UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

|

| WORLD ENERGY SOLUTIONS, INC. |

| (Name of Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| |

| x | | No fee required |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

World Energy Solutions, Inc.

100 Front Street, 20th Floor

Worcester, MA 01608

(508) 459-8100

April 30, 2013

Dear Stockholder:

We cordially invite you to attend our 2013 Annual Meeting of Stockholders, which will be held on Tuesday, June 11, 2013 at 10:00 a.m. at the Beechwood Hotel, 363 Plantation Street, Worcester, Massachusetts 01605.

On the pages following this letter you will find the notice of our 2013 Annual Meeting, which lists the business matters to be considered at the 2013 Annual Meeting, and the proxy statement, which describes the matters listed in the notice. We have also enclosed your proxy card and our annual report for the year ended December 31, 2012.

Whether or not you attend the 2013 Annual Meeting, it is important that your shares be represented and voted at the 2013 Annual Meeting. Your support of our efforts is important to the other directors and to me regardless of the number of shares you own. I hope you will vote as soon as possible. If you are a stockholder of record, you may vote by completing, signing and mailing the enclosed proxy card in the enclosed postage-prepaid envelope provided. If your shares are held in “street name” – that is, held for your account by a broker or other nominee – you will receive instructions from the holder of record that you must follow for your shares to be voted.

Following completion of the scheduled business at the 2013 Annual Meeting, we will review the current status of our business and answer questions from stockholders. We hope that you will be able to join us on June 11th.

|

| Sincerely, |

|

| /s/ Philip V. Adams |

|

PHILIP V. ADAMS Chief Executive Officer |

WORLD ENERGY SOLUTIONS, INC.

100 Front Street, 20th Floor

Worcester, MA 01608

(508) 459-8100

NOTICE OF 2013 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 11, 2013

To the Stockholders of

World Energy Solutions, Inc.

NOTICE IS HEREBY GIVEN that the 2013 Annual Meeting of Stockholders of World Energy Solutions, Inc., a Delaware corporation, or the 2013 Annual Meeting, will be held at the Beechwood Hotel, 363 Plantation Street, Worcester, Massachusetts 01605, on Tuesday, June 11, 2013, at 10:00 a.m., local time, for the following purposes:

| | 1. | To elect two Class I directors to our Board of Directors, to hold office for a three-year term, or until our 2016 Annual Meeting of Stockholders, and until such director’s successor is duly elected and qualified; |

| | 2. | To approve, on an advisory basis, the compensation paid to our named executive officers in 2012; |

| | 3. | To consider and vote, on an advisory basis, on how frequently we should seek approval from our stockholders, on an advisory basis, of the compensation paid to our named executive officers; |

| | 4. | To ratify the selection of Marcum LLP as our independent registered public accounting firm for the current fiscal year ending December 31, 2013; and |

| | 5. | To transact such other business as may properly come before the 2013 Annual Meeting or any adjournments or postponements thereof. |

The Board of Directors has fixed April 19, 2013 as the record date for the determination of stockholders entitled to notice of, and to vote at, the 2013 Annual Meeting. Accordingly, only stockholders of record at the close of business on April 19, 2013 will be entitled to notice of, and to vote at, the 2013 Annual Meeting or any adjournment or postponement thereof.

|

| By Order of the Board of Directors, |

|

| /s/ James Parslow |

|

JAMES PARSLOW Secretary |

Worcester, Massachusetts

April 30, 2013

WORLD ENERGY SOLUTIONS, INC.

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

This proxy statement is being furnished to our stockholders in connection with the solicitation of proxies by the Board of Directors of World Energy Solutions, Inc. (“we,” “us,” “World Energy” or the “Company”) for use at our 2013 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Tuesday, June 11, 2013 at 10:00 a.m., local time, at the Beechwood Hotel, 363 Plantation Street, Worcester, Massachusetts 01605 and at any adjournment or postponement of the Annual Meeting.

We are mailing this proxy statement and the enclosed proxy on or about April 30, 2013 to our stockholders of record as of April 19, 2013. We are also mailing our Annual Report for the fiscal year ended December 31, 2012 to such stockholders concurrently with this proxy statement. We will furnish, upon written request of any stockholder and the payment of an appropriate processing fee, copies of the exhibits to our Annual Report on Form 10-K for the fiscal year ended December 31, 2012. Please address all such requests to Carolyn Oldenburg, General Counsel, World Energy Solutions, Inc., 100 Front Street, 20th Floor, Worcester, MA 01608.

Only stockholders of record at the close of business on April 19, 2013, the record date for the Annual Meeting, are entitled to receive notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. Each share of our common stock, par value $0.0001 per share, outstanding on the record date is entitled to one vote for each matter presented. As of the close of business on April 19, 2013, there were outstanding and entitled to vote 12,115,621 shares of common stock including 145,000 shares of outstanding restricted stock that are not vested.

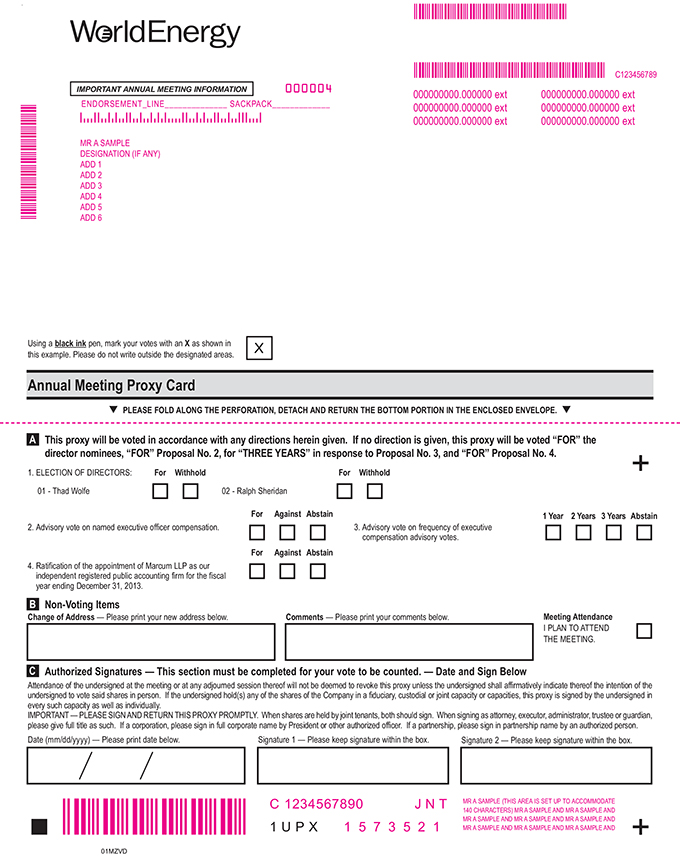

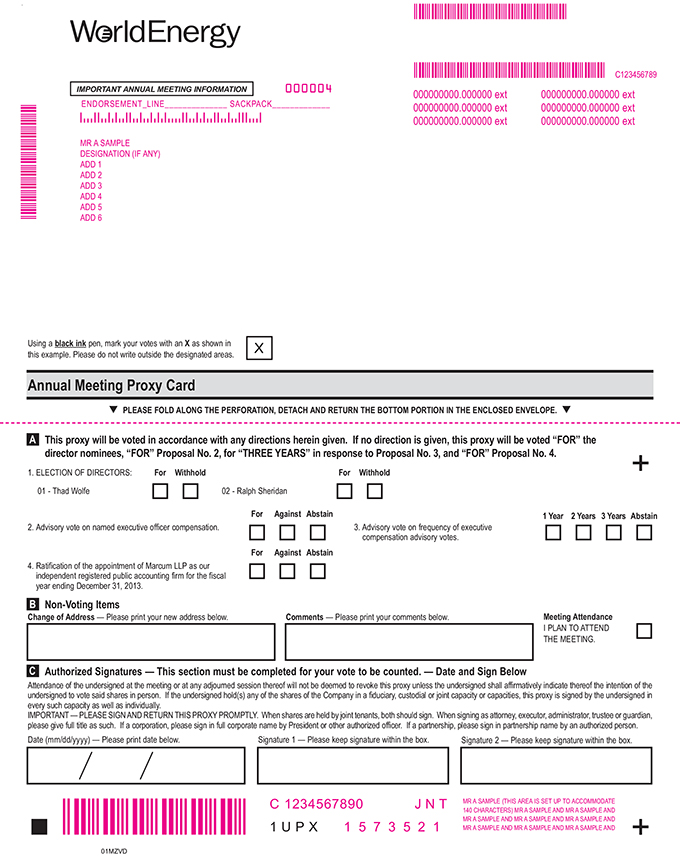

Stockholders of record can vote their shares: (1) by mailing a signed proxy card, or (2) in person at the Annual Meeting.

If your shares are held in “street name” by a bank or brokerage firm, your bank or brokerage firm, as the record holder of your shares, is required to vote your shares according to your instructions. In order to vote your shares, you will need to follow the directions your bank or brokerage firm provides you. Many banks and brokerage firms also offer the option of voting over the Internet or by telephone, instructions for which would be provided by your bank or brokerage firm on your voting instruction form.

The presence, in person or by proxy, of outstanding shares of common stock representing one-third of the total votes entitled to be cast is necessary to constitute a quorum for the transaction of business at our Annual Meeting. Shares that reflect abstentions and broker non-votes will be counted for purposes of determining whether a quorum is present for the transaction of business at the Annual Meeting.

You will be asked to vote, as follows:

| | • | | ForProposal No. 1, you will be asked, with respect to each nominee for Class I director, to vote “FOR” such nominee or to “WITHHOLD” your vote from such nominee. The two nominees for Class I director receiving the highest number of votes “FOR” election will be elected as directors. You may vote for the director nominees or withhold your vote from either one or both of the director nominees. Votes that are withheld, abstentions, and broker non-votes will not be included in the vote tally for the election of the directors and will have no effect on the results of the vote. |

| | • | | ForProposal No. 2, you will be asked to vote, on an advisory, non-binding basis, “FOR” the compensation paid to our named executive officers in 2012, “AGAINST” such compensation or to “ABSTAIN” from voting on such compensation. We will refer to this Proposal as the “Say-on-Pay Proposal.” Because this proposal asks for a non-binding, advisory vote, there is no required vote that would constitute approval. We value the opinions expressed by our stockholders in this advisory vote, and our Compensation Committee, which is responsible for overseeing and administering our executive compensation programs, will consider the outcome of the vote when designing our compensation programs and making future compensation decisions for our named executive officers. Abstentions and broker non-votes, if any, will not have any impact on this advisory vote. |

1

| | • | | ForProposal No. 3, you will be asked to vote, on an advisory, non-binding, basis, whether we should seek advisory stockholder approval of the compensation paid to our named executive officers every “ONE YEAR,” “TWO YEARS,” or “THREE YEARS” or to “ABSTAIN” from voting on the frequency with which we seek such approval. We will refer to this Proposal as the “Say-on-Frequency Proposal.” This proposal also calls for a non-binding, advisory vote. Our Board has recommended that the advisory vote by stockholders on the compensation paid to our named executive officers should occur every three years; however, if another frequency receives more votes, our Board will take that fact into account when making its decision on how often to hold advisory votes on our named executive officer compensation. Abstentions and broker non-votes, if any, will not have any effect on the results of those deliberations. |

| | • | | ForProposal No. 4, you will be asked to vote “FOR” the ratification of our selection of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013, “AGAINST” such ratification or to “ABSTAIN” from voting to so ratify our selection. The ratification of the selection of Marcum LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2013 requires the affirmative vote of the holders of a majority of all the votes present in person or represented by proxy at the Annual Meeting and entitled to vote on this proposal. Abstentions will have the practical effect of a vote to not ratify our selection. Because Proposal No. 4 is a routine proposal on which a broker or other nominee is generally empowered to vote, broker “non-votes” likely will not result from this Proposal. |

None of the matters described above to be acted upon at our Annual Meeting will result in rights of appraisal by stockholders or similar dissenters’ rights.

Shares represented by duly executed proxies received by us and not revoked will be voted at the Annual Meeting in accordance with the instructions contained therein. If no instructions are given, the proxies intend to vote the shares represented thereby:

| | • | | “FOR” Proposal No. 1 to elect the Class I director nominees named herein to the Board; |

| | • | | “FOR” Proposal No. 2, the Say-on-Pay Proposal, to approve, on an advisory basis, the compensation paid to our named executive officers in 2012; |

| | • | | for “THREE YEARS” in response to Proposal No. 3, the Say-on-Frequency Proposal, as the frequency with which we seek an advisory say-on-pay vote; |

| | • | | “FOR” Proposal No. 4 to ratify the selection of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013; and |

| | • | | in accordance with the proxies’ best judgment on any other matters that may properly come before the Annual Meeting. |

You may revoke your proxy at any time before it is voted on any matter by (1) giving written notice of such revocation to the Secretary of the Company at World Energy Solutions, Inc., 100 Front Street, 20th Floor, Worcester, MA 01608, (2) signing and duly delivering a proxy bearing a later date, or (3) attending our Annual Meeting and voting in person. Your attendance at our Annual Meeting will not, by itself, revoke your previously submitted proxy. If you are not a record holder of your shares, you may only revoke your proxy in accordance with the instructions provided to you by your bank or brokerage firm.

We will bear the expenses of preparing, printing and assembling the materials used in the solicitation of proxies. In addition to the solicitation of proxies by use of the mail, we may also use the services of some of our officers and employees (who will receive no compensation for such services in addition to their regular salaries) to solicit proxies personally and by telephone and email. Brokerage houses, nominees, fiduciaries and other custodians will be requested to forward solicitation materials to the beneficial owners of shares held of record by them and we may be required to reimburse them for their reasonable expenses.

Our management does not know of any business other than the matters set forth in the Notice of Annual Meeting of Stockholders and described above that will be presented for consideration at the Annual Meeting. If any other business should properly come before the Annual Meeting, the persons named as proxies will vote the proxies, insofar as the proxies are not limited to the contrary, in regard to such other matters, as seems to them to be in the best interest of our Company and our stockholders. Each of the persons appointed by the enclosed form of proxy present and acting at the meeting, in person or by substitution, may exercise all of the powers and authority of the proxies in accordance with their judgment.

Our principal executive offices are located at 100 Front Street, 20th Floor, Worcester, Massachusetts 01608.

2

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors (the “Board”) is classified into three classes. Our Board currently consists of five directors. Our current Class I directors are Thad Wolfe and Patrick Bischoff. Our current Class II directors are Edward Libbey and John Wellard. Our current Class III director is Philip V. Adams. Directors serve for three-year terms with one class of directors being elected by our stockholders at each Annual Meeting.

At the recommendation of the Corporate Governance and Nominating Committee, the Board of Directors has nominated Mr. Thad Wolfe for re-election. Our other current Class I director, Patrick Bischoff, has decided not to stand for re-election at the Annual Meeting in order to devote more time to his other professional and personal interests. At the recommendation of the Corporate Governance and Nominating Committee, the Board of Directors has nominated Mr. Ralph Sheridan for election as a Class I director. Unless otherwise specified in the proxy, it is the intention of the persons named in the proxy to vote the shares represented by each properly executed proxy for the re-election of Mr. Wolfe and the election of Mr. Sheridan as directors. If elected, each nominee will serve until our 2016 Annual Meeting of Stockholders and until such director’s successor has been duly elected and qualified. Management does not contemplate that either of the nominees will be unable to serve, but in that event, proxies solicited hereby may be voted for a substitute nominee designated by our Board or our Board may choose to reduce the number of directors serving on the Board.

Our Board of Directors recommends that stockholders vote “FOR” the election of the director nominees, Messrs. Thad Wolfe and Ralph Sheridan, as directors of World Energy Solutions, Inc.

INFORMATION AS TO DIRECTORS AND NOMINEES FOR DIRECTOR

Set forth below is the name and age of each member of our Board of Directors, including the nominees for Class I director, his principal occupation for at least the past five years, the year each became a member of our Board of Directors and certain other information regarding each director’s experience, attributes, skills and/or qualifications that led to the conclusion that the individual should be serving as a director of our Company. There are no arrangements or understandings between any director and any other person pursuant to which the director is or was to be selected as a director. The information is current as of April 2, 2013.

| | | | | | |

Name | | Age | | Present Principal Employment and Prior Business Experience | | Director Since |

|

Class I Directors: Term expires at 2013 Annual Meeting of Stockholders |

| | | |

Thad Wolfe | | 70 | | Since September 2008, Mr. Wolfe has been the owner of Polaris Results LLC and an independent contractor currently supporting various clients including Colorado Engineering Inc, an engineering company specializing in radar, Electronic Warfare, and ISR systems and subsystems development; Taxi 2000, a Personal Rapid Transit technology company; and is on the Board of Directors of NanoVapor Inc. Mr. Wolfe worked full-time as Air Force Practice Leader with the Thomas Group during 2007 and 2008. From 1999 to February 2007, Mr. Wolfe was employed with SAIC (NYSE: SAI), a Fortune 500 scientific, engineering and technology applications company, in various roles. Mr. Wolfe served over 31 years in the United States Air Force, retiring in 1996 as a Lieutenant General. Mr. Wolfe’s strong background in government business, long military career, depth of experience in public service, and experience at a public company in our industry assisted us in reaching the conclusion that Mr. Wolfe should serve as a director. | | 2007 |

3

| | | | | | |

Class II Directors: Term expires at 2014 Annual Meeting of Stockholders |

| | | |

| Edward Libbey | | 66 | | Dr. Libbey is the chairman of our Board of Directors and has served in this position since 2007. He brings to this post nearly 40 years of senior international management experience in the energy and high technology industries, including over 20 years with BP, where he served in a variety of commercial, strategic and operational roles in the U.S. and Europe. While at BP, Dr. Libbey played a leading role in creating and running the Company’s international oil trading business. For the last six years, he has been the co-owner and principal of Edward Libbey Consultants Limited, an energy advisory and recruitment consulting firm, where he has completed senior assignments for energy companies around the world. Dr. Libbey holds a First Class Degree and Doctorate in Chemistry from Cambridge and is a Fellow of the Energy Institute. Dr. Libbey’s vast experience in the field of energy and financial expertise assisted the Company in reaching the conclusion that Dr. Libbey should serve as a director. | | 1999 |

| | | |

| John Wellard | | 65 | | Mr. Wellard has been retired since 2006. From March 1996 to April 2005, Mr. Wellard was employed with Union Gas Limited, a Spectra Energy (NYSE: SE) company with $5 billion in assets. He was the Company’s President from May 2003 to December 2004 and served there in various other capacities, including as Senior Vice President of Sales and Marketing & Business Development, Vice President of Sales and Marketing, Senior Vice President of Asset Management and Vice President of Operations. Mr. Wellard’s significant experience in the field of energy assisted the Company in reaching the conclusion that Mr. Wellard should serve as a director. | | 2006 |

|

Class III Director: Term expires at 2015 Annual Meeting of Stockholders |

| | | |

| Philip V. Adams | | 55 | | Mr. Adams was appointed our Chief Executive Officer and a director of our Company on June 6, 2012. He has served as our President since October 2007, and held the position of Chief Operating Officer from October 2003 to June 2012. Mr. Adams sets the strategic direction of the Company and manages its successful execution across the business. Prior to October 2003, Mr. Adams was a senior executive at software and internet companies including Go2 market Momentum, LLC, Exchange Applications, Inc., Pegasystems, Inc., Corporate Software, Inc., Rowe Communications, Inc., and PC Connection, Inc. Mr. Adams also worked as a strategy consultant at Corporate Decisions, Inc., a company subsequently acquired by Mercer Consulting Inc. Mr. Adams is a valuable member of our Board due to his depth of operating, strategic, transactional, and senior management experience in our industry. Additionally, Mr. Adams’ success in planning and executing our growth strategy, underscored by his significant hands-on experience overseeing several key functional areas of our Company, assisted us in reaching the conclusion that Mr. Adams should serve as director. | | 2012 |

Nominees for Election as a Class I Director

Thad Wolfeis a current Class I director and has served as a director of our Company since 2007. Mr. Wolfe has been nominated for re-election at the Annual Meeting to serve until the 2016 Annual Meeting of Stockholders and until his successor is duly elected and qualified. His biography and qualifications are discussed above.

4

Ralph Sheridan, 63, is a nominee for a Class I director. Mr. Sheridan is the managing partner of Value Management LLC, specializing in technology advisory, business realignment and early stage investments. From 2005 to 2010, Mr. Sheridan was the CEO of Good Harbor Partners Acquisition Corporation, a special purpose acquisition corporation targeting acquisitions in security technology. From 1993 to 2003, Mr. Sheridan was President & Chief Executive Officer of American Science & Engineering, Inc. Mr. Sheridan was President and CEO of HEC Energy Corporation from 1987 to 1989. Earlier in his career, he was a business development specialist in energy production, generation and distribution. Mr. Sheridan holds both a BS in Chemistry and an MBA from Ohio State University. We believe Mr. Sheridan would be a valuable addition to the Board due to his financial and business expertise, including a diversified background of managing and directing public companies.

DIRECTOR COMPENSATION

Members of our Board of Directors who are employees of World Energy do not receive compensation for their service as directors. At December 31, 2012, Mr. Adams was our only employee director. Mr. Richard Domaleski served as our Chief Executive Officer and as a director of our Company until June 6, 2012.

Pursuant to our non-employee director compensation plan, each non-employee director receives an annual retainer of $15,000. The director also receives $1,500 for each regularly scheduled Board meeting or committee meeting attended in person. Effective June 6, 2012, we amended the compensation for the Chairman of the Board, Chairman of the Compensation Committee, and Chairman of the Audit Committee. Such amounts were pro-rated for the respective individuals for 2012. The Chairman of the Board receives an additional $15,000 annually; the Chairman of the Audit Committee receives an additional $10,000 annually; and the Chairman of the Compensation Committee receives an additional $5,000 annually.

In addition to cash compensation for services as a member of the Board, each non-employee director was provided the irrevocable option, at his sole election, to be compensated for all or a portion of his 2013 annual retainer and/or fee for in-person attendance at regularly scheduled Board and committee meetings in an equivalent dollar value of shares of common stock in lieu of cash, provided that such election was made prior to December 31, 2012. Mr. Wolfe and Mr. Wellard have elected to be paid 100% of their annual retainer in common stock of our Company, Dr. Libbey has elected to be paid 16.67% of his annual retainer in common stock of our Company, and Mr. Bischoff has elected to be paid 50% of his annual retainer in common stock of the Company. None of the directors elected to take any portion of the fee for in-person attendance at regularly scheduled meetings in shares of common stock. The date of grant is set as the date of the regularly scheduled applicable Board meeting and accordingly, the price of the common stock is set as the closing price of our common stock on the NASDAQ Capital Market as of the date of the applicable Board meeting.

Directors do not receive any additional compensation for participation in meetings held by conference call. We reimburse non-employee directors for reasonable out-of-pocket expenses incurred in connection with attending Board and committee meetings and for fees and reasonable out-of-pocket expenses for their attendance at director education seminars and programs they attend at the request of the Board.

The following table contains information on compensation earned by the non-employee members of our Board of Directors during the fiscal year ended December 31, 2012.

2012 DIRECTOR COMPENSATION

| | | | | | | | | | | | | | | | | | | | |

Name | | Fees Earned or

Paid in

Cash ($) (1) | | | Stock Awards

($) (2) | | | Option Awards

($) (3) | | | All Other

Compensation ($) | | | Total ($) | |

John Wellard | | | 12,000 | | | | 20,008 | | | | — | | | | — | | | | 32,008 | |

Edward Libbey | | | 29,500 | | | | 5,013 | | | | — | | | | — | �� | | | 34,513 | |

Patrick Bischoff | | | 19,500 | | | | — | | | | — | | | | 2,250 | (4) | | | 21,750 | |

Thad Wolfe | | | 12,000 | | | | 17,510 | | | | — | | | | — | | | | 29,510 | |

| (1) | Amounts reflect cash compensation earned in 2012, including prorated increases in annual retainers for the Chairman of the Board, Chairman of the Compensation Committee, and Chairman of the Audit Committee effective June 6, 2012, as applicable. |

5

| (2) | Reflects, if any, the portion of the annual retainer paid for 2012 that a director elected to take in shares of common stock. Represents the aggregate grant date fair value of stock awards granted in the respective fiscal year as computed in accordance with Financial Accounting Standards Board (“FASB”) ASC Topic 718, Compensation — Stock Compensation. There were no stock awards outstanding as of December 31, 2012 as the stock awards granted during the fiscal year were fully vested as of the grant date and the amounts presented in this column are equal to the full grant date fair value of the awards. |

| (3) | There were no stock options granted to our non-employee directors during 2012, and with respect to stock options, no dollar amounts were recognized for financial statement reporting purposes for the year ended December 31, 2012. There were no stock options held by non-employee directors at December 31, 2012. |

| (4) | This figure represents consulting fees paid by us to Mr. Bischoff. The Company had a consulting agreement with Mr. Bischoff which has expired. |

CORPORATE GOVERNANCE

Our Commitment to Good Corporate Governance

We believe that good corporate governance and an environment of the highest ethical standards are important for us to achieve business success and to create value for our stockholders. Our Board is committed to high governance standards and continually works to improve them. We periodically review our corporate governance policies and practices and compare them to those suggested by various authorities on corporate governance and other public companies. We also review guidance and interpretations provided from time to time by the Securities and Exchange Commission (“SEC”), The NASDAQ Stock Market, and under Canadian securities law rules, and consider changes to our corporate governance policies and practices in light of such guidance and interpretations.

Role of Our Board of Directors

Our Board monitors overall corporate performance and the integrity of our financial controls and legal compliance procedures, seeking the opinions of independent auditors and legal counsel as appropriate. It elects our chief executive officer who serves at the discretion of the Board. The Board may appoint other executive officers from time to time as it deems appropriate. There are no family relationships among any of our directors or officers.

Members of our Board keep informed about our business through discussions with our chief executive officer and other members of our senior management team, by reviewing materials provided to them on a regular basis and in preparation for Board and committee meetings, by participating in meetings of the Board and its committees, and by making other inquiries as they consider appropriate from time to time. In addition, we hold periodic meetings between members of executive management and the Board, during which members of the executive management team provide reviews of various aspects of our business operations and discuss our strategy with respect to such operations.

Our Board met six times during 2012. During 2012, each director attended all of the meetings of the Board and committees of the Board on which the director served.

Business Ethics and Compliance

We have adopted a Code of Business Conduct and Ethics applicable to all officers, employees and Board members. The Code of Business Conduct and Ethics is posted in the “Investors” section of our website at www.worldenergy.com, and a print copy will be made available free of charge on written request to Carolyn Oldenburg, General Counsel, World Energy Solutions, Inc., 100 Front Street, 20th Floor, Worcester, MA 01608. Any amendments to, or waivers of, the Code of Business Conduct and Ethics which apply to our Chief Executive Officer, Chief Financial Officer or any person performing similar functions will be disclosed on our website promptly following the date of such amendment or waiver.

Independence of Non-Employee Directors

SEC rules require that a majority of our Board be independent as defined under the rules of a United States national securities exchange. Our shares of common stock are listed on The NASDAQ Capital Market.

6

The NASDAQ Listing Rules define “independent director” as “a person other than an executive officer or employee of the Company or any other individual having a relationship which, in the opinion of the Company’s Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In addition, a director is not independent if: (a) a director who is, or at any time during the past three years was, employed by the Company; (b) a director who accepted or who has a family member who accepted any compensation from the Company in excess of $120,000 during any period of twelve consecutive months within the three years preceding the determination of independence, other than the following: (i) compensation for Board or Board committee service; (ii) compensation paid to a family member who is an employee (other than an executive officer) of the Company; or (iii) benefits under a tax-qualified retirement plan, or non-discretionary compensation; (c) a director who is a family member of an individual who is, or at any time during the past three years was, employed by the Company as an executive officer; (d) a director who is, or has a family member who is, a partner in, or a controlling stockholder or an executive officer of, any organization to which the Company made, or from which the Company received, payments for property or services in the current or any of the past three fiscal years that exceed 5% of the recipient’s consolidated gross revenues for that year, or $200,000, whichever is more, other than the following: (i) payments arising solely from investments in the Company’s securities; or (ii) payments under non-discretionary charitable contribution matching programs; (e) a director of the Company who is, or has a family member who is, employed as an executive officer of another entity where at any time during the past three years any of the executive officers of the Company serve on the compensation committee of such other entity; or (f) a director who is, or has a family member who is, a current partner of the Company’s outside auditor, or was a partner or employee of the Company’s outside auditor who worked on the Company’s audit at any time during any of the past three years.” For purposes of this rule, “family member” means a person’s spouse, parents, children and siblings, whether by blood, marriage or adoption, or anyone residing in such person’s home.

Pursuant to Canadian securities laws, Canadian reporting issuers are required to have a majority of independent directors. The Canadian securities laws generally provide that a director will not be independent unless such director has no material relationship with us (either directly, or as a partner, stockholder or officer of an organization that has a relationship with us). A material relationship is a relationship which could in the view of the Board of Directors, be reasonably expected to interfere with the exercise of a member’s independent judgment. In addition, a director is not independent if (a) the director is, or has been within the last three years, employed by us, is, or an immediate family member is, or has been within the last three years, one of our executive officers, (b) the director, or a member of the director’s immediate family, who is employed as an executive officer has received during any twelve-month period within the last three years more than C$75,000 (approx. US$75,000) in direct compensation from us other than director and committee fees and pension or other deferred compensation, (c) the director or an immediate family member is a current partner of a firm that is our internal or external auditor, the director is a current employee of such a firm, the director has an immediate family member who is a current employee of such a firm and who participates in the firm’s audit, assurance or tax compliance practice, or the director or an immediate family member was within the last three years a partner or employee of such a firm and personally worked on our audit within that time, (d) the director or a member of the director’s immediate family is, or has been within the last three years, employed as an executive officer of another company where one of our executive officers at the same time serves or served on the compensation committee of such company.

Our Board has reviewed all relationships between World Energy and each non-employee director to determine compliance with the Canadian and United States securities laws described above and to evaluate whether there are any other facts or circumstances that might impair a director’s independence. In making this determination, the Board considered the consulting arrangement between our Company and Mr. Bischoff, and determined it did not constitute a material relationship that could affect Mr. Bischoff’s independence. Based on its review, the Board determined that Dr. Libbey, Mr. Bischoff, Mr. Wellard and Mr. Wolfe are “independent directors” as defined under the standards of independence set forth in the NASDAQ Listing Rules, the rules under the Securities Exchange Act of 1934 and Canadian securities laws.

Accordingly, our Board has determined that a majority of its members are “independent” as that term is defined under the applicable SEC, NASDAQ, and Canadian securities law rules.

Communications with the Board

Our Board welcomes the submission of any comments or concerns from stockholders and any interested parties. Communications should be in writing and addressed to Carolyn Oldenburg, General Counsel, World Energy Solutions, Inc., 100 Front Street, 20th Floor, Worcester, MA 01608 and marked to the attention of the Board or any of its committees, individual directors or non-management directors as a group. All correspondence will be forwarded to the intended recipient(s).

Annual Meeting Attendance

Directors are encouraged to attend our annual meetings of stockholders. All five of our directors attended the 2012 Annual Meeting of Stockholders.

7

Committees of the Board

Our Board currently has three standing committees: the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee. Each committee is composed solely of directors determined by the Board to be independent under the applicable rules of the SEC, NASDAQ, and Canadian securities laws, including, in the case of all members of the Audit Committee, the independence requirements contemplated by Rule 10A-3 under the Securities Exchange Act of 1934. The Board has adopted a written charter for each standing committee. You may find copies of the charters of the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee in the “Investors” section of our website at www.worldenergy.com, and print copies will be made available free of charge on written request to Carolyn Oldenburg, General Counsel, World Energy Solutions, Inc., 100 Front Street, 20th Floor, Worcester, MA 01608. The Board also may appoint from time to time ad hoc committees to address specific matters.

Audit Committee. The members of our Audit Committee are Messrs. Libbey, Wellard and Wolfe, all of whom are independent. Dr. Libbey is our audit committee financial expert. The Audit Committee met six times in 2012. The Audit Committee is responsible for assisting the Board in fulfilling its responsibilities for oversight of our accounting and financial reporting processes and audits of our financial statements. The Audit Committee will, among other things, independently monitor our financial reporting process and internal control systems, review our financial statements to ensure their quality, integrity and compliance with accounting standards, ensure the adequacy of procedures related to such review and oversee the work of our external auditors. The Audit Committee is separately designated and established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934.

Compensation Committee. The members of our Compensation Committee are Messrs. Libbey, Wellard and Wolfe. The Compensation Committee met two times in 2012. The Compensation Committee is responsible for overseeing the discharge of the Board’s responsibilities related to compensation of our directors and executive officers. The Compensation Committee will, among other things, review the adequacy of compensation, review and approve corporate goals and objectives relevant to compensation and make recommendations regarding compensation of the Chief Executive Officer and our other directors and officers. The Compensation Committee will assess all aspects of compensation including salaries, bonuses, long-term incentive compensation and other performance based incentives, taking into account industry comparables to ensure that compensation is fair and reasonable.

The Compensation Committee has implemented an annual performance review program for our executives, under which annual performance goals are determined and set forth in writing at the beginning of each calendar year for our Company as a whole and each executive. Annual corporate goals are proposed by management and considered for approval by the Board of Directors at the end of each calendar year for the following year. Individual goals focus on contributions that facilitate the achievement of the corporate goals and are set during the first quarter of each calendar year. Executive officer goals are discussed with the Chief Executive Officer and considered for approval by the Compensation Committee. Annual salary increases, annual bonuses, and any stock awards granted to our executives are tied to the achievement of these corporate, department and individual performance goals. The Compensation Committee has the authority to select, retain and terminate compensation consultants and other outside advisors to assist in the evaluation of executive officer compensation. It did not engage any compensation consultant for assistance in determining or recommending the amount or form of executive or director compensation in 2012.

Corporate Governance and Nominating Committee. The members of our Corporate Governance and Nominating Committee are Messrs. Libbey, Wellard and Wolfe. The Corporate Governance and Nominating Committee met once in 2012. The Corporate Governance and Nominating Committee is responsible for assisting the Board in discharging its responsibilities related to corporate governance practices and the nomination of directors. The Corporate Governance and Nominating Committee will, among other things, develop our corporate governance practices, recommend procedures to assist the Board in functioning cohesively and effectively, supervise our securities compliance procedures and have the authority to engage outside advisors where necessary. This committee is also responsible for recommending to the Board director nominees to be elected at stockholder meetings, taking into consideration the appropriate size of the Board, the competencies and skills required and whether each nominee can sufficiently fulfill his or her duties as a member of the Board.

The Corporate Governance and Nominating Committee will consider for nomination to the Board candidates recommended by stockholders. Recommendations should be sent to the Corporate Governance and Nominating Committee, c/o Carolyn Oldenburg, General Counsel, World Energy Solutions, Inc., 100 Front Street, 20th Floor, Worcester, MA 01608. The deadline for making recommendations of director nominees for possible inclusion in our proxy statement for our 2014 Annual Meeting of Stockholders is described at the end of this proxy statement under “Stockholder Proposals.” Recommendations must be in writing and must contain the information set forth in the Company’s Amended and Restated By-Laws. The minimum qualifications and specific qualities and skills required for a nominee for director are that the nominee shall have the highest personal and professional integrity, shall have demonstrated exceptional ability and judgment, and shall be most effective, in conjunction with the other nominees to the Board, in collectively serving the long-term interests of the stockholders. In addition to considering candidates suggested by stockholders, the Corporate Governance and Nominating Committee may consider potential candidates suggested by current directors, Company officers, employees, third-party search firms and others. The Corporate Governance and Nominating Committee screens all potential candidates in the same manner regardless of the source of the recommendation. The Corporate Governance and Nominating Committee does not consider diversity a factor in choosing its nominees. The Corporate Governance and Nominating Committee determines whether the candidate meets our minimum qualifications and specific qualities and skills for directors and whether requesting additional information or an initial screening interview is appropriate. The current Class I director nominee was approved by the non-management directors. No other nominations were received.

8

Board Leadership Structure and Role in Risk Oversight

Currently, we have separate individuals serving as Chairman of the Board of Directors and our principal executive officer. The Board believes the separation of these two positions has served our Company well, but it has no set policy regarding the separation of the roles of Chairman of the Board of Directors and Chief Executive Officer in the future. Our Chief Executive Officer, Philip Adams, has served as a director of our Company since his appointment to the position of Chief Executive Officer in June 2012. Dr. Libbey, one of our independent directors, serves as our Chairman of the Board, and oversees a five member board, a majority of which are independent. The Chairman provides guidance to the Chief Executive Officer, assists on setting the agenda for Board meetings, and presides over meetings of the full Board. The Board of Directors believes that this leadership structure provides an appropriate allocation of roles and responsibilities at this time.

The Board of Directors takes an active role, as a whole and at the committee level, in overseeing management of our Company’s risks. Our management keeps the Board of Directors apprised of significant risks facing our Company and the approach being taken to understand, manage and mitigate such risks. Specifically, strategic risks are overseen by the full Board of Directors; financial risks are overseen by the Audit Committee; risks relating to compensation plans and arrangements are overseen by the Compensation Committee; and risks associated with director independence and potential conflicts of interest are overseen by the Audit Committee. Additional review or reporting on enterprise risks is conducted as needed or as requested by the full Board of Directors or the appropriate committee.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following tables set forth information regarding the beneficial ownership of our common stock as of April 2, 2013, by:

| | • | each person or entity known by us to own beneficially more than 5% of our common stock; |

| | • | each of our directors and director nominees; |

| | • | each of the executive officers named in the summary compensation table; and |

| | • | all of our directors and executive officers as a group. |

In accordance with SEC rules, we have included in the number of shares beneficially owned by each stockholder all shares over which such stockholder has sole or shared voting or investment power, and we have included all shares that the stockholder has the right to acquire within 60 days after April 2, 2013 through the exercise of stock options or any other right. Unless otherwise indicated, each stockholder has sole voting and investment power with respect to shares beneficially owned by that stockholder. For purposes of determining the equity and voting percentages for each stockholder, any shares that such stockholder has the right to acquire within 60 days after April 2, 2013 are deemed to be outstanding, but are not deemed to be outstanding for the purpose of determining the percentages for any other stockholder.

9

Stockholders Known by Us to Own Over 5% of Our Common Stock

| | | | | | | | |

Name and Address of Beneficial Owner | | Amount of

Beneficial

Ownership | | | Percent of Shares Beneficially Owned (1) | |

| | |

Richard Domaleski / Roman Holdings Trust / RD Holdings (2) | | | 1,679,527 | (3) | | | 13.9 | % |

Royce & Associates 745 Fifth Avenue New York, NY 10151 | | | 1,172,020 | (4) | | | 9.7 | % |

GSE Consulting, L.P. reporting group (5) | | | 1,000,000 | (6) | | | 8.3 | % |

Austin W. Marxe and David M. Greenhouse c/o Special Situations Funds 527 Madison Avenue, Suite 2600 New York, NY 10022 | | | 928,330 | (7) | | | 7.7 | % |

Ardsley Advisory Partners (8) 262 Harbor Drive Stamford, Connecticut 06902 | | | 794,750 | (9) | | | 6.6 | % |

| (1) | The number of shares and percentages has been determined as of April 2, 2013 in accordance with Rule 13d-3 of the Securities Exchange Act of 1934. At that date, a total of 12,115,621 shares of common stock were issued and outstanding, which includes 145,000 shares of restricted stock that are outstanding and not yet vested. |

| (2) | The address of Richard Domaleski is 40 Jackson Street, Suite 1090, Worcester, MA 01608; Roman Holdings Trust is 2935 Barrymore Court, Orlando, FL 32835; and RD Holdings is c/o Callister Nebeker & McCullough, Parkview Plaza 1, 2180 South East 1300 Suite 600, Salt Lake City, UT 84106. |

| (3) | Consists of 254,527 shares held in the name of Mr. Domaleski; 475,000 shares held by Dana Domaleski and David T. Bunker, as co-trustees of the Roman Holdings Trust, of which Mr. Domaleski is the principal beneficiary; and 950,000 shares held by RD Holdings LLC. Mrs. Domaleski and Mr. Bunker, as co-trustees, share voting and investment power with respect to the shares held by the Roman Holdings Trust. The trustees disclaim beneficial ownership of these shares. These shares are also pledged as collateral for a line of credit that Mr. Domaleski has with his financial institution. |

| (4) | The amount shown and the following information are based on a Schedule 13G/A filed with the SEC on January 29, 2013 by Royce & Associates, LLC. According to the Schedule 13G/A, various accounts managed by Royce & Associates, LLC have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of shares of our common stock. |

The beneficial ownership of one account, Royce Micro Cap Fund, an investment company registered under the Investment Company Act of 1940, and managed by Royce & Associates, LLC, amounted to 733,900 shares of our common stock.

| (5) | The address of GSE Consulting, L.P.; GSE Consulting, GP, LLC; Gulf States Energy, Inc.; Mr. Jason Helms; and Mr. Justin Helms is 200 Crescent Court, Suite 1065, Dallas, Texas 75201. The address of Glenwood Energy Partners, Ltd.; Glenwood, Energy Partners GP, LLC; Mr. Jeremiah Collins; and Mr. Byron G. Biggs is 550 Bailey, Suite 360, Fort Worth, Texas 76107. The address of Mr. Billy E. Fowler is 2721 N.W. 36th Street, Norman, Oklahoma, 73072. Pursuant to the GSE Schedule 13D, Mr. Brian Dafferner is not a controlling person and no address was provided. |

| (6) | We relied on a Schedule 13D filed with the SEC on November 10, 2011 by GSE Consulting, L.P (“GSE Consulting”); GSE Consulting GP, LLC; Gulf States Energy, Inc. (“Gulf States Energy”); Glenwood Energy Partners, Ltd. (“Glenwood Energy Partners”); Glenwood Energy Partners GP, LLC; Jason Helms; Justin Helms; Billy E. Fowler; Jeremiah Collins; and Byron G. Biggs (the “GSE Schedule 13D”) for this information. |

10

GSE Consulting owned 1,000,000 shares of common stock on or about October 31, 2011.

GSE Consulting, GP is the general partner of GSE Consulting. Gulf States Energy and Glenwood Energy Partners are the two managing members of GSE Consulting, GP. Glenwood Energy Partners GP is the general partner of Glenwood Energy Partners. GSE Consulting, GP; Gulf States Energy; Glenwood Energy Partners; and Glenwood Energy Partners GP shared the power to vote and direct the disposition of the common stock owned by GSE Consulting.

Mr. Jason Helms, Mr. Justin Helms, and Mr. Billy E. Fowler are the controlling persons of Gulf States Energy, which is the co-managing member of GSE Consulting, GP. In that capacity, Messrs. Helms, Helms, and Fowler shared the power to vote and direct the disposition of the 1,000,000 shares of common stock owned by GSE Consulting. Messrs. Helms, Helms, and Fowler were each deemed to beneficially own 1,000,000 shares of common stock.

Mr. Jeremiah Collins and Mr. Byron G. Biggs are the managing members of Glenwood Energy Partners GP, the general partner of Glenwood Energy Partners. In that capacity, Messrs. Collins and Biggs shared the power to vote and direct the disposition of the 1,000,000 shares of common stock owned by GSE Consulting. Messrs. Collins and Biggs were each deemed to beneficially own 1,000,000 shares of common stock.

Pursuant to Item 6 of the GSE Schedule 13D, on or about October 31, 2011, the 1,000,000 shares of common stock were distributed as follows:

| | | | |

Jason Helms | | | 237,500 shares | |

Justin Helms | | | 118,750 shares | |

Billy E. Fowler | | | 118,750 shares | |

Brian Dafferner | | | 50,000 shares | |

Glenwood Energy Partners | | | 475,000 shares | |

Total distribution | | | 1,000,000 shares | |

The GSE Schedule 13D does not disclose whether these individuals constitute a group as defined by Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, however, because of all of these individuals with the exception of Mr. Dafferner signed the GSE Schedule 13D, we have included this disclosure in our Proxy Statement.

| (7) | The amount shown and the following information are based on a Schedule 13G/A filed with the SEC on February 13, 2013 by Austin W. Marxe and David M. Greenhouse for this information. |

Special Situations Cayman Fund, L.P. owns 645,918 shares of common stock. Special Situations Fund III QP, L.P. owns 282,412 shares of common stock.

Messrs. Marxe and Greenhouse are the controlling principals of AWM Investment Company, Inc., the general partner of and investment adviser to Special Situations Cayman Fund, L.P. AWM Investment Company also serves as the general partner of MGP Advisers Limited Partnership, the general partner of and investment adviser to Special Situations Fund III QP, L.P.

Messrs. Marxe and Greenhouse share voting and investment power over 645,918 shares of common stock owned by Special Situations Cayman Fund, L.P., and 282,412 shares of common stock owned by Special Situations Fund III QP, L.P. Messrs. Marxe and Greenhouse are deemed to beneficially own an aggregate of 928,330 shares of common stock.

| (8) | The address of the business office of each of the reporting persons, with the exception of Ardsley Energy Offshore, is 262 Harbor Drive, Stamford, Connecticut 06902. The address of the registered office of Ardsley Energy Offshore is Romasco Place, Wickhams Cay 1, Road Town Tortola, British Virgin Islands. |

| (9) | We relied on a Schedule 13G/A filed with the SEC on February 13, 2013 by Ardsley Partners Renewable Energy Fund, L.P.; Ardsley Renewable Energy Offshore Fund, Ltd.; Ardsley Advisory Partners; Ardsley Partners I; and Philip J. Hempleman for this information. |

Ardsley Partners Renewable Energy Fund, L.P. owns 770,850 shares of common stock. Ardsley Renewable Energy Offshore Fund, Ltd owns 23,900 shares of common stock.

11

Ardsley Advisory Partners shares ownership of an aggregate of 794,750 shares of common stock. Ardsley Advisory Partners is the investment manager of Ardsley Renewable Energy Offshore Fund. It is also the investment adviser of Ardsley Partners Renewable Energy Fund and of a certain managed account. Ardsley Advisory Partners has the power to vote and direct the disposition of the common stock owned by Ardsley Renewable Energy Offshore Fund, Ardsley Partners Renewable Energy Fund, and the managed account.

Ardsley Partners I shares ownership of the 770,850 shares of common stock directly owned by Ardsley Partners Renewable Energy Fund. Ardsley Partners I is the general partner of Ardsley Partners Renewable Energy Fund and shares the power to vote and direct the disposition of the common stock owned by Ardsley Partners Renewable Energy Fund.

Mr. Philip J. Hempleman is the managing partner of Ardsley Advisory Partners and Ardsley Partners I and, in that capacity, directs their operations and may be deemed to be the indirect beneficial owner of an aggregate of 794,750 shares of common stock owned by Ardsley Renewable Energy Offshore Fund, Ardsley Partners Renewable Energy Fund, and the managed account. He disclaims beneficial ownership of all shares.

Directors, Director Nominees, and Officers

| | | | | | |

| | | | | | | Percent of shares |

Name and address of beneficial owner (1) | | Nature of beneficial ownership | | Amount of beneficial ownership (3) | | beneficially owned (2) |

Philip Adams (4) | | Chief Executive Officer and Director | | 328,625 | | 2.7% |

James Parslow (5) | | Chief Financial Officer | | 95,938 | | * |

Edward Libbey (6) | | Director | | 183,482 | | 1.5% |

Patrick Bischoff (7) | | Director | | 49,298 | | * |

Thad Wolfe | | Director | | 23,588 | | * |

John Wellard | | Director | | 20,396 | | * |

Ralph Sheridan | | Director Nominee | | 0 | | * |

All executive officers and directors (6 persons) (8) | | 701,327 | | 5.7% |

| * | Percentage of shares beneficially owned does not exceed one percent. |

| (1) | The address of each stockholder in the table is c/o World Energy Solutions, Inc., 100 Front Street, 20th Floor, Worcester, Massachusetts 01608. |

| (2) | The number of shares and percentages has been determined as of April 2, 2013 in accordance with Rule 13d-3 of the Securities Exchange Act of 1934. At that date, a total of 12,115,621 shares of common stock were issued and outstanding, which includes 145,000 shares of restricted stock that are outstanding and not yet vested. |

| (3) | Represents shares subject to outstanding stock options and warrants currently exercisable or exercisable, or currently vested or that will vest, within 60 days of April 2, 2013. |

| (4) | Includes 40,625 shares of common stock issuable upon exercise of stock options exercisable within 60 days of April 2, 2013, and 75,000 shares of restricted stock that are outstanding and not yet vested. |

| (5) | Includes 88,250 shares of common stock issuable upon exercise of stock options exercisable within 60 days of April 2, 2013. |

| (6) | Includes 66,300 shares of common stock held in the name of Dr. Libbey’s wife. |

| (7) | Includes 48,933 shares held by Spinnaker Ventures LLC, of which Mr. Bischoff is the managing director and over which he holds voting and investment power. Spinnaker Ventures LLC is owned by Bischoff Alaska LLC. Mr. Bischoff’s children are the beneficiaries of the trust. Mr. Bischoff disclaims beneficial ownership of these shares and is not a trustee of the Bischoff Alaska Irrevocable Trust and holds no voting or investment power. |

| (8) | Includes 128,875 shares of common stock issuable upon exercise of stock options exercisable within 60 days of April 2, 2013, and 75,000 shares of restricted stock that are outstanding and not yet vested. |

12

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Philosophy

World Energy seeks to instill our core values of integrity, trust, accountability, personal responsibility, employee empowerment, and transparency in our employees and to encourage them to strive to do their best while feeling rewarded. We believe in the power of open disclosure and know the best way to build and strengthen our reputation and Company is through honesty, trust, and hard work. The goal of our executive officer compensation program is the same as our goal in operating our company – to create long-term value for our stockholders. We welcome the opportunity to share this Compensation Discussion and Analysis (CD&A) with our stockholders. The Compensation Committee of our Board of Directors oversees our executive compensation program. In this role, the Compensation Committee annually reviews, sets and approves all compensation decisions for our named executive officers.

Objectives and Philosophy of Our Executive Compensation Program

The primary objectives of the Compensation Committee with respect to executive compensation are to:

| | • | | attract, retain and motivate the best possible executive talent; |

| | • | | align executives’ incentives with the creation of stockholder value; |

| | • | | ensure executive compensation is aligned with our corporate strategies and business objectives; |

| | • | | minimize risk to the organization through a reward program tightly aligned to business achievement objectives; and |

| | • | | promote the achievement of key strategic and financial performance measures by linking short- and long-term cash and equity incentives to the achievement of measurable corporate and individual performance goals. |

To achieve these objectives, the Compensation Committee evaluates our executive compensation program with the goal of setting compensation levels competitive with those of other companies in our industry and in our region who compete with us for executive talent. In addition, our executive compensation program ties each executive’s overall compensation to key strategic, financial and operational goals such as successful integration of our recent acquisitions, increased presence in the mid-market, additional analyst coverage, securing capital as needed and attainment of revenue and adjusted EBITDA targets. We may also provide a portion of our executive compensation as stock options or restricted stock that vest over time, which we believe helps to retain our executives and aligns their interests with those of our stockholders. Stock grants allow the executives to participate in the long term success of our Company as our stock price appreciates.

We compete for executive personnel. Accordingly, the Compensation Committee generally targets base salary and annual cash incentive bonuses for executives consistent with similarly situated executives in peer group companies. Variations may occur as dictated by the experience levels and market factors. For example, our executive officers did not receive a salary increase in 2009, 2010 or 2011 due to external economic conditions and a desire to conserve our financial resources during years of economic uncertainty. Then, the Compensation Committee decided that after a three-year salary freeze and in light of the financial success of the Company, our executives were entitled to an above average base salary increase. The Compensation Committee granted a 10.8% base pay increase in 2012 and also increased bonus targets for our executives. Specific bonus details will be described in the sections below.

Process for Executive Compensation Determination

The Compensation Committee is responsible for developing and administering the compensation program for executive officers. Their recommendations are then submitted to the full Board (excluding the CEO) for approval.

The CEO, with the assistance of our Human Resources department, makes annual recommendations to the Compensation Committee regarding base salaries, cash incentive payments and equity grants for all executive officers with the exception of the CEO, whose salary is determined by the Compensation Committee.

| | • | Salary recommendations are only made following the Compensation Committee’s review of peer executive compensation survey data and an evaluation of individual performance during the prior year. |

| | • | Annual cash incentive payments are primarily determined by our financial performance and individual objectives as defined below. |

13

Our process for evaluating executive compensation includes providing the Compensation Committee with comprehensive information and data on the elements of executive pay for officers and other key employees from peer companies as noted below. The peer groups chosen are those with revenue targets under $300 million, business focused on the alternative/green energy industry or high-tech software space, and within geographic proximity to World Energy’s location. The Compensation Committee uses its judgment supported by facts and documentation in making compensation decisions. Below is fiscal year 2011 compensation information for peer companies that was reviewed by the Compensation Committee and used as a baseline for decisions regarding executive pay practices.

| | | | |

Peer Company | | 2011 Annual

Revenue (in millions) | |

Fuel Cell Energy | | $ | 122.60 | |

Plug Power | | $ | 27.60 | |

WORLD ENERGY | | $ | 20.52 | |

Active Power, Inc. | | $ | 75.40 | |

Lime Energy | | $ | 120.10 | |

Comverge | | $ | 136.0 | |

Enernoc | | $ | 286.60 | |

Components of our Executive Compensation Program

The primary elements of our executive compensation program contain some or all of the following:

| | • | | annual cash incentive bonuses; |

| | • | | insurance, retirement and other employee benefits; and |

| | • | | in some cases, severance. |

We do not currently have a policy or target for allocating compensation between long-term and short-term compensation, between cash and non-cash compensation or among the different forms of non-cash compensation. In the event we institute long- and short-term compensation targets, the Compensation Committee will determine the appropriate level and mix of the various compensation components.

Base Salary

The Compensation Committee believes that base salaries recognize the experience, skills, knowledge and responsibilities required of all our employees, including our executive officers. We believe executive base salaries should be targeted near the median of the range of salaries for executives in similar positions at comparable companies. In comparing executive base pay salaries with those of peer companies, our Compensation Committee felt a 10.8% increase for executive base salaries in 2012 was warranted to move executive base salaries closer to peer company executives and to reward company achievement.

Base salaries are reviewed at least annually by our Compensation Committee, and are adjusted from time to time to realign salaries of our executive officers after taking into account individual responsibilities, performance and experience.

14

| | | | |

Average Base Salaries from Peer Companies | | | |

CEO | | $ | 395,558 | |

CFO | | $ | 342,793 | |

| |

World Energy 2012 Base Salaries | | | |

CEO | | $ | 276,937 | |

COO/President | | $ | 260,322 | |

CFO | | $ | 210,473 | |

Our Human Resources department uses publicly available peer company executive pay information to assess the market competitiveness of our senior executives’ salaries. Typically, salary and bonus recommendations for consideration are made by the CEO and presented to the Compensation Committee, and then the Compensation Committee’s recommendations are submitted to the full Board for approval. Because the CEO is a member of our Board of Directors he recuses himself from voting on compensation matters affecting CEO compensation.

Annual Cash Incentive Bonuses

We have an annual cash incentive bonus plan for our executives intended to compensate for achievement of company strategic, operational and financial goals. Amounts payable under the annual cash incentive bonus plan are fixed dollar targets. Bonus targets for 2011 were given equal weight in the bonus analysis. The corporate targets generally conform to the business plan approved by the Board, specifically revenue and adjusted EBITDA goals, and corporate strategic initiatives such as integration of acquisitions, attaining third party financing, if needed, expanding our foothold in the “mid-market” (small and medium size businesses), and obtaining additional analyst coverage. The Compensation Committee approves the Company and executive performance goals and the determination of potential bonus amounts based on achievement of those goals.

The Compensation Committee works with the Chief Executive Officer to develop corporate and individual goals that they believe can be reasonably achieved over the next year. To date, these have been task specific goals aligned with the Company’s business plan. We expect to continue to tie our executive bonuses to successful completion of our strategic initiatives and attaining corporate financial targets such as revenue and income. The Compensation Committee anticipates that this model will evolve as the Company grows.

For fiscal year 2012, bonus target parameters for our executive team were defined as follows:

| | | | | | | | | | | | |

2012 Executive Bonus Targets | | CEO | | | President/COO | | | CFO | |

Attainment of revenue goal | | $ | 66,667 | | | $ | 50,000 | | | $ | 30,000 | |

Attainment of Adjusted EBITDA goal | | $ | 66,667 | | | $ | 50,000 | | | $ | 30,000 | |

Achievement of strategic initiatives | | $ | 66,667 | | | $ | 50,000 | | | $ | 30,000 | |

Total Annual Bonus Targets | | $ | 200,000 | | | $ | 150,000 | | | $ | 90,000 | |

Cash incentive bonus participants are eligible for bonus payments ranging from 0% to over 200% of their targets. Below are specific payments made to our CEO and CFO. As of June 6, 2012 our former CEO, Richard Domaleski, resigned. Concurrently, Philip V. Adams, our former President/COO was appointed President/CEO. Mr. Adams’ bonus target for 2012 was a hybrid of his President/COO bonus for the first 5 months of the year and the CEO bonus target for the remainder of the year. See the table below for specific targets and achievements.

15

Bonuses for 2012 were structured such that one-third of each executive’s bonus payment was tied to each target as noted above. Based upon an analysis by our Compensation Committee of the attainment of the bonus target parameters for our two executive officers, and following a recommendation by our Chief Executive Officer with respect to our Chief Financial Officer, the Compensation Committee recommended and the Board approved the following 2012 bonus payments:

| | | | | | | | | | | | | | | | | | | | |

2012 Corporate and Individual Bonus Targets | | Target | | | Revenue

Achievement | | | Adj. EBITDA

Achievement | | | Strategic

Initiative | | | 2012 Bonus

Payment | |

Chief Executive Officer, Philip Adams | | $ | 179,166 | (1) | | $ | 59,722 | | | $ | 59,722 | | | $ | 107,500 | | | $ | 226,944 | |

Chief Financial Officer, James Parslow | | $ | 90,000 | | | $ | 30,000 | | | $ | 30,000 | | | $ | 54,000 | | | $ | 114,000 | |

| (1) | This represents the total target bonus amount for Mr. Adams in his roles as President & Chief Operating Officer and Chief Executive Officer, pro-rated for the period of time he served in each role for 2012. |

The above payments were based upon the Compensation Committee’s review of certain factors including: achievement of revenue target for 2012, achievement of the adjusted EBITDA target for 2012, and achievement of strategic initiatives. Strategic initiatives included securing $10.5 million of debt from two institutions, the successful closing of Northeast Energy Partners strategic acquisition, achievement of four quarters of sequential record revenue and a seamless CEO transition. The Compensation Committee has discretion to adjust bonus amounts within an executive officer’s total target bonus, based on the Compensation Committee’s assessment of corporate and individual achievements. The Compensation Committee considered the effect of the restatement of our financials on the executives’ achievement of the bonus targets and determined that the executives had materially met the targets established and awarded 100% for achievement of both the revenue and adjusted EBITDA goals.

Equity Award

Our equity award program is the primary vehicle for offering long-term incentives to our executives. We believe equity grants provide executives a strong link to our long-term performance, create an ownership culture, and help align interests of our executives with our stockholders. In addition, the vesting feature of our equity grants is intended to further our goal of executive retention by providing an incentive for our executives to remain in our employ during the vesting period. In determining the size of equity grants to our executives, our Compensation Committee considers comparable share ownership of executives in our compensation peer group, our company-level performance, the executive’s performance, the amount of equity previously awarded, recommendations of the Chief Executive Officer, and suggested grant levels as defined in our annual long-term incentive stock grant program.

Equity awards to executives are made in the form of stock options or restricted stock. In 2012, an equity grant was offered to our CFO in the amount of 12,000 options as part of our annual long-term incentive company grant program. This grant was approved by the Compensation Committee and by the entire Board.

After the appointment of Mr. Adams as CEO, the Compensation Committee granted Mr. Adams 50,000 shares of restricted stock. The shares will vest 100% at the four year anniversary of grant date.

The Compensation Committee reviews all components of the executive’s compensation when determining annual equity awards to ensure that an executive’s total compensation conforms to our overall philosophy and objectives. We intend that the annual aggregate value of these awards will be set near median levels for companies in our compensation peer group. Typically, any new stock granted to our executives vest 25% per year over the first four years of the seven-year option term except as noted above for the appointment of Mr. Adams as CEO. Vesting typically ceases upon termination of employment. Exercise rights cease shortly after termination of employment except in the case of death or disability.

We do not have a policy to grant awards annually to our executive team, but the Compensation Committee and Board may adopt such a policy in the future. The exercise price of all stock options is equal to the weighted average closing price of our stock on NASDAQ on the date on which the option is granted.

16

Benefits and Other Compensation

We maintain broad-based benefits that are provided to all employees, including medical and dental insurance, life and disability insurance, a 401(k) plan, and a Flexible Spending Account. Executives are eligible to participate in all of our employee benefit plans, in each case on the same basis as other employees. The 401(k) Plan has a Company contribution provision, which is subject to the Board’s discretion. To date, no Company contributions have been made to the Plan. The below table sets forth our general benefit package.

| | | | |

Benefit or Perquisite | | All Full-Time Employees | | Named Executive Officers |

Automobile Allowance | | Not Offered (1) | | Not Offered |

| | |

Deferred Compensation Plan | | Not Offered | | Not Offered |

| | |

Employee Stock Purchase Plan | | Not Offered | | Not Offered |

| | |

Flexible Spending Account | | ü | | ü |

| | |

Health Insurance | | ü | | ü |

| | |

Life Insurance | | ü | | ü |

| | |

Long-Term Disability | | ü | | ü |

| | |

Paid Time-Off | | ü | | ü |

| | |

Retirement Savings Plan | | ü | | ü |

| | |

Short-Term Disability | | ü | | ü |

| | |

Supplemental Life Insurance | | ü | | ü |

| | |

Tax Planning and Preparation | | Not Offered | | Not Offered |

| (1) | The Company has offered this benefit to certain non-executive employees. |

Employment Agreements and Potential Payments Upon Termination or Change in Control

We have entered into employment agreements with certain of the named executive officers and the material terms of which are summarized below.

Effective June 6, 2012, Mr. Philip Adams was appointed as our President and Chief Executive Officer. Prior to that time, he served as our President since October 2007 and Chief Operating Officer since October 2003. Pursuant to a letter of offer for employment with Mr. Adams, effective as of October 1, 2003 and which remained in effect until February 7, 2013 when it was superseded by a new employment agreement, Mr. Adams was paid a monthly base salary, subject to adjustments from time to time, and was eligible to participate in all bonus and benefit programs including our stock option plan. Effective February 7, 2013, we entered into a new employment agreement with Mr. Adams to reflect his new role and responsibilities as our Chief Executive Officer. Pursuant to the new employment agreement, Mr. Adams is to be paid a base salary of $25,000 per month, and is eligible for a bonus based on criteria to be determined by the Board of Directors. Pursuant to a separate restricted stock agreement dated February 7, 2013, Mr. Adams also received 25,000 shares of restricted common stock under our 2006 Stock Incentive Plan, which restricted stock shall vest on the fourth anniversary of the date of the employment agreement, provided that Mr. Adams is still employed with us at that time. Pursuant to the employment agreement, Mr. Adams may be terminated at will or for “cause”, as defined in the employment agreement, or Mr. Adams may terminate his employment for any reason or for “good reason,” as defined in the employment agreement. In the event that Mr. Adams is terminated at will or terminates his employment for good reason, Mr. Adams shall receive a severance equal to 12 months of his base salary. Mr. Adams has also entered into a non-competition and non-solicitation agreement with us, the terms of which are summarized below.

Mr. James Parslow has served as our Chief Financial Officer, Treasurer, and Secretary since May 2006. Pursuant to a letter of offer for employment with Mr. Parslow effective May 15, 2006, Mr. Parslow is to be paid a monthly base salary, and is eligible to participate in all bonus and benefit programs. Mr. Parslow has also entered into a non-competition and non-solicitation agreement, the terms of which are summarized below.

The non-competition and non-solicitation agreement for each of Messrs. Adams and Parslow provides that for a period of one year following the termination or cessation of employment with us, the employee will not (i) engage in a business that competes with our business; (ii) directly or indirectly solicit any of our employees; or (iii) directly or indirectly solicit, hire or engage as an independent contractor any person who was employed by us during the employee’s term of employment with us.

17

Impact of Regulatory Requirements