UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

þ Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

o Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to §240.14a-12

TRUPANION, INC.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

þ No fee required.

o Fee paid previously with preliminary materials.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

THIS PAGE LEFT INTENTIONALLY BLANK

PRELIMINARY PROXY STATEMENT - SUBJECT TO COMPLETION, DATED APRIL 17, 2023

A LETTER TO OUR STOCKHOLDERS

April [•], 2023

Dear Trupanion Stockholders,

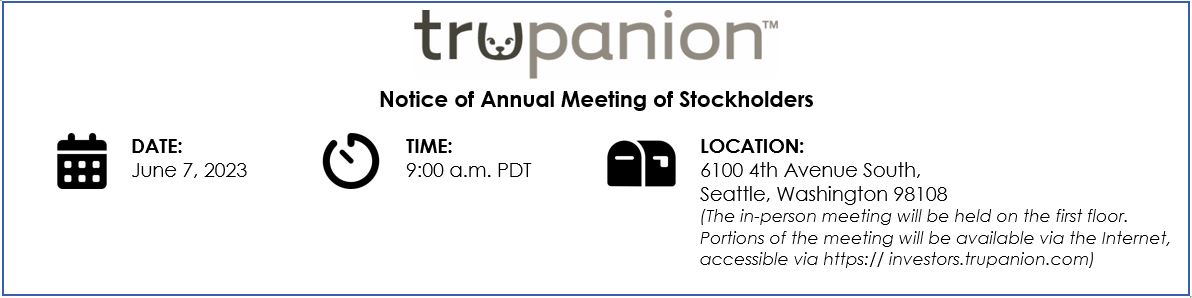

You are cordially invited to attend the 2023 Annual Meeting of Stockholders (the Annual Meeting) of Trupanion, Inc. (the Company or Trupanion). The matters expected to be acted upon at the Annual Meeting are described in detail in the following Notice of Annual Meeting of Stockholders and proxy statement.

We encourage those who want to participate with us in-person to please join us at 6100 4th Avenue South, Seattle, Washington 98108. For those unable to meet in-person, we will also be broadcasting the Annual Meeting via webcast. The details for joining our webcast will be posted on our investor relations website at https://investors.trupanion.com. We urge all stockholders to vote their shares in advance of the meeting through the Internet, mail or by telephone.

The Annual Meeting will be held on Wednesday, June 7, 2023 at 9 a.m. (Pacific Time). Stockholders will be able to join the formal business portions of the Annual Meeting, but not vote their shares, via a live teleconference by dialing +1-877-407-0784 (Toll Free) or +1-201-689-8560 (Toll/International). We ask our stockholders to vote through the Internet, mail or by telephone if possible. For specific instructions on how to vote your shares, please refer to the information provided in this proxy statement. The non-voting portions of the Annual Meeting will be broadcast via webcast, the details of which will be posted on our investor relations website at https://investors.trupanion.com.

In the event any changes to our Annual Meeting plans are necessary or appropriate, such as the date or location, or to hold the meeting solely by remote communication, we will announce the change in advance and post details, including instructions on how stockholders can participate, on our investor relations website at https://investors.trupanion.com and file them with the Securities and Exchange Commission (the SEC).

We continue to elect to deliver our proxy materials to the majority of our stockholders over the Internet, which provides stockholders with the information they need, while minimizing our environmental impact and lowering the distribution cost of proxy materials. On or around April [•], 2023, we expect to commence delivery to stockholders of a Notice of Internet Availability of Proxy Materials (Notice of Internet Availability) containing instructions on how to:

•access our proxy statement for the Annual Meeting and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as filed with the SEC (the Annual Report);

•vote through the Internet, mail or by telephone; and

•receive paper copies of the proxy materials by mail, if desired.

The matters to be acted upon at the meeting are described in the accompanying Notice of Annual Meeting of Stockholders and proxy statement.

Your vote is important to us. We encourage you to vote as soon as possible. Whether or not you plan to attend the Annual Meeting in-person, please vote your shares through the Internet, by mail, or by phone to ensure your shares are represented at the meeting. For those who plan to attend in-person, you will also have the opportunity to vote at the Annual Meeting.

Thank you for your support of Trupanion, Inc. We look forward to seeing you either in-person or electronically at the Annual Meeting.

Warm Regards,

Murray Low

Lead Independent Director of the Board of Directors

Seattle, Washington

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Agenda. We are holding the Annual Meeting for the purposes below, which are more fully described in the accompanying proxy statement.

Our Board of Directors currently consists of seven directors and is divided into three classes, designated as Class I, Class II, and Class III and each class of directors is nominated for election every three years. At the Annual Meeting, our stockholders will vote on a proposal to elect our Class III directors for a three-year term. However, we are also asking our stockholders to vote on a proposal to amend and restate our Certificate of Incorporation to declassify our Board of Directors such that each director will serve a one-year term and be subject to election at each Annual Meeting. As a demonstration of our commitment to annual director elections, we are also asking our stockholders to cast an advisory vote on our Class I and Class II directors, which directors have agreed to resign and will not be re-appointed to fill vacancies on our Board of Directors unless they receive a number of advisory votes that would be sufficient to elect them had they been subject to election at the Annual Meeting.

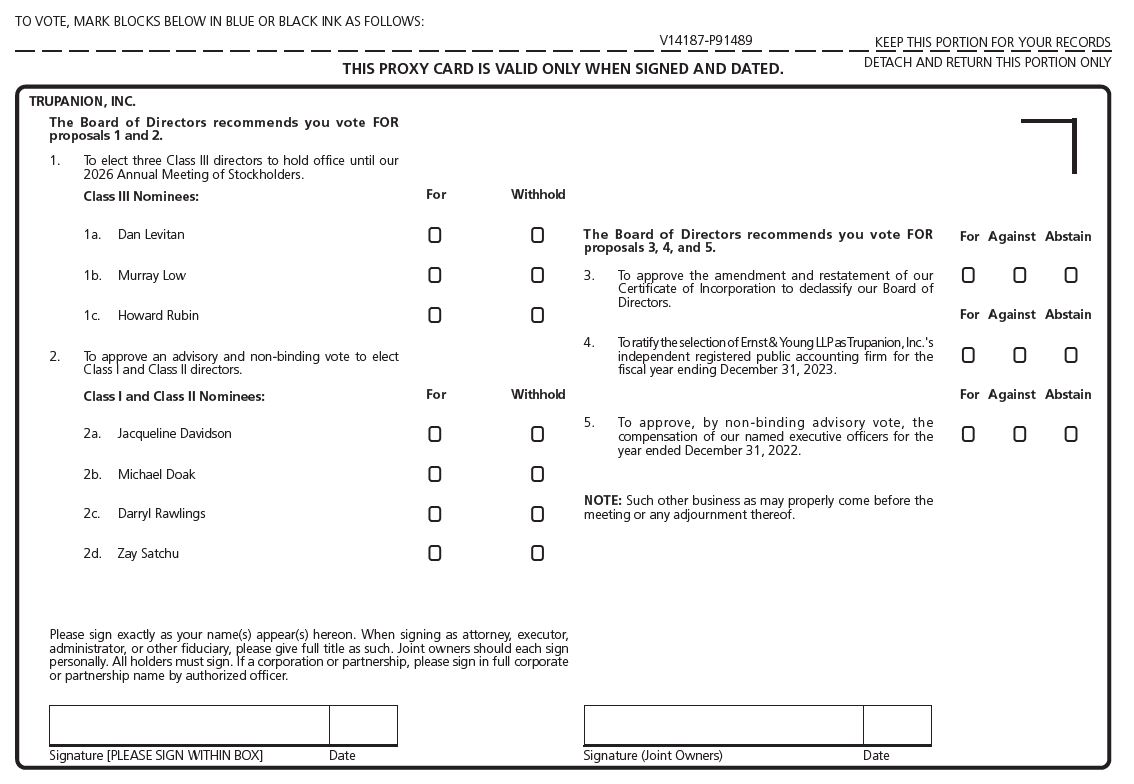

We are asking our stockholders to vote on the following proposals:

1.To elect three Class III directors to serve three-year terms through the third annual meeting of stockholders following this Annual Meeting and until a successor has been elected and qualified or until such director's earlier resignation or removal.

2.To conduct an advisory and non-binding vote to elect two Class I directors and two Class II directors to serve one-year terms through the 2024 annual meeting of stockholders and until a successor has been elected and qualified or until such director's earlier resignation or removal.

3.To approve the amendment and restatement of our Certificate of Incorporation to declassify our Board of Directors.

4.To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023.

5.To conduct an advisory and non-binding vote to approve the compensation provided to the Company’s named executive officers.

Record Date. Only stockholders of record at the close of business on April 10, 2023 are entitled to notice of, and to vote at, the Annual Meeting and any adjournments thereof. For ten days prior to the Annual Meeting, a complete list of the stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder for any purpose relating to the Annual Meeting during ordinary business hours at our headquarters, provided, stockholders will need to comply with Company policies in connection with visiting our headquarters.

Stock Ownership. For questions regarding your stock ownership, contact Trupanion’s Head of Investor Relations, Laura Bainbridge, by phone at (310) 829-5400 or by email at InvestorRelations@trupanion.com. If you are a registered holder, contact our transfer agent, Broadridge Corporate Issuer Solutions, Inc., by phone at (877) 830-4936 or by email through their website at https://shareholder.broadridge.com/bcis/.

Digital Proxy Statement and Annual Report. Visit https://investors.trupanion.com/financials/annual-reports/default.aspx to review or download a digital copy of this proxy statement and our Annual Report.

YOUR VOTE IS VERY IMPORTANT. Although you are legally entitled to attend the Annual Meeting in-person for the purposes of voting your shares, we recommend you vote your shares by proxy in advance of the Annual Meeting through the Internet, by mail or by telephone to ensure that your shares are represented at the meeting. For specific instructions on how to vote your shares, please refer to the information provided in this proxy statement.

By Order of the Board of Directors,

Darryl Rawlings

Chairperson of the Board of Directors

Seattle, Washington

April [•], 2023

| | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 7, 2023. The Proxy Statement and our 2022 Annual Report on Form 10-K are available at https://investors.trupanion.com/financials/annual-reports/default.aspx and at https://www.proxyvote.com. |

TABLE OF CONTENTS

| | | | | | | | | | | |

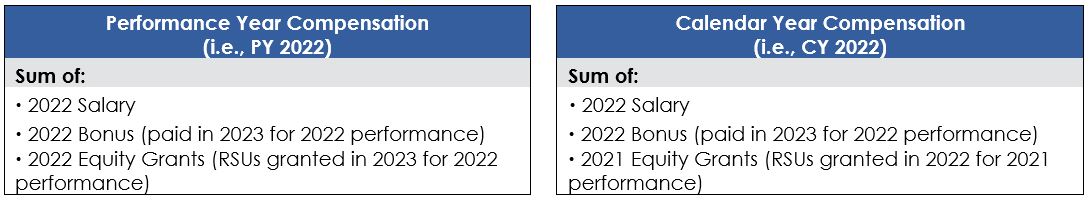

| | Part 1: Organization of this CD&A | 30 |

| Information About Solicitation and Voting | 1 | 1.1 CD&A Sections | 30 |

| Annual Meeting Agenda and Voting Recommendations | 1 | Part 2: Executive Summary | 31 |

| | 2.1 Named Executive Officers | 31 |

| Record Date; Quorum | 2 | 2.2 Business Overview and Performance | 31 |

| Internet Availability of Proxy Materials | 2 | 2.3 Compensation Highlights | 32 |

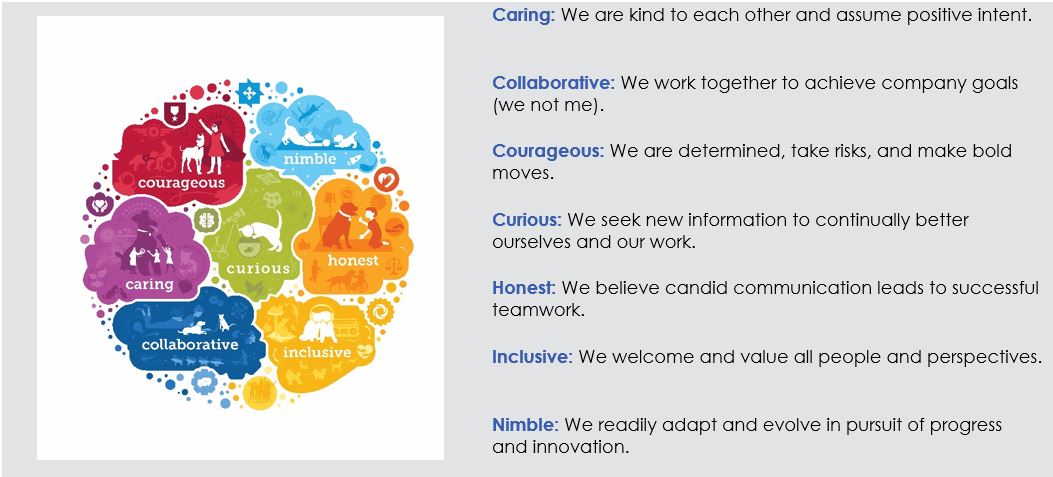

| Voting Rights; Required Vote | 2 | Part 3: Our Culture | 34 |

| How Your Shares Are Voted | 2 | 3.1 Who We Are | 34 |

| Voting Instructions; Voting of Proxies | 3 | Part 4: Governance of Executive Compensation | 35 |

| Expenses of Soliciting Proxies | 4 | 4.1 Role of the Compensation Committee | 35 |

| Revocability of Proxies | 4 | 4.2 Role of Management | 36 |

| Electronic Access to the Proxy Materials | 5 | 4.3 Role of Consultant | 36 |

| Voting Results | 5 | 4.4 Peer Group | 36 |

| | Part 5: Components of Executive Compensation | 38 |

| | 5.1 Key Elements of Compensation | 38 |

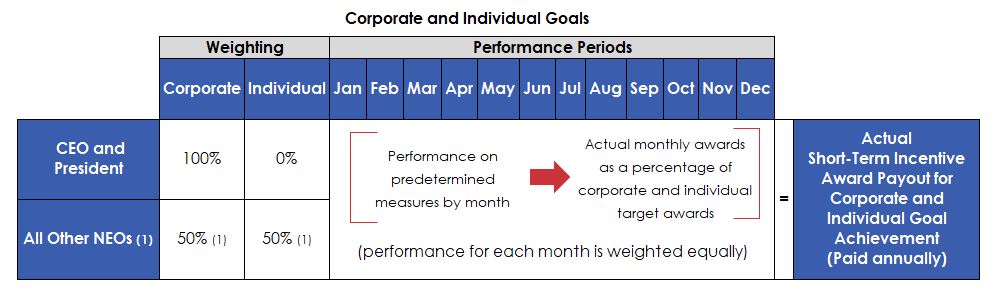

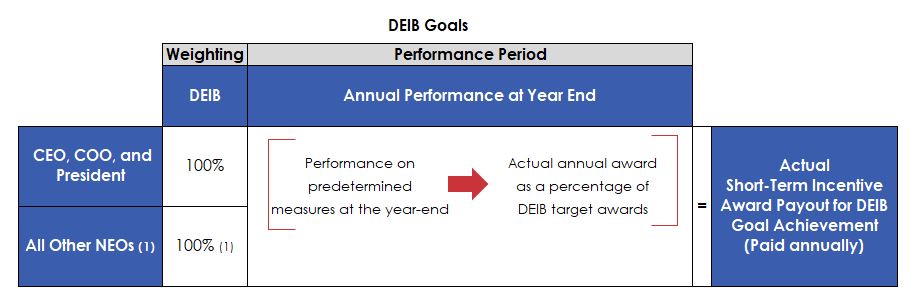

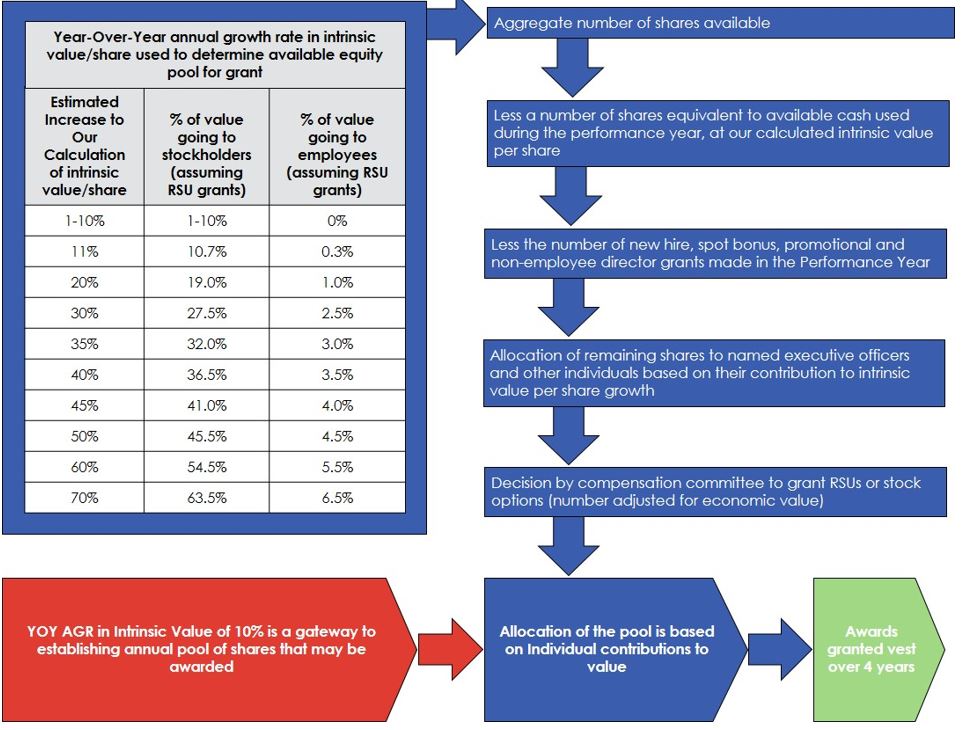

| | 5.2 Detailed Description of Each Element of Compensation and Determination of Compensation for the 2022 Performance Year | 39 |

| Board of Directors Snapshot | 8 | Part 6: Other Compensation Policies and Practices | 46 |

| Our Class III Director Nominees | 9 | 6.1 Employment Agreements | 46 |

| Our Class I and Class II Directors | 11 | 6.2 Severance and Change-in-Control Protection | 46 |

| | 6.3 Share Ownership | 47 |

| Non-Employee Director Compensation Program | 13 | 6.4 Risk Assessment | 47 |

| Additional Compensation for Non-Employee Directors | 13 | 6.5 Clawbacks | 47 |

| 2022 Non-Employee Director Compensation Table | 14 | 6.6 Pledging & Hedging | 47 |

| | 6.7 Discussion on Key Performance Metrics | 48 |

| | | |

| Corporate Governance Guidelines | 16 | | |

| Board Composition and Leadership Structure | 16 | Summary Compensation Table | 51 |

| Board's Role in Risk Oversight | 16 | Grants of Plan-Based Awards | 53 |

| Director Independence | 16 | Outstanding Equity Awards at Fiscal Year-End | 54 |

| Role of Lead Independent Director | 17 | Option Exercises and Stock Vested Table | 56 |

| Committees of Our Board of Directors | 17 | Termination of Employment and Change of Control Payments Table | 57 |

| Corporate Governance and Ethics Principles | 19 | Narrative Discussion to Termination of Employment and Change of Control Payment Table | 58 |

| Compensation Committee Interlocks and Insider Participation | 19 | | |

| Board and Committee Meetings, Attendance, and Executive Sessions | 19 | | |

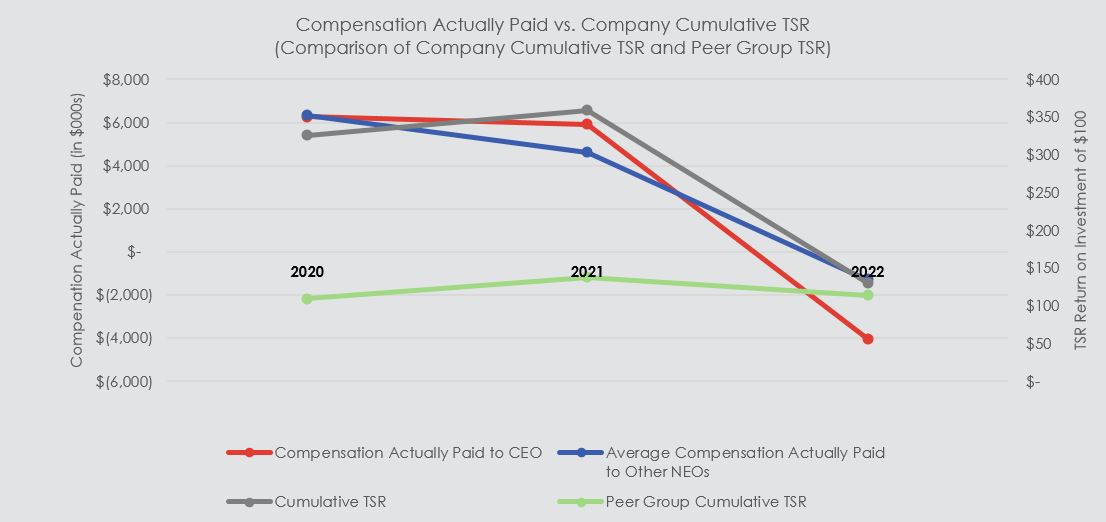

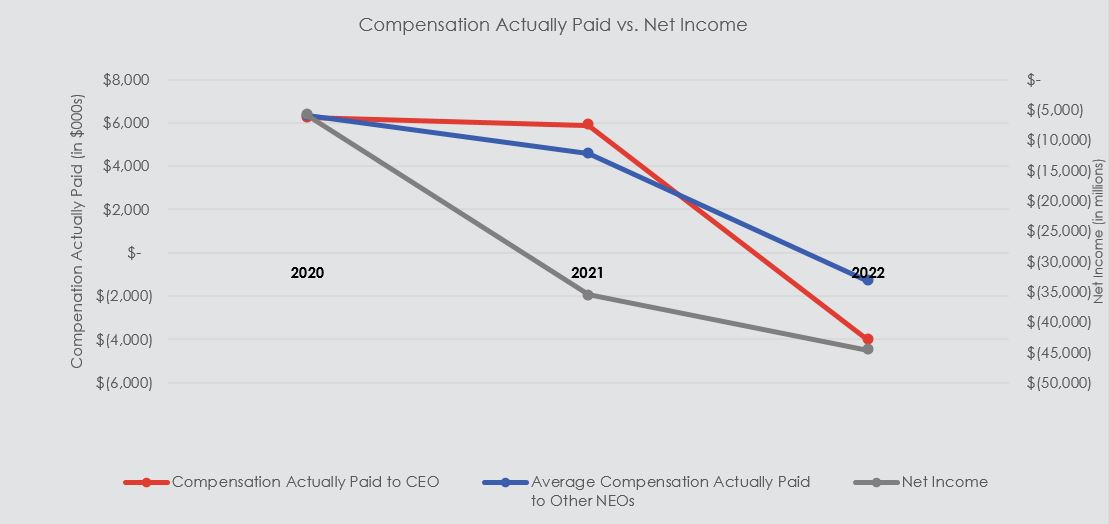

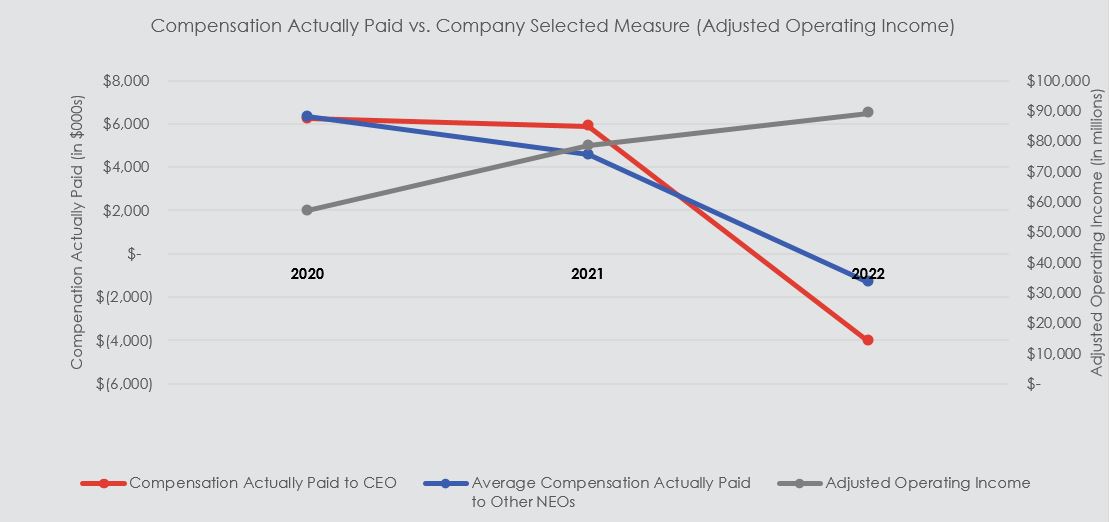

| Board Attendance at Annual Stockholders' Meeting | 20 | Pay Versus Performance Table | 60 |

| Role of Stockholder Engagement | 20 | Description of the Relationship Between Compensation Actually Paid to Our Named Executive Officers and Company Performance | 61 |

| Communication with Directors | 20 | The Company's Most Important Financial Performance Measures | 62 |

| Considerations in Evaluating Director Nominees | 20 | | |

| Stockholder Recommendations for Nominations to the Board of Directors | 21 | | |

| | | |

| Principal Accountant Fees and Services | 22 | Consulting Arrangements | 68 |

| Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services | 22 | Review, Approval or Ratification of Transactions with Related Parties | 68 |

| | | |

| | Stockholder Proposals to be Presented at Next Annual Meeting | 69 |

| Our Executive Officers | 24 | Delinquent Section 16(a) Reports | 69 |

| | Available Information | 69 |

| Say-On-Pay | 29 | "Householding" - Stockholders Sharing the Same Address | 70 |

| Say-On-Pay Resolution | 29 | Other Matters | 70 |

| | | |

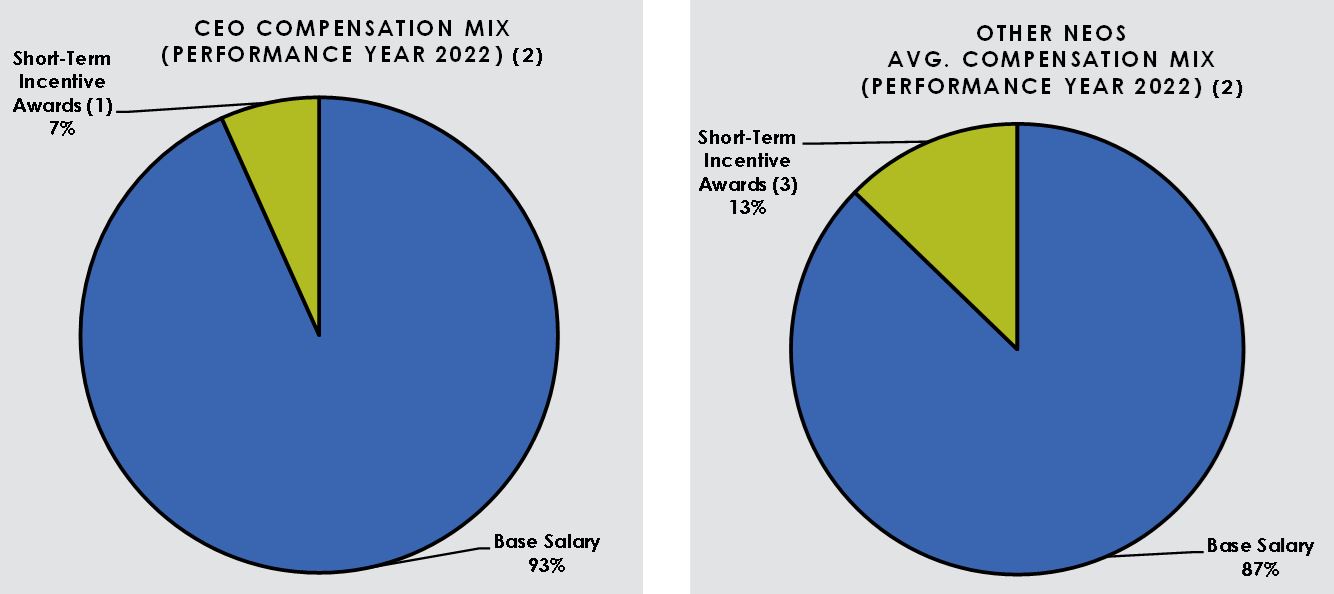

| Compensation Discussion and Analysis | 30 | | |

Proxy Statement Summary

Information About Solicitation and Voting

The accompanying proxy is solicited on behalf of Trupanion, Inc.’s Board of Directors for use at Trupanion’s 2023 Annual Meeting to be held on Wednesday, June 7, 2023, at 9:00 a.m., Pacific Time, and any adjournment or postponement thereof. The Annual Meeting will be held in-person at 6100 4th Avenue South, Seattle, Washington 98108 and stockholders will be able to attend the Annual Meeting and vote during the meeting in-person. However, we encourage stockholders to vote in advance of the Annual Meeting through the Internet, by mail or by telephone to ensure that your shares are represented at the Annual Meeting.

At the Annual Meeting, stockholders will act upon the proposals described in this proxy statement. In addition, we will consider any other matters that are properly presented for a vote at the Annual Meeting. We are not aware of any other matters to be submitted for consideration at the Annual Meeting. If any other matters are properly presented for a vote at the meeting, the persons named in the proxy, who are officers of the Company, have the authority in their discretion to vote the shares represented by the proxy.

Annual Meeting Agenda and Voting Recommendations

| | | | | | | | |

| Proposal | Description | Board Recommendation |

| Proposal 1 | Election of Three "Class III" Directors | "FOR" |

| Proposal 2 | Advisory and Non-Binding Vote to Elect the Two "Class I" and Two "Class II" Directors | "FOR" |

| Proposal 3 | Approval of Amendment and Restatement of Certificate of Incorporation to Declassify the Board of Directors | "FOR" |

| Proposal 4 | Ratification and Appointment of Independent Registered Public Accounting Firm for the Fiscal Year Ending December 31, 2023 | "FOR" |

| Proposal 5 | Advisory and Non-Binding Vote to Approve the Compensation Provided to the Company's Named Executive Officers for 2022 | "FOR" |

General Proxy Information

Record Date; Quorum

Only holders of record of our common stock at the close of business on April 10, 2023, the record date, will be entitled to vote at the Annual Meeting. At the close of business on April 10, 2023, Trupanion had 41,224,954 shares of common stock outstanding and entitled to vote.

The holders of a majority of the voting power of the shares of stock entitled to vote at the Annual Meeting as of the record date must be present or represented by proxy at the meeting in order to hold the Annual Meeting and conduct business. This presence is called a quorum. Your shares are counted as present at the Annual Meeting if you are present and vote in-person at the meeting or if you have properly submitted a proxy through the Internet, mail or by telephone.

Internet Availability of Proxy Materials

Under rules adopted by the SEC, we are furnishing proxy materials to our stockholders primarily via the Internet, instead of mailing printed copies to each stockholder. On or around April [•], 2023, we expect to commence delivery to our stockholders of a Notice of Internet Availability of Proxy Materials (Notice of Internet Availability) containing instructions on how to access our proxy materials, including our proxy statement and our annual report on Form 10-K for the year ended December 31, 2022. The Notice of Internet Availability also provides instructions on how to vote through the Internet or by telephone and includes instructions on how to receive paper copies of the proxy materials by mail or an electronic copy of the proxy materials by email.

This process is designed to reduce our environmental impact and lower the costs of printing and distributing our proxy materials without impacting our stockholders’ timely access to this important information. However, if you would prefer to receive printed proxy materials, please follow the instructions included in the Notice of Internet Availability.

Voting Rights; Required Vote

Each holder of shares of our common stock is entitled to one vote in respect of all matters at the Annual Meeting for each share of common stock held as of the close of business on April 10, 2023, the record date. You may vote all shares owned by you at such date, including (i) shares held directly in your name as the stockholder of record and (ii) shares held for you as the beneficial owner in street name through a brokerage firm, bank, or other nominee. Dissenters’ rights are not applicable to any of the matters being voted on.

How Your Shares Are Voted

Stockholder of Record: Shares Registered in Your Name. If on April 10, 2023, your shares were registered directly in your name with Trupanion’s transfer agent, Broadridge Corporate Issuer Solutions, Inc., then you are considered the stockholder of record with respect to those shares. As a stockholder of record, you may vote at the Annual Meeting, vote in advance through the Internet, by telephone, or if you request to receive paper proxy materials by mail, by filling out and returning a proxy card appointing a person to represent you and vote your shares at the Annual Meeting.

Beneficial Owner: Shares Registered in the Name of a Brokerage Firm, Bank or Other Nominee. If on April 10, 2023, your shares were held in an account with a brokerage firm, bank or other nominee, then you are the beneficial owner of the shares held in street name. As a beneficial owner, you have the right to direct your brokerage firm, bank or other nominee on how to vote the shares held in your account, and your brokerage firm, bank or other nominee provides voting instructions for you to use in directing it on how to vote your shares. Because the brokerage firm, bank or other nominee that holds your shares is the stockholder of record, if you wish to attend the Annual Meeting and vote your shares, you must obtain a valid proxy from the firm that holds your shares giving you the right to vote the shares at the Annual Meeting.

A proxy submitted by a stockholder may indicate that the shares represented by the proxy are not being voted with respect to the election of directors (stockholder withholding). Stockholder withholding will count for purposes of determining the presence of a quorum, but it will not be treated as a vote cast. Accordingly, stockholder withholding will have no effect on the election of the Class III directors or the advisory vote to elect the Class I and Class II directors. Similarly, abstentions will count for purposes of determining the presence of a quorum, but they will not be treated as votes cast, and, therefore, will have no effect on the advisory vote to elect the Class I and Class II directors, the ratification of the appointment of Ernst & Young LLP, or the advisory vote to approve the compensation provided to our named executive officers. In addition, while a broker has discretion to vote uninstructed shares held in street name on “routine” matters, under stock market rules, a broker lacks discretion to vote shares held in street name on “non-routine” matters in the absence of instructions from the beneficial owner of the stock (called a broker non-vote). Proposal 4 is a routine matter, but Proposal 1, Proposal 2, Proposal 3, and Proposal 5 are non-routine matters. Broker non-votes will count for purposes of determining the presence of a quorum, but will not be treated as votes cast on Proposals 1, 2, 3 and 5. Accordingly, broker non-votes will have no effect on the election of the Class III directors, the advisory vote to elect the Class I and Class II directors, and the advisory vote to approve compensation provided to our named executive officers. Because approval of Proposal 3 requires the vote of at least two-thirds of our outstanding stock, a broker non-vote will count as a vote against the proposal to amend and restate our Certificate of Incorporation to declassify our Board of Directors.

The following chart describes the proposals to be considered at the Annual Meeting, our recommended vote with respect to each matter, the vote required to approve each matter, and the manner in which votes will be counted:

| | | | | | | | | | | | | | | | | |

| Proposal | Recommended Vote | Vote Required | Impact of Withhold Votes/ Abstentions (5) | Broker

Non-Votes (6) |

| Proposal 1 | Election of Three "Class III" Directors | "FOR" | Plurality (1) | No Effect | No Effect |

| Proposal 2 | Advisory and Non-Binding Vote to Elect Two "Class I" and Two "Class II" Directors | "FOR" | Plurality (2) | No Effect | No Effect |

| Proposal 3 | Approval of Amendment and Restatement of Certificate of Incorporation to Declassify the Board of Directors | "FOR" | Two-thirds of outstanding shares (3) | Same as a Vote "AGAINST" | Same as a Vote "AGAINST" |

| Proposal 4 | Ratification and Appointment of Independent Registered Public Accounting Firm for the Fiscal Year Ending December 31, 2023 | "FOR" | Majority of votes cast (4) | No Effect | Not Applicable |

| Proposal 5 | Advisory Vote to Approve the Compensation Provided to Our Named Executive Officers in 2022 | "FOR" | Majority of votes cast (4) | No Effect | No Effect |

(1)The directors will be elected by a plurality of the votes cast at the meeting. This means that individuals nominated for election to the Board of Directors at the Annual Meeting receiving the highest number of “FOR” votes will be elected. You may either vote “FOR” the nominees, or “WITHHOLD” your vote with respect to one or more of the nominees. You may not cumulate votes in the election of directors.

(2)The directors receiving the highest number of "FOR" votes will be deemed approved. You may either vote "FOR" the nominees, or "WITHHOLD" your vote with respect to one or more of the nominees. You may not cumulate votes.

(3)Approval of Proposal 3 requires the holders of at least two-thirds of all outstanding shares on the record date to vote "FOR" the proposal.

(4)Approval of Proposal 4 and Proposal 5 will be obtained if the holders of a majority of the votes cast at the Annual Meeting vote “FOR” the proposal.

(5)Neither abstentions nor withhold votes will count as votes cast “FOR” or “AGAINST” Proposal 1, Proposal 2, Proposal 4, and Proposal 5, which means that they will have no direct effect on the outcome of these proposals. Abstentions will count as votes cast "AGAINST" Proposal 3.

(6)Broker non-votes will have no direct effect on Proposal 1, Proposal 2, and Proposal 5. Brokers are permitted to exercise their discretion and vote without specific instruction on Proposal 4. Broker non-votes will count as votes cast "AGAINST" Proposal 3.

Voting Instructions; Voting of Proxies

If you are a stockholder of record, you may:

•vote through the Internet — in order to do so, please visit https://www.proxyvote.com and follow the instructions shown on your Notice of Internet Availability or proxy card;

•vote by telephone — in order to do so, please follow the instructions shown on your Notice of Internet Availability or proxy card;

•vote by mail — if you request or receive a paper proxy card and voting instructions by mail, simply complete, sign and date the proxy card and return it in the envelope provided; or

•vote in-person at the meeting — we will provide a ballot to stockholders who attend the meeting and wish to vote in-person.

Votes submitted through the Internet, by mail, or by telephone must be received by 11:59 p.m., Eastern Time, on June 6, 2023. Submitting your proxy, whether through the Internet, by telephone, or by mail if you request or receive a paper proxy card, will not affect your right to vote in person should you decide to attend the Annual Meeting.

If you are not the stockholder of record, please refer to the voting instructions provided by your brokerage firm, bank or other nominee to direct it how to vote your shares.

For Proposal 1 and Proposal 2, you may either vote “FOR” each of the nominees to the Board of Directors, or you may withhold your vote from any nominee you specify. For Proposal 3, Proposal 4 and Proposal 5, you may vote “FOR” or “AGAINST” or “ABSTAIN” from voting. Your vote is important. Whether or not you plan to attend the Annual Meeting in-person, we urge you to vote in advance of the meeting through the Internet, by mail or by phone to ensure that your shares are represented at the meeting.

All proxies will be voted in accordance with the instructions specified on the proxy card. If you sign a physical proxy card and return it without instructions as to how your shares should be voted on a particular proposal at the Annual Meeting, your shares will be voted in accordance with the recommendations of our Board of Directors stated in the above table. The proxies also confer discretionary authority upon the person named therein with respect to any amendments, variations or other matters which may properly come before the Annual Meeting. As of the date hereof, the Company knows of no such amendments, variations or other matters to come before the Annual Meeting. However, if any such amendment, variation or other matter properly comes before the Annual Meeting, a proxy, when properly completed and delivered and not revoked, will confer discretionary authority upon the person named therein to vote on such other business in accordance with his or her best judgment, subject to any limitations imposed by applicable law or the rules of any applicable securities exchange.

If you received a Notice of Internet Availability, please follow the instructions included on the notice on how to access your proxy card and vote through the Internet or by telephone.

If you receive more than one proxy card or Notice of Internet Availability, your shares are registered in more than one name or are registered in different accounts. To make certain all of your shares are voted, please follow the instructions included on the Notice of Internet Availability on how to access and vote each proxy card.

Expenses of Soliciting Proxies

The expenses of soliciting proxies will be paid by Trupanion. Following the original distribution and mailing of the solicitation materials, we or our agents may solicit proxies by mail, email, telephone, or by other similar means, or in-person. Our directors, officers and other employees, without additional compensation, may solicit proxies for us personally or in writing, by mail, email, telephone, or by other similar means. Following the original distribution and mailing of the solicitation materials, we will request brokerage firms, banks and other nominees who are record holders to forward copies of those materials to persons for whom they hold shares and to request authority for the exercise of proxies. In such cases, we, upon the request of the record holders, will reimburse such holders for their reasonable expenses. If you choose to access the proxy materials and/or vote through the Internet, by phone or by mail, you are responsible for any Internet access, telephone or data usage or postage charges you may incur.

Revocability of Proxies

A stockholder of record who has given a proxy may revoke it at any time before the closing of the polls by the inspector of elections at the Annual Meeting by:

•delivering to the Corporate Secretary a written notice stating that the proxy is revoked;

•signing and delivering a proxy bearing a later date;

•voting again through the Internet or by telephone (by June 6, 2023, 11:59 p.m. Eastern Time); or

•attending and voting at the Annual Meeting (attendance at the meeting will not, by itself, revoke a proxy).

Please note, however, that if your shares are held of record by a brokerage firm, bank or other nominee and you wish to revoke a proxy, you must contact that firm to revoke or change any prior voting instructions.

Electronic Access to the Proxy Materials

The Notice of Internet Availability will provide you with instructions regarding how to:

•view our proxy materials for the meeting through the Internet;

•instruct us to mail paper copies of our future proxy materials to you; and

•instruct us to send our future proxy materials to you electronically by email.

To help us achieve our environmental goals, consider choosing to receive your future proxy materials by email, which will reduce the impact of our annual meetings of stockholders on the environment and lower the costs of printing and distributing our proxy materials. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

Voting Results

Voting results will be tabulated and certified by the inspector of elections appointed for the meeting. The preliminary voting results will be announced at the meeting and posted on the investor relations section of our website at https://investors.trupanion.com. The final results will be tallied by the inspector of elections and filed with the SEC in a current report on Form 8-K within four business days of the Annual Meeting.

Proposal No. 1: Election of Class III Directors

As of the date of this Proxy Statement, our Board of Directors consists of seven directors. Our Certificate of Incorporation currently divides the Board of Directors into three classes, and there are currently two directors in each of Class I and Class II and three directors in Class III. Directors in each class serve for three years, with the terms of office of the respective classes expiring in successive years. Mr. Dan Levitan, Dr. Murray Low, and Mr. Howard Rubin, each an incumbent Class III director, will stand for election at this Annual Meeting.

Our nominating and corporate governance committee nominated Messrs. Levitan and Rubin and Dr. Low for election as Class III directors at the 2023 Annual Meeting, and at the recommendation of our nominating and corporate governance committee, our Board of Directors proposes that Messrs. Levitan and Rubin and Dr. Low each be elected as a Class III director for a three-year term expiring at the 2026 annual meeting and until his successor is duly elected and qualified or until his earlier resignation or removal. Each Class III director has agreed to resign in the event stockholders approve Proposal 3 to declassify our Board of Directors.

Under our Bylaws, each director is elected by a plurality of the votes cast at the Annual Meeting. This means that the three individuals nominated for election to the Board of Directors at the Annual Meeting receiving the highest number of “FOR” votes will be elected. You may either vote “FOR” one, two, or three of the nominees or you may “WITHHOLD” your vote with respect to one, two, or three nominees. Shares represented by proxies will be voted “FOR” the election of each of the Class III nominees, unless the proxy is marked to withhold authority to so vote. You may not cumulate votes in the election of directors. If any nominee for any reason is unable to serve, the proxies may be voted for such substitute nominees as the proxy holders, who are officers of our Company, might determine. Each nominee has consented to being named in this proxy statement and to serve if elected, provided, in order to accomplish the declassification of our Board of Directors, each nominee has agreed to resign in the event Proposal 3 is approved. Proxies may not be voted for more than three directors.

| | |

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” ELECTION OF EACH OF THE NOMINATED CLASS III DIRECTORS. |

Proposal No. 2: Advisory and Non-Binding Vote to Approve the Class I and Class II Directors

As described in this proxy statement, we are recommending that our stockholders vote to approve Proposal 3 – a proposal to amend and restate our Certificate of Incorporation to declassify our Board of Directors such that each director will serve a one-year term and be subject to election at each Annual Meeting rather than every three years. In connection with the declassification, and as a demonstration of our commitment to annual director elections, we are asking our stockholders to cast an advisory vote on our Class I and Class II directors, which directors have agreed to resign and will be re-appointed to fill vacancies on our Board of Directors created by their resignations only if they receive a number of advisory votes that would be sufficient to elect them had they been subject to election at the Annual Meeting.

At the recommendation of our nominating and corporate governance committee, our Board of Directors proposes that Jackie Davidson and Zay Satchu, each an incumbent Class I director, and Michael Doak and Darryl Rawlings, each an incumbent Class II director, be, on an advisory basis, elected to the Board of Directors.

Each of our Class I and Class II directors has agreed to resign and will not be re-appointed to fill vacancies on our Board of Directors unless they receive a number of advisory votes that would be sufficient to elect them had they been subject to election at the Annual Meeting. Accordingly, any director who does not receive a plurality of the votes cast at the Annual Meeting will not be reappointed as a director. For directors who do receive the highest number of "FOR" votes, however, we expect that the remaining directors will appoint them to fill vacancies on our Board of Directors.

Although this is an advisory and nonbinding vote, we are otherwise conducting it in a manner similar to the election of directors. Accordingly, you may either vote “FOR” the directors subject to this Proposal 2 or you may “WITHHOLD” your vote with respect to the directors subject to this Proposal 2. Shares represented by proxies will be voted “FOR” the election of each of the directors subject to this Proposal 2, unless the proxy is marked to withhold authority to so vote. You may not cumulate votes in the election of directors. If any director subject to this Proposal 2 for any reason is unable to serve, the proxies may be voted for such substitute individuals as the proxy holders, who are officers of our Company, might determine. Each director subject to this Proposal 2 has consented to being named in this proxy statement and to serve if approved by our stockholders, provided, in order to accomplish the declassification of our Board of Directors, each director has agreed to resign in the event Proposal 3 is approved.

| | |

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF EACH OF THE CLASS I AND CLASS II DIRECTORS. |

Our Board of Directors

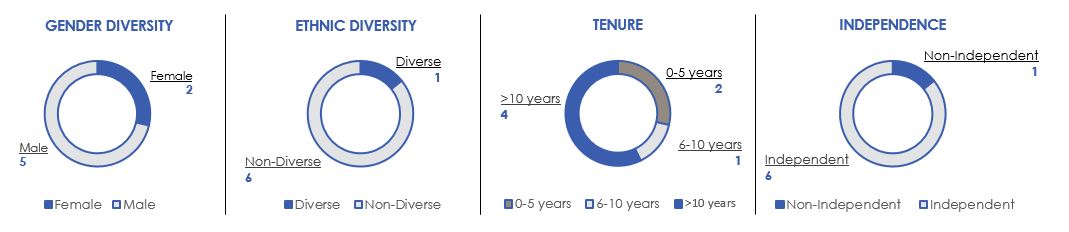

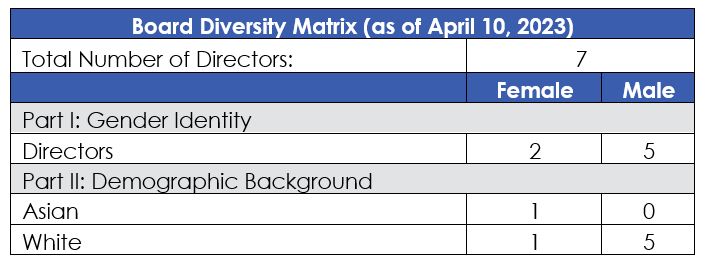

Board of Directors Snapshot

Our Board of Directors and their respective ages and class designation as of April 10, 2023 are as follows:

| | | | | | | | |

| Name | Age | Class Designation |

| Jacqueline "Jackie" Davidson | 62 | Class I Director |

| Zay Satchu | 34 | Class I Director |

| Michael Doak | 47 | Class II Director |

| Darryl Rawlings | 53 | Class II Director |

| Daniel "Dan" Levitan | 65 | Class III Director |

| Murray Low | 70 | Class III Director |

| Howard Rubin | 70 | Class III Director |

Information regarding our director nominees and continuing directors, including information they have furnished as to their principal occupations, certain other directorships they hold, or have held, and their ages as of April 10, 2023, is set forth below. There are no familial relationships among our directors and officers. Dan Levitan, Murray Low, and Howard Rubin are each nominated for election as a Class III director to the Board of Directors at the Annual Meeting. No nominee has an arrangement or understanding with another person under which he or she was or is to be selected as a director or nominee.

Our Class III Director Nominees

Our Class I and Class II Directors

Non-Employee Director Compensation

Non-Employee Director Compensation Program

In February 2018, our Board of Directors approved a non-employee director compensation program, which has been amended from time to time, most recently in 2023. The program in effect for calendar year 2022 provided for a phased-in increase to non-employee director compensation in calendar years 2022 and 2023. For calendar year 2022, each of our non-employee directors received an annual retainer in the amount of $112,500 and the chairs of each of the Board of Directors, audit committee, compensation committee and nominating and corporate governance committee received an additional annual retainer in the amount of $15,000, $15,000, $10,000 and $10,000, respectively. For calendar year 2023, these amounts will increase such that each of our non-employee directors will receive an annual retainer in the amount of $150,000 and the lead independent director and chairs of each of the audit committee, compensation committee and nominating and corporate governance committee will receive an additional annual retainer in the amount of $50,000. Annual awards will be pro-rated for any person who becomes a non-employee director, lead independent director, and/or chair after annual awards are granted for that year.

Under our non-employee director compensation program, each director receives his or her retainer in the form of either restricted stock units (RSUs) or non-qualified stock options, as our Board of Directors determines each year. However, each director may elect to receive 50% of his or her retainer in cash and 50% in equity (either RSUs or non-qualified stock options, as our Board of Directors determines each year). If our Board of Directors determines that the equity compensation will be paid in the form of RSUs, the number of shares of Common Stock underlying the RSUs will be based on our then-most recent determination of the intrinsic value of a share of Common Stock. If our Board of Directors determines that the equity compensation will be paid in the form of non-qualified stock options, the number of shares of Common Stock underlying the options will be determined by dividing the cash compensation by our then-most recent determination of the intrinsic value of a share of Common Stock then the quotient of this calculation is multiplied by a fraction, the numerator of which is the closing price of our Common Stock as reported by the NASDAQ stock market on the first day of the open trading window in which the grant will be made and the denominator is the value of the Common Stock calculated using the Black-Scholes valuation method as of the same date. For calendar year 2022, the Board of Directors determined that equity would be in the form of RSUs.

For calendar year 2022, no non-employee director elected to receive any portion of their retainer in cash and all non-employee director compensation was in the form of RSUs, with the number of RSUs granted determined by dividing the retainer amount by our then-most current calculation of intrinsic value of a share of our Common Stock.

Equity awards under our non-employee director compensation program are typically granted in the first open trading window of the calendar year and vest in four quarterly installments on March 31st, June 30th, September 30th, and December 31st, subject to the continued service of the non-employee director through the vesting date. Annual awards that are unvested at the time of resignation or termination of a non-employee director are forfeited. Similarly, no cash compensation will be paid following the effective date of a director’s resignation or other termination from our Board of Directors. The resignations described in Proposals 1, 2 and 3 in connection with our efforts to declassify our Board of Directors will only be deemed to be resignations for corporate law purposes and will not be deemed to be resignations for any other purpose, including vesting provisions under our equity incentive plan and related award agreements.

Additional Compensation for Non-Employee Directors

From time to time, our Board of Directors may also award additional compensation to directors when it determines doing so is in our best interests and those of our stockholders, such as for unexpected or additional service contributions.

The Company also provides reimbursement for reasonable travel, accommodation and out-of-pocket expenses of directors to attend Board meetings and participate in other corporate functions.

2022 Non-Employee Director Compensation Table

The following table presents the total compensation for each person who served as a non-employee member of our Board of Directors during the year ended December 31, 2022. Other than as set forth in the table, during the year ended December 31, 2022, we did not pay any fees to, make any equity awards or non-equity awards to, or pay any other compensation to the non-employee members of our Board of Directors, with the exception of reimbursement of travel expenses as described above. Mr. Rawlings, our Chief Executive Officer, received no compensation for his service as a director during the year ended December 31, 2022. The compensation provided to Mr. Rawlings is discussed in the section entitled “Executive Compensation”.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | Fees Earned or Paid in Cash (1) | Stock Awards

(2) | | All Other Compensation | Total | |

| Jackie Davidson | $ | — | | | $ | 125,930 | | | $ | — | | | $ | 125,930 | | |

| Michael Doak (3) | $ | — | | | $ | 121,001 | | | $ | — | | | $ | 121,001 | | |

| Eric Johnson (4) | $ | — | | | $ | 111,141 | | | $ | — | | | $ | 111,141 | | |

| Dan Levitan | $ | — | | | $ | 111,141 | | | $ | — | | | $ | 111,141 | | |

| Murray Low (5) | $ | — | | | $ | 135,789 | | | $ | — | | | $ | 135,789 | | |

| Howard Rubin | $ | — | | | $ | 111,141 | | | $ | — | | | $ | 111,141 | | |

| Zay Satchu | $ | — | | | $ | 111,141 | | | $ | — | | | $ | 111,141 | | |

(1)Under our non-employee director compensation program, each director receives his or her retainer in the form of either RSUs or non-qualified stock options, as our Board of Directors determines each year. However, each director may elect to receive 50% of his or her retainer in cash and 50% in equity (either RSUs or non-qualified stock options, as our Board of Directors determines each year). In 2022, all directors elected to receive equity only, which was in the form of RSUs.

(2)For 2022, our Board of Directors determined that equity granted pursuant to the non-employee director compensation program would be in the form of RSUs. The amounts in this column represent the aggregate grant date fair value of the RSUs, as computed in accordance with Accounting Standards Codification Topic 718 (without regard to forfeitures). The amounts reflect accounting cost and may not correspond to the actual economic value realized by our directors. See Note 11 to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2022 for a summary of the assumptions we apply in calculating these amounts.

(3)As of December 31, 2022, Mr. Doak held options to purchase 29,920 shares of Common Stock under certain option awards granted pursuant to our 2014 Equity Incentive Plan.

(4)Mr. Johnson resigned as a member of our Board of Directors effective as of January 1, 2023.

(5)As of December 31, 2022, Dr. Low held options to purchase 37,592 shares of Common Stock under certain option awards granted pursuant to our 2014 Equity Incentive Plan.

Proposal No. 3: Approval of Amendment and Restatement of Certificate of Incorporation to Declassify the Board of Directors

After careful consideration, our Board of Directors recommends that our stockholders approve the amendment and restatement of our Certificate of Incorporation to declassify our Board of Directors and provide that all directors elected at or after our 2024 annual meeting of stockholders be elected on an annual basis. The text of the amendment, marked to show the proposed deletions and insertions, is attached as Annex A to this proxy statement (the Declassification Amendment).

Since our initial public offering in 2014, we have had our classified board structure. In deciding to approve the Declassification Amendment and to recommend that our stockholders vote to adopt the proposed Declassification Amendment, our Board of Directors considered the benefits of retaining a classified board structure, such as providing continuity and stability, encouraging directors to take a long-term perspective and enhancing the independence of non-management directors by providing them with a longer term of office. However, our Board of Directors recognizes that our classified board structure does not enable stockholders to express a view on each director’s performance by means of an annual vote and therefore may be perceived as reducing directors’ accountability to stockholders. Our Board of Directors has carefully considered input from our stockholders, weighed the advantages and disadvantages of the current classified board structure, and determined that it is advisable and in the best interest of our company and our stockholders to adopt the Declassification Amendment to effect the declassification of our Board of Directors.

Currently, Article VI of our Certificate of Incorporation provides that our Board of Directors shall be classified into three classes with each class holding office for a three-year term. If our stockholders approve the Declassification Amendment, each director would be elected to an annual term beginning at our 2024 annual meeting of stockholders. Vacancies that may occur during the year may be filled by vote of a majority of the remaining members of our Board of Directors, and each director so appointed shall serve for a term which will expire at the next annual meeting of stockholders. The Declassification Amendment also eliminates the requirement in our Certificate of Incorporation that directors be removed for cause, because Delaware law only allows such provisions at companies with staggered boards. The Declassification Amendment will become effective upon the filing of the amended and restated Certificate of Incorporation with the Delaware Secretary of State.

Under Delaware law, the Declassification Amendment will not operate to remove a director or shorten the term of a director. If the Declassification Amendment is approved, and once the amended and restated Certificate of Incorporation is filed with the Delaware Secretary of State, each member of our Board of Directors whose term does not expire at our 2023 annual meeting (i.e., the Class I and Class II directors) will resign and, assuming they have received the advisory vote contemplated by Proposal 2, will be immediately re-appointed as directors for a term that expires at our 2024 annual meeting. Immediately after such directors are re-appointed to our Board of Directors, our Class III directors will resign and immediately be re-appointed as directors for a term that expires at our 2024 annual meeting. Following these resignations and re-appointments, no directors will remain classified and all directors will be subject to annual elections starting at our 2024 annual meeting.

If the Declassification Amendment is not approved, our Board of Directors will not declassify, and none of the resignations and re-appointments described above will occur.

If the Declassification Amendment is approved, our Board of Directors would also make conforming changes to our Bylaws as necessary or appropriate to declassify our Board of Directors. If our stockholders do not approve the Declassification Amendment, our Board of Directors will remain classified and such conforming changes to the Bylaws will be abandoned.

This description of the Declassification Amendment is only a summary of these amendments and is qualified in its entirety by reference to the actual text of Article VI as set forth on Annex A to this proxy statement.

| | |

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF PROPOSAL NO. 3 |

Corporate Governance

We are strongly committed to good corporate governance practices. These practices provide an important framework within which our Board of Directors and management pursue our strategic objectives for the benefit of our stockholders.

Corporate Governance Guidelines

Our Board of Directors has adopted Corporate Governance Guidelines that set forth expectations for directors, director independence standards, the board committee structure and functions and other policies for the governance of our Company. Our Corporate Governance Guidelines are available on the investor relations section of our website at https://investors.trupanion.com. Information contained on, or that can be accessed through, our website is not incorporated by reference, and you should not consider information on our website to be part of, this proxy statement.

Board Composition and Leadership Structure

Under our Corporate Governance Guidelines, our Board of Directors is free to choose its chairperson in any way that it deems best for us. Our Board of Directors, in consultation with our nominating and corporate governance committee, periodically considers its leadership structure and may change the structure as it deems appropriate. Since January 2023, the positions of Chief Executive Officer and Chairperson of our Board of Directors have been held by Mr. Rawlings. Our Board of Directors believes that having our Chief Executive Officer as chairperson of the Board of Directors will facilitate our Board of Directors’ decision-making process because Mr. Rawlings has first-hand knowledge of our operations and the major opportunities and challenges facing us. This also enables Mr. Rawlings to act as the key link between our Board of Directors and other members of management. To assure effective independent oversight, our Corporate Governance Guidelines provide that when the positions of Chairperson of our Board of Directors and Chief Executive Officer are held by the same person, our independent directors may designate a Lead Independent Director. Our former chairperson of the Board, Dr. Low, is currently serving as our Lead Independent Director. Mr. Rawlings' appointment to Chairperson of our Board is in connection with succession planning for our Chief Executive Officer. Our current intent is for Mr. Rawlings to serve as our Chief Executive Officer and also as Chairperson of the Board of Directors until 2025, after which time he will no longer serve as Chief Executive Officer and will only serve as Chairperson of the Board. Mr. Rawlings has indicated a willingness to serve as Chairperson of the Board until 2035, assuming our stockholders re-elect him to our Board of Directors.

Board’s Role in Risk Oversight

Our Board of Directors believes that open communication between management and the Board of Directors is essential for effective risk management and oversight. In addition to receiving daily Company performance reports, our Board of Directors meets with our Chief Executive Officer and other members of the senior management team at least quarterly at Board of Directors meetings, where, among other topics, they discuss strategy and risks in the context of reports from the management team and evaluate the risks inherent in our business and significant transactions. While our Board of Directors is ultimately responsible for risk oversight, our Board committees assist the Board of Directors in fulfilling its oversight responsibilities in certain areas of risk. Among other things, the audit committee assists our Board of Directors in fulfilling its oversight responsibilities with respect to risk management in the areas of internal control over financial reporting and disclosure controls and procedures. The compensation committee assists our Board of Directors in assessing whether Trupanion’s executive compensation programs and policies encourage undue or excessive risk-taking. The nominating and corporate governance committee assists our Board of Directors in fulfilling its oversight responsibilities with respect to the management of risk associated with Board membership and corporate governance.

Director Independence

Our Common Stock is listed on the NASDAQ Global Market. Under the rules of the NASDAQ Stock Market, independent directors must comprise a majority of a listed company’s board of directors. In addition, the rules of the NASDAQ Stock Market require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and corporate governance committees be independent. Under the rules of the NASDAQ Stock Market, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Audit committee members must also satisfy the heightened independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended. In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors or any other board committee: (i) accept, directly or indirectly, any consulting, advisory or other compensatory fee from the listed company or any of its subsidiaries or (ii) be an affiliated person of the listed company or any of its subsidiaries. Compensation committee members are also subject to heightened independence standards similar to those applicable to audit committee members.

Our Board of Directors has undertaken a review of the independence of each director and considered whether each director has a relationship with us that would interfere with his or her ability to exercise independent judgment in carrying out his or her responsibilities. As a result of this review, our Board of Directors determined that Ms. Davidson, Mr. Doak, Mr. Levitan, Dr. Low, Mr. Rubin and Dr. Satchu, representing six of our seven directors, are “independent directors” as defined under the applicable rules of the SEC and the listing requirements and rules of the NASDAQ Stock Market. Our Board of Directors did not conclude that Mr. Rawlings was independent because he is our Chief Executive Officer. Mr. Rubin was an executive officer of ours nine years ago. He also formerly provided certain consulting services to us and our Board of Directors determined that these services no longer affect Mr. Rubin's independence. In making these determinations, our Board of Directors reviewed and discussed information provided by the directors and the Company regarding each director’s business and personal activities and relationships as they may relate to us and our management, including the beneficial ownership of our capital stock by each director and other transactions involving them.

Role of Lead Independent Director

Dr. Low, in his role as our Lead Independent Director, works to ensure that “all voices are heard” within the boardroom, proactively spends considerable time with our Chief Executive Officer and President to understand our vision and strategy, and helps focus our Board of Directors on areas aligned with our vision and strategy. In addition to acting as the chairperson of the independent director sessions, the Lead Independent Director also assists our Board of Directors in assuring effective corporate governance.

In cases in which the Chairperson of our Board of Directors and Chief Executive Officer are the same person, the Chairperson of our Board of Directors, with the Lead Independent Director, may schedule and set the agenda for meetings of our Board of Directors, and the Chairperson of our Board of Directors or, if the Chairperson of our Board of Directors is not present, the Lead Independent Director, may chair such meetings. In addition, the Lead Independent Director may preside over executive sessions of independent directors, serve as a liaison between the Chairperson of our Board of Directors and the independent directors, coordinate information sent to our Board of Directors, approve meeting schedules to ensure sufficient time to cover all agenda items, consult with stockholders on an annual basis and perform such other functions and responsibilities as requested by our Board of Directors from time to time.

Committees of Our Board of Directors

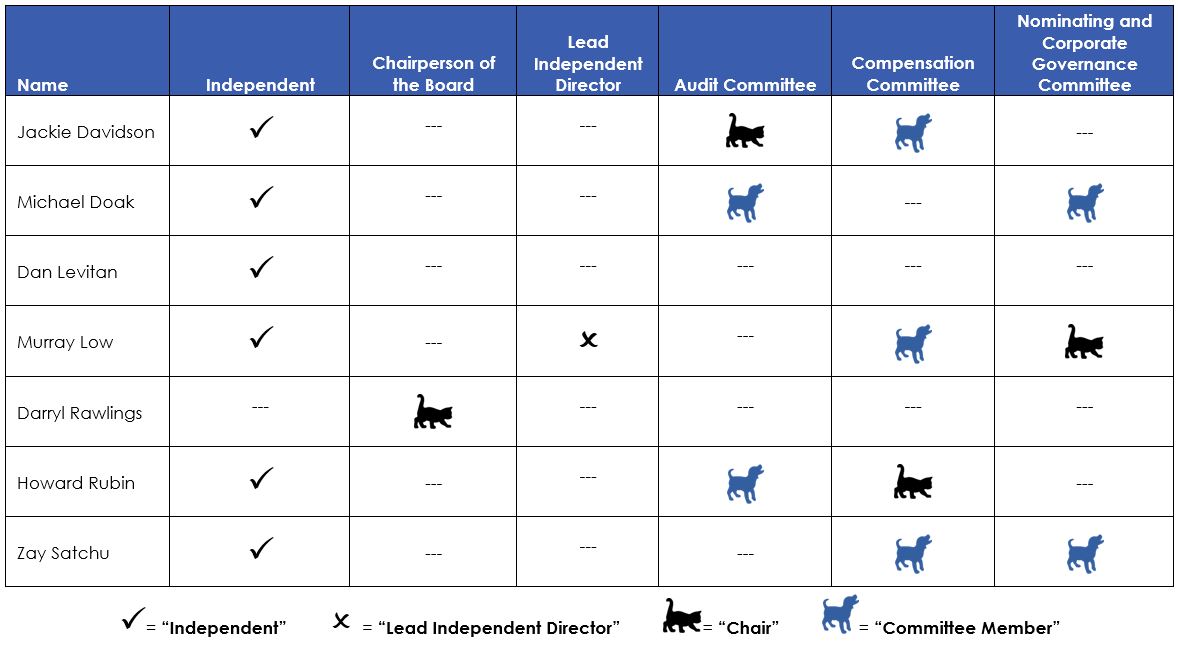

Our Board of Directors has established an audit committee, a compensation committee and a nominating and corporate governance committee, each of which has a charter. The composition and responsibilities of each committee are described below. Members serve on these committees until their resignations or until otherwise determined by the Board of Directors. Copies of the charters for each committee are available without charge on the investor relations website at https://investors.trupanion.com/governance/Committee-Charters-Governance-Documents/default.aspx. As of April 10, 2023, the Company's committee composition is as follows:

Audit Committee

In 2022, our audit committee was comprised of Ms. Davidson, Mr. Doak and Mr. Rubin, with Ms. Davidson serving as the chair of our audit committee. The composition of our audit committee meets the independence and other composition requirements under the applicable NASDAQ Stock Market and SEC rules and each member of our audit committee is financially literate. In addition, our Board of Directors has determined that each member of our audit committee is an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K promulgated under the Securities Act. Our audit committee’s principal functions are to assist our Board of Directors in its oversight of:

•our accounting and financial reporting processes, including our financial statement audits and the integrity of our financial statements;

•our compliance with legal and regulatory requirements;

•the qualifications, independence and performance of our independent auditors; and

•the preparation of the audit committee report included in our annual meeting proxy statements.

Compensation Committee

In 2022, our compensation committee was comprised of Ms. Davidson, Dr. Low, Dr. Satchu, and Mr. Rubin, with Dr. Low serving as chair of our compensation committee. Former director Eric Johnson also served on the compensation committee until his resignation from our Board of Directors on January 1, 2023. The composition of our compensation committee meets the requirements for independence under the applicable NASDAQ Stock Market and SEC rules. Our compensation committee’s principal functions are to assist our Board of Directors with respect to compensation matters, including:

•evaluating, recommending, approving and reviewing executive officer and director compensation arrangements, plans, policies and programs;

•administering our cash-based and equity-based compensation plans;

•making recommendations to our Board of Directors regarding any other Board of Director responsibilities relating to executive compensation; and

•preparing the compensation committee report to be included in our annual meeting proxy statements.

Nominating and Corporate Governance Committee

In 2022, our nominating and corporate governance committee was comprised of Mr. Doak, Dr. Low, and Dr. Satchu, with Mr. Doak serving as the chair of our nominating and corporate governance committee. Former director Eric Johnson also served on the nominating and corporate governance committee until his resignation from our Board of Directors in January 2023. Each nominating and corporate governance committee member is independent under the applicable NASDAQ Stock Market rules and SEC rules. Our nominating and corporate governance committee’s principal functions include:

•identifying, considering and recommending candidates for membership on our Board of Directors;

•developing and recommending our corporate governance guidelines and policies;

•overseeing the process of evaluating the performance of our Board of Directors; and

•advising our Board of Directors on other corporate governance matters.

Corporate Governance and Ethics Principles

A primary goal of our Board of Directors is to build long-term value for our stockholders. Our Board of Directors has adopted and follows corporate governance practices that it and our senior management believe are sound and, promote this purpose, including the establishment of the following:

•Code of Conduct and Ethics that sets forth our ethical principles and applies to all of our directors, officers and employees, including our Chief Executive Officer and Chief Financial Officer;

•Corporate Governance Guidelines that set forth our corporate governance principles;

•Insider Trading Policy and Pledging Guidelines for Directors and Officers that prohibit insider trading, limit pledging activities and prohibit engaging in any form of hedging transactions (derivatives, equity swaps, and so forth) in the Company's stock; and

•charters for our audit, compensation and nominating and corporate governance committees that require independent oversight of key functions.

The full text of our Code of Conduct and Ethics, Corporate Guidelines, and committee charters is posted on our investor relations website at https://investors.trupanion.com/governance/Committee-Charters--Governance-Documents/default.aspx. We intend to disclose any future amendments or waivers to our Code of Conduct and Ethics that applies to our executive officers on our website or in public filings. We also have a number of internal policies, procedures, and systems, including policies relating to insider trading, pledging, related-party transactions, clawback of incentive compensation and a confidential, anonymous system for employees and others to report concerns about fraud, accounting matters, violations of our policies and other matters. Information contained on, or that can be accessed through, our website is not incorporated by reference, and you should not consider information on our website to be part of, this proxy statement.

Compensation Committee Interlocks and Insider Participation

The members of our compensation committee during the last concluded fiscal year were Mr. Johnson, who resigned in January 2023, along with Ms. Davidson, Dr. Low, Dr. Satchu, and Mr. Rubin. With the exception of Mr. Rubin, no member of the compensation committee has served as an officer or employee of ours or any of our subsidiaries and no member of our compensation committee had any relationship with us requiring disclosure under Item 404 of Regulation S-K. Mr. Rubin currently serves as a director for American Pet Insurance Company, ZPIC Insurance Company, GPIC Insurance Company, and QPIC Insurance Company, each a wholly-owned subsidiary of the Company. None of our executive officers currently serves or has served on the Board of Directors or compensation committee of any entity whose executive officers included any of our directors.

Board and Committee Meetings, Attendance, and Executive Sessions

The Board of Directors and its committees meet regularly throughout the year and also hold special meetings and act by written consent from time to time. During 2022:

•the Board of Directors held five meetings and acted by written consent five times;

•the audit committee held five meetings;

•the compensation committee held four meetings and acted by written consent three times; and

•the nominating and corporate governance committee held four meetings.

During 2022, with the exception of Mr. Johnson, no director attended fewer than 75% of the aggregate of the number of meetings held by our Board of Directors. Mr. Johnson attended three of the five meetings held by our Board of Directors. No director attended fewer than 75% of the number of meetings held by all committees of our Board of Directors on which such director served, in each case during the time the director served on our Board of Directors.

Typically, in conjunction with the regularly scheduled meetings of our Board of Directors, the directors meet in executive sessions with our Chief Executive Officer outside the presence of other members of management and, separately, our non-employee directors meet outside the presence of the Chief Executive Officer. In 2022, our then-current Chairperson of our Board of Directors, Dr. Low, presided over such executive sessions.

Board Attendance at Annual Stockholders’ Meeting

We invite and encourage each member of our Board of Directors to attend our annual meetings of stockholders though we do not have a formal policy regarding attendance of annual meetings by the members of our Board of Directors. We may consider in the future whether our Company should adopt a more formal policy regarding director attendance at our annual meetings. Six of our eight then-current directors attended our 2022 Annual Meeting of Stockholders.

Role of Stockholder Engagement

Our Board of Directors believes it is important to regularly engage with our stockholders. In the past several years, we have proactively reached out to many of our largest stockholders to solicit their feedback on our executive compensation, corporate governance and disclosure practices in order to gain a better understanding of the practices they most value. In response to a common stockholder request, this year we are proposing that our stockholders approve the declassification of our Board of Directors. Our stockholder engagement team has consisted of certain independent directors and members of our investor relations and legal team. Stockholders have also regularly met with members of our senior management team to discuss our strategy and review our operational performance.

Communication with Directors

Stockholders and interested parties who wish to communicate with our Board of Directors, non-employee members of our Board of Directors as a group, a committee of the Board of Directors or a specific member of our Board of Directors (including our Chairperson and Lead Independent Director) may do so by letters addressed to the attention of our Corporate Secretary, Trupanion, Inc., 6100 4th Avenue South, Suite 400, Seattle, Washington 98108.

All communications are reviewed by our Corporate Secretary and provided to the members of the Board of Directors unless such communications are sales materials or other routine items, or items unrelated to the duties and responsibilities of our Board of Directors.

Considerations in Evaluating Director Nominees

Our nominating and corporate governance committee is responsible for identifying, evaluating and recommending nominees to our Board of Directors. A variety of methods are used to identify and evaluate director nominees, with the goal of maintaining and further developing a diverse, experienced and highly qualified Board of Directors. Candidates may come to our attention through current members of our Board of Directors, professional search firms, stockholders or other persons.

Our nominating and corporate governance committee will recommend to the Board of Directors for selection all nominees to be proposed by the Board of Directors for election by the stockholders, including approval or recommendation of a slate of director nominees to be proposed by the Board of Directors for election at each annual meeting of stockholders, and will recommend all director nominees to be appointed by the Board of Directors to fill interim director vacancies.

Our Board of Directors encourages selection of directors who will contribute to our Company’s overall corporate goals. The nominating and corporate governance committee may from time to time review and recommend to the Board of Directors the desired qualifications, expertise and characteristics of directors, including such factors as business experience, diversity and professional experience in management, technology, finance, marketing, financial reporting and other areas that are expected to contribute to an effective Board of Directors. In evaluating potential candidates for the Board of Directors, the nominating and corporate governance committee considers these factors in the light of the specific needs of the Board of Directors at that time.

In addition, under our Corporate Governance Guidelines, a director is expected to spend the time and effort necessary to properly discharge such director’s responsibilities. Accordingly, a director is expected to regularly attend meetings of the Board of Directors and committees on which such director sits and to review material distributed to the director. Thus, the number of other public company boards and other boards (or comparable governing bodies) on which a prospective nominee is a member, as well as his or her other professional responsibilities, will be considered. Under our Corporate Governance Guidelines, there are no limits on the number of terms that may be served by a director. However, in connection with evaluating recommendations for nomination for reelection, the nominating and corporate governance committee considers director tenure. We value diversity on a company-wide basis but have not adopted a specific policy regarding board diversity.

Stockholder Recommendations for Nominations to the Board of Directors

Our nominating and corporate governance committee will consider properly submitted stockholder recommendations for candidates for our Board of Directors who meet the minimum qualifications as described above. Our nominating and corporate governance committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a stockholder. A stockholder of record can nominate a candidate for election to our Board of Directors by complying with the procedures in Article I, Section 1.11 of our Bylaws. Any eligible stockholder who wishes to submit a nomination should review the requirements in our Bylaws on nominations by stockholders. Any nomination should be sent in writing to our Corporate Secretary, Trupanion, Inc., 6100 4th Avenue South, Suite 400, Seattle, Washington 98108. Submissions must include the full name of the proposed nominee, complete biographical information, a description of the proposed nominee’s qualifications as a director, other information specified in our Bylaws, and a representation that the nominating stockholder is a beneficial or record holder of our stock and has been a holder for at least one year. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected. These candidates are evaluated at meetings of the nominating and corporate governance committee, and may be considered at any point during the year. If any materials are provided by a stockholder in connection with the recommendation of a director candidate, such materials are forwarded to the nominating and corporate governance committee.

All proposals of stockholders that are intended to be presented by such stockholder at an annual meeting of stockholders must be in writing and notice must be delivered to the Corporate Secretary at our principal executive offices not later than the close of business on the 75th day, nor earlier than the close of business on the 105th day, prior to the first anniversary of the preceding year’s annual meeting. Stockholders are also advised to review our Bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and director nominations.

Proposal No. 4: Ratification of Independent Registered Public Accounting Firm

Our audit committee has selected Ernst & Young LLP as our independent registered public accounting firm to perform the audit of our consolidated financial statements for the fiscal year ending December 31, 2023. Ernst & Young LLP audited our financial statements for the fiscal year ended December 31, 2022 and has been our independent registered public accounting firm since 2012. We expect that representatives of Ernst & Young LLP will join the Annual Meeting in-person or via webcast, will be able to make a statement if they so desire, and will be available to respond to appropriate questions.

At the Annual Meeting, the stockholders are being asked to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023. Our audit committee is submitting the selection of Ernst & Young LLP to our stockholders because we value our stockholders’ views on our independent registered public accounting firm and as a matter of good corporate governance. If this proposal does not receive the affirmative approval of a majority of the votes cast on the proposal, the audit committee would reconsider the appointment. Notwithstanding its selection and even if our stockholders ratify the selection, our audit committee, in its discretion, may appoint another independent registered public accounting firm at any time during the year if the audit committee believes that such a change would be in our best interests and those of our stockholders.

| | |

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF PROPOSAL NO. 4 |

Principal Accountant Fees and Services

The following table presents fees for professional services for the fiscal years ended December 31, 2022 and 2021, for Ernst & Young LLP.

| | | | | | | | |

| Fiscal Year 2022 | Fiscal Year 2021 |

| Audit fees (1) | $ | 1,193,320 | | $ | 905,000 | |

| All other fees (2) | $ | 5,200 | | $ | 2,710 | |

| Total fees | $ | 1,198,520 | | $ | 907,710 | |

(1)Audit fees consist of fees for professional services provided in connection with the audits of our annual consolidated financial statements and our internal control over financial reporting, the reviews of our quarterly consolidated financial statements, and audit services that are normally provided by independent registered public accounting firms in connection with statutory and regulatory filings or engagements for those fiscal years, such as statutory audits.

(2)All other fees consist of fees for access to online accounting and tax research software and examination fees for the Department of Insurance for one of our subsidiaries.

Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services

Our audit committee generally pre-approves all audit and permissible non-audit services provided by the independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. Pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. The independent registered public accounting firm and management are required to periodically report to the audit committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date. Our audit committee may also pre-approve particular services on a case-by-case basis. All of the services relating to the fees described in the table above were pre-approved by our audit committee.

Report of the Audit Committee

The information contained in the following report of the audit committee is not considered to be “soliciting material”, “filed” or incorporated by reference in any past or future filing by us under the Securities Exchange Act of 1934 or the Securities Act of 1933 unless and only to the extent that we specifically incorporate it by reference.

The audit committee of the Board of Directors of Trupanion, Inc. (the "Company") has reviewed and discussed with the Company's management and Ernst & Young LLP the Company's audited consolidated financial statements as of and for the year ended December 31, 2022. The audit committee has also discussed with Ernst & Young LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (PCAOB) and the Securities and Exchange Commission.

The audit committee has received and reviewed the written disclosures and the letter from Ernst & Young LLP required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the audit committee concerning independence, and has discussed with Ernst & Young LLP its independence.

Based on the review and discussions referred to above, the audit committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company's annual report on Form 10-K for the year ended December 31, 2022 for filing with the Securities and Exchange Commission.

| | |

| Submitted by the Audit Committee |

| Jacqueline Davidson, Chair |

| Michael Doak |

| Howard Rubin |

Executive Officers

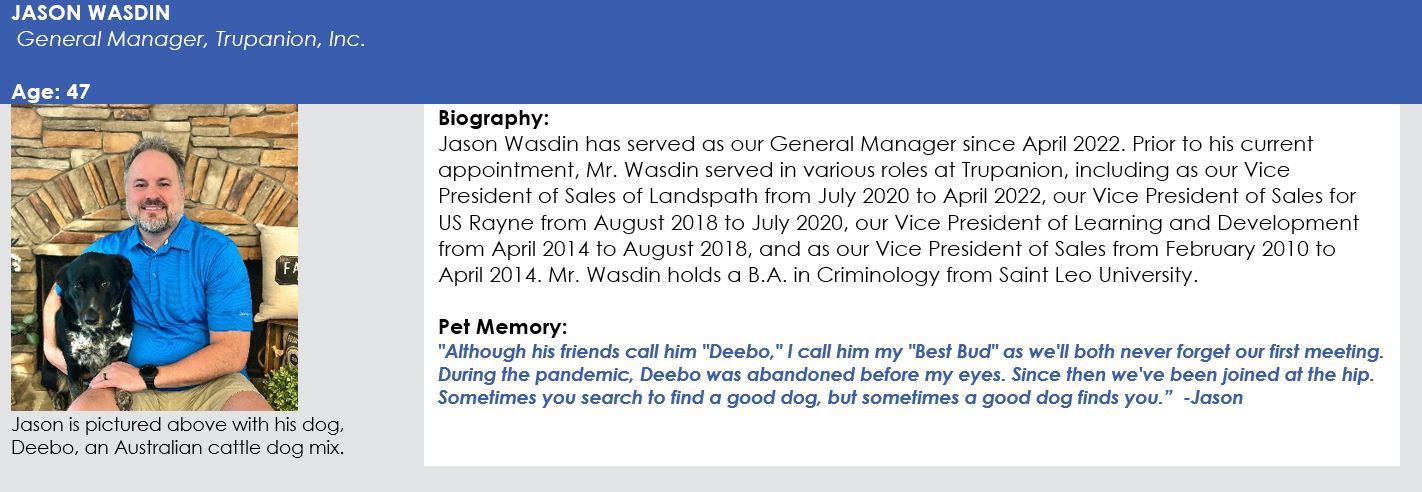

The following sets forth information regarding our executive officers, including their respective ages and positions as of the record date. Biographical information pertaining to Mr. Rawlings, who is both an executive officer and director of the Company, can be found in the Section titled "Our Board of Directors - Our Director Nominees." There are no family relationships among any of our directors or executive officers.

| | | | | | | | |

| Name | Age | Title |

| Darryl Rawlings | 53 | Chief Executive Officer, Director, and Chairperson of the Board of Directors |

| Andrew "Drew" Wolff | 52 | Chief Financial Officer |

| Margaret "Margi" Tooth | 44 | President |

| Brenna McGibney | 54 | Chief Administrative Officer |

| Emily Dreyer | 35 | Senior Vice President, Channels |

| Dr. Steve Weinrauch | 48 | Executive Vice President, North America and Veterinary Strategy |