Wachtell, Lipton, Rosen & Katz

VIA EDGAR AND FACSIMILE

Securities and Exchange Commission

100 F Street, N.E., Mail Stop 3561

Washington, DC 20549

| | |

| Attention: | | Dorine H. Miller, Financial Analyst |

| | Terrance O’Brien, Accounting Branch Chief |

| | Tracey Houser, Accountant |

| | |

| Re: | | Berry Plastics Corporation |

| | Registration Statement on Form S-4 |

| | Filed on April 22, 2008 |

| | File No. 333-150372 |

Dear Ms. Miller, Mr. O’Brien and Ms. Houser:

As counsel to Berry Plastics Corporation (the “Company”), I am responding to the comments of the staff of the Securities and Exchange Commission (the “Commission”) set forth in your letter dated May 2, 2008, addressed to Ira G. Boots with respect to the above-referenced registration statement (the “Registration Statement”). To facilitate the staff’s review, this letter includes each of the staff’s comments in italics followed by a response to the questions raised.

Securities and Exchange Commission

May 6, 2008

Page 2

Accounting Comments

Berry Plastics Holding Corporation Consolidated or Combined Financial Statements for the Fiscal Year Ended September 29, 2007

Basis of Presentation, page F-11

| 1. | We note that you have presented audited operating results and cash flows for Old Berry Holding for September 20, 2006 through September 30, 2006 and October 1, 2006 through September 29, 2007. Please provide us with your calculations of Old Berry Holding’s significance tests in accordance with Rule 1-02(w) of Regulation S-X. Depending on the results of these tests, please address the need, if any, for providing historical financial statements for Old Berry Holdings in accordance with Rule 3-05 of Regulation S-X. |

In connection with the merger of Old Berry Holding and Old Covalence Holding the Company determined that Old Berry Holding was significant based on the thresholds and tests prescribed by Rule 1-02(w) and Rule 3-05 of Regulation S-X. The results of these tests indicated that Old Berry Holding was in excess of the 50% threshold for the asset, investment and income tests. The Company has revised the Registration Statement to include the audited historical financial statements of Old Berry Holdings as of December 30, 2006 (Company) and December 31, 2005 (Predecessor), and the related consolidated statements of operations, stockholders’ equity, and cash flows for the periods from September 20, 2006 to December 30, 2006 (Company), January 1, 2006 to September 19, 2006 (Predecessor) and for each of the two years in the period ended December 31, 2005.

14. Subsequent Events

| 2. | We note that you acquired Captive Holdings, Inc. for approximately $500 million on February 5, 2008. Please provide us with your calculations of the significance tests for your acquisition of Captive Holdings, Inc. Depending on the results of the significance tests, please address the need, if any, to present historical pro forma financial statements for this acquisition. Refer to Rules 1-02(w) and 3-05 of Regulation S-X for guidance. |

In connection with the acquisition of Captive Holdings, Inc. the Company determined that Captive Holdings was not significant based on the thresholds and tests prescribed by Rule 1-02(w) and Rule 3-05 of Regulation S-X. The results of these tests indicated that neither the asset, investment or income tests were in excess of the 20% threshold. We have attached the results of this test in Annex A. Accordingly, we do not believe that historical or pro forma financial statements are required.

Securities and Exchange Commission

May 6, 2008

Page 3

Signatures, Page II-8

| 3. | The registration statement should also be signed by the registrant’s principal accounting officer or controller whose title should be shown on the signature page. |

We have revised the signature page of the Registration Statement to clearly indicate that Mr. James M. Kratochvil is the Company’s principal accounting officer. Mr. Kratochvil signed the Registration Statement through a power of attorney granted to Mr. Ira G. Boots, the Company’s President, Director and Chief Executive Officer, which power of attorney was filed with the Registration Statement.

The undersigned, on behalf of the Company, acknowledges that:

| | • | | the Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| | • | | staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| | • | | the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

* * * * *

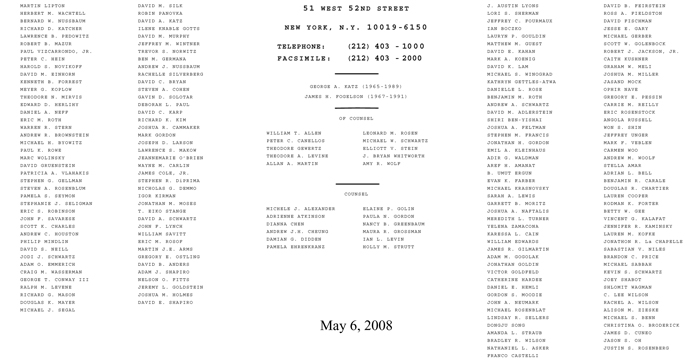

Should you have any questions or comments regarding this letter, please do not hesitate to contact me at (212) 403-1269 or my colleague Jonathan Gordon at (212) 403-1100.

|

| Very truly yours, |

|

/s/ Andrew J. Nussbaum |

| Andrew J. Nussbaum |

| cc: | Jeffrey D. Thompson, General Counsel, Berry Plastics Corporation |

Annex A

| | | | | | | | | | | |

Asset Test: | | Assets of Captive (2006 Audited) | | = | | 297,238,000 | | = | | 7.7 | % |

| | Assets of Berry Plastics Corporation | | | 3,869,400,000 | | |

| | | | | |

| | Assets of Captive (2007 Unaudited) | | = | | 299,617,000 | | = | | 7.7 | % |

| | Assets of Berry Plastics Corporation | | | 3,869,400,000 | | |

| | | | | |

Investment Test: | | Investment in Captive | | = | | 500,000,000 | | = | | 12.9 | % |

| | Assets of Berry Plastics Corporation | | | 3,869,400,000 | | |

| | | | | |

Income Test: | | Income/Loss of Captive (2006 Audited) | | = | | 6,691,000 | | = | | 3.2 | % |

| | Income/Loss of Berry Plastics Corporation | | | 207,500,000 | | |

| | | | | |

| | Income/Loss of Captive (2007 Unaudited) | | = | | 12,324,000 | | = | | 5.9 | % |

| | Income/Loss of Berry Plastics Corporation | | | 207,500,000 | | |

A-1