SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14D-9

Solicitation/Recommendation Statement under

Section 14(d)(4) of the Securities Exchange Act of 1934

World Energy Solutions, Inc.

(Name of Subject Company)

World Energy Solutions, Inc.

(Name of Person(s) Filing Statement)

Common Stock, par value $0.0001 per share

(Title of Class of Securities)

98145W208

(CUSIP Number of Class of Securities)

Philip V. Adams

President and CEO

World Energy Solutions, Inc.

100 Front Street

Worcester, Massachusetts 01608

Telephone: (508) 459-8100

(Name, Address, and Telephone Number of Person Authorized to Receive Notices and Communications

on Behalf of the Person(s) Filing Statement)

With Copies to:

Michael A. Refolo

Andrew Croxford

Mirick, O’Connell, DeMallie & Lougee, LLP

100 Front Street

Worcester, Massachusetts 01608-1477

Telephone: (508) 929-1622

| x | | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

This Schedule 14D-9 consists of the following documents relating to the proposed acquisition of World Energy Solutions, Inc. (“World Energy”) by Wolf Merger Sub Corporation, a wholly owned subsidiary (“Purchaser”) of EnerNOC Inc. (“EnerNOC”) pursuant to the terms of an Agreement and Plan of Merger, dated November 4, 2014, by and among World Energy, Purchaser and EnerNOC: (i) a Press Release of World Energy dated November 4, 2014; (ii) a power point presentation dated November 5, 2014 from Philip V. Adams, President and Chief Executive Officer of World Energy, to World Energy Solution employees; (iii) a power point presentation dated November 5, 2014 from Tim Healy, Chairman and CEO of EnerNOC, to World Energy Solution employees; (iv) letter to World Energy customers dated November 5, 2014; (v) letter to World Energy suppliers dated November 5, 2014; (vi) letter to World Energy subcontractors dated November 5, 2014; (vii) letter to World Energy channel partners dated November 5, 2014; and (viii) a Company email sent by Philip V. Adams, President and Chief Executive of World Energy, to World Energy employees dated November 4, 2014.

For Immediate Release

World Energy Solutions Enters into Agreement

to be Acquired by EnerNOC

Worcester, MA – November 4, 2014 – World Energy Solutions, Inc. (NASDAQ: XWES), an energy technology and services firm, today announced it has entered into an agreement to be acquired by EnerNOC, Inc. (NASDAQ: ENOC), a leading provider of energy intelligence software (EIS), for $5.50 per share.

Under the terms of the agreement, a subsidiary of EnerNOC will commence a tender offer to acquire all of the Company’s shares of common stock for $5.50 per share in cash, representing an approximate 35% premium over the 20 trading-day average of the Company’s shares and an approximate 33% premium to the closing price of the Company’s shares on November 3, 2014. EnerNOC’s obligation to purchase the shares of the Company’s common stock tendered in the tender offer is subject to certain conditions, including that holders of at least a majority of the shares are tendered during the tender offer period. Following completion of the tender offer, the remaining shares will be acquired in a second step merger at the same cash price as paid in the tender offer.

Under the terms of the agreement, the Company may solicit superior proposals from third parties during a “go-shop” process, run by Canaccord Genuity, that extends for 55 days. It is not anticipated that any developments will be disclosed with regard to this process unless and until the Company’s Board of Directors makes a decision to pursue a potential superior proposal. The agreement provides EnerNOC with a customary right to match any superior proposal.

2

A special committee of the Board of Directors, consisting solely of independent directors, and the Board of Directors, unanimously approved the transaction. The special committee also obtained and considered a fairness opinion from Duff & Phelps, an independent third-party financial advisor.

Peter Londa, Chairman of the Company and a member of the Special Committee, stated, “The Special Committee of the Board of Directors worked diligently to negotiate and enter into the Merger Agreement with EnerNOC. Through this negotiation, we secured the ability to run a thorough go-shop process to determine whether a more robust offer is available to increase the value being delivered to our shareholders. Our Board is proud of the Company’s management team and employees for their efforts in building a differentiated and market-leading business in our sector.”

Phil Adams, CEO of the Company, stated, “This transaction reflects World Energy’s strategic position and core competencies in the United States retail energy market. Our software-based auction platform continues to demonstrate significant value to participants in the retail energy sector and is poised to deliver significant synergies and cost savings to customers as part of EnerNOC’s energy intelligence software platform. The price premium reflected in EnerNOC’s offer supports our management’s objective to realize value for our shareholders and create an exciting opportunity for our employees.”

The closing of the transaction is subject to the satisfaction of customary conditions, including expiration of the go-shop period, and is expected to close in early January 2015. There is no financing condition to the obligations to consummate the transaction, and the transaction does not require receipt of antitrust approval.

World Energy currently serves more than 4,000 customers with its cloud-based software platform, the World Energy Exchange®. To date, World Energy’s platform is responsible for transacting over $45 billion in electricity, natural gas and environmental commodities for its customers, making the Company among the leaders in the energy procurement market within the U.S. Through the first six months of 2014, World Energy reported $18.9 million in revenue, with a total backlog of $45 million.

Q3 Financial Results

World Energy will release its third quarter financial results on Monday, November 10, after market close and will hold a call at 5:00 p.m. (ET) to discuss them. To access the conference call by telephone, dial 1 (800) 774-6070 (domestic) or 1 (630) 691-2753 (international) and enter passcode 8871616#. Participants may also access a live webcast of the conference call through the investor relations section of World Energy’s website, www.worldenergy.com.

Notice to Investors

The tender offer described herein has not yet been commenced. The description contained in this press release is neither an offer to purchase nor a solicitation of an offer to sell securities of the Company. At the time the tender offer is commenced, EnerNOC and its wholly owned subsidiary

3

intend to file a Tender Offer Statement on Schedule TO containing an offer to purchase, forms of letters of transmittal and other documents relating to the tender offer, and the Company intends to file a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer. Investors and stockholders of the Company are strongly advised to read the Tender Offer Statement on Schedule TO, including the offer to purchase, form of letter of transmittal and other documents related to the tender offer, and the Solicitation/Recommendation Statement on schedule 14D-9 that will be filed by the Company, and other relevant materials when they become available, because these materials contain important information regarding the tender offer. Stockholders of the Company will be able to obtain a free copy of these documents (when they become available) and other documents filed by the Company or EnerNOC with the SEC at the website maintained by the SEC at www.sec.gov. In addition, the Schedule TO and related exhibits, including the offer to purchase, forms of letters of transmittal, and other related tender offer documents may be obtained (when available) for free by contacting the Company at 100 Front Street, Worcester, MA 01608.

About World Energy Solutions, Inc.

World Energy Solutions, Inc. (NASDAQ: XWES) is an energy technology and services firm transforming energy procurement and energy efficiency for commercial, industrial, institutional, government and utility customers. The Company’s award-winning, cloud-based auction platform, the World Energy Exchange®, its team of energy experts, and a network of more than 500 suppliers and 300 channel partners form an ecosystem that enables customers to minimize their total cost of energy. To date, World Energy has transacted over $45 billion in energy, demand response and environmental commodities, creating more than $3 billion in value for its customers. World Energy is also a leader in the global carbon market, where its World Energy Exchange® supports the Regional Greenhouse Gas Initiative (RGGI), the first mandatory market-based regulatory program in the U.S. to reduce greenhouse gas emissions. For more information, please visit www.worldenergy.com.

This press release contains forward-looking statements which involve risk and uncertainties. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “forecasts,” “projects,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. The Company has based these forward-looking statements on its current expectations and projections about future events, including without limitation, its expectations of backlog and energy prices, and its expectations in growth in revenue, operating results, operating margins, and free cash flow. Although the Company believes that the expectations underlying any of its forward-looking statements are reasonable, these expectations may prove to be incorrect and all of these statements are subject to risks and uncertainties. Should one or more of these risks and uncertainties materialize, or should underlying assumptions, projections or expectations prove incorrect, actual results, performance or financial condition may vary materially and adversely from those anticipated, estimated or expected. Such risks and uncertainties include, but are not limited to the following: whether the acquisition will be consummated; whether the Company will obtain a superior proposal; the Company’s revenue

4

and backlog are dependent on actual future energy purchases pursuant to completed procurements; the demand for the Company’s services is affected by changes in regulated prices or cyclicality or volatility in competitive market prices for energy; the potential impact on the Company’s historical and prospective financial results of a change in accounting policy may negatively impact its stock price; and other factors outside the Company’s control that affect transaction volume in the electricity market. Additional risk factors are identified in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013 and subsequent reports filed with the Securities and Exchange Commission. The forward-looking statements made in this press release are made as at the date hereof. Readers are cautioned not to place undue reliance on forward-looking statements as actual results could differ materially from the forward-looking statements expressed in this press release. Forward-looking statements are provided for the purpose of presenting information about management’s current expectations relating to the future, and readers are cautioned that such statements may not be appropriate for other purposes. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, other than as required by securities laws.

For additional information, contact:

Dan Mees

World Energy Solutions

(508) 459-8156

dmees@worldenergy.com

5

Item2.

Welcome to the Company Meeting

Nov 5, 2014

6

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

6

Q. What just happened?

The Company has entered into a merger agreement to accept EnerNOC’s offer of $5.50 cash per share of World Energy stock,

AND

Begun a “Go Shop” process to see if another company may be interested in making a superior offer at a higher price.

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

Q. When will this close?

Likely in January, though the closing of the acquisition is subject to a number of conditions, most importantly:

that during the “Go Shop” process, we do not receive a superior proposal from another company that EnerNOC chooses not to match; and

that shareholders owning a majority of our outstanding common stock agree to tender their shares.

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

7

Q. Why are we selling?

The Board has a fiduciary duty to shareholders to maximize shareholder value and has come to the conclusion that the $5.50 cash offer meets the required fiduciary duty standard.

Q. Why now?

The Board did not actively shop the company.

EnerNOC approached us, and made an unsolicited offer, which prompted the Board to review the offer.

As part of that process, the Board appointed a Special Committee of independent directors to evaluate the offer, solicit a third party valuation of the company based on future projections, and make their recommendation to the Board. Based on that recommendation the Board made a unanimous decision to approve the transaction.

8

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

8

Q. What is a “Go Shop” process?

Our Investment banker, Canaccord, is now contacting other industry players who may be interested in us to see if they’d be willing to offer more than the $5.50 EnerNOC offered.

That process began yesterday, and will run until late December.

If other companies show interest, they may come in to the Worcester office for a management presentation to learn more about the company and meet members of the executive team.

Q. Will I have a job?

I cannot say at this time with certainty; however, our people and our technology are the assets of the business, and I would expect any acquirer to be interested in retaining a significant majority of our employees.

9

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

9

Q. Where will I work?

I cannot say at this time with certainty.

That said, our offices have leases, with HQ being in the third year of an attractively-priced 10 year lease.

Q. What happens to my stock?

If you own shares of stock, you will receive $5.50 cash for every share of stock you own.

If you have vested, in-the-money options, those will be cashed out at the difference between $5.50 and your strike price.

Unvested or out-of-the-money options will be converted to EnerNOC options based on a market-based conversion price.

Unvested Restricted Stock will be converted to a cash equivalent at the offer price and paid when vested.

10

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

10

Q. 2014 Bonuses/Commissions?

2014 year-end bonuses and commissions will be calculated and paid according to our incentive comp plan documents with two important distinctions.

Final EBITDA and Net Income calculations will factor out costs related to this transaction

You will be paid even if terminated for other than cause before the payment date

To memorialize these points, before the transaction closes, you will receive a letter confirming these terms as well as your participation in the plan. Payment will be made according to our traditional schedule.

Q. Will incentive comp plans change for 2015?

I cannot say at this time with certainty; however, as part of diligence, we have informed EnerNOC of our compensation structure and plans, so they are fully aware of how you currently are getting paid.

11

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

11

Q. Why EnerNOC? Is it good to be merged into them?

First, EnerNOC approached us, and made an offer the Board deemed to meet its fiduciary duty standard.

Second, there are a lot of similarities with our two companies culturally, and a lot of aspects that are complementary strategically.

We share a very similar vision for the direction of energy management though approach it from different heritages. Underpinning both our strategies is a belief in leveraging technology.

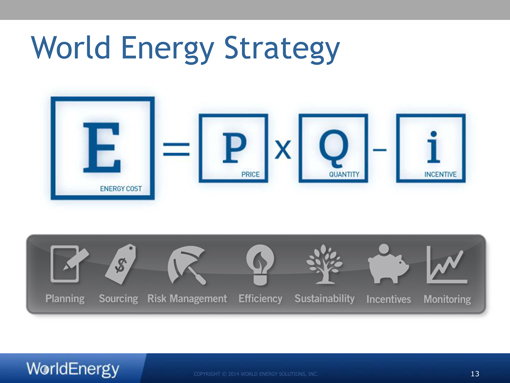

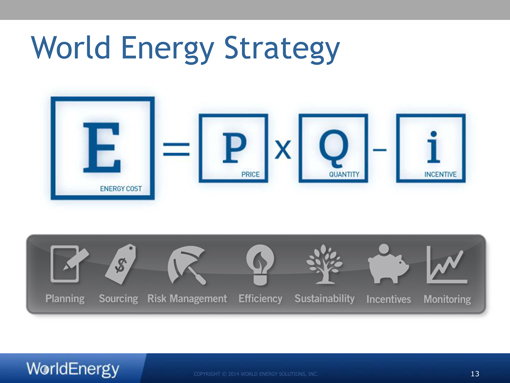

World Energy Strategy

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

12

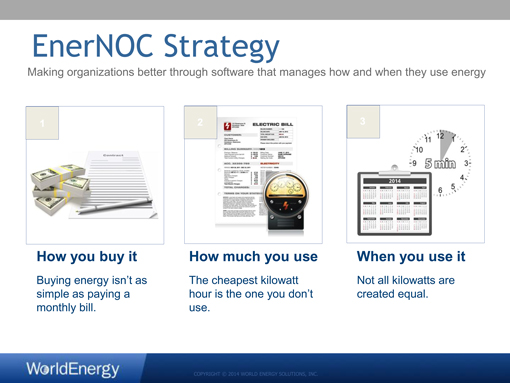

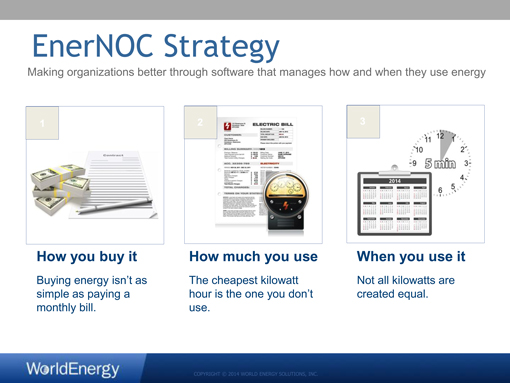

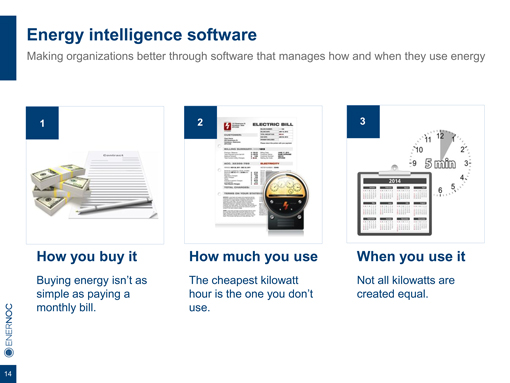

EnerNOC Strategy

Making organizations better through software that manages how and when they use energy

How you buy it

Buying energy isn’t as simple as paying a monthly bill.

How much you use

The cheapest kilowatt hour is the one you don’t use.

When you use it

Not all kilowatts are created equal.

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

13

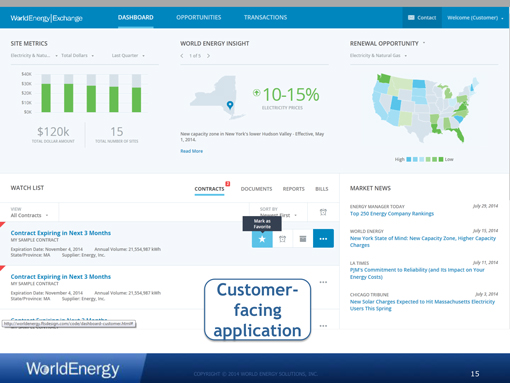

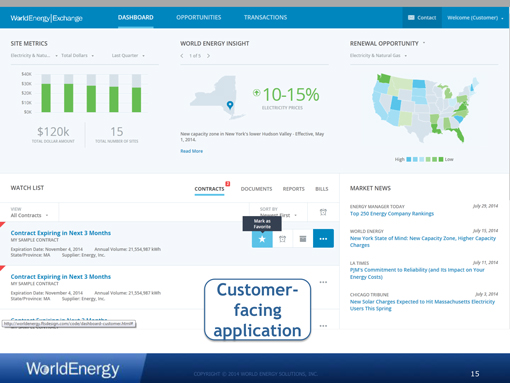

Customer-facing

application

Introducing Tim Healy, CEO EnerNOC

14

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

14

Q. What are we telling customers, partners, suppliers?

We will be sending an email under my name to all our key constituents explaining what has happened with this announcement.

We will also emphasize that EnerNOC has chosen us for our best-in-class procurement and efficiency capabilities, and that we expect to continue to execute as we always have up until and through a closing date.

Q. What can I/should I say if approached?

For customers, suppliers and partners, please reiterate what we say in the letters we’re sending – which will be made available to you.

For other inquiries, such as press, investors or analysts, please direct them to Dan Mees.

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

15

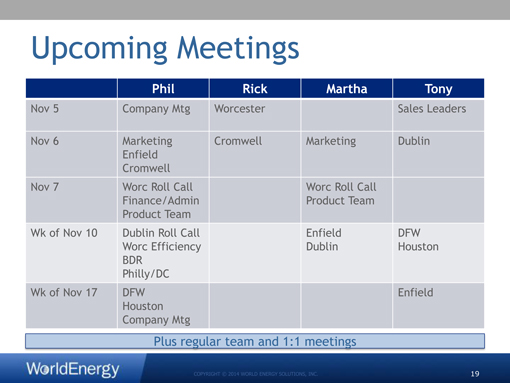

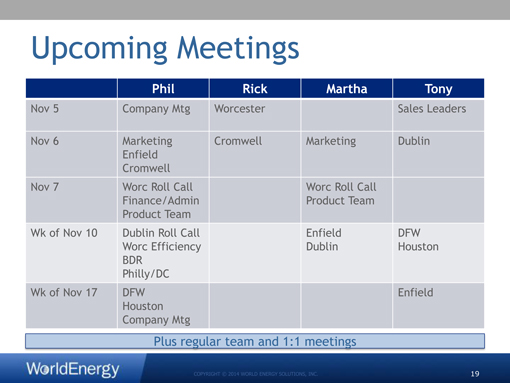

Upcoming Meetings

Phil Rick Martha Tony

Nov 5 Company Mtg Worcester Sales Leaders

Nov 6 Marketing Cromwell Marketing Dublin

Enfield

Cromwell

Nov 7 Worc Roll Call Worc Roll Call

Finance/Admin Product Team

Product Team

Wk of Nov 10 Dublin Roll Call Enfield DFW

Worc Efficiency Dublin Houston

BDR

Philly/DC

Wk of Nov 17 DFW Enfield

Houston

Company Mtg

Plus regular team and 1:1 meetings

Upcoming Meetings

We would also like to gather questions in preparation for our next company meeting.

Please send questions/concerns to your manager, Kristen or Scott in HR, or me directly, and we will do our best to answer them based on the information we have at the time.

16

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

16

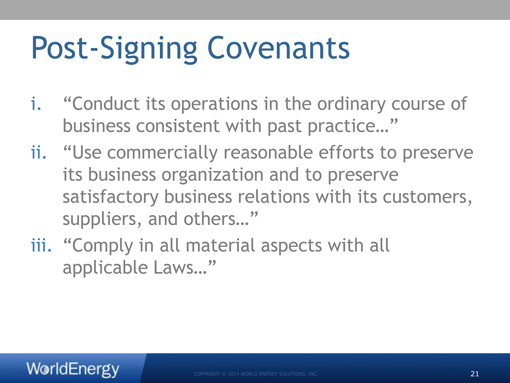

Post-Signing Covenants

“Conduct its operations in the ordinary course of business consistent with past practice…”

“Use commercially reasonable efforts to preserve its business organization and to preserve satisfactory business relations with its customers, suppliers, and others…”

“Comply in all material aspects with all applicable Laws…”

Post-Signing Covenants

Essentially this means we need to keep operating as we normally do.

It will be a busy quarter, and this news adds layers of questions and emotions, so it will be a challenge, but one I’m confident we will rise to.

We are open to hearing from you, and also expecting you to give your best, as you always do.

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

17

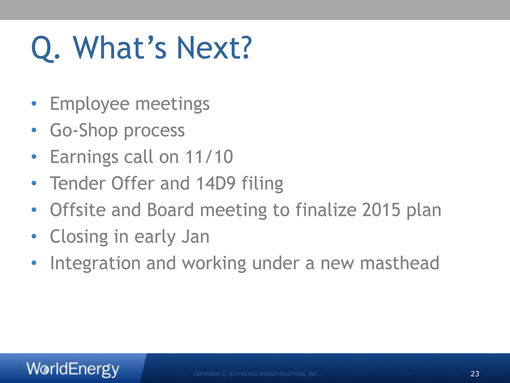

Q. What’s Next?

Employee meetings

Go-Shop process

Earnings call on 11/10

Tender Offer and 14D9 filing

Offsite and Board meeting to finalize 2015 plan

Closing in early Jan

Integration and working under a new masthead

Forward-Looking Statements

This document contains forward-looking statements. These statements relate to future events or to future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by the use of words such as “may”, “could”, “expect”, “intend”, “plan”, “seek”, “anticipate”, “believe”, “estimate”, “predict”, “potential”, or “continue” or the negative of these terms or other comparable terminology. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors that are, in some cases, beyond our control and that could materially affect actual results, levels of activity, performance or achievements.

Other factors that could materially affect actual results, levels of activity, performance or achievements can be found in World Energy’s filings with and the Securities and Exchange Commission and Canadian securities regulators , including our most recent Annual Report on Form 10-K as may be updated by our most recent Quarterly Report on Form 10-Q, each of which is on file with the SEC. If any of these risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary significantly from what we projected. Any forward-looking statement you read in this document reflects our current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to our operations, results of operations, growth strategy and liquidity. We assume no obligation to publicly update or revise these forward-looking statements for any reason, whether as a result of new information, future events or otherwise.

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

18

Notice to Investors

The tender offer described herein has not yet been commenced. The description contained in this report is neither an offer to purchase nor a solicitation of an offer to sell securities of the Company. At the time the tender offer is commenced, EnerNOC and its wholly owned subsidiary intend to file a Tender Offer Statement on Schedule TO containing an offer to purchase, forms of letters of transmittal and other documents relating to the tender offer, and the Company intends to file a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer.

Investors and stockholders of the Company are strongly advised to read the Tender Offer Statement on Schedule TO, including the offer to purchase, form of letter of transmittal and other documents related to the tender offer, and the Solicitation/Recommendation Statement on schedule 14D-9 that will be filed by the Company, and other relevant materials when they become available, because these materials contain important information regarding the tender offer. Stockholders of the Company will be able to obtain a free copy of these documents (when they become available) and other documents filed by the Company or EnerNOC with the SEC at the website maintained by the SEC atwww.sec.gov<http://www.sec.gov/>. In addition, the Schedule TO and related exhibits, including the offer to purchase, forms of letters of transmittal, and other related tender offer documents may be obtained (when available) for free by contacting the Company at 100 Front Street, Worcester, MA 01608

Thank You

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

19

Item 3.

EnerNOC Overview Q3 2014 to World Energy

Welcome!

Tim Healy Chief Executive Officer Neil Moses

Chief Financial Officer & Chief Operations Officer Micah Remley VP of Product Strategy

& Technology

Matthew Maloney VP of Sales Phil Pergola VP of Professional

Services

Sean Leaver

Director of Corporate

Development

2

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

20

NEWS

World Energy Solutions Enters into Agreement to be Acquired by EnerNOC

3

Agenda

Introduction to EnerNOC

Our People and Culture

EnerNOC’s EIS Strategy

Timeline

4

21

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

21

Our Vision & Mission

VisionThe future if we succeed in our mission

“To change the way the world uses energy.”

Mission Why we’re in business

“To enable intelligent energy choices.”

5

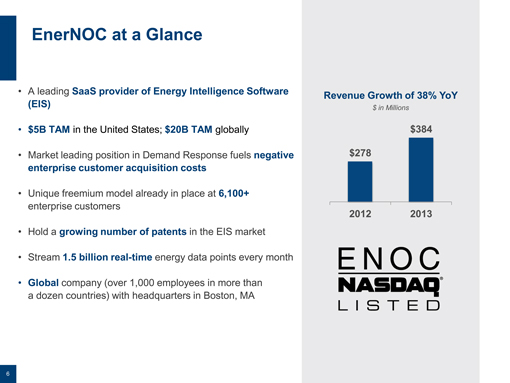

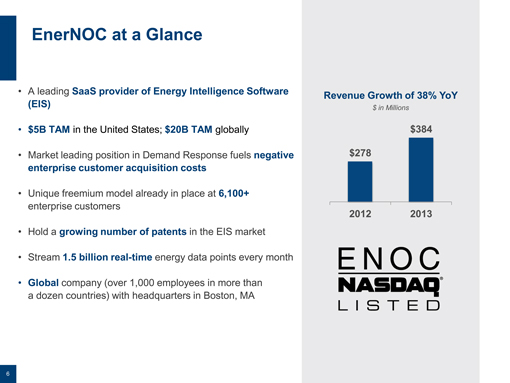

EnerNOC at a Glance A leading SaaS provider of Energy Intelligence Software (EIS) $5B TAM in the United States; $20B TAM globally

Market leading position in Demand Response fuels negative enterprise customer acquisition costs Unique freemium model already in place at 6,100+ enterprise customers

Hold a growing number of patents in the EIS market Stream 1.5 billion real-time energy data points every month

Global company (over 1,000 employees in more than a dozen countries) with headquarters in Boston, MA

Revenue Growth of 38% YoY $ in Millions

$278

$384

6

22

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

22

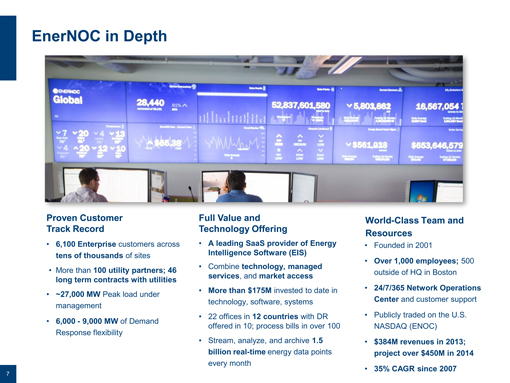

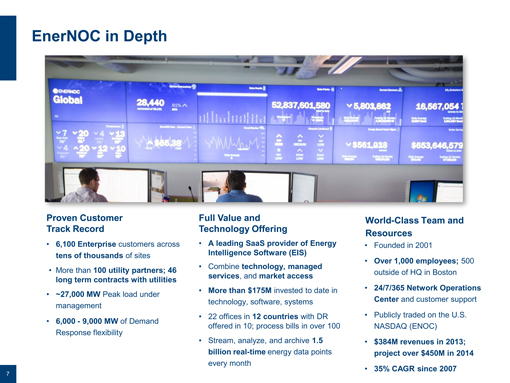

EnerNOC in Depth

Proven CustomerTrack Record

6,100 Enterprise customers across tens of thousands of sites

More than 100 utility partners; 46 long term contracts with utilities

~27,000 MW Peak load under management

6,000—9,000 MW of Demand Response flexibility

Full Value and Technology Offering

A leading SaaS provider of Energy Intelligence Software (EIS)

Combine technology, managed services, and market access More than $175M invested to date in technology, software, systems 22

offices in 12 countries with DR offered in 10; process bills in over 100 Stream, analyze, and archive 1.5 billion real-time energy data points every month

World-Class Team and Resources Founded in 2001 Over 1,000 employees; 500 outside of HQ in Boston

24/7/365 Network Operations Center and customer support Publicly traded on the U.S. NASDAQ (ENOC)

$384M revenues in 2013; project over $450M in 2014 35% CAGR since 2007

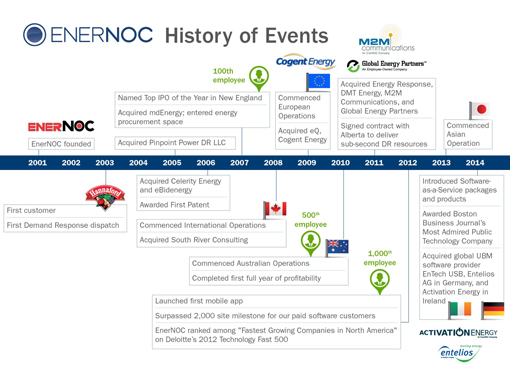

7 History of Events

23

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

23

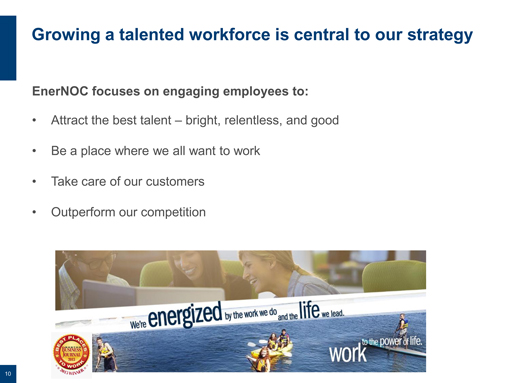

Our People and Culture

Growing a talented workforce is central to our strategy

EnerNOC focuses on engaging employees to:

Attract the best talent – bright, relentless, and good

Outperform our competition

Be a place where you and I want to work

Take care of our customers

10

24

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

24

A day in the life of an EnerNOC Employee

http://energysmart.enernoc.com/enernoc-goes-even-more-global

11

EnerNOC’s EIS Strategy

25

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

25

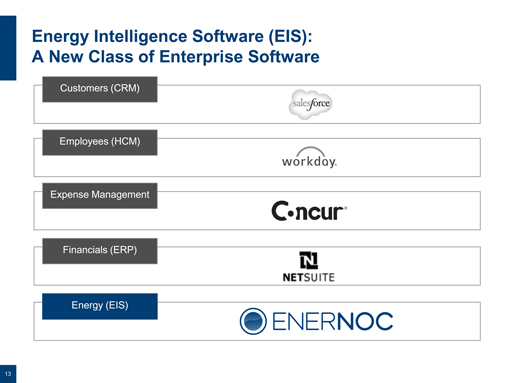

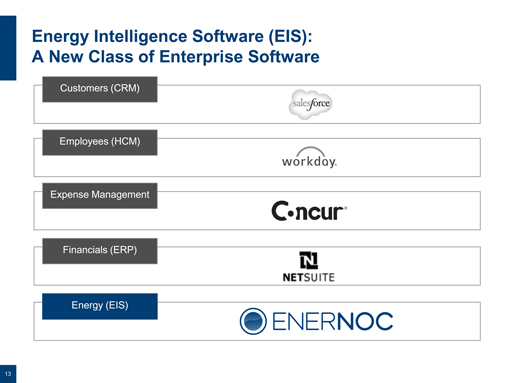

Energy Intelligence Software (EIS): A New Class of Enterprise Software Customers (CRM)

Employees (HCM)

Expense Management

Financials (ERP)

Energy (EIS)

13 Energy intelligence software

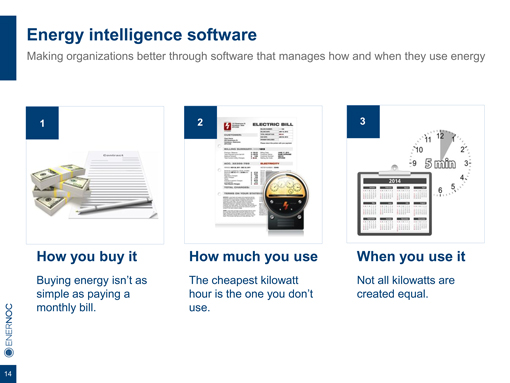

Making organizations better through software that manages how and when they use energy 1 2 3 How you buy it

Buying energy isn’t as simple as paying a monthly bill.

How much you use

The cheapest kilowatt hour is the one you don’t use.

When you use it

Not all kilowatts are created equal.

14

26

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

26

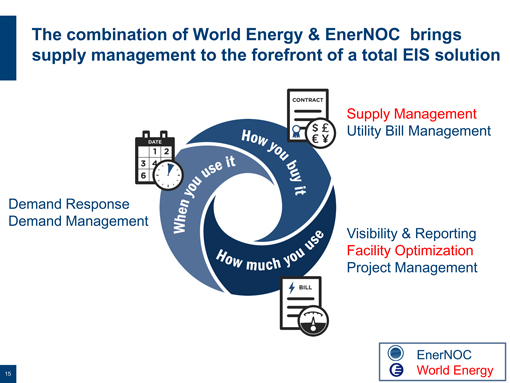

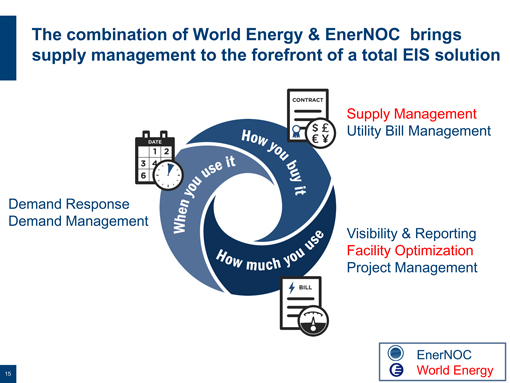

The combination of World Energy & EnerNOC brings supply management to the forefront of a total EIS solution Demand Response

Demand Management Supply Management Utility Bill Management

Visibility & Reporting Facility Optimization

Project Management EnerNOC World Energy 15

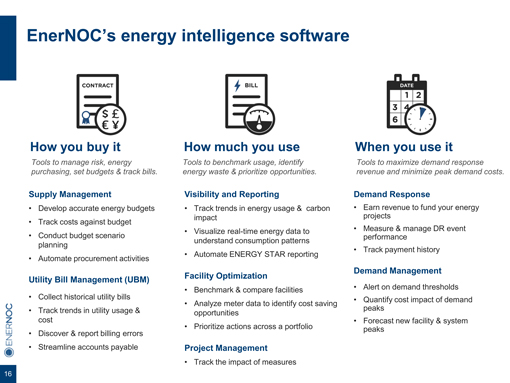

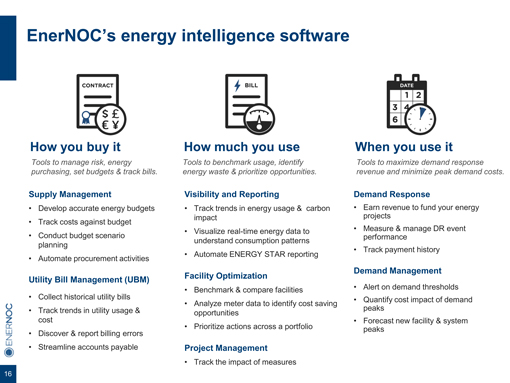

EnerNOC’s energy intelligence software How you buy it Tools to manage risk, energy purchasing, set budgets & track bills. Supply Management

Develop accurate energy budgets Track costs against budget Conduct budget scenario planning Automate procurement activities

Utility Bill Management (UBM) Collect historical utility bills

Track trends in utility usage & cost Discover & report billing errors

Streamline accounts payable

How much you use

Tools to benchmark usage, identify energy waste & prioritize opportunities.

Visibility and Reporting Track trends in energy usage & carbon impact Visualize real-time energy data to understand consumption patterns Automate ENERGY STAR reporting

Facility Optimization Benchmark & compare facilities

Analyze meter data to identify cost saving opportunities

Prioritize actions across a portfolio

Project Management

Track the impact of measures

When you use it

Tools to maximize demand response revenue and minimize peak demand costs.

Demand Response

Earn revenue to fund your energy projects

Measure & manage DR event performance

Track payment history

Demand Management

Alert on demand thresholds

Quantify cost impact of demand peaks

Forecast new facility & system peaks

16

27

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

27

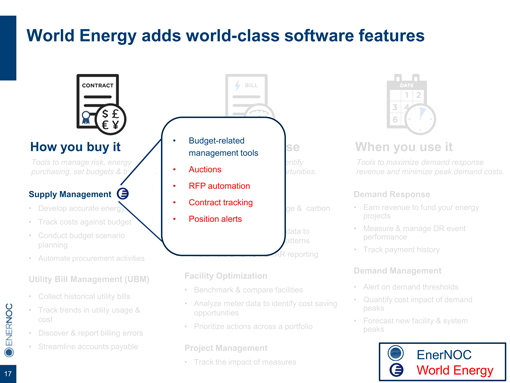

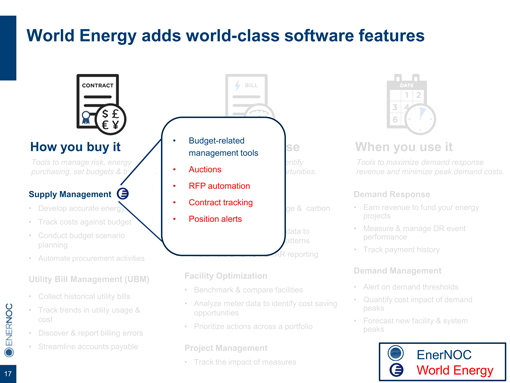

World Energy adds world-class software features

How you buy it

Tools to manage risk, energy purchasing, set budgets & track bills.

Supply Management

Develop accurate energy budgets

Track costs against budget

Conduct budget scenario planning

Automate procurement activities

Utility Bill Management (UBM)

Collect historical utility bills

Track trends in utility usage & cost

Discover & report billing errors

Streamline accounts payable

Budget-related management tools

Auctions

RFP automation

Contract tracking

Position alerts

Visibility and Reporting

Track trends in energy usage & carbon impact

Visualize real-time energy data to understand consumption patterns

Automate ENERGY STAR reporting

Facility Optimization

Benchmark & compare facilities

Analyze meter data to identify cost saving opportunities

Prioritize actions across a portfolio

Project Management

Track the impact of measures When you use it

Tools to maximize demand response revenue and minimize peak demand costs. Demand Response Earn revenue to fund your energy projects

Measure & manage DR event performance Track payment history

Demand Management Alert on demand thresholds

Quantify cost impact of demand peaks Forecast new facility & system peaks 17

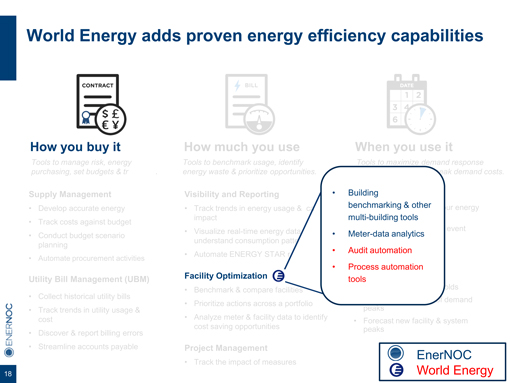

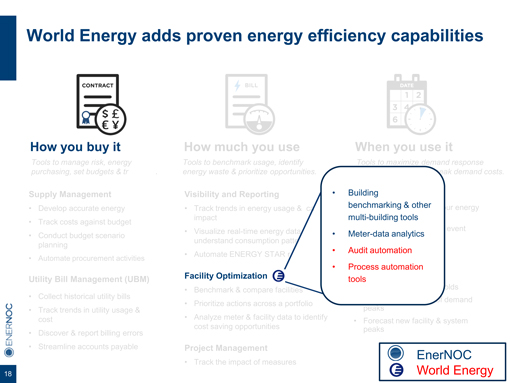

World Energy adds proven energy efficiency capabilities

How you buy it

Tools to manage risk, energy purchasing, set budgets & track bills.

Supply Management

Develop accurate energy budgets

Track costs against budget

Conduct budget scenario planning

Automate procurement activities

Utility Bill Management (UBM)

Collect historical utility bills

Track trends in utility usage & cost

Discover & report billing errors

Streamline accounts payable

How much you use

Tools to benchmark usage, identify energy waste & prioritize opportunities.

Visibility and Reporting

Track trends in energy usage & carbon impact

Visualize real-time energy data to understand consumption patterns

Automate ENERGY STAR reporting

Facility Optimization

Benchmark & compare facilities

Prioritize actions across a portfolio

Analyze meter & facility data to identify cost saving opportunities

Project Management

Track the impact of measures

When you use it

Tools to maximize demand response revenue and minimize peak demand costs.

Building benchmarking & other multi-building tools

Meter-data analytics

Audit automation

Process automation tools

Demand Response

Earn revenue to fund your energy projects

Measure & manage DR event performance

Track payment history

Demand Management

Alert on demand thresholds

Quantify cost impact of demand peaks

Forecast new facility & system peaks

18

28

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

28

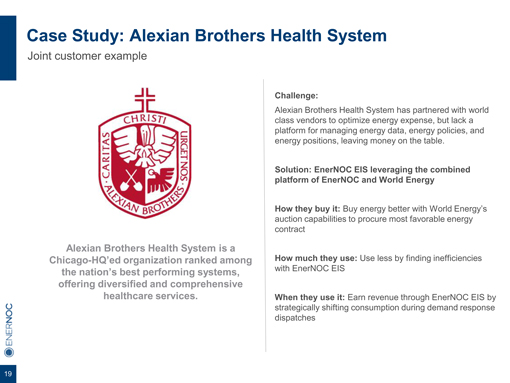

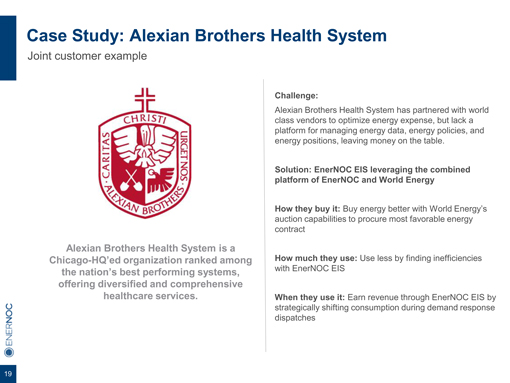

Case Study: Alexian Brothers Health System

Joint customer example

Alexian Brothers Health System is a Chicago-HQ’ed organization ranked among the nation’s best performing systems, offering diversified and comprehensive healthcare services.

Challenge:

Alexian Brothers Health System has partnered with world class vendors to optimize energy expense, but lack a platform for managing energy data, energy policies, and energy positions, leaving money on the table.

Solution: EnerNOC EIS leveraging the combined platform of EnerNOC and World Energy

How they buy it: Buy energy better with World Energy’s Auction capabilities to procure most favorable energy contract

How much they use: Use less by finding inefficiencies with EnerNOC EIS

When they use it: Earn revenue through EnerNOC EIS by strategically shifting consumption during demand response dispatches

19

Timeline

29

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

29

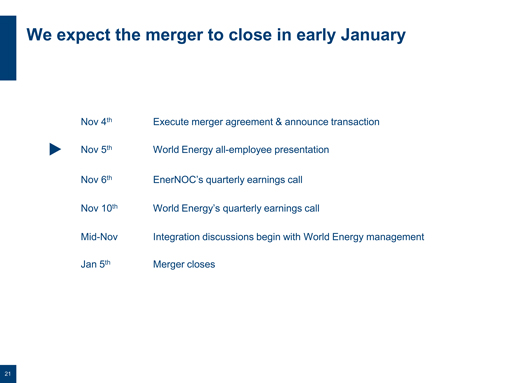

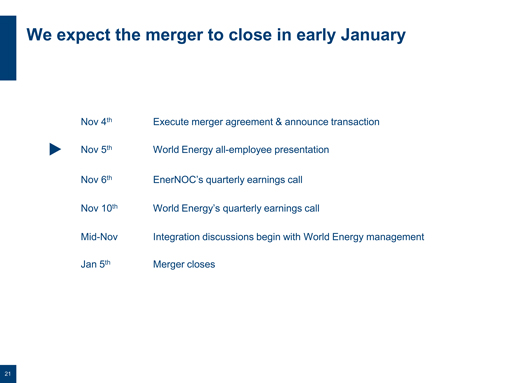

We expect the merger to close in early January

Nov 4th Execute merger agreement & announce transaction

Nov 5th World Energy all-employee presentation

Nov 6th EnerNOC’s quarterly earnings call

Nov 10th World Energy’s quarterly earnings call

Mid-Nov Integration discussions begin with World Energy management

Jan 5th Merger closes

Thank You

30

COPYRIGHT © 2014 WORLD ENERGY SOLUTIONS, INC.

30

EnerNOC, Inc. Safe Harbor Statement

Statements in this presentation regarding management’s future expectations, beliefs, intentions, goals, strategies, plans or prospects, including, without limitation, statements relating to the ability of the EnerNOC and World Energy to complete the transactions contemplated by the merger agreement, including the parties’ ability to satisfy the conditions to the consummation of the tender offer and the other conditions set forth in the merger agreement, EnerNOC’s vision for EIS, EnerNOC’s ability to help enterprises control costs and stay competitive in an increasingly global marketplace, the ability of the acquisition to deliver value to EnerNOC’s enterprise customers, may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Such forward-looking statements involve known and unknown risks, uncertainties and other factors including risks relating to any unforeseen changes to or the effects on liabilities, future capital expenditures, revenue, expenses, synergies, indebtedness, financial condition, losses and future prospects; failure to consummate or delay in consummating the transaction; our ability to retain key executives and employees; slowdowns or downturns in economic conditions, relationships with strategic partners, the presence of competitors with greater financial resources than ours and their strategic response to our products; and our ability to successfully integrate World Energy and the associated technology and achieve operational efficiencies, as well as those risks, uncertainties and factors referred to under the section “Risk Factors” in EnerNOC’s most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, as well as other documents that may be filed by EnerNOC from time to time with the Securities and Exchange Commission. As a result of such risks, uncertainties and factors, the Company’s actual results may differ materially from any future results, performance or achievements discussed in or implied by the forward-looking statements contained herein. EnerNOC is providing the information in this press release as of this date and assumes no obligations to update the information included in this press release or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Important Information

This presentation is for informational purposes only and is not an offer to buy or the solicitation of an offer to sell any shares of World Energy Solutions, Inc. common stock. The tender offer described herein has not yet been commenced. On the commencement date of the tender offer, an offer to purchase, a letter of transmittal and related documents will be filed with the Securities and Exchange Commission (SEC). The solicitation of offers to buy shares of World Energy Solutions, Inc. common stock will only be made pursuant to the offer to purchase, the letter of transmittal and related documents. Investors and World Energy Solutions, Inc. securityholders are strongly advised to read both the tender offer statement and the solicitation/recommendation statement that will be filed by World Energy Solutions, Inc. regarding the tender offer when they become available as they will contain important information. Investors and securityholders may obtain free copies of these statements (when available) and other documents filed with respect to the tender offer at the SEC’s website at www.sec.gov. In addition, copies of the tender offer statement and related materials (when available) may be obtained for free by directing such requests to the information agent for the tender offer or by directing such requests to the EnerNOC, Inc. investor relations at the e-mail address below. The solicitation/recommendation statement and related documents (when available) may be obtained by directing such requests to World Energy Solutions, Inc. investor relations at the phone number or e-mail address below.

EnerNOC, Inc. Investor Relations

Sarah McAuley

617-532-8195

news@enernoc.com

World Energy Solutions, Inc. Investor Relations

Dan Mees

508-459-8156

dmees@worldenergy.com

31

World Energy Announcement

Yesterday, we announced that World Energy has entered into an agreement to be acquired by EnerNOC, a leader in energy intelligence software. EnerNOC’s interest in World Energy validates what you already know – that World Energy has something special. Our people, our platform and our network of channel partners, suppliers, utilities and subcontractors provide an unequaled energy management experience for our customers.

World Energy and EnerNOC’s combined set of energy management services – including energy procurement, bill management, energy efficiency and demand management – offer the opportunity to deliver tremendous value to our customers and the greater market. While we are excited about joining EnerNOC, the transaction will not be finalized until January 2015.

Until then it will be business as usual at World Energy. You can expect us to be as focused as ever on meeting your energy management needs and delivering the high quality service and results you have come to rely on from us.

We look forward to continuing to serve you and providing you the very best in energy management. Should you have any questions, I would appreciate hearing from you.

Thank you for your business.

Sincerely,

Phil Adams

Chief Executive Officer

World Energy Solutions, Inc.

Notice to Investors

The tender offer described herein has not yet been commenced. The description contained in this press release is neither an offer to purchase nor a solicitation of an offer to sell securities of the Company. At the time the tender offer is commenced, EnerNOC and its wholly owned subsidiary intend to file a Tender Offer Statement on Schedule TO containing an offer to purchase, forms of letters of transmittal and other documents relating to the tender offer, and the Company intends to file a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer. Investors and stockholders of the Company are strongly advised to read the Tender Offer Statement on Schedule TO, including the offer to purchase, form of letter of transmittal and other documents related to the tender offer, and the Solicitation/Recommendation Statement on schedule 14D-9 that will be filed by the Company, and other relevant materials when they become available, because these materials contain important information regarding the tender offer. Stockholders of the Company will be able to obtain a free copy of these documents (when they become available) and other documents filed by the Company or

32

EnerNOC with the SEC at the website maintained by the SEC at www.sec.gov. In addition, the Schedule TO and related exhibits, including the offer to purchase, forms of letters of transmittal, and other related tender offer documents may be obtained (when available) for free by contacting the Company at 100 Front Street, Worcester, MA 01608.

| | |

| Item 5. | |  |

World Energy Announcement

Yesterday, we announced that World Energy has entered into an agreement to be acquired by EnerNOC, a leader in energy intelligence software. EnerNOC’s interest in World Energy validates what you already know – that World Energy has something special. Our people, our platform and our network of channel partners, suppliers, utilities and subcontractors provide an unequaled energy management experience for our customers.

World Energy and EnerNOC’s combined set of energy management services – including energy procurement, bill management, energy efficiency and demand management – offer the opportunity to deliver tremendous value to our customers and the greater market. While we are excited about joining EnerNOC, the transaction will not be finalized until January 2015.

Until then it will be business as usual at World Energy. We will be as focused-as-ever on meeting your needs and delivering the high quality service and transactional excellence you have come to expect from us.

We look forward to our ongoing work together. Should you have any questions, I would appreciate hearing from you.

Thank you for your business.

Sincerely,

Phil Adams

Chief Executive Officer

World Energy Solutions, Inc.

Notice to Investors

The tender offer described herein has not yet been commenced. The description contained in this press release is neither an offer to purchase nor a solicitation of an offer to sell securities of the Company. At the time the tender offer is commenced, EnerNOC and its wholly owned subsidiary intend to file a Tender Offer Statement on Schedule TO containing an offer to purchase, forms of letters of transmittal and other documents relating to the tender offer, and the Company intends to file a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer. Investors and stockholders of the Company are strongly advised to read the Tender Offer Statement on Schedule TO, including the offer to purchase, form of letter of transmittal and other documents related to the tender offer, and the Solicitation/Recommendation Statement on schedule 14D-9 that will be filed by the Company, and other relevant materials when they become available,

33

because these materials contain important information regarding the tender offer. Stockholders of the Company will be able to obtain a free copy of these documents (when they become available) and other documents filed by the Company or EnerNOC with the SEC at the website maintained by the SEC at www.sec.gov. In addition, the Schedule TO and related exhibits, including the offer to purchase, forms of letters of transmittal, and other related tender offer documents may be obtained (when available) for free by contacting the Company at 100 Front Street, Worcester, MA 01608.

| | |

| Item 6. | |  |

World Energy Announcement

Yesterday, we announced that World Energy has entered into an agreement to be acquired by EnerNOC, a leader in energy intelligence software. EnerNOC’s interest in World Energy validates what you already know – that World Energy has something special. Our people, our platform and our network of channel partners, suppliers, utilities and subcontractors provide an unequaled energy management experience for our customers.

World Energy and EnerNOC’s combined set of energy management services – including energy procurement, bill management, energy efficiency and demand management – offer the opportunity to deliver tremendous value to our customers and the greater market. While we are excited about joining EnerNOC, the transaction will not be finalized until January 2015.

Until then it will be business as usual at World Energy. We will be as focused-as-ever on implementing energy efficiency measures with you to meet utility and customer expectations and delivering the high quality service and results all have come to expect from us.

We look forward to ongoing success together, bringing you and our customers the very best in energy efficiency services. Should you have any questions, I would appreciate hearing from you.

Thank you for your business.

Sincerely,

Phil Adams

Chief Executive Officer

World Energy Solutions, Inc.

Notice to Investors

The tender offer described herein has not yet been commenced. The description contained in this press release is neither an offer to purchase nor a solicitation of an offer to sell securities of the Company. At the time the tender offer is commenced, EnerNOC and its wholly owned subsidiary intend to file a Tender Offer Statement on Schedule TO containing an offer to purchase, forms of letters of transmittal and other documents relating to the tender offer, and the Company intends to file a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer. Investors and stockholders of the Company are strongly advised to read the Tender Offer Statement on Schedule TO, including the offer to purchase, form of letter of

34

transmittal and other documents related to the tender offer, and the Solicitation/Recommendation Statement on schedule 14D-9 that will be filed by the Company, and other relevant materials when they become available, because these materials contain important information regarding the tender offer. Stockholders of the Company will be able to obtain a free copy of these documents (when they become available) and other documents filed by the Company or EnerNOC with the SEC at the website maintained by the SEC at www.sec.gov. In addition, the Schedule TO and related exhibits, including the offer to purchase, forms of letters of transmittal, and other related tender offer documents may be obtained (when available) for free by contacting the Company at 100 Front Street, Worcester, MA 01608.

| | |

| Item 7. | |  |

World Energy Announcement

Yesterday, we announced that World Energy has entered into an agreement to be acquired by EnerNOC, a leader in energy intelligence software. EnerNOC’s interest in World Energy validates what you already know – that World Energy has something special. Our people, our platform and our network of channel partners, suppliers, utilities and subcontractors provide an unequaled energy management experience for our customers.

World Energy and EnerNOC’s combined set of energy management services – including energy procurement, bill management, energy efficiency and demand management – offer the opportunity to deliver tremendous value to our customers and the greater market. While we are excited about joining EnerNOC, the transaction will not be finalized until January 2015.

Until then it will be business as usual at World Energy. We will be as focused-as-ever on meeting your needs and those of your customers, delivering the high quality service and results you have come to expect from us.

We look forward to ongoing success together, bringing you and your customers the very best in energy management. Should you have any questions, I would appreciate hearing from you.

Thank you for your business.

Sincerely,

Phil Adams

Chief Executive Officer

World Energy Solutions, Inc.

Notice to Investors

The tender offer described herein has not yet been commenced. The description contained in this press release is neither an offer to purchase nor a solicitation of an offer to sell securities of the Company. At the time the tender offer is commenced, EnerNOC and its wholly owned subsidiary intend to file a Tender Offer Statement on Schedule TO containing an offer to purchase, forms of letters

35

of transmittal and other documents relating to the tender offer, and the Company intends to file a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer. Investors and stockholders of the Company are strongly advised to read the Tender Offer Statement on Schedule TO, including the offer to purchase, form of letter of transmittal and other documents related to the tender offer, and the Solicitation/Recommendation Statement on schedule 14D-9 that will be filed by the Company, and other relevant materials when they become available, because these materials contain important information regarding the tender offer. Stockholders of the Company will be able to obtain a free copy of these documents (when they become available) and other documents filed by the Company or EnerNOC with the SEC at the website maintained by the SEC at www.sec.gov. In addition, the Schedule TO and related exhibits, including the offer to purchase, forms of letters of transmittal, and other related tender offer documents may be obtained (when available) for free by contacting the Company at 100 Front Street, Worcester, MA 01608.

Item 8.

From: Phil Adams

Sent: Tuesday, November 04, 2014 4:24 PM

To: we

Subject: Company Announcement: EnerNOC Agrees to Acquire World Energy

Hi Everyone,

I have some big news, among the biggest in our Company’s history. Today we announced that we have entered into an agreement to be acquired by EnerNOC (Nasdaq: ENOC), a leading provider of energy intelligence software. Details follow in the press release below. We will be holding a Company meeting tomorrow morning at 9:00 a.m. to discuss this news, what it means to you and the Company as a whole, and next steps. Tim Healy, CEO, and other EnerNOC senior leaders will be joining us for this meeting.

I imagine this announcement comes as a surprise. Tomorrow’s company meeting will be the beginning of a communication process, and I look forward to visiting with each of you to hear your questions and continue to provide information.

In the meantime, thank you for making World Energy the great company it is today and one that has attracted the attention of a world class player in energy management.

- Phil

For Immediate Release

World Energy Solutions Enters into Agreement to be Acquired by EnerNOC

36

Worcester, MA – November 4, 2014 – World Energy Solutions, Inc. (NASDAQ: XWES), an energy technology and services firm, today announced it has entered into an agreement to be acquired by EnerNOC, Inc. (NASDAQ: ENOC), a leading provider of energy intelligence software (EIS), for $5.50 per share.

Under the terms of the agreement, a subsidiary of EnerNOC will commence a tender offer to acquire all of the Company’s shares of common stock for $5.50 per share in cash, representing an approximate 35% premium over the 20 trading-day average of the Company’s shares and an approximate 33% premium to the closing price of the Company’s shares on November 3, 2014. EnerNOC’s obligation to purchase the shares of the Company’s common stock tendered in the tender offer is subject to certain conditions, including that holders of at least a majority of the shares are tendered during the tender offer period. Following completion of the tender offer, the remaining shares will be acquired in a second step merger at the same cash price as paid in the tender offer.

Under the terms of the agreement, the Company may solicit superior proposals from third parties during a “go-shop” process, run by Canaccord Genuity, that extends for 55 days. It is not anticipated that any developments will be disclosed with regard to this process unless and until the Company’s Board of Directors makes a decision to pursue a potential superior proposal. The agreement provides EnerNOC with a customary right to match any superior proposal.

A special committee of the Board of Directors, consisting solely of independent directors, and the Board of Directors, unanimously approved the transaction. The special committee also obtained and considered a fairness opinion from Duff & Phelps, an independent third-party financial advisor.

Peter Londa, Chairman of the Company and a member of the Special Committee, stated, “The Special Committee of the Board of Directors worked diligently to negotiate and enter into the Merger Agreement with EnerNOC. Through this negotiation, we secured the ability to run a thorough go-shop process to determine whether a more robust offer is available to increase the value being delivered to our shareholders. Our Board is proud of the Company’s management team and employees for their efforts in building a differentiated and market-leading business in our sector.”

Phil Adams, CEO of the Company, stated, “This transaction reflects World Energy’s strategic position and core competencies in the United States retail energy market. Our software-based auction platform continues to demonstrate significant value to participants in the retail energy sector and is poised to deliver significant synergies and cost savings to customers as part of EnerNOC’s energy intelligence software platform. The price premium reflected in EnerNOC’s offer supports our management’s objective to realize value for our shareholders and create an exciting opportunity for our employees.”

The closing of the transaction is subject to the satisfaction of customary conditions, including expiration of the go-shop period, and is expected to close in early January 2015. There is no financing condition to the obligations to consummate the transaction, and the transaction does not require receipt of antitrust approval.

37

World Energy currently serves more than 4,000 customers with its cloud-based software platform, the World Energy Exchange®. To date, World Energy’s platform is responsible for transacting over $45 billion in electricity, natural gas and environmental commodities for its customers, making the Company among the leaders in the energy procurement market within the U.S. Through the first six months of 2014, World Energy reported $18.9 million in revenue, with a total backlog of $45 million.

Q3 Financial Results

World Energy will release its third quarter financial results on Monday, November 10, after market close and will hold a call at 5:00 p.m. (ET) to discuss them. To access the conference call by telephone, dial 1 (800) 774-6070 (domestic) or 1 (630) 691-2753 (international) and enter passcode 8871616#. Participants may also access a live webcast of the conference call through the investor relations section of World Energy’s website, www.worldenergy.com.

Notice to Investors

The tender offer described herein has not yet been commenced. The description contained in this press release is neither an offer to purchase nor a solicitation of an offer to sell securities of the Company. At the time the tender offer is commenced, EnerNOC and its wholly owned subsidiary intend to file a Tender Offer Statement on Schedule TO containing an offer to purchase, forms of letters of transmittal and other documents relating to the tender offer, and the Company intends to file a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer. Investors and stockholders of the Company are strongly advised to read the Tender Offer Statement on Schedule TO, including the offer to purchase, form of letter of transmittal and other documents related to the tender offer, and the Solicitation/Recommendation Statement on schedule 14D-9 that will be filed by the Company, and other relevant materials when they become available, because these materials contain important information regarding the tender offer. Stockholders of the Company will be able to obtain a free copy of these documents (when they become available) and other documents filed by the Company or EnerNOC with the SEC at the website maintained by the SEC at www.sec.gov. In addition, the Schedule TO and related exhibits, including the offer to purchase, forms of letters of transmittal, and other related tender offer documents may be obtained (when available) for free by contacting the Company at 100 Front Street, Worcester, MA 01608.

About World Energy Solutions, Inc.

World Energy Solutions, Inc. (NASDAQ: XWES) is an energy technology and services firm transforming energy procurement and energy efficiency for commercial, industrial, institutional, government and utility customers. The Company’s award-winning, cloud-based auction platform, the World Energy Exchange®, its team of energy experts, and a network of more than 500 suppliers and 300 channel partners form an ecosystem that enables customers to minimize their total cost of energy. To date, World Energy has transacted over $45 billion in energy, demand response and environmental commodities, creating more than $3 billion in value for its

38

customers. World Energy is also a leader in the global carbon market, where its World Energy Exchange® supports the Regional Greenhouse Gas Initiative (RGGI), the first mandatory market-based regulatory program in the U.S. to reduce greenhouse gas emissions. For more information, please visit www.worldenergy.com.

This press release contains forward-looking statements which involve risk and uncertainties. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “forecasts,” “projects,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. The Company has based these forward-looking statements on its current expectations and projections about future events, including without limitation, its expectations of backlog and energy prices, and its expectations in growth in revenue, operating results, operating margins, and free cash flow. Although the Company believes that the expectations underlying any of its forward-looking statements are reasonable, these expectations may prove to be incorrect and all of these statements are subject to risks and uncertainties. Should one or more of these risks and uncertainties materialize, or should underlying assumptions, projections or expectations prove incorrect, actual results, performance or financial condition may vary materially and adversely from those anticipated, estimated or expected. Such risks and uncertainties include, but are not limited to the following: whether the acquisition will be consummated; whether the Company will obtain a superior proposal; the Company’s revenue and backlog are dependent on actual future energy purchases pursuant to completed procurements; the demand for the Company’s services is affected by changes in regulated prices or cyclicality or volatility in competitive market prices for energy; the potential impact on the Company’s historical and prospective financial results of a change in accounting policy may negatively impact its stock price; and other factors outside the Company’s control that affect transaction volume in the electricity market. Additional risk factors are identified in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013 and subsequent reports filed with the Securities and Exchange Commission. The forward-looking statements made in this press release are made as at the date hereof. Readers are cautioned not to place undue reliance on forward-looking statements as actual results could differ materially from the forward-looking statements expressed in this press release. Forward-looking statements are provided for the purpose of presenting information about management’s current expectations relating to the future, and readers are cautioned that such statements may not be appropriate for other purposes. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, other than as required by securities laws.

For additional information, contact:

Dan Mees

World Energy Solutions

(508) 459-8156

dmees@worldenergy.com

39

Phil Adams

Chief Executive Officer

(NASDAQ: XWES)

100 Front Street 20th floor

Worcester, MA 01608

508-459-8100

www.worldenergy.com

This e-mail is intended only for the named recipient(s) and may contain information that is privileged, confidential and/or exempt from disclosure under applicable law. No waiver of privilege, confidence or otherwise is intended by virtue of communication via the internet. Any unauthorized use, dissemination or copying is strictly prohibited. If you have received this e-mail in error, or are not named as a recipient, please immediately notify the sender and destroy all copies of this e-mail. Thank you.

40