BARRY HONIG

555 South Federal Highway, #450

Boca Raton, FL 33432

| | | |

| | By Email and UPS Overnight Service | | |

| | Stephen T. Lundy | | |

| | Chief Executive Officer Venaxis, Inc. | | |

| | 1585 South Perry Street | | |

| | Castle Rock, CO 80104 | | |

Re: Demand For Special Meeting of the Shareholders of Venaxis, Inc.

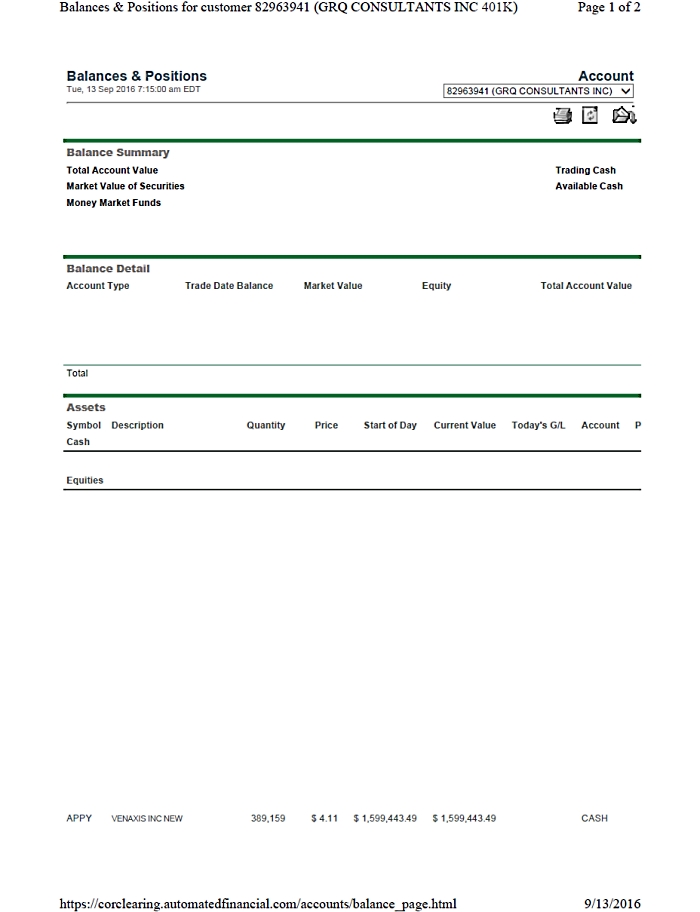

Barry Honig (the “Holder”) is the beneficial owner of shares of Venaxis, Inc., a Colorado corporation (“Venaxis” or the “Company”). The Holder beneficially owns shares representing greater than ten (10%) percent of all the votes entitled to be cast at a meeting of the shareholders of the Company. I have attached evidence of such ownership which consists of the Broker Statement and Schedule 13D filed with the Securities and Exchange Commission on September 13, 2016 and attached hereto as Exhibit A and Exhibit B, respectively.

Pursuant to Section 7-107-102 of the Colorado Revised Statutes (“CRS”), the Holder hereby demands a special meeting (the “Meeting”) of the shareholders of the Company be held. Notice of the Meeting should be provided by the Company to its shareholders within the timeframe allowed pursuant to the CRS and the Company’s Bylaws.

Pursuant to CRS 7-108-108, shareholders may remove one or more directors with or without cause. A director may be removed by the shareholders only at a meeting called for the purpose of removing the director. The purpose of this Meeting demanded by the Holders is to vote on the removal of five (5) directors, aside from you, currently serving on the Board of Directors. Additionally, proposals for a $7,500,000 dividend, to set the size of the board at no more than six (6) directors and for the election of five (5) new directors shall take place at the Meeting. These purposes shall be described in the notice of the Meeting you are required to provide to the shareholders under applicable Colorado law, to be substantially in the form of the form of such proposals included herewith as Exhibit C.

Should you have any questions regarding the foregoing, please do not hesitate to contact Harvey Kesner, Esq. at (212) 930-9700.

| | Very truly yours, |

| | |

| | /s/ Barry Honig __________________________ |

| | Barry Honig |

| | Shares Beneficially Owned: 389,159 (10.04%) |

Exhibit A

Exhibit B

[Omitted]

Exhibit C

PROPOSAL NO. 1

APPROVAL OF DIVIDEND

RESOLVED:

The Company shall be authorized and hereby is directed to declare and pay a special cash dividend to shareholders of record on the close of business on a date that shall be determined by the Board of Directors (not later than 30 days following shareholder authorization) such dividend to be paid on outstanding shares of the Company’s common stock, in the amount of $7,500,000 . The dividend paid shall constitute a reduction in capital of the Company.

The affirmative vote of a majority of the votes cast (either in person or by proxy) and entitled to vote on the matter is required to approve Proposal 1.

PROPOSAL NO. 2

APPROVAL TO FIX THE MAXIMUM NUMBER OF DIRECTORS OF THE COMPANY AT SIX (6) DIRECTORS

RESOLVED:

The Company shall be authorized and hereby is directed to establish the size of the Board of Directors and does hereupon fix the number of directors of the Company at a maximum of six (6) directors, such maximum number not to be revised except upon further shareholder authorization as provided in this resolution.

The affirmative vote of a majority of the votes cast (either in person or by proxy) and entitled to vote on the matter is required to approve Proposal 2.

PROPOSAL NO. 3

REMOVAL FROM OFFICE OF DIRECTORS

RESOLVED:

Colorado Revised Statute (C.R.S.) Section 7-108-108 states that shareholders of the Company may remove one or more directors with or without cause at a meeting called for the purpose of removing the director. The shareholders of the Company do hereby remove at a meeting called for the purpose of removal, the following directors from the Board of Directors of the Company:

| Name | | Age | | Date First Elected or Appointed | Position(s) |

| Gail S. Schoettler | | | 72 | | 2001 | Non-Executive Chair and Director |

| Susan A. Evans | | | 68 | | 2012 | Director |

| Daryl J. Faulkner | | | 67 | | 2009 | Director |

| David E. Welch | | | 68 | | 2004 | Director |

| Stephen A. Williams | | | 56 | | 2013 | Director |

Biographical information concerning the directors can be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015.

Vote Required

The number of votes cast in favor of removal exceeds the number of votes cast against removal of each named director is required for Proposal 3.

ELECTION OF FIVE (5) DIRECTORS

The following persons are hereby nominated for election to the Board of Directors of the Company, and are hereby elected to serve as directors and to serve until their successor(s) are duly qualified and elected on or following the 2017 annual meeting of shareholders of the Company, such directors may only be removed “for cause” or resignation. Although it is not contemplated that any person will decline or be unable to serve as a director, in such event, the remaining Board members are authorized to fill any such vacancies created.

| | | |

| Name | Age | |

| John Stetson | | | 31 | |

| John O’Rourke | | | 31 | |

| Jesse Sutton | | | 47 | |

| Michael Beeghley | | | 49 | |

| David Danziger | | | 59 | |

John Stetson has been the Managing Member of HS Contrarian Investments LLC, a private investment firm with a focus on early stage companies since 2010. In addition, Mr. Stetson served as Executive Vice President, Chief Financial Officer, and Director of Marathon Patent Group, Inc. (NASDAQ:MARA) June 2012 to February 2015, engaged in patenting, and patent acquisition, enforcement and monetization. Mr. Stetson was President & Co-Founder of Fidelity Property Group, Inc. from April 2010 to July 2014, a real estate development group focused on acquisition, rehabilitation, and short-term disposition of single family homes. Prior, Mr. Stetson held positions at Heritage Investment Group and Toll Brothers. Mr. Stetson also served as Chief Financial Officer, Executive Vice President and Secretary of Majesco Entertainment Company (NASDAQ:COOL) since September 2015. Mr. Stetson received his BA in Economics from the University of Pennsylvania.

John O’Rourke is an analyst and investor who currently serves as Managing Member of ATG Capital LLC, an investment fund focused on small and mid-cap growth companies possessing distinct competitive advantages and superior management teams. Mr. O'Rourke currently serves on the Board of Directors of Customer Acquisition Network Inc., a leading global performance based marketing company that reaches more than two billion users per month. Mr. O’Rourke formerly served on the Board of Directors of Rant, Inc., an innovator in U.S. digital media, prior to its sale to a Nasdaq listed company. He was formerly CFO of Fidelity Property Group, a real estate development company with a focus in California. He received his Bachelor of Science in Accounting with Honors from the University of Maryland and a Master of Science in Finance from George Washington University.

Jesse Sutton is a consultant for various analytic and gaming related companies. Mr. Sutton founded Majesco Entertainment Company (NASDAQ: COOL) in 1998 and served as its Chief Executive Officer until July 2015, as well as a director from December 5, 2003 until February 6, 2006 and again from August 23, 2006 until December 17, 2014. During this period, Mr. Sutton oversaw the successful launch and development of Zumba! Fitness which sold over $300 million in games, among many other successful brands brought to market like Cooking Mama, Jillian Michaels Fitness and Disney’s Phineus and Ferb and Alvin and the Chipmunks. Mr. Sutton consults with various online and digital companies engaged in internet commerce and game development. Mr. Sutton attended Yeshiva University in New York.

Michael Beeghley has been President and founder of Applied Economics LLC (“Applied Economics”), a national corporate finance and financial advisory services firm for 18 years. Mr. Beeghley has testified as an expert and provided expert opinions on numerous economic, financial and securities issues. Mr. Beeghley advises pharmaceutical, biologics and medical device companies. Recently, Mr. Beeghley served as advisor to a drug distribution company sale to a major private equity firm in a leveraged buy-out. Prior to forming Applied Economics, Mr. Beeghley was a Manager in the Corporate Finance Group of Ernst & Young, LLP and a Senior Analyst in the Corporate Finance Group of PricewaterhouseCoopers. Mr. Beeghley currently serves as a director of Majesco Entertainment Company (NASDAQ:COOL) since December 2015.

David Danziger is an Assurance Partner in MNP LLP’s Toronto office. He is the Senior Vice President of Assurance for the firm as well as the National Leader of MNP’s Public Companies practice. An accounting professional since 1980, Mr. Danziger is proficient in his field, serving in both the audit function and as a compliance advisor to public companies as well as to private firms looking to become public. His years of experience are a benefit to clients engaging in any form of public market transaction. Mr. Danziger also assists clients with significant transactions, complex accounting matters and regulatory issues as well as prospectus filing and other publicly filed documents. Mr. Danziger's experience with US Reporting Issuers as well as Canadian Reporting Issuers has required him to be fluent in both IFRS and US GAAP. Mr. Danziger has served as a Director for public companies for many years and currently has significant director positions with TSX, TSXV, NYSE and AMEX-listed public companies. Mr. Danziger graduated from the University of Toronto with a Bachelor of Commerce in 1980 and completed the School of Accountancy in 1983.

There are no family relationships between these nominees and any director or executive officer of the Company and there were no related party transactions between this nominee and the Company. No nominee has had any involvement in any legal proceedings (10 years) pursuant to Item 401 of Regulation S-K.

Vote Required

The affirmative vote of the holders of a plurality of the common stock present at the special meeting of stockholders is required for election of each director nominee set forth in this proposal.