BARRY HONIG

GRQ CONSULTANTS, INC 401K

GRQ CONSULTANTS, INC ROTH 401K FBO BARRY HONIG

555 South Federal Highway, #450

Boca Raton, FL 33432

T: 561-961-4237

F: 561-235-5379

E: brhonig@aol.com

December 1, 2016

By E-Mail and Overnight Mail

Chair, Nominating Committee

c/o Venaxis, Inc.

1585 South Perry Street

Castle Rock, Colorado 80104

Stephen T. Lundy

Chief Executive Officer

Venaxis, Inc.

1585 South Perry Street

Castle Rock, CO 80104

Re: Demand for Special Meeting of the Shareholders of Venaxis, Inc.

Nomination of Three (3) Director Candidates of Venaxis, Inc.

Gentlemen:

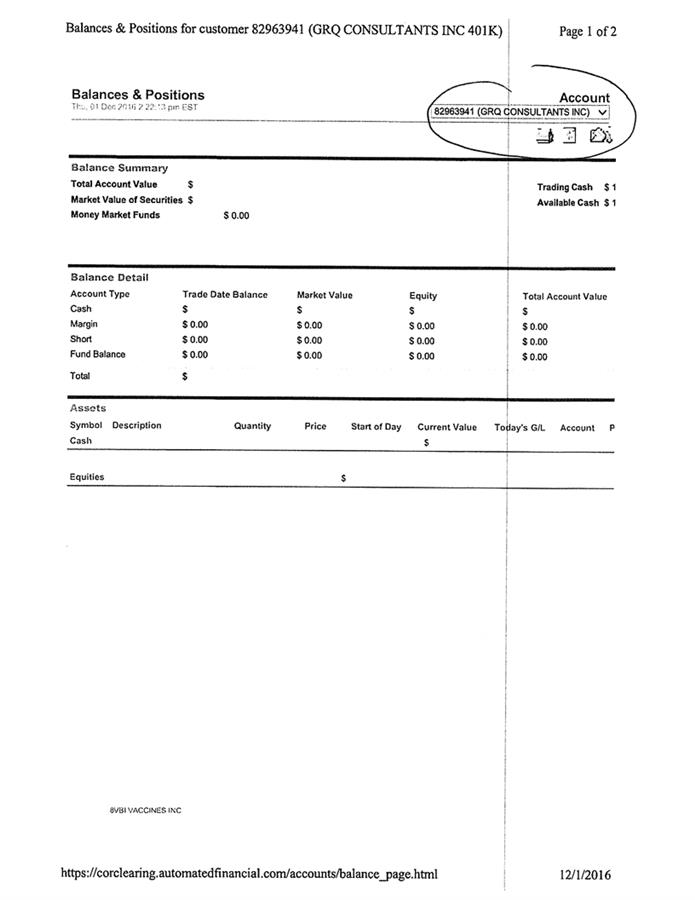

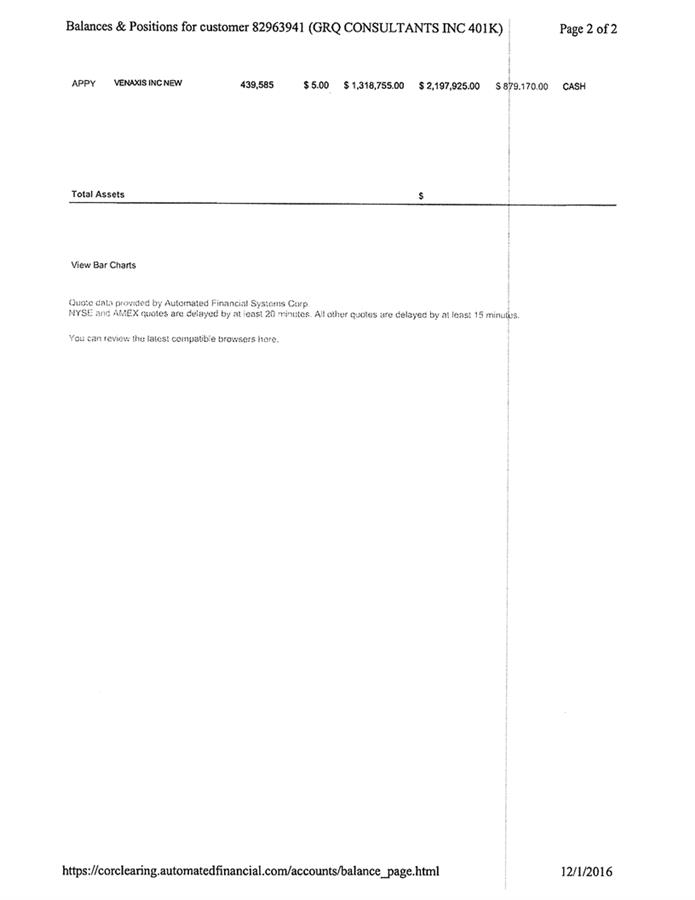

I am a record and beneficial holder (the “Holder”) of shares of Venaxis, Inc., a Colorado corporation (“Venaxis” or the “Company”). Individually, and as sole trustee of GRQ Consultants, Inc. 401K and GRQ Consultants, Inc. Roth 401K FBO Barry Honig, I beneficially control shares representing greater than ten (10%) percent of common stock of the Company and ten (10%) percent of all the votes entitled to be cast at a meeting of the shareholders of the Company. I have attached evidence of such ownership which consists of Schedule 13D/A and Broker Statements filed with the Securities and Exchange Commission (“SEC”) on December 1, 2016 attached as Exhibit A and Exhibit B, respectively. Additionally, evidence of the beneficial ownership of GRQ held shares by the Trustee (Holder) which has been previously provided to you is also included with this letter.

Pursuant to Section 7-107-102 of the Colorado Revised Statutes (“CRS”), the Holder hereby demands a special meeting (the “Meeting”) of the shareholders of the Company be held. Notice of the Meeting should be provided by the Company to its shareholders within the timeframe allowed pursuant to the CRS and the Company’s Bylaws. Pursuant to CRS 7-108-108, shareholders may remove one or more directors with or without cause. A director may be removed by the shareholders only at a meeting called for the purpose of removing the director. The purpose of this Meeting demanded is to vote on the removal of three (3) directors currently serving on the Board and for the election of three (3) new directors, which shall take place at the Meeting. These purposes shall be described in the notice of the Meeting you are required to provide to the shareholders under applicable Colorado law, to be substantially in the form of the form of such proposals included herewith as Exhibit C. Biographical information conforming to Regulation 14A is included below and in such Exhibit C.

Pursuant to the procedures for nominating a director candidate to the Board of Directors (the “Board”) of the Company, I hereby wish to nominate the following candidates to stand for election at the Meeting called to take place on a date of the Company’s choosing within the timeframe allowed pursuant to the CRS and the Company’s Bylaws:

a.

808 Solar Isle Dr., Fort Lauderdale, FL 33301

b.

T: 610-247-3917, F: 561-235-5379, E: john@atgcapitalllc.com

c.

Mr. O’Rourke is an analyst and investor who currently serves as Managing Member of ATG Capital LLC, an investment fund focused on small and mid-cap growth companies possessing distinct competitive advantages and superior management teams. Mr. O'Rourke currently serves on the Board of Directors of Customer Acquisition Network Inc., a leading global performance based marketing company that reaches more than two billion users per month. Mr. O’Rourke formerly served on the Board of Directors of Rant, Inc., an innovator in U.S. digital media, prior to its sale to a Nasdaq listed company. He was formerly CFO of Fidelity Property Group, a real estate development company with a focus in California. He received his Bachelor of Science in Accounting with Honors from the University of Maryland and a Master of Science in Finance from George Washington University.

d.

There are no family relationships between this nominee and any director or executive officer of the Company.

e.

No involvement in any legal proceedings (10 years).

f.

This nominee’s security ownership of the Company is as follows:

| Title of Class | Amount and Nature of Beneficial Ownership | Percent of Class |

| Common Stock | 20,470 Shares (1) | .45%(2) |

(1)

Represents 20,470 shares of common stock held by ATG Capital LLC (“ATG”). Mr. O’Rourke is the sole manager and member of ATG and in such capacity holds voting and dispositive power over the securities held by ATG.

(2)

Calculated based on 4,503,971 shares of the Common Stock outstanding as of November 11, 2016, as reported in the Company’s Form 10-Q for the period ended September 30, 2016 filed with the SEC on November 14, 2016.

g.

There were no related party transactions between this nominee and the Company.

a.

1103-25 Adelaide St E, Toronto Ontario, Canada M5C3A1

b.

T: 416-907-5644 x105, F: 647-476-5351, E: mgalloro@aloefinance.com

d.

Mr. Michael Bernardino Galloro, CA, CPA has been the Chief Executive Officer, President and Chief Financial Officer of Goldstream Minerals Inc. since December 2015 and a director of Goldstream Minerals Inc. since April 2013. He serves as the Chief Financial Officer of Yangaroo Inc. He serves as the Chief Financial Officer and Director for private and publicly listed companies operating abroad. He served as an Interim Chief Financial Officer of Alberta Oilsands Inc. from July 2012 to February 2016. Mr. Galloro served as Director, Chief Executive Officer, President and Chief Financial Officer of Black Sparrow Capital Corp, from 2011 to 2014. He continues to serve as as Interim Chief Financial Officer of Yangaroo Inc. since November 2010. He is a Founding Member of ALOE Financial Inc., a financial consulting and transaction advisory firm, established in 2010. He has been an Independent Director

of Santa Maria Petroleum Inc. since May 2014. He is a Chartered Professional Accountants having earned his designation while working for KPMG LLP. Mr. Galloro obtained his Honours Bachelor of Accounting in 1998 from Brock University.

d.

There are no family relationships between this nominee and any director or executive officer of the Company.

e.

No involvement in any legal proceedings (10 years).

f.

This nominee’s security ownership of the Company is as follows: No ownership.

g.

There were no related party transactions between this nominee and the Company.

a.

66 Snow Leopard Court, Brampton, Ontario, Canada L6R 2L7

b.

T: 416-907-5644 x140, F: 647-476-5351, E: mdai@aloefinance.com

c.

Mike Dai has been an associate with ALOE Finance Inc., a financial consulting and transaction advisory firm since 2012. Prior to his involvement with ALOE Finance, Mr. Dai held various roles at Grant Thornton LLP, an audit, tax and advisory firm between 2007 and 2012. Mr. Dai also serves as chief financial officer and director of Santa Maria Petroleum Inc. (TSXV:SMQ.H), a position he has held since 2014.

d. There are no family relationships between this nominee and any director or executive officer of the Company.

e.

No involvement in any legal proceedings (10 years).

f.

This nominee’s security ownership of the Company is as follows: No ownership.

g.

There were no related party transactions between this nominee and the Company.

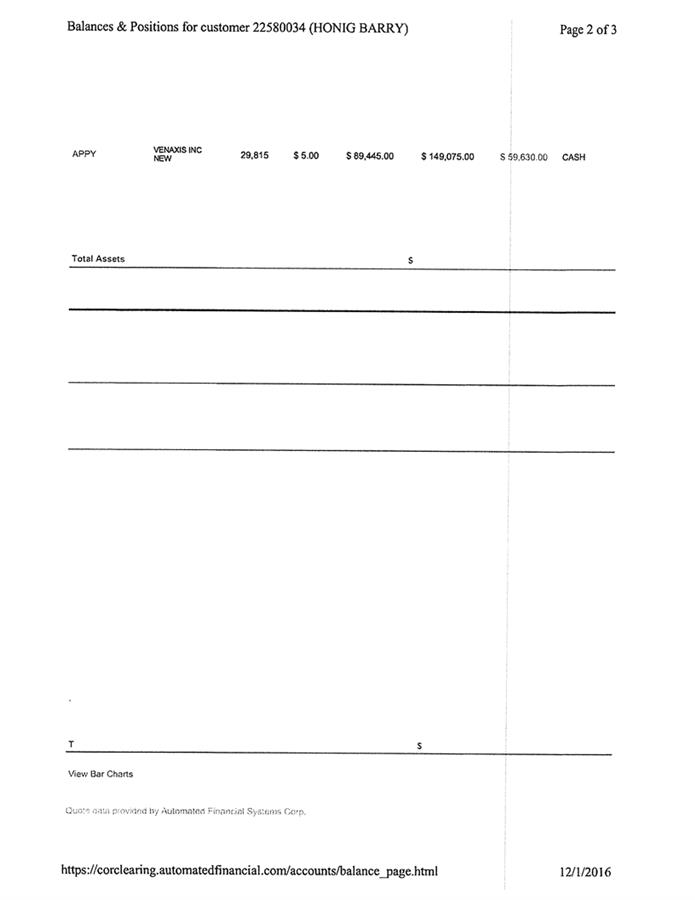

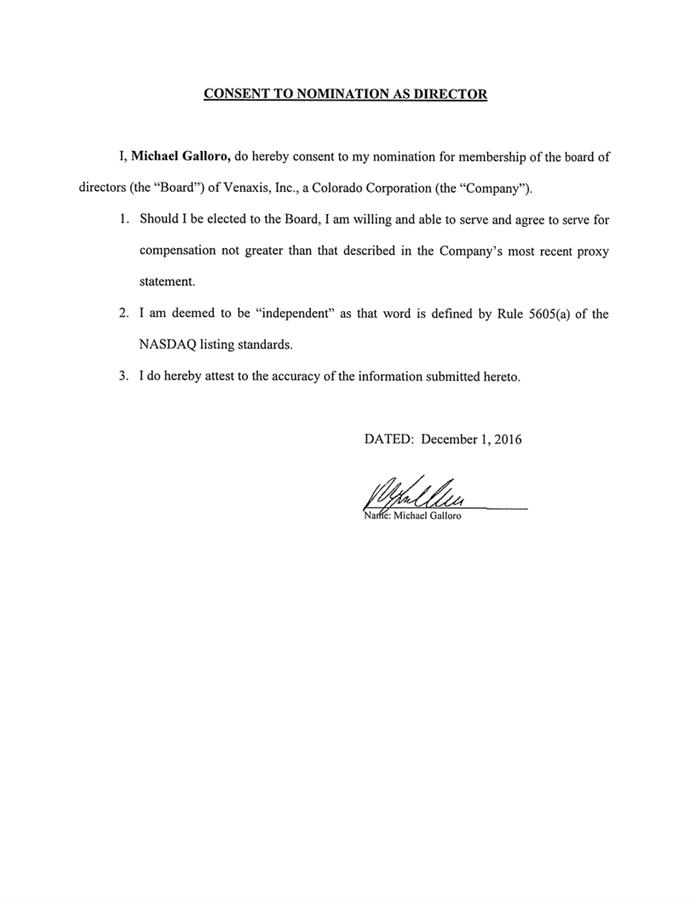

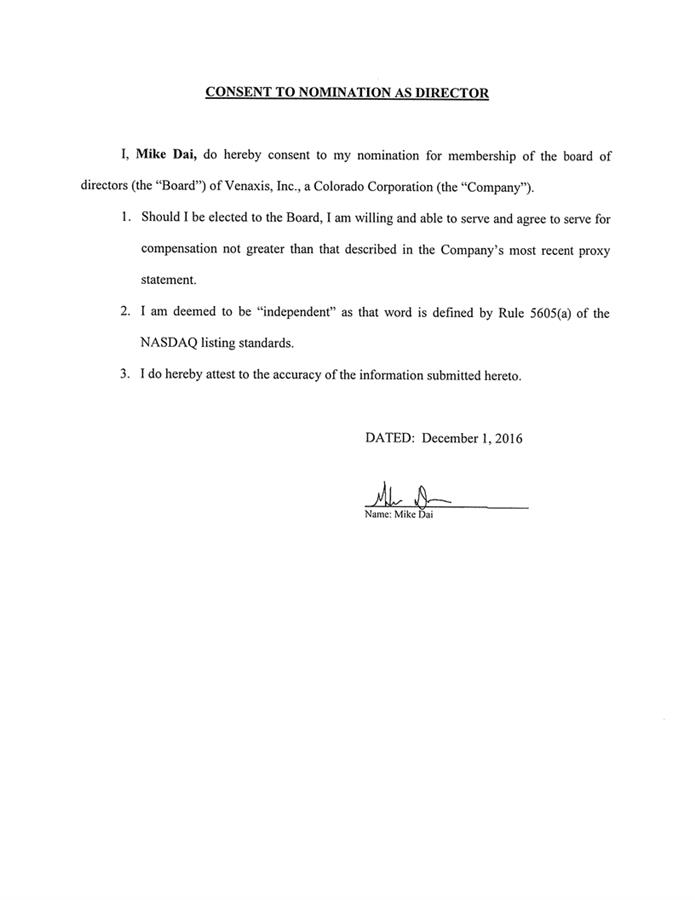

Furthermore, attached hereto as Exhibit D are the signed written consents of the nominees for election as director of the Company.

I have additionally satisfied each of the additional requirements under the Venaxis’ nomination procedures and bylaws as well as the objections posed by Mary Mullaney, Esq. and David Stauss, Esq., counsel to the Company in their prior correspondence. We reserve all rights to protest the exclusion of my prior director nominations and other proposals as set forth in my prior letter and demand for special meeting dated September 12, 2016 and to object to the results of such meeting, including the validity of the election of directors and shareholder vote held November 30, 2016. The 2016 Annual Meeting failed to include the opportunity for shareholders to vote on the proposals that I set forth and the proposals made by the Company differed from the matters set forth in my demand for special meeting.

Should you have any questions regarding the foregoing, please do not hesitate to contact our counsel Harvey Kesner, Esq. at (212) 930-9700.

| |

Very truly yours, |

/s/ Barry Honig

|

Barry Honig, individually and as trustee |

| |

Enclosures:

Articles of Incorporation of GRQ Consultants, Inc.

GRQ Consultants 401(K) Plan

Exhibit A

SCHEDULE 13D/A

Amendment No.4

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

RULE 13d-2(a)

| VENAXIS, INC. |

| (Name of Issuer) |

| Common Stock, no par value |

| (Title of Class of Securities) |

Barry Honig

555 South Federal Highway #450

Boca Raton, FL 33432

Copy To: Sichenzia Ross Ference Kesner LLP 61 Broadway, 32nd Floor New York, NY 10006 Attn: Harvey J. Kesner, Esq. |

| (Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications) |

| December 1, 2016 |

| (Date of Event which Requires Filing of this Statement) |

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. [X]

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| 1 | NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) | |

Barry Honig | |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) | |

(a) [ ] (b) [ ] | |

| 3 | SEC USE ONLY | |

| | |

| 4 | SOURCE OF FUNDS (See Instructions) | |

PF | |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) | |

[ ] | |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION | |

United States | |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER: | |

29,815 | |

| 8 | SHARED VOTING POWER: | |

470,185 (1) | |

| 9 | SOLE DISPOSITIVE POWER: | |

29,815 | |

| 10 | SHARED DISPOSITIVE POWER: 470,185 (1) | |

| | |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 500,000 (2) | |

| | |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) | |

[_] | |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 11.10% (based on 4,503,971 shares of common stock outstanding as of November 11, 2016) | |

| | |

| 14 | TYPE OF REPORTING PERSON (See Instructions) | |

| IN | |

(1)

Includes (i) 439,585 shares of common stock held by GRQ Consultants, Inc. 401K (“401K”) and (ii) 30,600 shares of common stock held by GRQ Consultants, Inc. Roth 401K FBO Barry Honig (“Roth 401K”). Mr. Honig is the trustee of 401K and Roth 401K in such capacity holds voting and dispositive power over the securities held by such entities.

(2)

Includes (i) 29,815 shares of common stock (ii) 439,585 shares of common stock held by 401K and (iii) 30,600 shares of common stock held by Roth 401K. Mr. Honig is the trustee of 401K and Roth 401K in such capacity holds voting and dispositive power over the securities held by such entities.

| 1 | NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) | |

GRQ Consultants, Inc. 401K | |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) | |

(a) [ ] (b) [ ] | |

| 3 | SEC USE ONLY | |

| | |

| 4 | SOURCE OF FUNDS (See Instructions) | |

WC | |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) | |

[ ] | |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION | |

Florida | |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER: | |

0 | |

| 8 | SHARED VOTING POWER: | |

439,585 (1) | |

| 9 | SOLE DISPOSITIVE POWER: | |

0 | |

| 10 | SHARED DISPOSITIVE POWER: 439,585 (1) | |

| | |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 439,585 (1) | |

| | |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) | |

[_] | |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 9.75% (based on 4,503,971shares of common stock outstanding as of November 11, 2016) | |

| | |

| 14 | TYPE OF REPORTING PERSON (See Instructions) | |

| OO | |

(1) Mr. Honig is the trustee of 401K and in such capacity holds voting and dispositive power over the securities held by 401K.

| 1 | NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) | |

GRQ Consultants, Inc. Roth 401K FBO Barry Honig | |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) | |

(a) [ ] (b) [ ] | |

| 3 | SEC USE ONLY | |

| | |

| 4 | SOURCE OF FUNDS (See Instructions) | |

WC | |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) | |

[ ] | |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION | |

Florida | |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER: | |

0 | |

| 8 | SHARED VOTING POWER: | |

30,600 (1) | |

| 9 | SOLE DISPOSITIVE POWER: | |

0 | |

| 10 | SHARED DISPOSITIVE POWER: 30,600 (1) | |

| | |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 30,600 (1) | |

| | |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) | |

[_] | |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 0.68% (based on 4,503,971shares of common stock outstanding as of November 11, 2016) | |

| | |

| 14 | TYPE OF REPORTING PERSON (See Instructions) | |

| OO | |

(1) Mr. Honig is the trustee of Roth 401K and in such capacity holds voting and dispositive power over the securities held by Roth 401K.

Item 1. Security and Issuer

The title and class of equity securities to which this Schedule 13D relates is common stock, no par value, of Venaxis, Inc., a Colorado corporation (the "Issuer"). The address of the principal executive offices of the Issuer is 1585 S. Perry Street, Castle Rock, CO 80104.

Item 2. Identity and Background

(a) This statement is filed on behalf of Barry Honig, 401K and Roth 401K (collectively the “Reporting Person”).

(b) The Reporting Person’s address is 555 South Federal Highway, #450, Boca Raton, FL 33432.

(c) Not applicable.

(d) During the last five years, the Reporting Person has not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) During the last five years, the Reporting Person has not been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result thereof was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

(f) The Reporting Person is a citizen of the United States and the State of Florida.

Item 3. Source and Amount of Funds or Other Considerations

All shares were purchased with the Reporting Person’s personal funds or working capital.

Item 4. Purpose of Transaction

All of the Issuer’s securities owned by the Reporting Person have been acquired for investment purposes only. Except as set forth herein and in Schedule 13D filed with the Securities and Exchange Commission (the “Commission”) on September 8, 2016, Amendment no. 1 filed with the Commission on September 13, 2016, Amendment no. 2 filed with the Commission on September 14, 2016, and Amendment no. 3 filed with the Commission on November 9, 2016, the Reporting Person has no present plans or proposals that relate to or would result in any of the actions required to be described in subsections (a) through (j) of Item 4 of Schedule 13D. The Reporting Person may, at any time, review or reconsider their positions with respect to the Issuer and formulate plans or proposals with respect to any of such matters, but has no present intention of doing so.

The Reporting Person may engage in discussions with management and security holders of the Issuer and other persons with respect to the subject class of securities, the Issuer, the Issuer’s industry, business, condition, operations, structure, governance, management, capitalization, policies, plans, and prospects and related and other matters. In particular, the Reporting Person may engage in discussions with management and security holders of the Issuer regarding the complexion of the Issuer’s board of directors and options for increasing shareholder value. The Reporting Person plans and proposes to review and analyze such Reporting Person’s interest in the Issuer on a continuing basis and may engage in such discussions, as well as discussions with the Issuer, the Issuer’s directors and officers and other persons related to the Issuer, as the Reporting Person deems necessary or appropriate in connection with the Reporting Person’s interest in the Issuer.

Depending upon the factors described below and any other factor that is or becomes relevant, the Reporting Person plans and proposes to: (a) acquire additional amounts of the subject class of securities or different equity, debt, or other securities of the Issuer, derivative securities related to securities of the Issuer or other securities related to the Issuer (collectively, “Issuer-Related Securities”) or a combination or combinations of Issuer-Related Securities, including by purchase or other method, pursuant to open market, private, tender offer, or other transactions, using borrowed or other funds or consideration of or from any source described herein or other source or via a combination or combinations of such methods, transactions, consideration, and sources; (b) dispose of all or part of the securities covered by this statement and any other Issuer- Related Securities, including by sale or other method, pursuant to open market, private, or other transactions or via a combination or combinations of such methods and transactions; (c) engage in financing, lending, hedging, pledging, or similar transactions involving the securities covered by this statement or other Issuer-Related Securities or a combination or combinations of such transactions; (d) engage in discussions and otherwise communicate with the Issuer, officers, directors, and security holders of the Issuer and other persons related to the Issuer with respect to Issuer-Related Securities, the Issuer, the Issuer’s industry, business, condition, operations, structure, governance, management, capitalization, dividend policy, other policies, plans, and prospects and related and other matters; (e) suggest or recommend a transaction or transactions involving the acquisition, sale, or exchange of all or part of the Issuer-Related Securities or assets of the Issuer, other actions or a combination or combinations of such actions, in any case, which relates or relate to (or could result in) a change or changes to the Issuer’s business, condition, operations, structure, governance, management, capitalization, policies, plans, and prospects and similar and other actions and changes; (f) make a proposal or proposals involving the acquisition or sale of all or part of the Issuer-Related Securities or assets of the Issuer; (g) make a proposal or proposals to request that the Issuer and/or the security holders of the Issuer consider an extraordinary or other transaction, such as a merger or reorganization, or a combination or combinations of such transactions; and (h) engage in a combination or combinations of the foregoing plans and/or proposals.

Each such plan or proposal may be subject to, and depend upon, a variety of factors, including (i) current and anticipated trading prices and the expected value of applicable Issuer-Related Securities, (ii) the Issuer’s financial condition and position, results of operations, plans, prospects and strategies, (iii) general industry conditions, (iv) the availability, form and terms of financing and other investment and business opportunities, (v) general stock market and economic conditions, (vi) tax considerations and (vii) other factors. Each acquisition, disposition, transaction, discussion, communication, suggestion, recommendation, proposal and other action described herein may be effected, made or taken, as applicable, at any time and/or from time to time without prior notice. Although the plans and proposals described herein reflect the plans and proposals presently contemplated by the Reporting Person with respect to the Issuer and the Issuer-Related Securities, as applicable, each such plan and proposal is subject to change at any time and from time to time dependent upon contingencies and assumed and speculative conditions and other factors, including actions taken by the Issuer, the Issuer’s board of directors, other security holders of the Issuer and other parties and the outcome of the discussions, communications, transactions and other actions described herein. There can be no assurance that any such plan or proposal will be consummated or pursued or result in any transaction described herein or other transaction or that any action contemplated by any such plan or proposal (or any similar action) will be taken.

Item 5. Interest in Securities of the Issuer

| (a) | Mr. Honig beneficially owns 29,815 shares of common stock, 439,585 shares of common stock held by 401K and 30,600 shares of common stock held by Roth 401K, or an aggregate of 11.10% of the Issuer’s common stock. Mr. Honig is the trustee of 401K and Roth 401K, and, in such capacity, has voting and dispositive power over the securities held by such entities. |

| (b) | Mr. Honig may be deemed to hold sole voting and dispositive power over 29,815 shares of common stock of the Issuer and shares voting and dispositive power over 470,185 shares of common stock. 401K may be deemed to hold shared voting and dispositive power over 439,585 shares of the Issuer’s common stock and Roth 401K may be deemed to hold shared voting and dispositive power over 30,600 shares of the Issuer’s common stock. |

| (c) | On December 1, 2016, Mr. Honig purchased 7,484 shares of the Issuer’s common stock at a purchase price of $4.95 per share. On December 1, 2016, Mr. Honig purchased 1,000 shares of the Issuer’s common stock at a purchase price of $5.32 per share. On December 1, 2016, Mr. Honig purchased 1,000 shares of the Issuer’s common stock at a purchase price of $5.30 per share. On December 1, 2016, Mr. Honig purchased 1,600 shares of the Issuer’s common stock at a purchase price of $5.00 per share. On December 1, 2016, Mr. Honig purchased 18,731 shares of the Issuer’s common stock at a purchase price of $5.05 per share. |

| (d) | To the best knowledge of the Reporting Person, except as set forth in this Schedule 13D, no person other than the Reporting Person has the right to receive, or the power to direct the receipt of, dividends from, or the proceeds from the sale of the 500,000 shares of common stock reported in Item 5(a). |

| (e) | Not applicable. |

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

Other than as described herein, there are no contracts, arrangements, understandings or relationships (legal or otherwise) between the Reporting Person and any other person with respect to the shares.

Item 7. Material to Be Filed as Exhibits

Exhibit Number | Description |

| | |

| 99.1 | Joint Filing Agreement with GRQ Consultants, Inc. 401K and GRQ Consultants, Inc. Roth 401K FBO Barry Honig |

| 99.6 | Letter to Issuer dated December 1, 2016 |

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| Dated: December 1, 2016 | | /s/ Barry Honig | |

| | | Barry Honig | |

| Dated: December 1, 2016 | | GRQ CONSULTANTS, INC. 401K | |

| | | | |

| | By: | /s/ Barry Honig | |

| | | Barry Honig Trustee | |

| Dated: December 1, 2016 | | GRQ CONSULTANTS, INC. ROTH 401K | |

| | | FBO BARRY HONIG | |

| | By: | /s/ Barry Honig | |

| | | Barry Honig Trustee | |

Exhibit B

Exhibit C

PROPOSAL NO. 1

APPROVAL TO FIX THE MAXIMUM NUMBER OF DIRECTORS OF THE COMPANY AT SIX (6) DIRECTORS

RESOLVED:

The Company shall be authorized and hereby is directed to establish the size of the Board of Directors and does hereupon fix the number of directors of the Company at a maximum of six (6) directors, such maximum number not to be revised except upon further shareholder authorization as provided in this resolution.

Vote Required

The affirmative vote of a majority of the votes cast (either in person or by proxy) and entitled to vote on the matter is required to approve Proposal 1.

PROPOSAL NO. 2

REMOVAL FROM OFFICE OF DIRECTORS

RESOLVED:

Colorado Revised Statute (C.R.S.) Section 7-108-108 states that shareholders of the Company may remove one or more directors with or without cause at a meeting called for the purpose of removing the director. The shareholders of the Company do hereby remove at a meeting called for the purpose of removal, the following directors from the Board of Directors of the Company:

| | | | | | | | |

| Name | | Age | | Date FirstElected orAppointed | | Position(s) |

| | | | | | | | |

| Gail S. Schoettler | | | 72 | | 2001 | | Chair and Director |

| | | | | | | | |

Susan A. Evans | | | 68 | | 2012 | | Director |

| David E. Welch | | | 68 | | 2004 | | Director |

Biographical information concerning the directors above can be found in the Company’s Proxy Statement for the Company’s 2016 Annual Meeting of Shareholders filed with the SEC October 17, 2016.

Vote Required

The number of votes cast in favor of removal exceeds the number of votes cast against removal of each named director is required for Proposal 2.

PROPOSAL NO. 3

ELECTION OF THREE (3) DIRECTORS

RESOLVED:

The following persons are hereby nominated for election to the Board of Directors of the Company, and are hereby elected to serve as directors and to serve until their successor(s) are duly qualified and elected on or following the 2017 annual meeting of shareholders of the Company, such directors may only be removed “for cause” or resignation. Although it is not contemplated that any person will decline or be unable to serve as a director, in such event, the remaining Board members are authorized to fill any such vacancies created.

| | | | | |

| Name | | Age | |

John O’Rourke | | 31 | |

Michael Galloro | | 42 | |

Mike Dai | | 30 | |

John O’Rourke

John O’Rourke is an analyst and investor who currently serves as Managing Member of ATG Capital LLC, an investment fund focused on small and mid-cap growth companies possessing distinct competitive advantages and superior management teams. Mr. O'Rourke currently serves on the Board of Directors of Customer Acquisition Network Inc., a leading global performance based marketing company that reaches more than two billion users per month. Mr. O’Rourke formerly served on the Board of Directors of Rant, Inc., an innovator in U.S. digital media, prior to its sale to a Nasdaq listed company. He was formerly CFO of Fidelity Property Group, a real estate development company with a focus in California. He received his Bachelor of Science in Accounting with Honors from the University of Maryland and a Master of Science in Finance from George Washington University.

Michael Galloro

Michael Galloro is a member of the Chartered Public Accountants of Ontario with over 20 years of experience having earned his designation while working for KPMG LLP. While engaged as Vice President of Finance for a public company that was listed on the Toronto Stock Exchange, Mr. Galloro gained experience in finance and capital markets, corporate governance, human resources, and administration. Michael pursued a consulting career working on various projects in securities legislation compliance, valuations, mergers and acquisitions and initial public offerings. His experience stems internationally having been exposed to various global markets. Michael currently acts as a Chief Financial Officer and Director for private and publicly listed companies operating abroad.

Mike Dai

Mike Dai is a Chartered Public Accountant and Chartered Financial Analyst with experience working in a variety of audit, advisory, M&A and valuation engagements. Mr. Dai has been involved in a number of public and private market transactions, including business acquisitions and reverse takeovers, both domestically and internationally. Mr. Dai is an alumnus of Grant Thornton LLP and obtained his Master of Accounting from the University of Waterloo.

There are no family relationships between these nominees and any director or executive officer of the Company and there were no related party transactions between this nominee and the Company. No nominee has had any involvement in any legal proceedings (10 years) pursuant to Item 401 of Regulation S-K.

Vote Required

The affirmative vote of the holders of a plurality of the common stock present at the special meeting of stockholders is required for election of each director nominee set forth in this Proposal 3.

Exhibit D