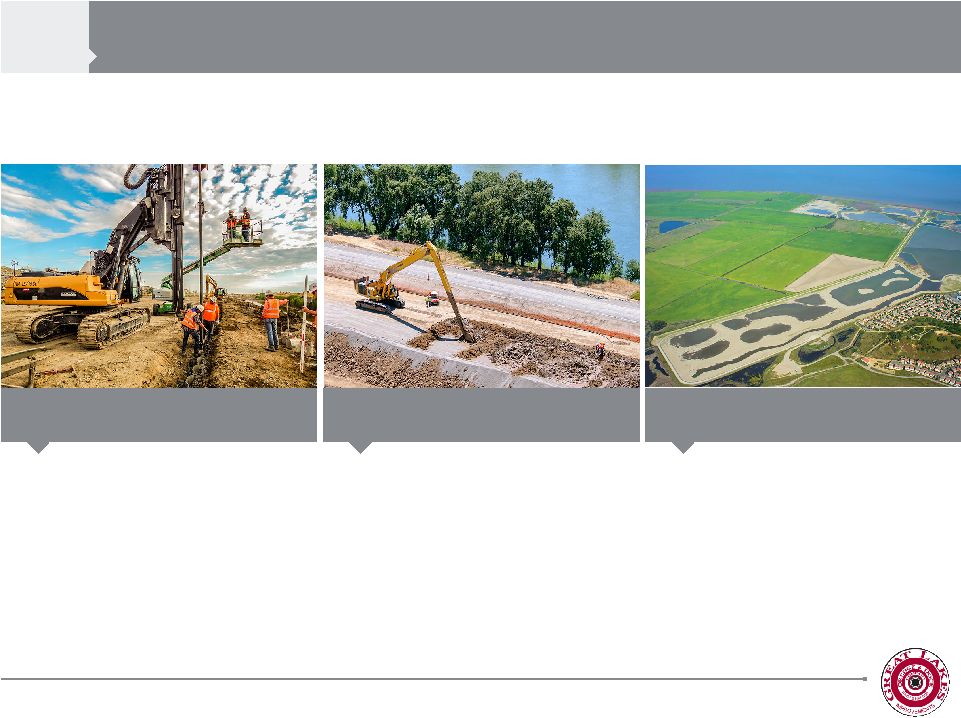

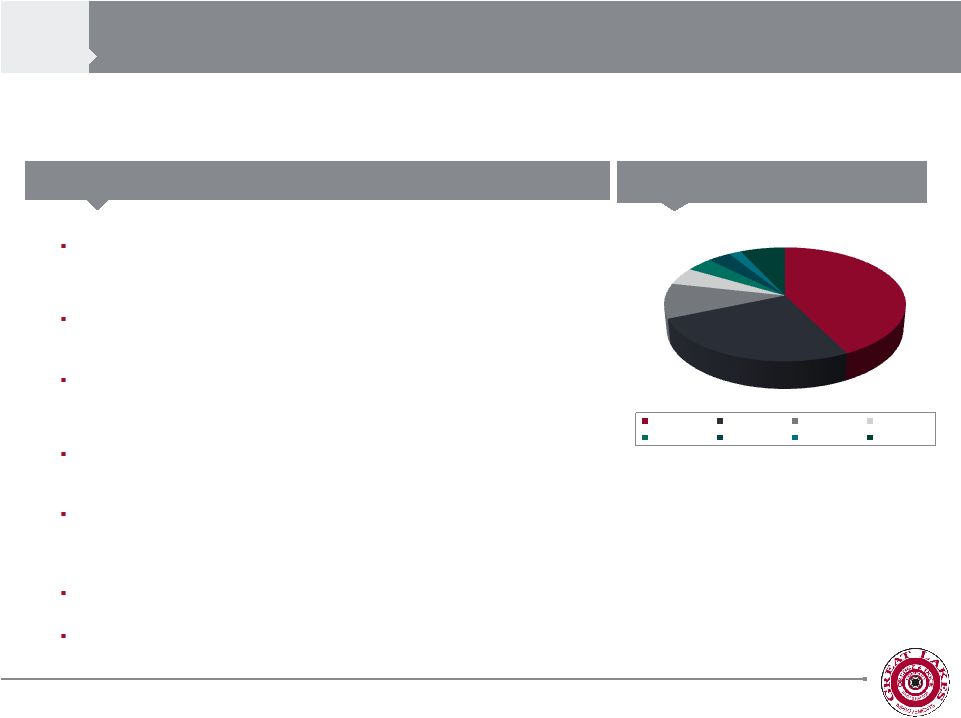

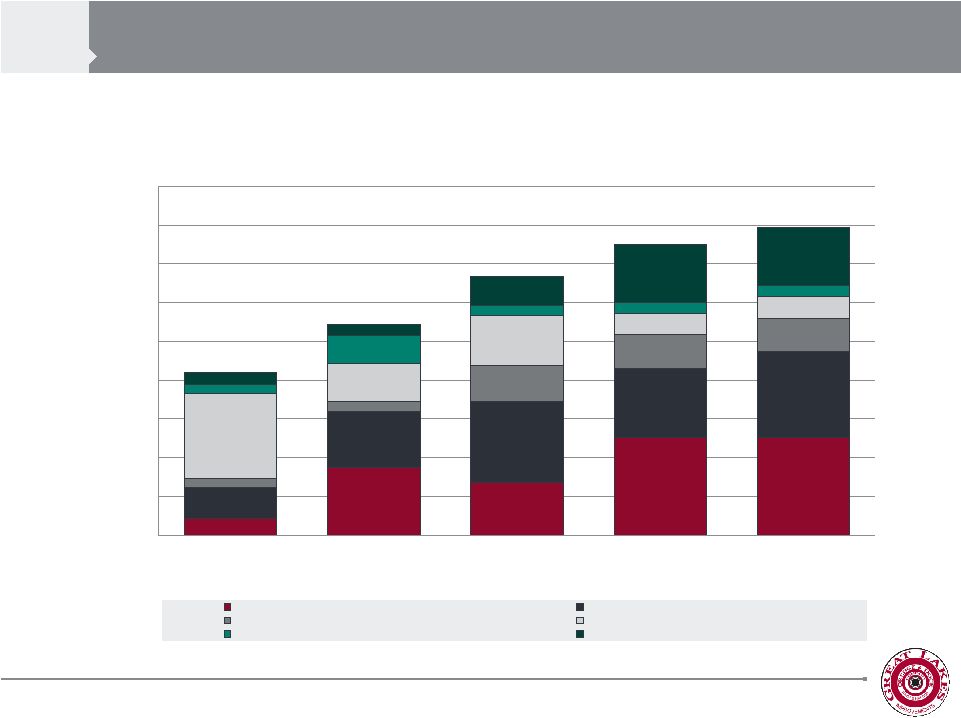

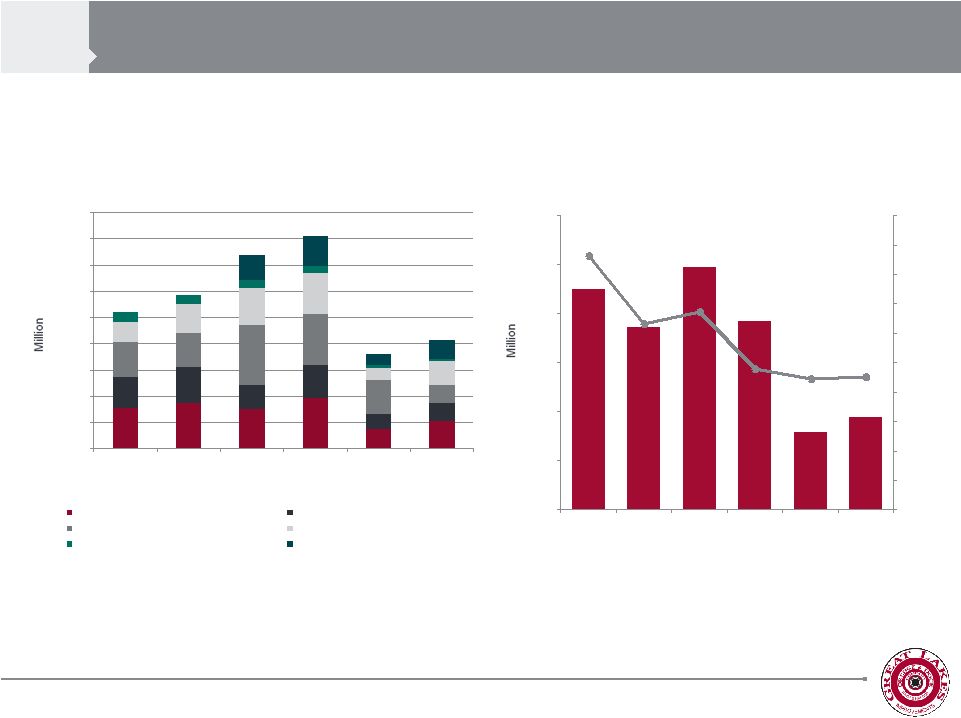

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM $6.4 $6.3 $5.4 $3.6 $3.1 $2.7 Conservation & Development Construction Site Remediation Building Remediation Emergency Response Special / Haz. Waste Other Rem. & Env. Clean-Up ABOUT US 01 12 $27.5 BILLION* > Highly fragmented – ~5,000 small, local and regional service providers with few large, public companies > Lower level of capital intensity compared to dredging > Drivers include: > Aging U.S. infrastructure – estimated $3.6 trillion investment needed for U.S. infrastructure by 2020 > Expansion and improvement of midstream assets and refining capacity: over $250 billion estimated spend in the next 25 years in natural gas, natural gas liquids and oil transmission infrastructure > Government oversight of environmental practices with tightened mandates and increased legislation > Superfund sites in the Northeast are now obtaining funding for environmental clean-up and remediation to develop brownfields > Natural disasters 2014 ENV. REMEDIATION & GEOTECHNICAL SERVICES – $27.5B > MARKET FOR ENVIRONMENTAL REMEDIATION EXPECTED TO GROW, PRIMARILY DRIVEN BY THE PRIVATE SECTOR MARKET OVERVIEW & DRIVERS Great Lakes was ranked #45 on Engineering News-Record’s “2014 Top 200 Environmental Firms List,” the Company’s inaugural year on the list Source: IBISworld, American Society of Civil Engineering and GLDD internal estimates |