Exhibit 10.8

*** Text Omitted and Filed Separately

Confidential Treatment Requested

Under 17 C.F.R. §§ 200.80(b)(4)

and 203.406

PHOTOVOLTAIC MODULE

MASTER

SUPPLY AGREEMENT

BETWEEN

NEXTERA ENERGY RESOURCES, LLC

AND

HANWHA SOLARONE U.S.A. INC.

Dated as of April 11, 2015

TABLE OF CONTENTS

| | | | | | |

| SECTION | | PAGE | |

| | |

1. | | PRODUCT SALES AND PURCHASE. | | | 1 | |

| | |

2. | | PRICES; PAYMENT; TAXES. | | | 3 | |

| | |

3. | | RIGHT OF FIRST OFFER | | | 5 | |

| | |

4. | | WARRANTIES | | | 6 | |

| | |

5. | | CONFIDENTIALITY AND OWNERSHIP | | | 6 | |

| | |

6. | | TERM; EVENTS OF DEFAULT; TERMINATION. | | | 7 | |

| | |

7. | | TERMINATION FOR CONVENIENCE | | | 11 | |

| | |

8. | | SURVIVAL | | | 12 | |

| | |

9. | | SEVERABILITY OF PROVISIONS | | | 12 | |

| | |

10. | | WAIVER | | | 12 | |

| | |

11. | | APPLICABLE LAW | | | 12 | |

| | |

12. | | DISPUTES; JURISDICTION & VENUE. | | | 12 | |

| | |

13. | | ASSIGNMENT | | | 14 | |

| | |

14. | | PUBLICITY | | | 14 | |

| | |

15. | | COMPLETE AGREEMENT; MODIFICATIONS | | | 14 | |

| | |

16. | | NOTICES | | | 14 | |

| | |

17. | | WAIVER OF CONSEQUENTIAL DAMAGES; LIMITATION OF LIABILITY. | | | 16 | |

| | |

18. | | ANTI-BRIBERY. | | | 18 | |

| | |

19. | | LETTER OF CREDIT | | | 20 | |

| | |

20. | | CORPORATE GUARANTEES | | | 22 | |

| | |

21. | | THIRD PARTY BENEFICIARY | | | 22 | |

| | |

22. | | COUNTERPARTS | | | 22 | |

| | |

23. | | DEFINED TERMS | | | 23 | |

i

|

SCHEDULES |

|

Schedule 1 – Basic Terms of Sale – PV Modules |

|

Schedule 2 – Form of Project Supply Agreement […***…] |

|

Schedule 3 – Schedule of Cancellation Payments |

|

Schedule 4 – Schedule of Projects |

|

Schedule 5 – Form of Letter of Credit |

|

Schedule 6 – Form of Supplier Parent Guaranty |

|

Schedule 7 – Project Supply Agreement Submission Deadlines |

|

Schedule 8 – Project Allocation of Upfront Payment |

|

Schedule 9 – Cover Cost Limits / Scheduled Letter of Credit Reductions |

* Confidential Treatment Requested

ii

PHOTOVOLTAIC MODULE MASTER SUPPLY AGREEMENT

This PHOTOVOLTAIC MODULE MASTER SUPPLY AGREEMENT (the “Agreement”) is made and entered into as of April 11, 2015 (the “Effective Date”) by and between Hanwha SolarOne U.S.A. Inc., a corporation formed under the laws of California (“Supplier”) and NextEra Energy Resources, LLC, a limited liability company formed under the laws of Delaware (“NEER”). Supplier and NEER may be referred to herein individually as a “Party” and collectively as the “Parties.” Capitalized terms used but not defined herein shall have the respective meanings set forth in the form of Project Supply Agreement attached as Schedule 2.

RECITALS

WHEREAS, Supplier supplies and delivers, and its Affiliates manufacture, photovoltaic modules;

WHEREAS, NEER is in the business of designing, constructing and installing solar electric systems utilizing photovoltaic modules, in its own capacity and acting through Affiliates with respect to particular solar electric generation projects (each such project as set forth on Schedule 4, a “Project” and the respective owner thereof, whether NEER or an Affiliate of NEER, a “Project Company”); and

WHEREAS, Supplier desires to sell and deliver to NEER, and NEER, in its own capacity or acting through one or more Project Companies, desires to purchase and receive from Supplier, photovoltaic modules on the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the premises and the covenants and agreements of the Parties hereinafter set forth and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Parties agree as follows:

AGREEMENT

| 1. | Product Sales and Purchase. |

| | 1.1 | Product Description. Pursuant to one or more Project Supply Agreements, Supplier shall provide NEER, or a Project Company as applicable, with photovoltaic modules, with minimum power ratings as set forth in Schedule 1 and as more specifically described in Appendix A to the applicable Project Supply Agreement (“PV Modules”). |

1

| | 1.2 | Firm Commitment Obligations; Project Supply Agreements; Optional Cancellation. |

| | (a) | Commencing on the Effective Date and pursuant to the terms of this Agreement, NEER or FPL (with respect to the FPL Projects only) shall purchase and receive, or NEER shall cause a Project Company that is a NEER subsidiary to purchase and receive, PV Modules for each Project in volumes in accordance with Schedule 4 and at the price in accordance with Schedule 1 (respectively, the “Scheduled Volumes” and “Scheduled Price”) by delivering to Supplier, from time to time, one or more Project Supply Agreements in the applicable form attached as Schedule 2 (each, a “Project Supply Agreement”) duly executed by NEER, or a Project Company (such executing entity, the “Purchaser”), which promptly shall be countersigned by Supplier and a duly executed copy thereof returned to Purchaser; provided that any such Project Supply Agreement so delivered by Purchaser to Supplier in accordance with the provisions of this Agreement and Section 16 (Notices) shall be valid and binding on Supplier and Purchaser (except with respect to standard delivery charges, which shall be invoiced to and paid by Purchaser at actual cost based on the delivery point specified by Purchaser in the applicable Project Supply Agreement), and pursuant to such Project Supply Agreement Supplier shall be obligated to sell and deliver to the Purchaser thereunder, and such Purchaser shall be obligated to purchase and accept delivery from Supplier, the Scheduled Volumes for such Project at the Scheduled Price reflected in Schedule 1 and in accordance with the delivery schedule reflected in Schedule 4 as set forth in the Project Supply Agreement, regardless of whether Supplier countersigns such Project Supply Agreement. Notwithstanding the foregoing or anything in any Project Supply Agreement to the contrary, if the weekly delivery schedule in any Project Supply Agreement varies from the Project by Project weekly delivery schedule attached hereto as Schedule 4, then absent a change order entered into pursuant to the applicable Project Supply Agreement, Schedule 4 hereto shall control. |

| | (b) | In the event that NEER is not the Purchaser under any Project Supply Agreement, with the exception of the FPL Project Agreements in which FPL shall be liable for all payment obligations, NEER shall execute such Project Supply Agreement for the limited purpose of remaining liable for all payment obligations of Purchaser under such Project Supply Agreement. |

| | (c) | If at any time NEER or FPL, as applicable, has not delivered Project Supply Agreements providing for the purchase, sale and delivery of PV Modules for a Project set forth on Schedule 4 by the deadline for submitting a Project Supply Agreement as set forth on Schedule 7 and NEER has not cancelled such Project pursuant to Section 7 hereof, then, at Supplier’s option, Supplier may deliver to NEER a Project Supply Agreement duly executed by Supplier and providing for the delivery of the Scheduled Volumes for such Project in accordance with the delivery schedule reflected in Schedule 4 at Purchaser’s option to the Project Site or to storage in the continental United States (at NEER’s cost and expense in accordance herewith), which promptly shall be countersigned by NEER as the Purchaser and a duly executed copy thereof returned to Supplier; provided that any such Project Supply Agreement so delivered by Supplier to NEER in accordance with the provisions of this Agreement and Section 16 (Notices) shall be valid and binding on NEER and Supplier (including with respect to delivery charges payable by Supplier which shall be to NEER’s account and billed separately to NEER), and pursuant to such Project Supply Agreement, NEER shall be obligated to purchase and accept delivery from Supplier, and Supplier shall be obligated to sell and deliver to the Purchaser thereunder, such PV Modules, regardless of whether NEER countersigns such Project Supply Agreement; and NEER acknowledges and agrees that NEER shall remain liable for all payment obligations of Purchaser under each Project Supply Agreement pursuant to the terms thereof. |

2

| | (d) | Purchaser may, upon written notice to Supplier delivered on or before July 31, 2015, cancel the purchase and delivery of up to […***…] MW in the aggregate of the Scheduled Volumes from the proposed Projects (as set forth in Schedule 4 hereto) (any such cancellation, an “Optional Cancellation”) and in such notice shall identify the Project(s) (or portion thereof) to be cancelled in such Optional Cancellation. Following such Optional Cancellation, Purchaser shall deliver a revised delivery schedule reflecting, as the only changes, the elimination of those deliveries for the PV Modules that are subject to the Optional Cancellation. Upon any Optional Cancellation, Purchaser shall not be entitled to any return or refund of the portion of the Upfront Payment allocable to such cancelled PV Modules, but such amounts shall be applied as a credit, with such credit applicable to the next delivered PV Modules under any Project Supply Agreement and successive deliveries thereafter until exhausted, or as otherwise determined by Purchaser in its reasonable discretion and upon written notice to Supplier. |

| | (e) | Unless the Parties mutually agree otherwise in writing in a Project Supply Agreement, Supplier shall deliver the PV Modules DDP (Incoterms 2010) to Purchaser at the site of each Project. |

| | (f) | The delivery of the Supplier Parent Guaranty by Supplier pursuant to Section 20 shall be a condition precedent to the obligations of each Party under this Agreement. |

| 2. | Prices; Payment; Taxes. |

| | 2.1 | Prices. The price for the PV Modules sold to Purchaser in accordance with any Project Supply Agreement shall be the “Scheduled Price” as set forth in Schedule 1. |

* Confidential Treatment Requested

3

| | 2.2 | Payments. With respect to calendar years 2015 and 2016, NEER shall or shall cause Purchasers to, pay the Scheduled Price for the applicable quantities of the PV Modules set forth on Schedule 1 as follows: |

| | (a) | Upfront Payment / Letter of Credit Exchange. Within five (5) Business Days following notice from Supplier that it is prepared to deliver the Letter of Credit pursuant to Section 19, NEER shall be prepared to pay Supplier an upfront payment (the “Upfront Payment”) in the amount of $[…***…] concurrently with the delivery of the Letter of Credit by Supplier as described in the following sentence. The Parties shall meet in the offices of Skadden, Arps, Slate, Meagher & Flom LLP in Seoul, Korea or such other mutually acceptable location where the original executed Letter of Credit shall be placed in escrow to be released to NEER upon confirmation that the Upfront Payment has been electronically transferred to the account of Supplier. Upon confirmation that the original, executed Letter of Credit is placed in escrow for release to NEER upon payment of the Upfront Payment to Supplier, NEER shall pay Supplier the Upfront Payment to the account of Supplier, which account information shall be provided by Supplier in its notice to Purchaser regarding delivery of the Letter of Credit. |

| | (b) | Application of Upfront Payment. The Upfront Payment shall be credited on a pro rata basis against the Purchase Price for the PV Modules to be delivered to NEER and its subsidiaries in 2015 and 2016 pursuant to this Agreement outside the State of Florida, and upon delivery of a Project Supply Agreement, the Upfront Payment for the Project subject to such Project Supply Agreement as set forth on Schedule 8 shall be deemed to have been made thereunder. |

| | (c) | Balance of Payments. Upon delivery of PV Modules to the carrier at the port of export for a Project Supply Agreement where NEER or a NEER Subsidiary is the counterparty, Supplier shall invoice Purchaser under the applicable Project Supply Agreement for (i) […***…]% of the Purchase Price for such PV Modules, which invoice shall be deemed paid in full upon issuance by applying the Upfront Payment as a credit to such invoice, and (ii) […***…]% of the Purchase Price for such PV Modules, which invoice shall be deemed paid upon issuance to the extent of any previously unapplied portion of the Upfront Payment by applying such unapplied portion pro rata against the PV Module Price for the PV Modules to be shipped as a credit to such invoice. Upon delivery of PV Modules to the carrier at the port of export for a Project Supply Agreement where FPL is the counterparty, Supplier shall invoice Purchaser under the applicable Project Supply Agreement for […***…]% of the Purchase Price for such PV Modules. |

* Confidential Treatment Requested

4

Upon Delivery of the PV Modules, Supplier shall invoice Purchaser under the applicable Project Supply Agreement for the remaining […***…]% of the Purchase Price for such PV Modules. On or prior to the tenth (10th) day of each calendar month, Supplier shall invoice Purchaser for delivery charges incurred during the prior calendar month. The amount of any credit applied to such invoice, if any, pursuant to Section 1.2(d) or Section 7(d) shall be annotated thereon. For the avoidance of doubt, no portion of the Upfront Payment amount shall be allocable to PV Modules to be purchased under the FPL Project Agreements. The portion of the Upfront Payment eligible for the Letter of Credit as set forth on Schedule 8 shall be applied to invoices for payment prior to the application of the remaining amount of the Upfront Payment.

| | (d) | Form of Payments. All payments under this Agreement and any Project Supply Agreement(s) shall be made in United States Dollars by automated clearing house (ACH) payment to the bank account designated by Supplier. |

| | (e) | Refund of Upfront Payment. Except as provided in Section 6.5, NEER shall not be entitled to a refund of the Upfront Payment. |

| | 2.3 | Invoices for Balance of Payments. Invoices for PV Modules delivered under any Project Supply Agreement shall be delivered and paid as provided in such Project Supply Agreement. |

| | 2.4 | Taxes. Liability for Taxes, if any, with respect to the sale of any PV Modules delivered under any Project Supply Agreement shall be as set forth under such Project Supply Agreement. The Upfront Payment includes no amount for Taxes relating to the purchase and sale of PV Modules pursuant to any Project Supply Agreement or hereunder. |

| 3. | Right of First Offer. Provided that no Supplier Event of Default has occurred and is continuing and provided further that the PV Modules are performing in accordance with their specifications as set forth in Appendix A to the Project Supply Agreement, then Commencing no later than July 1, 2016, the Parties shall discuss and negotiate the terms and conditions of the sale and purchase of Modules for NEER and its Affiliates during calendar years 2017-2018. During the calendar years 2017-2018, if NEER or any of its subsidiaries intends to enter into an agreement for the purchase of any photovoltaic modules (“Modules”) for the purposes of constructing a solar generation facility other than distributed generation projects, NEER shall, or shall cause such subsidiary to, notify Supplier in writing of its desire to purchase such photovoltaic modules including in such notice a proposed volume, pricing, power rating and delivery schedule. Supplier shall have fifteen (15) days following such notice to accept or reject NEER’s offer. If Supplier does not give such notice to NEER within the period described above with respect to any portion of the proposed volumes, NEER shall be free to purchase or cause any of its subsidiaries to purchase such portion of Modules from a Third Party; provided that such purchase is concluded on terms substantially similar to those presented by NEER to Supplier. Notwithstanding the foregoing, this Section 3 shall not apply with respect to projects: (i) that are subjects of engineering, procurement and construction agreements, where the contractor or its affiliate is obligated to provide the modules, (ii) where the approvals required for the construction of the project (other than approvals of NEER or its Affiliates) and/or associated power purchase agreement specify another manufacturer’s modules be utilized and (iii) where NEER or its subsidiary purchases a project after the project being acquired has become subject to a module supply agreement before such acquisition. |

* Confidential Treatment Requested

5

| 4. | Warranties. The Limited Warranty Agreement for the PV Modules shall be delivered under the applicable Project Supply Agreement. |

| 5. | Confidentiality and Ownership. |

| | 5.1 | Each Party agrees that the contents of this Agreement and any information relating to the negotiations or performance of this Agreement and any confidential information provided pursuant to this Agreement (the “Confidential Information”) shall be treated as confidential and that each Party, without the prior written consent of the disclosing Party, shall not disclose Confidential Information to any Person, except as permitted herein. Notwithstanding the foregoing, day-to-day notices and communications under this Agreement shall not be considered Confidential Information unless it is specifically designated as proprietary and confidential. |

| | 5.2 | Notwithstanding the foregoing, this Article 5 shall not prevent either Party from disclosing any Confidential Information, including the contents of the Agreement, if and to the extent: |

| | (a) | required to do so by Applicable Laws or any Government Authority, provided that the Party required to disclose such information shall give prior notice to the other of such required disclosure and, if so requested by the other Party, shall use all reasonable efforts to oppose the requested disclosure as appropriate under the circumstances at the sole cost and expense of the disclosing Party; |

| | (b) | disclosed to its Affiliates, Financing Parties (including potential Financing Parties), and their respective contractors (including potential contractors), employees, directors, officers, agents, advisors, insurers, legal counsel or legal representatives with a need-to-know the Confidential Information for the purposes of effecting the transactions contemplated by this Agreement, any financing arrangements in respect of any Project by NEER or its Affiliates, or a permitted sale or transfer of a Project by NEER or its Affiliates; provided that such Persons are informed of the confidential nature of the Confidential Information, and the Party disclosing such information shall be liable to the other for any disclosure by its employees in violation of the terms of this Article 5; |

6

| | (c) | such information was already publicly available prior to disclosure by the disclosing Party to the other, or which after disclosure entered the public domain other than by a breach of this Article 5 by the other Party or its Representatives; |

| | (d) | such information was known to the recipient prior to the date of receipt of any of the Agreement and not obtained or derived under or in connection with the Agreement; |

| | (e) | such information was obtained by the recipient from a Third Party whom such party reasonably believes to be in lawful possession of such information and not under a confidentiality obligation to the Party from whom such information originated. |

| | 5.3 | It is agreed that each Party shall be entitled to request the court provide injunctive relief in the event of any breach of this Article 5. |

| | 5.4 | All right and title to, and interest in, Purchaser’s Confidential Information shall remain with Purchaser. All right and title to, and interest in, Supplier’s Confidential Information shall remain with Supplier. |

| | 5.5 | At any time upon written request by a disclosing Party, the other Party shall promptly return to the disclosing Party or destroy all its Confidential Information, including all copies thereof, and shall promptly purge all electronic copies of such Confidential Information; provided that the other Party shall be entitled to keep copies of such Confidential Information in accordance with its record retention policies. The return of Confidential Information to the disclosing Party, the purging of electronic copies of Confidential Information or the retention of a copy of Confidential Information for legal records shall not release a Party from its obligations hereunder with respect to such Confidential Information. |

| 6. | Term; Events of Default; Termination. |

| | (a) | The term of this Agreement shall commence on the Effective Date and continue until the date when all of the obligations of each of the Parties under this Agreement shall have been fully performed or until this Agreement is earlier terminated in accordance with its terms (the “Term”); provided, that the termination of this Agreement shall not affect the obligations of the Parties to any then-binding Project Supply Agreements delivered hereunder. The obligations of Supplier to supply and deliver PV Modules and the obligations of NEER or FPL to purchase and receive PV Modules pursuant to Articles 1 and 2 hereof shall be deemed fully performed and their liabilities with respect to each other for such obligations shall be deemed released upon the delivery of Project Supply Agreements for all Scheduled Volumes that have not been terminated pursuant to Section 1.2(d), Section 6.6 or Section 7 or by the written agreement of the Parties. It is expressly intended that the term of this Agreement not be co-extensive with the term of any Project Supply Agreement or Limited Warranty Agreement entered into in connection with any Project Supply Agreement. |

7

| | (b) | The obligations of each Party under this Agreement shall be subject to Supplier’s receipt of the approval of the Bank of Korea for the Supplier Parent Guaranty and the delivery of such Supplier Parent Guaranty to Purchaser. |

| | 6.2 | Delivery of Upfront Payment and Letter of Credit. In the event that Supplier does not deliver the Letter of Credit to NEER prior to the date set forth in Section 19, Supplier shall be deemed in breach of this Agreement. In the event that Supplier has provided the notice described in Section 2.2(a) and NEER does not provide the Upfront Payment to Supplier in accordance with Section 2.2(a) hereunder, NEER shall be deemed in breach of this Agreement. Notwithstanding anything in Section 6.3 or Section 6.4 to the contrary, no cure period shall apply to either such breach. In the event of such breach, the non-breaching Party may immediately terminate this Agreement upon notice to the other Party. Upon such termination, the non-breaching Party’s sole and exclusive remedy for such breach shall be the payment of $[…***…] (the “Termination Payment”) by the breaching Party. The breaching Party shall pay the Termination Payment to the non-breaching Party no later than five (5) Business Days after the date of termination. The Parties acknowledge and agree that each Party’s damages for a failure of the other Party to deliver the Letter of Credit or Upfront Payment, as applicable, would be extremely difficult or impossible under the presently known and anticipated facts and circumstances to determine and fix, and the Termination Payment constitutes a reasonable approximation of the harm to or loss of the non-breaching Party. |

| | 6.3 | Supplier Events of Default. Each of the following events shall be an event of default of Supplier (each, a “Supplier Event of Default”): (i) a breach by Supplier of any material covenant or agreement under this Agreement and such breach is not cured within thirty (30) days after receipt of written notice from NEER of such failure (except for the obligation of Supplier to deliver the Letter of Credit to NEER prior to the date set forth in Section 19 which is subject to Section 6.2), (ii) the occurrence of a Supplier Insolvency Event, (iii) the occurrence of a Guarantor Insolvency Event, or (iv) failure of Supplier to maintain, or cause to be maintained, the Letter of Credit and the Supplier Parent Guaranty in accordance with the terms hereof unless Supplier has provided replacement credit support acceptable to NEER within five (5) Business Days. |

* Confidential Treatment Requested

8

| | 6.4 | NEER Events of Default. Each of the following events shall be an event of default of NEER (each, a “NEER Event of Default”): (i) a breach by NEER of any material covenant or agreement under this Agreement and such breach is not cured within thirty (30) days after receipt of written notice from Supplier of such failure (except for (x) the obligation of NEER to deliver the Upfront Payment to Supplier prior to the date set forth in Section 2.2(a) which is subject to Section 6.2, and (y) events listed in this Section 6.4 as a separate NEER Event of Default) or (ii) the occurrence of a NEER Insolvency Event. |

| | 6.5 | Remedies for a Supplier Event of Default. Upon the occurrence of a Supplier Event of Default, NEER may terminate this Agreement with respect to Scheduled Volumes not yet subject to a Project Supply Agreement. Upon such termination, NEER’s sole and exclusive remedy (without duplication) for the Supplier Event of Default shall be the following: |

| | (a) | after the delivery of the Supplier Parent Guaranty, but prior to the delivery of the Letter of Credit, make a claim against the Parent Guaranty for the Termination Payment; |

| | (b) | after the delivery of the Letter of Credit, upon five (5) Business Days’ notice to Supplier, draw upon the Letter of Credit pursuant to the terms of Section 19.1 for the amount of (i) the Upfront Payment eligible for the Letter of Credit set forth on Schedule 8 for the Projects not yet subject to a Project Supply Agreement, and (ii) Cover Costs not to exceed the amount of the Letter of Credit eligible for Cover Costs; |

| | (c) | seek Cover Costs from Supplier in accordance with the terms of Section 33 of a Project Supply Agreement for the Scheduled Volumes not yet subject to a Project Supply Agreement; and |

| | (d) | make a claim against the Supplier Parent Guaranty for Cover Costs. |

| | 6.6 | Remedies for a NEER Event of Default. |

| | (a) | Upon the occurrence of a NEER Event of Default, Supplier may terminate this Agreement with respect to Scheduled Volumes not yet subject to a Project Supply Agreement upon written notice to NEER. Upon such termination, Supplier’s sole and exclusive remedy for the NEER Event of Default shall be the payment of the Cancellation Payment by NEER; provided that Supplier shall not be deemed to have waived any rights with respect to claims of Supplier which accrued prior to such termination. |

| | (i) | No later than five (5) Business Days after the date of such termination, NEER shall be obligated to pay Supplier the amount determined in accordance with the cancellation schedule in Schedule 3 (“Cancellation Payment”). |

9

| | (ii) | Supplier shall be entitled to retain and offset from the Upfront Payment amounts not yet subject to a Project Supply Agreement an amount equal to the then applicable Cancellation Payment for such Project against the Cancellation Payment due. |

| | (iii) | Any portion of the Upfront Payment not retained and offset in accordance with Section 6.6(ii) above shall be applied as a credit at the port of export to the first Deliveries under a Project Supply Agreement after the date of such termination, until such credit is exhausted. |

| | (iv) | The limitation on NEER’s liability set forth in Section 17.5 shall not apply to the obligation of NEER to pay the Cancellation Payment. |

| | (b) | Upon the occurrence of an Insolvency Event of NEER or a Project Company during which a Purchaser Event of Default under Section 34(i) of a Project Supply Agreement has occurred and is continuing (“Payment Default”), |

| | (i) | The applicable Cancellation Payment for (x) the Project(s) subject to a Project Supply Agreement(s) under which a Payment Default has occurred and is continuing, and (y) Projects not yet subject to a Project Supply Agreement, in an amount equal to the then applicable Cancellation Payment for such Projects shall be due and payable; |

| | (ii) | Supplier shall be entitled to retain and offset from the Upfront Payment for the Projects set forth in subsection (i)(x) and (y), an amount equal to the then applicable Cancellation Payment for such Projects against the Cancellation Payment due. |

| | (iii) | The Upfront Payment for the Projects set forth in subsection (i)(x) and (y) shall be deemed to satisfy the amount of Cancellation Payment due to the extent of the amount of such Upfront Payment, and Supplier shall be entitled to retain and offset such amount of the Upfront Payment against the Cancellation Payment. |

| | (iv) | The limitation on NEER’s liability set forth in Section 17.5 shall not apply to the obligation of NEER to pay the Cancellation Payment. |

10

| | (c) | The Parties acknowledge and agree that Supplier’s damages for a NEER Event of Default would be extremely difficult or impossible under the presently known and anticipated facts and circumstances to determine and fix, and the Cancellation Payment constitutes a reasonable approximation of the harm to or loss of Supplier. |

| | 6.7 | Effect of Termination of This Agreement on the Project Supply Agreements. For the avoidance of doubt, if the Agreement is terminated pursuant to this Article 6, this Agreement shall not terminate with respect to any Project Supply Agreement delivered hereunder. |

| | 6.8 | Cancellation Payment. Notwithstanding anything to the contrary in this Agreement or in a Project Supply Agreement, in the event NEER or FPL, as applicable, does not pay Supplier the Cancellation Payment under Section 6 or 7 of this Agreement or Section 34 or 35 of a Project Supply Agreement by the required date set forth in such agreement, Supplier shall be entitled to retain and offset from the Upfront Payment, an amount equal to the then as applicable Cancellation Payment to be paid by Purchaser to Supplier. |

| 7. | Termination for Convenience. Upon five (5) Business Days’ advance written notice by NEER to Supplier, NEER may terminate one or more Projects in their entirety with respect to all Scheduled Volumes for such Project(s) that are not subject to a Project Supply Agreement issued hereunder at any time for its convenience without prejudice to any other right or remedy, and after such termination, no Project Supply Agreement with respect to such Scheduled Volumes may be issued hereunder; provided that this Section 7 shall not apply to the cancellation of Scheduled Volumes pursuant to the terms of Section 1.2(d). Subject to Supplier’s receipt of the Cancellation Payment, such termination shall be effective in accordance with the notice provisions set forth in Section 16. In the event of any termination by NEER in accordance with this Article 7: |

| | (a) | following such termination, Purchaser shall deliver a revised delivery schedule reflecting, as the only changes, the elimination of those deliveries of PV Modules that are subject to such termination; |

| | (b) | on the date of such termination, NEER shall be obligated to pay Supplier the Cancellation Payment; |

| | (c) | Supplier shall be entitled to retain and offset from the Upfront Payment amounts not yet subject to a Project Supply Agreement an amount equal to the then applicable Cancellation Payment for such terminated Project(s) against the Cancellation Payment due; |

| | (d) | any portion of the Upfront Payment not retained and offset in accordance with Section 7(c) above or Section 35 of a Project Supply Agreement shall be applied as a credit at the port of export to the first Deliveries under a Project Supply Agreement after the date of such termination, until such credit is exhausted; and |

11

| | (e) | the limitation on NEER’s liability set forth in Section 17.5 shall not apply to the obligation of NEER to pay the Cancellation Payment. |

The Parties acknowledge and agree that Supplier’s damages for a NEER termination would be extremely difficult or impossible under the presently known and anticipated facts and circumstances to determine and fix, and the Cancellation Payment constitutes a reasonable approximation of the harm to or loss of Supplier.

| 8. | Survival. The provisions of Sections 3, 5, 6.5, 6.6, 7, 8, 11, 12 and 17 shall survive the termination of this Agreement. |

| 9. | Severability of Provisions. If any provision of this Agreement is determined to be void, unlawful, or otherwise unenforceable, that provision shall be severed from the remainder of the Contract, and replaced automatically by a provision containing terms as nearly like the void, unlawful, or unenforceable provision as possible, or otherwise modified in such fashion as to preserve, to the maximum extent possible, the original intent of the Parties, and the Contract, as so modified, shall continue in full force and effect. |

| 10. | Waiver. The failure of either Party to insist upon the performance of any provision of this Agreement or to exercise any right or privilege granted to such Party under this Agreement shall not be construed as waiving such provision or any other provision of this Agreement, and the same shall continue in full force and effect. If any provision of this Agreement or any Project Supply Agreement is found to be illegal or otherwise unenforceable by any court or other judicial or administrative body, the other provisions of this Agreement or the relevant Project Supply Agreement shall not be affected thereby, and shall remain in full force and effect. |

| 11. | Applicable Law. The validity, performance, and construction of this Agreement and each Project Supply Agreement shall be governed by the laws of New York without regard to its conflicts of laws principles (other than Section 5-1401 of the New York General Obligations Law). The U.N. Convention on the International Sale of Goods shall not apply to this Agreement. |

| 12. | Disputes; Jurisdiction & Venue. |

| | 12.1 | Dispute Resolution Procedure. In the event of any dispute, controversy or claim arising out of or relating to any provision of this Agreement or the interpretation, enforceability, performance, breach, termination or validity hereof, including any dispute as to this Article 12 (a “Dispute”), the Parties will, in the first instance, attempt in good faith to resolve such Dispute by negotiations between senior executives of the Parties. |

| | (a) | If, for any reason, the Dispute has not been resolved in writing pursuant to Section 12.1 within sixty (60) days after the delivery of a written request for such resolution, such Dispute shall be finally settled under the Rules of Arbitration of the International Chamber of Commerce (the “ICC”) then in effect (the “Rules”), except as modified herein. |

12

| | (b) | The arbitral tribunal shall be comprised of three (3) independent and impartial arbitrators. Each Party shall nominate one arbitrator in accordance with the Rules, and the two arbitrators so nominated shall nominate a third arbitrator, who shall serve as the president of the arbitral tribunal, within twenty (20) days of the confirmation of the appointment of the second arbitrator (the “Chair”). Any arbitrator not timely nominated herein shall, on the written request of any party to the arbitration, be appointed by the Court of Arbitration of the ICC. |

| | (c) | The arbitration proceedings shall be conducted in the English language, and all documents not in English submitted by any party as evidence shall be accompanied, within a reasonable period of time to be determined by the tribunal, by an English translation of the portion relied on therein. The seat of arbitration shall be Paris, France. |

| | (d) | If the tribunal determines it required and necessary, each Party may request the other Party or Parties to produce certain specified documents or categories of documents relevant to the Dispute and material to its outcome. In making any determination regarding the scope of production, the arbitral tribunal shall apply the 2010 International Bar Association Rules on the Taking of Evidence in International Arbitration. |

| | (e) | The award shall be final and binding upon the Parties. Judgment upon any award may be entered in any court having jurisdiction thereof. |

| | (f) | By agreeing to arbitration, the Parties do not intend to deprive any court of its jurisdiction to issue a pre-arbitral injunction, pre-arbitral attachment or other order in aid of arbitration proceedings and the enforcement of any award. |

| | (g) | In order to facilitate the comprehensive resolution of related Disputes, the parties consent that any pending or contemplated arbitration hereunder may be consolidated with any other arbitration proceeding constituted under this Agreement or any arbitration proceeding constituted under any Project Supply Agreement. An application for such consolidation may be made by any party to this Agreement or any Project Supply Agreement to the tribunal for the prior arbitration. Such tribunal shall, after providing all interested parties the opportunity to comment on such application, order that any such pending or contemplated arbitration be consolidated into a prior arbitration if it determines that (i) there are issues of fact or law common to the proceedings so that a consolidated proceeding would be more efficient than separate proceedings, and (ii) no Party would be unduly prejudiced as a result of such consolidation through undue delay or otherwise. For the avoidance of doubt, consolidation under this paragraph is intended to promote efficiency, to avoid the possibility of inconsistent awards, and to prevent double recovery, and consolidation is therefore contemplated and understood to occur and apply to and between all parties to this Agreement and a Project Supply Agreement. |

13

| 13. | Assignment. Neither Party shall assign this Agreement without the prior written consent of the other Party hereto, and any purported assignment without such consent shall be deemed null and void, which consent shall not be unreasonably withheld, conditioned or delayed. |

| 14. | Publicity. Supplier shall not (and shall cause its Affiliates not to), and NEER shall not (and shall cause its Affiliates not to), make or authorize any news release, advertisement, or other disclosure which shall confirm the existence or convey any aspect of this Agreement or any Project Supply Agreement without the prior written consent of the other Party, which consent shall not be unreasonably withheld, conditioned or delayed, except as may be required to perform this Agreement or a Project Supply Agreement, and as required by Applicable Law (including the Securities Act of 1993 and the Securities Exchange Act of 1934 as well as rules and regulations promulgated by the United States Securities and Exchange Commission, the securities laws, rules and regulations of Korea, and the securities laws, rules and regulations of the Cayman Islands) or any applicable stock exchange rules and regulations. Following the Effective Date of this Agreement, the Parties hereby agree to cooperate in good faith to issue a press release with respect to this Agreement. |

| 15. | Complete Agreement; Modifications. This Agreement, including all exhibits, schedules, and annexes hereto, contains the complete and entire agreement among the Parties as to the subject matter hereof and replaces and supersedes any prior or contemporaneous communications, representations or agreements, whether oral or written, with respect to the subject matter of this Agreement. In the event of any conflict between this Agreement and any Project Supply Agreement, this Agreement shall control over the Project Supply Agreement. No modification of the Agreement shall be binding unless it is written and signed by both Parties. |

| 16. | Notices. Whenever a provision of the Agreement requires or permits any consent, approval, notice, request, or demand from one Party to another, the consent approval, notice, request, or demand must be in writing and delivered in order to be effective. Any such consent approval, notice, request, or demand shall be deemed delivered and received if: |

| | (a) | personally delivered or if delivered by overnight courier service, when actually received by the Party to whom notice is sent, at the address of such Party set forth below (or at such other address as such Party may designate by written notice to the other Party in accordance with this Section 16); or |

14

| | (b) | delivered by email on the day transmitted if before 5:00 p.m. and on the subsequent day if received after 5:00 p.m. New York time, and receipt is subsequently confirmed in writing by the recipient. |

Supplier:

Hanwha SolarOne U.S.A. Inc.

300 Spectrum Center Drive, Suite 1250

Irvine, CA 92618

Telephone for confirmation: […***…]

Attn: […***…]

Email: […***…]

and

Telephone for confirmation: […***…]

Attn: […***…]

Email: […***…]

With a copy to:

Hanwha SolarOne U.S.A. Inc.

300 Spectrum Center Drive, Suite 1250

Irvine CA 92618

Telephone for confirmation: […***…]

Attn: […***…], Legal Department

Email: […***…]

Purchaser:

NextEra Energy Resources, LLC

700 Universe Boulevard

Juno Beach, FL 33408-2683

Attn: VP Integrated Supply Chain

Telephone: […***…]

Email: […***…]

With a copy to:

NextEra Energy Resources, LLC

700 Universe Boulevard

Juno Beach, FL 33408-2683

Attn: General Counsel

Telephone: […***…]

Email: […***…]

* Confidential Treatment Requested

15

| 17. | Waiver of Consequential Damages; Limitation of Liability. |

| | 17.1 | NEITHER PARTY SHALL BE LIABLE TO THE OTHER PARTY FOR CONSEQUENTIAL, SPECIAL, EXEMPLARY, INDIRECT OR INCIDENTAL LOSSES OR DAMAGES ARISING FROM OR RELATING TO THIS AGREEMENT, AND SUPPLIER AND NEER EACH HEREBY RELEASE THE OTHER FROM SUCH LOSSES OR DAMAGES, INCLUDING LOSS OF PROFITS. THE FOREGOING LIMITATION SHALL NOT: (I) PRECLUDE RECOVERY, WHERE APPLICABLE, OF THE TERMINATION PAYMENT IN SECTION 6.2, THE CANCELLATION PAYMENT, LIQUIDATED DAMAGES, OR COVER COSTS IN SECTION 17.3; OR (II) APPLY TO ANY CLAIMS BASED ON GROSS NEGLIGENCE, WILLFUL MISCONDUCT, OR FRAUD. |

| | 17.2 | Except as otherwise provided herein, Supplier’s maximum cumulative liability under this Agreement and the Project Supply Agreements, taken together, shall be $[…***…] (the “Maximum Liability Amount”); provided that the Maximum Liability Amount shall be reduced by […***…]% of the [(total WDC Scheduled Volumes terminated pursuant to Section 1.2(d), 6.6 or Section 7 of this Agreement or Sections 34 or 35 of a Project Supply Agreement x Scheduled Price)] (such reductions if they occur, the “Reduction Amount”). For the avoidance of doubt, any refund of the Upfront Payment due to NEER resulting from Supplier’s breach of this Agreement shall not be included in any calculation of Supplier’s Maximum Liability Amount, and Suppliers Maximum Liability Amount shall not in any way limit Purchaser’s rights under the Limited Warranty Agreement. Notwithstanding the foregoing, Supplier’s maximum cumulative liability under the Project Supply Agreements with respect to Schedule Liquidated Damages (as defined in the Project Supply Agreement) for all initial Scheduled Volumes shall be limited to $[…***…], which is the sum of an amount equal to[…***…]% of the [total WDC Scheduled Volumes under the Project Supply Agreement x Scheduled Price] under all Project Supply Agreements (assuming the Project Supply Agreements delivered hereunder cover one hundred percent (100%) of the initial Scheduled Volumes) and Supplier’s maximum cumulative liability under the Project Supply Agreements with respect to Performance Liquidated Damages (as defined in the Project Supply Agreement) for all initial Scheduled Volumes shall be limited to $[…***…], which is the sum of an amount equal to […***…]% of the [total WDC Scheduled Volumes delivered under such Project Supply Agreement x Scheduled Price] under all Project Supply Agreements (assuming the Project Supply Agreements delivered hereunder cover one hundred percent (100%) of the initial Scheduled Volumes (other than the initial Scheduled Volumes to be delivered to a Project Site in Florida)). |

* Confidential Treatment Requested

16

| | 17.3 | Following termination of this Agreement or a Project Supply Agreement by NEER or an FPL Project Supply Agreement by FPL (in each case for cause), NEER or FPL, as applicable, shall be entitled to make a claim for Cover Costs; provided that there shall be no duplication of Cover Costs recovery under this Agreement and a Project Supply Agreement for a failure by Supplier to deliver to a single Project. With respect to claims for Cover Costs by such party or any Purchaser under this Agreement or any Project Supply Agreement, as applicable, each such claim shall be limited to an amount equal to the number of undelivered WDC under such contract multiplied by the corresponding “WDC Maximum Cover Costs” found in Schedule 9 hereto corresponding to the date of termination of such contract. Notwithstanding the foregoing, if such party fails to terminate this Agreement or a Purchaser fails to terminate a Project Supply Agreement within five (5) days from the date upon which such party had the right to terminate the respective contract, then for purposes of the above calculation, the termination date of such contract shall be deemed to be the day that is five (5) days from the date upon which its right to terminate was effective. NEER or FPL, as applicable shall provide reasonable evidence of Cover Costs when it submits any claim for Cover Costs, and after remitting such Cover Costs to NEER or FPL as applicable, Supplier shall have the right to have an independent audit of the Cover Costs and such party’s books and records relating to such Cover Costs. |

| | 17.4 | Except for Supplier’s Parent Guaranty and the Letter of Credit, NEER’s sole recourse for any damages or liabilities due to NEER by Supplier pursuant to this Agreement shall be limited to the assets of Supplier without recourse individually or collectively to the assets of any shareholders or Affiliates of Supplier or the officers, directors, employees or agents of Supplier, its shareholders or their Affiliates. |

| | 17.5 | NEER’s maximum cumulative liability under this Agreement shall be limited to an amount equal to the Maximum Liability Amount less the Reduction Amount, provided that such limitation of liability shall not apply to Purchaser’s obligation to pay the Cancellation Payment (to the extent such Cancellation Payment exceeds such limitation of liability). Supplier’s sole recourse for any damages or liabilities due to Supplier by NEER pursuant to this Agreement shall be limited to the assets of NEER without recourse individually or collectively to the assets of the members or the Affiliates of NEER or the officers, directors, employees or agents of NEER, its members or their Affiliates. |

| | 17.6 | Notwithstanding anything to the contrary in this Agreement or in any Project Supply Agreement, there shall be no duplication of recovery by Supplier, NEER or any Project Company, including their Affiliates and permitted assigns and successors, under this Agreement and any Project Supply Agreement. In the event that a Project Supply Agreement has been delivered under this Agreement, to the extent that the facts and circumstances may give rise to a claim of any party under such Project Supply Agreement, each of Supplier and NEER waive all such claims under this Agreement and release and discharge the other Party from any and all liability to NEER or Supplier, as applicable, under such claims under this Agreement (“Released Claims”). For the avoidance of doubt, such waiver and discharge does not apply to claims under a separate Project Supply Agreement delivered under this Agreement. NEER shall indemnify and hold Supplier and Supplier’s Affiliates harmless from and against any Released Claims including all costs, expenses, and attorneys’ fees assessed against or suffered by Supplier under this Agreement. |

17

| | 18.1 | Neither Party nor any past or present director, officer, parent, subsidiary or affiliate, employee, representative or agent of such Party or any other person or entity acting on such Party’s behalf for whose acts it is vicariously liable (any of the foregoing being a “Party Agent”) has directly or indirectly paid, promised or offered to pay, or authorized the payment of any money or anything of value in connection with this Agreement to: (i) an officer, employee, agent or representative of any government, including any department, agency or instrumentality of any government or any government-owned or government controlled entity or any person or entity acting in an official capacity on behalf thereof; (ii) a candidate for political office, any political party or any official of a political party; or (iii) any other person or entity while knowing or having reason to believe that some portion or all of the payment or thing of value will be offered, given or promised, directly or indirectly, to any person or entity described in this Article 18; for the purpose of, in each case under clause (i), (ii) or (iii) above, corruptly influencing any act or decision of such government official, political party, party official, or candidate in his or its official capacity, including a decision to do or omit to do any act in violation of the lawful duty of such person or entity, or inducing such person or entity to use his or its influence with the government or instrumentality thereof to affect or influence any act or decision in violation of any applicable anti-bribery laws, including the United States Foreign Corrupt Practices Act (“Anti-Bribery Laws”). |

| | 18.2 | Neither a Party nor any Party Agent shall violate any applicable Anti-Bribery Laws in connection with this Agreement. Without limiting the foregoing, each Party shall not (and shall cause each Party Agent not to), directly or indirectly, pay, promise or offer to pay, or authorize the payment of any money or anything of value to (including a “grease,” “expediting” or facilitation payment): (i) an officer, employee, agent or representative of any government, including any department, agency or instrumentality of any government or any government-owned or government-controlled entity or any person or entity acting in an official capacity on behalf thereof; (ii) a candidate for political office, any political party or any official of a political party; or (iii) any other person or entity while knowing or having reason to believe that some portion or all of the payment or thing of value will be offered, given or promised, directly or indirectly, to any person or entity described above; for the purpose of, in each case under clause (i), (ii) or (iii), corruptly influencing any act or decision of such government official, political party, party official, or candidate in his or its official capacity, including a decision to do or omit to do any act in violation of the lawful duty of such person or entity, or corruptly inducing such person or entity to use his or its influence with the government or instrumentality thereof to affect or influence any act or decision, for the benefit of NEER, any Purchaser, Supplier or any Party Agent in connection with this Agreement. |

18

| | 18.3 | Either Party shall notify the other Party immediately if it learns at any time during the term of this Agreement that a government official acquires an ownership, voting, or economic interest in such Party or a legal or beneficial interest in a Party’s payments under this Agreement. |

| | 18.4 | If either Supplier or Purchaser has knowledge of a violation of any anti-corruption laws in connection with the performance of this Agreement or the existence of any facts or circumstances surrounding any activities in connection with the representation of either Party that either Party knows constitutes a violation of any anti-corruption Laws, such Party shall immediately notify the other of such knowledge. |

| | (a) | Such notice shall be provided not later than five (5) days after either Party acquires such knowledge. |

| | (b) | Each of Purchaser and Supplier shall fully cooperate with the other or its designee in any inquiry into any violation of any anti-corruption Laws relating to activities conducted in connection with this Agreement. |

| | 18.5 | In addition, neither a Party nor any Party Agent shall make a payment to anyone for any reason on behalf or for the benefit of the other Party which is not properly and accurately recorded in the Party’s books and records, including the amount, purpose and recipient, all of which shall be maintained with supporting documentation. For three (3) years after such Party or Party Agent’s receipt of the last payment made under this Agreement or any Project Supply Agreement, the other Party shall have the right to have an independent Third Party audit of the Party, and subject to confidentiality restrictions of such agent or subcontractor, any Party Agent’s and subcontractor’s books and records to the extent permitted under the applicable agreement such Party and Party Agent or subcontractor, in each case with respect solely to payments made to anyone for any reason on behalf of or for the benefit of the other Party or any other Purchaser in violation of this Article 18. |

19

| | 19.1 | Supplier shall have sixty (60) days following the Effective Date to provide notice that it is prepared to deliver the Letter of Credit to NEER and shall use best efforts to do so, provided that Supplier shall have no obligation to release such Letter of Credit to NEER in the event NEER does not release funds to pay the Upfront Payment to Supplier upon such delivery in accordance with Section 2.2(a). Supplier shall deliver the Letter of Credit to NEER concurrently with NEER’s delivery of the Upfront Payment to Supplier. Notwithstanding the foregoing, if within such sixty (60) day period, the Letter of Credit Provider certifies that circumstances beyond its control are preventing it from issuing letters of credit generally, then the Parties shall negotiate in good faith for Supplier to provide an alternative means of credit support. If within five (5) Business Days of the receipt of the notice referenced in the previous sentence, the Parties have not agreed to an alternative means of credit support, then this Agreement shall immediately terminate and neither Party shall have any liability to the other for any cost or damages including the Termination Payment. Provided, however, that if the Parties agree to an alternative means of credit support, and that alternative means of credit support is anything other than a letter of credit, and at any point in during the Term of this Agreement, the Letter of Credit Provider is no longer prevented from issuing letters of credit, then Supplier shall use best efforts to replace the alternative means of credit support with a letter of credit from the Letter of Credit Provider, in the form of Schedule 5. |

| | 19.2 | [INTENTIONALLY OMITTED]. |

| | 19.3 | Upon (i) termination of a Project Supply Agreement in accordance therewith or (ii) an Insolvency Event of Supplier during which a Supplier Event of Default under Section 33.1(a) of a Project Supply Agreement has occurred and is continuing (such events, the “Additional Draw Event”), and in each case the passage of five (5) Business Days after the date of such event, NEER shall be entitled to draw down from the Letter of Credit an amount equal to: |

| | (a) | the portion of the Upfront Payment eligible for the Letter of Credit as set forth on Schedule 8 attributable to the undelivered WDC Scheduled Volumes under the terminated Project Supply Agreement (or in the case of an Additional Draw Event, the Project Supply Agreement(s) with the Event of Default under Section 33.1(a) thereof), and in either the same or a subsequent draw; and |

| | (b) | Cover Costs for the undelivered WDC Scheduled Volumes under the terminated Project Supply Agreement (or in the case of an Additional Draw Event, the Project Supply Agreement(s) with the Event of Default under Section 33.1(a) thereof), up to the amount calculated in accordance with Section 17.3. |

In the case of an Additional Draw Event, Supplier shall be relieved of its obligation to supply and deliver the undelivered WDC Scheduled Volumes under the Project Supply Agreement(s) with the Event of Default under Section 33.1(a) thereof.

| | 19.4 | The Letter of Credit shall not be subject to replenishment following any draw thereon. The face amount of the Letter of Credit shall step down from time to time in accordance with the terms set forth on Schedule 9. |

20

| | 19.5 | Upon presentment to NEER of a step-down certificate for the Letter of Credit after the occurrence of any of the events set forth in Schedule 9, NEER shall promptly execute such step-down certificate for such occurrence and return it to Supplier. NEER shall deliver an executed step-down certificate for any Scheduled Volumes terminated by NEER by means of an Optional Cancellation or a termination for convenience under Section 7 of this Agreement or Section 35 of a Project Supply Agreement with any notice of such termination provided to Supplier. |

| | 19.6 | In the event NEER fails to execute such step-down certificate for the Letter of Credit within five (5) Business Days following receipt, Supplier may, in addition to any other remedies it may have under this Agreement, provide the Auditor with true-and-correct copies of the Required Deliverables (as defined in the Project Supply Agreement) and such other documents or records that are reasonably and customary maintained to evidence shipping and deliver of the PV Modules evidencing delivery of all PV Modules that have not otherwise been acknowledged by NEER (the “Unacknowledged PV Modules”), certified by Supplier to be a true-and-correct copy of such Required Deliverables (such Required Delivered provided to Auditor, the “Delivery Documents”). The Auditor will review the Delivery Documents for the Unacknowledged PV Modules and provide in writing its determination regarding the amount of Unacknowledged PV Modules Delivered to NEER or a Purchaser within five (5) Business Days of receipt of such evidence. Upon the Auditor’s determination based solely on their review of the Delivery Documents and any receipts provided by the Purchaser to both the Auditor and Supplier and certified by Purchaser to be a true-and-correct copy of such receipts, with no independent inquiry that the Unacknowledged PV Modules were delivered to NEER or its affiliate, the Auditor shall provide Supplier, NEER and the Letter of Credit Provider such determination in writing which may be used by Supplier to satisfy its requirements with respect to Annex 4 of the Letter of Credit allowing for a reduction to the Letter of Credit in the applicable amount. The Auditor’s determination shall not be deemed to be determinative as between the Parties for any other purpose other than to allow for a reduction to the Letter of Credit. The Auditor’s written determination shall include the following statement: |

“We hereby certify to The Export-Import Bank of Korea and to NextEra Energy Resources, LLC, a Delaware limited liability company, that we have reviewed the documents and electronic records categorized below (the “Delivery Documents”) which have been presented to us as true and correct copies or originals:

| | 1. | Bills of lading for the PV Modules; and |

| | 2. | Such other documents or records that are reasonably and customarily maintained to evidence the shipping of PV Modules from the specified ports of shipping for delivery to specified delivery points. |

21

Based solely on a review of the Delivery Documents and without independent inquiry, the Delivery Documents evidence delivery of MW of PV Modules to the locations specified on the Delivery Documents.”

Upon making such certification, Auditor will execute Annex 4 to the Letter of Credit reflecting Auditor’s determination.

The Parties shall use commercially reasonable efforts to engage an Auditor for the purposes set forth in this Section 19.6. In the event that the Parties are not able to engage an Auditor who is willing to make such a certification under any circumstances, the Parties in good faith shall negotiate changes to the Auditor certification which reflect market practice for Auditors in such type of engagement. In the event the Auditor provides the requested certification for Unacknowledged PV Modules, NEER shall pay the fees of the Auditor for such review and certification. In the event the Auditor determines it cannot provide the requested certification, Supplier shall pay the fees of the Auditor for such review and certification.

| 20. | Corporate Guarantees. Subject to the terms of this Agreement and the approval of the Bank of Korea for the execution and delivery of the Supplier Parent Guaranty, Supplier shall provide to Purchaser a guarantee in the form of Schedule 6 attached hereto, incorporated and made a part hereof by this reference, duly executed by Guarantor for the benefit of NEER (the “Supplier Parent Guaranty”) pursuant to which Supplier Parent Company has guaranteed payment of, the Termination Payment, Cover Costs under this Agreement and the Project Supply Agreements, and Schedule Liquidated Damages, Performance Liquidated Damages, and indemnification claims under the Project Supply Agreements. Delivery of an electronic copy of the Supplier Parent Guaranty executed by the Guarantor shall constitute delivery of the Supplier Parent Guaranty hereunder, and thereafter Supplier shall deliver the original, executed Supplier Parent Guaranty to NEER. Supplier shall use commercially reasonable efforts to obtain the approval of the Bank of Korea of the Supplier Parent Guaranty within thirty (30) days after the Effective Date, and if Supplier has not delivered the Supplier Parent Guaranty for any reason within thirty (30) days after the Effective Date, either Party may terminate this Agreement upon written notice to the other Party. Upon such termination, both Parties shall be released from all obligations and liabilities hereunder. The limit on the amount guaranteed by the Supplier Parent Guaranty shall be reduced in accordance with the terms set forth in Schedule 9. |

| 21. | Third Party Beneficiary. The Parties agree that FPL shall be and is an intended third-party beneficiary of this Agreement, solely with respect to the FPL Projects. No other Person that is not a Party shall have any rights or interest, direct or indirect, in this Agreement and this Agreement is intended solely for the benefit of the Parties. The Parties expressly disclaim any intent to create any rights in any third party as a third-party beneficiary to this Agreement. |

| 22. | Counterparts. This Contract may be signed in counterparts and delivered by email or otherwise permitted by Applicable Laws, each such counterpart (whether delivered by email or otherwise), when executed, shall be deemed an original and all of which together constitute one and the same agreement. |

22

| 23. | Defined Terms. As used in this Agreement, including the appendices, exhibits and other attachments hereto, or any Project Supply Agreement, each of the following terms shall have the meaning assigned to such term as set forth below: |

“Additional Draw Event” has the meaning set forth in Section 19.3.

“Affiliate” means, in relation to any Person, any other Person which directly or indirectly controls, or is controlled by, or is under common control with, such Person. For purposes of this definition, the word “controls” means possession, directly or indirectly of the power to direct or cause the direction of the management or policies of a Person, whether through the ownership of voting securities, by contract or otherwise.

“Agreement” has the meaning set forth in the Preamble, and all exhibits, schedules, and annexes hereto, as same may be amended, supplemented or modified from time to time in accordance with the terms hereof.

“Anti-Bribery Laws” has the meaning set forth in Section 18.1.

“Applicable Laws” means all applicable laws, treaties, ordinances, judgments, decrees, injunctions, writs, orders, rules, regulations and interpretations of any Government Authority, to the extent having jurisdiction over Supplier, NEER, or the subject matter of this Agreement.

“Auditor” means the independent accounting firm engaged by the Parties with respect to Section 19.6 hereof and shall be one of the following; Deloitte LLP, PricewaterhouseCoopers, Ernst & Young or KPMG.

“Business Day” means any day other than a Saturday or Sunday or days on which the banking institutions in the State of New York are obligated or authorized by law to close.

“Cancellation Payment” has the meaning set forth in Section 6.6(a).

“Confidential Information” has the meaning set forth in Section 5.1.

“Cover Costs” means, following the termination of this Agreement or any Project Supply Agreement, if Purchaser acquires modules from a Third Party as replacement for PV Modules that had not been Delivered (as defined in the Project Supply Agreement), the additional incremental module and transportation costs (when compared to the PV Module Price and Delivery Charges (as defined in the Project Supply Agreement) Purchaser would have incurred under any Project Supply Agreement) actually incurred by Purchaser to acquire such replacement modules and have such replacement modules delivered to the Delivery Point (as defined in the Project Supply Agreement).

“Delivery” means delivery of the PV Modules by Supplier to the delivery point as defined in the applicable Project Supply Agreement.

23

“Delivery Documents” has the meaning set forth in Section 19.6.

“Dispute” has the meaning set forth in Section 12.1.

“Effective Date” has the meaning set forth in the Preamble.

“Financing Parties” means a lender, security holder, investor, export credit agency, multilateral institution, equity provider and other Person providing financing or refinancing to or on behalf of NEER for the development, construction, ownership, operation and/or maintenance of the Project or any portion thereof, or any trustee or agent acting on behalf of any of the foregoing; provided, however, such Person shall be a Third Party.

“FPL” means Florida Power & Light Company, a Florida corporation.

“FPL Project Agreements” means the Project Supply Agreements delivered or deemed delivered with respect to the FPL Projects.

“FPL Projects” means the projects on Schedule 4 named Citrus, Babcock and Manatee.

“Government Authority” means any and all foreign, national, federal, state, county, city, municipal, local or regional authorities, departments, bodies, commissions, corporations, branches, directorates, agencies, ministries, courts, tribunals, judicial authorities, legislative bodies, administrative bodies, regulatory bodies, autonomous or quasi-autonomous entities or taxing authorities or any department, municipality or other political subdivision thereof to the extent having jurisdiction over Supplier, NEER, Purchaser, a Project or any portion thereof, the Project Site, the PV Modules or this Agreement.

“Guarantor” means Hanwha Chemical Corporation, a corporation formed under the laws of Korea, or any successor entity.

“ICC” has the meaning set forth in Section 12.2(a).

“Insolvency Event” means, with respect to a Party, that (A) that Party consents to the appointment of or taking possession by, a receiver, a trustee, custodian, or liquidator of itself or of a substantial part of its assets, or fails or admits in writing its inability to pay its debts generally as they become due, or makes a general assignment for the benefit of creditors; (B) that Party files a voluntary petition in bankruptcy or a voluntary petition or an answer seeking reorganization in a proceeding under any applicable bankruptcy or insolvency laws or an answer admitting the material allegations of a petition filed against it in any such proceeding, or seeks relief by voluntary petition, answer or consent, under the provisions of any now existing or future bankruptcy, insolvency or other similar law providing for the liquidation, reorganization, or winding up of companies, or providing for an agreement, composition, extension, or adjustment with its creditors; (C) a substantial part of that Party’s assets is subject to the appointment of a receiver, trustee, liquidator, or custodian by court order and such order shall remain in effect for more than sixty (60) days; or (D) that Party is adjudged bankrupt or insolvent, has any property sequestered by court order and such order shall remain in effect for more than sixty (60) days, or has filed against it a petition or claim under any bankruptcy, reorganization, arrangement, insolvency, readjustment of debt, dissolution or liquidation law of any jurisdiction, whether now or hereafter in effect, and such petition shall not be dismissed within sixty (60) days of such filing.

24

“Letter of Credit” means an irrevocable standby letter of credit, with an initial stated amount equal to $[…***…], issued by the Letter of Credit Provider to NEER, substantially in the form of Schedule 5 hereto.

“Letter of Credit Provider” means the Export-Import Bank of Korea.

“Limited Warranty Agreement” means the limited warranty for the PV Modules to be provided by Hanwha Q CELLS Corp.

“Maximum Liability Amount” has the meaning set forth in Section 17.2.

“Modules” has the meaning set forth in Section 3.

“NEER” has the meaning set forth in the Preamble.

“NEER Event of Default” has the meaning set forth in Section 6.4.

“Optional Cancellation” has the meaning set forth in Section 1.2(d).

“Parties” has the meaning set forth in the Preamble.

“Party” has the meaning set forth in the Preamble.

“Party Agent” has the meaning set forth in Section 18.1.

“Person” means an individual, partnership, corporation, limited liability company, company, business trust, joint stock company, trust, unincorporated association, joint venture, Government Authority or other entity of whatever nature.

“Project” has the meaning set forth in the Recitals.

“Project Company” has the meaning set forth in the Recitals.

“Project Site” means the physical location upon which a Project is or shall be built.

“Project Supply Agreements” has the meaning set forth in Section 1.2(a).

“Proprietary Information” means all specifications, designs, drawings, process technology, data, technical information and other proprietary information.

“Purchase Price” means [(Total WDC Scheduled Volumes x Scheduled Price)].

* Confidential Treatment Requested

25

“Purchaser” has the meaning set forth in Section 1.2(a).

“PV Modules” has the meaning set forth in Section 1.1.

“Reduction Amount” has the meaning set forth in Section 17.2.

“Rules” has the meaning set forth in Section 12.2(a).

“Scheduled Prices” has the meaning set forth in Section 1.2(a).

“Scheduled Volumes” has the meaning set forth in Section 1.2(a).

“Supplier” shall have the meaning set forth in the Preamble to this Agreement.

“Supplier Event of Default” has the meaning set forth in Section 6.3.

“Supplier Parent Guaranty” has the meaning set forth in Section 20.

“Tax” or “Taxes” means all taxes of any kind, including any federal, state, local or foreign income, estimated, net investment, sales, use, ad valorem, receipts, value added, goods and services, profits, license, withholding, payroll, employment, unemployment, disability, welfare, workers’ compensation, excise, premium, property, net worth, escheat, unclaimed property, capital gains, transfer, stamp, documentary stamp, recording, mortgage recording, social security, environmental, utility, production, severance, inventory, recapture, alternative or add-on minimum, or occupation, tax and any other assessment, fee, levy, duty, custom, tariff, impost, universal service charge, obligation or governmental charge, together with all interest, penalties and additions imposed with respect to such amounts.

“Term” has the meaning set forth in Section 6.1(a).

“Third Party” means a Person that is not a Party or an Affiliate, successor or assign of a Party.

“Unacknowledged PV Modules” has the meaning set forth in Section 19.6.

“Upfront Payment” has the meaning set forth in Section 2.2(a).

“Warranty” means Supplier’s standard warranty as further described in the Project Supply Agreement.

“WDC” means watts of direct current.

[Remainder of Page Intentionally Blank]

26

IN WITNESS WHEREOF, the Parties hereto have signed this Agreement as of the date and year first above written.

Supplier:

HANWHA SOLARONE U.S.A. INC.

| | |

| By: | | /s/ Koo Yung Lee |

| Name: | | Koo Yung Lee |

| Title: | | Authorized Signatory |

NEER:

NEXTERA ENERGY RESOURCES, LLC

| | |

| By: | | /s/ Tom Broad |

| Name: | | Tom Broad |

| Title: | | Vice President Engineering and Construction |

[Signature Page to Photovoltaic Module Master Supply Agreement]

Schedule 1

Basic Terms of Sale – PV Modules

| 1) | PV Module Price for a Total of 1539.75 MW PV Modules: |

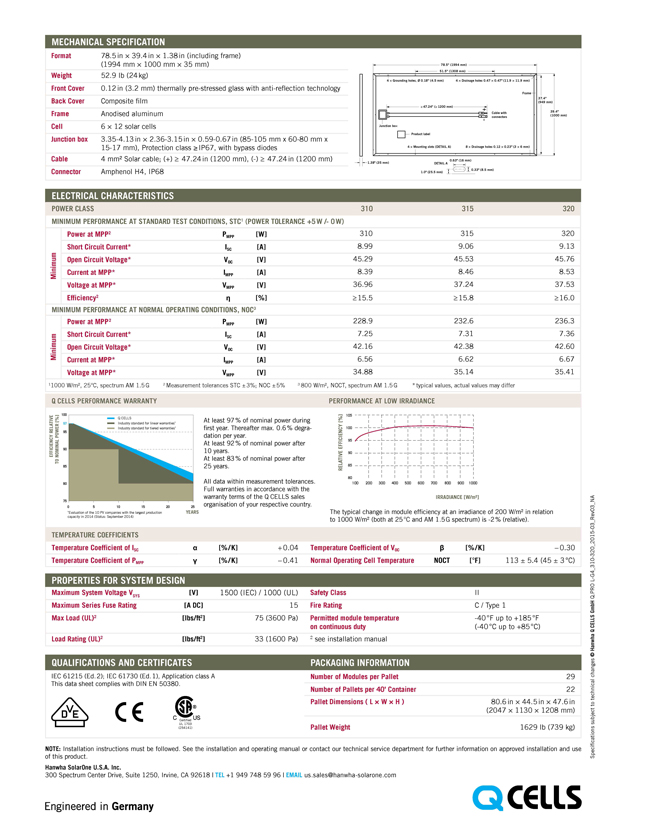

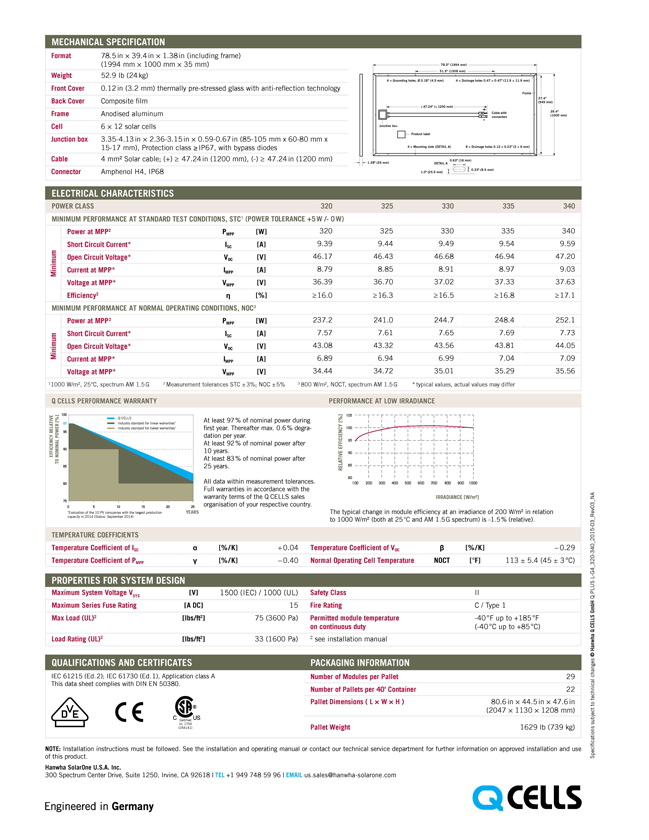

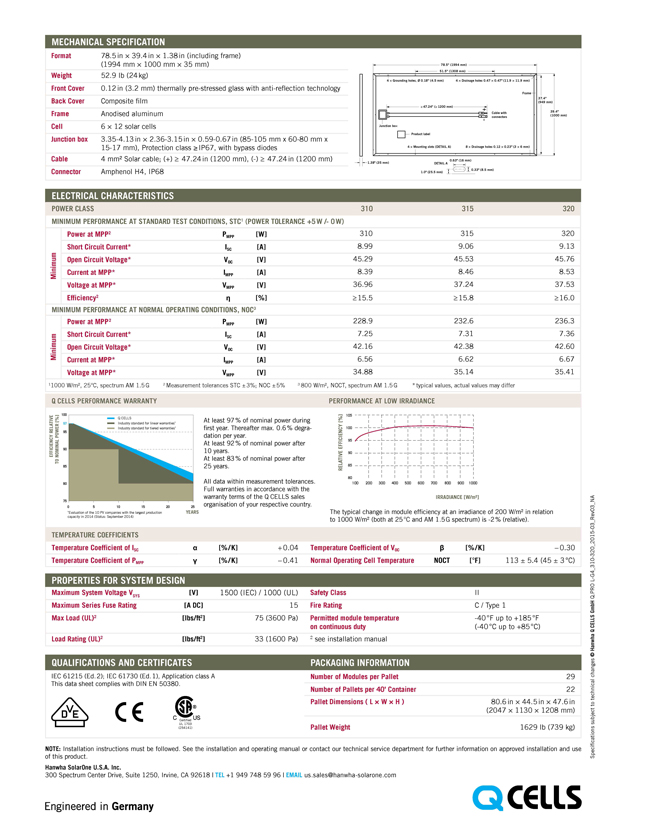

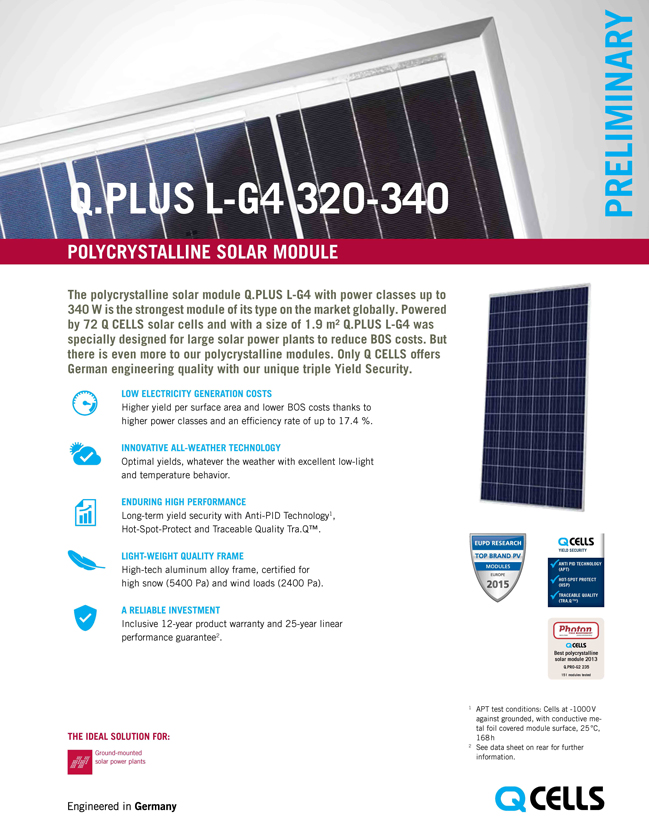

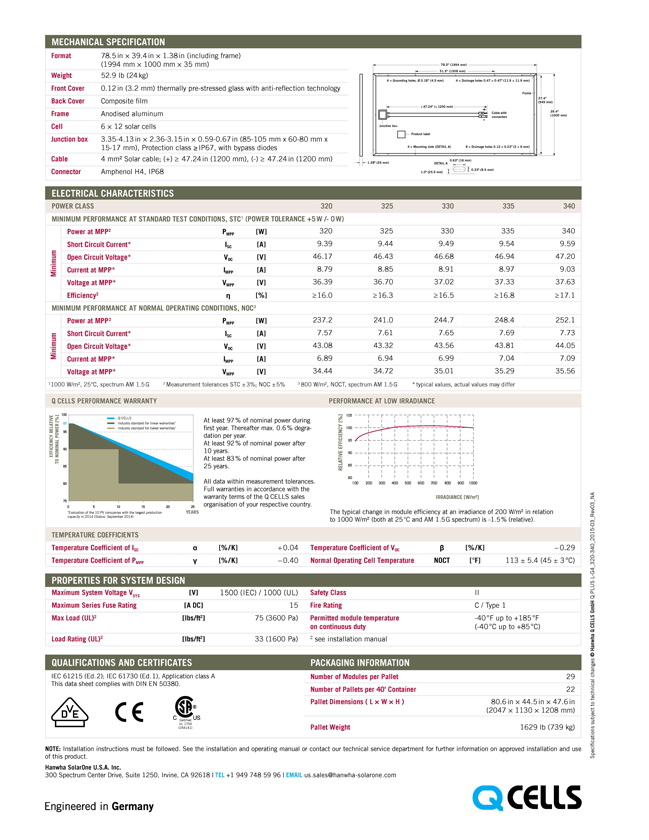

Supplier shall sell to Purchaser PV Modules, as further detailed in the data sheets attached hereto as Exhibit A, meeting the following minimum power ratings and at the prices set forth below and the volumes set forth in Schedule 4. The prices set forth below do not include Delivery Charges.

Table 1-A – Pricing Table for NEER Projects

| | | | | | |

Year | | Product | | Power Class (Wp) | | Price (US$/W) |

| 2015 | | Q.PRO L G4 | | 315 | | […***…] |

| 2016 | | Q.PLUS L G4 | | 325 | | […***…] |

Table 1-B – Pricing Table for FPL Projects

| | | | | | |

Year | | Product | | Power Class (Wp) | | Price (US$/W) |

| 2016 | | Q.PLUS L G4 | | 325 | | […***…] |

At any time during the term of this Agreement, Supplier may notify Purchaser that Supplier can make available PV Modules of the same model type, but with a higher or lower Wdc rating. Such notice shall indicate the Wdc rating of the proposed PV Module and the date on which deliveries of such PV Modules would begin. Upon receipt of the notice described above and provided that such higher or lower Wdc PV Modules shall not have an adverse effect on PV Module or Project performance, reliability or efficiency, Purchaser shall evaluate the impact of the proposed new higher or lower Wdc PV Modules on the engineering, timing and economics of the Project to which such PV Modules would be delivered. If following such evaluation Purchaser, in its sole and exclusive discretion, determines that it is able to incorporate such PV Modules into its Projects, Purchaser shall notify Supplier and the Parties shall negotiate in good faith a Change Order setting forth the revised pricing and delivery schedule for the PV Modules.

The aggregate Purchase Price of the PV Modules for each Project will be calculated based on (total Wdc Volume Delivered) x (Price/Wp) provided above for each Project. The aggregate Purchase Price for the PV Modules under this Agreement is $[…***…].

* Confidential Treatment Requested

The total Upfront Payment for the Projects to be entered into is $[…***…]. The Upfront Payment shall be credited pro rata against the PV Module Price for all NEER Projects. The portion of the Upfront Payment eligible for a draw upon the Letter of Credit is set forth on Schedule 8 to this Agreement.

Delivery Charges are an amount equal to the actual cost and expenses incurred by Supplier and its subcontractors to Deliver the PV Modules. Supplier shall not add any markup to such costs and expenses or costs to expedite shipment without approval of Purchaser. If Supplier elects to use air freight or any premium logistics to transport any PV Modules, the transportation costs charged to Purchaser for such PV Modules shall be an amount that Supplier and its subcontractors would have paid if such PV Modules had been transported using customary oversea and overland logistics.

Upon delivery of PV Modules to the carrier at the port of export for a Project Supply Agreement where NEER or a NEER Subsidiary is the counterparty, Supplier shall invoice Purchaser under the applicable Project Supply Agreement for (i) […***…]% of the Purchase Price for such PV Modules, which invoice shall be deemed paid in full upon issuance by applying the Upfront Payment as a credit to such invoice, and (ii) […***…]% of the Purchase Price for such PV Modules, which invoice shall be deemed paid upon issuance to the extent of any previously unapplied portion of the Upfront Payment by applying such unapplied portion pro rata against the PV Module Price for the PV Modules to be shipped as a credit to such invoice. Upon delivery of PV Modules to the carrier at the port of export for a Project Supply Agreement where FPL is the counterparty, Supplier shall invoice Purchaser under the applicable Project Supply Agreement for […***…]% of the Purchase Price for such PV Modules. Upon Delivery of the PV Modules, Supplier shall invoice Purchaser under the applicable Project Supply Agreement for the remaining […***…]% of the Purchase Price for such PV Modules. On or prior to the tenth (10th) day of each calendar month, Supplier shall invoice Purchaser for delivery charges incurred during the prior calendar month.

* Confidential Treatment Requested

Exhibit A

Specifications of PV Modules

[See attached]

Q.PRO L-G4 310-320

POLYcrYstaLLine sOLar mOduLe