UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES |

| | EXCHANGE ACT OF 1934 |

| | For the fiscal year ended April 30, 2008 |

Commission file number 000-52747

HENIX RESOURCES, INC.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation or organization)

19 West 60thAvenue

Vancouver, British Columbia

Canada V5X 1Z3

(Address of principal executive offices, including zip code.)

(778) 322-3191

(Registrant's telephone number, including area code)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.[ ] Yes No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act:[X] Yes No [ ]

Indicate by check mark whether the registrant(1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 day.[X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy ir information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 if the Exchange Act.

| Large Accelerated filer | [ | ] | Accelerated filer [ ] |

| Non-accelerated filer | [ | ] | Smaller reporting company [X] |

| (Do not check if a smaller reporting company) | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).[X] Yes [ ] No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as ofApril 30, 2008: $0.00.

| TABLE OF CONTENTS |

| |

| PART I | | Page |

| |

| Item 1. | Business. | 3 |

| Item 1A. Risk Factors. | 14 |

| Item 1B. Unresolved Staff Comments. | 15 |

| Item 2. | Properties. | 15 |

| Item 3. | Legal Proceedings. | 15 |

| Item 4. | Submission of Matters to a Vote of Security Holders. | 15 |

| |

| PART II | | |

| |

| Item 5. | Market For Common Stock and Related Stockholder Matters. | 15 |

| Item 6. | Selected Financial Data | 17 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition or Plan of | 17 |

| | Operation. | |

| |

| PART III | | |

| |

| Item 7A. Quantitative and Qualitative Disclosures about Market Risk. | 22 |

| Item 8. | Financial Statements and Supplementary Data. | 22 |

| Item 9. | Changes In and Disagreements With Accountants on Accounting and Financial | 33 |

| | Disclosure | |

| Item 9A. Controls and Procedures | 33 |

| Item 9B. Other Information | 35 |

| Item 10. | Directors, Executive Officers, Promoters and Control Persons; Compliance with | 36 |

| Section 16(a) of the Exchange Act | |

| Item 11. | Executive Compensation | 39 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management | 40 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 41 |

| |

| PART IV | | |

| |

| Item 14. | Principal Accountant Fees and Services. | 42 |

| Item 15. | Exhibits, Financial Statement Schedules. | 43 |

- 2 -

PART I

ITEM 1. BUSINESS

General

We were incorporated on January 26, 2006. We are an exploration stage corporation. An exploration stage corporation is one engaged in the search from mineral deposits or reserves which are not in either the development or production stage. We intend to conduct exploration activities on one property. Record title to the property upon which we intend to conduct exploration activities is not held in our name. Record title to the property is recorded in the name of James Shao, our president. We conducted sampling and testing activities during the year on one property located in the Province of British Columbia, Canada, and the result was less than ideal for us to conduct any further exploration work on the property, which consists of 20 mining claims. We intend to find and acquire other mineral properties to explore for gold.

We have no plan to change our business activities or to combine with another business, and are not aware of any events or circumstances that might cause us to change our plans.

Background

In January 2006, Mr. Shao, our president and a member of the board of directors acquired one mineral property containing 20 mining claims in British Columbia, Canada by arranging the staking of the same through James McLeod, a non affiliated third party. Mr. McLeod is a self-employed contract staker and field worker residing in Vancouver, British Columbia.

We have no revenues, have achieved losses since inception, have no operations, have been issued a going concern opinion and rely upon the sale of our securities and loans from our officers and directors to fund operations.

We have no plans to change our business activities or to combine with another business, and are not aware of any events or circumstances that might cause us to change our plans.

Canadian jurisdictions allow a mineral explorer to claim a portion of available Crown lands as its exclusive area for exploration by depositing posts or other visible markers to indicate a claimed area. The process of posting the area is known as staking. Mr. Shao paid Mr. McLeod approximately $3,500 to stake the claims. The claims were recorded in Mr. Shao’s name to avoid incurring additional costs at this time. The additional fees would be for incorporation of a British Columbia corporation and legal and accounting fees related to the incorporation. On January 30, 2006, Mr. Shao executed a declaration of trust acknowledging that he holds the property in trust for us and he will not deal with the property in any way, except to transfer the property to us. In the event that Mr. Shao transfers title to a third party, the declaration of trust will be used as evidence that he breached his fiduciary duty t o us. Mr. Shao has not provided us with a signed or executed bill of sale in our favor. Mr. Shao will issue a bill of sale to a subsidiary corporation to be formed by us should mineralized material be discovered on the property. Mineralized material is a mineralized body, which has been delineated by appropriate spaced drilling or underground sampling to support sufficient tonnage and average grade of metals to justify removal.

- 3 -

Under British Columbia law title to British Columbia mining claims can only be held by British Columbia residents. In the case of corporations, title must be held by a British Columbia corporation. In order to comply with the law we would have to incorporate a British Columbia wholly owned subsidiary corporation and obtain audited financial statements. We believe those costs would be a waste of our money at this time.

In the event that we find mineralized material and the mineralized material can be economically extracted, we will form a wholly owned British Columbia subsidiary corporation and Mr. Shao will convey title to the property to the wholly owned subsidiary corporation. Should Mr. Shao transfer title to another person and that deed is recorded before we record our documents, that other person will have superior title and we will have none. If that event occurs, we will have to cease or suspend operations. However, Mr. Shao will be liable to us for monetary damages for breaching the terms of his oral agreement with us to transfer his title to a subsidiary corporation we create. To date we have performed certain work on the property. All Canadian lands and minerals which have not been granted to private persons are owned by either the federal or provincial governments in the name of Her Majesty Elizabeth II. Ungra nted minerals are commonly known as Crown minerals. Ownership rights to Crown minerals are vested by the Canadian Constitution in the province where the minerals are located. In the case of our property, that is the province of British Columbia.

In the 19thcentury the practice of reserving the minerals from fee simple Crown grants was established. Legislation now ensures that minerals are reserved from Crown land dispositions. The result is that the Crown is the largest mineral owner in Canada, both as the fee simple owner of Crown lands and through mineral reservations in Crown grants. Most privately held mineral titles are acquired directly from the Crown. Our property is one such acquisition. Accordingly, fee simple title to our property resides with the Crown.

Our claims are mining leases issued pursuant to the British Columbia Mineral Act. The lessee has exclusive rights to mine and recover all of the minerals contained within the surface boundaries of the lease continued vertically downward.

The property is unencumbered and there are no competitive conditions which affect the property. Further, there is no insurance covering the property and we believe that no insurance is necessary since the property is unimproved and contains no buildings or improvements.

To date we have performed certain work on the property, revealing less than ideal feasibility of continuing further exploration work on the property.

There are no native land claims that affect title to the existing property. We have no plans to try interest other companies in the property. We intend to find and acquire other mineral properties for exploration; however, no acquisition has materialized as of the date of this report.

- 4 -

Claims

The following is a list of tenure numbers, claim, date of recording and expiration date of our claims:

| | | Date of | Date of |

| Tenure No. | Document Description | Recording | Expiration |

| |

| 526668 | HRI | January 30, 2006 | January 30, 2009 |

In order to maintain these claims we must pay a fee of CDN$1,820 per year for the tenure.

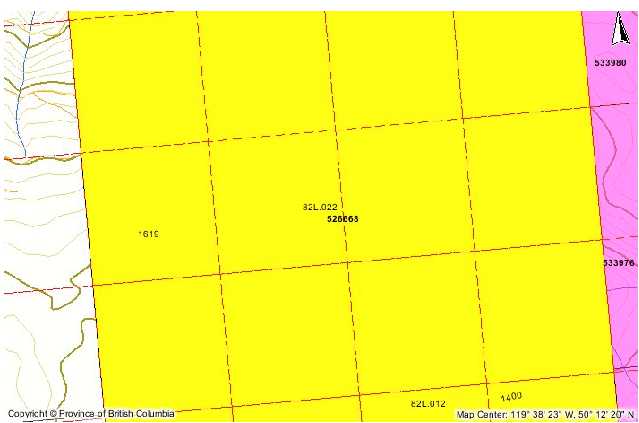

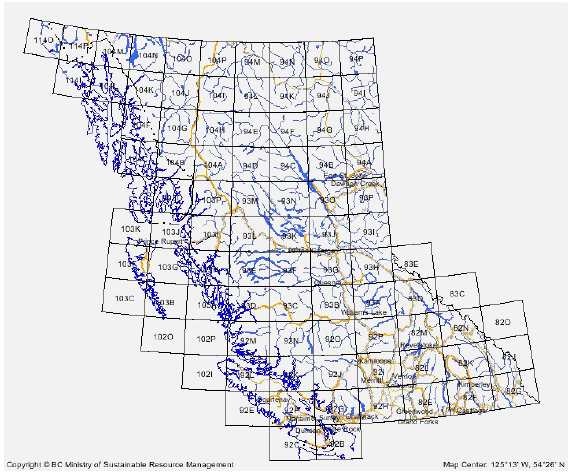

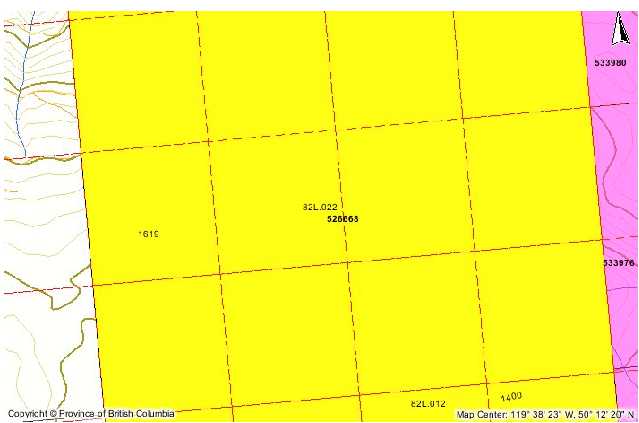

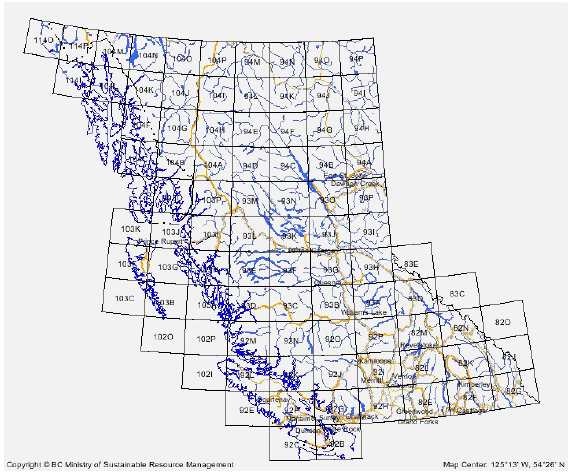

Location and Access

The HRI property is a mineral claim of 20 contiguous cells comprising a total of 1,022 acres and may be located on the NTS map sheets, 82L/4E. At the center of the property the latitude is 50' 13'=N and the longitude is 119' 40"W. The claim is located in the Okanagan Lake West area and is situated 20 airmiles (29 miles by good all weather, paved and gravel road) southwest of the City of Vernon, British Columbia, Canada.

The property is accessible by traveling southwest of Vernon, British Columbia, along the Okanagan Lake westside road for 15 miles on a good all weather, paved road to the confluence of Whiteman Creek and Okanagan Lake. An all-weather, gravel road is then taken for 11 miles to the west along the Whiteman Creek valley and then south for 3 miles along the southerly trending Hooknose Creek logging road to the center of the HRI mineral claim.

- 5 -

MAP 1

- 6 -

MAP 2

- 7 -

Physiography

The property is accessible by traveling southwest of Vernon, British Columbia, along the Okanagan Lake westside road for 15 miles on a good all weather, paved road to the confluence of Whiteman Creek and Okanagan Lake. An all-weather, gravel road is then taken for 11 miles to the west along the Whiteman Creek valley and then south for 3 miles along the southerly trending Hooknose Creek logging road to the center of the HRI mineral claim.

The HRI property lies within the Interior Dry Belt biotic zone and experiences about 15" of precipitation annually of which about 25% may occur as a snow equivalent. The summers can experience hot weather while the winters are generally mild and last from December through March.

Much of the Thompson Plateau area hosts patchy conifer cover of Ponderosa pine and Douglas fir mingled with open range and deciduous groves of aspen and poplar. The general area supports an active logging industry. Mining holds an historical and contemporary place in the development and economic well being of the area.

The City of Vernon, British Columbia which lies 29 miles by road northeast of the HRI mineral claim offers much of the necessary infrastructure required to base and carry-out an exploration program (accommodations, communications, equipment and supplies).

The property is located in the southern part of the Thompson Plateau above the westside of Okanagan Lake. The claim area ranges in elevation from 3,500 feet to 5,000 feet mean sea level. The physiographic setting of the property can be described as rounded, mountainous plateau terrain that has been surficially altered both by the erosional and depositional (drift cover) effects of glaciations. Thickness of drift cover in the valleys may vary considerably.

Property Geology

The geology of the HRI property area may be described as being underlain by intrusive rock unit of the Coast intrusions of Jurassic-Cretaceous age. They may be granite to grandiosity in composition. The next youngest observed units are the Cretaceous to Tertiary aged intrusive crystalline rocks of granitic to syenitic composition. The youngest rock units observed in the property area are Kamloops Group units of Tertiary (Oligocene or Miocene) age. These units occur as inter-layered volcanic flows and sediments. These rock units may be composed of basaltic lavas and flow breccias, minor hyalite lava and breccias, local sandstone, shale, conglomerate and coal.

Some or all of these units may be found to host economic mineralization. The property setting offers good underlying possibilities and all overburden areas should be checked if a field program is undertaken.

- 8 -

Mineralization

Mr. James W. McLeod, P.Geo., has observed in places within the general area pyrite-pyrrhotite-chalcopyrite mineralization as mesothermal replacements or vein-type of occurrences. These occurrences were found in volcanic flow hosts, but could occur in medium grain-sized intrusive rock units within steeply dipping to vertical fissure/fault zones with some dissemination in the adjacent wall-rock. Alteration accompanying the pyritization was observed as epidote-chlorite-calcite or a propylitic assemblage. The fault/fracture zones should be 10s of feet wide and 100s of feet in length and generally trend northerly (west or east). The gold quartz type mineralization may be of an epithermal origin, lower temperature and possibly with a carbonate accessory and be peripheral to a higher t emperature porphyry stockwork system.

History of Previous Work

The recorded mining history of the general area to the west of Okanagan lake dates from the turn of the century at which time the area was explored for placer gold. Some minor placer gold production was attained during the period 1889-1895. Creeks in the area that produced minor amounts of placer gold are Bouleau, Equisis, Naswhito and Whiteman. Of general interest is the lack of or only minor amounts of placer gold reported occurring on the eastside of the Okanagan valley.

Lode gold was first mentioned in the historical record for the general area about the turn of the century without more than prospecting interest until the 1930's, during the Great Depression. Two local discoveries a few miles to the south of the claim area, the White Elephant (Yellow Rose) and the Zion received some basic trenching and in the case of the White Elephant a small mill was constructed on site and some small shipments of concentrates were made to the smelter.

During the 1960's major mining companies undertook regional silt sampling programs in search of the porphyry copper-molybdenum deposits which lead to the discovery of several molybdenite-bearing siliceous stockwork prospects. The most notable being the Wood and the Whit prospects.

During the mid-1980's, Huntington Resources Ltd. optioned and worked on the Brett precious metal occurrence found on the northside of Whiteman Creek, approximately 3 miles northwest of the HRI property. The exploration involved geological work, drilling and carrying out an underground exploration drifting program to try and test the gold-bearing vein system. The drift was apparently stopped short of the projected target area. In 2004 a junior mineral exploration company undertook a surface diamond core drilling program that reportedly intersected the vein below the exploration drift level.

History of Our Exploration Activities

There is limited historical financial information about us upon which to base an evaluation of our performance. We are an exploration-stage corporation and have not generated any revenues from operations. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays in the exploration of our properties, and possible cost overruns due to price and cost increases in services.

- 9 -

To become profitable and competitive, we must find and acquire other mineral properties for further exploration. We are planning to seek additional equity financing to provide for the capital required to acquire other mineral properties.

We have no assurance that future financing will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to continue, develop or expand our operations. Equity financing could result in additional dilution to existing shareholders.

Supplies

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, such as dynamite, and certain equipment such as bulldozers and excavators that we might need to conduct exploration. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. We will attempt to locate products, equipment and materials after this offering is complete. If we cannot find the products and equipment we need, we will have to suspend our exploration plans until we do find the products and equipment we need.

Description of Property

Other than our interest in the property, we own no plants or other property. With respect to the property, our right to conduct exploration activity is based upon our oral agreement with Mr. Shao, our president, director and shareholder. Under this oral agreement, Mr. Shao has allowed us to conduct exploration activity on the property. Mr. Shao holds the property in trust for us pursuant to a declaration of trust dated January 30, 2006.

Our Proposed Exploration Program

We are a start-up, exploration-stage corporation and have not yet generated or realized any revenues from our business operations. We raised $100,900 from our public offering and issued 1,000,900 common shares at $0.10 per share on November 16, 2006. We believe that further financing (either debt or equity financing) are required for us to acquire other mineral properties.

Because the results of our exploration program on the existing property appeared to be less than ideal, we intend to acquire other mineral properties; however, no acquisition has been materialized as of this report. We are not going to buy or sell any plant or significant equipment during the next twelve months.

Our exploration target is to find and acquire other properties containing gold. Our success depends upon finding mineralized material from such acquired properties. This includes a determination by our consultant if the property contains reserves. Although we have successfully raised additional capital in 2006, we must find and acquire other mineral properties for further exploration.

- 10 -

Mineralized material is a mineralized body, which has been delineated by appropriate spaced drilling or underground sampling to support sufficient tonnage and average grade of metals to justify removal. If we don’t find mineralized material or we cannot remove mineralized material, either because we do not have the money to do it or because it is not economically feasible to do it, we will cease operations and you will lose your investment. In addition, we may not have enough money to complete our whole exploration program of any property we are going to find and acquire. If it turns out that we have not raised enough money to complete our acquisition and / or further exploration program, we will try to raise additional funds from a second public offering, a private placement or loans. At the present time, we have not made any plans to raise additional money and there is no assurance that we would be able to raise additional money in the future. If we need additional money and can raise it, we will have to suspend or cease operations.

We must find and acquire other mineral properties and conduct exploration to determine what amount of minerals, if any, exist on such properties and if any minerals which are found can be economically extracted and profitably processed. However, as of the date of this report, no acquisition has been materialized.

The existing property is undeveloped raw land. Results of the sampling and testing program undertaken on the property appeared to be less than ideal to warrant further exploration.

We do not know if we find mineralized materials in other mineral properties that we are currently trying to find and acquire.

We do not claim to have any minerals or reserves whatsoever at this time on any of the property.

We implemented an exploration program on the existing property in the current year, which consisted of core sampling. Core sampling is the process of drilling holes to a depth of up to 300 feet in order to extract a sample of earth. Mr. Shao did not receive fees for his services when such exploration program was performed. The samples were tested to determine if mineralized material is located on the property. Based upon the tests of the core samples, we determined not to proceed with additional exploration of the existing property and to find and acquire other mineral properties. The proceeds from our public offering remaining after the exploration program will be designed to only fund the costs of further acquisition of other mineral proeprties. We have taken our core samples to analytical chemists, geochemists and registered assayers located in Vancouver, British Columbia. Our consultant, Diamond S. Holdings Ltd., has made selections when performing surface work including a reconnaissance, prospecting, and sampling program to further confirm our exploration opportunities for the mineral property. The sampling and testing program revealed less than ideal results for us to warrant further exploration work. The cost of this sampling and testing program was $2,100.

If we are unable to find and acquire other mineral properties or to undertake any further exploration because we don't have enough money, we will cease operations until we raise more money. If we can't or don't raise more money, we will cease operations. If we cease operations, we don't know what we will do and we don't have any plans to do anything.

- 11 -

We do not intend to hire additional employees at this time. All of the work on the property will be conducted by unaffiliated independent contractors that we will hire. The independent contractors will be responsible for surveying, geology, engineering, exploration, and excavation. The geologists will evaluate the information derived from the exploration and excavation and the engineers will advise us on the economic feasibility of removing the mineralized material.

Competitive Factors

The gold mining industry is fragmented, that is there are many, many gold prospectors and producers, small and large. We do not compete with anyone. That is because there is no competition for the exploration or removal of minerals from the property. We will either find gold on the property or not. If we do not, we will cease or suspend operations. We are one of the smallest exploration companies in existence. We are an infinitely small participant in the gold mining market. Readily available gold markets exist in Canada and around the world for the sale of gold. Therefore, we will be able to sell any gold that we are able to recover.

Regulations

Our mineral exploration program is subject to the Canadian Mineral Tenure Act Regulation. This act sets forth rules for

| | * | locating claims |

| * | posting claims |

| * | working claims |

| * | reporting work performed |

We are also subject to the British Columbia Mineral Exploration Code which tells us how and where we can explore for minerals. We must comply with these laws to operate our business. Compliance with these rules and regulations will not adversely affect our operations.

Environmental Law

We are also subject to the Health, Safety and Reclamation Code for Mines in British Columbia. This code deals with environmental matters relating to the exploration and development of mining properties. Its goals are to protect the environment through a series of regulations affecting:

| | 1. | Health and Safety |

| 2. | Archaeological Sites |

| 3. | Exploration Access |

We are responsible to provide a safe working environment, not disrupt archaeological sites, and conduct our activities to prevent unnecessary damage to the property.

- 12 -

We will secure all necessary permits for exploration and, if development is warranted on the property, will file final plans of operation before we start any mining operations. We anticipate no discharge of water into active stream, creek, river, lake or any other body of water regulated by environmental law or regulation. No endangered species will be disturbed. Restoration of the disturbed land will be completed according to law. All holes, pits and shafts will be sealed upon abandonment of the property. It is difficult to estimate the cost of compliance with the environmental law since the full nature and extent of our proposed activities cannot be determined until we start our operations and know what that will involve from an environmental standpoint.

We are in compliance with the Health, Safety and Reclamation Code for Mines in British Columbia and will continue to comply with the Health, Safety and Reclamation Code for Mines in British Columbia in the future. We believe that compliance with this code will not adversely affect our business operations in the future.

Exploration stage companies have no need to discuss environmental matters, except as they relate to exploration activities. The only "cost and effect" of compliance with environmental regulations in British Columbia is returning the surface to its previous condition upon abandonment of the property. We believe the cost of reclaiming the property will be $0 because the existing property has not been explored in full scale and only small sampling and testing was done on the property. We have not allocated any funds for the reclamation of any property we own or to be acquired and the proceeds for the cost of reclamation will not be paid from the proceeds of the offering. Mr. Shao has agreed to pay the cost, if any, of reclaiming the property should the cost of such reclamation cost was levied.

Employees

We intend to use the services of subcontractors for manual labor exploration work on our properties.

Employees and Employment Agreements

At present, we have no full-time employees. Our two officers and directors are part-time employees and each will devote about 10% of their time or four hours per week to our operation. Our officers and directors do not have employment agreements with us. We presently do not have pension, health, annuity, insurance, stock options, profit sharing or similar benefit plans; however, we may adopt plans in the future. There are presently no personal benefits available to our officers and directors. Mr. Shao will handle our administrative duties. Because our officers and directors are inexperienced with exploration, they will hire qualified persons to perform the surveying, exploration, and excavating of the property. As of today, we have not looked for or talked to any geologists or engineers who will perform work for us in the future. We do not intend to do so until we complete this offering.

ITEM 1A. RISK FACTORS

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

- 13 -

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

We do not own any property. We only have the right to explore one property, title of which is not vested in our name.

ITEM 3. LEGAL PROCEEDINGS

We are not presently a party to any litigation.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

During the fourth quarter, there were no matters submitted to a vote of our shareholders.

PART II

| ITEM 5. | MARKET FOR COMMON STOCK AND RELATED STOCKHOLDERMATTERS |

Our shares are traded on the Bulletin Board operated by the National Association of Securities Dealers, Inc. under the symbol HENX. A summary of trading by quarter for the 2008 and 2007 fiscal years is as follows:

| Fiscal Quarter | High Bid | Low Bid |

| 2008 | | |

| Second Quarter 02-01-08 to 04-30-08 | $0.00 | $0.00 |

| First Quarter 11-01-07 to 01-30-08 | $0.00 | $0.00 |

| 2007 | | |

| Fourth Quarter 08-01-07 to 10-31-07 | $0.00 | $0.00 |

| Third Quarter 05-01-07 to 07-31-07 | $0.00 | $0.00 |

| Second Quarter 02-01-07 to 04-30-07 | $0.00 | $0.00 |

| First Quarter 11-01-06 to 01-30-07 | $0.00 | $0.00 |

| 2006 | | |

| Fourth Quarter 08-01-06 to 10-31-06 | $0.00 | $0.00 |

| Third Quarter 05-01-06 to 07-31-06 | $0.00 | $0.00 |

Of the 2,009,000 shares of common stock outstanding as of April 30, 2008, 1,000,000 shares are owned by our officers and directors and may only be resold in compliance with Rule 144 of the Securities Act of 1933.

At April 30, 2008, there were 46 shareholders of record.

- 14 -

Status of our public offering

On September 11, 2006, the Securities and Exchange Commission declared our Form SB-2 Registration Statement effective, file number 333-136688, permitting us to offer up to 2,000,000 shares of common stock at $0.10 per share. There was no underwriter involved in our public offering.

On November 16, 2006, we completed our public offering by raising $100,900. We sold 1,000,900 shares of our common stock at an offering price of $0.10 per share, to 44 persons. Since then, we have spent the proceeds as follows:

| Description | Amount ($) |

| Accounting and audit | $ | 15,746 |

| Legal fees | $ | 17,386 |

| Exploration work | $ | 2,100 |

| Transfer agent and filing fees | $ | 16,713 |

| Other general and administrative expenses | $ | 3,902 |

Dividends

We have not declared any cash dividends, nor do we intend to do so. We are not subject to any legal restrictions respecting the payment of dividends, except that they may not be paid to render us insolvent. Dividend policy will be based on our cash resources and needs and it is anticipated that all available cash will be needed for our operations in the foreseeable future.

Section Rule 15(g)of the Securities Exchange Act of 1934

Our shares are covered by section 15(g) of the Securities Exchange Act of 1934, as amended, and Rules 15g-1 through 15g-6, and 15g-9 promulgated thereunder. They impose additional sales practice requirements on broker/dealers who sell our securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses).

Rule 15g-1 exempts a number of specific transactions from the scope of the penny stock rules.

Rule 15g-2 declares unlawful broker/dealer transactions in penny stocks unless the broker/dealer has first provided to the customer a standardized disclosure document.

Rule 15g-3 provides that it is unlawful for a broker/dealer to engage in a penny stock transaction unless the broker/dealer first discloses and subsequently confirms to the customer current quotation prices or similar market information concerning the penny stock in question.

Rule 15g-4 prohibits broker/dealers from completing penny stock transactions for a customer unless the broker/dealer first discloses to the customer the amount of compensation or other remuneration received as a result of the penny stock transaction.

- 15 -

Rule 15g-5 requires that a broker/dealer executing a penny stock transaction, other than one exempt under Rule 15g-1, disclose to its customer, at the time of or prior to the transaction, information about the sales persons compensation.

Rule 15g-6 requires broker/dealers selling penny stocks to provide their customers with monthly account statements.

Rule 15g-9 requires broker/dealers to approve the transaction for the customer’s account; obtain a written agreement from the customer setting forth the identity and quantity of the stock being purchased; obtain from the customer information regarding his investment experience; make a determination that the investment is suitable for the investor; deliver to the customer a written statement for the basis for the suitability determination; notify the customer of his rights and remedies in cases of fraud in penny stock transactions; and, the FINRA's toll free telephone number and the central number of the North American Administrators Association, for information on the disciplinary history of broker/dealers and their associated persons.

The application of the penny stock rules may affect your ability to resell your shares.

Securities authorized for issuance under equity compensation plans

We do not have any equity compensation plans and accordingly we have no securities authorized for issuance thereunder.

ITEM 6. SELECTED FINANCIAL DATA

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

This section of the report includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this report. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions.

Plan of Operation

We are a start-up, exploration-stage corporation and have not yet generated or realized any revenues from our business operations. We have completed our public offering and raised $100,900. We believe that the additional cash flows are sufficient for us to meet our routine operational needs in the next twelve months. However, additional financing may be required for us to acquire other mineral properties.

- 16 -

We will be conducting research in the form of exploration of any other mineral properties we may find and acquire in the future. Our exploration program on existing property was explained in as much detail as possible in the business section of our prospectus filed with the U.S. Securities and Exchange Commission on September 13, 2006. We are not going to buy or sell any plant or significant equipment during the next twelve months.

The existing property is accessible by traveling southwest of Vernon, British Columbia, along the Okanagan Lake westside road for 15 miles on a good all weather, paved road to the confluence of Whiteman Creek and Okanagan Lake. An all weather, gravel road is then taken for 11 miles to the west along the Whiteman Creek valley and then south for 3 miles along the southerly trending Hooknose Creek logging road to the center of the HRI mineral claim.

Our exploration target is to find and acquire other mineral properties containing gold. Our success depends upon finding mineralized material. This includes a determination by our consultant if the property contains reserves. We raised capital for exploration activities which were conducted in the current year. We selected and engaged a consultant, Diamond S. Holdings Ltd., to perform surface work in the existing property including reconnaissance, prospecting, and a sampling program to further confirm ourexploration opportunities in the mineral property. However, the results of the work appeared to be less than ideal.

Mineralized material is a mineralized body, which has been delineated by appropriate spaced drilling or underground sampling to support sufficient tonnage and average grade of metals to justify removal. If we don' t find mineralized material or we cannot remove mineralized material, either because we do not have the money to do it or because it is not economically feasible to do it, we will cease operations and you will lose your investment. In addition, we may not have enough money to complete our whole exploration program of any property we are going to find and acquire. If it turns out that we have not raised enough money to complete our acquisition and / or further exploration program, we will try to raise additional funds from a second public offering, a private placement or loans. At the present time, we have not made any plans to raise additional money and there is no assurance that we would be able to raise additional money in the future. In we need additional money and can’t raise it, we will have to suspend or cease operations.

We conducted a sampling and testing program to determine what amount of minerals, if any, exist on our properties and if any minerals which are found can be economically extracted and profitably processed. The results revealed that further exploration may not be warranted and feasible in economic terms.

The property is undeveloped raw land. To our knowledge, the property has never been mined. Our exploration program results were not favorable and we decided not to perform further exploration on the existing property and must find and acquire other mineral properties for further exploration to find mineralized material.

We do not know if we will find and acquire other mineral properties containing mineralized material.

- 17 -

We do not claim to have any minerals or reserves whatsoever at this time on any of the property.

We have implemented an exploration program on the existing property in the current year, which consisted of core sampling. Core sampling is the process of drilling holes to a depth of up to 300 feet in order to extract a sample of earth. Mr. Shao did not receive fees for his services when such exploration program was performed. The samples were tested to determine if mineralized material is located on the property. Based upon the tests of the core samples, we have determined not to proceed with additional exploration of the existing property and to find and acquire other mineral properties. The proceeds from our public offering remaining after such exploration program will be designed to only fund the costs of further acquisition of other mineral proeprties. We have taken our core samples to analytical chemists, geochemists and registered assayers located in Vancouver, British Columbia. Our consultant, Diam ond S. Holdings Ltd., has made selections when performing surface work including a reconnaissance, prospecting, and sampling program to further confirm our exploration opportunities for the mineral property. The sampling and testing program revealed less than ideal results for us to warrant further exploration work. The cost of this sampling and testing program was $2,100.

If we are unable to find and acquire other mineral properties or to undertake any further exploration because we don't have enough money, we will cease operations until we raise more money. If we can't or don't raise more money, we will cease operations. If we cease operations, we don't know what we will do and we don't have any plans to do anything.

We do not intend to hire additional employees at this time. All of the work on the property will be conducted by unaffiliated independent contractors that we will hire. The independent contractors will be responsible for surveying, geology, engineering, exploration, and excavation. The geologists will evaluate the information derived from the exploration and excavation and the engineers will advise us on the economic feasibility of removing the mineralized material.

Limited Operating History

There is limited historical financial information about us upon which to base an evaluation of our performance. We are an exploration-stage corporation and have not generated any revenues from operations. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays in the exploration of our properties, and possible cost overruns due to price and cost increases in services.

To become profitable and competitive, we must find and acquire other mineral properties and conduct into more comprehensive research and exploration of such properties before we start production of any minerals we may find.

Results of Operations

We raised $100,900 from our public offering. Of the proceeds, we have spent $ 55,847.

We intend to acquire other mineral properties domestically or overseas. However, no such acquisition has materialized as of the date of this report.

- 18 -

Liquidity and Capital Resources

To meet our need for cash we raised $100,900 from our public offering. As of April 30, 2008, we have $35,483 in cash available. If we find mineralized material and it is economically feasible to remove the mineralized material, we will attempt to raise additional money through a subsequent private placement, public offering or through loans. If we do not raise enough money to complete our exploration of the property, we will have to find alternative sources, like a second public offering, a private placement of securities, or loans from our officers or others.

We acquired the rights to conduct exploration on one property containing 20 cells. As of the date of this report we have yet to generate any revenues.

Since inception and up to April 30, 2008, we have issued 2,009,000 shares of our common stock and received $100,910.

In January 2006, we issued 1,000,000 shares of common stock pursuant to the exemption from registration set forth in section 4(2) of the Securities Act of 1933. In November 2006, we issued 1,009,000 shares of common stock pursuant to our registration statement. The purchase price of the shares issued in January and November were $10 and $100,900, respectively. Both were accounted for as acquisitions of shares. James Shao covered our initial expenses covering incorporation, accounting and legal fees, and other operating expenses of $32,054 and $3,500 for staking, for a total of $35,554, all of which was paid directly to our staker, attorney, accountant, and other vendors. During the quarter ended July 31, 2007, $10,000 was repaid to Mr. Shao. The amount owed to Mr. Shao is non-interest bearing, unsecured and due on demand. Further the agreement with Mr. Shao is oral and there is no written document evidencin g the agreement.

As of April 30, 2008, our total current assets were $35,483 and our total current liabilities were $25,554, for a working capital balance of $9,929.

Recent accounting pronouncements

In May 2008, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 163, “Accounting for Financial Guarantee Insurance Contracts – An interpretation of FASB Statement No. 60”. SFAS No. 163 requires that an insurance enterprise recognize a claim liability prior to an event of default when there is evidence that credit deterioration has occurred in an insured financial obligation. It also clarifies how Statement 60 applies to financial guarantee insurance contracts, including the recognition and measurement to be used to account for premium revenue and claim liabilities, and requires expanded disclosures about financial guarantee insurance contracts. It is effective for financial statements issued for fiscal years beginning after December 15, 2008, except for some disclosures about the insurance enterprise’s risk-management activities. SFAS No. 163 requires that disclo sures about the risk-management activities of the insurance enterprise be effective for the first period beginning after issuance. Except for those disclosures, earlier application is not permitted. The adoption of this statement is not expected to have a material effect on the Company’s financial statements.

- 19 -

In May 2008, the FASB issued SFAS No. 162, “The Hierarchy of Generally Accepted Accounting Principles”. SFAS No. 162 identifies the sources of accounting principles and the framework for selecting the principles to be used in the preparation of financial statements of nongovernmental entities that are presented in conformity with generally accepted accounting principles in the United States. It is effective 60 days following the SEC’s approval of the Public Company Accounting Oversight Board amendments to AU Section 411, “The Meaning of Present Fairly in Conformity With Generally Accepted Accounting Principles”. The adoption of this statement is not expected to have a material effect on the Company’s financial statements.

In March 2008, the FASB issued SFAS No. 161, "Disclosures about Derivative Instruments and Hedging Activities". SFAS 161 requires companies with derivative instruments to disclose information that should enable financial-statement users to understand how and why a company uses derivative instruments, how derivative instruments and related hedged items are accounted for under FASB Statement No. 133 "Accounting for Derivative Instruments and Hedging Activities" and how derivative instruments and related hedged items affect a company's financial position, financial performance and cash flows. SFAS 161 is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008. The adoption of this statement is not expected to have a material effect on the Company's future financial position or results of operations.

In December 2007, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements - An amendment of ARB No. 51”.SFAS 160 requires companies with noncontrolling interests to disclose such interests clearly as a portion of equity but separate from the parent’s equity. The noncontrolling interest’s portion of net income must also be clearly presented on the Income Statement. SFAS 160 is effective for financial statements issued for fiscal years beginning after December 15, 2008. The adoption of this statement is not expected to have a material effect on the Company's future financial position or results of operations.

In September 2006, FASB issued Statement 157, Fair Value Measurements. This statement defines fair value and establishes a framework for measuring fair value in generally accepted accounting principles (GAAP). More precisely, this statement sets forth a standard definition of fair value as it applies to assets or liabilities, the principle market (or most advantageous market) for determining fair value (price), the market participants, inputs and the application of the derived fair value to those assets and liabilities. The effective date of this pronouncement is for all full fiscal and interim periods beginning after November 15, 2007. The Company adopted SFAS No. 157 as of February 1, 2008 and the adoption did not have an impact on the Company’s results of operations or financial condition.

In December 2007, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 141 (revised 2007), “Business Combinations”. SFAS 141 (R) applies the acquisition method of accounting for business combinations established in SFAS 141 to all acquisitions where the acquirer gains a controlling interest, regardless of whether consideration was exchanged. Consistent with SFAS 141, SFAS 141 (R) requires the acquirer to fair value the assets and liabilities of the acquiree and record goodwill on bargain purchases, with main difference the application to all acquisitions where control is achieved. SFAS 141 (R) is effective for financial statements issued for fiscal years beginning after December 15, 2008. The adoption of this statement is not expected to have a material effect on the Company's future financial position or results of operations.

- 20 -

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities”. SFAS No. 159 permits entities to choose to measure many financial instruments and certain other items at fair value that are not currently required to be measured at fair value. The objective is to improve financial reporting by providing entities with the opportunity to mitigate volatility in reported earnings caused by measuring related assets and liabilities differently without having to apply complex hedge accounting provisions. SFAS No. 159 also establishes presentation and disclosure requirements designed to facilitate comparisons between entities that choose different measurement attributes for similar types of assets and liabilities. SFAS No. 159 is effective for fiscal years beginning after November 15, 2007. The adoption of this statement is not expected to have a mater ial effect on the Company's future financial position or results of operations.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

Henix Resources, Inc.

(An Exploration Stage Company)

April 30, 2008

| | Index |

| |

| Report of Independent Registered Public Accounting Firm | F–1 |

| |

| Balance Sheets | F–2 |

| |

| Statements of Operations | F–3 |

| |

| Statements of Cash Flows | F–4 |

| |

| Statement of Stockholders’ Equity (Deficit) | F–5 |

| |

| Notes to the Financial Statements | F–6 |

- 21 -

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders of

Henix Resources, Inc.

(An Exploration Stage Company)

We have audited the accompanying balance sheets of Henix Resources, Inc. (An Exploration Stage Company) as of April 30, 2008 and 2007 and the related statements of operations, cash flows and stockholders’ equity (deficit) for the years then ended and accumulated from January 26, 2006 (Date of Inception) to April 30, 2008. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. An audit includes consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes assessing the accounting principles used and significant es timates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above, present fairly, in all material respects, the financial position of Henix Resources, Inc. (An Exploration Stage Company) as of April 30, 2008 and 2007, and the results of its operations and its cash flows for the years then ended and accumulated from January 26, 2006 (Date of Inception) to April 30, 2008 in conformity with accounting principles generally accepted in the United States.

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has not generated any revenue and has accumulated losses since inception and will need additional equity financing to begin realizing its business plan. These factors raise substantial doubt about the Company��s ability to continue as a going concern. Management’s plans in regard to these matters are also discussed in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

MANNING ELLIOTT LLP

Manning Elliott LLP

CHARTERED ACCOUNTANTS

Vancouver, Canada

July 17, 2008

F-1

- 22 -

| Henix Resources, Inc. | | | | |

| (An Exploration Stage Company) | | | | |

| Balance Sheets | | | | |

| (Expressed in U.S. dollars) | | | | |

| |

| |

| | April 30, | | April 30, | |

| | 2008 | | 2007 | |

| | $ | | $ | |

| |

| ASSETS | | | | |

| Current Assets | | | | |

| Cash | 35,483 | | 75,546 | |

| Total Assets | 35,483 | | 75,546 | |

| |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | |

| Current Liabilities | | | | |

| Due to related party (Note 3(a)) | 25,554 | | 35,554 | |

| Total Liabilities | 25,554 | | 35,554 | |

| | | | | |

| Contingencies (Note 1) | | | | |

| | | | | |

| Stockholders’ Equity | | | | |

| Preferred Stock, 100,000,000 shares authorized, $0.00001 par value; | | | | |

| None issued and outstanding | – | | – | |

| Common Stock, 100,000,000 shares authorized, $0.00001 par value; | | | | |

| 2,009,000 shares issued and outstanding | 20 | | 20 | |

| Additional paid-in capital | 100,890 | | 100,890 | |

| Donated capital (Note 3(b)) | 20,250 | | 11,250 | |

| Deficit accumulated during the exploration stage | (111,231 | ) | (72,168 | ) |

| Total Stockholders’ Equity | 9,929 | | 39,992 | |

| Total Liabilities and Stockholders’ Equity | 35,483 | | 75,546 | |

(The accompanying notes are an integral part of these financial statements)

F-2

- 23 -

| Henix Resources, Inc. | | | | | | |

| (An Exploration Stage Company) | | | | | | |

| Statements of Operations | | | | | | |

| (Expressed in U.S. dollars) | | | | | | |

| |

| |

| | | | | | Accumulated from | |

| | | | | | January 26, 2006 | |

| | Year Ended | | Year Ended | | (Date of Inception) | |

| | April 30, | | April 30, | | to April 30, | |

| | 2008 | | 2007 | | 2008 | |

| | $ | | $ | | $ | |

| |

| Revenue | – | | – | | – | |

| |

| Expenses | | | | | | |

| |

| General and administrative (Note 3(b)) | 36,963 | | 66,106 | | 105,631 | |

| Impairment of mineral property costs (Note 4) | – | | – | | 3,500 | |

| Mineral property costs | 2,100 | | – | | 2,100 | |

| |

| Total Expenses | 39,063 | | 66,106 | | 111,231 | |

| |

| Net Loss | (39,063 | ) | (66,106 | ) | (111,231 | ) |

| |

| Net Loss Per Share – Basic and Diluted | (0.02 | ) | (0.05 | ) | | |

| |

| Weighted Average Shares Outstanding | 2,009,000 | | 1,462,000 | | | |

(The accompanying notes are an integral part of these financial statements)

F-3

- 24 -

| Henix Resources, Inc. | | | | | | |

| (An Exploration Stage Company) | | | | | | |

| Statements of Cash Flows | | | | | | |

| (Expressed in U.S. dollars) | | | | | | |

| |

| | | | | | Accumulated from | |

| | | | | | January 26, 2006 | |

| | Year Ended | | Year Ended | | Date of Inception) | |

| | April 30, | | to April 30, | | to April 30, | |

| | 2008 | | 2007 | | 2008 | |

| | $ | | $ | | $ | |

| Operating Activities | | | | | | |

| Net loss | (39,063 | ) | (66,106 | ) | (111,231 | ) |

| Adjustments to reconcile net loss to net cash used in | | | | | | |

| operating activities: | | | | | | |

| Donated rent | 3,000 | | 3,000 | | 6,750 | |

| Donated services | 6,000 | | 6,000 | | 13,500 | |

| Impairment of mineral property costs | – | | – | | 3,500 | |

| Changes in operating assets and liabilities: | | | | | | |

| Prepaid expenses | – | | 10,000 | | – | |

| Due to related party | – | | 12,372 | | 26,064 | |

| Net Cash Used in Operating Activities | (30,063 | ) | (34,734 | ) | (61,417 | ) |

| Investing Activities | | | | | | |

| Mineral property costs | – | | – | | (3,500 | ) |

| Net Cash Used in Investing Activities | – | | – | | (3,500 | ) |

| Financing Activities | | | | | | |

| Advances from related party | – | | 5,000 | | (510 | ) |

| Repayment of related party loan | (10,000 | ) | – | | – | |

| Proceeds from issuance of common stock | – | | 100,900 | | 100,910 | |

| Net Cash Provided By Financing Activities | (10,000 | ) | 105,900 | | 100,400 | |

| Increase (Decrease) in Cash | (40,063 | ) | 71,166 | | 35,483 | |

| Cash - Beginning of Period | 75,546 | | 4,380 | | – | |

| Cash - End of Period | 35,483 | | 75,546 | | 35,483 | |

| Supplemental Disclosures | | | | | | |

| Interest paid | – | | – | | – | |

| Income taxes paid | – | | – | | – | |

(The accompanying notes are an integral part of these financial statements)

F-4

- 25 -

| Henix Resources, Inc. | | | | | | | | | | |

| (An Exploration Stage Company) | | | | | | | | | |

| Statement of Stockholders’ Equity (Deficit) | | | | | | | | | |

| For the period from January 26, 2006 (Date of Inception) to April 30, 2008 | | | | | | |

| (Expressed in U.S. dollars) | | | | | | | | | | |

| |

| |

| | | | | | | | Deficit | | | |

| | | | | | | | Accumulated | | | |

| | | | | | Additional | | During the | | | |

| | Preferred Stock | Common Stock | Paid-in | Donated | Exploration | | | |

| | Shares | Amount | Shares | Amount | Capital | Capital | Stage | | Total | |

| | # | $ | # | $ | $ | $ | $ | | $ | |

| |

| Balance – January 26, 2006 (Date | | | | | | | | | | |

| of Inception) | – | – | – | – | – | – | – | | | |

| |

| January 28, 2006 – common | | | | | | | | | | |

| shares issued for cash at $0.00001 | | | | | | | | | | |

| per share | – | – | 1,000,000 | 10 | – | – | – | | | |

| |

| Donated rent and services | – | – | – | – | – | | – | | 2,250 | |

| |

| Net loss for the period | – | – | – | – | – | – | (6,062 | ) | (6,062 | ) |

| Balance – April 30, 2006 | – | – | 1,000,000 | 10 | – | | (6,062 | ) | (3,802 | ) |

| |

| November 16, 2006 – common | | | | | | | | | | |

| shares issued for cash at $0.01 per | | | | | | | | | | |

| share | – | – | 1,009,000 | 10 | 100,890 | – | – | | 100,900 | |

| Donated rent and services | – | – | – | – | – | | – | | 9,000 | |

| Net loss for the year | – | – | – | – | – | – | (66,106 | ) | (66,106 | ) |

| Balance – April 30, 2007 | – | – | 2,009,000 | 20 | 100,890 | | (72,168 | ) | 39,992 | |

| Donated rent and services | – | – | – | – | – | | – | | 9,000 | |

| Net loss for the year | – | – | – | – | – | – | (39,063 | ) | (39,063 | ) |

| Balance – April 30, 2008 | – | – | 2,009,000 | 20 | 100,890 | | (111,231 | ) | 9,929 | |

(The accompanying notes are an integral part of these financial statements)

F-5

- 26 -

Henix Resources, Inc.

(An Exploration Stage Company)

Notes to the Financial Statements

April 30, 2007

(Expressed in U.S. dollars)

| 1. | Nature of Operations and Continuance of Business |

| |

| | The Company was incorporated in the State of Nevada on January 26, 2006. The Company is an Exploration Stage Company, as defined by Statement of Financial Accounting Standard (“SFAS”) No.7, “Accounting and Reporting by Development Stage Enterprises”. The Company’s principal business is the acquisition and exploration of mineral properties. The Company has not presently determined whether its properties contain mineral reserves that are economically recoverable. |

| |

| | These financial statements have been prepared on a going concern basis, which implies the Company will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has never generated revenues since inception and has never paid any dividends and is unlikely to pay dividends or generate earnings in the immediate or foreseeable future. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to obtain necessary equity financing to continue operations, confirmation of the Company’s interests in the underlying properties, and the attainment of profitable operations. As at April 30, 2008, the Company has never generated any revenues and has accumulated losses of $111,231 since inception. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern. |

| |

| | The Company filed an SB-2 Registration Statement (“SB-2”) with the United States Securities and Exchange Commission to register 2,000,000 shares of common stock for sale at $0.10 per share to raise cash proceeds of $200,000. The SB-2 was declared effective on September 11, 2006. On November 16, 2006, the Company issued 1,009,000 shares of common stock for proceeds of $100,900 pursuant to its SB-2. |

| |

| |

| 2. | Summary of Significant Accounting Policies |

| |

| | a) | Basis of Presentation |

| |

| | | These financial statements and related notes are presented in accordance with accounting principles generally accepted in the United States, and are expressed in U.S. dollars. The Company’s fiscal year-end is April 30. |

| |

| | b) | Use of Estimates |

| |

| | | The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. The Company regularly evaluates estimates and assumptions related to donated expenses and deferred income tax asset valuation allowances. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results expe rienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected. |

| |

| | c) | Earnings (Loss) Per Share |

| |

| | | The Company computes earnings (loss) per share in accordance with SFAS No. 128, "Earnings per Share". SFAS No. 128 requires presentation of both basic and diluted earnings per share (“EPS”) on the face of the income statement. Basic EPS is computed by dividing earnings (loss) available to common shareholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all dilutive potential common shares outstanding during the period using the treasury stock method and convertible preferred stock using the if-converted method. In computing diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excludes all dilutive potential shares if their effect is anti dilutive. |

| |

F-6

- 27 -

Henix Resources, Inc.

(An Exploration Stage Company)

Notes to the Financial Statements

April 30, 2007

(Expressed in U.S. dollars)

| 2. | Summary of Significant Accounting Policies (continued) |

| |

| | d) | Comprehensive Loss |

| |

| | | SFAS No. 130, “Reporting Comprehensive Income,” establishes standards for the reporting and display of comprehensive loss and its components in the financial statements. As at April 30, 2008 and 2007, the Company has no items that represent a comprehensive loss and, therefore, has not included a schedule of comprehensive loss in the financial statements. |

| |

| | e) | Cash and Cash Equivalents |

| |

| | | The Company considers all highly liquid instruments with maturity of three months or less at the time of issuance to be cash equivalents. |

| |

| | f) | Mineral Property Costs |

| |

| | | The Company has been in the exploration stage since its inception on January 26, 2006 and has not yet realized any revenues from its planned operations. It is primarily engaged in the acquisition and exploration of mining properties. Mineral property exploration costs are expensed as incurred. Mineral property acquisition costs are initially capitalized when incurred using the guidance in EITF 04-02, “Whether Mineral Rights Are Tangible or Intangible Assets”. The Company assesses the carrying costs for impairment under SFAS No. 144, “Accounting for Impairment or Disposal of Long Lived Assets” at each fiscal quarter end. When it has been determined that a mineral property can be economically developed as a result of establishing proven and probable reserves, the costs then incurred to develop such property, are capitalized. Such costs will be amortized using the units-of-production method over the estimated life of the probable reserve. If mineral properties are subsequently abandoned or impaired, any capitalized costs will be charged to operations. |

| |

| | g) | Long-lived Assets |

| |

| | | In accordance with SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets”, the carrying value of long-lived assets is reviewed on a regular basis for the existence of facts or circumstances that may suggest impairment. The Company recognizes impairment when the sum of the expected undiscounted future cash flows is less than the carrying amount of the asset. Impairment losses, if any, are measured as the excess of the carrying amount of the asset over its estimated fair value. |

| |

| | h) | Financial Instruments |

| |

| | | The fair values of financial instruments, which include cash and due to related party, were estimated to approximate their carrying values due to the immediate or short-term maturity of these financial instruments. The Company’s operations are in Canada, which results in exposure to market risks from changes in foreign currency rates. The financial risk is the risk to the Company’s operations that arise from fluctuations in foreign exchange rates and the degree of volatility of these rates. Currently, the Company does not use derivative instruments to reduce its exposure to foreign currency risk. |

| |

| | i) | Income Taxes |

| |

| | | The Company accounts for income taxes using the asset and liability method in accordance with SFAS No. 109, “Accounting for Income Taxes”. The asset and liability method provides that deferred tax assets and liabilities are recognized for the expected future tax consequences of temporary differences between the financial reporting and tax bases of assets and liabilities, and for operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using the currently enacted tax rates and laws that will be in effect when the differences are expected to reverse. The Company records a valuation allowance to reduce deferred tax assets to the amount that is believed more likely than not to be realized. |

| |

| | j) | Foreign Currency Translation |

| |

| | | The Company’s functional and reporting currency is the United States dollar. Occasional transactions may occur in a foreign currency and management has adopted SFAS No. 52, “Foreign Currency Translation”. Monetary assets and liabilities denominated in foreign currencies are translated using the exchange rate prevailing at the balance sheet date. Non-monetary assets and liabilities denominated in foreign currencies are translated at rates of exchange in effect at the date of the transaction. Average monthly rates are used to translate revenues and expenses. Gains and losses arising on translation or settlement of foreign currency denominated transactions or balances are included in the determination of income. |

| |

F-7

- 28 -

Henix Resources, Inc.

(An Exploration Stage Company)

Notes to the Financial Statements

April 30, 2007

(Expressed in U.S. dollars)

| 2. | Summary of Significant Accounting Policies (continued) |

| |

| | k) | Recent Accounting Pronouncements |

| |

| | | In May 2008, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 163, “Accounting for Financial Guarantee Insurance Contracts – An interpretation of FASB Statement No. 60”. SFAS No. 163 requires that an insurance enterprise recognize a claim liability prior to an event of default when there is evidence that credit deterioration has occurred in an insured financial obligation. It also clarifies how Statement 60 applies to financial guarantee insurance contracts, including the recognition and measurement to be used to account for premium revenue and claim liabilities, and requires expanded disclosures about financial guarantee insurance contracts. It is effective for financial statements issued for fiscal years beginning after December 15, 2008, except for some disclosures about the insurance enterprise’s risk-management activities. SFAS No. 163 requires that disclosures about the risk-management activities of the insurance enterprise be effective for the first period beginning after issuance. Except for those disclosures, earlier application is not permitted. The adoption of this statement is not expected to have a material effect on the Company’s financial statements. |

| |

| | | In May 2008, the FASB issued SFAS No. 162, “The Hierarchy of Generally Accepted Accounting Principles”. SFAS No. 162 identifies the sources of accounting principles and the framework for selecting the principles to be used in the preparation of financial statements of nongovernmental entities that are presented in conformity with generally accepted accounting principles in the United States. It is effective 60 days following the SEC’s approval of the Public Company Accounting Oversight Board amendments to AU Section 411, “The Meaning of Present Fairly in Conformity With Generally Accepted Accounting Principles”. The adoption of this statement is not expected to have a material effect on the Company’s financial statements. |

| |

| | | In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging Activities – an amendment to FASB Statement No. 133”. SFAS No. 161 is intended to improve financial standards for derivative instruments and hedging activities by requiring enhanced disclosures to enable investors to better understand their effects on an entity's financial position, financial performance, and cash flows. Entities are required to provide enhanced disclosures about: (a) how and why an entity uses derivative instruments; (b) how derivative instruments and related hedged items are accounted for under Statement 133 and its related interpretations; and (c) how derivative instruments and related hedged items affect an entity’s financial position, financial performance, and cash flows. It is effective for financial statements issued for fiscal years beginning after November 15, 2008, with early adoption encouraged. The Company is currently evaluating the impact of SFAS No. 161 on its financial statements, and the adoption of this statement is not expected to have a material effect on the Company’s financial statements. |

| |

| | | In December 2007, the FASB issued SFAS No. 141 (revised 2007), “Business Combinations”. SFAS No. 141 (revised 2007) establishes principles and requirements for how the acquirer of a business recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree. The statement also provides guidance for recognizing and measuring the goodwill acquired in the business combination and determines what information to disclose to enable users of the financial statements to evaluate the nature and financial effects of the business combination. SFAS No. 141 (revised 2007) applies prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008. The adoption of this statement is not expected to have a material effect on the Company's future reported financial p osition or results of operations. |

| |

| | | In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated FinancialStatements-an amendment of ARB No. 51”. SFAS No. 160 establishes accounting and reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary. SFAS No. 160 is effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2008. The adoption of this statement is not expected to have a material effect on the Company's future reported financial position or results of operations. |

| |

F-8

- 29 -

Henix Resources, Inc.

(An Exploration Stage Company)

Notes to the Financial Statements

April 30, 2007

(Expressed in U.S. dollars)

| 2. | Summary of Significant Accounting Policies (continued) |

| |

| | (k) | Recent Accounting Pronouncements (continued) |

| |

| | | In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities – Including an Amendment of FASB Statement No. 115”. This statement permits entities to choose to measure many financial instruments and certain other items at fair value. Most of the provisions of SFAS No. 159 apply only to entities that elect the fair value option. However, the amendment to SFAS No. 115 “Accounting for Certain Investments in Debt and Equity Securities” applies to all entities with available-for-sale and trading securities. SFAS No. 159 is effective as of the beginning of an entity’s first fiscal year that begins after November 15, 2007. Early adoption is permitted as of the beginning of a fiscal year that begins on or before November 15, 2007, provided the entity also elects to apply the provision of SFAS No. 157, “Fair Value Measurements”. The adoption of this statement is not expected to have a material effect on the Company's future reported financial position or results of operations. |

| |

| | | In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements”. The objective of SFAS No. 157 is to increase consistency and comparability in fair value measurements and to expand disclosures about fair value measurements. SFAS No. 157 defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles, and expands disclosures about fair value measurements. SFAS No. 157 applies under other accounting pronouncements that require or permit fair value measurements and does not require any new fair value measurements. The provisions of SFAS No. 157 are effective for fair value measurements made in fiscal years beginning after November 15, 2007. The adoption of this statement is not expected to have a material effect on the Company's future reported financial position or results of operations. |

| |