common shares entitled to vote at the Annual Meeting; and (ii) a majority of the outstanding common shares entitled to vote at the Annual Meeting that are not held by affiliated persons of the Company. The Investment Company Act of 1940, or 1940 Act, defines “a majority of the outstanding shares” as: (i) 67% or more of the voting securities present at a meeting if the holders of more than 50% of the outstanding voting securities of such company are present or represented by proxy; or (ii) 50% of the outstanding voting securities of a company, whichever is less. Second, Proposal II will also be approved if we receive approval from a majority of the number of beneficial holders of our common stock entitled to vote at the Annual Meeting, without regard to whether a majority of such shares are voted in favor of the proposal. Abstentions and broker non-votes on Proposal II will have the same effect as votes against the proposal.

Adjournment. The Annual Meeting may be adjourned from time to time pursuant to our bylaws. If a quorum is not present or represented at the Annual Meeting or if the chairman of the Annual Meeting believes it is in the best interests of the Company, the chairman of the Annual Meeting has the power to adjourn the meeting from time to time, in the manner provided in our bylaws, until a quorum will be present or represented or to provide additional time to solicit votes for one or more proposals.

Information Regarding This Solicitation

The Company will bear all costs and expenses related to the solicitation of proxies for the Annual Meeting, including the cost of preparing, printing and mailing this Proxy Statement, the accompanying Notice of Annual Meeting and proxy cards. Such costs and expenses are estimated to be approximately $50,000. If brokers, nominees, fiduciaries and other persons holding shares in their names, or in the name of their nominees, which are beneficially owned by others, forward the proxy materials to and obtain proxies from such beneficial owners, we will reimburse such persons for their reasonable expenses in so doing.

In addition to the solicitation of proxies by the use of the mail, proxies may be solicited in person and by telephone or facsimile transmission by directors, officers or employees of the Company, Tennenbaum Capital Partners, LLC, which is the Company’s investment adviser (the “Advisor”), and/or Series H of SVOF/MM, LLC, which is the Company’s administrator (the “Administrator”). The Advisor and the Administrator are located at 2951 28th Street, Suite 1000, Santa Monica, California 90405. No additional compensation will be paid to directors, officers, regular employees, the Advisor or the Administrator for such services.

The Company has also retained D.F. King & Co., Inc., to assist in the solicitation of proxies for a fee of approximately $9,500 plus reimbursement of certain expenses and fees for additional services requested. Please note that D.F. King & Co., Inc., may solicit stockholder proxies by telephone on behalf of the Company. They will not attempt to influence how you vote your shares, but only ask that you take the time to authorize your proxy. You may also be asked if you would like to vote over the telephone and to have your vote transmitted to the proxy tabulation firm.

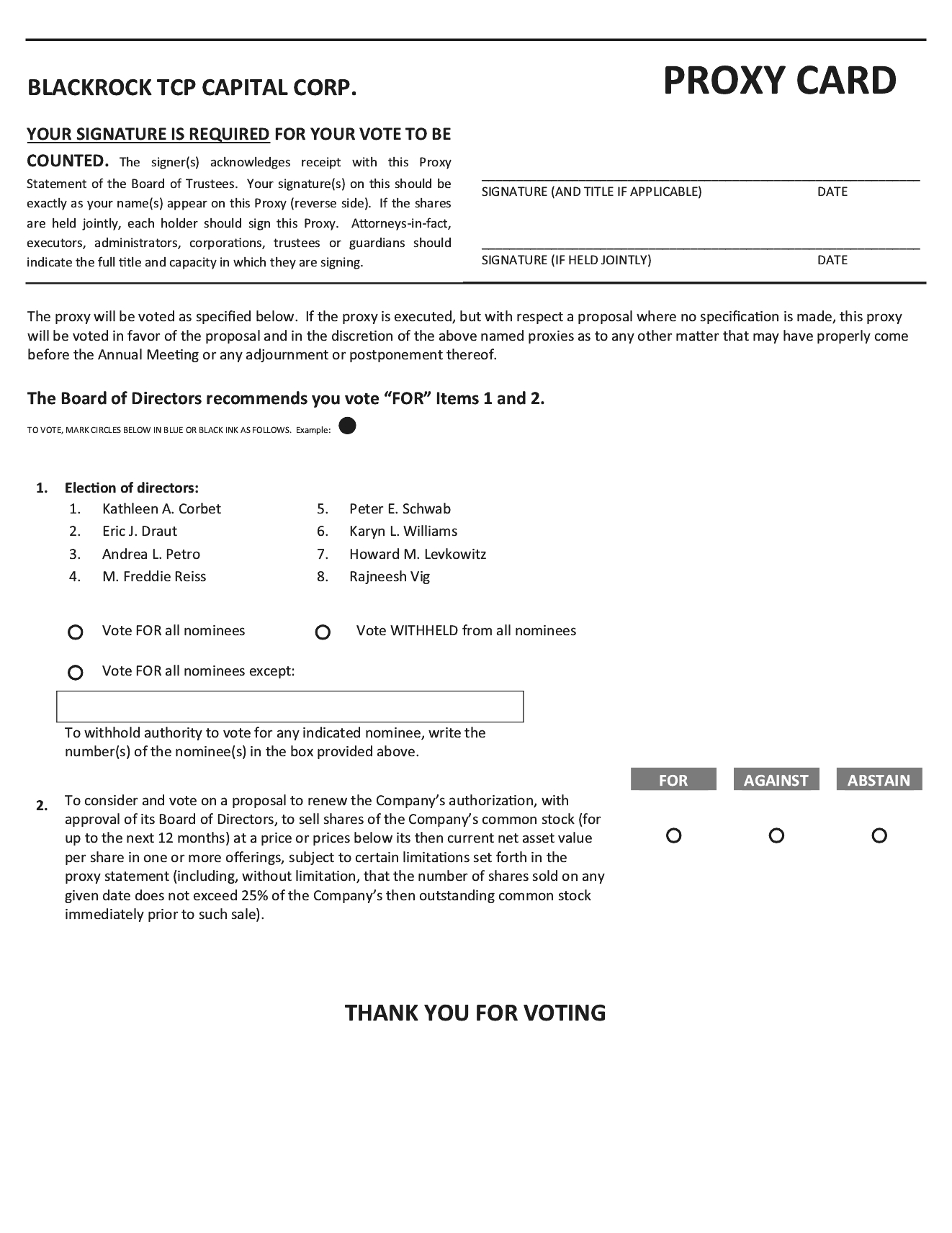

Stockholders may provide their voting instructions by telephone or through the Internet. These options require stockholders to input the control number which is located on each proxy card. After inputting this number, stockholders will be prompted to provide their voting instructions. Stockholders will have an opportunity to review their voting instructions and make any necessary changes before submitting their voting instructions and terminating their telephone call or Internet link. Stockholders who authorize a proxy via the Internet will be able to confirm their voting instructions prior to submission.

Any proxy given pursuant to this solicitation may be revoked by notice from the person giving the proxy at any time before it is exercised. Any such notice of revocation should be provided in writing and signed by the stockholder in the same manner as the proxy being revoked and delivered to our proxy tabulator.

Security Ownership of Certain Beneficial Owners and Management

As of March 29, 2021, there were no persons that owned more than 25% of our outstanding voting securities, and no person would be presumed to control us, as such term is defined in the 1940 Act.

Our Directors are divided into two groups — interested directors and independent directors. “Interested Directors” are those who are “interested persons” of the Company, as defined in the 1940 Act. “Independent Directors” are those who are not “interested persons” of the Company, as defined in the 1940 Act.

The following table sets forth, as of March 29, 2021, certain ownership information with respect to the Company’s shares for those persons who may, insofar as is known to us, directly or indirectly own, control or hold