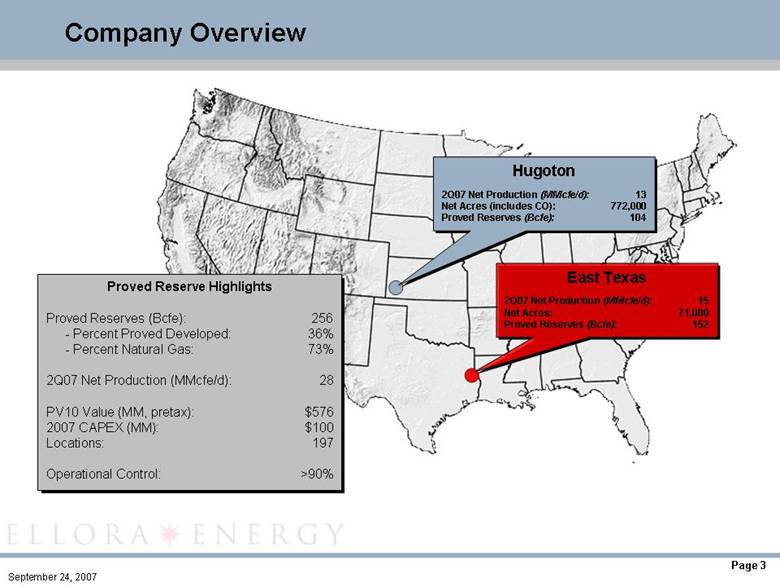

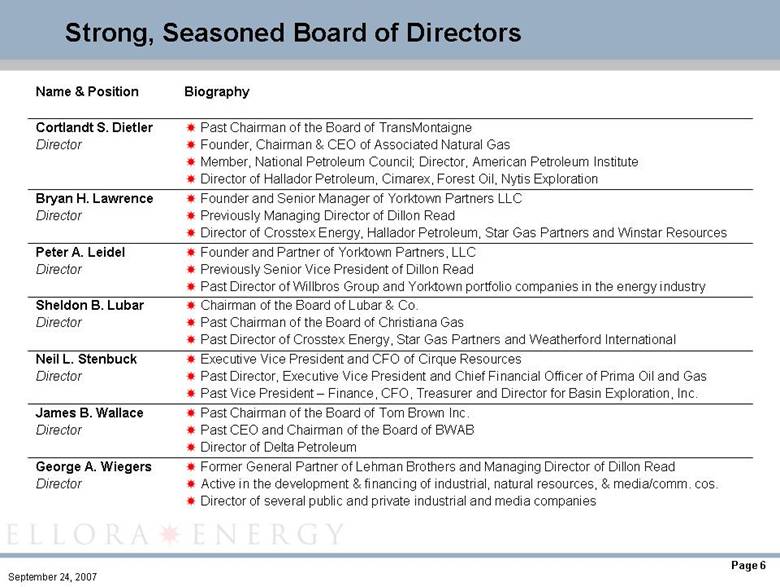

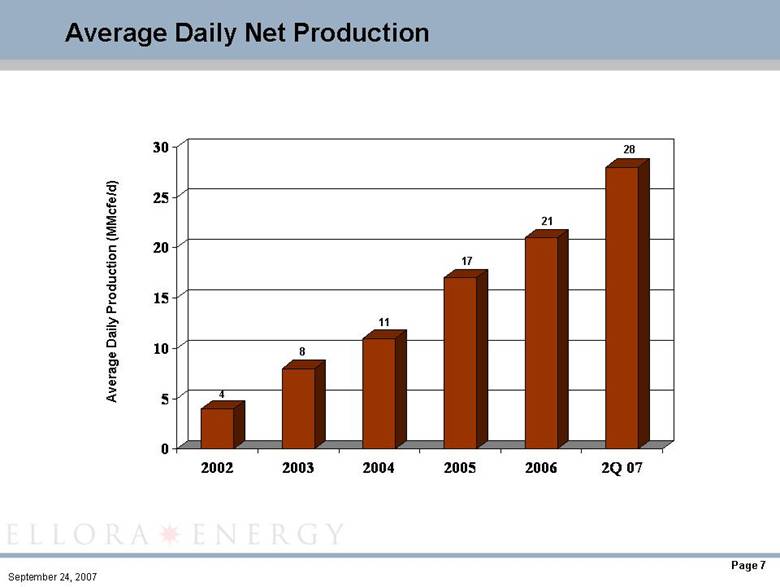

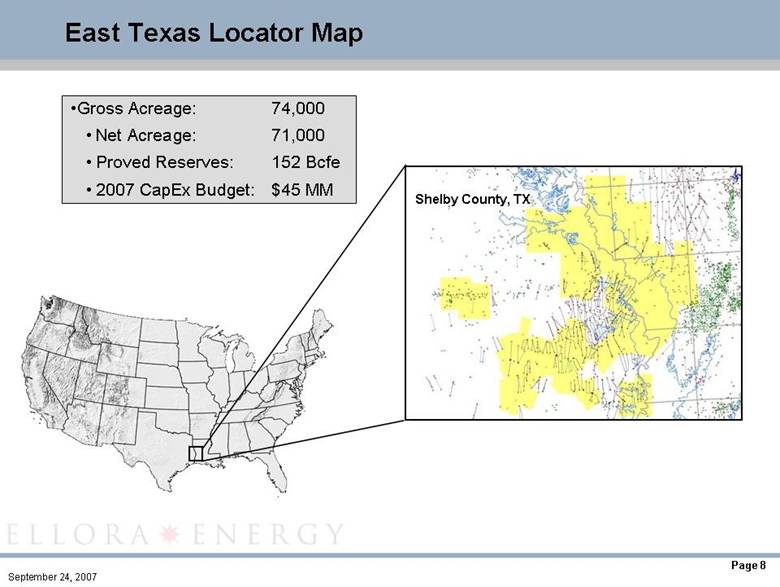

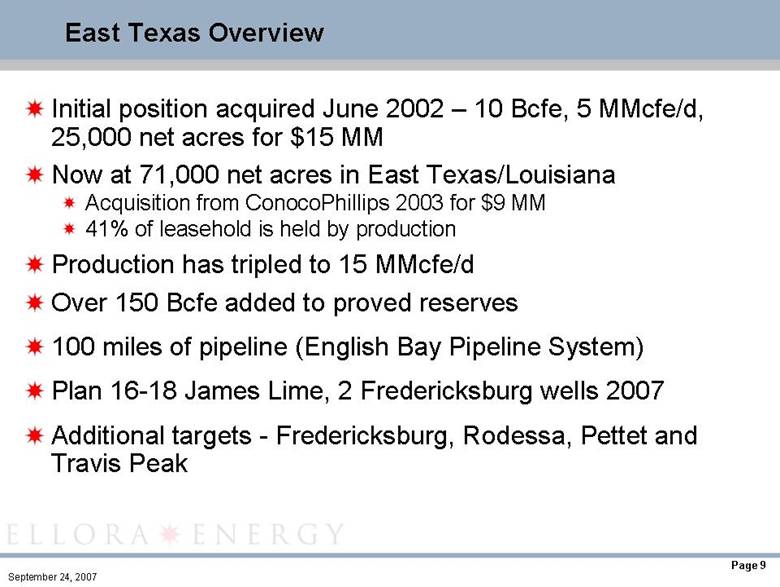

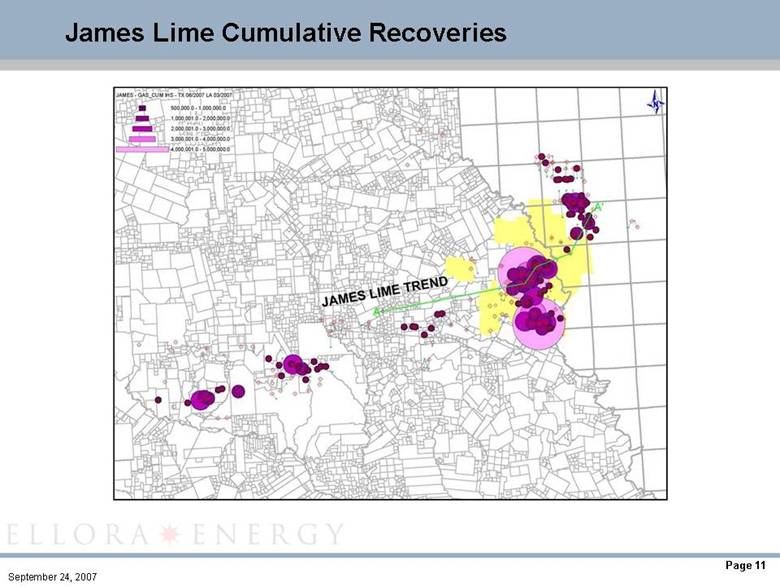

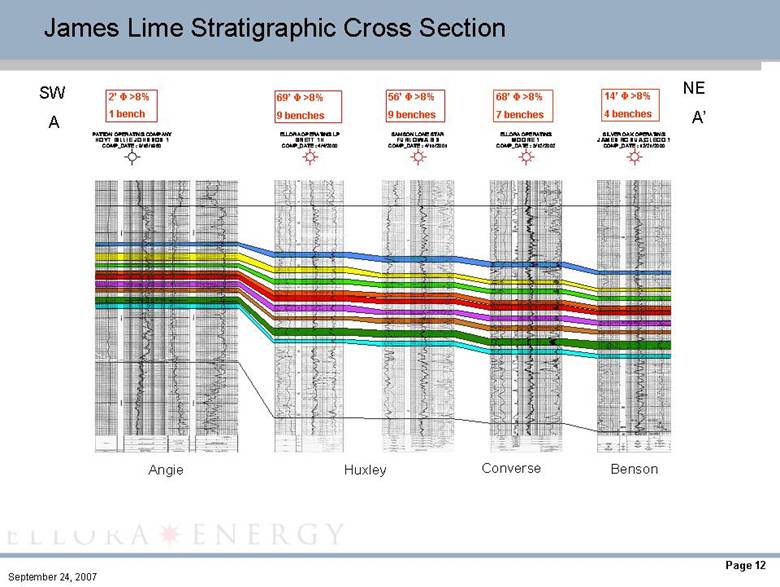

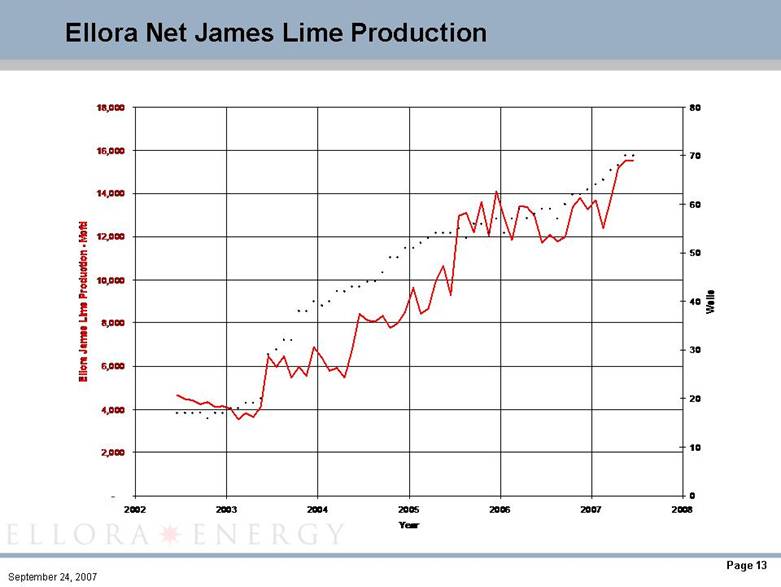

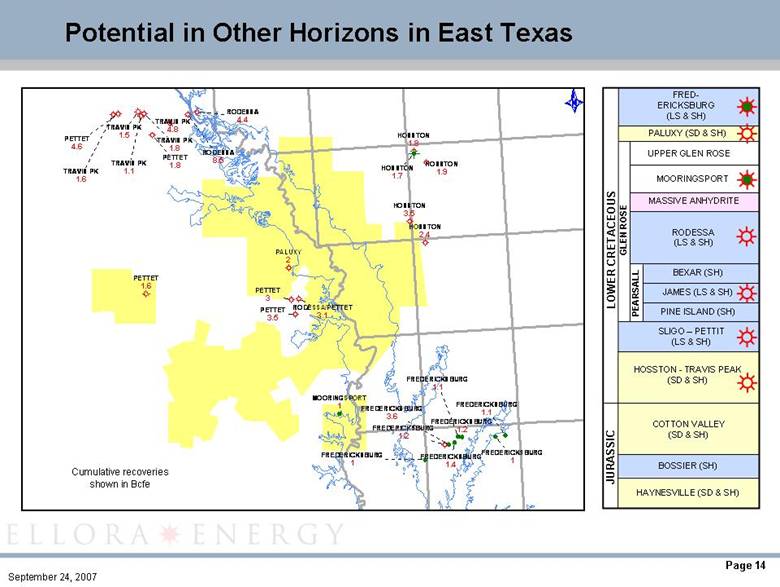

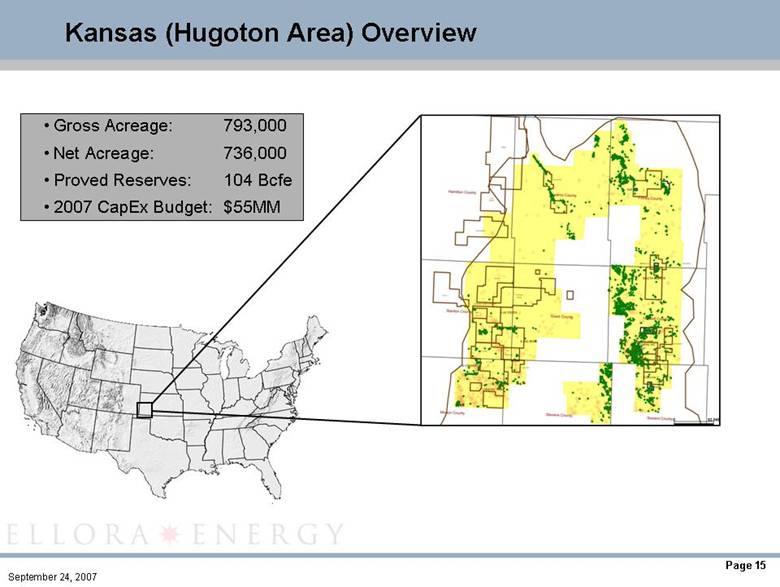

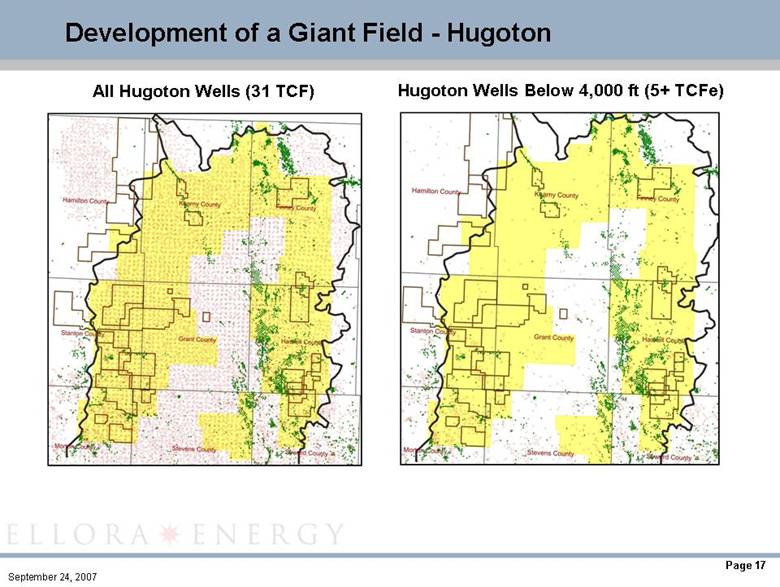

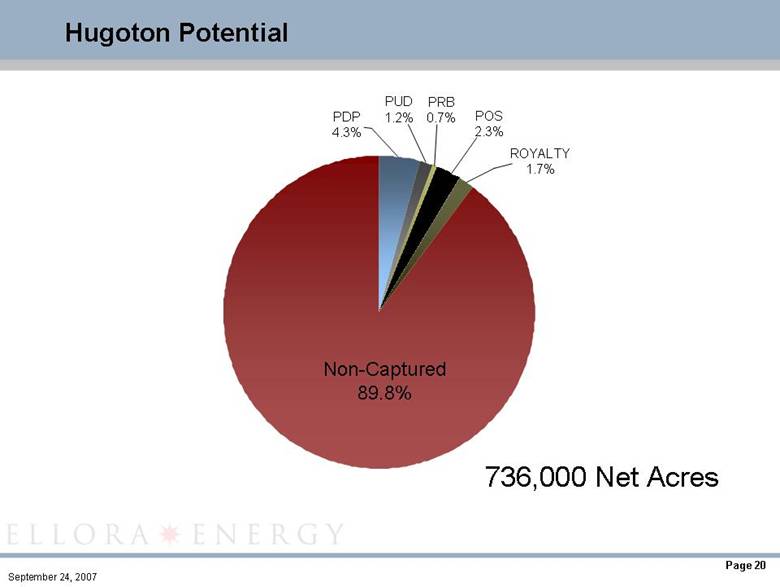

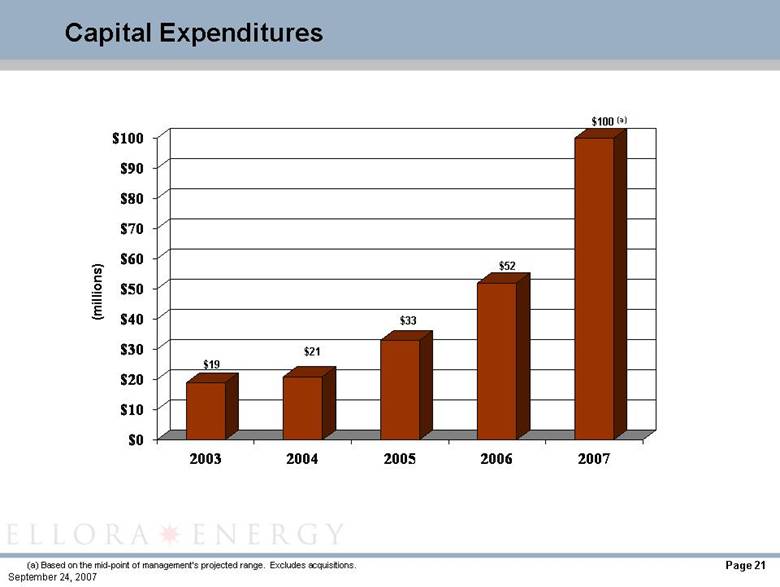

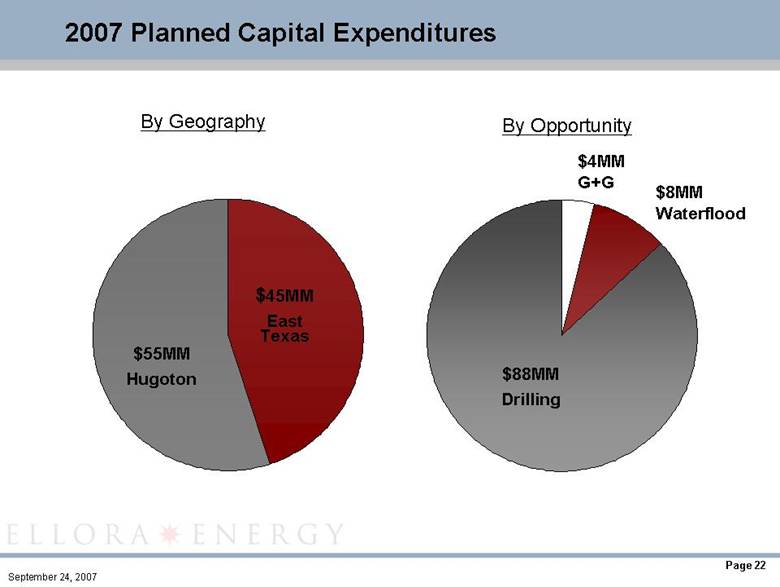

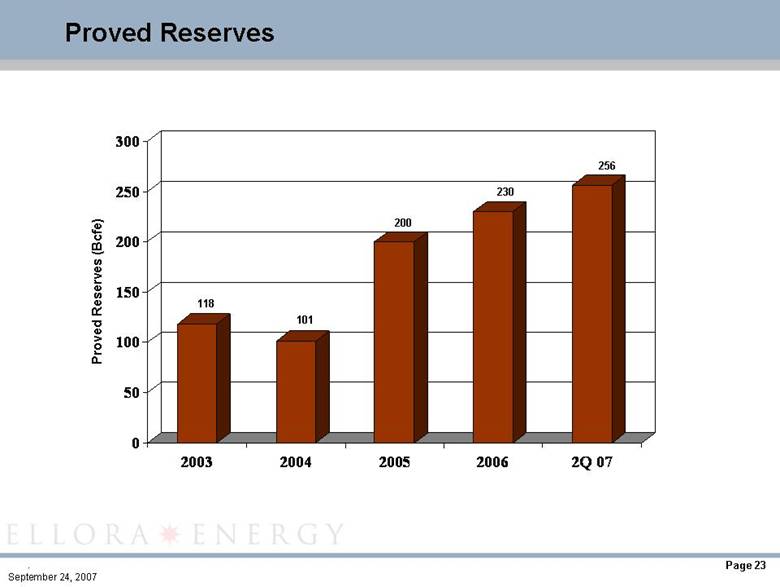

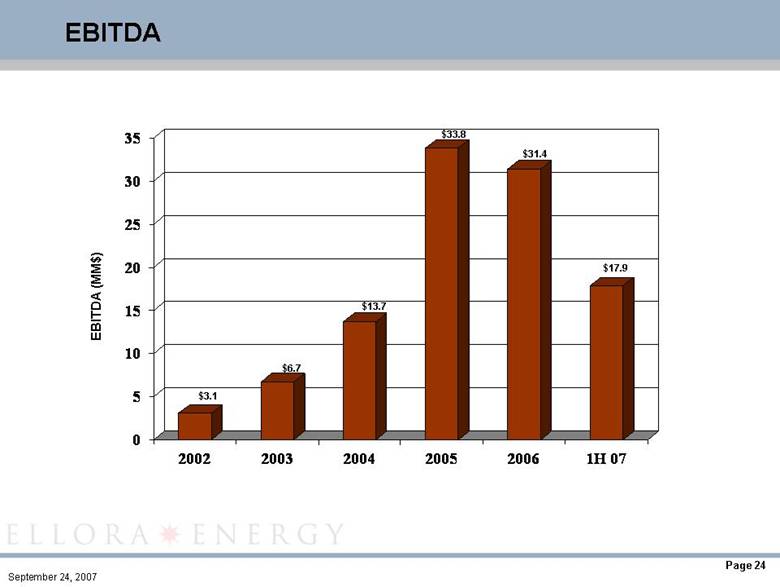

Key Investment Highlights Strong historical growth in production, reserves, and cash flow Low-cost, low-risk reserve additions 85%+ drilling success rate since inception in 2002 Very attractive $1.58/Mcfe F&D cost since inception Substantial acreage positions in Hugoton (Kansas) and James Lime (East Texas) 736,000 net acres in the Hugoton area – primarily held by production 71,000 net acres - one of the largest James Lime positions Multi-year drilling inventory provides visible, significant production and reserves growth (R/P 29 years on proved reserves) High level of control over pace of operations Operate 90%+ of our estimated proved reserves Less regulatory risk in KS and TX Own 100 mi. of gas pipeline in East Texas, enhancing realized pricing and providing market options 100% WI in Kansas and 95% WI in East Texas in most of our future drilling locations Strong financial position post-offering: no debt; ~$25 MM of cash, and $110MM available under credit facility Strong, experienced executive management and financial partner Yorktown Yorktown and Ellora management/directors will own 61% post-offering |