Monaker Group, Inc. 8-K

Exhibit 99.1

The Next Global Technology Play NASDAQ: MKGI NewCo Vision & Overview - August 2020 “Proposed Combination subject to shareholder approval”

NASDAQ: MKGI Important Cautions Regarding Forward - Looking Statements Forward - Looking Statements - Certain of the matters discussed in this communication which are not statements of historical fact constitute forward - looking st atements that involve a number of risks and uncertainties and are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Words such as “strategy,” “expects,” “continu es, ” “plans,” “anticipates,” “believes,” “would,” “will,” “estimates,” “intends,” “projects,” “goals,” “targets” and other words of similar meaning are intended to identify forward - looking statements but are not the exclusive means of identifying these stateme nts. As disclosed in the Current Report on Form 8 - K which Monaker Group, Inc. (the “Company”) filed with the Securities and Exchange Commission (SEC) on July 23, 2020, on July 23, 2020, the C om pany entered into (a) a Share Exchange Agreement with HotPlay Enterprise Limited (“ HotPlay ”) and the stockholders of HotPlay (the “ HotPlay Stockholders” and the “ HotPlay Share Exchange”); and (b) a Share Exchange Agreement with certain stockholders holding shares of Axion Ventures, Inc. (“Axion ” and the “Axion Stockholders”) and certain debt holders holding debt of Axion (the “Axion Creditors”, and the Axion Creditors, tog eth er with the Axion Stockholders, HotPlay Stockholders, HotPlay and the Company, the “Share Exchange Parties” and the “Axion Share Exchange”, and collectively with the HotPlay Exchange Agreement, the “Exchange Agreements” and the transactions contemplated therein, the “Share Exchanges”). Important factors that may cause actual results and outcomes to differ materially from those contained in such forward - looking s tatements include, without limitation, the ability of the parties to close the share exchange agreements on the terms set forth in, and pursuant to the required timing set forth in, the share exchange agreements, if at all; the occurrence of any e ven t, change or other circumstances that could give rise to the right of one or all of HotPlay , the HotPlay shareholders, Axion, the Axion shareholders, the Axion creditors or the Company (collectively, the “Share Exchange Parties”) to terminate the share ex cha nge agreements; the effect of such terminations; the outcome of any legal proceedings that may be instituted against Share Exchange Parties or their respective directors; the ability to obtain regulatory and other approvals and meet other clo sin g conditions to the share exchange agreements on a timely basis or at all, including the risk that regulatory and other approvals required for the share exchange agreements are not obtained on a timely basis or at all, or are obtained subject to co nditions that are not anticipated or that could adversely affect the combined company or the expected benefits of the transaction; the ability to obtain approval by the Company’s stockholders on the expected schedule of the transactions contem pla ted by the share exchange agreements; difficulties and delays in integrating HotPlay’s and the Company’s businesses; prevailing economic, market, regulatory or business conditions, or changes in such conditions, negatively affecting the parti es; risks associated with COVID - 19 and the global response thereto; risks that the transactions disrupt the Company’s or HotPlay’s current plans and operations; failing to fully realize anticipated cost savings and other anticipated benefits of the share e xc hange agreements when expected or at all; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the share exchange agreements; the ability of HotPlay and the Company to retain and hire key personnel; the diversion of management’s attention from ongoing business operations; u nc ertainty as to the long - term value of the common stock of the combined company following the share exchange agreements; the significant dilution wh ich will be created to ownership interests of the Company in connection with the closing of the share exchange agreements; the continued availability of capital and financing following the share exchange agreements; the business, econom ic and political conditions in the markets in which Share Exchange Parties operate; and the fact that the Company’s reported earnings and financial position may be adversely affected by tax and other factors. Other important factors that may ca use actual results and outcomes to differ materially from those contained in the forward - looking statements included in this communication are described in the Company’s publicly filed reports, including, but not limited to, the Company’s Annual Re port on Form 10 - K for the year ended February 29, 2020 and its Quarterly Report on Form 10 - Q for the quarter ended May 31, 2020 and subsequent filed reports. The Company cautions that the foregoing list of important factors is not complete, and do es not undertake to update any forward - looking statements except as required by applicable law. All subsequent written and oral forward - looking statements attributable to the Company or any person acting on behalf of any Share Exchange Parties are expressly qualified in their entirety by the cautionary statements referenced above. Additional Information and Where to Find It - In connection with the proposed share exchange agreements, the Company will file with the SEC a proxy statement to seek stock hol der approval for the share exchange agreements and the issuance of shares of common stock pursuant thereto and in connection therewith, which, when finalized, will be sent to the stockholders of the Company seeking their approval of the respective transaction - related proposals. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS AND ANY OTHER RELEVANT DOC UME NTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED SHARE EXCHANGE AGREEMENTS, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, HOTPLAY, AXI ON AND THE PROPOSED SHARE EXCHANGES. Investors and security holders may obtain copies of these documents free of charge through the website maintained by the SEC at www.sec.gov or from the Company at its website, www.monakergroup.com. Documents filed with the SEC by the Company will be available free of charge by accessing the Company’s website at www.monakergroup.com under the heading “Stock Inf o” or, alternatively, by directing a request by mail, email or telephone to Monaker Group, Inc. at 2893 Executive Park Drive, Suite 201, Weston, Florida 33331; info@monakergroup.com; or (954) 888 - 9779, respectively. Participants in the Solicitation - The Company and certain of its respective directors and executive officers may be deemed to be participants in the solicitati on of proxies from the respective stockholders of the Company in respect of the proposed share exchange agreements under the rules of the SEC. Information about the Company’s directors and executive officers is ava ila ble in the Company’s Annual Report on Form 10 - K/A (Amendment No. 1) for the year ended February 29, 2020, as filed with the Securities and Exchange Commission on June 25, 2020. Other information regarding the participants in the proxy solic ita tion and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC regarding the share exchange agreements when they becom e a vailable. Investors should read the proxy statement carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from the Company using the sources indicated above. No Offer or Solicitation - This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall the re be any sale of securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. © Copyright 2019 - 2020 Monaker Group, Inc. All Rights Reserved. A Product of CMA. 062620 2

NASDAQ: MKGI Important Cautions Regarding Forward - Looking Statements Forward - Looking Statements – Continued Additional Information and Where to Find It - In connection with the proposed share exchange agreements, the Company will file with the SEC a proxy statement to seek stock hol der approval for the share exchange agreements and the issuance of shares of common stock pursuant thereto and in connection therewith, which, when finalized, wi ll be sent to the stockholders of the Company seeking their approval of the respective transaction - related proposals. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT, AS WELL AS ANY AMENDMENTS O R SUPPLEMENTS TO THOSE DOCUMENTS AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED SHARE EXCHANGE AGREEMENTS, WHEN THEY BEC OME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, HOTPLAY, AXION AND THE PROPOSED SHARE EXCHANGES. Investors and security holders may obtain copies of these documents free of charge through the website maintained by the SEC at www.sec.gov or from the Company at its website, www.monakergroup.com. Documents filed with the SEC by the Company will be available free of charge by accessing the Company’s website at www.monake rgr oup.com under the heading “Stock Info” or, alternatively, by directing a request by mail, email or telephone to Monaker Group, Inc. at 2893 Executive Park Drive, Suite 201, Weston, Florida 33331; info@monakergroup.com; or (954) 888 - 9779, respectiv ely. Participants in the Solicitation - The Company and certain of its respective directors and executive officers may be deemed to be participants in the solicitati on of proxies from the respective stockholders of the Company in respect of the proposed share exchange agreements under the rules of the SEC. Information about the Company’s dire cto rs and executive officers is available in the Company’s Annual Report on Form 10 - K/A (Amendment No. 1) for the year ended February 29, 2020, as filed with the Securities and Exchange Commission on June 25, 202 0. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy stateme nt and other relevant materials to be filed with the SEC regarding the share exchange agreements when they become available. Investors should read the proxy statement carefully when it becomes available before m aki ng any voting or investment decisions. You may obtain free copies of these documents from the Company using the sources indicated above. No Offer or Solicitation - This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall the re be any sale of securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdict ion . Past performance and pro - forma information provided in this document is given for illustrative purposes only and should not be r elied upon as (and is not) an indication of future performance. In this document, we may rely on and refer to information regarding our industry and the market for our products and services in general from market research reports, analyst reports and other publicly available information. Although we believe that this information is reliable, we cannot guarantee the accuracy and completeness of this in formation, and we have not independently verified any of it. Some data is also based on our good faith estimates. © Copyright 2019 - 2020 Monaker Group, Inc. All Rights Reserved. A Product of CMA. 062620 3

NASDAQ: MKGI Contents - Monaker Group Update - Strategic Growth Plan - Planned Acquisition of HotPlay & Axion interest - Key Elements of Acquisition - Acquisition Benefits - Planned New Company Structure & Initiatives © Copyright 2019 - 2020 Monaker Group, Inc. All Rights Reserved. A Product of CMA. 062620 4

NASDAQ: MKGI Monaker’s Mission, Objectives & Guiding Principles in 2020 Monaker’s Mission is to Become the Industry Leader in Instantly - Bookable (instantly confirmed) Alternative Lodging Rentals Mission Objectives • Drive revenue growth and profitability across Monaker’s products & brands • Leveraging our proprietary technology in a multi - brand portfolio that penetrates each segment of the travel marketplace • Eliminate friction between traditional booking channels and Alternative Lodging • Drive innovation in the Alternative Lodging Industry to improve the customer experience Guiding Principles Cash Minimize cost by reducing the number of products and brands Focus brand leaders on revenue growth and profitability Diversify Penetrate both the B2B and B2C marketplace through distinct products and brands Synergize Leverage individual brands to cross - sell into other portfolio brands (i.e. NextTrip to Maupintour) Maximize Maximize return on investment for shareholders through disciplined execution 5

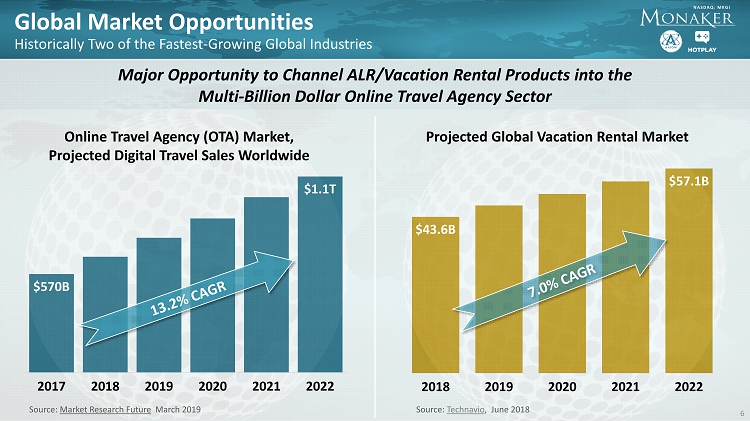

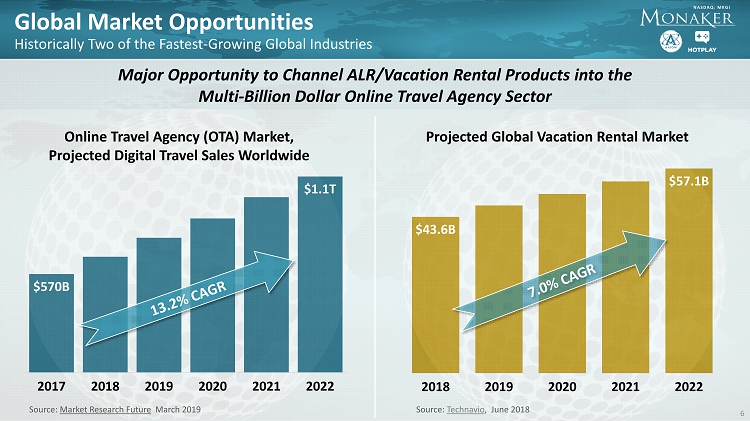

NASDAQ: MKGI $570B $1.1T 2017 2018 2019 2020 2021 2022 Global Market Opportunities Historically Two of the Fastest - Growing Global Industries Source: Market Research Future March 2019 Online Travel Agency (OTA) Market, Projected Digital Travel Sales Worldwide $43.6B $57.1B 2018 2019 2020 2021 2022 Projected Global Vacation Rental Market Source: Technavio , June 2018 Major Opportunity to Channel ALR/Vacation Rental Products into the Multi - Billion Dollar Online Travel Agency Sector 6

NASDAQ: MKGI ▪ The vacation/ALR market is the fastest growing travel sector, yet still in its infancy at only 10% of U.S. market. ▪ Growth driven by numerous factors, including increase in vacation rental users, especially by Millennials and Gen Zs 1 100M 361M 2019 2020 2021 2022 2023 Strong Market Drivers for Vacation/Alternative Lodging Rentals Expected Rapid Growth in Vacation Rental Users Worldwide Vacation/ALR Bookings Growing @ 32% CAGR vs. Online hotel room bookings @ only 10% CAGR 2 Source: PhocusWire , Sept. 2019 $242B $244B $23B $30B 0% 20% 40% 60% 80% 100% 2018 2019 Market Share ALR (Houses/Apts) Traditional Lodging (Hotels, etc.) Strong Forecast for Vacation/ALR Market Share Growth in U.S. Expanding from 8.6% to 10%, 2018 – 2019; Sales up 30% to $30 Billion 3 1) Technavio Aug 2019. 2) Guggenheim Analyst DEC 2018 ; 3) Shift Research , May 2019 7

NASDAQ: MKGI Post Lockdown ALR Booking Growth Surge in Vacation Home Bookings since lockdowns have eased Vacation Home recovery is accelerating Source: AirDNA , June 2020 Fastest Recovering Markets Booking Increase in last 6 weeks 8 New Bookings 189% 200% 202% 367% 465% Australia France United States Germany New Zealand France United States Germany Australia 2,098,900 836,000 1,960,800 3/1/2020 4/1/2020 5/1/2020 New Zealand Mar 1 Apr 5 May 17 Europe United States Booking Growth since April 1 57% 49% International Domestic 92% 57% International Domestic Distance Traveled (mi) 200 1,104 2019 2020 826 2,426 2019 2020 Highlights • Travel bookings have increased since April 1 • Travelers are staying closer to home • Vacation Home bookings are near pre - pandemic levels • Fast vacation home booking recoveries in markets that have eased lockdown restrictions

NASDAQ: MKGI 2020 Initiatives, Actions & Results Initiatives • Drive revenue growth • Achieve profitability • Bolster brands • Disrupt travel industry by making instantly - confirmed alternative lodging easily accessible to dynamic packaging channels Actions • Simplify the company into (3) distinct brands and products • Integrate core asset (Booking Engine) into Maupintour and NextTrip Platforms • Leverage strategic partnerships that support revenue growth and profitability • Drive short - term revenue growth through Maupintour • Modernize and standardize software platforms for eCommerce sites Planned Results • Create a diverse portfolio of refreshed brands and products synergized on Alternative Lodging • Increased bookings across all brands and products • Allow NextTrip and MBE products to mature and contribute to top line revenue • Maximize software development return on investment by standardizing on one platform l 9 Cash Diversify Synergize Maximize

NASDAQ: MKGI Customer Acquisition Travel Products 2020 Action Plan: Simplify brands & products Reduce Complexity & Increase Focus Industry leading ALR technology platform that eliminates friction of dynamic packaging with ALR inventory Corporate Travel Management solution for small to medium - sized business Transformed 10 Personalized Tours, Luxury Travel, and Vacation Home Rental packages Online publication focused on inspiring travelers to explore the world and generate traffic to our sites

NASDAQ: MKGI Monaker’s proprietary technology bridge that provides access to the largest number of instantly - bookable (confirmed) ALR properties 2020 Action Plan: Integrate Core Asset Into Brands Total Travel Management Solution for small to medium - sized business Personalized Tours, Luxury Travel and Vacation Home Rentals B2B B2C Synergize Alternative Lodging Into Brands 11

NASDAQ: MKGI 2020 Action Plan: Maximize Shareholder ROI 12 Accelerate revenue growth & profitability Accelerate growth by simplifying product portfolio, growing ALR distribution partnerships, and sourcing inventory where gaps exist Disciplined Execution Reduce costs and accelerate time to market through discipline project management, sales processes and P&L management Acquisitions & Mergers Identify acquisitions that accelerate or diversify revenue growth, and increase competitive advantage Strategic Partnerships Create strategic partnerships that enhance technical capabilities, reduce costs, or minimize risk

OTCQB: MKGI Strategic Growth Plan: Acquisition of HotPlay & 33% Interest in Axion 13

NASDAQ: MKGI HotPlay is a revolutionary in - game advertising (“IGA”) company, which shall leverage proprietary Artificial Intelligence and harmonizing engagement between businesses and consumers . For the most part, in - game advertising is conducted by intermediate display ads and interstitials which games most likely ignore ; however, the HotPlay technology seamlessly integrates native ads into games and enables client brands to insert non - intrusive and interactive digital coupons, redeemable through both online and offline channels . Brands can even track the conversion funnel from viewers to actual sales in real - time . Additionally, HotPlay helps game developers generate additional revenue streams by monetizing in - game real estate through advertising without compromising the integrity of the game . HotPlay has concluded contracts with a major retail POS platform and has and is in the process of licensing its Ad Tech to multiple video game developers, allowing advertisers to potentially address 27 . 8 million gamers in Thailand alone . Case studies demonstrated giving gamers real world value, in the form of promotional coupons, helps gamers retention rates . HotPlay is signing agreements to roll out the platform in several more countries in southeast Asia . Axion Ventures, is a publicly - traded company (TSX - V : AXV) that invests and operates through its subsidiaries in the technology sector . Post the proposed combination, Monaker will own over 33 % of Axion Ventures and hold over US $ 7 million in debt in Axion . Axion is a shareholder in several companies including Axion Games, a China based developer and publisher of online video games . Axion Games focuses on cross platform development of high production value, triple - A quality online video games . Axion Games' advantage lies in its rare combination of being a low - cost provider with extremely high - quality production capabilities, traits evidenced by a track record of development contributions to numerous global franchise game titles for the top video gaming companies of the world . Axion Ventures is a major shareholder in True Axion Interactive, a Thailand based Joint Venture with True Corporation . Axion Ventures also has an interest in HotNow , a location - based marketing automation solution and a business unit of Red Anchor Trading Corp . , and also Innovega , an innovative mixed reality eye - wear solution company . Proposed Acquisitions 14

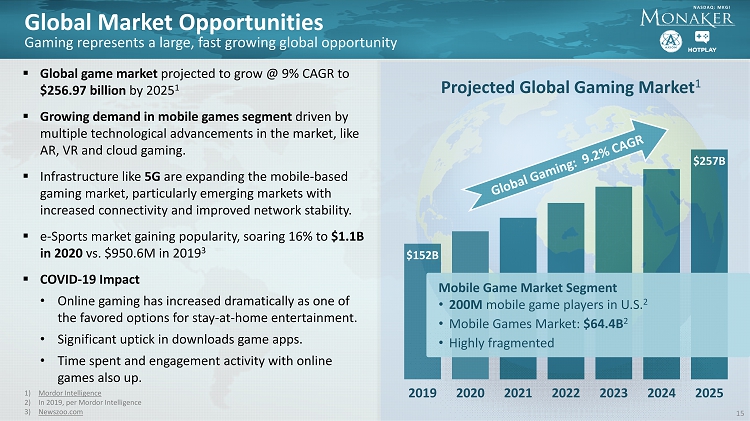

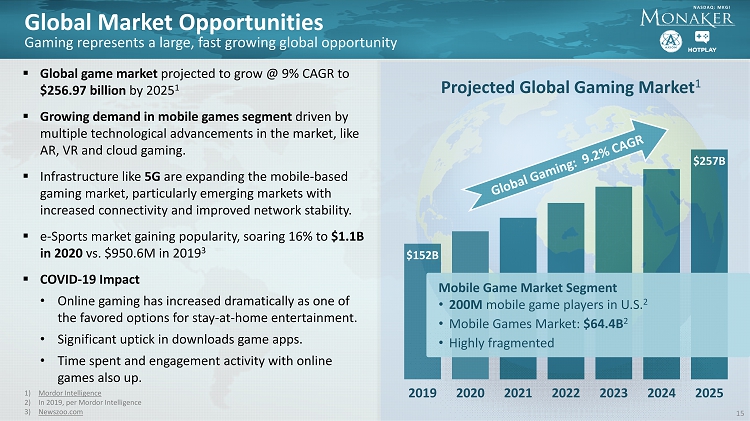

NASDAQ: MKGI $152B $257B 2019 2020 2021 2022 2023 2024 2025 Global Market Opportunities Gaming represents a large, fast growing global opportunity Projected Global Gaming Market 1 Mobile Game Market Segment • 200M mobile game players in U.S. 2 • Mobile Games Market: $64.4B 2 • Highly fragmented ▪ Global game market projected to grow @ 9% CAGR to $256.97 billion by 2025 1 ▪ Growing demand in mobile games segment driven by multiple technological advancements in the market, like AR, VR and cloud gaming. ▪ Infrastructure like 5G are expanding the mobile - based gaming market, particularly emerging markets with increased connectivity and improved network stability. ▪ e - Sports market gaining popularity, soaring 16% to $1.1B in 2020 vs. $950.6M in 2019 3 ▪ COVID - 19 Impact • Online gaming has increased dramatically as one of the favored options for stay - at - home entertainment. • Significant uptick in downloads game apps. • Time spent and engagement activity with online games also up. 1) Mordor Intelligence 2) In 2019, per Mordor Intelligence 3) Newszoo.com 15

NASDAQ: MKGI Global Market Opportunity Growing Traveler Gaming Market ▪ Multitude of video game conferences being held across the world: • i.e., ~300,000 fans from around the world travel to Paris for the Annual eSports World Convention during Paris Games Week • All require travel and accommodations. ▪ Travel companies increasingly offering special tours for today’s gamers: • i.e., follow Lara Croft to Thailand or visit Havana, Call of Duty ’s backdrop. • Tours include flights, accommodations and a “game plan.” ▪ Traveling while gaming • Gamers travel to specific locations to retrieve items and complete their missions to “level up” and win via augmented reality games, like Pokémon GO. Lara Croft eSports League of Legends North American Event 16

NASDAQ: MKGI Todd Bonner Founder & Director, Axion Began career as investment analyst at Alex . Brown & Sons . First start - up was Pacific Century Insurance with Richard Li in Hong Kong that eventually exited in $ 888 million transaction . Todd co - founded and was the executive director of Pacific Century Group, listed on the Hong Kong Stock Exchange ( 008 HK), acquiring Hong Kong Telecommunications Limited in 2000 , the largest transaction in Asia . Hong Kong Telecom has over 24 , 000 employees . After retiring from PCCW group in 2003 , Mr . Bonner co - founded NorthStar Pacific Partners, an Indonesian - based merchant bank, which later became a US $ 2 Billion fund . In 2006 , Todd was Co - Founder & Director at Axion Games Ltd . (formerly Epic Games China) Investor in, and driving development teams, gaming platform technologies for the past decade . Mark Vange Axion Ventures, HotPlay Mr . Vange has 30 years of experience as a technologist and entrepreneur . CEO & Founder at Token IQ . Founded Mobile Postproduction and Visionary Design Systems . He also served as Director & Chief Technical Officer at flooidCX Corp . Earlier was Chief Technology Officer of Circadence Corp . , Chief Technology Officer at Electronic Arts (NYSE : EA), a multi - billion gaming platform, and Executive Vice President of Mobile Post Production (a subsidiary of Electronic Arts) . He has been an advisor to several private and public companies, and a number of investment funds . Nithinan Boonyawattanapisut CEO & founder, HotPlay A serial entrepreneur with extensive management experience, specialized in tech startups and video games business . Nithinan co - founded Axion Group and is serving as a director of Axion Games (a JV between Axion and Epic Games, a US - based game company currently valued at US $ 17 billion due to Fortnite success) . Axion Games is one of the leading AAA independent video game studios in China . Nithinan also co - founded and currently serves as Chief Executive Officer and Chairwoman at True Axion Interactive Ltd . , the first and only AAA game development studio in Southeast Asia in JV with True Corp . , Thailand’s 2 nd largest telco operator . Chief Executive Officer at HotNow (Thailand) Co . , Ltd . , the issuer of HOT token - a utility token for HotNow platform, enabling the first gamified online - to - offline economy for Emerging Asia . She is also a Partner at Longroot Limited, the first Thai - SEC - approved ICO portal Axion & HotPlay Management

OTCQB: MKGI Key Elements of Proposed Acquisitions 18

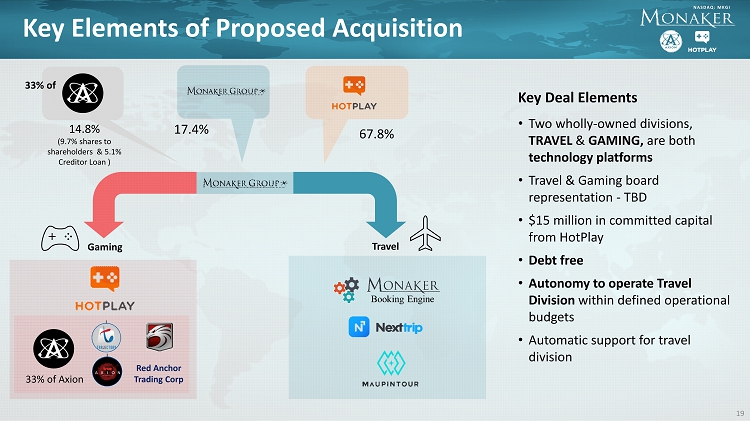

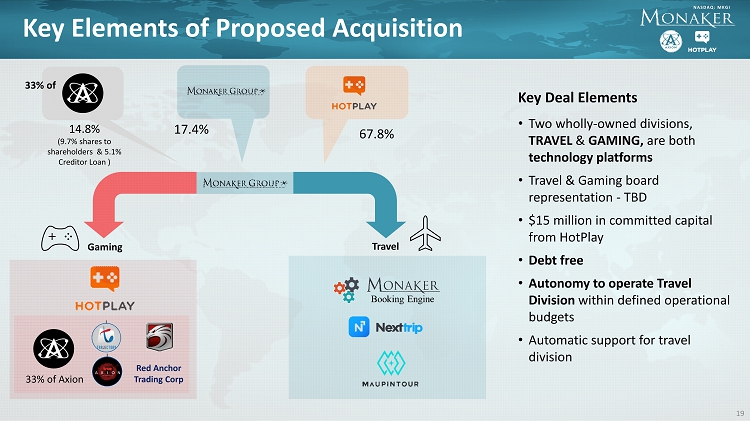

NASDAQ: MKGI Key Deal Elements • Two wholly - owned divisions, TRAVEL & GAMING, are both technology platforms • Travel & Gaming board representation - TBD • $15 million in committed capital from HotPlay • Debt free • Autonomy to operate Travel Division within defined operational budgets • Automatic support for travel division Key Elements of Proposed Acquisition 14.8% (9.7% shares to shareholders & 5.1% Creditor Loan ) 17.4% 67.8% Travel Red Anchor Trading Corp Gaming 33% of Axion 19 33% of

NASDAQ: MKGI 14.80% 67.80% 17.40% Proposed Acquisition Structure (Based on currently outstanding shares and subject to change) Total Consideration Shares % Axion Share Exchange 7,428,000 9.7% HotPlay Share Exchange 52,000,000 67.8% Axion HoldCo creditor Loan vend in 3,878,500 5.1% Total HotPlay / Axion HoldCo Consideration 63,306,500 82.6% Monaker Group pre - closing shares 13,381,839 17.4% Pro Forma Market Cap (Shares) 76,688,339 100.0% 20

OTCQB: MKGI Anticipated Acquisition Benefits 21

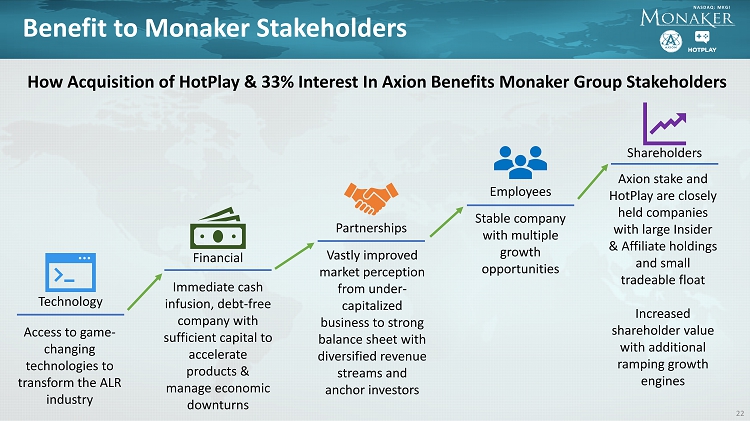

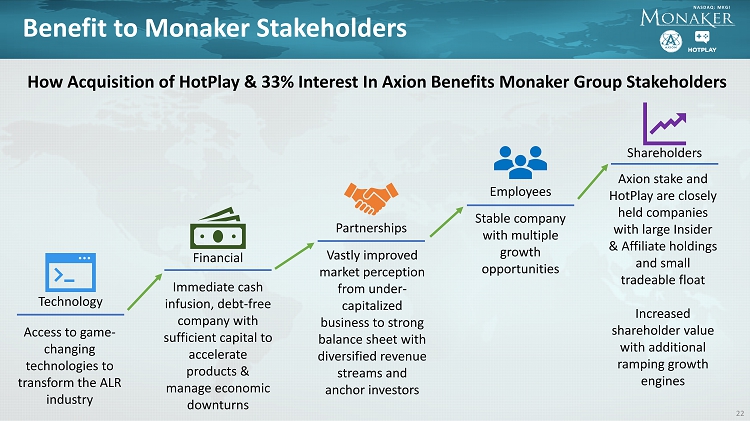

NASDAQ: MKGI Benefit to Monaker Stakeholders Technology Access to game - changing technologies to transform the ALR industry Financial Immediate cash infusion, debt - free company with sufficient capital to accelerate products & manage economic downturns Partnerships Vastly improved market perception from under - capitalized business to strong balance sheet with diversified revenue streams and anchor investors Employees Stable company with multiple growth opportunities Shareholders Axion stake and HotPlay are closely held companies with large Insider & Affiliate holdings and small tradeable float Increased shareholder value with additional ramping g rowth engines How Acquisition of HotPlay & 33% Interest In Axion Benefits Monaker Group Stakeholders 22

NASDAQ: MKGI Travel Gaming Benefits • Major Cash infusion at closing – becomes debt free • Strategic shareholders as partners • Improve company’s financial position & balance sheet • Enhanced market and partner perception • Cash infusion at closing • Representation on US stock exchange • Acceleration of video production facilities • Accelerate game development & release • Monetize in - game advertising Targeted Growth Plan • Accelerate product offerings • Launch NextTrip.biz • Engage in new & Increase strategic partnerships • RateGain /DHISCO, Trisept , (technology division at Apple Leisure Group) and other contracted large - scale distribution channels • Explore Opportunities (e.g. medical tourism) • Leverage SE Asia technology resources for AI, Blockchain, and Machine Learning development • Accelerate use of AI to present in - game advertising • Opportunity to Leverage relationship in Thailand and SE Asia to ramp in - game advertising revenue • Consolidate Video House & Production • Two games in launch with over 100,000 initial users and expected to ramp late 2020 and through 2021 • Expand HotPlay rollout from success in Thailand to across Asia Benefits of Acquisition & Growth Plan 23

NASDAQ: MKGI Industry Synergies Technology Driven Monaker & HotPlay Develop Technology Platforms Across the Leisure Industry Vertical Benefits • Two divisions with diversified revenue streams to weather travel economic downturns (i.e., COVID - 19) • Acceleration of Travel product growth through potential gamification (virtual reality, crypto - currency, etc.) • In - Game advertising for travel services • Focus and brand recognition in next - gen travel consumers 24 33% interest

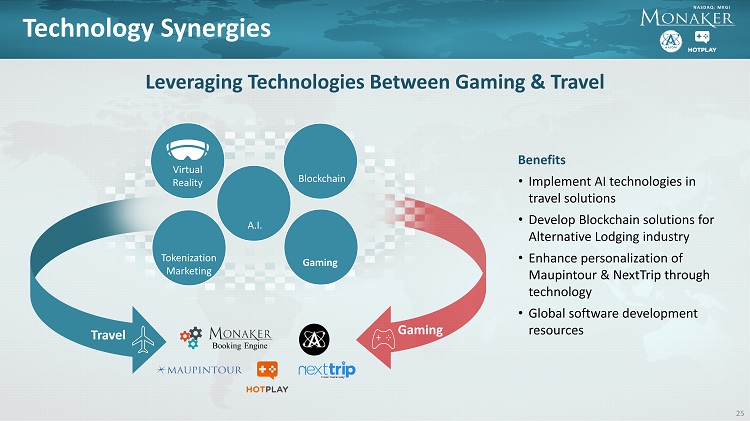

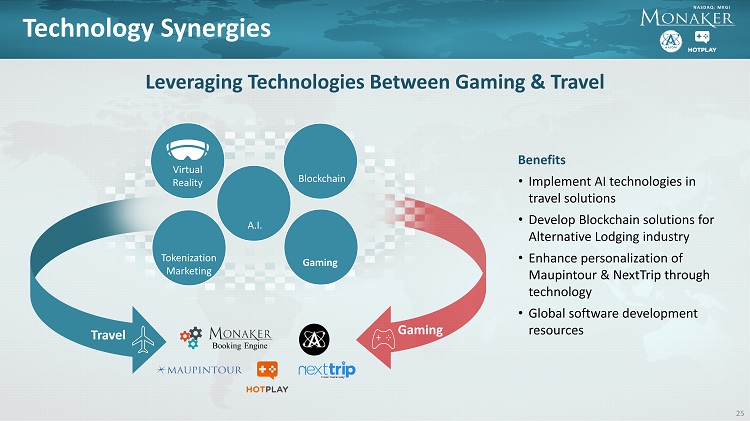

NASDAQ: MKGI Gaming Technology Synergies Leveraging Technologies Between Gaming & Travel Travel Benefits • Implement AI technologies in travel solutions • Develop Blockchain solutions for Alternative Lodging industry • Enhance personalization of Maupintour & NextTrip through technology • Global software development resources 25 Tokenization Marketing Gaming Blockchain A.I. Virtual Reality

NASDAQ: MKGI Technology That Changes ALR Virtual Reality Tokenization Marketing Gaming Blockchain A.I. Streamline the travel experience and build mutually fulfilling relationships with suppliers & customers Efficiently sort through vast amounts of information to create “learning” systems that adjust as needed Creation of virtual tours of hotels, ALR properties, tour packages, destinations, etc. Embed marketing and advertising into games that allow users to purchase “tokens” for travel use Creation of experiences in games that encouraged players to explore destinations Transaction Expected to Allow Monaker to Leverage Game - changing Technologies it Otherwise Could not do Alone 26 Post - closing Monaker plans to undertake the following initiatives:

OTCQB: MKGI Acquisition: New Company Structure & Initiatives 27

NASDAQ: MKGI NASDAQ: MKGI Vision: The Next Global Technology Play ▪ Join forces to lead the next major global technology play ▪ Exploit global growth of two major growth industries: gaming (entertainment) and travel, and the emerging new generation of travelers ▪ Leverage collective brand assets and proprietary technology for market advantage and high - margin growth ▪ Combination of companies, technology and talent, where the new whole becomes greater than the sum of the separate parts 28 33% stakeholder

NASDAQ: MKGI NewCo Mission & Key Messages Objectives • Leverage our expertise in gaming & alternative lodging to drive industry innovation • Leverage our global footprint to maximize market penetration and maintain our cost advantage • Create a diversified company that can weather fluctuations in gaming & travel Key Messages • Exciting and innovative organization • Diversified global company focused on leisure markets (Gaming & Travel) • Technology is the company’s core competency 29 Brand Mission Become a leading technology innovation company with global platforms for marketing, gaming, and travel.

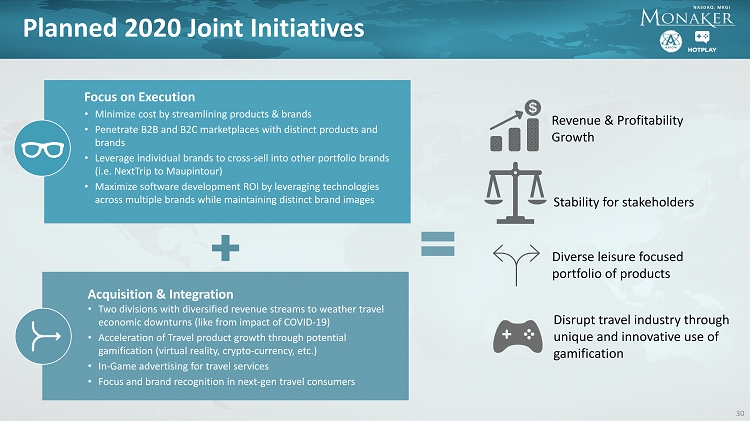

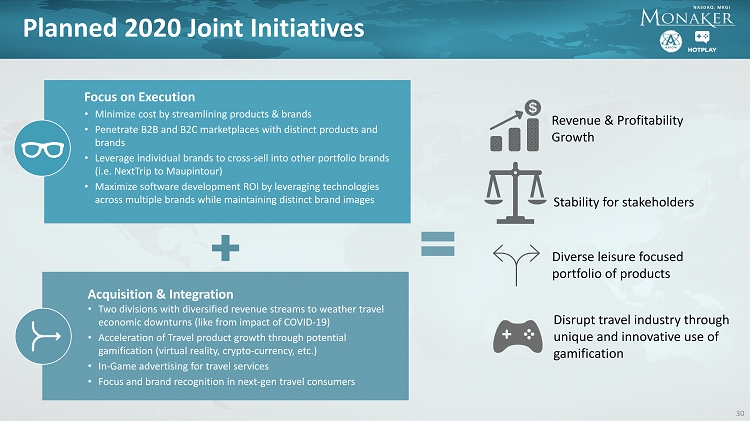

NASDAQ: MKGI Planned 2020 Joint Initiatives Acquisition & Integration • Two divisions with diversified revenue streams to weather travel economic downturns (like from impact of COVID - 19) • Acceleration of Travel product growth through potential gamification (virtual reality, crypto - currency, etc.) • In - Game advertising for travel services • Focus and brand recognition in next - gen travel consumers Revenue & Profitability Growth Stability for stakeholders Diverse leisure focused portfolio of products Disrupt travel industry through unique and innovative use of gamification Focus on Execution • Minimize cost by streamlining products & brands • Penetrate B2B and B2C marketplaces with distinct products and brands • Leverage individual brands to cross - sell into other portfolio brands (i.e. NextTrip to Maupintour) • Maximize software development ROI by leveraging technologies across multiple brands while maintaining distinct brand images 30

NASDAQ: MKGI Closely Held Global Company Shares closely held • Shareholders predominantly Management, Insiders & control Affiliates Market Capitalization • Expected to s olve undercapitalized issue that has blocked institutions from participating in Monaker stock Corporate • US - listed PubCo • US Travel platform Division • Southeast Asia Gaming & Advertising platform Division Immediate Strong East/West Corporate Footprint & Presence Shareholders & Partnerships • Significant and very accomplished shareholders • Opening of Far East Presence & Partnerships 31

NASDAQ: MKGI Company Contact Richard Marshall Director of Corporate Development Tel (954) 888 - 9779 rmarshall@monakergroup.com www.MonakerGroup.com 32 2893 Executive Park Drive, Suite #201 Weston, FL 33331