ABI Research, ON Semiconductor, and Quantenna 7SIGNIFICANT SAM EXPANSION – 2018 AND 2022 $1.2B 4x4 MIMO or higher in Fixed-Point Devices Mainstream Wi-Fi in Fixed-Point Devices $0.7B $1.9B Industrial IoT Connectivity $1.2B $1.3B 2022* 2018* * Source: ABI Research, ON Semiconductor, and Quantenna 7

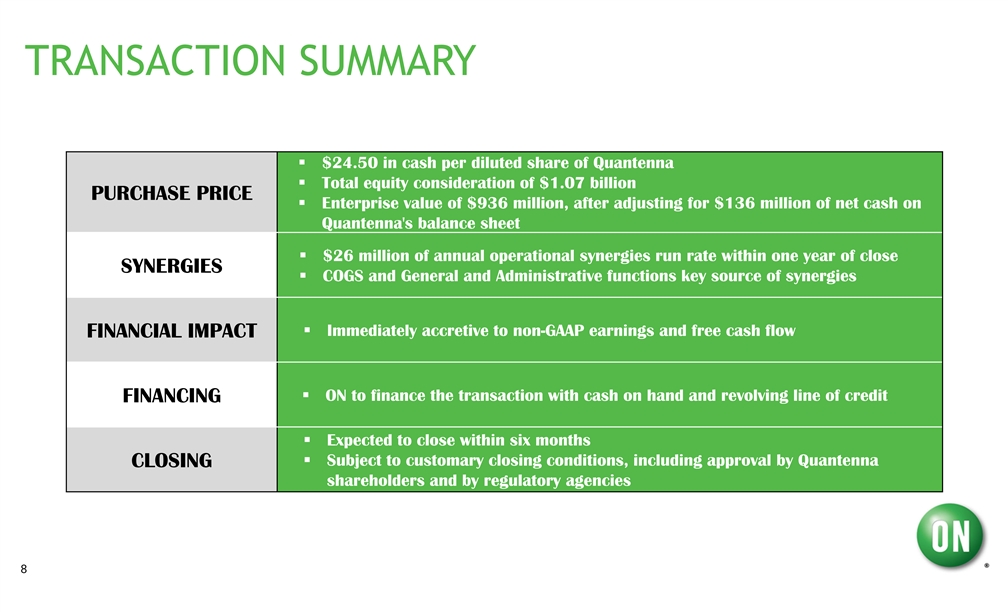

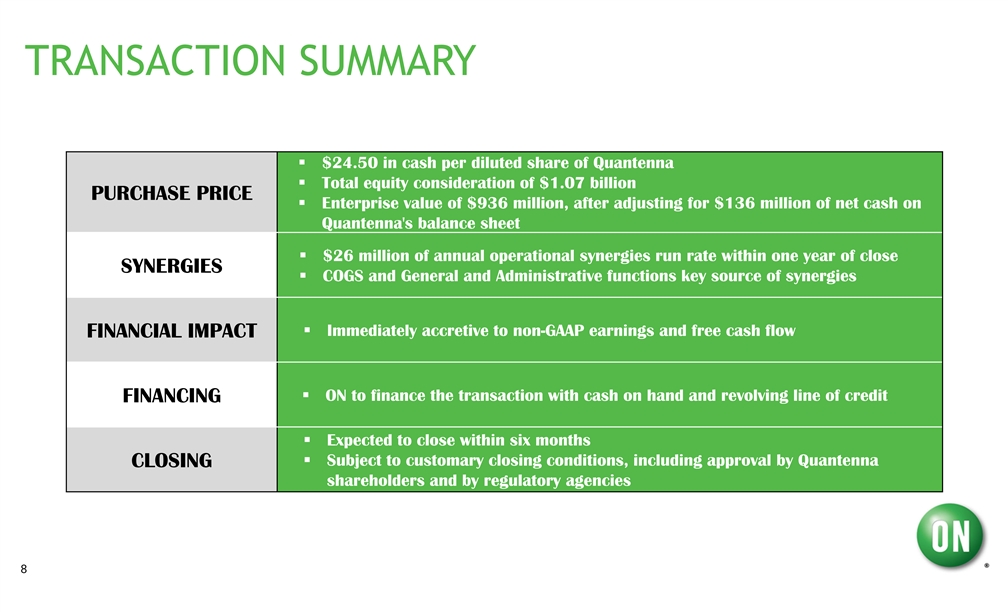

TRANSACTION SUMMARY § $24.50 in cash per diluted share of Quantenna § Total equity consideration of $1.07 billion PURCHASE PRICE § Enterprise value of $936 million, after adjusting for $136 million of net cash on Quantenna's balance sheet § $26 million of annual operational synergies run rate within one year of close SYNERGIES § COGS and General and Administrative functions key source of synergies § Immediately accretive to non-GAAP earnings and free cash flow FINANCIAL IMPACT § ON to finance the transaction with cash on hand and revolving line of credit FINANCING § Expected to close within six months § Subject to customary closing conditions, including approval by Quantenna CLOSING shareholders and by regulatory agencies 8TRANSACTION SUMMARY § $24.50 in cash per diluted share of Quantenna § Total equity consideration of $1.07 billion PURCHASE PRICE § Enterprise value of $936 million, after adjusting for $136 million of net cash on Quantenna's balance sheet § $26 million of annual operational synergies run rate within one year of close SYNERGIES § COGS and General and Administrative functions key source of synergies § Immediately accretive to non-GAAP earnings and free cash flow FINANCIAL IMPACT § ON to finance the transaction with cash on hand and revolving line of credit FINANCING § Expected to close within six months § Subject to customary closing conditions, including approval by Quantenna CLOSING shareholders and by regulatory agencies 8

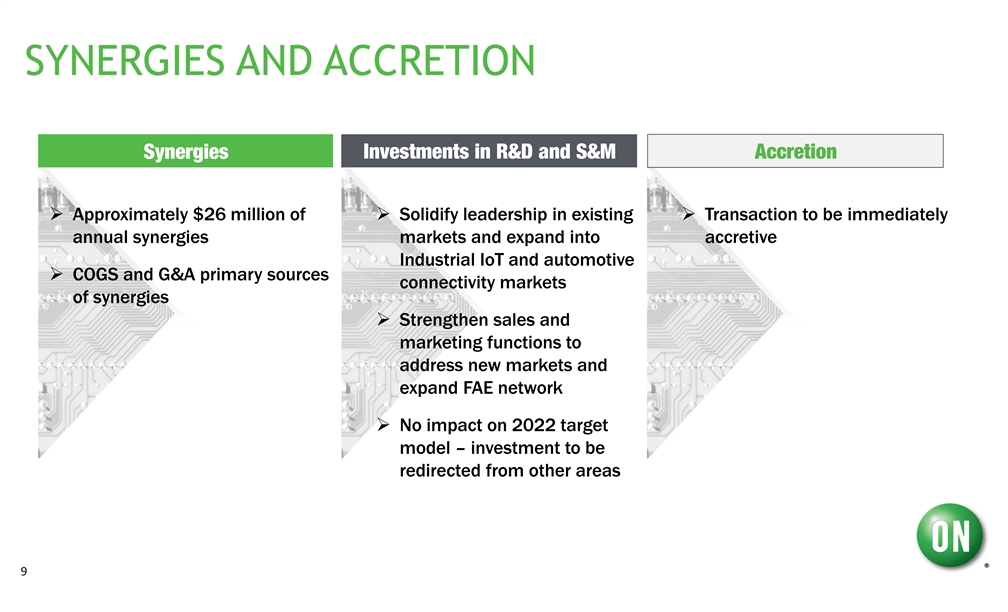

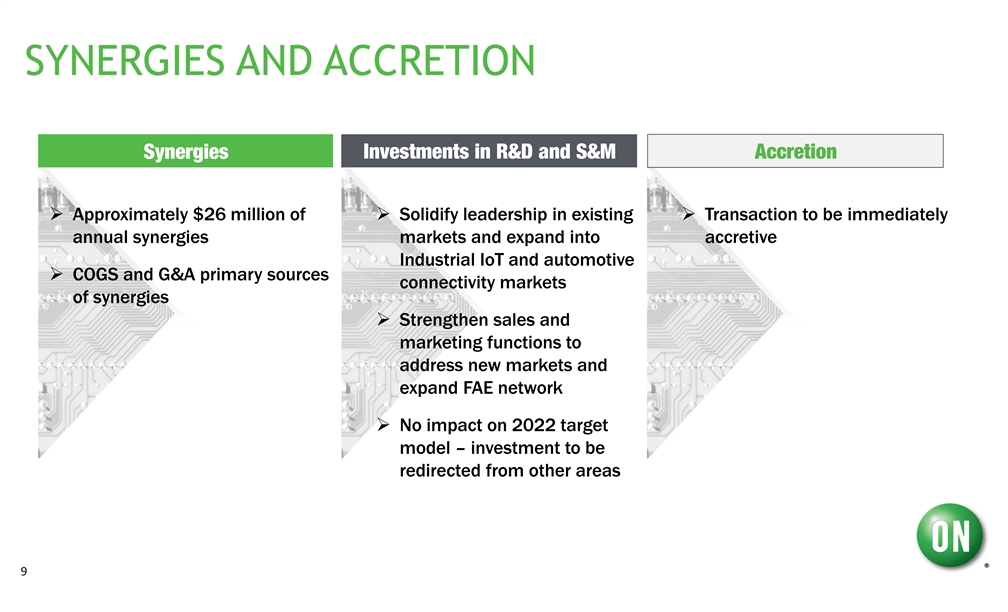

SYNERGIES AND ACCRETION Synergies Investments in R&D and S&M Accretion Ø Approximately $26 million of Ø Solidify leadership in existing Ø Transaction to be immediately annual synergies markets and expand into accretive Industrial IoT and automotive Ø COGS and G&A primary sources connectivity markets of synergies Ø Strengthen sales and marketing functions to address new markets and expand FAE network Ø No impact on 2022 target model – investment to be redirected from other areas 9SYNERGIES AND ACCRETION Synergies Investments in R&D and S&M Accretion Ø Approximately $26 million of Ø Solidify leadership in existing Ø Transaction to be immediately annual synergies markets and expand into accretive Industrial IoT and automotive Ø COGS and G&A primary sources connectivity markets of synergies Ø Strengthen sales and marketing functions to address new markets and expand FAE network Ø No impact on 2022 target model – investment to be redirected from other areas 9

CLOSURE TIMETABLE Expect to close within six months Subject to regulatory approvals in US and China Approval required from Quantenna shareholders 10CLOSURE TIMETABLE Expect to close within six months Subject to regulatory approvals in US and China Approval required from Quantenna shareholders 10

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in respect of the merger of Quantenna Communications, Inc. (“Quantenna”) with a wholly owned subsidiary of ON Semiconductor Corporation (“ON Semiconductor”). Quantenna intends to file relevant materials with the U.S. Securities and Exchange Commission (the “SEC”), including a proxy statement in preliminary and definitive form, in connection with the solicitation of proxies for the proposed merger. The definitive proxy statement will contain important information about the proposed merger and related matters. BEFORE MAKING A VOTING DECISION, STOCKHOLDERS OF QUANTENNA ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER RELEVANT MATERIALS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT QUANTENNA AND THE MERGER. Stockholders will be able to obtain copies of the proxy statement and other relevant materials (when they become available) and any other documents filed by Quantenna with the SEC for no charge at the SEC’s website at www.sec.gov. In addition, stockholders will be able to obtain free copies of the proxy statement from Quantenna by contacting Quantenna’s Investor Relations Department by telephone at (669)209-5500, by mail to Quantenna Communications, Inc., Attention: Investor Relations, 1704 Automation Parkway, San Jose, California 95131, or by going to Quantenna’s Investor Relations page on its corporate website at http://ir.quantenna.com.

Participants in Solicitation

Quantenna, its directors, and certain of its executive officers and employees may be deemed to be participants in the solicitation of proxies from Quantenna’s stockholders in respect of the merger. Information concerning the ownership of Quantenna’s securities by Quantenna’s directors and executive officers is included in their SEC filings on Forms 3, 4, and 5, and additional information about Quantenna’s directors and executive officers is also available in Quantenna’s proxy statement for its 2018 annual meeting of stockholders filed with the SEC on April 25, 2018, and is supplemented by other public filings made, and to be made, with the SEC by Quantenna. Other information regarding persons who may be deemed participants in the proxy solicitation, including their respective interests by security holdings or otherwise, will be set forth in the definitive proxy statement that Quantenna intends to file with the SEC. These documents can be obtained free of charge from the sources indicated above.

Forward Looking Statements

This filing communication contains forward-looking statements that involve risks and uncertainties concerning ON Semiconductor’s proposed acquisition of Quantenna. The potential risks and uncertainties include, among others, the possibility that Quantenna may be unable to obtain the required stockholder approval or antitrust regulatory approvals or that other conditions to closing the transaction may not be satisfied, such that the transaction will not close or that the closing may be delayed; the reaction of customers to the transaction; general economic conditions; the transaction may involve unexpected costs, liabilities or delays; risks that the transaction disrupts current plans and operations of the parties to the transaction; the amount of the costs, fees, expenses and charges related to the transaction; the outcome of any legal proceedings related to the transaction; the occurrence of any event, change or other circumstances that could give rise to the termination of the transaction agreement. In addition, please refer to the documents that Quantenna files with the SEC on Forms10-K,10-Q and8-K. The filings by Quantenna identify and address other important factors that could cause its financial and operational results to differ materially from those contained in the forward-looking statements set forth in this written communication. All forward-looking statements speak only as of the date of this written communication nor, in the case of any document incorporated by reference, the date of that document. Quantenna is under no duty to update any of the forward-looking statements after the date of this written communication to conform to actual results.