UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21941

AMERISTOCK ETF TRUST

(Exact name of registrant as specified in charter)

1320 Harbor Bay Parkway, Suite 145, Alameda, California 94502

(Address of principal executive offices) (Zip code)

Brown Brothers Harriman

40 Water Street, P. O. 962047,

Boston, MA 02196-2047

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-617-742-1818

Date of fiscal year end: June 30

Date of reporting period: June 30, 2007

ITEM 1. ANNUAL REPORT.

ANNUAL REPORT |

| | | | | | | |

June 30, 2007 |

| | | | | | | |

AMERISTOCK ETF TRUST |

| | | | | | | |

| | |  | |

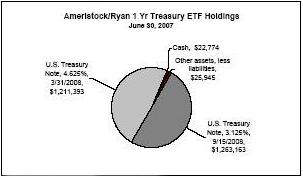

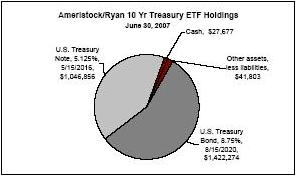

Ameristock/Ryan 1 Yr Treasury ETF | | | | | | | Ameristock/Ryan 10 Yr Treasury ETF | | | | | |

GKA | | | | | | | GKD | | | | | |

Security (Maturity date) | | Market Value | | % to Total | | | Security (Maturity date) | | Market Value | | % to Total | |

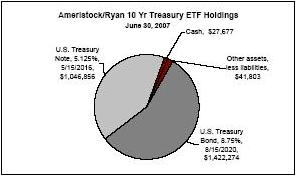

| U.S. Treasury Note, 3.125%, 9/15/2008 | | $ | 1,263,163 | | | 50 | % | | U.S. Treasury Bond, 8.75%, 8/15/2020 | | $ | 1,422,274 | | | 56 | % |

| U.S. Treasury Note, 4.625%, 3/31/2008 | | $ | 1,211,393 | | | 48 | % | | U.S. Treasury Note, 5.125%, 5/15/2016 | | $ | 1,046,856 | | | 41 | % |

| Cash | | $ | 22,774 | | | 1 | % | | Cash | | $ | 27,677 | | | 1 | % |

| Other assets, less liabilities | | $ | 25,945 | | | 1 | % | | Other assets, less liabilities | | $ | 41,803 | | | 2 | % |

Total Net Assets | | $ | 2,523,275 | | | | | | Total Net Assets | | $ | 2,538,610 | | | | |

| | |  | |

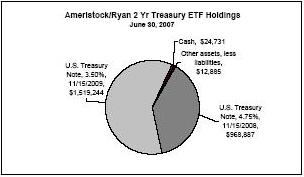

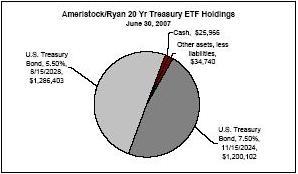

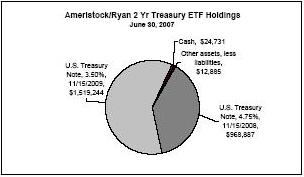

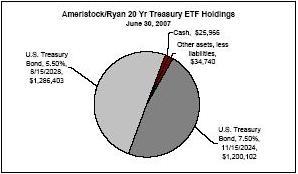

Ameristock/Ryan 2 Yr Treasury ETF | | | | | | | Ameristock/Ryan 20 Yr Treasury ETF | | | | | |

GKB | | | | | | | GKE | | | | | |

Security (Maturity date) | | Market Value | | % to Total | | | Security (Maturity date) | | Market Value | | % to Total | |

| U.S. Treasury Note, 4.75%, 11/15/2008 | | $ | 968,887 | | | 38 | % | | U.S. Treasury Bond, 7.50%, 11/15/2024 | | $ | 1,200,102 | | | 47 | % |

| U.S. Treasury Note, 3.50%, 11/15/2009 | | $ | 1,519,244 | | | 60 | % | | U.S. Treasury Bond, 5.50%, 8/15/2028 | | $ | 1,286,403 | | | 51 | % |

| Cash | | $ | 24,731 | | | 1 | % | | Cash | | $ | 25,966 | | | 1 | % |

| Other assets, less liabilities | | $ | 12,885 | | | 1 | % | | Other asets, less liabilities | | $ | 34,740 | | | 1 | % |

Total Net Assets | | $ | 2,525,747 | | | | | | Total Net Assets | | $ | 2,547,211 | | | | |

| | | | | | | | | | |

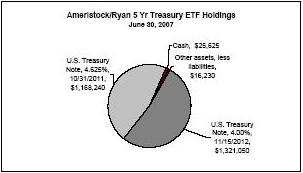

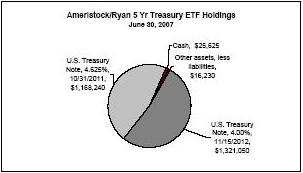

Ameristock/Ryan 5 Yr Treasury ETF | | | | | | | | | | | | | | | | |

Security (Maturity date) | | | Market Value | | | % to Total | | | | | | | | | | |

| U.S. Treasury Note, 4.00%, 11/15/2012 | | | 1,321,050 | | | 52 | % | | | | | | | | | |

| U.S. Treasury Note, 4.625%, 10/31/2011 | | | 1,168,240 | | | 46 | % | | | | | | | | | |

| Cash | | $ | 25,625 | | | 1 | % | | | | | | | | | |

| Other assets, less liabilities | | $ | 16,230 | | | 1 | % | | | | | | | | | |

Total Net Assets | | $ | 2,531,145 | | | | | | | | | | | | | |

DISCLOSURE OF FUND EXPENSES (UNAUDITED)

As a shareholder of an Ameristock Treasury ETF (each, a “Fund”), you may incur two potential types of costs: (1) transaction costs, such as brokerage commissions on purchases and sales of your Fund shares, (2) and ongoing costs, including management fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds. The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from June 28, 2007 until June 30, 2007.

Actual Return. The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, $8,600 account value divided by $1,000=8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical 5% Return. The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in a Fund and other exchange trade funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing costs only and do not reflect any transaction fees, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line of the table is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds.

Ameristock/Ryan 1 Year Treasury ETF | | | |

| | Beginning Account Value at 06/28/07 | Ending Account Value at 06/30/07 | Expense Paid During Period* 06/28/07 to 06/30/07 |

| Actual Fund Return | $1,000.00 | $1,000.80 | $0.01 |

| Hypothetical Fund Return | $1,000.00 | $1,000.27 | $0.01 |

Ameristock/Ryan 2 Year Treasury ETF | | | |

| | Beginning Account Value at 06/28/07 | Ending Account Value at 06/30/07 | Expense Paid During Period* 06/28/07 to 06/30/07 |

| Actual Fund Return | $1,000.00 | $1,002.00 | $0.01 |

| Hypothetical Fund Return | $1,000.00 | $1,000.27 | $0.01 |

Ameristock/Ryan 5 Year Treasury ETF | | | |

| | Beginning Account Value at 06/28/07 | Ending Account Value at 06/30/07 | Expense Paid During Period* 06/28/07 to 06/30/07 |

| Actual Fund Return | $1,000.00 | $1,004.00 | $0.01 |

| Hypothetical Fund Return | $1,000.00 | $1,000.27 | $0.01 |

Ameristock/Ryan 10 Year Treasury ETF | | | |

| | Beginning Account Value at 06/28/07 | Ending Account Value at 06/30/07 | Expense Paid During Period* 06/28/07 to 06/30/07 |

| Actual Fund Return | $1,000.00 | $1,006.80 | $0.01 |

| Hypothetical Fund Return | $1,000.00 | $1,000.27 | $0.01 |

Ameristock/Ryan 20 Year Treasury ETF | | | |

| | Beginning Account Value at 06/29/07 | Ending Account Value at 06/30/07 | Expense Paid During Period* 06/28/07 to 06/30/07 |

| Actual Fund Return | $1,000.00 | $1,010.40 | $0.01 |

| Hypothetical Fund Return | $1,000.00 | $1,000.27 | $0.01 |

* Expenses Paid During Period are calculated using each Fund’s annualized expense ratio of 0.15%, multiplied by the average account value over the period, multiplied by 2/365 (to reflect the fiscal period). Expenses Paid During Period reflect the short length of the fiscal period (two days). Expenses paid over a full half-year period would have been proportionately higher.

Ameristock/Ryan 1 Year Treasury ETF | | | | | |

Schedule of Investments | | | | | |

June 30, 2007 | | | | | |

| | | | | | |

| | | Principal | | Market | |

| | | Amount | | Value | |

U.S. TREASURY OBLIGATIONS - 98.07% | | | | | |

| | | | | | |

| U.S. Treasury Notes - 98.07% | | | | | |

| 3.125%, 9/15/08 | | $ | 1,291,000 | | $ | 1,263,163 | |

| 4.625%, 3/31/08 | | | 1,215,000 | | | 1,211,393 | |

| | | | 2,506,000 | | | 2,474,556 | |

| | | | | | | | |

Total U.S. Treasury Obligations (Cost $2,472,947) | | | 2,506,000 | | | 2,474,556 | |

| | | | | | | | |

| | | | | | | | |

SHORT-TERM INVESTMENTS - 0.90% | | | | | | | |

| | | | | | | | |

Time Deposit - 0.90% | | | | | | | |

| Brown Brothers Harriman & Co. | | | | | | | |

| 4.64%, 7/02/07 | | | 22,774 | | | 22,774 | |

| | | | | | | | |

Total Short-Term Investments (Cost $22,774) | | | 22,774 | | | 22,774 | |

| | | | | | | | |

TOTAL INVESTMENTS - 98.97% (Cost $2,495,721) | | | | | $ | 2,497,330 | |

OTHER ASSETS, LESS LIABILITIES - 1.03% | | | | | | 25,945 | |

NET ASSETS - 100.00% | | | | | $ | 2,523,275 | |

Federal Income Tax Basis of Investment Securities | |

The tax cost of the fund at June 30, 2007 based on securities owned | | | | | | | |

was $2,495,721 . | | | | | | | |

The accompanying notes are an integral part of the financial statements.

Ameristock/Ryan 2 Year Treasury ETF | | | | | |

Schedule of Investments | | | | | |

June 30, 2007 | | | | | |

| | | | | | |

| | | Principal | | Market | |

| | | Amount | | Value | |

U.S. TREASURY OBLIGATIONS - 98.51% | | | | | |

| | | | | | |

| U.S. Treasury Notes - 98.51% | | | | | |

| 3.50%, 11/15/09 | | $ | 1,568,000 | | $ | 1,519,244 | |

| 4.75%, 11/15/08 | | | 972,000 | | | 968,887 | |

| | | | 2,540,000 | | | 2,488,131 | |

| | | | | | | | |

Total U.S. Treasury Obligations (Cost $2,484,043) | | | 2,540,000 | | | 2,488,131 | |

| | | | | | | | |

| | | | | | | | |

SHORT-TERM INVESTMENTS - 0.98% | | | | | | | |

| | | | | | | | |

Time Deposit - 0.98% | | | | | | | |

| Brown Brothers Harriman & Co. | | | | | | | |

| 4.64%, 7/02/07 | | | 24,731 | | | 24,731 | |

| | | | | | | | |

Total Short-Term Investments (Cost $24,731) | | | 24,731 | | | 24,731 | |

| | | | | | | | |

TOTAL INVESTMENTS - 99.49% (Cost $2,508,774) | | | | | $ | 2,512,862 | |

OTHER ASSETS, LESS LIABILITIES - 0.51% | | | | | | 12,885 | |

NET ASSETS - 100.00% | | | | | $ | 2,525,747 | |

Federal Income Tax Basis of Investment Securities | |

The tax cost of the fund at June 30, 2007 based on securities owned | | | | | | | |

was $2,508,774 . | | | | | | | |

The accompanying notes are an integral part of the financial statements.

Ameristock/Ryan 5 Year Treasury ETF | | | | | |

Schedule of Investments | | | | | |

June 30, 2007 | | | | | |

| | | | | | |

| | | Principal | | Market | |

| | | Amount | | Value | |

U.S. TREASURY OBLIGATIONS - 98.35% | | | | | |

| | | | | | |

| U.S. Treasury Notes - 98.35% | | | | | |

| 4.00%, 11/15/12 | | $ | 1,378,000 | | $ | 1,321,050 | |

| 4.625%, 10/31/11 | | | 1,182,000 | | | 1,168,240 | |

| | | | 2,560,000 | | | 2,489,290 | |

| | | | | | | | |

Total U.S. Treasury Obligations (Cost $2,479,799) | | | 2,560,000 | | | 2,489,290 | |

| | | | | | | | |

| | | | | | | | |

SHORT-TERM INVESTMENTS - 1.01% | | | | | | | |

| | | | | | | | |

Time Deposit - 1.01% | | | | | | | |

| Brown Brothers Harriman & Co. | | | | | | | |

| 4.64%, 7/02/07 | | | 25,625 | | | 25,625 | |

| | | | | | | | |

Total Short-Term Investments (Cost $25,625) | | | 25,625 | | | 25,625 | |

| | | | | | | | |

TOTAL INVESTMENTS - 99.36% (Cost $2,505,424) | | | | | $ | 2,514,915 | |

OTHER ASSETS, LESS LIABILITIES - 0.64% | | | | | | 16,230 | |

NET ASSETS - 100.00% | | | | | $ | 2,531,145 | |

Federal Income Tax Basis of Investment Securities | |

The tax cost of the fund at June 30, 2007 based on securities owned | | | | | | | |

was $2,505,424 . | | | | | | | |

The accompanying notes are an integral part of the financial statements.

Ameristock/Ryan 10 Year Treasury ETF | | | | | |

Schedule of Investments | | | | | |

June 30, 2007 | | | | | |

| | | | | | |

| | | Principal | | Market | |

| | | Amount | | Value | |

U.S. TREASURY OBLIGATIONS - 97.26% | | | | | |

| | | | | | |

| U.S. Treasury Bond - 56.02% | | | | | |

| 8.75%, 8/15/20 | | $ | 1,065,000 | | $ | 1,422,274 | |

| | | | | | | | |

| U.S. Treasury Note - 41.24% | | | | | | | |

| 5.125%, 5/15/16 | | | 1,041,000 | | | 1,046,856 | |

| | | | | | | | |

Total U.S. Treasury Obligations (Cost $2,452,208) | | | 2,106,000 | | | 2,469,130 | |

| | | | | | | | |

| | | | | | | | |

SHORT-TERM INVESTMENTS - 1.09% | | | | | | | |

| | | | | | | | |

Time Deposit - 1.09% | | | | | | | |

| Brown Brothers Harriman & Co. | | | | | | | |

| 4.64%, 7/02/07 | | | 27,677 | | | 27,677 | |

| | | | | | | | |

Total Short-Term Investments (Cost $27,677) | | | 27,677 | | | 27,677 | |

| | | | | | | | |

TOTAL INVESTMENTS - 98.35% (Cost $2,479,885) | | | | | $ | 2,496,807 | |

OTHER ASSETS, LESS LIABILITIES - 1.65% | | | | | | 41,803 | |

NET ASSETS - 100.00% | | | | | $ | 2,538,610 | |

Federal Income Tax Basis of Investment Securities | |

The tax cost of the fund at June 30, 2007 based on securities owned | | | | | | | |

was $2,479,885 . | | | | | | | |

The accompanying notes are an integral part of the financial statements.

Ameristock/Ryan 20 Year Treasury ETF | | | | | |

Schedule of Investments | | | | | |

June 30, 2007 | | | | | |

| | | | | | |

| | | Principal | | Market | |

| | | Amount | | Value | |

U.S. TREASURY OBLIGATIONS - 97.62% | | | | | |

| | | | | | |

| U.S. Treasury Bonds - 97.62% | | | | | |

| 5.50%, 8/15/28 | | $ | 1,240,000 | | $ | 1,286,403 | |

| 7.50%, 11/15/24 | | | 954,000 | | | 1,200,102 | |

| | | | 2,194,000 | | | 2,486,505 | |

| | | | | | | | |

Total U.S. Treasury Obligations (Cost $2,460,994) | | | 2,194,000 | | | 2,486,505 | |

| | | | | | | | |

| | | | | | | | |

SHORT-TERM INVESTMENTS - 1.02% | | | | | | | |

| | | | | | | | |

Time Deposit - 1.02% | | | | | | | |

| Brown Brothers Harriman & Co. | | | | | | | |

| 4.64%, 7/02/07 | | | 25,966 | | | 25,966 | |

| | | | | | | | |

Total Short-Term Investments (Cost $25,966) | | | 25,966 | | | 25,966 | |

| | | | | | | | |

TOTAL INVESTMENTS - 98.64% (Cost $2,486,960) | | | | | $ | 2,512,471 | |

OTHER ASSETS, LESS LIABILITIES - 1.36% | | | | | | 34,740 | |

NET ASSETS - 100.00% | | | | | $ | 2,547,211 | |

Federal Income Tax Basis of Investment Securities | |

The tax cost of the fund at June 30, 2007 based on securities owned | | | | | | | |

was $2,486,960 . | | | | | | | |

The accompanying notes are an integral part of the financial statements.

STATEMENTS OF ASSETS AND LIABILITIES | | | | | | | | | |

June 30, 2007 | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | Ameristock/Ryan | | Ameristock/Ryan | | Ameristock/Ryan | | Ameristock/Ryan | | Ameristock/Ryan | |

| | | 1 Year | | 2 Year | | 5 Year | | 10 Year | | 20 Year | |

| | | Treasury ETF | | Treasury ETF | | Treasury ETF | | Treasury ETF | | Treasury ETF | |

Assets: | | | | | | | | | | | |

| Investments: | | | | | | | | | | | |

| Investments at Cost | | $ | 2,495,721 | | $ | 2,508,774 | | $ | 2,505,424 | | $ | 2,479,885 | | $ | 2,486,960 | |

Net Unrealized Appreciation on Investments | | | 1,609 | | | 4,088 | | | 9,491 | | | 16,922 | | | 25,511 | |

| Total Investments at Value | | | 2,497,330 | | | 2,512,862 | | | 2,514,915 | | | 2,496,807 | | | 2,512,471 | |

| Interest Receivable | | | 25,965 | | | 12,905 | | | 16,250 | | | 41,823 | | | 34,760 | |

| Total Assets: | | | 2,523,295 | | | 2,525,767 | | | 2,531,165 | | | 2,538,630 | | | 2,547,231 | |

| | | | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | | |

| Management Fees Payable | | | 20 | | | 20 | | | 20 | | | 20 | | | 20 | |

| Total Liabilities: | | | 20 | | | 20 | | | 20 | | | 20 | | | 20 | |

| | | | | | | | | | | | | | | | | |

Net Assets | | $ | 2,523,275 | | $ | 2,525,747 | | $ | 2,531,145 | | $ | 2,538,610 | | $ | 2,547,211 | |

| | | | | | | | | | | | | | | | | |

Shares of Beneficial Interest Outstanding, Unlimited Shares of $0.001 Par Value Authorized | | | 100,800 | | | 100,800 | | | 100,800 | | | 100,800 | | | 100,800 | |

| | | | | | | | | | | | | | | | | |

| Net Asset Value, Offering and Redemption Price per Share | | $ | 25.03 | | $ | 25.06 | | $ | 25.11 | | $ | 25.18 | | $ | 25.27 | |

| | | | | | | | | | | | | | | | | |

At June 30, 2007 the Components of Net Assets were as follows: | | | | | | | | | | | | | | | | |

| Par Value | | $ | 101 | | $ | 101 | | $ | 101 | | $ | 101 | | $ | 101 | |

| Paid-in Capital | | | 2,520,899 | | | 2,520,899 | | | 2,520,899 | | | 2,520,899 | | | 2,520,899 | |

Accumulated Undistributed Net Investment Income | | | 666 | | | 659 | | | 654 | | | 688 | | | 700 | |

Net Unrealized Appreciation of Investments | | | 1,609 | | | 4,088 | | | 9,491 | | | 16,922 | | | 25,511 | |

| | | $ | 2,523,275 | | $ | 2,525,747 | | $ | 2,531,145 | | $ | 2,538,610 | | $ | 2,547,211 | |

The accompanying notes are an integral part of the financial statements.

STATEMENTS OF OPERATIONS | | | | | | | | | | | |

For the Period from June 28, 2007 (Commencement of Operations) to June 30, 2007 | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | Ameristock/Ryan | | Ameristock/Ryan | | Ameristock/Ryan | | Ameristock/Ryan | | Ameristock/Ryan | |

| | | 1 Year | | 2 Year | | 5 Year | | 10 Year | | 20 Year | |

| | | Treasury ETF | | Treasury ETF | | Treasury ETF | | Treasury ETF | | Treasury ETF | |

Investment Income: | | | | | | | | | | | |

| Interest | | $ | 686 | | $ | 679 | | $ | 674 | | $ | 708 | | $ | 720 | |

| Total Investment Income | | | 686 | | | 679 | | | 674 | | | 708 | | | 720 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Expenses: | | | | | | | | | | | | | | | | |

| Management Fee (Note 3) | | | 20 | | | 20 | | | 20 | | | 20 | | | 20 | |

| Total Expenses | | | 20 | | | 20 | | | 20 | | | 20 | | | 20 | |

Net Investment Income: | | $ | 666 | | $ | 659 | | $ | 654 | | $ | 688 | | $ | 700 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Realized and Unrealized Gain/(Loss) | | | | | | | | | | | | | | | | |

on Investments: | | | | | | | | | | | | | | | | |

Net Realized Gain/(Loss) on Investments | | | - | | | - | | | - | | | - | | | - | |

Net Change in Unrealized Appreciation/ (Depreciation) on Investments | | | 1,609 | | | 4,088 | | | 9,491 | | | 16,922 | | | 25,511 | |

Net Realized and Unrealized Gain/ (Loss) on Investments | | | 1,609 | | | 4,088 | | | 9,491 | | | 16,922 | | | 25,511 | |

Net Increase in Net Assets Resulting from Operations | | $ | 2,275 | | $ | 4,747 | | $ | 10,145 | | $ | 17,610 | | $ | 26,211 | |

The accompanying notes are an integral part of the financial statements.

STATEMENTS OF CHANGES IN NET ASSETS | | | | | | | | | |

For the Period from June 28, 2007 (Commencement of Operations) to June 30, 2007 | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | Ameristock/Ryan | | Ameristock/Ryan | | Ameristock/Ryan | | Ameristock/Ryan | | Ameristock/Ryan | |

| | | 1 Year | | 2 Year | | 5 Year | | 10 Year | | 20 Year | |

| | | Treasury ETF | | Treasury ETF | | Treasury ETF | | Treasury ETF | | Treasury ETF | |

From Operations: | | | | | | | | | | | |

| Net Investment Income | | $ | 666 | | $ | 659 | | $ | 654 | | $ | 688 | | $ | 700 | |

Net Realized Gain/(Loss) on Investments | | | - | | | - | | | - | | | - | | | - | |

Net Change in Unrealized Appreciation/ (Depreciation) on Investments | | | 1,609 | | | 4,088 | | | 9,491 | | | 16,922 | | | 25,511 | |

Net Increase in Net Assets Resulting from Operations | | | 2,275 | | | 4,747 | | | 10,145 | | | 17,610 | | | 26,211 | |

| | | | | | | | | | | | | | | | | |

Share Transactions: | | | | | | | | | | | | | | | | |

| Shares Sold | | | 2,500,000 | | | 2,500,000 | | | 2,500,000 | | | 2,500,000 | | | 2,500,000 | |

| ETF Transaction Fees | | | 1,000 | | | 1,000 | | | 1,000 | | | 1,000 | | | 1,000 | |

Net Increase in Net Assets from Share Transactions | | | 2,501,000 | | | 2,501,000 | | | 2,501,000 | | | 2,501,000 | | | 2,501,000 | |

| | | | | | | | | | | | | | | | | |

Net Increase in Net Assets | | | 2,503,275 | | | 2,505,747 | | | 2,511,145 | | | 2,518,610 | | | 2,527,211 | |

| | | | | | | | | | | | | | | | | |

Net Assets: | | | | | | | | | | | | | | | | |

| Beginning of Period | | $ | 20,000 | | $ | 20,000 | | $ | 20,000 | | $ | 20,000 | | $ | 20,000 | |

| End of Period | | $ | 2,523,275 | | $ | 2,525,747 | | $ | 2,531,145 | | $ | 2,538,610 | | $ | 2,547,211 | |

Undistributed Net Investment Income | | $ | 666 | | $ | 659 | | $ | 654 | | $ | 688 | | $ | 700 | |

The accompanying notes are an integral part of the financial statements.

FINANCIAL HIGHLIGHTS | | | | | | | | | | |

Selected Data for a Share Outstanding for the Period from June 28, 2007 (Commencement of Operations) to June 30, 2007. | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | Ameristock/Ryan | | Ameristock/Ryan | | Ameristock/Ryan | | Ameristock/Ryan | | Ameristock/Ryan | |

| | | 1 Year | | 2 Year | | 5 Year | | 10 Year | | 20 Year | |

| | | Treasury ETF | | Treasury ETF | | Treasury ETF | | Treasury ETF | | Treasury ETF | |

| Net Asset Value at Beginning of Period | | $ | 25.00 | | $ | 25.00 | | $ | 25.00 | | $ | 25.00 | | $ | 25.00 | |

Net Investment Incomea | | | 0.01 | | | 0.01 | | | 0.01 | | | 0.01 | | | 0.01 | |

| Net Gains on Securities - | | | | | | | | | | | | | | | | |

| Realized and Unrealized | | | 0.01 | | | 0.04 | | | 0.09 | | | 0.16 | | | 0.25 | |

| Total From Investment Operations | | $ | 0.02 | | $ | 0.05 | | $ | 0.10 | | $ | 0.17 | | $ | 0.26 | |

| Paid in Capital from ETF Transaction Fees | | $ | 0.01 | | $ | 0.01 | | $ | 0.01 | | $ | 0.01 | | $ | 0.01 | |

| | | | | | | | | | | | | | | | | |

| Net Asset Value at End of Period | | | 25.03 | | | 25.06 | | | 25.11 | | | 25.18 | | | 25.27 | |

Total Returnb | | | 0.08 | % | | 0.20 | % | | 0.40 | % | | 0.68 | % | | 1.04 | % |

| | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | |

| Net Assets End of Period (millions) | | $ | 2.52 | | $ | 2.53 | | $ | 2.53 | | $ | 2.54 | | $ | 2.55 | |

Ratio of Expenses to Average Net Assetsc | | | 0.15 | % | | 0.15 | % | | 0.15 | % | | 0.15 | % | | 0.15 | % |

| Ratio of Net Investment Income to | | | | | | | | | | | | | | | | |

Average Net Assetsc | | | 4.86 | % | | 4.81 | % | | 4.77 | % | | 5.02 | % | | 5.11 | % |

Portfolio Turnover Rated | | | 0.0 | % | | 0.0 | % | | 0.0 | % | | 0.0 | % | | 0.0 | % |

a Based on Average Shares Outstanding

b Total investment return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption on the last day of the period. Transaction fees are not reflected in the calculation of total investment return. Total investment return calculated for a period of less than one year is not annualized.

cAnnualized

dPortfolio turnover is not annualized and does not include securities received or delivered from processing creations or redemptions.

The accompanying notes are an integral part of the financial statements.

Ameristock ETF Trust

Notes to Financial Statements

June 30, 2007

1) ORGANIZATION

The Ameristock ETF Trust (the “Trust”) currently consists of five separate investment portfolios (each a “Fund” and collectively the “Funds”): Ameristock/Ryan 1 Year Treasury ETF, Ameristock/Ryan 2 Year Treasury ETF, Ameristock/Ryan 5 Year Treasury ETF, Ameristock/Ryan 10 Year Treasury ETF, and Ameristock/Ryan 20 Year Treasury ETF. Each Fund seeks investment results, before fees and expenses that correspond generally to performance, of a particular U.S. Treasury securities index owned and compiled by Ryan Holdings LLC and Ryan ALM, Inc. The Trust was organized as a Delaware statutory trust on June 5, 2006, is authorized to have multiple series or portfolios, and may establish additional series or portfolios in the future. The Trust is an open-end management investment company, registered under the Investment Company Act of 1940, as amended (the “1940 Act”). Each Fund issues shares of beneficial interest with $0.001 par value.

2) SIGNIFICANT ACCOUNTING POLICIES

Security Valuation

Securities are valued at closing bid price. Other portfolio securities and assets for which market quotations are not readily available are valued based on fair value as determined in accordance with procedures adopted by the Board of Trustees. Investments in money market mutual funds are stated at net asset value.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates.

Expenses

Expenses of the Trust, which are directly identifiable to a specific Fund, are applied to that Fund except those expenses paid directly by the advisor. Expenses which are not readily identifiable to a specific Fund are allocated in such a manner as deemed equitable, taking into consideration the nature and type of expense and the relative net assets of each Fund.

Investment Transactions

Investment transactions are recorded on the trade date. Realized gains and losses from the sale or disposition of securities are calculated on the identified cost basis.

Federal Income Taxes

Each Fund intends to qualify as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended, and, if so qualified, will not be liable for federal income taxes to the extent earnings are distributed to shareholders on a timely basis. Therefore, no provision for federal income taxes is required.

Distributions to Shareholders

Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The Funds declare and pay dividends from net investment income quarterly and distribute from net realized capital gains at least annually.

Ameristock ETF Trust

Notes to Financial Statements (continued)

June 30, 2007

Indemnification

The Trust will indemnify its officers and trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties and which provide general indemnities. A Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Trust expects the risk of loss due to these warranties and indemnities to be remote.

Other

The Funds follow industry practice and record security transactions on the trade date. Dividend income is recognized on the ex-dividend date, and interest income is recognized on an accrual basis. Discounts and premiums on securities purchased are amortized over the lives of the respective securities.

3) INVESTMENT ADVISORY AND OTHER AGREEMENTS

Investment Adviser

The Ameristock Corporation (the “Adviser”) is the investment adviser to each Fund and as such has overall responsibility for the general management and administration of the Trust. The Adviser provides an investment program for each Fund and manages the investment of its assets.

Under the Investment Advisory Agreement, the Adviser is responsible for all expenses of the Trust, including the cost of transfer agency, custody, fund administration, legal, audit and other services, except independent trustee fees and expenses, interest expense, taxes, brokerage expenses, distribution or “12b-1” fees (if any), and extraordinary expenses. For the period ended June 30, 2007, the investment adviser earned and was owed $20 from the Ameristock/Ryan 1 Year Treasury ETF, $20 from the Ameristock/Ryan 2 Year Treasury ETF, $20 from the Ameristock/Ryan 5 Year Treasury ETF, $20 from the Ameristock/Ryan 10 Year Treasury ETF, and $20 from the Ameristock/Ryan 20 Year Treasury ETF.

The Adviser receives management fees from each Fund based on an annual percentage rate of each Fund’s average daily net assets, as shown in the following table:

Fund | Management Fee |

| Ameristock/Ryan 1 Year Treasury ETF | 0.15% |

| Ameristock/Ryan 2 Year Treasury ETF | 0.15% |

| Ameristock/Ryan 5 Year Treasury ETF | 0.15% |

| Ameristock/Ryan 10 Year Treasury ETF | 0.15% |

| Ameristock/Ryan 20 Year Treasury ETF | 0.15% |

The Adviser has agreed to waive its management fees and/or make payments to limit Fund expenses in the amount of any independent trustee fees and expenses otherwise payable by the Fund until at least June 30, 2008.

Administrator, Custodian and Transfer Agent

Brown Brothers Harriman & Co. (“BBH”) serves as administrator, custodian and transfer agent for the Funds. Under the Administrative Agency Agreement with the Trust, BBH performs certain administrative, accounting, transfer agency and dividend disbursing services for the Funds and prepares certain SEC reports on behalf of the Trust and the Funds. Under the Custodian Agreement with the Trust, BBH maintains in separate accounts cash, securities and other assets of each Fund, keeps all necessary accounts

Ameristock ETF Trust

Notes to Financial Statements (continued)

June 30, 2007

and records, and provides other services. BBH is required, upon the order of the Trust, to deliver securities held by BBH and to make payments for securities purchased by the Trust for each Fund. As compensation for the foregoing services, BBH receives certain out-of-pocket costs, transaction fees, and asset-based fees which are paid by the Adviser.

Distributor

ALPS Distributors, Inc. (the “Distributor”) is the distributor of shares of the Trust. The Distributor has entered into a Distribution Agreement with the Trust pursuant to which it distributes shares of each Fund in creation unit aggregations. The Distributor is a broker-dealer registered under the Securities Exchange Act of 1934 and a member of the National Association of Securities Dealers, Inc. Fees under the Distribution Agreement are also paid by the Adviser, and the Adviser may, from time to time and from its own resources, make other distribution-related payments to the Distributor or other persons.

Consulting Services and Licensing Agreement

The Adviser has entered into a Consulting Services and Licensing Agreement (the “Consulting Agreement”) with Ryan Holdings LLC, Ryan ALM, Inc., and Ryan ALM Advisers, LLC (the “Ryan Parties”). Under the Consulting Agreement, Ryan ALM Advisers, LLC provides consulting services with respect to the calculation and make-up of the indices the performance of which the Funds attempt to closely match (the “Underlying Indices”) and with respect to the markets for and trading in U.S. government securities. Also under the Consulting Agreement, Ryan Holdings LLC and Ryan ALM, Inc. license the use of certain trademarks, service marks and trade names of the Ryan Parties and the Underlying Indices for use by the Adviser. Fees under Consulting Agreement are paid by the Adviser, which in turn has entered into a sub-license agreement with the Trust permitting the Funds to use such marks and names without charge.

Certain officers and/or trustees of the Adviser and Administrator are also officers/ trustees of the Trust.

4) INVESTMENT TRANSACTIONS - PURCHASES AND SALES

Excluding short-term securities and in-kind transactions, there were no purchases or sales of securities, for the period ended June 30, 2007.

5) CAPITAL

Shares are issued and redeemed by the Trust only in creation unit size blocks of 100,000 shares or multiples thereof at net asset value. Such transactions are generally permitted on an in-kind basis, with a balancing cash component to equate the transaction to the net asset value per share of each portfolio of the Trust on the transaction date. An investor who wishes to create or redeem Creation Units at net asset value is subject to a standard transaction fee of $1,000 on the date of such creation or redemption, regardless of the number of Creation Units created or redeemed on that day.

6) DISTRIBUTIONS AND TAXES

It is each Fund’s policy to qualify as a regulated investment company by complying with the requirements of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies and by distributing substantially all of its earnings to shareholders. Therefore, no federal income tax provision is required.

Income distributions and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. There were no distributions paid in 2007.

Ameristock ETF Trust

Notes to Financial Statements (continued)

June 30, 2007

At June 30, 2007, the components of accumulated earnings/loss on a tax-basis were as follows:

| | Ameristock/Ryan | Ameristock/Ryan | Ameristock/Ryan | Ameristock/Ryan | Ameristock/Ryan |

| | 1 Year | 2 Year | 5 Year | 10 Year | 20 Year |

| | Treasury ETF | Treasury ETF | Treasury ETF | Treasury ETF | Treasury ETF |

Accumulated/ Undistributed Earnings | $666 | $659 | $654 | $688 | $700 |

Net Accumulated Capital and other Gains/(Losses) | $0 | $0 | $0 | $0 | $0 |

Unrealized Appreciation/ (Depreciation) | $1,609 | $4,088 | $9,491 | $16,922 | $25,511 |

| Gross Unrealized Appreciation | $1,609 | $4,088 | $9,491 | $16,922 | $25,511 |

| Gross Unrealized Depreciation | $0 | $0 | $0 | $0 | $0 |

| Total Accumulated Earnings/(Loss) | $2,275 | $4,747 | $10,145 | $17,610 | $26,211 |

7) BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a Fund creates a presumption of control of the Fund, under Section 2(a)(9) of the Investment Company Act of 1940, As of June 30, 2007 Merrill Lynch owned the following percentage of the outstanding shares:

Fund | % |

| Ameristock/Ryan 1 Year Treasury ETF | 99.21% |

| Ameristock/Ryan 2 Year Treasury ETF | 99.21% |

| Ameristock/Ryan 5 Year Treasury ETF | 99.21% |

| Ameristock/Ryan 10 Year Treasury ETF | 99.21% |

| Ameristock/Ryan 20 Year Treasury ETF | 99.21% |

8) TRUSTEES’ FEES

The Trust compensates each Trustee who is not an employee of the Adviser or its affiliates. Total Trustees' fees are allocated to each Fund based on its average net assets. Prior to the Funds’ commencement of operations, $8,750 in payments were made to the Trustees during the organization of the Funds. Such payments were made as part of the organization and offering costs of the Fund which were borne by the Adviser.

9) RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

In June 2006, the Financial Accounting Standards Board issued Interpretation No. 48 Accounting for Uncertainty in Income Taxed (“FIN 48”). FIN 48 sets forth a recognition threshold and measurement method for the financial statement recognition and measurement of a tax position taken or expected to be taken on a tax return. Adoption of FIN 48 is required for fiscal periods beginning December 15, 2006 and is to be applied to all open tax years as of the effective date. Accordingly, the Funds have applied FIN 48

Ameristock ETF Trust

Notes to Financial Statements (continued)

June 30, 2007

for the period ended June 30, 2007 and management has determined that there is no resulting impact to the amounts reported and discussed in the financial statements as of June 30, 2007.

In September 2006, Statement of Financial Accounting Standards No. 157, Fair Value Measurements (“SFAS 157”), was issued and is effective for fiscal years beginning after November 15, 2007. SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. Management is currently evaluating the impact the adoption of SFAS 157 will have on the Funds’ financial statement disclosures.

10) PORTFOLIO HOLDINGS (unaudited)

The Funds file their complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q within 60 days after the end of the period. Copies of the Funds’ Forms N-Q will be available (after the Funds’ initial Form N-Q filings in November 2008) without a charge, upon request, by contacting the Funds at 1-866-821-5592 and on the Commission’s website at hhtp://www.sec.gov. You may also review and copy Form N-Q at the Commission’s Public Reference Room in Washington, D.C. For more information about the operation of the Public Reference Room, please call the Commission at 1-800-SEC-0330.

Ameristock ETF Trust

Board Consideration of the Investment Advisory Agreement June 30, 2007 (Unaudited)

At an in-person meeting on February 12, 2007, the Board of Trustees of the Trust, including the trustees who are not “interested persons” of the Trust as defined in the Investment Company Act of 1940 (the “Independent Trustees”), unanimously approved the Investment Advisory Agreement (the “Agreement”) between the Trust and Ameristock Corporation (the “Adviser”) with respect to each Fund.

Prior to the Board meeting, the Trustees were provided with written guidance from experienced counsel for the Trust and Adviser summarizing the factors and types of information that the Trustees should consider in reviewing and deciding whether to approve the Agreement. The Trustees also were provided prior to the meeting with certain other information pertinent to their review of the Agreement, including information specifically requested by the Trustees and provided by the Adviser.

Prior to voting at the meeting, the Trustees reviewed with counsel for the Trust and Adviser and separate counsel for the Independent Trustees the information received from the Adviser and the materials from counsel discussing the legal standards applicable to the Trustees’ consideration of the Agreement. The Independent Trustees also discussed the approval of the Agreement in a private session with their separate counsel, at which no representatives of the Adviser were present. Based on their evaluation of all material factors, including those described below, the Trustees determined to approve the Agreement until June 30, 2008. In voting to approve the Agreement, the Trustees did not identify any one factor, piece of information or written document as all-important or controlling, and each Trustee attributed different weights to different factors.

The Trustees evaluated the capabilities of the Adviser to provide the services required by the Advisory Agreement. The Trustees were familiar with the experience and performance of the Adviser and its personnel in managing the certain other investment companies for which the Trustees served as directors or trustees (the “Ameristock Mutual Funds”). They noted that an affiliate of the Adviser had experience managing an exchange-traded commodities pool and that the Adviser had recently engaged a new portfolio manager who would focus on the Funds. While the Adviser did not have any special expertise in investing in U.S. Treasuries or in operating a registered exchange-traded fund, the expectation of the Trustees was that, prior to commencement of operations of the Funds, the Adviser would perform significant testing of model Fund portfolios and consult with various parties on potential investment strategies and operations, including Ryan ALM Advisers, LLC, with which the Trust intended to enter into a consulting agreement. Because the Funds had not yet commenced operations, the Trustees could not and did not consider performance information for the Funds or compare Fund performance with the performance of other similar investment companies or appropriate securities indices.

The Trustees considered the financial resources, and compliance program and history, of the Adviser. Among other things, it was noted that the compliance policies and procedures of the Trust, the Adviser and the other service providers of the Trust would be presented to the Board at a future meeting before the Funds’ launch. It was also noted that the Adviser had had no material compliance issues related to the Ameristock Mutual Funds.

The Trustees evaluated the proposed advisory fees and total expense ratios of the Funds. It was noted that the Adviser had agreed to pay substantially all of the operating expenses of the Funds, other than the advisory fees, and that the total expense ratios of the Funds would be the same or lower than those of existing fixed income exchange-traded funds sponsored by a manager with far greater assets under management.

While the Trustees could not review information regarding the Adviser’s actual profitability with respect to the Funds because the Funds were new, the Trustees reviewed an estimated profitability analysis provided by the Adviser. It did not appear from the analysis that the Funds would be profitable to the Adviser until they had attracted substantial assets. The Trustees determined to defer to an appropriate time consideration of potential economies of scale and breakpoints in the advisory fee. The Trustees acknowledged the inherent limitations of profitability analyses, including the incomplete or dissimilar data available and the uncertainty of the various allocations and other assumptions necessary. It did not appear from the

Ameristock ETF Trust

Board Consideration of the Investment Advisory Agreement June 30, 2007 (Unaudited) (continued)

information provided that the Adviser would receive significant benefits from the Funds other than the advisory fee.

Finally, the Trustees considered the specific terms of the Advisory Agreement. They noted that the Advisory Agreement should be clarified in certain respects, particularly as to the precise nature of the Fund operating expenses that the Adviser was agreeing to pay.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholder and

Board of Trustees of

Ameristock ETF Trust

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of the Ameristock ETF Trust, comprising the Ameristock/Ryan I Year Treasury Fund, the Ameristock/Ryan 2 Year Treasury Fund, the Ameristock/Ryan 5 Year Treasury Fund, the Ameristock/Ryan 10 Year Treasury Fund, and the Ameristock/Ryan 20 Year Treasury Fund (the "Funds"), as of June 30, 2007 and the related statement of operations for the period June 28, 2007 (commencement of operations) through June 30, 2007, the statements of changes in net assets for the period June 28, 2007 (commencement of operations) through June 30, 2007, and financial highlights for the period then ended. These financial statements and financial highlights are the responsibility of Fund management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of June 30, 2007 by correspondence with the Funds' custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Ameristock ETF Trust, comprising the Ameristock/Ryan 1 Year Treasury Fund, the Ameristock/Ryan 2 Year Treasury Fund, the Ameristock/Ryan 5 Year Treasury Fund, the Ameristock/Ryan 10 Year Treasury Fund, and the Ameristock/Ryan 20 Year Treasury Fund as of June 30, 2007, the results of its operations for the period June 28, 2007 (commencement of operations) through June 30, 2007, the changes in its net assets for the period June 28, 2007 (commencement of operations) through June 30, 2007, and financial highlights for the period then ended, in conformity with accounting principles generally accepted in the United States of America.

COHEN FUND AUDIT SERVICES, LTD.

Westlake, Ohio

August 13, 2007

TRUSTEES AND OFFICERS (Unaudited)

June 30, 2007

The business and affairs of the Trust are managed under the direction of the Trust’s Board of Trustees. Information pertaining to the trustees and officers of the Trust is set forth below. The Trust’s Statement of Additional Information includes additional information about the trustees and is available without charge, upon request by calling 1-866-821-5592.

Name, Address and Age1 | Positions Held with the Trust | Serving as Officer or Trustee Since2 | Principal Occupation(s) During Past 5 Years | Number of Funds in Fund Complex3 Overseen by Trustee | Other Directorships Held4 |

| | | | | | |

INDEPENDENT TRUSTEES | | | | | |

| Alev Efendioglu PhD (64) | Trustee | 2007 | Professor of Management, School of Business and Management, University of San Francisco (1977-Present). | 6 | 0 |

| Stephen J. Marsh (54) | Chairman of the Board of Trustee | 2007 | President, Bridgeway Cellars, Inc. (winery) (2003-Present). Senior Vice President, FMV Opinions, Inc. (appraisal firm) (1998-2003). | 6 | 0 |

| Steven A. Wood (58) | Trustee | 2007 | President and Chief Economist, Insight Economics LLC (economic consulting firm) (2003-Present). Chief Economist, Financial Oxygen (capital markets technology company) (2001-2003). | 6 | 0 |

| | | | | | |

INTERESTED TRUSTEES | | | | | |

| Nicholas D. Gerber (44) | Trustee, President , Treasurer and Chief Legal Officer | Trustee since 2006; other offices since 2007 | President, director and portfolio manager for the Adviser (1995-Present); President and director, Wainwright Holdings, Inc (“Wainwright”) (financial services holding company) (2004-Present); Chief Investment Officer and director, Lyons Gate Reinsurance Company Ltd. (“Lyons Gate”) (2004-Present); President, Chief Executive Officer, Chairman, management director and portfolio manager, Victoria Bay Asset Management, LLC (“Victoria Bay”) (commodities pool operator) (2005-Present). | 6 | 0 |

| Andrew F. Ngim (47) | Trustee | 2007 | Director of and portfolio manager for the Adviser (1995-Present); Managing Director of the Adviser (1999-Present); Director, Wainwright (2004-Present); Treasurer and management director, Victoria Bay (2005-Present). | 6 | 0 |

| | | | | | |

| OFFICERS | | | | | |

| Howard Mah (43) | Secretary and Chief Compliance Officer | 2007 | Director of the Adviser (1995-Present); Compliance Officer of the Adviser (2000-Present); Chief Compliance Officer, Ameristock Mutual Fund, Inc. (2004-Present); Director, Wainwright (2004-Present); Director, Lyon’s Gate (2004-Present); Management director and Secretary, Victoria Bay (2005-Present); Chief Compliance Officer and Chief Financial Officer, Victoria Bay (2006-Present); tax and financial consultant in private practice (1995 - Present). | N/A | N/A |

| | | | | | |

1 Each Trustee may be contacted by writing to the Trustee, c/o Ameristock ETF Trust, 1320 Harbor Bay Parkway, Alameda, CA 94502.

2 Each Trustee holds office for an indefinite term until the earlier of (i) the election of his successor or (ii) the date the Trustee dies, resigns or is removed.

3 Fund Complex includes Funds with a common investment adviser or an adviser which is an affiliated person. The Fund Complex consists of the Funds and Ameristock Mutual Fund, Inc.

4 Directorships of companies required to report to the SEC under the Securities Exchange Act of 1934 (i.e., public companies) or other investment companies registered under the 1940 Act (other than the funds in the Fund Complex).

Investment Adviser |

| | Ameristock Corporation |

| | 1320 Harbor Bay Parkway, Suite 145 |

| | Alameda, California 94502 |

| | |

Administrator, Bookkeeping and Pricing Agent and Transfer Agent |

| | Brown Brothers Harriman & Co. |

| | 40 Water Street |

| | Boston, MA 02109 |

| | |

Distributor |

| | ALPS Distributors, Inc. |

| | 1290 Broadway, Suite 1100 |

| | Denver, CO 80203 |

| | |

Custodian |

| | Brown Brothers Harriman & Co. |

| | 40 Water Street |

| | Boston, MA 02109 |

| | |

Independent Registered Public Accounting Firm |

| | Cohen Fund Audit Services, Ltd. |

| | 800 Westpoint Parkway, Suite 1100 |

| | Westlake, OH 44145-1524 |

| | |

Legal Counsel |

| | Sutherland Asbill & Brennan LLP |

| | 1275 Pennsylvania Avenue, N.W. |

| | Washington, D.C. 20004-2415 |

| | |

Trustees | |

| | Alev M. Efendioglu |

| | Nicholas D. Gerber |

| | Stephen J. Marsh |

| | Andrew F. Ngim |

| | Steven A. Wood |

| | |

| | |

A description of the policies and procedures that the Adviser uses to determine how to vote proxies relating to portfolio securities of the Funds is available (i) without a charge by calling 1(866) 821-5592; and (ii) on the Securities and Exchange Commission website at www.sec.gov.

While no proxies for the Funds' portfolio securities were voted during the period from commencement of operations until June 30, 2007, information regarding how proxies were voted for each Fund for the most recent 12 month period ended June 30 is available (i) without a charge through the Fund's website at www.ameristock.com; and (ii) on the Securities and Exchange Commission website at www.sec.gov.

ALPS Distributors, Inc., distributor

For more information or to obtain a prospectus, please call 1(866) 821-5592 or visit www.ameristock.com.

ITEM 2. CODE OF ETHICS.

(a) The registrant, as of the end of the period covered by this report, has adopted a code of ethics that applies to the registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party.

(b) Not Applicable

(c) There have been no amendments, during the period covered by this report, to a provision of the code of ethics that applies to the registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, and that relates to any element of the code of ethics definition enumerated in Item 2(b) of Form N-CSR.

(d) The registrant has not granted any waiver, including any implicit waiver, from a provision of the code of ethics to the registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, that relates to one or more of the items set forth in Item 2(b) of Form N-CSR.

(e) Not Applicable

(f) The registrant has included a copy of its code of ethics as an exhibit to this report.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

The registrant’s board of trustees has determined that there is no “audit committee financial expert” serving on its audit committee. In this regard, the board of trustees determined that having such a person serve on its audit committee was unnecessary in light of the broad range of experience and expertise in financial matters possessed by the members of the audit committee even though no such member was considered to have been an audit committee financial expert under the relatively narrow definition of such term.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

AUDIT FEES

(a) For the fiscal year ended June 30, 2007, the aggregate fees billed for professional services rendered by the principal accountant for the audit of the registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for that fiscal year were $5,000. As the registrant commenced operations on June 28, 2007, no such fees were billed for the period ended June 30, 2006.

AUDIT-RELATED FEES

(b) For the fiscal year ended June 30, 2007, the aggregate fees billed for assurance and related services rendered to the registrant by the principal accountant that are reasonably related to the performance of the audit of the registrant's financial statements and are not reported under paragraph (a) of this Item were $0. As the registrant commenced operations on June 28, 2007, no such fees were billed for the period ended June 30, 2006. The aggregate fees billed for assurance and related services rendered by the principal accountant to the registrant’s investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services for the registrant, that are reasonably related to the performance of the audit of the registrant’s financial statements, that must be approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, and that are not reported under paragraph (a) of this Item, were $0 for the fiscal year ended June 30, 2007 and $0 for the fiscal year ended June 30, 2006.

TAX FEES

(c) For the fiscal year ended June 30, 2007, the aggregate fees billed for professional services rendered to the registrant by the principal accountant for tax compliance, tax advice, and tax planning were $0. As the registrant commenced operations on June 28, 2007, no such fees were billed for the period ended June 30, 2006. The aggregate fees billed for professional services rendered by the principal accountant to the registrant’s investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant, for tax compliance, tax advice and tax planning that must be approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X were $0 for the fiscal year ended June 30, 2007 and $0 for the fiscal year ended June 30, 2006.

ALL OTHER FEES

(d) For fiscal year ended June 30, 2007, the aggregate fees billed for products and services provided to the registrant by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item were $0. As the registrant commenced operations on June 28, 2007, no such fees were billed for the period ended June 30, 2006. The aggregate fees billed for products or services provided by the principal accountant to the investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant, that must be approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, other than the services reported in paragraph (a) through (c) of this Item, were $0 for the fiscal year ended June 30, 2007 and $0 for the fiscal year ended June 30, 2006.

(e) The audit committee has not adopted pre-approval policies and procedures. Instead, pursuant to the registrant’s Audit Committee Charter that has been adopted by the audit committee, the audit committee shall approve, prior to appointment, the engagement of the auditor to provide audit services to the registrant and non-audit services to the registrant, its investment adviser or any entity controlling, controlled by or under common control with the investment adviser that provides on-going services to the registrant if the engagement relates directly to the operations and financial reporting of the registrant.

(f) Not applicable

(g) The aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant and to the registrant’s investment adviser and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant, were $0 for the fiscal year ended June 30, 2007 and $0 for the fiscal year ended June 30, 2006.

(h) No non-audit services were rendered by the registrant’s principal accountant to the registrant’s investment adviser or any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant. Accordingly, the registrant’s audit committee has had no reason to consider whether such services are compatible with maintaining the principal accountant’s independence.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

The registrant has a separately designated standing audit committee, established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended.

The members of the registrant's audit committee are: Alev F. Efendioglu, Chairman, Steven A. Wood, and Stephen J. Marsh

ITEM 6. SCHEDULE OF INVESTMENTS.

A Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period is included as part of the report to shareholders filed under Item 1 of this Form N-CSR.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not Applicable.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not Applicable.

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANIES AND AFFILIATED PURCHASERS.

Not Applicable.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

The registrant’s board of trustees, as of the end of the period covered by the report, had not adopted procedures by which shareholders may recommend nominees to the registrant’s board of directors.

ITEM 11. CONTROLS AND PROCEDURES.

(a) The registrant's principal executive officer and principal financial officer has concluded that the registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended) are effective, as of a date within 90 days of the filing date of this report, based on his evaluation of these disclosure controls and procedures as required by Rule 30a-3(b) under the 1940 Act, as amended, 17 CFR 270.30a-3(b)), and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d-15(b)).

(b) There were no changes in the registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act, as amended (17 CFR 270.30a-3(d)), that occurred during the registrant's second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

ITEM 12. EXHIBITS.

(a)(1) Code of ethics, or any amendment thereto, that is the subject of disclosure required by Item 2 is attached hereto.

(a)(2) Certifications pursuant to Rule 30a-2(a) under the 1940 Act and Section 302 of the Sarbanes-Oxley Act of 2002 are attached hereto.

(a)(3) Not Applicable.

(b) Certifications pursuant to Rule 30a-2(b) under the 1940 Act and Section 906 of the Sarbanes-Oxley Act of 2002 are attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Ameristock ETF Trust

By: /s/ Nicholas D. Gerber

Name: Nicholas D. Gerber

Title: President, Treasurer and Chief Legal Officer

Date: September 7, 2007

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: /s/ Nicholas D. Gerber

Name: Nicholas D. GerberTitle: President, Treasurer and Chief Legal Officer

Date: September 7, 2007