Exhibit 99.1

Exhibit 99.1

CAPITAL BANCORP ANNUAL SHAREHOLDERS MEETING

MAY 21, 2014

FORWARD LOOKING STATEMENTS

Readers are cautioned that this presentation contains forward-looking statements made pursuant to safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based on management’s current knowledge, assumptions, and analyses, which it believes are appropriate in the circumstances regarding future events, and may address issues that involve significant risks including, but not limited to: changes in interest rates; changes in accounting principles, policies, or guidelines; significant changes in general economic, competitive, and business conditions; significant changes in or additions to laws and regulatory requirements; and significant changes in securities markets. Additionally, such aforementioned uncertainties, assumptions, and estimates may cause actual results to differ materially from the anticipated results or other expectations expressed in the

forward-looking statements.

ECONOMIC REVIEW

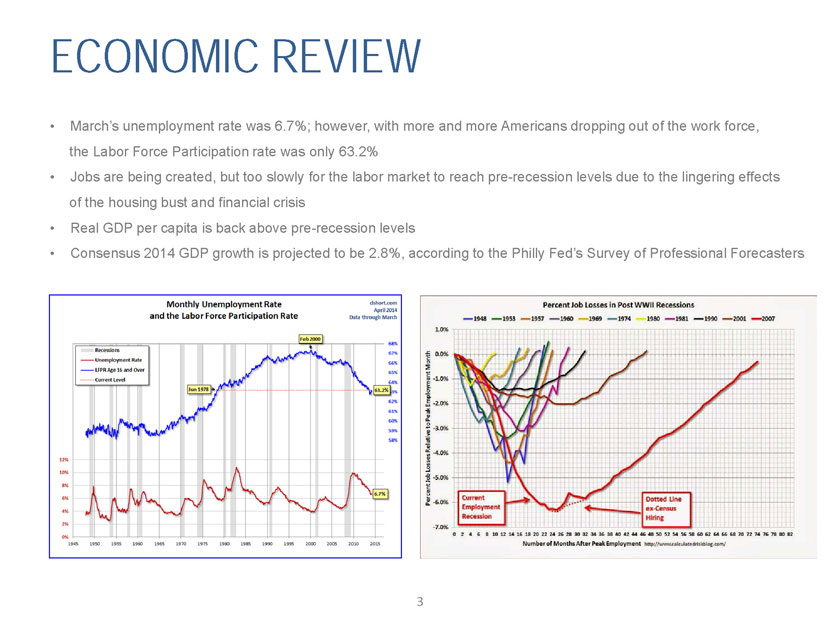

March’s unemployment rate was 6.7%; however, with more and more Americans dropping out of the work force, the Labor Force Participation rate was only 63.2%

Jobs are being created, but too slowly for the labor market to reach pre-recession levels due to the lingering effects of the housing bust and financial crisis

Real GDP per capita is back above pre-recession levels

Consensus 2014 GDP growth is projected to be 2.8%, according to the Philly Fed’s Survey of Professional Forecasters

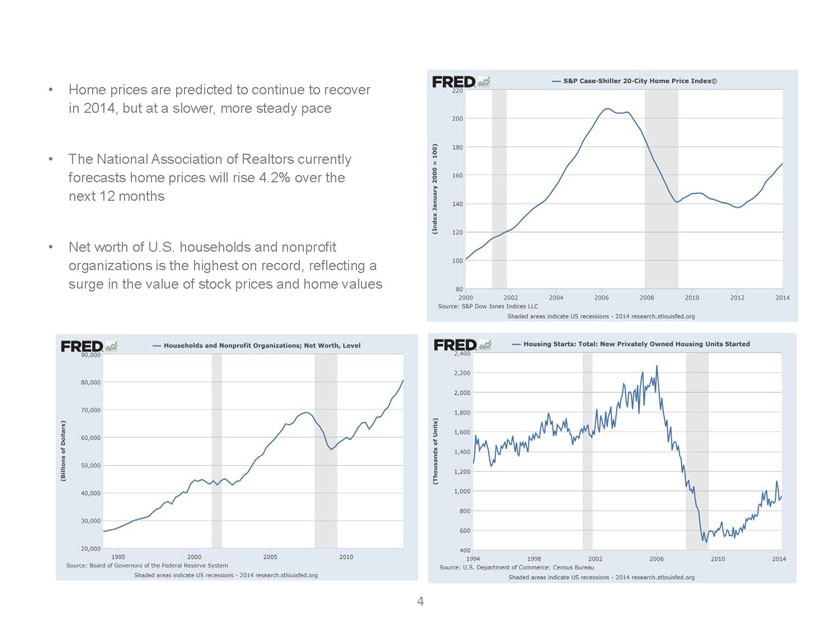

Home prices are predicted to continue to recover in 2014, but at a slower, more steady pace

The National Association of Realtors currently forecasts home prices will rise 4.2% over the next 12 months

Net worth of U.S. households and nonprofit organizations is the highest on record, reflecting a surge in the value of stock prices and home values

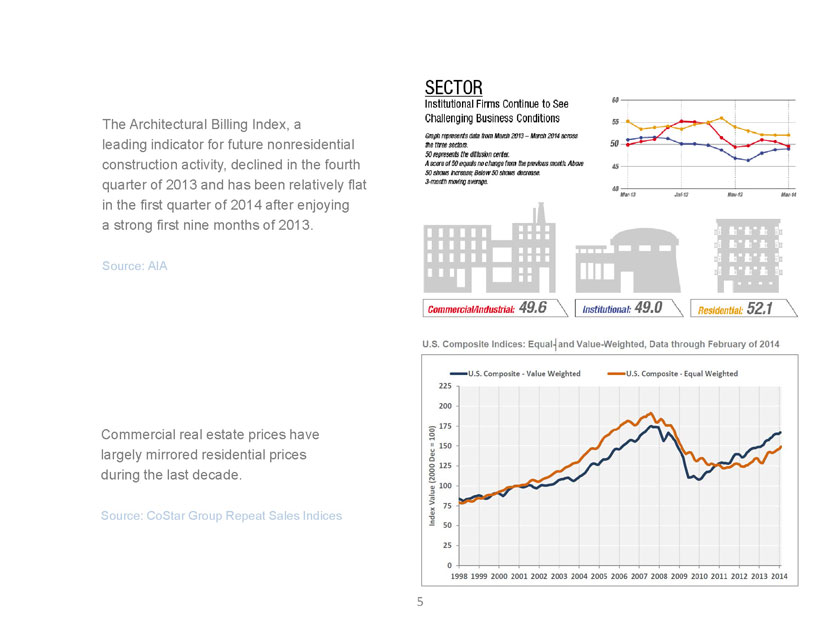

5 | | The Architectural Billing Index, a |

leading indicator for future nonresidential construction activity, declined in the fourth quarter of 2013 and has been relatively flat in the first quarter of 2014 after enjoying

a strong first nine months of 2013.

Source: AIA

Commercial real estate prices have largely mirrored residential prices

during the last decade.

Source: CoStar Group Repeat Sales Indices

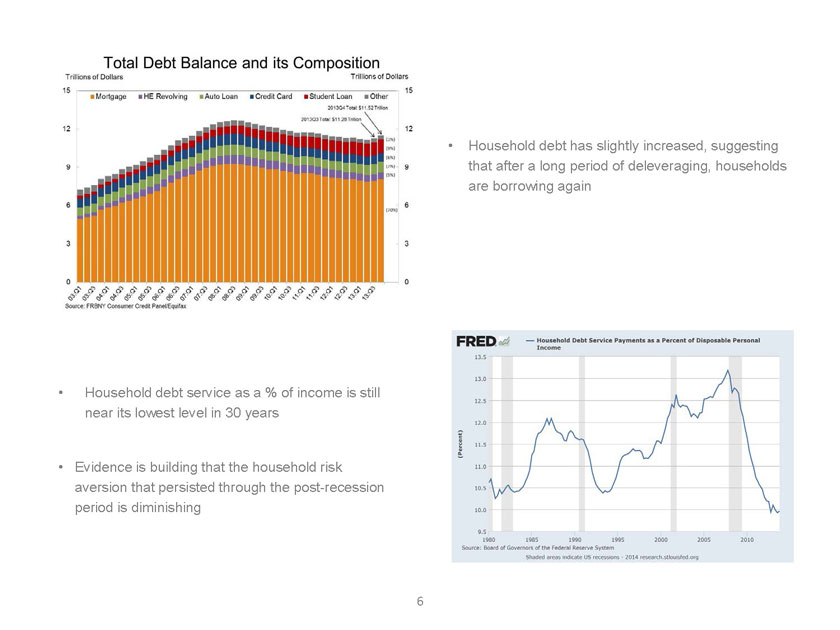

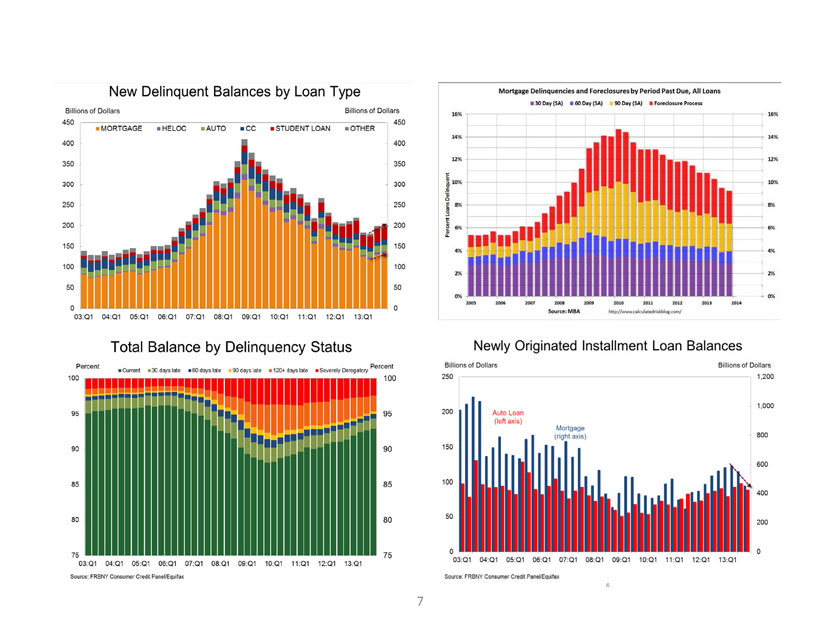

Household debt has slightly increased, suggesting that after a long period of deleveraging, households are borrowing again

Household debt service as a % of income is still near its lowest level in 30 years

Evidence is building that the household risk aversion that persisted through the post-recession period is diminishing

9

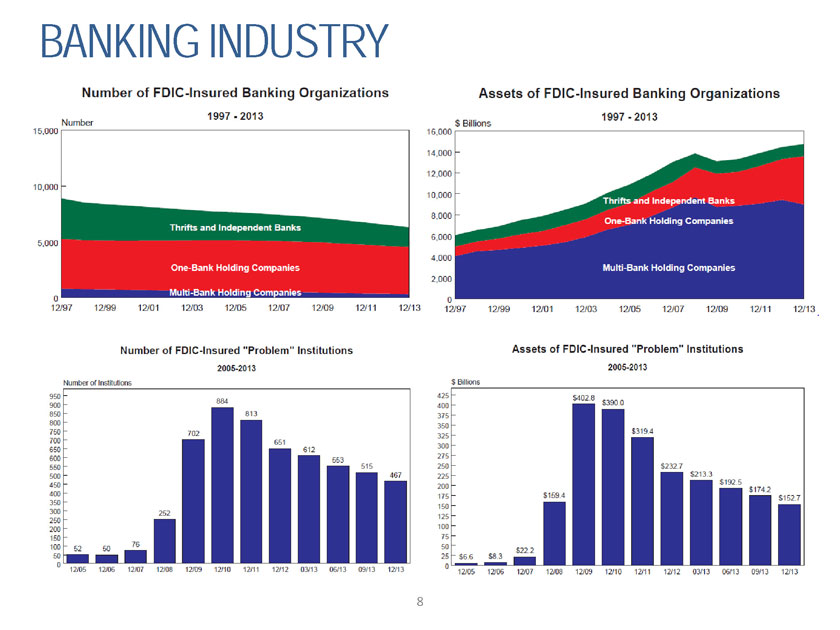

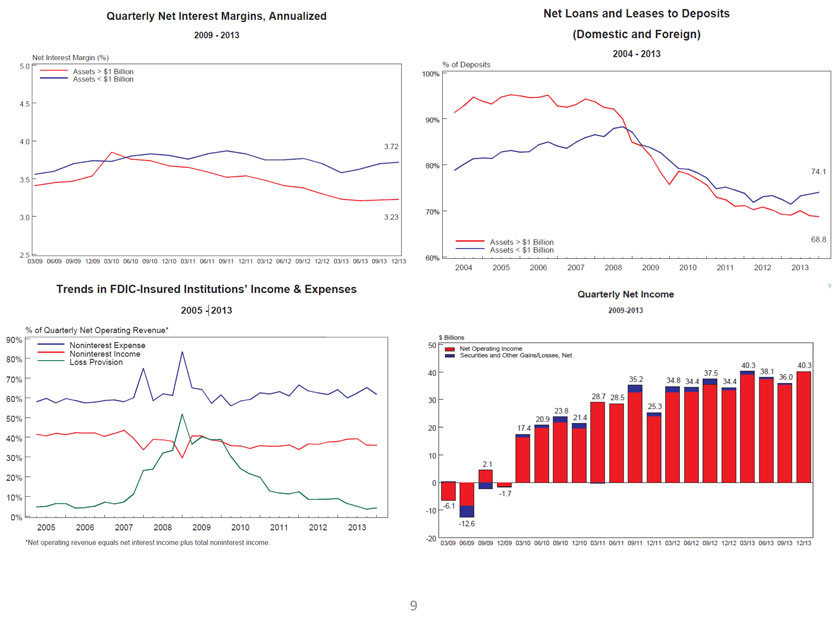

BANKING INDUSTRY

WHY ARE BANK STOCKS STILL DEPRESSED?

HEADWINDS TAILWINDS

Slow job recovery

Continuing margin pressure

Greater regulatory burden

Higher capital requirements

Fiscal concerns / DC dysfunction

Capital is expensive and limited

Still a buyer’s M&A market

Higher barriers to entry

Economy is improving

Housing is improving

Stock market has been strong

Multiple Expansion

Improving NPA levels

More industry consolidation

BOTTOM LINE: Bank stocks earned growth stock multiples pre-crisis as they grew earnings at double-digit rates and generated returns on equity approaching 15-20%. Investor’s fear that the new normal will generate much lower growth and returns on capital.

10

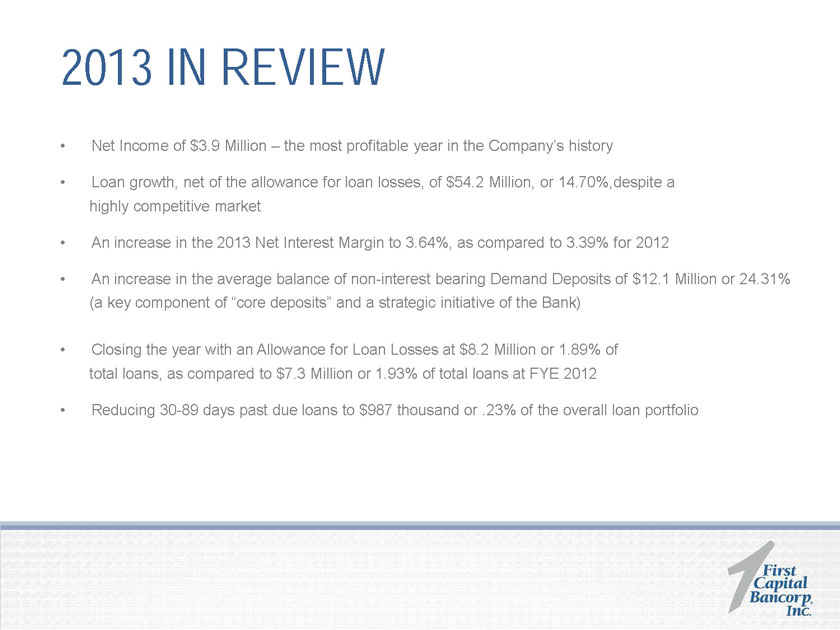

2013 IN REVIEW

Net Income of $3.9 Million – the most profitable year in the Company’s history

Loan growth, net of the allowance for loan losses, of $54.2 Million, or 14.70%, despite a

highly competitive market

An increase in the 2013 Net Interest Margin to 3.64%, as compared to 3.39% for 2012

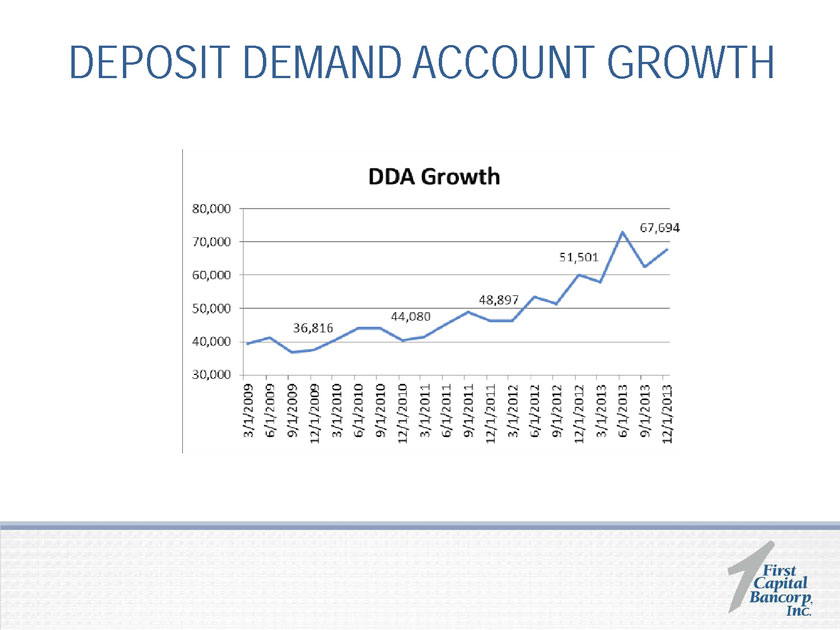

An increase in the average balance of non-interest bearing Demand Deposits of $12.1 Million or 24.31%

(a key component of “core deposits” and a strategic initiative of the Bank)

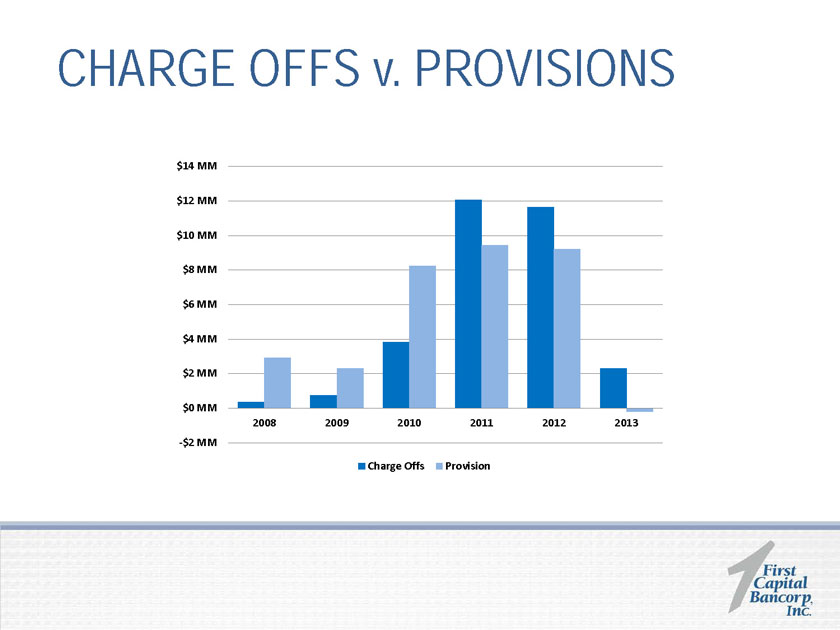

Closing the year with an Allowance for Loan Losses at $8.2 Million or 1.89% of

total loans, as compared to $7.3 Million or 1.93% of total loans at FYE 2012

Reducing 30-89 days past due loans to $987 thousand or .23% of the overall loan portfolio

2013 IN REVIEW (Cont’d)

Continued improvement in the Bank’s Efficiency Ratio – a 2013 and 2014 strategic initiative

An employee turnover ratio of less than 5%—significantly outperforming industry standards

Triggering a strategic initiative to complete the redemption of the Company’s remaining

TARP-related securities

Building a successful foundation for implementing a new marketing and branding campaign

for the Bank

DRIVING SHAREHOLDER VALUE

FIVE MISSION-CRITICAL ELEMENTS

Earnings

Growth

Asset Quality

Capital

Franchise Development

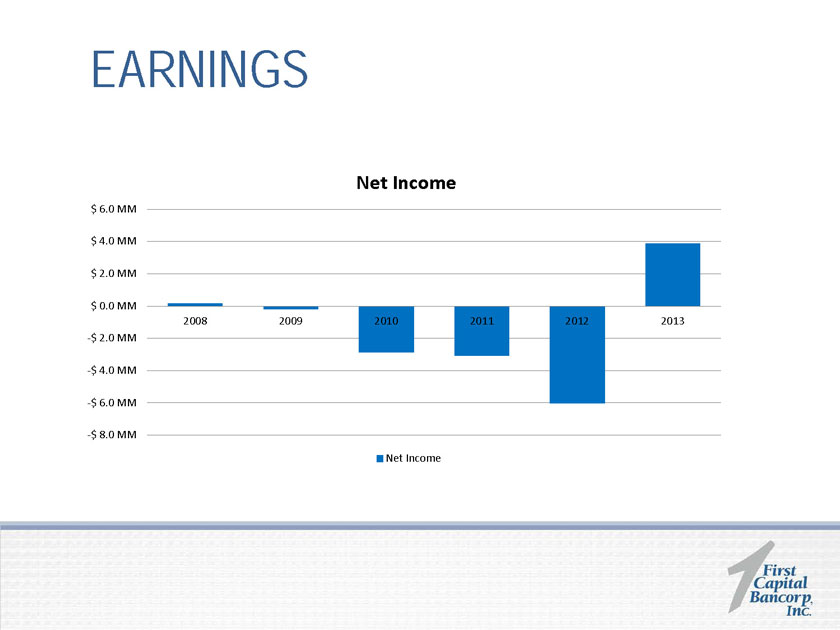

EARNINGS

-$ 8.0 MM

-$ 6.0 MM

-$ 4.0 MM

-$ 2.0 MM

$ 0.0 MM

$ 2.0 MM

$ 4.0 MM

$ 6.0 MM

2008

2009

2010

2011

2012

2013

Net Income

Net Income

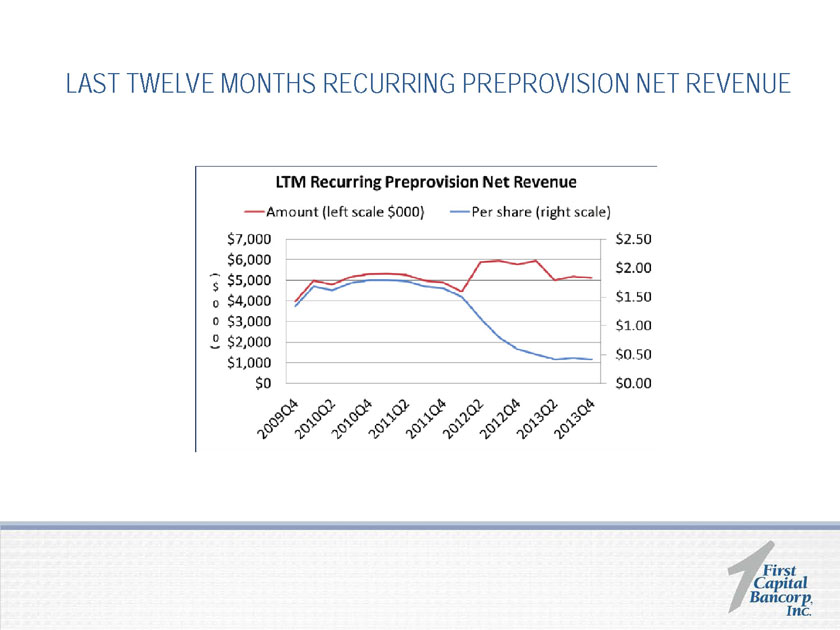

LAST TWELVE MONTHS RECURRING PREPROVISION NET REVENUE

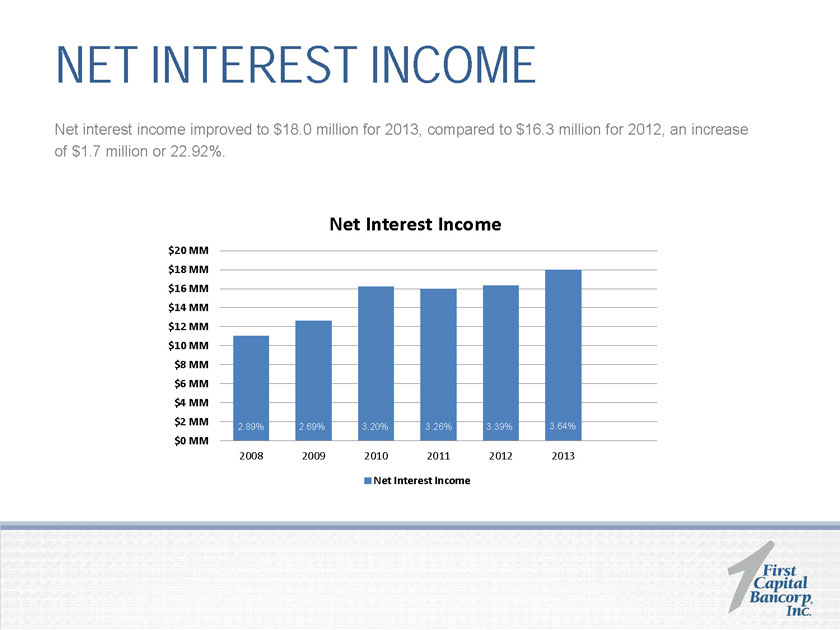

NET INTEREST INCOME

Net interest income improved to $18.0 million for 2013, compared to $16.3 million for 2012, an increase

of $1.7 million or 22.92%.

Net Interest Income

$0 MM

$2 MM

$4 MM

$6 MM

$8 MM

$10 MM

$12 MM

$14 MM

$16 MM

$18 MM

$20 MM

2008

2009

2010

2011

2012

2013

2014

Net Interest Income

2.89% 2.69%

2.89%

3.20%

3.26%

3.39%

3.64%

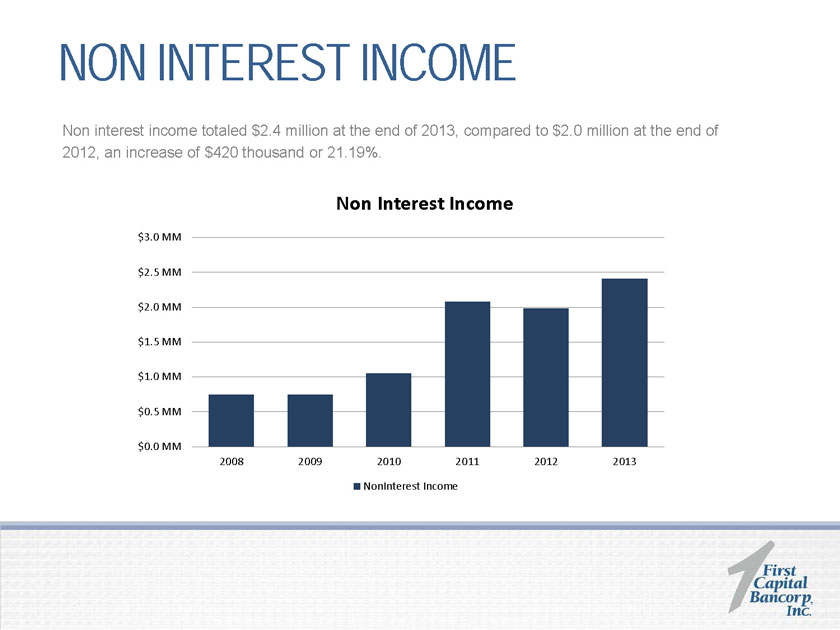

NON INTEREST INCOME Non interest income totaled $2.4 million at the end of 2013, compared to $2.0 million at the end of 2012, an increase of $420 thousand or 21.19%.

Non Interest Income

$0.0 MM

$0.5 MM

$1.0 MM

$1.5 MM

$2.0 MM

$2.5 MM

$3.0 MM

2008

2009

2010

2011

2012

2013

NonInterest Income

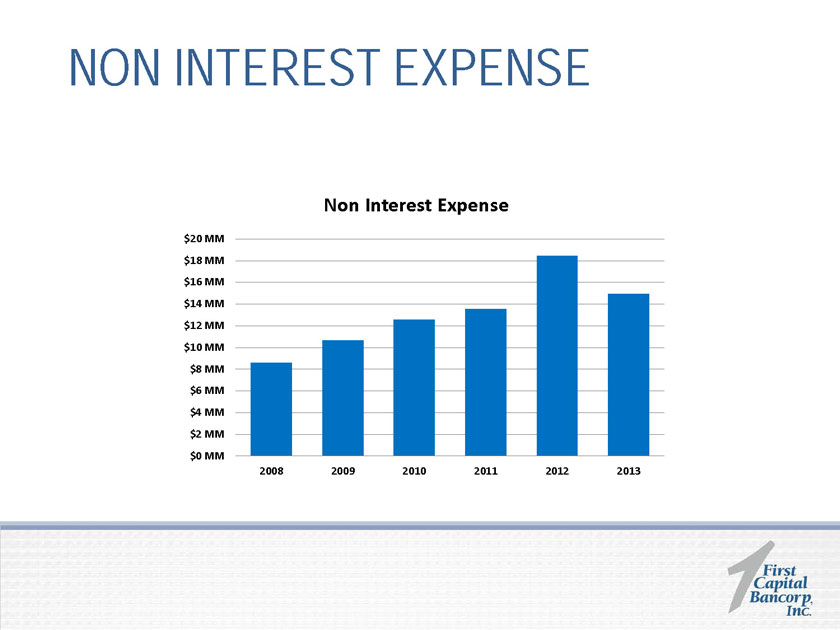

NON INTEREST EXPENSE

$0 MM

$2 MM

$4 MM

$6 MM

$8 MM

$10 MM

$12 MM

$14 MM

$16 MM

$18 MM

$20 MM

2008

2009

2010

2011

2012

2013

Non Interest Expense

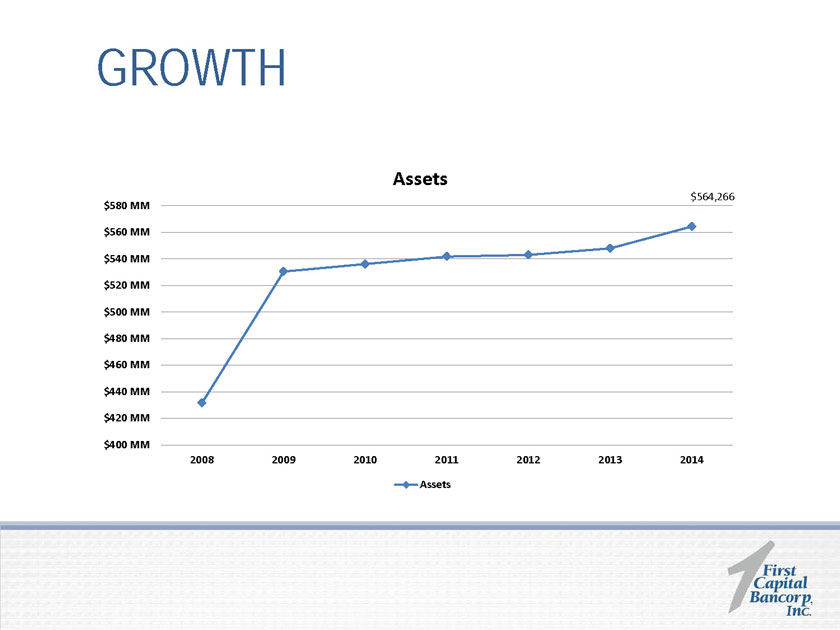

GROWTH

$564,266

$400 MM

$420 MM

$440 MM

$460 MM

$480 MM

$500 MM

$520 MM

$540 MM

$560 MM

$580 MM

2008

2009

2010

2011

2012

2013

2014Assets

Assets

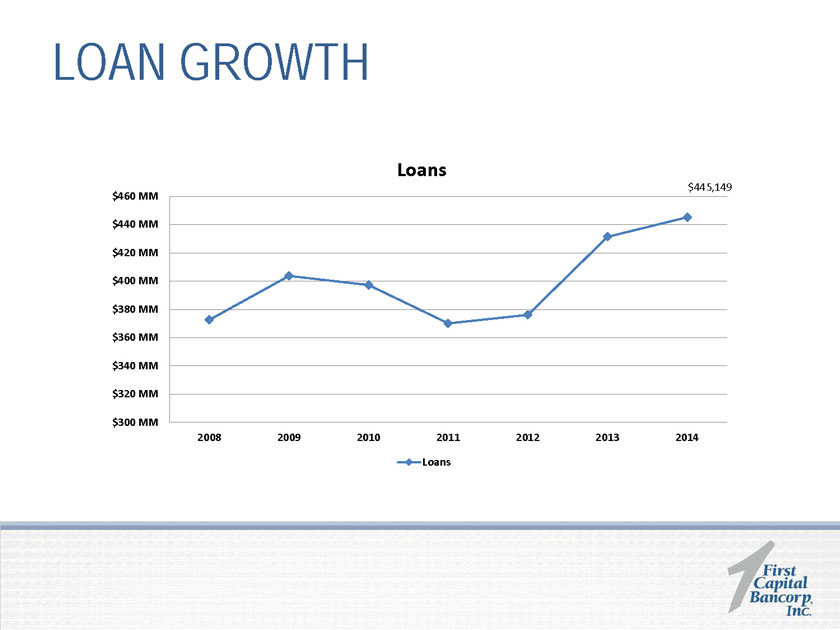

LOAN GROWTH

$445,149

$300 MM

$320 MM

$340 MM

$360 MM

$380 MM

$400 MM

$420 MM

$440 MM

$460 MM

2008

2009

2010

2011

2012

2013

2014Loans

Loans

2008 LOAN PORTFOLIO

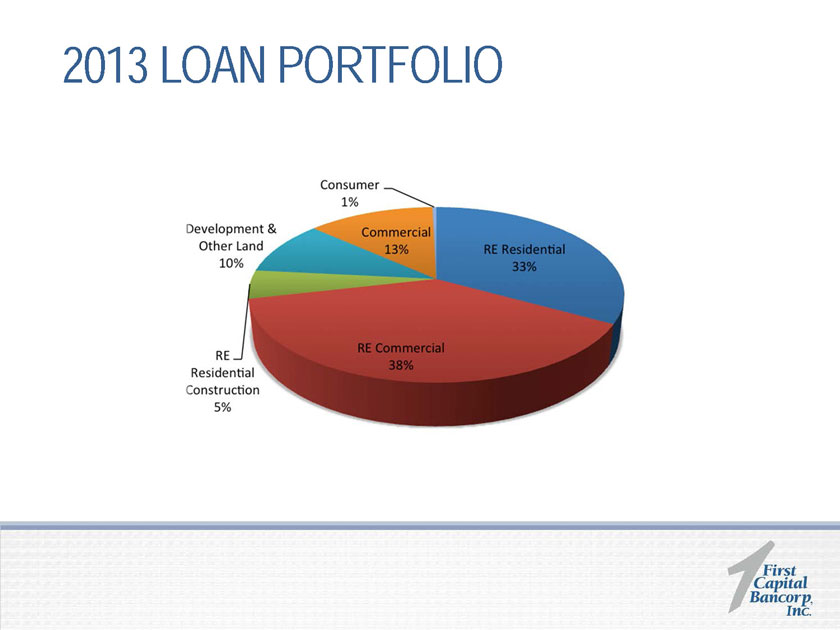

2013 LOAN PORTFOLIO

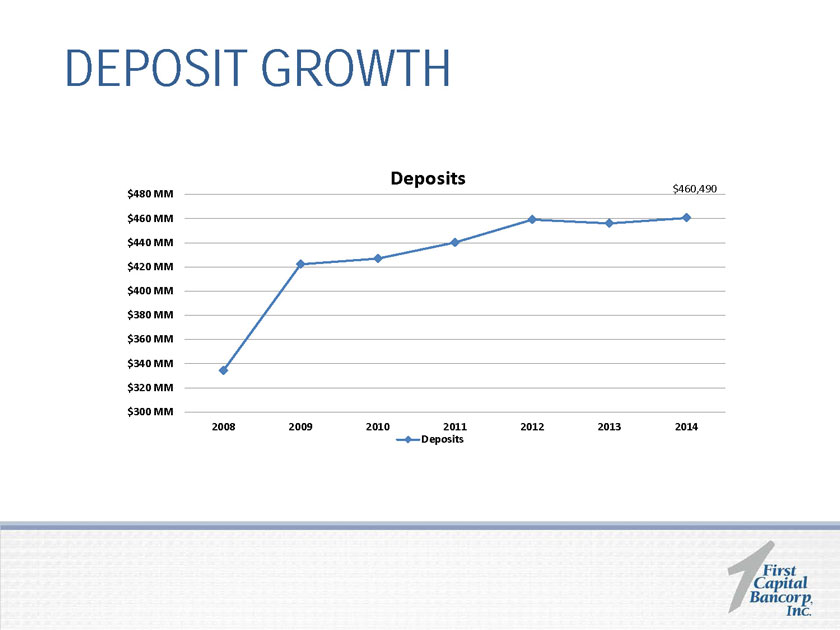

DEPOSIT GROWTH

$460,490

$300 MM

$320 MM

$340 MM

$360 MM

$380 MM

$400 MM

$420 MM

$440 MM

$460 MM

$480 MM

2008

2009

2010

2011

2012

2013

2014

Deposits

Deposits

DEPOSIT DEMAND ACCOUNT GROWTH

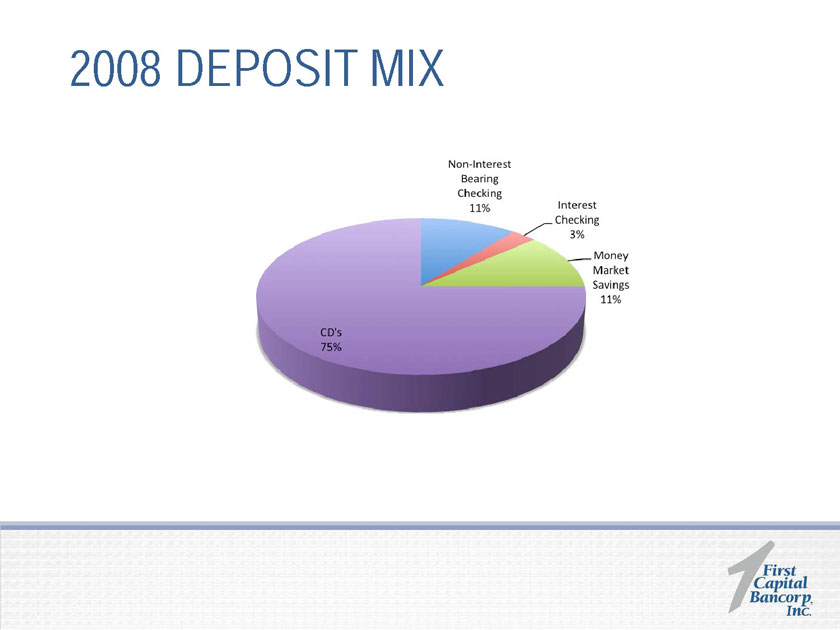

2008 DEPOSIT MIX

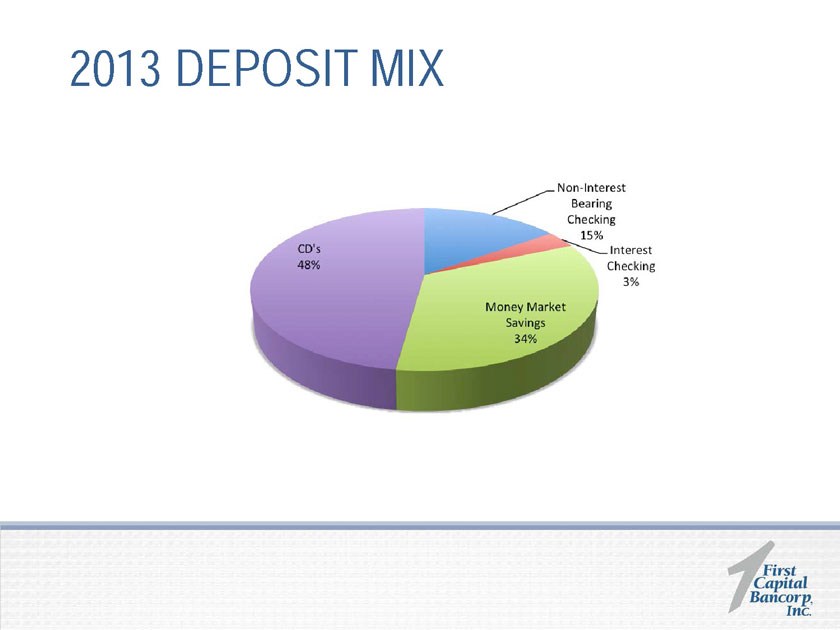

2013 DEPOSIT MIX

CHARGE OFFS v. PROVISIONS

-$2 MM

$0 MM

$2 MM

$4 MM

$6 MM

$8 MM

$10 MM

$12 MM

$14 MM

2008

2009

2010

2011

2012

2013

Charge Offs

Provision

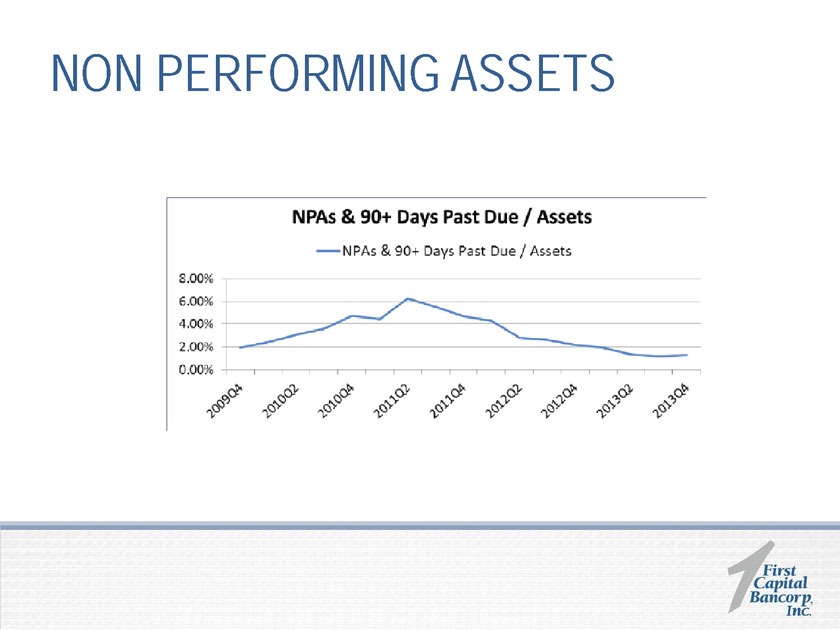

NON PERFORMING ASSETS

CAPITAL STRATEGY

Our balance sheet management over the past year has been an important piece of the success of 2013 as

we have been able to drive an improvement in deposit mix, push the net interest margin higher, and manage

to increase capital levels despite a year of material loan growth. These are all achievements that should continue to payoff in 2014.

0.00%

20.00%

40.00%

60.00%

80.00%

100.00%

120.00%

12.20%

12.40%

12.60%

12.80%

13.00%

13.20%

13.40%

13.60%

13.80%

14.00%

14.20%

Total Adversely Classified items/Tier 1 + ALLL

Total Risk Based Capital Ratio

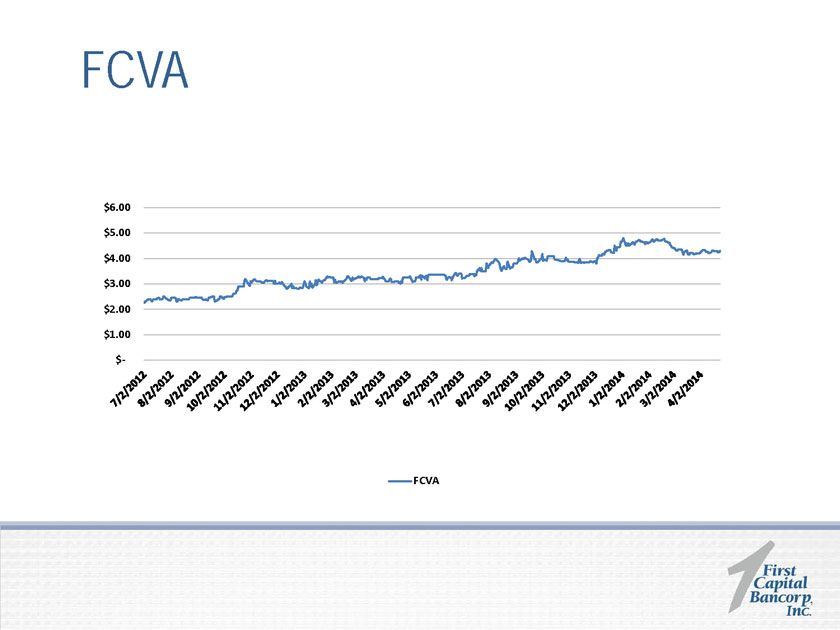

FCVA

$-

$1.00

$2.00

$3.00

$4.00

$5.00

$6.00

FCVA

FRANCHISE DEVELOPMENT

OUTDOOR BILLBOARDS

RADIO

SWIFT CREEK BRANCH

Opening June 13, 2014

Open Monday-Friday 10-7, Saturdays 10-2

Staffed by Full-Service Bankers

Promotion from within the First Capital Bank Team

SWIFT CREEK BRANCH

August 2014

Four Wal-Mart locations

Expanded Squirrels Partnership