Exhibit 99.1 |

FBR & CO. (NASDAQ: FBRC) CAUTIONARY STATEMENT 1 FBR & Co. was formed as a Virginia corporation in June 2006 to be the holding company for FBRC. This document is intended for information purposes only, and shall not constitute a solicitation or an offer to buy or sell, any security or services, or an endorsement of any particular investment strategy. This document is intended solely for the use of the party to whom FBR has provided it, and is not to be reprinted or redistributed without the permission of FBR. All references to “FBR” refer to FBR & Co. and its subsidiaries as appropriate. Investment banking, sales, trading, and research services¹ are provided by FBR Capital Markets & Co., Inc. (FBRC). FBRC is a broker-dealer registered with the SEC and is a member of FINRA. Loan Trading services are provided by FBR’s affiliate – FBR Capital Markets LT, Inc. CAUTIONS ABOUT FORWARD-LOOKING INFORMATION This presentation and the information incorporated by reference in this presentation include forward looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Some of the forward-looking statements can be identified by the use of forward-looking words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “plans,” “estimates” or “anticipates” or the negative of those words or other comparable terminology. Statements concerning projections, future performance developments, events, revenues, expenses, earnings, run rates, and any other guidance on present or future periods constitute forward-looking statements. Such statements include, but are not limited to, those relating to the effects of growth, revenues and earnings, our principal investing activities, levels of assets under management and our current equity capital levels. Forward-looking statements involve risks and uncertainties. You should be aware that a number of important factors could cause our actual results to differ materially from those in the forward-looking statements. These factors include, but are not limited to, deterioration in the business environment in the specific sectors in which we focus or a decline in the market for securities of companies within these sectors, substantial fluctuations in our financial results, our ability to retain senior professionals, pricing and other competitive pressures, changes in laws and regulations and industry practices that affect our sales and trading business, incurrence of losses in the future, the singular nature of our capital markets and strategic advisory engagements, competition among financial services firms for business and personnel, larger and more frequent capital commitments in our trading and underwriting business, limitations on our access to capital, infrastructure or operational failures, the overall environment for interest rates, changes in our business strategy, and our ability to deploy offering proceeds. We will not necessarily update the information presented or incorporated by reference in this presentation if any of these forward looking statements turn out to be inaccurate. Risks affecting our business are described throughout our annual report on Form 10-K and our quarterly reports on Form 10-Q, especially in the section entitled “Risk Factors”, filed with the Securities and Exchange Commission. Our latest annual report and quarterly reports should be read for a complete understanding of our business and the risks associated with our business. 1. Research is provided by FBRC’s Research department, which is independent from the Investment Banking department of FBRC, and has the sole authority to determine which companies receive research coverage and the recommendation contained in the coverage. In the normal course of its business, FBRC seeks to perform investment banking and other fee generating services for companies that are the subject of FBRC research reports. Research analysts are eligible to receive bonus compensation that is based on FBRC’s overall operating revenues, including revenues generated by FBRC’s investment banking department. Specific information is contained in each research report concerning FBRC’s relationship with the company that is the subject of the report. |

FBR HIGHLIGHTS 2 1. Employee data as of 8/31/2014. 2. Balance sheet data as of 6/30/2014; total shares outstanding of 10,626,000 used for per share calculations. 3. Repurchase data through 8/31/2014. 2 3 Ticker: FBRC Founded: 1989 Employees 1 : 305 Headquarters: Arlington, VA Offices: Boston, MA Houston, TX Irvine, CA New York, NY San Francisco, CA Leading Middle Market Equities Franchise A top tier middle market initial equity underwriter Dominance in strong and defensible banking niche with overwhelming market share in core product Complementary Sales, Trading and Research with extensive client coverage Stable Revenue and Profitability Creating Opportunities for Growth and Strategic Capital Management Unique revenue mix generates 35% operating margin before non-comp fixed cost, coupled with lower costs, allows profitability in a wide variety of market conditions One of the industry leaders in revenue per head driving consistent earnings Undertaking complementary growth in industry verticals, products and business lines Returning significant value to shareholders with over $166 million in accretive share repurchases since 2010 Highly Liquid, Transparent Balance Sheet Cash and investable capital of approximately $306 million and no debt Book value per share of $28.04 up 76% since 1/1/2012 |

What Makes Us Unique 3 * * * * * * * * * * |

BOUTIQUE FOCUS, BULGE BRACKET CAPABILITIES 4 Investment Banking Investment Banking Mergers & Acquisitions Restructuring & Recaps Financial Sponsors 29 senior coverage and product bankers Equity Capital Raising through Public Offerings and Private Placements (144As) Equity-Linked Securities High Yield and Leveraged Loans Broad industry coverage with highly-disciplined analytical underwriting process Cash Equities Equity-Linked Securities Credit Trading Listed Options Securities Lending 29 Senior Institutional Equities Salespeople – ratio of approximately 1:1 with writing Research Analysts Market-Maker in over 1,300 Equity and Debt Securities Cover more than 1,200 Institutional Investors Use of FBR Capital in Trading 32 Publishing Analysts Approximately 500 Companies under Research Coverage 7 Industry Sectors Institutional Brokerage and Equities¹ Institutional Brokerage and Equities¹ Quality research platform* with extensive sector coverage & well-regarded, highly-experienced analysts A top initial equity bookrunner offering a range of products and services relevant to small and mid-cap clients Broad distribution beyond the top 100 institutional accounts with diverse investor participation in FBR banking transactions 1. Data as of 6/30/2014. 2. Research is provided by FBRC’s Research department, which is independent from the Investment Banking department of FBRC, and has the sole authority to determine which companies receive research coverage and the recommendation contained in the coverage. In the normal course of its business, FBRC seeks to perform investment banking and other fee generating services for companies that are the subject of FBRC research reports. Research analysts are eligible to receive bonus compensation that is based on FBRC’s overall operating revenues, including revenues generated by FBRC’s Investment Banking Department. Specific information is contained in each research report concerning FBRC’s relationship with the company that is the subject of the report. Nimbleness, creativity, speed to market, focus on fundamentals World class distribution 2 Healthcare Insurance Real Estate Technology, Media & Telecommunications Consumer Diversified Industrials Energy & Natural Resources Financial Institutions |

RECOGNIZED LEADER IN INITIAL CAPITAL RAISING 1 5 Dominance in initial equity capital raising for mid-cap issuers over the last 5 years Top initial equity bookrunner #1 bookrunner in broadly-distributed institutional private placements across all industries 1 #1 bookrunner in initial common stock offerings across all industries Leader in FBR core industries #1 bookrunner in Financial Institutions #1 bookrunner in Insurance #9 bookrunner in Real Estate Leading execution and performance $13.3 billion in bookrun equity volume 4 17.2% average total return, creating $4.0 billion in shareholder value 5 Second best performing IPO in each of 2012 and 2013 6 1. Source: Dealogic. Apportioned credit to all book-running managers; Rank Eligible transactions only, US and Bermuda Issuers only. Issuer market cap < $1.5B. PIPO (144A) offerings only. 7/1/2009 – 6/30/2014. 2. Source: Dealogic. Apportioned credit to all book- running managers; Rank Eligible and SEC registered transactions only, US and Bermuda Issuers only. Issuer market cap < $1.5B. Initial common stock offerings only (IPO and PIPO) 7/1/2009 – 6/30/2014. 3. Source: Dealogic. Apportioned credit to all book-running managers; Rank Eligible and SEC registered transactions only, US and Bermuda Issuers only. Issuer market cap < $1.5B. All common stock offerings only (IPO, FO, and PIPO) 7/1/2009 – 6/30/2014. 4. Unapportioned deal credit 7/1/2009 – 6/30/2014. 5. 144A to IPO / listing date 7/1/2009 – 6/30/2014. 6. Source: FactSet 2 3 3 3 |

SMALL FIRM WITH A BOOKRUNNING EQUITY FRANCHISE 6 June 4, 2010 $1,001,000,000 Private Placement Sole Placement Agent April 24, 2012 $550,000,000 Private Placement Financial Advisor & Sole Placement Agent Follow On Lead Placement Agent August 2010 $730,000,000 Early Stage Capital Raises around High Return Ideas Complicated Stories/ Over- leveraged Capital Structures Speed to Market Critical Strong Aftermarket Performance *pending FCC approval |

DIFFERENTIATED DISTRIBUTION CAPABILITIES 7 1. FBR: 16 bookrun deals in 2013. Bulge Bracket 2013 average: 1 deal every 2.2 days (Citi 160 deals, Barclays 129 deals, BOA/ML 200 deals, Morgan Stanley 162 deals, Goldman Sachs 171 deals). 2. Headcount as of 6/30/2014. FBR Typical Bulge Bracket Bookrun Offerings 1 ~1 every 30 days ~1 every other day Research / Sales Ratio 2 1.1:1 2:1 Equity Salespeople 29 30 – 50 Publishing Analysts 32 50 – 75 Focus – Limited number of active transactions allows time for extensive preparation and education on opportunities – full commitment of resources firmwide to successful completion of deals Commitment – Unlike competitors, FBR’s equity sales force is equal in size to the number of writing research analysts and remains focused on sole task of selling stock to investors Reach – Each salesperson covers large institutional investors as well as middle market, small funds, and family offices – active coverage of over 1,000 accounts rather than just the top 100 |

FOCUSED RESEARCH MODEL 8 3 - 4 core issues drive performance FBR believes that both intermediate and long-term stock performance in public markets comes down to 3-4 core issues per company. Tail issues may cause near- term swings but are not focus of value creation. Deep-dive research FBR analysts do deep-dive research to thoroughly understand the core issues and develop an opinion on future direction. The results are encapsulated in “The Debate” – a concise and focused issue assessment. Creative and timely resources and access to companies FBR follows-up “The Debate” with further resources and exclusive events so investors can understand our conclusions and feel confident in our recommendations. Fundamental research combined with a unique Washington Policy perspective |

RESEARCH COVERAGE 9 Growth in our Research Team in the last year has increased names under coverage by 150, expanding total coverage of S&P 500 to 31% |

What Makes Us Consistently Profitable 10 * * * * * * * * * * |

REVENUE MIX WEIGHTED TO HIGH MARGIN BANKING BUSINESS 11 Revenue Mix – High mix of banking-to- brokerage revenue results in industry leading revenue per head Compensation / Net Revenue – Maintain an appropriate and sustainable ratio of compensation to net revenue Low Fixed Costs – Leaner back office provides more profitable employee base; ongoing strict management of non-comp fixed expenses keeps break-even low Revenue Mix – Banking vs. Brokerage 1 January 1 – December 31, 2013 1. Source: 10K filings. FBRC: Revenue of $38.3 million and estimated variable compensation of $17 million from NMI Holdings, Inc. investment banking transaction removed from 2013 and added to 2012 to reflect the transaction’s April 2012 closing date. GAAP Net Revenue for 2013 and 2012 was $259.8 million and $151.5 million, respectively. Compensation per Employee ($000s) 1 $0 $100 $200 $300 $400 $500 FBR COWN PJC JMP 2010 2011 2012 2013 By generating the largest portion of our revenue from the highest ROE business (i.e., initial capital raising), FBR is able to pay for production and retain key employees |

EQUITIES REVENUE GROWTH DESPITE DECLINING VOLUMES 12 . Y/Y Quarterly Volume : Revenue Comparison Quarterly Revenue ($) Declining industry volumes and commission levels challenging but FBR continues to grow revenue year over year – Gross commissions in July and August of 2014 up more than 15% from the same period of 2013 Steadily increasing revenue in 6 of the last 7 quarters with the exception of the historically, seasonally slow third quarter A primary driver of revenue growth has been the addition of 7 senior analysts and 15 senior sales and sales-trading personnel, greatly expanding coverage and creating more resource opportunities for accounts |

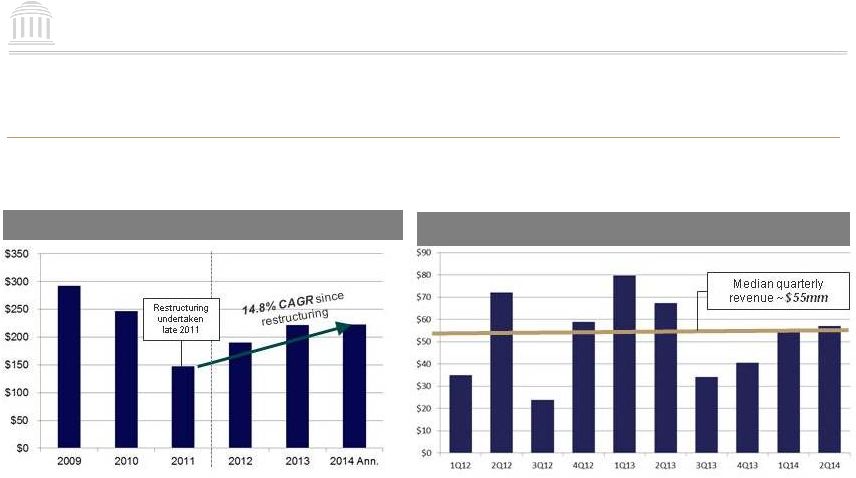

13 CONSISTENCY OF REVENUE Annual Net Revenue ($ thousands) Quarterly Net Revenue ($ millions) 1,2 1. Results as originally reported (asset management operations included in 2008 – 2011, excluded in 2012 and beyond as discontinued operations). 2008 Net Revenue excludes $81.3 million in investment losses. 2. Revenue from NMI Holdings, Inc. investment banking transaction of $38.3 million removed from 1Q13 net revenue and added to 2Q12 net revenue to reflect its April 2012 transaction closing date. GAAP Net Revenue for 2013 and 2012 was $259.8 million and $151.5 million, respectively, and for 1Q13 and 2Q12 and was $117.9 and $32.7, respectively. Earnings impact of change is estimated to be $20.5 million, which assumes $17 million variable compensation and 4% effective tax rate. Despite quarterly lumpiness, annual revenue and earnings have been consistent and growing following the 2011 restructuring 1,2 |

14 FBR consistently profitable at revenue levels exceeding $500K in revenue / head Reaching this benchmark allows us to properly balance the interests of shareholders and employees Several years prior to 2011 restructuring, FBR running below $500K / head target – post- restructuring stability of platform allows for steady revenue and earnings REVENUE PER HEAD – KEY METRIC FOR FBR Earnings Analysis 1 Revenue per Employee ($000s) 1 1. Source: SEC filings. FBRC: Revenue from NMI Holdings, Inc. investment banking transaction of $38.3 million removed from 2013 net revenue and added to 2012 net revenue to reflect its April 2012 transaction closing date. GAAP Net Revenue for 2013 and 2012 was $259.8 million and $151.5 million, respectively. Earnings impact of change is estimated to be $20.5 million, which assumes $17 million variable compensation and 4% effective tax rate. 2. 2008 revenue per head excludes investment losses. 2008 GAAP Net Revenue was $181.9 million. |

15 For Illustrative Purposes Only –prior year expense and net income amounts recast using current year expense rates / levels (see Annual Expense Rate Assumptions) $000’s Annual Expense Rate Assumptions 2008 Recast 2 2009 Recast 2010 Recast 2011 Recast 2012 Recast 3 2013 Actual 3 1H 2014 Annualized Adjusted net revenue (“NR”) 1 NA $ 263,241 $ 292,233 $ 246,587 $ 147,151 $ 189,814 $ 221,521 $ 222,912 Compensation and benefits 56% of NR 147,415 163,650 138,089 82,405 106,296 127,720 126,740 Other variable costs 10% of NR 26,324 29,223 24,659 14,715 18,981 14,188 17,138 Non-comp. fixed costs $42mm 42,000 42,000 42,000 42,000 42,000 43,643 43,054 Net income before taxes $ 47,502 $ 57,359 $ 41,840 $ 8,031 $ 22,537 $ 35,970 $ 35,980 Operating margin 18.0% 19.6% 17.0% 5.5% 11.9% 16.2% 16.1% “RECAST” PRIOR YEAR COST STRUCTURE 1. As originally reported except as otherwise noted (i.e., asset management operations included in 2008 – 2011, excluded in 2012 and 2013 as discontinued operations). 2. 2008 Adjusted Net Revenue excludes investment losses. 2008 GAAP Net Revenue was $181.9 million. 3. Revenue of $38.3 million from NMI Holdings, Inc. investment banking transaction removed from 2013 Adjusted Net Revenue and added to 2012 Adjusted Net Revenue to reflect the transaction’s April 2012 closing date. GAAP Net Revenue for 2013 and 2012 was $259.8 million and $151.5 million, respectively. Related variable compensation of $17 million removed from 2013 Compensation & Benefits. Net effect on 2013 Net Income is $21.3 million. |

Our Opportunities 16 * * * * * * * * * * |

17 Stability of business platform and balance sheet supports strategic growth in industry verticals and complementary business lines to capitalize on competitive advantages GROWTH INITIATIVES Front end expansion – addition of 31 sales, trading and research professionals in 4Q13 – Widened primary pipe to drive higher commission levels – Increased relevance to sales accounts – Re-stocked research analyst coverage in Healthcare, Consumer, TMT, and Alternative Energy – Created opportunity for building out banking in those industry verticals Capitalizing on expanded banking opportunities in growth industries with senior level hiring – already seeing meaningful revenue in added verticals – Healthcare – Technology, Media & Telecommunications – Alternative Energy / Renewables Focused growth in advisory business with several dedicated M&A bankers embedded across industry verticals – healthy pipeline reflecting new expanded capabilities in high volume market Acquired complementary securities lending business – $600mm+ assigned from existing client base; solid growth potential from our strong capital levels – Current high margin business with significant revenue growth potential NOTE: Research is provided by FBRC’s Research department, which is independent from the Investment Banking department of FBRC, and has the sole authority to determine which companies receive research coverage and the recommendation contained in the coverage. In the normal course of its business, FBRC seeks to perform investment banking and other fee generating services for companies that are the subject of FBRC research reports. Research analysts are eligible to receive bonus compensation that is based on FBRC’s overall operating revenues, including revenues generated by FBRC’s Investment Banking Department. Specific information is contained in each research report concerning FBRC’s relationship with the company that is the subject of the report. |

18 1. All share amounts and prices reflect the 1 for 4 reverse stock split effected on 2/28/13. 2. GAAP basis. AGGRESSIVELY RETURNING CAPITAL TO SHAREHOLDERS 1 Tangible Book Value per Share ² Accretive Impact of Share Repurchases Since 2010, FBR has repurchased ~51% of starting share count of 17,580,566 – approximately half of that in the last 12 months alone – with a meaningfully accretive impact to Book Value / Share Committed to holding share count at current levels or lower Targeting inside ownership for 30%, which we believe to be achievable over the next three years, further aligning management and shareholder interests |

Our Financials and Valuation 19 * * * * * * * * * * |

Year ended December 31, 2013 2012 Investment banking $196,213 $90,669 Institutional brokerage 53,738 52,472 Net investment and other income 9,870 8,351 Total revenue $259,821 $151,492 Compensation and benefits $144,720 $82,672 Professional services 12,326 12,839 Business development 9,602 9,394 Clearing and brokerage fees 4,922 7,490 Occupancy and other operating expenses 30,981 35,169 Total expense $202,551 $147,564 Income (loss) from cont. operations before taxes $57,270 $3,928 Income tax (benefit) provision (27,483) (1,078) Income (loss) from cont. operations, net of taxes $84,753 $5,006 Income from discontinued operations, net of taxes 8,159 24,685 Net income (loss) $92,912 $29,691 Compensation & benefits / revenue 56% 55% Basic earnings per share $7.77 $2.24 Diluted earnings per share $7.17 $2.15 Weighted average shares - basic 11,963 13,274 Weighted average shares - diluted 12,960 13,798 Balances as of June 30, 2014 Dec. 31, 2013 Cash and cash equivalents $176,905 $207,973 Receivables 335,865 10,092 Investments 192,907 152,424 Deferred tax assets, net 27,356 30,893 Other assets 13,088 9,190 Total assets $746,121 $410,572 Debt $0 $0 Other liabilities 448,184 119,795 Shareholders' equity 297,937 290,777 Total liabilities & shareholders' equity $746,121 $410,572 Tangible book value per share $28.04 $26.86 20 Balance Sheet Income Statement Unlevered balance sheet and no debt $176 million in cash $298 million in shareholders’ equity TRANSPARENT BALANCE SHEET WITH LIQUID ASSETS GAAP presentation. Does not include adjustment for NMI Holdings, Inc. transaction. 1. Balance Sheet and Income Statement $ in thousands, except per share amounts 1 |

DELIVERING RESULTS SIMILAR TO ADVISORY PEERS 21 FBR EVR GHL LAZ Moelis Revenue / Head $810k $765k $893k $830k $875k Comp / Revenue 56% 63% 54% 64% 64% Operating Margin 16% 18% 25% 21% 18% ROE 15% 11% 16% 8% 16%* Total Capital $290mm $503mm $277mm $630mm $309mm Sources: Earnings Releases and SEC filings for public companies; Moelis information from S-1 filing. Operating margin calculated as Pre-Tax Profit / Net Revenue. FBRC: Revenue from NMI Holdings, Inc. investment banking transaction of $38.3 million removed from 2013 net revenue and added to 2012 net revenue to reflect its April 2012 transaction closing date. Earnings impact of change is estimated to be $20.5 million, which assumes $17 million variable compensation and 4% effective tax rate. *As a private partnership, taxes have been passed through. This percentage assumes a 35% effective tax rate. Appropriate valuation comparison is to traditional, high-performing advisory firms with compensation, revenue, and cost models similar to FBR (vs. traditional broker dealers) FBR current business model sustainable – and profitable – even in difficult markets Price / Book (8/31/14) / (6/30/14) 1.0x 3.0x 5.8x 13.4x 3.7x Price / Earnings (8/31/14) / (trailing 4 quarters) 12.9x 31.8x 57.0x 26.0x n/m |

THE BOTTOM LINE 22 FBR is a uniquely valuable franchise – a transaction driven business model focused on ideas and execution that make money for our clients – not relying on revenue generated from our capital – dominant in the high margin initial equity capital raising arena – operating on a low fixed cost structure – allowing us to consistently achieve profitability in all market conditions This stable platform and consistent earnings and profitability have positioned us well for: – pro-active growth initiatives – strategic management of capital – attractive returns on equity – returning capital to shareholders |

Metropolitan Washington, D.C. Headquarters 1001 Nineteenth Street North . Arlington, VA 22209 703.312.9500 T . 703.312.9501 F . www.fbr.com Boston Houston Irvine (Los Angeles) New York San Francisco 100 Federal Street, 29th Floor Boston, MA 02110 617.757.2900 9 Greenway Plaza, Suite 2050 Houston, TX 77046 713.226.4700 18101 Von Karman Ave., Suite 950 Irvine, CA 92612 949.477.3100 299 Park Avenue, 7th Floor New York, NY 10171 212.457.3300 1 Embarcadero Center, Suite 2140 San Francisco, CA 94111 415.248.2900 Note: Not all services available from all offices |