From the desk of... Highwater Ethanol, LLC CEO Brian Kletscher Highwater Ethanol, LLC April 2023 Volume 1 | Issue 1 Ethanol In This Issue... 1-2 Brian Kletscher 3 Luke Schneider 4-5 Employee Spotlight 6 Dillon Imker & Derek Trapp 7 Tom Streifel Spring has finally sprung; it is nearing 80 degrees as I write this today! After wrapping up a very successful 2022 Fiscal Year, what will propel us forward in 2023? Current demand for renewable fuels remains strong and robust as we head into the Spring/Summer driving season. We are excited about the demand now and into the future. Fourteen years in operation has continued to provide a different opportunity every year! Ethanol, dried distillers grain, modified distillers grain and corn oil demand currently remain strong. We are optimistic that current levels of demand for these products may remain that way for the next three quarters. We completed the First Quarter of our 2023 Fiscal Year with a net income of $2,331,977. Highwater Ethanol paid a distribution in December 2021 of $1500/unit and one of $2300/unit in February 2022 for a total distribution of $3,800/unit for the fiscal year ended October 31, 2022. We also paid a distribution of $3200/unit in December 2022 bringing the total distributions for those periods to $7000/unit or a total of $33,367,900. We will continue to strive to return money to our investors while maintaining the facility that you can be extremely proud to be part of! We continue to focus on operations to ensure the best efficiencies we can get at your facility. During the First Quarter of our 2023 Fiscal Year, we produced an average of approximately 3.016 gallons of denatured ethanol per bushel of corn ground. We have maintained these efficiencies since August 2019 due to several factors. We continue to review enzymes, yeast, and other items to ensure the best efficiencies and we are proud of our team for maintaining this production rate! Our efficiencies in corn oil production have continued to improve with adjustments made in the process to boost our production to over .97 pounds per bushel ground. Please see the table on the next page on additional efficiencies in the past five years. Highwater Ethanol continues to monitor the following technologies: Sustainable Aviation Fuel {SAF}, Renewable Diesel, Carbon Capture technologies, and others. Weighing each technology, improving efficiencies, and lowering our Carbon Index score in the future will be important for Highwater and the ethanol industry. Utilizing the corn that is produced by our area producers remains very important for the entire Ag industry. For the past three months, we have been operating at an ethanol production level of approximately 69 million gallons per year which is near permitted rates. Our ethanol production rates were similar during our 2022 Fiscal Year. This was accomplished with your current facility with no additional capital expenses. During our 2022 Fiscal Year, we saw demand for ethanol increase domestically by approximately 3 – 4% and export demand remain stable to improved slightly. We believe that our 2023 Fiscal Year will likely be a very interesting year for renewable ethanol and renewable biofuels, and we will continue to work to obtain additional market share for our products. Highwater continues to review opportunities at diversifying our product lines. We continue to market approximately 3.5% - 5.2% of our production as cellulosic ethanol. This was tested out and approval received in March 2021 by the California Air Resources Board {CARB}.

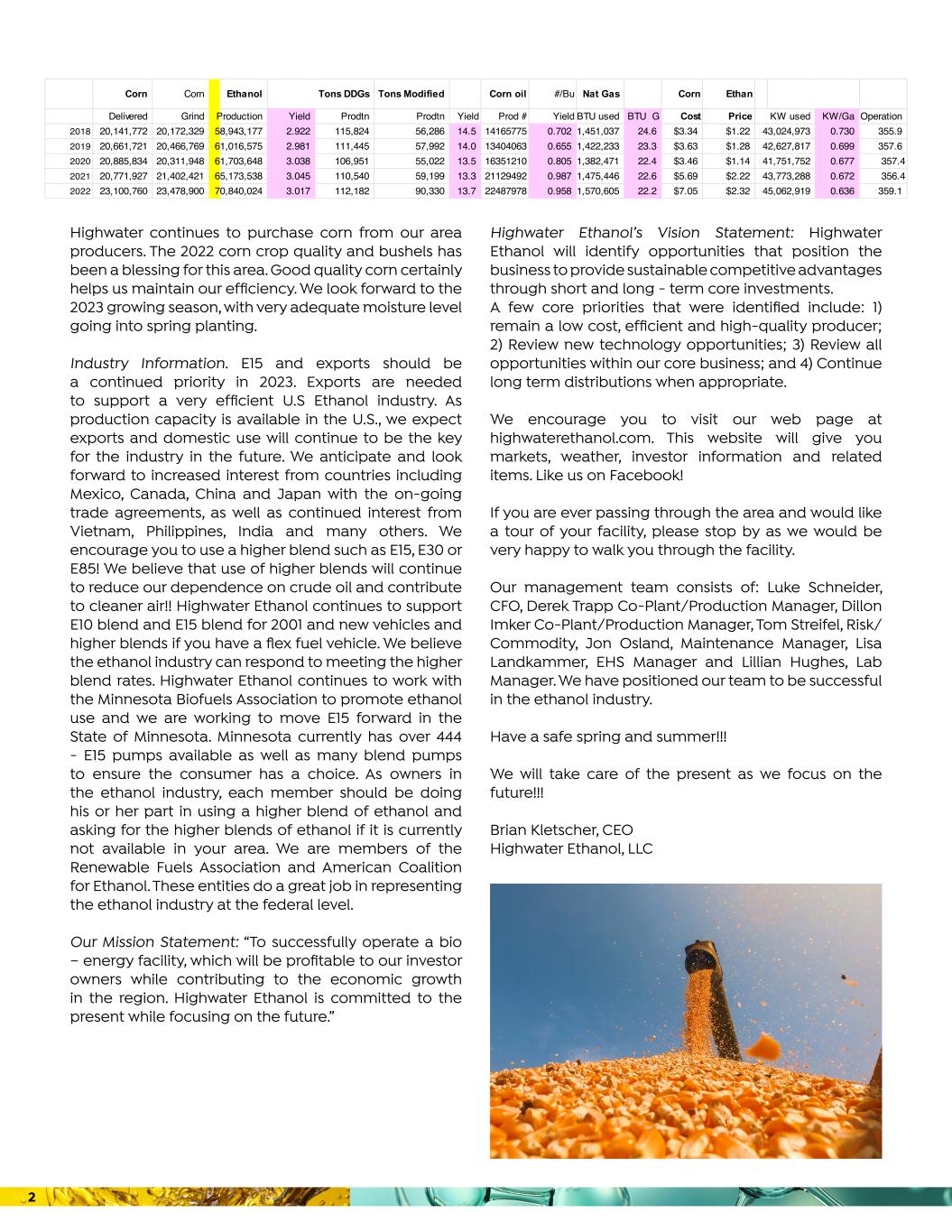

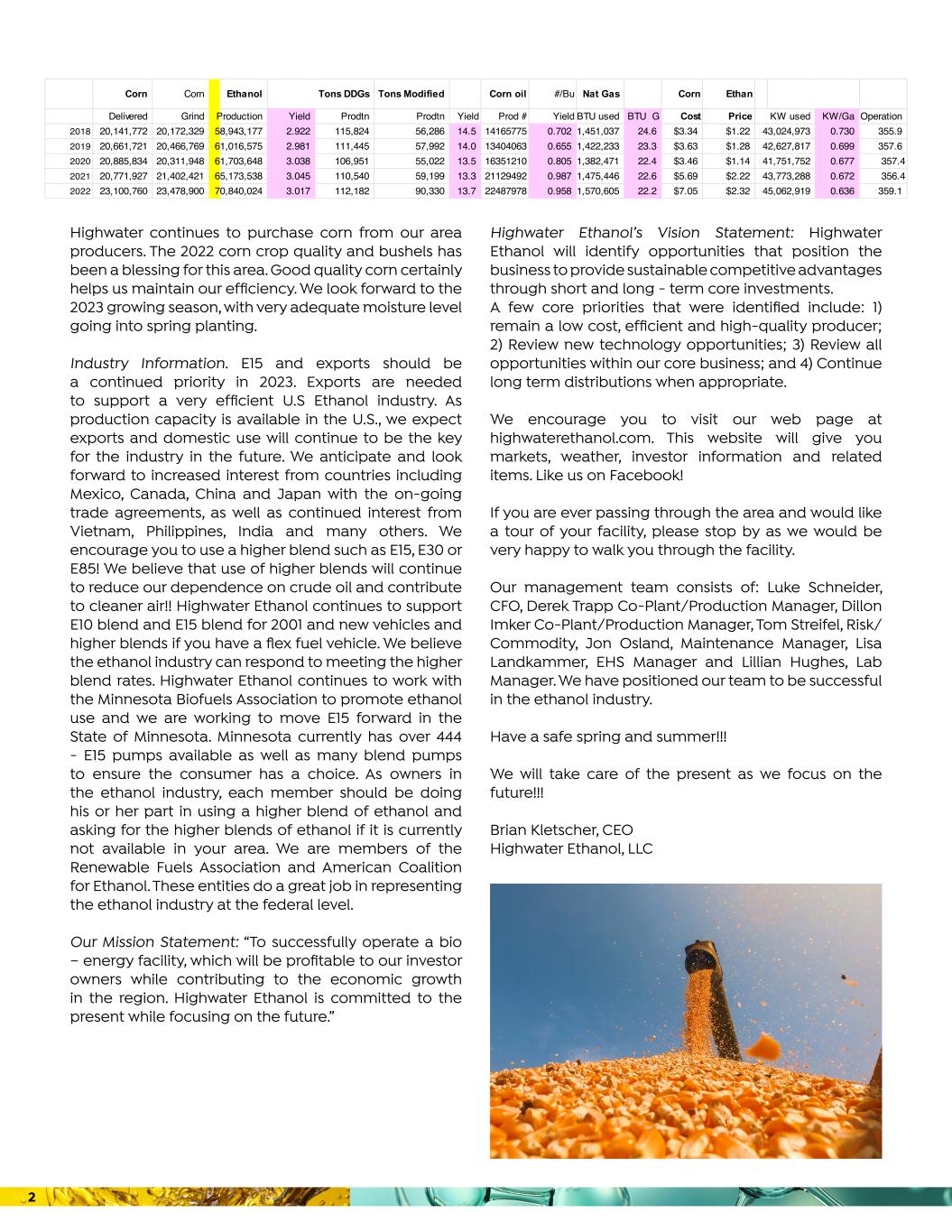

Highwater continues to purchase corn from our area producers. The 2022 corn crop quality and bushels has been a blessing for this area. Good quality corn certainly helps us maintain our efficiency. We look forward to the 2023 growing season, with very adequate moisture level going into spring planting. Industry Information. E15 and exports should be a continued priority in 2023. Exports are needed to support a very efficient U.S Ethanol industry. As production capacity is available in the U.S., we expect exports and domestic use will continue to be the key for the industry in the future. We anticipate and look forward to increased interest from countries including Mexico, Canada, China and Japan with the on-going trade agreements, as well as continued interest from Vietnam, Philippines, India and many others. We encourage you to use a higher blend such as E15, E30 or E85! We believe that use of higher blends will continue to reduce our dependence on crude oil and contribute to cleaner air!! Highwater Ethanol continues to support E10 blend and E15 blend for 2001 and new vehicles and higher blends if you have a flex fuel vehicle. We believe the ethanol industry can respond to meeting the higher blend rates. Highwater Ethanol continues to work with the Minnesota Biofuels Association to promote ethanol use and we are working to move E15 forward in the State of Minnesota. Minnesota currently has over 444 - E15 pumps available as well as many blend pumps to ensure the consumer has a choice. As owners in the ethanol industry, each member should be doing his or her part in using a higher blend of ethanol and asking for the higher blends of ethanol if it is currently not available in your area. We are members of the Renewable Fuels Association and American Coalition for Ethanol. These entities do a great job in representing the ethanol industry at the federal level. Our Mission Statement: “To successfully operate a bio – energy facility, which will be profitable to our investor owners while contributing to the economic growth in the region. Highwater Ethanol is committed to the present while focusing on the future.” Highwater Ethanol’s Vision Statement: Highwater Ethanol will identify opportunities that position the business to provide sustainable competitive advantages through short and long - term core investments. A few core priorities that were identified include: 1) remain a low cost, efficient and high-quality producer; 2) Review new technology opportunities; 3) Review all opportunities within our core business; and 4) Continue long term distributions when appropriate. We encourage you to visit our web page at highwaterethanol.com. This website will give you markets, weather, investor information and related items. Like us on Facebook! If you are ever passing through the area and would like a tour of your facility, please stop by as we would be very happy to walk you through the facility. Our management team consists of: Luke Schneider, CFO, Derek Trapp Co-Plant/Production Manager, Dillon Imker Co-Plant/Production Manager, Tom Streifel, Risk/ Commodity, Jon Osland, Maintenance Manager, Lisa Landkammer, EHS Manager and Lillian Hughes, Lab Manager. We have positioned our team to be successful in the ethanol industry. Have a safe spring and summer!!! We will take care of the present as we focus on the future!!! Brian Kletscher, CEO Highwater Ethanol, LLC From the Desk of Highwater Ethanol, LLC CEO Brian Kletscher Spring has finally sprung; it is nearing 80 degrees as I write this today! After wrapping up a very successful 2022 Fiscal Year, what will propel us forward in 2023? Current demand for renewable fuels remains strong and robust as we head into the Spring/Summer driving season. We are excited about the demand now and into the future. Fourteen years in operation has continued to provide a different opportunity every year! Ethanol, dried distillers grain, modified distillers grain and corn oil demand currently remain strong. We are optimistic that current levels of demand for these products may remain that way for the next three quarters. We completed the First Quarter of our 2023 Fiscal Year with a net income of $2,331,977. Highwater Ethanol paid a distribution in December 2021 of $1500/unit and one of $2300/unit in February 2022 for a total distribution of $3,800/unit for the fiscal year ended October 31, 2022. We also paid a distribution of $3200/unit in December 2022 bringing the total distributions for those periods to$7000/unit or a total of $33,367,900. We will continue to strive to return money to our investors while maintaining the facility that you can be extremely proud to be part of! We continue to focus on operations to ensure the best efficiencies we can get at your facility. During the First Quarter of our 2023 Fiscal Year, we produced an average of approximately 3.016 gallons of denatured ethanol per bushel of corn ground. We have maintained these efficiencies since August 2019 due to several factors. We continue to review enzymes, yeast, and other items to ensure the best efficiencies and we are proud of our team for maintaining this production rate! Our efficiencies in corn oil production have continued to improve with adjustments made in the process to boost our production to over .97 pounds per bushel ground. Please see the table below on additional efficiencies in the past five years. Highwater Ethanol continues to monitor the following technologies: Sustainable Aviation Fuel {SAF}, Ren wable Diesel, Carbon Capture technologies, and others. Weighing each techn logy, mproving efficiencies, and lowering our Carbon Index score in the future will be important for Highwater and the ethanol i dustry. Utilizi g the corn that is produced by our area producers remains very important for the entire Ag industry. For the past three months, we have been operating at an ethanol production level of approximately 69 million gallons per year which is near permitted rates. Our ethanol production rates were similar during our 2022 Fiscal Year. Thi was accomplished with your current facility with no additional capital expenses. During our 2022 Fiscal Year, we saw demand for ethanol increase domestically by approximately 3 – 4% and export d and remain stable to improved slightly. Corn Corn Ethanol Tons DDGs Tons Modified Corn oil #/Bu Nat Gas Corn Ethan Delivered Grind Production Yield Prodtn Prodtn Yield Prod # Yield BTU used BTU G Cost Price Days Operation 2018 20,141,772 20,172,329 58,943,177 2.922 115,824 56,286 14.5 14165775 0.702 1,451,037 24.6 $3.34 $1.22 355.9 2019 20,661,721 20,466,769 61,016,575 2.981 111,445 57,992 14.0 13404063 0.655 1,422,233 23.3 $3.63 $1.28 357.6 2020 20,885,834 20,311,948 61,703,648 3.038 106,951 55,022 13.5 16351210 0.805 1,382,471 22.4 $3.46 $1.14 357.4 2021 20,771,927 21,402,421 65,173,538 3.045 110,540 59,199 13.3 21129492 0.987 1,475,446 22.6 $5.69 $2.22 356.4 2022 23,100,760 23,478,900 70,840,024 3.017 112,182 90,330 13.7 22487978 0.958 1,570,605 22.2 $7.05 $2.32 359.1 43,773,288 0.672 45,062,919 0.636 43,024,973 0.730 42,627,817 0.699 41,751,752 0.677 KW used KW/Ga Formatted: Font: 10 pt 2

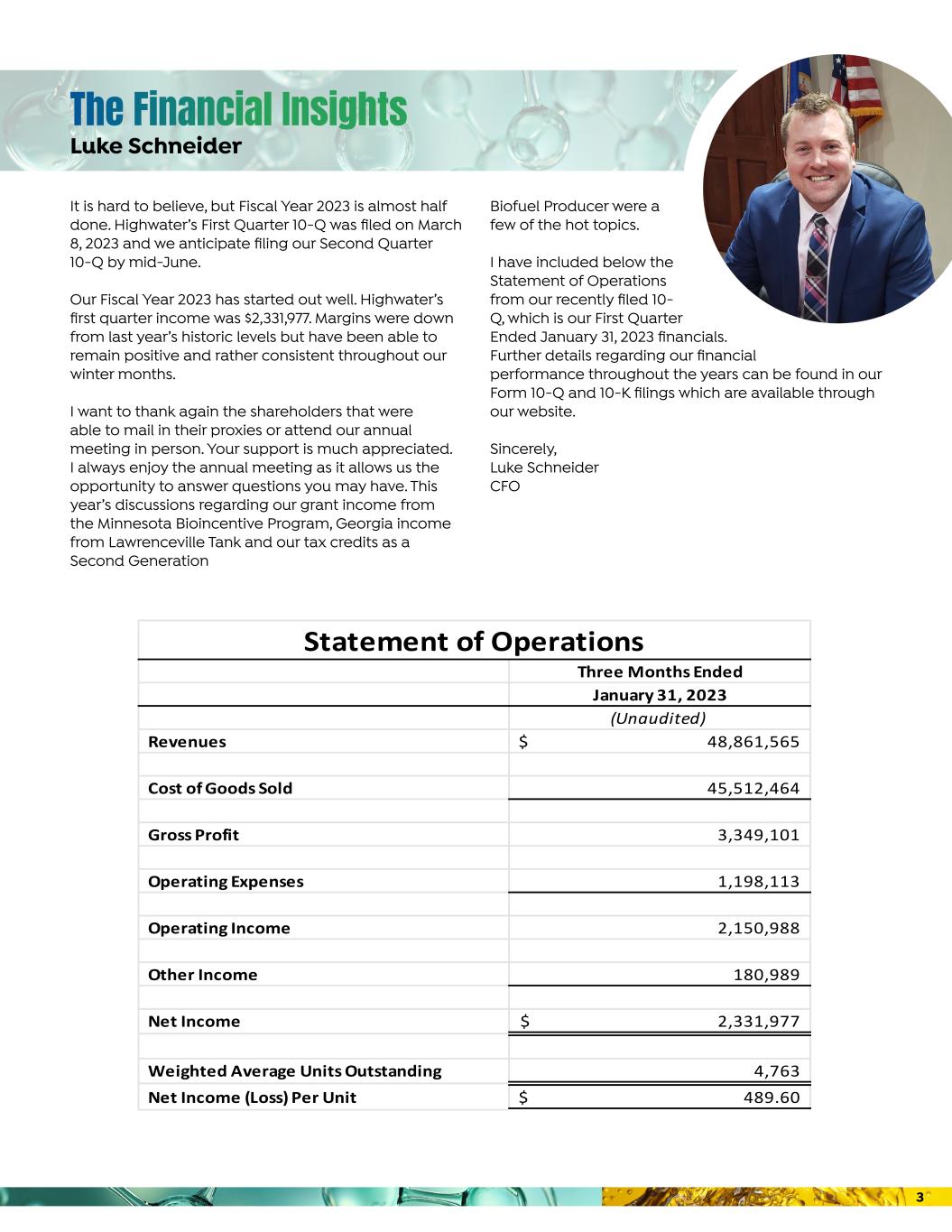

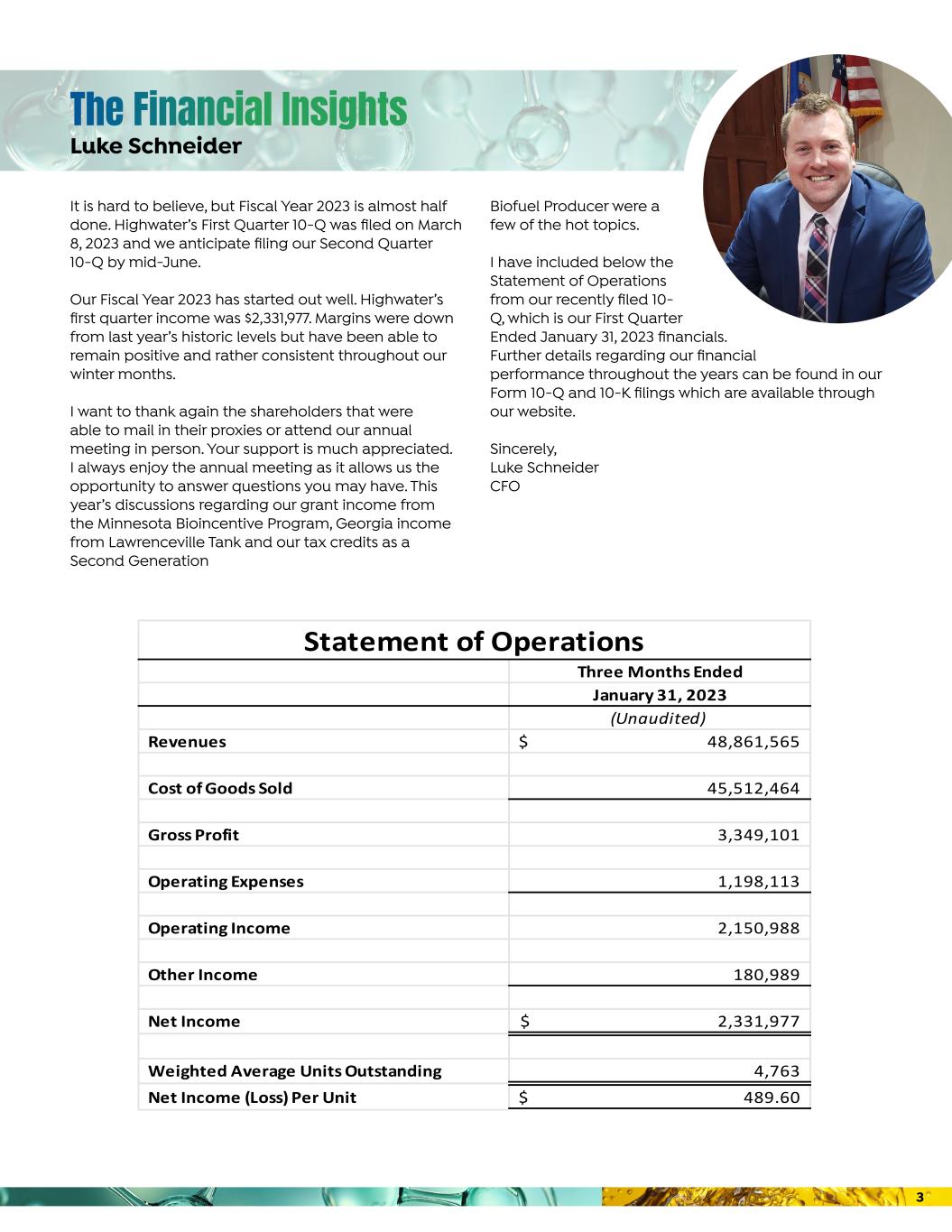

It is hard to believe, but Fiscal Year 2023 is almost half done. Highwater’s First Quarter 10-Q was filed on March 8, 2023 and we anticipate filing our Second Quarter 10-Q by mid-June. Our Fiscal Year 2023 has started out well. Highwater’s first quarter income was $2,331,977. Margins were down from last year’s historic levels but have been able to remain positive and rather consistent throughout our winter months. I want to thank again the shareholders that were able to mail in their proxies or attend our annual meeting in person. Your support is much appreciated. I always enjoy the annual meeting as it allows us the opportunity to answer questions you may have. This year’s discussions regarding our grant income from the Minnesota Bioincentive Program, Georgia income from Lawrenceville Tank and our tax credits as a Second Generation Biofuel Producer were a few of the hot topics. I have included below the Statement of Operations from our recently filed 10- Q, which is our First Quarter Ended January 31, 2023 financials. Further details regarding our financial performance throughout the years can be found in our Form 10-Q and 10-K filings which are available through our website. Sincerely, Luke Schneider CFO The Financial Insights Luke Schneider It is hard to believe, but Fiscal Year 2023 is almost half done. Highwater’s First Quarter 10-Q was filed on March 8, 2023 and we anticipate filing our Second Quarter 10-Q by mid-June. Our Fiscal Year 2023 has started out well. Highwater’s first quarter income was $2,331,977. Margins were down from last year’s historic levels but have been able to remain positive and rather consistent throughout our winter months. I want to thank again the shareholders that were able to mail in their proxies or attend our annual meeting in person. Your support is much appreciated. I always enjoy the annual meeting as it allows us the opportunity to answer questions you may have. This year’s discussions regarding our grant income from the Minnesota Bioincentive Program, Georgia inco e from Lawrenceville Tank and our tax credits as a Second Generation Biofuel Producer were a few of the hot topics. I have included below the Statement of Operations from our recently filed 10-Q, which is our First Quarter Ended January 31, 2023 financials. Further details regarding our financial performance throughout the years can be found in our Form 10-Q and 10-K filings which are available through our website. Three Months Ended January 31, 2023 (Unaudited) Revenues 48,861,565$ Cost of Goods Sold 45,512,464 Gross Profit 3,349,101 Operating Expenses 1,198,113 Operating Income 2,150,988 Other Income 180,989 Net Income 2,331,977$ Weighted Average Units Outstanding 4,763 Net Income (Loss) Per Unit 489.60$ Statement of Operations Sincerely, Luke Schneider CFO 3

Highwater Ethanol, LLC Employees are Committed to working for you: The average length of employment at Highwater Ethanol, LLC is 8.5 years, which is remarkably astounding at approximately 60% higher than the reported US national average. This is a strong testament to our work environment/ culture and allows Highwater Ethanol to run the facility at capacity and efficiently! Our average tenure for our Management Team is 10.61 years, which has given us the added advantage to continue to run the facility in all aspects of operations. We believe in providing our employees with opportunities to grow within the company! Providing our employees with the necessary training and tools not only allows them to be successful at their position, but prepares them for their next steps. The commitment from our employees goes well beyond our Management Team. The average tenure for our combined production, maintenance, and administration teams is an incredible 8.75 years! Developing our employees to multiple opportunities in different positions has allowed for cross-training, which we believe is remarkably successful for our employees and Highwater! This commitment from Management and production/maintenance/ administration staff is integral to our succession planning and for employee growth. Working at Highwater Ethanol is more than a job. For the majority of our team, they take ownership of their position and use their experience to make it possible to meet the daily challenges of their job without missing a thing. We are proud of our employees and happy they have chosen Highwater Ethanol to be part of their journey! Thank you to all our employees for the fantastic job you do! From Left; Kurt, Kyle, & David From left; Todd, Justin, Mike, & Greg From Left Front; Luke S., & Brian K. – From left back; Tom, Dillon, Lillian, Derek, Lisa, & Jon From Left Front; Kimberly, Rach el, & Nate From left back; Rich, Tom, Luke S., & Brian K. From left; Lillian and Nissa 4

From Left Front; Kimberly, Rach el, & Nate From left back; Rich, Tom, Luke S., & Brian K. From left; Peter, Bryan W., Shane, Dean, Andy, & Chief Boiler Operator, Chad A. From left; Ross, Austin, Josh H., Todd, Chad, & Safety Coordinator Josh M. From left; Christian, Steven S., Jeremy, Ray, Steve W., & Tom From left; Lillian and Nissa From Left; Sarah, Bryan S., Luke M, Brian H., & Casey 5

Spring has finally started to show this week. After a cooler than normal March, we are starting to see some 70- and 80-degree weather at the plant. With the warmer temps throughout the week, the team at Highwater enjoyed some work outside without having to be bundled up. Just like last year, we decided to cancel the spring maintenance outage that was supposed to take place in March. We had planned on shutting the plant down for 4 days to complete some routine cleaning and maintenance. When working through our outage list, it became apparent that it was in the best interest of Highwater to cancel our spring outage. We will look to our fall maintenance outage to complete some of the tasks that we had on our spring outage schedule. On August 21, we will take the plant down for four days and complete all our routine cleaning and maintenance with the intention of starting up on August 24. We continue to operate the plant at 195,000 gallons of Denatured Ethanol per day. At this rate, we are right below our permit limit of 70.2 million gallons per year. We closed out March at 3.017 gallons of Denatured Ethanol produced from one bushel of corn. Corn oil separation continues to be positive, as well. As we discussed in our last newsletter, we were waiting for our spare assembly to arrive on site. We were glad to see it arrive in February. On April 13, we installed our spare assembly. Without a spare assembly on site, we were looking at a 3–4- week turnaround for the rebuild process. During those 3-4 weeks, we would see a significant drop in pounds per bushel of corn oil. Having a spare assembly will help us maximize our corn oil yield. Corn oil is holding around 0.55 cents per pound. This is a decrease from what we seen last year but still over double the price it was at the low. Corn oil yield averaged 0.96lbs/ Bu in March. As weather permits, we will look to start our lab expansion. Our hope is to get work started in April with the intention of having the project finished by November. This project will allow us to have ample space for all our equipment currently needed. It will also allow us to add equipment that is necessary in the future. As we continue to work through 2023, we look forward to the opportunities this year brings. Dillon Imker & Derek Trapp Co-Plant Managers Dillon Imker & Derek Trapp 6

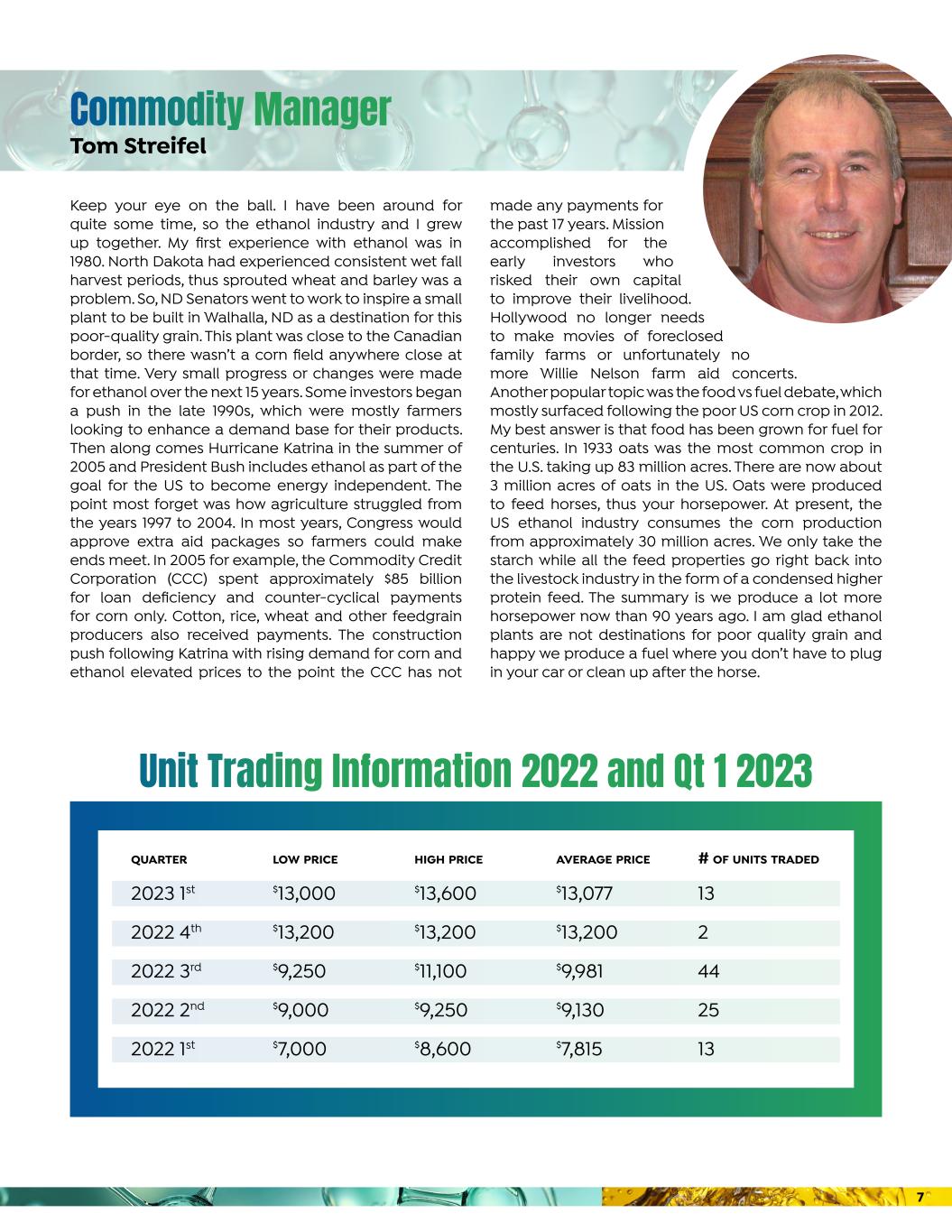

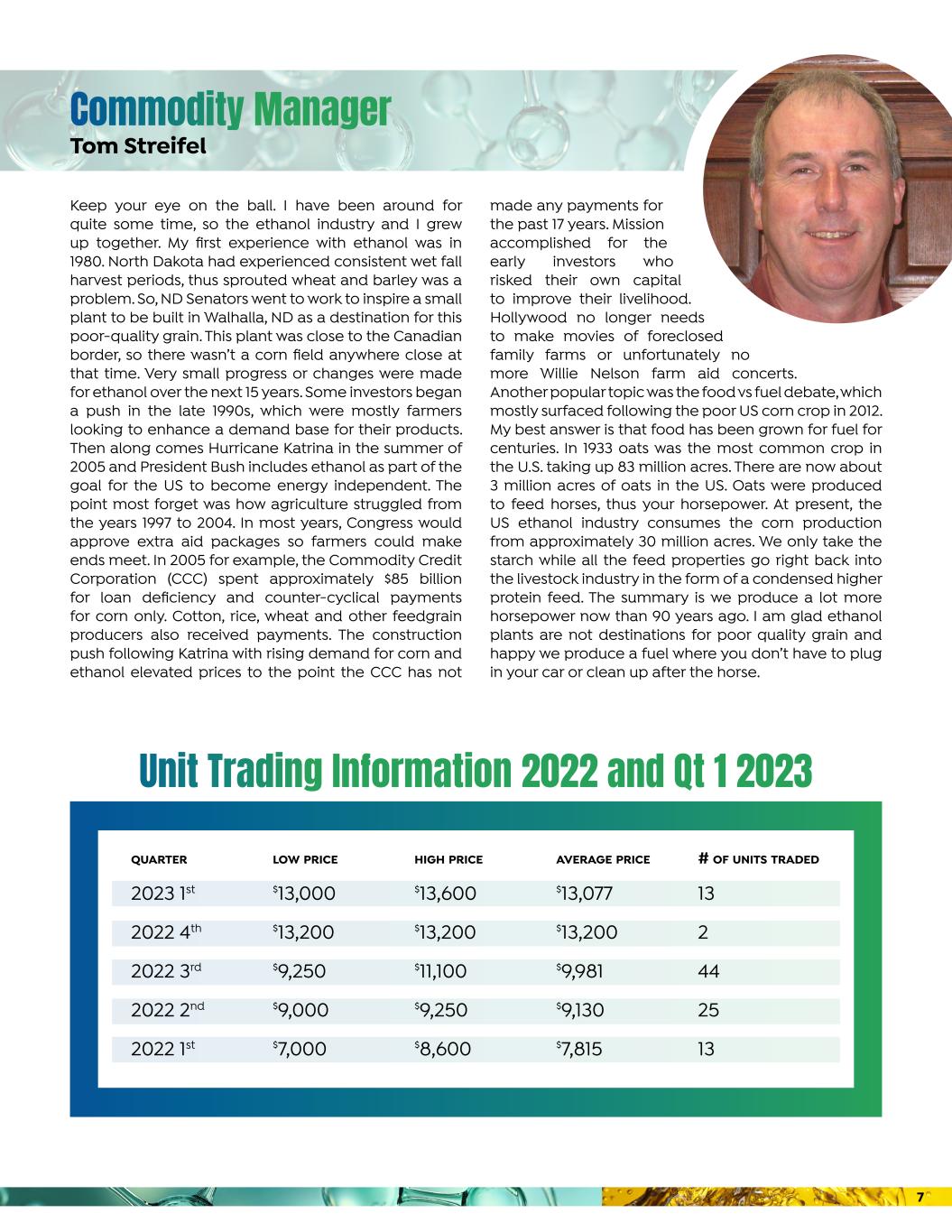

Keep your eye on the ball. I have been around for quite some time, so the ethanol industry and I grew up together. My first experience with ethanol was in 1980. North Dakota had experienced consistent wet fall harvest periods, thus sprouted wheat and barley was a problem. So, ND Senators went to work to inspire a small plant to be built in Walhalla, ND as a destination for this poor-quality grain. This plant was close to the Canadian border, so there wasn’t a corn field anywhere close at that time. Very small progress or changes were made for ethanol over the next 15 years. Some investors began a push in the late 1990s, which were mostly farmers looking to enhance a demand base for their products. Then along comes Hurricane Katrina in the summer of 2005 and President Bush includes ethanol as part of the goal for the US to become energy independent. The point most forget was how agriculture struggled from the years 1997 to 2004. In most years, Congress would approve extra aid packages so farmers could make ends meet. In 2005 for example, the Commodity Credit Corporation (CCC) spent approximately $85 billion for loan deficiency and counter-cyclical payments for corn only. Cotton, rice, wheat and other feedgrain producers also received payments. The construction push following Katrina with rising demand for corn and ethanol elevated prices to the point the CCC has not made any payments for the past 17 years. Mission accomplished for the early investors who risked their own capital to improve their livelihood. Hollywood no longer needs to make movies of foreclosed family farms or unfortunately no more Willie Nelson farm aid concerts. Another popular topic was the food vs fuel debate, which mostly surfaced following the poor US corn crop in 2012. My best answer is that food has been grown for fuel for centuries. In 1933 oats was the most common crop in the U.S. taking up 83 million acres. There are now about 3 million acres of oats in the US. Oats were produced to feed horses, thus your horsepower. At present, the US ethanol industry consumes the corn production from approximately 30 million acres. We only take the starch while all the feed properties go right back into the livestock industry in the form of a condensed higher protein feed. The summary is we produce a lot more horsepower now than 90 years ago. I am glad ethanol plants are not destinations for poor quality grain and happy we produce a fuel where you don’t have to plug in your car or clean up after the horse. Unit Trading Information 2022 and Qt 1 2023 quarter low price high price average price # of units traded 2023 1st 2022 4th 2022 3rd 2022 2nd 2022 1st $13,000 $13,200 $9,250 $9,000 $7,000 $13,600 $13,200 $11,100 $9,250 $8,600 $13,077 $13,200 $9,981 $9,130 $7,815 13 2 44 25 13 Commodity Manager Tom Streifel 7

This newsletter contains forward-looking statements that involve future events, our future performance and our expected future operations and actions. In some cases, you can identify forward-looking statements by the use of words such as “may,” “will,” “should,” “anticipate,” “believe,” “expect,” “plant,” “future,” “intend,” “could,” “estimate,” “predict,” “hope,” “potential,” “continue,” or the negative of these terms or other similar expressions. These forward-looking statements are only our predictions and involve numerous assumptions, risks and uncertainties, including, but not limited to those listed below and those business risks and factors described in our filings with the Securities and Exchange Commission (“SEC”). Changes in our business strategy, capital improvements or development plans; Changes in plant production capacity or technical difficulties in operating the plant; Changes in the environmental regulations that apply to our plant site and operations; Changes in general economic conditions or the occurrence of certain events causing an economic impact in the agriculture, oil or grains; Changes in federal and/or state laws (including the elimination of any federal and/or state ethanol tax incentives); Overcapacity within the ethanol industry; Changes and advances in ethanol production technology; Competition in the ethanol industry and from alternative fuel additives; Lack of transportation, storage and blending infrastructure preventing ethanol from reaching high demand markets; Volatile commodity and financial markets; and the results of our hedging transactions and other risk management strategies. Our actual results or actions could and likely will differ materially from those anticipated in the forward-looking statements for many reasons, including the reasons described in these communications. We are not under any duty to update the forward-looking statements contained in this newsletter. We cannot guarantee future results, levels of activity, performance or achievements. We caution you not to put undue reliance on any forward-looking statements, which speak only as of the date of this communication. You should read this newsletter with the understanding that our actual results may be materially different from what we currently expect. We qualify all of our forward-looking statements by these cautionary statements. Highwater Ethanol, LLC 24500 US Highway 14 Lamberton, Minnesota 56152 info@highwaterethanol.com www.highwaterethanol.com 507.752.6160 PRST STD U.S. POSTAGE PAID MN MAIL