Use these links to rapidly review the document

TABLE OF CONTENTS

Index to Financial Statements of Ellora Energy Inc

As filed with the Securities and Exchange Commission on November 9, 2006

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Ellora Energy Inc.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of

incorporation or organization) | | 1311

(Primary Standard Industrial

Classification Code Number) | | 01-0717160

(I.R.S. Employer

Identification Number) |

5480 Valmont, Suite 350

Boulder, CO 80301

(303) 444-8881

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices) |

T. Scott Martin

Chairman, President and Chief Executive Officer

5480 Valmont, Suite 350

Boulder, CO 80301

(303) 444-8881

(Name, address, including zip code, and telephone number, including area code, of agent for service) |

Copies to: |

Dallas Parker

Thompson & Knight LLP

333 Clay Street, Suite 3300

Houston, TX 77002

(713) 654-8111 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement is declared effective.

If any securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the "Securities Act"), check the following box. ý

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

|

Title of each class of Securities to be registered

| | Amount

to be registered

| | Proposed maximum

offering price

per share(1)

| | Proposed

maximum

aggregate

offering price(1)

| | Amount of

registration fee

|

|---|

|

| Common Stock, par value $0.001 per share | | 11,623,261 | | $12.00 | | $139,479,132 | | $14,925 |

|

- (1)

- Estimated solely for the purpose of calculating the registration fee under Rule 457(c) under the Securities Act. No exchange or over-the-counter-market exists for registrant's common stock; however, the registrant is in the process of applying to list shares of the registrant's common stock on the Nasdaq Global Market, and the registrant's shares of common stock issued to qualified institutional buyers in connection with its July 2006 private equity placement are eligible for the PORTAL Market. There is currently no market price for the shares of the Registrant's common stock; however, the price of the shares issued in the registrant's July 2006 private placement was $12.00 per share.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in the prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 9, 2006

PRELIMINARY PROSPECTUS

11,623,261 Shares

Common Stock

This prospectus relates to up to 11,623,261 shares of the common stock of Ellora Energy Inc., which may be offered and sold, from time to time, by the selling stockholders named in this prospectus. The selling stockholders acquired the shares of common stock offered by this prospectus in a private equity placement. We are registering the offer and sale of the shares of common stock to satisfy registration rights we have granted to the selling stockholders. We are not selling any shares of common stock under this prospectus and will not receive any proceeds from the sale of common stock by the selling stockholders.

The shares of common stock to which this prospectus relates may be offered and sold from time to time directly by the selling stockholders or alternatively through underwriters or broker-dealers or agents. The shares of common stock may be sold in one or more transactions, at fixed prices, at prevailing market prices at the time of sale, or at negotiated prices. Prior to this offering, there has been no public market for the common stock. We estimate that the selling stockholders initially will sell their shares at prices between $ per share and $ per share, if any shares are sold. Future prices will likely vary from this range and initial sales may not be indicative of prices at which our common stock will trade in the future. Please read "Plan of Distribution."

We have applied to list our common stock on the Nasdaq Global Market under the symbol "LORA."

Investing in our common stock involves a high degree of risk. You should read the section entitled "Risk Factors" beginning on page 13 for a discussion of certain risks that you should consider before buying shares of our common stock.

You should rely only on the information contained in this prospectus or any prospectus supplement or amendment. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2006.

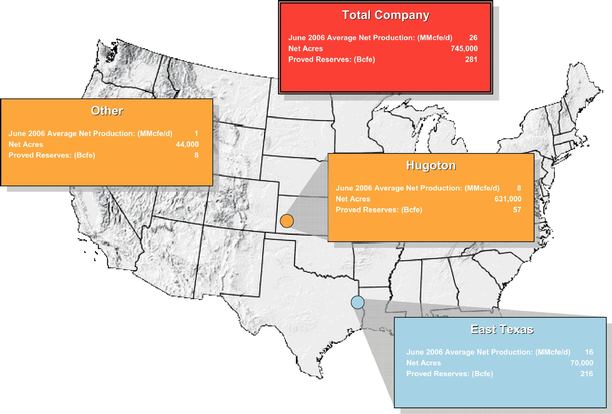

Ellora Energy Inc. Areas of Operation

As of June 30, 2006

TABLE OF CONTENTS

PROSPECTUS SUMMARY

This summary highlights selected information from this prospectus but does not contain all information that you should consider before investing in our common stock. You should read this entire prospectus carefully, including "Risk Factors" beginning on page 13, and the financial statements included elsewhere in this prospectus. In this prospectus, we refer to Ellora Energy Inc., its subsidiaries and predecessors as "Ellora Energy" "we," "us," "our," or "our company." References to the number of shares of our common stock outstanding have been revised to reflect a 8.09216-for-1 stock split effected in July 2006. The estimates of our proved reserves included in this prospectus as of December 31, 2005 are based on a reserve report prepared by us and audited by MHA Petroleum Consultants, Inc., independent petroleum engineers ("MHA"), and as of June 30, 2006 are based on a reserve report prepared by MHA. Summaries of their reports with respect to these estimated proved reserves as of December 31, 2005 and June 30, 2006 are attached to this prospectus as Appendix A. We discuss sales volumes, per Mcf revenue, per Mcf cost and other data in this prospectus net of any royalty owner's interest. We have provided definitions for some of the industry terms used in this prospectus in the "Glossary of Selected Oil and Gas Terms."

Ellora Energy Inc.

Overview

We are an independent oil and gas company engaged in the acquisition, exploration, development and production of onshore domestic U.S. oil and gas properties. We primarily operate in two areas: east Texas and adjacent lands in western Louisiana, which we collectively refer to as East Texas, and the Hugoton field in southwest Kansas. We have assembled combined acreage of approximately 794,000 gross (745,000 net) acres providing us with 680 identified drilling locations. At June 30, 2006 we owned interests in 232 gross (144 net) producing wells, and during June 2006 our average net production was approximately 26 MMcfe/d. At June 30, 2006, our estimated total proved oil and gas reserves were approximately 281 Bcfe. Our proved reserves are approximately 84% gas and 33% proved developed. Our total proved reserves have a reserve life index of approximately 37 years and our proved producing reserves have a reserve life index of 11 years. Using prices as of June 30, 2006, our proved reserves had an estimated pre-tax net present value, discounted at 10%, or PV-10, of approximately $487 million, of which 41% was proved developed. See "Selected Combined Historical Financial Data—Reconciliation of Non-GAAP Financial Measures" for additional information regarding PV-10. As operator of over 90% of our proved reserves, we have a high degree of control over our capital expenditure budget and other operating matters.

The following table sets forth by operating area a summary of our estimated net proved reserves and estimated average daily net production information as of and for the six months ended June 30, 2006.

| | Estimated Proved Reserves at June 30, 2006

| |

| | Production for the Six Months Ended

June 30, 2006

| |

|---|

| | Developed (Bcfe)

| | Undeveloped (Bcfe)

| | Total (Bcfe)

| | Percent of Total Reserves

| | PV-10(1)

($Millions)

| | Identified

Drilling

Locations(2)

| | Net

Average MMcfe/d

| | Percent of Total

| |

|---|

| East Texas | | 73 | | 143 | | 216 | | 77 | % | $ | 285 | | 271 | | 14 | | 67 | % |

| Hugoton (Kansas) | | 17 | | 40 | | 57 | | 20 | | | 183 | | 392 | | 6 | | 28 | |

| Other | | 4 | | 4 | | 8 | | 3 | | | 19 | | 17 | | 1 | | 5 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| | Total | | 94 | | 187 | | 281 | | 100 | % | $ | 487 | | 680 | | 21 | | 100 | % |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

- (1)

- Based on June 30, 2006 NYMEX spot prices of $6.10 per MMBtu of gas and $73.93 per Bbl of oil, respectively, adjusted for basis and held flat for the life of the reserves and adjusted for quality differentials.

- (2)

- Represents total gross drilling locations identified by management as of June 30, 2006. Of the total, 203 locations are classified as proved.

1

East Texas

We are one of the largest producers and acreage holders in the James Lime play. We acquired our initial acreage position and wells producing 5 MMcfe/d in Shelby County, Texas in June 2002. Since then we have amassed 87,000 gross (70,000 net) acres in East Texas. From June 2002 through June 30, 2006, we invested $50 million to drill and complete 21 of 22 James Lime wells, for a 95% completion rate. At June 30, 2006, we had 58 productive wells and total proved reserves of approximately 260 Bcfe in the James Lime. During the first six months of 2006, we produced an average of 14 MMcfe/d from this region. We have identified 150 drilling locations and anticipate drilling 12 wells in the James Lime in 2006 at a budgeted cost per completed well of $2.1 million for unstimulated wells and $3.1 million for stimulated wells.

We also produce out of the shallower Fredericksburg (or Edwards) formation on our East Texas acreage. Since 2004 we have invested $16 million to drill and complete seven of eight Fredericksburg wells, an 88% completion rate. At June 30, 2006, we had seven productive wells and total proved reserves of approximately 38 Bcfe in the Fredericksburg formation, of which 4 Bcfe were proved developed producing. We have identified 110 drilling locations and anticipate drilling two wells in the Fredericksburg formation in 2006 at a budgeted cost per completed well of $1.1 million.

English Bay Pipeline, L.P.

We own and operate 80 miles of four-to-eight-inch gas gathering lines and gas pipelines and 13 compressor stations with 9,630 total compression horsepower, which gather, process and transport our gas and third party gas in our East Texas operations area. Our ownership of this pipeline system provides us with the benefit of controlling compression location and timing of connection to newly completed wells. Our system interconnects to the Texas Eastern, Centerpoint and Shelby County pipelines. During the six months ended June 30, 2006 we transported an average of approximately 27.3 MMcf/d of gas. Our pipeline activities produced third party revenues of approximately $5.6 million for the full year 2005 and $2.4 million for the six months ended June 30, 2006.

Kansas

The Hugoton field has produced over 31 Tcf of gas since its discovery in 1927, making it the most prolific gas field in North America. We acquired our Hugoton field acreage position in April 2005 through our purchase of Presco Western, LLC, which is a party to a farmout agreement with a subsidiary of BP Amoco. Our farmout covers approximately 651,000 gross (631,000 net) acres in the heart of the Hugoton field, making us one of the largest acreage holders in the field. The farmout, which terminates in 2013, grants us the mineral rights in reservoirs we develop below the Heebner Shale (located at a depth of approximately 4,000 feet) as long as we fulfill our obligation to drill a minimum of 10 exploratory wells per year. Since we acquired this position in 2005 we have invested $11.9 million to complete 25 of 30 wells, an 83% completion rate. At June 30, 2006, we had 68 productive wells and total proved reserves of approximately 57 Bcfe, of which 17 Bcfe were proved developed producing. During the first six months of 2006, we produced an average of 6 MMcfe/d, up from 2 MMcfe/d at the time of the acquisition. We have identified three waterfloods, 392 drilling locations and anticipate drilling 33 wells in 2006.

2

Recent Developments

In mid-2006 we applied a new frac technology that we believe will allow for higher initial production rates and ultimate reserve recoveries for our East Texas wells than have previously been achieved. We have drilled four wells to date using this new frac technology, and we have experienced production at significantly higher rates than has been experienced using unstimulated production techniques. Incremental capital expenditure costs for using this new technology is approximately $1 million per well. We currently anticipate using this new frac technology to drill and complete additional wells during the remainder of 2006.

Summary of Capital Expenditures

The following table summarizes information regarding our historical 2005 and our estimated 2006 and 2007 capital expenditures. The estimated 2006 capital expenditures shown are preliminary full year estimates, including approximately $27 million spent from January 1, 2006 through June 30, 2006. The estimated capital expenditures are subject to change depending upon a number of factors, including availability of capital, drilling results, oil and gas prices, costs of drilling and completion and availability of drilling rigs, equipment and labor.

| |

| | Estimated

|

|---|

| | Historical

| | Year Ending December 31,

|

|---|

| | Year Ended December 31,

2005

|

|---|

| | 2006

| | 2007

|

|---|

| | (In thousands)

|

|---|

| Capital expenditures: | | | | | | | | | |

| | East Texas | | $ | 25,336 | | $ | 34,400 | | $ | 36,000 |

| | Hugoton | | | 4,565 | | | 18,986 | | | 21,657 |

| Other | | | 4,034 | | | 9,258 | | | 8,789 |

| Geological and geophysical | | | 35 | | | 4,000 | | | 4,000 |

| Growth capital expenditures(1) | | | — | | | 7,000 | | | 60,000 |

| | |

| |

| |

|

| | Total capital expenditures | | $ | 33,970 | | $ | 73,644 | | $ | 130,446 |

| | |

| |

| |

|

- (1)

- Growth capital expenditures are for the acceleration of drilling and secondary recovery in addition to capital expenditures contemplated in the reserve report. We do not budget for possible acquisitions.

Strategy

Our strategy is to increase stockholder value by profitably increasing our reserves, production, cash flow and earnings using a balanced program of (1) developing existing properties, (2) exploiting and exploring undeveloped properties, (3) completing strategic acquisitions and (4) maintaining financial flexibility. The following are key elements of our strategy:

- •

- Maintain Technological Expertise. We intend to utilize and expand the technological expertise that has enabled us to achieve a drilling completion rate of over 90% since our inception and helped us improve and maximize field recoveries. We will use advanced geological and geophysical technologies, detailed petrophysical analyses, advanced reservoir engineering, and sophisticated completion and stimulation techniques, including multi-stage stimulation frac technology, to profitably grow our reserves and production.

3

- •

- Accelerate the Development of our Existing Properties. We intend to further develop the significant remaining upside potential of our properties.

- •

- When we acquired the East Texas properties in June 2002, we estimated that each acquired well had average proved reserves of 2.5 Bcfe. From June 2002 to June 30, 2006, we drilled and completed 21 James Lime wells, and due to the improved geosteering, drilling and completion techniques we used in drilling them, we estimate that each of these 21 newly completed wells has average proved reserves of 3.5 Bcfe.

- •

- In East Texas we have begun to utilize multi-stage stimulation frac technology that we believe will allow for higher initial production rates and ultimate reserve recoveries than have previously been achieved in analogous horizontal wells. We have tested this technology on four wells, and we have experienced production at significantly higher rates than has been experienced using unstimulated production techniques. We achieved commercial production using this technology during the third quarter of 2006.

- •

- In the Hugoton field we are completing studies of two secondary recovery projects that will use traditional waterflood techniques. One of the areas identified has shown increased production in response to waterflood projects operated by others on contiguous properties. We expect to commence initial operations on the first of these two projects during the first quarter of 2007.

- •

- In the Hugoton field, we drill to the lowest known hydrocarbon producing formation in our area, then attempt completion in zones that have shown the presence of hydrocarbons during drilling. Geological evaluation through traditional logging methods is not as successful as this pragmatic test. We have found at least two economic production zones in each completed well using this method.

- •

- We intend to acquire an additional 350 square miles of proprietary 3-D seismic data with respect to our Hugoton properties over the next five years. This data will add to our current inventory of 350 square miles of proprietary 3-D seismic and 275 square miles of licensed 3-D seismic, providing seismic coverage of approximately two thirds of our Hugoton interest by 2011.

- •

- Acquisition Growth. We continually review opportunities to acquire producing properties, undeveloped acreage and drilling prospects. We will focus particularly on opportunities where we believe our reservoir management and operational expertise will enhance the value and performance of acquired properties. Initial acquisition targets are expected to be in and around our major producing and activity areas. We may enter into hedging agreements in connection with future acquisitions to protect our return on investment. Our management team members have gained significant acquisition experience during their careers with Ellora and previous employers.

- •

- Endeavor to be a Low Cost Producer. We will strive to minimize our operating costs by concentrating our assets within geographic areas where we can consolidate operating control and capture operating efficiencies.

- •

- Maintain Financial Flexibility. Upon the completion of our initial public offering, we expect to have approximately $ million in cash, no bank debt and at least $110 million available for borrowings under our revolving line of credit, providing us with significant financial flexibility to pursue our business strategy. Our goal is to limit borrowing to no more than 50% of book capital to assure that we have flexibility to expand and invest, and to avoid the problems associated with highly leveraged companies, including large interest costs and possible debt reductions that can restrict ongoing operations. We have historically used puts (or floors) to protect a portion of our exposure to commodity price fluctuations while capturing all of the

4

upside potential of prices. We may enter into additional commodity hedge agreements, including fixed price, forward price, physical purchase and sales contracts, futures, financial swaps, option contracts and put options.

Competitive Strengths

We believe our historical success is, and future performance will be, directly related to the following combination of strengths which enable us to implement our strategy:

- •

- Experienced Management Team and Directors. The members of our executive management team have an average of over 22 years of experience in the oil and gas industry and significant experience in managing public and private oil and gas companies. Several of our directors also have significant experience in managing both public and private oil and gas firms.

- •

- High Quality, Operated Asset Base. We own a high quality asset base comprised of long-lived reserves along with shorter-lived, higher return reserves. We operate over 90% of our estimated proved reserves. Approximately 84% of our reserves are gas, and almost all of our assets are located in East Texas and the Hugoton field. We believe this property profile will produce stable cash flows while providing us with a large number of development, exploitation and exploration opportunities.

- •

- Large Acreage Positions. We are a significant acreage holder in each of our two primary operating areas. In East Texas we control over 87,000 gross (70,000 net) acres and in the Hugoton field our BP Amoco farmout covers 651,000 gross (631,000 net) acres. We believe we have assembled a high quality asset portfolio in prolific oil and gas fields that would be difficult to replicate.

- •

- Significant Hugoton Reserve Potential. With production commencing in the late 1920's, a substantial majority of gas sold from the Hugoton field has been sold at prices under $2 per Mcf. As a result of these historically lower prices, we believe the deeper zones of the Hugoton field have not been fully explored or developed. Accordingly, we believe that significant amounts of gas and oil remain to be recovered in the current higher price environment using modern exploration and production technologies.

- •

- Drilling Inventory. We have identified 680 drillable, low to moderate risk locations providing us with multiple years of drilling inventory. Of these locations, 203 are classified as proved undeveloped. We have traditionally drilled locations that management deems to have the greatest economic potential as opposed to drilling wells designed to impact our reported proved reserve value by converting probable or possible reserves to proved reserves.

- •

- Proven Technical Team. Our technical staff includes 17 geologists, geophysicists, reservoir engineers and technicians with an average of over 16 years of relevant technical experience. Our staff has a proven record of analyzing complex structural and stratigraphic plays using 3-D seismic, geological and geophysical expertise, producing and optimizing oil and gas reservoirs, and drilling, completing and fracing tight gas reservoirs. Our professionals have developed new horizontal drilling and completion techniques that enhance initial production rates and ultimate reserve recoveries.

- •

- High Rate of Drilling Success. The competencies of our proven technical team focused in our large and productive acreage holdings have helped us to achieve a drilling success rate of over 90% since our inception in 2002. Our technical expertise has also allowed us to improve the production rates and ultimate hydrocarbon recoveries on our wells as compared to those wells drilled by others in similar reservoirs in our primary operating areas.

- •

- Low Finding and Development Costs. Our significant reserve potential in our operating areas, our technical expertise and high drilling success have allowed us to achieve relatively lower finding

5

and development costs. Since our inception, we have invested approximately $100 million to drill and complete 52 wells in our East Texas and Hugoton operating areas. Our average acquisition, finding and development costs from inception to June 30, 2006 was $1.27 per Mcfe.

- •

- Control of Low-Pressure Gas Gathering Infrastructure. We own and operate approximately 80 miles of gas gathering lines and gas pipelines that collect and transport our production and third party production in our East Texas operations area. We intend to acquire or construct additional gas gathering assets as necessary to fully develop our East Texas opportunities.

- •

- Gas Marketing Flexibility. Production from both East Texas and the Hugoton field has access to multiple delivery points to several regional and interstate pipelines that provide more than sufficient take away capacity to sell our production.

- •

- Significant Equity Held by Management. After giving effect to our initial public offering, our management and employees will own more than % of our equity on a fully diluted basis.

East Texas

The Lower Cretaceous James Lime play extends in Texas from Angelina County through portions of Nacogdoches, San Augustine, Sabine and Shelby Counties into De Soto and Sabine Parishes of Louisiana. The James Lime is an East Texas carbonate trend that is a horizontal drilling objective. The companies currently active in the James Lime include Ellora, St. Mary Land & Exploration Company, Marathon Oil Corporation, Hunt Oil Company, Samson Lone Star, L.P. and several smaller companies.

We acquired our initial position in East Texas in June 2002. Our acreage is in the Huxley and East Bridges fields, which we believe are the most productive areas of the James Lime. We drill our horizontal wells using fresh water and without drilling mud, which is known as underbalanced drilling. The James Lime has a vertical depth of approximately 6,100 feet and horizontal lengths up to 8,000 feet. Our acreage across the James Lime is a porous packstone with up to 125 feet of net pay with net porosity greater than 8% in nine different intervals in the limestone. The wells drilled to date have all been completed naturally with open-hole horizontal well bores. An average well costs approximately $2.1 million to drill and complete for unstimulated wells and $3.1 million for stimulated wells. The average initial flow rate of the unstimulated wells we have completed since June 2002 has been 2 MMcfe/d and the average proved reserves attributable to these wells is approximately 3.5 Bcfe. We have recently begun implementing a new stimulation technology plan in this area that is estimated by us to cost an additional $1 million per well. We believe this new stimulation technology will increase initial production rates and ultimate recovery rates above current estimates for unstimulated wells. We completed our first well using this new stimulation technology in June 2006, and to date have completed four wells using this new technology, and we have experienced production of significantly higher rates than has been experienced using unstimulated production techniques.

We have 58 productive wells with production to date of 52 Bcfe. We have completed 21 of 22 wells we have drilled in the James Lime since June 2002.

In addition to the James Lime play we started developing the lower Cretaceous Fredericksburg (or Edwards) formation using horizontal drilling. The Fredericksburg formation has a vertical depth of approximately 3,100 feet, and we drill several laterals of up to 5,000 feet in each completed well. A typical Fredericksburg well can be drilled and completed for approximately $1.1 million. Our wells in this area have average proved reserves of 1.1 Bcfe and an average initial flow of 800 Mcfe/d. Fredericksburg wells are also drilled underbalanced with water and completed with no stimulation. The productive thickness ranges from six to 38 feet with the average porosity over 20%. We have completed seven of eight wells in the Fredericksburg, and we have identified 110 additional drillable locations, of which 39 locations have been identified as proved undeveloped.

6

Additional deep potential on our acreage includes the Travis Peak sands, which have a vertical depth of approximately 7,200 feet. Other shallow productive horizons include the Saratoga Chalk, Annona Chalk, Blossom and Paluxy fluvial sands. The Glen Rose, Mooringsport and Pettet formations are being exploited using horizontal drilling in adjacent counties.

The majority of our drilling in East Texas will be developmental drilling. We have allocated $34 million for 2006, of which we have spent $15.2 million as of June 30, 2006, and $36 million for 2007 for developmental drilling in East Texas.

Hugoton Field

We believe that substantial recoverable reserves remain in the Hugoton field. Companies active in the Hugoton field include EOG Resources, Inc., Occidental Petroleum Corporation, Cimarex Energy Co., XTO Energy Inc. and BP Amoco. The majority of gas produced to date has been from the shallower Permian formations, which produce primarily gas from 2,400 to 3,200 feet.

We believe the deeper, yet still comparatively shallow, potential of the Hugoton field has been historically underexploited due to the prolific shallow production and historically low gas prices received from 1927 to the 1980s. A substantial majority of the 31 Tcf of gas produced from the field was sold at prices under $2 per Mcf, which we believe led to the early abandonment of wells and the bypassing of deeper gas reserves that were not economic to recover in a lower price environment and without the benefit of modern drilling and completion technologies. The deeper Hugoton has produced 3.3 Tcf of gas and 323 MMBbls of oil and condensate in the nine county area where our acreage is located.

We acquired our rights to develop the Hugoton's deeper potential through our acquisition of Presco Western, LLC in April 2005. We are a party to a farmout agreement with a subsidiary of BP Amoco covering approximately 651,000 gross acres in the Hugoton field, which terminates in 2013. We are currently in negotiations to extend our Hugoton farmout past 2013. In the event we are unable to extend this farmout, we intend to partner with other industry participants to develop our remaining acreage before 2013. Through this farmout agreement, we have one of the largest acreage positions in the Hugoton field. The farmout grants us the right to all mineral interests that we develop below the Heebner Shale as long as we fulfill our obligation to drill a minimum of 10 exploratory wells per year. Certain expenditures we make for seismic and geophysical work can be substituted for a portion of our exploratory drilling obligations. We receive a 640-acre assignment for each gas well we complete and a 160-acre assignment for each oil well we complete. We expect to be able to downspace drilling to 320 acres per well for gas wells and 40 acres per well for oil wells. We estimate that 8,000 wells have been drilled above the Heebner Shale in the nine counties where our acreage position is located. There are 13 productive horizons below the Heebner Shale (generally 4,000 feet), which we refer to as the Hugoton Deep, and we drill all of our Hugoton wells to the base of the deepest known producing formation in the area.

In the 18 months we have held our Hugoton acreage, we have already identified three waterfloods, and 392 potential drilling locations, covering only 40,000 out of our total of 651,000 acres. We have increased production from 2 MMcfe/d to over 8 MMcfe/d through the drilling of 30 wells and participating in three farmouts with only five dry holes. We intend to exploit waterflood potential in the field as well as the stacked pay potential. The primary targets are Morrow and Chester Valley sands which can be detected seismically. Drilling and completion costs in the field are currently $480,000 per well. The average initial flow rate of our wells drilled in the Hugoton Deep has been 623 Mcfe/d, and the average proved reserves attributable to these wells is approximately 0.7 Bcfe. Our development budget for Kansas is $19 million for 2006, of which we have spent $4.7 million as of June 30, 2006, and $22 million for 2007.

7

Corporate Information

Ellora Energy Inc. was formed in June 2002 and secured an equity investment from Yorktown Energy Partners V, L.P. to fund our first East Texas acquisition that same year.

In July 2006, we completed a private equity offering of 12,400,000 shares of our common stock, consisting of 2,500,000 shares issued by us and 9,900,000 shares sold by certain of our existing stockholders. We received aggregate consideration (before offering expenses of approximately $800,000 but after the initial purchaser's discount) of approximately $27.9 million, or $11.16 per share. We did not receive any proceeds from the shares sold by the selling stockholders. However, we did receive approximately $6.3 million from certain of the selling stockholders for repayment of loans from us, including accrued and unpaid interest thereon. We used the net proceeds from the offering, together with the proceeds from the repayment of the selling stockholders' loans, principally to pay down the entire outstanding balance on our credit facility.

Prior to the private equity offering in July 2006 we operated as two separate entities, Ellora Energy Inc. and Ellora Oil & Gas Inc., with one management team and substantially similar ownership. Ellora Oil and Gas Inc. was formed in April 2005 to acquire Presco Western, LLC and Ellora Energy Inc.'s assets in Colorado and interests in a joint venture with Centurion Exploration Company. These entities were merged prior to the closing of the private equity offering, with Ellora Energy Inc. as the surviving entity. Third-party valuations were used to provide a valuation comparison of the two companies. Ellora Oil & Gas Inc. stockholders received 2.49 shares of Ellora Energy Inc. for each share of Ellora Oil & Gas Inc. Following the merger, we effected an 8.09216-to-1 stock split of our common stock.

Presentations in this prospectus that reflect shares, shares outstanding, or weighted average shares of our common stock or options exercisable for shares of our common stock are reflected on a post-merger and post-split basis. Information presented in the financial statement section of this prospectus, which begins on page F-1, does not reflect these new share calculations except for weighted average share calculations and earnings per share calculations.

Ellora Energy Inc., a Delaware corporation, was incorporated in June 2002. Our principal executive offices are located at 5480 Valmont, Suite 350, Boulder, Colorado 80301. Our telephone number is (303) 444-8881. Our corporate website address iswww. .

8

THE OFFERING

| Common stock offered by the selling stockholders | | 11,623,261 shares. |

Common stock to be outstanding after this offering(1) |

|

shares. |

Use of proceeds |

|

We will not receive any proceeds from the sale of the shares of common stock offered in this prospectus. |

Dividend policy |

|

We do not anticipate that we will pay cash dividends in the foreseeable future. Our existing credit facility restricts our ability to pay cash dividends. |

Risk factors |

|

For a discussion of factors you should consider in making an investment, see "Risk Factors." |

Proposed Nasdaq Global Market symbol |

|

"LORA" |

- (1)

- Assumes the issuance of shares of our common stock in our initial public offering. Excludes options to purchase 2,692,293 shares of our common stock outstanding as of October 31, 2006, of which 1,914,520 were exercisable within 60 days.

9

SUMMARY COMBINED HISTORICAL FINANCIAL DATA

The following table shows the combined historical financial data as of and for each of the three years ended December 31, 2003, 2004 and 2005, the unaudited pro forma financial data for the year ended December 31, 2005, and the unaudited combined historical financial data as of and for each of the six-month periods ended June 30, 2005 and 2006 for Ellora Energy Inc. and Ellora Oil & Gas Inc. as if they had been one entity throughout the periods presented. These entities were merged in July 2006. You should read the following summary combined historical financial information together with the combined financial statements and related notes included elsewhere in this prospectus. The historical combined financial data as of December 31, 2004 and 2005 and for the three fiscal years ended December 31, 2003, 2004 and 2005 were derived from the combined audited financial statements included in this prospectus. The data for the six-month periods ended June 30, 2005 and 2006 were derived from the unaudited combined interim financial statements also included in this prospectus. The unaudited pro forma financial data for the year ended December 31, 2005 were derived from the unaudited pro forma financial statements included in this prospectus and show the pro forma effect of our acquisition of Presco Western, LLC and the Shelby County Acquisition Properties in 2005. The summary combined historical results are not necessarily indicative of results to be expected in future periods.

| |

| |

| |

| |

| | Six Months Ended

June 30,

|

|---|

| | Year Ended December 31,

| |

|

|---|

| | Pro Forma

Year Ended

December 31, 2005

|

|---|

| | 2003

| | 2004

| | 2005

| | 2005

| | 2006

|

|---|

| |

| |

| |

| |

| | (Unaudited)

|

|---|

| | (In thousands, except per share data)

|

|---|

| Operating Results Data | | | | | | | | | | | | | | | | | | |

| Revenue | | | | | | | | | | | | | | | | | | |

| | Oil and gas sales | | $ | 11,810 | | $ | 22,780 | | $ | 47,595 | | $ | 51,789 | | $ | 16,146 | | $ | 26,824 |

| | Gas aggregation, pipeline sales and other | | | 365 | | | 1,491 | | | 5,487 | | | 6,499 | | | 2,169 | | | 4,874 |

| | |

| |

| |

| |

| |

| |

|

| | | Total revenue | | | 12,175 | | | 24,271 | | | 53,082 | | | 57,288 | | | 18,315 | | | 31,698 |

| Costs and expenses | | | | | | | | | | | | | | | | | | |

| | Lease operating expense | | | 2,580 | | | 4,539 | | | 6,141 | | | 6,661 | | | 1,718 | | | 5,770 |

| | Production taxes | | | 473 | | | 1,291 | | | 1,813 | | | 1,944 | | | 321 | | | 602 |

| | Gas aggregation and pipeline cost of sales | | | — | | | 1,316 | | | 4,020 | | | 4,020 | | | 1,210 | | | 2,111 |

| | Depreciation, depletion and amortization | | | 1,432 | | | 3,479 | | | 8,189 | | | 9,732 | | | 2,688 | | | 4,543 |

| | Exploration | | | — | | | — | | | 422 | | | 422 | | | — | | | 284 |

| | General and administrative | | | 2,497 | | | 3,407 | | | 11,766 | | | 11,989 | | | 8,476 | | | 4,284 |

| | Interest | | | 219 | | | 355 | | | 716 | | | 1,778 | | | 268 | | | 1,032 |

| | |

| |

| |

| |

| |

| |

|

| | | Total costs and expenses | | | 7,201 | | | 14,387 | | | 33,067 | | | 36,546 | | | 14,681 | | | 18,626 |

| | |

| |

| |

| |

| |

| |

|

| Income before provision for income taxes | | | 4,974 | | | 9,884 | | | 20,015 | | | 20,742 | | | 3,634 | | | 13,072 |

| Current income tax expense | | | (254 | ) | | — | | | — | | | — | | | — | | | — |

| Provision for deferred income taxes | | | 2,053 | | | 3,850 | | | 9,234 | | | 9,510 | | | 3,226 | | | 5,241 |

| | |

| |

| |

| |

| |

| |

|

| Cumulative effect of accounting change | | | 30 | | | — | | | — | | | | | | — | | | — |

| | |

| |

| |

| |

| |

| |

|

| Net income | | $ | 3,205 | | $ | 6,034 | | $ | 10,781 | | $ | 11,232 | | $ | 408 | | $ | 7,831 |

| | |

| |

| |

| |

| |

| |

|

| Basic income per share | | $ | 0.15 | | $ | 0.22 | | $ | 0.28 | | | 0.29 | | | 0.01 | | | 0.19 |

| Diluted income per share | | $ | 0.15 | | $ | 0.22 | | $ | 0.27 | | | 0.28 | | | 0.01 | | | 0.18 |

| Weighted average number of shares of common stock – basic | | | 21,691,999 | | | 27,541,033 | | | 38,754,598 | | | 38,754,598 | | | 35,198,989 | | | 42,310,871 |

| Weighted average number of shares of common stock – diluted | | | 21,915,302 | | | 27,945,641 | | | 40,089,555 | | | 40,089,555 | | | 30,161,260 | | | 44,055,137 |

10

| | Year Ended December 31,

| | Six Months Ended

June 30,

| |

|---|

| | 2003

| | 2004

| | 2005

| | 2005

| | 2006

| |

|---|

| | (In thousands, except per share data)

| | (Unaudited)

| |

|---|

| Balance Sheet Data | | | | | | | | | | | | | | | | |

| Property and equipment, net, successful efforts method | | $ | 44,566 | | $ | 70,811 | | $ | 170,094 | | | | | $ | 193,807 | |

| Total assets | | | 51,681 | | | 80,206 | | | 192,300 | | | | | | 211,187 | |

| Notes payable | | | 6,333 | | | 10,683 | | | 25,750 | | | | | | 30,940 | |

| Stockholders' equity | | | 37,423 | | | 51,757 | | | 131,669 | | | | | | 142,001 | |

| Working capital (deficiency) | | | 96 | | | (1,581 | ) | | 3,648 | | | | | | 519 | |

| Other Financial Data | | | | | | | | | | | | | | | | |

| Net cash provided (used) by: | | | | | | | | | | | | | | | | |

| | Operating activities | | $ | 6,746 | | $ | 16,313 | | $ | 31,322 | | $ | 9,666 | | $ | 24,383 | |

| | Investing activities | | | (19,165 | ) | | (27,491 | ) | | (107,511 | ) | | (59,621 | ) | | (27,539 | ) |

| | Financing activities | | | 10,448 | | | 12,350 | | | 76,602 | | | 53,567 | | | 4,206 | |

| EBITDAX(1) | | $ | 6,655 | | $ | 13,718 | | $ | 34,199 | | $ | 11,447 | | $ | 19,632 | |

- (1)

- See "Selected Combined Historical Financial Data—Reconciliation of Non-GAAP Financial Measures" for a reconciliation of our net income to EBITDAX.

SUMMARY OF OIL AND GAS DATA

Operating Data

The following table presents certain information with respect to our historical operating data for the years ended December 31, 2003, 2004 and 2005 and for the six months ended June 30, 2006:

| |

| |

| |

| | Six Months Ended June 30, 2006

|

|---|

| | Year Ended December 31,

|

|---|

| | 2003

| | 2004

| | 2005

|

|---|

| Gross wells | | | | | | | | | | | | |

| | Drilled | | | 6 | | | 14 | | | 23 | | | 18 |

| | Completed | | | 6 | | | 14 | | | 20 | | | 15 |

| Net wells | | | | | | | | | | | | |

| | Drilled | | | 4.5 | | | 9.7 | | | 21.6 | | | 17.5 |

| | Completed | | | 4.5 | | | 9.7 | | | 18.6 | | | 14.5 |

| Net production data | | | | | | | | | | | | |

| | Net volume (MMcfe) | | | 2,872 | | | 4,449 | | | 6,098 | | | 3,762 |

| | Average daily volume (MMcfe/d) | | | 7.9 | | | 9.9 | | | 15.7 | | | 20.8 |

| Average sales price (per Mcfe) | | | | | | | | | | | | |

| | Average sales price (without hedge) | | $ | 4.03 | | $ | 5.12 | | $ | 7.81 | | $ | 7.13 |

| | Average sales price (with hedge) | | | 4.03 | | | 5.12 | | | 7.79 | | | 7.90 |

| Expenses (per Mcfe) | | | | | | | | | | | | |

| | Lease operating | | $ | 0.90 | | $ | 1.02 | | $ | 1.23 | | $ | 1.53 |

| | Production and ad valorem taxes | | | 0.16 | | | 0.29 | | | 0.30 | | | 0.16 |

| | General and administrative | | | 0.87 | | | 0.77 | | | 1.93 | | | 1.14 |

| | Depreciation, depletion and amortization | | | 0.50 | | | 0.78 | | | 1.34 | | | 1.21 |

11

Estimated Reserve Data

The estimates in the table below of proved reserves as of December 31, 2005 are based on a reserve report prepared by us and audited by MHA Petroleum Consultants, Inc. and on a reserve report as of June 30, 2006 prepared by MHA.

| | As of December 31, 2005

| | As of June 30, 2006

|

|---|

| Estimated Proved Reserves | | | | | | |

| | Gas (Bcf) | | | 217 | | | 236 |

| | Oil (MMBbls) | | | 10 | | | 8 |

| | |

| |

|

| | | Total proved reserves (Bcfe) | | | 277 | | | 281 |

| | |

| |

|

| | Total proved developed reserves (Bcfe) | | | 65 | | | 94 |

| PV-10 value (millions)(1) | | | | | | |

| | Proved developed reserves | | $ | 195 | | $ | 201 |

| | Proved undeveloped reserves | | | 470 | | | 286 |

| | |

| |

|

| | | Total PV-10 value | | $ | 665 | | $ | 487 |

| | |

| |

|

- (1)

- Based on June 30, 2006 NYMEX spot prices of $6.10 per MMBtu of gas and $73.93 per Bbl of oil and December 31, 2005 prices of $9.00 per MMBtu of gas and $60.00 per Bbl of oil, respectively, each adjusted for basis and held flat for the life of the reserves and adjusted for quality differentials. See "Selected Combined Historical Financial Data—Reconciliation of Non-GAAP Financial Measures" for a reconciliation of PV-10 to the standardized measure of discounted future net cash flows.

12

RISK FACTORS

You should consider carefully each of the risks described below, together with all of the other information contained in this prospectus, before deciding to invest in our common stock.

Risks Related to Our Business

Oil and gas prices are volatile, and a decline in oil and gas prices would significantly affect our financial results and impede our growth.

Our revenues, profitability and cash flow depend substantially upon the prices and demand for oil and gas. The markets for these commodities are volatile, and even relatively modest drops in prices can affect significantly our financial results and impede our growth. Prices for oil and gas fluctuate widely in response to relatively minor changes in the supply and demand for oil and gas, market uncertainty and a variety of additional factors beyond our control, such as:

- •

- domestic and foreign supply of oil and gas;

- •

- price and quantity of foreign imports;

- •

- domestic and foreign governmental regulations;

- •

- political conditions in or affecting other oil producing and gas producing countries, including the current conflicts in the Middle East and conditions in South America and Russia;

- •

- weather conditions, including unseasonably warm winter weather;

- •

- technological advances affecting oil and gas consumption;

- •

- overall U.S. and global economic conditions; and

- •

- price and availability of alternative fuels.

Further, oil prices and gas prices do not necessarily fluctuate in direct relationship to each other. Because more than 84% of our estimated proved reserves as of June 30, 2006 were gas reserves, our financial results are more sensitive to movements in gas prices. In the past, the price of gas has been extremely volatile, and we expect this volatility to continue. For example, during the year ended December 31, 2005, the NYMEX natural gas spot price ranged from a high of $15.39 per MMBtu to a low of $5.50 per MMBtu. The NYMEX natural gas spot price at December 31, 2005 was $11.23 per MMBtu and on June 30, 2006 it was $6.10 per MMBtu. At October 31, 2006, the NYMEX spot gas price was $7.53 per MMBtu. The results of higher investment in the exploration for and production of gas and other factors may cause the price of gas to drop. Lower oil and gas prices may not only decrease our revenues but also may reduce the amount of oil and gas that we can produce economically. This may result in our having to make substantial downward adjustments to our estimated proved reserves and could have a material adverse effect on our financial condition, results of operations and cash flows.

Our future revenues are dependent on the ability to successfully complete drilling activity.

Drilling and exploration are the main methods we utilize to replace our reserves. However, drilling and exploration operations may not result in any increases in reserves for various reasons. Exploration activities involve numerous risks, including the risk that no commercially productive oil or gas reservoirs will be discovered. In addition, the future cost and timing of drilling, completing and producing wells is often uncertain. Furthermore, drilling operations may be curtailed, delayed or canceled as a result of a variety of factors, including:

- •

- lack of acceptable prospective acreage;

13

- •

- inadequate capital resources;

- •

- unexpected drilling conditions; pressure or irregularities in formations; equipment failures or accidents;

- •

- adverse weather conditions, including hurricanes;

- •

- unavailability or high cost of drilling rigs, equipment or labor;

- •

- reductions in oil and gas prices;

- •

- limitations in the market for oil and gas;

- •

- title problems;

- •

- compliance with governmental regulations; and

- •

- mechanical difficulties.

Our decisions to purchase, explore, develop and exploit prospects or properties depend in part on data obtained through geophysical and geological analyses, production data and engineering studies, the results of which are often uncertain. Even when used and properly interpreted, 3-D seismic data and visualization techniques only assist geoscientists and geologists in identifying subsurface structures and hydrocarbon indicators. They do not allow the interpreter to know conclusively if hydrocarbons are present or producible economically. In addition, the use of 3-D seismic and other advanced technologies require greater predrilling expenditures than traditional drilling strategies.

In addition, we are utilizing a new frac technology to enhance our recoveries from our James Lime properties in East Texas. We have used a variation of this technology on four wells and there can be no assurance that it will be as effective (or effective at all) as we currently expect it to be.

In addition, higher oil and gas prices generally increase the demand for drilling rigs, equipment and crews and can lead to shortages of, and increasing costs for, such drilling equipment, services and personnel. Such shortages could restrict our ability to drill the wells and conduct the operations which we currently have planned. Any delay in the drilling of new wells or significant increase in drilling costs could adversely affect our ability to increase our reserves and production and reduce our revenues.

The credit default of one of our customers could have an adverse effect on us.

Our revenues are generated under contracts with a limited number of customers. Results of operations would be adversely affected as a result of non-performance by any of these customers of their contractual obligations under the various contracts. A customer's default or non-performance could be caused by factors beyond our control. A default could occur as a result of circumstances relating directly to the customer, or due to circumstances caused by other market participants having a direct or indirect relationship with such counterparty. We seek to mitigate the risk of default by evaluating the financial strength of potential customers and utilizing industry standard credit provisions in our contracts, however, despite our mitigation efforts, defaults by customers may occur from time to time, and this could negatively impact our results of operations, financial position and cash flows.

Unless we replace our oil and gas reserves, our reserves and production will decline.

Our future oil and gas production depends on our success in finding or acquiring additional reserves. If we fail to replace reserves through drilling or acquisitions, our level of production and cash flows will be affected adversely. In general, production from oil and gas properties declines as reserves are depleted, with the rate of decline depending on reservoir characteristics. Our total proved reserves will decline as reserves are produced unless we conduct other successful exploration and development activities or acquire properties containing proved reserves, or both. Our ability to make the necessary

14

capital investment to maintain or expand our asset base of oil and gas reserves would be impaired to the extent cash flow from operations is reduced and external sources of capital become limited or unavailable. We may not be successful in exploring for, developing or acquiring additional reserves.

Our identified drilling location inventories are scheduled out over several years, making them susceptible to uncertainties that could materially alter the occurrence or timing of their drilling.

Our management team has specifically identified and scheduled drilling locations as an estimation of our future multi-year drilling activities on our acreage. Our drilling locations represent a significant part of our growth strategy. Our ability to drill and develop these locations depends on a number of factors, including the availability of capital, seasonal conditions, regulatory approvals, oil and gas prices, costs and drilling results. Our final determination on whether to drill any of these drilling locations will be dependent upon the factors described elsewhere in this prospectus as well as, to some degree, the results of our drilling activities with respect to our proved drilling locations. Because of these uncertainties, we do not know if the drilling locations we have identified will be drilled within our timeframe or will ever be drilled or if we will be able to produce oil or gas from these or any other potential drilling locations. As such, our actual drilling activities may be materially different from those presently identified, which could adversely affect our business, results of operations or financial condition.

Our actual production, revenues and expenditures related to our reserves are likely to differ from our estimates of our proved reserves. We may experience production that is less than estimated and drilling costs that are greater than estimated in our reserve reports. These differences may be material.

The proved oil and gas reserve information included in this prospectus represents estimates. Petroleum engineering is a subjective process of estimating underground accumulations of oil and gas that cannot be measured in an exact manner. Estimates of economically recoverable oil and gas reserves and of future net cash flows necessarily depend upon a number of variable factors and assumptions, including:

- •

- historical production from the area compared with production from other similar producing areas;

- •

- the assumed effects of regulations by governmental agencies;

- •

- assumptions concerning future oil and gas prices; and

- •

- assumptions concerning future operating costs, severance and excise taxes, development costs and workover and remedial costs.

Because all reserve estimates are to some degree subjective, each of the following items may differ materially from those assumed in estimating proved reserves:

- •

- the quantities of oil and gas that are ultimately recovered;

- •

- the production and operating costs incurred;

- •

- the amount and timing of future development expenditures; and

- •

- future oil and gas sales prices.

As of June 30, 2006, approximately 69% of our proved reserves were either proved undeveloped or proved non-producing. Estimates of proved undeveloped or proved non-producing reserves are even less reliable than estimates of proved developed producing reserves.

Furthermore, different reserve engineers may make different estimates of reserves and cash flows based on the same available data. Our actual production, revenues and expenditures with respect to

15

reserves will likely be different from estimates and the differences may be material. The discounted future net cash flows included in this prospectus should not be considered as the current market value of the estimated oil and gas reserves attributable to our properties. As required by the SEC, the estimated discounted future net cash flows from proved reserves are generally based on prices and costs as of the date of the estimate, while actual future prices and costs may be materially higher or lower. Actual future net cash flows also will be affected by factors such as:

- •

- the amount and timing of actual production;

- •

- supply and demand for oil and gas;

- •

- increases or decreases in consumption; and

- •

- changes in governmental regulations or taxation.

In addition, the 10% discount factor, which is required by the SEC to be used to calculate discounted future net cash flows for reporting purposes, is not necessarily the most appropriate discount factor based on interest rates in effect from time to time and risks associated with us or the oil and gas industry in general.

You should not assume that the present value of future net revenues from our proved reserves referred to in this prospectus is the current market value of our estimated oil and natural gas reserves. In accordance with SEC requirements, we generally base the estimated discounted future net cash flows from our proved reserves on prices and costs on the date of the estimate. Actual future prices and costs may differ materially from those used in the present value estimate. If gas prices decline by $1.00 per Mcf, then our PV-10 as of June 30, 2006 would decrease from $487 million to $403 million.

Our bank lenders can limit our borrowing capabilities, which may materially impact our operations.

At October 31, 2006 our bank debt outstanding was approximately $10.0 million. We intend to use a portion of the proceeds from our initial public offering to repay the outstanding balance under our credit facility. The borrowing base limitation under our credit facility is redetermined semi-annually. Redeterminations are based upon a number of factors, including commodity prices and reserve levels. In addition, as is typical in the oil and gas industry, our bank lenders have substantial flexibility to reduce our borrowing base due to subjective factors. Upon a redetermination, we could be required to repay a portion of our bank debt to the extent our outstanding borrowings at such time exceeds the redetermined borrowing base. We may not have sufficient funds to make such repayments, which could result in a default under the terms of the loan agreement and an acceleration of the loan. We intend to finance our development, acquisition and exploration activities with cash flow from operations, bank borrowings and other financing activities. In addition, we may significantly alter our capitalization to make future acquisitions or develop our properties. These changes in capitalization may significantly increase our level of debt. If we incur additional debt for these or other purposes, the related risks that we now face could intensify. A higher level of debt also increases the risk that we may default on our debt obligations. Our ability to meet our debt obligations and to reduce our level of debt depends on our future performance which is affected by general economic conditions and financial, business and other factors. Many of these factors are beyond our control. Our level of debt affects our operations in several important ways, including the following:

- •

- a portion of our cash flow from operations is used to pay interest on borrowings;

- •

- the covenants contained in the agreements governing our debt limit our ability to borrow additional funds, pay dividends, dispose of assets or issue shares of preferred stock and otherwise may affect our flexibility in planning for, and reacting to, changes in business conditions;

16

- •

- a high level of debt may impair our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions, general corporate or other purposes;

- •

- a leveraged financial position would make us more vulnerable to economic downturns and could limit our ability to withstand competitive pressures; and

- •

- any debt that we incur under our revolving credit facility will be at variable rates which makes us vulnerable to increases in interest rates.

We are subject to complex government regulation which could adversely affect our operations.

Our activities are subject to complex and stringent environmental and other governmental laws and regulations. The exploration and production of oil and gas requires numerous permits, approvals and certificates from appropriate federal, state and local governmental agencies. Numerous governmental authorities, such as the U.S. Environmental Protection Agency, also known as the "EPA," and analogous state agencies, have the power to enforce compliance with these laws and regulations and the permits, approvals and certificates issued under them, oftentimes requiring difficult and costly actions. Failure to comply with these laws, regulations, and permits may result in the assessment of administrative, civil, and criminal penalties, the imposition of corrective actions, and the issuance of injunctions limiting or preventing some or all of our operations. Existing laws and regulations may be revised or reinterpreted, or new laws and regulations may become applicable to us that could have a negative effect on our business and results of operations. We may be unable to obtain all necessary licenses, permits, approvals and certificates for proposed projects. Intricate and changing environmental and other regulatory requirements may necessitate substantial expenditures to obtain and maintain permits. If a project is unable to function as planned due to changing requirements or local opposition, it may create expensive delays, extended periods of non-operation or significant loss of value in a project.

We depend on our management and employees.

Our success is largely dependent on the skills, experience and efforts of our people. The loss of the services of one or more members of our senior management or of several employees with critical skills could have a negative effect on our business, financial conditions and results of operations and future growth. We have not entered into, and do not expect to enter into, employment agreements or non-competition agreements with any of our key employees, other than T. Scott Martin, our President and Chief Executive Officer. See "Management—Employment Agreements and Other Arrangements." Our ability to manage our growth, if any, will require us to continue to train, motivate and manage our employees and to attract, motivate and retain additional qualified personnel. Competition for these types of personnel is intense and we may not be successful in attracting, assimilating and retaining the personnel required to grow and operate our business profitably.

Our results are subject to quarterly and seasonal fluctuations.

Our quarterly operating results have fluctuated in the past and could be negatively impacted in the future as a result of a number of factors, including:

- •

- seasonal variations in oil and gas prices;

- •

- variations in levels of production; and

- •

- the completion of exploration and production projects.

17

Market conditions or transportation impediments may hinder our access to oil and gas markets or delay our production.

Market conditions, the unavailability of satisfactory oil and gas processing and transportation may hinder our access to oil and gas markets or delay our production. Although currently we control the pipeline operations for all of our production in East Texas, we do not have such control in other areas in which we conduct operations. The availability of a ready market for our oil and gas production depends on a number of factors, including the demand for and supply of oil and gas and the proximity of reserves to pipelines or trucking and terminal facilities. In addition, the amount of oil and gas that can be produced and sold is subject to curtailment in certain circumstances, such as pipeline interruptions due to scheduled and unscheduled maintenance, excessive pressure, physical damage to the gathering or transportation system or lack of contracted capacity on such systems. The curtailments arising from these and similar circumstances may last from a few days to several months and in many cases we are provided with limited, if any, notice as to when these circumstances will arise and their duration. As a result, we may not be able to sell, or may have to transport by more expensive means, the oil and gas production from wells or we may be required to shut in gas wells or delay initial production until the necessary gather and transportation systems are available. Any significant curtailment in gathering system or pipeline capacity, or significant delay in construction of necessary gathering and transportation facilities, could adversely affect our business, financial condition or results of operations.

We will require additional capital to fund our future activities. If we fail to obtain additional capital, we may not be able to implement fully our business plan, which could lead to a decline in reserves.

We depend on our ability to obtain financing beyond our cash flow from operations. Historically, we have financed our business plan and operations primarily with internally generated cash flow, bank borrowings, and issuances of common stock. We also require capital to fund our capital budget, which is expected to be approximately $130 million for 2007. As of June 30, 2006, approximately 67% of our total estimated proved reserves were undeveloped. Recovery of such reserves will require significant capital expenditures and successful drilling operations. We will be required to meet our needs from our internally generated cash flow, debt financings, and equity financings.

If our revenues decrease as a result of lower commodity prices, operating difficulties, declines in reserves or for any other reason, we may have limited ability to obtain the capital necessary to sustain our operations at current levels. We may, from time to time, need to seek additional financing. Our revolving credit facility contains covenants restricting our ability to incur additional indebtedness without the consent of the lender. There can be no assurance that our lender will provide this consent or as to the availability or terms of any additional financing. If we incur additional debt, the related risks that we now face could intensify.

Even if additional capital is needed, we may not be able to obtain debt or equity financing on terms favorable to us, or at all. If cash generated by operations or available under our revolving credit facility is not sufficient to meet our capital requirements, the failure to obtain additional financing could result in a curtailment of our operations relating to exploration and development of our projects, which in turn could lead to a possible loss of properties and a decline in our natural gas reserves.

The unavailability or high cost of drilling rigs, equipment, supplies, personnel, and oilfield services could adversely affect our ability to execute our exploration and development plans on a timely basis and within our budget.

Our industry is cyclical, and from time to time there is a shortage of drilling rigs, equipment, supplies or qualified personnel. During these periods, the costs and delivery times of rigs, equipment, and supplies are substantially greater. As a result of historically strong prices of gas, the demand for

18

oilfield and drilling services has risen, and the costs of these services are increasing. For example, average day rates for land-based rigs has increased substantially during the last two years. We are particularly sensitive to higher rig costs and drilling rig availability, as we presently have one rig under contract on a month-to-month basis. If the unavailability or high cost of drilling rigs, equipment, supplies, or qualified personnel were particularly severe in the areas where we operate, we could be materially and adversely affected.

Competition in the oil and gas industry is intense, and many of our competitors have resources that are greater than ours.

We operate in a highly competitive environment for acquiring prospects and productive properties, marketing oil and gas and securing equipment and trained personnel. Many of our competitors, major and large independent oil and gas companies, possess and employ financial, technical and personnel resources substantially greater than ours. Those companies may be able to develop and acquire more prospects and productive properties than our financial or personnel resources permit. Our ability to acquire additional prospects and discover reserves in the future will depend on our ability to evaluate and select suitable properties and consummate transactions in a highly competitive environment. Also, there is substantial competition for capital available for investment in the oil and gas industry. Larger competitors may be better able to withstand sustained periods of unsuccessful drilling and absorb the burden of changes in laws and regulations more easily than we can, which would adversely affect our competitive position. We may not be able to compete successfully in the future in acquiring prospective reserves, developing reserves, marketing hydrocarbons, attracting and retaining quality personnel and raising additional capital.

Operating hazards, natural disasters or other interruptions of our operations could result in potential liabilities, which may not be fully covered by our insurance.

The oil and gas business involves certain operating hazards such as:

- •

- well blowouts;

- •

- cratering;

- •

- explosions;

- •

- uncontrollable flows of oil, gas or well fluids;

- •

- fires;

- •

- pollution; and

- •

- releases of toxic gas.

The occurrence of one of the above may result in injury, loss of life, suspension of operations, environmental damage and remediation and/or governmental investigations and penalties.

In addition, our operations in Texas and Louisiana are especially susceptible to damage from natural disasters such as hurricanes and involve increased risks of personal injury, property damage and marketing interruptions. Any of these operating hazards could cause serious injuries, fatalities or property damage, which could expose us to liabilities. The payment of any of these liabilities could reduce, or even eliminate, the funds available for exploration, development, and acquisition, or could result in a loss of our properties. Consistent with insurance coverage generally available to the industry, our insurance policies provide limited coverage for losses or liabilities relating to pollution, with broader coverage for sudden and accidental occurrences. Our insurance might be inadequate to cover our liabilities. The insurance market in general and the energy insurance market in particular have been difficult markets over the past several years. Insurance costs are expected to continue to increase

19

over the next few years and we may decrease coverage and retain more risk to mitigate future cost increases. If we incur substantial liability and the damages are not covered by insurance or are in excess of policy limits, or if we incur liability at a time when we are not able to obtain liability insurance, then our business, results of operations and financial condition could be materially adversely affected.

Environmental liabilities may expose us to significant costs and liabilities.

There is inherent risk of incurring significant environmental costs and liabilities in our oil and natural gas operations due to the handling of petroleum hydrocarbons and generated wastes, the occurrence of air emissions and water discharges from work-related activities, and the legacy of pollution from historical industry operations and waste disposal practices. Joint and several, strict liability may be incurred under these environmental laws and regulations in connection with spills, leaks or releases of petroleum hydrocarbons and wastes on, under or from our properties and facilities, many of which have been used for exploration, production or development activities for many years, oftentimes by third parties not under our control. Private parties, including the owners of properties upon which we conduct drilling and production activities as well as facilities where our petroleum hydrocarbons or wastes are taken for reclamation or disposal, may also have the right to pursue legal actions to enforce compliance as well as to seek damages for non-compliance with environmental laws and regulations or for personal injury or property damage. In addition, changes in environmental laws and regulations occur frequently, and any such changes that result in more stringent and costly waste handling, storage, transport, disposal, or remediation requirements could have a material adverse effect on our production or our operations or financial position. We may not be able to recover some or any of these costs from insurance. See "Business—Environmental Matters."

Our growth strategy could fail or present unanticipated problems for our business in the future, which could adversely affect our ability to make acquisitions or realize anticipated benefits of those acquisitions.

Our growth strategy may include acquiring oil and gas businesses and properties. We may not be able to identify suitable acquisition opportunities or finance and complete any particular acquisition successfully.

Furthermore, acquisitions involve a number of risks and challenges, including:

- •

- diversion of management's attention;

- •

- the need to integrate acquired operations;

- •

- potential loss of key employees of the acquired companies;

- •

- potential lack of operating experience in a geographic market of the acquired business; and

- •

- an increase in our expenses and working capital requirements.

Any of these factors could adversely affect our ability to achieve anticipated levels of cash flows from the acquired businesses or realize other anticipated benefits of those acquisitions.

We engage in hedging transactions which involve risks that can harm our business.

To manage our exposure to price risks in the marketing of our oil and gas production, we enter into oil and gas price hedging agreements. While intended to reduce the effects of volatile oil and gas prices, such transactions may limit our potential gains and increase our potential losses if oil and gas prices were to rise substantially over the price established by the hedge. In addition, such transactions may expose us to the risk of loss in certain circumstances, including instances in which our production is less than expected, there is a widening of price differentials between delivery points for our production and the delivery point assumed in the hedge arrangement or the counterparties to the hedging agreements fail to perform under the contracts.

20

The requirements of complying with the Exchange Act may strain our resources and distract management.

As a public company we will be subject to the reporting requirements of the Exchange Act and the Sarbanes-Oxley Act. In addition, The Nasdaq Global Market requires changes in corporate governance practices of public companies. These requirements may place a strain on our systems and resources and we will incur significant legal, accounting and other expenses that we did not incur in the past. The Exchange Act requires that we file annual, quarterly and current reports with respect to our business and financial condition. The Sarbanes-Oxley Act requires that we maintain effective disclosure controls and procedures, corporate governance standards and internal controls over financial reporting. Significant resources and management oversight will be required as we may need to devote additional time and personnel to legal, financial and accounting activities to ensure our ongoing compliance with public company reporting requirements. The effort to prepare for these obligations may divert management's attention from other business concerns, which could have a material adverse affect on our business, financial condition, results of operations or cash flows.