UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

|

| | |

| Check the appropriate box: |

| | | |

| x | | Preliminary Proxy Statement |

| | | |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

| | | |

| ¨ | | Definitive Proxy Statement |

| | | |

| ¨ | | Definitive Additional Materials |

| | | |

| ¨ | | Soliciting Material Pursuant to §240.14a‑11(c) or §240.14a‑2 |

QUANTENNA COMMUNICATIONS, INC.

(Name of Registrant as Specified In Its Charter)

|

| | |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0‑11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

PRELIMINARY PROXY STATEMENT — SUBJECT TO COMPLETION

QUANTENNA COMMUNICATIONS, INC.

3450 W. Warren Avenue

Fremont, California 94538

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 9:00 a.m. Pacific Time on Friday, June 9, 2017

Dear Stockholders of Quantenna Communications, Inc.:

We cordially invite you to attend the 2017 Annual Meeting of Stockholders (the “Annual Meeting”) of Quantenna Communications, Inc., a Delaware corporation, which will be held by virtual meeting on Friday, June 9, 2017 at 9:00 a.m. Pacific Time. You can access the virtual Annual Meeting by visiting www.virtualshareholdermeeting.com/QTNA where you will be able to listen to the meeting live, submit questions and vote online. We believe that a virtual stockholder meeting offers a number of benefits, including improved efficiency, reduced cost and greater access to those who may want to attend.

We are holding the Annual Meeting for the following purposes, as more fully described in the accompanying proxy statement:

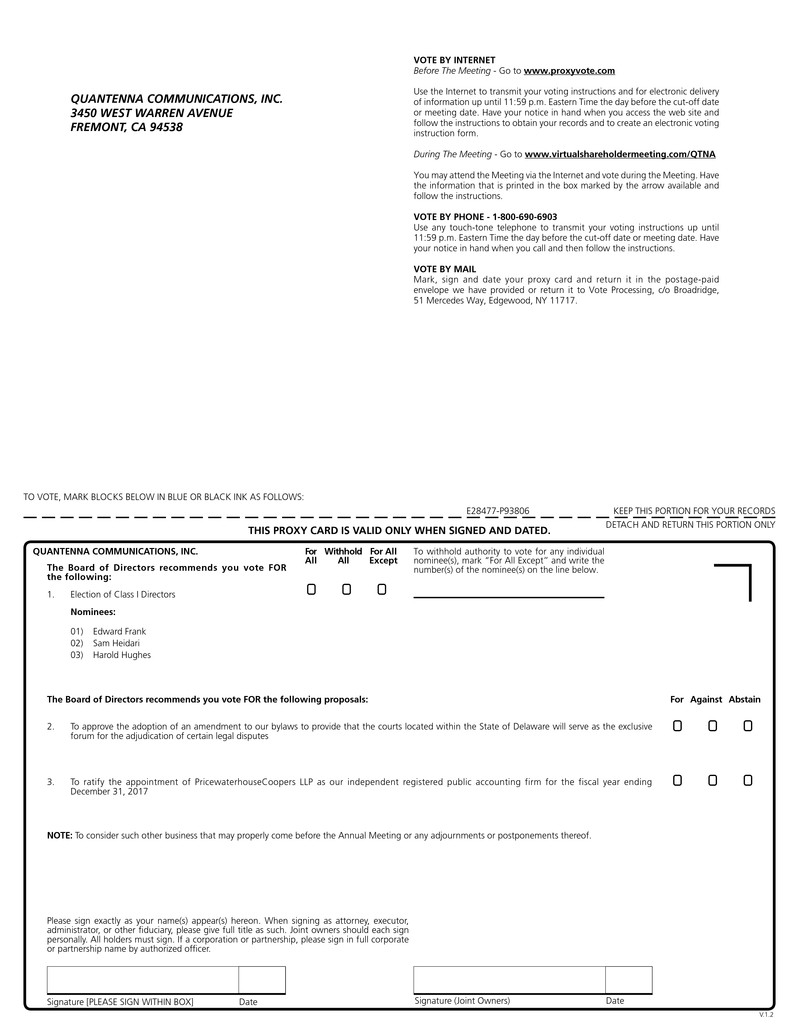

1.To elect three Class I directors to serve until the 2020 Annual Meeting of Stockholders and until their respective successors are duly elected and qualified;

2.To approve the adoption of an amendment to our bylaws to provide that the courts located within the State of Delaware will serve as the exclusive forum for the adjudication of certain legal disputes;

3.To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017; and

4.To transact such other business that may properly come before the Annual Meeting or any adjournments or postponements thereof.

Our Board of Directors has fixed the close of business on April 12, 2017 as the record date for the Annual Meeting. Only stockholders of record on April 12, 2017 are entitled to notice of and to vote at the virtual Annual Meeting. Further information regarding voting rights and the matters to be voted upon is presented in the accompanying proxy statement.

On or about April 28, 2017, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement and annual report. The Notice provides instructions on how to vote via the Internet or by telephone and includes instructions on how to receive a paper copy of our proxy materials by mail. The accompanying proxy statement and our annual report can be accessed directly at the following Internet address: www.virtualshareholdermeeting.com/QTNA. You will be asked to enter the sixteen-digit control number located on your Notice.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the virtual Annual Meeting, we urge you to submit your vote via the Internet, telephone or mail as soon as possible to ensure your shares are represented. For additional instructions on voting by telephone or the Internet, please refer

to your proxy card. Returning the proxy does not deprive you of your right to attend the virtual Annual Meeting and to vote your shares at the virtual Annual Meeting.

We appreciate your continued support of Quantenna Communications, Inc.

By order of the Board of Directors,

/s/ Sam Heidari

Sam Heidari

Chairman and Chief Executive Officer

Fremont, California

April 28, 2017

TABLE OF CONTENTS

PRELIMINARY PROXY STATEMENT — SUBJECT TO COMPLETION

QUANTENNA COMMUNICATIONS, INC.

3450 W. Warren Avenue

Fremont, California 94538

PROXY STATEMENT

FOR 2017 ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 9:00 a.m. Pacific Time on Friday, June 9, 2017

This proxy statement and the enclosed form of proxy are furnished in connection with the solicitation of proxies by our board of directors (the “Board of Directors”) for use at the 2017 Annual Meeting of Stockholders of Quantenna Communications, Inc., a Delaware corporation, and any postponements, adjournments or continuations thereof (the “Annual Meeting”). The Annual Meeting will be held via a virtual meeting on Friday, June 9, 2017 at 9:00 a.m. Pacific Time. You can attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/QTNA, where you will be able to listen to the meeting live, submit questions and vote online. The Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access this proxy statement and our annual report is first being mailed on or about April 28, 2017 to all stockholders entitled to vote at the Annual Meeting.

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read this entire proxy statement carefully. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in this proxy statement are inactive textual references only.

What matters am I voting on?

You will be voting on:

| |

| • | the election of three Class I directors to serve until our 2020 Annual Meeting of Stockholders and until their respective successors are duly elected and qualified; |

| |

| • | the adoption of an amendment to our bylaws to provide that the courts located within the State of Delaware will serve as the exclusive forum for the adjudication of certain legal disputes; |

| |

| • | a proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017; and |

| |

| • | any other business as may properly come before the virtual Annual Meeting. |

What if other matters are properly brought before the Annual Meeting?

As of the date of this proxy statement, we are not aware of any other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the annual meeting, the persons named as proxies will be authorized to vote or otherwise act on those matters in accordance with their judgment.

How does the Board of Directors recommend I vote on these proposals?

Our Board of Directors recommends a vote:

| |

| • | “FOR” the election of Edward Frank, Sam Heidari and Harold Hughes as Class I directors; |

| |

| • | “FOR” the approval of the adoption of an amendment to our bylaws to provide that the courts located within the State of Delaware will serve as the exclusive forum for the adjudication of certain legal disputes; and |

| |

| • | “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2017. |

Who is entitled to vote?

Holders of our common stock as of the close of business on April 12, 2017, the record date for the virtual Annual Meeting, may vote at the virtual Annual Meeting. As of the record date, there were 33,144,831 shares of our common stock outstanding. Stockholders are not permitted to cumulate votes with respect to the election of directors.

Registered Stockholders. If shares of our common stock are registered directly in your name with our transfer agent, you are considered the stockholder of record with respect to those shares and the Notice was provided to you directly by us. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote live at the virtual Annual Meeting. Throughout this proxy statement, we refer to these registered stockholders as “stockholders of record.”

Street Name Stockholders. If shares of our common stock are held on your behalf in a brokerage account or by a bank or other nominee, you are considered to be the beneficial owner of shares that are held in “street name,” and the Notice was forwarded to you by your broker or nominee, who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank or other nominee as to how to vote your shares. Beneficial owners are also invited to attend the virtual Annual Meeting. However, since a beneficial owner is not the stockholder of record, you may not vote your shares of our common stock live at the virtual Annual Meeting unless you follow your broker’s procedures for obtaining a legal proxy. If you request a printed copy of our proxy materials by mail, your broker, bank or other nominee will provide a voting instruction form for you to use. Throughout this proxy statement, we refer to stockholders who hold their shares through a broker, bank or other nominee as “street name stockholders.”

How many votes are needed for approval of each proposal?

| |

| • | Proposal No. 1: The election of directors requires a plurality of the voting power of the shares of our common stock present virtually or by proxy at the Annual Meeting and entitled to vote thereon to be approved. “Plurality” means that the nominees who receive the largest number of votes cast “For” such nominees are elected as directors. As a result, any shares not voted “For” a particular nominee (whether as a result of stockholder abstention or a broker non-vote) will not be counted in such nominee’s favor and will have no effect on the outcome of |

the election. You may vote “For” or “Withhold” on each of the nominees for election as a director.

| |

| • | Proposal No. 2: The approval of the adoption of an amendment to our bylaws to provide that the courts located within the State of Delaware will serve as the exclusive forum for the adjudication of certain legal disputes requires the affirmative vote of at least a majority of the voting power of our common stock present virtually or by proxy at the Annual Meeting and entitled to vote thereon to be approved. You may vote “For,” “Against,” or “Abstain” with respect to this proposal. Abstentions are considered votes present and entitled to vote on this proposal, and thus, will have the same effect as a vote “Against” this proposal. Broker non-votes will have no effect on the outcome of this proposal. |

| |

| • | Proposal No. 3: The ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2017, requires the affirmative vote of a majority of the voting power of the shares of our common stock present virtually or by proxy at the Annual Meeting and entitled to vote thereon to be approved. Abstentions are considered votes present and entitled to vote on this proposal, and thus, will have the same effect as a vote “Against” this proposal. Broker non-votes will have no effect on the outcome of this proposal. |

What is a quorum?

A quorum is the minimum number of shares required to be present at the Annual Meeting to properly hold an annual meeting of stockholders and conduct business under our amended and restated bylaws and Delaware law. The presence, virtually or by proxy, of a majority of the voting power of all issued and outstanding shares of our common stock entitled to vote at the Annual Meeting will constitute a quorum at the virtual Annual Meeting. Abstentions, withhold votes and broker non-votes are counted as shares present and entitled to vote for purposes of determining a quorum.

How do I vote?

If you are a stockholder of record, there are four ways to vote:

| |

| • | by Internet at www.proxyvote.com, 24 hours a day, seven days a week, until 11:59 p.m., Eastern Time, on June 8, 2017 (have your Notice in hand when you visit the website); |

| |

| • | by toll-free telephone at 1-800-690-6903 (be sure to have your Notice in hand when you call) To be valid, your vote by mail must be received by us by 11:59 p.m., Eastern Time, on June 8, 2017; |

| |

| • | by completing, signing, dating and mailing your proxy card (if you received printed proxy materials). To be valid, your vote by mail must be received by us by 11:59 p.m., Eastern Time, on June 8, 2017; or |

| |

| • | by attending the virtual Annual Meeting by visiting www.virtualshareholdermeeting.com/QTNA, where stockholders may vote and submit questions during the meeting (have your Notice in hand when you visit the website). |

Even if you plan to attend the virtual Annual Meeting, we recommend that you also vote by proxy so that your vote will be counted if you later decide not to attend the virtual Annual Meeting.

If you are a street name stockholder, you will receive voting instructions from your broker, bank or other nominee. You must follow the voting instructions provided by your broker, bank or other nominee in order to direct your broker, bank or other nominee on how to vote your shares. Street name stockholders should generally be able to vote by returning a voting instruction form, or by telephone or on the Internet. However, the availability of telephone and Internet voting will depend on the voting process of your broker, bank or other nominee. As discussed above, if you are a street name stockholder, you may not vote your shares live at the Annual Meeting unless you obtain a legal proxy from your broker, bank or other nominee.

Can I change my vote?

Yes. If you are a stockholder of record, you can change your vote or revoke your proxy any time before the Annual Meeting by:

| |

| • | entering a new vote by Internet or by telephone; |

| |

| • | completing and returning a later-dated proxy card; |

| |

| • | notifying the Corporate Secretary of Quantenna in writing at Quantenna Communications, Inc., 3450 W. Warren Avenue, Fremont, California 94538, Attention: Corporate Secretary; or |

| |

| • | attending and voting at the virtual Annual Meeting (although attendance at the virtual Annual Meeting will not, by itself, revoke a proxy). |

If you are a street name stockholder, your broker, bank or other nominee can provide you with instructions on how to change your vote.

What do I need to do to attend the virtual Annual Meeting?

You will be able to attend the virtual Annual Meeting line, submit your questions during the meeting and vote your shares electronically at the meeting by visiting www.virtualshareholdermeeting.com/QTNA. To participate in the virtual Annual Meeting, you will need the control number included on your Notice. The virtual Annual Meeting webcast will begin promptly at 9:00 a.m. Pacific Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 8:45 a.m. Pacific Time, and you should allow ample time for the check-in procedures.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our Board of Directors. Sean Sobers, Chief Financial Officer, and Tom MacMitchell, General Counsel and Corporate Secretary, have been designated as proxy holders by our Board of Directors. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our Board of Directors as described above. If any matters not described in this proxy statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote the shares. If the Annual Meeting is adjourned, the proxy holders can

vote the shares on the new Annual Meeting date as well, unless you have properly revoked your proxy instructions, as described above.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of a full set of proxy materials?

In accordance with the rules of the Securities and Exchange Commission (the “SEC”), we have elected to furnish our proxy materials, including this proxy statement and our annual report, primarily via the Internet. The Notice containing instructions on how to access our proxy materials is first being mailed on or about April 28, 2017 to all stockholders entitled to vote at the Annual Meeting. Stockholders may request to receive all future proxy materials in printed form by mail or electronically by e-mail by following the instructions contained in the Notice. We encourage stockholders to take advantage of the availability of our proxy materials on the Internet to help reduce the environmental impact and cost of our annual meetings of stockholders.

How are proxies solicited for the Annual Meeting?

Our Board of Directors is soliciting proxies for use at the Annual Meeting. All expenses associated with this solicitation will be borne by us. We will reimburse brokers or other nominees for reasonable expenses that they incur in sending our proxy materials to you if a broker, bank or other nominee holds shares of our common stock on your behalf. In addition, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication, but will not be paid any additional compensation for soliciting proxies.

How may my brokerage firm or other intermediary vote my shares if I fail to provide timely directions?

Brokerage firms and other intermediaries holding shares of our common stock in street name for their customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker will have discretion to vote your shares on our sole “routine” matter: the proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2017. Your broker will not have discretion to vote on any other proposals, which are “non-routine” matters, absent direction from you.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four business days after the Annual Meeting, we will file a Current Report on Form 8-K to publish preliminary results and will provide the final results in an amendment to the Current Report on Form 8-K as soon as they become available.

What does it mean if I receive more than one Notice of Internet Availability or more than one set of printed materials?

If you receive more than one Notice of Internet Availability or more than one set of printed materials, your shares may be registered in more than one name and/or are registered in different

accounts. Please follow the voting instructions on each Notice of Internet Availability or each set of printed materials, as applicable, to ensure that all of your shares are voted.

I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

We have adopted a procedure called “householding,” which the SEC has approved. Under this procedure, we deliver a single copy of the Notice and, if applicable, our proxy materials to multiple stockholders who share the same address unless we have received contrary instructions from one or more of such stockholders. This procedure reduces our printing costs, mailing costs, and fees. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will deliver promptly a separate copy of the Notice and, if applicable, our proxy materials to any stockholder at a shared address to which we delivered a single copy of any of these materials. To receive a separate copy, or, if a stockholder is receiving multiple copies, to request that we only send a single copy of the Notice and, if applicable, our proxy materials, such stockholder may contact us at the following address:

Quantenna Communications, Inc.

Attention: Investor Relations

3450 W. Warren Avenue

Fremont, California 94538

Tel: (510) 743-2260

Street name stockholders may contact their broker, bank or other nominee to request information about householding.

What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?

Stockholder Proposals

Stockholders may present proper proposals for inclusion in our proxy statement and for consideration at next year’s annual meeting of stockholders by submitting their proposals in writing to our Corporate Secretary in a timely manner. For a stockholder proposal to be considered for inclusion in our proxy statement for the 2018 Annual Meeting of Stockholders, our Corporate Secretary must receive the written proposal at our principal executive offices not later than December 29, 2017. In addition, stockholder proposals must comply with the requirements of Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Stockholder proposals should be addressed to: Quantenna Communications, Inc., Attention: Corporate Secretary, 3450 W. Warren Avenue, Fremont, California 94538.

Our Amended and Restated Bylaws also establish an advance notice procedure for stockholders who wish to present a proposal before an annual meeting of stockholders but do not intend for the proposal to be included in our proxy statement. Our Amended and Restated Bylaws provide that the only business that may be conducted at an annual meeting of stockholders is business that is (i) specified in our proxy materials with respect to such annual meeting, (ii) otherwise properly brought before such annual meeting by or at the direction of our Board of Directors, or (iii) properly brought before such meeting by a stockholder of record entitled to vote at such annual meeting who has delivered timely written notice to our Corporate Secretary, which notice must contain the information specified in our amended and restated bylaws. To be timely for our 2018 Annual Meeting of Stockholders, our Corporate Secretary must receive the written notice at our principal executive offices:

| |

| • | not earlier than February 12, 2018; and |

| |

| • | not later than the close of business on March 14, 2018. |

In the event that we hold the 2018 Annual Meeting of Stockholders more than 30 days before or more than 60 days after the one-year anniversary of the Annual Meeting, notice of a stockholder proposal that is not intended to be included in our proxy statement must be received no earlier than the close of business on the 120th day before the 2018 Annual Meeting of Stockholders and no later than the close of business on the later of the following two dates:

| |

| • | the 90th day prior to the 2018 Annual Meeting of Stockholders; or |

| |

| • | the 10th day following the day on which public announcement of the date of our 2018 Annual Meeting of Stockholders is first made. |

If a stockholder who has notified us of his, her or its intention to present a proposal at an annual meeting of stockholders does not appear to present his, her or its proposal at such annual meeting, we are not required to present the proposal for a vote at such annual meeting.

Nomination of Director Candidates

Holders of our common stock may propose director candidates for consideration by our Nominating and Corporate Governance Committee. Any such recommendations should include the nominee’s name and qualifications for membership on our Board of Directors and should be directed to our Corporate Secretary at the address set forth above. For additional information regarding stockholder recommendations for director candidates, see the section titled “Board of Directors and Corporate Governance—Stockholder Recommendations for Nominations to the Board of Directors.”

In addition, our Amended and Restated Bylaws permit stockholders to nominate directors for election at an annual meeting of stockholders. To nominate a director, the stockholder must provide the information required by our Amended and Restated Bylaws. In addition, the stockholder must give timely notice to our Corporate Secretary in accordance with our Amended and Restated Bylaws, which, in general, require that the notice be received by our Corporate Secretary within the time periods described above under the section titled “Stockholder Proposals” for stockholder proposals that are not intended to be included in a proxy statement.

Availability of Bylaws

A copy of our Amended and Restated Bylaws is available on our website at http://ir.quantenna.com/corporate-governance.cfm. You may also contact our Corporate Secretary at the address set forth above for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates.

What are the implications of being an “emerging growth company”?

We are an “emerging growth company” under applicable federal securities laws and therefore permitted to take advantage of certain reduced public company reporting requirements. As an emerging growth company, we provide in this Proxy Statement the scaled disclosure permitted under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), including certain executive compensation disclosures required of a “smaller reporting company,” as that term is defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934, as amended, or the Exchange Act. In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We will remain an emerging growth company until the earliest of (i) the last day of the fiscal year following the fifth anniversary of the completion of our initial public offering, (ii) the last day of the first fiscal year in which our annual gross revenue is $1 billion or more, (iii) the date on which we have, during the previous rolling three-year period, issued more than $1 billion in non-convertible debt securities or (iv) the date on which we are deemed to be a “large accelerated filer” as defined in the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Our business affairs are managed under the direction of our Board of Directors, which is currently composed of nine members. Our Board of Directors has determined that eight of our directors are independent within the meaning of the listing standards of the NASDAQ Stock Market. Our Board of Directors is divided into three staggered classes of directors. At each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the same class whose term is then expiring.

The following table sets forth the names, ages as of March 31, 2017, and certain other information for each of the members of our Board of Directors with terms expiring at the Annual Meeting (who are also nominees for election as a director at the Annual Meeting) and for each of the continuing members of our Board of Directors:

|

| | | | | | | | | | | | |

| | Class | | Age | | Position | | Director

Since | | Current

Term

Expires | | Expiration

of Term

For Which

Nominated |

| Directors with Terms Expiring at the Annual Meeting/Nominees | | | | | | | | | | | |

| Sam Heidari | I | | 50 | | Chairman and Chief Executive Officer | | 2011 | | 2017 | | 2020 |

|

| Edward Frank (4) | I | | 60 | | Director | | 2016 | | 2017 | | 2020 |

|

| Harold Hughes (1) | I | | 71 | | Director | | 2014 | | 2017 | | 2020 |

|

| Continuing Directors | | | | | | | | | | | |

| Fahri Diner (3) | II | | 48 | | Director | | 2007 | | 2018 | | — |

|

| Edwin (Ned) B. Hooper III (5) | II | | 49 | | Director | | 2014 | | 2018 | | — |

|

| John Scull (6) | II | | 60 | | Director | | 2014 | | 2018 | | — |

|

| Jack Lazar (2)(6) | III | | 51 | | Director | | 2016 | | 2019 | | — |

|

| Mark Stevens (2)(4) | III | | 57 | | Director | | 2016 | | 2019 | | — |

|

| Lip-Bu Tan (7) | III | | 57 | | Director | | 2015 | | 2019 | | — |

|

| |

| (1) | Chairperson of our Audit Committee |

| |

| (2) | Member of our Audit Committee |

| |

| (3) | Chairperson of our Compensation Committee |

| |

| (4) | Member of our Compensation Committee |

| |

| (5) | Chairperson of our Nominating and Corporate Governance Committee |

| |

| (6) | Member of our Nominating and Corporate Governance Committee |

| |

| (7) | Lead Independent Director |

Nominees for Director

Sam Heidari. Dr. Heidari has served as our Chief Executive Officer since February 2011, a member of our Board of Directors since March 2011 and Chairman of our Board of Directors since June 2016. From July 2009 to February 2011, Dr. Heidari served as our Vice President of Research and Development. From August 2006 to July 2009, Dr. Heidari served as Chief Technology Officer and Vice President of Engineering at Ikanos Communications, Inc., an advanced semiconductor products and software company. Dr. Heidari currently serves as the chairman of the board of directors of SiTune Corporation, a privately held integrated circuits company, and a member of the board of directors of several other privately held companies. Dr. Heidari holds a B.S. in Electrical Engineering from

Northeastern University and an M.S. and Ph.D. in Electrical Engineering from the University of Southern California.

Dr. Heidari was selected to serve on our Board of Directors because of the perspective and experience he provides as our Chief Executive Officer, as well as his extensive experience with technology companies.

Edward Frank. Dr. Frank has served on our Board of Directors since July 2016. Since January 2014, Dr. Frank has served as co-founder and Chief Executive Officer of Cloud Parity, an early-stage voice of the customer startup. From May 2009 to October 2013, Dr. Frank served as Vice President, Macintosh Hardware Systems Engineering at Apple, Inc., a consumer technology company. Dr. Frank currently serves on the boards of directors of Analog Devices, Inc., a global semiconductor company; Cavium, Inc., a provider of highly integrated semiconductor products; and eASIC Corporation, a privately held provider of ASIC semiconductor devices. He served as a director of Fusion-IO, Inc., a computer hardware and software systems company, from October 2013 until July 2014, when it was acquired by SanDisk Corporation. Dr. Frank holds a B.S. and M.S. in Electrical Engineering from Stanford University and a Ph.D. in Computer Science from Carnegie Mellon University.

Dr. Frank was selected to serve on our Board of Directors because of his deep understanding of the communications and hardware technology markets and his extensive executive leadership experience.

Harold Hughes. Mr. Hughes has served on our Board of Directors since October 2014. From March 2014 to October 2015, Mr. Hughes has served as the Chief Executive Officer of Manutius IP, Inc., a patent solutions company. Mr. Hughes served as the Chief Executive Officer and President at Rambus Inc., a semiconductor and IP products company, from January 2005 to June 2012 and served on the board of directors from June 2003 to April 2013. Mr. Hughes served on the board of directors of Planar Systems Inc., a display and digital signage technology company, from February 2014 until it was acquired by Leyard American Corporation in November 2015. Mr. Hughes holds a B.A. in Liberal Arts from the University of Wisconsin and an M.B.A. from the University of Michigan.

Mr. Hughes was selected to serve on our Board of Directors because of his significant business leadership experience in the semiconductor industry.

Continuing Directors

Fahri Diner. Mr. Diner has served on our Board of Directors since July 2007. Since October 2007, Mr. Diner has served as a Managing Director at Sigma Partners, a technology venture capital firm. Mr. Diner has served as Chief Executive Officer of Plume Design, Inc., a privately held cloud-based Wi-Fi control and management software company, since December 2014. Mr. Diner also currently serves on the boards of directors of a number of privately held companies. Mr. Diner holds a B.S. in Electrical Engineering from the Florida Institute of Technology.

Mr. Diner was selected to serve on our Board of Directors because of his significant operational and management experience in the technology and venture capital industries.

Edwin (Ned) B. Hooper III. Mr. Hooper has served on our Board of Directors since October 2014. Since August 2012, Mr. Hooper has served as a founder and managing partner of Centerview Capital Technology Fund (Delaware), L.P., a private investment firm. From February 1998 to July 2012, Mr. Hooper held multiple roles at Cisco Systems, Inc., a producer of networking equipment, including serving as Senior Vice President and Chief Strategy Officer. Mr. Hooper also currently serves on the

boards of directors of a number of privately held companies. Mr. Hooper holds a B.A. in International Affairs from the University of Colorado Boulder, and an M.B.A. from the University of Virginia Darden Graduate School of Business Administration.

Mr. Hooper was selected to serve on our Board of Directors because of his significant experience in the wireless and networking industry and because of his strategy and business expertise.

John Scull. Mr. Scull has served on our Board of Directors since November 2014. Mr. Scull has served as the co-founding managing director of Southern Cross Venture Partners, an Asia-Pac focused technology venture capital firm, since August 2006. Mr. Scull currently serves on the board of directors of Bigtincan Holdings Limited, an Australian public company that provides enterprise mobility software, and of a number of privately held companies. Prior to becoming a venture capitalist, Mr. Scull was a marketing executive at Apple, Inc. and then served as the chief executive officer of three venture capital-backed software companies. Mr. Scull holds a B.B.A. in Economics from the University of Oklahoma, and an M.B.A. from Harvard University.

Mr. Scull was selected to serve on our Board of Directors because of his significant strategy and marketing expertise in the technology software markets and his venture capital experience.

Jack Lazar. Mr. Lazar has served on our Board of Directors since July 2016. Since March 2016, Mr. Lazar has been an independent business and financial consultant. From January 2014 to March 2016, Mr. Lazar served as the Chief Financial Officer at GoPro, Inc., a provider of wearable and mountable capture devices. From January 2013 to January 2014, he was an independent business and financial consultant. From May 2011 to January 2013, Mr. Lazar served as Senior Vice President, Corporate Development and General Manager of Qualcomm Atheros, Inc., a developer of communications semiconductor solutions. From September 2003 until it was acquired by Qualcomm in May 2011, Mr. Lazar served in various positions at Atheros Communications, Inc., a provider of communications semiconductor solutions, most recently as Senior Vice President of Corporate Development, Chief Financial Officer and Secretary. Mr. Lazar has served on the board of directors of Silicon Laboratories Inc., a semiconductor company, since April 2013 and served on the board of directors of TubeMogul, Inc., an enterprise software company for digital branding (acquired by Adobe Systems Incorporated in December 2016), from October 2013 to December 2016. Mr. Lazar is a certified public accountant (inactive) and holds a B.S. in Commerce with an emphasis in Accounting from Santa Clara University.

Mr. Lazar was selected to serve on our Board of Directors because of his strong financial, technological and operational expertise gained from his experience as a technology company executive and consultant.

Mark Stevens. Mr. Stevens has served on our Board of Directors since July 2016. Mr. Stevens has served as the managing partner of S-Cubed Capital, a private family office investment firm, and as a special limited partner of Sequoia Capital, a venture capital investment firm, in each case since April 2012. From March 1993 to April 2012, Mr. Stevens served as a managing partner of Sequoia Capital, where he had been an associate for the initial four years. From December 2006 to October 2012, Mr. Stevens served as a member of the board of directors of Alpha and Omega Semiconductor Limited, a semiconductor technology company. Currently, Mr. Stevens serves as a director of NVIDIA Corporation, a graphics processor company. Mr. Stevens holds a B.S. in Electrical Engineering, a B.A. in Economics and an M.S. in Computer Engineering from the University of Southern California and an M.B.A. from Harvard Business School.

Mr. Stevens was selected to serve on our Board of Directors because of his extensive experience in the venture capital and semiconductor industries.

Lip-Bu Tan. Mr. Tan has served on our Board of Directors since June 2015. Since 1987, Mr. Tan has served as the founder and Chairman of Walden International, an international venture capital firm. He has also served as President and Chief Executive Officer of Cadence Design Systems, Inc., an electronic design automation software and engineering services company, since January 2009. Mr. Tan currently serves on the boards of directors of Cadence Design Systems, Inc., Hewlett Packard Enterprise, an information technology enterprise company, Ambarella, Inc., a developer of video compression and image processing semiconductors, and Semiconductor Manufacturing International Corporation, a semiconductor manufacturing company. He previously served on the board of directors of Inphi Corporation, a semiconductor corporation, from 2002 to 2012; Flextronics International Ltd. from 2003 to 2012; and SINA Corporation from 1999 to 2015. Mr. Tan holds a B.S. in Physics from Nanyang University in Singapore, an M.S. in Nuclear Engineering from the Massachusetts Institute of Technology, and an M.B.A. from the University of San Francisco.

Mr. Tan was selected to serve on our Board of Directors because of his extensive management and operational experience in the electronic design and semiconductor industries, and as a current and former board member of a number of technology companies, as well as his expertise in international operations and corporate governance.

Director Independence

Our Board of Directors has undertaken a review of the independence of each director. Based on information provided by each director concerning his background, employment and affiliations, our Board of Directors has determined that none of Messrs. Diner, Hooper, Hughes, Lazar, Scull, Stevens and Tan and Dr. Frank has relationships that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the listing standards of the NASDAQ Stock Market. In making these determinations, our Board of Directors considered the current and prior relationships that each non-employee director has with our Company and all other facts and circumstances our Board of Directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director, and the transactions involving them described in the section titled “Certain Relationships and Related Person Transactions.”

Lead Independent Director

Our Board of Directors has adopted Corporate Governance Guidelines that provide that one of our independent directors will serve as our Lead Independent Director at any time when our Chief Executive Officer serves as the Chairman of our Board of Directors or if the Chairman is not otherwise independent. Because Sam Heidari is our Chairman and is not an “independent” director as defined in the listing standards of the NASDAQ Stock Market, our Board of Directors has appointed Lip-Bu Tan as our Lead Independent Director. As Lead Independent Director, Mr. Tan presides over periodic meetings of our independent directors, serves as a liaison between our Chairman and our independent directors and performs such additional duties as our Board of Directors may otherwise determine and delegate from time to time.

Board Meetings and Committees

During our fiscal year ended January 1, 2017, our Board of Directors held nine (9) meetings (including regularly scheduled and special meetings), and each director attended at least 75% of the aggregate of (i) the total number of meetings of our Board of Directors held during the period for which he has been a director and (ii) the total number of meetings held by all committees of our Board of Directors on which he served during the periods that he or she served.

Although our Corporate Governance Policy and Guidelines does not require each member of our Board of Directors to attend annual meetings of stockholders, we strongly encourage all of our directors to attend.

Our Board of Directors has established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The composition and responsibilities of each of the committees of our Board of Directors is described below. Members serve on these committees until their resignation or until otherwise determined by our Board of Directors. Our Board of Directors also has the authority to establish other committees from time to time with the scope and responsibilities of such committee to be defined by the Board of Directors.

Audit Committee

Our Audit Committee is comprised of Messrs. Hughes, Lazar and Stevens, each of whom satisfies the requirements for independence and financial literacy under the applicable rules and regulations of the SEC and listing standards of the NASDAQ Stock Market. Mr. Hughes serves as the chair of our Audit Committee, qualifies as an “Audit Committee financial expert” as defined in the rules of the SEC, and satisfies the financial sophistication requirements under the listing standards of the NASDAQ Stock Market. Our Audit Committee is responsible for, among other things:

| |

| • | selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements; |

| |

| • | helping to ensure and evaluate the independence and performance of the independent registered public accounting firm; |

| |

| • | discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and the independent registered public accounting firm, our interim and year-end results of operations; |

| |

| • | developing procedures for employees to submit concerns confidentially and anonymously about questionable accounting or audit matters; |

| |

| • | reviewing our policies on risk assessment and risk management; |

| |

| • | reviewing the adequacy and effectiveness of our internal controls; |

| |

| • | reviewing related party transactions; and |

| |

| • | approving or, as required, pre-approving, all audit and all permissible non-audit services, other than de minimis non-audit services, to be performed by the independent registered public accounting firm. |

Our Audit Committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of the NASDAQ Stock Market. The charter is available on our website at http://ir.quantenna.com/corporate-governance.cfm. Our Audit Committee held seven (7) meetings during 2016.

Compensation Committee

Our Compensation Committee is comprised of Dr. Frank and Messrs. Diner and Stevens, each of whom satisfies the requirements for independence under the applicable rules and regulations of the SEC and listing standards of the NASDAQ Stock Market. Mr. Diner serves as the chair of our Compensation Committee. Each member of our Compensation Committee is also a non-employee director, as defined pursuant to Rule 16b‑3 promulgated under the Exchange Act, and an outside director, as defined pursuant to Section 162(m) of the Internal Revenue Code (the “Code”). Our Compensation Committee is responsible for, among other things:

| |

| • | reviewing, approving and determining, or making recommendations to our Board of Directors regarding, the compensation of our executive officers; |

| |

| • | administering our equity compensation plans; |

| |

| • | reviewing, approving and making recommendations to our Board of Directors regarding incentive compensation and equity compensation plans; and |

| |

| • | establishing and reviewing general policies relating to compensation and benefits of our employees. |

Our Compensation Committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of the NASDAQ Stock Market. The charter is available on our website at http://ir.quantenna.com/corporate-governance.cfm. Our Compensation Committee held twelve (12) meetings during 2016.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee is comprised of Messrs. Hooper, Lazar and Scull, each of whom satisfies the requirements for independence under the applicable rules and regulations of the SEC and listing standards of the NASDAQ Stock Market. Mr. Hooper serves as the chair of our Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee is responsible for, among other things:

| |

| • | identifying, evaluating and selecting, or making recommendations to our Board of Directors regarding, nominees for election to our Board of Directors and its committees; |

| |

| • | evaluating the performance of our Board of Directors and of individual directors; |

| |

| • | considering and making recommendations to our Board of Directors regarding the composition of our Board of Directors and its committees; |

| |

| • | reviewing developments in corporate governance practices; |

| |

| • | evaluating the adequacy of our corporate governance practices and reporting; and |

| |

| • | developing and making recommendations to our Board of Directors regarding corporate governance guidelines and matters. |

Our Nominating and Corporate Governance Committee operates under a written charter that satisfies the applicable listing standards of the NASDAQ Stock Market. The charter is available on our website at http://ir.quantenna.com/corporate-governance.cfm. Our Nominating and Corporate Governance Committee held six (6) meetings during 2016.

Board Leadership Structure

Sam Heidari currently serves as both the Chairman of our Board of Directors and as our Chief Executive Officer. Our independent directors bring experience, oversight and expertise from outside of our company, while Dr. Heidari brings company-specific experience and expertise. As a long-time member of our executive team, Dr. Heidari is best positioned to identify strategic priorities, lead critical discussion and execute our business plans. We believe that the structure of our Board of Directors and its committees provides effective independent oversight of management while Dr. Heidari’s combined role enables strong leadership, creates clear accountability and enhances our ability to communicate our message and strategy clearly and consistently to stockholders.

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee is or has been an officer or employee of our Company. None of our executive officers currently serves, or in the past year has served, as a member of the Board of Directors or Compensation Committee (or other board committee performing equivalent functions) of any entity that has one or more of its executive officers serving on our Board of Directors or Compensation Committee.

Considerations in Evaluating Director Nominees

Our Nominating and Corporate Governance Committee uses a variety of methods for identifying and evaluating director nominees. In its evaluation of director candidates, our Nominating and Corporate Governance Committee will consider the current size and composition of our Board of Directors and the needs of our Board of Directors and the respective committees of our Board of Directors. Some of the qualifications that our Nominating and Corporate Governance Committee considers include, without limitation, issues of character, integrity, judgment, diversity, independence, area of expertise, corporate, industry and eco-system experience, length of service, potential conflicts of interest, availability and other commitments. Nominees must also have the highest personal and professional ethics and integrity, proven achievement and competence in their respective field and the ability to exercise sound business judgment, skills that are complementary to those of the existing Board of Directors, and the ability to assist and support management and make significant contributions to the Company’s success. Members of our Board of Directors are expected to prepare for, attend, and participate in all Board of Directors and applicable committee meetings. Other than the foregoing, there are no stated minimum criteria for director nominees, although our Nominating and Corporate Governance Committee may also consider such other factors as it may deem, from time to time, are in our and our stockholders’ best interests.

Although our Board of Directors does not maintain a specific policy with respect to board diversity, our Board of Directors believes that our Board of Directors should be a diverse body, and our Nominating and Corporate Governance Committee considers a broad range of backgrounds and experiences. Our Nominating and Corporate Governance Committee also considers these and other factors as it oversees the annual Board of Directors and committee evaluations. After completing its

review and evaluation of director candidates, our Nominating and Corporate Governance Committee recommends to our full Board of Directors the director nominees for selection.

Stockholder Recommendations for Nominations to the Board of Directors

Our Nominating and Corporate Governance Committee will consider candidates for director recommended by stockholders holding at least five percent (5%) of the fully diluted capitalization of our company continuously for at least twelve (12) months prior to the date of the submission of the recommendation, so long as such recommendations comply with our amended and restated certificate of incorporation and amended and restated bylaws and applicable laws, rules and regulations, including those promulgated by the SEC. Our Nominating and Corporate Governance Committee will evaluate such recommendations in accordance with its charter, our amended and restated bylaws, our policies and procedures for director candidates, as well as the regular director nominee criteria described above. This process is designed to ensure that our Board of Directors includes members with diverse backgrounds, skills and experience, including appropriate financial and other expertise relevant to our business. Eligible stockholders wishing to recommend a candidate for nomination should contact our General Counsel or our Legal Department in writing. Such recommendations must include information about the candidate, including the candidate’s name, home and business contact information, detailed biographical data and relevant qualifications, a statement of support by the recommending stockholder, evidence of the recommending stockholder’s ownership of our common stock and a signed letter from the candidate confirming willingness to serve on our Board of Directors. Our Nominating and Corporate Governance Committee has discretion to decide which individuals to recommend for nomination as directors.

Under our bylaws, stockholders may also nominate persons for our Board of Directors. Any nomination must comply with the requirements set forth in our bylaws and should be sent in writing to our General Counsel or our Legal Department at Quantenna Communications, Inc., 3450 W. Warren Avenue, Fremont, California 94538. To be timely for our 2018 Annual Meeting of Stockholders, our General Counsel or Legal Department must receive the nomination no earlier than February 12, 2018 and no later than March 14, 2018.

Communications with the Board of Directors

Interested parties wishing to communicate with our Board of Directors or with an individual member or members of our Board of Directors may do so by writing to our Board of Directors or to the particular member or members of our Board of Directors, and mailing the correspondence to our General Counsel at Quantenna Communications, Inc., 3450 W. Warren Avenue, Fremont, California 94538. Our General Counsel, in consultation with appropriate members of our Board of Directors as necessary, will review all incoming communications and, if appropriate, all such communications will be forwarded to the appropriate member or members of our Board of Directors, or if none is specified, to the Chairman of our Board of Directors.

Corporate Governance Guidelines and Code of Business Conduct and Ethics

Our Board of Directors has adopted Corporate Governance Guidelines that address items such as the qualifications and responsibilities of our directors and director candidates and corporate governance policies and standards applicable to us in general. In addition, our Board of Directors has adopted a Code of Business Conduct and Ethics that applies to all of our employees, officers and directors. Our Board of Directors has also adopted a Code of Ethics for our Chief Executive Officer and Senior Financial Officers. The full text of our Corporate Governance Guidelines, Code of Business Conduct and Ethics and Code of Ethics for our Chief Executive Officer and Senior Financial Officers is posted on the

Corporate Governance portion of our website at http://ir.quantenna.com/corporate-governance.cfm. We will post amendments to our Code of Business Conduct and Ethics, Code of Ethics for our Chief Executive Officer and Senior Financial Officers or waivers of the applicable codes for directors, executive officers and senior financial officers on the same website in accordance with applicable requirements.

Risk Management

Risk is inherent with every business, and we face a number of risks, including strategic, financial, business and operational, legal and compliance, and reputational. We have designed and implemented processes to manage risk in our operations. Management is responsible for the day-to-day management of risks the company faces, while our Board of Directors, as a whole and assisted by its committees, has responsibility for the oversight of risk management. In its risk oversight role, our Board of Directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are appropriate and functioning as designed.

Our Board of Directors believes that open communication between management and our Board of Directors is essential for effective risk management and oversight. Our Board of Directors meets with our Chief Executive Officer and other members of our senior management team at quarterly meetings of our Board of Directors, where, among other topics, they discuss strategy and risks facing the company, as well at such other times as they deem appropriate.

While our Board of Directors is ultimately responsible for risk oversight, the committees of our Board of Directors assist our Board of Directors in fulfilling its oversight responsibilities in certain areas of risk. Our Audit Committee assists our Board of Directors in fulfilling its oversight responsibilities with respect to risk management in the areas of internal control over financial reporting and disclosure controls and procedures, liquidity, and legal and regulatory compliance related to financial matters, and discusses with management and the independent auditor guidelines and policies with respect to risk assessment and risk management. Our Audit Committee also reviews our major financial risk exposures and the steps management has taken to monitor and control these exposures. Our Nominating and Corporate Governance Committee assists our Board of Directors in fulfilling its oversight responsibilities with respect to the management of risk associated with board organization, membership and structure, and corporate governance. Our Compensation Committee assesses risks created by the incentives inherent in our compensation policies. Finally, our full Board of Directors reviews strategic and operational risk in the context of reports from the management team, receives reports on all significant committee activities at each regular meeting, and evaluates the risks inherent in significant transactions.

Non-Employee Director Compensation

Outside Director Compensation Prior to Initial Public Offering

Prior to our initial public offering, our non-employee directors did not receive any cash compensation for their service on our Board of Directors and committees thereof.

We entered into offer letters with each of Dr. Frank and Messrs. Lazar and Stevens in connection with their appointment to our Board of Directors in July 2016. Each offer letter provided for the grant of an option to purchase 72,000 shares of our common stock, which options are subject to vesting equally on a monthly basis over 36 months and full acceleration of vesting upon a change of control of our company. These options were granted to each of Dr. Frank and Messrs. Lazar and Stevens on July 13, 2016, with a vesting commencement date as of such date. The offer letters also provide for reimbursement for reasonable travel expenses incurred in connection with attendance at meetings of our Board of Directors.

See the section titled “Certain Relationships and Related Party Transactions” for additional information about these offer letters. In addition, Harold Hughes was granted options to purchase an aggregate of 72,000 shares of our common stock, consisting of an option to purchase 64,000 shares of our common stock granted to him on October 16, 2014 and which vests equally on a monthly basis over 48 months commencing as of such date and an option to purchase 8,000 shares of our common stock granted to him on June 30, 2016 and which vests equally on a monthly basis over 36 months commencing as of such date, in each case subject to full acceleration of vesting upon a change of control of our company.

Outside Director Compensation Policy

Members of our Board of Directors who are not employees are eligible for compensation under our Outside Director Compensation Policy, which became effective on October 27, 2016, the date of the effectiveness of the registration statement in connection with our initial public offering. Under our Outside Director Compensation Policy, each non-employee director is entitled to receive compensation for his or her service consisting of annual cash retainers and equity awards as described below. Our Board of Directors and our Compensation Committee will have the discretion to revise non-employee director compensation as they deem necessary or appropriate.

Cash Compensation. Under our Outside Director Compensation Policy, all non-employee directors are entitled to receive the following cash compensation for their services:

| |

| • | $35,000 per year for service as a board member; |

| |

| • | $20,000 per year additionally for service as lead independent director of the board; |

| |

| • | $15,000 per year additionally for service as chair of the Audit Committee; |

| |

| • | $7,500 per year additionally for service as an Audit Committee member other than chair; |

| |

| • | $10,000 per year additionally for service as chair of the Compensation Committee; |

| |

| • | $5,000 per year additionally for service as a Compensation Committee member other than chair; |

| |

| • | $5,000 per year additionally for service as chair of the Nominating and Corporate Governance Committee; and |

| |

| • | $2,500 per year additional for services as a Nominating and Corporate Governance Committee member other than chair. |

All cash payments to non-employee directors will be paid quarterly in arrears on a prorated basis to each non-employee director who served in the relevant capacity at any point during the immediately preceding fiscal quarter.

Each non-employee director is also entitled to reimbursement by the Company of reasonable, customary and properly documented travel expenses to attend meetings of the Board of Directors and committees thereof.

Equity Compensation. Under our Outside Director Compensation Policy, nondiscretionary, automatic grants of restricted stock units are made to our non-employee directors as described below.

Non-employee directors are eligible to receive all types of equity awards (except incentive stock options) under our 2016 Omnibus Equity Incentive Plan (the “2016 Plan”) (or the applicable equity plan in place at the time of grant) including discretionary awards not covered under our Outside Director Compensation Policy. All grants of awards under our Outside Director Compensation Policy will be automatic and nondiscretionary.

Initial Award. Each person who first becomes a non-employee director after October 27, 2016, the effective date of our Outside Director Compensation Policy, will be granted a restricted stock unit award having a grant date value equal to $270,000 (the “Initial Award”). The Initial Award automatically will be granted on the date on which such person first becomes a non-employee director. A director who is an employee who ceases to be an employee director but who remains a director will not receive an Initial Award.

If the Initial Award is granted in connection with our annual stockholder meeting, then, subject to the non-employee director continuing to serve as a director through each applicable vesting date, one-third of the shares subject to the Initial Award shall vest on the one-year anniversary of the date of grant (and if there is no corresponding day, on the last day of the month), or, if earlier, on the day prior to the first annual meeting of stockholders following the date of grant, an additional one-third of the shares subject to such Initial Award will vest on the two-year anniversary of the date of grant (and if there is no corresponding day, on the last day of the month), or, if earlier, on the day prior to the second annual meeting of stockholders following the date of grant, and the final one-third of the shares subject to such Initial Award will vest on the three-year anniversary of the date of grant (and if there is no corresponding day, on the last day of the month), or, if earlier, the day prior to the third annual meeting of stockholders following the date of grant.

If the Initial Award is granted not in connection with an annual meeting of stockholders, then, subject to the non-employee director continuing to serve as a director through each applicable vesting date, one-third of the shares subject to such Initial Award will vest on each annual anniversary of the date of grant thereafter (and if there is no corresponding day, on the last day of the month).

Annual Awards. On the date of each annual meeting of stockholders beginning with the upcoming Annual Meeting following the effective date of our Outside Director Compensation Policy, each non-employee director, if he has served as a director since the previous annual meeting of stockholders, will automatically be granted a restricted stock unit award having a grant date value equal to $135,000 (the “Annual Award”); provided that any non-employee director who is not continuing as a director following the applicable annual meeting will not receive an Annual Award with respect to such annual meeting. If, as of the date of an annual meeting of stockholders, a non-employee director had not been a non-employee director as of the previous annual meeting of stockholders, then he or she will not be granted a full Annual Award and instead will automatically be granted a prorated Annual Award, or Pro Rata Annual Award, with a total value equal to the result of (x) $135,000 multiplied by (y) a fraction (i) the numerator of which is the number of months he or she has served as a non-employee director (which will not exceed 12) and (ii) the denominator of which is 12. Any non-employee director who is not continuing as a director following the applicable annual meeting of stockholders will not receive an Annual Award or Pro-Rata Annual Award with respect to such annual meeting of stockholders. Each Annual Award and Pro-Rata Annual Award will vest as to 100% of the shares subject thereto upon the earlier of the one-year anniversary of the grant date or the day prior to our next annual meeting occurring after the grant date, subject to the individual’s continued service as a director through the applicable vesting date.

The value of all equity awards granted under our Outside Director Compensation Policy will be determined using the fair market value of the shares subject thereto or such other methodology as our Board of Directors or our Compensation Committee may determine prior to the grant of the awards becoming effective, as applicable.

Our 2016 Plan provides that in the event of a change in control, as defined in our 2016 Plan, each outstanding equity award granted under our 2016 Plan to a non-employee director will fully vest, all restrictions on the shares subject to such award will lapse, and with respect to awards with performance‑based vesting, all performance goals or other vesting criteria will be deemed achieved at 100% of target levels, and all of the shares subject to such award will become fully exercisable, if applicable, unless specifically provided otherwise under the applicable award agreement or other written agreement with the director.

Compensation for Fiscal Year 2016

The following table provides information regarding the total compensation that was granted to each of our non-employee directors in our fiscal year ended January 1, 2017.

|

| | | | | | | | |

| | | | | | | |

| Director | | Fees Earned or Paid in Cash ($) | | Option

Awards($)(1) | | Total Compensation |

| Fahri Diner | | $7,691 | | -- | | $7,691 |

| Edward Frank | | $6,837 | | $235,498 | | $242,335 |

| Edwin (Ned) B. Hooper III | | $6,837 | | -- | | $6,837 |

| Harold Hughes | | $8,545 | | $26,157 | | $34,702 |

| Jack Lazar | | $7,691 | | $235,498 | | $243,189 |

| John Scull | | $6,409 | | -- | | $6,409 |

| Mark Stevens | | $8,119 | | $235,498 | | $243,617 |

| Lip-Bu Tan | | $9,401 | | -- | | $ | 9,401 |

|

| |

| (1) | The amounts reported represent the aggregate grant-date fair value of the stock options and restricted stock units awarded to the director, calculated in accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718. The assumptions used in calculating the grant-date fair value of the stock options and restricted stock units reported in this column are set forth in Note 11 to our audited consolidated financial statements included in our Annual Report on Form 10-K, as filed with the SEC on March 1, 2017. |

The following table provides information regarding aggregate number of shares subject to outstanding equity awards held by non-employee directors as of January 1, 2017.

|

| | | | | | | | | | | |

| | | Option Awards |

| Name | | Grant Date | | | Number of Securities Underlying Unexercised Options (#) Exercisable | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | Option Exercise Price ($)(1) | | Option Expiration Date |

| Fahri Diner | | — | | | — | | — | | — | | — |

| Edward Frank | | 7/13/2016 | (2) | | 72,000 | | -- | | $8.50 | | 7/13/2026 |

| Edwin (Ned) B. Hooper III | | — | | | — | | — | | — | | — |

| Harold Hughes | | 10/16/2014 | (3) | | 34,674 | | 29,326 | | $2.00 | | 10/16/2024 |

| | | 6/30/2016 | (4) | | 8,000 | | -- | | $8.50 | | 6/30/2026 |

| Jack Lazar | | 7/13/2016 | (5) | | 72,000 | | --- | | $8.50 | | 7/13/2026 |

| John Scull | | — | | | — | | — | | — | | — |

| Mark Stevens | | 7/13/2016 | (5) | | 72,000 | | -- | | $8.50 | | 7/13/2026 |

| Lip-Bu Tan | | — | | | — | | — | | — | | — |

_____________________

| |

| (1) | The column represents the fair market value of our common stock on the date of grant as determined by the board of directors. |

| |

| (2) | Common stock was acquired pursuant to an early exercise option and is currently subject to vesting. One thirty-sixth (1/36) of the shares vested monthly commencing on July 6, 2016, and one thirty-sixth (1/36) of the shares vest monthly thereafter, subject to continued service on each such vesting date. |

| |

| (3) | One forty-eighth (1/48) of the shares subject to the option vest moon October 16, 2014, and one forty-eighth (1/48) of the shares vest monthly thereafter, subject to continued service on each such vesting date. |

| |

| (4) | This option is subject to an early exercise provision and is immediately exercisable. One thirty-sixth (1/36) of the shares subject to the option vest monthly commencing on June 30, 2016, and one thirty-sixth (1/36) of the shares vest monthly thereafter, subject to continued service on each such vesting date. |

| |

| (5) | This option is subject to an early exercise provision and is immediately exercisable. One thirty-sixth (1/36) of the shares subject to the option vest monthly commencing on July 6, 2016, and one thirty-sixth (1/36) of the shares vest monthly thereafter, subject to continued service on each such vesting date. |

Directors who are also our employees receive no additional compensation for their service as directors. During the fiscal year ended January 1, 2017, Dr. Heidari was our only employee director. See the section titled “Executive Compensation” for additional information about Dr. Heidari’s compensation.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our Board of Directors is currently comprised of nine members. In accordance with our Amended and Restated Certificate of Incorporation, our Board of Directors is divided into three staggered classes of directors. At the Annual Meeting, three Class I directors will be elected for a three-year term to succeed the same class whose term is then expiring.

Each director’s term continues until the election and qualification of his or her successor, or such director’s earlier death, resignation, or removal. Any increase or decrease in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of our directors. This classification of our Board of Directors may have the effect of delaying or preventing changes in control of our company.

Nominees

Our Nominating and Corporate Governance Committee has recommended, and our Board of Directors has approved, Edward Frank, Sam Heidari and Harold Hughes as nominees for election as Class I directors at the Annual Meeting. If elected, each of Drs. Frank and Heidari and Mr. Hughes will serve as Class I directors until our 2020 Annual Meeting of Stockholders and until their successors are duly elected and qualified. Each of the nominees is currently a director of our company. For information concerning the nominees, please see the section titled “Board of Directors and Corporate Governance.”

If you are a stockholder of record and you sign your proxy card or vote by telephone or over the Internet but do not give instructions with respect to the voting of directors, your shares will be voted “For” the election of Drs. Frank and Heidari and Mr. Hughes. We expect that each of Drs. Frank and Heidari and Mr. Hughes will accept such nomination; however, in the event that a director nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee designated by our Board of Directors to fill such vacancy. If you are a street name stockholder and you do not give voting instructions to your broker or nominee, your broker will leave your shares unvoted on this matter.

Vote Required

The election of directors requires a plurality of the voting power of the shares of our common stock present virtually or by proxy at the Annual Meeting and entitled to vote thereon to be approved. Any shares not voted “For” a particular nominee (whether as a result of stockholder abstention or a broker non-vote) will not be counted in such nominee’s favor and will have no effect on this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

EACH OF THE NOMINEES NAMED ABOVE.

PROPOSAL NO. 2

ADOPTION OF AN AMENDMENT TO OUR BYLAWS TO PROVIDE THAT THE COURTS LOCATED WITHIN THE STATE OF DELAWARE WILL SERVE AS THE EXCLUSIVE FORUM FOR THE ADJUDICATION OF CERTAIN LEGAL DISPUTES

We are asking stockholders to approve an amendment (the "Amendment") to our Amended and Restated Bylaws (the "Bylaws") that, if adopted, would result in the courts located within the State of Delaware serving as the exclusive forum for the adjudication of certain legal actions involving us. Specifically, if this proposal is approved by our stockholders, the Bylaws will be amended to insert a new provision as Article X to the Bylaws and to make appropriate conforming changes, including the re-designation of current Article X (Amendments) as Article XI. The text of the new Article X is as follows:

ARTICLE X – EXCLUSIVE FORUM FOR ADJUDICATION OF DISPUTES

Unless the corporation consents in writing to the selection of an alternative forum, the sole and exclusive forum for (i) any derivative action or proceeding brought on behalf of the corporation, (ii) any action asserting a claim of breach of a fiduciary duty owed by any current or former director, officer or other employee of the corporation to the corporation or the corporation’s stockholders, (iii) any action asserting a claim arising pursuant to any provision of the General Corporation Law of the State of Delaware or the Certificate of Incorporation or these Bylaws (in each case, as they may be amended from time to time), or (iv) any action asserting a claim governed by the internal affairs doctrine shall be the Court of Chancery in the State of Delaware (or, if the Court of Chancery does not have jurisdiction, the federal district court for the District of Delaware). Any person or entity purchasing or otherwise acquiring any interest in shares of capital stock of the corporation shall be deemed to have notice of and consented to the provisions of this Bylaw.

The Amendment provides that all intra-corporate disputes will be litigated in the State of Delaware, where we are incorporated and whose law governs those disputes. The Board believes that adopting the Amendment is in the best interests of the Company and its stockholders for the following reasons:

| |

| • | The Delaware courts have developed considerable expertise in dealing with corporate law issues, as well as a substantial and influential body of case law construing Delaware’s corporate law and long-standing precedent regarding corporate governance; |

| |

| • | The Amendment will help us avoid multiple lawsuits in multiple jurisdictions relating to such disputes, thus saving the significant costs and effort in addressing cases brought in multiple jurisdictions; |

| |

| • | The Amendment will reduce the risk that the outcome of cases in multiple jurisdictions could be inconsistent, even though each jurisdiction purports to follow Delaware law; |

| |