Lehman Brothers Financial Services Conference

September 9, 2008

This document is intended solely for the use of the party to whom FBR Capital Markets

has provided it, and is not to be reprinted or redistributed without the permission of FBR

Capital Markets. All references to “FBR Capital Markets” refer to FBR Capital

Markets Corporation and its subsidiaries as appropriate. Investment banking, sales,

trading and research services are provided by Friedman, Billings, Ramsey & Co.,

Inc. (FBRC), and those services in the U.K. and Europe are provided by Friedman,

Billings, Ramsey International, Ltd. (FBRIL). FBRC is a broker-dealer registered with the

SEC and is a member of FINRA, the Nasdaq Stock Market and the Securities Investor

Protection Corporation. FBRIL, based in the UK, is Authorised and regulated by the

Financial Services Authority. Asset management services, including managed hedge

funds, mutual funds, private equity and venture capital funds, are provided by FBR

Capital Markets subsidiaries FBR Investment Management, Inc. (FBRIM) and FBR

Fund Advisers, Inc., which are investment advisers registered with the SEC.

FBR Capital Markets Corporation was formed as a Virginia

corporation in June 2006 to be the holding company for FBRC,

FBRIL, FBRIM and FBR Fund Advisers, Inc.

This document is intended for information purposes only, and

shall not constitute a solicitation or an offer to buy or sell any

security or services, or an endorsement of any particular

investment strategy.

CAUTIONS ABOUT FORWARD-LOOKING INFORMATION

This presentation and the information incorporated by reference in this presentation include forward looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended. Some of the forward-looking statements can be identified by the use of forward-looking words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “plans,” “estimates” or “anticipates” or the negative of those words or other comparable terminology. Statements concerning projections, future performance developments, events, revenues, expenses, earnings, run rates, and any other guidance on present or future periods constitute forward-looking statements. Such statements include, but are not limited to, those relating to the effects of growth, revenues and earnings, our principal investing activities, levels of assets under management and our current equity capital levels. Forward-looking statements involve risks and uncertainties. You should be aware that a number of important factors could cause our actual results to differ materially from those in the forward-looking statements. These factors include, but are not limited to, deterioration in the business environment in the specific sectors in which we focus or a decline in the market for securities of companies within these sectors, substantial fluctuations in our financial results, our ability to retain senior professionals, pricing and other competitive pressures, changes in laws and regulations and industry practices that affect our sales and trading business, incurrence of losses in the future, the singular nature of our capital markets and strategic advisory engagements, competition among financial services firms for business and personnel, larger and more frequent capital commitments in our trading and underwriting business, limitations on our access to capital, infrastructure or operational failures, the overall environment for interest rates, changes in our business strategy, and our ability to deploy offering proceeds. We will not necessarily update the information presented or incorporated by reference in this presentation if any of these forward-looking statements turn out to be inaccurate. Risks affecting our business are described throughout our Registration Statement on Form S-1, as amended, File Number 33-138824, especially in the section entitled “Risk Factors.” The entire Registration Statement, including the Consolidated Financial Statements and the notes and any other documents incorporated by reference into the Registration Statement, as well as the Forms 10-Q and 8-K filed subsequent to the Registration Statement, should be read for a complete understanding of our business and the risks associated with that business.

1.

Research is provided by FBRC’s Research department, which is independent from the Investment Banking department of FBRC, and has the sole authority to determine which

companies receive research coverage and the recommendation contained in the coverage. In the normal course of its business, FBRC seeks to perform investment banking and other

fee-generating services for companies that are the subject of FBRC research reports. Research analysts are eligible to receive bonus compensation that is based on FBRC’s overall

operating revenues, including revenues generated by FBRC’s Investment Banking department. Specific information is contained in each research report concerning FBRC’s relationship

with the company that is the subject of the report.

FBR Capital Markets Corporation (NASDAQ: FBCM)

CAUTIONARY STATEMENT

2

FBR Capital Markets at a Glance

Leading Investment Banking platform

Largest underwriter of small cap equity

Unique equity distribution capability

Balanced presence in seven focus industries

M&A capabilities across all industries and broad financial sponsors coverage

Recent addition of Equity Linked Securities Group

Institutional Brokerage with 5-year share volume CAGR approaching 20%

Asset management business positioned for growth

Strong, liquid balance sheet

Equity of $482 million, of which $300 million is in the form of cash

3

Strategic Objectives: Growth and Diversification

Broaden corporate finance capabilities to more fully serve middle market issuers

in our focus industries

Continue growth of institutional brokerage, leveraging our strong research

product

Expand existing asset management business, both organically and through

targeted acquisitions

Maintain the strength of our capital position and liquidity

4

Investment Banking

OVERVIEW

Leading underwriter of domestic small cap equity

#1 book-running manager of common stock offerings for U.S. companies valued

$1 billion and under over the last five years 1

#2 in raising initial equity capital for U.S. and Bermuda small and mid-cap companies (<$5B market cap)

over the past five years 2

Balance among industries where FBR Capital Markets has developed in-depth expertise

and relationships with a focus on the middle market

Wide spectrum of equity capital markets expertise and services among 150 professionals

% Share

12.12

11.27

10.98

10.12

9.33

8.17

7.43

7.15

5.36

3.78

# of Deals

112

82

106

129

107

104

91

81

68

59

Deal Value ($m)

$ 19,072.8

17,728.6

17,283.4

15,931.8

14,676.8

12,864.3

11,245.6

8,438.8

5,944.7

3,745.8

Book-Running Mgr.

Goldman Sachs

FBR Capital Markets

Morgan Stanley

JP Morgan

Merrill Lynch

Credit Suisse

Lehman Brothers

Citigroup

UBS

Banc of America

Top 10 Book Runners of Initial Equity for Small and Mid

Cap Companies 3

Market Cap $5B and Under – IPOs and

144A Common Stock Combined

US and Bermuda Issuers — 7/1/2003 thru 6/30/2008

1. Source: Dealogic; (07/1/2003 – 06/30/2008).

2. Source: Dealogic; initial common equity includes IPOs and PIPOs (Pre-IPOs) (07/1/2003 – 06/30/2008).

3. Source: Dealogic; includes IPOs and PIPOs.

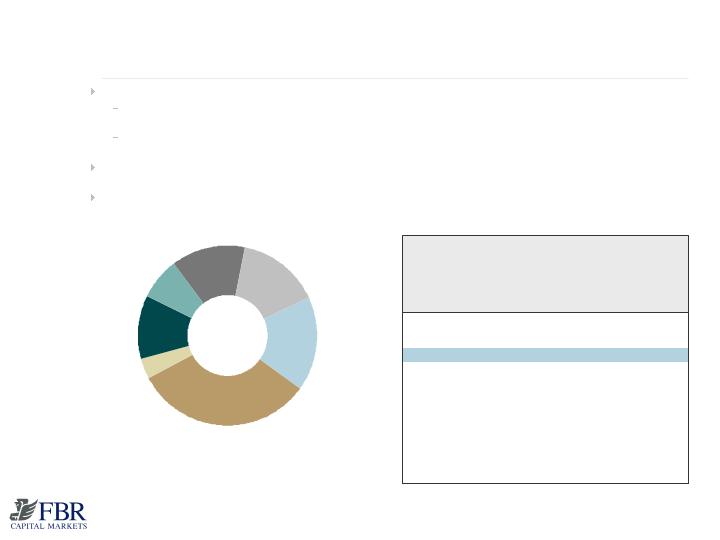

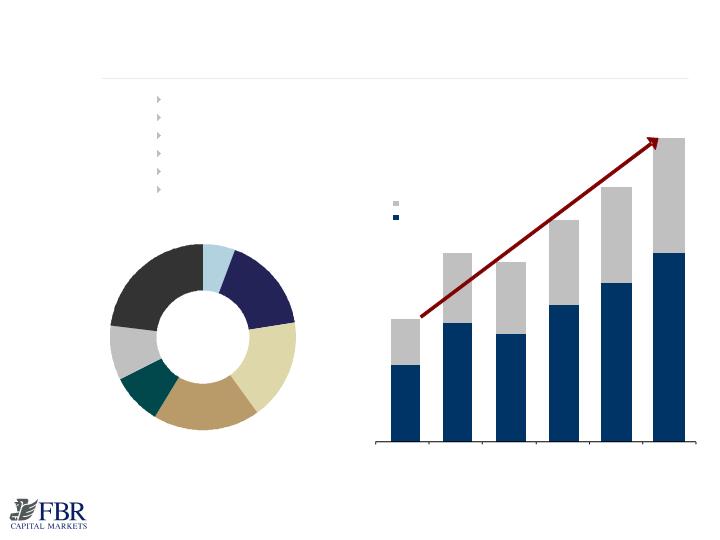

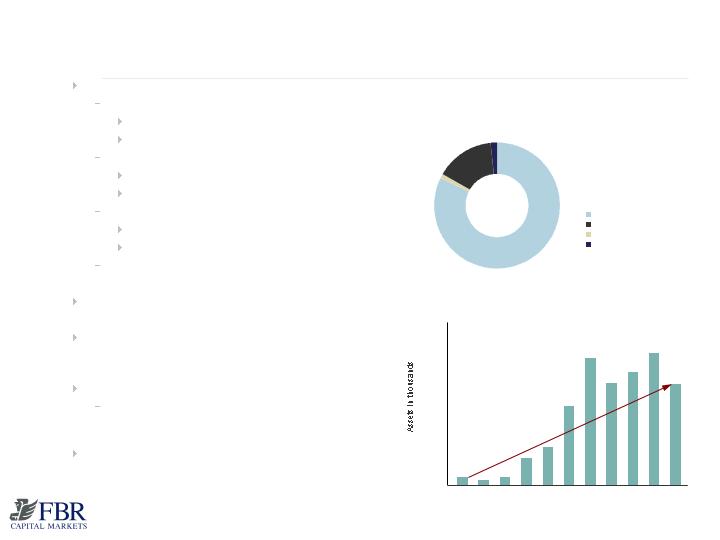

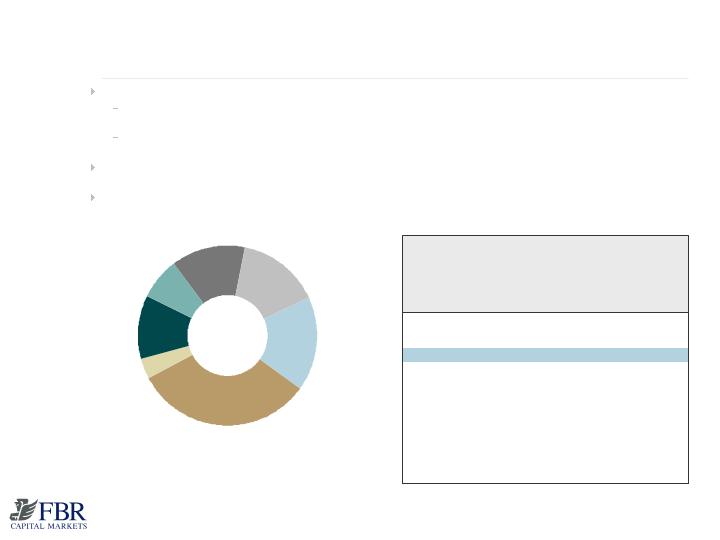

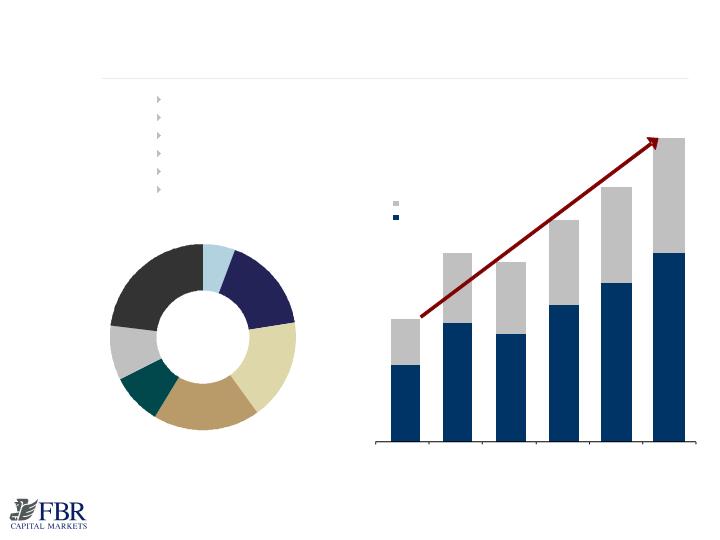

Investment Banking Transactions by Industry

(% to total; LTM Q2 2008)

Energy & Natural

Resources

17%

INDUSTRY

COMPOSITION

Technology, Media &

Telecom.

13%

Consumer

4%

Diversified Industrials

15%

Real Estate

11%

Financial Institutions

32%

Insurance

8%

5

Investment Banking

PROVEN BUSINESS MODEL

Sustainable competitive advantage

Unique capability and intense focus on speed and execution

All resources of firm dedicated to every transaction

Integrated knowledge of capital markets and industry

FBR Capital Markets is the industry leader in 144A private equity

offerings

Alternative to IPO

Added value to financial sponsors

Alternative to M&A

6

Investment Banking

EXPANDING THE SERVICE OFFERING

Leading middle-market advisory platform

Building from January 2007 acquisition of Legacy Partners

Dedicated senior M&A professionals averaging more than 15 years of

experience1

Bulge bracket experience and capabilities with boutique level attention

Small, knowledgeable transaction teams focused on middle-market companies

Extensive M&A experience within specific industry sectors complemented by

FBR Capital Markets’ widely respected corporate finance and capital markets

expertise

Recently added convertible securities origination, Sales/Trading

Permanent asset class likely to support a significant amount of issuers’ growth

capital and recapitalization

U.S. convertible market today has ~$350B of market cap

Companies of all sizes use convertible market to achieve low cost debt

financing or equity capital alternatives

For existing FBCM banking clients, convertible product is additional tool to

continue life-cycle banking service

1. As of 6/30/2008

7

Unprecedented disruption in the financial markets has created a need for

innovative solutions to re-capitalize impacted firms

Scope of the current need for financing covers the broad spectrum of regulated

and non-regulated financial services companies

FBCM has historically thrived in similar times of acute market stress

Deep industry research and corporate finance experience in this sector position

the firm to be a leader in successfully re-capitalizing quality franchises

Combination of our convertibles product addition and “speed to market”

capabilities positions us well to meet meaningful demand

Current Environment

CHALLENGES AND OPPORTUNITIES

8

OTC

Listed

2008 5

931.9

1,436.2

1,334.8

1,651.3

1,916.6

2,288.5

554.4

788.6

1,025.2

1,165.1

1,376.6

849.9

2003

2004

2005

2006

2007

1,486.3

2,286.1

2,123.4

2,676.5

3,081.7

3,665.1

CAGR 19.8%

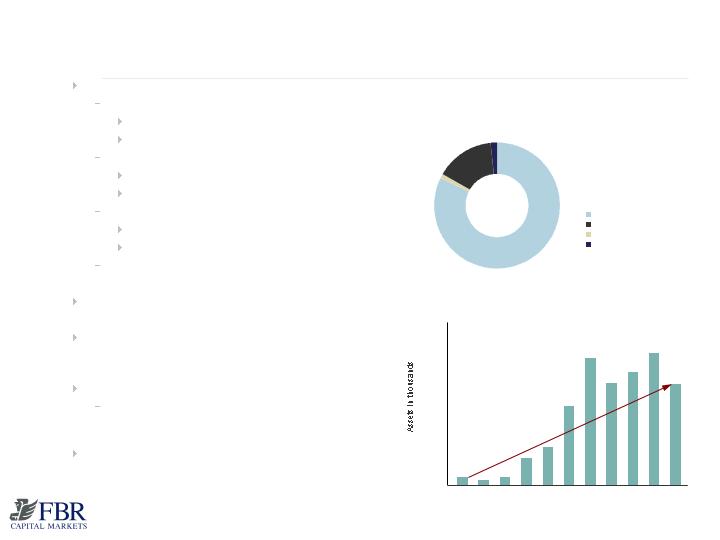

Institutional Brokerage

RESEARCH AND SALES, TRADING & SALES TRADING

1.

Headcount numbers approximate as of 7/15/08. 2. Compound Annual Growth Rate (CAGR) of customer equities trading volume. 3. As of 7/15/08. Research is provided by FBRC’s Research department, which is independent from the Investment Banking department of FBRC, and has the sole authority to determine which companies receive research coverage and the recommendation contained in the coverage. In the normal course of its business, FBRC seeks to perform investment banking and other fee-generating services for companies that are the subject of FBRC research reports. Research analysts are eligible to receive bonus compensation that is based on FBRC’s overall operating revenues, including revenues generated by FBRC’s Investment Banking department. Specific information is contained in each research report concerning FBRC’s relationship with the company that is the subject of the report. 4. As of 6/4/08 5. 2008: 1st 6 months Annualized

Customer Equities Trading Volumes

(millions of shares)

Research Coverage: All Companies

(number of companies; as of July 15, 2008)

Insurance

9%

Technology, Media

& Telecom

22%

Real Estate

10%

Financial Institutions

18%

Energy & Natural

Resources

18%

Diversified

Industrials

17%

Consumer

6%

107

26

82

86

45

41

79

178 institutional brokers, traders and sales traders; 80 research analysts 1

Comprehensive investment philosophy leads to powerful distribution platform

19.8% trading volume CAGR from 2003 through Q2 2008 2

Currently provide research on 24% of S&P 500 by market capitalization 3

Over 460 companies under research coverage 3

Market-maker 975 securities 4

9

Institutional Brokerage

STRONG, SUSTAINED GROWTH

A key component of our strategy is acquiring, on an opportunistic basis,

high-quality, senior-level talent

The current shakeout in large U.S. investment banks provides ample

opportunity to upgrade talent in all areas, including Sales, Trading and

Research

Industry trend toward shrinking per share commissions not as prevalent

in our “high touch” business model

International share volume and revenue growth outpace overall rates

during last two years

Addition of convertibles securities team will accelerate growth rate

10

Asset Management

POSITIONED FOR GROWTH

Current capabilities and proprietary strategies

Domestic equity strategies

Small, mid and large-cap

Value, Growth and Blend

Sector and specialty strategies

Financial, Technology and Utilities

Focus

Alternative

Fund of hedge funds

Equity long-short

Money Market

Private Wealth Advisory services

Gross Assets Under Management in excess of $1.9

billion 1

Seed new asset management vehicles including

Externally managed companies, separately

managed accounts, alternative partnerships and

LLCs

Exploring strategic acquisitions

Gross Assets Under Management

as of 6/30/2008

Mutual Funds

Managed Accounts

Hedge Funds – Onshore

Private Equity/Venture Capital Funds

1. As of 06/30/08

2. Source: Strategic Insight; FBR Accounting.

Equity Mutual Fund Assets

(for 10 years ended 6/30/08) 2

CAGR 28%

0

500

1,000

1,500

2,000

2,500

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

1.8%

1.1%

14.8%

82.3%

11

Financial Initiatives

Reduce fixed expenses by annualized $28 million

Includes net reduction in headcount by ~12% since January 2008

Enhance variable margin, primarily through compensation adjustments

Fully deploy capital resources to enhance returns

Expected result is cash breakeven on Capital Markets business at

annual revenues of $270 million

We will continue to make strategic hires and build businesses in focus

areas

12

FBCM Culture and Employees

Renewed focus on ownership culture at all levels throughout the firm

Partnership program covering broad leadership group

Expansion of equity component to employee compensation

Historically, low turnover among senior professionals

Non-Wall Street culture

Washington, DC headquarters

Growing financial services community

Capital Markets employer of choice

Senior executive involvement in day-to-day operations

Opportunity to execute creative industry-leading transactions and products

13

Addendum

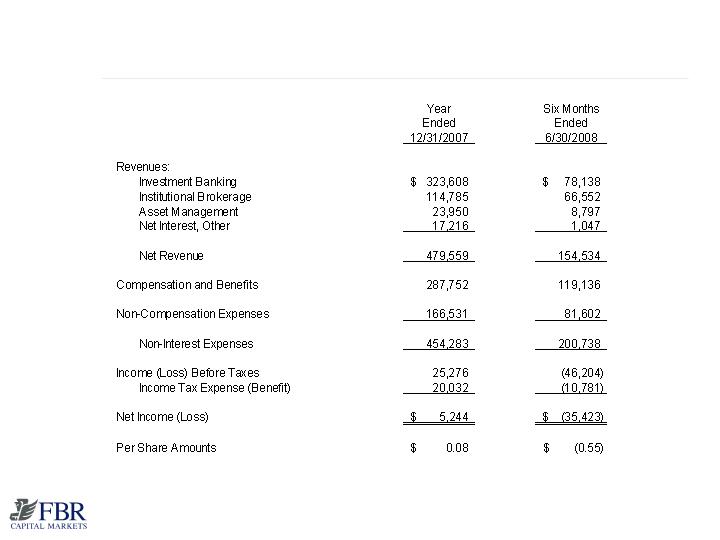

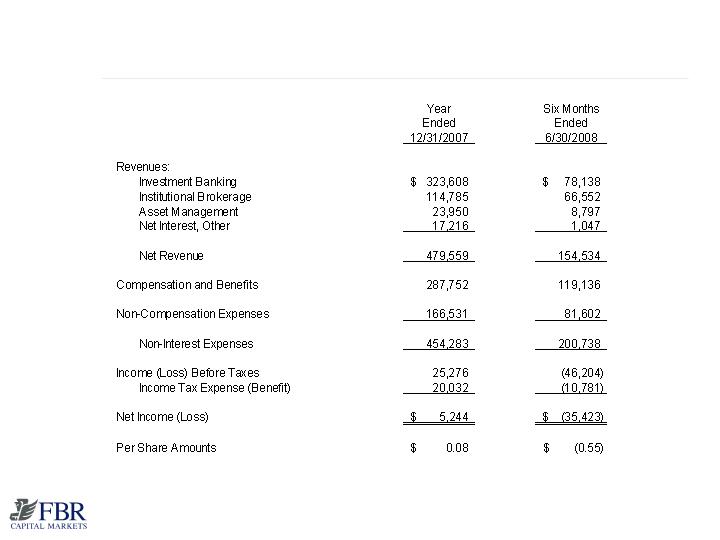

Condensed Financial Results

(Unaudited, Dollars in Thousands)

15

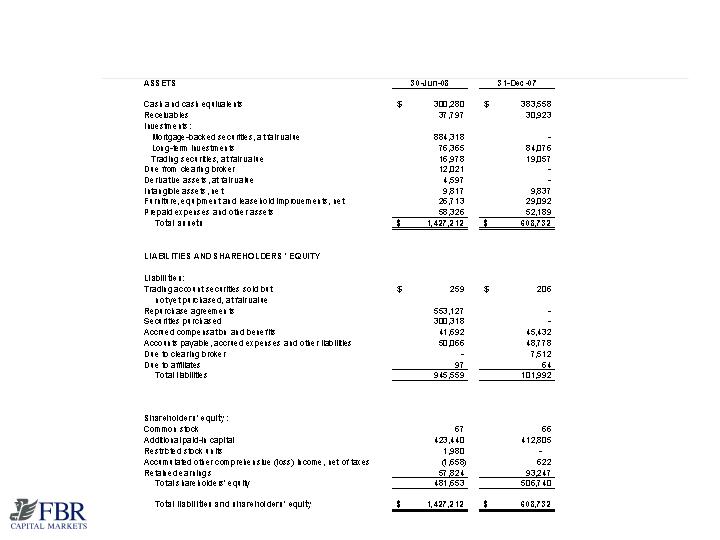

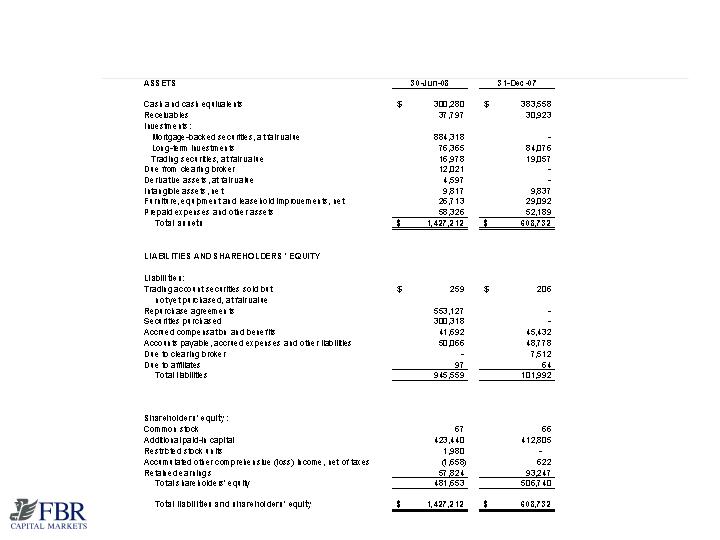

Consolidated Balance Sheets

(UNAUDITED, DOLLARS IN THOUSANDS)

16

Boston

100 Federal Street, 29 th Floor Boston, MA 02110

617.757.2900

Dallas

2100 McKinney Avenue, Suite 1940 Dallas, TX 75201

469.341.1200

Houston

600 Travis Street, Suite 6070 Houston, TX 77002

713.343.1000

Irvine (Los Angeles)

18101 Von Karman Ave., Suite 950 Irvine, CA 92612

949.477.3100

New York

299 Park Avenue, 7th Floor New York, NY 10171

212.457.3300

San Francisco

4 Embarcadero Center, Suite 1950 San Francisco, CA 94111

415.248.2900

FBR International Ltd.

London, United Kingdom

8th Floor, Berkeley Square House

Berkeley Square

London WIJ 6DB

011.44.20.7409.5300

Sydney, Australia

Level 31

88 Phillip Street

Sydney, NSW 2000

011.61.2.8211.0563

NOTE: Not all services are available from all offices.

FBR Capital Markets Corporation

Metropolitan Washington, D.C. Headquarters

1001 Nineteenth Street North . Arlington, VA 22209

703.312.9500 T . 703.312.9501 F . www.fbrcapitalmarkets.com