Exhibit 99.2 2023 Q1 Earnings Presentation May 11, 2023

Important Information Cautionary Statement Regarding Forward-Looking Statements This presentation contains forward-looking statements. The matters discussed in this presentation, as well as in future oral and written statements by management of Portman Ridge Finance Corporation (“PTMN”, “Portman Ridge” or the “Company”), that are forward-looking statements are based on current management expectations that involve substantial risks and uncertainties which could cause actual results to differ materially from the results expressed in, or implied by, these forward-looking statements. Forward-looking statements relate to future events or our future financial performance and include, but are not limited to, projected financial performance, expected development of the business, plans and expectations about future investments, our contractual arrangements and relationships with third parties, the ability of our portfolio companies to achieve their objectives, the ability of the Company’s investment adviser to attract and retain highly talented professionals, our ability to maintain our qualification as a regulated investment company and as a business development company, our compliance with covenants under our borrowing arrangements, and the future liquidity of the Company. We generally identify forward-looking statements by terminology such as may, will, should, expects, plans, anticipates, could, intends, target, projects, “outlook”, contemplates, believes, estimates, predicts, potential or continue or the negative of these terms or other similar words. Forward-looking statements are based upon current plans, estimates and expectations that are subject to risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove to be incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. Forward-looking statements are subject to change at any time based upon economic, market or other conditions, including with respect to the impact of the COVID-19 pandemic and its effects on the Company and its portfolio companies’ results of operations and financial condition. More information on these risks and other potential factors that could affect the Company’s financial results, including important factors that could cause actual results to differ materially from plans, estimates or expectations included herein, is included in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including in the “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s most recently filed quarterly report on Form 10-Q and annual report on Form 10-K, as well as in subsequent filings. In light of these and other uncertainties, the inclusion of a projection or forward-looking statement in this presentation should not be regarded as a representation by us that our plans and objectives will be achieved. We do not undertake to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required to be reported under the rules and regulations of the SEC. 2

Q1’23 Highlights F Fi ir rst st Q Qu ua ar rt te er r 2 20 02 23 3 H Hi ig gh hl li ig gh ht ts s § Total investment income for the first quarter of 2023 was $20.3 million, an increase of $1.7 million as compared to $18.6 million for the fourth quarter of 2022 and an increase of $3.4 million as compared to $16.9 million for the first quarter of 2022. (1) § Core total investment income , excluding the impact of purchase price accounting, for the first quarter of 2023 was $19.3 million, an increase of $1.6 million as compared to $17.7 million for the fourth quarter of 2022 and an increase of $4.2 million as compared to $15.1 million for the first quarter of 2022. § Net investment income (“NII”) for the first quarter of 2023 was $8.5 million ($0.89 per share), an increase of $1.4 million as compared to $7.1 million ($0.74 per share) for the fourth quarter of 2022 and an increase of $0.6 million as compared to $7.9 million ($0.82 per share) for the first quarter of 2022. § Total shares repurchased in open market transactions under the Renewed Stock Repurchase Program during the quarter ended March 31, 2023 were 35,613 at an aggregate cost of approximately $0.8 million. § Total investments at fair value as of March 31, 2023 was $539.1 million; when excluding CLO funds, Joint Ventures, and short-term investments, these investments are spread across 28 different industries and 106 different entities with an average par balance per entity of approximately $3.3 million. This compares to $576.5 million of total investments at fair value (excluding derivatives) as of December 31, 2022, comprised of investments in 119 different entities (excluding CLO funds, Joint Ventures, and short-term investments). § Weighted average contractual interest rate on our interest earning Debt Securities Portfolio as of March 31, 2023 and December 31, 2022 was approximately 11.7% and 11.1%, respectively. § Non-accruals on debt investments, as of March 31, 2023, were five debt investments, which compares to four debt investments on non-accrual status as of December 31, 2022 and six debt investments on non-accrual status as of March 31, 2022. As of March 31, 2023, debt investments on non-accrual status represented 0.3% and 1.5% of the Company’s investment portfolio at fair value and amortized cost, respectively. This compares to debt investments on non-accrual status representing 0.0% and 0.6% of the Company’s investment portfolio at fair value and amortized cost, respectively, as of December 31, 2022 and 0.2% and 1.9% of the Company’s investment portfolio at fair value and amortized cost, respectively, as of March 31, 2022. § Net asset value (“NAV”) for the first quarter of 2023 was $225.1 million ($23.56 per share) as compared to $232.1 ($24.23 per share) for the fourth quarter of 2022. § Par value of outstanding borrowings, as of March 31, 2023, was $358.3 million with an asset coverage ratio of total assets to total borrowings of 162%. On a net basis, (2) (2) leverage as of March 31, 2023 was 1.39x compared to net leverage of 1.49x as of December 31, 2022. § Increased Stockholder distribution from $0.63 in the second quarter of 2022 to $0.69 in the second quarter of 2023. The latest increase to $0.69 represents three consecutive quarters of stockholder distribution increases and the fifth stockholder distribution increase over the last seven quarters. (1) Core investment income represents reported total investment income as determined in accordance with U.S. generally accepted accounting principles, or U.S. GAAP, less the impact of purchase price discount accounting in connection with the Garrison Capital Inc. (“GARS”) and Harvest Capital Credit Corporation (“HCAP”) mergers. Portman Ridge believes presenting core investment income and the related per share amount is useful and appropriate supplemental disclosure for analyzing its financial performance due to the unique circumstance giving rise to the purchase accounting adjustment. However, core investment income is a non-U.S. GAAP measure and should not be considered as a replacement for total investment income and other earnings measures presented in accordance with U.S. GAAP. Instead, core investment income should be reviewed only in connection with such U.S. GAAP measures in analyzing Portman Ridge’s 3 financial performance. (2) Net leverage is calculated as the ratio between (A) debt, excluding unamortized debt issuance costs, less available cash and cash equivalents, and restricted cash and (B) NAV. Portman Ridge believes presenting a net leverage ratio is useful and appropriate supplemental disclosure because it reflects the Company’s financial condition net of $46.1 million and $33.1 million of cash and cash equivalents and restricted cash for the quarters ended March 31, 2023 and December 31, 2022, respectively. However, the net leverage ratio is a non-U.S. GAAP measure and should not be considered as a replacement for the regulatory asset coverage ratio and other similar information presented in accordance with U.S. GAAP. Instead, the net leverage ratio should be reviewed only in connection with such U.S. GAAP measures in analyzing Portman Ridge’s financial condition.

Financial Highlights ($ in thousands) Q1 2023 Core investment income $19,285 Expenses: Management fees 1,953 Performance-based incentive fees 1,808 Interest and amortization of debt issuance costs 6,332 Professional fees 603 Administrative services expense 671 Other general and administrative expenses 431 Total expenses $11,798 (1) $7,669 Core net investment income Net realized gain (loss) on investments (3,085) Net unrealized gain (loss) on investments (5,960) Tax (provision) benefit on realized and unrealized gains (losses) on investments 571 Net increase/(decrease) in Core net assets resulting from operations ($805) Per Share Q1 2023 Core Net Investment Income $0.80 Net Realized and Unrealized Gain / (Loss) ($0.95) Net Core Earnings ($0.08) Distributions declared $0.69 Net Asset Value $23.56 (1) Core net investment income represents reported total net investment income as determined in accordance with U.S. generally accepted accounting principles, or U.S. GAAP, less the impact of purchase price discount accounting in connection with the GARS and HCAP mergers, while also considering the impact of accretion from these mergers on expenses, such as incentive fees. Portman Ridge believes presenting core net investment income and the related per share amount is useful and appropriate supplemental disclosure for 4 analyzing its financial performance due to the unique circumstance giving rise to the purchase accounting adjustment. However, core net investment income is a non-U.S. GAAP measure and should not be considered as a replacement for total net investment income and other earnings measures presented in accordance with U.S. GAAP. Instead, core net investment income should be reviewed only in connection with such U.S. GAAP measures in analyzing Portman Ridge’s financial performance. See slide 8 for a presentation of Reported net investment income in comparison to Core net investment income and a reconciliation thereof.

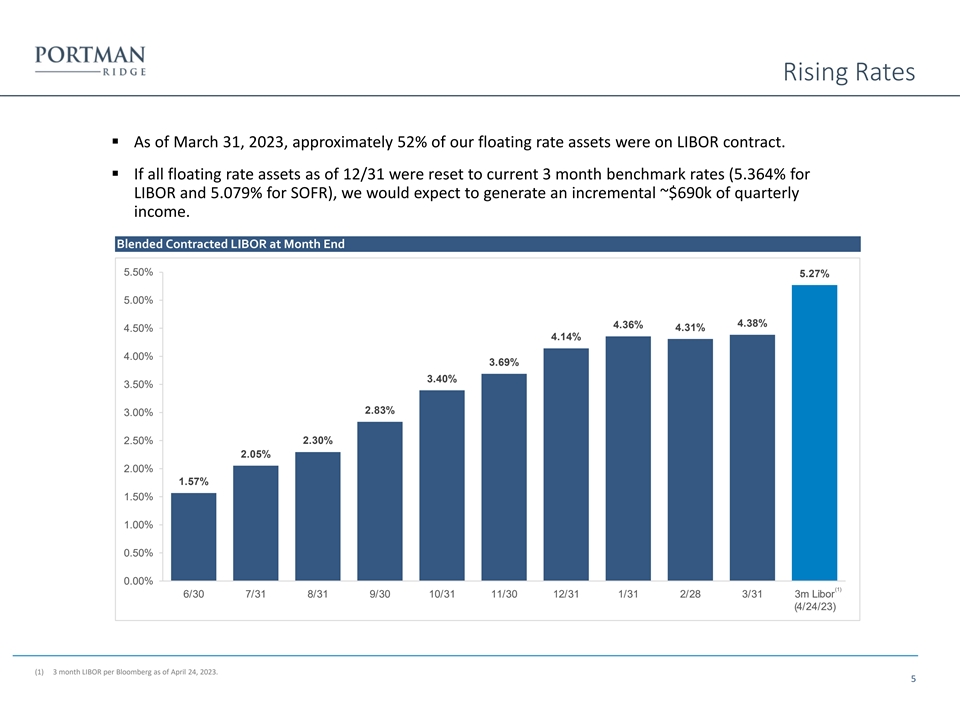

Rising Rates § As of March 31, 2023, approximately 52% of our floating rate assets were on LIBOR contract. § If all floating rate assets as of 12/31 were reset to current 3 month benchmark rates (5.364% for LIBOR and 5.079% for SOFR), we would expect to generate an incremental ~$690k of quarterly income. Blended Contracted LIBOR at Month End 5.50% 5.27% 5.00% 4.38% 4.36% 4.31% 4.50% 4.14% 4.00% 3.69% 3.40% 3.50% 2.83% 3.00% 2.50% 2.30% 2.05% 2.00% 1.57% 1.50% 1.00% 0.50% 0.00% (1) 6/30 7/31 8/31 9/30 10/31 11/30 12/31 1/31 2/28 3/31 3m Libor (4/24/23) (1) 3 month LIBOR per Bloomberg as of April 24, 2023. 5

Limited Repayment Activity § Over the last three years, Portman has experienced an average of $1.4 million in income related to repayment / prepayment activity as compared to the current quarter of $0.85 million. Paydown Income by Quarter ($ in 000s) 5,000 4,500 4,000 3,500 3,000 2,500 2,000 Quarterly Average: $1,440 1,500 850 1,000 50% of Average: $720 500 -- Mar-20 Jun-20 Sep-20 Dec-20 Mar-21 Jun-21 Sep-21 Dec-21 Mar-22 Jun-22 Sep-22 Dec-22 Mar-23 6

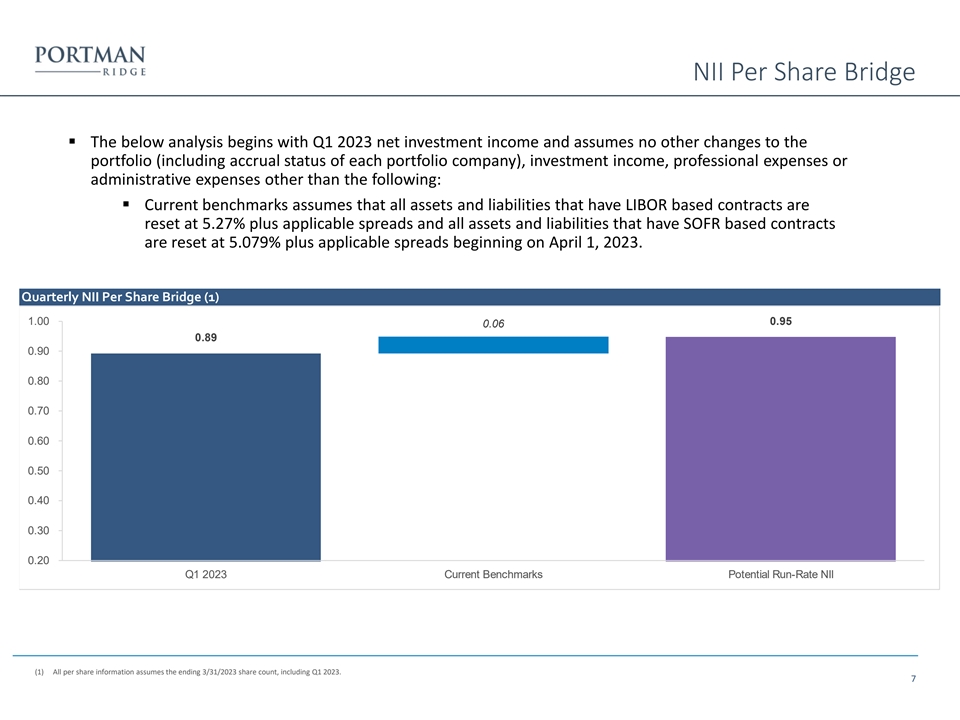

NII Per Share Bridge § The below analysis begins with Q1 2023 net investment income and assumes no other changes to the portfolio (including accrual status of each portfolio company), investment income, professional expenses or administrative expenses other than the following: § Current benchmarks assumes that all assets and liabilities that have LIBOR based contracts are reset at 5.27% plus applicable spreads and all assets and liabilities that have SOFR based contracts are reset at 5.079% plus applicable spreads beginning on April 1, 2023. Quarterly NII Per Share Bridge (1) 1.00 0.95 0.06 0.89 0.90 0.80 0.70 0.60 0.50 0.40 0.30 0.20 Q1 2023 Current Benchmarks Potential Run-Rate NII (1) All per share information assumes the ending 3/31/2023 share count, including Q1 2023. 7

Core Earning Analysis ($ in ‘000s except per share) Q1 2023 Interest Income: Non-controlled/non-affiliated investments 14,846 Non-controlled affiliated investments 849 Total interest income 15,695 Payment-in-kind income: Non-controlled/non-affiliated investments 1,527 Non-controlled affiliated investments 73 Total payment-in-kind income 1,600 Dividend income: Non-controlled affiliated investments 1,384 Controlled affiliated investments 1,075 Total dividend income 2,459 Fees and other income: Non-controlled/non-affiliated investments 573 Total fees and other income 573 Reported Investment Income $20,327 Less: Purchase discount accouting (1,042) Core Investment Income $19,285 Reported Net Investment Income $8,529 NII Per Share $0.89 Co re (1) $7,669 Net Investment Income NII Per Share $0.80 (1) Core net investment income represents reported total net investment income as determined in accordance with U.S. generally accepted accounting principles, or U.S. GAAP, less the impact of purchase price discount accounting in connection with the GARS and HCAP mergers, while also considering the impact of accretion from these mergers on expenses. Portman Ridge believes presenting core net investment income and the related per share amount is useful and appropriate supplemental 8 disclosure for analyzing its financial performance due to the unique circumstance giving rise to the purchase accounting adjustment. However, core net investment income is a non-U.S. GAAP measure and should not be considered as a replacement for total net investment income and other earnings measures presented in accordance with U.S. GAAP. Instead, core net investment income should be reviewed only in connection with such U.S. GAAP measures in analyzing Portman Ridge’s financial performance.

Net Asset Value Rollforward ($ in ‘000s) Q1 2023 NAV, Beginning of Period $232,123 Net realized gains (losses) from investment transactions (3,085) Net change in unrealized appreciation (depreciation) on investments (5,960) Net Investment Income 8,529 Net decrease in net assets resulting from stockholder distributions (6,495) Tax (provision) benefit on realized and unrealized gains (losses) on investments 571 Stock repurchases (792) Distribution reinvestment plan 215 NAV, End of Period $225,106 Leverage and Asset Coverage Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Gross Leverage 1.3x 1.4x 1.5x 1.6x 1.6x (1) 1.0x 1.2x 1.3x 1.5x 1.4x Net Leverage Asset Coverage 180% 170% 167% 160% 162% (1) Net leverage is calculated as the ratio between (A) debt, excluding unamortized debt issuance costs, less available cash and cash equivalents, and restricted cash and (B) NAV. Portman Ridge believes presenting a net leverage ratio is useful and appropriate supplemental disclosure because it reflects the Company’s financial condition net of $46.1 million and $33.1 million of cash and cash equivalents and restricted cash for the quarters ended March 31, 2023 and December 31, 2022, respectively. However, the net leverage ratio is a non-U.S. GAAP measure and should not be considered as a replacement for the regulatory asset coverage ratio and other similar information presented in accordance with U.S. GAAP. Instead, the net leverage ratio should be reviewed only in connection with such U.S. GAAP 9 measures in analyzing Portman Ridge’s financial condition.

(1) Current Portfolio Profile (2) Diversified Portfolio of Assets Diversification by Borrower 4.4% Top 5 Borrowers, 3.9% 17.4% 106 Debt + Equity Portfolio Investee Companies 3.3% 3.0% $3.3mm / 1% Average Debt Position Size 2.8% Remainder 43.3% U.S Centric Investments: Nearly 100% US-Based Companies Next 5-10 Investments 12.8% Focus on Non-Cyclical Industries with High FCF Generation Credit quality has been stable to improving during the Next 11-25 rotation period Investments 26.5% (2) (2) Industry Diversification Asset Mix Transportation: Cargo Other 2.5% 23.6% High Tech Industries Beverage, Food and Tobacco 16.9% 2.7% Junior Secured Loan Textiles and Leather Senior Secured Loan 11.1% 2.8% 85.6% Consumer goods: Durable Equity Security 2.9% 3.3% Services: Business Senior Unsecured Bond Metals & Mining 14.5% 0.0% 3.0% Media: Broadcasting & Subscription 3.2% Banking, Finance, Insurance & Real Estate Finance 14.4% 4.0% Healthcare & Pharmaceuticals 9.5% (1) As of March 31, 2023. Figures shown do not include short term investments, CLO holdings, F3C JV or Series A-Great Lakes Funding II LLC, and derivatives. 10 (2) Shown as % of debt and equity investments at fair market value.

(1)(2) Portfolio Trends ($ in ‘000s) Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 P o rtfo lio So urcing (at F air Value): BC Partners $303,378 $336,689 $351,940 $367,771 $360,061 Legacy KCAP $68,378 $59,646 $53,156 $52,847 $44,061 Legacy OHAI $9,894 $10,315 $9,447 $9,179 $6,943 Legacy GARS $124,048 $120,799 $101,948 $106,494 $95,343 (3) Legacy HCAP $62,289 $54,011 $55,157 $40,187 $32,714 P o rtfo lio Summary: Total portfolio, at fair value $ 567,988 $ 581,459 $ 571,648 $ 576,478 $ 539,122 Total number of debt portfolio companies / Total number of 95 / 186 95 / 190 93/197 96/198 87 / 184 (4) investments Weighted Avg EBITDA of debt portfolio companies $95,546 $76,678 $85,460 $98,260 $98,349 Average size of debt portfolio company investment, at fair value $3,082 $3,292 $3,204 $3,046 $3,033 Weighted avg first lien / total leverage ratio (net) of debt portfolio 4.8x / 5.3x 4.7x / 5.3x 4.7x / 5.3x 4.9x / 5.4x 5.0x / 5.5x P o rtfo lio Yields and Spreads: (5) Weighted average yield on debt investments at par value 8.0% 8.6% 10.0% 11.1% 11.9% Average Spread to LIBOR 727 bps 725 bps 725 bps 708 bps 759 bps P o rtfo lio A ctivity: Beginning balance $549,985 $567,988 $581,459 $571,648 $576,478 Purchases / draws 63,964 70,081 54,635 43,094 14,878 Exits / repayments / amortization (47,346) (46,066) (56,496) (21,052) (46,158) Gains / (losses) / accretion 1,385 (10,544) (7,950) (17,212) (6,076) Ending B alance $ 567,988 $ 581,459 $ 571,648 $ 576,478 $ 539,122 (1) For comparability purposes, portfolio trends metrics exclude short-term investments and derivatives. (2) Excludes select investments where the metric is not applicable, appropriate, data is unavailable for the underlying statistic analyzed 11 (3) Includes assets purchased from affiliate of HCAP’s former manager in a separate transaction. (4) CLO holdings and Joint Ventures are excluded from investment count. (5) Excluding non-accrual and partial non-accrual investments and excluding CLO holdings and Joint Ventures.

Credit Quality § As of March 31, 2023, five of the Company’s debt investments were on non-accrual status and represented 0.3% and 1.5% of the Company’s investment portfolio at fair value and amortized cost, respectively ($ in ‘000s) Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 (1) Investments Credit Quality – Internal Rating Performing 94.5% 95.3% 95.7% 94.3% 95.1% Underperforming 5.5% 4.7% 4.3% 5.7% 4.9% Investments on Non-Accrual Status Number of Non-Accrual Investments 6 3 3 4 5 Non-Accrual Investments at Cost $11,730 $1,693 $1,735 $3,708 $9,317 Non-Accrual Investments as a % of Total Cost 1.9% 0.3% 0.3% 0.6% 1.5% Non-Accrual Investments at Fair Value $1,039 $244 $238 $236 $1,682 Non-Accrual Investments as a % of Total Fair Value 0.2% 0.0% 0.0% 0.0% 0.3% (1) Based on FMV. 12

(1) Portfolio Composition Investment Portfolio ($ in ‘000s) Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Senior Secured Loan $395,062 $414,920 $415,819 $418,722 $392,022 Junior Secured Loan 60,976 59,147 61,535 56,400 50,795 Senior Unsecured Bond 43 43 43 43 43 Equity Securities 22,633 24,805 24,487 21,905 15,320 CLO Fund Securities 29,057 24,271 24,623 20,453 19,241 Joint Ventures 60,217 58,273 45,141 58,955 61,701 Ending Balance $567,988 $581,459 $571,648 $576,478 $539,122 Investment Portfolio (% of total) Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Senior Secured Loan 69.6% 71.4% 72.7% 72.6% 72.7% Junior Secured Loan 10.7% 10.2% 10.8% 9.8% 9.4% Senior Secured Bond 0.0% 0.0% 0.0% 0.0% 0.0% Equity Securities 4.0% 4.3% 4.3% 3.8% 2.8% CLO Fund Securities 5.1% 4.2% 4.3% 3.5% 3.6% Joint Ventures 10.6% 10.0% 7.9% 10.2% 11.4% Total 100.0% 100.0% 100.0% 100.0% 100.0% (1) At Fair Value. Does not include activity in short-term investments and derivatives. 13

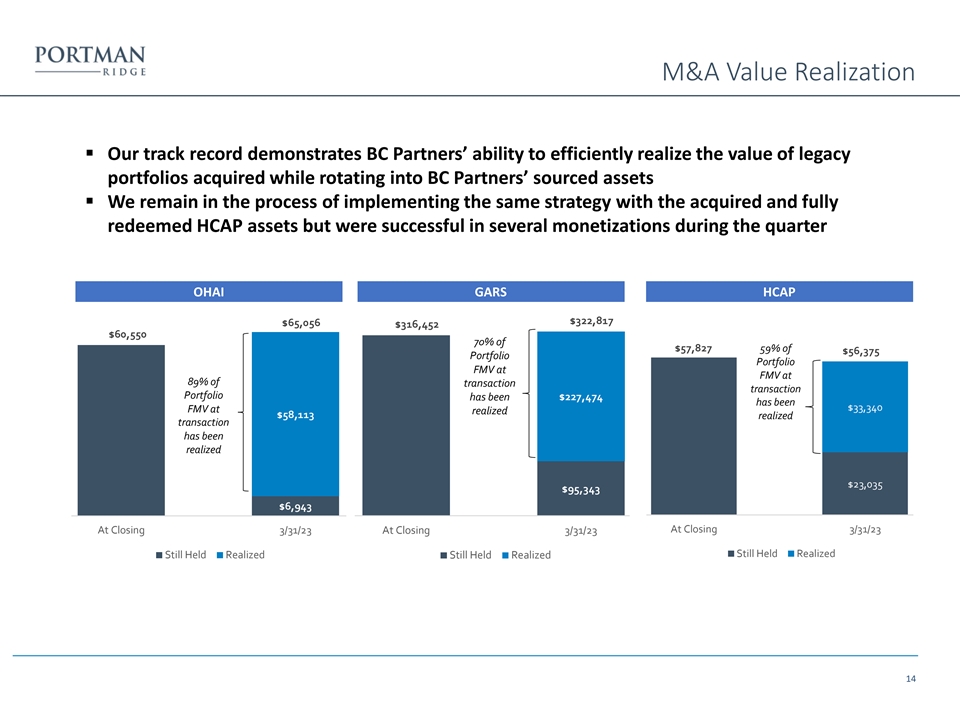

M&A Value Realization § Our track record demonstrates BC Partners’ ability to efficiently realize the value of legacy portfolios acquired while rotating into BC Partners’ sourced assets § We remain in the process of implementing the same strategy with the acquired and fully redeemed HCAP assets but were successful in several monetizations during the quarter O OH HA AI I GA GAR RS S H HC CA AP P $322,817 $65,056 $316,452 $60,550 70% of $57,827 59% of $56,375 Portfolio Portfolio FMV at FMV at 89% of transaction transaction Portfolio $227,474 has been has been $33,340 FMV at realized $58,113 realized transaction has been realized $23,035 $95,343 $6,943 At Closing 3/31/23 At Closing 3/31/23 At Closing 3/31/23 Still Held Realized Still Held Realized Still Held Realized 14

Appendix

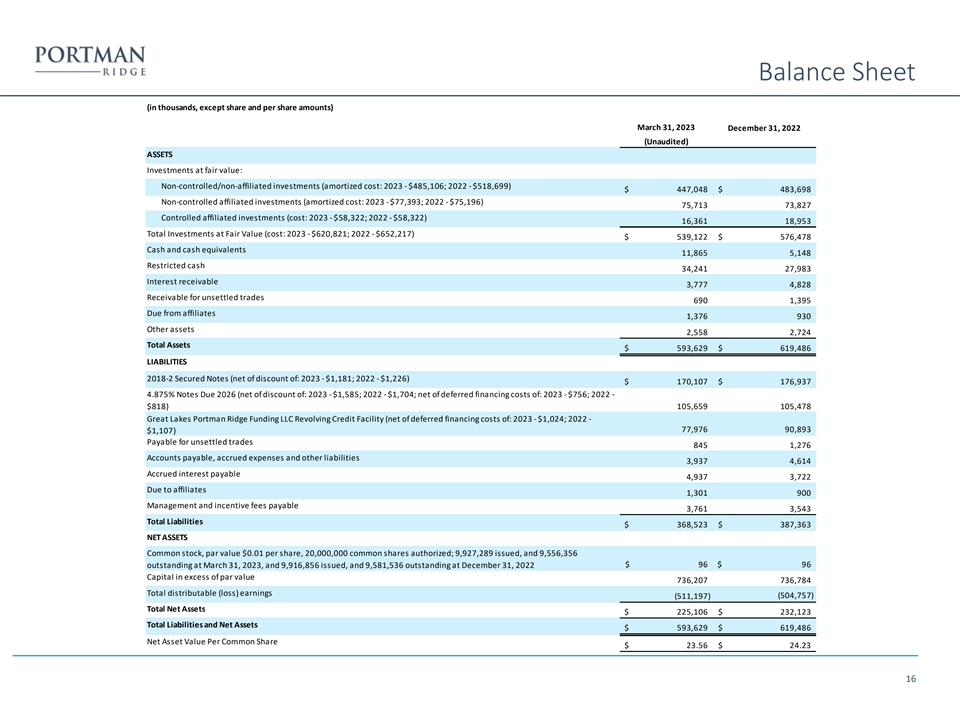

Balance Sheet (in thousands, except share and per share amounts) March 31, 2023 December 31, 2022 (Unaudited) ASSETS Investments at fair value: Non-controlled/non-affiliated investments (amortized cost: 2023 - $485,106; 2022 - $518,699) $ 447,048 $ 483,698 Non-controlled affiliated investments (amortized cost: 2023 - $77,393; 2022 - $75,196) 75,713 73,827 Controlled affiliated investments (cost: 2023 - $58,322; 2022 - $58,322) 16,361 18,953 Total Investments at Fair Value (cost: 2023 - $620,821; 2022 - $652,217) $ 539,122 $ 576,478 Cash and cash equivalents 11,865 5,148 Restricted cash 34,241 27,983 Interest receivable 3,777 4,828 Receivable for unsettled trades 690 1,395 Due from affiliates 1,376 930 Other assets 2,558 2,724 Total Assets $ 593,629 $ 619,486 LIABILITIES 2018-2 Secured Notes (net of discount of: 2023 - $1,181; 2022 - $1,226) $ 170,107 $ 176,937 4.875% Notes Due 2026 (net of discount of: 2023 - $1,585; 2022 - $1,704; net of deferred financing costs of: 2023 - $756; 2022 - $818) 105,659 105,478 Great Lakes Portman Ridge Funding LLC Revolving Credit Facility (net of deferred financing costs of: 2023 - $1,024; 2022 - 77,976 90,893 $1,107) Payable for unsettled trades 845 1,276 Accounts payable, accrued expenses and other liabilities 3,937 4,614 Accrued interest payable 4,937 3,722 Due to affiliates 1,301 900 Management and incentive fees payable 3,761 3,543 Total Liabilities $ 368,523 $ 387,363 NET ASSETS Common stock, par value $0.01 per share, 20,000,000 common shares authorized; 9,927,289 issued, and 9,556,356 outstanding at March 31, 2023, and 9,916,856 issued, and 9,581,536 outstanding at December 31, 2022 $ 9 6 $ 96 Capital in excess of par value 736,207 736,784 Total distributable (loss) earnings (511,197) (504,757) Total Net Assets $ 225,106 $ 232,123 Total Liabilities and Net Assets $ 593,629 $ 619,486 Net Asset Value Per Common Share $ 23.56 $ 24.23 16

Income Statement (in thousands, except share and per share amounts) For the Three Months Ended March 31, 2023 2022 INVESTMENT INCOME Interest income: Non-controlled/non-affiliated investments $ 1 4,846 $ 1 2,667 Non-controlled affiliated investments 849 591 Total interest income $ 1 5,695 $ 1 3,258 Payment-in-kind income: (1) Non-controlled/non-affiliated investments $ 1 ,527 $ 1 ,126 Non-controlled affiliated investments 73 256 Total payment-in-kind income $ 1 ,600 $ 1 ,382 Dividend income: Non-controlled affiliated investments $ 1 ,384 $ 9 45 Controlled affiliated investments 1,075 1,163 Total dividend income $ 2 ,459 $ 2 ,108 Fees and other income Non-controlled/non-affiliated investments $ 5 73 $ 1 96 Total fees and other income $ 5 73 $ 1 96 Total investment income $ 2 0,327 $ 1 6,944 EXPENSES Management fees $ 1 ,953 $ 2 ,135 Performance-based incentive fees 1,808 1,678 Interest and amortization of debt issuance costs 6,332 3,344 Professional fees 603 845 Administrative services expense 671 847 Other general and administrative expenses 431 187 Total expenses $ 1 1,798 $ 9 ,036 NET INVESTMENT INCOME $ 8 ,529 $ 7 ,908 REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS Net realized gains (losses) from investment transactions: Non-controlled/non-affiliated investments $ ( 3,085) $ ( 3,670) Non-controlled affiliated investments - 212 Derivatives - (2,095) Net realized gain (loss) on investments $ ( 3,085) $ ( 5,553) Net change in unrealized appreciation (depreciation) on: Non-controlled/non-affiliated investments $ ( 3,057) $ 8 29 Non-controlled affiliated investments (311) 117 Controlled affiliated investments (2,592) (1,245) Derivatives - 2,442 Net unrealized gain (loss) on investments $ ( 5,960) $ 2 ,143 Tax (provision) benefit on realized and unrealized gains (losses) on investments $ 5 71 $ ( 440) Net realized and unrealized appreciation (depreciation) on investments, net of taxes $ ( 8,474) $ ( 3,850) NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS $ 5 5 $ 4 ,058 Net Increase (Decrease) In Net Assets Resulting from Operations per Common Share: Basic and Diluted: $ 0 .01 $ 0 .42 Net Investment Income Per Common Share: Basic and Diluted: $ 0 .89 $ 0 .82 Weighted Average Shares of Common Stock Outstanding—Basic and Diluted 9,555,125 9,698,099 (1) During the period ended March 31, 2023, the Company received $301 thousand of non-recurring fee income that was paid in-kind and included in this financial statement line item. 17

Corporate Leverage & Liquidity Cash and Cash Equivalents § Unrestricted cash and cash equivalents totaled $11.9 million as of March 31, 2023 § Restricted cash of $34.2 million as of March 31, 2023 Debt Summary § As of March 31, 2023, par value of outstanding borrowings was $358.3 million; there was $36.0 million of available borrowing capacity under the Senior Secured Revolving Credit Facility and no available borrowing capacity under the 2018-2 Secured Notes. 18

(1) Regular Distribution Information Date Declared Record Date Payment Date Distribution per Share 5/10/2023 5/22/2023 5/31/2023 $0.69 3/9/2023 3/20/2023 3/31/2023 $0.68 11/8/2022 11/24/2022 12/13/2022 $0.67 8/9/2022 8/16/2022 9/2/2022 $0.63 5/10/2022 5/24/2022 6/7/2022 $0.63 3/10/2022 3/21/2022 3/30/2022 $0.63 11/3/2021 11/15/2021 11/30/2021 $0.62 8/4/2021 1 for 10 Reverse Stock Split effective 8/26/21 8/4/2021 8/17/2021 8/31/2021 $0.60 5/6/2021 5/19/2021 6/1/2021 $0.60 2/12/2021 2/22/2021 3/2/2021 $0.60 10/16/2020 10/26/2020 11/27/2020 $0.60 8/5/2020 8/17/2020 8/28/2020 $0.60 3/17/2020 5/7/2020 5/27/2020 $0.60 2/5/2020 2/18/2020 2/28/2020 $0.60 11/5/2019 11/15/2019 11/29/2019 $0.60 8/5/2019 8/12/2019 8/29/2019 $0.60 (1) The Company completed a Reverse Stock Split of 10 to 1 effective August 26, 2021, the distribution per share amounts have been adjusted retroactively to reflect the split for all periods presented. 19