UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SB-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Atomic Ventures, Corp.

(Name of small business issuer in its charter)

Nevada | 1000 | 98-0502506 |

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (IRS Employer Identification No.) |

Atomic Ventures, Corp.

502 E. John Street

Carson City, Nevada

89706

(Address of principal executive offices)

Aaron D. McGeary, Attorney, 405 Airport Fwy., Suite 5, Bedford, Texas 76021

Tel 817.268.5885

Fax 817.282.5886

(Name, address and telephone number of agent for service)

Copies of all communication to:

Atomic Ventures, Corp.

502 E. John Street

Carson City, Nevada

89706

Approximate date of proposed sale to the public: As soon as practicable after the effective date of the Registration Statement.

| If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. | x |

| | |

| If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. | o |

| | |

| If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. | o |

| | |

| If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. | o |

| | |

| If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. | o |

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered | Dollar Amount to be registered | Number of Shares to be registered | Proposed maximum offering price per unit | Amount of registration fee |

| Common stock | $10,000 | 2,000,000 | $0.005 | $1.07 |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Disclosure alternative used (check one): Alternative 1 Alternative 2 X

Subject to Completion, Dated August 10, 2006

PROSPECTUS

Atomic Ventures, Corp.

2,000,000 Shares of Common Stock

The selling shareholder named in this prospectus is offering 2,000,000 shares of common stock of Atomic Ventures, Corp. We will not receive any of the proceeds from the sale of these shares. The shares were acquired by the selling shareholder directly from us in a private offering of our common stock that was exempt from registration under the securities laws. The selling shareholder has set an offering price for these securities of $0.005 per share and an offering period of four months from the date of this prospectus. See “Security Ownership of Selling Shareholder and Management” for more information about the selling shareholder.

Our common stock is presently not traded on any market or securities exchange. The offering price may not reflect the market price of our shares after the offering.

This investment involves a high degree of risk. You should purchase shares only if you can afford a complete loss. See “Risk Factors” beginning on page 7.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of the prospectus. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Shares Offered by Selling Shareholder | Price To Public | Selling Agent Commissions | Proceeds to Selling Shareholder |

| Per Share | $0.005 | Not applicable | $0.005 |

| Minimum Purchase | Not applicable | Not applicable | Not applicable |

| Total Offering | $10,000 | Not applicable | $10,000 |

Proceeds to the selling shareholder do not include offering costs, including filing fees, printing costs, legal fees, accounting fees, and transfer agent fees estimated at $10,000. Atomic Ventures, Corp. will pay these expenses.

This Prospectus is dated August 10, 2006.

Atomic Ventures, Corp.

502 E. John Street

Carson City, Nevada

89706

TABLE OF CONTENTS

| Page |

| | |

PART I | 5 |

PROSPECTUS SUMMARY | 5 |

THE OFFERING | 5 |

RISK FACTORS | 6 |

RISKS RELATED TO OUR COMPANY AND OUR INDUSTRY | 6 |

RISKS RELATED TO OUR FINANCIAL CONDITION AND BUSINESS MODEL | 10 |

RISKS RELATED TO THIS OFFERING AND OUR STOCK | 10 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | 12 |

DILUTION | 13 |

PLAN OF DISTRIBUTION | 13 |

USE OF PROCEEDS TO ISSUER | 15 |

BUSINESS OF THE ISSUER | 15 |

GLOSSARY OF MINING TERMS | 15 |

GENERAL OVERVIEW | 20 |

PROPERTY ACQUISITIONS DETAILS | 20 |

LAND STATUS, TOPOGRAPHY, LOCATION AND ACCESS | 20 |

MINING CLAIMS | 21 |

GEOLOGY OF THE MINERAL CLAIMS | 22 |

DEPOSIT TYPE | 22 |

EXPLORATION HISTORY AND PREVIOUS OPERATIONS | 23 |

PROPOSED PROGRAM AND COST ESTIMATES OF EXPLORATION | 23 |

OVERVIEW OF URANIUM AND THE URANIUM INDUSTRY | 24 |

COMPLIANCE WITH GOVERNMENT REGULATION | 25 |

EMPLOYEES | 26 |

MANAGEMENT DISCUSSION AND ANALYSIS OR PLAN OF OPERATION | 26 |

PLAN OF OPERATIONS | 26 |

RESULTS OF OPERATIONS | 26 |

LIQUIDITY AND CAPITAL RESOURCES | 27 |

DIRECTORS, EXECUTIVE OFFICERS AND SIGNIFICANT EMPLOYEES | 27 |

REMUNERATION OF DIRECTORS AND OFFICERS | 28 |

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITY HOLDERS | 29 |

INTEREST OF MANAGEMENT AND OTHERS IN CERTAIN TRANSACTIONS | 29 |

SECURITIES BEING OFFERED | 29 |

TRANSFER AGENT AND REGISTRAR | 30 |

SEC POSITION ON INDEMNIFICATION | 30 |

LEGAL MATTERS | 30 |

EXPERTS | 30 |

AVAILABLE INFORMATION | 30 |

REPORTS TO STOCKHOLDERS | 31 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 32 |

NOTES TO FINANCIAL STATEMENTS | 37 |

PART II - INFORMATION NOT REQUIRED IN PROSPECTUS | 43 |

ITEM 1. INDEMNIFICATION OF DIRECTORS AND OFFICERS | 43 |

ITEM 2. OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION | 43 |

ITEM 3. UNDERTAKINGS | 44 |

ITEM 4. UNREGISTERED SECURITIES ISSUED OR SOLD WITHIN ONE YEAR. | 45 |

ITEM 5. INDEX TO EXHIBITS. | 45 |

ITEM 6. DESCRIPTION OF EXHIBITS. | 45 |

SIGNATURES | 46 |

PART I

PROSPECTUS SUMMARY

Atomic Ventures, Corp.

Atomic Ventures, Corp. (“Atomic” or the “Company”) was organized under the laws of the State of Nevada on January 6, 2006 to explore mining claims in the Province of British Columbia, Canada.

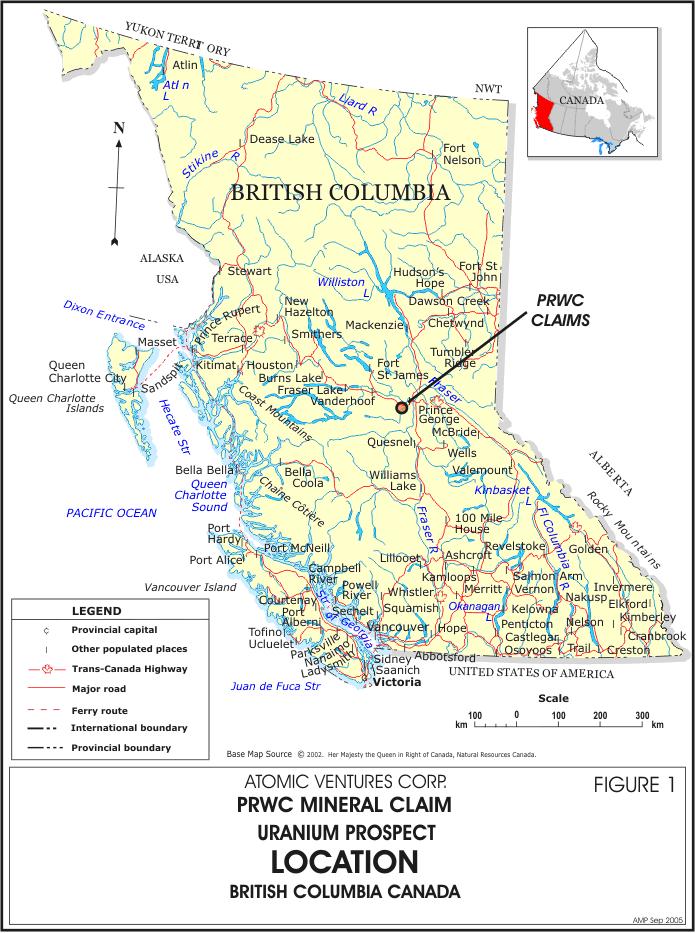

Atomic was formed to engage in the exploration of mineral properties for uranium. The Company has staked a prospect that contains one mining claim located in Central British Columbia, Canada, 20 km southwest of the City of Prince George. We refer to this claim as the PRWC property.

We are an exploration stage company and we have not realized any revenues to date. We do not have sufficient capital to enable us to commence and complete our exploration program. We will require financing in order to conduct the exploration program described in the section entitled, "Business of the Issuer." Our auditors have issued a going concern opinion, raising substantial doubt about Atomic’s financial prospects and the Company’s ability to continue as a going concern.

We are not a "blank check company," as we do not intend to participate in a reverse acquisition or merger transaction. A "blank check company" is defined by securities laws as a development stage company that has no specific business plan or purpose or has indicated that its business plan is to engage in a merger or acquisition with an unidentified company or companies, or other entity or person.

Our offices are located at 502 E. John Street, Carson City, Nevada 89706

The Offering

| Securities offered | 2,000,000 shares of common stock |

| Selling shareholder(s) | Kenneth Cabianca |

| Offering price | $0.005 per share |

| Shares outstanding prior to the offering | 3,000,000 shares of common stock |

| Shares to be outstanding after the offering | 3,000,000 shares of common stock |

| Use of proceeds | We will not receive any proceeds from the sale of the common stock by the selling shareholder. |

RISK FACTORS

INVESTING IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. IN ADDITION TO THE OTHER INFORMATION CONTAINED IN THIS PRIVATE PLACEMENT MEMORANDUM, PROSPECTIVE PURCHASERS OF THE SECURITIES OFFERED HEREBY SHOULD CONSIDER CAREFULLY THE FOLLOWING FACTORS IN EVALUATING THE COMPANY AND ITS BUSINESS.

IF ANY OF THE FOLLOWING RISKS OCCUR, OUR BUSINESS, OPERATING RESULTS AND FINANCIAL CONDITION COULD BE SERIOUSLY HARMED. THE RISKS AND UNCERTAINTIES DESCRIBED BELOW ARE NOT THE ONLY ONES WE FACE. ADDITIONAL RISKS AND UNCERTAINTIES, INCLUDING THOSE THAT WE DO NOT KNOW ABOUT OR THAT WE CURRENTLY DEEM IMMATERIAL, ALSO MAY ADVERSELY AFFECT OUR BUSINESS. THE TRADING PRICE OF OUR SHARES OF COMMON STOCK COULD DECLINE DUE TO ANY OF THESE RISKS, AND YOU MAY LOSE ALL OR PART OF YOUR INVESTMENT.

THE SECURITIES WE ARE OFFERING THROUGH THIS REGISTRATION STATEMENT ARE SPECULATIVE BY NATURE AND INVOLVE AN EXTREMELY HIGH DEGREE OF RISK AND SHOULD BE PURCHASED ONLY BY PERSONS WHO CAN AFFORD TO LOSE THEIR ENTIRE INVESTMENT. WE ALSO CAUTION PROSPECTIVE INVESTORS THAT THE FOLLOWING RISK FACTORS, AMONG OTHERS, COULD CAUSE OUR ACTUAL FUTURE OPERATING RESULTS TO DIFFER MATERIALLY FROM THOSE EXPRESSED IN ANY FORWARD LOOKING STATEMENTS, ORAL OR WRITTEN, MADE BY OR ON BEHALF OF US. IN ASSESSING THESE RISKS, WE SUGGEST THAT YOU ALSO REFER TO OTHER INFORMATION CONTAINED IN THIS REGISTRATION STATEMENT, INCLUDING OUR FINANCIAL STATEMENTS AND RELATED NOTES.

Risks Related to Our Company and Our Industry

ATOMIC HAS NEVER EARNED A PROFIT. THERE IS NO GUARANTEE THAT WE WILL EVER EARN A PROFIT.

From inception January 6, 2006 to the period ended May 31, 2006, the Company had no revenue-producing operations. The Company is not currently operating profitably and it should be anticipated that it will operate at a loss at least until such time when the production stage is achieved, if production is, in fact, ever achieved.

OUR COMPANY WAS RECENTLY FORMED, AND WE HAVE NOT PROVEN THAT WE CAN GENERATE A PROFIT. IF WE FAIL TO GENERATE INCOME AND ACHIEVE PROFITABILITY, AN INVESTMENT IN OUR SECURITIES MAY BE WORTHLESS.

We have no operating history and have not proved we can operate successfully. If we fail, your investment in our common stock will become worthless. From inception January 6, 2006 to the period ended May 31, 2006, we have not earned any revenue. We face all of the risks inherent in a new business. The purchase of the securities offered hereby must therefore be regarded as the placing of funds at a high risk in a new or "start-up" venture with all the unforeseen costs, expenses, problems, and difficulties to which such ventures are subject.

WE HAVE NO OPERATING HISTORY. THERE CAN BE NO ASSURANCE THAT WE WILL BE SUCCESSFUL IN GROWING OUR URANIUM EXPLORATION ACTIVITIES.

The Company has no history of operations. As a result, our success to date in entering into ventures to acquire interests in exploration blocks is not indicative that we will be successful in entering into any further ventures. There can be no assurance that we will be successful in growing our uranium exploration activities. Any future significant growth in our uranium exploration activities will place demands on our executive officers, and any increased scope of our operations will present challenges to us due to our current limited management resources. Our future performance will depend upon our management and their ability to locate and negotiate opportunities to participate in joint venture and other arrangements whereby we can participate in exploration opportunities. There can be no assurance that we will be successful in these efforts. Our inability to locate additional opportunities, to hire additional management and other personnel or to enhance our management systems could have a material adverse effect on our results of operations. There can be no assurance that the Company's operations will be profitable.

THERE IS A HIGHER RISK OUR BUSINESS WILL FAIL BECAUSE OUR PRESIDENT AND DIRECTOR DOES NOT HAVE FORMAL TRAINING SPECIFIC TO THE TECHNICALITIES OF MINERAL EXPLORATION.

Mr. Kenneth Cabianca, our President and a Director of the Company, does not have formal training as a geologist or in the technical aspects of management of a mineral exploration company. Mr. Cabianca lacks technical training and experience with exploring for, starting, and operating a mine. With no direct training or experience in these areas, he may not be fully aware of the specific requirements related to working within this industry. His decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to management's lack of experience in this industry.

MR. KENNETH CABIANCA, OUR ONLY OFFICER AND DIRECTOR, MAY LACK THE ABILITY TO SUCCESSFULLY IMPLEMENT THE COMPANY’S BUSINESS OBJECTIVES.

Because Mr. Kenneth Cabianca, our sole Executive Officer and Director, has no career experience related to mining and mineral exploration, he may be unable to successfully operate and develop our business. We cannot guarantee that we will overcome this obstacle. There may be additional risk to the Company in that Mr. Cabianca may lack the ability to successfully implement growth plans given that the absence of an executive management team, and that all plans rely exclusively on the ability and management of our Executive Officer and Director, Mr. Cabianca.

WE ARE SOLELY GOVERNED BY MR. KENNETH CABIANCA, OUR SOLE OFFICER AND DIRECTOR, AND, AS SUCH, THERE MAY BE SIGNIFICANT RISK TO THE COMPANY FROM A CORPORATE GOVERNANCE PERSPECTIVE.

Mr. Kenneth Cabianca, our sole Executive Officer and Director, makes decisions such as the approval of related party transactions, the compensation of Executive Officers, and the oversight of the accounting function. Accordingly, there will be no segregation of executive duties and there may not be effective disclosure and accounting controls to comply with applicable laws and regulations, which could result in fines, penalties and assessments against us. Accordingly, the inherent controls that arise from the segregation of executive duties may not prevail. In addition, Mr. Cabianca will exercise full control over all matters that typically require the approval of a Board of Directors. Mr. Cabianca’s actions are not subject to the review and approval of a Board of Directors and, as such, there may be significant risk to the Company from the corporate governance perspective.

Mr. Kenneth Cabianca, our sole Executive Officer and Director exercises control over all matters requiring shareholder approval including the election of directors and the approval of significant corporate transactions. We have not voluntarily implemented various corporate governance measures, in the absence of which, shareholders may have more limited protections against the transactions implemented by Mr. Cabianca, conflicts of interest and similar matters.

We have not adopted corporate governance measures such as an audit or other independent committees as we presently only have one independent director. Shareholders should bear in mind our current lack of corporate governance measures in formulating their investment decisions.

SINCE MR.KENNETH CABIANCA, OUR SOLE EXECUTIVE OFFICER AND DIRECTOR, IS NOT A RESIDENT OF THE UNITED STATES, IT MAY BE DIFFICULT TO ENFORCE ANY LIABILITIES AGAINST HIM.

Shareholders may have difficulty enforcing any claims against the Company because Mr. Kenneth Cabianca, our sole Executive Officer and Director, resides outside the United States. If a shareholder desired to sue, shareholders would have to serve a summons and complaint. Even if personal service is accomplished and a judgment is entered against that person, the shareholder would then have to locate assets of that person, and register the judgment in the foreign jurisdiction where the assets are located.

BECAUSE OUR SOLE EXECUTIVE OFFICER HAS OTHER BUSINESS INTERESTS, HE MAY NOT BE ABLE OR WILLING TO DEVOTE A SUFFICIENT AMOUNT OF TIME TO OUR BUSINESS OPERATIONS, WHICH MAY CAUSE OUR BUSINESS TO FAIL.

It is possible that the demands on Mr. Kenneth Cabianca, our sole Executive Officer and Director, from other obligations could increase with the result that he would no longer be able to devote sufficient time to the management of our business. In addition, Mr. Cabianca may not possess sufficient time to manage our business if the demands of managing our business increased substantially.

WE ARE SENSITIVE TO URANIUM PRICE FLUCTUATIONS. THE PRICE OF URANIUM IS VOLATILE AND PRICE CHANGES ARE BEYOND OUR CONTROL.

Uranium prices are subject to fluctuation. The prices for uranium have been and will continue to be affected by numerous factors beyond the Company's control. Factors that affect the price of uranium include the demand for nuclear power, political and economic conditions in uranium producing and consuming countries, uranium supply from secondary sources and uranium production levels and costs of production. Price volatility and downward price pressure, which can lead to lower prices for uranium, could have a material adverse effect on the costs or the viability of our projects.

THE IMPRECISION OF MINERAL DEPOSIT ESTIMATES MAY PROVE ANY RESOURCE CALCULATIONS THAT WE MAKE TO BE UNRELIABLE.

Mineral deposit estimates and related databases are expressions of judgment based on knowledge, mining experience, and analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. By their nature, mineral deposit estimates are imprecise and depend upon statistical inferences, which may ultimately prove unreliable. Furthermore, none of the Company's mineral deposits are considered reserves, and there can be no assurances that any of such deposits will ever be reclassified as reserves. Mineral deposit estimates included here have not been adjusted in consideration of these risks and, therefore, no assurances can be given that any mineral deposit estimate will ultimately be reclassified as reserves.

MINERAL EXPLORATION AND PROSPECTING FOR URANIUM IS HIGHLY COMPETITIVE AND SPECULATIVE AND WE MAY NOT BE SUCCESSFUL IN SEEKING AVAILABLE OPPORTUNITIES.

The process of mineral exploration and prospecting for uranium is a highly competitive and speculative business. In seeking available opportunities, the Company will compete with a number of other companies, including established, multi-national companies that have more experience and resources than the Company. We compete with other exploration companies looking for uranium deposits. Because we may not have the financial and managerial resources to compete with other companies, we may not be successful in our efforts to acquire new projects. However, while we compete with other exploration companies, there is no competition for the exploration or removal of mineral from our claims.

COMPLIANCE WITH ENVIRONMENTAL CONSIDERATIONS AND PERMITTING COULD HAVE A MATERIAL ADVERSE EFFECT ON THE COSTS OR THE VIABILITY OF OUR PROJECTS. THE HISTORICAL TREND TOWARD STRICTER ENVIRONMENTAL REGULATION MAY CONTINUE, AND, AS SUCH, REPRESENTS AN UNKNOWN FACTOR IN OUR PLANNING PROCESSES.

All mining is regulated in Canada by the Federal and Provincial Governments. Compliance with such regulation could have a material effect on the economics of our operations and the timing of project development. Our primary regulatory costs have been related to obtaining licenses and permits from government departments before the commencement of mining activities. An environmental impact study that must be obtained on each property in order to obtain governmental approval to mine on the properties is also a part of the overall operating costs of a mining company.

Although the Company believes that its operations are in compliance, in all material respects, with all relevant permits, licenses and regulations involving worker health and safety as well as the environment, the historical trend toward stricter environmental regulation may continue. The uranium industry is subject not only to the worker health and safety and environmental risks associated with all mining businesses, but also to additional risks uniquely associated with uranium mining and milling. The possibility of more stringent regulations exists in the areas of worker health and safety, the disposition of wastes, the decommissioning and reclamation of mining and milling sites, and other environmental matters, each of which could have a adverse material effect on the costs or the viability of a particular project.

MINING AND EXPLORATION ACTIVITIES ARE SUBJECT TO EXTENSIVE REGULATION BY FEDERAL AND PROVINCIAL GOVERNMENTS. FUTURE CHANGES IN GOVERNMENTS, REGULATIONS AND POLICIES, COULD ADVERSELY AFFECT THE COMPANY'S RESULTS OF OPERATIONS FOR A PARTICULAR PERIOD AND ITS LONG-TERM BUSINESS PROSPECTS.

Mining and exploration activities in Canada are subject to extensive regulation by Federal and Provincial Governments. Such regulation relates to production, development, exploration, exports, taxes and royalties, labor standards, occupational health, waste disposal, protection and remediation of the environment, mine and mill reclamation, mine and mill safety, toxic substances and other matters. Compliance with such laws and regulations has increased the costs of exploring, drilling, developing, constructing, operating mines and other facilities. Furthermore, future changes in governments, regulations and policies, could adversely affect the Company's results of operations in a particular period and its long-term business prospects.

The development of mines and related facilities is contingent upon governmental approvals, which are complex and time consuming to obtain and which, depending upon the location of the project, involve various governmental agencies. The duration and success of such approvals are subject to many variables outside the Company's control.

Risks Related To Our Financial Condition And Business Model

THE COMPANY HAS NOT PAID ANY CASH DIVIDENDS ON ITS SHARES OF COMMON STOCK AND DOES NOT ANTICIPATE PAYING ANY SUCH DIVIDENDS IN THE FORESEEABLE FUTURE.

Payment of future dividends, if any, will depend on earnings and capital requirements of the Company, the Company’s debt facilities and other factors considered appropriate by the Company’s Board of Directors. To date, the Company has not paid any cash dividends on its shares of Common Stock and does not anticipate paying any such dividends in the foreseeable future.

IF WE DO NOT CONDUCT MINERAL EXPLORATION ON OUR MINERAL CLAIMS AND KEEP THE CLAIMS IN GOOD STANDING, THEN OUR RIGHT TO THE MINERAL CLAIMS WILL LAPSE AND WE WILL LOSE EVERYTHING THAT WE HAVE INVESTED AND EXPENDED TOWARDS THESE CLAIMS.

We must complete mineral exploration work on our mineral claims and keep the claims in good standing. If we do not fulfill our work commitment requirements on our claims or keep the claims in good standing, then our right to the claims will lapse and we will lose all interest that we have in these mineral claims.

BECAUSE OF OUR LIMITED RESOURCES AND THE SPECULATIVE NATURE OF OUR BUSINESS, THERE IS A SUBSTANTIAL DOUBT AS TO OUR ABILITY TO CONTINUE AS A GOING CONCERN.

The report of our independent auditors, on our audited financial statements for the period ended May 31, 2006 indicates that there are a number of factors that raise substantial doubt about our ability to continue as a going concern. Our continued operations are dependent on our ability to obtain financing and upon our ability to achieve future profitable operations from the development of our mineral properties. If we are not able to continue as a going concern, it is likely investors will lose their investment.

IF WE DO NOT OBTAIN ADDITIONAL FINANCING, OUR BUSINESS WILL FAIL.

We will need to obtain additional financing in order to complete our business plan. We currently do not have any operations and we have no income. We do not have any arrangements for financing and we may not be able to find such financing if required. Obtaining additional financing would be subject to a number of factors, including investor acceptance of mineral claims and investor sentiment. These factors may adversely affect the timing, amount, terms, or conditions of any financing that we may obtain or make any additional financing unavailable to us.

Risks Related To This Offering and Our Stock

WE WILL NEED TO RAISE ADDITIONAL CAPITAL, IN ADDITION TO THE FINANCING AS REPORTED IN THIS REGISTRATION STATEMENT. IN SO DOING, WE WILL FURTHER DILUTE THE TOTAL NUMBER OF SHARES ISSUED AND OUTSTANDING. THERE CAN BE NO ASSURANCE THAT THIS ADDITIONAL CAPITAL WILL BE AVAILABLE OR ACCESSIBLE BY US.

Atomic will need to raise additional capital, in addition to the financing as reported in this registration statement, by issuing additional shares of common stock and will, thereby, increase the number of common shares outstanding. There can be no assurance that this additional capital will be available to meet these continuing exploration and development costs or, if the capital is available, that it will be available on terms acceptable to the Company. If the Company is unable to obtain financing in the amounts and on terms deemed acceptable, the business and future success of the Company will almost certainly be adversely affected. If we are able to raise additional capital, we cannot be assured that it will be on terms that enhance the value of our common shares.

IF WE COMPLETE A FINANCING THROUGH THE SALE OF ADDITIONAL SHARES OF OUR COMMON STOCK IN THE FUTURE, THEN SHAREHOLDERS WILL EXPERIENCE DILUTION.

The most likely source of future financing presently available to us is through the sale of shares of our common stock. Any sale of common stock will result in dilution of equity ownership to existing shareholders. This means that if we sell shares of our common stock, more shares will be outstanding and each existing shareholder will own a smaller percentage of the shares then outstanding. To raise additional capital we may have to issue additional shares, which may substantially dilute the interests of existing shareholders. Alternatively, we may have to borrow large sums, and assume debt obligations that require us to make substantial interest and capital payments.

THERE IS NO PUBLIC MARKET FOR OUR COMMON SHARES, WHICH LIMITS OUR SHAREHOLDERS' ABILITY TO RESELL THEIR SHARES OR PLEDGE THEM AS COLLATERAL.

There is currently no public market for our shares, and we cannot assure you that a market for our stock will develop. Consequently, investors may not be able to use their shares for collateral or loans and may not be able to liquidate at a suitable price in the event of an emergency. In addition, investors may not be able to resell their shares at or above the price they paid for them or may not be able to sell their shares at all.

FUTURE SALES OF COMMON SHARES COULD NEGATIVELY AFFECT THE MARKET PRICE OF OUR COMMON STOCK.

Sales of substantial amounts of Common Stock in the public market could adversely affect the market price of the Common Stock. There are at present 3,000,000 shares of Common Stock issued and outstanding.

OUR STOCK IS A PENNY STOCK. TRADING OF OUR STOCK MAY BE RESTRICTED BY THE SEC'S PENNY STOCK REGULATIONS AND THE NASD’S SALES PRACTICE REQUIREMENTS, WHICH MAY LIMIT A STOCKHOLDER'S ABILITY TO BUY AND SELL OUR STOCK.

The Company’s common shares may be deemed to be “penny stock” as that term is defined in Regulation Section “240.3a51-1” of the Securities and Exchange Commission (the “SEC”). Penny stocks are stocks: (a) with a price of less than U.S. $5.00 per share; (b) that are not traded on a “recognized” national exchange; (c) whose prices are not quoted on the NASDAQ automated quotation system (NASDAQ - where listed stocks must still meet requirement (a) above); or (d) in issuers with net tangible assets of less than U.S. $2,000,000 (if the issuer has been in continuous operation for at least three years) or U.S. $5,000,000 (if in continuous operation for less than three years), or with average revenues of less than U.S. $6,000,000 for the last three years.

Section “15(g)” of the United States Securities Exchange Act of 1934, as amended, and Regulation Section “240.15g(c)2” of the SEC require broker dealers dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually signed and dated written receipt of the document before effecting any transaction in a penny stock for the investor’s account. Potential investors in the Company’s common shares are urged to obtain and read such disclosure carefully before purchasing any common shares that are deemed to be “penny stock”.

Moreover, Regulation Section “240.15g-9” of the SEC requires broker dealers in penny stocks to approve the account of any investor for transactions in such stocks before selling any penny stock to that investor. This procedure requires the broker dealer to: (a) obtain from the investor information concerning his or her financial situation, investment experience and investment objectives; (b) reasonably determine, based on that information, that transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as to be reasonably capable of evaluating the risks of penny stock transactions; (c) provide the investor with a written statement setting forth the basis on which the broker dealer made the determination in (ii) above; and (d) receive a signed and dated copy of such statement from the investor confirming that it accurately reflects the investor’s financial situation, investment experience and investment objectives. Compliance with these requirements may make it more difficult for investors in the Company’s common shares to resell their common shares to third parties or to otherwise dispose of them. Stockholders should be aware that, according to Securities and Exchange Commission Release No. 34-29093, dated April 17, 1991, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include:

(i) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer

(ii) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases

(iii) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons

(iv) excessive and undisclosed bid-ask differential and markups by selling broker-dealers

(v) the wholesale dumping of the same securities by promoters and broker dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses

Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains "forward-looking statements" that involve risks and uncertainties. We use words such as "anticipate", "expect", "intend", "plan", "believe", "seek" and "estimate", and variations of these words and similar expressions to identify such forward-looking statements. You should not place too much reliance on these forward-looking statements. Our actual results are most likely to differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us described in the preceding "Risk Factors" section and elsewhere in this prospectus. These forward-looking statements address, among others, such issues as:

| Ø | future earnings and cash flow |

| Ø | expansion and growth of our business and operations |

| Ø | our estimated financial information |

These statements are based on assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate under the circumstances. However, whether actual results and developments will meet our expectations and predictions depend on a number of risks and uncertainties, which could cause our actual results, performance and financial condition to differ materially from our expectation.

Consequently, these cautionary statements qualify all of the forward-looking statements made in this prospectus. We cannot assure you that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they would have the expected effect on us or our business or operations.

DILUTION

The common stock to be sold by the selling shareholder is common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing shareholders.

PLAN OF DISTRIBUTION

The selling shareholder or their donees, pledges, transferees or other successors-in-interest selling shares received after the date of this prospectus from a selling shareholder as a gift, pledge, distribution or otherwise, may, from time to time, sell any or all of their shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These sales may be at fixed prices, at prevailing market prices, at prices related to prevailing market prices, at varying prices or negotiated prices. The selling shareholder may use any one or more of the following methods when selling shares:

| Ø | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| Ø | block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| Ø | purchases by a broker-dealer as principal and resale by the broker-dealer for its own account; |

| Ø | an exchange distribution following the rules of the applicable exchange; |

| Ø | privately negotiated transactions; |

| Ø | short sales that are not violations of the laws and regulations of any state of the United States; |

| Ø | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| Ø | broker-dealers may agree with the selling shareholders to sell a specified number of such shares at a stipulated price per share; and |

| Ø | a combination of any such methods of sale or any other lawful method. |

The selling shareholder may, from time to time, pledge or grant a security interest in some or all of the shares of common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of selling shareholder to include the pledgee, transferee or other successors-in-interest as selling shareholder under this prospectus. The selling shareholder also may transfer the shares of common stock in other circumstances, in which case the transferees, pledgees or other successors-in-interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of our common stock or interests therein, the selling shareholder may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The selling shareholder also may sell shares of our common stock short and deliver these securities to close out their short positions, or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling shareholder also may enter into option or other transactions with broker-dealers or other financial institutions for the creation of one or more derivative securities which require the delivery to the broker-dealer or other financial institution of shares offered by this prospectus, which shares the broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect the transaction).

The aggregate proceeds to the selling shareholder from the sale of the common stock offered by them will be the purchase price of the common stock less discounts or commissions, if any. A selling shareholder reserves the right to accept and, together with its agents from time to time, to reject, in whole or in part, any proposed purchase of common stock to be made directly or through agents. We will not receive any of the proceeds from this offering.

The selling shareholder and any underwriters, broker-dealers or agents that participate in the sale of the common stock or interests therein may be "underwriters" within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the shares may be underwriting discounts and commissions under the Securities Act. A selling shareholder that is an "underwriter" within the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act.

To the extent required, the shares of our common stock to be sold, the names of the selling shareholder, the respective purchase prices and public offering prices, the names of any agents, dealers or underwriters, and any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

Sales Pursuant to Rule 144

Any shares of common stock covered by this prospectus, which qualify for sale pursuant to Rule 144 under the Securities Act, as amended, may be sold under Rule 144 rather than pursuant to this prospectus.

Regulation M

We plan to advise the selling shareholder that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and to the activities of the selling security holders and their affiliates. Regulation M under the Exchange Act prohibits, with certain exceptions, participants in a distribution from bidding for, or purchasing for an account in which the participant has a beneficial interest, any of the securities that are the subject of the distribution. Accordingly, the selling shareholder is not permitted to cover short sales by purchasing shares while the distribution it taking place. Regulation M also governs bids and purchases made in order to stabilize the price of a security in connection with a distribution of the security. In addition, we will make copies of this prospectus available to the selling security holder for the purpose of satisfying the prospectus delivery requirements of the Securities Act.

State Securities Laws

Under the securities laws of some states, the shares may be sold in such states only through registered or licensed brokers or dealers. In addition, in some states the common shares may not be sold unless the shares have been registered or qualified for sale in the state or an exemption from registration or qualification is available and is complied with.

Expenses of Registration

We are bearing substantially all costs relating to the registration of the shares of common stock offered hereby. These expenses are estimated to be $10,000, including, but not limited to, legal, accounting, printing and mailing fees. The selling shareholder, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of such shares common stock.

USE OF PROCEEDS TO ISSUER

We will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling shareholder.

BUSINESS OF THE ISSUER

Glossary of Mining Terms

Archean | | Of or belonging to the earlier of the two divisions of Precambrian time, from approximately 3.8 to 2.5 billion years ago, marked by an atmosphere with little free oxygen, the formation of the first rocks and oceans, and the development of unicellular life. Of or relating to the oldest known rocks, those of the Precambrian Eon, that are predominantly igneous in composition. |

| | | |

Assaying | | Laboratory examination that determines the content or proportion of a specific metal (ie: gold) contained within a sample. Technique usually involves firing/smelting. |

| | | |

Conglomerate | | A coarse-grained clastic sedimentary rock, composed of rounded to subangular fragments larger than 2 mm in diameter (granules, pebbles, cobbles, boulders) set in a fine-grained matrix of sand or silt, and commonly cemented by calcium carbonate, iron oxide, silica, or hardened clay; the consolidated equivalent of gravel. The rock or mineral fragments may be of varied composition and range widely in size, and are usually rounded and smoothed from transportation by water or from wave action. |

| | | |

Cratons | | Parts of the Earth's crust that have attained stability, and have been little deformed for a prolonged period. |

| | | |

Development Stage | | A “development stage” project is one which is undergoing preparation of an established commercially mineable deposit for its extraction but which is not yet in production. This stage occurs after completion of a feasibility study. |

| | | |

Dolomite Beds | | Dolomite beds are associated and interbedded with limestone, commonly representing postdepositional replacement of limestone. |

| | | |

Doré | | Unrefined gold bullion bars containing various impurities such as silver, copper and mercury, which will be further refined to near pure gold. |

| | | |

Dyke or Dike | | A tabular igneous intrusion that cuts across the bedding or foliation of the country rock. |

| | | |

Exploration Stage | | An “exploration stage” prospect is one which is not in either the development or production stage. |

| | | |

Fault | | A break in the continuity of a body of rock. It is accompanied by a movement on one side of the break or the other so that what were once parts of one continuous rock stratum or vein are now separated. The amount of displacement of the parts may range from a few inches to thousands of feet. |

| | | |

Feldspathic | | Said of a rock or other mineral aggregate containing feldspar. |

| | | |

Fold | | A curve or bend of a planar structure such as rock strata, bedding planes, foliation, or cleavage |

| | | |

Foliation | | A general term for a planar arrangement of textural or structural features in any type of rock; esp., the planar structure that results from flattening of the constituent grains of a metamorphic rock. |

| | | |

Formation | | A distinct layer of sedimentary rock of similar composition. |

| | | |

Gabbro | | A group of dark-colored, basic intrusive igneous rocks composed principally of basic plagioclase (commonly labradorite or bytownite) and clinopyroxene (augite), with or without olivine and orthopyroxene; also, any member of that group. It is the approximate intrusive equivalent of basalt. Apatite and magnetite or ilmenite are common accessory minerals. |

| | | |

Geochemistry | | The study of the distribution and amounts of the chemical elements in minerals, ores, rocks, solids, water, and the atmosphere. |

| | | |

Geophysicist | | One who studies the earth; in particular the physics of the solid earth, the atmosphere and the earth’s magnetosphere. |

| | | |

Geotechnical | | The study of ground stability. |

| | | |

Gneiss | | A foliated rock formed by regional metamorphism, in which bands or lens-shaped strata or bodies of rock of granular minerals alternate with bands or lens-shaped strata or bodies or rock in which minerals having flaky or elongate prismatic habits predominate. |

| | | |

Granitic | | Pertaining to or composed of granite. |

| | | |

Heap Leach | | A mineral processing method involving the crushing and stacking of an ore on an impermeable liner upon which solutions are sprayed that dissolve metals such as gold and copper; the solutions containing the metals are then collected and treated to recover the metals. |

| | | |

Intrusions | | Masses of igneous rock that, while molten, were forced into or between other rocks. |

| | | |

Kimberlite | | A blue/gray igneous rock that contains olivine, serpentine, calcite and silica and is the principal original environment of diamonds. |

| | | |

Lamproite | | Dark-colored igneous rocks rich in potassium and magnesium. |

| | | |

Lithospere | | The solid outer portion of the Earth. |

| | | |

Mantle | | The zone of the Earth below the crust and above the core. |

| | | |

Mapped or Geological | | The recording of geologic information such as the distribution and nature of rock |

| | | |

Mapping | | Units and the occurrence of structural features, mineral deposits, and fossil localities. |

| | | |

Metavolcanic | | Said of partly metamorphosed volcanic rock. |

| | | |

Migmatite | | A composite rock composed of igneous or igneous-appearing and/or metamorphic materials that are generally distinguishable megascopically. |

| | | |

Mineral | | A naturally formed chemical element or compound having a definite chemical composition and, usually, a characteristic crystal form. |

| | | |

Mineralization | | A natural occurrence in rocks or soil of one or more metal yielding minerals. |

| | | |

Mineralized Material | | The term “mineralized material” refers to material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction. |

| | | |

Mining | | Mining is the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product. Exploration continues during the mining process and, in many cases, mineral reserves are expanded during the life of the mine operations as the exploration potential of the deposit is realized. |

| | | |

Outcrop | | That part of a geologic formation or structure that appears at the surface of the earth. |

| | | |

Pipes | | Vertical conduits. |

| | | |

Plagioclase | | Any of a group of feldspars containing a mixture of sodium and calcium feldspars, distinguished by their extinction angles. |

| | | |

Probable Reserve | | The term “probable reserve” refers to reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation. |

| | | |

Production Stage | | A “production stage” project is actively engaged in the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product. |

| | | |

Proterozoic | | Of or relating to the later of the two divisions of Precambrian time, from approximately 2.5 billion to 570 million years ago, marked by the buildup of oxygen and the appearance of the first multicellular eukaryotic life forms. |

| | | |

Reserve | | The term “reserve” refers to that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves must be supported by a feasibility study done to bankable standards that demonstrates the economic extraction. (“Bankable standards” implies that the confidence attached to the costs and achievements developed in the study is sufficient for the project to be eligible for external debt financing.) A reserve includes adjustments to the in-situ tonnes and grade to include diluting materials and allowances for losses that might occur when the material is mined. |

| | | |

Sedimentary | | Formed by the deposition of sediment. |

| | �� | |

Shear | | A form of strain resulting from stresses that cause or tend to cause contiguous parts of a body of rock to slide relatively to each other in a direction parallel to their plane of contact. |

| | | |

Sill | | A concordant sheet of igneous rock lying nearly horizontal. A sill may become a dike or vice versa. |

| | | |

Strike | | The direction or trend that a structural surface, e.g. a bedding or fault plane, takes as it intersects the horizontal. |

| | | |

Strip | | To remove overburden in order to expose ore. |

| | | |

Till | | Generally unconsolidated matter, deposited directly by and underneath a glacier without subsequent reworking by meltwater, and consisting of a mixture of clay, silt, sand, gravel, and boulders ranging widely in size and shape. |

| | | |

Unconformably | | Not succeeding the underlying rocks in immediate order of age or not fitting together with them as parts of a continuous whole. |

| | | |

Vein | | A thin, sheet like crosscutting body of hydrothermal mineralization, principally quartz. |

| | | |

Wall Rock | | The rock adjacent to a vein. |

| | | |

General Overview

Atomic Ventures, Inc. (“Atomic” or the “Company”) was incorporated in the State of Nevada on January 6, 2006 and is engaged in the acquisition and exploration of uranium properties.

Atomic’s property, which is referred to as the PRWC property, consists of one Mineral Cell Title Submission (MCX) recorded as a Mineral Claim on January 22, 2006 with Tenure record ID No 526037. The claim contains 20 cells with a total surface area of 382.01 Hectares (943.95 acres).

The PRWC claim occurs in an area with very high uranium in stream waters and covers a portion of a 6 by 4 km cap of plateau basalt that forms a low topographic high. This setting is very similar to the setting of the Blizzard basal uranium deposit in southern BC. We believe that the PRWC claim is highly prospective for uranium mineralization, which is preserved in a paleochannels or channels under the basalt cap. A report authored by Andre M. Pauwels, P.Geo, recommends the exploration of the area of the claim, initially with mapping and soil sampling and later, if high uranium is found in soils, with a first campaign of core drilling. Cost of mapping and sampling is estimated at approximately USD $5,805 and the cost of drilling at USD $86,850.

We are an exploration company and we cannot provide assurance to investors that our mineral claims contain a commercially exploitable mineral deposit, or reserve, until appropriate exploratory work is done and an economic evaluation based on such work concludes economic feasibility.

Property Acquisitions Details

On May 30, 2006 Atomic Ventures purchased the PRWC property for USD $4,000.

Land Status, Topography, Location and Access

The PRWC property is located in Central British Columbia, Canada, 20 km southwest of the City of Prince George on NTS Sheet 93G (Latitude: 51º 39’ 12’’N and Longitude: 123º 1’ 13’’ W).

The property is situated in Central British Columbia 20 km southwest of the City of Prince George (see figures 1 and 2 below). The property can be reached by road from Prince George by following paved Highway 16 to a point 12 km west of the City Limits and then south for 4km along a dense network of logging roads to the claim.

The City of Prince George is a regional population centre with many services and amenities for industrial, educational and leisure activities. The airport at Prince George has daily scheduled flights to Vancouver.

The property is situated in the Fraser plateau an area generally with gentle relief, but deeply incised by the Fraser River and its tributaries. Elevations on the property vary from 680m to 750 m above sea level. Vegetation consists mainly of Lodge pole pine. The climate is characterised by hot and dry summers and cold but wetter winters. Most precipitation falls in the form of snow during the wintertime. Snow cover prevails from mid November until early April.

Mining Claims

Since January 2005 all mineral claims in British Columbia are acquired by an internet based map staking system, so location and title is secure and easily verifiable. The author verified titles at the website of the British Columbia Ministry of Energy and Mines (http://www.mtonline.gov.bc.ca/).

The property consists of one Mineral Cell Title Submission (MCX) recorded as a Mineral Claim on January 22, 2006 with Tenure record ID No 526037. The claim contains 20 cells with a total surface area of 382.01 Hectares (943.95 acres).

The mineral claim is in good standing until January 22, 2007. To keep the claim in good standing, assessment work, acceptable to the British Columbia Minister of Energy and Mines, has to be performed before January 22, 2007. The requirement is $100 CDN per year per cell for each of the first 3 years after January 2007 and $200 CDN per cell per year post January 2009. Assessment work has to be completed by a qualified person and registered before the expiry date of the claim. Cash can be paid in lieu of assessment work. In addition to the assessment work or cash in lieu, a yearly fee of $0.40 per hectare per year is required. Total minimum costs to maintain the PRWC claims until January 22, 2008 are $ 2,152.80 CDN.

Geology of the Mineral Claims

The property is situated in the intermontane morphogeological belt or superterrane of Central British Columbia. The Intermontane belt is composed of a large number of terranes and is flanked to the east by the ancestral North American Continent. The terranes of the intermontane belt accreted to the North American Continent at various times starting 200 million years ago.

In general this belt, that runs parallel to the general north-westerly trend of the Cordillera through the whole length of British Columbia, is composed of volcanic and sedimentary rock ranging in age from Devonian to Recent and has early Mesozoic to early Tertiary granitic intrusions.

Regionally the oldest rocks are sedimentary rocks of the Pennsylvanian Cache Creek Terrane flanked to the east by intermediate volcanics and minor sediments of the Middle to Upper Triassic Nicola Group of the Stikinia Terrane. The geological history after the accretion is dominated by several episodes of deposition of flat lying volcanic rocks and minor sediments from Eocene to Recent. Regionally the tertiary volcanics rocks are Pliocene to recent basalt flows and sediments of the Chilcotin group and minor coarse clastic sediments of Pliocene to Miocene Age. The most recent regional geological event is extensive glaciation. Glacial deposits mantle much of the plateau west and so obscure the underlying older strata.

For the purpose of this report the results of uranium in water were studied. The whole area, like most of British Columbia, has been the subject of systematic regional stream sediment and water surveys. The density of sampling is approximately 1 per 10 to 20 km2. The work was done by the Geological Survey of Canada, often in cooperation with the BC Geological survey and is fully depicted on the MapPlace website of the B.C. Geological Survey (http://www.em.gov.bc.ca/Mining/Geolsurv/MapPlace/). These data were used for this report.

Several streams that drain the local basalt cap exhibit exceptionally high uranium in stream waters. Two sample sites, located just 3km west of the PRWC claim measure 7.5 and 5.5 ppb U (see figure 5). Such values are exceptionally high, considering that province- wide; the 98 percentile of all values of Uranium in water is 4 ppb. The local basalt cap, of which the PRWC claim covers a portion, is topographically higher than the water sample sites. We believe that the amounts of uranium in streams represent the amount and rate of uranium liberated through natural weathering processes from bedrock sources or in selected cases directly indicate uranium mineralization.

Deposit Type

The area of the claims is prospective for Basal-Type uranium deposits. This type of deposit is known from Japan, USA and locally in British Columbia. The most prominent local example is the Blizzard Deposit located southeast of the city of Kelowna in the Okanagan Region of Southern British Columbia. The Blizzard deposit was extensively drilled by Norcen Energy Resources in the late seventies and Norcen cited a total of 4,020 metric tonnes of uranium contained within the deposit (Norcen 1979).

The geology and geochemistry of this type of deposits in British Columbia is described by D. Boyle (1980) and D. Boyle and S. Ballantyne (1982). Briefly these deposits are formed in unconsolidated stream channel sediments by uranium rich groundwater. The deposits are preserved by basalt flows that fill in the stream valleys and form an impermeable cap over the paleochannels. Uranium rich groundwater appear not only to need an uranium rich source rock such as alkaline intrusions and volcanic rocks, but also are enhanced by large regional fault zones. Deposition of uranium appears to need the presence of organic carbon, such as plant material, within the stream sediments. Uranium mineralization follows favourable parts of the paleochannels and is essentially sandwiched between the relatively impermeable basalt flow above and impermeable un-weathered bedrock below. Erosion, subsequent to the deposition of the basalt flows in a river valley, will happen along the thin edges of the basalt flow. The effect over time is an inversion of topography. The basalt covering the paleochannel will become a topographic ridge

Because of the emplacement of uranium mineralization between impermeable layers, exploitation by in situ leaching is probably feasible. In situ leaching, a technique used in the USA, Australia and in areas of the former USSR and other locales, consists of closely spaced, drilled injection and recovery wells and a modestly sized plant to extract uranium from recovered solutions. In-situ leaching has minimal impact on the environment of the area and is much less disruptive than mining by open pit excavation. Because of this not only are the capital requirements much lower than for excavation mining, but also the acceptance by all stakeholders of the enterprise is enhanced

Exploration History and Previous Operations

No records could be found of any prior exploration on the property. The general area, as is most of British Columbia, is covered by regional stream sediment surveys, systematic wide spaced aeromagnetic coverage and regional geological mapping. These data were generated by the Geological Survey of Canada and/or the BC Geological survey and is fully depicted on the MapPlace website of the B.C. Geological Survey (http://www.em.gov.bc.ca/Mining/Geolsurv/MapPlace/).

Proposed Program and Cost Estimates of Exploration

The PRWC claim occurs in an area with very high uranium in stream waters and covers a portion of a 6 by 4 km cap of plateau basalt that forms a low topographic high. This setting is very similar to the setting of the Blizzard basal uranium deposit in southern BC. Based on stream sediment surveys conducted by the Geological Survey of Canada and the BC Geological survey, we believe that the claim is highly prospective for uranium mineralization preserved in a paleochannel or channels under the basalt cap.

Andre M. Pauwels, P.Geo, examined all available documentation about the property and in a report he authored dated May 30, 2006 recommended a multi-stage exploration program to explore the potential of the PRWC property. Accordingly, we plan to explore the area of the deposit as follows:

| 1. | Map the extent of the basalt cap: Available maps of the area are regional and insufficiently detailed. In practice it is recommended to do traverses spaced 250 meter apart across the topographic ridge and geologically map all outcrops. |

| 2. | Soil sampling: The contact zone of the basalt cap, as mapped under 1. above, needs to be systematically sampled at 100 meter intervals. This will detect any uranium leaching from a mineralized paleochannel under the basalt or from a paleochannels partly uncovered by erosion at the edge of the basalt cap. |

| 3. | Drilling: If anomalous concentrations of uranium are detected from the soil sampling campaign, drilling through the basalt, up slope from the high uranium in soils, is recommended |

| BUDGET |

| Budget 1 & 2 | | C$ | US $* |

| Mapping | Geologist 2 days @ $500/day | 1000 | |

| Soil sampling | Technician 3 days @ $250/day | 750 | |

| Food/lodging | at $ 125/day/person | 750 | |

| Analysis | 60 samples at $20 | 1200 | |

| Travel 2 person-days | | 750 | |

| Transportation | | 500 | |

| Report | | 1500 | |

| | | 6,450 | 5,805* |

| Budget 3 | | | |

| Diamond drilling | 4 holes a 100 m each @ $150/m | 60000 | |

| Permitting | | 5000 | |

| Supervision logging | Geologist 10 days | 5000 | |

| Drill pads and access | | 8000 | |

| Report and drafting | | 6000 | |

| Analysis | | 4000 | |

| Domicile and transport | | 4000 | |

| Contingency 5% | | 4500 | |

| | | 96,500 | 86,850* |

* As of May 26, 2005, the noon rate of exchange, as reported by the Federal Reserve Bank of New York for the conversion of United States dollars into Canadian dollars was CAD $1.107 (US $1.00 = CAD $1.107).

Overview of Uranium and the Uranium Industry

Uranium occurs as uranium oxide in minerals such as pitchblende (Uraninite in massive form is called pitchblende which is the chief uranium ore). Uranium is an unusual metal compared to base and precious metals in that its value has really only been recognized in the past 60 years. Uranium ore is the basic resource for the production of electrical energy through nuclear power.

The only significant commercial use for uranium is as fuel for nuclear power plants for the generation of electricity. Nuclear technology uses the energy released by splitting the atoms of certain elements. It was first developed in the 1940s, and during the Second World War research initially focused on producing bombs by splitting the atoms of either uranium or plutonium. Only in the 1950s did attention turn to the peaceful purposes of nuclear fission, notably for power generation.

Today, the world produces as much electricity from nuclear energy as it did from all sources combined in 1960. Civil nuclear power can now boast over 12,000 reactor years of experience and supplies 16% of global needs, in 30 countries. See, Nuclear Power in the World Today, February 2006, www.world-nuclear.org/info/inf01.htm

Worldwide there were 440 nuclear power plants (NPPs) operating in 31 countries, with over 364,000 MWe of total capacity, at the end of 2004. Over the course of the year, nuclear power supplied 16% of the world’s electricity. This percentage has been roughly stable since 1986, indicating that nuclear power has grown at the same rate as total global electricity for 18 years. See, International Atomic Energy Agency, Nuclear Technology Review - Update 2005, http://www.iaea.org/About/Policy/GC/GC49/Documents/gc49inf-3.pdf.

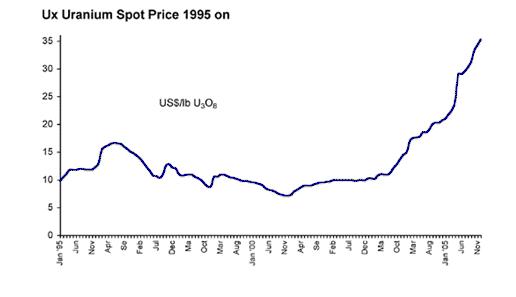

The Ux Consulting Company, LLC reports that spot prices ( the price at which uranium may be purchased for delivery within one year) have been more volatile historically than long-term contract prices, increasing from $6.00 per pound in 1973 to $43.00 per pound in 1978, declining to $7.25 per pound in October 1991, increasing to $16.50 per pound in May 1996 and again declining to $7.10 at December 31, 2000. Since year-end 2000 the spot price has increased to $10.20 at December 31, 2002. The spot price at March 31, 2003 was $10.10.

The following graph shows spot prices per pound from 1972 to the end of 2004, as reported by Trade Tech and The Ux Consulting Company, www.uxc.com. .

All prices beginning in 1993 represent U3O8 deliveries available to U.S. utilities.

High prices in the late 1970s in the uranium market gave way to low prices in the early 1990s, with spot prices being below the cost of production for most mines. In 1996 spot prices recovered to the point where some mines could produce profitably. Prices declined again and only recovered late in 2003. See, Nuclear Issues Briefing Paper 36 May 2006; http://www.uic.com.au/nip36.htm

Since 2003, uranium prices have steadily been on the rise. On June 26, 2006, the price of uranium was U.S. $45.50 per pound. See, The Ux Consulting Company Weekly Spot Prices; www.uxc.com/

The decline in global commercial uranium inventories is rapidly shifting froman inventory-driven market to one that is production-driven. Consolidation over the last several years has squeezed the number of uranium suppliers. In the interim, long-term indicators are pointing toward a demand curve that will exceed supply within the next several years and ultimately lead to higher prices. See, The Ux Consulting Company, Uranium Suppliers Annual 2005, www.uxc.com

Compliance With Government Regulation

We will be required to conduct all mineral exploration activities in accordance with provincial and federal regulations in Canada. Such operations are subject to various laws governing land use, the protection of the environment, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, well safety and other matters. Unfavorable amendments to current laws, regulations and permits governing operations and activities of resource exploration companies, or more stringent implementation thereof, could have a materially adverse impact and cause increases in capital expenditures which could result in a cessation of operations.

Employees

At present, we have no employees. We anticipate that we will be conducting most of our business through agreements with consultants and third parties.

MANAGEMENT DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

The following discussion of our financial condition and results of operations should be read in conjunction with our consolidated financial statements and the notes to those statements included elsewhere in this prospectus. In addition to the historical consolidated financial information, the following discussion and analysis contains forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of certain factors, including those set forth under "Risk Factors" and elsewhere in this prospectus.

Plan of Operations

Our business plan is to proceed with the exploration of the PRWC mine property to determine whether there is any potential for uranium located on the property that comprises the mineral claims. We have decided to proceed with the two phases of a staged exploration program recommended by the geological report. We anticipate that these phases of the recommended geological exploration program will cost approximately $5,805 USD and $86,850 USD respectively. We had $Nil in cash reserves as of the period ended May 31, 2006. The lack of cash has kept us from conducting any exploration work on the property.

We anticipate that we will incur the following expenses over the next twelve months:

| Ø | $5,805 USD in connection with the completion of Phase 1 of our recommended geological work program, which includes mapping, soil sampling, food and lodging, sample analysis, travel, transportation, and geological report; |

| Ø | $86,850 USD in connection with the completion of Phase 2 of our recommended geological work program, which includes diamond drilling, permitting, supervision logging, drill pads and access, geological report and drafting, drill core analysis, domicile and transport, and contingency (5%); and |

| Ø | $10,000 USD for operating expenses, including professional legal and accounting expenses associated with compliance with the periodic reporting requirements after we become a reporting issuer under the Securities Exchange Act of 1934, but excluding expenses of the offering. |

| Ø | $2,152 CDN to the provincial government to keep the claims valid |

If we determine not to proceed with further exploration of our mineral claims due to a determination that the results of our initial geological program do not warrant further exploration or due to an inability to finance further exploration, we plan to pursue the acquisition of an interest in other mineral claims. We anticipate that any future acquisition would involve the acquisition of an option to earn an interest in a mineral claim as we anticipate that we would not have sufficient cash to purchase a mineral claim of sufficient merit to warrant exploration. This means that we might offer shares of our stock to obtain an option on a property. Once we obtain an option, we would then pursue finding the funds necessary to explore the mineral claim by one or more of the following means: engaging in an offering of our stock; engaging in borrowing; or locating a joint venture partner or partners.

Results Of Operations

We have not yet earned any revenues. We anticipate that we will not earn revenues until such time as we have entered into commercial production, if any, of our mineral properties. We are presently in the exploration stage of our business and we can provide no assurance that we will discover commercially exploitable levels of mineral resources on our properties, or if such resources are discovered, that we will enter into commercial production of our mineral properties.

Liquidity And Capital Resources

Our cash totaled $NIL at the end of the period on May 31, 2006. Accounts payable at the end of the period on May 31, 2006 was $855. Since our inception on January 06, 2006 to the end of the period on May 31, 2006, we have incurred a loss of $4,855. At May 31, 2006, we had an accumulated deficit of $4,855.

For the period ended May 31, 2006, net cash provided by investing activities was $4,000, of which $3,000 was derived from the issuance of common stock and $1,000 was derived from additional paid-in capital. For the period ended May 31, 2006, net cash used in the purchase of the PWRC property was $4,000.

Based on our current operating plan, we do not expect to generate revenue that is sufficient to cover our expenses for at least the next twelve months. In addition, we do not have sufficient cash and cash equivalents to execute our operations for at least the next twelve months. We will need to obtain additional financing to operate our business for the next twelve months. We will raise the capital necessary to fund our business through a private placement and public offering of its common stock. Additional financing, whether through public or private equity or debt financing, arrangements with stockholders or other sources to fund operations, may not be available, or if available, may be on terms unacceptable to us. Our ability to maintain sufficient liquidity is dependent on our ability to raise additional capital. If we issue additional equity securities to raise funds, the ownership percentage of our existing stockholders would be reduced. New investors may demand rights, preferences or privileges senior to those of existing holders of our common stock. Debt incurred by us would be senior to equity in the ability of debt holders to make claims on our assets. The terms of any debt issued could impose restrictions on our operations. If adequate funds are not available to satisfy either short or long-term capital requirements, our operations and liquidity could be materially adversely affected and we could be forced to cease operations.

We are bearing all costs relating to the registration of the common stock, which are estimated at $10,000. The selling shareholder, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

We are paying the expenses of the offering because we seek to (i) become a reporting company with the Commission under the Securities Exchange Act of 1934 (the "1934 Act"); and (ii) enable our common stock to be traded on the OTC Bulletin Board. We believe that the registration of the resale of shares on behalf of our existing shareholder may facilitate the development of a public market in our common stock if our common stock is approved for trading on the OTC Bulletin Board. We have not yet determined whether we will separately register our securities under Section 12 of the 1934 Act.

DIRECTORS, EXECUTIVE OFFICERS AND SIGNIFICANT EMPLOYEES

Information about our sole director and executive officer follows:

| NAME | AGE | POSITION AND TERM OF OFFICE |

| | | |

| Kenneth Cabianca | 62 | President, Secretary, Treasurer, Director |

At present, we have only one Executive Officer and Director. Our Bylaws provide for a board of directors ranging from 1 to 9 members, with the exact number to be specified by the board. All Directors will hold office until the next annual meeting of the stockholders following their election and until their successors have been elected and qualified. The Board of Directors appoints Officers. Officers will hold office until the next annual meeting of our Board of Directors following their appointment and until their successors have been appointed and qualified.

Set forth below is a brief description of the recent employment and business experience of our sole Executive Officer and Director:

Kenneth Cabianca

Since 1983, Mr. Cabianca has been an independent businessman and a management consultant of various companies. Many of his activities have been conducted through his company, Wellington Financial Corporation. During the past five years, he has not served as an officer or director of any company, other than Brinx Resources Ltd. His experience includes raising venture capital, general management, and public relations. From August 1991 to September 1999, Mr. Cabianca was a director and president of Primo Resources International Inc., a mining company whose stock trades on the CDNX. While he served as president Primo Resources, he engaged in joint ventures projects with Mitsubishi Corp., Mitsubishi Materials Corp., and Golden Peaks Resources Ltd. He served as a director of Primo Resources International again from October 2001 to November 2002. He received a D.D.S. degree and practiced dentistry in Vancouver, British Columbia from 1965 to 1986. He also received a Bachelor of Science degree from Creighton University in 1965.

REMUNERATION OF DIRECTORS AND OFFICERS

The following table sets forth the remuneration of our sole director and officer for the period from inception January 6, 2006 to the end of the period May 31, 2006:

| NAME OF INDIVIDUAL | CAPACITIES IN WHICH REMUNERATION WAS RECEIVED | AGGREGATE REMUNERATION |

| Kenneth Cabianca | Sole Executive Officer | $0 |

We have no employment agreements with our sole Executive Officer and Director. We will not pay compensation to a Director for attendance at meetings. We will reimburse a Directors for reasonable expenses incurred during the course of their performance.

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITY HOLDERS

The following table lists the share ownership of persons who, as of the date of this prospectus owned of record or beneficially, directly or indirectly, more than five percent (5%) of the outstanding common stock, and our sole Executive Officer and Director:

NAME AND ADDRESS OF OWNER | SHARES OWNED PRIOR TO OFFERING | SHARES TO BE OFFERING FOR SELLING SHAREHOLDER'S ACCOUNT | SHARES TO BE OWNED UPON COMPLETION OF OFFERING | PERCENTAGE OF CLASS (1) |

| BEFORE OFFERING | AFTER OFFERING |

Kenneth Cabianca 211- 1455 Bellevue Ave. West Vancouver BC V7T 1C3 | 3,000,000 | 2,000,000 | 1,000,000 | 100% | 33.33% |

(1) This table is based on 3,000,000 shares of common stock outstanding

As of the date of this prospectus, Kenneth Cabianca was our only shareholder.

INTEREST OF MANAGEMENT AND OTHERS IN CERTAIN TRANSACTIONS