Exhibit 99.1

GREAT LAKES DREDGE & DOCK CORPORATION

INVESTOR PRESENTATION

Q4 2012

GREAT LAKES

DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

SAFE

HARBOR

This presentation includes “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, the Private Securities Litigation Reform Act of 1995 or in releases made by the SEC, all as may be amended from time to time. Such statements include declarations regarding the intent, belief, or current expectation of the Company and its management. The Company cautions that any such forward-looking statements are not guarantees of future performance, and involve a number of risks, assumptions and uncertainties that could cause actual results of the Company and its subsidiaries, or industry results, to differ materially from those expressed or implied by any forward-looking statements contained herein, including, but not limited to, as a result of the factors, risks and uncertainties described in other securities filings of the Company made with the SEC, such as the Company’s most recent Report on Form 10-K. You should not place undue reliance upon these forward-looking statements. Forward-looking statements provided herein are made only as of the date hereof or as a specified date herein and the Company does not have or undertake any obligation to update or revise them, unless required by law.

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

PRESENTERS

CHIEF EXECUTIVE OFFICER, DIRECTOR

JONATHAN BERGER

• Board member since December 2006

• Former Managing Director and Co-head of Corporate Finance for Navigant Consulting, Inc.

• Former partner at KPMG, LLP and past National Partner in charge of Corporate Finance at KPMG

SENIOR VICE PRESIDENT, CHIEF FINANCIAL OFFICER

WILLIAM STECKEL

• Previously served as CEO, president, CFO and treasurer at Daystar Technologies, Inc. (NASDAQ: DSTI).

• Served as senior vice president, CFO and treasurer at Norwood Promotional Products

• Held management positions with Invensys (FTSE: ISIS) in its Lambda Power, Seibe Climate Controls and CTS Corporation Divisions

TREASURER, DIRECTOR OF INVESTOR

RELATIONS

KATIE HAYES

• Named Treasurer in March 2011

• Served as Director of Investor Relations since the Company went public in 2006

• Joined the Company in 2006 and has over 18 years of accounting and finance experience

• Previously worked at TransUnion as Director of Corporate Accounting.

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

WHO IS GREAT LAKES DREDGE & DOCK CORPORATION?

INFRASTRUCTURE & ENVIRONMENTAL

DOMESTIC DREDGING

INTERNATIONAL DREDGING

DEMOLITION

ENVIRONMENTAL SERVICES

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

DREDGING & THE

ECONOMY

“The health of the U.S. economy depends, in part, upon the vitality and expansion of international trade. International trade depends upon the Nation’s navigation infrastructure, which serves as a conduit for transportation, trade, and tourism and connects us to the global community.

Marine transportation is one of the most efficient, effective, safe and environmentally sound ways to transport people and goods. It is a keystone of the U.S. economy. Ninety-five percent of our international trade moves through the Nation’s ports.”

Honorable Jo-Ellen Darcy Assistant Secretary of the Army (Civil Works)

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

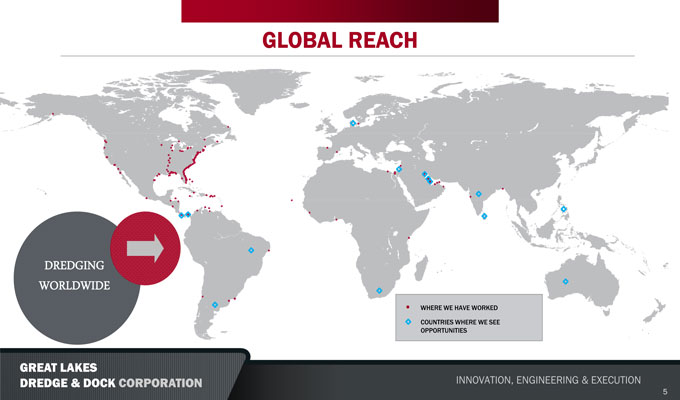

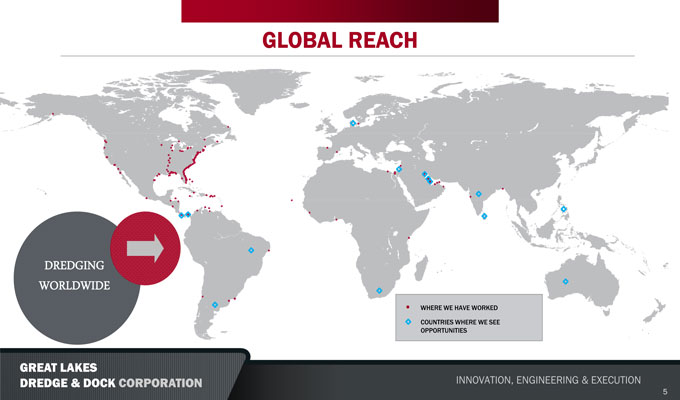

GLOBAL REACH

DREDGING WORLDWIDE

WHERE WE HAVE WORKED

COUNTRIES WHERE WE SEE OPPORTUNITIES

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

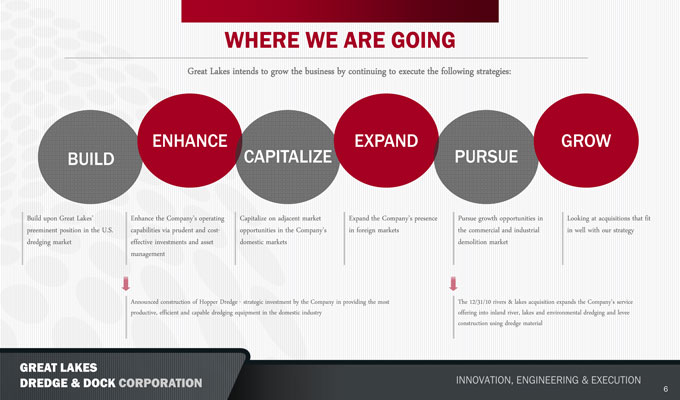

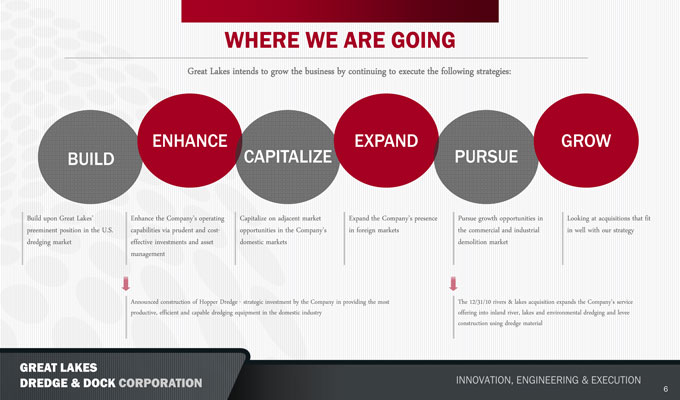

WHERE WE ARE GOING

Great Lakes intends to grow the business by continuing to execute the following strategies:

BUILD

Build upon Great Lakes’ preeminent position in the U.S. dredging market

ENHANCE

Enhance the Company’s operating capabilities via prudent and cost-effective investments and asset management

CAPITALIZE

Capitalize on adjacent market opportunities in the Company’s domestic markets

EXPAND

Expand the Company’s presence in foreign markets

PURSUE

Pursue growth opportunities in the commercial and industrial demolition market

GROW

Looking at acquisitions that fit in well with our strategy

Announced construction of Hopper Dredge - strategic investment by the Company in providing the most productive, efficient and capable dredging equipment in the domestic industry

The 12/31/10 rivers & lakes acquisition expands the Company’s service offering into inland river, lakes and environmental dredging and levee construction using dredge material

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

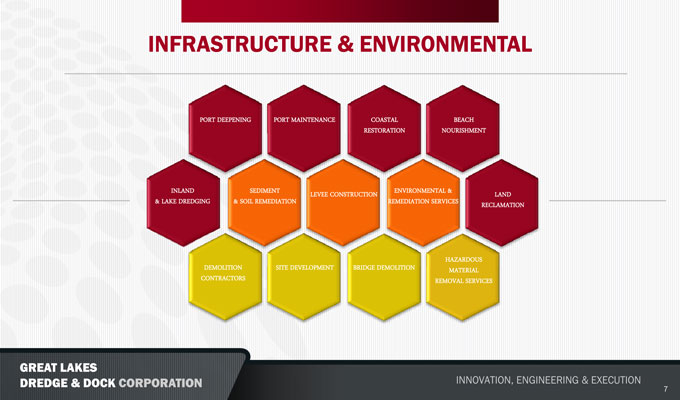

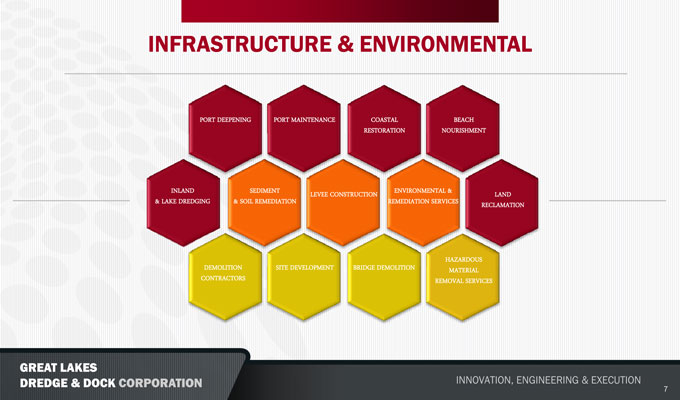

INFRASTRUCTURE & ENVIRONMENTAL

PORT DEEPENING

PORT MAINTENANCE

COASTAL RESTORATION

BEACH NOURISHMENT

INLAND & LAKE DREDGING

SEDIMENT & SOIL REMEDIATION

LEVEE CONSTRUCTION

ENVIRONMENTAL & REMEDIATION SERVICES

LAND RECLAMATION

DEMOLITION CONTRACTORS

SITE DEVELOPMENT

BRIDGE DEMOLITION

HAZARDOUS MATERIAL REMOVAL SERVICES

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

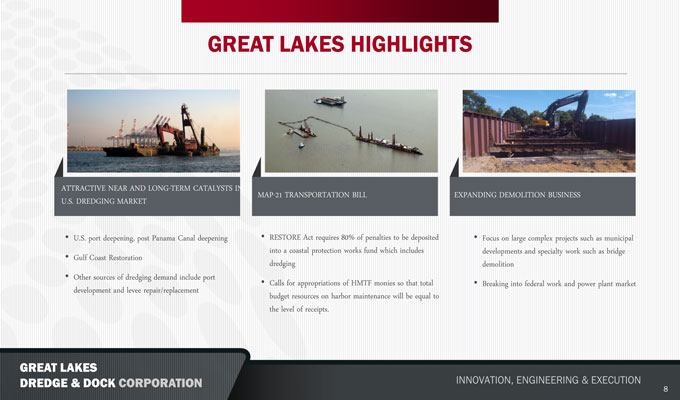

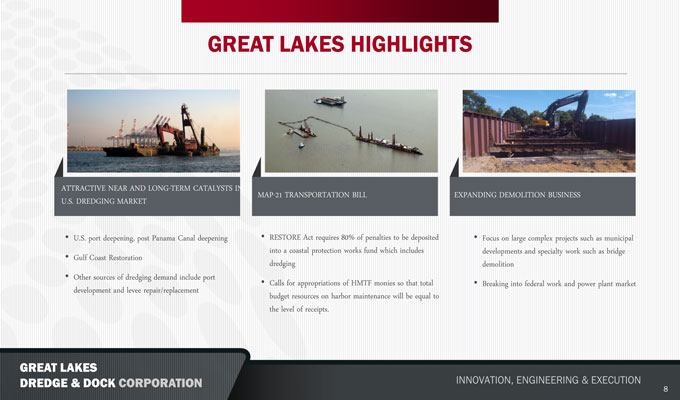

GREAT LAKES HIGHLIGHTS

ATTRACTIVE NEAR AND LONG-TERM CATALYSTS IN U.S. DREDGING MARKET

• U.S. port deepening, post Panama Canal deepening

• Gulf Coast Restoration

• Other sources of dredging demand include port development and levee repair/replacement

MAP-21 TRANSPORTATION BILL

• RESTORE Act requires 80% of penalties to be deposited into a coastal protection works fund which includes dredging

• Calls for appropriations of HMTF monies so that total budget resources on harbor maintenance will be equal to the level of receipts.

EXPANDING DEMOLITION BUSINESS

• Focus on large complex projects such as municipal developments and specialty work such as bridge demolition

• Breaking into federal work and power plant market

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

BOSTON 40’

NEW YORK 50’

PORTS WITH DEEPENING EXPEDITED BY OBAMA DELAWARE 40’ ADMINISTRATION

PORTS WITH PLANS FOR EXPANSION

SAN DIEGO 35’ CHARLESTON 45’

SAVANNAH 42’

MOBILE 45’ JACKSONVILLE 40’ NEW ORLEANS 45’ HOUSTON 45’

PORT EVERGLADES 42’

MIAMI 42’

PORTS WITH PLANS FOR EXPANSION

International trade, particularly in the intermodal container shipping business, is undergoing significant change as a result of the Panama Canal expansion. Many shipping lines have announced plans to deploy larger ships which, due to channel dimension requirements, currently cannot use many U.S. East and Gulf Coast ports.

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

9

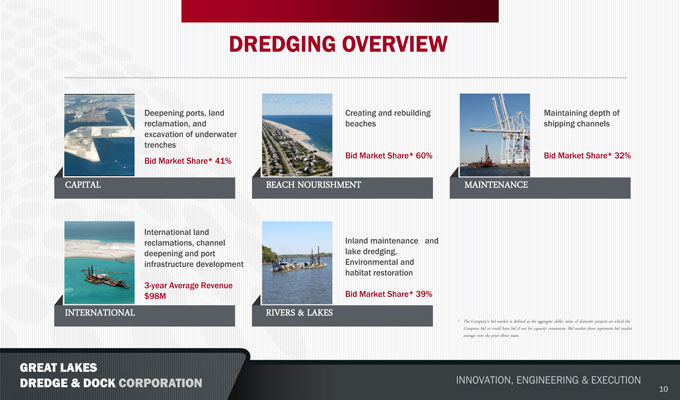

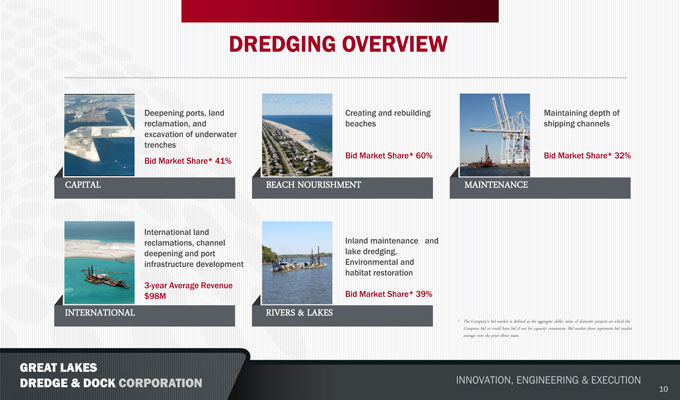

DREDGING OVERVIEW

Deepening ports, land reclamation, and excavation of underwater trenches Bid Market Share* 41%

CAPITAL

Creating and rebuilding beaches

Bid Market Share* 60%

BEACH NOURISHMENT

Maintaining depth of shipping channels

Bid Market Share* 32%

MAINTENANCE

International land reclamations, channel deepening and port infrastructure development

3-year Average Revenue $98M

INTERNATIONAL

Inland maintenance and lake dredging, Environmental and habitat restoration

Bid Market Share* 39%

RIVERS & LAKES

* The Company’s bid market is defined as the aggregate dollar value of domestic projects on which the Company bid or could have bid if not for capacity constraints. Bid market share represents bid market average over the prior three years.

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

10

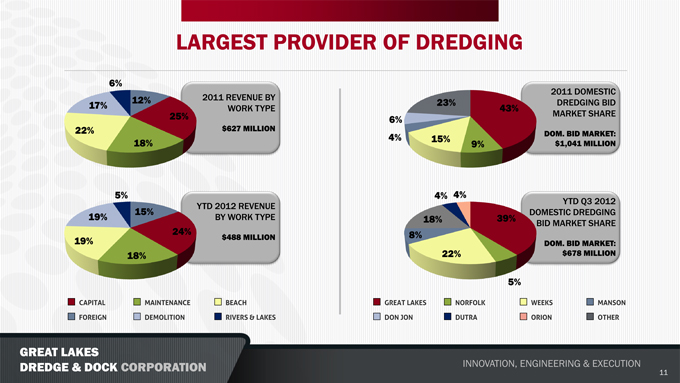

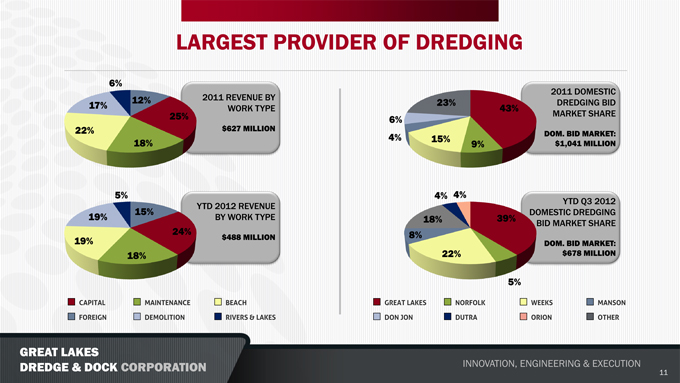

LARGEST PROVIDER OF DREDGING

6% 12 17%

%2011 REVENUE BY

WORK TYPE

25

% $627 MILLION

22 18

% %

19 5% 15

%YTD 2012 REVENUE

% BY WORK TYPE

24

$488 MILLION

%

19 18

% %

CAPITAL MAINTENANCE BEACH

FOREIGN DEMOLITION RIVERS & LAKES

23 2011 DOMESTIC

% 43 DREDGING BID

6% MARKET SHARE

%

4% DOM. BID MARKET: $1,041 MILLION

15

% 9%

18 4% 4% 39

YTD Q3 2012

% % DOMESTIC

DREDGING BID MARKET SHARE

8% DOM. BID MARKET:

22 $678 MILLION

5% %

GREAT LAKES NORFOLK WEEKS MANSON

DON JON DUTRA ORION OTHER

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

11

LARGE & FLEXIBLE FLEET U.S. & INTERNATIONAL MARKETS

ESTIMATE FLEET REPLACEMENT COST IN EXCESS OF $1.5 BILLION IN CURRENT MARKET

HYDRAULIC

Dredge Alaska at Hilton Head

• 20 Vessels*: 16 U.S., 4 Middle East (19 U.S. flagged)

• Including the only two large electric cutterhead dredges available in the U.S. for environmentally sensitive regions requiring lower emissions

HOPPER

Dredge Liberty Island at Panama City Beach

• | | 8 Vessels: 4 U.S., 4 Middle East, (4 U.S. flagged) |

• Highly mobile, able to operate in rough waters

• Little interference with other ship traffic

MECHANICAL

Dredge New York at Port Jersey Channel

• | | 5 Vessels: All U.S (All U.S. flagged) |

• Operates one of two environmentally friendly electric clamshell dredges in the U.S.

• Maneuverability in tight areas such as docks and terminals

* Note: Nine vessels were added from 2010 rivers & lakes acquisition which are hydraulic but have less capacity, ideal for rivers and environmental dredging

+ 19 Material Transportation Barges and Over 160 Other Specialized Support Vessels

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

12

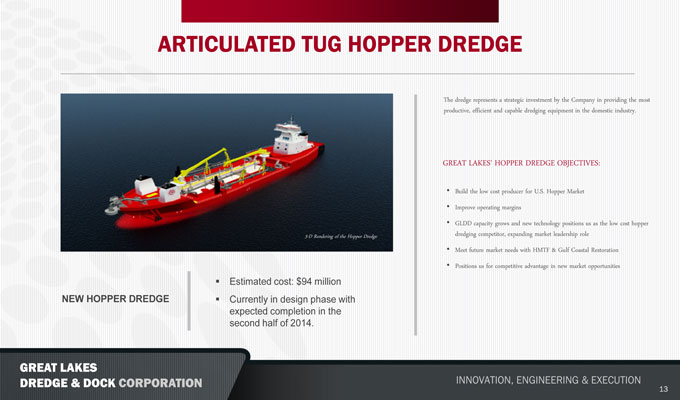

ARTICULATED TUG HOPPER DREDGE

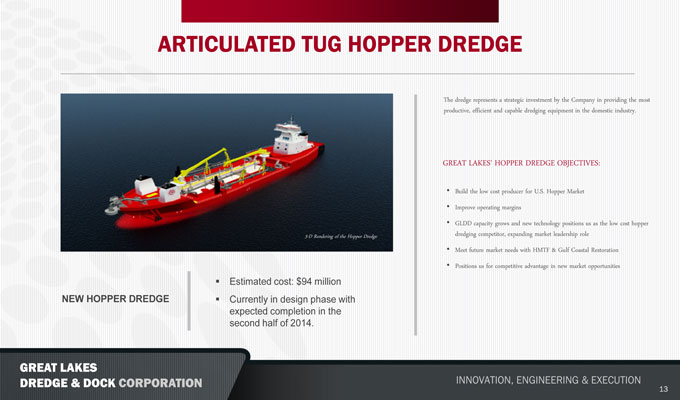

3-D Rendering of the Hopper Dredge

NEW HOPPER DREDGE

Estimated cost: $94 million Currently in design phase with expected completion in the second half of 2014.

The dredge represents a strategic investment by the Company in providing the most productive, efficient and capable dredging equipment in the domestic industry.

GREAT LAKES’ HOPPER DREDGE OBJECTIVES:

• Build the low cost producer for U.S. Hopper Market

• Improve operating margins

• GLDD capacity grows and new technology positions us as the low cost hopper dredging competitor, expanding market leadership role

• Meet future market needs with HMTF & Gulf Coastal Restoration

• Positions us for competitive advantage in new market opportunities

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

13

TWO NEW MATERIAL SCOWS

3-D Rendering of Material Scow

TWO NEW SCOWS

Estimated cost: $17 million ($8.5 million each) Scows will be delivered in 2013

GREAT LAKES’ NEW MATERIAL SCOWS

• The scows will be used primarily on capital deepening and coastal restoration work on the East and Gulf coasts.

• GLDD has become very successful loading scows with cutter suction dredges. This has allowed us to match the dredging ability of the cutter suction dredges on projects, giving us an effective transportation system and a cost advantage over our competitors.

• Construction of the dredge and scows will create approximately 250 new U.S. shipyard and engineering jobs over the construction period.

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

14

OUR INTELLECTUAL PROPERTY AND HUMAN CAPITAL ARE A COMPETITIVE ADVANTAGE

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

15

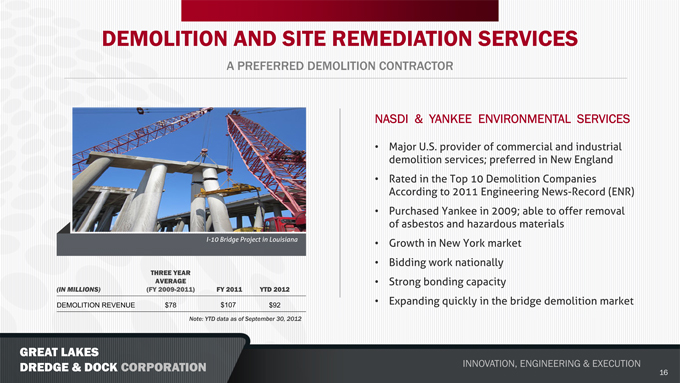

DEMOLITION AND SITE REMEDIATION SERVICES

A PREFERRED DEMOLITION CONTRACTOR

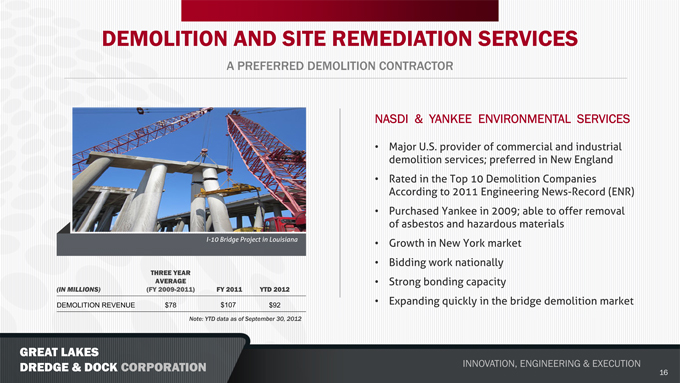

I-10 Bridge Project in Louisiana

THREE YEAR

AVERAGE

(IN MILLIONS) (FY 2009-2011) FY 2011 YTD 2012

$10

DEMOLITION REVENUE $78 7 $92

Note: YTD data as of September 30, 2012

NASDI & YANKEE ENVIRONMENTAL SERVICES

• Major U.S. provider of commercial and industrial demolition services; preferred in New England

• Rated in the Top 10 Demolition Companies According to 2011 Engineering News-Record (ENR)

• Purchased Yankee in 2009; able to offer removal of asbestos and hazardous materials

• Growth in New York market

• Bidding work nationally

• Strong bonding capacity

• Expanding quickly in the bridge demolition market

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

16

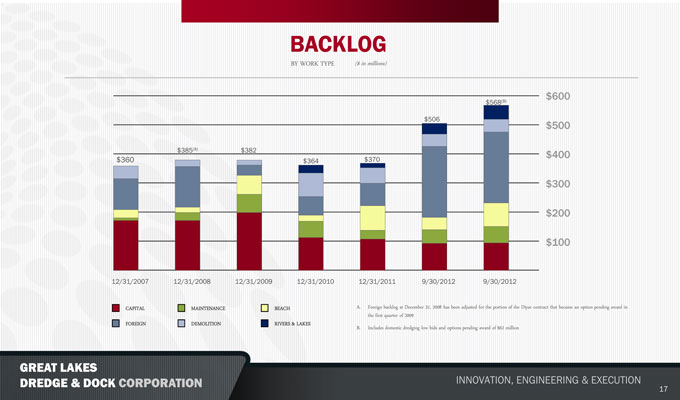

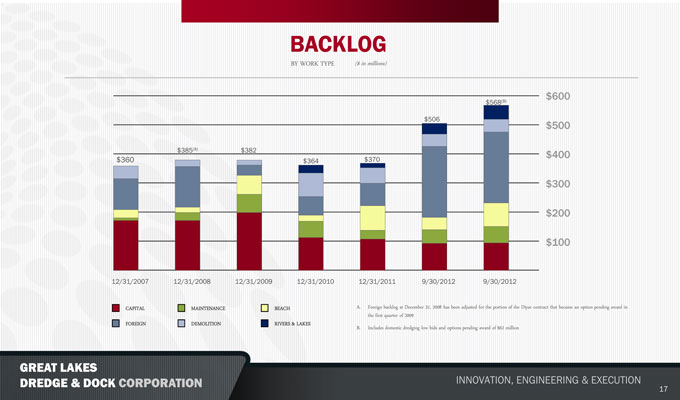

BACKLOG

BY WORK TYPE ($ in millions)

$600

$568(B)

$506 $500

$385(A) $382 $400

$360 $364 $370

$300

$200

$100

12/31/2007 12/31/2008 12/31/2009 12/31/2010 12/31/2011 9/30/2012 9/30/2012

CAPITAL MAINTENANCE BEACH

FOREIGN DEMOLITION RIVERS & LAKES

A. Foreign backlog at December 31, 2008 has been adjusted for the portion of the Diyar contract that became an option pending award in the first quarter of 2009

B. Includes domestic dredging low bids and options pending award of $62 million

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

17

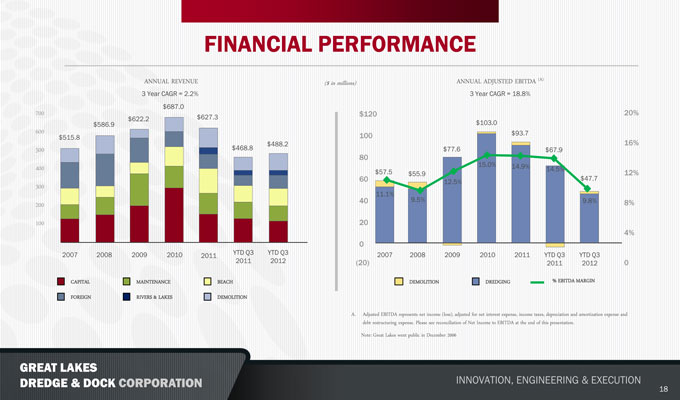

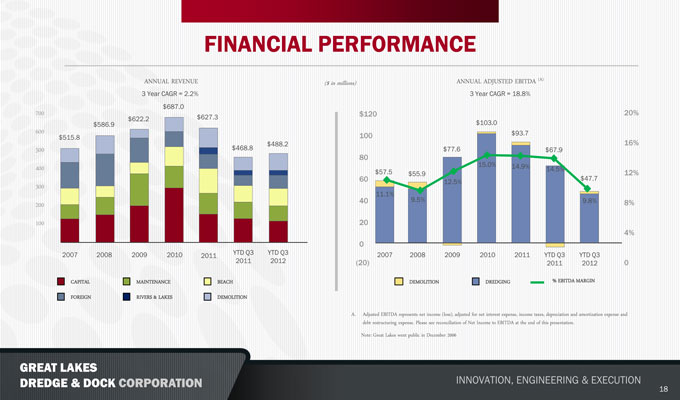

FINANCIAL PERFORMANCE

ANNUAL REVENUE

3 | | Year CAGR = 2.2% 700 $687.0 $622.2 $627.3 $586.9 600 $515.8 $488.2 500 $468.8 |

400 300 200 100

2007 2008 2009 2010 YTD Q3 YTD Q3 2011 2011 2012

CAPITAL MAINTENANCE BEACH

FOREIGN RIVERS & LAKES DEMOLITION

($ in millions)

ANNUAL ADJUSTED EBITDA (A)

$120 20% $103.0 100 $93.7

$77.6 $67.9 16% 80

15.0% 14.9%

$57.5 14.5% 12%

$55.9

60 $47.7

12.5%

11.1%

40 9.5% 9.8% 8%

20

4% 0

2007 2008 2009 2010 2011 YTD Q3 YTD Q3

DEMOLITION DREDGING % EBITDA MARGIN

A. Adjusted EBITDA represents net income (loss), adjusted for net interest expense, income taxes, depreciation and amortization expense and debt restructuring expense. Please see reconciliation of Net Income to EBITDA at the end of this presentation.

Note: Great Lakes went public in December 2006

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

18

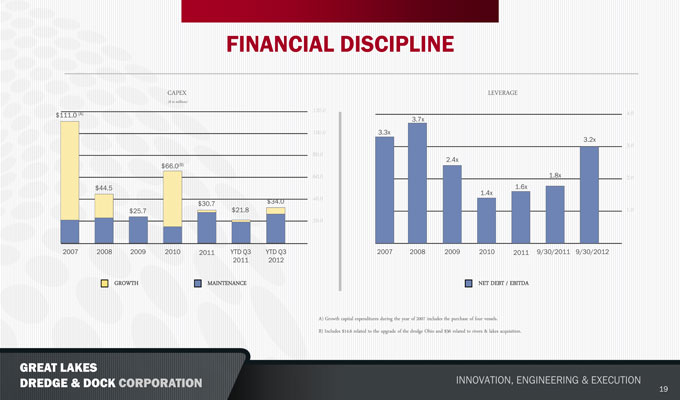

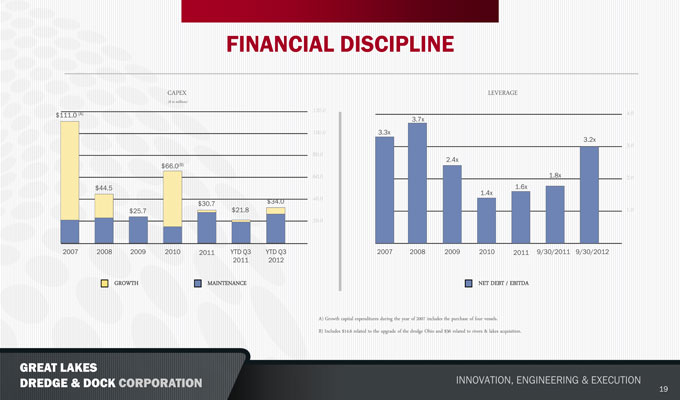

FINANCIAL DISCIPLINE

CAPEX

($ in millions)

120.0 $111.0 (A)

100.0

80.0

$66.0(B)

60.0

$44.5

$34.0 40.0

$30.7 $21.8

$25.7

20.0

2007 2008 2009 2010 2011 YTD Q3 YTD Q3 2011 2012

GROWTH MAINTENANCE

LEVERAGE

3.7x 4.0

3.3x

3.2x

3.0

2.4x

1.8x 2.0

1.4x 1.6x

1.0

2007 2008 2009 2010 2011 9/30/2011 9/30/2012

NET DEBT / EBITDA

A) Growth capital expenditures during the year of 2007 includes the purchase of four vessels.

B) Includes $14.6 related to the upgrade of the dredge Ohio and $36 related to rivers & lakes acquisition.

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

19

INVESTMENT HIGHLIGHTS

• LARGEST U.S. DREDGING PROVIDER IN THE U.S.

• PROTECTED MARKET & PROVEN RECORD

• “Dredging Act” and “Jones Act” effectively serve as barriers to entry for non-U.S.-owned dredging companies

• Demonstrated record of successful project completion having never failed to complete a marine project

• STRONG CAPITAL STRUCTURE

• INTERNATIONAL PRESENCE

• U.S. dredging operator with significant international presence

• Portfolio of flexible fleet enables repositioning of vessels as necessary

• EXPANDING DEMOLITION BUSINESS

• Completed quick and successful turnaround in 2011

• Expanding demolition business into bridge demolition and sediment & soil remediation

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

20

APPENDIX

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

21

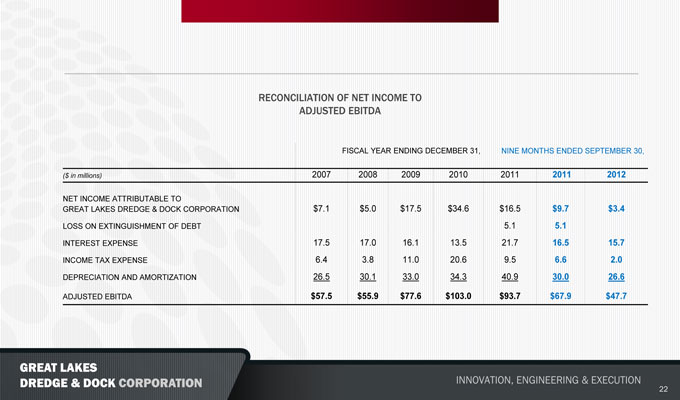

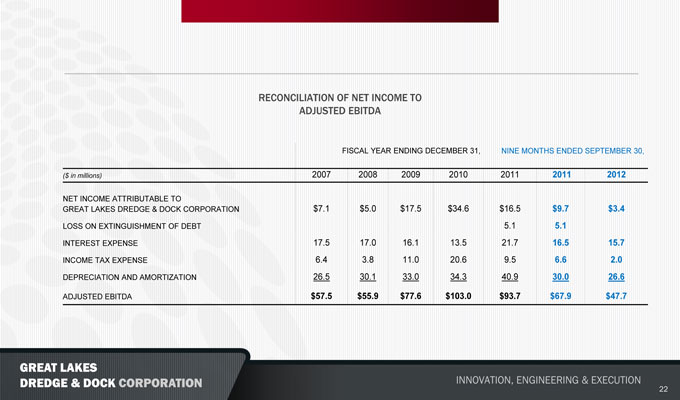

RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA

FISCAL YEAR ENDING DECEMBER 31, NINE MONTHS ENDED SEPTEMBER 30,

($ in millions) 2007 2008 2009 2010 2011 2011 2012

NET INCOME ATTRIBUTABLE TO

GREAT LAKES DREDGE & DOCK CORPORATION $7.1 $5.0 $17.5 $34.6 $16.5 $9.7 $3.4

LOSS ON EXTINGUISHMENT OF DEBT 5.1 5.1

INTEREST EXPENSE 17.5 17.0 16.1 13.5 21.7 16.5 15.7

INCOME TAX EXPENSE 6.4 3.8 11.0 20.6 9.5 6.6 2.0

DEPRECIATION AND AMORTIZATION 26.5 30.1 33.0 34.3 40.9 30.0 26.6

ADJUSTED EBITDA $57.5 $55.9 $77.6 $103.0 $93.7 $67.9 $47.7

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

22

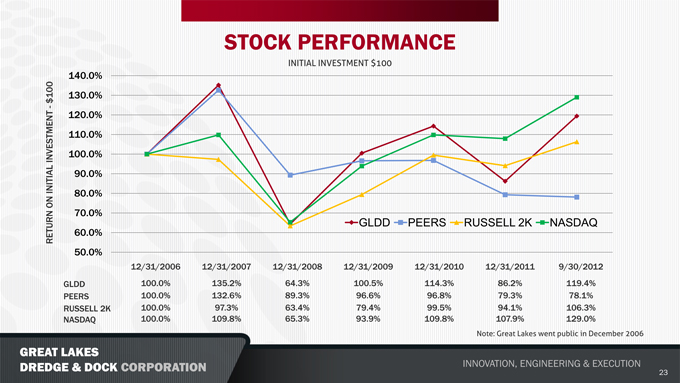

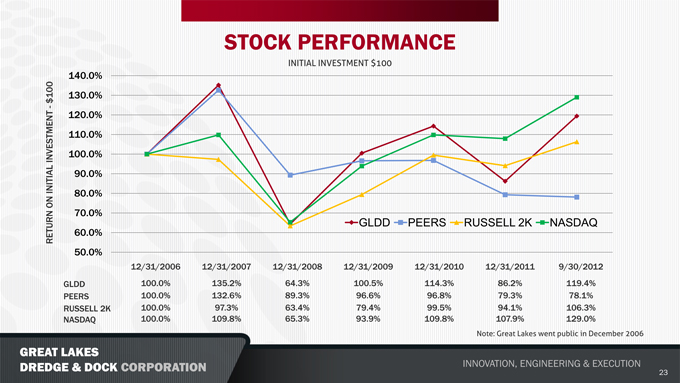

STOCK PERFORMANCE

INITIAL INVESTMENT $100

RETURN ON INITIAL INVESTMENT - $100

140.0% 130.0% 120.0% 110.0% 100.0%

90.0%

80.0%

70.0%

60.0% GLDD PEERS

50.0%

12/31/2006 12/31/2007 12/31/2008 12/31/2009 12/31/2010 12/31/2011 9/30/2012

GLDD 100.0% 135.2% 64.3% 100.5% 114.3% 86.2% 119.4%

PEERS 100.0% 132.6% 89.3% 96.6% 96.8% 79.3% 78.1%

RUSSELL 2K 100.0% 97.3% 63.4% 79.4% 99.5% 94.1% 106.3%

NASDAQ 100.0% 109.8% 65.3% 93.9% 109.8% 107.9% 129.0%

Note: Great Lakes went public in December 2006

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

23

GREAT LAKES DREDGE & DOCK CORPORATION

INNOVATION, ENGINEERING & EXECUTION

24