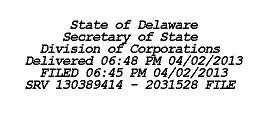

Exhibit 3.1

CERTIFICATE OF DESIGNATION

OF SERIES B PREFERRED STOCK OF

KALEX CORP.

to be filed with the Secretary of State

of the State of Delaware

on or about April 2, 2013

Kalex Corp. (the “Corporation”), a corporation organized and existing under the laws of Delaware, does hereby certify that, pursuant to authority conferred upon the Board of Directors of the Corporation by the Certificate of Incorporation, as amended, of the Corporation, and the Board of Directors of the Corporation, has adopted resolutions (a) authorizing the issuance of 100 shares of preferred “B” stock, $0.00001 par value per share (individually or collectively the “Preferred B Stock”), of the Corporation and (b) providing for the designations, preferences and relative participating, optional or other rights, and the qualifications, limitations or restrictions thereof, as follows:

1. Dividends and Distributions

1.1. Dividend Rate and Rights. Holders of the Preferred B Stock shall not be entitled to receive dividends.

2. Conversion into Common Stock.

2.1. Right to Convert. Holders of the Preferred B Stock shall not be entitled to convert any of their outstanding Preferred B Stock into the common stock (“Common Stock”) of the Corporation.

3. Liquidation Preference.

Distribution of Assets in Liquidation. In the event of any liquidation, dissolution, or winding up of the Corporation, whether voluntary or involuntary (a "Liquidation"), the holders of Preferred B Stock shall not be entitled to distribution of the assets of the Corporation by virtue of their Preferred B Stock holdings.

4. Voting Rights.

4.1. Voting Rights. The record holders of the Preferred B Stock shall have the right to vote on any matter with holders of Common Stock voting together as one (1) class. The record holder(s) of the 100 shares of Preferred B Stock shall have that number of votes (identical in every other respect to the voting rights of the holders of Common Stock entitled to vote at any regular or special meeting of the shareholders) equal to that number of Common Stock which is not less than 51% of the vote required to approve any action, which Delaware law provides may or must be approved by vote or consent of the holders of Common Stock or the holders of other securities entitled to vote, if any.

The record holders of the Preferred B Stock shall be entitled to the same notice of any regular or special meeting of the shareholders as may or shall be given to holders of Common Stock entitled to vote at such meetings. No corporate actions requiring majority shareholder approval or consent may be submitted to a vote of Common Stock which in any way precludes the Preferred B Stock from exercising its voting or consent rights as though it is or was a Common Stock holder.

For purposes of determining a quorum for any regular or special meeting of the shareholders, the 100 shares of Preferred B Stock shall be included and shall be deemed as the equivalent of 51% of all shares of Common Stock represented at and entitled to vote at such meetings.

5. Reissuance.

No share or shares of Preferred B Stock acquired by the Corporation by reason of cancellation or otherwise shall be reissued as Preferred B Stock, and all such shares thereafter shall be returned to the status of undesignated and unissued shares of Preferred Stock of the Corporation.

6. Notices.

6.1. Form of Notice. Unless otherwise specified in the Corporation’s Certificate of Incorporation or Bylaws, all notices or communications given hereunder shall be in writing and, if to the Corporation, shall be delivered to it as its principal executive offices, and if to any holder of Preferred B Stock, shall be delivered to it at its address as it appears on the stock books of the Corporation.

RESOLVED, that the date of the adoption of the amendment by all of the Directors of the Corporation is April 2, 2013. Pursuant to Article Fourth of the Certificate of Incorporation, no shareholder approval is required.

DATE: April 2, 2013

| | | |

| | | | |

| | By: | /s/ Arnold F. Sock, | |

| | | Arnold F. Sock, President | |

| | | | |

| | | | |