UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period endedJuly 31, 2010

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________

COMMISSION FILE NUMBER000-52391

ROYAL MINES AND MINERALS CORP.

(Exact name of registrant as specified in its charter)

| NEVADA | 20-4178322 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

| Suite 112, 2580 Anthem Village Dr. | |

| Henderson, NV | 89052 |

| (Address of principal executive offices) | (Zip code) |

(702) 588-5973

(Registrant's telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (s. 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes[ ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | | Accelerated filer [ ] |

| Non-accelerated filer [ ] | (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes[ ] No [X]

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date:As of September 3, 2010, the Registrant had 111,785,352 shares of common stockoutstanding.

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS.

The accompanying unaudited financial statements have been prepared in accordance with the instructions to Form 10-Q and Rule 8-03 of Regulation S-X, and, therefore, do not include all information and footnotes necessary for a complete presentation of financial position, results of operations, cash flows, and stockholders' equity in conformity with generally accepted accounting principles. In the opinion of management, all adjustments considered necessary for a fair presentation of the results of operations and financial position have been included and all such adjustments are of a normal recurring nature. Operating results for the three months ended July 31, 2010 are not necessarily indicative of the results that can be expected for the year ending April 30, 2011.

As used in this Quarterly Report, the terms “we,” “us,” “our,” “Royal Mines,” and the “Company” mean Royal Mines And Minerals Corp. and its subsidiaries, unless otherwise indicated. All dollar amounts in this Quarterly Report are expressed in U.S. dollars, unless otherwise indicated.

2

ROYAL MINES AND MINERALS CORP.

(An Exploration Stage Company)

BALANCE SHEET

(Unaudited)

| | | As of | | | As of | |

| | | July 31, 2010 | | | April 30, 2010 | |

| | | | | | | |

| ASSETS | |

| | | | | | | |

| Current assets | | | | | | |

| Cash and cash equivalents | $ | 26,665 | | $ | 37,559 | |

| Loan receivable | | 480,000 | | | 400,000 | |

| Total current assets | | 506,665 | | | 437,559 | |

| | | | | | | |

| Property and equipment, net | | 203,536 | | | 218,601 | |

| Intellectual property, net | | 140,000 | | | 150,000 | |

| Mineral properties | | 35,800 | | | 35,800 | |

| Other assets | | 5,500 | | | 5,500 | |

| Total non-current assets | | 384,836 | | | 409,901 | |

| | | | | | | |

| Total assets | $ | 891,501 | | $ | 847,460 | |

| | | | | | | |

| | | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | |

| | | | | | | |

| Current liabilities | | | | | | |

| Accounts payable | $ | 52,026 | | $ | 16,937 | |

| Accounts payable - related party | | 105,000 | | | 87,000 | |

| NVRM payable | | 90,000 | | | 90,000 | |

| Loans payable - related party | | 498,855 | | | 245,277 | |

| Accrued interest - related party | | 131,591 | | | 121,123 | |

| Total current liabilities | | 877,472 | | | 560,337 | |

| | | | | | | |

| Long-term debt | | - | | | - | |

| | | | | | | |

| Total liabilities | | 877,472 | | | 560,337 | |

| | | | | | | |

| Commitments and contingencies | | | | | | |

| | | | | | | |

| Stockholders' equity (deficit) | | | | | | |

Common stock, $0.001 par value; 300,000,000 shares

authorized, 111,785,352 and 111,785,352 shares,

respectively, issued and outstanding | | 111,785 | | | 111,785 | |

Preferred stock, $0.001 par value; 100,000,000 shares

authorized, zero shares issued and outstanding | | - | | | - | |

| Additional paid-in capital | | 9,770,178 | | | 9,770,178 | |

| Accumulated deficit during exploration stage | | (9,867,934 | ) | | (9,594,840 | ) |

| Total stockholders' equity (deficit) | | 14,029 | | | 287,123 | |

| | | | | | | |

| Total liabilities and stockholders' equity (deficit) | $ | 891,501 | | $ | 847,460 | |

See Accompanying Notes to Financial Statements

F-1

ROYAL MINES AND MINERALS CORP.

(An Exploration Stage Company)

STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | For the Period | |

| | | | | | | | | July 13, 2005 | |

| | | | | | | | | (Date of Inception) | |

| | | For the Three Months Ended | | | Through | |

| | | July 31, 2010 | | | July 31, 2009 | | | July 31, 2010 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Revenue | $ | 14,285 | | $ | 41,811 | | $ | 83,284 | |

| | | | | | | | | | |

| Operating expenses | | | | | | | | | |

| Mineral exploration and evaluation expenses | | 124,356 | | | 263,484 | | | 2,387,098 | |

| Mineral exploration and evaluation expenses - related party | | 30,000 | | | - | | | 605,500 | |

| General and administrative | | 46,490 | | | 37,033 | | | 2,519,794 | |

| General and administrative - related party | | 51,000 | | | 111,000 | | | 3,954,282 | |

| Depreciation and amortization | | 25,065 | | | 46,515 | | | 447,467 | |

| | | | | | | | | | |

| Total operating expenses | | 276,911 | | | 458,032 | | | 9,914,141 | |

| | | | | | | | | | |

| Loss from operations | | (262,626 | ) | | (416,221 | ) | | (9,830,857 | ) |

| | | | | | | | | | |

| Other income (expense): | | | | | | | | | |

| Other income | | - | | | - | | | 99,115 | |

| Interest income | | - | | | - | | | 4,551 | |

| Interest expense | | (10,468 | ) | | (13,777 | ) | | (140,743 | ) |

| | | | | | | | | | |

| Total other income (expense) | | (10,468 | ) | | (13,777 | ) | | (37,077 | ) |

| | | | | | | | | | |

| Loss from operations before provision for income taxes | | (273,094 | ) | | (429,998 | ) | | (9,867,934 | ) |

| | | | | | | | | | |

| Income tax benefit | | - | | | - | | | - | |

| | | | | | | | | | |

| Net loss | $ | (273,094 | ) | $ | (429,998 | ) | $ | (9,867,934 | ) |

| | | | | | | | | | |

| Loss per common share - basic and diluted: | | | | | | | | | |

| Net loss | $ | (0.00 | ) | $ | (0.01 | ) | | | |

| | | | | | | | | | |

Weighted average common shares outstanding -

Basic and diluted | | 111,785,352 | | | 73,087,461 | | | | |

See Accompanying Notes to Financial Statements

F-2

ROYAL MINES AND MINERALS CORP.

(An Exploration Stage Company)

STATEMENT OF STOCKHOLDERS' EQUITY (DEFICIT)

(Unaudited)

| | | | | | | | | | | | Accumulated | | | | |

| | | | | | | | | | | | Deficit During | | | Total | |

| | | Common Stock | | | Additional | | | Exploration | | | Stockholders' | |

| | | Shares | | | Amount | | | Paid-in Capital | | | Stage | | | Equity (Deficit) | |

| | | | | | | | | | | | | | | | |

| Balance, July 13, 2005 | | - | | $ | - | | $ | - | | $ | - | | $ | - | |

| | | | | | | | | | | | | | | | |

| Issuance of common stock for cash, $0.001 per share | | 1,000 | | | 1 | | | - | | | - | | | 1 | |

| | | | | | | | | | | | | | | | |

| Net loss | | - | | | - | | | - | | | (174,500 | ) | | (174,500 | ) |

| | | | | | | | | | | | | | | | |

| Balance, April 30, 2006 | | 1,000 | | | 1 | | | - | | | (174,500 | ) | | (174,499 | ) |

| | | | | | | | | | | | | | | | |

| Issuance of common stock for cash, $0.001 per share | | 12,500,000 | | | 12,500 | | | - | | | - | | | 12,500 | |

| | | | | | | | | | | | | | | | |

| Issuance of common stock for cash, $0.01 per share | | 7,800,000 | | | 7,800 | | | 70,200 | | | - | | | 78,000 | |

| | | | | | | | | | | | | | | | |

| Issuance of common stock for mineral property options, $0.01 per share | | 1,050,000 | | | 1,050 | | | 9,450 | | | - | | | 10,500 | |

| | | | | | | | | | | | | | | | |

| Issuance of common stock for cash, $0.10 per share | | 1,250,000 | | | 1,250 | | | 123,750 | | | - | | | 125,000 | |

| | | | | | | | | | | | | | | | |

| Issuance of common stock for cash, Reg. S - Private Placement, $0.10 per share | | 1,800,000 | | | 1,800 | | | 178,200 | | | - | | | 180,000 | |

| | | | | | | | | | | | | | | | |

| Issuance of common stock in acquisition of intellectual property and equipment, $0.10 per share | | 2,000,000 | | | 2,000 | | | 198,000 | | | - | | | 200,000 | |

| | | | | | | | | | | | | | | | |

| Net loss | | - | | | - | | | - | | | (517,768 | ) | | (517,768 | ) |

| | | | | | | | | | | | | | | | |

| Balance, April 30, 2007 | | 26,401,000 | | $ | 26,401 | | $ | 579,600 | | $ | (692,268 | ) | $ | (86,267 | ) |

| | | | | | | | | | | | | | | | |

| Issuance of common stock for cash and subscriptions received, Reg. S - Private Placement, $0.25 per share | | 2,482,326 | | | 2,482 | | | 618,100 | | | - | | | 620,582 | |

| | | | | | | | | | | | | | | | |

| Issuance of common stock for cash, Reg. D - Private Placement, $0.25 per share | | 3,300,000 | | | 3,300 | | | 821,700 | | | - | | | 825,000 | |

| | | | | | | | | | | | | | | | |

| Issuance of common stock in reverse acquisition of Centrus Ventures Inc. | | 13,968,926 | | | 13,969 | | | (77,164 | ) | | - | | | (63,195 | ) |

| | | | | | | | | | | | | | | | |

| Issuance of stock options for 4,340,000 shares of common stock to three officers and five consultants. | | - | | | - | | | 3,583,702 | | | - | | | 3,583,702 | |

| | | | | | | | | | | | | | | | |

| Net loss | | - | | | - | | | - | | | (5,256,444 | ) | | (5,256,444 | ) |

| | | | | | | | | | | | | | | | |

| Balance, April 30, 2008 | | 46,152,252 | | $ | 46,152 | | $ | 5,525,938 | | $ | (5,948,712 | ) | $ | (376,622 | ) |

| | | | | | | | | | | | | | | | |

| Issuace of common stock for cash, Reg. S - Private Placement, $0.50 per share; with attached warrants exercisable at $0.75 per share | | 200,000 | | | 200 | | | 99,800 | | | - | | | 100,000 | |

| | | | | | | | | | | | | | | | |

| Issuance of common stock in satisfaction of debt, $0.30 per share, with attached warrants exercisable at $0.50 per share. | | 450,760 | | | 451 | | | 134,777 | | | - | | | 135,228 | |

| | | | | | | | | | | | | | | | |

| Issuance of stock options for 5,000,000 shares of common stock to two officers and nine consultants. | | - | | | - | | | 342,550 | | | - | | | 342,550 | |

| | | | | | | | | | | | | | | | |

| Issuace of common stock for cash, $0.05 per share, with attached warrants exercisable at $0.10 per share. | | 9,140,000 | | | 9,140 | | | 447,860 | | | - | | | 457,000 | |

| | | | | | | | | | | | | | | | |

| Issuance of common stock in satisfaction of loans made to the Company, $0.05 per share, with attached warrants exercisable at $0.10 per share. | | 12,400,000 | | | 12,400 | | | 607,600 | | | - | | | 620,000 | |

See Accompanying Notes to Financial Statements

F-3

ROYAL MINES AND MINERALS CORP.

(An Exploration Stage Company)

STATEMENT OF STOCKHOLDERS' EQUITY (DEFICIT)

(Unaudited)

| | | | | | | | | | | | Accumulated | | | Total | |

| | | | | | | | | Additional | | | Deficit During | | | Stockholders' | |

| | | Common Stock | | | Paid-in | | | Exploration | | | Equity | |

| | | Shares | | | Amount | | | Capital | | | Stage | | | (Deficit) | |

| | | | | | | | | | | | | | | | |

| Issuance of common stock in satisfaction of debt, $0.05 per share, with attached warrants exercisable at $0.10 per share. | | 1,336,840 | | | 1,337 | | | 65,505 | | | - | | | 66,842 | |

| | | | | | | | | | | | | | | | |

| Issuance of common stock to one officer as compensation pursuant to the management consulting agreement. | | 3,000,000 | | | 3,000 | | | 117,000 | | | - | | | 120,000 | |

| | | | | | | | | | | | | | | | |

| Net loss | | - | | | - | | | - | | | (1,717,000 | ) | | (1,717,000 | ) |

| | | | | | | | | | | | | | | | |

| Balance, April 30, 2009 | | 72,679,852 | | $ | 72,680 | | $ | 7,341,030 | | $ | (7,665,712 | ) | $ | (252,002 | ) |

| | | | | | | | | | | | | | | | |

| Issuance of common stock in satisfaction of loans made to the Company, $0,05 per share, with attached warrants exercisable at $0.10 per share. | | 2,000,000 | | | 2,000 | | | 98,000 | | | - | | | 100,000 | |

| | | | | | | | | | | | | | | | |

| Issuance of common stock in satisfaction of debt, $0.05 per share, with attached warrants exercisable at $0.10 per share. | | 500,000 | | | 500 | | | 24,500 | | | - | | | 25,000 | |

| | | | | | | | | | | | | | | | |

| Issuance of common stock for warrants excercised, $0.10 per share, in satisfaction of debt for legal services. | | 295,000 | | | 295 | | | 29,205 | | | - | | | 29,500 | |

| | | | | | | | | | | | | | | | |

| Issuance of common stock for options excercised, $0.05 per share, in satisfaction of debt for legal services. | | 750,000 | | | 750 | | | 36,750 | | | - | | | 37,500 | |

| | | | | | | | | | | | | | | | |

| Issuance of common stock to investor relations services firm pursuant to terms of consulting agreement. | | 1,500,000 | | | 1,500 | | | - | | | - | | | 1,500 | |

| | | | | | | | | | | | | | | | |

| Issuance of common stock in satisfaction of loans to the Company, $0.10 per share, with attached warrants excercisable at $0.20 per share. | | 3,500,000 | | | 3,500 | | | 346,500 | | | - | | | 350,000 | |

| | | | | | | | | | | | | | | | |

| Issuance of stock options for 7,000,000 shares of common stock to two directors and nine consultants. | | - | | | - | | | 391,478 | | | - | | | 391,478 | |

| | | | | | | | | | | | | | | | |

| Issuance of common stock for options excercised, $0.05 per share, in satisfaction of debt for legal services. | | 900,000 | | | 900 | | | 44,100 | | | - | | | 45,000 | |

| | | | | | | | | | | | | | | | |

| Issuance of common stock in satisfaction of loans to the Company, $0.05 per share, with attached warrants exercisable at $0.10 per share. | | 19,400,000 | | | 19,400 | | | 950,600 | | | - | | | 970,000 | |

| | | | | | | | | | | | | | | | |

| Issuace of common stock for cash, $0.05 per share, with attached warrants exercisable at $0.10 per share. | | 8,280,000 | | | 8,280 | | | 405,720 | | | - | | | 414,000 | |

| | | | | | | | | | | | | | | | |

| Issuance of common stock in satisfaction of debt, $0.05 per share, with attached warrants exercisable at $0.10 per share. | | 1,775,500 | | | 1,775 | | | 87,000 | | | - | | | 88,775 | |

| | | | | | | | | | | | | | | | |

| Issuance of common stock for options excercised, $0.05 per share, in satisfaction of debt for legal services. | | 100,000 | | | 100 | | | 4,900 | | | - | | | 5,000 | |

| | | | | | | | | | | | | | | | |

| Issuance of common stock for warrants excercised, $0.10 per share, in satisfaction of debt for legal services. | | 105,000 | | | 105 | | | 10,395 | | | - | | | 10,500 | |

| | | | | | | | | | | | | | | | |

| Net loss | | - | | | - | | | - | | | (1,929,128 | ) | | (1,929,128 | ) |

| | | | | | | | | | | | | | | | |

| Balance, April 30, 2010 | | 111,785,352 | | $ | 111,785 | | $ | 9,770,178 | | $ | (9,594,840 | ) | $ | 287,123 | |

| | | | | | | | | | | | | | | | |

| Net loss | | - | | | - | | | - | | | (273,094 | ) | | (273,094 | ) |

| | | | | | | | | | | | | | | | |

| Balance, July 31, 2010 | | 111,785,352 | | $ | 111,785 | | $ | 9,770,178 | | $ | (9,867,934 | ) | $ | 14,029 | |

See Accompanying Notes to Financial Statements

F-4

ROYAL MINES AND MINERALS CORP.

(An Exploration Stage Company)

STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | For the Period | |

| | | | | | | | | July 13, 2005 | |

| | | | | | | | | (Date of Inception) | |

| | | For the Three Months Ended | | | Through | |

| | | July 31, 2010 | | | July 31, 2009 | | | July 31, 2010 | |

| | | | | | | | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | | |

| Net loss | $ | (273,094 | ) | $ | (429,998 | ) | $ | (9,867,934 | ) |

Adjustments to reconcile loss from operating to net

cash used in operating activities: | | | | | | | | | |

| Depreciation and amortization | | 25,065 | | | 46,515 | | | 447,467 | |

| Stock based expenses | | - | | | - | | | 1,095,447 | |

| Stock based expenses - related party | | - | | | - | | | 3,342,283 | |

| Changes in operating assets and liabilities: | | | | | | | | - | |

| Other current assets and liabilities | | - | | | (8,933 | ) | | (12,683 | ) |

| Other assets | | - | | | - | | | (5,500 | ) |

| Loan receivable | | (80,000 | ) | | - | | | (480,000 | ) |

| Accounts payable and accrued interest | | 35,089 | | | (64,325 | ) | | 544,890 | |

| Accounts payable and accrued interest- related party | | 28,468 | | | 46,148 | | | 278,481 | |

| | | | | | | | | | |

| Net cash used in operating activities | | (264,472 | ) | | (410,593 | ) | | (4,657,549 | ) |

| | | | | | | | | | |

| CASH FLOW FROM INVESTING ACTIVITIES | | | | | | | | | |

| Cash paid on mineral property claims | | - | | | - | | | (25,300 | ) |

| Cash acquired on reverse merger | | - | | | - | | | 2,306 | |

| Purchase of fixed assets | | - | | | (18,734 | ) | | (591,003 | ) |

| | | | | | | | | | |

| Net cash used in investing activities | | - | | | (18,734 | ) | | (613,997 | ) |

| | | | | | | | | | |

| CASH FLOW FROM FINANCING ACTIVITIES | | | | | | | | | |

| Proceeds from stock issuance | | - | | | - | | | 2,813,581 | |

| Share subscriptions | | - | | | - | | | - | |

| Proceeds / (Payments) on long-term debt | | - | | | - | | | - | |

| Proceeds / (Payments) on borrowings - related party | | 253,578 | | | 487,580 | | | 2,484,630 | |

| | | | | | | | | | |

| Net cash provided by financing activities | | 253,578 | | | 487,580 | | | 5,298,211 | |

| | | | | | | | | | |

| NET CHANGE IN CASH | | (10,894 | ) | | 58,253 | | | 26,665 | |

| | | | | | | | | | |

| CASH AT BEGINNING OF PERIOD | | 37,559 | | | 1,819 | | | - | |

| | | | | | | | | | |

| CASH AT END OF PERIOD | $ | 26,665 | | $ | 60,072 | | $ | 26,665 | |

| | | | | | | | | | |

| | | | | | | | | | |

| SUPPLEMENTAL INFORMATION | | | | | | | | | |

| | | | | | | | | | |

| Interest Paid | $ | - | | $ | 1,093 | | $ | 3,833 | |

| Income Taxes Paid | $ | - | | $ | - | | $ | - | |

| | | | | | | | | | |

| SUPPLEMENTARY DISCLOSURE FOR NON-CASH | | | | | | | | | |

| INVESTING AND FINANCING ACTIVITIES | | | | | | | | | |

| | | | | | | | | | |

| Acquisition of intellectual property for stock | $ | - | | $ | - | | $ | 200,000 | |

| Acquisition of mineral property for stock | $ | - | | $ | - | | $ | 10,500 | |

| Stock issued in reverse acquisition of Centrus Ventures Inc. | $ | - | | $ | - | | $ | (63,195 | ) |

| Stock issued in satisfaction of debt | $ | - | | $ | 25,000 | | $ | 25,000 | |

| Stock issued in satisfaction of loans made to the Company | $ | - | | $ | 100,000 | | $ | 100,000 | |

| Stock issued as compensation | $ | - | | $ | - | | $ | 120,000 | |

See Accompanying Notes to Financial Statements

F-5

ROYAL MINES AND MINERALS CORP.

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

(Unaudited)

JULY 31, 2010

| 1. | DESCRIPTION OF BUSINESS, HISTORY AND SUMMARY OF SIGNIFICANT POLICIES |

| | |

| Basis of Presentation– These financial statements and related notes are presented in accordance with accounting principles generally accepted in the United States. The Company’s fiscal year-end is April 30. |

| | |

| Description of Business– The Company is considered an exploration stage company. The Company's primary objectives are to 1) commercially extract and refine precious and base metals from its own and others mining assets, 2) joint venture, acquire and develop projects in North America, and 3) generate ongoing revenues from the licensing of its proprietary, environmentally-friendly lixiviation process. The Company has not yet realized significant revenues from its primary objectives. |

| | |

| History– The Company was incorporated on December 14, 2005 under the laws of the State of Nevada. On June 13, 2007, the Company incorporated a wholly-owned subsidiary, Royal Mines Acquisition Corp., in the state of Nevada. |

| | |

| On October 5, 2007, Centrus Ventures Inc. (Centrus) completed the acquisition of Royal Mines Inc. (“Royal Mines”). The acquisition of Royal Mines was completed by way of a “triangular merger” pursuant to the provisions of the Agreement and Plan of Merger dated September 24, 2007 (the “First Merger Agreement”) among Centrus, Royal Mines Acquisition Corp. (“Centrus Sub”), a wholly owned subsidiary of Centrus, Royal Mines and Kevin B. Epp, the former sole executive officer and director of Centrus. On October 5, 2007, under the terms of the First Merger Agreement, Royal Mines was merged with and into Centrus Sub, with Centrus Sub continuing as the surviving corporation (the “First Merger”). |

| | |

| On October 6, 2007, a second merger was completed pursuant to an Agreement and Plan of Merger dated October 6, 2007 (the “Second Merger Agreement”) between Centrus and its wholly owned subsidiary, Centrus Sub, whereby Centrus Sub was merged with and into Centrus, with Centrus continuing as the surviving corporation (the “Second Merger”). As part of the Second Merger, Centrus changed its name from “Centrus Ventures Inc.” to “Royal Mines And Minerals Corp.”(“the Company”). Other than the name change, no amendments were made to the Articles of Incorporation. |

| | |

| Under the terms and conditions of the First Merger Agreement, each share of Royal Mines’ common stock issued and outstanding immediately prior to the completion of the First Merger was converted into one share of Centrus’ common stock. As a result, a total of 32,183,326 shares of Centrus common stock were issued to former stockholders of Royal Mines. In addition, Mr. Epp surrendered 23,500,000 shares of Centrus common stock for cancellation in consideration of payment by Centrus of $0.001 per share for an aggregate consideration of $23,500. As a result, upon completion of the First Merger, the former stockholders of Royal Mines owned approximately 69.7% of the issued and outstanding common stock. |

| | |

| As such, Royal Mines is deemed to be the acquiring enterprise for financial reporting purposes. All acquired assets and liabilities of Centrus were recorded at fair value on the date of the acquisition, as required by the purchase method of accounting, and the tangible net liabilities were debited against equity of the Company. There are no continuing operations of Centrus from the date of acquisition. |

| | |

| Going Concern- As of July 31, 2010, the Company has incurred cumulative net losses of approximately $9,867,934 from operations and has negative working capital of $370,807. The Company is still in the exploration stage and has not fully commenced its mining and minerals processing operations, raising substantial doubt about its ability to continue as a going concern. |

| | |

| The ability of the Company to continue as a going concern is dependent on the Company raising additional sources of capital and the successful execution of the Company’s objectives. The Company will seek additional |

F-6

ROYAL MINES AND MINERALS CORP.

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

(Unaudited)

JULY 31, 2010

| 1. | DESCRIPTION OF BUSINESS, HISTORY AND SUMMARY OF SIGNIFICANT POLICIES(continued) |

| | |

| sources of capital through the issuance of debt or equity financing, but there can be no assurance the Company will be successful in accomplishing its objectives. The financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern. |

| | |

| Use of Estimates- The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. |

| | |

| Cash and Cash Equivalents- The Company considers all investments with an original maturity of three months or less to be a cash equivalent. |

| | |

| Property and Equipment- Property and equipment are stated at cost less accumulated depreciation. Depreciation is provided principally on the straight-line method over the estimated useful lives of the assets, which are generally 3 to 10 years. The cost of repairs and maintenance is charged to expense as incurred. Expenditures for property betterments and renewals are capitalized. Upon sale or other disposition of a depreciable asset, cost and accumulated depreciation are removed from the accounts and any gain or loss is reflected in other income (expense). |

| | |

| The Company periodically evaluates whether events and circumstances have occurred that may warrant revision of the estimated useful life of fixed assets or whether the remaining balance of fixed assets should be evaluated for possible impairment. The Company uses an estimate of the related undiscounted cash flows over the remaining life of the fixed assets in measuring their recoverability. |

| | |

| Mineral Property Rights– Costs of acquiring mining properties are capitalized upon acquisition. Mine development costs incurred either to develop new ore deposits, to expand the capacity of mines, or to develop mine areas substantially in advance of current production are also capitalized once proven and probable reserves exist and the property is a commercially mineable property. Costs incurred to maintain current production or to maintain assets on a standby basis are charged to operations. Costs of abandoned projects are charged to operations upon abandonment. The Company evaluates the carrying value of capitalized mining costs and related property and equipment costs, to determine if these costs are in excess of their recoverable amount whenever events or changes in circumstances indicate that their carrying amounts may not be recoverable. Evaluation of the carrying value of capitalized costs and any related property and equipment costs would be based upon expected future cash flows and/or estimated salvage value in accordance with Accounting Standards Codification (ASC) 360-10-35-15,Impairment or Disposal of Long-Lived Assets. |

| | |

| Exploration Costs– Mineral exploration costs are expensed as incurred. |

| | |

| Impairment of Long-Lived Assets– The Company reviews and evaluates long-lived assets for impairment when events or changes in circumstances indicate the related carrying amounts may not be recoverable. The assets are subject to impairment consideration under ASC 360-10-35-17,Measurement of an Impairment Loss, if events or circumstances indicate that their carrying amount might not be recoverable. As of July 31, 2010 exploration progress is on target with the Company’s exploration and evaluation plan and no events or circumstances have happened to indicate the related carrying values of the properties may not be recoverable. When the Company determines that an impairment analysis should be done, the analysis will be performed using the rules of ASC 930-360-35,Asset Impairment, and 360-10-15-3 through 15-5,Impairment or Disposal of Long-Lived Assets. |

F-7

ROYAL MINES AND MINERALS CORP.

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

(Unaudited)

JULY 31, 2010

| 1. | DESCRIPTION OF BUSINESS, HISTORY AND SUMMARY OF SIGNIFICANT POLICIES(continued) |

| | |

| Various factors could impact our ability to achieve forecasted production schedules. Additionally, commodity prices, capital expenditure requirements and reclamation costs could differ from the assumptions the Company may use in cash flow models used to assess impairment. The ability to achieve the estimated quantities of recoverable minerals from exploration stage mineral interests involves further risks in addition to those factors applicable to mineral interests where proven and probable reserves have been identified, due to the lower level of confidence that the identified mineralized material can ultimately be mined economically. |

| | |

| Material changes to any of these factors or assumptions discussed above could result in future impairment charges to operations. |

| | |

| Asset Retirement Obligation- The Company follows ASC 410,Asset Retirement and Environmental Obligations, which requires that an asset retirement obligation (“ARO”) associated with the retirement of a tangible long-lived asset be recognized as a liability in the period in which it is incurred and becomes determinable, with an offsetting increase in the carrying amount of the associated asset. The cost of the tangible asset, including the initially recognized ARO, is depleted, such that the cost of the ARO is recognized over the useful life of the asset. The ARO is recorded at fair value, and accretion expense is recognized over time as the discounted liability is accreted to its expected settlement value. The fair value of the ARO is measured using expected future cash flow, discounted at the Company’s credit-adjusted risk-free interest rate. To date, no significant asset retirement obligation exists due to the early stage of exploration. Accordingly, no liability has been recorded. |

| | |

| Fair Value of Financial Instruments- Fair value accounting establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are described below: |

| | Level1 | Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities; |

| | Level2 | Quoted prices in markets that are not active, or inputs that are observable, either directly or indirectly, for substantially the full term of the asset or liability; and |

| | Level3 | Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (supported by little or no market activity). |

The Company’s financial instruments consist of mineral property purchase obligations. These obligations are classified within Level 2 of the fair value hierarchy as their fair value is determined using interest rates which approximate market rates. The Company is not exposed to significant interest or credit risk arising from these financial instruments.

Revenue Recognition –Revenues are recognized during the period in which the revenues are earned. Revenue from licensing our technology is recognized over the term of the license agreement. Costs and expenses are recognized during the period in which they are incurred.

Research and Development - All research and development expenditures are expensed as incurred.

Earnings (Loss) Per Share - The Company follows ASC 260,Earnings Per Share,and ASC 480,Distinguishing Liabilities from Equity,which establish standards for the computation, presentation and disclosure requirements for basic and diluted earnings per share for entities with publicly held common shares and potential common stock issuances. Basic earnings (loss) per share are computed by dividing net income by the weighted average number of

F-8

ROYAL MINES AND MINERALS CORP.

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

(Unaudited)

JULY 31, 2010

| 1. | DESCRIPTION OF BUSINESS, HISTORY AND SUMMARY OF SIGNIFICANT POLICIES(continued) |

| | |

| common shares outstanding. In computing diluted earnings per share, the weighted average number of shares outstanding is adjusted to reflect the effect of potentially dilutive securities, such as stock options and warrants. Common stock equivalent shares are excluded from the computation if their effect is antidilutive. Common stock equivalents, which include stock options and warrants to purchase common stock, on July 31, 2010 that were not included in the computation of diluted EPS because the effect would be antidilutive were 68,688,100. |

| | |

| Income Taxes- The Company accounts for its income taxes in accordance with ASC 740,Income Taxes, which requires recognition of deferred tax assets and liabilities for future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and tax credit carry-forwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. |

| | |

| For acquired properties that do not constitute a business as defined in ASC 805-10-55-4,Definition of a Business, deferred income tax liability is recorded on GAAP basis over income tax basis using statutory federal and state rates. The resulting estimated future federal and state income tax liability associated with the temporary difference between the acquisition consideration and the tax basis is computed in accordance with ASC 740-10-25-51,Acquired Temporary Differences in Certain Purchase Transactions that are Not Accounted for as Business Combinations, and is reflected as an increase to the total purchase price which is then applied to the underlying acquired assets in the absence of there being a goodwill component associated with the acquisition transactions. |

| | |

| Expenses of Offering- The Company accounts for specific incremental costs directly to a proposed or actual offering of securities as a direct charge against the gross proceeds of the offering. |

| | |

| Stock-Based Compensation– The Company accounts for share based payments in accordance with ASC 718,Compensation - Stock Compensation, which requires all share-based payments to employees, including grants of employee stock options, to be recognized in the financial statements based on the grant date fair value of the award. In accordance with ASC 718-10-30-9,Measurement Objective – Fair Value at Grant Date, the Company estimates the fair value of the award using a valuation technique. For this purpose, the Company uses the Black-Scholes option pricing model. The Company believes this model provides the best estimate of fair value due to its ability to incorporate inputs that change over time, such as volatility and interest rates, and to allow for actual exercise behavior of option holders. The compensation cost is recognized over the requisite service period which is generally equal to the vesting period. Upon exercise, shares issued will be newly issued shares from authorized common stock. |

| | |

| Recent Accounting Standards– From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board (FASB) that are adopted by the Company as of the specified effective date. Unless otherwise discussed, management believes that the impact of recently issued standards did not or will not have a material impact on the Company’s financial statements upon adoption. |

| | |

| Effective July 1, 2009, the FASB Accounting Standards Codification (ASC) (Topic 105, “Generally Accepted Accounting Principles”), became the single source for authoritative nongovernmental U.S. generally accepted accounting principles. Rules and interpretive releases of the SEC under authority of federal securities laws are also sources of authoritative U.S. GAAP for SEC registrants. The ASC does not change US GAAP but is intended to simplify user access to all authoritative U.S. GAAP by providing all the authoritative literature related to a particular topic in one place. Effective September 15, 2009, all public filings of the Company will reference the ASC as the sole source of authoritative literature. |

F-9

ROYAL MINES AND MINERALS CORP.

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

(Unaudited)

JULY 31, 2010

| 1. | DESCRIPTION OF BUSINESS, HISTORY AND SUMMARY OF SIGNIFICANT POLICIES(continued) |

| | |

| In January 2010, the FASB issued ASU 2010-06,Improving Disclosures About Fair Value Measurements, which requires reporting entities to make new disclosures about recurring or nonrecurring fair value measurements including significant transfers into and out of Level 1 and Level 2 fair value measurements and information on purchases, sales, issuances, and settlements on a gross basis in the reconciliation of Level 3 fair value measurements. ASU 2010-6 is effective for annual reporting periods beginning after December 15, 2009, except for Level 3 reconciliation disclosures which are effective for annual periods beginning after December 15, 2010. The Company does not have any assets or liabilities classified as Level 3. The Company has adopted the Level 1 and Level 2 amendments accordingly. As the update only pertained to disclosures, it had no impact on the Company’s financial position, results of operations, or cash flows upon adoption. |

| | |

| In February 2010, the FASB issued ASU 2010-09,Subsequent Events (Topic 855), Amendment to Certain Recognition and Disclosure Requirements, to remove the requirement for SEC filers to disclose the date through which an entity has evaluated subsequent events. This change removes potential conflicts with current SEC guidance and clarifies the intended scope of the reissuance disclosure provisions. The update was effective upon its date of issuance, February 24, 2010, and the Company has adopted the amendments accordingly. As the update only pertained to disclosures, it had no impact on the Company’s financial position, results of operations, or cash flows upon adoption. |

| | |

| 2. | LOAN RECEIVABLE |

| | |

| Between October 8, 2009 and July 31, 2010, the Company advanced $480,000 to Golden Anvil, in accordance with the toll processing agreement dated December 3, 2009, bearing no interest and secured by Golden Anvil’s interest in shipments of concentrate, their land and their facilities. |

| | |

| 3. | PROPERTY AND EQUIPMENT |

| | |

| Property and equipment consists of the following: |

| | | As of | | | As of | |

| | | July 31, 2010 | | | April 30, 2010 | |

| Process, lab and office equipment | $ | 411,734 | | $ | 411,734 | |

| Site Equipment | | 179,269 | | | 179,269 | |

| Less: accumulated depreciation | | 387,467 | | | 372,402 | |

| | $ | 203,536 | | $ | 218,601 | |

| 4. | INTELLECTUAL PROPERTY |

| | |

| On April 2, 2007 the Company entered into a Technology and Asset Purchase Agreement (“NVRM Agreement”) with Robert H. Gunnison and New Verde River Mining Co. Inc. (“NVRM”), whereby the Company acquired equipment and the technology for lixiviation of metals from ore utilizing thiourea stabilization (“Intellectual Property”). The equipment and intellectual property were acquired with the issuance of 2,000,000 shares of the Company’s $0.10 per share common stock and a future cash payment of $300,000, for a purchase price of $500,000. The purchase price was allocated to the assets acquired and liabilities assumed based on their respective fair values at the date of acquisition. The intellectual property was valued at $200,000 and will be amortized quarterly on a straight-line basis over a 5 year period starting with the recognition of revenue from the licensing of the Company’s technology. The Company recorded $10,000 of amortization expense for the three months ended July 31, 2010 and 2009. |

F-10

ROYAL MINES AND MINERALS CORP.

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

(Unaudited)

JULY 31, 2010

| 5. | MINERAL PROPERTIES |

| | |

| As of July 31, 2010 and April 30 2010, mineral properties totaling $35,800, consist of twenty-one (21) mining claims located south of Searchlight, Nevada in the Piute Valley. On January 28, 2007, the Company entered into mineral option agreements to acquire an 87.5% interest in twenty-four (24) mining claims with the issuance of 1,050,000 shares of the Company’s common stock on the date of signing of the option agreement, with the provision that the Company issue an additional 420,000 and 210,000 shares on the fifth anniversary and tenth anniversary, respectively, of the signing of the option agreement if the Company wishes to acquire legal interest to the mining claims. The transaction was valued at an agreed upon price of $10,500. Annual renewal fees are capitalized. Each mining claim is comprised of 160 acres. In August 2008 the Company did not pay the renewal fee on four (4) of the mining claims after confirming title to the claims were void due to not being properly located and being subject to prior segregation. |

| | |

| On March 16, 2007 the Company entered into a lease agreement of property with one (1) mining claim, for a term of twenty years, for exploration and potential mining production on 20 acres in Searchlight, Nevada. The Company paid a one-time signing bonus of $5,000 upon execution of the agreement and pays a $4,000 rental fee each August. The Company will also pay an annual royalty equal to five (5) percent of the net profit from any mining production on the property. |

| | |

| Mining claims are capitalized as tangible assets in accordance with Emerging Issues Task Force abstract 04-02. Upon completion of a bankable feasibility study, the claims will be amortized using the unit-of-production method over the life of the claim. If the Company does not continue with exploration after the completion of the feasibility study, the claims will be expensed at that time. |

| | |

| 6. | ACCOUNTS PAYABLE - RELATED PARTY |

| | |

| As of July 31, 2010 and April 30, 2010, accounts payable – related party consisted of $105,000 and $87,000, respectively, due to directors and officers of the Company for consulting fees. |

| | |

| 7. | NVRM PAYABLE |

| | |

| As of July 31, 2010 and April 30, 2010, NVRM payable consists of $90,000, payable to New Verde River Mining and Robert H. Gunnison pursuant to the NVRM Agreement noted above (see Note 4). Mr. Gunnison signed an extension agreement extending the payment deadline to June 30, 2011. The payable bears 6% interest annually. |

| | |

| 8. | LOANS PAYABLE AND ACCRUED INTEREST – RELATED PARTY |

| | |

| As of July 31, 2010 and April 30, 2010, loans payable – related party of $498,855 and $245,277, respectively, consists of borrowings, directly and indirectly, from one director and one affiliate (5% or greater beneficial owner) of the Company. The balances bear 10% interest, are unsecured and are due on demand. As of July 31, 2010 and April 30, 2010, accrued interest – related party was $131,591 and $121,123, respectively. |

| | |

| 9. | COMMITMENTS AND CONTINGENCIES |

| | |

| Lease obligations– The Company has operating leases for its corporate office and plant facility. Future minimum lease payments under the operating leases as of July 31, 2010 are as follows: |

| Fiscal year ending April 30, 2011 | $ | 51,795 | |

| Fiscal year ending April 30, 2012 | $ | 56,307 | |

| Fiscal year ending April 30, 2013 | $ | 64,740 | |

| Thereafter | $ | 21,972 | |

F-11

ROYAL MINES AND MINERALS CORP.

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

(Unaudited)

JULY 31, 2010

| 9. | COMMITMENTS AND CONTINGENCIES(continued) |

| | | |

| Legal proceedings– The Company is not a party to any legal proceeding and, to our knowledge, no other legal proceedings are pending, threatened or contemplated. |

| | | |

| 10. | STOCKHOLDERS’ EQUITY |

| | | |

| Common and Preferred Stock: |

| | | |

| As of July 31, 2010 and April 30, 2010, there were 111,785,352 shares of common stock outstanding and zero shares of preferred stock outstanding. Outstanding shares of common stock consist of the following: |

| | | |

| a) | On March 16, 2006, the Company issued 1,000 shares of common stock to one individual for cash at $0.001 per share. |

| | | |

| b) | On November 30, 2006, the Company issued 12,500,000 shares of common stock to three individuals for cash at $0.001 per share. |

| | | |

| c) | On December 29, 2006, the Company issued 7,800,000 shares of common stock for cash at $0.01 per share. |

| | | |

| d) | On January 10, 2007, the Company issued 1,050,000 shares of common stock for the purchase of 7/8ths interest in 24 minerals claims at $0.01 per share. |

| | | |

| e) | On February 28, 2007, the Company issued 1,250,000 shares of common stock to three individuals for cash at $0.10 per share. |

| | | |

| f) | On March 31, 2007, the Company issued 1,800,000 shares of common stock to four individuals for cash at $0.10 per share. |

| | | |

| g) | On April 2, 2007, the Company issued 2,000,000 shares of common stock to one individual, in connection with the NVRM Agreement, for the purchase of intellectual property and equipment. |

| | | |

| h) | On May 31, 2007, the Company closed a private placement offering for proceeds of $620,582, of which $505,114 was received and recorded as share subscriptions received as of April 30, 2007. The Company issued 2,482,326 shares of common stock, at $0.25 per share, to non-U.S. investors pursuant to Regulation S of the Securities Act of 1933. |

| | | |

| i) | On June 4, 2007, the Company closed a private placement offering for proceeds of $825,000 and issued 3,300,000 shares of common stock, at $0.25 per share, to accredited U.S. investors pursuant to Regulation D of the Securities Act of 1933. |

| | | |

| j) | On October 5, 2007, the Company issued 13,968,926 shares of common stock in the reverse acquisition of Centrus Ventures Inc. |

| | | |

| k) | On September 3, 2008, the Company completed a private placement of 200,000 units at a price of $0.50 per unit for total proceeds of $100,000. Each unit is comprised of one share of common stock and one-half of one share purchase warrant. Each whole share purchase warrant will entitle the holder to purchase one additional share of common stock at a price of $0.75 per share for a period ending September 2, 2010. |

| | | |

| l) | On November 15, 2008, under the terms of a settlement agreement, the Company issued 450,760 units at a price of $0.30 per unit, with each unit consisting of one common share and one share purchase warrant of the Company. Each warrant is exercisable to purchase an additional common share at a price of $0.50 per |

F-12

ROYAL MINES AND MINERALS CORP.

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

(Unaudited)

JULY 31, 2010

| 10. | STOCKHOLDERS’ EQUITY(continued) |

| | | share for a period of two (2) years from the date of issuance. The units were issued pursuant to the provisions of Regulation S promulgated under the Securities Act of 1933. |

| | | |

| | m) | On February 24, 2009, the Company issued 9,140,000 units for $457,000 in cash, 12,400,000 units for $620,000 ($400,000 from one director) in loans made to the Company and 1,336,840 units to retire $65,505 in corporate indebtedness under three separate private placement offerings. Each unit was comprised of one share of the Company’s common stock and one share purchase warrant, with each warrant entitling the holder to purchase an additional share of common stock for a period of two years at an exercise price of $0.10 per share. The Company also entered into a management consulting agreement with an officer of the Company, and pursuant to the terms of the agreement issued an aggregate of 3,000,000 restricted shares of its common stock. |

| | | |

| | n) | On July 16, 2009, the Company issued 2,000,000 units for $100,000 in loans made to the Company and 500,000 units to retire $25,000 in corporate indebtedness for consulting services under two separate private placement offerings. Each unit was comprised of one share of the Company’s common stock and one share purchase warrant, with each warrant entitling the holder to purchase an additional share of common stock for a period of two years at an exercise price of $0.10 per share. |

| | | |

| | o) | On August 4, 2009, the Company issued 295,000 shares of common stock for warrants exercised at $0.10 per share and 750,000 shares of common stock for options exercised at $0.05 per share in satisfaction of debt for legal services. |

| | | |

| | p) | On August 14, 2009, the Company issued 1,500,000 shares of common stock to an investor relations services firm pursuant to the terms of the consulting agreement. |

| | | |

| | q) | On August 18, 2009, the Company issued 3,500,000 units, for $350,000 in loans made to the Company by one director, at a price of $0.10 per unit, with each unit consisting of one share of common stock and one share purchase warrant, with each warrant entitling the holder to purchase one additional share of common stock at a price of $0.20 per share for a period of two years from the date of issue. |

| | | |

| | r) | On December 15, 2009, the Company issued 900,000 shares of common stock for options exercised at $0.05 per share in satisfaction of debt for legal services. |

| | | |

| | s) | On January 31, 2010, the Company issued 19,400,000 units for $970,000 ($900,000 from one director) in loans made to the Company, 8,280,000 units for $414,000 in cash and 1,775,500 units to retire $88,775 in corporate indebtedness, at a price of $0.05 per unit, with each unit consisting of one share of common stock and one share purchase warrant, with each warrant entitling the holder to purchase one additional share of common stock at a price of $0.10 per share for a period of two years from the date of issue. |

| | | |

| | t) | On February 26, 2010, the Company issued 105,000 shares of common stock for warrants exercised at $0.10 per share and 100,000 shares of common stock for options exercised at $0.05 per share in satisfaction of debt for legal services. |

| 11. | STOCK INCENTIVE PLANS |

| | |

| 2010 Stock Incentive Plan- Effective December 7, 2009, the Company adopted the 2010 Stock Incentive Plan (the “2010 Plan"). The 2010 Plan allows the Company to grant certain options to its directors, officers, employees and eligible consultants. A total of 10,000,000 shares of the Company’s common stock are available for issuance under the 2010 Plan. However, the Company may increase the maximum aggregate number of shares of the Company’s common stock that may be optioned and sold under the 2010 Plan provided the |

F-13

ROYAL MINES AND MINERALS CORP.

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

(Unaudited)

JULY 31, 2010

| 11. | STOCK INCENTIVE PLANS(continued) |

| | |

| maximum aggregate number of shares of common stock that may be optioned and sold under the 2010 Plan shall at no time be greater than 12.5% of the total number of shares of common stock outstanding. |

| | |

| On December 8, 2009, the Company granted non-qualified stock options under the 2010 Plan for the purchase of 7,000,000 shares of common stock at $0.05 per share. The nonqualified stock options were granted to various officers, directors and consultants, are fully vested and expire December 7, 2011. As of July 31, 2010, 1,000,000 options under the 2010 Plan have been exercised. |

| | |

| From the date of inception through July 31, 2010, compensation expense related to the granting of stock options under the 2010 Plan was $391,478 and is included in general and administrative expense. The Company calculated the value of the options using the Black-Scholes option pricing model using the following assumptions: a risk-free rate of 1.00%, volatility of 252%, estimated life of 2 years and closing stock price of $0.06 per share on the date of grant. |

| | |

| 2009 Stock Incentive Plan- Effective January 12, 2009, the Company adopted the 2009 Stock Incentive Plan (the “2009 Plan"). The 2009 Plan allows the Company to grant certain options to its directors, officers, employees and eligible consultants. A total of 5,000,000 shares of the Company’s common stock are available for issuance under the 2009 Plan. |

| | |

| On January 16, 2009, the Company granted non-qualified stock options under the 2009 Plan for the purchase of 5,000,000 shares of common stock at $0.05 per share. The nonqualified stock options were granted to various officers, directors and consultants, are fully vested and expire January 15, 2011. As of July 31, 2010, 750,000 options under the 2009 Plan have been exercised. |

| | |

| From the date of inception through July 31, 2010, compensation expense related to the granting of stock options under the 2009 Plan was $342,550 and is included in general and administrative expense. The Company calculated the value of the options using the Black-Scholes option pricing model using the following assumptions: a risk-free rate of 1.00%, volatility of 316%, estimated life of 2 years and closing stock price of $0.07 per share on the date of grant. |

| | |

| Effective December 7, 2009, the Company suspended the 2009 Plan. No new options may be granted under the 2009 Plan and the 2009 Plan will be terminated once all outstanding options granted under the 2009 Plan have been exercised, expired or otherwise terminated. |

| | |

| 2008 Stock Incentive Plan- Effective February 1, 2008, the Company adopted the 2008 Stock Incentive Plan (the “2008 Plan"). The 2008 Plan allowed the Company to grant certain options to its directors, officers, employees and eligible consultants. A total of 4,600,000 shares of the Company’s common stock were available for issuance under the 2008 Plan. |

| | |

| On February 1, 2008, the Company granted non-qualified stock options under the 2008 Plan for the purchase of 4,340,000 shares of common stock at $0.74 per share. The nonqualified stock options were granted to various officers, directors and consultants, were fully vested and expired January 31, 2010. All 4,340,000 stock options expired without exercise. |

| | |

| Compensation expense related to the granting of stock options under the 2008 Plan was $3,583,702 and is included in general and administrative expense. The Company calculated the value of the options using the Black-Scholes option pricing model using the following assumptions: a risk-free rate of 4.50%, volatility of 107%, estimated life of 2 years and closing stock price of $1.22 per share on the date of grant. |

F-14

ROYAL MINES AND MINERALS CORP.

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

(Unaudited)

JULY 31, 2010

| 12. | RELATED PARTY TRANSACTIONS |

| | |

| For the three months ended July 31, 2010 and 2009, the Company incurred $81,000 and $111,000, respectively, in consulting fees expense from companies with a common director or officer. |

| | |

| 13. | SUBSEQUENT EVENTS |

| | |

| Between August 1, 2010 and August 25, 2010, the Company loaned Golden Anvil an additional $120,000 to permit Golden Anvil to complete its refurbishment and relocation of its mineral processing plant in Nayarit, Mexico. On August 25, 2010, the Company entered into a loan agreement with Golden Anvil, covering the total $600,000 advanced by the Company to Golden Anvil. The loan bears no interest and matures on December 31, 2011. Golden Anvil has agreed to grant security over its equipment and mineral claims to secure the indebtedness under the loan agreement. The loan agreement replaces the loan provisions of the toll processing agreement dated December 3, 2009 (see Note 2). |

F-15

ITEM 2. | MANAGEMENT'S DISCUSSIONANDANALYSISOFFINANCIALCONDITIONANDRESULTS OF OPERATIONS. |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Quarterly Report constitute "forward-looking statements.” These statements, identified by words such as “plan,” "anticipate," "believe," "estimate," "should," "expect" and similar expressions include our expectations and objectives regarding our future financial position, operating results and business strategy. These statements reflect the current views of management with respect to future events and are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry results, to be materially different from those described in the forward-looking statements. Such risks and uncertainties include those set forth under the caption "Part II – Item 1A. Risk Factors" and elsewhere in this Quarterly Report. We do not intend to update the forward-looking information to reflect actual results or changes in the factors affecting such forward-looking information. We advise you to carefully review the reports and documents, particularly our Annual Reports, Quarterly Reports and Current Reports, that we file from time to time with the United States Securities and Exchange Commission (the “SEC”).

OVERVIEW

We were incorporated on December 14, 2005 under the laws of the State of Nevada. We are an exploration stage company and our primary objectives are to: (i) commercially extract and refine precious metals from mined ore at our Phoenix Facility; (ii) joint venture, acquire and develop mining projects in North America; and (iii) generate ongoing revenues from the licensing of our proprietary, environmentally-friendly lixiviation.

We are focusing our business on toll processing mined ore for third party mining companies at our processing and refining plant located in Phoenix, Arizona (the “Phoenix Facility”). Our Phoenix Facility is a compact, modular, cost efficient, turn-key operation, with a capacity to process up to 10 tons per day. In processing ore at our Phoenix Facility, we utilize our environmentally friendly proprietary technology for the lixiviation of minerals using thiourea stabilization (the “Lixiviation Technology”). The use of thiourea stabilization is more environmentally friendly than cyanide or sulfuric acid, which have traditionally been used for this purpose. See “Phoenix Facility and Lixiviation Technology” below.

We entered into a Toll Processing Agreement with Golden Anvil, SA de CV (“Golden Anvil”) to process concentrates at our Phoenix Facility. We have also entered into a Letter of Intent with Golden Anvil with respect to a proposed 50/50 joint venture. See “Golden Anvil” below.

We also plan to engage in the exploration and development of our Piute Valley Property located in Clark County, Nevada. Our Piute Valley Property is a potential gold project that consists of a mineral lease covering 20.61 acres of patented claims (the “Smith Lease”) and an option to acquire a 7/8th interest in 20 unpatented claims (the “BLM Claims”) located near the Smith Lease. Each BLM Claim is comprised of 160 acres. See “The Piute Valley Property” below.

We are actively seeking to enter into agreements to license our Lixiviation Technology to third parties and we are also seeking to enter into joint ventures with third parties to explore and develop additional mining projects. There are no assurances that we will be able to license our Lixiviation Technology or enter into joint ventures for the exploration and development of additional mining projects.

RECENT CORPORATE DEVELOPMENTS

The following corporate developments occurred since our fiscal year ended April 30, 2010:

Golden Anvil Loan Agreement

On August 25, 2010, we entered into a loan agreement (the “Loan Agreement”) with Golden Anvil. The Loan Agreement covers the $600,000 we advanced to Golden Anvil to permit Golden Anvil to refurbish and relocate its mineral processing plant in Nayarit, Mexico which concentrates ores from Golden Anvil’s mineral property. Concentrates from Golden Anvil are processed at our facility in Phoenix, Arizona. The loan bears no interest and matures on December 31, 2011.

3

Golden Anvil has agreed to grant security over its equipment and mineral claims to secure the indebtedness under the Loan Agreement. We are in the final stages of negotiating a memorandum of understanding with Golden Anvil to joint venture the concentrating plant and mineral claims. In the event that a joint venture is successfully concluded, which is not assured, our loan to Golden Anvil may be converted into a contribution to the joint venture.

2011 Stock Incentive Plan

Effective September 7, 2010, we adopted the 2011 Stock Incentive Plan (the “2011 Plan"). The 2011 Plan allows us to grant certain options to our directors, officers, employees and eligible consultants. A total of 16,700,000 shares of our common stock are available for issuance under the 2011 Plan. We may increase the maximum aggregate number of shares that may be optioned and sold under the 2011 Plan provided the maximum aggregate number of shares that may be optioned and sold under the 2011 Plan shall at no time be greater than 15% of the total number of shares of common stock outstanding.

Stock Option Grants

On September 7, 2010, we granted non-qualified stock options to acquire an aggregate of 6,000,000 shares of our common stock under the 2011 Stock Incentive Plan to various officers, directors and consultants. Each of the options was granted with an exercise price of $0.02 per share and expires on September 6, 2014. Of the 6,000,000 options granted, we granted 1,200,000 options to Ian Matheson, our Chief Executive Officer and director, 1,200,000 options to Jason Mitchell, our Chief Financial Officer and Director, and 1,200,000 options to Michael Boyko, a member of our Board of Directors.

PHOENIX FACILITY AND LIXIVIATION TECHNOLOGY

We acquired our interest in the Lixiviation Technology and our Phoenix Facility on April 2, 2007 under the terms of a Technology and Asset Purchase Agreement (the “Technology Agreement”) with New Verde River Mining Co., Inc. (“New Verde”) and Robert H. Gunnison. In consideration of the Lixiviation Technology and the Phoenix Facility, we paid and issued the following:

| | (a) | $300,000 to New Verde for the purchase of the equipment within the Phoenix Facility as follows: |

| | | | |

| | | (i) | $175,000 upon execution of the Technology Agreement (which amount has been paid); and |

| | | | |

| | | (ii) | $125,000 of which $90,000 is outstanding. |

| | | | |

| | (b) | issued 2,000,000 shares to Mr. Gunnison for the Lixiviation Technology. |

Concurrent with the acquisition of the Lixiviation Technology and the Phoenix Facility, we entered into an Employment Agreement dated April 2, 2007 (the “Employment Agreement”) with Robert H. Gunnison whereby Mr. Gunnison agreed to act as our Production Manager commencing on April 2, 2008. In consideration of Mr. Gunnison’s services, we pay Mr. Gunnison a salary of $120,000 per annum.

On March 13,2009, we entered into the Payment Extension and License Agreement with New Verde and Mr. Gunnison whereby New Verde and Mr. Gunnison agreed to extend the deadline for the balance owed to New Verde to June 30, 2010. In consideration of the extension, we agreed to pay interest at 6% per annum on the balance owing to New Verde. We also agreed to grant New Verde and Mr. Gunnison a non-exclusive worldwide license on the Technology (the “License”). The License will only take effect in the event of the termination of the employment agreement between Mr. Gunnison and the Company. New Verde and Mr. Gunnison will not be permitted to assign or sub-license without our prior written approval. On July 22,2010, we entered into a payment extension with New Verde and Mr. Gunnison whereby New Verde and Mr. Gunnison agreed to extend the deadline for the balance owed to New Verde to June 30, 2011. In consideration of the extension, we agreed to extend the accrual of interest at 6% per annum on the balance owing to New Verde.

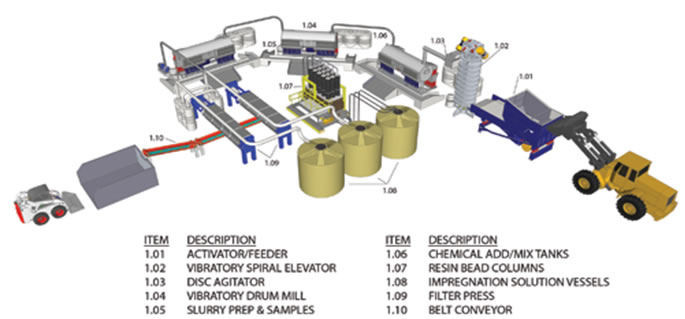

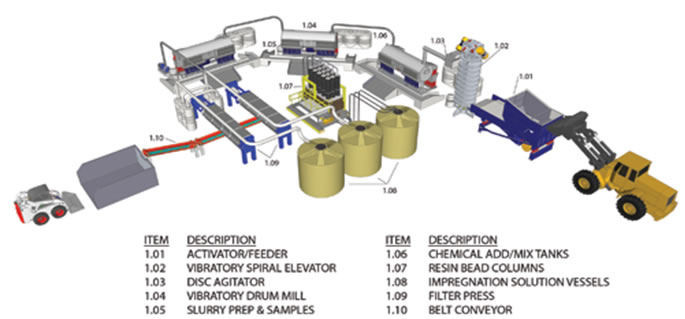

Our Phoenix Facility is an industrial building of approximately 9,809 square feet located in Phoenix, Arizona. The Phoenix Facility is designed as a compact, modular, cost efficient, turn-key operation, with a capacity of processing 10 tons of ore per day. In processing ore at our Phoenix Facility, we utilize our Lixiviation Technology, being a closed loop, zero liquid discharge, leach extraction process. Below is a basic diagram on the processing of ore at our Phoenix Facility.

4

We recently received approximately 400 oz of high grade gold placer concentrate from a private party that we refined into 351 oz of gold dore bars. We earned a 5% processing fee for our service.

THE PIUTE VALLEY PROPERTY

The Piute Valley Property is a potential gold project consisting of the Smith Lease and the BLM Claims. We intend to focus our operations on the Smith Lease based on its development and status.

The Smith Lease is a leased patented mineral claim covering approximately 20.61 acres located in Clark County, Nevada. We acquired our interest in the Smith Lease upon entering into a Restatement and Amendment to Lease Agreement dated April 12, 2007 (the “Lease Agreement”) with Erline Y. Smith, Trustee, Erline Y. Smith Trust and Lawana Hooper (collectively referred to as the “Lessors”). Under the terms of the Lease Agreement, we were granted the right to explore, and if proved feasible, develop the Smith Lease. These rights were granted as a lease for a term of 20 years. As consideration for the Smith Lease, we agreed to do the following:

| | (a) | pay $5,000 to the Lessors upon execution of the Lease Agreement (which amount has been paid); |

| | | |

| | (b) | pay an annual rental fee of $1,000 to the Lessors per each five acre parcel of the Smith Lease (we have paid the annual rental fee through August 13, 2011); and |

| | | |

| | (c) | pay an annual royalty equal to five percent of “net smelting profit” from production. Net smelting profit is defined as the net profit derived from the sale of metals and minerals produced from the Smith Lease. |

In addition to the Smith Lease, our BLM Claims consist of an option to acquire a 7/8th undivided interest in 20 mineral claims, covering approximately 3,200 acres located in Clark County, Nevada. Readers are cautioned that eight of the BLM Claims appear to be invalid due to conflicts with patented claims or more senior claims. We are investigating this further in order to determine the exact extent of the conflict with these claims

Under the terms of various option agreements entered into in January 2007 (the “Option Agreements”) with certain optionors (the “Optionors”), we are required to issue to the Optionors the following consideration in order to maintain and exercise our option on the BLM Claims:

5

| | (a) | 1,050,000 shares of common stock on execution of the Option Agreements (which shares have been issued); |

| | | |

| | (b) | an additional 420,000 shares of common stock on the fifth anniversary of the Option Agreements; and |

| | | |

| | (c) | an additional 210,000 shares of common stock on the tenth anniversary of the Option Agreements. |

GOLDEN ANVIL

Letter of Intent with Golden Anvil

On October 21, 2009, we entered into a letter of intent with Golden Anvil with respect to the formation and funding of a proposed joint venture for the exploration, development and production of gold and silver from mineral concessions (the "Mineral Concessions") owned by Golden Anvil located in the State of Nayarit, Mexico. The Mineral Concessions are currently being mined sporadically at a rate of 50 tons per day. A concentration plant on the Mineral Concessions is currently producing approximately 24 tons of concentrate per month. Concentrates from Golden Anvil are currently being processed at our Phoenix Facility.

Subject to each party satisfactorily completing its due diligence review, the parties intend to enter into a joint venture agreement. The proposed principal terms of the joint venture agreement are as follows:

| | (a) | We will acquire a 50% undivided interest in the joint venture by providing funding of $3,000,000 (the "Funding") as follows: |

| | | | |

| | | (i) | $1,500,000 to purchase additional equipment and to refurbish and relocate the concentration plant currently located on the Mineral Concessions to an area with better power and access; |

| | | | |

| | | (ii) | $500,000 for Golden Anvil to pay its current liabilities, late taxes and mining duties; and |

| | | | |

| | | (iii) | $1,000,000 (the "Repurchase Loan") loaned to Golden Anvil, with no interest, to fund the costs of a repurchase of the outstanding shares of Golden Anvil (the "Share Repurchase"). |

| | | | |

| | (b) | Revenue from the joint venture shall be split proportionate to ownership. However, 25% of the share of revenue accruing to Golden Anvil will go towards the payment of the Repurchase Loan until paid in full, and in any event, the Repurchase Loan shall be repaid within 12 months from the date of funding. |

Under the terms of the Letter of Intent, we had until December 20, 2009 to complete our due diligence to determine if we wished to proceed with the proposed joint venture. Under the terms of the Toll Processing Agreement dated for reference December 3, 2009, the Due Diligence Period was extended to February 15, 2010. On March 12, 2010, we entered into an extension agreement dated for reference February 15, 2010 with Golden Anvil whereby the Due Diligence Period was further extended to April 30, 2010. We are currently engaged in discussions with Golden Anvil to further extend the Due Diligence Period.

There is no assurance that the proposed transaction will be completed as planned or at all. If we elect to proceed after completion of due diligence, there is no assurance we will be able to obtain the necessary financing.

Toll Processing Agreement with Golden Anvil

On December 4, 2009, we entered into a Toll Processing Agreement dated for reference December 3, 2009 with Golden Anvil. Under the terms of the Toll Processing Agreement, we have agreed to process

6

concentrates delivered by Golden Anvil to our Phoenix Facility for a per ton fee of $500 plus 8% of the value of the precious metals recovered and to loan $400,000 to Golden Anvil, (which amount has been advanced) to pay Golden Anvil’s costs to acquire additional land for relocation of its concentrating facilities, and to fund the relocation and upgrading of Golden Anvil’s ore concentrating facilities (the “Land Purchase and Facilities Relocation Loan”). Our loans will be secured by Golden Anvil’s land and ore concentrating facilities. In addition, concentrates shipped to the Phoenix Facility to date secure an advance of $70,000 previously made to Golden Anvil.

In the event that we are able to consummate our proposed joint venture under the Letter of Intent:

| | (a) | the Land Purchase and Facilities Relocation Loan will be considered a portion of our contribution requirement under the proposed joint venture and Golden Anvil will not be required to repay such loans; and |

| | | |

| | (b) | all concentrates produced by the joint venture will be shipped to the Phoenix Facility and processed by us on the same terms as the initial shipment and prior shipment until such time as the proposed joint venture may establish its own refining facility in Mexico. |

In the event that we are not able to consummate our proposed joint venture under the Letter of Intent:

| | (a) | The Land Purchase and Facilities Relocation Loan shall be repaid to us out of 15% of the amounts payable to Golden Anvil in respect of concentrates shipped to the Phoenix Facility; and |

| | | |

| | (b) | Golden Anvil will continue to ship to us all concentrates produced by Golden Anvil until one year following the repayment of the Land Purchase and Facilities Relocation Loan. |

As of the date of this Quarterly Report, Golden Anvil has delivered 23 tons of concentrates to us. We have produced approximately 25 oz of gold and over 400 oz of silver from the original three shipments (23 tons) of concentrate generated at the Golden Anvil project in Mexico. We are focused on improving the amount of time it takes to separate and extract precious metals from the concentrate. Accordingly, we have hired experts to assist us in optimizing the total percentage of precious metals recovered from the concentrate. However, the optimization of our process has been slowed while we await additional concentrates from Golden Anvil.

On August 25, 2010, we entered into a Loan Agreement with Golden Anvil that covers the $600,000 previously advanced to Golden Anvil to permit Golden Anvil to refurbish and relocate its mineral processing plant in Nayarit, Mexico which concentrates ores from Golden Anvil’s mineral property. The loan bears no interest and matures on December 31, 2011. Golden Anvil has agreed to grant security over its equipment and mineral claims to secure the indebtedness under the Loan Agreement. We are in the final stages of negotiating a memorandum of understanding with Golden Anvil to joint venture the concentrating plant and mineral claims. In the event that a joint venture is successfully concluded, which is not assured, our loan to Golden Anvil may be converted into a contribution to the joint venture.

We have hired a professional mining engineer to evaluate the progress of the Golden Anvil concentration plant and to review the mine site and related historic data. The concentration plant expects to begin operations within 45 days at a projected production rate of 200 tons of head ore per day, resulting in 75 tons of concentrate per month.

PLAN OF OPERATION

Our plan of operation over the next twelve months is to focus our financial resources on the continued development of our ore processing business at our Phoenix Facility. We will continue to seek out to enter into ore processing agreements with third party mining companies to process ore at our Phoenix Facility. However, there are no assurances that we will be able to enter into any additional ore processing agreements with third party mining companies on terms acceptable to us or at all.

7

We anticipate that over the next twelve months our plan of operation for our Phoenix Facility and the Piute Valley Property will consist of:

| 1. | Upgrading our Phoenix Facility by installing another vibratory drum mill and filter press to increase the process rate at the Phoenix Facility to 2,000 lbs per hour. We anticipate that we will require $400,000 in order to implement these upgrades at our Phoenix Facility. |

| | |

| 2. | Implementing our drilling program of prime targets on the Smith Lease. The implementation of this drilling program may require the filing of a Notice with the Federal Bureau of Land Management. We anticipate that this drilling program will cost approximately $500,000. The completion of this drilling program will depend on obtaining sufficient funds for the drilling and mineral analysis. |

| | |

| 3. | Proceeding with the purchase of a larger concentrator to be installed on the Smith Lease, subject to raising substantial financing and having a third party concentration technology evaluate the material from our pilot product test. If we are able to raise financing and purchase a concentrator, of which there is no assurance, we plan to commence the processing of mined material on the property. |

| | |