UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2006 or

| o | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from _____________ to _____________

Commission file number: 333-136528

World Energy Solutions, Inc.

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 04-3474959

(I.R.S. Employer Identification Number) |

446 Main Street

Worcester, Massachusetts 01608

(Address of principal executive offices)

(508) 459-8100

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Act:

None

(Title of class)

Securities registered under Section 12(g) of the Act:

None

Indicate by checkmark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by checkmark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer o | Non-accelerated filer x |

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting stock held by non-affiliates of the registrant based on the last sale price of such stock as reported by the Toronto Stock Exchange on December 29, 2006 was approximately $45,967,000. The registrant’s voting stock was not publicly traded as at the end its most recently completed second fiscal quarter.

As of March 2, 2007, the registrant had 76,511,741 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the Annual Meeting of Stockholders to be held on May 17, 2007, are incorporated by reference in Part III of this Report.

World Energy Solutions, Inc.

Form 10-K

For the Year Ended December 31, 2006

Table of Contents

PART I | | |

| | | |

| Item 1. | Business | 1 |

| Item 1A. | Risk Factors | 11 |

| Item 1B. | Unresolved Staff Comments | 19 |

| Item 2. | Properties | 19 |

| Item 3. | Legal Proceedings | 19 |

| Item 4. | Submission of Matters to a Vote of Security Holders | 19 |

| | | |

PART II | | |

| | | |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 20 |

| Item 6. | Selected Consolidated Financial Data | 21 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 22 |

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 33 |

| Item 8. | Financial Statements and Supplementary Data | 34 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 34 |

| Item 9A. | Controls and Procedures | 34 |

| Item 9B. | Other Information | 34 |

| | | |

| | | |

PART III | | |

| | | |

| Item 10. | Directors, Executive Officers and Corporate Governance | 35 |

| Item 11. | Executive Compensation | 35 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 35 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 35 |

| Item 14. | Principal Accountant Fees and Services | 35 |

| | | |

| | | |

PART IV | | |

| | | |

| | | |

| Item 15. | Exhibits and Financial Statement Schedules | 36 |

| Signatures | | 37 |

| Exhibit Index | |

FORWARD-LOOKING STATEMENTS

This Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which statements involve risks and uncertainties. These statements relate to our future plans, objectives, expectations and intentions. These statements may be identified by the use of words such as “may”, “could”, “would”, “should”, “will”, “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and similar expressions. Our actual results and timing of certain events could differ materially from those discussed in these statements. Factors that could contribute to these differences include but are not limited to, those discussed under “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, and elsewhere in this Report. The cautionary statements made in this report should be read as being applicable to all forward-looking statements wherever they appear in this report.

PART I

Item 1. Business

Overview

World Energy Solutions, Inc. is an energy brokerage company that has developed an online auction platform, the World Energy Exchange, through which energy consumers in the United States are able to purchase electricity and other energy resources from competing energy suppliers which have agreed to participate on our auction platform in a given auction. We were founded in response to the restructuring of the electricity industry in some U.S. states, which are increasingly permitting energy consumers to choose their electricity supplier. While our core competency is brokering electricity, we adapted our World Energy Exchange auction platform to accommodate the brokering of natural gas in 2002, green power in 2003 (i.e., electricity generated by renewable resources) and certain other energy-related products in 2005. Since 2001, we have brokered over 31 billion kilowatt hours of electricity for energy consumers in North America on the World Energy Exchange. We believe that we are among the pioneering companies brokering electricity online and we are not aware of any third-party competitor brokering more electricity online than we do. In addition, we have adapted our World Energy Exchange auction platform to accommodate transactions in fuel oils including: diesel, heating oil, propane and jet fuel and are in the process of adapting the platform to accommodate green credit transactions.

In the United States, the electricity industry restructuring that has permitted energy consumers a choice of supplier has taken place on a state-by-state basis. This development presents energy consumers with a number of challenges because they generally lack the expertise, experience and information necessary to effectively source electricity from competitive energy suppliers. We provide energy consumers that choose to switch to a competitive energy supplier with a comprehensive energy procurement solution that is designed to ensure that they receive market-based pricing terms. To date we have focused on commercial, industrial and government (CIG) energy consumers.

The Industry

We currently provide brokerage services primarily in two industries: deregulated retail and wholesale energy in the United States. Subsequent to year end, we provided brokerage services in a third emerging industry: the trading of green credits.

Electricity Deregulation

The electricity industry in the United States is governed by both federal and state laws and regulations, with the federal government having jurisdiction over the sale and transmission of electricity at the wholesale level in interstate commerce, and the states having jurisdiction over the sale and distribution of electricity at the retail level.

The federal government regulates the electricity wholesale and transmission business through the Federal Energy Regulatory Commission, or FERC, which draws its jurisdiction from the Federal Power Act, and from other legislation such as the Public Utility Regulatory Policies Act of 1978, the Energy Policy Act of 1992, or EPA 1992, and the recently enacted Energy Policy Act of 2005. FERC has comprehensive and plenary jurisdiction over the rates and terms for sales of power at wholesale, and over the organization, governance and financing of the companies engaged in such sales. States regulate the sale of electricity at the retail level within their respective jurisdictions, in accordance with individual state laws which can vary widely in material respects. Restructuring of the retail electricity industry in the United States began in the mid-1990s, when certain state legislatures restructured their electricity markets to create competitive markets that enable energy consumers to purchase electricity from competitive energy suppliers.

Prior to the restructuring of the retail electricity industry, the electricity market structure in the United States consisted of vertically integrated utilities which had a near monopoly over the generation, transmission and distribution of electricity to retail energy consumers. In states that have embraced electricity restructuring, the generation component (i.e., the source of the electricity) has become more competitive while the energy delivery functions of transmission and distribution remain as monopoly services provided by the incumbent local utility and subject to comprehensive rate regulation. In other words, in these states, certain retail energy consumers (specifically, those served by investor-owned utilities and not by municipal power companies or rural power cooperatives) can choose their electricity supplier but must still rely upon their local utility to deliver

that electricity to their home or place of business.

The structure and, ultimately, the success level of industry restructuring has been determined on a state by state basis. There have been three general models for electricity industry restructuring: (i) delayed competition, (ii) phased-in competition, and (iii) full competition. The delayed competition model consists of the state passing legislation authorizing competitive retail electricity markets (i.e., customer choice of electric energy supplier), however, no action is taken by the state regulatory authority charged with utility industry oversight within such state to change the incumbent utility rates for electric energy to encourage competition. The phased-in competition model consists of the state passing legislation authorizing competitive retail electricity markets together with a gradual change of the incumbent local utility’s retail electric rates to encourage the competitive supply of electricity over time. The full competition model consists of the state passing legislation authorizing competitive retail electricity markets together with an immediate change to the incumbent local utilities’ retail electric rates that results in the whole CIG electricity market in such state being competitive immediately.

Energy consumers who choose to switch electricity suppliers can either do it themselves by contacting competitive energy suppliers directly, or indirectly, by engaging aggregators, brokers or consultants, collectively referred to as ABCs, to assist them with their electricity procurement.

Competitive Energy Suppliers: These entities take title to power and resell it directly to energy consumers. These are typically well-funded entities, which both service energy consumers and also work with ABCs to contract with energy consumers. Presently, we estimate there are over 40 competitive suppliers several of which operate on a national level and are registered in nearly all of the 14 states and the District of Columbia that permit CIG energy consumers to choose their electricity supplier and have deregulated pricing to create competitive markets.

Aggregators, Brokers and Consultants: ABCs facilitate transactions by having competitive energy suppliers compete against each other in an effort to get their energy customers the lowest price. This group generally uses manual request for proposal (RFP) processes that are labor intensive, relying on phone, fax and email solicitations. We believe that the online RFP process is superior to the traditional paper based RFP process as it involves a larger number of energy suppliers, can accommodate a larger number of bids within a shorter time span, and allows for a larger amount of contract variations including various year terms, territories and energy usage patterns.

Online Brokers: Online brokers are a subset of the ABCs. These entities use online platforms to run electronic RFP processes in an effort to secure the lowest prices for their energy customers by having competitors bid against one another. We believe that we are among the pioneering companies brokering electricity online and we are not aware of any competitor that has brokered more electricity online than we have.

Natural Gas

The natural gas industry in the United States is governed by both federal and state laws and regulations, with the federal government having jurisdiction over the transmission of natural gas in interstate commerce, and the states having jurisdiction over the sale and distribution of electricity at the retail level.

The federal government regulates the natural gas transmission business through FERC which draws its jurisdiction from the Natural Gas Act, and from other legislation such as the recently enacted Energy Policy Act of 2005. FERC has comprehensive and plenary jurisdiction over the rates and terms for transmission of gas in interstate commerce, and over the organization, governance and financing of the companies engaged in such transmission. States regulate the distribution and sale of gas at the retail level within their respective jurisdictions, in accordance with individual state laws which can vary widely in material respects.

The natural gas market in the United States is deregulated in most states and offers retail energy consumers access to their choice of natural gas commodity supplier.

Following a period of heavy regulation, the gas industry was deregulated in three phases as a result of legislation enacted in 1978 followed by multiple orders of FERC. The expected result of this deregulation was to stimulate competition in the natural gas industry down the pipeline to the distribution level.

At the retail level, reforms and restructuring have taken place on a state-by-state basis, with varying nuances to the restructuring in different states. For example, state commissions have allowed local distribution companies to offer unbundled transportation service to large customers; occasionally to provide flexible pricing in competitive markets; and to engage in other competitive activities.

Today, the Company estimates that utilities in over 40 states permit retail natural gas consumers to choose their natural gas commodity suppliers. In most instances, the incumbent local distribution utility still delivers the commodity to the consumers’ premises, even if a different supplier is selected to provide the commodity. The level of competitive choice available to retail CIG energy consumers has increased, with a wide range of products and a significant number of suppliers participating in both retail and wholesale transactions.

Green Credits

Concerns about global warming have spawned a number of initiatives to reduce greenhouse gas emissions. The most well known of these initiatives is the Kyoto Protocol pursuant to which many countries in Europe, Asia and elsewhere have created carbon cap and trade systems. While the United States has not adopted the Kyoto Protocol at a federal level, there are a number of initiatives in the U.S. at the regional, state and local level aimed at limiting greenhouse gas emissions including the Regional Greenhouse Gas Initiative, a collaboration of seven Northeastern states and renewable portfolio standards - initiatives adopted by states and the District of Columbia regarding the minimum requirements mandated to utilities to derive power from renewable sources, including initiatives such as the New Jersey Solar Renewable Energy Credit (SREC) initiative.

These mandates are spurring investments in renewable energy, carbon efficiency and recovery processes to create credits that can be traded to countries or companies seeking to get beneath mandated carbon emission limits. Thus far these credits are being traded privately or via exchanges (such as the European Climate Exchange, Evomarkets, and the Chicago Climate Exchange) that have been formed to take advantage of these opportunities, although we believe that a structured auction event may be a more efficient mechanism for transacting these credits.

Company Strategy and Operations

Overview

World Energy is an energy brokerage company that has developed an online auction platform, the World Energy Exchange. We bring energy suppliers and CIG energy consumers together in our virtual marketplace, often with the assistance of our channel partners, who identify and work with energy consumers on our behalf. The World Energy Exchange is part of a comprehensive online energy procurement process that includes the following modules:

| • | energy sourcing management — a database of suppliers and contacts; |

| • | deal and task management — a module to list, assign and track steps to complete a procurement successfully; |

| • | market intelligence — a database of information related to market rules and pricing trends for deregulated markets; |

| • | RFP development — a module to create RFPs with a variety of terms and parameters; |

| • | conducting auctions — underlying software to manage the bidding and timing of an auction and display the results; |

| • | energy consumer portfolio management — a database of consumer contracts, sites, accounts and usage; |

| • | commission reporting — a system to display forecasted and actual commissions due to channel partners; and |

| • | receivables management — a system to upload data received from suppliers and track payment receipt. |

Our technology-based comprehensive energy brokerage solution is attractive to channel partners as it provides them with a business automation platform to enhance their growth, profitability and customer satisfaction. Channel partners are important to our business because these entities offer our World Energy Exchange auction platform to enhance their service offerings to their customers. By accessing our market intelligence and automated auction platform, channel partners significantly contribute to our transaction volume and the volume of energy procured via our auction platform, and in return we pay them a commission at a fixed contractual commission rate based on the revenues earned from energy suppliers. The contractual commission rate is negotiated in the channel partner agreement based on a number of factors, including expected volume, effort required in the auction process and competitive factors.

As a requirement to bid in an auction (which is described in greater detail below), energy suppliers must agree to an on-line agreement to pay our fee if they execute a contract as a result of the auction. Following an auction event, our employees continue to work with the energy consumer and energy supplier through the contract negotiation process and, accordingly, we are aware of whether a contract between the energy consumer and energy supplier is consummated. If a contract is entered into between an energy consumer and an energy supplier using the World Energy Exchange auction platform, we are compensated based upon a commission that is built into the price of the energy commodity. This approach is attractive to energy suppliers and energy consumers because there is no fee charged to the energy supplier or the energy consumer if the brokering process does not result in an energy procurement contract. Our commissions are based on energy usage transacted between the energy supplier and energy consumer multiplied by our contractual commission rate, and is set forth in two contracts between us and the energy supplier. The first agreement is an energy supplier master agreement, whereby energy suppliers are allowed to bid on energy consumer usage in exchange for agreeing to pay the fee that we have negotiated with the energy consumer, and the second is a fee addendum to the contract between the energy consumer and energy supplier that sets forth the fee and energy accounts to which the fee applies.

Monthly revenue is based on actual usage data obtained from the energy supplier for a given month or, to the extent actual usage data is not available, based on the estimated amount of electricity and gas delivered to the energy consumer for that month. While the number of contracts closed via the World Energy Exchange in any given period can fluctuate widely due to a number of factors, this revenue recognition method provides for a relatively predictable revenue stream, as revenue is based on the energy consumers actual historical energy usage profile. However, monthly revenue can still vary from our expectations because usage is affected by a number of variables which cannot always be accurately predicted, such as the weather and general business conditions affecting our energy consumers.

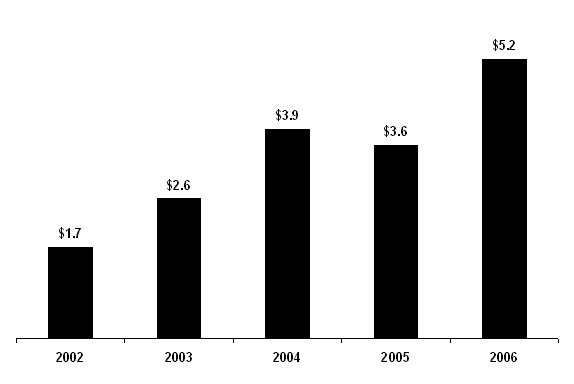

Contracts between CIG energy consumers and energy suppliers are signed for a variety of term lengths, with a one year contract term being typical for commercial and industrial energy consumers, and government contracts typically having two to three year, and occasionally five year terms. The chart below displays our annualized backlog as at year-end from 2002 through 2006. Annualized backlog represents the revenue that we would derive within the twelve months following the date on which the backlog is calculated from contracts between CIG energy consumers and energy suppliers that are in force on such date, assuming such CIG energy consumers use energy at their historical usage levels. For any particular contract, annualized backlog is calculated by multiplying the CIG energy consumer’s historical usage by our fixed contractual commission rate. This metric is not intended as an estimate of overall future revenues, since it does not purport to include revenues that may be earned during the relevant 12 month backlog period from new contracts or renewals of contracts that expire during such period. In addition, annualized backlog does not represent guaranteed future revenues, and to the extent actual usage under a particular contract varies from historical usage, our revenues under such contract will differ from the amount included in annualized backlog. Annualized backlog as at December 31, 2006 contains all contracts in force as of December 31, 2006 that have expected revenue associated with them from January 1, 2007 through December 31, 2007. These contracts may expire during the period and therefore the annualized backlog does not include any revenue from expected contract renewals.

Annualized Backlog

(in millions)

Because the calculation of backlog is a calculation of a contracted commission rate multiplied by a historical energy usage figure, our annualized backlog may not necessarily be indicative of future results. Annualized backlog should not be viewed in isolation or as a substitute for our historical revenues presented in the financial statements included in this Form 10-K. Events that may cause future revenues from contracts in force to differ materially from our annualized backlog include the events that may affect energy usage, such as overall business activity levels, changes in energy consumers’ businesses, weather patterns and other factors described under “Risk Factors”.

The Brokerage Process

Our brokerage process is supported by a variety of software modules designed with the goal to find energy supplies at the lowest possible price while providing step-by-step process management and detailed documentation prior to, during and following the auction. Our process includes data collection and analysis, establishing the utility benchmark price, conducting multiple auction events to enable testing of various term and price combinations and assisting in contract completion. We create an audit trail of all the steps taken in a given transaction. Specific web pages track all information provided to energy suppliers including energy supplier calls, supplier invitations, usage profiles and desired contract parameters.

At the commencement of the process, non-government energy consumers will enter into a procurement consulting agreement with us pursuant to which we are appointed as the energy brokerage service provider to solicit and obtain bids for the supply of energy and to assist in the procurement of energy. Government energy consumers will send out a solicitation at the commencement of the brokerage process which sets out the contract terms. Only energy suppliers that are qualified under the solicitation may participate in the auction. Energy suppliers who wish to bid on the provision of energy to such energy consumers must partake in our brokerage process and cannot contract with energy consumers outside of our brokerage process. The procurement consulting agreement authorizes us to retrieve the energy consumer’s energy usage history from the utility serving its accounts. We utilize the usage history to identify and analyze the energy consumer’s energy needs and to run a rate and tariff model which calculates the utility rate for that energy consumer’s facilities. This price is used as a benchmark price to beat for the auction event.

Prior to conducting the auction, the auction parameters, including target price, supplier preferences, contract terms, payment terms and product mix, as applicable, are discussed with the energy consumer and agreed upon. Approximately two to five days prior to the auction, we will post RFP’s with these auction parameters on our World Energy Exchange and alert the potential energy suppliers. Additionally, energy suppliers are provided with information about the energy consumer, historical energy usage information relating to the energy consumer’s facilities, and the desired contract parameters, several days in advance of the auction as part of the RFP. This advanced notice gives the energy suppliers the opportunity to analyze the value of a potential deal and the creditworthiness of the energy consumer. We believe that, using this information along with the auction parameters described in the RFP, the energy suppliers develop a bidding strategy for the auction.

The auction is run on the World Energy Exchange, which is our auction platform. The auction creates a competitive bidding environment that is designed to cause energy suppliers to bid their prices down during the auction event in response to other competitive bids. Specifically, energy suppliers enter an auction by submitting an opening bid at or lower than the suggested opening bid posted on the RFP. After they enter the auction and assess the bidding activity, energy suppliers may begin testing the competition by submitting a bid lower than the then leading bid. They do this presumably to test their pricing and to gauge the relative level of competition for the deal. There is typically a modest level of bidding and counter-bidding activity among energy suppliers until the final 30 seconds of the auction when bidding activity tends to increase. In the final seconds, all energy suppliers see the then-leading bid and must make a judgment as to how low to submit their last bid in order to win the deal. At this point in the auction, energy suppliers make their final bid without knowledge of what any other energy suppliers are bidding. We call this a final “blind” bid. Because an energy supplier does not know what the other energy suppliers will bid in their blind bid, this process has often resulted in the leading energy supplier outbidding itself at the moment before the auction closes in an effort to maintain its lead position and win the auction event.

Typically, a number of auctions tailored to the energy consumer’s specific energy needs will be held. Our World Energy Exchange provides rapid results and can accommodate a multitude of permutations for offers, including various year terms, utility territories, load factors and green power requirements. For commercial and industrial energy consumers, we typically run two to six auction events and for large government aggregations that generally are more complex, we typically run 20 to 40 auction events. Each auction event usually lasts less than 15 minutes. Included as part of any auction transaction are date and time stamping of bids, comparison of each bid with utility rates where determinable rates are available, as well as automated stop times, which ensure the integrity of auction events. The World Energy Exchange is also periodically synchronized to the atomic clock which is intended to ensure that auction start and stop times are precise.

Following an auction, the auction results are analyzed and if the auction has been successful, we assist the energy consumer with the contracting process with the energy supplier which is typically finalized within one hour of the closing of the last auction event. In the case of a commercial energy consumer, we facilitate any remaining discussion between the leading energy supplier and the energy consumer relating to the energy supplier’s contract terms that were not addressed in establishing the auction parameters. In the case of government energy consumers, the energy suppliers have seen and, in general, have agreed to the form of supply contract being required by the government energy consumer. Accordingly, the time period between the end of the auction and the execution of a contract is usually shorter than in the case of non-government energy consumers. Not all auctions result in awarded contracts.

As part of the contracting process between the successful energy supplier and the energy consumer, the energy supplier will enter into a fee addendum with us which provides for payment of a commission on a monthly basis based on actual energy usage by the energy consumer during the contract term. We also receive a monthly summary accounting of the energy consumer’s energy consumption. For electricity contracts, we have historically received a commission ranging generally from $0.00005 to $0.0025 per kilowatt hour consumed by the energy consumer. For natural gas contracts, we have historically received a

commission ranging generally from $0.01 to $0.10 per decatherm of gas consumed by the energy consumer. If a channel partner was involved, the channel partner will receive a commission based on a fee sharing arrangement it has negotiated with us in the applicable channel partner agreement.

The incumbent local utility serving a given location is typically obligated to deliver electric energy to the customer’s premises from the location where the supplier delivers electricity into that local utility’s delivery system. However, the energy supplier is responsible for enrolling the energy consumer’s account with the applicable local utility and the energy supplier remains liable for any costs resulting from the physical loss of energy during transmission and delivery to the customer’s premises. We never buy, sell or take title to the energy products on our auction platform.

We typically interface directly with the energy consumer through the brokerage process. However, if a channel partner is involved, the channel partner will often perform one or more of the following functions: working with an energy consumer to sign a procurement consulting agreement, interacting with the energy consumer relating to World Energy analyses, supporting the decision-making, and interfacing with the energy consumer during the contracting process. However, even if a channel partner is involved, we are still primarily responsible for tasks such as interacting with utilities to obtain an energy consumer’s usage history, performing analyses, creating RFPs, interfacing with suppliers, and scheduling, conducting and monitoring auctions and collecting the commission earned from the energy supplier.

Growth Strategy

Our overall objective is to achieve a preeminent position as the exchange for executing transactions in energy and energy-related products. We seek to achieve our objective by expanding our community of channel partners, energy consumers and energy suppliers on our exchange, strengthening and expanding long-term relationships with government agencies, broadening our exchange to include other geographic markets and other energy and energy-related markets, including wholesale transactions with utilities and the emerging green credits market, making strategic acquisitions, and growing our sales force. Key elements of our strategy are as follows:

Continuing to Develop Channel Partner Relationships A significant majority of the energy consumers using our auction platform have been introduced to us through our channel partners. Our primary growth strategy is to focus on developing and increasing our number of channel partner relationships in an effort to expand the base of energy consumers using our auction platform and to increase the volume of energy procured on our World Energy Exchange. As illustrated by the diagram below, we have consistently increased the number of channel partners since 2002 from 3 to 29, and have recently made investments to focus on recruitment and training in an effort to accelerate the addition of channel partners. We will also consider future opportunities to work with channel partners who have succeeded in establishing a significant customer base. The following table sets out the growth in our channel partner relationships since the fiscal year ended December 31, 2002 and data is presented as at December 31, 2006.

Number of Channel Partners

Strengthening and Expanding Long-term Relationships with Government Agencies We intend to build on the relationships we have established with federal, state and local government agencies. We expect that our expertise in brokering cost-saving energy contracts for government agencies will continue to be in demand as contract terms expire and governments look to contract for low energy prices in a competitive market. In 2001, we first penetrated the government segment by brokering energy for the United States Federal Government’s General Services Administration, or GSA, as a subcontractor to channel partner Science Applications International Corporation, or SAIC. In September 2005, we were

awarded a five-year contract to provide energy brokerage services to the GSA. Working with SAIC, we have completed hundreds of auctions resulting in dozens of procurements for GSA and its federal government electricity consumers in four states and for natural gas in over 30 states.

In 2004, together with SAIC, we assisted the State of Maryland in procuring a two-year electricity supply contract through our World Energy Exchange, leading to an annual savings that we estimate to be over $5 million compared to the incumbent utility’s previous rate. In 2005, Maryland was awarded the National Association of State Facilities Administrators Innovation Award and the National Association of State Chief Administrators Outstanding Program Award in recognition of its innovative approach to energy procurement and leadership. This recognition has contributed to us along with our channel partner being awarded contracts to broker energy for the Commonwealth of Massachusetts, Montgomery County, Maryland, the District of Columbia and the Commonwealth of Pennsylvania. We intend to leverage this recognition to secure business relationships with other state and local governments. We believe that this strategy will not only permit us to grow our business laterally by establishing a business presence in other states but will also provide an opportunity for us to increase our base of energy consumers by branching out into other sectors and increasing our penetration into other levels of a particular state’s government agencies and organizations.

Targeting Other Energy-Related Markets While our core competence lies in electricity brokerage for CIG energy consumers, we intend to expand our brokerage services into new markets. To date, we have brokered over 64 million decatherms of natural gas under contract under GSA’s Natural Gas Acquisition Program and continue to grow our natural gas brokering activities to support existing energy consumer relationships. At the request of participants on our auction platform, we have adapted our World Energy Exchange platform to accommodate transactions in fuel oils including: diesel, heating oil, propane and jet fuel. Our World Energy Exchange has been and can further be modified to expand our capabilities to broker other energy-related transactions with appropriate resource allocation.

Targeting Utilities We have added the capability to auction energy-related products, and several auctions were closed for an aggregate of over 5 billion kilowatt hours of electricity. We believe that there is an opportunity for us to further expand our business operations to facilitate the brokering of energy-related products for utilities. Having successfully tested our wholesale market model with the recent auction described above, we seek to leverage our initial success and aim to build this aspect of our operations by replicating the auction process with other utilities.

Brokering Green Credits We also plan to expand our operations by entering into the green credits market through our established relationships and growing reputation in the energy procurement marketplace. The brokerage of green credits would complement our current business and remains aligned with our focus on brokerage of cost-effective energy transactions. As countries attempt to reduce their environmental emissions in order to achieve compliance under the Kyoto Protocol and U.S.-based initiatives, we believe that the creation and trading of green credits will accelerate. We intend to utilize our auction platform to create an ascending auction for the trading of green credits between countries and companies who have made energy efficient improvements to reduce their emissions below the permissible levels, and those who have not.

Making Strategic Acquisitions We are also pursuing strategic acquisitions to help us expand geographically, add expertise and product depth, provide accretive revenue and profit streams or a combination of two or more of the above.

Growing our Direct Sales Force In certain CIG markets and in the emerging Wholesale and Green Markets, it makes sense to have a direct sales presence. A key growth strategy for us will be to open regional offices (in addition to our current Worcester and Washington, DC sales offices), and staff them with direct sales people. Subsequent to year end, we have hired a new Senior Vice President of Sales and are in the process of opening a sales office in Houston.

Energy Suppliers, Energy Consumers and Channel Partners

Energy Suppliers Our success is heavily dependent on our energy supplier relationships, the credibility of our energy suppliers and the integrity of the auction process. There are approximately 240 competitive electricity, natural gas and wholesale electricity suppliers registered on the World Energy Exchange, representing a majority of all suppliers in the deregulated electricity and natural gas markets. Of the registered energy suppliers, approximately 45 had active contracts with energy consumers that were brokered through our World Energy Exchange as of December 31, 2006. Four of these energy suppliers each accounted for over 10% individually and approximately 51% in the aggregate of our revenue for the year ended December 31, 2006, and four of these energy suppliers each accounted for over 10% individually and approximately 57% in the aggregate of our revenue for the year ended December 31, 2005. In order to participate in an auction event, energy suppliers must register with us by either entering into a standard-form agreement pursuant to which the energy supplier is granted a license to access our auction platform and bid at auction events or by qualifying to participate in an auction pursuant to a government solicitation. Our national standard form agreement is for an indefinite term, may be terminated by either party upon 30 days prior written notice, is non-exclusive, non-transferable and cannot be sublicensed. Under our standard-form agreement or the government solicitation, the energy supplier agrees to pay us a commission, which varies from contract to contract and which is based on a set rate per energy unit consumed by the energy consumer.

Energy Consumers Energy consumers using our auction platform to procure energy include government agencies and commercial and industrial energy consumers. Government energy consumers have complex energy needs in terms of both scope and scale, which management believes can best be met with a technology-based solution such as the World Energy Exchange. Additionally, the automated nature of our World Energy Exchange auction platform is designed to support protest free auctions. Working with our channel partner, SAIC, we have brokered energy for the GSA and over 25 federal agencies, Montgomery County, Maryland, the State of Maryland, the District of Columbia, the Commonwealth of Massachusetts, and the Commonwealth of Pennsylvania.

Our contracts for the online energy procurements with these governmental entities are typically for multiple years ranging from 2 to 5 years. During this contractual period, the governmental entity may run various auctions for different locations or agencies that fall under their purview. As a result, revenue from these customers could extend beyond the actual contractual term. We currently have contracts with 3 of the 14 currently deregulated states and have recently run an auction for Delaware and were awarded a contract with New Jersey to assist in their online energy procurement needs. As additional states open their electricity markets to competition and suppliers enter those markets, we plan to actively market our services to them. These contracts do not require that the government energy consumer use our services and, as is typical in government procurements, contain termination for convenience clauses. If a contract was terminated for convenience, it would typically not have any bearing on existing energy procurements run through the termination date. A summary of our major governmental contracts is as follows:

| · | In September 2005, we were awarded a five-year contract to assist GSA in its procurement of energy, and since that award we have run several procurements for electricity in Texas, Illinois, New York and New Jersey, and natural gas in over 30 states. Most of the consummated electricity contracts were for five-year terms and provide the company with expected revenue through 2012. The gas contracts were for one- and two-year terms. |

| · | In January 2006, we successfully completed a retail, electric power procurement for the Operating Services Division of the Commonwealth of Massachusetts under the terms of a multi-year contract that was signed in December 2005. |

| · | In March 2006, we were awarded a multi-year contract to assist Montgomery County, Maryland with its energy procurement. During the second quarter of 2006, we ran a successful procurement that placed certain facilities in Montgomery County under one-year contracts with two option years. |

| · | In August 2006, for the District of Columbia, we received a co-award for the continuation of energy procurement services. In February 2007, the District of Columbia terminated this co-award for convenience. It was not clear as to the reasons for the District of Columbia’s actions and if they will re-issue the co-contract or reopen the RFP process. |

| · | In September 2006, we ran a series of gas auctions under the terms of a three-year contract with the Commonwealth of Pennsylvania Department of General Services. |

| · | In November 2006, the State of Maryland Department of General Services renewed its energy procurement contract with us through 2009. Subsequent to that award, we ran procurements that resulted in new contracts for existing accounts to lock in supply and pricing through June 2009, and for the first time included new accounts for the University system, which formerly used consultants to secure supply contracts. |

Four of the energy consumers using our auction platform (Maryland Department of General Services, District of Columbia Energy Office, General Services Administration and the Commonwealth of Massachusetts) each accounted for over 10% individually and approximately 63% in the aggregate of our revenue for the year ended December 31, 2006, and three of these energy consumers accounted for over 10% individually and approximately 51% in the aggregate of our revenue for the year ended December 31, 2005.

Contract Party | Percent of Revenue for the Year Ended December 31, 2006 |

| State of Maryland | 20% |

| General Services Administration | 17% |

| District of Columbia | 16% |

| Commonwealth of Massachusetts | 10% |

We also maintain a direct sales arm. Targets of direct sales efforts are typically large companies with facilities in many geographic locations including hotel chains, wholesale clubs, property management firms, big box retailers, supermarkets, department stores, drug stores, convenience stores, restaurant chains, financial services firms, and manufacturers across various industries.

Channel Partners We target commercial and industrial energy consumers primarily through channel partners. These are firms with existing client relationships with certain commercial and industrial energy consumers that would benefit from the addition of an online energy procurement solution. Channel partners consist of a diverse array of companies including energy service companies, demand side consultants and manufacturers, ABCs and strategic sourcing companies, but in the most general terms they are resellers or distributors. As of December 31, 2006, we have entered into agreements with 29 channel partners, including SAIC and Cargill Energy Services, LLC, which are currently engaged in efforts to source potential transactions to the World Energy Exchange although not all have sourced a transaction for which an auction has been completed. Upon identifying opportunities with new channel partners, we enter into a non-exclusive channel partner agreement that grants the channel partner a non-exclusive right to sell our procurement process for a term of one year, which term renews automatically unless terminated upon 30 days written notice. The channel partner receives a commission based on the amount of involvement of the channel partner in the procurement process.

Direct Sales We also maintain a direct sales arm. Targets of direct sales efforts are typically large companies with facilities in many geographic locations including hotel chains, wholesale clubs, property management firms, big box retailers, supermarkets, department stores, drug stores, convenience stores, restaurant chains, financial services firms, and manufacturers across various industries. This sales force also will be expanded to support our efforts to secure relationships with wholesales buyers and green credit players.

Competition

Energy consumers have a broad array of options when purchasing energy. Energy consumers can either purchase energy directly from the utility at the utility’s rate or purchase energy in the deregulated market through one of the following types of entities: competitive energy suppliers, ABCs and online brokers. We compete with competitive energy suppliers, ABCs and other online brokers for energy consumers that are seeking an alternative to purchasing directly from the utility.

Online Brokers Online brokers are a subset of the ABCs. These entities use online platforms to run electronic RFP processes in an effort to secure the lowest prices for their energy customers by having competitors bid against one another. We believe that we are among the pioneering companies brokering electricity online and we are not aware of any competitor that has brokered more electricity online than we have.

Aggregators, Brokers and Consultants ABCs facilitate transactions by having competitive energy suppliers compete against each other in an effort to get their energy customers the lowest price. This group generally uses manual RFP processes that are labor intensive, relying on phone, fax and email solicitations.

Competitive Energy Suppliers These entities take title to power and resell it directly to energy consumers. These are typically well-funded entities, which both service energy consumers and also work with ABCs to contract with energy consumers.

Technology

Our World Energy Exchange auction platform is comprised of a scalable transaction processing architecture and web-based energy consumer user interface. The auction platform is primarily based on internally developed proprietary software, but also includes third party components for user interface elements and reporting. The World Energy Exchange auction platform supports the selling and buying processes of energy-related products including bid placements, energy supplier registration and management, channel partner management, energy consumer management, deal process management, contract management, site management, collection and commission management, and reporting. The auction platform maintains current and historical data online for all of these components.

Our technology systems are monitored and upgraded as necessary to accommodate increasing levels of traffic and transaction volume on the website. However, future upgrades or additional technology licensing may be required to ensure optimal performance of our auction platform services. See “Risk Factors” at Item 1A. To provide maximum uptime and system availability, our auction platform is hosted in a multi-tiered, secure, and reliable fault tolerant environment which includes backup power supply to computer equipment, climate control, as well as physical security to the building and data center. In the event of a major system component failure, such as a system motherboard, spare servers are available.

We strive to offer a high level of data security in order to build the confidence in our services among energy consumers and to protect the energy consumers’ private information. Our World Energy Exchange security infrastructure has been designed to protect data from unauthorized access, both physically and over the Internet. The most sensitive data and hardware of the World Energy Exchange reside at the data centers.

Intellectual Property

We enter into confidentiality and non-disclosure agreements with third parties with whom we conduct business in order to limit access to and disclosure of our proprietary information.

We operate our auction platform under the trade names “World Energy Exchange” and “World Green Exchange”. We also own the following domain names: worldenergy.com, wesplatform.com, wexch.com, worldenergyexchange.com, echoicenet.com, e-choicenet.com, worldenergysolutions.com, worldenergysolutions.net, worldenergy.biz, worldgreenexchange.biz, worldgreenexchange.info, worldgreenexchange.us and worldpowerexchange.com. To protect our intellectual property, we rely on a combination of copyright and trade secret laws and the domain name dispute resolution system.

Our corporate name and certain of our trade names may not be eligible for protection if, for example, they are generic or in use by another party. We may be unable to prevent competitors from using trade names or corporate names that are confusingly similar or identical to ours. A company organized under the laws of the State of Florida and whose shares are publicly traded under the symbol “WEGY” also operates under the name “World Energy Solutions, Inc.” According to its filings with the Securities and Exchange Commission, this other company changed its name to “World Energy Solutions” in November 2005, and is in the business of manufacturing and selling transient voltage surge suppressors and related products and commercial and residential energy-saving equipment and applications to distributors and customers throughout the United States. Such filings indicate that this other company plans to implement a new business model to market a multi-product package to commercial, industrial and residential facilities in order to lower their overall cost of electricity, gas and water. This appears to be a different business than ours. We cannot assure you that this other company will not seek to challenge our right to the use of our name, in which case we could be drawn into litigation and, if unsuccessful could be required, or could decide, to cease using the name World Energy Solutions, Inc., in which case we would not realize any value we had built in our name. Additionally, our reputation could be damaged if the other company continues its use of the name World Energy Solutions, Inc. and such other company develops a negative reputation.

We do not have any patents and if we are unable to protect our copyrights, trade secrets or domain names, our business could be adversely affected. Others may claim in the future that we have infringed their intellectual property rights.

Personnel

As of December 31, 2006, we had 24 employees, which includes 20 full-time and four part-time employees. Full-time staff consists of three members of senior management, four sales employees, two information technology employees, eight trading desk employees and three administrative employees. In addition, we rely on a number of consultants and other advisors. The extent and timing of any increase in staffing will depend on the availability of qualified personnel and other developments in our business. None of the employees are represented by a labor union, and we believe that we have good relationships with our employees.

Company Information

We commenced operations through an entity named Oceanside Energy, Inc., which was incorporated under the laws of the State of Delaware on September 3, 1996. We incorporated World Energy Solutions, Inc. under the laws of the State of Delaware under the name “World Energy Exchange, Inc.” on June 22, 1999, and on October 31, 1999, Oceanside became a wholly-owned subsidiary of World Energy Solutions, Inc. through a share exchange whereby Oceanside stockholders were given shares of common stock of World Energy in exchange for their Oceanside shares. Pursuant to a certificate of amendment filed on November 30, 1999, World Energy Exchange, Inc. changed its name to “World Energy Exchange.com, Inc.” and then back to “World Energy Exchange, Inc.” on November 2, 2000. World Energy Exchange, Inc. subsequently changed its name to World Energy Solutions, Inc. pursuant to a certificate of amendment filed on February 4, 2002. Oceanside was subsequently dissolved on May 18, 2006. On December 21, 2006, we incorporated a 100% owned subsidiary, World Energy Securities Corp., under the laws of the Commonwealth of Massachusetts.

On December 5, 2006 we concluded our initial public offering for the sale of 23,000,000 shares of common stock resulting in net proceeds to the Company of approximately $17.5 million (net of offering costs of approximately $3.6 million). In connection with the closing of this offering all of the outstanding shares of convertible preferred stock and non-voting common stock converted into 19,416,310 shares of voting common stock.

Our registered and principal office is located at 446 Main Street, Worcester, Massachusetts, 01608, United States of America, and our telephone number is (508) 459-8100. Our website is located at www.worldenergy.com.

Item 1A. Risk Factors

You should carefully consider the risks and uncertainties described below before deciding to invest in shares of our common stock. If any of the following risks or uncertainties actually occurs, our business, prospects, financial condition and operating results would likely suffer, possibly materially. In that event, the market price of our common stock could decline and you could lose all or part of your investment.

Risks Related to Our Business

We have limited operating experience and a history of operating losses, and we may be subject to risks inherent in early stage companies, which may make it difficult for you to evaluate our business and prospects.

We have a limited operating history upon which you can evaluate our business and prospects. We began assisting in energy transactions in 2001 and introduced our current auction model in April of that same year. Further, we have a history of losses and, at December 31, 2006, we had an accumulated deficit of approximately $4.2 million. We cannot provide any assurance that we will be profitable in any given period or at all. You must consider our business, financial history and prospects in light of the risks and difficulties we face as an early stage company with a limited operating history. In particular, our management may have less experience in implementing our business plan and strategy compared to our competitors, including our strategy to increase our market share and build our brand name. In addition, we may face challenges in planning and forecasting accurately as a result of our limited historical data and inexperience in implementing and evaluating our business strategies. Our inability to successfully address these risks, difficulties and challenges as a result of our inexperience and limited operating history may have a negative impact on our ability to implement our strategic initiatives, which may have a material adverse effect on our business, prospects, financial condition and results of operations.

Our business is heavily influenced by how much regulated utility prices for energy are above or below competitive market prices for energy and, accordingly, any changes in regulated prices or cyclicality or volatility in competitive market prices heavily impacts our business.

When energy prices increase in competitive markets above the price levels of the regulated utilities, energy consumers are less likely to lock-in to higher fixed price contracts in the competitive markets and so they are less likely to use our auction platform. Accordingly, reductions in regulated energy prices can severely negatively impact our business. Any such reductions in regulated energy prices over a large geographic area or over a long period of time would have a material adverse effect on our business, prospects, financial condition and results of operations. Similarly, cyclicality or volatility in competitive market prices that have the effect of driving those prices above the regulated utility prices will make our auction platform less useful to energy consumers and will negatively impact our business.

The online brokerage of electricity and other energy-related products is a relatively new and emerging market and it is uncertain whether our auction model will gain widespread acceptance.

The emergence of competition in the electricity market and other energy-related products is a relatively recent development, and industry participants have not yet achieved consensus on how to most efficiently take advantage of the competitive environment. We believe that as the online energy brokerage industry matures, it is likely to become dominated by a relatively small number of competitors that can offer access to the largest number of competitive suppliers and consumers. Brokerage exchanges with the highest levels of transaction volume will likely be able to offer energy suppliers lower transaction costs and offer consumers better prices, which we believe will increasingly create competitive barriers for smaller online brokerage exchanges. For us to capitalize on our position as an early entrant into this line of business, we will need to generate widespread support for our auction platform and continue to rapidly expand the scale of our operations. Other online auction or non-auction strategies may prove to be more attractive to the industry than our auction model. If an alternative brokerage exchange model becomes widely accepted in the electricity industry and/or the other energy-related industries we participate in, our business will fail.

We depend on a small number of key energy consumers for a significant portion of our revenue, many of which are government entities that have no obligation to use our auction platform or continue their relationship with us, and the partial or complete loss of business of one or more of these consumers could negatively affect our business.

We have an energy consumer base comprised primarily of large businesses and government organizations. Four of these energy consumers each accounted for over 10% individually and approximately 63% in the aggregate of our revenue for the year ended December 31, 2006, and three of these energy consumers accounted for over 10% individually and approximately 51% in the aggregate of our revenue for the year ended December 31, 2005. Our government contracts are typically for multiple years but are subject to government funding contingencies and cancellation for convenience clauses. Although our non-government contracts create a short-term exclusive relationship with the energy consumer, typically this exclusivity relates only to the specific auction event and expires during the term of the energy contract. Accordingly, we do not have ongoing commitments from these energy consumers to purchase any of their incremental energy requirements utilizing our auction platform, and they are not prohibited from using competing brokerage services. The loss of any of these key energy consumers will negatively impact our

revenue, particularly in the absence of our ability to attract additional energy consumers to use our service.

We do not have contracts for fixed volumes with the energy suppliers who use our auction platform and we depend on a small number of key energy suppliers, and the partial or complete loss of one or more of these energy suppliers as a participant on our auction platform could undermine our ability to execute effective auctions.

We do not have contracts for fixed volumes with any of the energy suppliers who use our auction platform. Four energy suppliers each accounted for over 10% individually and approximately 51% in the aggregate of our revenue for the year ended December 31, 2006, and four of these energy suppliers each accounted for over 10% individually and approximately 57% in the aggregate of our revenue for the year ended December 31, 2005. The loss of any of these, or other significant, suppliers will negatively impact our operations, particularly in the absence of our ability to locate additional national suppliers. We do not have agreements with any of these suppliers preventing them from directly competing with us or utilizing competing services.

We depend on our channel partners to establish and develop certain of our relationships with energy consumers and the loss of certain channel partners could result in the loss of certain key energy consumers.

We rely on our channel partners to establish certain of our relationships with energy consumers. Our ability to maintain our relationships with our channel partners will impact our operations and revenue. We depend on the financial viability of our channel partners and their success in procuring energy consumers on our behalf. One of our channel partners was involved with identifying and qualifying energy consumers which entered into contracts that accounted for approximately 63% of our revenue for the year ended December 31, 2006, and two of our channel partners were involved with identifying and qualifying energy consumers which entered into contracts that accounted for over 10% individually and approximately 80% in the aggregate of our revenue for the year ended December 31, 2005. Channel partners may be involved in various aspects of a deal including but not limited to lead identification, the selling process, project management, data gathering, contract negotiation, deal closing and post-auction account management. To the extent that a channel partner ceases to do business with us, or goes bankrupt, dissolves, or otherwise ceases to carry on business, we may lose access to that channel partner’s existing client base, in which case the volume of energy traded through the World Energy Exchange will be adversely affected and our revenue will decline.

If we are unable to rapidly implement some or all of our major strategic initiatives, our ability to improve our competitive position may be negatively impacted.

Our strategy is to improve our competitive position by implementing certain key strategic initiatives in advance of competitors, including the following:

| • | continuing to develop channel partner relationships; |

| • | strengthen and expand long-term relationships with government agencies; |

| • | target other energy-related markets; |

| • | target utilities in order to broker energy-related products for them; and |

| • | develop a green credits auction platform. |

We cannot assure you that we will be successful in implementing any of these key strategic initiatives, or that our time to market will be sooner than that of competitors. Some of these initiatives relate to new services or products for which there are no established markets, or in which we lack experience and expertise. In addition, the execution of our growth strategies will require significant increases in working capital expenses and increases in capital expenditures and management resources and may subject us to additional regulatory oversight.

If we are unable to rapidly implement some or all of our key strategic initiatives in an effective and timely manner, our ability to improve our competitive position may be negatively impacted, which would have a material and adverse effect on our business and prospects.

We currently derive substantially all of our revenue from the brokerage of electricity, and as a result our business is highly susceptible to factors affecting the electricity market over which we have no control.

We derived approximately 93% of revenue during 2006 and 91% of revenue during 2005 from the brokerage of electricity. Although we expect that our reliance on the brokerage of electricity will diminish as we implement our strategy to expand brokerage into other markets, we believe that our revenue will continue to be highly dependent on the level of activity in the electricity market for the near future. Transaction volume in the electricity market is subject to a number of variables, such as consumption levels, pricing trends, availability of supply and other variables. We have no control over these variables, which are affected by geopolitical events such as war, threat of war, terrorism, civil unrest, political instability, environmental or climatic factors and general economic conditions. We are particularly vulnerable during periods when energy consumers perceive that

electricity prices are at elevated levels since transaction volume is typically lower when prices are high relative to regulated utility prices. Accordingly, if electricity transaction volume declines sharply, our results will suffer.

Our success depends on the widespread adoption of purchasing electricity from competitive sources.

Our success will depend, in large part, on the willingness of commercial, industrial and governmental, or CIG, energy consumers to embrace competitive sources of supply, and on the ability of our energy suppliers to consistently source electricity at competitive rates. In most regions of North America, energy consumers have either no or relatively little experience purchasing electricity in a competitive environment. Although electricity consumers in deregulated regions have been switching from incumbent utilities to competitive sources, there can be no assurance that the trend will continue. In a majority of states and municipalities, including some areas which are technically “deregulated”, electricity is still provided by the incumbent local utility at subsidized rates or at rates that are too low to stimulate meaningful competition by other providers. In addition, extreme price volatility could delay or impede the widespread adoption of competitive markets. To the extent that competitive markets do not continue to develop rapidly our prospects for growth will be constrained. Also, there can be no assurance that trends in government deregulation of energy will continue or will not be reversed. Increased regulation of energy would significantly damage our business.

Even if our auction brokerage model achieves widespread acceptance as the preferred means to transact electricity and other energy-related products, we may be unsuccessful in competing against current and future competitors.

We expect that competition for online brokerage of electricity and other energy-related products will intensify in the near future in response to expanding restructured energy markets that permit consumer choice of energy sources and as technological advances create incentives to develop more efficient and less costly energy procurement in regional and global markets. The barriers to entry into the online brokerage marketplace are relatively low, and we expect to face increased competition from traditional off-line energy brokers, other established participants in the energy industry and online services companies that can launch online auction services that are similar to ours.

Many of our competitors and potential competitors have longer operating histories, better brand recognition and significantly greater financial resources than we do. The management of some of these competitors may have more experience in implementing their business plan and strategy and they may have pre-existing commercial or other relationships with large energy consumers and or suppliers which would give them a competitive advantage. We expect that as competition in the online marketplace increases, brokerage commissions for the energy industry will decline, which could have a negative impact on the level of brokerage fees we can charge per transaction and may reduce the relative attractiveness of our exchange services. We expect that our costs relating to marketing and human resources may increase as our competitors undertake marketing campaigns to enhance their brand names and to increase the volume of business conducted through their exchanges. We also expect many of our competitors to expend financial and other resources to improve their network and system infrastructure to compete more aggressively. Our inability to adequately address these and other competitive pressures would have a material adverse effect on our business, prospects, financial condition and results of operations.

Our costs will increase significantly as we expand our business and in the event that our revenue does not increase proportionately, we will generate significant operating losses in the future.

We expect to significantly increase our operating expenses as we continue to expand our brokerage capabilities to offer additional energy-related products, increase our sales and marketing efforts, and develop our administrative organization. We also are incurring increased costs as a result of being a publicly held company with shares listed on the Toronto Stock Exchange. As we seek to expand our business rapidly, we may incur significant operating losses. For the twelve months ended December 31, 2006 we incurred a net loss of approximately $501,000, which was a direct result of these increased costs. In addition, our budgeted expense levels are based, in significant part, on our expectations as to future revenue and are largely fixed in the short term. As a result, we may be unable to adjust spending in a timely manner to compensate for any unexpected shortfall in revenue which could compound those losses in any given fiscal period.

We depend on the services of our senior executives and other key personnel, the loss of whom could negatively affect our business.

Our future performance will depend substantially on the continued services of our senior management and other key personnel, including our vice president of sales, vice president of business development, vice president of channel sales, chief information officer, vice president of operations and account management, and our market directors. If any one or more of such persons leave their positions and we are unable to find suitable replacement personnel in a timely and cost efficient manner, our business may be disrupted and we may not be able to achieve our business objectives, including our ability to manage our growth and successfully implement our strategic initiatives. We do not have long-term employment agreements with our senior management or other key personnel and we do not have a non-competition agreement with our current chief executive officer.

We must also continue to seek ways to retain and motivate all of our employees through various means, including through enhanced compensation packages. In addition, we will need to hire more employees as we continue to implement our key strategy

of building on our market position and expanding our business. Competition for qualified personnel in the areas in which we compete remains intense and the pool of qualified candidates is limited. Our inability to attract, hire and retain qualified staff on a cost efficient basis may have a material adverse effect on our business, prospects, financial condition, results of operations and ability to successfully implement our growth strategies.

We depend on third-party service and technology providers and any loss or break-down in those relationships could damage our operations significantly if we are unable to find alternative providers.

We depend on a number of third party providers for web hosting, elements of our online auction system, data management and other systems, as well as communications and networking equipment, computer hardware and software and related support and maintenance. There can be no assurance that any of these providers will be able to continue to provide these services without interruption and in an efficient, cost-effective manner or that they will be able to adequately meet our needs as our transaction volume increases. An interruption in or the cessation of such third-party services and our inability to make alternative arrangements in a timely manner, or at all, could have a material adverse effect on our business, financial condition and operating results. There is also no assurance that any agreements that we have in place with such third-party providers will be renewed, or if renewed, renewed on favorable terms.

Our business depends heavily on information technology systems the interruption or unavailability of which could materially damage our operations.

The satisfactory performance, reliability and availability of our exchange, processing systems and network infrastructure are critical to our reputation and our ability to attract and retain energy consumers and energy suppliers to the World Energy Exchange. Our efforts to mitigate systems risks may not be adequate and the risk of a system failure or interruption cannot be eliminated. Although we have never experienced an unscheduled interruption of service, any such interruption in our services may result in an immediate, and possibly substantial, loss of revenue and damage to our reputation.

Our business also depends upon the use of the Internet as a transactions medium. Therefore, we must remain current with Internet use and technology developments. Our current technological architecture may not effectively or efficiently support our changing business requirements.

Any substantial increase in service activities or transaction volume on the World Energy Exchange and the development of the World Green Exchange may require us to expand and upgrade our technology, transaction processing systems and network infrastructure. There can be no assurance that we will be able to successfully do so, and any failure could have a material adverse effect on our business, results of operations and financial condition.

Breaches of online security could damage or disrupt our reputation and our ability to do business.

To succeed, online communications must provide a secure transmission of confidential information over public networks. Security measures that are implemented may not always prevent security breaches that could harm our business. Although to our knowledge we have never experienced a breach of online security, compromise of our security could harm our reputation, cause users to lose confidence in our security systems and to not source their electricity using our auction platform and also subject us to lawsuits, sanctions, fines and other penalties. In addition, a party who is able to circumvent our security measures could misappropriate proprietary information, cause interruptions in our operations, damage our computers or those of our users, or otherwise damage our reputation and business. Our insurance policies may not be adequate to reimburse us for losses caused by security breaches.

We may need to expend significant resources to protect against security breaches or to address problems caused by breaches. These issues are likely to become more difficult and costly as our business expands.