UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | |

| ☐ | | Preliminary Proxy Statement |

| | |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| ☐ | | Definitive Proxy Statement |

| | |

| ☒ | | Definitive Additional Materials |

| | |

| ☐ | | Soliciting Material Pursuant to §240.14a-2 |

Box, Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| | |

| ☒ | | No fee required. |

| | | |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | (5) | | Total fee paid: |

| | | |

| ☐ | | Fee paid previously with preliminary materials. |

| | | |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid: |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | (3) (4) | | Filing Party: Date Filed: |

On July 19, 2021, Box, Inc. (the “company”) launched a website in connection with the company’s 2021 annual meeting of stockholders. A copy of the materials (other than those previously filed under cover of Schedule 14A) on the website can be found below.

* * * * *

Box Announces Strategic Partnership with KKR, including $500 Million KKR-led Investment

Company Intends to Repurchase Up to $500 Million of Common Stock Through Self-Tender Offer

KKR’s Head of Americas Technology Private Equity, John Park, to Join Box Board

REDWOOD CITY, Calif., April 8, 2021 – Box, Inc. (NYSE: BOX), the leading Content Cloud, and KKR, a leading global investment firm, today announced an agreement for KKR funds to lead a $500 million investment in the company in the form of convertible preferred stock. The investment from KKR will advance the company’s strategy to deliver the Box Content Cloud and enable customers to modernize how they work and drive digital transformation throughout their organizations.

Box anticipates using substantially all of the proceeds to fund a share repurchase through a “Dutch auction” self-tender of up to $500 million of its common stock, with specific amount and pricing of the self-tender to be determined based on market conditions and stock prices at the time when the self-tender is launched. The self-tender is expected to commence after Box releases its fiscal first quarter financial results in May 2021. Further details on the self-tender will be included in filings with the U.S. Securities and Exchange Commission (“SEC”) at the time of its commencement.

“The investment from KKR is a strong vote of confidence in our vision, strategy, and continued efforts to increase growth and profitability,” said Aaron Levie, co-founder and CEO of Box. “KKR is one of the world’s leading technology investors with a deep understanding of our market and a proven track record of partnering successfully with companies to create value and drive growth. With their support, we will be even better positioned to build on Box’s leadership in cloud content management as we continue to deliver value for our customers around the world.”

“We are pleased to establish this relationship with KKR and bring their team’s expertise to Box at this important time in the company’s evolution,” said Dana Evan, Lead Independent Director of Box Board of Directors. “Our Board has been focused on ways to support and accelerate the company’s strategy while driving shareholder value. After undertaking a comprehensive review of a wide range of strategic options, the Board unanimously determined that continuing to execute Box’s long-term strategy in combination with a significant share repurchase and the support of KKR, is the optimal path to drive the company’s next phase of growth.”

Continued Evolution of the Board of Directors and Strengthened Corporate Governance

Upon closing of the transaction, John Park, Head of Americas Technology Private Equity at KKR, will join Box’s Board of Directors. With this addition, Box’s Board will be expanded to ten directors.

Mr. Levie continued, “We are thrilled to welcome John, a highly respected voice in the technology industry, to the Board. John brings substantial experience advising and supporting software and other technology companies with a focus on the cloud. We look forward to adding his expertise to our Board as Box continues innovating and transforming how enterprises work in the digital age.”

“Box has a highly differentiated product platform with a customer-centric vision that makes it an ideal investment for KKR,” said Mr. Park. “Under Aaron’s leadership, Box has been transforming and simplifying how people and businesses work, and I look forward to working closely with him, Box’s Board and the broader leadership team to support the company in its next stage of growth.”

Box also announced today that current director Bethany Mayer will be appointed as Chair of the Board of Directors, effective May 1, 2021. Ms. Mayer joined the Box Board in April 2020 as an independent director. Ms. Mayer brings more than 30 years of strategic leadership experience driving growth for technology companies, including operating roles as former CEO of Ixia, Senior Vice President and General Manager of the Networking Business Unit at Hewlett Packard, and Senior Vice President of Worldwide Marketing and Alliances at Blue Coat Systems. Current Board Chair and Box CEO Aaron Levie will remain on the Box Board of Directors.

“As we continue to evolve our Board and adopt best-in-class corporate governance practices, we are pleased to name Bethany as Chair,” said Aaron Levie, co-founder and CEO of Box. “Bethany’s deep technology experience scaling multi-billion-dollar enterprise businesses at various stages and sizes has been incredibly valuable to me and the entire Board. We’re looking forward to working with her in this new role.”

“Box has pioneered cloud content management and I believe we have the right strategy and right team in place to further cement our leadership position in the market by driving growth, operational efficiency, and shareholder value,” said Bethany Mayer. “I’m thrilled to take on the role of Board Chair and to continue to work closely with Aaron and the rest of the Board as we lead the company forward.”

Advancing the Box Content Cloud and Driving Next Phase of Growth

Box today reaffirmed its vision to deliver the Content Cloud and drive profitable growth. Bolstered by the support of KKR, the company is focused on advancing its land-and-expand strategy to generate growth from new and existing customers while driving continued demand for its advanced product capabilities and adoption of Box Suites. To further open up new areas for growth and innovation, the company is growing its product portfolio and expanding its presence in key international markets.

To accelerate its strategy Box has expanded into new market adjacencies like e-signatures with Box Sign, the new e-signature capability that will be natively embedded in Box, while also continuing to double down on product areas like Box Shield and Box Governance for advanced security and compliance, and Box Relay for workflow automation. Box also continues to cultivate strong partnerships with leading technology companies and system integrators, including IBM, Google, Salesforce, Slack, Zoom, Cisco Okta, and Microsoft, to ensure it is delivering its Content Cloud to customers at scale.

As previously announced, Box is committed to achieving a revenue growth rate between 12-16%, with operating margins of between 23-27%, by fiscal 2024. Box remains confident in its ability to achieve these results based on the customer momentum underway, as well as the company’s product roadmap and the total addressable market opportunity ahead.

Investment Terms

KKR will lead the purchase of $500 million of convertible preferred stock. The preferred stock will be convertible into shares of Box common stock at a conversion price of $27.00 per share. In the event that the 10-day volume-weighted average price, or VWAP, ending April 21, 2021 is less than a threshold price of $20.77 per share, the conversion price will be proportionately adjusted downward from $27.00. Any downward adjustment will maintain the same ratio of conversion price to 10-day VWAP as the unadjusted conversion price to such threshold price, subject to a minimum conversion price of $24.00 per share. The investment from KKR is being made through certain of its investment funds.

The preferred stock carries a 3% dividend, which will be payable in kind or in cash, at Box’s election. On an as-converted basis, the preferred stock will represent approximately 11% of Box’s shares outstanding after giving effect to the investment and before any share repurchases.

The preferred stock can be converted into common stock at any time, and Box may be required to redeem the preferred stock after seven years.

Conversely, Box can require conversion into common stock after three years if the stock price exceeds certain thresholds and can redeem the preferred stock after five years, subject to a call schedule.

Consummation of this investment is subject to satisfaction of customary closing conditions. Box currently expects the investment to close in May 2021.

Further details will be included in a Form 8-K to be filed with the SEC in due course.

Advisors

Morgan Stanley & Co. LLC is serving as financial advisor to Box. Wilson Sonsini Goodrich & Rosati, P.C. and Sidley Austin LLP are serving as legal advisors to Box.

About John Park

John Park leads the technology industry team within KKR’s Americas Private Equity platform. He is also a member of the Investment Committee and Portfolio Management Committee for Americas Private Equity. Mr. Park is currently a member of the Board of Directors of BMC Software, Calabrio, Corel, Internet Brands, Optiv and Ticket Monster, and was involved with KKR’s investments in ASG Technologies, Autodata Solutions, Cylance, Epicor, Exact, GoDaddy, Mitchell International, Ping Identity, Reliance Jio Platforms and SunGard Data Systems.

Mr. Park holds an A.B., cum laude, in Economics from Princeton University and an M.B.A. from Harvard Business School.

About Bethany Mayer

Bethany Mayer is currently an executive partner at Siris Capital Group and serves on the public company Board of Directors of Box, Inc. (BOX), Lam Research Inc (LRC), Marvell Technologies (MRVL), and Sempra Energy (SRE). Prior to joining Siris Capital Group, she was the President and Chief Executive Officer, and Director of Ixia, a publicly-traded company and a leader in test, visibility and security solutions. Mayer served as CEO of Ixia when it was acquired by Keysight Technologies Inc. Previously, she served as Senior Vice President and General Manager of the Networking Business Unit at Hewlett Packard and Senior Vice President of Worldwide Marketing and Alliances at Blue Coat Systems.

Ms. Mayer holds an M.B.A. from California State University, Monterey Bay and bachelor’s degree from Santa Clara University.

About Box

Box (NYSE:BOX) is a leading cloud content management platform that enables organizations to accelerate business processes, power workplace collaboration, and protect their most valuable information, all while working with a best-of-breed enterprise IT stack. Founded in 2005, Box simplifies work for leading organizations globally, including AstraZeneca, JLL, and Morgan Stanley. Box is headquartered in Redwood City, CA, with offices in the United States, Europe, and Asia. To learn more about Box, visit http://www.box.com. To learn more about how Box powers nonprofits to fulfill their missions, visit Box.org.

About KKR

KKR is a leading global investment firm that offers alternative asset management and capital markets and insurance solutions. KKR aims to generate attractive investment returns by following a patient and disciplined investment approach, employing world-class people, and supporting growth in its portfolio companies and communities. KKR sponsors investment funds that invest in private equity, credit and real assets and has strategic partners that manage hedge funds. KKR’s insurance subsidiaries offer retirement, life and reinsurance products under the management of The Global Atlantic Financial Group. References to KKR’s investments may include the activities of its sponsored funds and insurance subsidiaries. For additional information about KKR & Co. Inc. (NYSE: KKR), please visit KKR’s website at www.kkr.com and on Twitter @KKR_Co.

Forward-Looking Statements

Certain statements contained herein contain forward-looking statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the assumptions prove incorrect, our results may differ materially from those expressed or implied by such forward-looking statements. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to, statements about the contemplated investment and whether and when such investment would be consummated and achievement of its potential benefits; any potential repurchase of shares of Box common stock, whether, when, in what amount and by what method (whether by tender offer or otherwise) any such repurchase would be consummated, and the per share price of any such repurchase; our future financial and operating results, including expectations regarding revenues, deferred revenue, billings, remaining performance obligations, gross margins and operating income; our market opportunity, business plan and ability to effectively manage our growth; our ability to maintain an adequate rate of revenue and billings growth and our expectations regarding such growth; our ability to achieve profitability and expand or maintain positive cash flow; our ability to achieve our long-term margin objectives; our ability to grow our unrecognized revenue and remaining performance obligations; our expectations regarding our revenue mix; costs associated with defending intellectual property infringement and other claims and the frequency of such claims; our ability to attract and retain end-customers; our ability to further penetrate our existing customer base; our expectations regarding our retention rate; our ability to displace existing products in established markets; our ability to expand our leadership position as a cloud content management platform; our ability to timely and effectively scale and adapt our existing technology; our ability to timely and effectively scale and adapt our existing technology; our investment strategy, including our plans to further invest in our business, including investment in research and development, sales and marketing, our data center infrastructure and our professional services organization, and our ability to effectively manage such investments; our ability to expand internationally; expectations about competition and its effect in our market and our ability to compete; the effects of seasonal trends on our operating results; use of non-GAAP financial measures; our belief regarding the sufficiency of our cash, cash equivalents and our credit facilities to meet our working capital and capital expenditure needs for at least the next 12 months; our expectations concerning relationships with third parties; our ability to attract and retain qualified employees and key personnel; our ability to realize the anticipated benefits of our partnerships with third parties; the effects of new laws, policies, taxes and regulations on our business; management’s plans, beliefs and objectives, including the importance of our brand and culture on our business; our ability to maintain, protect and enhance our brand and intellectual property; and future acquisitions of or investments in complementary companies, products, services or technologies and our ability to successfully integrate such companies or assets. These statements are based on estimates and information available to us at the time of this presentation and are no guarantees of future performance. We assume no obligation and do not intend to update these forward-looking statements or to conform these statements to actual results or to changes in our expectations.

Certain Information Regarding the Tender Offer

The description contained herein is for informational purposes only and is not a recommendation, an offer to buy or the solicitation of an offer to sell any shares of Box’s common stock. A tender offer for the outstanding shares of Box’s common stock has not commenced. If a tender offer is commenced, if ever, Box will file or cause to be filed a Tender Offer Statement on Schedule TO with the SEC. The Tender Offer Statement (including an Offer to Purchase, a related Letter of Transmittal and other tender offer documents) will contain important information that should be read carefully before any decision is made with respect to the tender offer. Those materials will be made available to Box’s stockholders at no expense to them through Box’s website at www.boxinvestorrelations.com. In addition, those materials (and any other documents filed with the SEC) will be available at no charge on the SEC’s website at www.sec.gov.

Investors:

Elaine Gaudioso

+1 650-209-3463

ir@box.com

Media:

Denis Roy and Rachel Levine

+1 650-543-6926

press@box.com

OR

Joele Frank, Wilkinson Brimmer Katcher

Leigh Parrish / Dan Moore

+ 1 212-355-4449

KKR:

Cara Major or Miles Radcliffe-Trenner

media@kkr.com

Box Reports Strong Fiscal First Quarter 2022 Financial Results

Raises Revenue Guidance and Non-GAAP Operating Profit Expectations for the Fiscal Year

| • | Revenue of $202.4 Million, Up 10% Year-Over-Year |

| • | Remaining Performance Obligations of $864.8 Million, Up 20% Year-Over-Year |

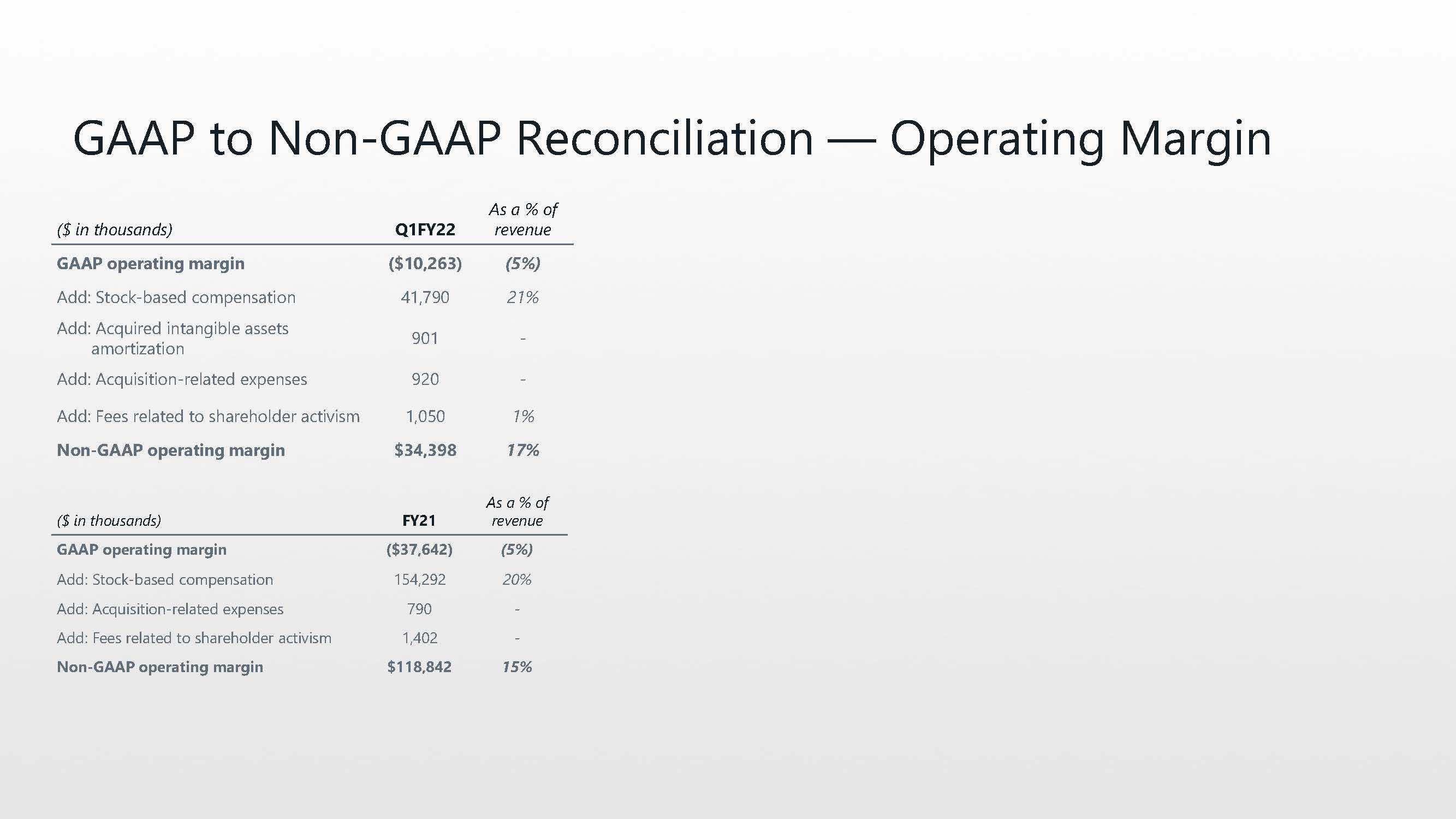

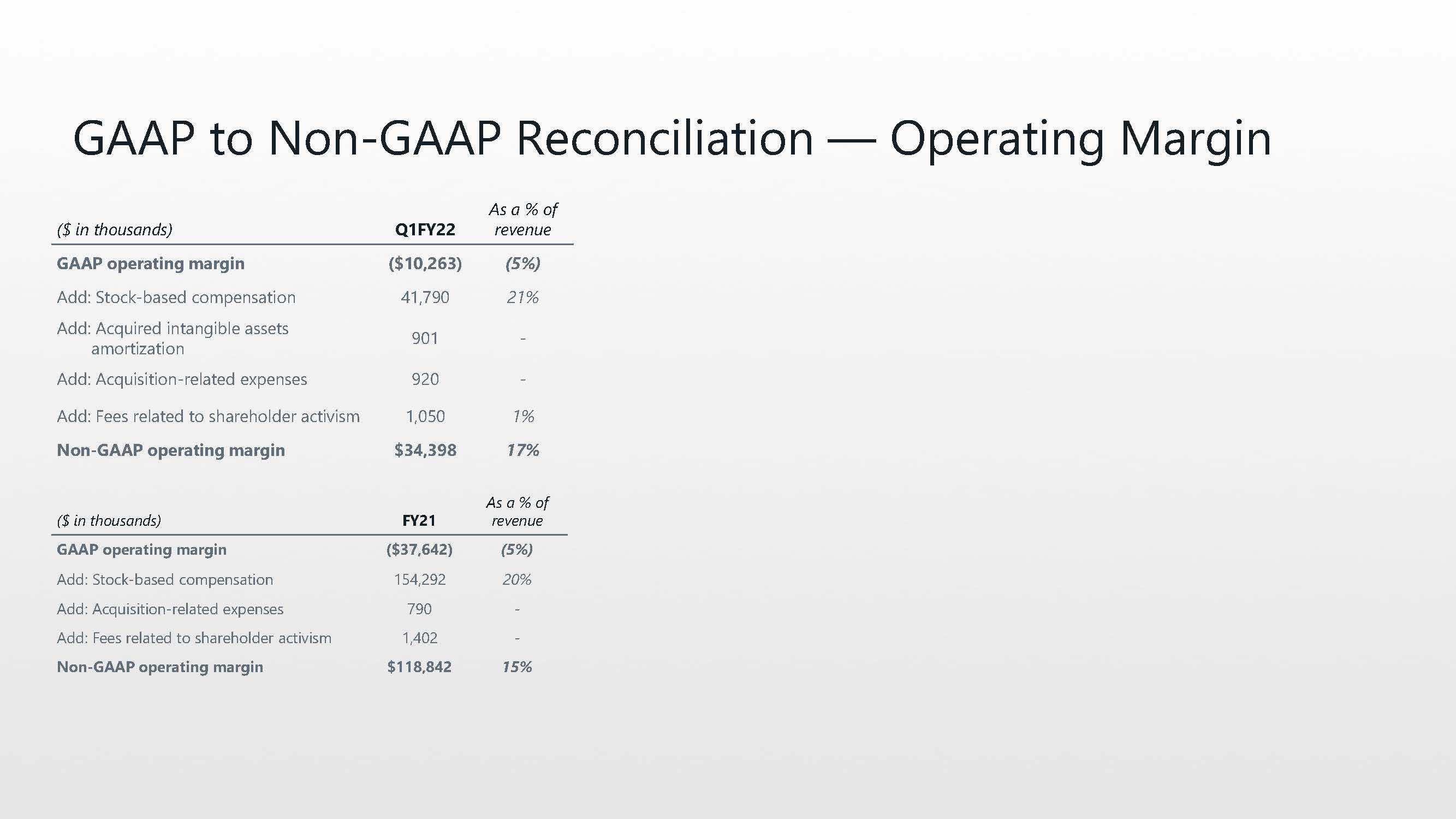

| • | GAAP Operating Margin of Negative 5%, An Improvement of 8 Percentage Points Year-Over-Year |

| • | Non-GAAP Operating Margin of 17%, Up 8 Percentage Points Year-Over-Year |

| • | Cash Flow from Operations of $94.8 Million, Up $32.9 Million Year-Over-Year |

| • | Free Cash Flow of $75.9 Million, Up $36.0 Million Year-Over-Year |

| • | Raises FY22 revenue guidance to $845 to $853 Million |

| • | Initiates FY22 non-GAAP operating margin guidance of 18% to $18.5% |

REDWOOD CITY, Calif. – May 27, 2021 – Box, Inc. (NYSE:BOX), the leading Content Cloud, today announced financial results for the first quarter of fiscal year 2022, which ended April 30, 2021.

"Our vision for the Content Cloud is resonating with our customers. They recognize the strategic importance of securing, automating, integrating, and collaborating on content, and are investing in the full power of Box," said Aaron Levie, co-founder and CEO of Box. "The strategy we've been executing on is yielding positive results as reflected in our strong start to FY22 and we’re poised to build on our leadership and drive our next phase of growth.”

"Q1 was an excellent start to the year, highlighted by strong billings, RPO, and revenue growth, in addition to increased profitability," said Dylan Smith, Box’s co-founder and CFO. “As we build on this momentum and continue to focus on driving profitable growth, we're well positioned to accelerate revenue growth over time and achieve our long-term financial targets.”

Fiscal First Quarter Financial Highlights

| • | Revenue for the first quarter of fiscal year 2022 was $202.4 million, an increase of 10% from the first quarter of fiscal year 2021. |

| • | Remaining performance obligations as of April 30, 2021 were $864.8 million, an increase of 20% from the first quarter of fiscal year 2021. |

| • | Deferred revenue as of April 30, 2021 was $423.2 million, an increase of 15% from the first quarter of fiscal year 2021. |

| • | Billings for the first quarter of fiscal year 2022 were $159.4 million, an increase of 24% from the first quarter of fiscal year 2021. |

| • | GAAP gross profit for the first quarter of fiscal year 2022 was $141.5 million, or 70% of revenue. This compares to a GAAP gross profit of $129.6 million, or 71% of revenue, in the first quarter of fiscal year 2021. |

| • | Non-GAAP gross profit for the first quarter of fiscal year 2022 was $147.9 million, or 73% of revenue. This compares to a non-GAAP gross profit of $134.1 million, or 73% of revenue, in the first quarter of fiscal year 2021. |

| • | GAAP operating loss in the first quarter of fiscal year 2022 was $10.3 million, or 5% of revenue. This compares to a GAAP operating loss of $24.2 million, or 13% of revenue, in the first quarter of fiscal year 2021. |

| • | Non-GAAP operating income in the first quarter of fiscal year 2022 was $34.4 million, or 17% of revenue. This compares to a non-GAAP operating income of $17.2 million, or 9% of revenue, in the first quarter of fiscal year 2021. |

| • | GAAP net loss per share, basic and diluted, in the first quarter of fiscal year 2022 was $0.09 on 161.7 million weighted-average shares outstanding. This compares to a GAAP net loss per share of $0.17 in the first quarter of fiscal year 2021 on 151.9 million weighted-average shares outstanding. |

| • | Non-GAAP net income per share, diluted, in the first quarter of fiscal year 2022 was $0.18. This compares to a non-GAAP net income per share of $0.10 in the first quarter of fiscal year 2021. |

| • | Net cash provided by operating activities in the first quarter of fiscal year 2022 was $94.8 million, an increase of 53% from net cash provided by operating activities of $61.9 million in the first quarter of fiscal year 2021. |

| • | Free cash flow in the first quarter of fiscal year 2022 was positive $75.9 million. This compares to free cash flow of positive $39.9 million in the first quarter of fiscal year 2021. |

For more information on the non-GAAP financial measures and key metrics discussed in this press release, please see the section titled, “About Non-GAAP Financial Measures and Other Key Metrics,” and the reconciliations of non-GAAP financial measures and certain key metrics to their nearest comparable GAAP financial measures at the end of this press release.

Business Highlights since Last Earnings Release

| • | Delivered wins and expansions with leading organizations such as D.A. Davidson Companies, DoorDash, IQVIA, Isuzu Motors Limited, Penguin Random House, and Tokyo Institute of Technology. |

| • | Continued integration of the SignRequest team and development of Box Sign, Box's native e-signature capability, which is expected to launch this summer. |

| • | Enhanced Box for Microsoft 365 to make it easier for joint customers to securely work in the cloud, from any location. Building on Box’s seamless experience within Microsoft environments, these updates included new security integrations, enhanced functionality in Teams and Office Online, and a new Box connector for Microsoft Graph. |

| • | Announced new and deepened integrations with Cisco Webex to enable customers to work securely and effectively in the cloud. The new integration will make it even easier for users to create workflows that span the two platforms. |

| • | Introduced a new integration with Dolby, a leader in immersive entertainment experiences, that makes production-quality audio as simple as uploading a file to Box. |

| • | Announced more advanced security features in Box to prevent accidental data leaks and protect content in the cloud. These included enhanced auto-classification functionality within Box Shield, in addition to a set of identity and permission management updates to the core product. |

| • | Announced new Annotations and document scanning enhancements in Box, to help power productivity and keep work moving forward in the Content Cloud. |

| • | Announced the addition of Sebastien Marotte as the new President for Box EMEA. Sebastien will join Box after more than 10 years at Google Cloud. |

| • | Recognized as one of Fortune's Best Workplaces in Technology for 2021. |

| • | Announced a strategic partnership with KKR, including a $500 million KKR-led investment and appointment of John Park, KKR’s Head of Americas Technology Private Equity, to the Board of Directors. |

Outlook

The following outlook reflects the impact of Box’s preferred stock issuance and anticipated common stock repurchase. On a quarterly basis, until conversion of the preferred stock into common stock, Box anticipates a roughly 2.5¢ non-cash accounting impact to EPS related to the preferred stock dividend, which Box expects to settle in shares of common stock. This preferred stock dividend will appear below the net income line in Box’s Statements of Operations and in the Earnings Per Share Note accompanying Box’s financial statements. Note that this preferred stock dividend will have no impact on Box’s reported net income. Additionally, for Q2 and full year FY22, Box anticipates a 2¢ impact from a temporarily elevated share count during the period between the issuance of the preferred stock on May 12, 2021, and Box’s anticipated common stock repurchase. Combined, these items will result in a 4¢ impact to EPS in Q2, and a 9¢ impact to EPS for the full year.

| • | Q2 FY22 Guidance: Revenue is expected to be in the range of $211 million to $212 million. GAAP operating margin is expected to be in the range of negative 5% to negative 4.5%, and non-GAAP operating margin is expected to be in the range of 18% to 18.5%. GAAP basic and diluted net loss per share are expected to be in the range of $0.13 to $0.12. Non-GAAP diluted net income per share is expected to be in the range of $0.17 to $0.18. Weighted-average basic and diluted shares outstanding are expected to be approximately 160 million and 167 million, respectively. |

| • | Full Year FY22 Guidance: Revenue is expected to be in the range of $845 million to $853 million. GAAP operating margin is expected to be negative 4%, and non-GAAP operating margin is expected to be in the range of 18% to 18.5%. GAAP basic and diluted net loss per share are expected to be in the range of $0.50 to $0.45. Non-GAAP diluted net |

| | income per share is expected to be in the range of $0.71 to $0.76. Weighted-average basic and diluted shares outstanding are expected to be approximately 154 million and 161 million, respectively. |

All forward-looking non-GAAP financial measures contained in this section titled “Outlook” exclude estimates for stock-based compensation expense, intangible assets amortization, and as applicable, other special items. Box has provided a reconciliation of GAAP to non-GAAP net income (loss) per share guidance at the end of this press release.

Webcast and Conference Call Information

Box’s management team will host a conference call today beginning at 2:00 PM (PT) / 5:00 PM (ET) to discuss Box’s financial results, business highlights and future outlook. A live audio webcast of this call will be available through Box’s Investor Relations website at www.box.com/investors for a period of 90 days after the date of the call.

The conference call can be accessed by registering online at http://www.directeventreg.com/registration/event/3751856, at which time registrants will receive dial-in information as well as a passcode and registrant ID.A telephonic replay of the call will be available approximately two hours after the call and will run for one week. The replay can be accessed by dialing:

+ 1-800-585-8367 (U.S. and Canada), conference ID: 3751856

+ 1-416-621-4642 (international), conference ID: 3751856

Box has used, and intends to continue to use, its Investor Relations website (www.box.com/investors), as well as certain Twitter accounts (@box, @levie and @boxincir), as a means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD. Information on or that can be accessed through Box’s Investor Relations website, these Twitter accounts, or that is contained in any website to which a hyperlink is provided herein is not part of this press release, and the inclusion of Box’s Investor Relations website address, these Twitter accounts, and any hyperlinks are only inactive textual references.

This press release, the financial tables, as well as other supplemental information including the reconciliations of non-GAAP financial measures and certain key metrics to their nearest comparable GAAP financial measures, are also available on Box’s Investor Relations website. Box also provides investor information, including news and commentary about Box’s business and financial performance, Box’s filings with the Securities and Exchange Commission, notices of investor events and Box’s press and earnings releases, on Box’s Investor Relations website.

Forward-Looking Statements

This press release contains forward-looking statements that involve risks, uncertainties, and assumptions, including statements regarding Box’s expectations regarding the size of its market opportunity, its leadership position in the cloud content management market, the demand for its products, the impact of its acquisitions on future Box product offerings, the benefits to its customers from completing acquisitions, the time needed to integrate acquired businesses into Box, the impact of the COVID-19 pandemic on its business, its ability to grow and scale its business and drive operating efficiencies, its ability to achieve revenue targets and billings expectations, its ability to achieve profitability on a quarterly or ongoing basis, its free cash flow, its ability to continue to grow unrecognized revenue and remaining performance obligations, the timing of recent and planned product introductions, enhancements and integrations, the short- and long-term success, market adoption and retention, capabilities, and benefits of such product introductions and enhancements, the success of strategic partnerships, its revenue, billings, gross margin, GAAP and non-GAAP net income (loss) per share, non-GAAP operating margins for future periods, the related components of GAAP and non-GAAP net income (loss) per share, weighted-average outstanding share count expectations for Box’s fiscal second quarter and full fiscal year 2022 in the section titled “Outlook” above, the KKR-led investment and achievement of its potential benefits, any potential repurchase of its common stock, whether, when, in what amount and by what method (whether by tender offer or otherwise) any such repurchase would be consummated, and the share price of any such repurchase. There are a significant number of factors that could cause actual results to differ materially from statements made in this press release, including: (1) adverse changes in general economic or market conditions, including those caused by the COVID-19 pandemic; (2) delays or reductions in information technology spending; (3) factors related to Box’s highly competitive market, including but not limited to pricing pressures, industry consolidation, entry of new competitors and new applications and marketing initiatives by Box’s current or future competitors; (4) the development of the cloud content management market; (5) the risk that Box’s customers do not renew their subscriptions, expand their use of Box’s services, or adopt new products offered by Box on a timely basis, or at all; (6) Box’s ability to provide timely and successful enhancements, integrations, new features and modifications to its platform and services; (7) actual or perceived security vulnerabilities in Box’s services or any breaches of Box’s security controls; (8) Box’s ability to realize the expected benefits of its third-party partnerships; (9) the potential impact of shareholder activism on Box’s business and operations; and (10) Box’s ability to successfully integrate acquired businesses and achieve the expected benefits from those acquisitions. In addition, the preliminary financial results set forth in this release are estimates based on information currently available to Box. While Box believes these estimates are meaningful, they could differ from the actual amounts that Box ultimately reports in its Quarterly Report on Form 10-Q for the fiscal quarter ended April 30, 2021. Box assumes no obligations and does not intend to update these estimates prior to filing its Form 10-Q for the fiscal quarter ended April 30, 2021.

Additional information on potential factors that could affect Box’s financial results is included in the reports on Forms 10-K, 10-Q and 8-K and in other filings Box makes with the Securities and Exchange Commission from time to time, including the Annual Report on Form 10-K filed for the fiscal year ended January 31, 2021. These documents are available on the SEC Filings section of Box’s Investor Relations website located at www.box.com/investors. Box does not assume any obligation to update the forward-looking statements contained in this press release to reflect events that occur or circumstances that exist after the date on which they were made.

Certain Information Regarding the Tender Offer

The description contained herein is for informational purposes only and is not a recommendation, an offer to buy or the solicitation of an offer to sell any shares of Box’s common stock. A tender offer for the outstanding shares of Box’s common stock has not commenced. If a tender offer is commenced, if ever, Box will file or cause to be filed a Tender Offer Statement on Schedule TO with the SEC. The Tender Offer Statement (including an Offer to Purchase, a related Letter of Transmittal and other tender offer documents) will contain important information that should be read carefully before any decision is made with respect to the tender offer. Those materials will be made available to Box’s stockholders at no expense to them through Box’s Investor Relations website at www.boxinvestorrelations.com. In addition, those materials (and any other documents filed with the SEC) will be available at no charge on the SEC’s website at www.sec.gov.

About Non-GAAP Financial Measures and Other Key Metrics

To supplement Box’s consolidated financial statements, which are prepared and presented in accordance with GAAP, Box provides investors with certain non-GAAP financial measures and other key metrics, including non-GAAP operating income (loss), non-GAAP operating margin, non-GAAP net income (loss), non-GAAP net income (loss) per share, billings, remaining performance obligations, and free cash flow. The presentation of these non-GAAP financial measures and key metrics is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. For more information on these non-GAAP financial measures and key metrics, please see the reconciliation of these non-GAAP financial measures and certain key metrics to their nearest comparable GAAP financial measures at the end of this press release.

Box uses these non-GAAP financial measures and key metrics for financial and operational decision-making and as a means to evaluate period-to-period comparisons. Box’s management believes that these non-GAAP financial measures and key metrics provide meaningful supplemental information regarding Box’s performance by excluding certain expenses that may not be indicative of Box’s recurring core business operating results. Box believes that both management and investors benefit from referring to these non-GAAP financial measures and key metrics in assessing Box’s performance and when planning, forecasting, and analyzing future periods. These non-GAAP financial measures and key metrics also facilitate management's internal comparisons to Box’s historical performance as well as comparisons to Box’s competitors' operating results. Box believes these non-GAAP financial measures and key metrics are useful to investors both because (1) they allow for greater transparency with respect to key metrics used by management in its financial and operational decision-making and (2) they are used by Box’s institutional investors and the analyst community to help them analyze the health of Box’s business.

A limitation of non-GAAP financial measures and key metrics is that they do not have uniform definitions. Further, Box’s definitions will likely differ from the definitions used by other companies, including peer companies, and therefore comparability may be limited. Thus, Box’s non-GAAP financial measures and key metrics should be considered in addition to, and not as a substitute for, or in isolation from, measures prepared in accordance with GAAP. Additionally, in the case of stock-based compensation expense, if Box did not pay a portion of compensation in the form of stock-based compensation expense, the cash salary expense included in cost of revenue and operating expenses would be higher, which would affect Box’s cash position.

Non-GAAP operating income (loss) and non-GAAP operating margin. Box defines non-GAAP operating income (loss) as operating income (loss) excluding expenses related to stock-based compensation (“SBC”), intangible assets amortization, and as applicable, other special items. Non-GAAP operating margin is defined as non-GAAP operating income (loss) divided by revenue. Although SBC is an important aspect of the compensation of Box’s employees and executives, determining the fair value of certain of the stock-based instruments Box utilizes involves a high degree of judgment and estimation and the expense recorded may bear little resemblance to the actual value realized upon the vesting or future exercise of the related stock-based awards. Furthermore, unlike cash compensation, the value of stock options, which is an element of Box’s ongoing stock-based compensation expense, is determined using a complex formula that incorporates factors, such as market volatility, that are beyond Box’s control. For restricted stock unit awards, the amount of stock-based compensation expenses is not reflective of the value ultimately received by the grant recipients. Management believes it is useful to exclude SBC in order to better understand the long-term performance of Box’s core business and to facilitate comparison of Box’s results to those of peer companies. Management also views amortization of acquisition-related intangible assets, such as the amortization of the cost associated with an acquired company’s developed technology and trade names, as items arising from pre-acquisition activities determined at the time of an acquisition. While these intangible assets are continually evaluated for impairment,

amortization of the cost of purchased intangibles is a static expense that is not typically affected by operations during any particular period. Furthermore, Box excludes the following expenses as they are considered by management to be special items outside of Box’s core operating results: (1) fees related to shareholder activism, which include directly applicable third-party advisory and professional service fees, (2) expenses related to certain litigation, (3) expenses associated with restructuring activities, consisting primarily of severance and other personnel-related costs, and (4) expenses related to announced acquisitions, including transaction and discrete tax costs. There are no expenses related to litigation excluded from non-GAAP operating income (loss) in any of the periods presented.

Non-GAAP net income (loss) and non-GAAP net income (loss) per share. Box defines non-GAAP net income (loss) as GAAP net income (loss) excluding expenses related to SBC, intangible assets amortization, and as applicable, other special items as described in the preceding paragraph. In January 2021, Box issued $345 million aggregate principal amount of 0.00% convertible senior notes due in 2026 (the “Notes”). Upon issuance, Box recorded a debt discount for the conversion feature of the Notes, separately accounted for as equity, which was amortized as interest expense together with the issuance costs of the Notes. Box excluded the amortization of the debt discount and issuance costs associated with the Notes, in addition to the expenses described above, as they are considered by management to be special items outside of Box’s core operating results. Box adopted Accounting Standards Update (“ASU”) 2020-06, Debt – Debt with Conversion and Other Options (Subtopic 470-20) and Derivative and Hedging – Contracts in Entity’s Own Equity (Subtopic 815-40), effective February 1, 2021, and upon adoption, eliminated the debt discount for the conversion feature of the Notes. Box defines non-GAAP net income (loss) per share as non-GAAP net income (loss) divided by the weighted-average outstanding shares.

Billings. Billings reflect, in any particular period, (1) sales to new customers, plus (2) subscription renewals and (3) expansion within existing customers, and represent amounts invoiced for all products and professional services. Box calculates billings for a period by adding changes in deferred revenue and contract assets in that period to revenue. Box believes that billings help investors better understand sales activity for a particular period, which is not necessarily reflected in revenue as a result of the fact that Box recognizes subscription revenue ratably over the subscription term. Box considers billings a significant performance measure. Box monitors billings to manage the business, make planning decisions, evaluate performance and allocate resources. Box believes that billings offers valuable supplemental information regarding the performance of the business and helps investors better understand the sales volumes and performance of the business. Although Box considers billings to be a significant performance measure, Box does not consider it to be a non-GAAP financial measure because it is calculated using exclusively revenue, deferred revenue, and contract assets, all of which are financial measures calculated in accordance with GAAP.

Remaining performance obligations. Remaining performance obligations (“RPO”) represent, at a point in time, contracted revenue that has not yet been recognized. RPO consists of deferred revenue and backlog, offset by contract assets. Backlog is defined as non-cancellable contracts deemed certain to be invoiced and recognized as revenue in future periods. Future invoicing is determined to be certain when we have an executed non-cancellable contract and invoicing is not dependent on a future event such as the delivery of a specific new product or feature, or the achievement of contractual contingencies. While Box believes RPO is a leading indicator of revenue as it represents sales activity not yet recognized in revenue, it is not necessarily indicative of future revenue growth as it is influenced by several factors, including seasonality, contract renewal timing, average contract terms and foreign currency exchange rates. Box monitors RPO to manage the business and evaluate performance. Box considers RPO to be a significant performance measure. Box does not consider RPO to be a non-GAAP financial measure because it is calculated in accordance with GAAP, specifically under ASC Topic 606.

Free cash flow. Box defines free cash flow as cash flows from operating activities less purchases of property and equipment, principal payments of finance lease liabilities, capitalized internal-use software costs, and other items that did not or are not expected to require cash settlement and that management considers to be outside of Box’s core business. Box specifically identifies adjusting items in the reconciliation of GAAP to non-GAAP financial measures. Box considers free cash flow to be a profitability and liquidity measure that provides useful information to management and investors about the amount of cash generated by the business that can possibly be used for investing in Box's business and strengthening its balance sheet, but it is not intended to represent the residual cash flow available for discretionary expenditures. The presentation of non-GAAP free cash flow is also not meant to be considered in isolation or as an alternative to cash flows from operating activities as a measure of liquidity. The accompanying tables have more details on the reconciliations of non-GAAP financial measures and certain key metrics to their nearest comparable GAAP financial measures.

About Box

Box (NYSE:BOX) is the leading Content Cloud that enables organizations to accelerate business processes, power workplace collaboration, and protect their most valuable information, all while working with a best-of-breed enterprise IT stack. Founded in 2005, Box simplifies work for leading organizations globally, including AstraZeneca, JLL, and Morgan Stanley. Box is headquartered in Redwood City, CA, with offices in the United States, Europe, and Asia. To learn more about Box, visit http://www.box.com. To learn more about how Box powers nonprofits to fulfill their missions, visit Box.org.

Contacts |

|

Investors: |

Elaine Gaudioso |

+1 650-209-3463 |

ir@box.com |

|

Media: |

Denis Roy and Rachel Levine |

+1 650-543-6926 |

press@box.com |

BOX, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In Thousands)

(Unaudited)

| | April 30, | | | January 31, | |

| | 2021 | | | 2021 | |

ASSETS | | | | | | | | |

Current assets: | | | | | | | | |

Cash and cash equivalents | | $ | 561,459 | | | $ | 595,082 | |

Short-term investments | | | 50,000 | | | | — | |

Accounts receivable, net | | | 112,253 | | | | 228,309 | |

Prepaid expenses and other current assets | | | 26,371 | | | | 16,785 | |

Deferred commissions | | | 39,514 | | | | 39,110 | |

Total current assets | | | 789,597 | | | | 879,286 | |

Property and equipment, net | | | 146,100 | | | | 160,148 | |

Operating lease right-of-use assets, net | | | 183,401 | | | | 194,253 | |

Goodwill | | | 75,597 | | | | 18,740 | |

Deferred commissions, non-current | | | 63,487 | | | | 66,481 | |

Other long-term assets | | | 51,949 | | | | 32,774 | |

Total assets | | $ | 1,310,131 | | | $ | 1,351,682 | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | |

Current liabilities: | | | | | | | | |

Accounts payable, accrued expenses and other current liabilities | | $ | 34,904 | | | $ | 32,128 | |

Accrued compensation and benefits | | | 20,761 | | | | 39,123 | |

Finance lease liabilities | | | 47,110 | | | | 49,888 | |

Operating lease liabilities | | | 43,881 | | | | 47,771 | |

Deferred revenue | | | 406,049 | | | | 443,929 | |

Total current liabilities | | | 552,705 | | | | 612,839 | |

Debt, net, non-current | | | 366,061 | | | | 297,614 | |

Finance lease liabilities, non-current | | | 49,877 | | | | 60,351 | |

Operating lease liabilities, non-current | | | 182,348 | | | | 192,531 | |

Other long-term liabilities | | | 34,327 | | | | 37,282 | |

Total liabilities | | | 1,185,318 | | | | 1,200,617 | |

Stockholders’ equity: | | | | | | | | |

Common stock (1) | | | 16 | | | | 16 | |

Additional paid-in capital | | | 1,462,038 | | | | 1,474,843 | |

Treasury stock | | | (1,177 | ) | | | (1,177 | ) |

Accumulated other comprehensive loss | | | (371 | ) | | | (938 | ) |

Accumulated deficit | | | (1,335,693 | ) | | | (1,321,679 | ) |

Total stockholders’ equity | | | 124,813 | | | | 151,065 | |

Total liabilities and stockholders’ equity | | $ | 1,310,131 | | | $ | 1,351,682 | |

(1) | As of April 30, 2021, there were 162,762 shares of Box’s Class A common stock outstanding. |

BOX, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In Thousands, Except Per Share Data)

(Unaudited)

| | Three Months Ended | |

| | April 30, | |

| | 2021 | | | 2020 | |

Revenue | | $ | 202,441 | | | $ | 183,561 | |

Cost of revenue (1) | | | 60,947 | | | | 53,995 | |

Gross profit | | | 141,494 | | | | 129,566 | |

Operating expenses: | | | | | | | | |

Research and development (1) | | | 50,859 | | | | 53,114 | |

Sales and marketing (1) | | | 69,811 | | | | 72,750 | |

General and administrative (1) | | | 31,087 | | | | 27,942 | |

Total operating expenses | | | 151,757 | | | | 153,806 | |

Loss from operations | | | (10,263 | ) | | | (24,240 | ) |

Interest and other expense, net | | | (3,999 | ) | | | (1,103 | ) |

Loss before provision for income taxes | | | (14,262 | ) | | | (25,343 | ) |

Provision for income taxes | | | 311 | | | | 207 | |

Net loss | | $ | (14,573 | ) | | $ | (25,550 | ) |

Net loss per share, basic and diluted | | $ | (0.09 | ) | | $ | (0.17 | ) |

Weighted-average shares used to compute net loss per share, basic and diluted | | | 161,733 | | | | 151,943 | |

| | | | | | | | |

(1) Includes stock-based compensation expense as follows: | | | | | | | | |

| | | | | | | | |

| | Three Months Ended | |

| | April 30, | |

| | 2021 | | | 2020 | |

Cost of revenue | | $ | 5,340 | | | $ | 4,541 | |

Research and development | | | 15,453 | | | | 17,287 | |

Sales and marketing | | | 11,551 | | | | 10,079 | |

General and administrative | | | 9,446 | | | | 8,136 | |

Total stock-based compensation | | $ | 41,790 | | | $ | 40,043 | |

BOX, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In Thousands)

(Unaudited)

| | Three Months Ended | |

| | April 30, | |

| | 2021 | | | 2020 | |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | | |

Net loss | | $ | (14,573 | ) | | $ | (25,550 | ) |

Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | | | | |

Depreciation and amortization | | | 19,380 | | | | 17,946 | |

Stock-based compensation expense | | | 41,790 | | | | 40,043 | |

Amortization of deferred commissions | | | 10,517 | | | | 8,159 | |

Other | | | 443 | | | | 74 | |

Changes in operating assets and liabilities: | | | | | | | | |

Accounts receivable, net | | | 116,835 | | | | 110,367 | |

Deferred commissions | | | (7,927 | ) | | | (7,695 | ) |

Operating lease right-of-use assets, net | | | 10,852 | | | | 9,713 | |

Prepaid expenses and other assets | | | (8,816 | ) | | | (4,925 | ) |

Accounts payable, accrued expenses and other liabilities | | | (11,906 | ) | | | (19,713 | ) |

Operating lease liabilities | | | (13,927 | ) | | | (11,002 | ) |

Deferred revenue | | | (47,896 | ) | | | (55,500 | ) |

Net cash provided by operating activities | | | 94,772 | | | | 61,917 | |

CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | |

Purchase of short-term investment | | | (50,000 | ) | | | — | |

Purchases of property and equipment, net of proceeds from sales | | | (1,145 | ) | | | (1,407 | ) |

Capitalized internal-use software costs | | | (1,178 | ) | | | (3,291 | ) |

Acquisitions, net of cash acquired | | | (56,642 | ) | | | — | |

Proceeds from the sale of a strategic equity investment | | | — | | | | 107 | |

Net cash used in investing activities | | | (108,965 | ) | | | (4,591 | ) |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | |

Convertible debt issuance costs | | | (471 | ) | | | — | |

Proceeds from borrowings, net of borrowing costs | | | — | | | | 30,000 | |

Proceeds from exercise of stock options | | | 1,356 | | | | 965 | |

Proceeds from issuances of common stock under employee stock purchase plan | | | 12,510 | | | | 11,906 | |

Employee payroll taxes paid related to net share settlement of restricted stock units | | | (15,684 | ) | | | (10,212 | ) |

Principal payments of finance lease liabilities | | | (13,262 | ) | | | (17,356 | ) |

Capitalized internal-use software costs | | | (3,297 | ) | | | — | |

Net cash (used in) provided by financing activities | | | (18,848 | ) | | | 15,303 | |

Effect of exchange rate changes on cash, cash equivalents, and restricted cash | | | (211 | ) | | | 200 | |

Net (decrease) increase in cash, cash equivalents, and restricted cash | | | (33,252 | ) | | | 72,829 | |

Cash, cash equivalents, and restricted cash, beginning of period | | | 595,511 | | | | 195,586 | |

Cash, cash equivalents, and restricted cash, end of period | | $ | 562,259 | | | $ | 268,415 | |

BOX, INC.

RECONCILIATION OF GAAP TO NON-GAAP DATA

(In Thousands, Except Per Share Data and Percentages)

(Unaudited)

| | Three Months Ended | | |

| | April 30, | | |

| | 2021 | | | | 2020 | | |

GAAP gross profit | | $ | 141,494 | | | | $ | 129,566 | | |

Stock-based compensation | | | 5,340 | | | | | 4,541 | | |

Acquired intangible assets amortization | | | 901 | | | | | — | | |

Acquisition-related expenses | | | 135 | | | | | — | | |

Non-GAAP gross profit | | $ | 147,870 | | | | $ | 134,107 | | |

| | | | | | | | | | |

GAAP gross margin | | | 70 | | % | | | 71 | | % |

Stock-based compensation | | | 3 | | | | | 2 | | |

Acquired intangible assets amortization | | | — | | | | | — | | |

Acquisition-related expenses | | | — | | | | | — | | |

Non-GAAP gross margin | | | 73 | | % | | | 73 | | % |

| | | | | | | | | | |

GAAP operating loss | | $ | (10,263 | ) | | | $ | (24,240 | ) | |

Stock-based compensation | | | 41,790 | | | | | 40,043 | | |

Acquired intangible assets amortization | | | 901 | | | | | — | | |

Acquisition-related expenses | | | 920 | | | | | — | | |

Fees related to shareholder activism | | | 1,050 | | | | | 1,402 | | |

Non-GAAP operating income | | $ | 34,398 | | | | $ | 17,205 | | |

| | | | | | | | | | |

GAAP operating margin | | | (5 | ) | % | | | (13 | ) | % |

Stock-based compensation | | | 21 | | | | | 22 | | |

Acquired intangible assets amortization | | | — | | | | | — | | |

Acquisition-related expenses | | | — | | | | | — | | |

Fees related to shareholder activism | | | 1 | | | | | — | | |

Non-GAAP operating margin | | | 17 | | % | | | 9 | | % |

| | | | | | | | | | |

GAAP net loss | | $ | (14,573 | ) | | | $ | (25,550 | ) | |

Stock-based compensation | | | 41,790 | | | | | 40,043 | | |

Acquired intangible assets amortization | | | 901 | | | | | — | | |

Acquisition-related expenses | | | 920 | | | | | — | | |

Fees related to shareholder activism | | | 1,050 | | | | | 1,402 | | |

Amortization of debt issuance costs | | | 469 | | | | | — | | |

Non-GAAP net income | | $ | 30,557 | | | | $ | 15,895 | | |

| | | | | | | | | | |

GAAP net loss per share, basic and diluted | | $ | (0.09 | ) | | | $ | (0.17 | ) | |

Stock-based compensation | | | 0.26 | | | | | 0.26 | | |

Acquired intangible assets amortization | | | — | | | | | — | | |

Acquisition-related expenses | | | 0.01 | | | | | — | | |

Fees related to shareholder activism | | | 0.01 | | | | | 0.01 | | |

Amortization of debt issuance costs | | | — | | | | | — | | |

Non-GAAP net income per share, basic | | $ | 0.19 | | | | $ | 0.10 | | |

Non-GAAP net income per share, diluted | | $ | 0.18 | | | | $ | 0.10 | | |

Weighted-average shares used to compute GAAP net loss per share, basic and diluted | | | 161,733 | | | | | 151,943 | | |

Weighted-average shares used to compute Non-GAAP net income per share | | | | | | | | | | |

Basic | | | 161,733 | | | | | 151,943 | | |

Diluted | | | 169,221 | | | | | 157,608 | | |

| | | | | | | | | | |

Net cash provided by operating activities | | $ | 94,772 | | | | $ | 61,917 | | |

Purchases of property and equipment, net of proceeds from sales | | | (1,145 | ) | | | | (1,407 | ) | |

Principal payments of finance lease liabilities | | | (13,262 | ) | | | | (17,356 | ) | |

Capitalized internal-use software costs | | | (4,475 | ) | | | | (3,291 | ) | |

Free cash flow | | $ | 75,890 | | | | $ | 39,863 | | |

Net cash used in investing activities | | $ | (108,965 | ) | | | $ | (4,591 | ) | |

Net cash (used in) provided by financing activities | | $ | (18,848 | ) | | | $ | 15,303 | | |

BOX, INC.

RECONCILIATION OF GAAP REVENUE TO BILLINGS

(In Thousands)

(Unaudited)

| | Three Months Ended | |

| | April 30, | |

| | 2021 | | | 2020 | |

GAAP revenue | | $ | 202,441 | | | $ | 183,561 | |

Deferred revenue, end of period | | | 423,249 | | | | 368,349 | |

Less: deferred revenue, beginning of period | | | (465,613 | ) | | | (423,849 | ) |

Contract assets, beginning of period | | | 25 | | | | — | |

Less: contract assets, end of period | | | (677 | ) | | | — | |

Billings | | $ | 159,425 | | | $ | 128,061 | |

RECONCILIATION OF GAAP NET LOSS TO NON-GAAP NET INCOME PER SHARE GUIDANCE

(In Thousands, Except Per Share Data)

(Unaudited)

| | Three Months Ended | | | Fiscal Year Ended | |

| | July 31, 2021 | | | January 31, 2022 | |

GAAP net loss per share range, basic and diluted | | $ | (0.13 | ) | - | $ | (0.12 | ) | | $ | (0.50 | ) | - | $ | (0.45 | ) |

Stock-based compensation | | | 0.28 | | | | 0.28 | | | | 1.15 | | | | 1.15 | |

Acquired intangible asset amortization | | | 0.01 | | | | 0.01 | | | | 0.03 | | | | 0.03 | |

Acquisition-related expenses | | | — | | | | — | | | | 0.01 | | | | 0.01 | |

Fees related to shareholder activism | | | 0.02 | | | | 0.02 | | | | 0.03 | | | | 0.03 | |

Litigation expenses | | | — | | | | — | | | | 0.01 | | | | 0.01 | |

Amortization of debt issuance costs | | | — | | | | — | | | | 0.01 | | | | 0.01 | |

Non-GAAP net income per share range, basic | | $ | 0.18 | | - | $ | 0.19 | | | $ | 0.74 | | - | $ | 0.79 | |

Non-GAAP net income per share range, diluted | | $ | 0.17 | | - | $ | 0.18 | | | $ | 0.71 | | - | $ | 0.76 | |

| | | | | | | | | | | | | | | | |

Weighted-average shares used to compute GAAP net loss per share, basic and diluted | | 159,739 | | | 153,768 | |

Weighted-average shares used to compute Non-GAAP net income per share: | | | | | | | | | | | | | | | | |

Basic | | 159,739 | | | 153,768 | |

Diluted | | 166,540 | | | 160,616 | |

Box, Inc. Announces Final Results of Modified Dutch Auction Tender Offer

REDWOOD CITY, Calif., July 2, 2021 — (BUSINESS WIRE) — Box, Inc. (NYSE: BOX) (“Box”), the leading Content Cloud, today announced the final results of its “modified Dutch Auction” tender offer, which expired at 12:00 midnight, New York City time, at the end of the day on June 29, 2021.

Based on the final count by Computershare Trust Company, N.A., the depositary for the tender offer, a total of 9,248,694 shares of Box’s Class A common stock, par value $0.0001 per share (each share of Box’s Class A common stock, a “Share,” and collectively, “Shares”), were properly tendered and not properly withdrawn at or below the purchase price of $25.75 per Share.

Box has accepted for purchase a total of 9,248,694 Shares through the tender offer at a price of $25.75 per Share, for an aggregate cost of approximately $238 million, excluding fees and expenses relating to the tender offer. The total of 9,248,694 Shares that Box has accepted for purchase represents approximately 5.6% of the total number of Shares outstanding as of July 1, 2021. The Box Board of Directors has authorized Box to use the unused portion of the $500 million intended for the tender offer to opportunistically repurchase additional Shares.

Morgan Stanley & Co. LLC acted as dealer manager for the tender offer. Box stockholders who have questions or would like additional information about the tender offer may contact the information agent for the tender offer, Innisfree M&A Incorporated, toll-free at 1 (877) 750-8233.

About Box, Inc.

Box (NYSE:BOX) is the leading Content Cloud that enables organizations to accelerate business processes, power workplace collaboration, and protect their most valuable information, all while working with a best-of-breed enterprise IT stack. Founded in 2005, Box simplifies work for leading organizations globally, including AstraZeneca, JLL, and Morgan Stanley. Box is headquartered in Redwood City, CA, with offices in the United States, Europe, and Asia. To learn more about Box, visit http://www.box.com. To learn more about how Box powers nonprofits to fulfill their missions, visit Box.org.

Forward-Looking Statements

This press release may include statements that may constitute “forward-looking statements,” including statements regarding the closing of the tender offer, Box’s expectations regarding its purchase of Shares in the tender offer, the amount of Shares to be purchased, the purchase price per Share, other terms and conditions of the tender offer, and Box’s future use of the unused portion of the $500 million intended for the tender offer to opportunistically repurchase shares (the timing of such repurchases being dependent upon a variety of factors including market conditions and other corporate considerations), as well as statements containing the words “believe,” “estimate,” “project,” “expect” or similar expressions. Forward-looking statements inherently involve risks and uncertainties that could cause actual results of Box and its subsidiaries to differ materially from the forward-looking statements. Factors that could contribute to such differences include (1) developments or changes in economic or market conditions, (2) developments or changes in the securities markets, (3) developments or changes in our business, financial condition or cash flows, and (4) the factors identified under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended January 31, 2021, as amended, our Quarterly Report on Form 10-Q for the fiscal quarter ended April 30, 2021, and in other reports filed by Box with the SEC. Box undertakes no obligation to update these forward-looking statements for revisions or changes after the date of this release.

Contacts

Investors:

Cynthia Hiponia and Elaine Gaudioso

+1 650-209-3467

ir@box.com

Media:

Denis Roy and Rachel Levine

+1 650-543-6926

press@box.com